The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach

Abstract

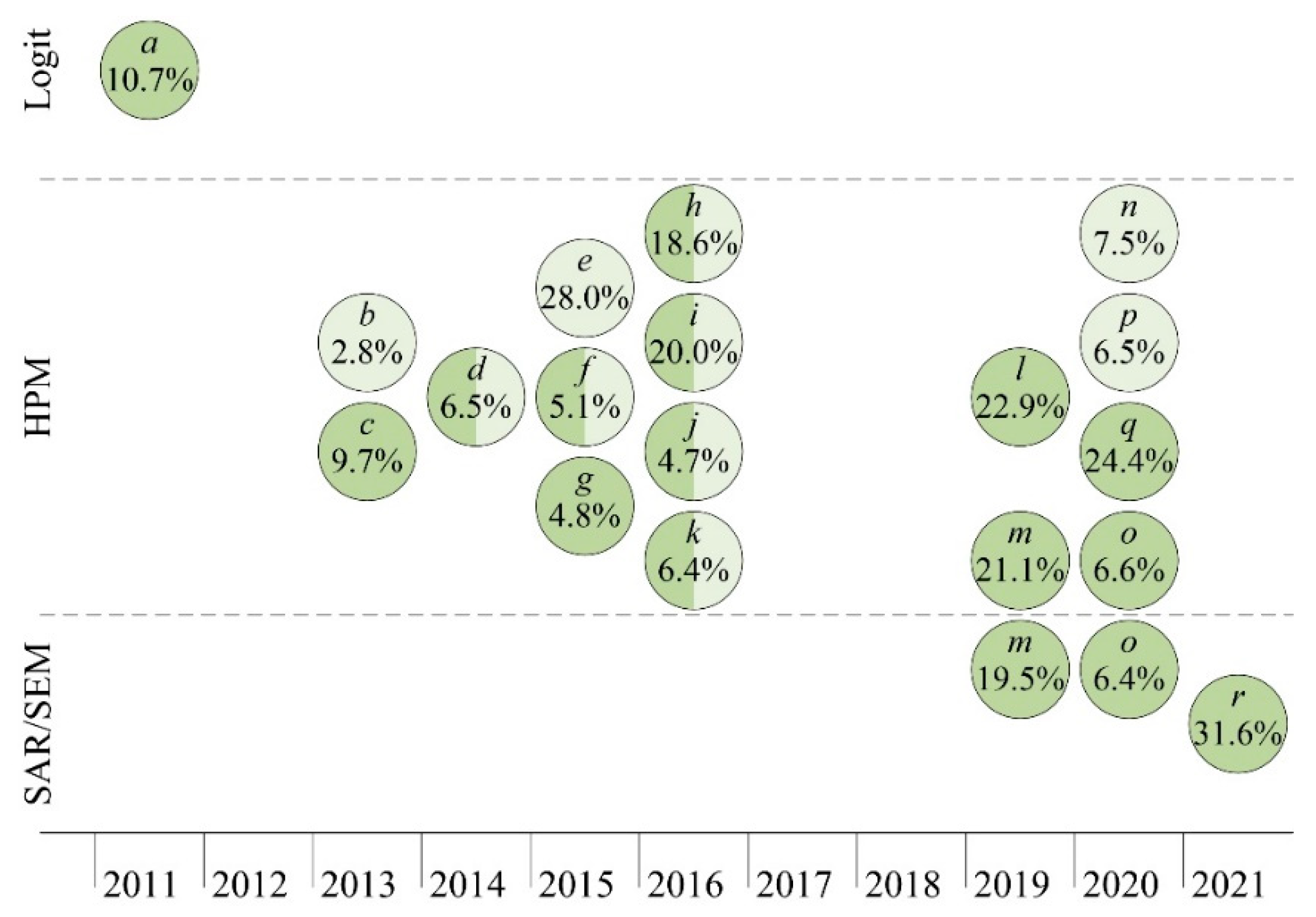

:1. Introduction and Background Literature

2. Method and Models

2.1. Hedonic Price Model and Spatial Regression Approach

2.2. Multi-Criteria Optimization Approach

- to rank the n alternatives (namely, properties) according to their price y;

- to rank separately the same n alternatives (namely, properties) according to the criteria (namely, attributes) Xk and Wy;

- to compare the two rankings and match them so to elicit the weights of the criteria (namely, attributes).

3. Case Study and Data

4. Results and Discussion

4.1. Results for the Spatial Autoregressive Model

4.1.1. Overview of the Significant Attributes

0.4140 (0.6792)

0.9636 (0.3360)

4.1.2. Energy Rating Bands and Energy Performance Index

- 55% for the energy rating band A4 (again in comparison to the D one);

- 42% for the energy rating bands A3, A2, A1, and A;

- 20% for the B and C-labeled properties;

- −14% and −29% for the F and G-rated building units, respectively.

