Abstract

Greece’s entry into the Eurozone was regarded as a unique opportunity to reform the country’s inefficient growth model. These hopes were dashed as the decade-long crisis of the 2010s wiped out a substantial part of the wealth accumulated during the previous decades and threatened the stability of Greece’s political system. The crisis highlighted the weaknesses of the Economic and Monetary Union (EMU); the economic governance agreed upon at Maastricht was inadequate to support a monetary union comprising many, widely diverse economies. On the other hand, given the EMU’s economic and institutional architecture, Greece was ill-prepared and unwilling to undertake the necessary adjustments to survive in the Eurozone. Understanding the economic and political aspects of this dual and mutually reinforcing failure is crucial for analyzing the challenges facing the Greek economy. In this article, we take a long-term view of the evolution of Greece’s political economy, adopting a framework inspired by the recent literature on comparative political economy. The aim is to determine whether Greece’s EMU membership affected its growth model and, if so, in what ways. The analysis shows that EMU membership has been crucial for the performance of the Greek economy during different periods but less so for the transformation of its demand-led growth model, which exhibits remarkable stability. This is because neither the ex ante nor the ex post conditionality imposed on Greece in the run-up to EMU entry and during the 2010s crisis, respectively, focused on the structural features of the Greek growth model.

1. Introduction

Greece’s entry into the Eurozone was widely regarded as a unique opportunity and a potentially critical juncture for the reform of the country’s productive model, which had proven incapable of producing sustainable growth (Pagoulatos 2000; Panagiotarea 2013). In a political system characterized by intense polarization, the country’s entry into the Economic and Monetary Union (EMU) became a national objective shared by most political parties but also society at large (Andreou and Maravegias 2018). Effectively, it came to embody a long-acknowledged need for modernization (Tsoukalas 1995), which in Greece was linked to membership in the European Union (EU) and was increasingly identified with a process of Europeanization (Featherstone 1998; Ioakimidis 2000). The unique political consensus achieved for Greece’s entry into the Eurozone and the consequent successful implementation of an ambitious adjustment policy program during the 1990s to satisfy the Maastricht criteria were considered to be a testament to Greece’s economic and political commitment towards this transformation.

The first years in the Eurozone seemed to confirm the success of this effort as Greece’s economy grew fast and converged to the average European Union (EU) per capita income. However, under the surface, significant structural problems remained, and major economic imbalances developed, which undermined the sustainability of Greece’s growth trajectory (Roukanas and Sklias 2016). When, in 2009, revelations about Greece’s unexpectedly high fiscal deficit became known, the resulting loss of credibility, in combination with the international investors’ low-risk appetite in the aftermath of the global financial crisis, shut the country out of the markets, forcing the Greek government to make an official request for aid. The crisis that followed was unprecedented in terms of intensity and duration and led to a dramatic transformation of the political system after 40 years of stability.

In this article, we take a long-term view of the evolution of Greece’s political economy, adopting a framework inspired by the recent literature on comparative political economy. In this context, we emphasize the importance of the interaction between national and EU political choices in shaping both the EMU architecture (Iversen et al. 2016) and member states’ growth models (Vukov 2023). The aim is to determine whether Greece’s entry into the EMU affected its growth model and, if so, in what ways.

The analysis shows that EMU membership has been crucial for the performance of the Greek economy during different periods but less so for the transformation of its demand-led growth model. This is because neither the ex ante nor the ex post conditionality imposed on Greece in the run-up to EMU entry and during the 2010s crisis, respectively, focused on the structural features of the Greek growth model. The first targeted nominal convergence of the prices of production factors, goods, and services, while the latter prioritized fiscal consolidation. Moreover, the political and institutional limitations of EMU’s governance relieved pressure for adjustment once inside the Eurozone, magnifying the imbalances produced by the Greek growth model, ultimately leading to the crisis.

The article contributes to the literature in a number of ways: (a) it employs the most up-to-date comparative political economy theoretical framework, which, with few exceptions (Myrodias 2024), has not been used in the case of Greece; (b) it offers a long-term account of the evolution of Greece’s political economy linking different periods into a unified, coherent narrative; (c) unlike most economic analyses of the Greek crisis, it offers a discussion of the links between the country’s economic structure and the political coalitions that shaped and/or sustained it; and (d) contrary to the prevailing tendency in the European political economy literature to locate the causes of the Greek crisis either at the domestic or the European and international levels, it focuses on the interaction between the two, linking EMU’s conditionality and governance to developments in the Greek political economy.

