Optimizing Warehouse Building Design for Simultaneous Revenue Generation and Carbon Reduction in Taiwan: A Fuzzy Nonlinear Multi-Objective Approach

Abstract

:1. Introduction

2. Literature Review

3. Methodology

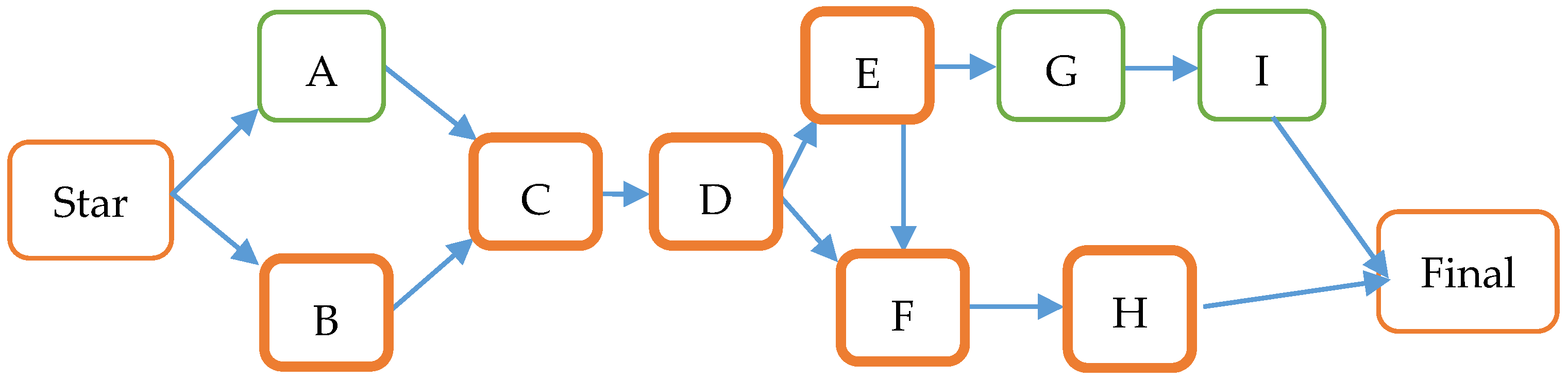

3.1. Research Structure

3.2. Case Assumptions

3.3. Case Methodology

4. Sample Problem and Results

4.1. Case Introduction

4.2. Fuzzy Nonlinear Multi-Objective Method for TCQR

5. Discussion

6. Conclusions

6.1. Research Conclusions

- (1)

- Investment Revenue: Investment revenue is crucial for reducing carbon emissions, but development cannot be achieved if investors find a given venture unprofitable. In the long term, SPPPs generate clean energy without emitting carbon dioxide or other harmful gases. Additionally, SPPPs provide a source of revenue by selling green energy.

- (2)

- Emissions Management: Adopting a crash mode methodology expedites the construction of SPPPs, showcasing a critical mode of time management [33]. The primary achievement of this approach is the reduction in carbon emissions during construction via the minimization of construction time.

- (3)

- Methodology Choice: Fuzzy nonlinear multi-objective programming suits complex systems with high uncertainty and fuzzy objectives. Compared with NSGA-II, it is better at dealing with large-scale deterministic multi-objective problems; depending on the characteristics of the problem, researchers should select the more suitable model for their particular problem.

6.2. Research Recommendations

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Kumar, P.; Gupta, S.; Dagar, V. Sustainable energy development through non-residential rooftop solar photovoltaic adoption: Empirical evidence from India. Sustain. Dev. 2024, 32, 795–814. [Google Scholar] [CrossRef]

- Ronyastra, I.M.; Saw, L.H.; Low, F.S. Techno-economic analysis with financial risk identification for solar power plant as post-mining land use in Indonesia. Energy Sustain. Dev. 2024, 80, 101462. [Google Scholar] [CrossRef]

- Alzarrad, M.A.; Moynihan, G.P.; Hatamleh, M.T.; Song, S. Fuzzy multicriteria decision-making model for time-cost-risk trade-off optimization in construction projects. Adv. Civ. Eng. 2019, 2019, 7852301. [Google Scholar] [CrossRef]

- Ghadir, H.; Shayannia, S.A.; Miandargh, M.A. Solving the problem of time, cost, and quality trade-off in project scheduling under fuzzy conditions using meta-heuristic algorithms. Discret. Dyn. Nat. Soc. 2022, 2022, 6401061. [Google Scholar] [CrossRef]