4.2. Results for the Multi-Criteria Optimization Model

4.2.1. Role Played by Land and Building Attributes in Shaping Property Prices

4.2.2. Role Played by Energy Rating Bands in Shaping Property Prices

- 53.4% for the A4 band in comparison to D (54.7% in the SAR model with EPI and sqEPI, with a gap as low as 1.3%);

- 45.3% for the A to A3 bands compared to D (42.0% in the SAR model with EPI and sqEPI and a margin of error of 3.3%);

- 19.4% for the B or C band in comparison to D (19.5% in the SAR model with EPI and sqEPI, which marks the narrowest gap of 0.1%);

- −10.4% for the F band (−14.1% in the SAR model with EPI and sqEPI and a margin of error of 3.7%);

- −10.8% for the G band (−29.3% in the SAR model with EPI and sqEPI, which marks the most significant gap of 18.5%).

4.3. Limitations

5. Conclusions and Further Developments

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Copiello, S.; Gabrielli, L.; Micelli, E. Building Industry and Energy Efficiency: A Review of Three Major Issues at Stake. In Computational Science and Its Applications—ICCSA 2021. ICCSA 2021. Lecture Notes in Computer Science; Gervasi, O., Murgante, B., Misra, S., Garau, C., Blečić, I., Taniar, D., Apduhan, B.O., Rocha, A.M.A.C., Tarantino, E., Torre, C.M., Eds.; Springer: Cham, Switzerland, 2021; pp. 226–240. [Google Scholar]

- Bartlett, E.; Howard, N. Informing the decision makers on the cost and value of green building. Build. Res. Inf. 2000, 28, 315–324. [Google Scholar] [CrossRef]

- Ekung, S.; Odesola, I.; Oladokun, M. Dimensions of cost misperceptions obstructing the adoption of sustainable buildings. Smart Sustain. Built Environ. 2021, 11, 852–869. [Google Scholar] [CrossRef]

- Copiello, S. Building energy efficiency: A research branch made of paradoxes. Renew. Sustain. Energy Rev. 2017, 69, 1064–1076. [Google Scholar] [CrossRef]

- Dwaikat, L.N.; Ali, K.N. Green buildings cost premium: A review of empirical evidence. Energy Build. 2016, 110, 396–403. [Google Scholar] [CrossRef]

- Russ, N.M.; Hanid, M.; Ye, K.M. Literature review on green cost premium elements of sustainable building construction. Int. J. Technol. 2018, 9, 1715–1725. [Google Scholar] [CrossRef] [Green Version]

- Matthiessen, L.F.; Morris, P. Costing Green: A Comprehensive Cost Database and Budgeting Methodology; Davis Langdon: London, UK, 2014. [Google Scholar]

- Rehm, M.; Ade, R. Construction costs comparison between ‘green’ and conventional office buildings. Build. Res. Inf. 2013, 41, 198–208. [Google Scholar] [CrossRef]

- Kats, G.H. Green Building Costs and Financial Benefits; Massachusetts Technology Collaborative: Westborough, MA, USA, 2003. [Google Scholar]

- Chong, H.-Y.; Tam, V.W.Y.; Lai, W.C.; Sutrisna, M.; Wang, X.; Illankoon, I.M.C.S. Cost implications for certified Green Building Index buildings. Proc. Inst. Civ. Eng.-Waste Resour. Manag. 2017, 170, 29–40. [Google Scholar] [CrossRef]

- Ade, R.; Rehm, M. At what cost? An analysis of the green cost premium to achieve 6-Homestar in New Zealand. J. Green Build. 2020, 15, 131–155. [Google Scholar] [CrossRef]

- Nyikos, D.M.; Thal, A.E.; Hicks, M.J.; Leach, S.E. To LEED or Not to LEED: Analysis of Cost Premiums Associated With Sustainable Facility Design. Eng. Manag. J. 2012, 24, 50–62. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. The price of innovation: An analysis of the marginal cost of green buildings. J. Environ. Econ. Manag. 2019, 98, 102248. [Google Scholar] [CrossRef]

- Ade, R.; Rehm, M. Reaching for the stars: Green construction cost premiums for Homestar certification. Constr. Manag. Econ. 2020, 38, 570–580. [Google Scholar] [CrossRef]

- Uğur, L.O.; Leblebici, N. An examination of the LEED green building certification system in terms of construction costs. Renew. Sustain. Energy Rev. 2018, 81, 1476–1483. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhu, L.; Wang, Y.; Cheong, X. Green Building Construction Projects in Singapore: Cost Premiums and Cost Performance. Proj. Manag. J. 2017, 48, 67–79. [Google Scholar] [CrossRef] [Green Version]

- Tadeu, S.; Tadeu, A.; Simões, N.; Gonçalves, M.; Prado, R. A sensitivity analysis of a cost optimality study on the energy retrofit of a single-family reference building in Portugal. Energy Effic. 2018, 11, 1411–1432. [Google Scholar] [CrossRef]

- Zalejska-Jonsson, A.; Lind, H.; Hintze, S. Low-energy versus conventional residential buildings: Cost and profit. J. Eur. Real Estate Res. 2012, 5, 211–228. [Google Scholar] [CrossRef] [Green Version]

