Risk Analysis in International Construction Projects: A Look at the Prefabricated Wood Construction Sector in the Province of Quebec

Abstract

:1. Introduction

2. Literature Review

2.1. Risk

2.2. Risk Management

3. Methods

4. Results and Discussion

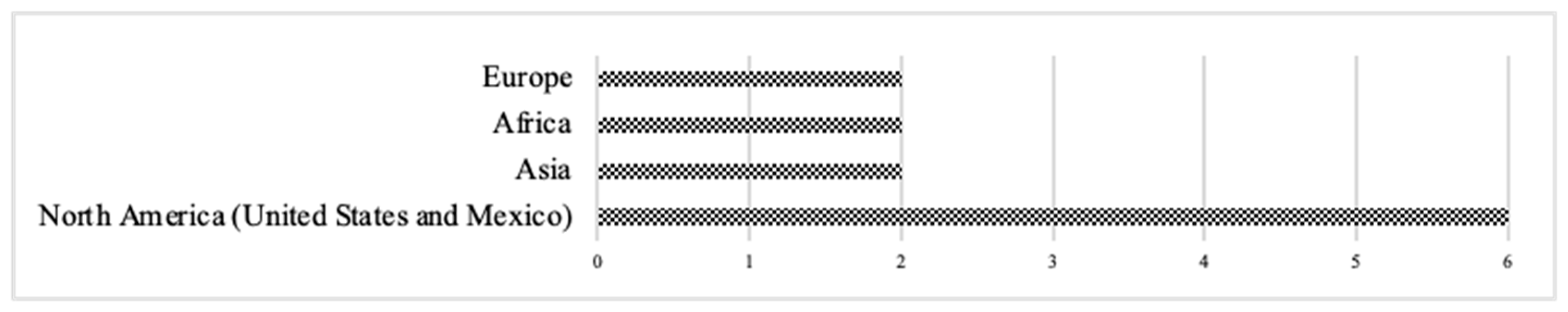

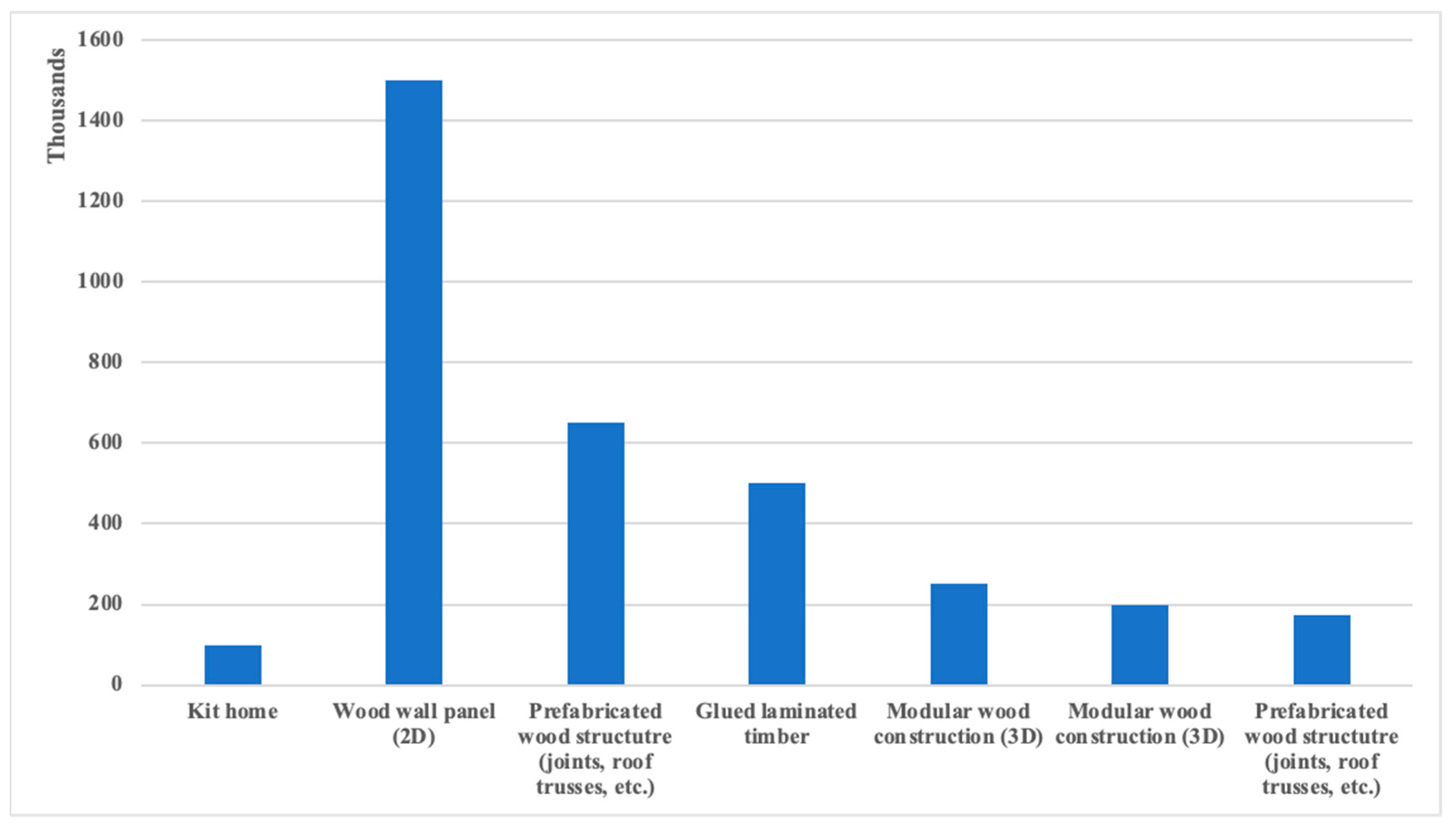

4.1. Case Study

4.2. Characterization of Respondents

