Resilience of Colombian Entrepreneurships during COVID-19 Pandemic Crisis

Abstract

:1. Introduction

2. Theoretical Background

2.1. Crisis as a Research Phenomenon

2.2. Entrepreneurial Resilience in Times of Crisis

2.3. Colombian Business Context during COVID-19 Crisis

3. Methods and Materials

3.1. Sample and Population

3.2. Variables

3.3. Measurements of Association

3.4. Structural Equation Model and Mediation Analysis

4. Results

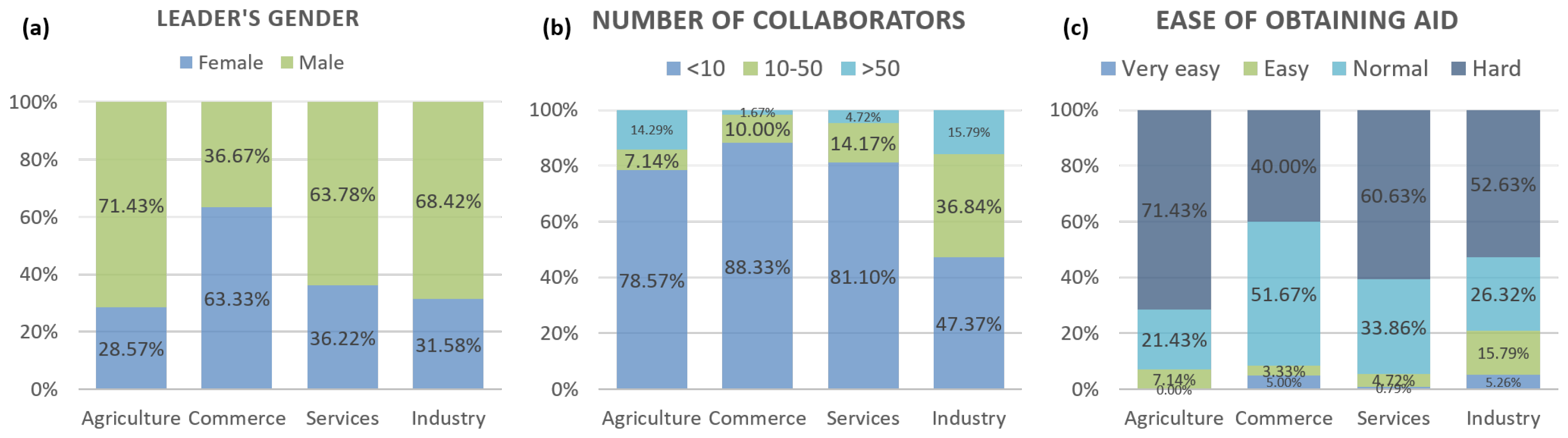

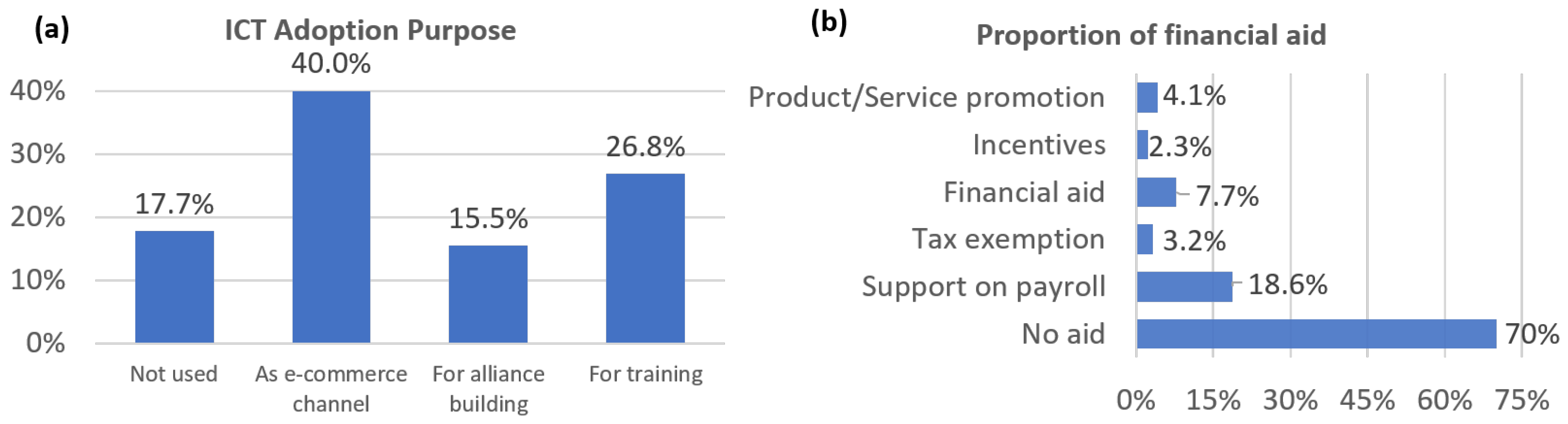

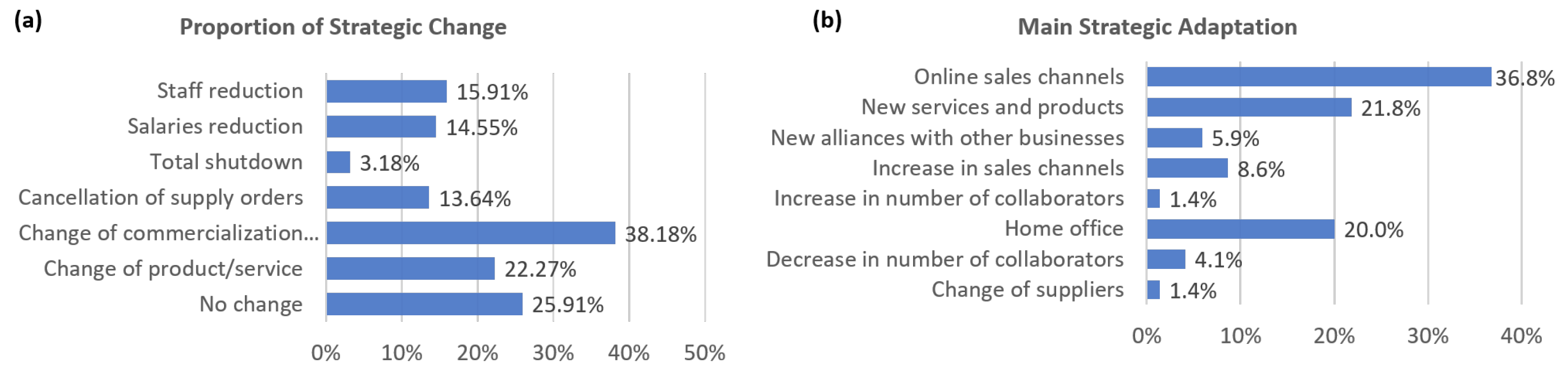

4.1. Descriptive Analysis

4.2. Causal Analysis of Number of Aids Obtained

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agresti, Alan. 2018. Statistical Methods for the Social Sciences. Boston: Pearson. [Google Scholar]

- Alos-Simo, Lirios, Antonio J. Verdu-Jover, and Jose-Maria Gomez-Gras. 2017. How transformational leadership facilitates e-business adoption. Industrial Management & Data Systems 117: 382–97. [Google Scholar] [CrossRef]

- Alves, Jose C., Tan Cheng Lik, Yubo Luo, and Wei Hao. 2020. Crisis challenges of small firms in Macao during the COVID-19 pandemic. Frontiers of Business Research in China 14: 26. [Google Scholar] [CrossRef]

- Archibugi, Daniele, Andrea Filippetti, and Marion Frenz. 2013. Economic crisis and innovation: Is destruction prevailing over accumulation? Research Policy 42: 303–14. [Google Scholar] [CrossRef] [Green Version]

- Berry, Kenneth. 2018. The Measurement of Association: A Permutation Statistical Approach. Cham: Springer. [Google Scholar]

- Björklund, Tua A., Maria Mikkonen, Pauliina Mattila, and Floris van der Marel. 2020. Expanding entrepreneurial solution spaces in times of crisis: Business model experimentation amongst packaged food and beverage ventures. Journal of Business Venturing Insights 14: e00197. [Google Scholar] [CrossRef]

