Defect Repair Cost and Home Warranty Deposit, Korea

Abstract

:1. Introduction

2. Literature Study

2.1. Defect Warranty Deposit

2.1.1. Outline

2.1.2. Regulations

2.2. Defect Repair Cost

2.3. Project Conditions

2.4. Lawsuit Issues

3. Materials and Methods

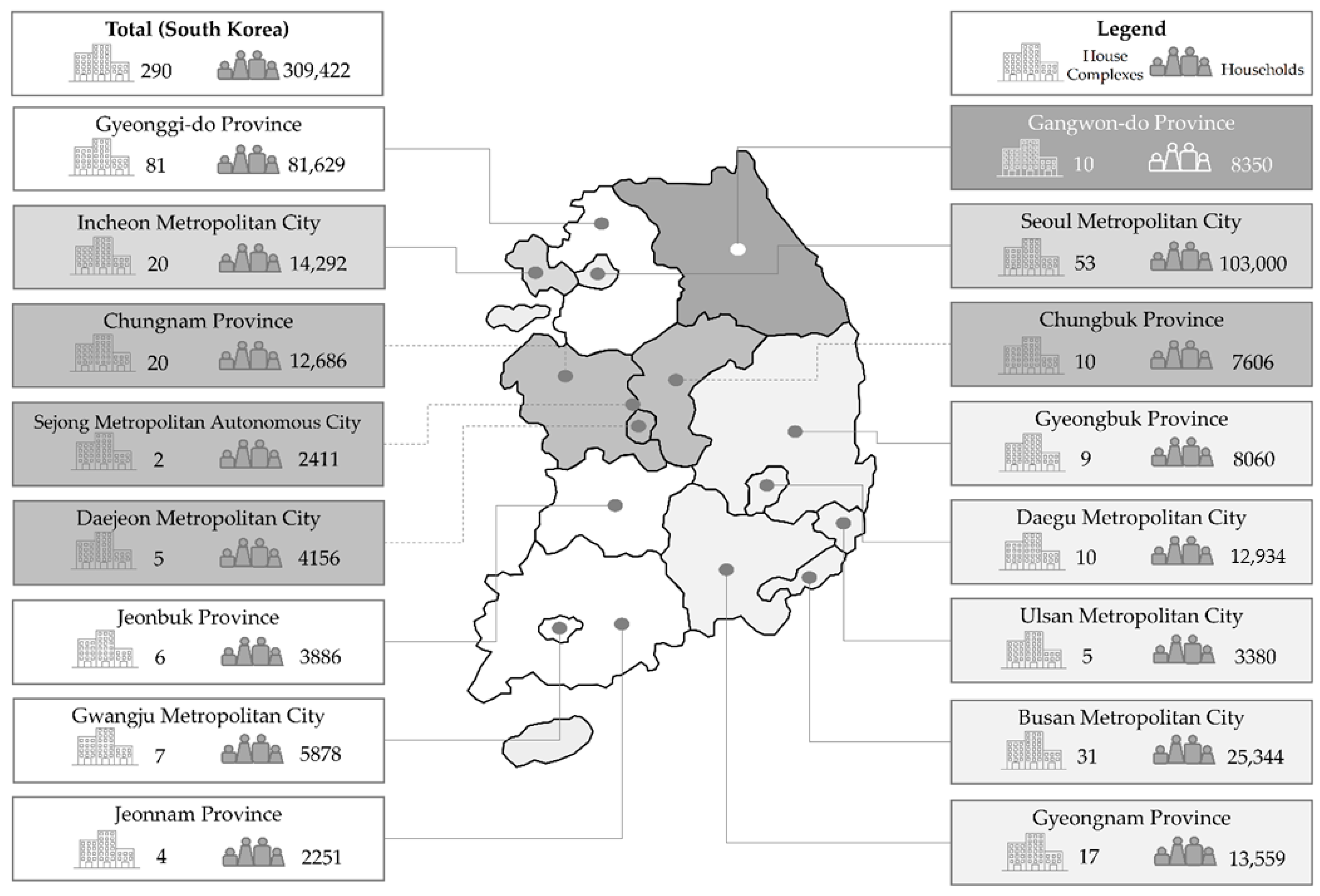