- Copiello, S.; Donati, E. Is investing in energy efficiency worth it? Evidence for substantial price premiums but limited profitability in the housing sector. Energy Build. 2021, 251, 111371. [Google Scholar] [CrossRef]

- Taemthong, W.; Chaisaard, N. An analysis of green building costs using a minimum cost concept. J. Green Build. 2019, 14, 53–78. [Google Scholar] [CrossRef]

- Gilmer, R.W. Energy labels and economic search. Energy Econ. 1989, 11, 213–218. [Google Scholar] [CrossRef]

- Dinan, T.M.; Miranowski, J.A. Estimating the implicit price of energy efficiency improvements in the residential housing market: A hedonic approach. J. Urban Econ. 1989, 25, 52–67. [Google Scholar] [CrossRef]

- Addae-Dapaah, K.; Chieh, S.J. Green Mark Certification: Does the Market Understand? J. Sustain. Real Estate 2011, 3, 162–191. [Google Scholar] [CrossRef]

- Deng, Y.; Li, Z.; Quigley, J.M. Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg. Sci. Urban Econ. 2012, 42, 506–515. [Google Scholar] [CrossRef] [Green Version]

- Deng, Y.; Wu, J. Economic returns to residential green building investment: The developers’ perspective. Reg. Sci. Urban Econ. 2014, 47, 35–44. [Google Scholar] [CrossRef]

- Heinzle, S.L.; Boey Ying Yip, A.; Low Yu Xing, M. The Influence of Green Building Certification Schemes on Real Estate Investor Behaviour: Evidence from Singapore. Urban Stud. 2013, 50, 1970–1987. [Google Scholar] [CrossRef]

- Fesselmeyer, E. The value of green certification in the Singapore housing market. Econ. Lett. 2018, 163, 36–39. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bottero, M. Green premium in buildings: Evidence from the real estate market of Singapore. J. Clean. Prod. 2021, 286, 125327. [Google Scholar] [CrossRef]

- Aydin, E.; Correa, S.B.; Brounen, D. Energy performance certification and time on the market. J. Environ. Econ. Manag. 2019, 98, 102270. [Google Scholar] [CrossRef]

- Comerford, D.A.; Lange, I.; Moro, M. Proof of concept that requiring energy labels for dwellings can induce retrofitting. Energy Econ. 2018, 69, 204–212. [Google Scholar] [CrossRef]

- Economidou, M.; Todeschi, V.; Bertoldi, P.; D’Agostino, D.; Zangheri, P.; Castellazzi, L. Review of 50 years of EU energy efficiency policies for buildings. Energy Build. 2020, 225, 110322. [Google Scholar] [CrossRef]

- Mudgal, S.; Lyons, L.; Cohen, F.; Lyons, R.; Fedrigo-Fazio, D. Energy Performance Certificates in Buildings and Their Impact on Transaction Prices and Rents in Selected EU Countries; Final report prepared for European Commission; DG Energy: Brussels, Belgium, 2013. [Google Scholar]

- Bruegge, C.; Carrión-Flores, C.; Pope, J.C. Does the housing market value energy efficient homes? Evidence from the energy star program. Reg. Sci. Urban Econ. 2016, 57, 63–76. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalization of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Fuerst, F.; Shimizu, C. Green luxury goods? The economics of eco-labels in the Japanese housing market. J. Jpn. Int. Econ. 2016, 39, 108–122. [Google Scholar] [CrossRef]

- Fuerst, F.; Warren-Myers, G. Does voluntary disclosure create a green lemon problem? Energy-efficiency ratings and house prices. Energy Econ. 2018, 74, 1–12. [Google Scholar] [CrossRef]

- Aroul, R.R.; Rodriguez, M. The Increasing Value of Green for Residential Real Estate. J. Sustain. Real Estate 2017, 9, 112–130. [Google Scholar] [CrossRef]

- Reichardt, A.; Fuerst, F.; Rottke, N.; Zietz, J. Sustainable Building Certification and the Rent Premium: A Panel Data Approach. J. Real Estate Res. 2012, 34, 99–126. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. Supply, Demand and the Value of Green Buildings. Urban Stud. 2014, 51, 22–43. [Google Scholar] [CrossRef] [Green Version]

- Das, P.; Wiley, J.A. Determinants of premia for energy-efficient design in the office market. J. Prop. Res. 2014, 31, 64–86. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef] [Green Version]

- Wiley, J.A.; Benefield, J.D.; Johnson, K.H. Green Design and the Market for Commercial Office Space. J. Real Estate Financ. Econ. 2010, 41, 228–243. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Green Noise or Green Value? Measuring the Effects of Environmental Certification on Office Values. Real Estate Econ. 2011, 39, 45–69. [Google Scholar] [CrossRef]

- Das, P.; Tidwell, A.; Ziobrowski, A. Dynamics of Green Rentals over Market Cycles: Evidence from Commercial Office Properties in San Francisco and Washington DC. J. Sustain. Real Estate 2011, 3, 1–22. [Google Scholar] [CrossRef]