4.3. Risk Measurement

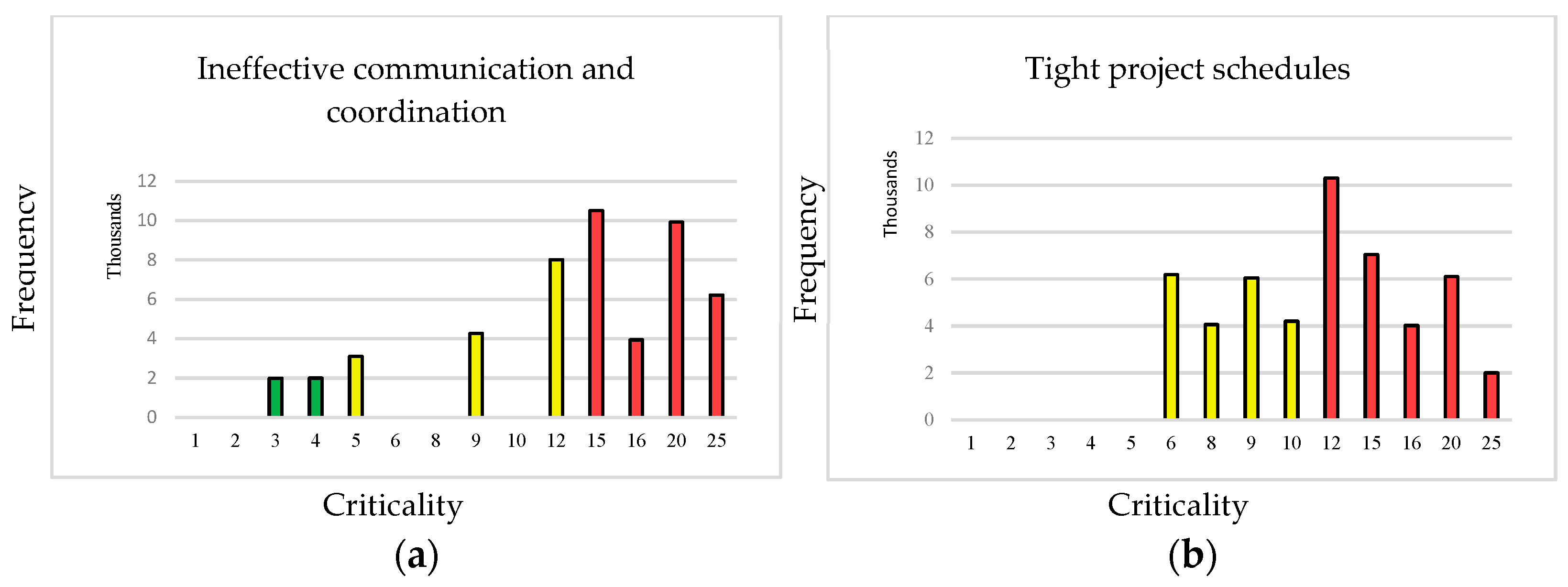

4.3.1. Operational Risks

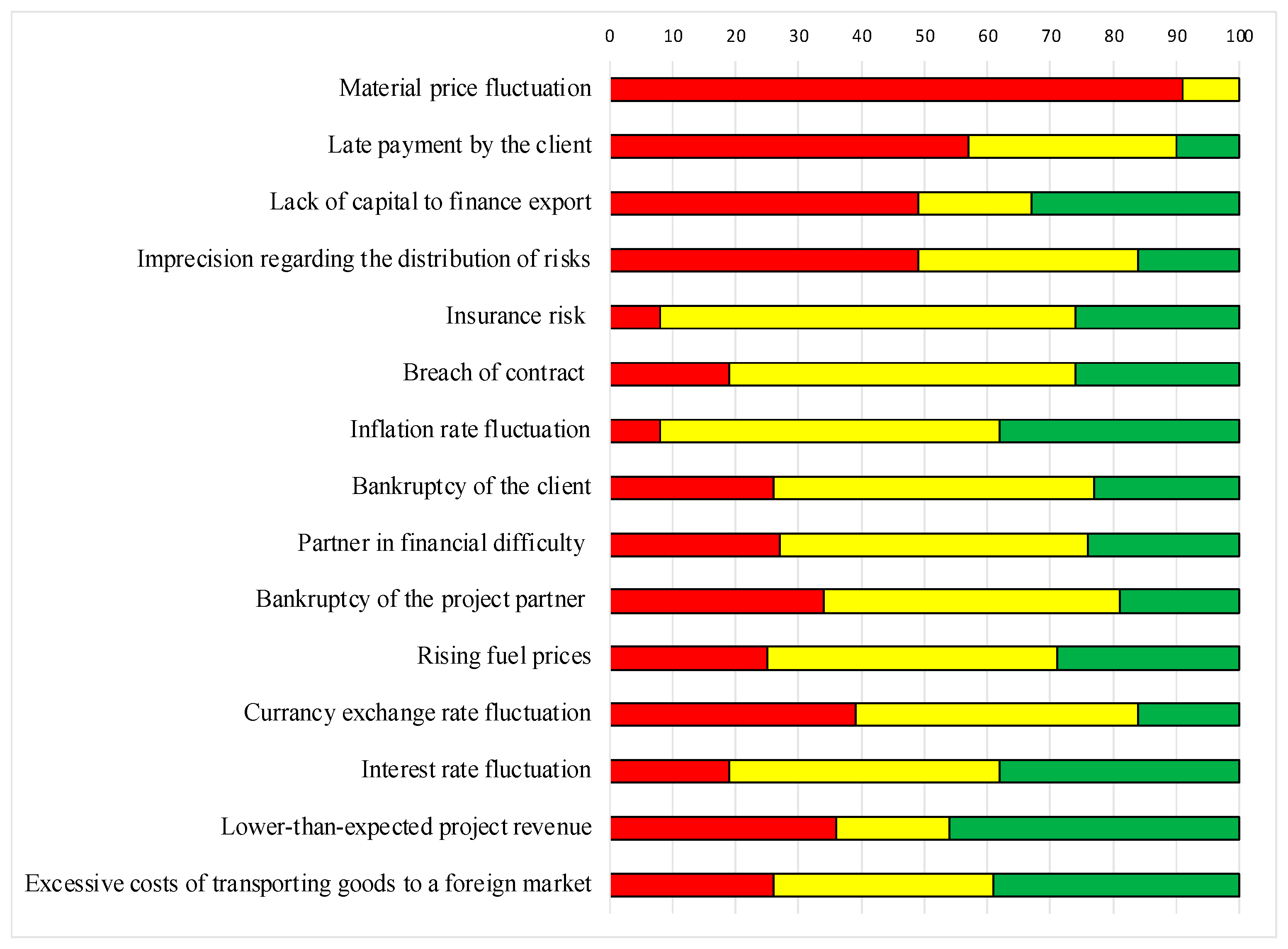

4.3.2. Financial Risks

4.4. Managerial Insights and Recommendations

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Renuka, S.M.; Umarani, C.; Kamal, S. A review on critical risk factors in the life cycle of construction projects. J. Civ. Eng. Res. 2014, 4, 31–36. [Google Scholar]

- Taroun, A. Towards a better modelling and assessment of construction risk: Insights from a literature review. Int. J. Proj. Manag. 2014, 32, 101–115. [Google Scholar] [CrossRef]

- Latham, S.M. Constructing the Team. HMSO. 1994. Available online: https://constructingexcellence.org.uk/wp-content/uploads/2014/10/Constructing-the-team-The-Latham-Report.pdf (accessed on 7 July 2022).

