Financial Literacy as a Key to Entrepreneurship Education: A Multi-Case Study Exploring Diversity and Inclusion

Abstract

:1. Introduction

2. Literature Review

2.1. Financial Education for Young Students with a Gender Perspective

2.2. The Relationship between Complex Thinking and Financial Literacy with a Gender Perspective

2.3. Socio-Demographic Variables Related to Financial Literacy in Mexico

3. Objectives, Hypotheses, and Variables

4. Methodology

4.1. Participants

4.2. Instruments

4.2.1. Financial Literacy Questionnaire

4.2.2. Reasoning for Complexity Questionnaire

4.2.3. Interview Protocol for the Focus Groups on Financial Literacy and Complex Thinking

4.3. Procedure and Data Analysis

5. Results

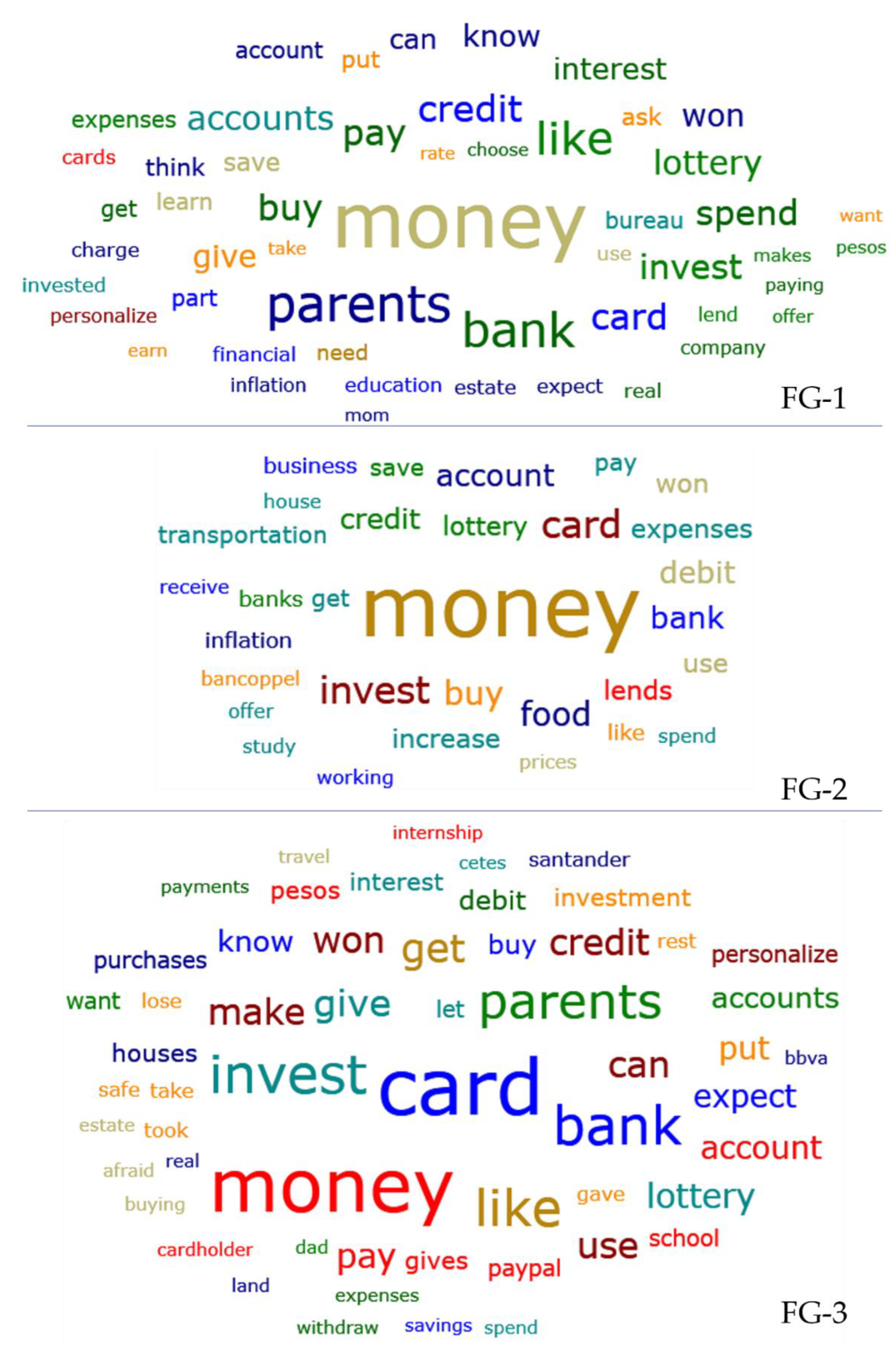

5.1. Financial Knowledge, Behaviors, and Attitudes of Young Adults (Objective 1)

5.2. Differences in Financial Knowledge, Behaviors, and Attitudes as a Function of Socio-Demographic Variables (Gender, Educational Stage —Pre-University and University— and Type of Institution: Public or Private) (Objective 2)

5.3. Relationship between Financial Literacy Competency and Complex Thinking Competency (Objective 3)

5.4. The Predictive Capacity of Complex Thinking Sub-competencies on Financial Literacy Competency (Objective 4)

- Regarding predicting financial behaviors, the model was configured with a predictor for critical thinking: β = 0.124, t = 2.097, p < 0.037.

- Concerning predicting financial attitudes, the model was configured with a predictor for critical thinking: β = 0.138, t = 0.620, p < 0.536.

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agasisti, Tommaso, Marta Cannistrà, Mara Soncin, and Daniele Marazzina. 2022. Financial Education during COVID-19—Assessing the effectiveness of an online programme in a high school. Applied Economics 54: 4006–29. [Google Scholar] [CrossRef]

- Ali, Paul, Malcom Edward Anderson, Cosima Hay McRae, and Ian Ramsay. 2016. The financial literacy of young people: Socio-economic status, language background, and the rural-urban chasm. Australian and International Journal of Rural Education 26: 54–66. [Google Scholar] [CrossRef]

- Amagir, Aisa, Wim Groot, Henriëtte Maassen van den Brink, and Arie Wilschut. 2020. Financial literacy of high school students in the Netherlands: Knowledge, attitudes, self-efficacy, and behavior. International Review of Economics Education 34: 100185. [Google Scholar] [CrossRef]