3.1. Object and Scope

3.2. Data Collection

3.3. Comparison Method

4. Results

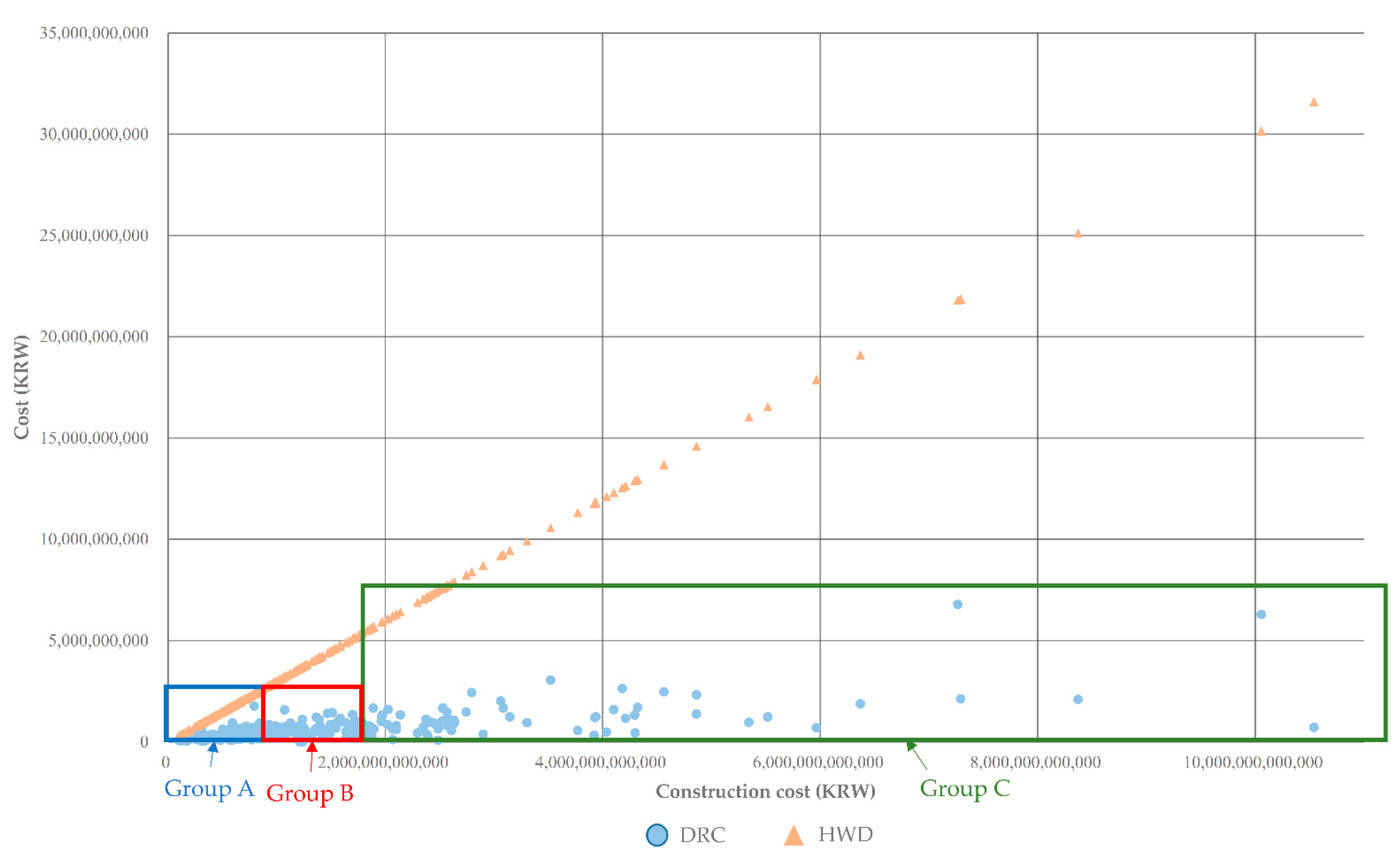

4.1. Defect Repair Cost and Home Warranty Deposit

4.1.1. Comparison of Total Case

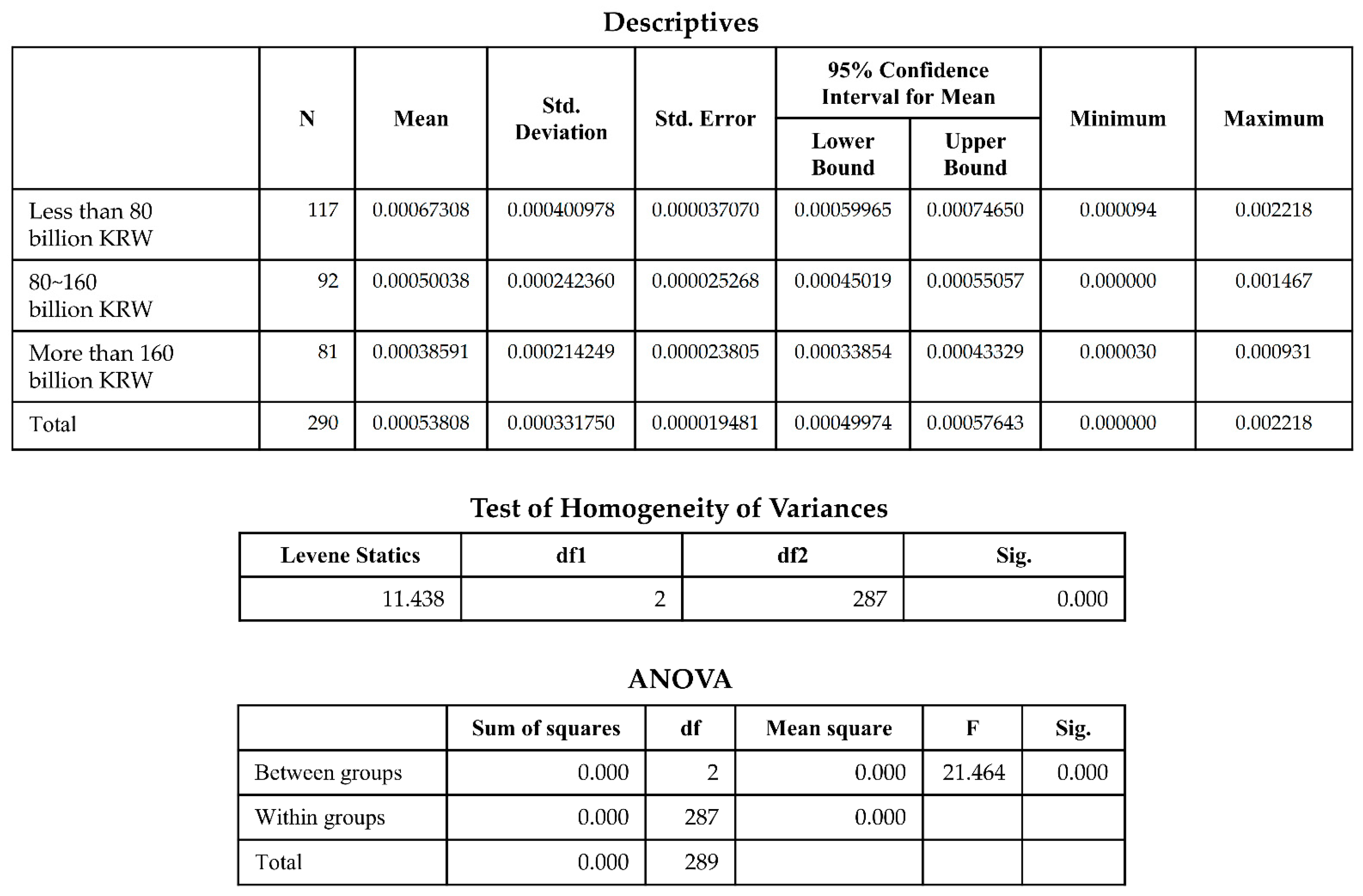

4.1.2. Comparison of The Construction Cost Scale

4.2. Comparison of Project Conditions