- Zhi, H. Risk management for overseas construction projects. Int. J. Proj. Manag. 1995, 13, 231–237. [Google Scholar] [CrossRef]

- Bu-Qammaz, A.S.; Dikmen, I.; Birgonul, M.T. Risk assessment of international construction projects using the analytic network process. Can. J. Civ. Eng. 2009, 36, 1170–1181. [Google Scholar] [CrossRef]

- Viswanathan, S.K.; Jha, K.N. Critical risk factors in international construction projects: An Indian perspective. Eng. Constr. Archit. Manag. 2020, 27, 1169–1190. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Zavadskas, E.K.; Turskis, Z. Multi-criteria risk assessment of a construction project. Procedia Comput. Sci. 2013, 17, 129–133. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhao, X.; Toh, L.P. Risk management in small construction projects in Singapore: Status, barriers and impact. Int. J. Proj. Manag. 2014, 32, 116–124. [Google Scholar] [CrossRef]

- Qazi, A.; Dikmen, I. From risk matrices to risk networks in construction projects. IEEE Trans. Eng. Manag. 2019, 68, 1449–1460. [Google Scholar] [CrossRef]

- Li, M.; Li, G.; Huang, Y.; Deng, L. Research on investment risk management of Chinese prefabricated construction projects based on a system dynamics model. Buildings 2017, 7, 83. [Google Scholar] [CrossRef]

- Pan, W.; Goodier, C. House-building business models and off-site construction take-up. Int. J. Proj. Manag. 2012, 18, 84–93. [Google Scholar] [CrossRef]

- Goulding, J.; Arif, M. Offsite Production and Manufacturing—Research Roadmap Report; Bakens, W., Ed.; International Council for Research and Innovation in Building and Construction (CIB): Rotterdam, The Netherlands, 2013. [Google Scholar]

- Brege, S.; Stehn, L.; Nord, T. Business models in industrialized building of multi-storey houses. Constr. Manag. Econ. 2014, 32, 208–226. [Google Scholar] [CrossRef]

- Goulding, J.S.; Pour Rahimian, F.; Arif, M.; Sharp, M.D. New offsite production and business models in construction: Priorities for the future research agenda. Archit. Eng. Des. Manag. 2015, 11, 163–184. [Google Scholar] [CrossRef]

- Goverse, T.; Hekkert, M.P.; Groenewegen, P.; Worrell, E.; Smits, R.E. Wood innovation in the residential construction sector; opportunities and constraints. Resour. Conserv. Recycl. 2001, 34, 53–74. [Google Scholar] [CrossRef]

- Piccardo, C.; Hughes, M. Design strategies to increase the reuse of wood materials in buildings: Lessons from architectural practice. J. Clean. Prod. 2022, 368, 133083. [Google Scholar] [CrossRef]

- Behera, P.; Mohanty, R.P.; Prakash, A. Understanding construction supply chain management. Prod. Plan. Control 2015, 26, 1332–1350. [Google Scholar] [CrossRef]

- Dainty, A.R.; Briscoe, G.H.; Millett, S.J. Subcontractor perspectives on supply chain alliances. Constr. Manag. Econ. 2001, 19, 841–848. [Google Scholar] [CrossRef]

- Rezgui, Y.; Miles, J. Exploring the potential of SME alliances in the construction sector. J. Constr. Eng. Manag. 2010, 136, 558–567. [Google Scholar] [CrossRef]

- Michna, A.; Kmieciak, R.; Czerwińska-Lubszczyk, A. Dimensions of intercompany cooperation in the construction industry and their relations to performance of SMEs. Eng. Econ. 2020, 31, 221–232. [Google Scholar] [CrossRef]

- Commission de la Construction du Québec. Annual Construction Industry Statistics 2020; Commission de la Construction du Québec: Montreal, QC, Canada, 2021. [Google Scholar]

- Ritchie, B.; Brindley, C. Supply chain risk management and performance: A guiding framework for future development. Int. J. Oper. Prod. Manag. 2007, 27, 303–322. [Google Scholar] [CrossRef]

- Rao, S.; Goldsby, T.J. Supply chain risks: A review and typology. Int. J. Logist. Manag. 2009, 20, 97–123. [Google Scholar] [CrossRef]

- Lehoux, N.; D’Amours, S.; Langevin, A. Inter-firm collaborations and supply chain coordination: Review of key elements and case study. Prod. Plan. Control 2014, 25, 858–872. [Google Scholar] [CrossRef]

- Gentry, J.J.; Vellenga, D.B. Using logistics alliances to gain a strategic advantage in the marketplace. J. Mark. Theory Pract. 1996, 4, 37–44. [Google Scholar] [CrossRef]

- Bleeke, J.; Ernst, D. Is your strategic alliance really a sale? Harv. Bus. Rev. 1995, 73, 97–105. [Google Scholar]

- Kauser, S.; Shaw, V. International Strategic Alliances: Objectives, motives and success. J. Glob. Mark. 2004, 17, 7–43. [Google Scholar] [CrossRef]

- Sampson, R.C. R&D alliances and firm performance: The impact of technological diversity and alliance organization on innovation. Acad. Manag. J. 2007, 50, 364–386. [Google Scholar]