- Angelici, Marta, Daniela Del Boca, Noemi Oggero, Paola Profeta, Maria Cristina Rossi, and Claudia Villosio. 2022. Pension information and women’s awareness. The Journal of the Economics of Ageing 23: 1–26. [Google Scholar] [CrossRef]

- Arceo-Gómez, Eva O., and F. Alejandro Villagómez. 2017. Financial literacy among Mexican High School Teenagers. International Review of Economics Education 24: 1–17. [Google Scholar] [CrossRef]

- Atkinson, Adele, and Flore-Ann Messy. 2012. Measuring Financial Literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot Study. In OECD Working Papers on Finance. Insurance and Private Pensions, No. 15. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Bae, Kyounghun, Ga-Young Jang, Hyoung-Goo Kang, and Parleen Tan. 2022. Financial Education, and Gender Equity. Asia-Pacific Journal of Financial Studies 51: 372–400. [Google Scholar] [CrossRef]

- Baena-Rojas, José Jaime, María Soledad Ramírez-Montoya, Diego Mauricio Mazo-Cuervo, and Edgar Omar López-Caudana. 2022. Traits of Complex Thinking: A Bibliometric Review of a Disruptive Construct in Education. Journal of Intelligence 10: 37. [Google Scholar] [CrossRef] [PubMed]

- Blaschke, Justus. 2022. Gender differences in financial literacy among teenagers—Can confidence bridge the gap? Cogent Economics & Finance 10: 2144328. [Google Scholar] [CrossRef]

- Bordalo, Pedro, Katherine Coffman, Nicola Gennaioli, and Andrei Shleifer. 2019. Beliefs about gender. American Economic Review 109: 739–73. [Google Scholar] [CrossRef]

- Bottazzi, Laura, and Annamaria Lusardi. 2020. Stereotypes in financial literacy: Evidence from PISA. Journal of Corporate Finance 71: 101831. [Google Scholar] [CrossRef]

- Bucher-Koenen, Taeba, Rob J. Alessie, Annamaria Lusardi, and Maarten van Rooij. 2021. Fearless Woman: Financial Literacy and Stock Market Participation. NBER Working Paper No. 28723. Cambridge, MA: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Castillo-Martínez, Isolda, and Maria Ramírez-Montoya. 2022. Reasoning for complexity competency instrument (e-Complexity): Content validation and expert judgment. In Education in the Knowledge Society. in press. [Google Scholar]