- Blind, Knut, Sören S. Petersen, and Cesare A. F. Riillo. 2017. The impact of standards and regulation on innovation in uncertain markets. Research Policy 46: 249–64. [Google Scholar] [CrossRef]

- Boianovsky, Mauro. 2021. Economists, scientific communities, and pandemics: An exploratory study of Brazil (1918–2020). EconomiA 22: 1–18. [Google Scholar] [CrossRef]

- Boin, Arjen, and Paul ’t Hart. 2010. Organising for effective emergency management: Lessons from research1. Australian Journal of Public Administration 69: 357–71. [Google Scholar] [CrossRef] [Green Version]

- Bosma, Niels, Stephen Hill, Aileen Ionescu-Somers, Donna Kelley, Jonathan Levie, and Anna Tarnawa. 2020. Global Entrepreneurship Monitor: 2019/2020 Report. London: Global Entrepreneurship Research Association. [Google Scholar]

- Brown, Ross, and Augusto Rocha. 2020. Entrepreneurial uncertainty during the COVID-19 crisis: Mapping the temporal dynamics of entrepreneurial finance. Journal of Business Venturing Insights 14: e00174. [Google Scholar] [CrossRef]

- Buchanan, David A., and David Denyer. 2012. Researching tomorrow’s crisis: Methodological innovations and wider implications. International Journal of Management Reviews 15: 205–24. [Google Scholar] [CrossRef]

- Cappelli, Alessio, and Enrico Cini. 2020. Will the COVID-19 pandemic make us reconsider the relevance of short food supply chains and local productions? Trends in Food Science & Technology 99: 566–67. [Google Scholar] [CrossRef]

- Cepel, Martin, Beata Gavurova, Jan Dvorsky, and Jaroslav Belas. 2020. The impact of the COVID-19 crisis on the perception of business risk in the SME segment. Journal of International Studies 13: 248–63. [Google Scholar] [CrossRef]

- Chamber of Commerce of Bogotá. 2021. Las MiPymes son la base del tejido empresarial de Bogotá y la Región, representan el 99.3% de las empresas activas. Available online: https://www.ccb.org.co/observatorio/Dinamica-Empresarial/Dinamica-empresarial/Las-Mipymes-son-la-base-del-tejido-empresarial-de-Bogota-y-la-Region-representan-el-99-3-de-las-empresas-activas (accessed on 15 June 2022).

- Ciasullo, Maria Vincenza, Raffaella Montera, and Alexander Douglas. 2022. Building SMEs’ resilience in times of uncertainty: The role of big data analytics capability and co-innovation. Transforming Government: People, Process and Policy 16: 203–17. [Google Scholar] [CrossRef]

- Coombs, W. Timothy. 2007. Protecting organization reputations during a crisis: The development and application of situational crisis communication theory. Corporate Reputation Review 10: 163–76. [Google Scholar] [CrossRef] [Green Version]

- Cucculelli, Marco, and Cristina Bettinelli. 2016. Corporate governance in family firms, learning and reaction to recession: Evidence from italy. Futures 75: 92–103. [Google Scholar] [CrossRef]

- Departamento Nacional de Estadística. 2020. Medición de empleo informal y seguridad social: Trimestre móvil mayo–julio 2020. In Boletín Técnico—DANE; September 11. Available online: https://www.dane.gov.co/files/investigaciones/boletines/ech/ech_informalidad/bol_geih_informalidad_may20_jul20.pdf (accessed on 15 June 2022).

- Departamento Nacional de Planeación. 2021. Bases del Plan Nacional de Desarrollo 2018–2022: Pacto por Colombia pacto por la equidad. Available online: https://colaboracion.dnp.gov.co/CDT/Prensa/BasesPND2018-2022n.pdf (accessed on 24 January 2023).