- Egwunatum, S.I.; Oboreh, J.C. Factors limiting knowledge management among construction small and medium enterprises. J. Eng. Proj. Prod. Manag. 2022, 12, 25–38. [Google Scholar] [CrossRef]

- Aminbakhsh, S.; Abdulsattar, A.M. Optimizing Three-Dimensional Trade-Off Problem of Time–Cost–Quality over Multi-Mode Projects with Generalized Logic. Buildings 2024, 14, 1676. [Google Scholar] [CrossRef]

- Tarigan, E. Rooftop PV system policy and implementation study for a household in Indonesia. Int. J. Energy Econ. Policy 2020, 10, 110–115. [Google Scholar] [CrossRef]

- Komurlu, R.; Kalkan Ceceloglu, D.; Arditi, D. Exploring the Barriers to Managing Green Building Construction Projects and Proposed Solutions. Sustainability 2024, 16, 5374. [Google Scholar] [CrossRef]

- Briera, T.; Lefèvre, J. Reducing the cost of capital through international climate finance to accelerate the renewable energy transition in developing countries. Energy Policy 2024, 188, 114104. [Google Scholar] [CrossRef]

- Muñoz, Y.; Suárez, C.A.; Castro, A.O.; López, O.J. Technical and financial analysis for the implementation of small-scale self-generation projects, based on grid-tied photovoltaic solar energy, for residential users under Colombian regulations. Int. J. Energy Econ. Policy 2024, 14, 197–205. [Google Scholar] [CrossRef]

- Brest, P.; Gilson, R.J.; Wolfson, M.A. Essay: How investors can (and can’t) create social value. J. Corp. L. 2018, 44, 205. [Google Scholar]

- Stala-Szlugaj, K.; Olczak, P.; Kulpa, J.; Soltysik, M. Methodology for Selecting a Location for a Photovoltaic Farm on the Example of Poland. Energies 2024, 17, 2394. [Google Scholar] [CrossRef]

- Leewiraphan, C.; Ketjoy, N.; Thanarak, P. An assessment of the economic viability of delivering solar PV rooftop as a service to strengthen business investment in the residential and commercial sectors. Int. J. Energy Econ. Policy 2024, 14, 226–233. [Google Scholar] [CrossRef]

- Imasiku, K. A solar photovoltaic performance and financial modeling solution for grid-connected homes in Zambia. Int. J. Photoenergy 2021, 2021, 8870109. [Google Scholar] [CrossRef]

- Balducci, P.; Mongird, K.; Wu, D.; Wang, D.; Fotedar, V.; Dahowski, R. An evaluation of the economic and resilience benefits of a microgrid in Northampton Massachusetts. Energies 2020, 13, 4802. [Google Scholar] [CrossRef]

- Mashhadizadeh, M.; Dastgir, M.; Salahshour, S. Economic appraisal of investment projects in solar energy under uncertainty via fuzzy real option approach (case study: A 2-MW photovoltaic plant in South of Isfahan, Iran). Adv. Math. Financ. Appl. 2019, 3, 29–51. [Google Scholar] [CrossRef]

- Nuriyev, M. Z-numbers based hybrid MCDM approach for energy resources ranking and selection. Int. J. Energy Econ. Policy 2020, 10, 9950. [Google Scholar] [CrossRef]

- Thomasi, V.; Siluk, J.C.M.; Rigo, P.D.; Rosa, C.B.; Garcia, E.D.; Cassel, R.A.; Ramos, C.F.D.S. A model for measuring the photovoltaic project performance in energy auctions. Int. J. Energy Econ. Policy 2022, 12, 501–511. [Google Scholar] [CrossRef]

- Mohammadi, A.; Sheikholeslam, F. Intelligent optimization: Literature review and state-of-the-art algorithms (1965–2022). Eng. Appl. Artif. Intell. 2023, 126, 106959. [Google Scholar] [CrossRef]

- Bellman, R.E.; Zadeh, L.A. Decision-making in a fuzzy environment. Manag. Sci. 1970, 17, B-141–B-273. [Google Scholar] [CrossRef]

- Leandry, L.; Sosoma, I.; Koloseni, D. Basic fuzzy arithmetic operations using α-cut for the Gaussian membership function. J. Fuzzy Ext. Appl. 2022, 3, 337–348. [Google Scholar]

- Yang, J.; Liu, C.; Mi, Y.; Zhang, H.; Terzija, V. Optimization operation model of electricity market considering renewable energy accommodation and flexibility requirement. Glob. Energy Interconnect. 2021, 4, 227–238. [Google Scholar] [CrossRef]