- Creswell, John W., and Vicki L. Plano Clark. 2007. Designing and Conducting Mixed Methods Research. Thousand Oaks: Sage. [Google Scholar] [CrossRef]

- Creswell, John W., Vicki L. Plano Clark, Michelle L. Gutmann, and William E. Hanson. 2003. Advanced Mixed Methods Research Designs. In Handbook of Mixed Methods in Social and Behavioral Research. Edited by A. Tashakkori and C. Teddlie. Thousand Oaks: Sage, pp. 209–40. [Google Scholar]

- Çera, Gentjan, and Bruna Tuzi. 2019. Does Gender Matter in Financial Literacy? A Case Study of Young People in Tirana. Scientific Papers of the University of Pardubice 27: 5–16. [Google Scholar]

- Denzin, N. K., and Y. S. Lincoln. 2015. Data Collection and Analysis Methods. In Handbook of Qualitative Research. Compiled by Norman K. Denzin, and Yvonna S. Lincoln. Barcelona: Gedisa, vol. IV, pp. 43–57. [Google Scholar]

- Di Vaio, Assunta, Rohail Hassan, and Rosa Palladino. 2023. Blockchain technology and gender equality: A systematic literature review. International Journal of Information Management 68: 102517. [Google Scholar] [CrossRef]

- Dogra, Pallavi, Arun Kaushal, and Rishi Raj Sharma. 2023. Antecedents of the Youngster’s Awareness About Financial Literacy: A Structure Equation Modelling Approach. Vision 27: 48–62. [Google Scholar] [CrossRef]

- Duarte, Paulo, Susana Silva, Wilian Ramlho Feitosa, and Rui Sebastião. 2022. Are business students more financially literate? Evidence of differences in financial literacy amongst Portuguese college students. Young Consumers 23: 144–61. [Google Scholar] [CrossRef]

- Encuesta Nacional de Inclusión Financiera. 2018. Informe Operativo y de Procesamiento. Mexico City: Instituto Nacional de Estadística y Geografía (INEGI). [Google Scholar]

- Erner, Carsten, Michael Goedde-Menke, and Michael Oberste. 2016. Financial literacy of high school students: Evidence from Germany. The Journal of Economic Education 47: 95–105. [Google Scholar] [CrossRef]

- Fan, Lu, HanNa Lim, and Jae Min Lee. 2022. Young adults’ financial advice-seeking behavior: The roles of parental financial socialization. Family Relations 71: 1226–46. [Google Scholar] [CrossRef]

- García Mata, Osvaldo, Ana Luz Zorrilla del Castillo, Arturo Briseño García, and Eduardo Arango Herrera. 2021. Actitud financiera, comportamiento financiero y conocimiento financiero en México. Cuadernos de Economía 40: 431–57. [Google Scholar] [CrossRef]

- Garg, Neha, and Shveta Singh. 2018. Financial literacy among youth. International Journal of Social Economics 45: 173–86. [Google Scholar] [CrossRef]

- Grohmann, Antonia, Theres Klühs, and Lukas Menkhoff. 2018. Does financial literacy improve financial inclusion? Cross-country evidence. World Development 111: 84–96. [Google Scholar] [CrossRef]

- Gudjonsson, Sigurdur, Inga Minelgaite, Kari Kristinsson, and Sigrún Pálsdóttir. 2022. Financial Literacy and Gender Differences: Women Choose People While Men Choose Things? Administrative Sciences 12: 179. [Google Scholar] [CrossRef]

- Hayei, Abdul Afaf, and Haniza Khalid. 2019. Inculcating financial literacy among young adults through trust and experience. International Journal of Accounting, Finance and Business 4: 78–91. [Google Scholar]

- Hernández, Sergio, Arturo García-Santillán, and Elena Moreno-García. 2022. Financial literacy and its relationship with socio-demographic variables. Economics and Sociology 15: 40–55. [Google Scholar] [CrossRef]

- IICA. 2021. Ciudades Intermedias como Instrumento para el Desarrollo Territorial Sostenible e Innovador. Blog del IICA, Sembrando Hoy la Agricultura del Future, 6 abril 2021. Available online: https://blog.iica.int/blog/ciudades-intermedias-como-instrumento-para-desarrollo-territorial-sostenible-e-innovador (accessed on 15 December 2022).