- Doern, Rachel, Nick Williams, and Tim Vorley. 2018. Special issue on entrepreneurship and crises: Business as usual? An introduction and review of the literature. Entrepreneurship & Regional Development 31: 400–12. [Google Scholar] [CrossRef]

- Etemad, Hamid. 2020. Managing uncertain consequences of a global crisis: SMEs encountering adversities, losses, and new opportunities. Journal of International Entrepreneurship 18: 125–44. [Google Scholar] [CrossRef]

- Frare, Anderson Betti, and Ilse Maria Beuren. 2021. Job autonomy, unscripted agility and ambidextrous innovation: Analysis of brazilian startups in times of the COVID-19 pandemic. Revista de Gestão 28: 263–78. [Google Scholar] [CrossRef]

- Grube, Laura E., and Virgil Henry Storr. 2018. Embedded entrepreneurs and post-disaster community recovery. Entrepreneurship & Regional Development 30: 800–21. [Google Scholar] [CrossRef]

- Hausman, Angela, and Wesley J. Johnston. 2014. The role of innovation in driving the economy: Lessons from the global financial crisis. Journal of Business Research 67: 2720–26. [Google Scholar] [CrossRef]

- Herbane, Brahim. 2012. Exploring crisis management in UK small- and medium-sized enterprises. Journal of Contingencies and Crisis Management 21: 82–95. [Google Scholar] [CrossRef]

- Hudecheck, Michael, Charlotta Sirén, Dietmar Grichnik, and Joakim Wincent. 2020. How companies can respond to the coronavirus. MIT Sloan Management Review. March 9. Available online: https://sloanreview.mit.edu/article/how-companies-can-respond-to-the-coronavirus/ (accessed on 24 January 2023).

- Imai, Kosuke, Luke Keele, and Dustin Tingley. 2010. A general approach to causal mediation analysis. Psychological Methods 15: 309–34. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Imai, Kosuke, Luke Keele, and Teppei Yamamoto. 2010. Identification, inference and sensitivity analysis for causal mediation effects. Statistical Science 25: 51–71. [Google Scholar] [CrossRef] [Green Version]

- Ivanov, Dmitry. 2020. Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transportation Research Part E: Logistics and Transportation Review 136: 101922. [Google Scholar] [CrossRef]

- Kaytaz, Mehmet, and Misra C. Gul. 2014. Consumer response to economic crisis and lessons for marketers: The turkish experience. Journal of Business Research 67: 2701–6. [Google Scholar] [CrossRef]

- Kimhi, Shaul, Yohanan Eshel, Hadas Marciano, and Bruria Adini. 2021. Fluctuations in National Resilience during the COVID-19 Pandemic. International Journal of Environmental Research and Public Health 18: 3876. [Google Scholar] [CrossRef]

- Kline, Rex B. 2016. Principles and Practice of Structural Equation Modeling. New York: Guilford Press. [Google Scholar]

- Klyver, Kim, and Sharon Grant. 2010. Gender differences in entrepreneurial networking and participation. International Journal of Gender and Entrepreneurship 2: 213–27. [Google Scholar] [CrossRef]

- Kuckertz, Andreas, Leif Brändle, Anja Gaudig, Sebastian Hinderer, Carlos Arturo Morales Reyes, Alicia Prochotta, Kathrin M. Steinbrink, and Elisabeth S. C. Berger. 2020. Startups in times of crisis—A rapid response to the COVID-19 pandemic. Journal of Business Venturing Insights 13: e00169. [Google Scholar] [CrossRef]

- Kuckertz, Andreas, and Leif Brändle. 2021. Creative reconstruction: A structured literature review of the early empirical research on the COVID-19 crisis and entrepreneurship. Management Review Quarterly 72: 281–307. [Google Scholar] [CrossRef]

- Liguori, Eric, and Christoph Winkler. 2020. From offline to online: Challenges and opportunities for entrepreneurship education following the COVID-19 pandemic. Entrepreneurship Education and Pedagogy 3: 346–51. [Google Scholar] [CrossRef] [Green Version]

- Lim, Dominic S. K., Eric A. Morse, and Naryoung Yu. 2020. The impact of the global crisis on the growth of SMEs: A resource system perspective. International Small Business Journal: Researching Entrepreneurship 38: 492–503. [Google Scholar] [CrossRef]

- Linnenluecke, Martina K. 2015. Resilience in business and management research: A review of influential publications and a research agenda. International Journal of Management Reviews 19: 4–30. [Google Scholar] [CrossRef]

