The Net Zero Emissions Decision Model of the Sustainable Path of Chinese Business Parks

Abstract

:1. Introduction

1.1. Background

1.2. Literature Review

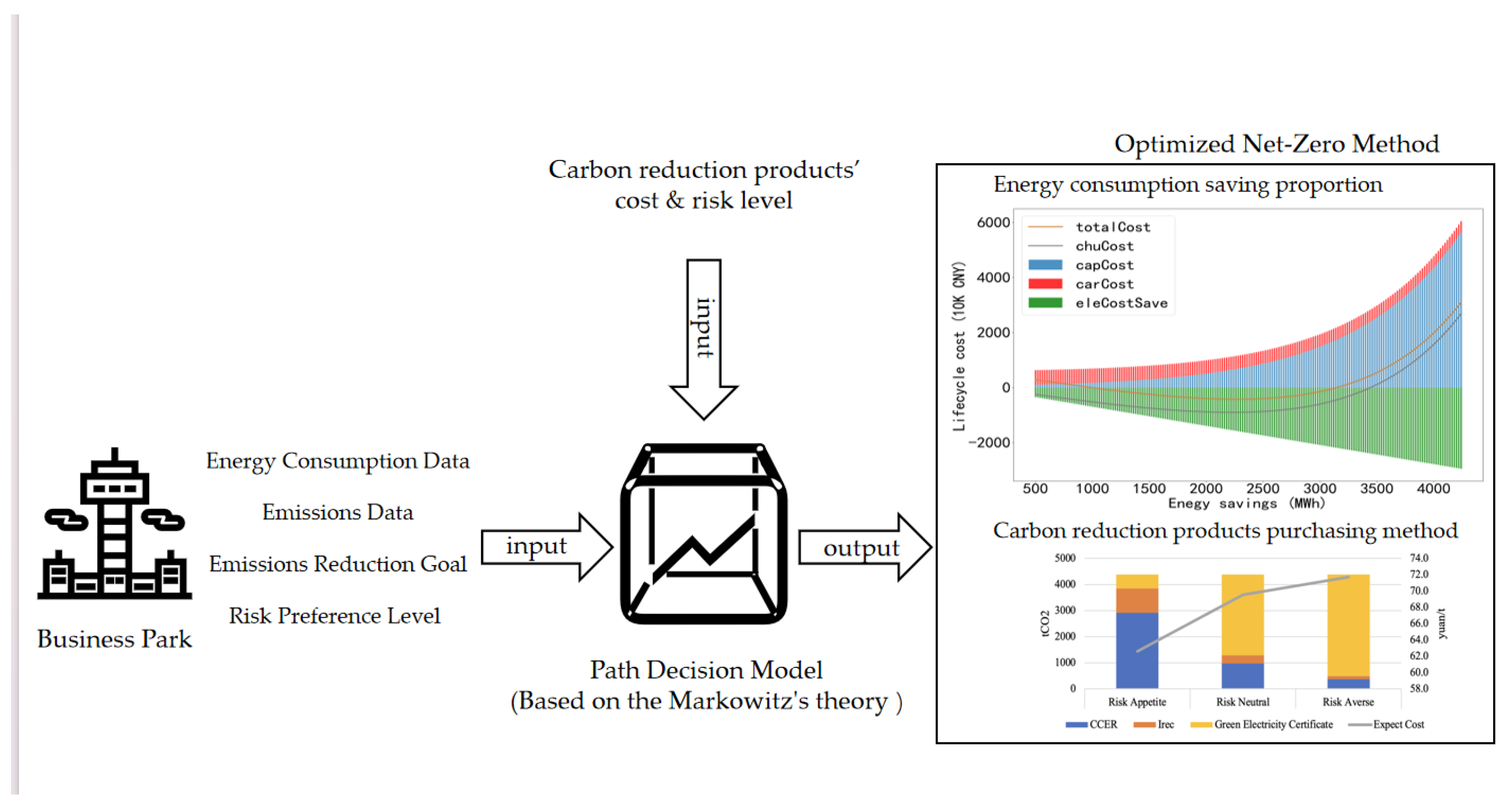

1.3. Framework

2. Materials and Methods

2.1. Park Energy Consumption and Carbon Emission Benchmarks

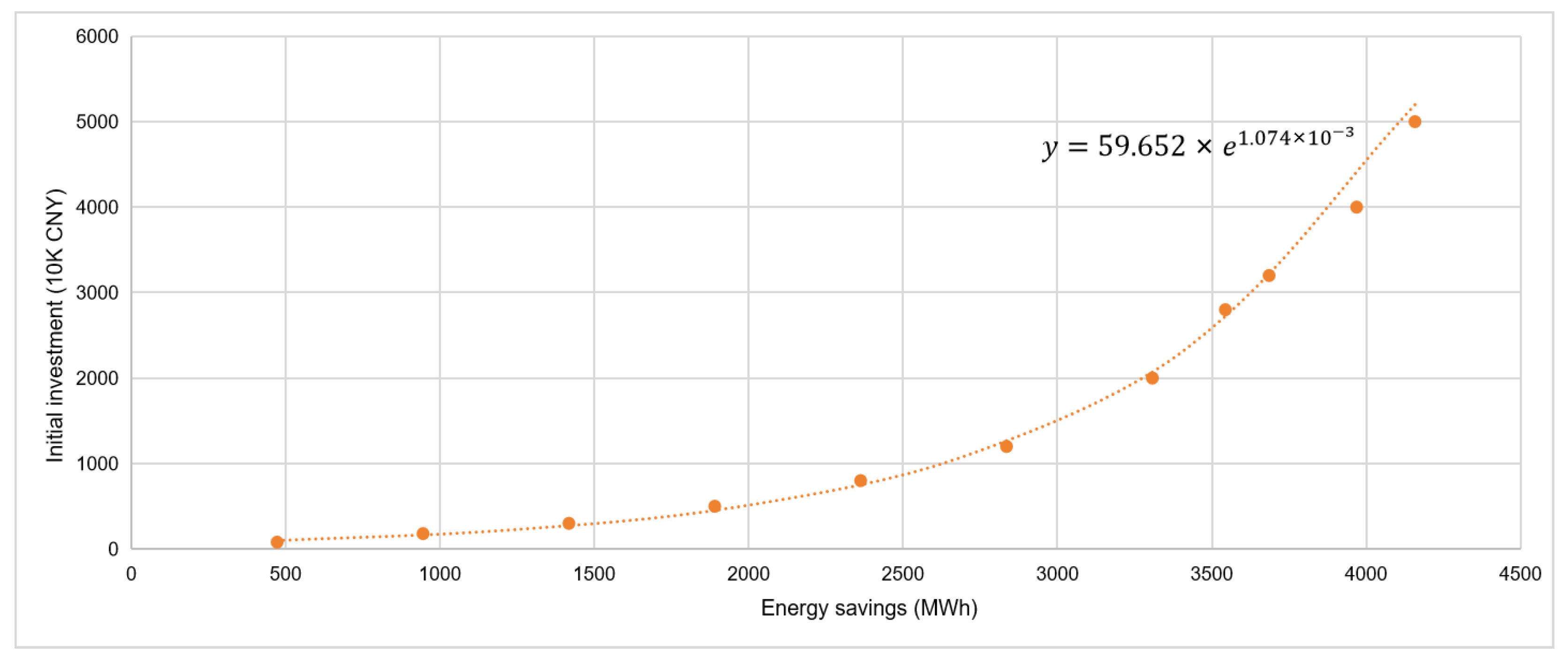

2.2. Initial Investment and Energy Saving of Energy-Saving Renovation

2.3. Carbon Reduction Products and Decision-Making Methods

2.3.1. Green Electricity Certificate (GEC)

2.3.2. International Renewable Energy Certificate (I-REC)