- Middelhauve, L.; Baldi, F.; Stadler, P.; Maréchal, F. Grid-aware layout of photovoltaic panels in sustainable building energy systems. Front. Energy Res. 2021, 8, 573290. [Google Scholar] [CrossRef]

- Grisales-Noreña, L.F.; Montoya, O.D.; Cortés-Caicedo, B.; Zishan, F.; Rosero-García, J. Optimal power dispatch of PV generators in AC distribution networks by considering solar, environmental, and power demand conditions from Colombia. Mathematics 2023, 11, 484. [Google Scholar] [CrossRef]

- Zimmermann, H.J. Applications of fuzzy set theory to mathematical programming. Read. Fuzzy Sets Intell. Syst. 1993, 795–809. [Google Scholar] [CrossRef]

- Mohammadjafari, A.; Ghannadpour, S.F.; Bagherpour, M.; Zandieh, F. Multi-Objective Multi-mode Time-Cost Tradeoff modeling in Construction Projects Considering Productivity Improvement. arXiv 2024, arXiv:2401.12388. [Google Scholar] [CrossRef]

- Dong, W.; Shah, H.C. Vertex methods for computing functions of fuzzy variable. Fuzzy Sets Syst. 1987, 24, 65–78. [Google Scholar] [CrossRef]

- Yager, R.R. Concepts, theory, and techniques a new methodology for ordinal multi-objective decisions based on fuzzy sets. Decis. Sci. 1981, 12, 589–600. [Google Scholar] [CrossRef]

- Liou, T.S.; Wang, M.J.J. Ranking fuzzy numbers with integral value. Fuzzy Sets Syst. 1992, 50, 247–255. [Google Scholar] [CrossRef]

- Alwulayi, S.; Debbage, K. Factors Affecting the Willingness to Adopt Residential Rooftop Solar Panels: Evidence from Saudi Arabia. Arab. World Geogr. 2024, 27, 141–149. [Google Scholar] [CrossRef]

- Sama, J.D.L.C.; Some, K. Solving fuzzy nonlinear optimization problems using null set concept. Int. J. Fuzzy Syst. 2024, 26, 674–685. [Google Scholar] [CrossRef]

- Pham, V.H.S.; Nguyen Dang, N.T.; Nguyen, V.N. Achieving improved performance in construction projects: Advanced time and cost optimization framework. Evol. Intell. 2024, 17, 2885–2897. [Google Scholar] [CrossRef]

- Chiang, K.L. Delivering Goods Sustainably: A Fuzzy Nonlinear Multi-Objective Programming Approach for E-Commerce Logistics in Taiwan. Sustainability 2024, 16, 5720. [Google Scholar] [CrossRef]

| Item | Prerequisites | Time (Days) | Cost (TWD) | Quality (%) | Quality Cost (TWD/%) | ||||

|---|---|---|---|---|---|---|---|---|---|

| Normal | Crash | Normal | Crash | Normal | Crash | Normal | Crash | ||

| A | 3 | 1 | 770,000 | 831,600 | 100 | 100 | 10,100 | 38,500 | |

| B | 4 | 1 | 1,026,667 | 1,108,800 | 100 | 100 | 11,100 | 47,200 | |

| C | B | 60 | 60 | 154,000 | 154,000 | 100 | 100 | – | – |

| D | B | 60 | 60 | 462,000 | 462,000 | 100 | 100 | – | – |

| E | D | 83 | 52 | 9,800,617 | 10,584,666 | 98 | 75 | 16,000 | 70,600 |

| F | B, D | 51 | 48 | 4,825,176 | 5,211,190 | 95 | 93 | 13,500 | 54,400 |

| G | F | 51 | 48 | 4,078,001 | 4,698,600 | 95 | 93 | 7800 | 27,700 |

| H | F, G | 30 | 30 | 154,000 | 154,000 | 100 | 100 | – | – |

| I | F, G, H | 30 | 30 | 154,000 | 154,000 | 100 | 100 | – | – |

| Wd (%) | FKd (%) | Ws (%) | FKs (%) | FT (%) | FWACC (%) |

|---|---|---|---|---|---|

| 0 | – | 100 | [1.3, * 1.710546, 2.2] | [30, 30, 30] | [1.3, 1.710546, 2.2] |

| 10 | [1.635, 1.767987, 1.908] | 90 | [1.2, 1.608033, 2.1] | [30, 30, 30] | [1.202625, 1.579828, 2.0331] |

