Abstract

Joint construction ventures are a global business partnership approach to accomplishing jointly executed construction objectives. The success of joint ventures is not achieved without militating factors and complexity affecting the process. This study assessed the militating factors against joint venture success in the construction industry in South Africa. A quantitative research approach was adopted, using a purposive sampling technique to select participants for this study. In total, 190 copies of the questionnaire were sent out to construction stakeholders in Gauteng province, South Africa, and 185 copies of the questionnaire were retrieved. Data analysis was conducted in three stages: data reliability and validity, descriptive statistics, and exploratory factor analysis. The exploratory factor analysis (EFA) returned seven factors that provided a relevant understanding of the militating factors against joint venture success: differences in partners’ work values, ineffective regulatory frameworks, undefined goals, clashes between partners’ cultural values, economic viability, operational constraints, and conflicts of interest. This study recommends that joint venture formulation requires due diligence from partners to understand policy, organisational culture, sharing ratios, and economic viability to avoid unnecessary conflicts of interest and operational constraints.

1. Introduction

Joint ventures are a business concept that describes alliances between construction industry business partners to boost performance and project delivery [1]. They provide many opportunities to respond to business, expand capacity, access new markets, meet governmental policies, and transfer technology [2,3]. Joint ventures are project partnerships or strategic partnerships that provide collaborative processes among partners based on common goals, increased efficiency, shared resources, and continuous improvement [4,5]. In joint ventures, ownership is shared by the participants with more or less equal equity distribution and without absolute dominance by one party. Still, one of the partners must be an operating entity that wishes to broaden its activities to profit-motivated business [6,7]. Joint ventures in the construction industry are business partnerships to accomplish jointly executed construction objectives [8]. They encourage unrelated businesses or professional entities to share engineering, consulting, procurement, and construction management services by consolidating the skills and resources of the participants [9,10].

The increasing magnitude, complexity, and risk associated with major construction projects have brought together firms with diverse strengths and weaknesses to bid for and execute construction projects jointly [11]. Minja [12] noted that the complexity of clients’ requirements and technological advancements in construction have increased the competitiveness of construction projects. Recent construction projects have complex site natures, take time, have imbalanced cash flows, and require complex contractual agreements [13]. Different risks prevent construction projects from being completed on time and within budget [6,14]. Hence, construction firms enter joint ventures in the construction industry at varying levels to stay in business, pool resources together, share risks, complete large and complex projects, complement strengths, and increase productivity and competitive edge in ways they could not have managed alone [12,13,15].

Globally, there are several success factors of joint ventures within the construction industry [16]. For instance, successful joint ventures for construction projects have included the Three Gorges Dam in China, the Channel Tunnel between the United Kingdom and France, the Taiwan high-speed railway, and Nigeria’s eastern railway and western narrow-gauge rail line [17,18]. Joint ventures in the South African construction industry provide groups of contractors that jointly accept to enter into contractual construction arrangements [19]. These contractual arrangements exist between small and large firms working mutually on construction projects where partners contribute knowledge in their field and learn from others [20]. The current policy on procurement reforms by the South African government has also explicitly inspired joint ventures between emerging and established businesses as the prerequisite for awarding major construction-related contracts [12].

However, the success of joint ventures is not achieved without militating factors and complexity that affect construction processes and procedures [21]. Ozorhon [22] concurred that the complexity and dynamic environment (political system and market) in which construction-related joint ventures operate and survive affect partnerships’ success. This is because managing joint venture construction projects is much more difficult than the usual projects undertaken by individual construction firms [23]. Lin [21] postulated that the ineffective cooperation and management of joint ventures in the construction industry usually leads to the poor performance of construction projects. It is important to note that construction projects are highly vulnerable to external risks, which is an important factor that needs attention for joint ventures to succeed in the construction industry [24]. Xuan [24] attributed the external factors militating against joint venture success to influences of the operating environments, such as government policies and foreign exchange.

Addressing the militating factors against joint venture success in the South African construction industry, few studies have investigated the militating factors that could influence joint venture success in the construction industries of developing economies [23,24,25]. Holistically identifying these militating factors against joint venture operations from a global view in the existing literature and validating the variables through statistical analysis constitute gaps in knowledge among developing countries, including the South African construction industry [23,24]. Thus, this study assessed the militating factors against joint venture success in the South African construction industry. The South African construction industry was chosen for this study because of its peculiarity compared to other developing countries’ construction industries and the high numbers of joint venture construction projects that are ongoing in the South African construction industry [19,20,23]. The study’s objective was established through a literature review of factors militating against joint venture success in the construction industry. Further, the study’s practical and theoretical implications were established to guide stakeholders in the construction industry, especially those involved in joint ventures, and provide better guidance and predictions for future joint ventures in terms of the execution and processes of construction projects.

2. Literature Review

2.1. The Construction Industry

The construction industry is one of the riskiest, most dynamic, most challenging, and most rewarding fields [19,26]. In the construction industry, business risk is inherent in every construction project and is normally assumed by the owner unless it is transferred to or assumed by another party (i.e., contractors, sub-contractors, etc.) for fair compensation [19,27]. Akintunde [28] contended that the need for technical competence, poor project financial appraisals and management, not embracing modern innovation, and the shortage of managerial skills make indigenous construction lack competitive advantage over foreign firms in developing countries. Firms in the construction industries of developing countries lack adequate planning, making unpredictable economic and business operations affect construction activities because of their inability to meet the requirements for securing loans [29]. Helen [30] attributed the factors affecting these firms’ construction projects to the skills shortage, ineffective site management, and poor leadership and supervision. Construction firms experience economic disadvantages, insecurity, inferiority, project delivery behind schedule, escalated material prices, project abandonment, and unmet project goals [31].

However, yearning for a more holistic contractual approach has made construction stakeholders seek innovative procurement systems around the globe. Mohammed [32] posited that joint ventures are gaining attention in global construction markets as an alternative and better procurement approach for successful construction project execution. Sim [33] noted that joint venture strategies in developed and developing countries has increased the number of construction projects procured. Kumaraswamy [11] asserted that the increase in factors militating against construction firms in terms of quality, time, and cost performance has led to the formulation of joint ventures within the industry, which allow firms to collectively pull resources together and jointly secure and execute projects together. Adnan [2] posited that joint ventures allow construction firms to enter new markets and compete. For joint ventures to succeed within the construction industry, there is a need for a critical analysis of the militating political, social, and cultural factors affecting their success within the construction business environment.

2.2. Joint Ventures in the Construction Industry

Using joint ventures in the construction industry provides the concentration of economic resources, skills, and knowledge required to negotiate bonds and complete large-scale construction projects [34,35]. Joint ventures are carried out in the construction industry to reduce the risk involved in construction processes and operations [35]. Most individual construction firms often look at a project’s size and the capacity of their manpower, management, material, and equipment resources, financial capability, and technical ability [34]. Joint ventures enable stakeholders in the construction industry to participate in and create innovative working methods, reducing the costs and project times of construction processes and operations.

Kale [35,36] noted that forming joint ventures in the construction industry is based on the following reasons: resource dependence theory, the transaction cost approach, tax implications, technology transfer, the sharing of political risks, the sharing of commercial risks, and competition strategy. Zirape [36] asserted that joint venture implementation in the construction industry requires strategic planning, partner selection feasibility studies, and incorporation. Joint ventures vary in type and economic development and are developed through business activities [37]. Howell [38] posited that partners in joint ventures tend to share technological skills and easily obtain external capital for their construction projects. Most construction organisations deploy joint ventures to align their business strategies toward meeting current dynamic business environments on national and international scales [39]. The nature of joint ventures that are entered into within the construction industry is pivotal in determining whether they will yield fruitful and productive outcomes. Organisations, including construction firms, gain resources and market information through the establishment of joint ventures when bidding for projects or venturing into new construction markets [38,39].

