1. Introduction

Residential properties with co-living structures have gained popularity due to the allure of shared operating costs and access to high-quality amenities (such as swimming pools, jacuzzi, saunas, tennis courts, gardens, and restaurants) [

1]. For individual residential properties, operating and maintenance costs may be prohibitively high and access to amenities may be limited. However, co-living residential spaces with efficient building maintenance and management have the appeal of lower operating costs. Consequently, the concept of sharing costs among residents has been embraced by many homebuyers, leading to the emergence of housing estates, especially in densely populated cities like Hong Kong [

2]. These large-scale housing estates, characterized by high-rise residential towers, also typically offer ample open spaces and amenities, with some even featuring clubhouses resembling those found in hotels. Employing professional property management with robust security systems and efficient maintenance services further justifies the appeal of such co-living housing arrangements [

3]. Nevertheless, the advantages of co-living in housing estates may be outweighed by their inconveniences. For instance, excessive congestion or poor management could induce significant costs for co-living residential properties [

4].

The concept of sharing spaces and facilities in a housing estate can be viewed as an alternative form of co-living, as co-living is defined as housing arrangements in which individuals have a private self-contained housing space (a house, a flat, or a bedroom) but share a range of communal facilities with others [

5]. Co-living has emerged as a new way of urban living that emphasizes community and convenience [

5]. However, most previous studies on co-living spaces have focused on small-scale arrangements, such as room sharing within a house [

3,

6].

This paper aims to investigate the large-scale effect of co-living, in the form of residential ownership, by examining the economies/diseconomies of scale in housing estates. So far, limited research has been conducted on the economies or diseconomies of scale in co-living within housing estates, primarily due to the scarcity of data on large-scale residential developments worldwide. We utilize data from Hong Kong as the city’s many big housing estates are ideal for providing a wealth of data with multiple transactions within a district that shares common geographical, economic, and local amenity features. Using a revealed preference approach, we conduct an empirical study supplemented by qualitative evidence to examine the hypotheses regarding the economies and diseconomies of scale in co-living.

Specifically, this study leverages a comprehensive housing transaction database in a single district in Hong Kong with many fairly similar high-rise housing estates to examine the premiums or discounts associated with housing estates in that district. In particular, this study investigates the influence of the number of housing units in a housing estate on transaction prices, indicating economies or diseconomies of scale. The research question focuses on the financial costs and benefits of co-living from the perspective of homebuyers. In theory, residents desire access to superior facilities without bearing high management and maintenance costs. Sharing with fellow residents can help reduce operating and maintenance expenses, but may also introduce additional negative externalities (such as congestion and quarrels) and transaction costs (due to poor management). This study therefore posits two hypotheses: (1) housing estates command a premium due to economies of scale, and (2) beyond a certain threshold, economies of scale transition into diseconomies of scale as a result of increased negative externalities and transaction costs. Moreover, we are interested in (3) examining the effect of housing estate age on the relationship between housing estate premium and economies of scale, as operating and maintenance costs tend to become more substantial for aging housing estates. We are also interested in (4) examining the relationship between estate amenities and housing estate premium, as amenities constitute a major benefit of co-living in housing estates.

This paper is divided into six sections, with the subsequent section reviewing the relevant literature on co-living arrangements within housing estates and the factors influencing co-living prices.

Section 3 provides an overview of the data and research design, while

Section 4 and

Section 5 present and discuss the empirical results. Finally,

Section 6 concludes the paper.

2. Related Literature

Co-living arrangements in residential properties have garnered significant attention in recent years as a response to the escalating housing rents in major cities [

3,

7,

8,

9]. Many individuals turn to co-living as a means to attain homeownership in a more delayed fashion or as a viable alternative when traditional homeownership seems unattainable [

10,

11]. Co-living refers to a living arrangement where individuals, sometimes unrelated individuals, or families, live together in a shared space, typically in a residential property or community. This arrangement involves sharing common areas, amenities, and sometimes even resources such as kitchens, living rooms, and bathrooms while also maintaining private living spaces like bedrooms [

3].

Co-living can take various forms, including short-term rental markets and small-scale home sharing facilitated by platforms like Airbnb, which promote sharing economies and sustainability [

12,

13]. The concept of co-living often emphasizes community interaction, socialization, and the sharing of responsibilities and resources among residents [

14,

15]. This study argues that co-living has also been a prevalent practice in many housing estates within high-density cities. These housing estates can be viewed as co-living arrangements, where homeowners come together to share common spaces and estate facilities available within the estates [

16].

The management of these common facilities becomes crucial. Facility management, which involves the coordination of space, infrastructure, people, and organization, plays a significant role in the administration, day-to-day operations, and shaping organizational culture [

17,

18,

19,

20]. The emergence of housing estates resembling hotels can be attributed to residents’ desire to enjoy the comforts and conveniences typically associated with hotel accommodations. These housing estates offer a wide range of clubhouse amenities, contributing to a luxurious living experience and enhancing the perceived value of the properties [

21]. Agents will also present home buyers with the value of these amenities [

22].