- Lai, W.H.; Chang, P.L. Corporate motivation and performance in R&D alliances. J. Bus. Res. 2010, 63, 490–496. [Google Scholar]

- Nielsen, B.B. Strategic fit, contractual, and procedural governance in alliances. J. Bus. Res. 2010, 63, 682–689. [Google Scholar] [CrossRef]

- Li, L.; Qian, G.; Qian, Z. Do partners in international strategic alliances share resources, costs, and risks? J. Bus. Res. 2013, 66, 489–498. [Google Scholar] [CrossRef]

- Chopra, S.; Sodhi, M.S. Supply-chain breakdown. MIT Sloan Manag. Rev. 2004, 46, 53–61. [Google Scholar]

- Gulati, R. Alliances and networks. Strateg. Manag. J. 1998, 19, 293–317. [Google Scholar] [CrossRef]

- Hallikas, J.; Karvonen, I.; Pulkkinen, U.; Virolainen, V.M.; Tuominen, M. Risk management processes in supplier networks. Int. J. Prod. Econ. 2004, 90, 47–58. [Google Scholar] [CrossRef]

- Deleris, L.A.; Erhun, F. Risk management in supply networks using Monte-Carlo simulation. In Proceedings of the Winter Simulation Conference, Orlando, FL, USA, 4 December 2005. [Google Scholar]

- Antonio, J.M.A.; Gema, S.R.; Angel, R.L. Financial risks in construction projects. Afr. J. Bus. Manag. 2011, 5, 12325–12328. [Google Scholar] [CrossRef]

- Khan, R.A.; Gul, W. Emperical study of critical risk factors causing delays in construction projects. In Proceedings of the 2017 9th IEEE International Conference on Intelligent Data Acquisition and Advanced Computing Systems: Technology and Applications (IDAACS), Bucharest, Romania, 21–23 September 2017; Volume 2, pp. 900–906. [Google Scholar]

- Kolhatkar, M.J.; Dutta, A.B. Financial risks and construction projects. Int. J. Appl. Innov. Eng. Manag. (IJAIEM) 2013, 2, 235–239. [Google Scholar]

- Mustafa, M.A.; Al-Bahar, J.F. Project risk assessment using the analytic hierarchy process. IEEE Trans. Eng. Manag. 1991, 38, 46–52. [Google Scholar] [CrossRef]

- Hastak, M.; Shaked, A. ICRAM-1: Model for international construction risk assessment. J. Manag. Eng. 2000, 16, 59–69. [Google Scholar] [CrossRef]

- Dikmen, I.; Birgonul, M.T.; Han, S. Using fuzzy risk assessment to rate cost overrun risk in international construction projects. Int. J. Proj. Manag. 2007, 25, 494–505. [Google Scholar] [CrossRef]

- Abd Karim, N.A.; Rahman, I.A.; Memmon, A.H.; Jamil, N.; Azis, A.A.A. Significant risk factors in construction projects: Contractor’s perception. In Proceedings of the 2012 IEEE Colloquium on Humanities, Science and Engineering (CHUSER), Kota Kinabalu, Malaysia, 3–4 December 2012; pp. 347–350. [Google Scholar]

- Rezakhani, P. Classifying key risk factors in construction projects. Bul. Inst. Politeh. Din Lasi 2012, 58, 27–38. [Google Scholar]

- Liu, J.; Zhao, X.; Yan, P. Risk paths in international construction projects: Case study from Chinese contractors. J. Constr. Eng. Manag. 2016, 142, 05016002. [Google Scholar] [CrossRef]

- Abd El-Karim, M.S.B.A.; Mosa El Nawawy, O.A.; Abdel-Alim, A.M. Identification and assessment of risk factors affecting construction projects. HBRC J. 2017, 13, 202–216. [Google Scholar] [CrossRef]

- Abdelghany, Y.; Ezeldin, A.S. Classification of risks for international construction joint ventures (ICJV) projects. In Proceedings of the Construction Research Congress 2010: Innovation for Reshaping Construction Practice, Banff, AB, Canada, 8–10 May 2010; pp. 1254–1263. [Google Scholar]

- Bing, L.; Tiong, R.L. Risk management model for international construction joint ventures. J. Constr. Eng. Manag. 1999, 125, 377–384. [Google Scholar] [CrossRef]

- Bing, L.; Tiong, R.L.K.; Fan, W.W.; Chew, D.A.S. Risk management in international construction joint ventures. J. Constr. Eng. Manag. 1999, 125, 277–284. [Google Scholar] [CrossRef]

- Shen, L.Y.; Wu, G.W.; Ng, C.S. Risk assessment for construction joint ventures in China. J. Constr. Eng. Manag. 2001, 127, 76–81. [Google Scholar] [CrossRef]