Understanding the impact of EMU membership on the Greek political economy is crucial for analyzing the challenges facing Greece today. The country, shortly after its official exit from the economic adjustment programs in 2018, struggled with a new, pandemic-induced crisis. Fortunately for Greece, after some initial wavering, the EU managed to agree on a large package of fiscal support for the EU economies. This, among other EU initiatives, like the common procurement of vaccines, stimulated the strong recovery of the Greek economy. However, the challenge for Greece remains as urgent as ever; not only does it continue to be part of a monetary union with more advanced and competitive economies, but it also needs to recover the ground lost during the devastating crisis of the previous decade.

The article is organized as follows. The next section offers an overview of a comparative political economy (CPE) account of the Eurozone. Next, Greece’s growth model is examined, and the challenge of its membership in the Eurozone is outlined. The next sections describe the developments after Greece entered the EMU, the handling of the crisis, and its impact on the Greek growth model. This is followed by a brief discussion of the pandemic crisis and the post-pandemic economic recovery. The final section summarizes and discusses the findings in the context of the recent comparative political economy literature.

2. The CPE Framework and the EMU

The CPE literature emphasizes the fact that different economies have different economic, political, and institutional features and dynamics. Accordingly, these features shape their growth trajectory, not least by affecting the way external shocks and developments are internalized. At the turn of the century, Hall and Soskice’s (2001) Varieties of Capitalism (VoC) approach dominated the field. The VoC approach focused on the supply side of the economy, placing the firm at the epicenter of its attention. National diversity was explained in terms of the strategic interactions of firms in order to resolve coordination problems with their institutional environment in key domains, like corporate governance, funding, education, the labor market, and research and innovation. The approach distinguished between Liberal Market Economies (LMEs) and Coordinated Market Economies (CMEs), with the former relying primarily on the market mechanism for resolving coordination problems and the latter on institutionalized cooperation.

Despite its appeal, the approach was criticized on many counts (for a review, see Hancké et al. 2007). In the aftermath of the global financial crisis and its transmutation into the Eurozone debt crisis, criticism focused on the apparent absence of macroeconomics from the VoC framework (Baccaro and Pontusson 2016; Blyth and Matthijs 2017). This critique led to a new “growth models” (GM) approach (Baccaro and Pontusson 2016; Baccaro et al. 2022), which stresses the significance of the demand side of the economy. More specifically, drawing on post-Keynesian and Kaleckian economic analysis, it argues that “output is determined by effective demand in the long run as well as in the short run” and that “distribution affects aggregate demand” (Baccaro et al. 2022, p. 10). According to this approach, following the demise of the Fordist, wage-led growth regime, different countries focused on different components of aggregate demand as drivers of growth, leading to the emergence of two main models: export-led growth and debt-financed, consumption-led growth (Stockhammer 2015).1 The models roughly correspond to the growth trajectories of the Northern and Southern EMU member states, respectively.

While the GM approach addresses many of the gaps in the VoC analysis, in recent years, scholars have noted that focusing exclusively on the demand side of the economy is as counterproductive as focusing only on the supply side; accordingly, recent research has sought to bridge the gap between these approaches, aiming to show that they could work in a complementary way (Hope and Soskice 2016; Iversen et al. 2016; Hassel and Palier 2021; Hall 2022; Vukov 2023; Myrodias 2024). In this context, research has tried to integrate the supply and demand sides of the economy, coining in the process new terms such as “growth regimes” and “growth strategies” (e.g., Hassel and Palier 2021; Hall 2022).

Following this “middle-ground” approach, Greece belongs to a group of Mixed Market Economies (MMEs) (Molina and Rhodes 2007), which have been characterized by demand-led growth regimes (Hall 2014; Iversen et al. 2016). These economies, typically identified with Southern European economies, including Greece, are dependent on the stimulus of domestic demand (Johnston and Regan 2016; Baccaro and Bulfone 2022; Stockhammer and Otero 2022; Myrodias 2024). On the macroeconomic front, this is achieved by expansionary fiscal and monetary policies coupled with periodic exchange rate devaluations to counter the effects on inflation and the current account, i.e., to deal with balance of payments crises. The exchange rate interventions are deemed necessary to temporarily restore the competitiveness of these economies. Following the entry into EMU and the loss of the exchange rate and monetary policy tools, the sustainability of these growth models hinged on the availability of debt financing. On the supply side of the economy, fragmented interest representation, which includes both labor unions and employer associations, prohibits coordinated wage negotiations and technical skill formation, while the prevalence of very small enterprises limits capital formation and economies of scale. Lacking physical and human capital, these enterprises are concentrated on low-value-added activities, particularly services and non-tradables.