Furthermore, efficient building maintenance and management services ensure a hassle-free lifestyle for residents [

23,

24]. One of the primary motivations for residents to opt for hotel-like housing estates is the opportunity to share costs associated with the provisions and the upkeep of facilities. Maintaining and managing these amenities individually would be financially burdensome for homeowners, making the shared cost model an attractive solution [

25]. This shared cost model allows residents to access superior amenities while mitigating the financial strain, leading to the popularity of housing estates, particularly in high-density cities like Hong Kong.

However, it is important to acknowledge that there are drawbacks to co-living arrangements, one of which is the potential loss of privacy [

26,

27]. Privacy is considered a crucial element of individuals’ quality of life, and the absence of privacy in co-living situations can have a negative impact on residents [

27]. It is worth noting, however, that the social interactions and support provided within co-living environments may serve as a potential counterbalance to the concerns related to privacy [

28,

29].

The service quality gap and the level of consumer satisfaction are influenced by the discrepancy between consumers’ perceptions and expectations [

30]. When there is an increased number of residents involved, the upkeep and maintenance of different aspects become more challenging, which can impact resident satisfaction [

31,

32,

33]. In a study conducted by Au-Yong [

34], the factors contributing to the breakdown of lift systems in low-cost, high-rise residential buildings were examined. The findings revealed that ineffective maintenance significantly affected resident satisfaction, highlighting the importance of regular and effective facility maintenance in high-density residential buildings.

Olanrele and Thontteh conducted a study that assessed and compared the delivery of facilities management services in public high-rise residential buildings in Nigeria. Their findings indicated that the availability of services and resident satisfaction varied among different estates, suggesting that the quality of services and the social class of residents can influence satisfaction levels [

30]. Mokhsin et al. developed a mobile application aimed at improving communication and information sharing for high-rise residential management [

35]. This innovative approach has the potential to reduce costs and enhance resident satisfaction. The study highlights the challenges and difficulties faced in enhancing resident satisfaction in high-density residential settings, especially when more residents are involved.

Indeed, co-living arrangements can be viewed as exhibiting economies of scale, particularly in terms of cost sharing and resource utilization. By living together and sharing common spaces, amenities, and facilities, residents can benefit from reduced costs per capita. The pooling of resources allows for greater efficiency and economies in terms of maintenance, utilities, and other shared expenses. Moreover, co-living fosters opportunities for collaborative consumption, where residents can collectively purchase and utilize resources more effectively, potentially leading to cost savings and improved resource allocation.

However, diseconomies of scale within co-living arrangements are possible. The loss of privacy and potential conflicts arising from shared living spaces can lead to a reduction in overall resident satisfaction. As the number of co-living residents increases, coordination and decision-making processes may become more complex, potentially hindering effective management and decision making. Furthermore, the maintenance and management of facilities can become challenging with a larger number of residents, potentially decreasing service quality and resident satisfaction.

Therefore, the extent to which the advantages outweigh the disadvantages in co-living arrangements depends on how to implement effective governance structures, communication channels, and maintenance protocols that can help address challenges associated with increased resident numbers and ensure a positive co-living experience. The success of co-living all depends on striking a balance between the benefits of scale and the effective management of potential drawbacks, thus optimizing the overall experience for residents.

3. Materials and Methods

3.1. Data

We collected 23,979 housing transaction data from the EPRC [

36], which covered all the residential property transactions in the district of Tseung Kwan O (

Figure A1), Hong Kong, from January 2011 to December 2019. We focused on a single district to minimize variations in geography, local economies, and public amenities. All samples were transactions of apartment units, the dominant housing type in Hong Kong. The data set also contained various attributes for controlling their effects on prices. These variables included our primary variable of interest, i.e., estate dummy (co-living or not) and the number of housing units of each estate; and housing structures such as gross floor area, building age, and floor level. As the sale of units of housing estates is open to all interested parties, this implies that co-living households nearby could be strangers. Detailed descriptions of the variables are provided in

Table 1.