- Ganbat, T.; Chong, H.Y.; Liao, P.C. Mapping BIM uses for risk mitigation in international construction projects. Adv. Civ. Eng. 2020, 2020, 5143879. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Theoretical review on critical risk factors in oil and gas construction projects in Yemen. Eng. Constr. Archit. Manag. 2020, 28, 934–968. [Google Scholar] [CrossRef]

- Qazi, A.; Simsekler, M.C.E. Risk assessment of construction projects using Monte Carlo simulation. Int. J. Manag. Proj. Bus. 2021, 14, 1202–1218. [Google Scholar] [CrossRef]

- Kubíčková, L.; Toulová, M. Risk factors in the internationalization process of SMEs. Acta Univ. Agric. Silvic. Mendel. Brun. 2013, 61, 2385–2392. [Google Scholar] [CrossRef]

- Calvelli, A.; Cannavale, C. Key Risks of Internationalization. In Internationalizing Firms; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 129–164. [Google Scholar] [CrossRef]

- Ozorhon, B.; Arditi, D.; Dikmen, I.; Birgonul, M.T. Performance of international joint ventures in construction. J. Manag. Eng. 2010, 26, 209–222. [Google Scholar] [CrossRef]

- Safaeian, M.; Fathollahi-Fard, A.M.; Kabirifar, K.; Yazdani, M.; Shapouri, M. Selecting appropriate risk response strategies considering utility function and budget constraints: A case study of a construction company in Iran. Buildings 2022, 12, 98. [Google Scholar] [CrossRef]

- Yousri, E.; Sayed, A.E.B.; Farag, M.A.; Abdelalim, A.M. Risk identification of building construction projects in Egypt. Buildings 2023, 13, 1084. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Ellram, L.M.; Carter, J.R.; Cavinato, J.L. An analysis of supply risk assessment techniques. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 397–413. [Google Scholar] [CrossRef]

- Ouabouch, L.; Amri, M. Analysing supply chain risk factors: A probability-impact matrix applied to pharmaceutical industry. J. Logist. Manag. 2013, 2, 35–40. [Google Scholar]

- McCormack, K.; Wilkerson, T.; Marrow, D.; Davey, M.; Shah, M.; Yee, D. Managing risk in your organization with the SCOR methodology. Supply Chain. Counc. Risk Res. Team 2008, 1, 1–32. [Google Scholar]

- Huang, J.W.; Wang, X.X. Risk analysis of construction schedule based on PERT and MC simulation. In Proceedings of the 2009 International Conference on Information Management, Innovation Management and Industrial Engineering, Xi’an, China, 26–27 December 2009; Volume 2, pp. 150–153. [Google Scholar]

- Hacura, A.; Jadamus-Hacura, M.; Kocot, A. Risk analysis in investment appraisal based on the Monte Carlo simulation technique. Eur. Phys. J. B-Condens. Matter Complex Syst. 2001, 20, 551–553. [Google Scholar] [CrossRef]

- Kontio, J.; Lehtola, L.; Bragge, J. Using the focus group method in software engineering: Obtaining practitioner and user experiences. In Proceedings of the 2004 International Symposium on Empirical Software Engineering, ISESE’04, Redondo Beach, CA, USA, 20 August 2004; pp. 271–280. [Google Scholar]

- Hambach, R.; Mairiaux, P.; François, G.; Braeckman, L.; Balsat, A.; Van Hal, G.; Vandoorne, C.; Van Royen, P.; Van Sprundel, M. Workers’ perception of chemical risks: A focus group study. Risk Anal. Int. J. 2011, 31, 335–342. [Google Scholar] [CrossRef]

- Kidd, P.S.; Parshall, M.B. Getting the focus and the group: Enhancing analytical rigor in focus group research. Qual. Health Res. 2000, 10, 293–308. [Google Scholar] [CrossRef] [PubMed]

- Statistique CANADA. Trade Data Online. 2023. Available online: https://ised-isde.canada.ca/site/trade-data-online/en (accessed on 10 June 2024).

- Cid, A. Market Study Report. CIRCERB Report for the Industrialized Construction Initiative (ICI), June 2020. Available online: https://circerb.chaire.ulaval.ca/wp-content/uploads/2020/07/market-study-report-juin-2020_allan-cid_final.pdf (accessed on 10 June 2024).

- Blanquet du Chayla, C.; Blanchet, P.; Lehoux, N. A Method to Qualify the Impacts of Certifications for Prefabricated Constructions. Buildings 2021, 11, 331. [Google Scholar] [CrossRef]

- Gouvernement du Québec. 2018. Available online: https://cdn-contenu.quebec.ca/cdn-contenu/adm/min/energie-ressources-naturelles/publications-adm/strategie/STR_industrie_foret_2018-2023_MFFP.pdf (accessed on 16 August 2024).

