Abstract

This study investigates how energy retrofitting measures contribute to increasing the market value of multi-family residential buildings within the European real estate market. It examines how energy efficiency improvements, driven by EU decarbonization strategies, enhance the actual and perceived value of these properties. The research employs a dual-methodology approach, integrating the Cost Approach to estimate the financial impact of retrofitting with the Contingent Valuation Method (CVM) to evaluate consumer willingness-to-pay (WTP) for energy-efficient properties. Two real case studies are considered to evaluate the methodology and how the monetary value of buildings is affected by their energy efficiency. The results revealed that buildings subjected to deep energy retrofitting are more attractive to potential buyers, who are willing to pay a premium of 13.5% over properties in pre-retrofit conditions. This underscores the tangible market value increment attributed to energy efficiency enhancements. This study bridges the gap between the quantifiable costs of energy retrofitting and the market valuation, offering a dual perspective by integrating both actual cost analysis and perceived market value. Moreover, this work highlights the correlation between energy retrofit investments and increased market value in the European real estate sector.

1. Introduction

The building sector accounts for 30% of global final energy use and 27% of energy-related emissions [1]. In the European Union (EU), they account for approximately 40% of total energy consumption and 36% of greenhouse gas emissions, making them a key target for sustainability and decarbonization efforts [1,2]. To address this, the EU has implemented several legislative measures, notably the Energy Efficiency Directive 2012/27/EU and the Energy Performance of Buildings Directive (EPBD) 2010/31/recently updated in the release 2024/1275 [3]. These directives establish a framework for transforming low-energy performance buildings into nearly Zero-Energy Buildings (nZEBs) and Zero-Emission Buildings (ZEmB). As a result, EU governments, decision-makers, and private entities have allocated significant resources to promote the transition toward ZEmB and enhance energy efficiency in the building sector [3,4,5].

In support of these strategies, a Minimum Energy Performance Standard (MEPS) was proposed by the European Commission in July 2021 as part of the broader “Fit for 55” initiative. This initiative aims to reduce greenhouse gas emissions by 55% by 2030, compared to 1990 levels [6]. The MEPS specifically targets the retrofitting of energy-inefficient buildings, particularly those having the worst energy rating [6].

Energy efficiency has emerged as a critical factor in determining a building’s market value, as potential buyers are increasingly willing to pay a premium for properties that offer lower energy costs [7,8,9]. Tax incentives and financial support from governments further bolster the market appeal of energy-efficient properties [10]. The European Commission (2021) estimates that upgrading buildings from energy class G to F could result in annual energy savings of 4.6–6.2 million tons of oil equivalent (Mtoe), highlighting the significant energy-saving potential of retrofitting measures. To support the implementation of MEPS by 2030, the EU has allocated up to EUR150 billion from its budget [11].

The benefits of building energy retrofitting can be broadly categorized into four key dimensions: economic, societal, environmental, and operational. From a financial perspective, retrofitting reduces energy costs, stimulates economic growth, enhances property valuation, supports public finances, and lowers costs associated with energy imports [12,13,14]. However, quantifying the precise impact of energy retrofitting on market value remains a complex and multifaceted issue [15,16]. Despite increasing interest in this area, existing research presents inconsistent results, influenced by local market conditions and building-specific characteristics, such as location, construction year, and technical attributes. These factors encompass both technological and socio-economic aspects [17]. Furthermore, the relationship between retrofitting costs and market value appreciation is contingent on factors including the scope of retrofitting measures, local property market dynamics, and specific energy efficiency interventions.

Given these complexities, the generalization of findings on the market value of retrofitted buildings presents a considerable challenge. This work aims to address this gap by applying an assessment method to evaluate the market value of energy retrofitting, focusing on two main phases: partial/standard retrofitting and deep retrofitting, and applying case studies from two different European countries. The study also introduces a methodology combining the Contingent Valuation Method (CVM), which captures consumer willingness-to-pay, with the cost approach, providing cost-based estimates to evaluate both perceived and actual impacts of retrofitting. The inclusion of both partial and deep retrofitting scenarios reflects varying investment levels and their distinct market outcomes. This approach compares actual retrofit costs with perceived market benefits, focusing on understanding the factors influencing property value, based on customer preferences gathered through surveys to identify key value drivers. In alignment with Manganelli’s (2006) principles [18], of economic efficiency in real estate, the proposed methodology explores:

- Financial viability, assessing the financial feasibility of retrofitting investments to ensure adequate returns.

- Data-driven decision making, offering actionable insights for stakeholders to make informed retrofitting investment decisions [19].

- Balancing cost and value, ensuring retrofitting costs align with potential property value appreciation.

- The study focuses on the market effects of three energy performance scenarios:

- high-performance with deep retrofitting;

- medium performance with partial retrofit;

- low performance, which represents the pre-retrofit scenario.

Finally, the proposed methodology is applied to two real-world case studies within the framework of the European Union project funded by Horizon 2020 [20]. The case studies are located in Bagnolo in Piano, Italy, and Lyon, France, and were selected as they host the case studies of the Horizon 2020 HEART project; the two analyzed buildings reflect two distinct but comparable European contexts with representative features of the EU multi-family housing. Indeed, they have a similar typology but are placed in two slightly different climates (continental climate in Lyon and temperate climate in Bagnolo) and market contexts (large metropolitan area for Lyon and small town for Bagnolo), which are well-representative of the EU context.

This study prioritizes residential buildings, given their substantial share in the European building stock and their importance as a primary target of EU energy policies.

Overall, this research offers a comprehensive analysis of the added value derived from building energy retrofitting. It combines insights from actual retrofit costs and perceived market benefits. The study evaluates both the financial feasibility and the broader market impacts of retrofitting investments, aiming to provide actionable recommendations. The findings aim to support policymakers and stakeholders in making data-driven decisions, advancing energy efficiency in the building sector, and addressing existing gaps in the literature on retrofitting’s market value.

2. Literature Review

The market for energy retrofitting in the European Union holds considerable potential, driven by the pressing need to enhance energy efficiency across the existing building stock. With current renovation rates at only 1% per year, the EU aims to raise this figure to 3% by 2050 to meet zero-carbon targets [2]. Understanding the value that energy retrofitting adds to market prices is critical for encouraging investments and accelerating the adoption of energy-efficient solutions. Energy retrofitting includes both partial upgrades to specific components and deep retrofitting, which involves comprehensive enhancements to building energy systems. This section focuses on how energy retrofitting affects property market value, particularly by examining the price premiums associated with energy-efficient buildings. It also reviews the primary valuation techniques used to assess the market value of retrofitted buildings, such as the Cost Approach and Income Approach [13,21]. By identifying key factors that influence market value, this review highlights the role of energy efficiency in shaping property investment trends.

2.1. Impact of Energy Retrofitting on Market Value

Energy retrofitting significantly enhances the market value of residential buildings by improving energy performance, reducing operational costs, and increasing buyer appeal through enhanced sustainability features. Two key factors influence a residential building’s market value: locative attributes (extrinsic factors like location and surrounding amenities) and structural attributes (intrinsic factors related to the building’s physical characteristics, including its EPC ranking). The latter is essential in determining the marginal price of a property, which reflects the additional price paid for specific features like energy efficiency [22,23].

The marginal price for energy efficiency varies across Europe and even within individual countries, regions, or cities due to differences in climate, construction materials and methods, and local cultural attitudes toward sustainability [24]. The Energy Efficiency Directive 2012/27/EU and the Energy Performance of Buildings Directive enable the measurement and rating of building energy performance through an EPC. The classification system rates buildings on a scale ranging from ‘A’, indicating the highest efficiency, to ‘G’, representing the lowest efficiency. Understanding this classification system allows potential buyers to make better-informed decisions when purchasing a property [25]. A recent review [15] analyzed how building energy retrofitting impacts real estate values by combining EPC ratings with other building characteristics [23]. It noted that EPC ratings can reduce uncertainty and assessment errors in the real estate market. Moreover, a European Commission study [26] revealed that energy retrofitting, as reflected in improved EPC ratings, can increase property values by 1.5% to 11% across various countries. This demonstrates a clear correlation between retrofitting measures and higher property valuations.

Due to the instability of the property market, it can be challenging to outline comparisons among different subsegments over a long time span. Nonetheless, understanding general price trends can still be useful. For example, a study [27] compared the appraisals of affordable rental accommodation in different countries across two time spans: 2012 and 2015 for England, and 2010 and 2015 for the Netherlands. According to the authors, valuation methods for energy efficiency evolved over time. In the first time span of their study, they found that the energy performance of the housing did not significantly impact its valuation. However, during the second time span, the existence and rate of the energy labels demonstrated a significant impact on housing valuation. This change could be attributed to greater market awareness of retrofitting’s impact on building value and policy changes during the second time span.

Several studies, like [28], have explored methods to quantify the long-term financial benefits of energy efficiency. They identified various building characteristics—including size, maintenance, floor level, and the Energy Performance Index (EPI)—as key drivers of market value. Among these, EPI emerged as the most significant factor influencing market value. These findings underscore the growing recognition of energy retrofitting as a key driver of increased market value, making it a vital consideration for property stakeholders.