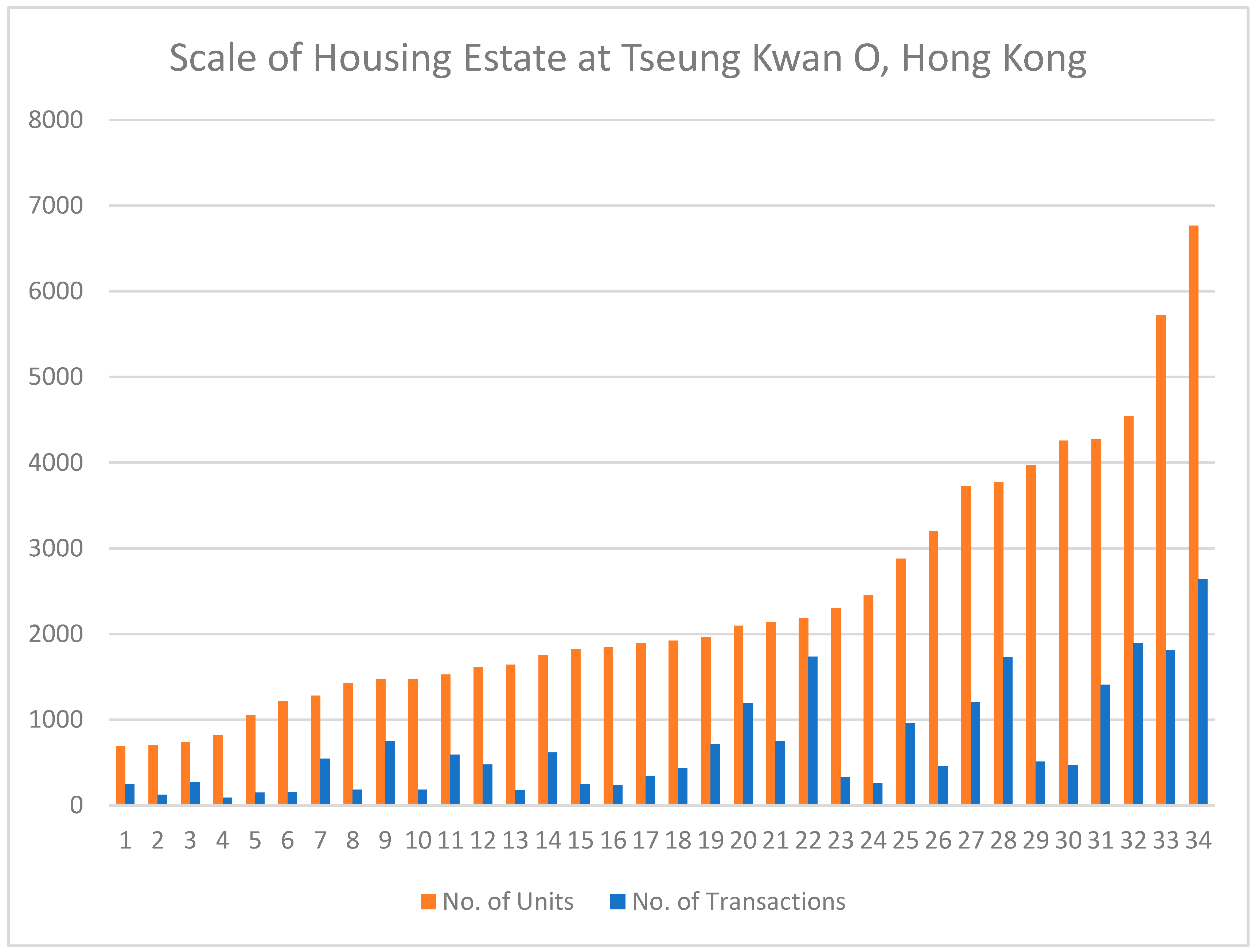

As shown in

Figure 1, there are 34 housing estates in Tseung Kwan O in the sample, and the number of housing units in an estate range from 688 to 6768. The average number of amenities provided in each estate is about 15. All of them were actively transacted in the market during the study period as shown in the number of transactions of each estate in

Figure 1.

3.2. Methodology

The hedonic price model is commonly used to examine the effects of housing attributes. Rosen [

37] theoretically interpreted the hedonic method and more scholars extended it to the housing market [

38,

39]. The model suggests that consumers’ utility is derived from their properties or characteristics. Goods are valued for their utility-bearing attributes, and the bundles of characteristics define a set of implicit prices.

3.3. Baseline Model

This study conducts a conventional semi-log hedonic price model analysis (Equation (1)) on the individual housing level using the listed housing transaction price to test the economy of scale effect of co-living. Many studies have favored and highlighted the advantages of the semi-logarithmic functional form compared to other linear forms. Malpezzi [

40] highlights that the semi-logarithmic form simplifies the interpretation of regression coefficients by representing them as the percentage change in price given a unit change in the housing attribute. Additionally, it accommodates variations in the current value of each housing characteristic and helps mitigate heteroskedasticity issues. Based on these advantages, we adopted the natural logarithm of price (ln(P)) as the dependent variable in our model.

We first conducted a baseline analysis of the premium or discount for co-living in a housing estate. Due to the limitation of non-estate data in the Tseung Kwan O district as shown in

Table 2, our baseline analysis was based on the total sample of Hong Kong. We used a total of 169,339 observations for this analysis across the sample period.

where

represents the natural logarithm of the transaction prices and

represents the estate type dummy. The coefficient

of estate dummy

measures the average premium or discount for housing-estate-type units, (i.e., scope effect).

represent all other control variables, including structure attributes and amenities (GFA, NBED, FLR, AGE, AMN, and BW) of each unit

i, direction dummies where the main windows of a living room of house

i are located, and time dummies in the month when the listing of house

i ends. We also include the district fixed effect. In essence, Model 1 is the baseline model testing the price difference between estate-type and non-estate-type housing units.

We next explore our main research question regarding economies/diseconomies of scale in housing estates by employing a specification estimation with a test sample from housing transactions in the Tseung Kwan O district. This district was selected for its emblematic large-scale, homogeneous, and amenity-rich residential developments, which presents a pertinent context for exploring scale effects in housing markets, as detailed in the

Appendix A.

where

represents the natural logarithm of the transaction prices and

represents the number of housing units

i within the estate. The coefficient of the number of housing units within the estate

measures the average premium or discount for one more housing unit in the estate, (i.e., the scale effect). We also include the quadratic term of the number of housing units, as we expect changing marginal utility in the economies of scale.

represent all other control variables. In essence, Model 2 examines the economies and diseconomies of scale of co-living in housing estates.