| 20 | [1.363, 1.494876, 1.635] | 80 | [1.1, 1.505167, 2] | [30, 30, 30] | [1.08445, 1.428365, 1.84525] |

| 30 | [1.09, 1.221415, 1.363] | 70 | [1, 1.401868, 1.9] | [30, 30, 30] | [0.94525, 1.256126, 1.636675] |

| 40 | [1.09, 1.09, 1.09] | 60 | [0.9, 1.298025, 1.8] | [30, 30, 30] | [0.867, 1.105815, 1.407] |

| 50 | [1.09, 1.221415, 1.363] | 50 | [0.8, 1.193483, 1.7] | [30, 30, 30] | [0.80875, 1.054772, 1.361125] |

| 60 | [1.363, 1.494876, 1.635] | 40 | [0.7, 1.088024, 1.6] | [30, 30, 30] | [0.89335, 1.107904, 1.37575] |

| 70 | [1.635, 1.767987, 1.908] | 30 | [0.8, 1.193483, 1.7] | [30, 30, 30] | [1.098375, 1.286238, 1.5117] |

| Debt Ratio (%) | α-Cut | ||||

|---|---|---|---|---|---|

| 0 | 0 | [1.3, 2.2] | 1.505272874 | 1.955272874 | 3.460545749 |

| 0.2 | [1.382109, 2.102109] | ||||

| 0.4 | [1.464218, 2.004218] | ||||

| 0.6 | [1.546327, 1.906327] | ||||

| 0.8 | [1.628437, 1.808437] | ||||

| 1 | [1.710546, 1.710546] | ||||

| 10 | 0 | [1.202625, 2.0331] | 1.391226652 | 1.806464152 | 3.197690804 |

| 0.2 | [1.278066, 1.942446] | ||||

| 0.4 | [1.353506, 1.851791] | ||||

| 0.6 | [1.428947, 1.761137] | ||||

| 0.8 | [1.504388, 1.670483] | ||||

| 1 | [1.579828, 1.579828] | ||||

| 20 | 0 | [1.08445, 1.84525] | 1.256407623 | 1.636807623 | 2.893215246 |

| 0.2 | [1.153233, 1.761873] | ||||

| 0.4 | [1.222016, 1.678496] | ||||

| 0.6 | [1.290799, 1.595119] | ||||

| 0.8 | [1.359582, 1.511742] | ||||

| 1 | [1.428365, 1.428365] | ||||

| 30 | 0 | [0.94525, 1.636675] | 1.100688093 | 1.446400593 | 2.547088686 |

| 0.2 | [1.007425, 1.560565] | ||||

| 0.4 | [1.0696, 1.484455] | ||||

| 0.6 | [1.131776, 1.408346] | ||||

| 0.8 | [1.193951, 1.332236] | ||||

| 1 | [1.256126, 1.256126] | ||||

| 40 | 0 | [0.867, 1.407] | 0.986407384 | 1.256407384 | 2.242814768 |

| 0.2 | [0.914763, 1.346763] | ||||

| 0.4 | [0.962526, 1.286526] | ||||

| 0.6 | [1.010289, 1.226289] | ||||

| 0.8 | [1.058052, 1.166052] | ||||

| 1 | [1.105815, 1.105815] | ||||

| 50 | 0 | [* 0.80875, * 1.361125] | 0.931761138 | 1.207948638 | * 2.139709777 |

| 0.2 | [0.857954, 1.299854] | ||||

| 0.4 | [0.907159, 1.238584] | ||||

| 0.6 | [0.956363, 1.177313] | ||||

| 0.8 | [1.005568, 1.116043] | ||||

| 1 | * [1.054772, 1.054772] | ||||

| 60 | 0 | [0.89335, 1.37575] | 1.000626905 | 1.241826905 | 2.24245381 |

| 0.2 | [0.936261, 1.322181] | ||||

| 0.4 | [0.979172, 1.268612] | ||||

| 0.6 | [1.022082, 1.215042] | ||||

| 0.8 | [1.064993, 1.161473] | ||||

| 1 | [1.104904, 1.107904] | ||||

| 70 | 0 | [1.098375, 1.5117] | 1.192306596 | 1.398969096 | 2.591275691 |

| 0.2 | [1.135948, 1.466608] | ||||

| 0.4 | [1.17352, 1.421515] | ||||

| 0.6 | [1.211093, 1.376423] | ||||

| 0.8 | [1.248666, 1.331331] | ||||

| 1 | [1.286238, 1.286238] |

| Item | Time (Days) | Cost (TWD) | Quality (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| B | 1 | 2.15 | 4 | 1,026,667 | 1,067,206.75 | 1,108,800 | 100 | 100.00 | 100 |