- Kok, N.; Jennen, M. The impact of energy labels and accessibility on office rents. Energy Policy 2012, 46, 489–497. [Google Scholar] [CrossRef]

- Bond, S.A.; Devine, A. Certification Matters: Is Green Talk Cheap Talk? J. Real Estate Financ. Econ. 2016, 52, 117–140. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Stephenson, R.; Ashuri, B. Valuation of energy efficient certificates in buildings. Energy Build. 2018, 158, 1226–1240. [Google Scholar] [CrossRef]

- Pride, D.; Little, J.; Mueller-Stoffels, M. The value of residential energy efficiency in interior Alaska: A hedonic pricing analysis. Energy Policy 2018, 123, 450–460. [Google Scholar] [CrossRef]

- McCord, M.; Lo, D.; Davis, P.T.; Hemphill, L.; McCord, J.; Haran, M. A spatial analysis of EPCs in The Belfast Metropolitan Area housing market. J. Prop. Res. 2020, 37, 25–61. [Google Scholar] [CrossRef]

- Kholodilin, K.A.; Michelsen, C. The Market Value of Energy Efficiency in Buildings and the Mode of Tenure. SSRN Electron. J. 2014. [Google Scholar] [CrossRef]

- Kholodilin, K.A.; Mense, A.; Michelsen, C. The market value of energy efficiency in buildings and the mode of tenure. Urban Stud. 2017, 54, 3218–3238. [Google Scholar] [CrossRef]

- Cerin, P.; Hassel, L.G.; Semenova, N. Energy Performance and Housing Prices. Sustain. Dev. 2014, 22, 404–419. [Google Scholar] [CrossRef]

- Stanley, S.; Lyons, R.C.; Lyons, S. The price effect of building energy ratings in the Dublin residential market. Energy Effic. 2016, 9, 875–885. [Google Scholar] [CrossRef]

- Högberg, L. The impact of energy performance on single-family home selling prices in Sweden. J. Eur. Real Estate Res. 2013, 6, 242–261. [Google Scholar] [CrossRef]

- Taltavull de La Paz, P.; Perez-Sanchez, V.; Mora-Garcia, R.-T.; Perez-Sanchez, J.-C. Green Premium Evidence from Climatic Areas: A Case in Southern Europe, Alicante (Spain). Sustainability 2019, 11, 686. [Google Scholar] [CrossRef] [Green Version]

- Aydin, E.; Brounen, D.; Kok, N. The capitalization of energy efficiency: Evidence from the housing market. J. Urban Econ. 2020, 117, 103243. [Google Scholar] [CrossRef]

- Wahlström, M.H. Doing good but not that well? A dilemma for energy conserving homeowners. Energy Econ. 2016, 60, 197–205. [Google Scholar] [CrossRef]

- Bloom, B.; Nobe, M.; Nobe, M. Valuing Green Home Designs: A Study of ENERGY STAR® Homes. J. Sustain. Real Estate 2011, 3, 109–126. [Google Scholar] [CrossRef]

- Zheng, S.; Wu, J.; Kahn, M.E.; Deng, Y. The nascent market for “green” real estate in Beijing. Eur. Econ. Rev. 2012, 56, 974–984. [Google Scholar] [CrossRef]

- Mesthrige Jayantha, W.; Sze Man, W. Effect of green labelling on residential property price: A case study in Hong Kong. J. Facil. Manag. 2013, 11, 31–51. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Polit. Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Freybote, J.; Sun, H.; Yang, X. The Impact of LEED Neighborhood Certification on Condo Prices. Real Estate Econ. 2015, 43, 586–608. [Google Scholar] [CrossRef]

- Zhang, L.; Liu, H.; Wu, J. The price premium for green-labelled housing: Evidence from China. Urban Stud. 2017, 54, 3524–3541. [Google Scholar] [CrossRef]

- Taltavull, P.; Anghel, I.; Ciora, C. Impact of energy performance on transaction prices. J. Eur. Real Estate Res. 2017, 10, 57–72. [Google Scholar] [CrossRef]

- Walls, M.; Gerarden, T.; Palmer, K.; Bak, X.F. Is energy efficiency capitalized into home prices? Evidence from three U.S. cities. J. Environ. Econ. Manag. 2017, 82, 104–124. [Google Scholar] [CrossRef]

- McCord, M.; Haran, M.; Davis, P.; McCord, J. Energy performance certificates and house prices: A quantile regression approach. J. Eur. Real Estate Res. 2020, 13, 409–434. [Google Scholar] [CrossRef]

- Massimo, D.E.; De Paola, P.; Musolino, M.; Malerba, A.; Del Giudice, F.P. Green and Gold Buildings? Detecting Real Estate Market Premium for Green Buildings through Evolutionary Polynomial Regression. Buildings 2022, 12, 621. [Google Scholar] [CrossRef]

- Halvorsen, R.; Palmquist, R. The Interpretation of Dummy Variables in Semilogarithmic Equations. Am. Econ. Rev. 1980, 70, 474–475. [Google Scholar]

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef] [Green Version]