2.3.3. Chinese Certified Emission Reductions (CCER)

2.4. Path Decision Modeling

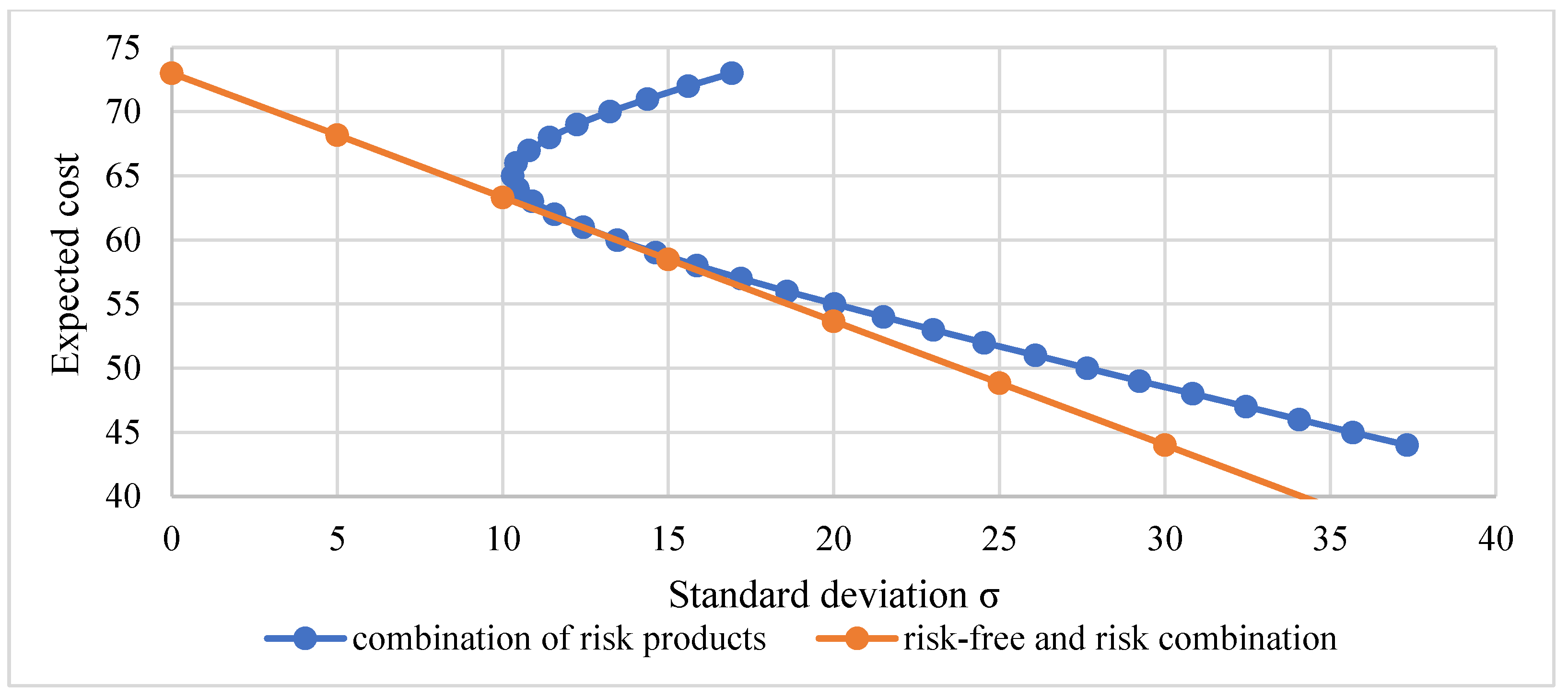

2.4.1. Calculate the Optimal Combination of Carbon Reduction Products

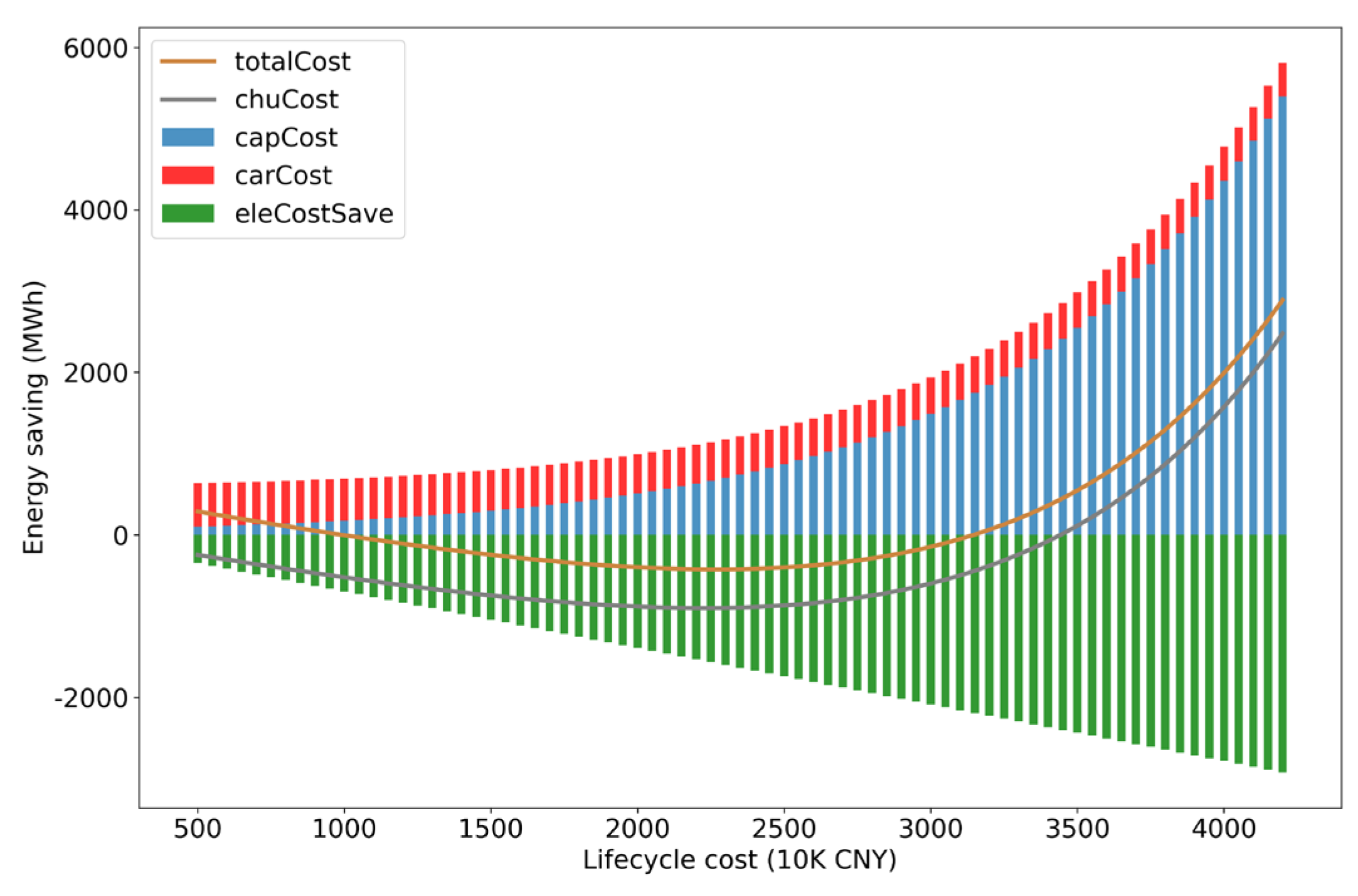

2.4.2. Initial Investment and Annual Carbon Reduction Product Purchase Cost Optimization

2.5. Model Framework

3. Results

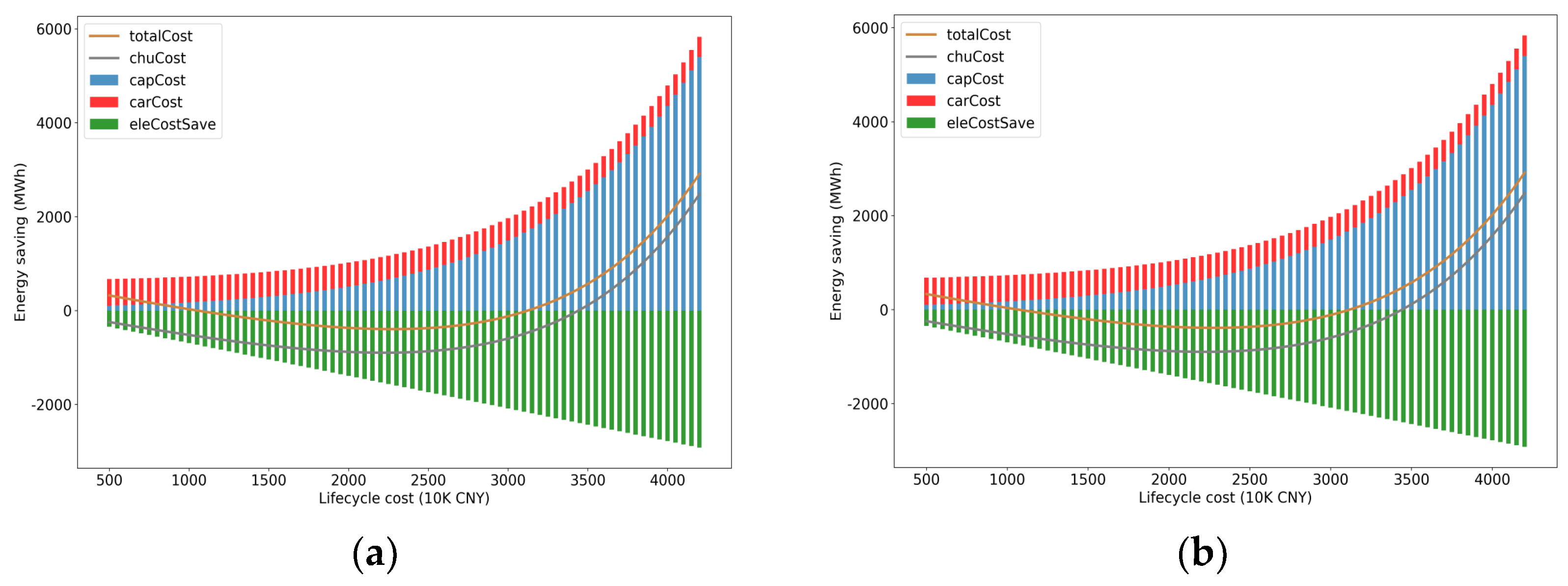

3.1. Baseline Scenario

3.2. Risk Appetite Sensitivity Analysis

3.3. Carbon Market Price Rising

4. Conclusions and Discussion

4.1. Conclusions