Subsequently, we examine the role of building age in moderating scale effects by implementing Model 3. Within this model, we incorporate an interaction term—the product of the number of units and the estate’s age—to explore its moderating impact of building age on the scale effects discernible in the housing transaction prices within the TKO area.

where the interaction term,

, is introduced to evaluate the moderation effect. Its coefficient elucidates the nuanced influence of building age on the scale effect in the housing transaction prices.

4. Results

4.1. Empirical Results of the Economies and Diseconomies of Scale of Housing Estates

Table 3 shows the empirical results of the estimations. The baseline model (Model 1), using all housing transactions in Hong Kong, shows a strong positive coefficient on estate-type housing units, indicating that homebuyers are willing to pay a 7.8% premium on average for estate-type developments. Such a premium is well perceived in the markets, though it is not the focus of our study to examine the determinants of the premium.

Model 2, confined to estate-type transactions in Tseung Kwan O only, examines our main research question of economies of scale in co-living residential arrangements. The results show an inverted U-shaped effect of the number of housing units in the estate on housing prices (

Figure 2). In fact, the coefficient of the number of units is positive and significant, which confirms the economies of scale hypothesis that a larger housing estate can have a higher premium in housing prices before the threshold in diseconomies of scale, ceteris paribus. The estimated coefficients are statistically significant at the 1% level.

We next observe a negative coefficient for the quadratic term, indicating decreasing returns when housing estates become too large. The turning point is estimated to be about 5031 housing units (−1.254 × 10

−4/(2 × −1.247 × 10

−8)), which covers about 81% of all the transactions in the sample. This implies that the market generally optimizes the economies of scale effect of housing estates until the estates become too big to manage. This finding is consistent with some previous research results [

41], indicating that there is an optimal range for housing estate development scale. Subsequently, further exploration investigates the moderating effects of various factors on this scale effect.

Model 3 is the model testing the moderating effect of building age on the scale effect of a housing estate on housing prices. The results show that the scale effect is more valuable in younger housing estates, where building maintenance costs are much lower. This supports the hypothesis that the premium on the scale effect is on sharing amenities but avoiding high maintenance costs. The results indicate that estates will have a positive scale effect until they pass 77.3 years of age (−3.234 × 10−5/−3.487 × 10−8)/12, which exceeds the general design life span (50 years) of housing structures in Hong Kong. While acknowledging the impact of building age in younger estates, the result suggests a greater appeal for investors due to notable scale effects. For developers, focusing on sensible development scale planning early on means that the advantages of scale effects will not markedly diminish as buildings age, offering even more justification for well-thought-out housing development projects.

4.2. Additional Analyses on Amenities

We further conducted two additional tests on the effects of the number of amenities on housing premium.

Table 4 shows the empirical results of the estimations. Model 4 examines the non-linear effects of the number of amenities on housing premia. The results also show an inverted U-shaped effect of the number of amenities in the estate on housing prices, with the turning point at about 31 amenities (−0.024/(2 × −0.0004)). The estimated coefficients are statistically significant at the 1% level. In Model 5, we introduced an interaction term to examine how the number of amenities moderates the scale effect of housing estates on price premiums. The results show the positive and significant effects of the number of units and the number of amenities on prices, but the negative and significant coefficient of the interaction term between the number of units and the number of amenities implies that the positive scale effect on price premium will become negative (i.e., diseconomies of scale) when the number of amenities exceeds 21 (−0.0001/(−4.67 × 10

−6)).

4.3. Case Study

The economies of scale benefits are likely to be derived from the sharing of more and better amenities, as well as the sharing of management and maintenance costs of the estates. Trying to triangulate the association between estate scale, number of amenities, and management fees, we conducted a case analysis of eighteen residential complexes, for which we could obtain sufficient information, in the district. These selected estates collectively represent a significant portion (more than half) of the residential complexes previously analyzed in the Tseung Kwan O district. The selection criteria encompassed a diverse range of scales and features, providing insights into co-living dynamics across different contexts.

Among these samples, seven estates provided a less-than-average number of amenities, i.e., fewer than 15 amenities, as shown in blue dots in

Figure 3. Conversely, the remaining eleven estates exhibited more comprehensive amenities, totaling 15 or more, as shown in orange dots in

Figure 3. Notably, the mean property management fee for complexes with a less-than-average number of amenities was HKD 2.2 per square foot, while those with a greater-than-average number of amenities averaged around HKD 2.9 per square foot. This observation implies a potential correlation between an increased number of amenities and a corresponding rise in property management costs, as the maintenance and operation demand of a greater-than-average number of amenities could escalate overall expenses, especially when the amenities become old and dilapidated. However, it is noteworthy that we have observed instances where certain estates with abundant amenities exhibit comparatively lower management fees. This intriguing observation persists across both groups characterized by high and low amenity counts.

Expanding on the insights gained from the observations regarding the relationship between amenity counts and management fees, a deeper understanding of the underlying dynamics comes into focus. While the number of amenities positively correlates with unit management fees, another significant determinant emerges—the scale effect.