As in other sectors, joint ventures in the construction industry can be integrated, non-integrated, or combined [35]. In integrated joint ventures, the parties involved in the partnerships share profits and losses in proportion to their interests in the construction projects, as agreed by the parties involved based on the use of their combined business resources and personnel [35,40]. One positive point for this type of joint venture is that they create strong and lengthy relationships among the parties involved. They are suitable for complex construction projects with highly structured planning and construction processes [35,40]. On the other hand, in non-integrated joint ventures, partners are chosen for the precise scope of work in the construction projects and are responsible for profits or losses linked with that scope of work [27,35]. Thus, each partner is solely responsible for the essential resources for completing its specific scope of work within the construction contract. Kale [35] asserted that there is a limitation to the relationships among partners with distinct work scopes in non-integrated joint ventures for construction projects.

Further, combined joint ventures allow each partner to take on a specific scope of work within projects and be accountable for profits or losses associated with that scope of work [35,41]. Individuals in these joint ventures also agree to act as partners with respect to portions of the essential work, which may include sharing the preliminaries and general conditions, as well as the actual performance of the portions of work that are vital for each member’s different scope of work within construction projects [41]. This type of joint venture can be used in larger and more complex projects [35,41].

However, Kale [35] sustained that joint ventures used for construction projects could be generally classified into equity and contractual joint ventures. Equity joint ventures involve two or more parties setting up separate legal firms or creating new corporate entities to act as the vehicle for carrying out projects [35,42]. Each partner owns a given share of the equity capital and the redistribution of shares between the parties of existing firms can also be shared with and transferred to other parties in the joint venture [41,43]. Partners’ inputs can be staff, capital, plant, and other resources that need not be on an equal basis but the sharing of profits and furnishing of bonds must be agreed upon [35,43]. In contractual joint ventures, parties’ interests are aligned, which allows for relationships between two or more parties who share the same objectives in carrying out certain project task(s) [33,43]. Parties do not set up separate legal entities for projects but work in partnership to share losses and profits on the conditions set out in the joint venture contract [35]. The weakness of contractual joint ventures is that contract details must be negotiated, which may take time, be expensive, and derail potential ventures as parties might not agree on every detail [27]. Thus, contractual joint ventures may not be appropriate for construction projects that need to avoid litigation [6].

2.3. Factors Militating against Joint Venture Success in the Construction Industry

Joint venture activity in the construction industry has been seen as one of the major changes in international business environments in the past decade as they are a popular means of entry into the industry for multinational construction firms [44]. The benefits of joint ventures are undisputed in the construction industry; however, construction firms in developed countries have not witnessed many domestic and international joint ventures [45]. Considering the current state of joint ventures in the construction sectors in developing countries, there are factors militating against the success of joint ventures in construction projects.

Kale [35] postulated that factors militating against joint venture success in construction projects are unclear partner roles, the unequal sharing of risks and benefits, inevitable crises, no exit mechanisms, inadequate training, and a misunderstanding of the partnering concept. A common problem with joint ventures is a lack of clarity regarding the scope of the partnership and how the two sides intend to work together [14]. Walker [46] noted that in joint ventures with a clear majority owner, the other partner (minority) could contribute a brand name, money, or patent right to technology with less interest in the day-to-day decisions. Thus, a willing docile partner is key to the success of joint ventures. When both partners bring 50-50, they are expected to put in roughly the same amount of effort into the venture [46]. The key factor in 50-50 joint ventures is bringing unique skill sets together with clear partner roles. However, to have clear partnership roles, the key partners in joint ventures should be involved during negotiations to define the benefits they expect and their contributions [35]. Value and gain generated by partners in joint ventures need to be distributed between the partners as agreed to avoid conflicts in the operational processes of the partnerships [45]. Conflicts deteriorate joint ventures beyond the capacity of the partners where parties believe they cannot cope with working together again, so they must have formal exit mechanisms in place [47]. This helps both parties to avoid time-consuming and costly litigation. It has been observed that many partners in joint ventures do not pay adequate attention to managing partner relations [36]. Nonetheless, establishing exit mechanisms in joint venture planning stages will help to avoid joint ventures from failing without needing to negotiate the dangerous minefield of one measure or another. This will also help to avoid operational issues in joint venture [35].

Zirape [36] posited that insufficient staff training is one reason for joint venture failures in the construction industry. Most partners and participants in joint ventures do not understand the concept. Thus, they are not able to implement partnering successfully in joint ventures. Misunderstanding the joint venture concept militates partnering implementation. Zirape [36] opined that a poor partnership approach with limited experience affects the knowledge and understanding of project participants in joint ventures. Misunderstanding and unfamiliarity among partners with the partnering concept could cause irrevocable failure. Adnan [27] opined that the militating factors affecting joint venture project success include a lack of mutual understanding, a lack of inter-partner trust, a lack of proper agreement on the contract, poor commitment, poor cooperation, financial instability and incoordination, and poor communication and management control.

Moreover, Gale [48] noted that the selection of unsuitable partners, unclear statements in joint venture agreements, poor information on partners before negotiations, and a lack of the clear identification of partners’ objectives affect the success of joint ventures in the construction industry. Ikuabe [23] identified 28 risk factors for joint venture success in the construction industry. These militating factors include, but are not limited to, poor inter-partner trust, a lack of proper agreement on the contract, poor commitment, a lack of mutual understanding, a clash of personalities, unchanging attitudes, and a lack of planning, among others.

The study by Ozorhon [22] aimed to investigate the performance and risk of joint ventures in the construction industry. The findings showed that the study was based on statistical procedures for examining the effects of inter-partner fit/relations, structural characteristics, host country factors, and project-related factors. On the other hand, the study by Razzaq [49] analysed the impact of the risks of joint ventures in the construction industry on the project success criteria of time, cost, and quality using factor analysis as an identifier tool. The contributions of this study differ from both of these studies because we assessed the factors militating against the success of joint ventures in the construction industry based on the perspectives of professionals in the construction industry. Further, the retrieved data in this study were analysed using descriptive and exploratory factor analysis.

It is pertinent to note that the success of joint ventures in the construction industry can be affected by different factors, leading to issues affecting project output rate or actualisation [14]. One important aspect of joint ventures within construction is that transparency and trust is vital among partners, and the early identification of militating factors can predict performance, which must be established from the onset. Consequently, as shown in Table 1, our synthesis of the views developed by various authors provided a more holistic outline to guide this study. Thus, detailed in Table 1 are the factors militating against the success of joint ventures that guided this study, as extracted from the relevant literature. As seen in the literature review, the factors represented in the different studies have primarily focused on factors militating against the success of joint ventures in construction projects.

Table 1.

Militating factors against joint venture success in the construction industry.