2.2. Price Premium of Energy-Efficient Buildings

The added value of a retrofitted building can be quantitatively assessed by comparing its post-retrofit market value to its pre-retrofit market value. This difference, known as the price premium, is a measure of the economic benefits of the retrofit. Numerous studies have shown that buildings with high-energy performance achieve higher sales and rental prices. A positive premium refers to a higher value of the property, but its calculation is complex as it is influenced by numerous factors. These factors include the type of retrofit being undertaken, the location of the building, obtained performances, the age of the building, and local building codes and regulations. This variability makes it challenging to generalize and quantify the exact price premium of building retrofitting.

The translation of better energy performance into a price premium is grounded in the theory of willingness-to-pay (WTP), where eco-labels play a vital role. Credible and user-friendly eco-labels enhance transparency, reduce information asymmetry, and drive higher WTP for energy-efficient buildings [29]. In this regard, systematic reviews conducted by different research teams have used meta-analysis techniques to quantify the price premium of building energy retrofitting under various data conditions, boundary conditions, and reference cases [8,29,30]. Considering the global estimation of the quantified price increase related to building retrofitting, the quantitative meta-analysis for the price premiums in the housing of all the classes (A-G) highlighted both the premiums in Europe for each energy class as well as a global effect on price premium on housing sales when the property holds an EPC [30]. However, heterogeneity in energy classes, reference cases, and energy efficiency criteria used across studies hinders the comparison of price premiums, leading to inconsistent and incomparable results. To address this issue, Reference [30] employed an analysis based on two reference bases: (i) energy classes groupings (comparing the reference groups ABCD and ABC with groups EFG and DEFG, respectively) and (ii) individual classes (classes D, F, G, or No Label as reference). The meta-analysis estimated a price premium of 4.20% for dwellings holding an EPC in the global market, with premiums of 2.32% in Europe, 5.36% in North America, and 4.81% in Asia.

Moreover, some researchers have considered different types of energy certifications of the building such as LEED, Energy Star certifications, or EPCs, and compared them to non-certified buildings in their meta-analysis. For instance, in a systematic review [31] of housing with LEED or Energy Star certifications, or EPCs of individual houses, buildings with higher energy labels, such as classes A, B, or C, were identified as certified properties. It revealed that energy-certified buildings have a total 4.3% average weighted price premium compared to non-certified ones. Similarly, another study [32] applied the same meta-analysis approach for energy-certified buildings using data from 205 feasibility assessments worldwide. This study highlighted a higher price premium for energy-certified buildings, regardless of energy class, compared to non-certified ones, with an average premium of 7.6% in the overall analysis. To identify some of the underlying factors driving this variance—such as reference instances—a meta-regression technique was employed. Additionally, another meta-analysis [9] reviewed over 50 evaluations and estimated that the sale price premium is recognized by economic agents. This analysis reported that correcting the major publication bias reduced the original estimates by half, showing a price premium ranging from 4% to 8% for any energy class of energy-certified buildings compared to non-certified ones.

Furthermore, a broader study conducted by the European Commission (2018) reported that building retrofitting can greatly impact the developers/owners, public interest, tenants, and sustainability by reducing operational costs, lowering environmental impact, and reducing the use of primary resources [8]. They reported that having an energy efficiency label/certification can lead to a rise in residential asset prices by 3–8% and rental prices by 3–5%, in comparison with non-certificated buildings. However, for commercial buildings, this price improvement is significantly higher, ranging between 10 and 20% for sales price. Notably, rental prices also show positive effects of 2–5%. It is important to note that the impact on market value can vary significantly depending on the type of retrofitting that can play a significant role. Other factors, such as the region, country, property type, and timeframe, also influence property value. A study by [33] analyzed the price premium associated with different EPC ratings, using a G rating as a reference, without focusing on specific retrofits. The hedonic analysis, based on a sample of 378 residential properties for sale in Padua, Italy, at the end of 2019, evaluated price increases for various energy ratings through a regression model. The study found that the price premium for buildings with an EPC of A or B compared to G ranged from 11.2% to 39.8%. The broad range can be attributed to missing variables related to energy performance, such as heating/cooling system efficiency, insulation, and air leakage. This highlights the need to consider specific retrofits when interpreting these findings.

2.3. Valuation Techniques and Approaches

In theory, the value of a property is determined by both its quality and quantity. Quantity refers to physical characteristics (e.g., size, age, and construction material), while quality is more subjective. Quality includes the neighborhood, socioeconomic, and environmental characteristics of the building, such as location, accessibility, green spaces, and energy efficiency [34]. These characteristics are considered in various methods for valuing real estate [35,36]. Several evaluation techniques can be used for the estimation of the price premium of building retrofitting. Some of the most common include the most popular International Valuation Standards (IVSs) methods—Cost Approach, Income Capitalization Approach, Market/Sales Comparison Approach—as well as the Hedonic Prices Model (HPM), the Contingent Valuation Method (CVM), and the Hybrid Approach [34,35,36]. While IVS methods focus on market value estimation, HPM and CVM rely primarily on the preferences and willingness-to-pay of potential buyers or stakeholders. The Hybrid Approach, in contrast, combines two or more methods to estimate building prices when individual methods are insufficient.

This study focuses on reviewing and evaluating the CVM and the Cost Approach. The CVM gathers stated preferences directly from potential buyers or stakeholders in cases where comparable market data are unavailable. The Cost Approach, on the other hand, is a straightforward method that considers the current market price of materials, labor, and other associated costs to determine the relevant total cost figures for the building. This method provides a solid foundation for estimating the market value of buildings by considering the actual/potential costs of constructing a similar building from scratch. It operates under the principle that buyers would pay no more for assets than the total costs of obtaining assets with the same utility level (see IVSs).

2.4. Contingent Valuation Method (CVM)

The CVM is a direct method that considers the specific preferences and circumstances of the individuals or communities being surveyed, based on hypothetical markets. In a hypothetical environment, the research team can determine individuals’ or communities’ WTP for public goods or services [24,37,38]. The hypothetical nature of market modeling is linked to the potential preference concerning a good/service that is not available on the market yet, a fact that makes its availability uncertain. This uncertainty arises not only from individual preferences but also from the actions and funding decisions of other actors and stakeholders. These funding decisions are often delayed or dependent on future decisions, which contributes to the overall uncertainty of the market model.

The CVM is mostly used for the assessment of the value of environmental goods, though it has also been applied in regular market conditions where assets being evaluated can be directly compared due to having similar features (Pandolfi 2020). Furthermore, it is a method that relies on real market prices, meaning it may be negatively affected by the absence of reliable and sufficient data in specific periods of the typical real estate market cycles [39,40].

Consumers’ WTP for residential nZEBs was studied in South Korea through a CVM survey [40]. The households there placed a significant value on residential nZEBs compared to conventional buildings. They found that buyers’ WTP includes a premium of 401 euros per m2 for residential nZEBs, representing 17% of the typical residential building price per square meter in South Korea. Similarly, a study in Switzerland analyzed WTP for several residential building solutions focused on energy saving [41]. In this case, the WTP for the retrofitting interventions was 13% more for high-performance windows, 8% for the regular value for the ventilation system, and 3% for the normal value for an improved thermal envelope. Moreover, the WTP for Home Energy Management Systems (HEMS) was analyzed [42], considering how socioeconomic and demographic characteristics affect the probability of demand in Tokyo and New York utilizing CVM. Over 60% of the participants in both cities expressed their WTP for HEMS features.

However, limited research has focused on the economic and energy performance of buildings undergoing deep retrofitting. For instance, a study was conducted on the effectiveness of deeply retrofitted home HVAC systems [43], finding that combining some retrofitting interventions can considerably reduce energy usage while still being cost-effective.

The added market value of a building through energy retrofitting can be evaluated using the CVM [42,44], which can help estimate the value that individuals place on the benefits of the retrofit, such as reduced energy costs, enhanced indoor air quality, and emissions reduction. Table 1 illustrates how CVM can be useful in estimating the value of non-monetary benefits that are difficult to quantify, such as improved comfort or reduced environmental impact [45].

Table 1.

Main benefits and limitations of the CVM to estimate the added value of building energy retrofitting [37,39,41,44,46].

2.5. Cost Approach and Valuation Standards Benchmarks

The approach involves estimating the price of the properties by calculating the cost to construct any improvements on the property, subtracting any depreciation, and finally adding the value of the land at its highest and best use. This method is based on the principle that the property’s value is determined by the price to acquire the land and construct the building [37,47]. The cost approach calculates the property valuation as the sum of the price of the land and its depreciated value of any additional enhancement made on the property. While the Cost Approach is widely used in real estate valuation, it has some limitations. For instance, it does not take into account market trends and consumer preferences, which can affect a property’s value [48]. Table 2 outlines the main benefits and limitations of this approach.

Table 2.

Main benefits and limitations of the Cost Approach for estimating the added value related to building retrofitting [47,48].