Figure 4 shows a nuanced relationship between estate scale and unit management fees emerges. Notably, when the scale of estates is between around 1000 units and 2500 units, a discernible increase in management fees is apparent. This trend signifies the potential higher costs of sharing the facilities per square foot of floor area. This scenario probably reflects that within a certain lower range of scale, the heightened provision of amenities can result in a substantial rise in the costs associated with management and maintenance shared by each square foot of floor area.

However, complexes exhibit a contrasting trend beyond an estate scale of 2500 units. With an increase in scale, these complexes manifest a substantial decrease in management fees. This observation aligns with the concept of economies of scale, signifying the effective allocation of costs in larger-scale properties with an appropriate number of amenities. The downward trend implies that the benefits of scale outweigh the potential costs associated with increased management complexity.

The symbiotic relationship from

Figure 3 and

Figure 4 implies that when an estate goes above and beyond in terms of the optimal number of provided amenities, it can inadvertently trigger a shift towards diseconomies of scale. This outcome is attributed to the heightened costs associated with the management and maintenance of an extensive range of amenities. In essence, while ample facilities contribute positively to residents’ living experience, the balance must be carefully maintained to avoid crossing the threshold into diseconomies of scale. The sustainability of lower management fees with increasing estate scales and the possibility of rising costs due to managing larger communities necessitates further investigation, highlighting the multifaceted nature of the scale-management costs relationship.

This case analysis aligns with the previous models proposed in the study, supporting the hypothesis of the presence of economies of scale on housing estate developments. These findings collectively support the conclusions drawn from the quantitative models, enhancing understanding of co-living dynamics and emphasizing the cost-sharing benefits of larger estates with an optimal number of amenities.

5. Discussion

This empirical study investigates the economies and diseconomies of scale in housing estates, focusing on amenity-sharing arrangements. Findings offer insights into the premium for estate-type units, economies of scale within estates, and moderating effects of building age and amenities. First, Model 1 identified a significant 7.8% premium for estate-type housing units, reflecting buyer willingness to pay for amenity sharing in a housing estate. Model 2 examines economies of scale, showing an inverted U-shaped effect. Larger estates command a premium up to around 5031 units, beyond which the positive effect diminishes, indicating potential diseconomies of scale. Model 3 underscores a subtle, yet significant value in younger estates, deriving not from immediate price impact but from potential future gains. This discovery, tied to lower maintenance and contemporary amenities, sends a clear message to developers and policymakers: reasonable development planning at early development stages is crucial to unlock all benefits from the scale effect. Additional tests confirm the relationship between amenities and prices, with an optimal amenity number enhancing prices, but excessive amenities leading to diminishing returns (Model 4). Model 5 shows this amenity effect can shift economies of scale to diseconomies.

The case study of eighteen complexes reinforces the findings. It shows a positive correlation between amenities and unit management fees, alongside the influence of estate scale on fees. Larger estates exhibit decreasing management costs, supporting economies of scale. However, the study also indicates when the group of estates providing more amenities charges higher on average management fees, which can be a cause of diseconomies of scale. This is attributed to not only the costs of purchasing and installing the amenities, but also related to managing and maintaining them. Consequently, an over-provision of amenities can result in these costs not being effectively shared, causing an overall increase in expenses per housing unit as the scale grows. These insights contribute to a comprehensive understanding of the interplay between scale, amenities, and management costs in housing developments.

In summary, this study illuminates the dynamics of sharing or co-living arrangements in housing estates. These insights are pertinent for developers and homebuyers, emphasizing the importance of optimizing estate size and amenities for cost-sharing advantages and effective management. Future research can expand these insights to other regions and property types, enhancing our understanding of co-living’s influence on housing markets.

6. Conclusions

This study provides two major contributions. First, it tests the hypothesis of estate premium and the economies/diseconomies of scale effect of co-living in housing estates. The results confirm a premium (of about 7.8%) from an estate-type housing unit in comparison with a non-estate-type housing unit. The result reveals the market preference for co-living in housing estates. Furthermore, the results show a housing estate’s economies of scale effect, as the scale effect on prices is increasing at a decreasing rate up to about 5031 units, which covers almost 81% of the sample. The scale effect, however, is positive and stronger in younger estates, implying that the benefits of co-living in housing estates are sharing management and maintenance costs of facilities in aging buildings.

In high-density and high-rise cities, such as Hong Kong, housing units are generally in apartment-sharing building structures and open spaces. This develops a vertical city model, enabling hotel-like residential developments with shared clubhouse facilities and spaces [

41,

42]. Cost sharing among homeowners in the estates allows them to enjoy more and better facilities and management and maintenance services. Yet, it can be very costly to operate and maintain these facilities; it usually requires an account of sinking funds from a large number of contributors for many years to ensure sustainable operations of the facilities [

43,

44]. Thus, the premium of aged housing estates can come from a large amount of sinking funds, besides the benefits of space and facilities.

This study is novel in its exploration of the costs and benefits of co-living among owner-occupied homeowners in big cities. This finding has important practical and policy implications for developing and governing co-living spaces in cities, especially on the scale of the developments [

41,

45]. However, the study is limited by being confined to a single district in Hong Kong, and due to the lack of a full set of data on management fees, the empirical study cannot test the scale implications on management fees. A case study of 18 housing estates in the district was therefore incorporated to examine the relationships between estate scale, number of facilities, and management fees. The case study results support the empirical findings.