In EMU, this group of countries is typically juxtaposed to the Northern Europe CMEs characterized by export-led growth regimes. These economies depend on their ability to compete in world markets to grow; their success is underpinned by systems of technical skill formation, research, and innovation, as well as by wage restraint facilitated by centralized wage bargaining. All these features are made possible by a set of complementary institutions underpinned by a relatively collaborative relationship between employers and trade unions. The macroeconomic corollary to these political economy features is tight fiscal and monetary policies to prevent inflation and exchange rate appreciation, which would undermine their competitiveness.

As Iversen et al. (2016) have argued, the differences in growth regimes shaped different preferences for the establishment and characteristics of the EMU. Northern European, export-led economies had a strong preference for exchange rate stability both for them and their competitors. Consequently, they favored a currency union that could accomplish this objective. In addition, such a union should be based on fiscal and monetary discipline, which is necessary for the efficient operation of its growth regime. On the other hand, Mediterranean demand-led economies also wanted to join the EMU, but for different reasons. They wanted to commit themselves to a low-inflation policy environment (Dyson and Featherstone 1996); this would facilitate the reduction of interest rates and allow them to access investment capital necessary for “catching up” to the North. Given that the intensity of preferences over the specific features of EMU’s governance architecture was greater for the export-led CMEs compared to that of the Mediterranean economies, the outcome was much closer to the preferences of the former group (Iversen et al. 2016).

More specifically, in the field of monetary policy, the functioning of the Union was institutionally embedded in the European Central Bank (ECB), a supranational organization with a clear mandate to maintain, as a matter of priority, monetary stability. On the other hand, the fiscal governance of the EMU was based on the Stability and Growth Pact (SGP), a set of fiscal rules designed to operate in a decentralized manner and be enforced by the Council. With these institutions, Germany and other Northern European countries wanted to ensure monetary and fiscal discipline for the Eurozone’s member states. At the same time, they tried to minimize the risk of fiscal transfers by resisting the creation of supranational fiscal capacity, inserting a “no-bailout” clause in the Treaty, and forbidding monetary financing by the ECB. Finally, other economic policies also lacked an effective coordination mechanism; they were only addressed in the context of the so-called Broad Economic Policy Guidelines (BEPG), general and non-binding proposals with limited policy impact (Pisani-Ferry 2006).

This institutional set-up implied a significant burden of adjustment for Southern economies. The inflation differentials that would unavoidably result from the co-existence of these different growth regimes under a common monetary policy could not be addressed anymore by the typical macroeconomic tools, i.e., exchange rate adjustments and monetary policy interventions (Johnston and Regan 2016). In this context, to avoid the development of destabilizing economic dynamics, demand-led economies would have to change; they would need to adjust to the low-inflation environment through fiscal discipline and structural reforms to increase the flexibility of their labor (and product) markets. The pressure for domestic adjustment increased by the no-bailout clause and the lack of solidarity mechanisms at the supranational level, which were thought to act as amplifiers of market discipline.

3. Greece’s Growth Model: Economic and Political Foundations

The roots of Greece’s growth model are to be found in the early years after the restoration of democracy. The economic upheaval of the 1970s and significant domestic political changes, which included the restoration of the parties of the Left and the emergence of increasingly active social and labor movements following the fall of the dictatorship in 1974, led to a shift in economic policy towards redistribution and the stimulation of domestic demand (Alogoskoufis 1995; Iordanoglou 2020).2 The transition to the new growth model was completed under the Panhellenic Socialist Movement (PASOK), which came to power following a landslide victory in 1981. Given its ideological profile, PASOK fully embraced the new growth model; it adopted an expansionary fiscal policy with a focus on redistribution, it increased the presence of the state in the economy and continued the crawling peg of the drachma to a basket of currencies established a few years earlier, resorting when necessary to more abrupt devaluations.