4.2. Discussion

4.3. Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yang, S.; Yang, D.; Shi, W.; Deng, C.; Chen, C.; Feng, S. Global evaluation of carbon neutrality and peak carbon dioxide emissions: Current challenges and future outlook. Environ. Sci. Pollut. Res. 2022, 30, 81725–81744. [Google Scholar] [CrossRef] [PubMed]

- The United Nations. Paris Agreement. 2015. Available online: https://heinonline.org/HOL/LandingPage?handle=hein.journals/intlm55&div=46&id=&page= (accessed on 15 August 2016).

- Houkai, W. The Strategic Choice and Policy Reconstruction to Promote Coordinated Regional Development. New Urban 2023, 6, 25–30. [Google Scholar]

- Chen, L.J. Carbon Dioxide Emissions from Industrial Parks Account for 31% of the Country, and the Four Strategic Paths Promote Carbon Emission Reduction in Parks. CECC-China. 15 March 2021. Available online: http://www.cecc-china.org/index/other/detail.html?id=25284 (accessed on 9 July 2023).

- Zhou, L.; Chen, Y.; Yu, Y. Optimization of Comprehensive Energy System in Low-Carbon Parks Based on Ladder Carbon Trading. Electrotechnical 2023, 8, 58–61+65. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Ionescu, L.; Andronie, M.; Dijmărescu, I. Sustainability Management and Performance in the Urban Corporate Economy: A Systematic Literature Review. Sustainability 2020, 12, 7705. [Google Scholar] [CrossRef]

- China’s State Council. Circular of the State Council on Printing and Distributing the Action Plan for Carbon Peak Peak by 2030. Central People’s Government of the People’s Republic of China, 26 October 2021. Available online: https://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 10 July 2023).