- Cajias, M.; Piazolo, D. Green performs better: Energy efficiency and financial return on buildings. J. Corp. Real Estate 2013, 15, 53–72. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef] [Green Version]

- Fuerst, F.; Oikarinen, E.; Shimizu, C.; Szumilo, N. Measuring “Green Value”: An International Perspective; Green Value Associates: London, UK, 2014. [Google Scholar]

- Davis, P.T.; McCord, J.A.; McCord, M.; Haran, M. Modelling the effect of energy performance certificate rating on property value in the Belfast housing market. Int. J. Hous. Mark. Anal. 2015, 8, 292–317. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef] [Green Version]

- Bonifaci, P.; Copiello, S. Price premium for buildings energy efficiency: Empirical findings from a hedonic model. Valori Valutazioni 2015, 14, 5–15. [Google Scholar]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Energy performance ratings and house prices in Wales: An empirical study. Energy Policy 2016, 92, 20–33. [Google Scholar] [CrossRef]

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green signalling effects in the market for energy-efficient residential buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef] [Green Version]

- de Ayala, A.; Galarraga, I.; Spadaro, J.V. The price of energy efficiency in the Spanish housing market. Energy Policy 2016, 94, 16–24. [Google Scholar] [CrossRef] [Green Version]

- Jensen, O.M.; Hansen, A.R.; Kragh, J. Market response to the public display of energy performance rating at property sales. Energy Policy 2016, 93, 229–235. [Google Scholar] [CrossRef]

- Manganelli, B.; Morano, P.; Tajani, F.; Salvo, F. Affordability Assessment of Energy-Efficient Building Construction in Italy. Sustainability 2019, 11, 249. [Google Scholar] [CrossRef] [Green Version]

- Dell’Anna, F.; Bravi, M.; Marmolejo-Duarte, C.; Bottero, M.C.; Chen, A. EPC Green Premium in Two Different European Climate Zones: A Comparative Study between Barcelona and Turin. Sustainability 2019, 11, 5605. [Google Scholar] [CrossRef] [Green Version]

- Bisello, A.; Antoniucci, V.; Marella, G. Measuring the price premium of energy efficiency: A two-step analysis in the Italian housing market. Energy Build. 2020, 208, 109670. [Google Scholar] [CrossRef]

- Fuerst, F.; Haddad, M.F.C.; Adan, H. Is there an economic case for energy-efficient dwellings in the UK private rental market? J. Clean. Prod. 2020, 245, 118642. [Google Scholar] [CrossRef]

- Evangelista, R.; Ramalho, E.A.; Andrade e Silva, J. On the use of hedonic regression models to measure the effect of energy efficiency on residential property transaction prices: Evidence for Portugal and selected data issues. Energy Econ. 2020, 86, 104699. [Google Scholar] [CrossRef] [Green Version]

- Copiello, S.; Grillenzoni, C. Is the cold the only reason why we heat our homes? Empirical evidence from spatial series data. Appl. Energy 2017, 193, 491–506. [Google Scholar] [CrossRef]

- Alipour, M.; Salim, H.; Stewart, R.A.; Sahin, O. Predictors, taxonomy of predictors, and correlations of predictors with the decision behaviour of residential solar photovoltaics adoption: A review. Renew. Sustain. Energy Rev. 2020, 123, 109749. [Google Scholar] [CrossRef]

- Brady, R.R. Measuring the diffusion of housing prices across space and over time. J. Appl. Econom. 2011, 26, 213–231. [Google Scholar] [CrossRef] [Green Version]

- Osland, L. An Application of Spatial Econometrics in Relation to Hedonic House Price Modeling. J. Real Estate Res. 2010, 32, 289–320. [Google Scholar] [CrossRef]

- Copiello, S. Spatial dependence of housing values in Northeastern Italy. Cities 2020, 96, 102444. [Google Scholar] [CrossRef]

- Tobler, W.R. A Computer Movie Simulating Urban Growth in the Detroit Region. Econ. Geogr. 1970, 46, 234. [Google Scholar] [CrossRef]

- Elhorst, J.P. Spatial Econometrics; SpringerBriefs in Regional Science; Springer: Berlin/Heidelberg, Germany, 2014; ISBN 978-3-642-40339-2. [Google Scholar]

- Copiello, S.; Grillenzoni, C. Robust space–time modeling of solar photovoltaic deployment. Energy Rep. 2021, 7, 657–676. [Google Scholar] [CrossRef]

- Huber, G.P. Multi-Attribute Utility Models: A Review of Field and Field-Like Studies. Manag. Sci. 1974, 20, 1393–1402. [Google Scholar] [CrossRef]

- Belton, V. A comparison of the analytic hierarchy process and a simple multi-attribute value function. Eur. J. Oper. Res. 1986, 26, 7–21. [Google Scholar] [CrossRef]

- Zahedi, F. A utility approach to the analytic hierarchy process. Math. Model. 1987, 9, 387–395. [Google Scholar] [CrossRef] [Green Version]