| E | 52 | 66.29 | 83 | 9,800,617 | 10,187,613.07 | 10,584,666 | 75 | 85.99 | 98 |

| F | 48 | 49.48 | 51 | 4,825,176 | 5,015,707.33 | 5,211,190 | 93 | 94.00 | 95 |

| Item | Unit Time Cost | Unit Time Quality | |||||||

| B | −24,639.90 | −27,286.11 | −30,115.44 | 0 | 0.00 | 0 | |||

| E | −22,762.71 | −25,207.31 | −27,821.09 | 0.666 | 0.74 | 0.814 | |||

| F | −186,179.70 | −206,174.46 | −227,552.96 | 0.603 | 0.67 | 0.737 | |||

| α | Item | ||

|---|---|---|---|

| B | E | F | |

| 0 | [1, 4] | [52, 83] | [48, 51] |

| 0.2 | [1.23, 3.63] | [54.858, 79.658] | [48.296, 50.696] |

| 0.4 | [1.46, 3.26] | [57.716, 50.392] | [48.592, 50.392] |

| 0.6 | [1.69, 2.89] | [48.888, 72.974] | [48.888, 50.088] |

| 0.8 | [1.92, 2.52] | [63.432, 69.632] | [49.184, 49.784] |

| 1 | [2.15, 2.15] | [66.29, 66.29] | [49.48, 49.48] |

| Ranking | 4.65 | * 133.79 | 98.98 |

| α | Item | ||

|---|---|---|---|

| B | E | F | |

| 0 | [1,026,667, 1,108,800] | [9,800,617, 10,584,666] | [4,825,176, 5,211,190] |

| 0.2 | [1,034,775, 1,100,481] | [9,878,016, 10,505,255] | [4,863,282, 5,172,093] |

| 0.4 | [1,042,883, 1,092,163] | [9,955,415, 10,425,845] | [4,901,389, 5,132,997] |

| 0.6 | [1,050,991, 1,083,844] | [10,032,815, 10,346,434] | [4,939,495, 5,093,900] |

| 0.8 | [1,059,099, 1,075,525] | [10,110,214, 10,267,024] | [4,977,601, 5,054,804] |

| 1 | [1,067,207, 1,067,207] | [10,187,613, 10,187,613] | [5,015,707, 5,015,707] |

| Ranking | 2,134,940.249 | * 20,380,254.57 | 10,033,890.33 |

| α | Item | ||

|---|---|---|---|

| B | E | F | |

| 0 | [11,100, 47,200] | [16,000, 70,600] | [13,500, 54,400] |

| 0.2 | [13,842.09, 42,722.09] | [20,114.21, 63,794.21] | [16,642.8, 49,362.8] |

| 0.4 | [16,584.18, 38,244.18] | [24,228.42, 56,988.42] | [19,785.59, 44,325.59] |

| 0.6 | [19,326.27, 33,766.27] | [28,342.63, 50,182.63] | [22,928.39, 39,288.39] |

| 0.8 | [22,068.35, 29,288.35] | [32,456.85, 43,376.85] | [26,071.19, 34,251.19] |