3. Research Method

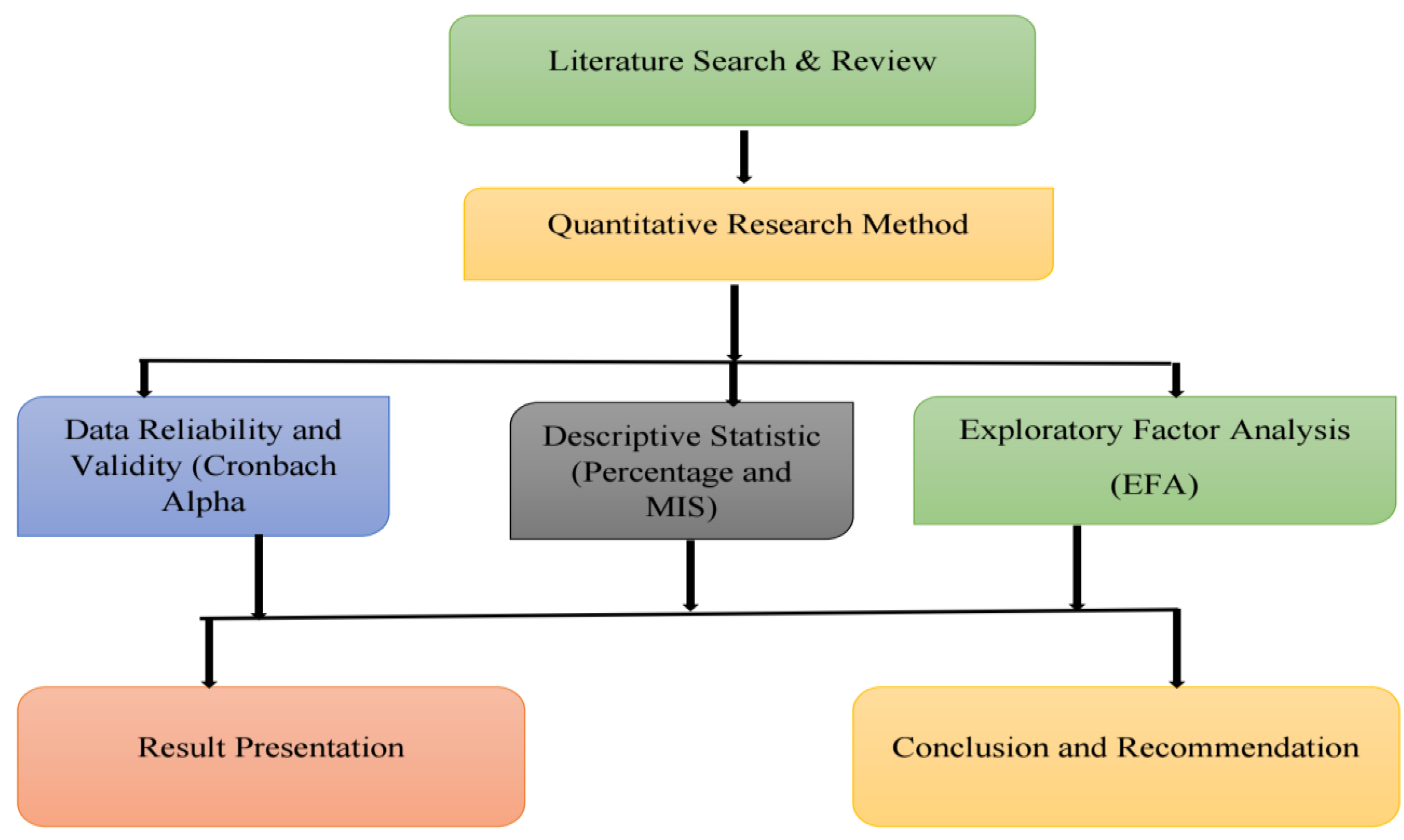

This study adopted a quantitative research approach to assess the militating factors against the success of joint ventures in the South African construction industry (see Figure 1). According to Babbie [58], quantitative research approaches unbiasedly analyse mathematical and numerical data. Quantitative research designs use structured questionnaires, voting polls, survey studies, or computational techniques to treat or validate existing statistical data [59]. Thus, the South African construction industry was used for this study because of the high numbers of construction professionals involved in joint ventures in the construction industry in the country [23,60,61]. Additionally, the construction industry in South Africa is at the edge of a digital revolution, with countless technologies providing innovative answers to the age-old issues of executing construction projects to meet clients’ budgets, quality, and timing [60,61]. Further, the South African construction industry plays a critical role in creating enabling business environments for joint ventures in construction operations and processes [14,20,23]. It is also a vital sector for the country’s economy and is responsible for stimulating investment, creating jobs, and improving infrastructure [23,61].

Figure 1.

The research method.

This study surveyed the opinions of professionals within the construction industry, including architects, construction managers, project managers, engineers, project controllers, contract managers, quantity surveyors, and planners/schedulers. The stakeholder preferences were based on their experiences in joint venture construction projects in the South African construction industry. Hence, Table 1 summarises the militating factors against joint venture success identified in the literature, which was used to design a Likert scale survey questionnaire that was in line with the research objective.

A purposive sampling technique was used to select participants for this study. According to Creswell and Plano-Clark [62], purposive sampling is a non-probability method that uses the subjective method to select individual participants who have knowledge or experience of a phenomenon. Wilkins [63,64] maintained that non-probability sampling allows for the selection of research participants based on their willingness to participate in a survey when a random sampling method could not be used to choose respondents. The respondents in this study were requested to signify their level of agreement with each identified militating factor against joint venture success in the South African construction industry. A five-point Likert scale was used as follows: 5 = strongly agree (S.A.); 4 = agree (A); 3 = neutral (N); 2 = disagree (D); 1 = strongly disagree (S.D.). Using the purposive quota sampling technique, 190 questionnaires were administered to construction professionals within the study area. Out of the administered questionnaires, 185 copies were retrieved from the respondents for the analysis. This represented 97.36% of the total questionnaires administered. Around 28,000 registered construction professionals work within the study area [20]. Thus, Yamane’s [59] equation, as cited by [60], was used to calculate the sample size that could represent the total population of 28,000 construction professionals in the Gauteng province of South Africa. Yamane’s [59] equation provides a simplified formula to calculate sample sizes, allowing inferences and conclusions drawn from surveys to be applied to the complete population from which the sample was drawn. Hence, Equation (1) was used to calculate the sample size for this research with respect to the population under study.

where n is the random sample size, N is the population size, and e is the level of precision. In Yamane’s equation (1967), the level of precision is set at a 95% significant level and is equivalent to p = 0.05, which was adopted for this equation in this research.

n = N/[1 + N(e)2]

n = 8792/1 + (8792) (0.075)2 = 174

According to Equation (1), the sample size required for this study was 174 respondents. However, the actual number of respondents was 185. The 185 responses used for this study were in line with the recommendations in [65]. Hence, the retrieved data were analysed using descriptive and exploratory factor analysis (EFA). We used IBM SPSS Statistics version 26 to analyse the data obtained from the field survey. The study also conducted descriptive analysis, including percentage, frequency, mean item score (MIS), and standard deviation. The descriptive analysis using the mean item score (MIS) was conducted to examine the outcomes of the Likert inquiries about this research questionnaire. Manikandan [66] maintained that the mean is often used to measure data-central tendencies. The computation of MIS was based on the weighted responses from the survey participants for each question. It was also aligned with the scores chosen by the respondents’ that were deemed collectively as the analytically agreed indicators of comparative significance. Thus, the MIS index was the overall actual score (applying a 5-point Likert scale) indicated by each respondent as a fraction of the entirety of each of the more significant probable outcomes on the Likert scale, which each respondent could add to that criterion. The standard deviation explains the sample through a descriptive statistic that computes the numbers spread across the mean [67].

The descriptive analysis conducted included percentage, frequency, and standard deviation. The data adequacy for the exploratory factor analysis (EFA) was determined using Kaiser–Meyer–Olkin (KMO) and Bartlett’s sphericity tests. EFA helps to reduce large data into small components by discovering their levels of relationship [68]. Cronbach’s alpha test was conducted to determine the data reliability and the interrelatedness of the variables in each component [68]. Tavakol [69] posited that Cronbach’s alpha test explores the scale reliability of data through their internal consistency. The data collection instrument reliability test returned a value of 0.910 for the coefficient of Cronbach’s alpha scale, which was higher than the 0.6 value recommended by [70]. As noted by Yong and Pearce [71], a 0.40 loading cut-off is considered a significant variable in exploratory factor components based on pragmatic reasons. Thus, this study retained underlying variables with loadings of less than 0.5. This explained the reliability of the data collection instrument and the validity of the field survey responses. The results of the analysis were presented in figures and tables.