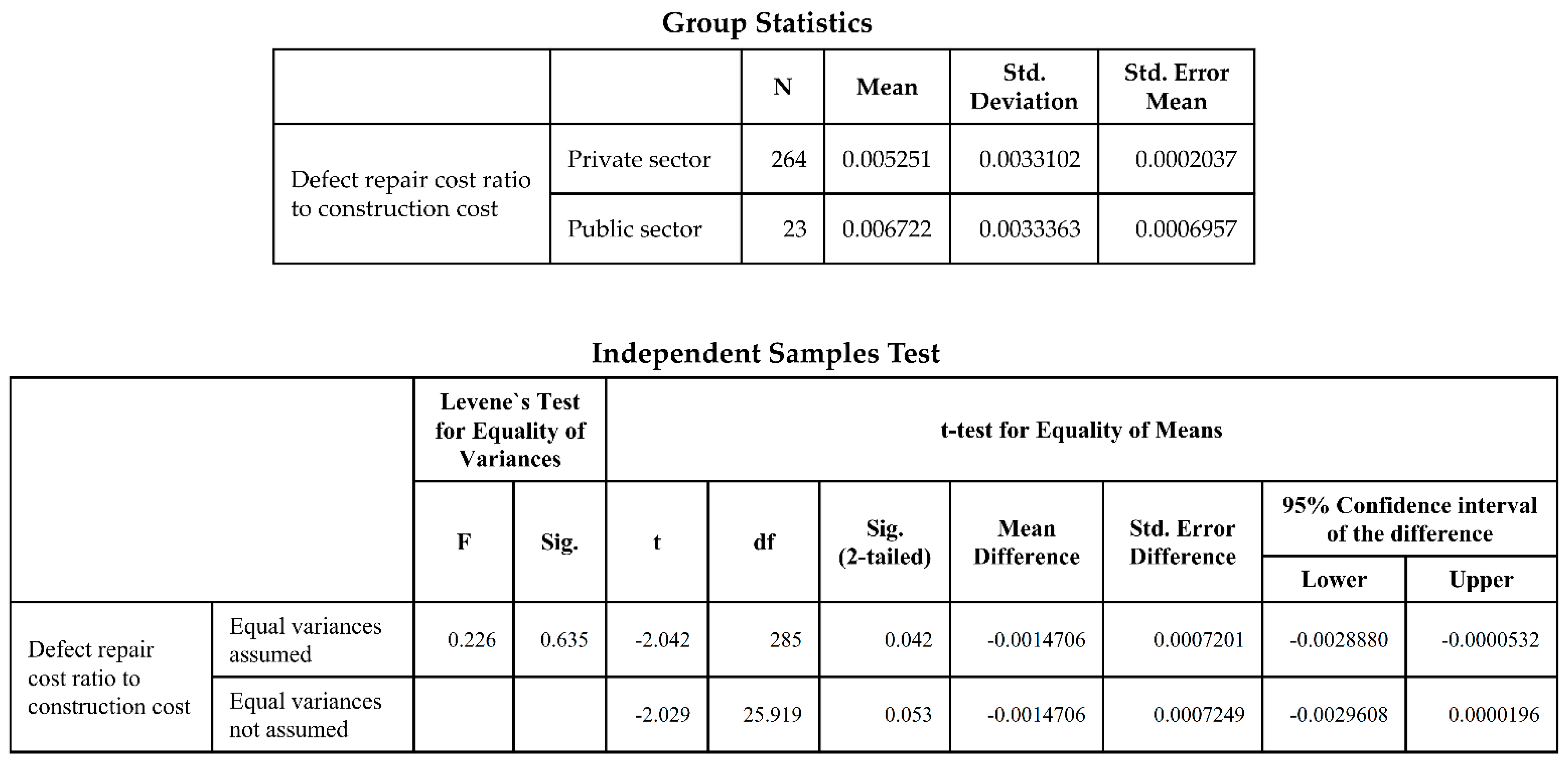

4.2.1. Project Execution Sector

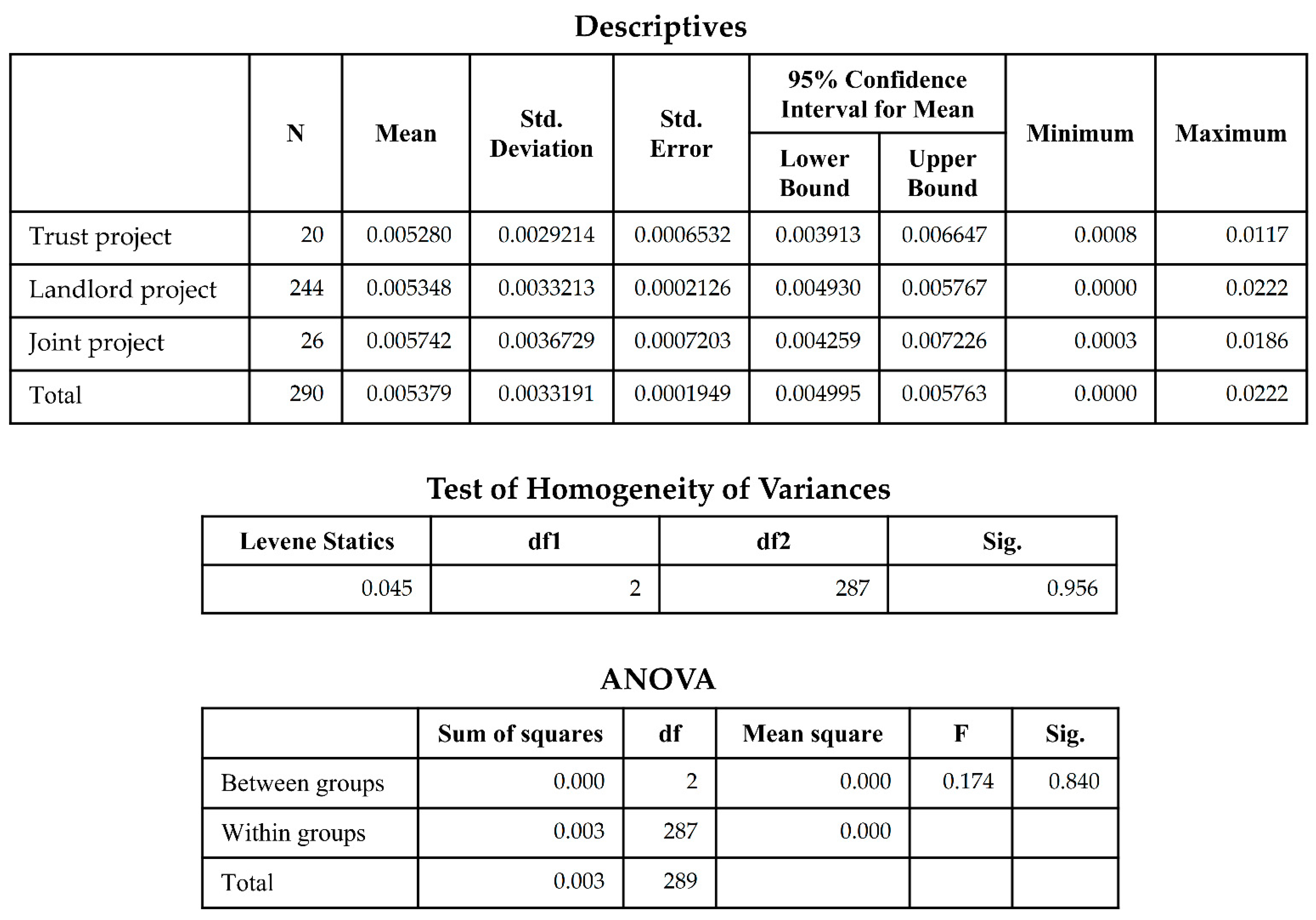

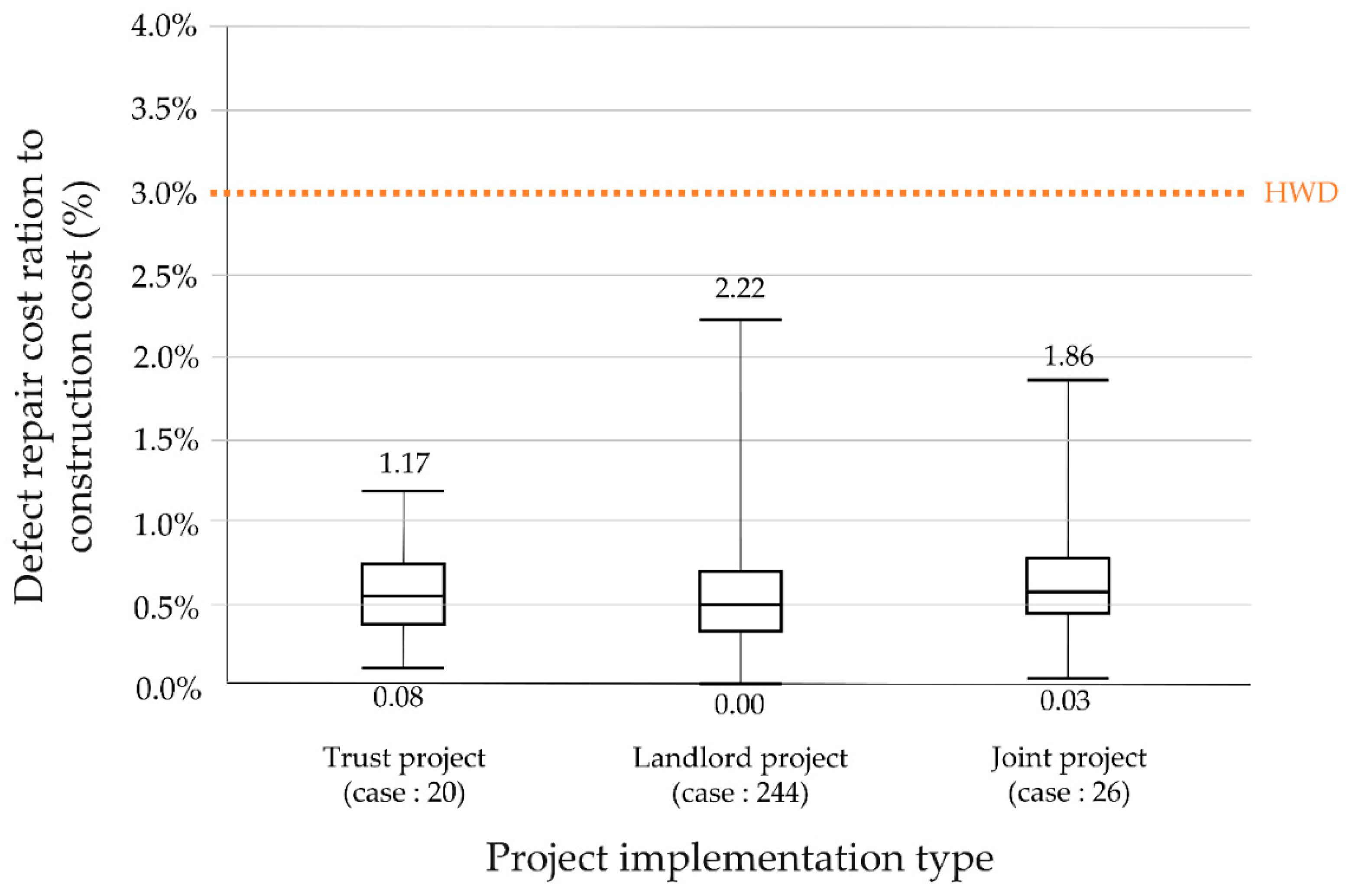

4.2.2. Project Implementation Type

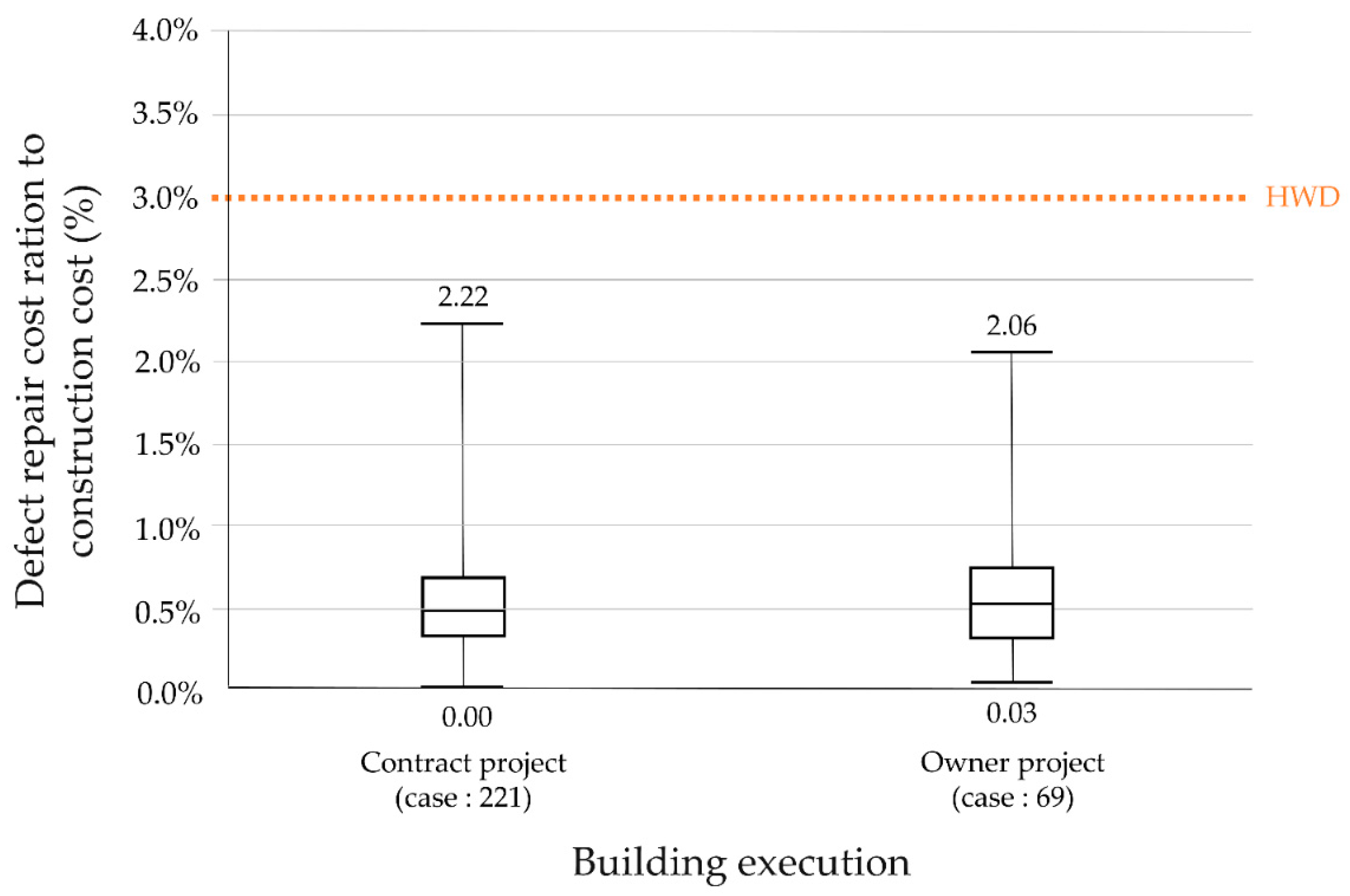

4.2.3. Building Execution

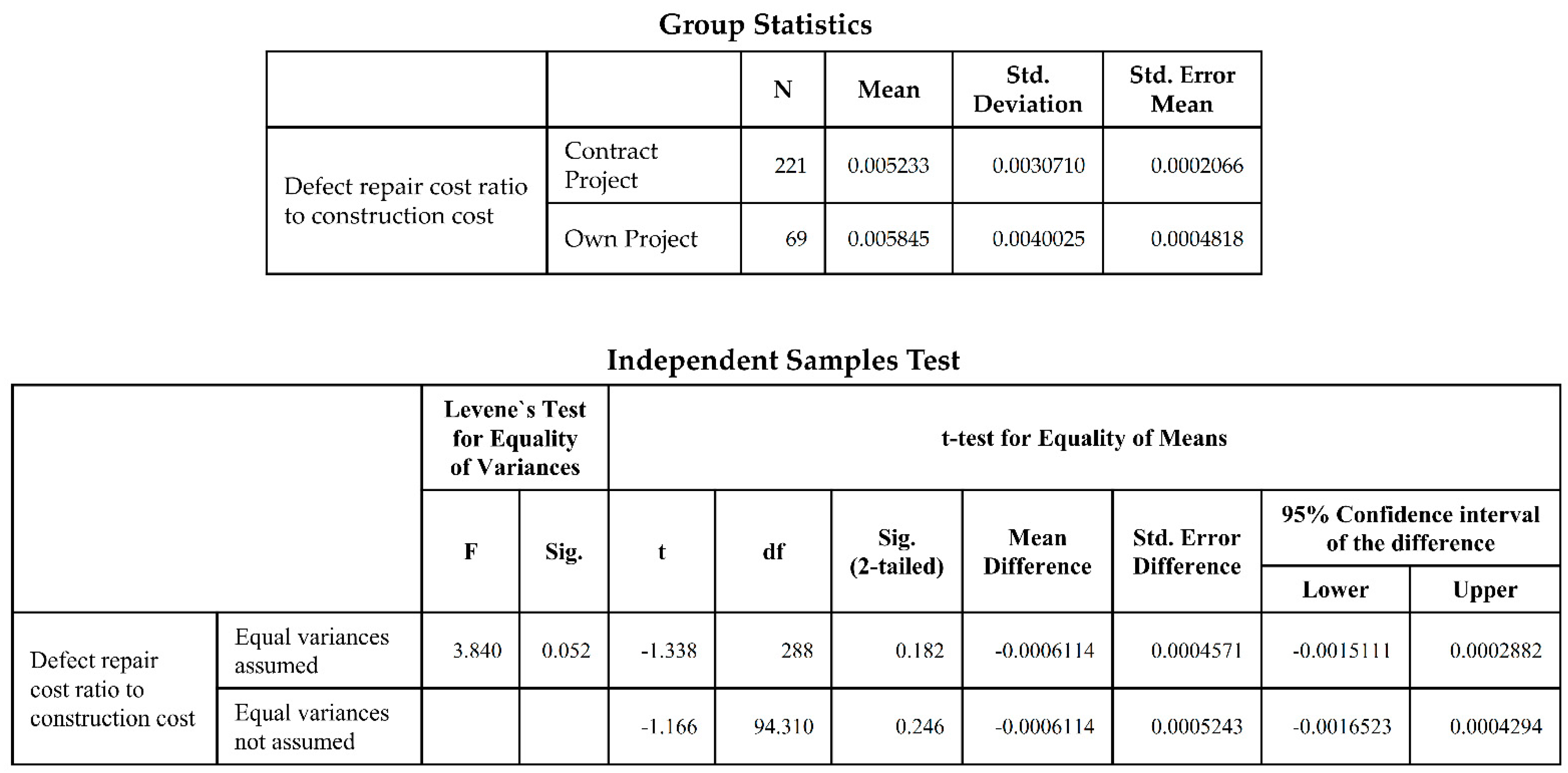