To overcome uncertainties and limitations of the CVM, the results of this method could be compared with the Cost Approach techniques, which can determine the actual market value of buildings starting from their cost profiles. This comparison helps to highlight the so-called ‘green premium’ [49], which rises from the growing attention and demand in the building market for green buildings. Nonetheless, the need to include and connect socio-economic variables, generally sampled just for the most important profiling factors, can lead to issues and misconceptions in the disaggregation of values. To address this, a Cost Approach evaluation has been performed to identify the difference in market value determined by the perception of various factors elicited by the CVM; it also allows for establishing the threshold of valuation in accordance with the financial principle that prohibits buyers from paying more than the cost to obtain an equivalent asset through purchase, except when there are a significant risk, time constraints, inconvenience or other factors to consider [48]. This principle determines that the market value should be evaluated as the sum of all the expenses needed to build a structure, starting from the value of the green land plot, and summing all the other economic factors, including the developer profit.

In alignment with the research objectives, a potential solution for addressing environmental challenges in the built environment is to enhance consumer awareness about operational energy consumption. Such awareness has the potential to shift consumer behavior toward more environmentally conscious decisions, specifically a preference for retrofitted buildings over non-retrofitted ones. By choosing energy-efficient buildings, consumers can drive a broader market for retrofitted buildings, thereby reducing the overall operational energy of the built environment and contributing to the decarbonization goals of the built environment. Recent price volatility in energy markets has placed significant economic pressure on both building construction and operational costs [50]. This volatility underscores the importance of effective investment in retrofitting, as indicated by life cycle cost analyses [51]. Beyond individual buildings, retrofitting can impact the overall sustainability of neighborhoods, cities, and metropolitan areas [52]. Additionally, enhanced energy efficiency can contribute to increased property values, thereby influencing market cycles and price levels.

In summary, this review identifies critical gaps in the existing literature, including inconsistent findings on the market impacts of energy retrofitting, a lack of comparative analysis between partial and deep retrofitting, and limitations in existing valuation approaches for capturing non-monetary benefits and regional variations. This study bridges these gaps through the application of a dual-method framework, integrating real-world case studies to explore the financial and market impacts of retrofitting.

3. Research Methodology

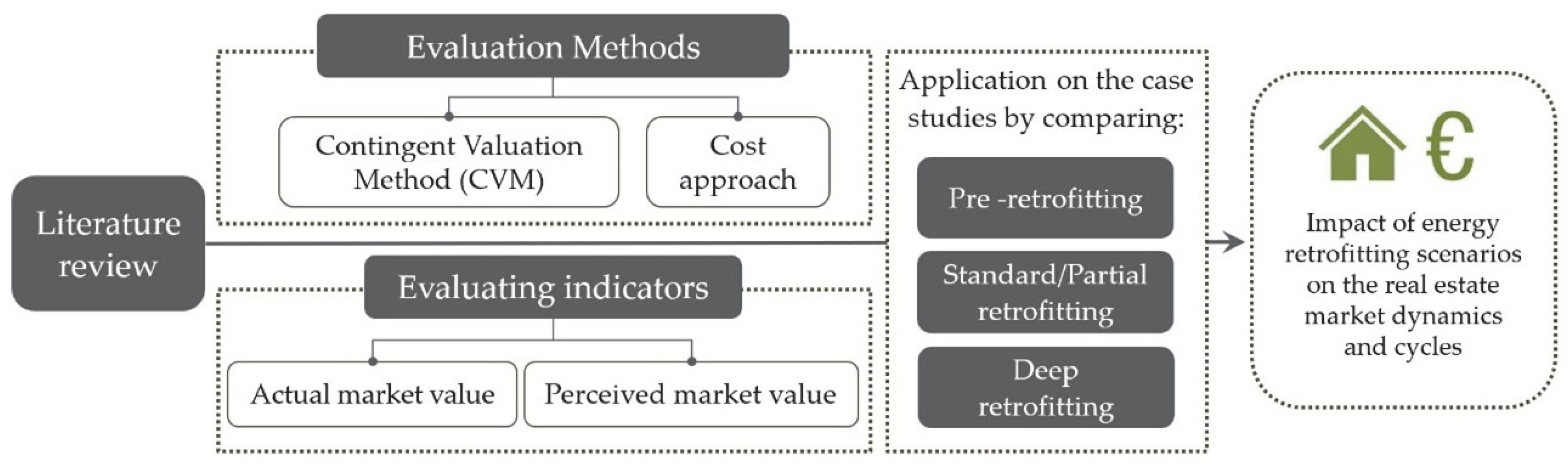

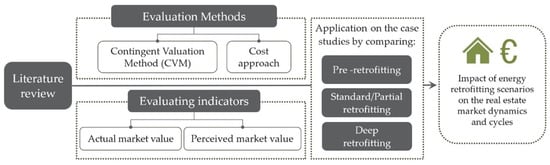

This study employs a structured framework that integrates the CVM to capture consumer willingness-to-pay and the Cost Approach to assess the financial impacts of retrofitting on property value. The methodology is applied to case studies in Italy and France, evaluating both partial and deep retrofitting to provide comprehensive insights into perceived and actual market impacts. Additionally, the study employs a dual-method approach to assess the impact of energy retrofitting on market values within a European context. By combining CVM and the Cost Approach, the study provides a detailed analysis of how retrofitting interventions influence the market value of residential buildings. Figure 1 provides an overview of the research methodology employed in this study.

Figure 1.

Overview of the research methodology.

The primary objective is to assess how different levels of energy retrofitting—partial and deep retrofitting—influence market value. This comparison is drawn from both the perceived value, obtained from consumer surveys using the CVM, and the real value, estimated through detailed cost analyses using the Cost Approach. To structure the study, two real-world case studies were selected from the Horizon2020 HEART project: one in Bagnolo in Piano, Italy, and the other in Lyon, France. These retrofitting projects represent two representative contexts to assess the impact of high-efficiency energy conservation measures on multi-family buildings’ property value. The survey used for the CVM analysis followed a multi-step process to ensure reliability and relevance. This process began with the identification of the study area and target properties, followed by the design of a survey instrument using Google Forms. The survey introduced different retrofitting strategies and presented participants with potential payment options for such investments.

In the first phase, to segment respondents based on their spending preferences, the survey included a screening question related to car preferences. Asking participants to choose between cars with similar prices but differing features, such as energy efficiency, is a strategy to capture their underlying spending behaviors. This approach provided insights into how individuals value non-market attributes (e.g., energy efficiency) in products, which could then be compared to their attitudes toward energy-efficient retrofitting decisions.

More in detail, a pilot study with 131 participants was conducted to refine the survey and ensure its clarity. The participants, primarily architects and architectural engineers with master’s or Ph.D. degrees, were selected based on their expertise in building design, energy retrofitting, and market valuation. This targeted selection ensured comprehensive coverage of qualified experts and provided informed feedback on the survey design. After the pilot study, the feedback was used to make minor refinements in phrasing and structure, without altering the core methodology.