- Pop, R.A.; Dabija, D.C.; Pelau, C.; Dinu, V. Usage Intentions, Attitudes, and Behaviours towards Energy-Efficient Applications during the COVID-19 Pandemic. J. Bus. Econ. Manag. 2022, 23, 668–689. [Google Scholar] [CrossRef]

- Feng, J.-C.; Yan, J.; Yu, Z.; Zeng, X.; Xu, W. Case Study of an Industrial Park toward Zero Carbon Emission. Appl. Energy 2018, 209, 65–78. [Google Scholar] [CrossRef]

- Tian, J.; Guo, Q.; Chen, Y.; Li, X.; Shi, H.; Chen, L. Study on Industrial Metabolism of Carbon in a Chinese Fine Chemical Industrial Park. Environ. Sci. Technol. 2013, 47, 1048–1056. [Google Scholar] [CrossRef]

- Wang, H.; Lei, Y.; Wang, H.; Liu, M.; Yang, J.; Bi, J. Carbon Reduction Potentials of China’s Industrial Parks: A Case Study of Suzhou Industry Park. Energy 2013, 55, 668–675. [Google Scholar] [CrossRef]

- Ozarisoy, B.; Altan, H. Limitations: Developing an Evidence-Based Energy Policy Framework to Asset Robust Energy Performance Evaluation and Certification Schemes. In Handbook of Retrofitting High Density Residential Buildings; Springer: Cham, Switzerland, 2023; pp. 617–640. [Google Scholar] [CrossRef]

- Wei, X.; Qiu, R.; Liang, Y.; Liao, Q.; Klemeš, J.J.; Xue, J.; Zhang, H. Roadmap to carbon emissions neutral industrial parks: Energy, economic and environmental analysis. Energy 2022, 238, 121732. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Ionescu, L.; Uță, C.; Hurloiu, I.; Andronie, M.; Dijmărescu, I. Environmentally Responsible Behavior and Sustainability Policy Adoption in Green Public Procurement. Sustainability 2020, 12, 2110. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, K.; Xu, W. Carbon Offset Constraint Limit of Green Electricity Trading and Carbon Trading in Zero Carbon Buildings. China National Knowledge Infrastructure, 2023. Available online: www.cnki.net (accessed on 1 August 2023).

- Sun, Y. Industrial Park’s Carbon Emissions Reduction Design Study Based on Multi-objective Optimization Model. Master’s Thesis, Shandong Jianzhu University, Shandong, China, 2023. [Google Scholar]

- Mei, X.; Zhang, M.; Liu, S.-T.; Qu, Z.-H. Study on Operational Feasibility of Park Based on Zero Carbon Model. In Volume 23: Proceedings of the 3rd International Conference on Green Energy, Environment and Sustainable Development (GEESD2022); Advances in Transdisciplinary Engineering Series; IOS Press: Amsterdam, The Netherlands, 2022; pp. 416–421. [Google Scholar] [CrossRef]

- Chen, J.; Gao, M.; Mangla, S.K.; Song, M.; Wen, J. Effects of technological changes on China’s carbon emissions. Technol. Forecast. Soc. Chang. 2020, 153, 119938. [Google Scholar] [CrossRef]

- Alabi, T.M.; Lu, L.; Yang, Z. A novel multi-objective stochastic risk co-optimization model of a zero-carbon multi-energy system (ZCMES) incorporating energy storage aging model and integrated demand response. Energy 2021, 226, 120258. [Google Scholar] [CrossRef]

- Song, D.; Lu, W.; Zhu, J. Quantitative Analysis of Value Investment Strategy of Listed Companies in New Energy Industry under the Goal of “Double Carbon”. Nat. Sci. J. Harbin Norm. Univ. 2022, 38, 5–13. [Google Scholar]