4. Discussion of Findings

4.1. Respondent Background Information

Table 2 shows the demographic information of the respondents. In terms of years of experience, the results showed that 26% had above six years of experience, 22% had five years of experience, 18% had four years of working experience, 15% had three years of working experience, while 13% had two years working experience, 5% had one year, and 1% had less than one year of working experience. The professional designations of the respondents comprised 21% construction managers, 21% project managers, 15% engineers, 12% project controllers, 10% contract managers, 8% quantity surveyors, 7% architects, and 6% planners/schedulers. The respondents’ academic qualifications comprised 33% honours degrees, 23% master’s degrees, 19% bachelor’s degrees, 16% diploma degrees, and 8% professional certificates. Just 1% of respondents had the highest academic qualification (doctorate). Table 2 further shows the number of joint venture projects that the respondents had been involved with in the construction industry. The results indicated that 13% of respondents were involved in more than six joint venture projects, 7% were involved in five joint venture projects, 21% were involved in four joint venture projects, 19% were involved in three joint venture projects, 27% were involved in two joint venture projects, while 7% of the respondents were involved in less than one joint venture project in the construction industry. Hence, the respondents had good knowledge of joint venture operations in the construction industry.

Table 2.

The respondents’ background information.

4.2. Descriptive analysis of Militating Factors against Joint Venture Success in the Construction Industry

As shown in Table 3, the results revealed the mean item score and standard deviation of the descriptive analysis of militating factors affecting joint venture operations in the South African construction industry. The respondents indicated their level of agreement with the identified militating factors against joint ventures using the following 5-point scale: 5 = strongly agree (S.A.); 4 = agree (A); 3 = neutral (N); 2 = disagree (D); 1 = strongly disagree (S.D.). The militating factors against joint venture success in the South African construction industry were ranked using the mean item score (MIS) and standard deviation (σ).

Table 3.

Factors militating against joint venture success in the construction industry.

The factors that were ranked highly as militating factors against joint venture success in the construction industry included “lack of inter-partner trust”, which ranked first with an MIS of 4.16 and a σ of 0.870, “corruption (local and international)”, which ranked second with an MIS of 4.09 and a σ of 0.893, “lack of proper agreement on the contract”, which ranked third with an MIS of 4.08 and a σ of 0.840, and “economy fluctuations”, which ranked fourth with an MIS of 4.06 and a σ of 0.894, while “poor management control”, with an MIS of 3.97 and a σ of 0.843, and “financial instability”, with an MIS of 3.97 and a σ of 0.902, were ranked fifth. “Poor commitment from partners”, with an MIS of 3.96 and a σ of 0.856, “poor cooperation from partners”, with an MIS of 3.96 and a σ of 0.946, and “costly coordination of inter-partners”, with an MIS of 3.96 and a σ of 0.937, were ranked seventh.

The factors that ranked above average as militating factors against joint venture success in the construction industry included “inexperience with joint venture projects”, which ranked tenth with an MIS of 3.95 and a σ of 0.886, and “communication breakdown”, which ranked eleventh with an MIS of 3.94 and a σ of 0.760, while “poor project relations among partners’ teams”, with an MIS of 3.93 and a σ of 0.879, and “unresolved disputes”, with an MIS of 3.91 and a σ of 0.883, ranked thirteenth. The factors ranked fourteenth included “losses incurred due to corruption and bribery”, with an MIS of 3.89 and a σ of 0.896, “special responsibilities not clearly defined”, with an MIS of 3.89 and a σ of 0.840, “varying financial objectives”, with an MIS of 3.89 and a σ of 0.787, “inadequate compensation for proprietary”, with an MIS of 3.89 and a σ of 0.787. Meanwhile, “special roles not clearly defined” ranked eighteenth with an MIS of 3.88 and a σ of 0.895, “lack of belief in the system” ranked nineteenth with an MIS of 3.74 and a σ of 1.108, and “excessive demands by clients”, with an MIS of 3.71 and a σ of 1.118, and “lack of mutual understanding”, with an MIS of 3.71 and a σ of 1.079, ranked twentieth. Then, “excessive variations in projects” ranked twenty-second with an MIS of 3.68 and a σ of 1.054 and “clash of personalities” ranked twenty-third with an MIS of 3.62 and a σ of 1.136. The twenty-fourth ranked factors were “unchanging attitudes”, with a mean score of 3.57 and a σ of 1.155, “clash of organisational cultures”, with an MIS of 3.57 and a σ of 1.031, and “unfavourable government regulations”, with an MIS of 3.57 and a σ of 1.077. The last three militating factors against joint venture success in the construction industry, ranked twenty-seventh to twenty-ninth, were “disputes among partners (sharing of work, profits, and losses)”, with an MIS of 3.56 and a σ of 1.160, “lack of planning”, with an MIS of 3.48 and a σ of 1.064, and “breach of contract by partners”, with an MIS of 3.44 and a σ of 1.067.

4.3. Exploratory Factor Analysis Results

The exploratory factor analysis of militating factors against joint venture success in the South African construction industry revealed 29 established militating factors against joint venture success in the South African construction industry using the IBM SPSS statistics version 26. The exploratory factors analysis used principal component analysis to check the data suitability for factor analysis.

Table 4 shows the KMO and Bartlett’s tests for the militating factors against joint venture success in the construction industry. The 0.832 value of the KMO test for sample adequacy obtained from the results in Table 4 was higher than the 0.6 recommended value for exploratory factor analysis [70,72]. Significant values for Bartlett’s test of sphericity (represented by “Sig”) show the measure of the multivariate normality of dataset distributions. Our data returned a 0.000 significance value, indicating the acceptability of the data for factor analysis. According to George [73], a significant value less than 0.05 represents research data that could be accepted for EFA because the data do not generate an identity matrix. Therefore, the correlation coefficient of >0.3 supported the KMO and Bartlett’s tests for the factorability of the dataset.

Table 4.

The KMO and Bartlett’s tests for factors militating against joint venture success.

Table 5 reveals the communalities for the militating factors against joint venture success in the construction industry. The extraction value of the results in Table 4 was >0.3, which meant the listed militating factors against joint venture success in the South African construction industry fit well in their components without any signs of variance. The factor grouping was reliable because none of the factors had low extraction values.

Table 5.

Communalities.