| 1 | [24,810.44, 24,810.44] | [36,571.06, 36,571.06] | [29,213.99, 29,213.99] |

| Ranking | 53,960.44262 | * 79,871.05817 | 63,163.98592 |

| α | Item | ||

|---|---|---|---|

| B | E | F | |

| 0 | [−24,557.5, −30,014.7] | [−22,686.6, −27,728] | [−185,557, −226,792] |

| 0.2 | [−25,103.2, −29,469] | [−23,190.7, −27,223.9] | [−189,681, −222,668] |

| 0.4 | [−25,648.9, −28,923.3] | [−23,694.9, −26,719.7] | [−193,804, −218,545] |

| 0.6 | [−26,194.7, −28,377.5] | [−24,199, −26,215.6] | [−197,927, −214,421] |

| 0.8 | [−26,740.4, −27,831.8] | [−24,703.2, −25,711.5] | [−202,051, −210,298] |

| 1 | [−27,286.1, −27,286.1] | [−25,207.3, −25,207.3] | [−206,174, −206,174] |

| Ranking | −54,572.2104 | * −50,414.62215 | −412,348.9284 |

| α | Item | ||

|---|---|---|---|

| B | E | F | |

| 0 | [0, 0] | [0.666, 0.814] | [0.603, 0.737] |

| 0.2 | [0, 0] | [0.680305, 0.798705013] | [0.615952, 0.723152] |

| 0.4 | [0, 0] | [0.69461, 0.783410026] | [0.628904, 0.709304] |

| 0.6 | [0, 0] | [0.708915, 0.768115039] | [0.641856, 0.695456] |

| 0.8 | [0, 0] | [0.72322, 0.752820052] | [0.654807, 0.681607] |

| 1 | [0, 0] | [0.737525, 0.737525065] | [0.667759, 0.667759] |

| Ranking | 0 | * 1.477525065 | 1.337759181 |

| Year | FMIRR (%) | Year | FMIRR (%) |

|---|---|---|---|

| 1 | [−84.4965, −84.4018, −84.3190] | 11 | [5.8952, 5.9538, 6.0049] |

| 2 | [−44.0510, −43.8805, −43.7317] | 12 | [6.2446, 6.2985, 6.3454] |

| 3 | [−22.0282, −21.8699, −21.7319] | 13 | [6.4842, 6.5341, 6.5775] |

| 4 | [−10.6232, −10.4870, −10.3685] | 14 | [6.6451, 6.6915, 6.7318] |

| 5 | [−4.2377, −4.1211, −4.0195] | 15 | [6.7485, 6.7918, 6.8295] |

| 6 | [−0.4087, −0.3076, −0.2196] | 16 | [6.8095, 6.8502, 6.8855] |

| 7 | [2.0088, 2.0976, 2.1748] | 17 | [6.8390, 6.8772, 6.9105] |

| 8 | [3.5934, 3.6723, 3.7409] | 18 | [6.8448, 6.8809, 6.9124] |

| 9 | [4.6599, 4.7307, 4.7924] | 19 | [6.8327, 6.8670, 6.8968] |

| 10 | [5.3903, 5.4545, 5.5104] | 20 | [6.8073, 6.8398, 6.8681] |

| Item | Time (Days) | Cost (TWD) | Quality (%) | Crash Time (Days) (7) = (1) − (2) | Unit Time Cost (TWD/Day) [((3) − (4))/(7)] | Unit Time Quality (%/Day) [((5) − (6))/(7)] | |||

|---|---|---|---|---|---|---|---|---|---|

| Normal (1) | Crash (2) | Normal (3) | Crash (4) | Normal (5) | Crash (6) | ||||

| A | 3 | 1 | 770,000 | 831,600 | 100 | 100 | 2 | −30,800 | 0 |

| B | 4 | 1 | 1,026,667 | 1,108,800 | 100 | 100 | 3 | −27,377.67 | 0 |

| C | 60 | 60 | 154,000 | 154,000 | 100 | 100 | 0 | 0 | 0 |

| D | 60 | 60 | 462,000 | 462,000 | 100 | 100 | 0 | 0 | 0 |

| E | 83 | 52 | 9,800,617 | 10,584,666 | 98 | 75 | 31 | −25,291.90 | 0.74 |

| F | 51 | 48 | 4,825,176 | 5,211,190 | 95 | 93 | 3 | −128,671.33 | 0.67 |

| G | 51 | 48 | 4,078,001 | 4,698,600 | 95 | 93 | 3 | −206,866.33 | 0.67 |

| H | 30 | 30 | 154,000 | 154,000 | 100 | 100 | 0 | 0 | 0 |

| I | 30 | 30 | 154,000 | 154,000 | 100 | 100 | 0 | 0 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiang, K.-L. Optimizing Warehouse Building Design for Simultaneous Revenue Generation and Carbon Reduction in Taiwan: A Fuzzy Nonlinear Multi-Objective Approach. Buildings 2024, 14, 2441. https://doi.org/10.3390/buildings14082441

Chiang K-L. Optimizing Warehouse Building Design for Simultaneous Revenue Generation and Carbon Reduction in Taiwan: A Fuzzy Nonlinear Multi-Objective Approach. Buildings. 2024; 14(8):2441. https://doi.org/10.3390/buildings14082441

Chicago/Turabian StyleChiang, Kang-Lin. 2024. "Optimizing Warehouse Building Design for Simultaneous Revenue Generation and Carbon Reduction in Taiwan: A Fuzzy Nonlinear Multi-Objective Approach" Buildings 14, no. 8: 2441. https://doi.org/10.3390/buildings14082441