The new growth model was embedded in a new political landscape; following the restoration of democracy and until the crisis of the 2010s, the political system in Greece was dominated by two parties, PASOK and the center-right New Democracy.3 These two parties alternated in power with strong single-party governments. This political “duopoly” strengthened a culture of intense political polarization, which was actively reinforced by the parties themselves, particularly during election times. Polarization was easy to take root because of previous major cleavages in Greek political history, most importantly that of the post-WWII civil war, when the clash between the conservative government and the communist left deteriorated into a prolonged armed conflict.

PASOK’s coming to power also inaugurated a new period of populist politics; Andreas Papandreou, PASOK’s charismatic leader, adopted a typical machinean populist rhetoric, presenting PASOK as the representative of “the people” against the privileged elites, which belonged to, and were effectively identified with the right (Lyritzis 1993). In terms of policy, populism used the state as a “common cash register from which every social group could claim its share” (Ibid, p. 32). In this sense, populism became inextricably linked with clientelism, a core feature of the Greek political economy, from the first years of the existence of the modern Greek state (Mouzelis 1986; Sotiropoulos 1993).4 However, during this period and particularly after PASOK came to power, clientelism was gradually transformed from a mainly traditional patronage-based system where individual politicians developed personal networks to a fully blown clientelist system where collective agents, including political parties, trade unions, and other interest associations, took the roles of both patron (principal) and agent (Spanou 1996; Mavrogordatos 1997; Trantidis 2016). In this system, the power of the state has been used by political parties (not just PASOK, but New Democracy as well, once it regained power) to extend benefits and privileges in exchange for electoral support. Various concepts have been used to describe this system, including “bureaucratic clientelism” (Lyrintzis 1984), “clientelist state” (Sotiropoulos 2001), and “party patronage democracy” (Pappas and Assimakopoulou 2012). This development has had significant repercussions for Greece’s growth model, as it elevated the state to an unprecedented status of dominance over the economy, used, however, not as a developmental mechanism but as an instrument of clientelist politics.