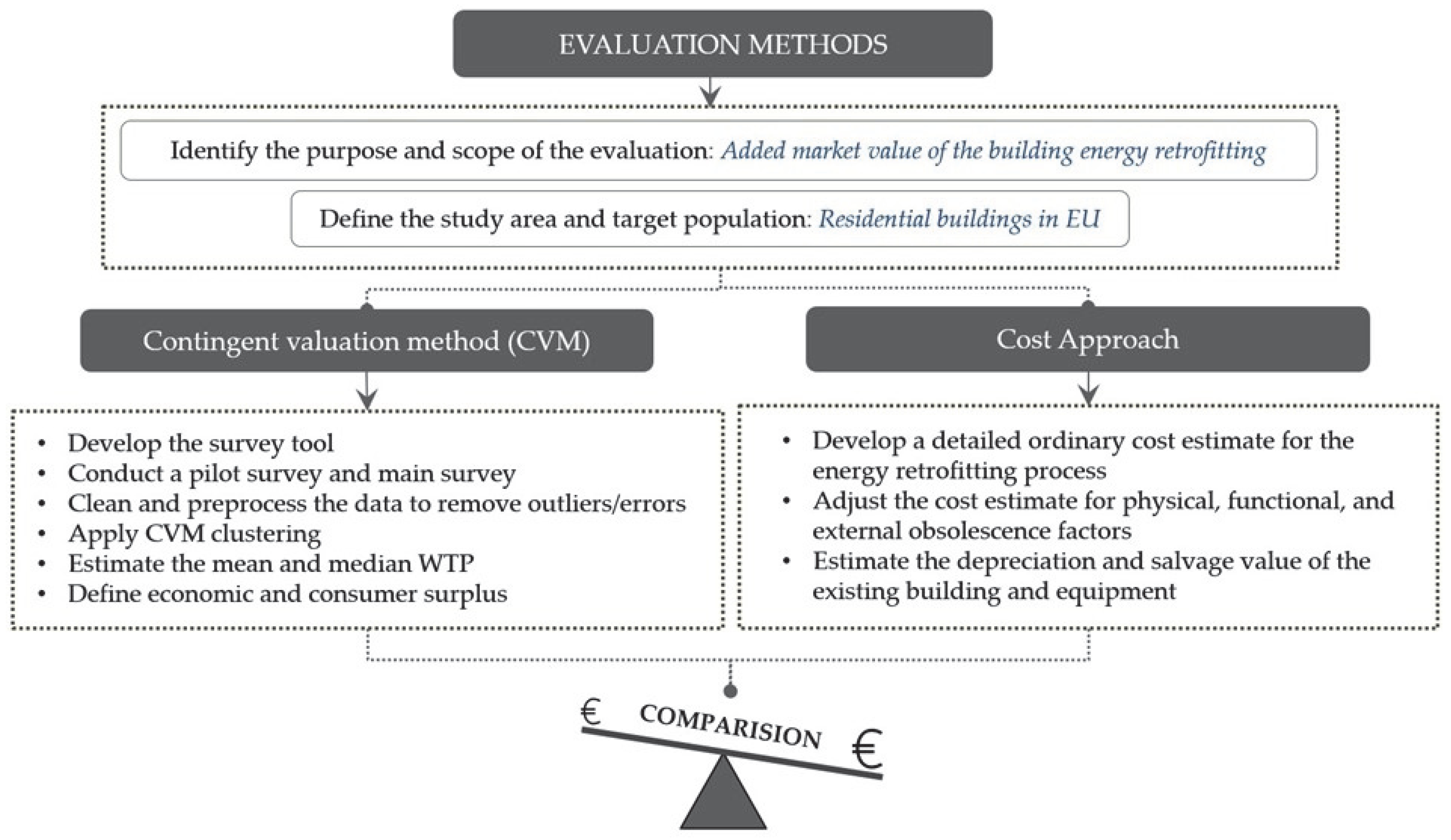

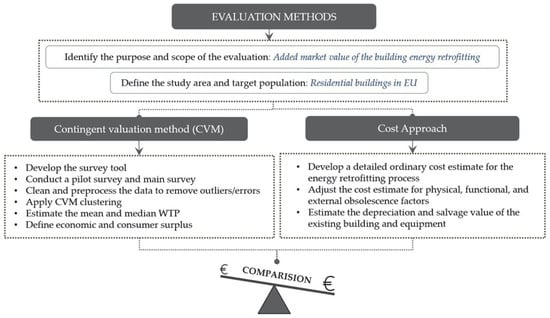

For the final survey, participants with similar expertise and qualifications were selected to ensure consistency and reliability in the data collection process while minimizing the potential for bias. The adopted selection process targeted random sampling to ensure a homogenous sample, capturing consistent and comparable perspectives on energy-efficient retrofitting. The final respondent pool maintained a balanced gender distribution, with 51.15% female and 48.85% male participants. Figure 2 shows the evaluation process of the research methodology.

Figure 2.

Evaluation process with CVM and Cost Approach.

3.1. Application of Contingent Valuation Method (CVM)

The Contingent Valuation Method (CVM) was used to assess respondents’ willingness-to-pay (WTP) for energy retrofitting measures. The survey was designed using Google Forms and was carefully structured to capture perceptions of energy efficiency, including different retrofitting strategies and potential payment methods. The feedback from the pilot study led to minor adjustments in the survey’s phrasing and structure, but the core methodology remained the same.

The survey collected demographic data and presented product choices to assess how respondents valued non-market attributes such as sustainability and energy efficiency. Respondents compared two energy-efficient building products, identical except for one feature, to segment them based on spending preferences. This segmentation provided insights into their attitudes toward retrofitting decisions. Participants then evaluated retrofitting measures on real buildings in Bagnolo in Piano and Lyon, representing both partial and deep retrofitting. They were asked to indicate their WTP for retrofitting, using a sliding scale based on standard market values of EUR 100,000 for Bagnolo in Piano and EUR 300,000 for Lyon. Clear descriptions of partial and deep retrofitting measures were provided to ensure respondents understood the scenarios, enabling consistent and comparable valuation of energy-efficient upgrades.

Since the study sample primarily included architects and engineers with expertise in building design and energy retrofitting, ensuring informed responses, this homogeneity may limit the generalizability of findings to broader populations. Additionally, the hypothetical nature of the CVM introduces potential bias, as stated preferences may not fully align with real market behaviors. Despite these limitations, CVM is a robust tool for assessing consumer perceptions when comparable market data are unavailable, aligning with the study’s objectives. The data underwent cleaning to remove incomplete or inconsistent responses, and outliers were handled using standard statistical methods. A CVM clustering analysis was applied to segment respondents by their WTP, offering a deeper understanding of consumer groups’ preferences for retrofitting interventions. The results were generalized into reference profiles, providing valuable insights into how different retrofitting projects are perceived in terms of value. Further development may incorporate geographical data (e.g., GIS) to enhance the model’s applicability across Europe.

3.2. Application of Cost Approach

In parallel with the CVM, the Cost Approach was applied to assess the financial costs of retrofitting. This approach included a detailed cost estimate for each project, covering materials, labor costs, design and engineering fees, and overhead expenses. The estimates were then adjusted for physical, functional, and external obsolescence, considering factors such as age, condition, and remaining useful life of building components.

These adjustments were proportional to the building’s total area (in square meters), ensuring that larger buildings, which experience greater depreciation due to physical wear and tear and functional inefficiencies, were appropriately evaluated. The salvage value of the property was also considered to account for the long-term financial impact of retrofitting on the building’s value. Depreciation of building components was calculated to reflect the building’s condition and useful life, and this was factored into the final cost assessment. The results from the Cost Approach were then compared with the WTP data from the CVM, providing a comprehensive view of the economic efficiency of retrofitting. This comparison aimed at determining whether the investment in energy efficiency was financially justifiable from both the consumer’s and the investor’s perspectives. It is important to recognize that not all retrofitting costs translate directly into market value increases. Factors like local demand for energy-efficient properties and broader market dynamics can create a discrepancy between actual investment costs and perceived market value. This was considered when comparing the results of the Cost Approach and CVM outcomes, ensuring a balanced view of both the financial and perceptual impacts of retrofitting.

In applying the Cost Approach, several technical assumptions were made to ensure accurate cost and market value estimations. Depreciation was calculated based on the building’s age, condition, and remaining useful life, with adjustments for physical, functional, and external obsolescence according to the total area of each building. Regional market conditions, such as labor and material costs, were considered to reflect local differences between the case study locations of Lyon and Bagnolo in Piano. Additionally, broader economic factors, including expected future savings from energy efficiency improvements, were incorporated into the overall cost analysis to provide a realistic and comprehensive estimate of post-retrofit market value.

4. Case Studies

As previously introduced, the proposed research methodology has been applied to two residential buildings subjected to deep retrofitting within the Horizon 2020 HEART project. These buildings, located in Bagnolo in Piano, Italy, and Lyon, France, were specifically chosen as case studies for this work due to their suitability for evaluating the market increase in multi-family housing resulting from a representative deep retrofit intervention and their potential for providing insights into the market value of residential properties in two European regions. The approach toward deep retrofitting in this work is assessed through three phases: Pre-retrofit, standard/partial retrofit, and deep retrofit, hereafter described in detail.

Pre-retrofit: Both studied buildings are medium-sized multi-family houses. The building in France was built in 1985 and has a net surface area of 1397 m2 with 26 apartments in total, while the building in Italy is a four-story building constructed in 1975 and characterized by a net surface area of around 738 m2 with 12 apartments in total. Both case studies had simple double-glazing windows and envelopes with minimal or no thermal insulation. The heating system of the Italian case study was powered by a centralized boiler, while in the French one, there were decentralized gas boilers in each dwelling. The control system in the Italian one was based on a fixed climatic curve, while in the French one was based on thermostats. The water distribution pipes were made of steel and were not insulated. Both case studies were deep retrofitted. To assess the benefits of retrofitting, the pre-retrofit buildings were compared with both the standard and deep retrofit scenarios.

Partial retrofit (building envelope): In this scenario, window refurbishment/substitution and the application of opaque envelope insulation panels on façades and roofs were considered.

Deep retrofit (building envelope + HVAC systems): Here, in addition to the partial retrofit, the HEART toolkit was employed for a deep retrofitting of the building. High-energy performance heat pumps were installed to replace the existing fuel-powered generators. More in detail, the new heating system is based on a configuration that includes centralized direct-current air-to-water heat pumps (DC-HP) to pre-heat/pre-cool the building water loop. Connected to the latter there are DC smart fan coils installed in each room, which act as water-to-air decentralized heat pumps, heating up/cooling down ambient air utilizing a vapor-compression circuit. To provide and store Domestic Hot Water (DHW), smart DHW boilers are installed in each apartment and act as water/water heat pumps.