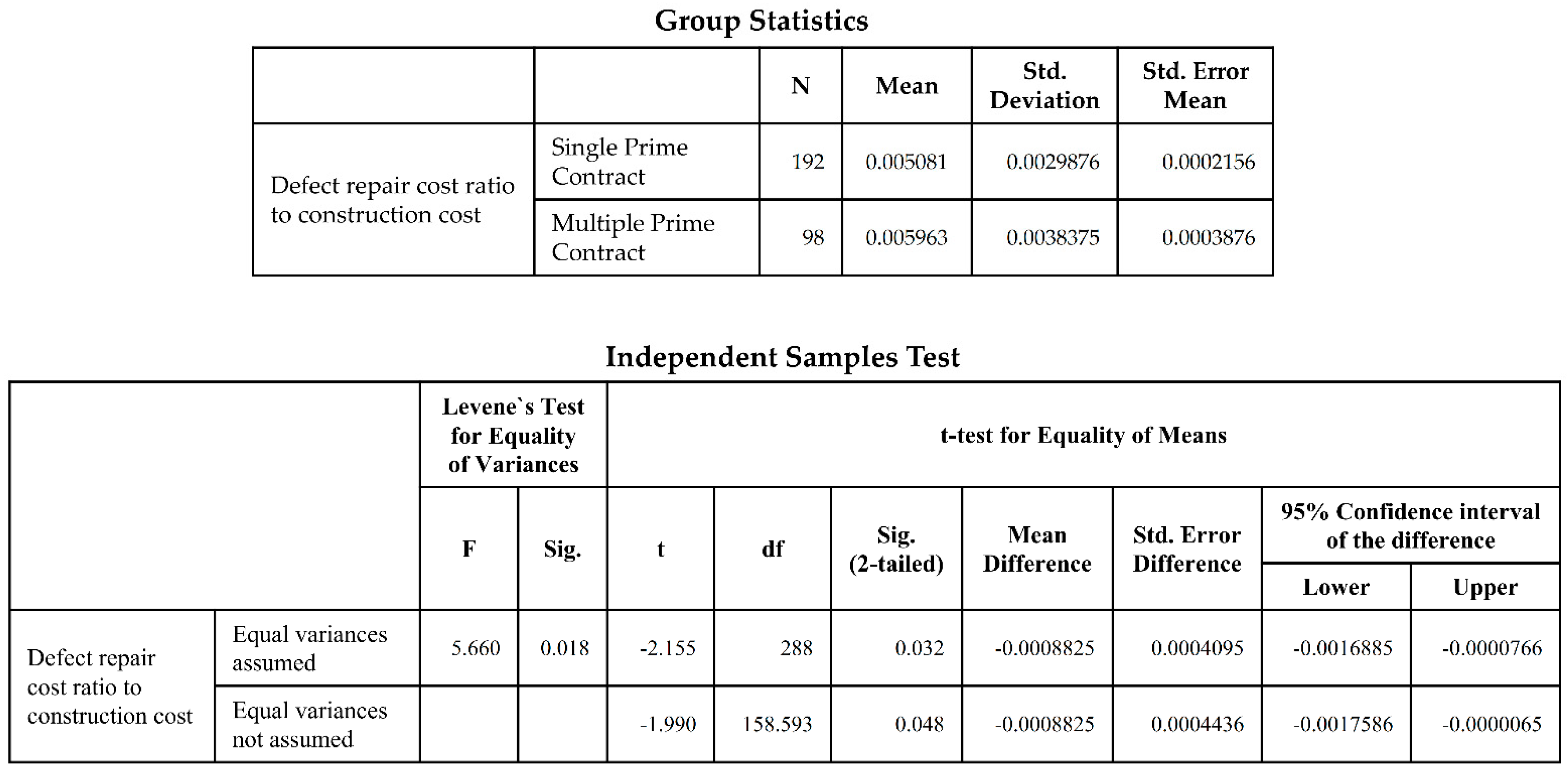

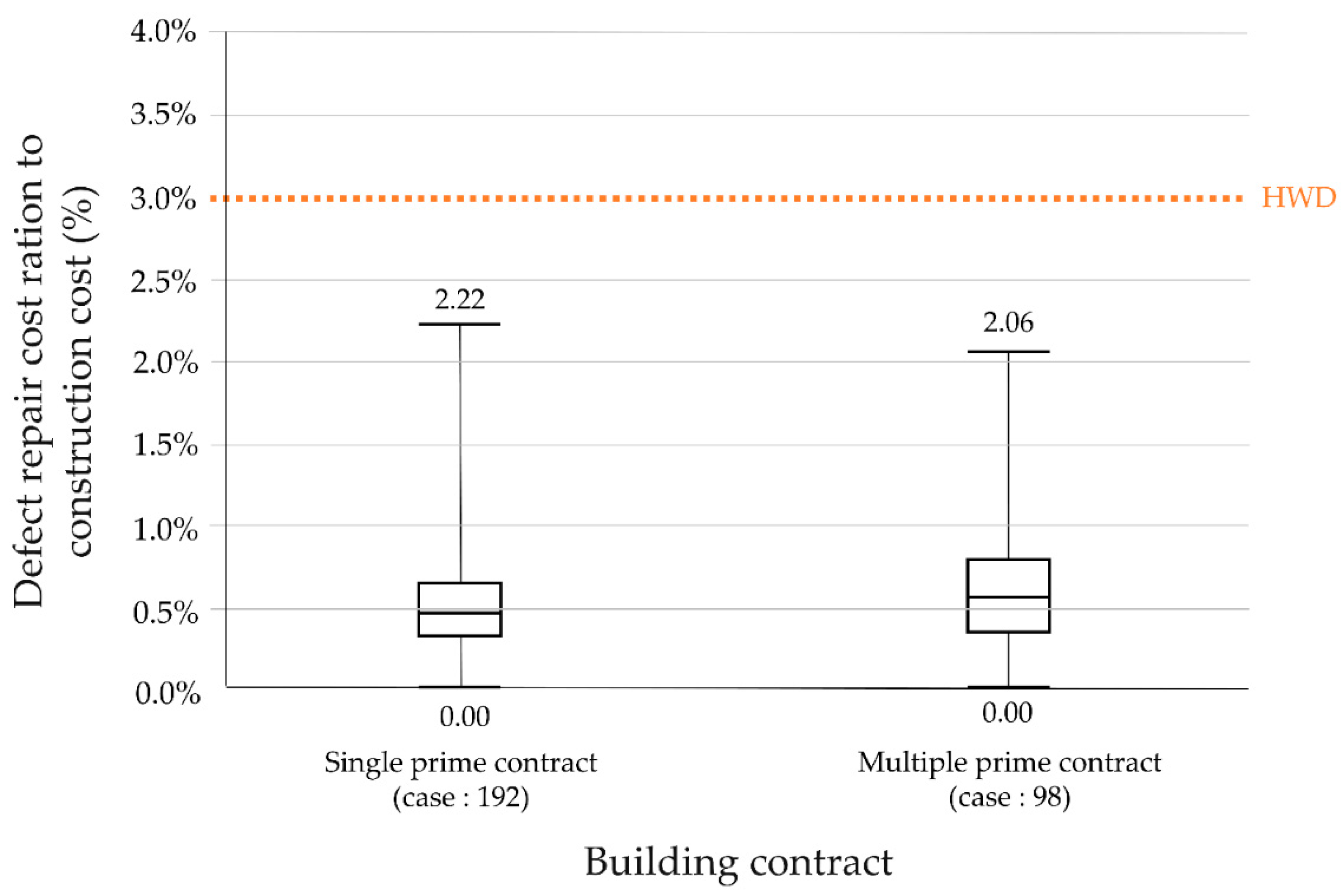

4.2.4. Building Contract

4.3. Comparison of Lawsuit issues

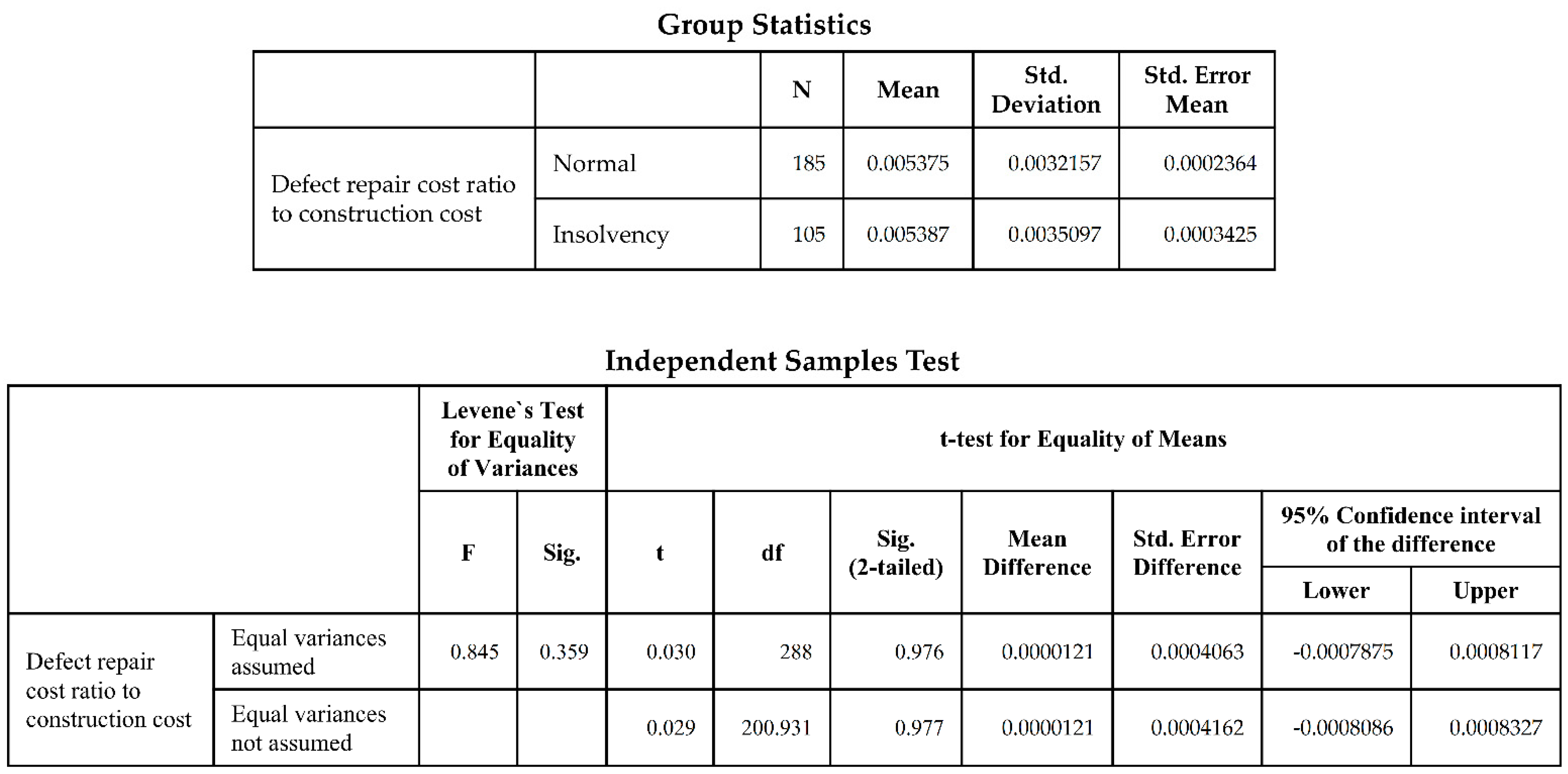

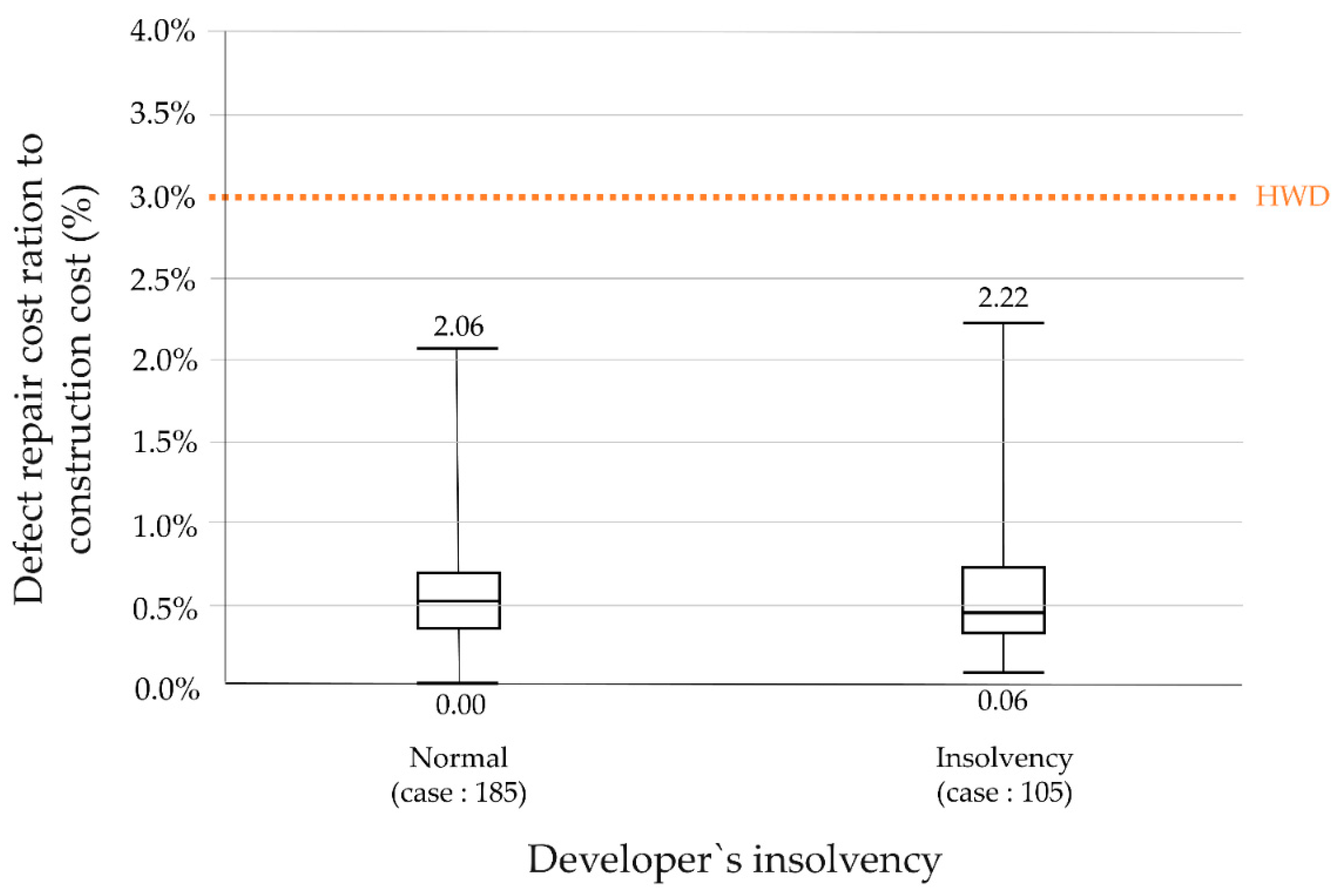

4.3.1. Developer’s Insolvency

4.3.2. Builder’s Insolvency

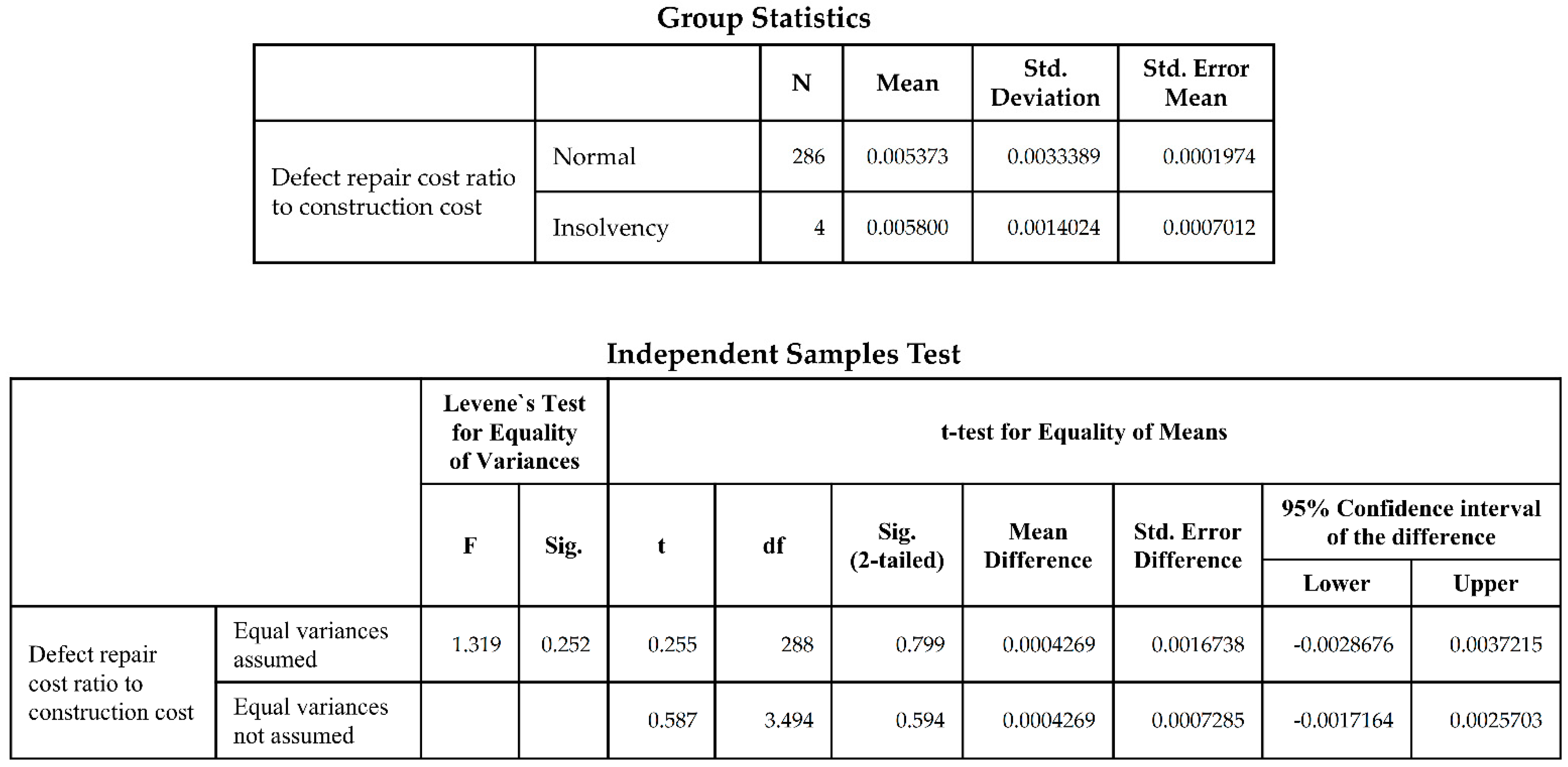