- Jansen, S.J.T. The Multi-attribute Utility Method. In The Measurement and Analysis of Housing Preference and Choice; Jansen, S.J.T., Coolen, H.C.C.H., Goetgeluk, R.W., Eds.; Springer: Dordrecht, The Netherlands, 2011; pp. 101–125. [Google Scholar]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Saaty, T.L. Priority Setting in Completing Problems. IEEE Trans. Eng. Manag. 1983, 30, 140–155. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process: Decision Making in Complex Environments. In Quantitative Assessment in Arms Control; Springer: Boston, MA, USA, 1984; pp. 285–308. [Google Scholar]

- Copiello, S.; Donati, E. Unraveling the Role Played by Energy Rating Bands in Shaping Property Prices Using a Multi-criteria Optimization Approach: The Case Study of Padua’s Housing Market. In Computational Science and Its Applications—ICCSA 2022 Workshops. ICCSA 2022. Lecture Notes in Computer Science, vol 13378; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Garau, C., Eds.; Springer: Cham, Switzerland, 2022; pp. 600–614. [Google Scholar]

- Bonifaci, P.; Copiello, S. Real estate market and building energy performance: Data for a mass appraisal approach. Data Br. 2015, 5, 1060–1065. [Google Scholar] [CrossRef] [PubMed]

- Chiarazzo, V.; Caggiani, L.; Marinelli, M.; Ottomanelli, M. A Neural Network based Model for Real Estate Price Estimation Considering Environmental Quality of Property Location. Transp. Res. Procedia 2014, 3, 810–817. [Google Scholar] [CrossRef] [Green Version]

- Kryvobokov, M.; Wilhelmsson, M. Analysing location attributes with a hedonic model for apartment prices in Donetsk, Ukraine. Int. J. Strateg. Prop. Manag. 2007, 11, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Deng, T.; Ma, M.; Nelson, J.D. Measuring the impacts of Bus Rapid Transit on residential property values: The Beijing case. Res. Transp. Econ. 2016, 60, 54–61. [Google Scholar] [CrossRef]

- McGreal, S.; Brown, L.; Adair, A. List price and sale price variation across the housing market cycle. Int. J. Hous. Mark. Anal. 2010, 3, 89–99. [Google Scholar] [CrossRef]

- Horowitz, J.L. The role of the list price in housing markets: Theory and an econometric model. J. Appl. Econom. 1992, 7, 115–129. [Google Scholar] [CrossRef]

- Han, L.; Strange, W.C. What is the role of the asking price for a house? J. Urban Econ. 2016, 93, 115–130. [Google Scholar] [CrossRef]

- Özdilek, Ü. Property Price Separation between Land and Building Components. J. Real Estate Res. 2016, 38, 205–228. [Google Scholar] [CrossRef]

- Copiello, S.; Cecchinato, F.; Salih, M.H. The Effect of Hybrid Attributes on Property Prices. Real Estate Manag. Valuat. 2021, 29, 36–52. [Google Scholar] [CrossRef]

- Malpezzi, S. Hedonic Pricing Models: A Selective and Applied Review. In Housing Economics and Public Policy; O’Sullivan, T., Gibb, K., Eds.; Blackwell Science Ltd.: Oxford, UK, 2003; pp. 67–89. [Google Scholar]

- Mayer, M.; Bourassa, S.C.; Hoesli, M.; Scognamiglio, D. Estimation and updating methods for hedonic valuation. J. Eur. Real Estate Res. 2019, 12, 134–150. [Google Scholar] [CrossRef]

- Hill, R.J. Hedonic price indexes for residential housing: A survey, evaluation and taxonomy. J. Econ. Surv. 2012, 27, 879–914. [Google Scholar] [CrossRef]

- Chau, K.W.; Chin, T.L. A Critical Review of Literature on the Hedonic Price Model. Int. J. Hous. Sci. Its Appl. 2003, 27, 145–165. [Google Scholar]

- Lee, C.L.; Gumulya, N.; Bangura, M. The Role of Mandatory Building Efficiency Disclosure on Green Building Price Premium: Evidence from Australia. Buildings 2022, 12, 297. [Google Scholar] [CrossRef]

- Gabe, J. An empirical comparison of voluntary and mandatory building energy performance disclosure outcomes. Energy Policy 2016, 96, 680–687. [Google Scholar] [CrossRef]

- Hsu, D. How much information disclosure of building energy performance is necessary? Energy Policy 2014, 64, 263–272. [Google Scholar] [CrossRef] [Green Version]

- Fabbri, K. Building and fuel poverty, an index to measure fuel poverty: An Italian case study. Energy 2015, 89, 244–258. [Google Scholar] [CrossRef]

- Fregonara, E.; Rolando, D.; Semeraro, P. Energy performance certificates in the Turin real estate market. J. Eur. Real Estate Res. 2017, 10, 149–169. [Google Scholar] [CrossRef]

- Allison, P.D. Multiple Regression: A Primer; Pine Forge Press: Thousand Oaks, CA, USA, 1999. [Google Scholar]

- Lusht, K.M. Real Estate Valuation: Principles and Applications; Richard D. Irwin: Chicago, IL, USA, 1997. [Google Scholar]