Building upon this study’s findings concerning economies and diseconomies of scale in co-living models, an intriguing avenue for future research would be studying the relationship between these models and fluctuations in the global real estate market more deeply. Specifically, the capability of co-living to act as a way to make housing more affordable warrants further exploration. Additionally, moving beyond the economic lens of this study, the environmental dividends of co-living warrant a crucial exploration, notably its potential to enhance energy sharing and mitigate an estate’s carbon emissions, thereby facilitating sustainable urban development. The escalating global emphasis on environmental conservation and sustainability underscores the urgency and relevance of such an investigation. Moreover, there remains an untapped opportunity to assess the potentials and challenges of implementing co-living models in diverse socio-economic and cultural landscapes. This entails exploring the role of scale in various contexts, including urban renewal areas or slums, where the interplay of social diversity and resident identity may lead to distinct patterns in residential satisfaction and safety perceptions. Understanding the psychological factors that underlie these differences in scale effects will shed light on effective implementation strategies. Furthermore, comparing different co-living models, particularly those serving various age demographics, presents an opportunity to explore possible differences or similarities in economic benefits, management effectiveness, and local economic impacts, enriching our understanding of co-living’s diverse implications across varied urban contexts.

In conclusion, this study not only provides valuable insights into the economies and diseconomies of scale in co-living but also opens doors to an array of intriguing research opportunities. By examining the interplay between co-living and real estate markets, probing its environmental impact, and considering its applicability across diverse contexts, future research can make significant contributions to the field of urban development and housing.

Author Contributions

Conceptualization, K.S.C., D.T. and C.Y.Y.; methodology, K.S.C., D.T. and C.Y.Y.; formal analysis, Z.C., K.S.C., D.T. and C.Y.Y.; investigation, Z.C., K.S.C., D.T. and C.Y.Y.; resources, Z.C., K.S.C. and D.T.; data curation, Z.C., K.S.C. and D.T.; writing—original draft preparation, Z.C., K.S.C., D.T. and C.Y.Y.; writing—review and editing, Z.C., K.S.C., D.T. and C.Y.Y.; supervision, K.S.C., D.T. and C.Y.Y.; project administration, K.S.C., D.T. and C.Y.Y.; funding acquisition, K.S.C. and C.Y.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the University of Auckland Business School, grant number (Grant Ref.: 9507-3722103) and the University of Auckland Early Career Researcher Excellence Award 2022 (Grant Ref.: 9490-3726886).

Data Availability Statement

House price data were collected from the EPRC database [

36] which is accessible via subscription from the Chinese University of Hong Kong. The amenity quantity data and management fee information are publicly available at the Centaline Property Agency (

https://hk.centanet.com/info/en/index, accessed on 10 August 2023).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Background of Tseung Kwan O Housing Estate Developments

Tseung Kwan O (TKO) new town, with a population of 396,000 over 17.18 km2 in 2016, located in the eastern part of the New Territories, Hong Kong, is renowned for its vibrant residential estates. TKO has witnessed rapid development and transformation over the years, evolving into a bustling and thriving community. The distinctive characteristic of TKO lies in its homogeneous estate features, where large-scale housing developments dominate the landscape.

The estates in TKO are marked by their uniform architectural styles, reflecting a cohesive and harmonious design approach. The housing estates in the area showcase a blend of modern aesthetics and practical functionality. With their high-rise buildings and well-planned layouts, the estates exude a sense of order and efficiency, creating a visually appealing and homogenous environment for residents.

The development of TKO’s estates has been notable for its speed and scale. The area has experienced a remarkable surge in population and urbanization, leading to the creation of numerous large-scale housing developments. These developments, comprising both public housing estates and private residential complexes, have provided a wide range of housing options to cater to the diverse needs of residents.

What sets the estates of TKO apart is the wealth of facilities they offer within each residential complex. These estates are designed with the aim of providing residents with a comprehensive and self-contained living environment. Each estate is equipped with a multitude of amenities and facilities, including clubhouse facilities, recreational spaces, shopping centers, educational institutions, and healthcare services. The abundance of facilities within the estates ensures that residents have easy access to essential services and recreational opportunities, fostering a convenient and fulfilling lifestyle.

In summary, Tseung Kwan O is characterized by its homogeneous estate features, rapid development, and a multitude of facilities within each estate. The cohesive architectural designs, coupled with the extensive amenities, contribute to the appeal and livability of the residential estates in TKO, making it an attractive choice for individuals seeking a well-planned and amenity-rich living environment.

Figure A1.

Map of Tseung Kwan O, Hong Kong. Source: Esri [

46]. The map was created using ArcGIS

® software by Esri. ArcGIS

® and ArcMap™ are the intellectual property of Esri and are used herein under license. Copyright © Esri. For more information about Esri

® software, please visit

www.esri.com (accessed on 10 August 2023).

Figure A1.

Map of Tseung Kwan O, Hong Kong. Source: Esri [

46]. The map was created using ArcGIS

® software by Esri. ArcGIS

® and ArcMap™ are the intellectual property of Esri and are used herein under license. Copyright © Esri. For more information about Esri

® software, please visit

www.esri.com (accessed on 10 August 2023).