- Jayaraman, Jayadhurganandh, and Saigeetha Jambunathan. 2018. Financial literacy among high school students: Evidence from India. Citizenship, Social and Economics Education 17: 168–87. [Google Scholar] [CrossRef]

- Jha, Saumitra, and Moses Shayo. 2021. Trading Stocks Builds Financial Confidence and Compresses the Gender Gap. Stanford University Graduate School of Business Research Paper No. 3673. Stanford: Institute for Economic Policy Research (SIEPR). [Google Scholar] [CrossRef]

- Johnson, R. Burke, Anthony J. Onwuegbuzie, and Lisa A. Turner. 2007. Toward a definition of mixed methods research. Journal of Mixed Methods Research 1: 112–33. [Google Scholar] [CrossRef]

- Kiliyanni, Abdul Latheef, and Sunitha Sivaraman. 2016. The perception-reality gap in financial literacy: Evidence from the most literate state in India. International Review of Economics Education 23: 47–64. [Google Scholar] [CrossRef]

- Kim, Namhoon, and Travis P. Mountain. 2019. Financial Knowledge and “Don’t Know” Response. The Journal of Consumer Affairs 53: 1948–69. [Google Scholar] [CrossRef]

- Klapper, Leora, Annamaria Lusardi, and Peter Van Oudheusden. 2015. Financial Literacy around the World. Washington, DC: World Bank. [Google Scholar]

- Liu, Aiping, Elena Urquía-Grande, Pilar López-Sánchez, and Ángel Rodríguez-López. 2023. Research into microfinance and ICTs: A bibliometric analysis. Evaluation and Program Planning 97: 102215. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, Pierre-Carl Michaud, and Olivia S. Mitchell. 2017. Optimal financial knowledge and wealth inequality. Journal of Political Economy 125: 431–77. [Google Scholar] [CrossRef]

- Lührmann, Melanie, Marta Serra-Garcia, and Joachim Winter. 2015. Teaching teenagers in finance: Does it work? Journal of Banking & Finance 54: 160–74. [Google Scholar] [CrossRef]

- Moreno-García, Elena, Arturo García-Santillán, and Daniel Martínez Navarrete. 2022. Empirical Study on Financial Knowledge among High School Students in Veracruz. International Journal of Innovative Research and Scientific Studies 5: 162–69. [Google Scholar] [CrossRef]

- OCDE/CAF. 2020. Estrategias Nacionales de Inclusión y Educación Financiera en América Latina y el Caribe: Retos de Implementación. Available online: https://www.oecd.org/finance/financial-education/Estrategias-nacionales-de-inclusion-y-educacion-financiera-en-America-Latina-y-el-Caribe.pdf (accessed on 11 January 2023).

- Pérez-Roa, Lorena, Santos Allendes, and Catalina Fontecilla. 2022. Women and Finances: Exploring the Place of Women in the Chilean Financial Education Programs. Affilia: Feminist Inquiry in Social Work 37: 364–81. [Google Scholar] [CrossRef]

- Ramírez-Montoya, Maria Soledad, Isolda Margarita Castillo-Martínez, Jorge C. Sanabria-Zepeda, and Jhonattan Miranda. 2022. Complex Thinking in the Framework of Education 4.0 and Open Innovation—A Systematic Literature Review. Journal of Open Innovation: Technology, Market, and Complexity 8: 4. [Google Scholar] [CrossRef]

- Reynolds, Travis W., Pierre E. Biscaye, C. Leigh Anderson, Caitlin O’Brien-Carelli, and Joanna Keel. 2023. Exploring the gender gap in mobile money awareness and use: Evidence from eight low and middle-income countries. Information Technology for Development 29: 228–55. [Google Scholar] [CrossRef]

- Rodríguez-Abitia, Guillermo, Maria Soledad Ramírez-Montoya, Sandra Martínez-Pérez, and Edgar Omar López-Caudana. 2022. Cultural differences in complexity reasoning in higher education. Paper presented at 10th International Conference on Technological Ecosystems for Enhancing Multiculturality (TEEM 2021), Salamanca, Spain, October 19–21. [Google Scholar]