- FPInnovations. Compétitivité et Opportunités pour l’Industrie Québécoise des Bâtiments Préfabriqués—RTHQ; FPInnovations: Pointe Claire, QC, Canada, 2015. [Google Scholar]

- Ministère Du Développement Durable. De L’environnement et de la Lutte Contre les Changements Climatiques. Stratégie Gouvernementale de Développement Durable 2015–2020. 2017. Available online: https://cdn-contenu.quebec.ca/cdn-contenu/adm/min/environnement/publications-adm/developpement-durable/strategie-dd-2015-2020.pdf (accessed on 15 August 2024).

- Gosselin, A. Marchés et Modèles d’Affaires: Construction Non-Résidentielle Structurale en Bois. Ph.D. Dissertation, Université Laval, Québec, QC, Canada, 2018. [Google Scholar]

- Marketline. Marketline Industry Profile. Residential Construction in North America; Marketline: Manchester, UK, 2018. [Google Scholar]

- Gouvernement du Canada. Portrait Sectoriel du Québec 2023–2025: Construction. 2024. Available online: https://www.guichetemplois.gc.ca/analyse-tendances/rapports-marche-travail/quebec/construction (accessed on 15 August 2024).

- Bygballe, L.E.; Jahre, M.; Swärd, A. Partnering relationships in construction: A literature review. J. Purch. Supply Manag. 2010, 16, 239–253. [Google Scholar] [CrossRef]

- Gadde, L.E.; Dubois, A. Partnering in the construction industry—Problems and opportunities. J. Purch. Supply Manag. 2010, 16, 254–263. [Google Scholar] [CrossRef]

- Annunen, P.; Haapasalo, H. Industrial operation model for the construction industry. Int. J. Constr. Manag. 2022, 23, 2736–2745. [Google Scholar] [CrossRef]

- Construforce. Immigration Trends in Canada’s Construction Sector; Construforce: Ottawa, ON, Canada, 2020. [Google Scholar]

- Akintoye, A.S.; MacLeod, M.J. Risk analysis and management in construction. Int. J. Proj. Manag. 1997, 15, 31–38. [Google Scholar] [CrossRef]

- Naderpour, H.; Kheyroddin, A.; Mortazavi, S. Risk assessment in bridge construction projects in Iran using Monte Carlo simulation technique. Pract. Period Struct. Des. Constr. 2019, 24, 04019026. [Google Scholar] [CrossRef]

| Category | Operational Risk | Authors |

|---|---|---|

| Design | Design error | [4,39,40,41,42,43,44,45] |

| Ill-defined project | [4,36,37,42,45,46] | |

| Design changes | [36,37,39,43,44,45,46,47,48,49,50,51,52] | |

| Standards | Different construction standards | [4,43,44,45,46] |

| Amendments to laws and regulations | [37,39,45,48,50] | |

| Different measurement systems | [44] | |

| Strict safety and health requirements | [4,46] | |

| Strict quality requirements | [4] | |

| Strict environmental regulations | [4,39,42] | |

| Quality control difficulty | [4,10,45,51] | |

| Coordination | Damage caused by human error | [4,39] |

| Late possession of construction site | [4] | |

| Ineffective communication and coordination | [4,37,40] | |

| Tight project schedules | [45,52] | |

| Unforeseen ground conditions | [4,45,49] | |

| Lack of proper construction techniques | [4,41,44] | |

| Resources | Lack of subcontractors | [4,41,45,52] |

| Unavailability of labor | [4,10,37,43,45] | |

| Defective materials | [4,40,45] | |

| Unavailability of materials | [4,36,37,40,42,43,45,49] | |

| Unavailability of equipment | [4,10,37,40,42,45] |

| Category | Financial Risk | Authors |

|---|---|---|

| Internal | Lack of capital to finance export | [4,37,41,42,45,52,53] |

| Lower-than-expected project revenue | [40] | |

| Partner | Breach of contract | [36] |

| Imprecision regarding the distribution of risks | [41,44,46,47,48] | |

| Bankruptcy of the project partner | [36,38,49] | |

| Partner in financial difficulty | [46,48] | |

| Client | Bankruptcy of the client | [36,37,43,44] |

| Late payment by the client | [36,37,39,40,41,42,43,44,45,46,48] | |

| Market | Excessive costs of transporting goods to a foreign market | [46,51,53] |