References

- Times Property. The Rising Trend of Co-Living Spaces. Times Property, 25 January 2023. Available online: https://timesproperty.com/news/post/rising-trend-of-co-living-spaces-blid3772?fbclid=IwAR3-h72w5CdeuF6CSecmOdI-8kkkpkjaoKxXUhFwOrkeH25jL7Ep2TS3vNA#2(accessed on 2 February 2023).

- Leung, K.M.; Yiu, C.Y. How do the poor survive in an unaffordable city?—An empirical study of informal housing households living in Hong Kong. Int. J. Urban Sci. 2022, 26, 398–419. [Google Scholar] [CrossRef]

- Corfe, S. Co-Living: A Solution to the Housing Crisis? Social Market Foundation: London, UK, February 2019; Available online: https://thinkhouse.org.uk/site/assets/files/1885/smf0219.pdf (accessed on 2 February 2023).

- Springer, T.; Waller, N. Maintenance of residential rental property: An empirical analysis. J. Real Estate Res. 1996, 12, 89–99. [Google Scholar] [CrossRef]

- Coricelli, F. The co-’s of co-living: How the advertisement of living is taking over housing realities. Urban Plan. 2022, 7, 296–304. [Google Scholar] [CrossRef]

- Yiu, C.Y.; Cheung, K.S.; Xiong, C. Economies of scale of co-living—An empirical study of the New Zealand rental housing markets. Pac. Rim Prop. Res. J. 2023, 28, 1–19. [Google Scholar] [CrossRef]

- Maalsen, S. I cannot afford to live alone in this city and I enjoy the company of others: Why people are share housing in Sydney? Aust. Geogr. 2019, 50, 315–332. [Google Scholar] [CrossRef]

- Kim, J.; Woo, A.; Cho, G.-H. Is shared housing a viable economic and social housing option for young adults? Willingness to pay for shared housing in Seoul. Cities 2020, 102, 102732. [Google Scholar] [CrossRef]

- Heath, S.; Davies, K.; Edwards, G.; Scicluna, R. Shared Housing, Shared Lives: Everyday Experiences across the Lifecourse; Routledge: London, UK, 2017. [Google Scholar]

- Druta, O.; Ronald, R.; Heath, S. Urban singles and shared housing. Soc. Cult. Geogr. 2021, 22, 1195–1203. [Google Scholar] [CrossRef]

- Forrest, R.; Murie, A.; Williams, P. Home Ownership: Differentiation and Fragmentation; Routledge: London, UK, 2021. [Google Scholar]

- Cheung, K.S.; Yiu, C.Y. Touristification, Airbnb and the tourism-led rent gap: Evidence from a revealed preference approach. Tour. Manag. 2022, 92, 104567. [Google Scholar] [CrossRef]

- Yiu, C.Y.; Cheung, K.S. Urban zoning for sustainable tourism: A continuum of accommodation to enhance city resilience. Sustainability 2021, 13, 7317. [Google Scholar] [CrossRef]

- Von Zumbusch, J.S.H.; Lalicic, L. The role of co-living spaces in digital nomads’ well-being. Inf. Technol. Tour. 2020, 22, 439–453. [Google Scholar] [CrossRef]

- Markle, E.A.; Rodgers, R.; Sanchez, W.; Ballou, M. Social support in the cohousing model of community: A mixed-methods analysis. Community Dev. 2015, 46, 616–631. [Google Scholar] [CrossRef]

- Durrett, C.; McCamant, K. Creating Cohousing: Building Sustainable Communities; New Society Publishers: Gabriola Island, BC, Canada, 2011. [Google Scholar]

- Bengtsson, B. Tenants’ dilemma-on collective action in housing. Hous. Stud. 1998, 13, 99–120. [Google Scholar] [CrossRef]

- Yip, N.M.; Forrest, R. Property owning democracies? Home owner corporations in Hong Kong. Hous. Stud. 2002, 17, 703–720. [Google Scholar] [CrossRef]

- Alexander, K. (Ed.) Facilities Management: Theory and Practice; Routledge: London, UK, 2013. [Google Scholar]

- Ho, D.C.; Gao, W. Collective action in apartment building management in Hong Kong. Habitat Int. 2013, 38, 10–17. [Google Scholar] [CrossRef]

- Small, K.A.; Steimetz, S.S. Spatial hedonics and the willingness to pay for residential amenities. J. Reg. Sci. 2012, 52, 635–647. [Google Scholar] [CrossRef]

- Xiong, C.; Cheung, K.S. Understanding sellers’ agents in the residential property market. Int. J. Strateg. Prop. Manag. 2021, 25, 179–189. [Google Scholar] [CrossRef]

- Losada-Baltar, A.; Jiménez-Gonzalo, L.; Gallego-Alberto, L.; Pedroso-Chaparro, M.D.S.; Fernandes-Pires, J.; Márquez-González, M. We are staying at home: Association of self-perceptions of aging, personal and family resources, and loneliness with psychological distress during the lock-down period of COVID-19. J. Gerontol. Ser. B 2020, 76, 10–16. [Google Scholar] [CrossRef] [PubMed]