- Zhong, J.; Li, Y.; Cao, Y.; Tan, Y.; Peng, Y.; Zeng, Z.; Cao, L. Stochastic optimization of integrated energy system considering network dynamic characteristics and psychological preference. J. Clean. Prod. 2020, 275, 122992. [Google Scholar] [CrossRef]

- Fantozzi, F.; Bartocci, P. Carbon Footprint as a Tool to Limit Greenhouse Gas Emissions. In Greenhouse Gases; IntechOpen: London, UK, 2016. [Google Scholar]

- Le, T.-H.; Chang, Y.; Park, D. Renewable and Nonrenewable Energy Consumption, Economic Growth, and Emissions: International Evidence. Energy J. 2020, 41, 73–92. [Google Scholar] [CrossRef]

- Larionov, A.; Metechko, L.; Davydov, A.; Davydov, D. Prospects for the Development of Green and Energy Efficient Technologies in Construction. MATEC Web Conf. 2018, 193, 04027. [Google Scholar] [CrossRef]

- Ozarisoy, B. Energy effectiveness of passive cooling design strategies to reduce the impact of long-term heatwaves on occupants’ thermal comfort in Europe: Climate change and mitigation. J. Clean. Prod. 2022, 330, 129675. [Google Scholar] [CrossRef]

- Harputlugil, T.; de Wilde, P. The Interaction between Humans and Buildings for Energy Efficiency: A Critical Review. Energy Res. Soc. Sci. 2021, 71, 101828. [Google Scholar] [CrossRef]

- Li, C.Z.; Zhang, L.; Liang, X.; Xiao, B.; Tam, V.W.Y.; Lai, X.; Chen, Z. Advances in the Research of Building Energy Saving. Energy Build. 2022, 254, 111556. [Google Scholar] [CrossRef]

- Zhao, F.; Bai, F.; Liu, X.; Liu, Z. A Review on Renewable Energy Transition under China’s Carbon Neutrality Target. Sustainability 2022, 14, 15006. [Google Scholar] [CrossRef]

- Jia, H.; Liu, D.; Zhuo, G.; Feng, Y.; Han, Y. Review for Global Practices of Renewable Energy Certificates. In Proceedings of the 2023 8th Asia Conference on Power and Electrical Engineering (ACPEE), Tianjin, China, 14–16 April 2023; pp. 642–646. [Google Scholar]

- International Renewable Energy Certificates: The I-REC Standard (Part-I). Ccarbon.info. 27 April 2023. Available online: https://www.ccarbon.info/part-i-international-renewable-energy-certificates-the-i-rec-standard/ (accessed on 4 July 2023).

- Lo, A.Y.; Cong, R. After CDM: Domestic Carbon Offsetting in China. J. Clean. Prod. 2017, 141, 1391–1399. [Google Scholar] [CrossRef]

- Song, X.; Zhang, W.; Ge, Z.; Huang, S.; Huang, Y.; Xiong, S. A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability 2022, 14, 8002. [Google Scholar] [CrossRef]

- Beijing Emissions Electronic Trading System. Available online: https://www.bjets.com.cn/article/jyxx/?92 (accessed on 1 July 2023).

- Kiker, G.A.; Bridges, T.S.; Varghese, A.; Seager, P.T.P.; Linkov, I. Application of Multicriteria Decision Analysis in Environmental Decision Making. Integr. Environ. Assess. Manag. 2005, 1, 95–108. [Google Scholar] [CrossRef]

- Weyel, P.; Harry, M. Markowitz—Portfolio Theory and the Financial Crisis; Grin Publishing: Munich, Germany, 2011. [Google Scholar]

- Liu, Q.; Sun, Y.; Wu, M. Decision-Making Methodologies in Offshore Wind Power Investments: A Review. J. Clean. Prod. 2021, 295, 126459. [Google Scholar] [CrossRef]

- Lee, W. Practical Applications of Risk-Based Product Allocation: A New Answer to an Old Question? Pract. Appl. 2013, 1, 1–3. [Google Scholar] [CrossRef]