- Liu, Zheng, Yongjiang Shi, and Bo Yang. 2022. Open Innovation in Times of Crisis: An Overview of the Healthcare Sector in Response to the COVID-19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity 8: 21. [Google Scholar] [CrossRef]

- MacKinnon, David, and David P. MacKinnon. 2008. Introduction to Statistical Mediation Analysis (Multivariate Applications Series). New York: Erlbaum Psych Press. [Google Scholar]

- Manolova, Tatiana S., Candida G. Brush, Linda F. Edelman, and Amanda Elam. 2020. Pivoting to stay the course: How women entrepreneurs take advantage of opportunities created by the COVID-19 pandemic. International Small Business Journal: Researching Entrepreneurship 38: 481–91. [Google Scholar] [CrossRef]

- Otrachshenko, Vladimir, Olga Popova, Milena Nikolova, and Elena Tyurina. 2022. COVID-19 and entrepreneurship entry and exit: Opportunity amidst adversity. Technology in Society 71: 102093. [Google Scholar] [CrossRef]

- Pearson, Christine M., and Judith A. Clair. 1998. Reframing crisis management. Academy of Management Review 23: 59–76. [Google Scholar] [CrossRef]

- Pedroni, Florencia. 2022. Innovación como estrategia de resiliencia durante la crisis por COVID-19: Análisis cualitativo de mipymes argentinas. Cuadernos Latinoamericanos de Administración 18. [Google Scholar] [CrossRef]

- Polas, Mohammad Rashed Hasan, and Valliappan Raju. 2021. Technology and entrepreneurial marketing decisions during COVID-19. Global Journal of Flexible Systems Management 22: 95–112. [Google Scholar] [CrossRef]

- Ratten, Vanessa. 2020. Coronavirus (COVID-19) and entrepreneurship: Changing life and work landscape. Journal of Small Business & Entrepreneurship 32: 503–16. [Google Scholar] [CrossRef]

- Salamzadeh, Aidin, and Leo Paul Dana. 2020. The coronavirus (COVID-19) pandemic: Challenges among iranian startups. Journal of Small Business & Entrepreneurship 33: 489–512. [Google Scholar] [CrossRef]

- Sales, Adam C. 2016. Review: Mediation package in R. Journal of Educational and Behavioral Statistics 42: 69–84. [Google Scholar] [CrossRef] [Green Version]

- Spigel, Ben. 2017. The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice 41: 49–72. [Google Scholar] [CrossRef] [Green Version]

- Schepers, Jelle, Pieter Vandekerkhof, and Yannick Dillen. 2021. The Impact of the COVID-19 Crisis on Growth-Oriented SMEs: Building Entrepreneurial Resilience. Sustainability 13: 9296. [Google Scholar] [CrossRef]

- Schulman, Paul R. 2021. Reliability, uncertainty and the management of error: New perspectives in the COVID-19 era. Journal of Contingencies and Crisis Management 30: 92–101. [Google Scholar] [CrossRef]

- Villaseca, David, Julio Navío-Marco, and Ricardo Gimeno. 2021. Money for female entrepreneurs does not grow on trees: Start-ups’ financing implications in times of COVID-19. Journal of Entrepreneurship in Emerging Economies 13: 698–720. [Google Scholar] [CrossRef]

- Williams, Trenton A., Daniel A. Gruber, Kathleen M. Sutcliffe, Dean A. Shepherd, and Eric Yanfei Zhao. 2017. Organizational response to adversity: Fusing crisis management and resilience research streams. Academy of Management Annals 11: 733–69. [Google Scholar] [CrossRef]

- Wind, Tim R., Marleen Rijkeboer, Gerhard Andersson, and Heleen Riper. 2020. The COVID-19 pandemic: The ‘black swan’ for mental health care and a turning point for e-health. Internet Interventions 20: 100317. [Google Scholar] [CrossRef]

- Winston, Andrew. 2020. Is the COVID-19 outbreak a black swan or the new normal. MIT Sloan Management Review 16: 154–73. [Google Scholar]