- Gaeta, L.; Brydges, C.R. Coronavirus-related anxiety, social isolation, and loneliness in older adults in Northern California during the stay-at-home order. J. Aging Soc. Policy 2020, 33, 320–331. [Google Scholar] [CrossRef]

- El-Haram, M.A.; Horner, M.W. Factors affecting housing maintenance cost. J. Qual. Maint. Eng. 2002, 8, 115–123. [Google Scholar] [CrossRef]

- De Macedo, P.F.; Ornstein, S.W.; Elali, G.A. Privacy and housing: Research perspectives based on a systematic literature review. J. Hous. Built Environ. 2022, 37, 653–683. [Google Scholar] [CrossRef] [PubMed]

- Bashari, S.; Hashim, A.H.; Samah, A.A.; Ahmad, N. The moderating effect of privacy in the relationships between residential livability and residents’ life satisfaction. J. Constr. Dev. Ctries. 2021, 26, 45–62. [Google Scholar] [CrossRef]

- McCartney, S.; Rosenvasser, X. Privacy territories in student university housing design: Introduction of the hierarchy of isolation and privacy in architecture tool (HIPAT). SAGE Open 2022, 12, 21582440221089953. [Google Scholar] [CrossRef]

- Cho, G.H.; Woo, A.; Kim, J. Shared housing as a potential resource for community building. Cities 2019, 87, 30–38. [Google Scholar] [CrossRef]

- Olanrele, O.; Thontteh, E. FM service delivery and quality service measurement in public high rise residential buildings in Nigeria: The use of SERVQUAL and satisfaction index. J. Manag. Sustain. 2014, 4, 145–155. [Google Scholar] [CrossRef]

- Ramli, A.M.A.; Harun, A.N.; Nawi, M.M.; Haron, N.A. Systematic review on the attributes of resident satisfaction measurement in the facility management context. J. Adv. Res. Bus. Manag. Stud. 2020, 21, 27–39. [Google Scholar] [CrossRef]

- Van Mossel, H.J.; Jansen, S.J. Maintenance services in social housing: What do residents find important? Struct. Surv. 2010, 28, 215–229. [Google Scholar] [CrossRef]

- Van Rysin, G.G. The impact of resident management on residents’ satisfaction with public housing: A process analysis of quasi-experimental data. Eval. Rev. 1996, 20, 485–506. [Google Scholar] [CrossRef]

- Au-Yong, C.P.; Azmi, N.F.; Mahassan, N.A. Maintenance of lift systems affecting resident satisfaction in low-cost high-rise residential buildings. J. Facil. Manag. 2018, 16, 17–25. [Google Scholar] [CrossRef]

- Mokhsin, M.; Shahuddin, A.Z.; Zainol, A.S.; Som, M.H.M.; Hazemi, N.B. A prototype of high rise residential management systems in Malaysia: A case study for Seroja Apartment. Int. J. Innov. Enterp. Syst. 2020, 4, 1–11. [Google Scholar] [CrossRef]

- EPRC. Hong Kong Housing Database. 2022. Available online: http://easyaccess.lib.cuhk.edu.hk/limited/hkhousing.htm (accessed on 2 February 2023).

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Yan, W. Factors affecting the accommodation price of shared rental platforms under the epidemic—Empirical analysis based on big data. In Proceedings of the 2020 International Conference on Big Data and Social Sciences (ICBDSS), Xi’an, China, 14–16 August 2020. [Google Scholar] [CrossRef]

- Leung, K.M.; Yiu, C.Y. Rent determinants of sub-divided units in Hong Kong. J. Hous. Built Environ. 2019, 34, 133–151. [Google Scholar] [CrossRef]

- Malpezzi, S. Hedonic pricing models: A selective and applied review. Hous. Econ. Public Policy 2003, 1, 67–89. [Google Scholar]

- Tang, B.; Yiu, C.Y. Space and scale: A study of development intensity and housing price in Hong Kong. Landsc. Urban Plan. 2013, 96, 172–182. [Google Scholar] [CrossRef]

- Chan, E.H.; Tang, B.S.; Wong, W.S. Density control and the quality of living space: A case study of private housing development in Hong Kong. Habitat Int. 2002, 26, 159–175. [Google Scholar] [CrossRef]

- Yau, Y.; Ho DC, W. The effects of building management practices on residential property prices in Hong Kong. J. Build. Apprais. 2009, 4, 157–167. [Google Scholar] [CrossRef]

- Ho, D.C.W.; Chau, K.W.; Cheung, A.K.C.; Yau, Y.; Wong, S.K.; Leung, H.F.; Lau, S.S.Y.; Wong, W.S. A survey of the health and safety conditions of apartment buildings in Hong Kong. Build. Environ. 2008, 43, 764–775. [Google Scholar] [CrossRef]

- Cheung, K.S.; Wong, S.K.; Wu, H.; Yiu, C.Y. The land governance cost on co-ownership: A study of the cross-lease in New Zealand. Land Use Policy 2021, 108, 105561. [Google Scholar] [CrossRef]

- Esri. “Topographic” [Basemap]. “World Topographic Map”. Available online: https://www.arcgis.com/home/webmap/viewer.html?layers=b9b1b422198944fbbd5250b3241691b6 (accessed on 10 August 2023).

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

_Cheung.jpeg)