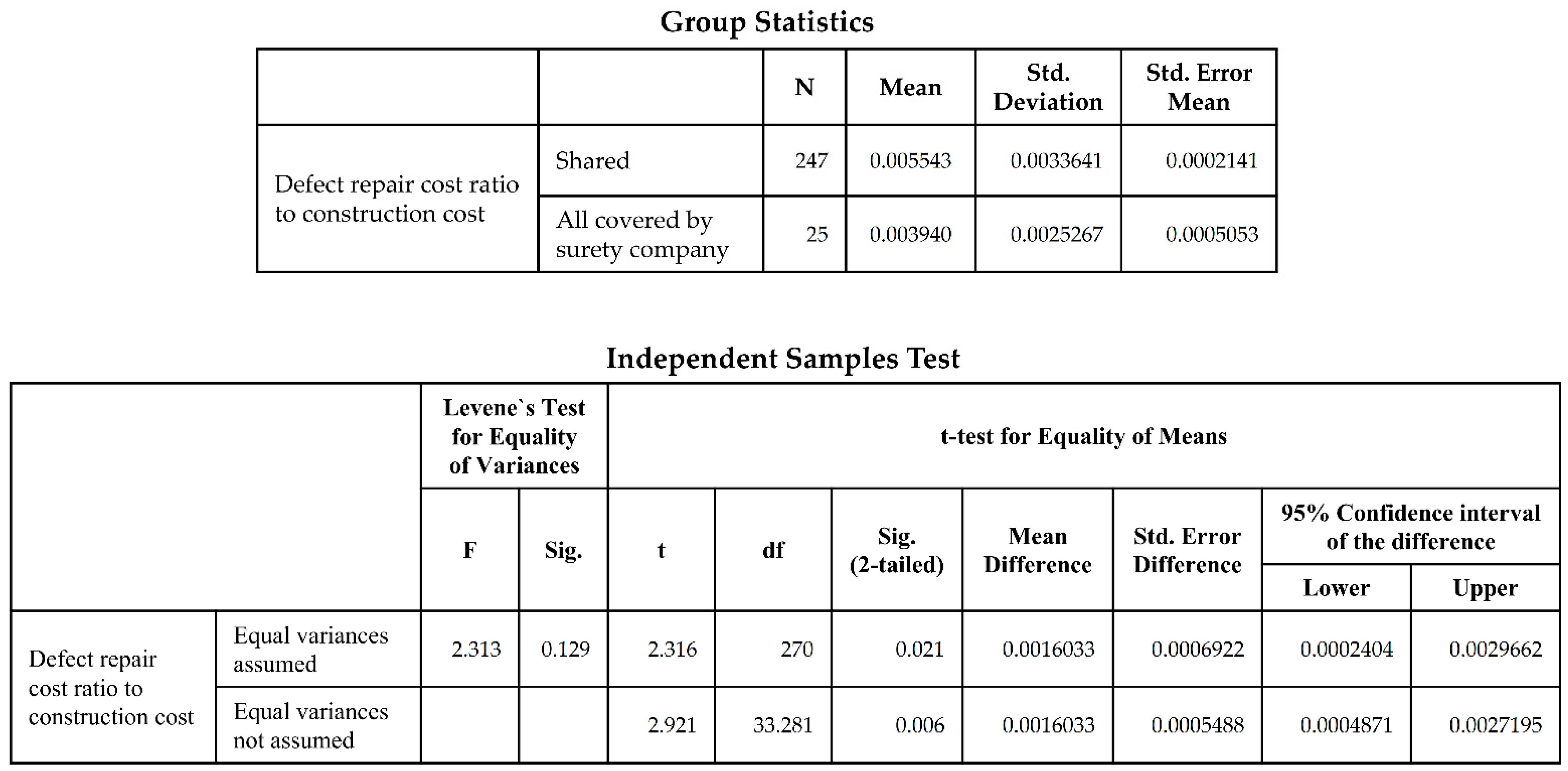

4.3.3. Shared Condition to Defect Repair Cost

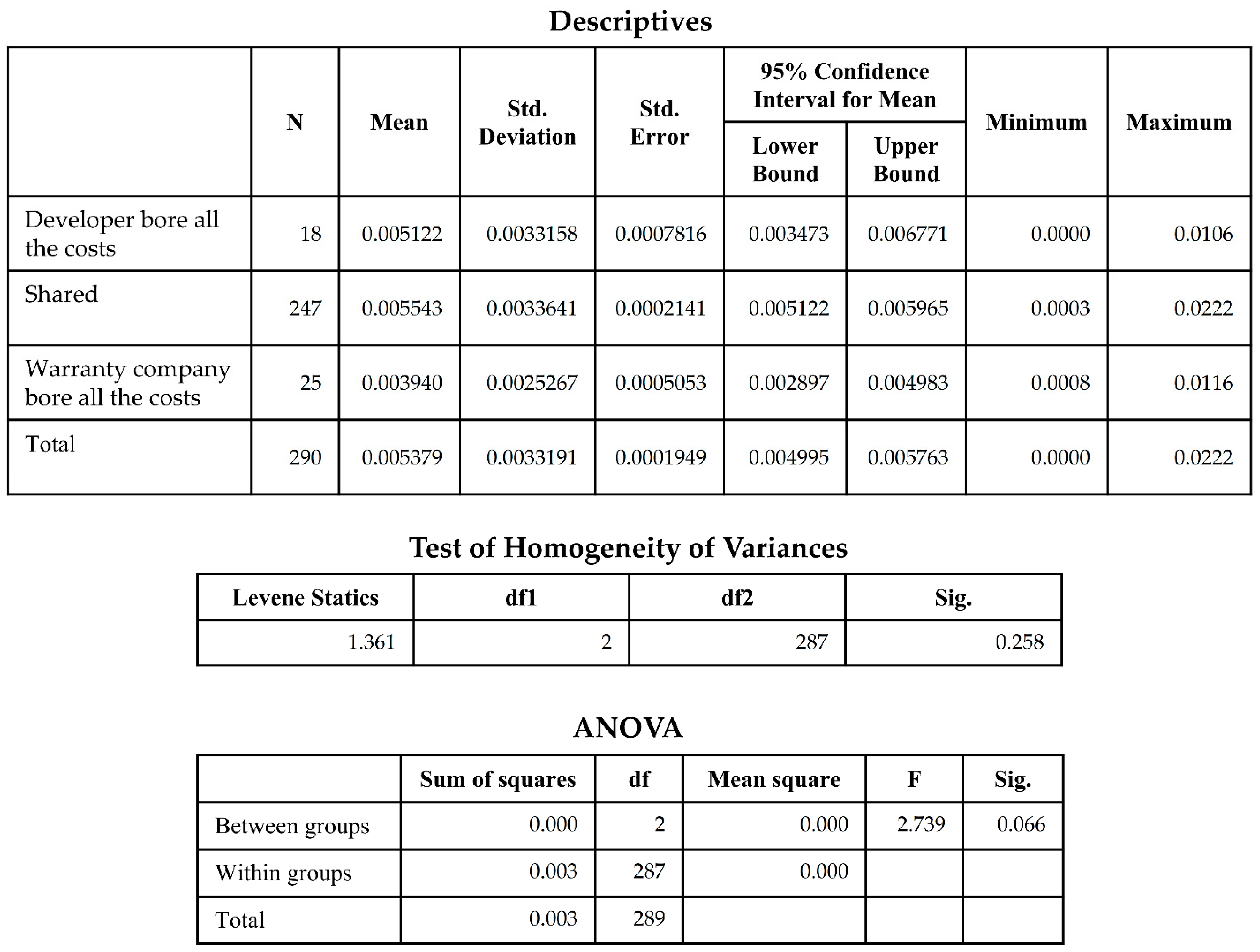

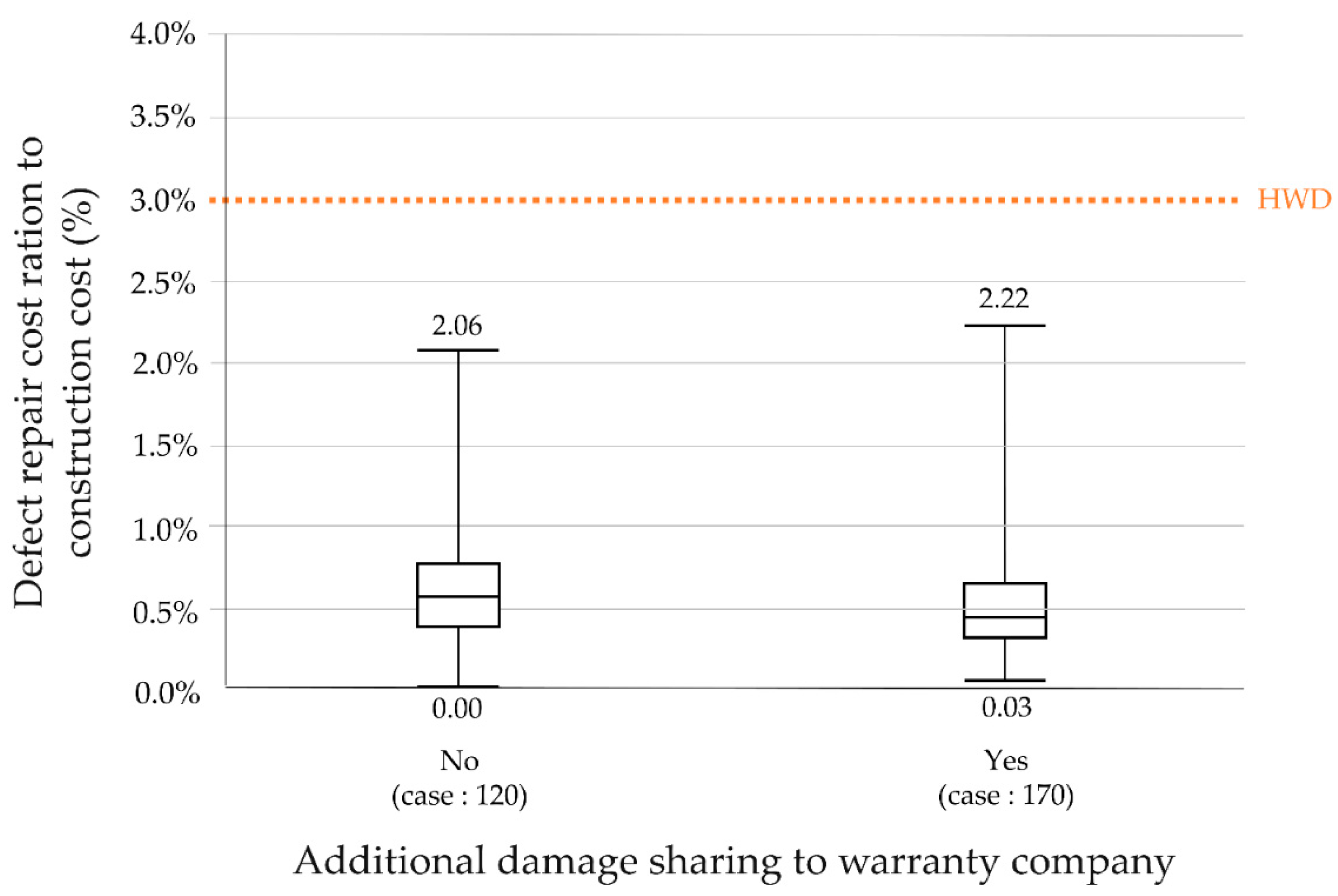

4.3.4. Additional Damage Sharing by The Warranty Company

5. Discussion

5.1. Reasonable Standard of Home Warranty Deposit

5.2. Influence on Project Conditions

5.3. Influence on Lawsuit Issues

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

References

- Zaneldin, E. Construction Claims in United Arab Emirates: Types, causes, and frequency. Int. J. Proj. Manag. 2006, 24, 453–459. [Google Scholar] [CrossRef] [Green Version]