- Roy, Priyanka, and Binoti Patro. 2022. Financial Inclusion of Women and Gender Gap in Access to Finance: A Systematic Literature Review. Vision 26: 282–99. [Google Scholar] [CrossRef]

- Sánchez Fontalvo, Ivan Manuel, Luis Alfredo González Monroy, and Simón José Esmeral Ariza. 2020. Qualitative Methodologies in Educational Research. Santa Martha: Universidad del Magdalena. [Google Scholar]

- Silinskas, Gintautas, Arto K. Ahonen, and Terhi-Anna Wilska. 2021. Financial literacy among Finnish adolescents in PISA 2018: The role of financial learning and dispositional factors. Large-Scale Assessments in Education 9: 24. [Google Scholar] [CrossRef]

- Sproesser, Ute, Markus Vogel, Tobias Dörfler, and Andreas Eichler. 2022. Changing between representations of elementary functions: Students’ competencies and differences with a specific perspective on school track and gender. International Journal of STEM Education 9: 33. [Google Scholar] [CrossRef]

- Suri, Ankit, and Lokesh Jindal. 2022. Financial literacy for well-being: Scientific mapping and bibliometric analysis. Citizenship, Social and Economics Education 21: 209–33. [Google Scholar] [CrossRef]

- Vázquez-Parra, José Carlos, Isolda Margarita Castillo-Martínez, María Soledad Ramírez-Montoya, and A. Millán. 2022. Development of the perception of achievement of complex thinking: A disciplinary approach in a Latin American student population. Education Sciences 12: 289. [Google Scholar] [CrossRef]

- Villagómez, F. Alejandro. 2016. Financial literacy among high school students in the Mexico City metropolitan area. Trimestre Económico 83: 677–706. [Google Scholar]

- Wakabayashi, Akio, Simon Baron-Cohen, Sally Wheelwright, Nigel Goldenfeld, Joe Delaney, Debra Fine, Richard Smith, and Leonora Weil. 2006. Development of short forms of the Empathy Quotient (EQ-Short) and the Systemizing Quotient (SQ-Short). Personality and Individual Differences 41: 929–40. [Google Scholar] [CrossRef]

- Wee, Lynn Ling Min, and Siew Ching Goy. 2022. The effects of ethnicity, gender, and parental financial socialization on financial knowledge among Gen Z: The case of Sarawak, Malaysia. International Journal of Social Economics 49: 1349–67. [Google Scholar] [CrossRef]

- West, Tracey, and Elizabeth Mitchell. 2022. Australian women with good financial knowledge fare better in divorce. Australian Journal of Management 47: 203–24. [Google Scholar] [CrossRef]

- World Economic Forum. 2020. Global Gender Gap (GGG) Report 2020. Available online: http://www3.weforum.org/docs/WEF_GGGR_2020.pdf (accessed on 8 February 2023).

- Yew, Siew-Yong, Chen-Chen Yong, Kee-Cheok Cheong, and Nai-Peng Tey. 2017. Does financial education matter? Education literacy among undergraduates in Malaysia. Institutions and Economies 9: 43–60. [Google Scholar]