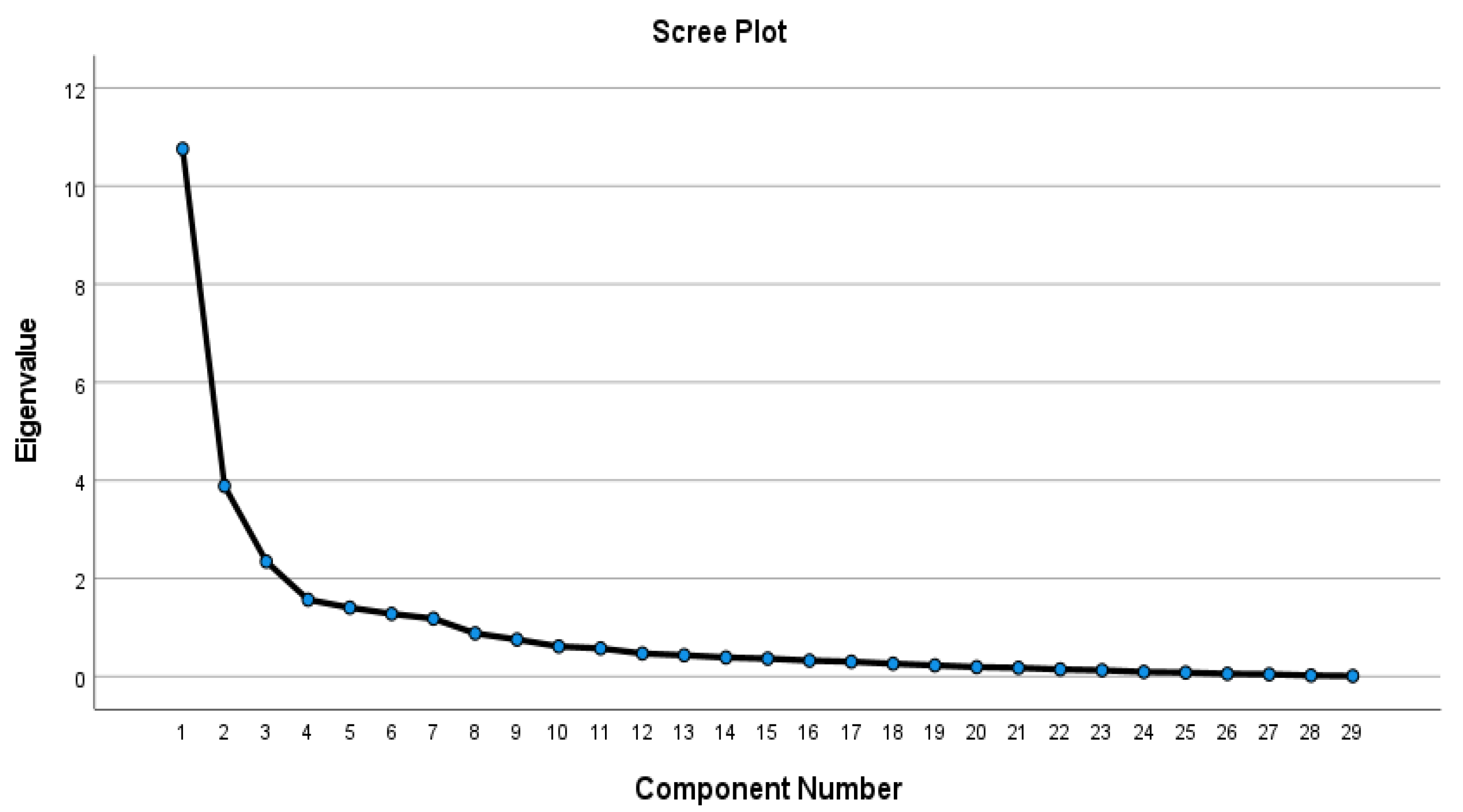

Table 6 explains how the latent root, or Kaiser’s criterion, was used to retain components with eigenvalues > 1.0 for the total variance explained of the militating factors against joint venture success in the South African construction industry. There were seven components with eigenvalues > 1.0: 10.759, 3.886, 2.346, 1.568, 1.405, 1.279, and 1.181, which explained 37.100%, 13.401%, 8.901%, 5.405%, 4.846%, 4.410%, and 4.074%, respectively. Hence, these seven components explained a cumulative percentage of 77.328 of the variance, highlighting the significance of the variables within the seven components.

Table 6.

Total variance explained.

The scree plot graph (see Figure 2) used the Oblimin method of rotation to further highlight the eigenvalues of the 27 identified militating factors against joint venture success in the South African construction industry. The scree plot graph shows how the seven components correlated with one another to a certain degree. The scree plot shows how the seven components were clustered, before the break in the steep slope, as factors that needed interpretation via factor analysis, according to the direct Oblimin rotation of the correlations between the 27 variables. The steep slope shown in Figure 2 represents the significant factors, while the gradual trailing represents the rest of the factors with eigenvalues < 1.0.

Figure 2.

Scree plot.

4.4. Discussion of Exploratory Factor Component Report

The pattern matrix for the 29 militating factors against joint venture success in the South African construction industry is presented in Table 7. The 29 militating factors against joint venture success were clustered into seven components. The components were interpreted based on the inherent relationships between the variables in each component before common names were assigned to the components. Additionally, a further inspection of the scree plot revealed the last significant break on the plot was on the seventh factor, which confirmed the extraction of seven factors. The steeper portion of the slope shows the large factors, while the gradual trailing shows the rest of the factors that had eigenvalues lower than 1. Hence, Factor 1 was named “differences in partners’ work values”, Factor 2 was named “ineffective regulatory frameworks”, Factor 3 was named “undefined goals”, Factor 4 was named “clashes between partners’ cultural values”, Factor 5 was named “economic viability”, Factor 6 was named “operational constraints”, and Factor 7 was named “conflicts of interest”.

Table 7.

Pattern matrix (a).

4.4.1. Factor 1: Differences in Partners’ Work Values

In total, six variables were clustered into the first factor, including inadequate compensation for proprietary (88%), varying financial objectives (88%), lack of proper agreement on the contract (81%), poor commitment from partners (61%), lack of belief in the system (60%), and lack of inter-partner trust (43%). The variables explained a cumulative percentage of 37.100 of the variance. The variables in this factor explained the complexity of joint ventures, which is one of the main problems affecting joint venture success in construction processes and procedures [21]. Managing differences between partners is one of the most challenging aspects of joint venture operations [23]. This study’s findings also aligned with the conclusion of Kale [35], who asserted that the factors affecting the success of joint ventures in construction projects are the misunderstanding of the partnering concept and legal agreements between both partners. Adnan [27] concluded that poor commitment, a lack of inter-partner trust, and financial instability and incoordination affect the success of joint ventures. Thus, partners involved in joint ventures in the construction industry need to understand their individual differences in terms of personal work ethics, experience, organisational values, legal conditions, commitment, trust, and financial capability.

4.4.2. Factor 2: Ineffective Regulatory Frameworks

In total, five variables were clustered into this factor, which included unfavourable government regulations (92%), breach of contract by partners (91%), excessive variations in projects (88%), excessive demands by clients (87%), and disputes among partners (sharing of work, profits, and losses) (77%). The variables explained a cumulative percentage of 13.401 of the variance. The variables in this factor were related to the regulatory frameworks guiding internal and external operations in joint ventures within the South African construction industry. Xuan [24] concurred that the external factors militating joint venture success are mostly due to operating environment influences, such as government policies and financial regulations. Kale [35] opined that the failure of joint venture partners to set clear partnership roles during negotiations affects joint venture success. Joint venture regulatory frameworks are also needed to guide agreements, profit sharing, and partner operations. These findings collaborated with the submissions of Samanta [45], who stated that the sharing of value and gain generated by partners in joint ventures needs to be agreed upon to avoid conflicts during the operational processes of partnerships. Hence, joint venture regulatory frameworks are needed to guide agreements, profit sharing, and operations, which could reduce conflicts of interest and litigation among joint venture partners.

4.4.3. Factor 3: Undefined Goals

In total, five variables were clustered into the third factor, as follows: special roles not clearly defined (90%), inexperience with joint venture projects (86%), poor project relations among partners’ teams (80%), special responsibilities not clearly defined (70%), and unresolved disputes (68%). These variables explained a cumulative percentage of 8.091 of the variance. The undefined goals of joint venture partners are the common relationships linking the factors in this component. Gale [48,52] attributed the militating factors affecting joint venture success to the selection of unsuitable partners, unclear statements in joint venture agreements, poor information on partners before negotiation, and the ambiguous identification of partners’ objectives. Kale [23,35] posited that the long-term sustainability of joint ventures depends on defining justifiable risk–benefit ratios and exit policies for non-performing partners. Zirape [36] also noted that many partners in joint ventures do not pay adequate attention to managing partner relations, which could later affect their contractual relations. These findings also agreed with the submission of Abdulrahman [56], who identified breach of contract by partners, excessive demands and variations by clients, and poor project relations among partners as factors affecting construction firms involved in joint ventures. Hence, for efficient joint ventures in the construction industry, clarity in the goals of partnerships is essential, which must be established from the beginning of the partnerships.

4.4.4. Factor 4: Clashes between Partners’ Cultural Values

In total, two variables were clustered into the fourth factor, which were the clash of organisational cultures (85%) and lack of mutual understanding (71%). These variables explained a cumulative percentage of 5.405 of the variance. This was in line with the findings of Kale [35,55], who found that clashes in organisational cultures affect the operation of joint ventures. These problems can be due to differences in the cultures and languages of organisations [52]. Similarly, Xiong [57,73] contended that the factors affecting the operation of joint ventures in Africa include the national culture of joint venture performance (complexity, ambiguity, and uncertainty) and cultural differences in knowledge transfer. This clearly shows that international partners should more understanding of their partners’ cultures and values to achieve efficient and successful joint ventures in the construction industry, especially when partners are from different cultural backgrounds or countries.