In the Italian case study, an 8.5 kWp Building-Integrated Photovoltaics (BIPV) system is responsible for generating the building’s electricity, which is primarily used to directly power two heat pumps through a multi-input multi-output power converter (MIMO). Similarly, in the French case study, the roof is covered with a BIPV system of around 15 kWp, which is directly combined with two power converters and four DC-HPs. Moreover, thermal energy storages are installed in both case studies: they are used to store PV energy in the form of thermal energy. Lastly, a cloud-based energy management system was used to properly control and manage the buildings. Furthermore, the entire retrofit concept had a significant impact on non-renewable primary energy consumption. The pre-retrofit energy consumption of the Italian case study was equal to 154 [kWh/m2yr], which was then reduced to 21 [kWh/m2yr] as a result of the deep retrofit. Similarly, in the French case study, this indicator decreased from 280 [kWh/m2yr] to 55 [kWh/m2yr].

The Italian and French property markets showed expanding trends in 2021, with a significant rise in residential building transactions following a challenging 2020 due to COVID-19 and lockdowns. These markets, compared to other European and North American contexts, show a significant fragmentation of real estate property, with most residential units being owned by their occupants. Only in the biggest cities is the rental segment somehow more lively, with an increasing level of prices, which marked an important evolution of the situation before COVID [53].

House pricing is relatively higher in France, compared to the Italian national average situation, though in Italy, there is a significant gap between different locations (North/South, bigger cities/smaller towns), probably wider than in the French context, determining a fluctuating variance that will only be filled by recent trends (need for green spaces, smart working solutions). The price increase recorded in 2021 intensified in 2022, mostly in the French provinces, not only for newer properties but for the entire market residential stock. This does not counterbalance some recent concerns determined by the scarce stock replacement and new production trends that will surely continue in the future in both countries, thanks to a new and different sensitivity towards the topic of soil preservation [53].

The building market in Lyon is shaped by its central role in regional development. As the core of urban growth in the Rhône province, Lyon sees higher average property prices than surrounding areas [54]. Apartments tend to have higher prices than houses, not only because of their location and the availability of services in dense, central areas but also due to strong demand and higher purchasing power (solvency) among buyers in these regions. Additionally, engineering and construction costs, particularly in urban apartment developments, contribute to the price increase. The rental market shows more consistency, with significantly higher prices concentrated in the city center (1st arrondissement) compared to the outer zones [55]. The area of the case study in Lyon has an average price for residential units of 2340 EUR/m2, regardless of their specific features [56].

Bagnolo in Piano is, instead, a secondary town in its reference urban system (being a peripheral town close to Reggio Emilia), which means that its average price is significantly lower than in Lyon. Though being a small town in a medium-level urban system in terms of available facilities and attractivity, Bagnolo in Piano has recorded stationary prices in the last two years, with some minor increases for the rental segment. From the kind of residential stock available, most of the houses in Bagnolo in Piano can be considered old (built before 1991) and are quite small in terms of building size (mostly two floors) and big in terms of unit layout (4–5 rooms). For such a context, the average price for residential units, independent of their features in the city zone of Bagnolo in Piano, is around 1000 EUR/m2 [57].

5. Evaluations and Results

This section summarizes the results of the evaluation process carried out according to the methodology described in Section 3.

5.1. Results of Application of Contingent Valuation Method (CVM)

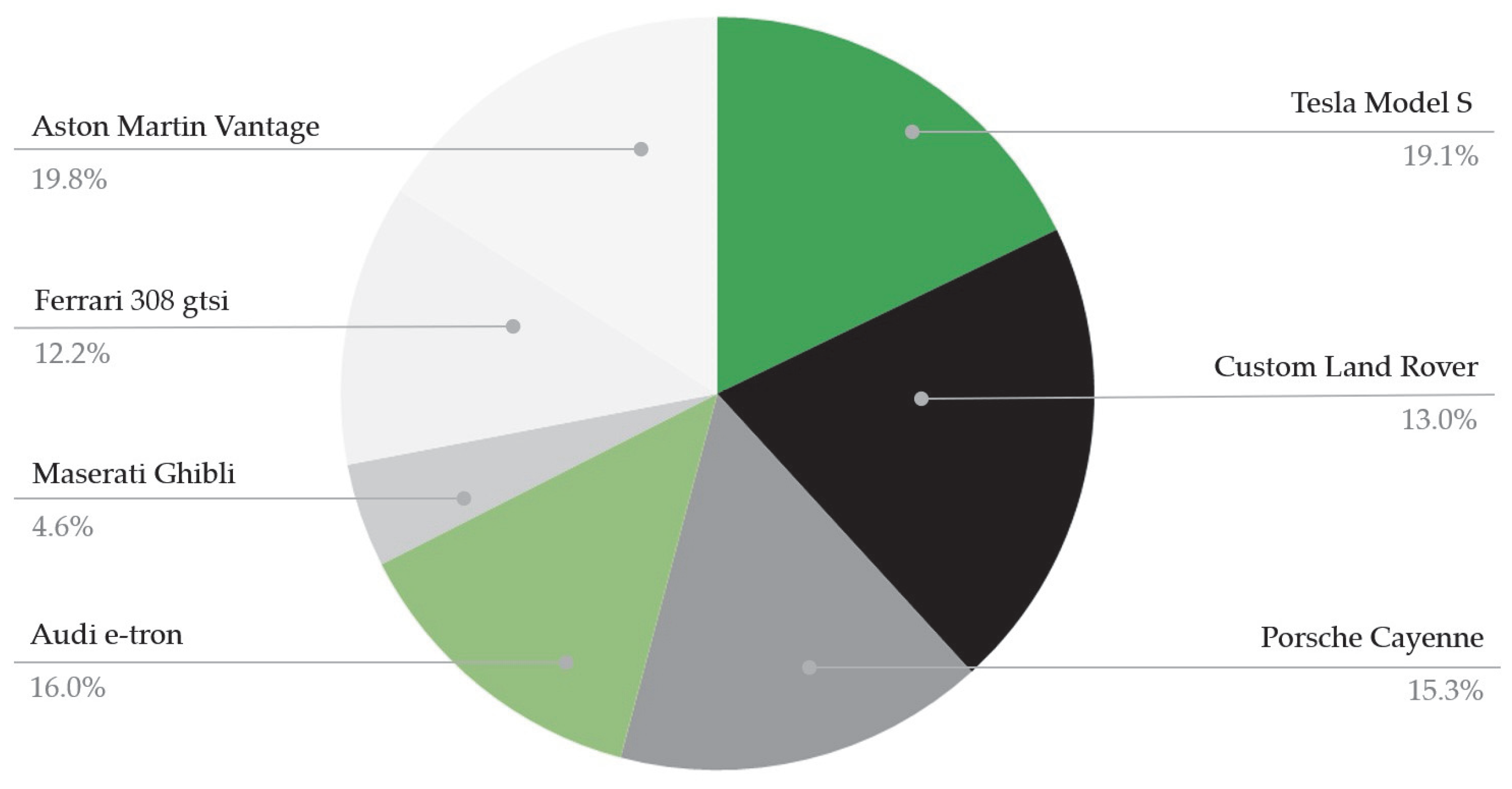

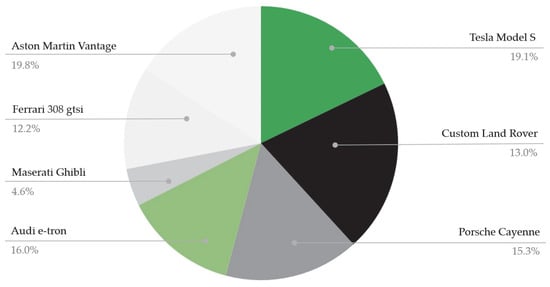

The first screening section related to car preferences segmented respondents according to spending preferences. As shown in Figure 3, the Aston Martin Vantage (19.85%), Tesla Model S (19.08%), and Audi e-tron (16.03%) were the top preferences. This result reflects diverse priorities, including performance and sustainability, rather than strictly cost-sensitive choices.

Figure 3.

The results of the CVM survey in the screening questions related to car preferences.