- Gurmu, A.; Krezel, A.; Ongkowijoyo, C. Fuzzy-Stochastic Model to Assess Defects in Low-Rise Residential Buildings. J. Build. Eng. 2021, 40, 102318. [Google Scholar] [CrossRef]

- Aalbers, M. The Great Moderation, the Great Excess and the Global Housing Crisis. Int. J. Hous. Policy 2015, 15, 43–60. [Google Scholar] [CrossRef]

- Winston, N.; Pareja Eastaway, M. Sustainable Housing in the Urban Context: International Sustainable Development Indicator Sets and Housing. Soc. Indic. Res. 2008, 87, 211–221. [Google Scholar] [CrossRef]

- OECD Directorate of Employment, Labour and Social Affairs—Social Policy Division. HM1.1. Housing Stock and Construction. Available online: https://www.oecd.org/els/family/HM1-1-Housing-stock-and-construction.pdf (accessed on 5 July 2022).

- UK Commission for Employment and Skills. Sector Skills Insights: Construction, Evidence Report 50, UK Commissions for Employment and Skills 2012. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/304475/Sector_Skills_Insights_Construction_evidence_report_50.pdf (accessed on 5 July 2022).

- Home Builders Federation. The Economic Footprint of UK House Building, Home Builders Federation 2015. Available online: https://www.hbf.co.uk/documents/6203/Economic_Fotprint_BPF_Report_March_2015_WEB.pdf (accessed on 5 July 2022).

- Hopkin, T.; Lu, S.; Rogers, P.; Sexton, M. Detecting Defects in the UK New-Build Housing Sector: A Learning Perspective. Constr. Manag. Econ. 2016, 34, 35–45. [Google Scholar] [CrossRef]

- Berrio, S.; Cladera, J. Demand Preferences on Residential Building Materials: Case Study with Adaptive Conjoint Analysis. Archit. City Environ. 2020, 15, 1–22. [Google Scholar] [CrossRef]

- Helgesen, M.; Arvesen, P. Policies to Reduce Child Poverty in Norway: Can Municipalities Ensure Positive Functionings for Children through Housing Policies? Societies 2022, 12, 25. [Google Scholar] [CrossRef]

- Auchterlounie, T. Recurring Quality Issues in the UK Private House Building Industry. Struct. Surv. 2009, 27, 241–251. [Google Scholar] [CrossRef]

- HomeOwners Alliance. Homeowner Survey 2019: Top UK Housing Concerns Revealed. Available online: https://hoa.org.uk/2019/08/homeowner-survey-2019 (accessed on 5 July 2022).

- Matsumoto, K.; Matsumura, S.; Tonami, T.; Numaoi, T.; Hokura, S.; Suganuma, Y.; Inagaki, N. Housing and Home Warranty Programs World Research; Organization for Housing Warranty: Tokyo, Japan, 2005. [Google Scholar]

- Smith, D. Builders’ Warranty: First Resort or Last Resort or Does It Really Matter?” Paper Presented at the Institute of Actuaries of Australia XVth General Insurance Seminar, Sydney, Australian, 16–19 October 2005. Available online: https://actuaries.asn.au/Library/gipaper_smith_paper0510.pdf (accessed on 5 July 2022).

- Estienne, J.; Kamei, K. Japan’s House Construction Warranty and Its Reinsurance System. Saf. Sci. Rev. 2013, 3, 21–40. Available online: http://hdl.handle.net/10112/00018568 (accessed on 5 July 2022).

- Apartment Defect Dispute Mediation Committee. Defect Management Information System. Available online: https://www.adc.go.kr (accessed on 5 July 2022).

- Ministry of Land, Infrastructure and Transport. Collapse of HDC Apartment Due to Unauthorized Structural Change. 2022. Available online: http://www.molit.go.kr/LCMS/DWN.jsp?fold=/eng0301/&fileName=(15MAR)%20Collapse%20of%20HDC%20Apartment%20Due%20to%20Unauthorized%20Structural%20Change.pdf (accessed on 5 July 2022).

- Park, J.; Seo, D. Defect Repairing Cost and Its Bond on Apartment Building in Relation to Lawsuit Parties. Int. J. Innov. Technol. Explor. Eng. 2019, 9, 4882–4887. [Google Scholar] [CrossRef]

- Park, J.; Seo, D. Construction Defect and Maintenance Problem of Watering Apparatus and Sanitary Work in Apartment Building. Int. J. Adv. Sci. Technol. 2020, 29, 949–961. [Google Scholar]

- Konno, Y. An Empirical Analysis of the Exit of SMEs Rendering for Public Works in the Japanese Construction Industry. J. Financ. Manag. Prop. Constr. 2014, 19, 101–116. [Google Scholar] [CrossRef]

- Li, L.; Bannerman, P.; Xiang, D.; Elliott, E.; Ewart, G.; Xiaoying, K. The Motives for and Consequences of Underpricing for Construction Contractors—Evidence from Australia. J. Mod. Proj. Manag. 2016, 3, 36–45. [Google Scholar]

- Kostelni, N. Some Unsustainable’ Projects forced the Suburban Contractor to Seek Protection Under Chapter 11. 2017. Available online: http://www.bizjournals.com/philadelphia/news/2017/03/08/eallen-reeves-construction-cre-bankruptcy-filing.html (accessed on 11 December 2021).

- New York Times. Collapse of U.K. Construction Giant Rattles the Government. Available online: http://nytimes.com/2018/01/15/world/europe/carillion-bankruptcy-outsourcing-britain.html (accessed on 5 July 2022).

- Japantimes. Japan’s November Business Failures Hit a 56-Year Low, Survey Shows. Available online: https://www.japantimes.co.jp/news/2021/12/08/business/november-business-failures (accessed on 5 July 2022).

- Economist. How a Housing Downturn Could Wreck China’s Growth Model. Available online: https://www.economist.com/finance-and-economics/how-a-housing-downturn-could-wreck-chinas-growth-model/21805115 (accessed on 5 July 2022).

- Construction Association of Korea. Construction Statstics. Available online: http://www.cak.or.kr/board/boardList.do?boardId=statistic_build&menuId=86 (accessed on 5 July 2022).

- Josephson, P.; Larsson, B.; Li, H. Illustrative Benchmarking Rework and Rework Costs in Swedish Construction Industry. J. Manag. Eng. 2002, 18, 76–83. [Google Scholar] [CrossRef]

- Mills, A.; Love, P.; Williams, P. Defect costs in residential construction. J. Constr. Eng. Manag. 2009, 135, 12–16. [Google Scholar] [CrossRef]

- Hwang, B.; Thomas, S.; Haas, C.; Caldas, C. Measuring the Impact of Rework on Construction Cost Performance. J. Constr. Eng. Manag. 2009, 135, 187–198. [Google Scholar] [CrossRef]

- Choi, J. Evaluation of Defect Repairing Bond Ratio through Defect Lawsuit Case Study in Apartment Building. Ph.D. Dissertation, Chungbuk National University, Cheongju, Korea, 2017. Available online: https://dcollection.chungbuk.ac.kr/public_resource/pdf/000000046423_20220705120413.pdf (accessed on 5 July 2022).

- Forcada, N.; Gangolells, M.; Casals, M. Factors Affecting Rework Costs in Construction. J. Constr. Eng. Manag. 2017, 20, 445–465. [Google Scholar] [CrossRef] [Green Version]

- Love, P.; Teo, P.; Morrison, J. Revisiting Quality Failure Costs in Construction. J. Constr. Eng. Manag. 2018, 144, 05017020. [Google Scholar] [CrossRef]

- Liu, Q.; Ye, G.; Feng, Y.; Wang, C.; Peng, Y. Case-based Insights into Rework Costs of Residential Building Projects in China. Int. J. Constr. Manag. 2020, 20, 347–355. [Google Scholar] [CrossRef]

- Kempner, J. The Home Owners Warranty Program: An Initial Analysis. Stanf. Law Rev. 1976, 28, 357–380. [Google Scholar] [CrossRef]

- Sharp. W. Housing Defect Act 1984; Her Majesty’s Stationery Office: London, UK, 1984. [Google Scholar]

- Housing and Home Finance Agency. Brief Summary of the Housing Act of 1954 Public Law 560, 83rd Congress 68 Stat. 590. Washington DC, USA. 1954. Available online: https://repository.library.northeastern.edu/downloads/neu:bz60jd10c?datastream_id=content#:~:text=The%20Housing%20Act%20of%201954%2C%20approved%20by%20the%20President%200n,intensive%20study%20of%20the%20Federal (accessed on 5 July 2022).