4.4.5. Factor 5: Economic Viability

In total, two variables were clustered into the fifth component, which were the costly coordination of inter-partners (88%) and corruption (local and international) (76%). These variables explained a cumulative percentage of 4.846 of the variance. The factors in this component were related to the economic viability of partners involved in joint venture businesses. These findings were supported by Ikuabe [5,51], who expressed that the economic benefits of joint venture partnerships contribute to the successful operations of joint ventures in the construction industry. Zhang [74,75] maintained that differences in the economic importance of joint venture partners significantly impacts joint venture success in the construction industry. Thus, the economic viability of the country or each partner in joint ventures is an essential condition that needs critical consideration by all partners. Economic viability is important in joint ventures because it helps businesses, including those in the construction industry, grow faster, generate greater profits, and increase productivity. Further, it helps to create access to new markets and increase partners’ capacity. This shows that capitalising on the financing of new infrastructural developments, products, innovations, technologies, and processes by companies involved in joint ventures will positively impact national economies and social well-being.

4.4.6. Factor 6: Operational Constraints

In total, five variables were clustered into this factor, which were economy fluctuations (77%), unchanging attitudes (75%), lack of planning (75%), losses incurred due to corruption and bribery (74%), and communication breakdown (74%). These variables explained a cumulative percentage of 4.410 of the variance. The factors in this component were linked to operational constraints affecting successful joint ventures in the South African construction industry. Oswald [51,55] expressed that inappropriate planning, unchanging attitudes, and communication breakdowns are major operational constraints affecting joint ventures in the construction industry. Similarly, Abdulrahman [56] maintained that joint ventures are influenced by economic fluctuations and foreign exchange. The factors in this component are significant for the successful operations of joint ventures. Thus, this shows that the aim of forming joint ventures in the construction industry is for partners to combine resources to offer better construction services that individual firms could not achieve.

4.4.7. Factor 7: Conflicts of Interest

In total, four variables were clustered into the seventh factor, as follows: financial instability (89%), clash of personalities (86%), poor management control (49%), and poor cooperation from partners (44%). These variables explained a cumulative percentage of 4.074 of the variance. Mba [50] postulated that issues related to the operation and formation of joint ventures have been the subject of considerable review among construction firms. Thus, certain issues, such as a clash of personalities among joint venture employees, could affect joint venture success. Lonsdale [52] contended that conflicts of interest are inevitable when joint venture management teams are not collaboratively set up at the start of partnerships. Therefore, joint venture partners must jointly design their business agreements and articles of memorandum to avoid conflicts of interest among their employees.

The existence of positive relationships between the variables within the component correlation matrix is shown in Table 8. The values of the relationships between the component variables were around 0.30.

Table 8.

Component correlation matrix.

A reliability test was conducted on the variables in each component, which indicated that the measured variables were valid for each component. Table 9 shows that the Cronbach’s alpha value for each component of militating factors affecting joint venture success in the South African construction industry ranged between 0.575 and 0.921.

Table 9.

Reliability of clustered factors.

4.5. Conclusions and Recommendations

This study assessed the militating factors against joint venture success in the construction industry in South Africa. A quantitative research approach was adopted, using a purposive sampling technique to select participants among construction professionals in Gauteng province, South Africa. The EFA clustered the 29 identified militating factors against joint venture success in the South African construction industry into seven components. The seven components of militating factors against joint venture success were differences in partners’ work values, ineffective regulatory frameworks, undefined goals, clashes between partners’ cultural values, economic viability, operational constraints, and conflicts of interest. The empirical findings from the study aligned with the theoretical review. According to the ranking of the variables, lack of inter-partner trust, corruption, lack of formal agreement, economic fluctuations, and poor management control were the top-ranked factors militating against joint venture success in the construction industry. Therefore, without establishing adequate working conditions with predictable systems, the operations of joint venture partnerships will be affected. This study showed that joint ventures in the construction industry require due diligence from all partners to understand policy, organisational culture, sharing ratios, and economic viability to avoid unnecessary conflicts of interest and operational constraints that could undermine joint venture success.

The critical outcome of this study showed that it has theoretical and practical implications. Empirically, the study affirmed the need to understand the factors militating against joint venture success in the construction industry. The seven identified components could assist construction professionals and partners in the design of joint venture contracts and operations/processes to achieve joint venture success. The study could theoretically advance our knowledge of the factors militating against joint venture success in the construction industry, as represented in the seven components. Among the vital components were economic viability and ineffective regulatory frameworks for joint ventures, indicating that viable economy systems and efficient policy frameworks are key to successful joint ventures in the construction industry. On a practical note, the study findings could provide a relevant understanding of the militating factors against joint venture success before the commencement of partnerships. These identified militating factors could help to improve trust and prevent stakeholders, professionals, construction firms, and individual partners involved in joint ventures from paying excessive compensation due to unforeseen issues in partnerships.

The study concluded that successful joint ventures in the construction industry require due diligence from all partners to understand policy, organisational culture, sharing ratios, and economic viability to avoid unnecessary conflicts of interest and operational constraints. Therefore, the study recommends that the seven components of militating factors against joint venture success should guide stakeholders, professionals, construction firms, and individual partners involved in joint ventures within the construction industry to avoid conflicts and the abandonment of projects. Similarly, the study recommends that different strategies are required to improve the success rate of joint venture and the long-term sustainability of partnerships in the South African construction industry. Potential strategies include establishing guiding principles and effective management frameworks, exploiting partners’ technical ability, effective communication and monitoring systems, and the agreement of the memoranda of incorporation.

Due to time constraints, this study was limited to construction professionals within Gauteng province, South Africa, which meant the findings could not be generalised for the whole South African construction industry. Notwithstanding, it is important to emphasise that the construction stakeholders in Gauteng Province who were surveyed in this study fairly represented stakeholder activities within the South African construction industry. Hence, further research should be designed with samples collected from all provinces to examine whether the knowledge and success rate of joint ventures in the South African construction industry could be generalised.

Author Contributions

Conceptualisation, B.F.O. and M.P.S.; methodology, M.P.S., B.F.O. and C.O.A.; resources, M.P.S. and B.F.O.; writing—original draft preparation, M.P.S. and B.F.O.; writing—review and editing, B.F.O., C.O.A. and M.P.S.; visualisation, M.P.S. and B.F.O.; supervision, B.F.O. and C.O.A.; project administration, B.F.O., C.O.A. and M.P.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to acknowledge the Sustainable Human Settlement and Construction Research Centre, Faculty of Engineering and the Built Environment, University of Johannesburg (cidb Centre of Excellence).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Babatunde, S.O.; Perera, S.; Zhou, L.; Udeaja, C. Stakeholder perceptions on critical success factors for public-private partnership projects in Nigeria. Built Environ. Proj. Asset Manag. 2016, 6, 74–91. [Google Scholar] [CrossRef]

- Ogunbayo, B.; Aigbavboa, C.; Thwala, D.; Akinradewo, O.; Oguntona, O. Institutional Evaluation of Public and Private Partnerships Relevant Contributions to Housing Delivery System. Hum. Factors Archit. Sustain. Urban Plan. Infrastruct. 2022, 58, 370–378. [Google Scholar]

- Ogunbayo, B.F.; Aigbavboa, C.O.; Thwala, W.; Akinradewo, O.; Ikuabe, M.; Adekunle, S.A. Review of Culture in Maintenance Management of Public Buildings in Developing Countries. Buildings 2022, 12, 677. [Google Scholar] [CrossRef]

- Chan, A.P.C. Project Partnering in Hong Kong: A case study of a prestigious office development project. In Proceedings of the Conference Proceedings Presented at Queensland University of Technology Research Week, Brisbane, Australia, 4–8 July 2004. [Google Scholar]