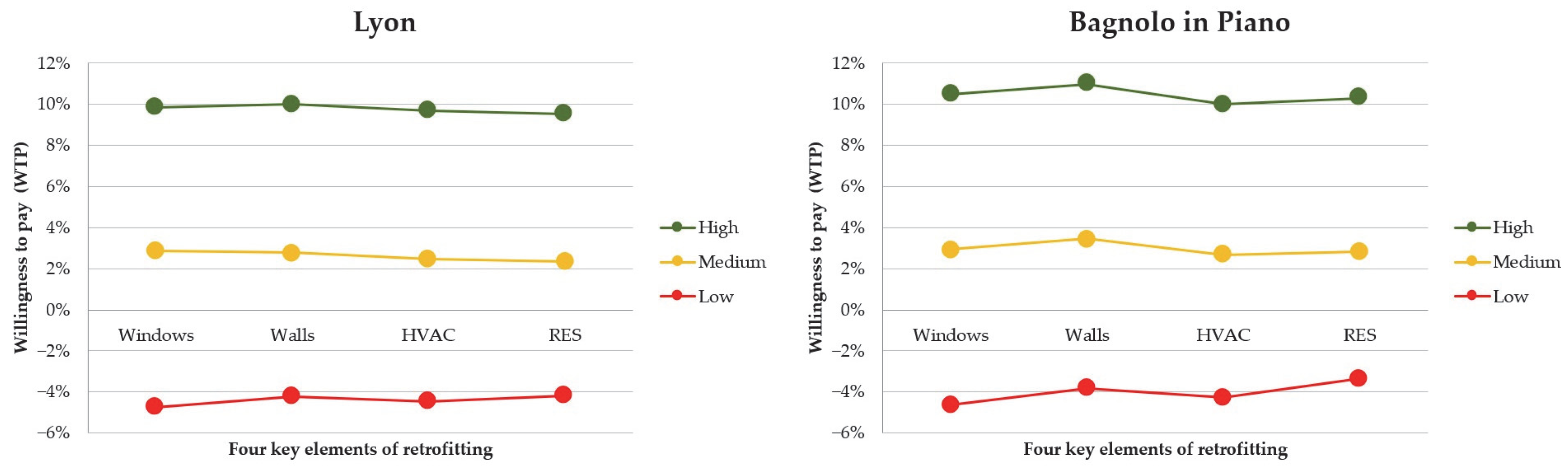

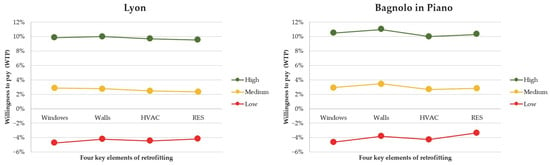

The data analysis shows significant stability in the respondents’ WTP, with similar perceived value for the four key elements of retrofitting (windows, walls, HVAC systems, and renewable energy solutions). This trend was observed in both Lyon and Bagnolo in Piano, with a slight preference for Bagnolo in Piano, likely due to its lower initial property values. Notably, high-performance windows and renewable energy solutions were rated highest, indicating their importance in energy efficiency and long-term savings. Respondents’ preferences seem to highlight their awareness of both functional and financial benefits.

Figure 4 presents a comparison of the average WTP results from the CVM for both Lyon and Bagnolo in Piano. Although the average WTP for Bagnolo is slightly higher—by approximately 0.31% in the deep retrofit scenario—this can be attributed to the lower initial market values in Bagnolo, reflecting local market conditions. While this difference is small in percentage terms, the gap becomes substantially more pronounced when WTP is converted into monetary values, favoring Lyon significantly. This highlights the greater variability and larger market value gains in Lyon, especially when comparing deep retrofit performance with the pre-retrofit scenario.

Figure 4.

Average willingness-to-pay (WTP) for key retrofitting elements in Lyon (left) and Bagnolo in Piano (right) across different retrofit scenarios.

This variation in WTP can be attributed to local market conditions rather than the retrofitting measures, which were comparable in both case studies. The higher market values in Lyon provide more flexibility for absorbing the costs of retrofitting, allowing for a greater return on investment. In contrast, the lower property values in Bagnolo constrain WTP, even though the relative percentage increase due to retrofitting remains significant. This underscores the role of market conditions in shaping buyer perceptions and their willingness to invest in energy-efficient upgrades.

This concept is further supported by the Evans diagrams [50], which indicate that perceived value increases are often influenced by the percentage of improvement relative to the original market value, rather than the intrinsic value of the retrofitting itself. Over time, the value of built environments declines due to physical and economic deterioration, with retrofitting playing a key role in mitigating this. By extending a building’s lifecycle, retrofitting not only maintains but enhances its perceived value, reducing the risk of premature replacement. The perceived value of retrofitting is fundamentally tied to its ability to prolong the building’s operational life, making the investment increasingly appealing over time.

This relationship becomes evident when considering that the greater the perceived value increase from retrofitting, the longer the extension of the building’s useful lifetime. This reduces the likelihood of premature abandonment or replacement. The financial tipping point—determining when it is more cost-effective to replace the structure—depends on the efficiency of retrofitting procedures in lowering energy consumption and enhancing the building’s sustainability. When the retrofitting process successfully extends the building’s lifecycle, replacement can be deferred until a complete transformation becomes financially justifiable. Respondents implicitly understood this balance, recognizing the significant influence of the proposed solutions on prolonging the useful lifetime of the two case studies through more efficient retrofitting. Regarding sale probability, the introductory questions revealed a clear preference for properties in the deep retrofitting scenario, which are significantly more attractive to potential buyers. However, the average WTP shows only a 7.00% increase compared to the partial retrofitting scenario and a 13.50% increase above the pre-retrofit entry price for both cases.

5.2. Evaluation of Cost Approach and Valuation Standards Benchmarks

Following the completion of the CVM analysis, the results are compared to those derived from the cost approach, which determines market value based on the building’s cost profile. This method is aligned with the International Valuation Standards [47]. More in detail, the Lyon case study had a total cost in the deep retrofitting scenario of EUR 421,000, which is reduced to EUR 171,000 for the average performance proposal. For the Bagnolo in Piano case study, the costs were lower, at EUR 80,000 for the average retrofitting and EUR 235,000 for the deep retrofitting. The cost breakdown presented in Table 3 serves as a key input for the Cost Approach valuation method, which goes beyond simple cost estimation. These costs were adjusted to reflect broader market factors, including the building’s age, physical condition, and obsolescence. These adjustments ensure that the final post-retrofit market value accurately reflects not only the costs but also the long-term depreciation, local market conditions, and expected lifespan of the retrofitting measures. This method aligns with the principles outlined in IVS and ensures that the resulting valuation reflects both the investment in retrofitting and the overall financial impact on the property’s market position.

Table 3.

Detailed cost evaluation for building retrofitting scenarios of case studies (the costs refer to the industrialization phase of the different technologies developed in the HEART project, excluding VAT and professional fees).

Table 3 illustrates the cost of retrofitting the two selected buildings, and the impact of these retrofits on the overall market value of the buildings. The cost differences between the two case studies are related to their slightly different sizes, but also reflect regional factors such as labor costs, material availability, and market conditions, which ultimately influence the return on investment for deep retrofitting. The pre-retrofit, partial retrofit and deep retrofit scenarios illustrate how energy-efficient upgrades progressively enhance property value. In Lyon, with its higher baseline market value, the deep retrofit yields a greater return on investment compared to smaller towns like Bagnolo in Piano, where the market dynamics and baseline property values are lower. Additionally, the total costs for the building are determined using the Cost Approach and adjusted for market factors [58].

Table 4 highlights a higher WTP compared to the total market value calculated with the Cost Approach, particularly in Lyon. This discrepancy arises because WTP reflects consumer perceptions and preferences, which are shaped by factors such as market volatility, perceived energy savings, and future cost reductions. These are components of value that cannot be directly quantified in traditional cost calculations. These results highlight that the difference in value perception does not always correspond to actual cost increases, mainly in high volatility periods, such as the most recent one. This could stimulate a deeper reflection on how the market value perception is formed in the minds of respondents and, more broadly, in target market customers.

Table 4.

Unitary market value and willingness-to-pay comparison.

The findings of this research are consistent with the guidelines on energy efficiency valorization in the real estate market, as they suggest a similar method to the one employed in this study. This alignment with established guidelines further supports the soundness and consistency of the research approach, ultimately strengthening the credibility of the research findings [59].

In summary, the results presented align directly with the study’s objectives of evaluating the impact of energy retrofitting on the market value of residential buildings. The CVM analysis revealed that participants exhibit a clear willingness-to-pay (WTP) premium for deep retrofitting scenarios, with an average increase of 13.5% over pre-retrofit conditions. This result indicates the significant perceived value of retrofitting investments, particularly in regions with higher baseline property values, such as Lyon. The comparison between CVM results and the Cost Approach underscores the economic viability of retrofitting, with findings highlighting the combined impact of perceived market value and financial investments. Local market conditions play a pivotal role, with deep retrofitting generating stronger returns in regions with higher baseline property values. These findings provide actionable insights for tailoring retrofitting strategies to regional contexts, addressing the study’s aim of analyzing the impact on property value.

Assessing the payback period relative to these costs provides crucial insights into the feasibility and potential returns of the investment. In both cases, the simple payback period, considering only economic savings from increased efficiency, is slightly over 20 years. This can be considered a good result for a deep retrofit intervention, but is, in any case, a rather long payback time for a private investor. However, including also the market value uplift reported in Table 3, the payback time is essentially zero, as in both cases, this uplift is higher than the investment required. However, it should be pointed out that the previously assumed costs do not include technical expenses (e.g., permitting/design) and VAT. Even with these additional costs factored in, the payback period remains under 5 years, making the investment highly attractive.

6. Discussion

The findings revealed that properties undergoing deep retrofitting attract significantly higher buyer interest, with a 13.5% increase in willingness-to-pay (WTP) over pre-retrofit conditions. This increased market value not only offsets a considerable portion of retrofit investment costs but also highlights retrofitting’s dual benefit, i.e., energy savings and enhanced property value. These insights underscore the importance of designing retrofitting strategies that align with regional market dynamics, particularly in areas with lower property values where financial barriers may impede adoption.