- Wolverton, M.L. Empirical study of the relationship between residential lot price, size and view. J. Prop. Valuat. Investig. 1997, 15, 48–57. [Google Scholar] [CrossRef]

- Kamal, A.; Al-Ghamdi, S.G.; Koc, M. Revaluing the costs and benefits of energy efficiency: A systematic review. Energy Res. Soc. Sci. 2019, 54, 68–84. [Google Scholar] [CrossRef]

- Gaterell, M.R.; McEvoy, M.E. The impact of energy externalities on the cost effectiveness of energy efficiency measures applied to dwellings. Energy Build. 2005, 37, 1017–1027. [Google Scholar] [CrossRef]

- Marquardt, D.W. Generalized Inverses, Ridge Regression, Biased Linear Estimation, and Nonlinear Estimation. Technometrics 1970, 12, 591–612. [Google Scholar] [CrossRef]

- Muzzicato, S.; Sabbatini, R.; Zollino, F. Prices of Residential Property in Italy: Constructing a New Indicator; Bank of Italy: Rome, Italy, 2008. [Google Scholar]

- Copiello, S. An Empirical Study of Land Leverage as a Function of Market Value Using a Spatial Autoregressive Model. In Appraisal and Valuation. Green Energy and Technology; Morano, P., Oppio, A., Rosato, P., Sdino, L., Tajani, F., Eds.; Springer: Cham, Switzerland, 2021; pp. 29–41. [Google Scholar]

- Bostic, R.W.; Longhofer, S.D.; Redfearn, C.L. Land Leverage: Decomposing Home Price Dynamics. Real Estate Econ. 2007, 35, 183–208. [Google Scholar] [CrossRef]

- Brunelli, M. A survey of inconsistency indices for pairwise comparisons. Int. J. Gen. Syst. 2018, 47, 751–771. [Google Scholar] [CrossRef] [Green Version]

- Kuenz Murphy, C. Limits on the analytic hierarchy process from its consistency index. Eur. J. Oper. Res. 1993, 65, 138–139. [Google Scholar] [CrossRef]

- Ágoston, K.C.; Csató, L. Inconsistency thresholds for incomplete pairwise comparison matrices. Omega 2022, 108, 102576. [Google Scholar] [CrossRef]

- Franek, J.; Kresta, A. Judgment Scales and Consistency Measure in AHP. Procedia Econ. Financ. 2014, 12, 164–173. [Google Scholar] [CrossRef] [Green Version]

- Saaty, T.L. Decision-making with the AHP: Why is the principal eigenvector necessary. Eur. J. Oper. Res. 2003, 145, 85–91. [Google Scholar] [CrossRef]

| Variable | Description | Scale of Measurement | Unit of Measure or Coding System |

|---|---|---|---|

| y | Property price | Ratio | Euros/m2 |

| Sa | Saleable area | Ratio | m2 |

| ERB | Energy rating band | Ordinal | A4; A3 to A; B or C; D (reference); E; F; G |

| EPI | Energy performance index | Ratio | kWh/m2 y |

| Bt | Building typology | Nominal | 1 = Flat; 2 = Studio; 3 = Detached house; 4 = Terraced house; 5 = Semi-detached house |

| Cy | Construction year | Interval | |

| Mc | Maintenance conditions | Nominal | 1 = New or refurbished; 2 = Fit for residential use; 3 = To be renovated |

| Rm | Rooms | Interval | |

| Br | Bathrooms | Interval | |

| Gr | Garage | Dichotomous | 1 = yes |

| Pl | Privately owned parking lots | Interval | |

| Gd | Private garden | Dichotomous | 1 = yes |

| Lf | Lift | Dichotomous | 1 = yes |

| Fl | Floor level | Interval | |

| Ns | Number of stories | Interval | |

| Ph | Penthouse | Dichotomous | 1 = yes |

| Etics | External thermal insulation cladding system | Dichotomous | 1 = yes |

| Fw | Windows and frames | Nominal | 1 = Single glazed, wood frame; 2 = Single glazed, other frame; 3 = Double glazed, wood frame; 4 = Double glazed, solid metal frame |

| Hs | Heating system | Nominal | 1 = Floor heating; 2 = Fan coils; 3 = Radiators |

| Mev | Mechanical extract ventilation | Dichotomous | 1 = yes |

| Hp | Heat pump | Dichotomous | 1 = yes |

| Ps | Photovoltaic system | Dichotomous | 1 = yes |

| Oe | ‘Out of the ordinary’ equipment * | Dichotomous | 1 = yes |

| Cc | Distance to the city center | Ratio | km |

| Ml | Distance to the nearest mall | Ratio | km |

| Bw | Distance to the closest beltway ramp | Ratio | km |

| Model for ERBs | Model for EPI | |||||||

|---|---|---|---|---|---|---|---|---|

| Coeff. | Std. Err. | t-Stat + | p-Value | Coeff. | Std. Err. | t-Stat + | p-VALUE | |