- Awodele, O.A.; Ogunsemi, D.R. An assessment of success factors and benefits of project partnering in Nigerian construction industry. In Proceedings of the W092-Special Track 18th C.I.B. World Building Congress, Salford, UK, 10–13 May 2010; p. 180. [Google Scholar]

- Cherinet, D. Effectiveness of joint venture for local contractors in a mega project construction. Am. J. Civ. Eng. 2020, 8, 97–105. [Google Scholar] [CrossRef]

- Ogunbayo, B.F.; Ohis Aigbavboa, C.; Thwala, W.D.; Akinradewo, O.I. Assessing maintenance budget elements for building maintenance management in Nigerian built environment: A Delphi study. Built Environ. Proj. Asset Manag. 2022, 12, 649–666. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhao, X.; Yu, G.S. Risk identification and allocation in underground rail construction joint ventures: Contractors’ perspective. J. Civ. Eng. Manag. 2016, 22, 758–767. [Google Scholar] [CrossRef]

- Hong, Y.; Chan, D.W. Research trend of joint ventures in construction: A two-decade taxonomic review. J. Facil. Manag. 2014, 12, 118–141. [Google Scholar] [CrossRef]

- Ogunbayo, B.F.; Aigbavboa, C.O.; Amusan, L.M.; Ogundipe, K.E.; Akinradewo, O.I. Appraisal of facility provisions in public-private partnership housing delivery in southwest Nigeria. Afr. J. Reprod. Health 2021, 25, 45. [Google Scholar]

- Kumaraswamy, M.; Palaneeswaran, E.; Humphreys, P. Selection matters in construction supply chain optimization. Int. J. Phys. Distrib. Logist. Manag. 2001, 30, 661–680. [Google Scholar] [CrossRef]

- Minja, S.; Kikwasi, G.; Thwala, W. A study of joint venture formation between construction organizations in Tanzania. Australas. J. Constr. Econ. Build.-Conf. Ser. 2012, 1, 32–42. [Google Scholar] [CrossRef]

- Mishra, A.K.; Mallik, K. Factors and impact of risk management practice on success of construction projects of housing developers, Kathmandu, Nepal. Int. J. Sci. Basic Appl. Res. (IJSBAR) 2017, 36, 206–232. [Google Scholar]

- Masoetsa, T.G.; Ogunbayo, B.F.; Aigbavboa, C.O.; Awuzie, B.O. Assessing Construction Constraint Factors on Project Performance in the Construction Industry. Buildings 2022, 12, 1183. [Google Scholar] [CrossRef]

- Lau, T.; Chan, K.F.; Tai, S.H.C.; Ng, D.K.C. Corporate entrepreneurship of I.J.V.s in China. Manag. Res. Rev. 2010, 33, 6–22. [Google Scholar] [CrossRef]

- Chan, A.P.; Tetteh, M.O.; Nani, G. Drivers for international construction joint ventures adoption: A systematic literature review. Int. J. Constr. Manag. 2022, 22, 1571–1583. [Google Scholar] [CrossRef]

- Girmscheid, G.; Brockmann, C. Inter-and intraorganizational trust in international construction joint ventures. J. Constr. Eng. Manag. 2010, 136, 353–360. [Google Scholar] [CrossRef]

- Liang, R.; Wu, C.; Sheng, Z.; Wang, X. Multi-criterion two-sided matching of public–private partnership infrastructure projects: Criteria and methods. Sustainability 2018, 10, 1178. [Google Scholar] [CrossRef]

- Manitshana, B. Assessment of the Critical Success Factors of Joint Ventures in the South African Construction Industry. Master’s Dissertation, University of Johannesburg, Johannesburg, South Africa, 2013. [Google Scholar]

- Construction Industry Development Board (CIDB). The Construction Industry as a Vehicle for Contractor Development and Transformation; CIDB: Pretoria, South Africa, 2012.

- Lin, Y.H.; Ho, S.P. Impacts of governance structure strategies on the performance of construction joint ventures. J. Constr. Eng. Manag. 2013, 139, 304–311. [Google Scholar] [CrossRef]

- Ozorhon, B.; Arditi, D.; Dikmen, I.; Birgonul, M.T. Effect of host country and project conditions in international construction joint ventures. Int. J. Proj. Manag. 2007, 25, 799–806. [Google Scholar] [CrossRef]

- Ikuabe, M.; Aigbavboa, C.; Thwala, W.; Chiyangwa, D.; Oke, A. Risks of joint venture formation in the South African construction industry. Int. J. Constr. Manag. 2022, 29, 1–9. [Google Scholar] [CrossRef]

- Xuan, M.; Omran, A.; Pakir, A.H.; Gebril, A.O.; Zakiulfuad, A. The weaknesses of China’s contractors in overseas construction project management: 2 case studies. Manager 2012, 15, 175–189. [Google Scholar]

- Tetteh, M.O.; Chan, A.P.; Darko, A.; Nani, G. Factors affecting international construction joint ventures: A systematic literature review. Int. J. Constr. Manag. 2023, 23, 98–113. [Google Scholar] [CrossRef]

- Mills, A. A systematic approach to risk management for construction. Struct. Surv. 2001, 19, 245–252. [Google Scholar] [CrossRef]

- Adnan, H.; Morledge, R. Application of Delphi method on critical success factors in joint venture projects in the Malaysian construction industry. In Proceedings of the 1st Scottish Conference for Postgraduate Researchers of the Built and Natural Environment, Glasgow, UK, 18–19 November 2003; Glasgow Caledonian University: Glasgow, UK, 2003; pp. 41–49. [Google Scholar]

- Akintunde, I. Nigerian Construction Industry: Past, Present, Problems and Prospects; Ibadan University Printery: Ibadan, Nigeria, 2003. [Google Scholar]

- Ogechukwu, A. The Role of Small-Scale Industry in National Development in Nigeria. In Proceedings of the Association for Small Business & Entrepreneurship 32nd Annual Conference, Philadelphia, PA, USA, 19–22 January 2017. [Google Scholar]

- Helen, B.I.; Emmanuel, O.O.; Lawal, A.; Elkanah, A. Factors influencing the performance of construction projects in Akure, Nigeria. Int. J. Civ. Eng. Constr. Estate Manag. 2015, 3, 57–67. [Google Scholar]

- Ibrahim, I.I.; Githae, W.; Stephen, D. Indigenous Contractors Involvement and Performance in Construction Procurement Systems in Nigeria. J. Gen. Eng. 2014, 14, 1–10. [Google Scholar]

- Mohammed, S. Risk assessment in bidding for international projects—The Australian experience. Asia Pac. Build. Constr. Manag. J. 2002, 15, 135–152. [Google Scholar]

- Sim, A.B.; Ali, Y. Performance of international joint ventures from developing and developed countries: An empirical study in a developing country context. J. World Bus. 1998, 33, 357–377. [Google Scholar] [CrossRef]

- Carter, J.; Cushman, R.; Hartz, C. Handbook of Joint Venturing; Homewood., I.L., Ed.; Dow Jones-Irving: Oakland, CA, USA, 1988. [Google Scholar]

- Kale, V.V.; Patil, S.S.; Hiravennavar, A.R.; Kamane, S.K. Joint venture in construction industry. IOSR J. Mech. Civ. Eng. 2013, 60–65. [Google Scholar]

- Zirape, L.B.; Warudkar, A.A.; Scholar, U. Risk management in construction joint venture projects in real estate. Int. J. Eng. Sci. Comput. 2016, 6, 4541–4544. [Google Scholar]

- Alashwal, A.M.; Ann, T.S. Application of home-country joint venture (H.J.V.) for international construction contractors. Int. J. Constr. Manag. 2021, 21, 1278–1286. [Google Scholar]

- Howell, S.T. Joint ventures and technology adoption: A Chinese industrial policy that backfired. Res. Policy 2018, 47, 1448–1462. [Google Scholar] [CrossRef]