In addition to the “green premium”, which describes increased market value for energy-efficient properties, the study highlights the “brown discount”—properties that fail to meet evolving energy standards, particularly in regions with strict regulations— are likely to lose value over time. These buildings may become less attractive to both buyers and renters, emphasizing the urgency of retrofitting. While retrofitting provides immediate benefits in energy efficiency and comfort, technological advancements and changing market conditions could affect the long-term value of these upgrades. Future research into the durability of retrofitting improvements and their adaptability to market changes is essential.

The study also highlights distinctions between sales price premiums and rental premiums. The “split incentive” issue, where landlords bear retrofitting costs but tenants reap benefits like reduced utility bills, complicates decisions to invest in retrofitting. Additionally, external market factors and consumer perceptions can create a gap between actual investment costs and perceived value, particularly during volatile economic periods. Further research is needed to refine valuation methods that capture these market behaviors and perceptions more accurately.

While this study relied on valuation-based methods and consumer perceptions, the absence of actual transaction price data is a burden. Incorporating transaction data in future studies would offer a more robust understanding of retrofitting’s market impact. Demographic attributes (e.g., income levels and age distribution) and market-specific regulations were also not fully analyzed in this study, but they may significantly influence WTP and market value. Future research should consider these factors to provide a more comprehensive understanding of how local dynamics shape retrofitting outcomes.

7. Conclusions

As energy efficiency becomes a critical concern in the European building market, this study examined how retrofitting measures impact both the perceived and actual market values of multi-family housing. Compared to new construction, retrofitting offers a cost-effective and practical solution to managing energy needs at both urban and metropolitan scales. However, significant gaps exist in the literature regarding the market impacts of retrofitting, particularly for partial and deep retrofitting scenarios. This research aimed to address these gaps by evaluating how different retrofitting strategies influence market values, using a combination of a cost-based valuation approach and the Contingent Valuation Method (CVM). Two case studies in Lyon (France) and Bagnolo in Piano (Italy) provided two representative contexts for this analysis.

The obtained findings highlight that deep retrofitting scenarios provide a 13.5% WTP premium, representing a clear financial return on investment and greater market appeal, particularly in regions with higher baseline property values, such as Lyon.

At a macroeconomic level, retrofitting supports economic growth through job creation, reduced energy dependency, and progress toward decarbonization goals. The dual benefits of energy efficiency and increased market value can motivate stakeholders to adopt retrofitting practices. However, the long-term effects of retrofitting on property value and energy performance remain unexplored. Future longitudinal studies could assess how sustained benefits evolve over time under varying market conditions. The study also highlights the need for integrating complementary valuation methods, such as those that consider consumer preferences and broader market dynamics, to better capture the complexity of retrofitting’s economic and societal impacts. Additionally, the framework presented here could be adapted to other regions with similar market conditions, offering insights for scaling retrofitting strategies globally.

Despite its limitations, the outcome of this research provides actionable recommendations for policymakers and stakeholders. Policymakers can use these findings to design incentives and regulations that promote retrofitting, particularly in regions with financial barriers. Future research could explore strategies to amplify these benefits, encouraging the widespread adoption of energy-efficient retrofitting practices across Europe and beyond.

Author Contributions

Conceptualization, M.G., A.M.P., C.D.P., F.L. and L.S.; Methodology, M.G., A.M.P., C.D.P., F.L. and L.S.; Software, M.G. and A.M.P.; Validation, A.M.P., C.D.P., F.L. and L.S.; Formal analysis, M.G., A.M.P., C.D.P., F.L. and L.S.; Investigation, C.D.P. and L.S.; Resources, A.M.P., C.D.P., F.L. and L.S.; Data curation, M.G., A.M.P. and C.D.P.; Writing—original draft, M.G., A.M.P., C.D.P., F.L. and L.S.; Writing—review & editing, M.G., A.M.P., C.D.P., F.L. and L.S.; Visualization, M.G. and A.M.P.; Supervision, C.D.P. and L.S.; Project administration, C.D.P. and L.S.; Funding acquisition, C.D.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research work was funded by the EU Research and Innovation Programme Horizon 2020 under grant number 768921—HEART Project.

Data Availability Statement

All analyzed data and the information necessary for this study are already presented in the manuscript.

Acknowledgments

The authors are grateful to the European Commission for providing financial support for this project.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Kedwan, F. European commission, implementation plan implementation working group on, energy efficiency in buildings (IWG5). In NLP Application; CRC Press: Boca Raton, FL, USA, 2024; pp. 47–62. [Google Scholar] [CrossRef]

- European Commission. A Renovation Wave for Europe—Greening our buildings, creating jobs, improving lives. Off. J. Eur. Union 2020, 662, 26. [Google Scholar]

- EPBD. Directive (EU) 2024/1275 of the European Parliament and of the Council of 24 April 2024 on the energy performance of buildings. Off. J. Eur. Union 2024, 1275, 1–68. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52021DC0550&from=EN (accessed on 24 April 2024).

- Aste, N.; Adhikari, R.S.; Buzzetti, M.; Del Pero, C.; Huerto-Cardenas, H.E.; Leonforte, F.; Miglioli, A. nZEB: Bridging the gap between design forecast and actual performance data. Energy Built Environ. 2022, 3, 16–29. [Google Scholar] [CrossRef]

- D’Agostino, D.; Zangheri, P.; Cuniberti, B.; Paci, D.; Bertoldi, P. Synthesis Report on the National Plans for NZEBs; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar] [CrossRef]

- European Commission. Proposal for a Directive of the European Parliament and of the Council on the energy performance of buildings (recast). Off. J. Eur. Union 2021, 0426, 10–27. [Google Scholar]

- Bragolusi, P.; D’Alpaos, C. The valuation of buildings energy retrofitting: A multiple-criteria approach to reconcile cost-benefit trade-offs and energy savings. Appl. Energy 2022, 310, 118431. [Google Scholar] [CrossRef]

- Zancanella, P.; Bertoldi, P.; Boza-Kiss, B. Energy Efficiency, the Value of Buildings and the Payment Default Risk; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Fizaine, F.; Voye, P.; Baumont, C. Does the literature support a high willingness to pay for green label buildings? An answer with treatment of publication bias. Rev. Econ. Polit. 2018, 128, 1013–1046. [Google Scholar] [CrossRef]

- FP7-PEOPLE Program. Stochastic Model Predictive Control, Energy Efficient Building Control, Smart Grid | SMPCBCSG Project | FP7 | CORDIS | European Commission. 2014. Available online: https://cordis.europa.eu/project/id/302255 (accessed on 23 March 2020).

- European Commission. Revision of the Energy Performance of Buildings Directive. Eur. Comm. 2021. Available online: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_6686 (accessed on 15 December 2024).

- Morano, P.; Tajani, F.; Di Liddo, F.; Amoruso, P. A Feasibility Analysis of Energy Retrofit Initiatives Aimed at the Existing Property Assets Decarbonisation. Sustainability 2024, 16, 3204. [Google Scholar] [CrossRef]

- Kong, W.; Luo, H.; Yu, Z.; Li, Y.; Wang, C.; Meng, X. Economic evaluation of retrofitting existing buildings from a sustainability perspective: Global trends and bibliometric analysis. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Staniaszek, D. A Guide to Developing Strategies For Building Energy Renovation; Buildings Performance Institute Europe: Brussels, Belgium, 2013. [Google Scholar]

- Fregonara, E.; Irene, R. Buildings’ energy performance, green attributes and real estate prices: Methodological perspectives from the European literature. Aestimum 2021, 79, 43–73. [Google Scholar] [CrossRef]

- McCord, M.; Davis, P.; McCord, J.; Haran, M.; Davison, K. An exploratory investigation into the relationship between energy performance certificates and sales price: A polytomous universal model approach. J. Financ. Manag. Prop. Constr. 2020, 25, 247–271. [Google Scholar] [CrossRef]

- Himeur, Y.; Alsalemi, A.; Bensaali, F.; Amira, A.; Varlamis, I.; Bravos, G.; Sardianos, C.; Dimitrakopoulos, G. Techno-economic assessment of building energy efficiency systems using behavioral change: A case study of an edge-based micro-moments solution. J. Clean. Prod. 2022, 331, 129786. [Google Scholar] [CrossRef]

- Manganelli, B. Real Estate Investing Market Analysis, Valuation Techniques, and Risk Management; Springer: Cham, Switzerland, 2006; Volume 32. [Google Scholar]

- Sarmas, E.; Marinakis, V.; Doukas, H. A data-driven multicriteria decision making tool for assessing investments in energy efficiency. Oper. Res. 2022, 22, 5597–5616. [Google Scholar] [CrossRef]

- HEART Project. The Holistic Energy and Architectural Retrofit Toolkit (HEART). 2020. Available online: https://heartproject.eu/ (accessed on 20 October 2024).