| Rising fuel prices | [38,50] | |

| Material price fluctuation | [4,37,44,45] | |

| Inflation rate fluctuation | [4,5,10,36,38,39,40,43,44,45,46,47,48,54] | |

| Interest rate fluctuation | [4,5,10,36,38,44,45,47,48] | |

| Currency exchange rate fluctuation | [4,5,10,36,38,39,44,45,46,47,48,51,52,53,54,55] | |

| Insurance risk | [4,36,38] |

| Probability of Occurrence (PO), % | Magnitude of the Impact (MI) | |||

|---|---|---|---|---|

| 1 | Rarely | <20 | 1 | Very small |

| 2 | Somewhat likely | 20–40 | 2 | Small |

| 3 | Likely | 40–60 | 3 | Medium |

| 4 | Very likely | 60–80 | 4 | Large |

| 5 | Almost definite | >80 | 5 | Very large |

| Category | Operational Risk | Prefabricated Wood Structure | Glued Laminated Timber | Wood Wall Panel | Modular | Kit Home |

|---|---|---|---|---|---|---|

| Design | Design error | |||||

| Ill-defined project | ||||||

| Design changes | ||||||

| Standards | Different construction standards | |||||

| Amendments to laws and regulations | ||||||

| Different measurement systems | ||||||

| Strict safety and health requirements | ||||||

| Strict quality requirements | ||||||

| Strict environmental regulations | ||||||

| Quality control difficulty | ||||||

| Coordination | Damage caused by human error | |||||

| Late possession of construction site | ||||||

| Ineffective communication and coordination | ||||||

| Tight project schedules | ||||||

| Unforeseen ground conditions | ||||||

| Lack of proper construction techniques | ||||||

| Resources | Lack of subcontractors | |||||

| Unavailability of labor | ||||||

| Defective materials | ||||||

| Unavailability of materials | ||||||

| Unavailability of equipment |

| Category | Financial Risk | Prefabricated Wood Structure | Glued Laminated Timber | Wood Wall Panel | Modular | Kit Home |

|---|---|---|---|---|---|---|

| Internal | Lack of capital to finance export | |||||

| Lower-than-expected project revenue | ||||||

| Partner | Breach of contract | |||||

| Imprecision regarding the distribution of risks | ||||||

| Bankruptcy of the project partner | ||||||

| Partner in financial difficulty | ||||||

| Client | Bankruptcy of the client | |||||

| Late payment by the client | ||||||

| Market | Excessive costs of transporting goods to a foreign market | |||||

| Rising fuel prices | ||||||

| Material price fluctuation | ||||||

| Inflation rate fluctuation | ||||||

| Interest rate fluctuation | ||||||

| Currency exchange rate fluctuation | ||||||

| Insurance risk |

| High Criticality | Moderate Criticality | Low Criticality |

|---|---|---|

| Ineffective communication and coordination 78% Tight project schedules 59% Damage caused by human error 48% Unavailability of labor 40% | Amendments to laws and regulations 58% Strict quality requirements 53% Design changes 51% Design error 51% Late possession of the site 51% Different construction standards 50% Strict environmental regulations 50% Unforeseen ground conditions 47% Ill-defined project 45% | Different measurement systems 69% Strict safety and health requirements 57% Defective materials 57% Unavailability of equipment 53% Lack of subcontractors 47% Quality control difficulty 46% Lack of proper construction techniques 45% Unavailability of materials 43% |

| High Criticality | Moderate Criticality | Low Criticality |

|---|---|---|

| Material price fluctuation 92% Late payment by the client 57% Lack of capital to finance export 49% Imprecision regarding the distribution of risks 49% | Insurance risk 65% Breach of contract 55% Inflation rate fluctuation 54% Bankruptcy of the project partner 51% Bankruptcy of the client 49% Partner in financial difficulty 47% Rising fuel prices 46% Currency exchange rate fluctuation 45% Interest rate fluctuation 43% | Lower-than-expected project revenue 46% Excessive costs of transporting goods to a foreign market 39% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guimarães, L.G.d.A.; Blanchet, P.; Cimon, Y. Risk Analysis in International Construction Projects: A Look at the Prefabricated Wood Construction Sector in the Province of Quebec. Buildings 2024, 14, 2563. https://doi.org/10.3390/buildings14082563

Guimarães LGdA, Blanchet P, Cimon Y. Risk Analysis in International Construction Projects: A Look at the Prefabricated Wood Construction Sector in the Province of Quebec. Buildings. 2024; 14(8):2563. https://doi.org/10.3390/buildings14082563

Chicago/Turabian StyleGuimarães, Luciana Gondim de A., Pierre Blanchet, and Yan Cimon. 2024. "Risk Analysis in International Construction Projects: A Look at the Prefabricated Wood Construction Sector in the Province of Quebec" Buildings 14, no. 8: 2563. https://doi.org/10.3390/buildings14082563