- Xia, Yan, and Yanyun Yang. 2018. RMSEA, CFI, and TLI in structural equation modeling with ordered categorical data: The story they tell depends on the estimation methods. Behavior Research Methods 51: 409–28. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Hui, Ying Chen, and Xiaohu Zhou. 2020. Gender and financing in entrepreneurship: Research evidence from china. Chinese Management Studies 14: 677–94. [Google Scholar] [CrossRef]

| Financial Benefits | Credit for micro-enterprises. |

| Relief and grace periods. | |

| Longer terms and preferential conditions in re-discount loans. | |

| Expansion of the working capital line. | |

| Refinancing of liabilities. | |

| Expansion of debt quotas and guarantees to enterprises. | |

| Strengthening of guarantees for SMEs and large enterprises. | |

| Line of guarantees for bond issuance. | |

| The line for debt funds. | |

| Guarantee for invoice financing (confirming). | |

| Payroll loans. | |

| Tax benefits | Tariff reduction for imports of inputs and raw materials. |

| VAT (value-added tax) free day. | |

| National and regional tax benefits. | |

| Reduction of trade tariffs. | |

| Subsidies | Subsidized payment of social benefits. |

| Payroll subsidy. | |

| Platforms and digitalization of services | Development of platforms for access to working capital. |

| Virtual business roundtables. |

| Correlation/p-Value | Venture’s Size | Venture’s Age | Venture’s Maturity | Leader’s Gender | Number of Aids | Obstacles for Aids | Strategic Changes | ICT Embracement | Present Impact | Expected Impact |

|---|---|---|---|---|---|---|---|---|---|---|

| Venture’s size | 0.000 | 0.0000 | 0.0008 | 0.0006 | 0.2657 | 0.0522 | 0.2088 | 0.0076 | 0.0080 | |

| Venture’s age | 0.3491 2 | 0.0000 | 0.0000 | 0.0000 | 0.0113 | 0.0089 | 0.5405 | 0.0001 | 0.0004 | |

| Venture’s maturity | 0.3455 2 | 0.5086 2 | 0.0095 | 0.0007 | 0.6737 | 0.0346 | 0.5273 | 0.2774 | 0.9853 | |

| Leader’s Gender | 0.2218 2 | 0.2453 2 | 0.1655 2 | 0.0641 | 0.9768 | 0.1157 | 0.6354 | 0.0227 | 0.9085 | |

| Number of aids | 0.2242 2 | 0.3323 2 | 0.2117 2 | 0.1228 | 0.0017 | 0.0003 | 0.0083 | 0.0028 | 0.0003 | |

| Obstacles for aids | −0.0716 | −0.1483 1 | −0.0261 | 0.0020 | −0.2012 2 | 0.9143 | 0.3539 | 0.2390 | 0.7889 | |

| Strategic changes | 0.1250 | 0.1534 1 | 0.1309 1 | 0.1033 | 0.2304 2 | −0.0069 | 0.0590 | 0.0033 | 0.0152 | |

| ICT Embracement | 0.0834 | 0.0371 | 0.0404 | 0.0322 | 0.1750 2 | 0.0608 | 0.1239 | 0.0988 | 0.3206 | |

| Present impact | 0.1637 2 | 0.2133 2 | 0.0642 | 0.1425 | 0.1836 2 | 0.0714 | 0.1781 2 | 0.1033 | 0.0000 | |

| Expected impact | 0.1726 2 | 0.2083 2 | 0.0012 | 0.0077 | 0.2334 2 | −0.0173 | 0.1564 1 | 0.0660 | 0.4965 2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Acevedo, O.L.; Méndez-Pinzón, M.; Vélez-Rolón, A.M. Resilience of Colombian Entrepreneurships during COVID-19 Pandemic Crisis. Soc. Sci. 2023, 12, 130. https://doi.org/10.3390/socsci12030130

Acevedo OL, Méndez-Pinzón M, Vélez-Rolón AM. Resilience of Colombian Entrepreneurships during COVID-19 Pandemic Crisis. Social Sciences. 2023; 12(3):130. https://doi.org/10.3390/socsci12030130

Chicago/Turabian StyleAcevedo, Oscar Leonardo, Manuel Méndez-Pinzón, and Adela Margarita Vélez-Rolón. 2023. "Resilience of Colombian Entrepreneurships during COVID-19 Pandemic Crisis" Social Sciences 12, no. 3: 130. https://doi.org/10.3390/socsci12030130