- Meeks, C.; Oudekerk, E. Home Warranties: An Analysis of an Emerging Development in Consumer Protection. J. Consum. Aff. 1981, 15, 271–289. [Google Scholar] [CrossRef]

- Peters, G. How the Magnuson-Moss Warranty Act Affects the Builder/Seller of New Housing. Real Estate Law J. 1977, 5, 338. [Google Scholar]

- Federal Register of Legislation. Trade Practices Amendment (Australian Consumer Law) Act (No. 2) 2010. Available online: https://www.legislation.gov.au/Details/C2012C00868 (accessed on 5 July 2022).

- Abbott, N. Domestic Building Contracts Act 1995. Available online: https://www.cbp.com.au/WWW_CBP/files/1c/1c76e9c7-1a64-4193-a774-2bfcd51596d6.pdf (accessed on 5 July 2022).

- Queen’s Printer. Homeowner Protection Act and Insurance Act. Available online: https://www.bclaws.gov.bc.ca/civix/document/id/complete/statreg/29_99#section7 (accessed on 5 July 2022).

- Matsumoto, K. The New Home Warranty System in Japan. Habitat Int. 1986, 10, 71–92. [Google Scholar] [CrossRef]

- Japanese Digital Agency. Act on Assurance of Performance of Specified Housing Defect Warranty. Available online: https://elaws.e-gov.go.jp/document?lawid=419AC0000000066_20210930_503AC0000000048&keyword=%E4%BD%8F%E5%AE%85 (accessed on 5 July 2022).

- Construction Law of the People’s Republic of China. Available online: https://www.ilo.org/dyn/natlex/docs/ELECTRONIC/76995/108052/F-1117495410/CHN76995%20Eng.pdf (accessed on 5 July 2022).

- Database of Laws and Regulations. Guaranty Law of the People’s Republic of China. Available online: http://www.npc.gov.cn/zgrdw/englishnpc/Law/2007-12/12/content_1383719.htm (accessed on 5 July 2022).

- Korea Ministry of Government Legislation. Housing Act. Korean Law Information Center. Available online: https://www.law.go.kr/LSW/eng/engLsSc.do?menuId=2§ion=lawNm&query=housing+act&x=0&y=0#liBgcolor38 (accessed on 5 July 2022).

- Korea Ministry of Government Legislation. Act on Ownership and Management of Condominium Buildings. Korean Law Information Center. Available online: https://www.law.go.kr/LSW/eng/engLsSc.do?menuId=2§ion=lawNm&query=housing+act&x=0&y=0#liBgcolor2 (accessed on 5 July 2022).

- Korea Ministry of Government Legislation. Framework Act on the Construction Industry. Korean Law Information Center. Available online: https://www.law.go.kr/LSW/eng/engLsSc.do?menuId=2§ion=lawNm&query=Framework+Act+on+the+Construction+Industry&x=0&y=0#liBgcolor31 (accessed on 5 July 2022).

- Korea Ministry of Government Legislation. Multi-Family Housing Management Act. Korean Law Information Center. Available online: https://www.law.go.kr/LSW/eng/engLsSc.do?menuId=2§ion=lawNm&query=Multi-Family+Housing+Management+Act&x=0&y=0#liBgcolor5 (accessed on 5 July 2022).

- Szumowski, W. Transparentność Jednostek Samorządu Terytorialnego. Przegląd Organ. 2019, 5, 47–57. [Google Scholar] [CrossRef]

- Kusio, T. Stakeholders of Public-Private Partnerships in Poland: An Analysis of an Evolving Phenomenon. Int. J. Organ. Anal. 2021, 29, 1483–1505. [Google Scholar] [CrossRef]

- Damoah, I.; Ayakwah, A.; Aryee, K.; Twum, P. The Rise of PPPs in Public Sector Affordable Housing Project Delivery in Ghana: Challenges and Policy Direction. Int. J. Constr. Manag. 2020, 20, 3897. [Google Scholar] [CrossRef]

- Avanzini, M.; Pinheiro, M.; Gomes, R.; Rolim, C. Energy Retrofit as an Answer to Public Health Costs of Fuel Poverty in Lisbon Social Housing. Energy Policy 2022, 160, 112658. [Google Scholar] [CrossRef]

- Martin, C.; Westerhoff, F. Regulating Speculative Housing Markets via Public Housing Construction Programs: Insights from a Heterogeneous Agent Model. J. Econ. Stat. 2019, 239, 627–660. [Google Scholar] [CrossRef] [Green Version]

- Cotter, J.; Richard, R. A Comparative Anatomy of Residential REITs and Private Real Estate Markets: Returns, Risks and Distributional Characteristics. Real Estate Econ. 2014, 43, 209–240. [Google Scholar] [CrossRef]

- Topuz, J.; Isik, I. Meet the ‘Born Efficient’ Financial Institutions: Evidence from the Boom Years of US REITs. Q. Rev. Econ. Financ. 2017, 66, 70–99. [Google Scholar] [CrossRef]

- Grybauskas, A.; Pilinkiene, V. Is the Rest of the EU Missing out on REITs? Eur. J. Manag. Bus. Econ. 2020, 29, 110–122. [Google Scholar] [CrossRef] [Green Version]

- Ambrose, B.; Ehrlich, R.; Hughes, W.; Wachter, M. REIT Economies of Scale: Fact or Fiction? J. Real Estate Financ. Econ. 2000, 20, 211–224. [Google Scholar] [CrossRef]

- Vogel, J. Why the Conventional Wisdom about REITs is Wrong. J. Real Estate Financ. 1997, 14, 7–12. [Google Scholar]

- Kawaguchi, Y.; Schilling, J.; Sa-Aady, J. REIT Stock Price Volatility During the Financial Crisis. Eur. Financ. Manag. 2012, 17, 1–33. Available online: https://www.biz.uiowa.edu/faculty/jsaaadu/REIT_Var_21913.pdf (accessed on 5 July 2022).

- Zou, P.; Couani, P. Managing Risks in Green Building Supply Chain. Archit. Eng. Des. Manag. 2012, 8, 143–158. [Google Scholar] [CrossRef]

- Korkmaz, S.; Riley, D.; Horman, M. Assessing Project Delivery for Sustainable, High-Performance Buildings through Mixed Methods. Archit. Eng. Des. Manag. 2011, 7, 266–274. [Google Scholar] [CrossRef]

- Neap, H.; Aysal, S. Owner’s Factor in Value-Based Project Management in Construction. J. Bus. Ethics 2004, 50, 97–103. [Google Scholar] [CrossRef]

- Serpell, A.; Ferrada, X.; Rubio, N. Fostering the Effective Usage of Risk Management in Construction. J. Civ. Eng. Manag. 2017, 23, 858–867. [Google Scholar] [CrossRef]

- Nooteboom, U. Interface Management Improves on-Time, on-Budget Delivery of Megaprojects. J. Pet. Technol. 2004, 56, 32–34. [Google Scholar] [CrossRef]

- Al-Hammad, A. Common Interface Problems among Various Construction Parties. J. Perform. Constr. Facil. 2000, 14, 71–74. [Google Scholar] [CrossRef]

- Debella, D.; Ries, R. Construction Delivery Systems: A Comparative Analysis of Their Performance within School Districts. J. Constr. Eng. Manag. 2006, 132, 1131. [Google Scholar] [CrossRef]

- Society for Construction Lawsuit in Seoul Central District Court. Construction Appraisal Practice, 3rd ed.; Society for Construction Lawsuit in Seoul Central District Court: Seoul, Korea, 2016. (In Korean) [Google Scholar]

- Ministry of Land, Infrastructure and Transport. Construction Work Standard Estimating System. Available online: http://www.molit.go.kr/USR/BORD0201/m_69/DTL.jsp?id=N01_B&cate=&mode=view&idx=243955&key=&search=%EA%B1%B4%EC%84%A4%EA%B3%B5%EC%82%AC%20%ED%91%9C%EC%A4%80%ED%92%88%EC%85%88&search_regdate_s=2020-12-12&search_regdate_e=2021-12-12&order=&desc=asc&srch_prc_stts=&item_num=0&search_dept_id=&search_dept_nm=&srch_usr_nm=N&srch_usr_titl=Y&srch_usr_ctnt=N&srch_mng_nm=N&old_dept_nm=&search_gbn=&search_section=&source=&search1=%EA%B1%B4%EC%84%A4%EA%B3%B5%EC%82%AC%20%ED%91%9C%EC%A4%80%ED%92%88%EC%85%88&lcmspage=1 (accessed on 5 July 2022).

- Park, J.; Seo, D.; Choi, J.; Kim, O.; Park, K.; Jo, J. Analysis on Legal Issue of Lawsuits and Subjective Judgment on Defects in Apartment Building. J. Korea Inst. Build. Constr. 2012, 12, 42–53. [Google Scholar] [CrossRef] [Green Version]

| Researcher | Scope | Case Quantities | Defect Repair Cost Ratio to Construction Cost | Reference | |||

|---|---|---|---|---|---|---|---|

| Total | Home | Minimum | Average | Maximum | |||

| Josephson. | Various | 7 | 1 | 2.30% | 4.40% | 9.40% | [27] |

| Mill | Home | Unknown | Unknown | - | 4.00% | - | [28] |

| Hwang | Owner | 181 | Unknown | - | 5.40% | - | [29] |

| Contractor | 178 | Unknown | - | 2.20% | - | ||

| Choi | Home | 48 | 48 | - | 1.10% | - | [30] |

| Forcada | Various | 40 | 1 | - | 2.75% | - | [31] |

| Love | Various | 68 | Unknown | - | 0.18% | - | [32] |

| Liu | Home | 6 | 6 | 2.07% | 4.95% | 10.27% | [33] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J.; Seo, D. Defect Repair Cost and Home Warranty Deposit, Korea. Buildings 2022, 12, 1027. https://doi.org/10.3390/buildings12071027

Park J, Seo D. Defect Repair Cost and Home Warranty Deposit, Korea. Buildings. 2022; 12(7):1027. https://doi.org/10.3390/buildings12071027

Chicago/Turabian StylePark, Junmo, and Deokseok Seo. 2022. "Defect Repair Cost and Home Warranty Deposit, Korea" Buildings 12, no. 7: 1027. https://doi.org/10.3390/buildings12071027

APA StylePark, J., & Seo, D. (2022). Defect Repair Cost and Home Warranty Deposit, Korea. Buildings, 12(7), 1027. https://doi.org/10.3390/buildings12071027