- Ahmed, R.S.H.; Ahmed, S.S.H. The future of joint ventures: Literature review. Int. J. Bus. Manag. Stud. 2013, 5, 230–240. [Google Scholar]

- Moskalev, S.A.; Swensen, R.B. Joint ventures around the globe from 1990–2000: Forms, types, industries, countries, and ownership patterns. Rev. Financ. Econ. 2007, 16, 29–67. [Google Scholar] [CrossRef]

- Norwood, S.R.; Mansfield, N.R. Joint venture issues concerning European and Asian construction markets of the 1990's. Int. J. Prod. Manag. 1999, 17, 89–93. [Google Scholar] [CrossRef]

- Wada, T. Equity Joint Ventures and the Scope of Knowledge Transfer between Diversified Firms: Evidence from US-Japan Alliances; Faculty of Economics, Gakushuin University: Tokyo, Japan, 2001. [Google Scholar]

- Naylor, J.; Lewis, M. Internal alliances: Using joint ventures in a diversified company. Long Range Plan. 1997, 30, 678–688. [Google Scholar] [CrossRef]

- Demirbag, M.; Mirza, H. Factors affecting international joint venture success: An empirical analysis of foreign–local partner relationships and performance in joint ventures in Turkey. Int. Bus. Rev. 2000, 9, 1–35. [Google Scholar] [CrossRef]

- Samanta, P.K.; Singla, H.K. Factors Affecting the Success of Joint Ventures in Indian Construction Firms. IUP J. Manag. Res. 2019, 18, 39–50. [Google Scholar]

- Walker, D.H.; Johannes, D.S. Construction industry joint venture behaviour in Hong Kong—Designed for collaborative results? Int. J. Prod. Manag. 2003, 21, 39–49. [Google Scholar] [CrossRef]

- Asfaw, E.W. Literature Review of Readiness for Change in Ethiopia: In Theory One Thing; In Reality Another. In Management Challenges in Different Types of African Firms; Achtenhagen, L., Brundin, E., Eds.; Frontiers in African Business Research; Springer: Singapore, 2017. [Google Scholar]

- Gale, A.; Luo, J. Factors affecting construction joint ventures in China. Int. J. Prod. Manag. 2004, 22, 33–42. [Google Scholar] [CrossRef]

- Razzaq, A.; Thaheem, M.J.; Maqsoom, A.; Gabriel, H.F. Critical external risks in international joint ventures for construction industry in Pakistan. Int. J. Civ. Eng. 2018, 16, 189–205. [Google Scholar] [CrossRef]

- Mba, B.; Agumba, J. Factors for selecting joint venture partner for construction project in South Africa. In Proceedings of the 5th Construction Management Conference, Port Elizabeth, South Africa, 28–29 November 2016. [Google Scholar]

- Oswald, D.; Sherratt, F.; Smith, S.D. Investigating collaborative challenges on a large international joint-venture construction project. In Proceedings of the 16th Engineering Project Organisation Conference (EPOC), Brijuni, Croatia, 25–27 June 2018; pp. 22–34. [Google Scholar]

- Lonsdale, J.; Lucas, C. The Influence of Key Performance Indicators on relationship and performance of joint venture construction projects in the United Kingdom. In Proceedings of the ARCOM 2019—Productivity, Performance and Quality Conundrum, Leeds, UK, 2–4 September 2019. [Google Scholar]

- Tabish, S.Z.S.; Jha, K.N. The impact of anti-corruption strategies on corruption free performance in public construction projects. Constr. Manag. Econ. 2012, 30, 21–35. [Google Scholar] [CrossRef]

- Do, S.T.; Nguyen, V.T.; Likhitruangsilp. RSIAM risk profile for managing risk factors of international construction joint ventures. Int. J. Constr. Manag. 2023, 23, 1148–1162. [Google Scholar] [CrossRef]

- Akintoye, A.; Main, J. Collaborative relationships in construction: The U.K. contractors’ perception. Eng. Constr. Arch. Manag. 2007, 14, 597–617. [Google Scholar] [CrossRef]

- Abdulrahman, R.S.; Ibrahim, A.D.; Chindo, P.G. Assessment of Risk Management Maturity of Construction Organisations in Joint Venture Projects. J. Eng. Proj. Prod. Manag. 2019, 9, 20. [Google Scholar]

- Xiong, M.N.; Wang, T.; Zhao, P. How cultural distance affects the formation of international strategic alliance—An explanation of the transaction costs theory. Nankai Bus. Rev. Int. 2021, 13, 173–200. [Google Scholar] [CrossRef]

- Babbie, E. The Practice of Social Research; Nelson Education Ltd.: Wadsworth, NSW, Sydney, 2010. [Google Scholar]

- Akinradewo, O.; Aghimien, D.; Aigbavboa, C.; Onyia, M. Factors influencing the adoption of insurance as a risk treatment tool by contractors in the construction industry. Int. J. Constr. Manag. 2020, 22, 2484–2492. [Google Scholar] [CrossRef]

- Oke, E.A.; Omoregie, A.D.; Koloko, A.C.O. Challenges of digital collaboration in the South African construction industry. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Bandung, Indonesia, 6–8 March 2018; pp. 6–8. [Google Scholar]

- Chiyanga, D.M. An Assessment of Joint Ventures in Construction Projects in South Africa. Master’s Dissertation, University of Johannesburg, Johannesburg, South Africa, 2021. Available online: http://hdl.handle.net/102000/0002 (accessed on 26 April 2022).

- Cresswell, J.W.; Plano Clark, V.L. Designing and Conducting Mixed-Method Research, 2nd ed.; Sage: Thousand Oaks, CA, USA, 2011. [Google Scholar]

- Wilkins, J.R. Construction workers’ perceptions of health and safety training programmes. Constr. Manag. Econ. 2011, 29, 1017–1026. [Google Scholar] [CrossRef]

- Ezennia, I.S. Insights of housing providers’ on the critical barriers to sustainable affordable housing uptake in Nigeria. World Dev. Sustain. 2022, 1, 100023. [Google Scholar] [CrossRef]

- Pallant, J. SPSS Survival Manual; McGraw-Hill Education: London, UK, 2013. [Google Scholar]

- Andrade, C. Understanding the difference between standard deviation and standard error of the mean and knowing when to use which. Indian J. Psychol. Med. 2020, 42, 409–410. [Google Scholar] [CrossRef]

- Bell, E.; Bryman, A. The ethics of management research: An exploratory content analysis. Br. J. Manag. 2007, 18, 63–77. [Google Scholar] [CrossRef]

- Tavakol, M.; Dennick, R. Making sense of Cronbach’s alpha. Int. J. Med. Educ. 2011, 2, 53. [Google Scholar] [CrossRef]

- Eiselen, R.; Uys, T.; Potgieter, T. Analysing Survey Data Using SPSS13; University of Johannesburg: Johannesburg, South Africa, 2007. [Google Scholar]

- Yong, A.G.; Pearce, S. A beginner’s guide to factor analysis: Focusing on exploratory factor analysis. Tutor. Quant. Methods Psychol. 2013, 9, 79–94. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis, 6th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- George, D.; Mallery, P. IBM SPSS Statistics 19 Step by Step; Mass: Boston, MA, USA, 2012. [Google Scholar]

- Kothari, C.R. Research Methodology: Methods and Techniques; New Age International: Hong Kong, China, 2004. [Google Scholar]

- Zhang, X.; Wen, J. The impacts of economic importance difference of a joint venture (J.V.) held by partners and partners’ size difference on the extraction of rivalrous and non-rivalrous private benefits in a JV. Int. Rev. Financ. Anal. 2016, 48, 46–54. [Google Scholar] [CrossRef]

- Romeli, N.; Halil, F.M.; Ismail, F.; Abd Shukor, A.S. Economic Challenges in Joint Venture Infrastructure Projects: Towards Contractor’s Quality of Life. Procedia-Soc. Behav. Sci. 2016, 234, 19–27. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).