- Copiello, S.; Coletto, S. The Price Premium in Green Buildings: A Spatial Autoregressive Model and a Multi-Criteria Optimization Approach. Buildings 2023, 13, 276. [Google Scholar] [CrossRef]

- Liu, M.; Wei, Y.D.; Wu, Y. Urban Structure, Housing Prices and the Double Role of Amenity: A Study of Nanjing, China. Appl. Spat. Anal. Policy 2024, 17, 27–53. [Google Scholar] [CrossRef]

- Geske, J. The value of energy efficiency in residential buildings—A matter of heterogeneity?! Energy Econ. 2022, 113, 106173. [Google Scholar] [CrossRef]

- Marmolejo-Duarte, C.; García-Hooghuis, A.; Masià, A.G. How much and why are we willing to pay for energy-efficient homes? A stated preferences analysis in Barcelona. Archit. City Environ. 2020, 14, 9215. [Google Scholar] [CrossRef]

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green signalling effects in the market for energy-efficient residential buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef]

- Mudgal, S.; Lyons, L.; Cohen, F.; Bio Intelligence Service; Ronan Lyons, O.U.; Doreen Fedrigo-Fazio, I. Energy Performance Certificates in Buildings and Their Impact on Transaction Prices and Rents in Selected EU Countries. April 2013, p. 151. Available online: http://eur-lex.europa.eu/legal-content/ET/TXT/HTML/?uri=CELEX:32010L0031&from=EN (accessed on 15 December 2024).

- Chegut, A.; Eichholtz, P.; Holtermans, R.; Palacios, J. Energy Efficiency Information and Valuation Practices in Rental Housing. J. Real Estate Financ. Econ. 2020, 60, 181–204. [Google Scholar] [CrossRef]

- De Ruggiero, M.; Forestiero, G.; Manganelli, B.; Salvo, F. Buildings energy performance in a market comparison approach. Buildings 2017, 7, 16. [Google Scholar] [CrossRef]

- Yau. Eco-labels and Willingness-to-Pay: A Hong Kong Study. 2012. Available online: https://www.researchgate.net/publication/259823782_Eco-labels_and_willingness-to-pay_A_Hong_Kong_study (accessed on 15 December 2024).

- Cespedes-Lopez, M.F.; Mora-Garcia, R.T.; Perez-Sanchez, V.R.; Perez-Sanchez, J.C. Meta-analysis of price premiums in housing with energy performance certificates (EPC). Sustainability 2019, 11, 6303. [Google Scholar] [CrossRef]

- Brown, M.J.; Watkins, T. The “green premium” for environmentally certified homes: A meta-analysis and exploration. Res. Gate Work. Pap. 2015. [Google Scholar] [CrossRef]

- Ankamah-Yeboah, I.; Rehdanz, K. Explaining the Variation in the Value of Building Energy Efficiency Certificates: A Quantitative meta-Analysis; Kiel Working Papers: Kiel, Germany, 2014. [Google Scholar]

- Copiello, S. Economic viability of building energy efficiency measures: A review on the discount rate. AIMS Energy 2021, 9, 257–285. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bottero, M. Green premium in buildings: Evidence from the real estate market of Singapore. J. Clean. Prod. 2021, 286, 125327. [Google Scholar] [CrossRef]

- Miller, N.G.; Geltner, D.M. Real Estate Principles for the New Economy; Thomson South-Western: Mason, OH, USA, 2005; Volume 12. [Google Scholar]

- Morgante, F.C.; Gholamzadehmir, M.; Sdino, L.; Rosasco, P. How to invest in the “Market of Sustainability”: Evaluating the impacts of a Real Estate investment across ESG criteria. Valori e Valutazioni 2023, 2023, 65–84. [Google Scholar] [CrossRef]

- Adetiloye, K.A.; Omoruyi Eke, P. A review of real estate valuation and optimal pricing techniques. Asian Econ. Financ. Rev. 2014, 4, 99–125. [Google Scholar] [CrossRef]

- Pagourtzi, E.; Assimakopoulos, V.; Hatzichristos, T.; French, N. Real estate appraisal: A review of valuation methods. J. Prop. Invest. Financ. 2003, 21, 383–401. [Google Scholar] [CrossRef]

- Pandolfi, A.M. The Need for A Wider Application of the Total Economic Value Theories. Int. J. Eng. Tech. Res. 2020, 9, 593–598. [Google Scholar]

- Kim, J.H.; Kim, H.J.; Yoo, S.H. Consumers’ Willingness to pay for net-zero energy apartment in South Korea. Sustainability 2018, 10, 1564. [Google Scholar] [CrossRef]

- Banfi, S.; Farsi, M.; Filippini, M.; Jakob, M. Willingness to pay for energy-saving measures in residential buildings. Energy Econ. 2008, 30, 503–516. [Google Scholar] [CrossRef]

- Washizu, A.; Nakano, S.; Ishii, H.; Hayashi, Y. Willingness to pay for home energy management systems: A survey in New York and Tokyo. Sustainability 2019, 11, 4790. [Google Scholar] [CrossRef]

- Heide, V.; Thingbø, H.S.; Lien, A.G.; Georges, L. Economic and Energy Performance of Heating and Ventilation Systems in Deep Retrofitted Norwegian Detached Houses. Energies 2022, 15, 7060. [Google Scholar] [CrossRef]

- Encinas, F.; Marmolejo-Duarte, C.; Sánchez de la Flor, F.; Aguirre, C. Does energy efficiency matter to real estate-consumers? Survey evidence on willingness to pay from a cost-optimal analysis in the context of a developing country. Energy Sustain. Dev. 2018, 45, 110–123. [Google Scholar] [CrossRef]

- Park, J.; Woo, J.; Jin, T. Implicit discount rate for energy efficiency investment in household sector: A case study on dehumidifier. Innov. Stud. 2022, 17, 189–206. [Google Scholar] [CrossRef]

- Lee, C.Y.; Heo, H. Estimating willingness to pay for renewable energy in South Korea using the contingent valuation method. Energy Policy 2016, 94, 150–156. [Google Scholar] [CrossRef]

- IVSC. International Valuation Standards (IVS); International Valuation Standards Council: London, UK, 2020; Available online: https://www.ivsc.org/consultations/ivs-agenda-consultation-2020/ (accessed on 15 December 2024).

- Guo, J.; Xu, S.; Bi, Z. An integrated cost-based approach for real estate appraisals. Inf. Technol. Manag. 2014, 15, 131–139. [Google Scholar] [CrossRef]

- Massimo, D.E.; De Paola, P.; Mariangela, M.; Alessandro, M.; Del Giudice, F.P. Green and Gold Buildings? Detecting Real Estate Market Premium for Green Buildings through Evolutionary Polynomial Regression. Buildings 2022, 12, 621. [Google Scholar] [CrossRef]

- Mattia, S.; Alessandra, O.; Alessandra, P. Developing the Green Building Challenge (GBC) evaluation model: A multidimensional framework for the assessment of regional and urban regeneration interventions. Aestimum 2012, 499–510. [Google Scholar] [CrossRef]

- Evans, A.W. Economics, Real Estate and the Supply of Land; Blackwell: Oxford, UK, 2004. [Google Scholar]

- Kumar, T.M.V. Smart Global Megacities, Advances in 21st Century Human Settlements; Wiley-Blackwell: Oxford, UK; Springer: Singapore, 2021. [Google Scholar]

- Bastard, C. French Real Estate Market View | Weekly Paper. 2022. Available online: https://www.cushmanwakefield.com/en/france/insights/covid-19-impacts-france-real-estate (accessed on 27 October 2024).

- IGEDD. Property Price and Rent History, 1936-2022 in France and 1200-2022 in Paris: Statistics and Analyses. 2022. Available online: https://www.igedd.developpement-durable.gouv.fr/house-prices-in-france-property-price-index-french-a1117.html (accessed on 30 October 2024).

- Montesinos, P.; Violeau, F.; Delesalle, T.; Frémont, É.; Otte, F.; Vichot, F.; Compère, O.; Proost, F.; Mouton, Q. French Property: Analysis of the Market. 2022. Available online: https://www.notaires.fr/en/housing-tax-system/french-property-market/french-property-market-analysis (accessed on 27 October 2024).

- RealAdvisor. Lyon: Property Prices, Price per m2 (sqm), Online Valuation. 2022. Available online: https://realadvisor.fr/en/property-prices/city-lyon (accessed on 28 October 2024).

- Agenzia Entrate. 2023. Available online: https://www.agenziaentrate.gov.it (accessed on 28 October 2024).

- European Union. House Price Index, Deflated—Annual Data. 2022. Available online: https://ec.europa.eu/eurostat/web/products-datasets/-/tipsho10 (accessed on 28 October 2024).

- ABI; ANIA; Assovib; CDP Immobiliare; Confedilizia; Tecnoborsa. Indicazioni metodologiche preliminari sulle modalità di valutazione dell’efficienza energetica e della qualificazione sismica degli edifici nel valore di mercato. Braz. Dent. J. 2022, 33, 1–12. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).