| const | 8.8170 | 0.9004 | 9.792 *** | 0.0000 | 7.0920 | 0.3452 | 20.540 *** | 0.0000 |

| ys−1 ++ | 0.0909 | 0.0418 | 2.172 ** | 0.0306 | 0.1038 | 0.0469 | 2.214 ** | 0.0276 |

| Sa | −0.0013 | 0.0002 | −6.069 *** | 0.0000 | −0.0015 | 0.0003 | −5.139 *** | 0.0000 |

| A4 +++ | 0.5638 | 0.0561 | 10.050 *** | 0.0000 | ||||

| A3-A +++ | 0.4535 | 0.0543 | 8.345 *** | 0.0000 | ||||

| B-C +++ | 0.1611 | 0.0495 | 3.256 *** | 0.0013 | ||||

| F +++ | −0.1030 | 0.0413 | −2.496 ** | 0.0131 | ||||

| G +++ | −0.2446 | 0.0404 | −6.054 *** | 0.0000 | ||||

| EPI | −0.0015 | 0.0002 | −7.871 *** | 0.0000 | ||||

| Cy | −0.0009 | 0.0004 | −2.201 ** | 0.0285 | ||||

| Mc(2) | 0.2042 | 0.0339 | 6.020 *** | 0.0000 | 0.1105 | 0.0386 | 2.864 *** | 0.0045 |

| Br | 0.0591 | 0.0283 | 2.085 ** | 0.0379 | ||||

| Fl | −0.0442 | 0.0107 | −4.123 *** | 0.0000 | −0.0504 | 0.0120 | −4.186 *** | 0.0000 |

| Ph | 0.2751 | 0.0591 | 4.657 *** | 0.0000 | 0.3188 | 0.0617 | 5.169 *** | 0.0000 |

| Fw(1) | −0.1397 | 0.0622 | −2.245 ** | 0.0255 | ||||

| Fw(2) | −0.1373 | 0.0573 | −2.395 ** | 0.0172 | ||||

| Fw(4) | −0.1160 | 0.0325 | −3.570 *** | 0.0004 | −0.1138 | 0.0351 | −3.244 *** | 0.0013 |

| Mev | 0.2140 | 0.0539 | 3.970 *** | 0.0001 | ||||

| Cc | −0.1160 | 0.0107 | −10.85 *** | 0.0000 | −0.1112 | 0.0113 | −9.870 *** | 0.0000 |

| Ml | 0.0661 | 0.0159 | 4.159 *** | 0.0000 | 0.0742 | 0.0160 | 4.635 *** | 0.0000 |

| Bw | 0.0689 | 0.0208 | 3.314 *** | 0.0010 | 0.0813 | 0.0223 | 3.638 *** | 0.0003 |

| Adj. R2 | 0.6034 | 0.5281 | ||||||

| AIC ++++ | 12.3985 | 67.2394 | ||||||

| Model for EPI and sqEPI | ||||

|---|---|---|---|---|

| Coeff. | Std. Err. | t-Stat + | p-Value | |

| const | 7.2164500 | 0.3340 | 21.600 *** | 0.0000 |

| ys−1 ++ | 0.1054310 | 0.0445 | 2.367 ** | 0.0186 |

| Sa | −0.0015717 | 0.0003 | −5.520 *** | 0.0000 |

| EPI | −0.0037067 | 0.0004 | −9.144 *** | 0.0000 |

| sqEPI | 0.0000054 | 0.0000 | 6.426 *** | 0.0000 |

| Mc(2) | 0.1832250 | 0.0364 | 5.030 *** | 0.0000 |

| Br | 0.0592567 | 0.0274 | 2.161 ** | 0.0315 |

| Fl | −0.0451867 | 0.0120 | −3.771 *** | 0.0002 |

| Ph | 0.3210940 | 0.0619 | 5.188 *** | 0.0000 |

| Fw(2) | −0.1011550 | 0.0532 | −1.900 * | 0.0584 |

| Fw(4) | −0.1184110 | 0.0327 | −3.618 *** | 0.0003 |

| Mev | 0.1469560 | 0.0534 | 2.753 *** | 0.0063 |

| Cc | −0.1126880 | 0.0110 | −10.250 *** | 0.0000 |

| Ml | 0.0724747 | 0.0153 | 4.726 *** | 0.0000 |

| Bw | 0.0635119 | 0.0219 | 2.901 *** | 0.0040 |

| Adj. R2 | 0.5540 | |||

| AIC +++ | 49.1543 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Copiello, S.; Coletto, S. The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach. Buildings 2023, 13, 276. https://doi.org/10.3390/buildings13020276

Copiello S, Coletto S. The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach. Buildings. 2023; 13(2):276. https://doi.org/10.3390/buildings13020276

Chicago/Turabian StyleCopiello, Sergio, and Simone Coletto. 2023. "The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach" Buildings 13, no. 2: 276. https://doi.org/10.3390/buildings13020276

APA StyleCopiello, S., & Coletto, S. (2023). The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach. Buildings, 13(2), 276. https://doi.org/10.3390/buildings13020276