| Focus Group | Institution Type | Educational Stage | Gender | Total | Age | |

|---|---|---|---|---|---|---|

| F | M | |||||

| FG-1 | Private Catholic | High School | 16 | 17 | 33 | 17–18 |

| FG-2 | Public | University | 5 | 6 | 11 | 18–19 |

| FG-3 | Private | University | 3 | 4 | 7 | 20–24 |

| 51 | 17–24 | |||||

| Dimensions | N | Mean | Standard Deviation |

|---|---|---|---|

| Financial knowledge | 275 | 2.484 | 0.34 |

| Financial behaviors | 275 | 2.944 | 0.47 |

| Financial attitudes | 275 | 2.917 | 0.33 |

| Dependent Variable | Gender | Mean | Standard Deviation | T | g.l. | p |

|---|---|---|---|---|---|---|

| Financial knowledge | Male | 2.53 | 0.34 | −2.586 | 273 | 0.010 |

| Female | 2.43 | 0.34 | ||||

| Financial behaviors | Male | 2.86 | 0.33 | 2.705 | 273 | 0.007 |

| Female | 3.01 | 0.33 | ||||

| Financial attitudes | Male | 2.91 | 0.32 | −0.082 | 273 | 0.935 |

| Female | 2.9 | 0.30 |

| FG-1 | FG-2 | FG-3 | |||||

|---|---|---|---|---|---|---|---|

| Female | Male | Female | Male | Female | Male | ||

| Financial knowledge | Investment | 1 | 1 | 1 | 1 | 1 | 1 |

| Inflation | 1 | 1 | 0 | 1 | 1 | 1 | |

| Interest | 1 | 1 | 1 | 1 | 1 | 1 | |

| Financial behaviors | Savings | 1 | 1 | 1 | 1 | 1 | 1 |

| Credit management | 1 | 1 | 1 | 1 | 1 | 1 | |

| Investment | 1 | 1 | 0 | 1 | 1 | 1 | |

| Financial attitudes | Savings | 1 | 1 | 1 | 1 | 1 | 1 |

| Credit management | 1 | 1 | 0 | 1 | 1 | 1 | |

| Investment | 1 | 1 | 0 | 1 | 1 | 1 | |

| FG-1 | FG-2 | FG-3 | ||||

|---|---|---|---|---|---|---|

| Yes | No | Yes | No | Yes | No | |

| Female | 6 | 9 | 0 | 4 | 2 | 0 |

| Male | 4 | 13 | 3 | 3 | 4 | 0 |

| Dependent Variable | Educational Stage | Mean | Standard Deviation | T | g.l. | p |

|---|---|---|---|---|---|---|

| Financial knowledge | High School | 2.40 | 0.34 | −3.585 | 273 | 0.000 |

| University | 2.55 | 0.34 | ||||

| Financial behaviors | High School | 2.96 | 0.33 | 0.541 | 273 | 0.589 |

| University | 2.93 | 0.33 | ||||

| Financial attitudes | High School | 2.91 | 0.32 | 0.058 | 273 | 0.954 |

| University | 2.91 | 0.30 |

| Dependent Variable | Type of Institution | Mean | Standard Deviation | T | g.l. | p |

|---|---|---|---|---|---|---|

| Financial knowledge | Public | 2.41 | 0.346 | −3.633 | 273 | 0.000 |

| Private | 2.56 | 0.332 | ||||

| Financial behaviors | Public | 2.97 | 0.498 | 1.219 | 273 | 0.224 |

| Private | 2.90 | 0.449 | ||||

| Financial attitudes | Public | 2.90 | 0.320 | −0.550 | 273 | 0.583 |

| Private | 2.92 | 0.345 |

| Financial Knowledge | Financial Behaviors | Financial Attitudes | |

|---|---|---|---|

| Systemic thinking p | −0.005 | 0.054 | 0.005 |

| 0.934 | 0.369 | 0.937 | |

| Scientific thinking p | −0.058 | 0.002 | −0.042 |

| 0.338 | 0.980 | 0.485 | |

| Critical thinking p | 0.037 | 0.124 | 0.038 |

| 0.544 | 0.040 * | 0.036 * | |

| Innovative thinking p | 0.037 | 0.086 | −0.500 |

| 0.543 | 0.156 | 0.405 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Medina-Vidal, A.; Buenestado-Fernández, M.; Molina-Espinosa, J.M. Financial Literacy as a Key to Entrepreneurship Education: A Multi-Case Study Exploring Diversity and Inclusion. Soc. Sci. 2023, 12, 626. https://doi.org/10.3390/socsci12110626

Medina-Vidal A, Buenestado-Fernández M, Molina-Espinosa JM. Financial Literacy as a Key to Entrepreneurship Education: A Multi-Case Study Exploring Diversity and Inclusion. Social Sciences. 2023; 12(11):626. https://doi.org/10.3390/socsci12110626

Chicago/Turabian StyleMedina-Vidal, Adriana, Mariana Buenestado-Fernández, and José Martín Molina-Espinosa. 2023. "Financial Literacy as a Key to Entrepreneurship Education: A Multi-Case Study Exploring Diversity and Inclusion" Social Sciences 12, no. 11: 626. https://doi.org/10.3390/socsci12110626

APA StyleMedina-Vidal, A., Buenestado-Fernández, M., & Molina-Espinosa, J. M. (2023). Financial Literacy as a Key to Entrepreneurship Education: A Multi-Case Study Exploring Diversity and Inclusion. Social Sciences, 12(11), 626. https://doi.org/10.3390/socsci12110626