- deLlano-Paz, F.; Martínez Fernandez, P.; Soares, I. Addressing 2030 EU Policy Framework for Energy and Climate: Cost, Risk and Energy Security Issues. Energy 2016, 115, 1347–1360. [Google Scholar] [CrossRef]

- Dow, J.; da Costa Werlang, S.R. Uncertainty Aversion, Risk Aversion, and the Optimal Choice of Portfolio. In Uncertainty in Economic Theory; Taylor & Francis: Abingdon, UK, 2010; pp. 419–428. [Google Scholar]

- Frijns, B.; Koellen, E.; Lehnert, T. On the Determinants of Portfolio Choice. J. Econ. Behav. Organ. 2008, 66, 373–386. [Google Scholar] [CrossRef]

- Brick, K.; Visser, M.; Burns, J. Risk Aversion: Experimental Evidence from South African Fishing Communities. Am. J. Agric. Econ. 2012, 94, 133–152. [Google Scholar] [CrossRef]

- Choi, T.-M.; Li, D.; Yan, H. Mean–Variance Analysis for the Newsvendor Problem. IEEE Trans. Syst. Man Cybern. Part A Syst. Hum. 2008, 38, 1169–1180. [Google Scholar] [CrossRef]

- Li, B.; Han, S.; Wang, Y.; Wang, Y.; Li, J.; Wang, Y. Feasibility Assessment of the Carbon Emissions Peak in China’s Construction Industry: Factor Decomposition and Peak Forecast. Sci. Total Environ. 2020, 706, 135716. [Google Scholar] [CrossRef]

- Jang, D.; Kim, J.; Kim, D.; Han, W.-B.; Kang, S. Techno-Economic Analysis and Monte Carlo Simulation of Green Hydrogen Production Technology through Various Water Electrolysis Technologies. Energy Convers. Manag. 2022, 258, 115499. [Google Scholar] [CrossRef]

- Zhang, X.; Huang, X.; Zhang, D.; Geng, Y.; Tian, L.; Fan, Y.; Chen, W. Research on the Pathway and Policies for China’s Energy and Economy Transformation toward Carbon Neutrality. J. Manag. World 2022, 38, 35–55. [Google Scholar] [CrossRef]

| Energy Consumption | Carbon Emission/tCO2 | |

|---|---|---|

| Electricity (Scope 1) | 9450 MWh | 5764.5 |

| Natural gas (Scope 2) | 1.603 million m3 | 3399.7 |

| Steam (Scope 2) | 2000 t | 709.1 |

| Inti Investment/10 k CNY | Electricity Saving/MWh |

|---|---|

| 80 | 472.5 |

| 180 | 945 |

| 300 | 1417.5 |

| 500 | 1890 |

| 800 | 2362.5 |

| 1200 | 2835 |

| 2000 | 3307.5 |

| 2800 | 3543.75 |

| 3200 | 3685.5 |

| 4000 | 3969 |

| 5000 | 4158 |

| CCER | 2908 | 66.5 |

| I-REC | 937 | 44.5 |

| GEC | 535 | 73 |

| Total | 4380 | 62.6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, G.; Yang, Y.; Xu, X.; Chen, Y.; Yang, B.; Wu, X.; Wang, X. The Net Zero Emissions Decision Model of the Sustainable Path of Chinese Business Parks. Buildings 2023, 13, 2638. https://doi.org/10.3390/buildings13102638

Tian G, Yang Y, Xu X, Chen Y, Yang B, Wu X, Wang X. The Net Zero Emissions Decision Model of the Sustainable Path of Chinese Business Parks. Buildings. 2023; 13(10):2638. https://doi.org/10.3390/buildings13102638

Chicago/Turabian StyleTian, Guang, Yang Yang, Xiaoran Xu, Yiming Chen, Bo Yang, Xu Wu, and Xinhao Wang. 2023. "The Net Zero Emissions Decision Model of the Sustainable Path of Chinese Business Parks" Buildings 13, no. 10: 2638. https://doi.org/10.3390/buildings13102638