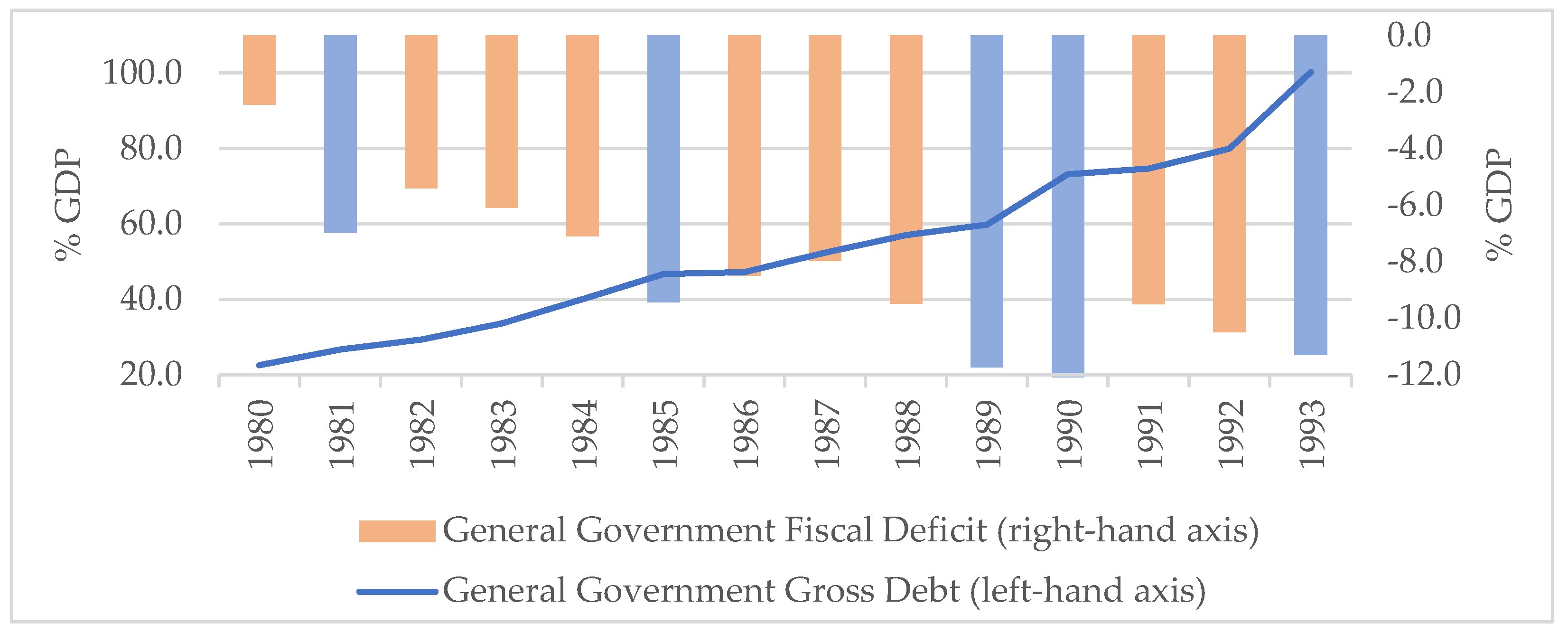

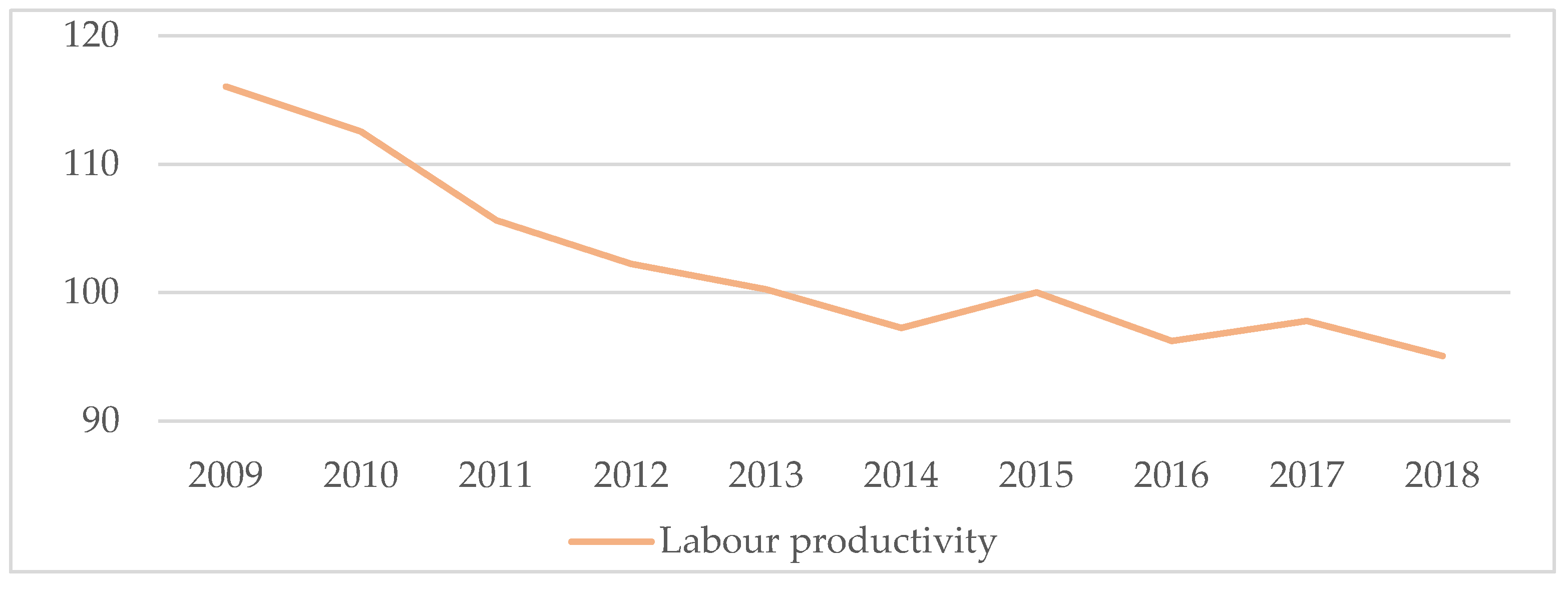

The combination of clientelist politics and an expansionary economic policy resulted in a tremendous increase in the fiscal deficit (Figure 1). During the period 1980–1993, the fiscal deficit averaged an astounding 8.5% of GDP. Fiscal profligacy increased during election years (marked with blue in Figure 1), leading to politically induced budget cycles at both the central government (e.g., Chortareas et al. 2018) and the municipal level (Chortareas et al. 2016). As a result, the debt-to-GDP ratio soared from 22.5% in 1980 to 100% by 1993 (Figure 1).

Figure 1.

Fiscal deficit and gross public debt, % of GDP (1980–2023). Source: IMF.

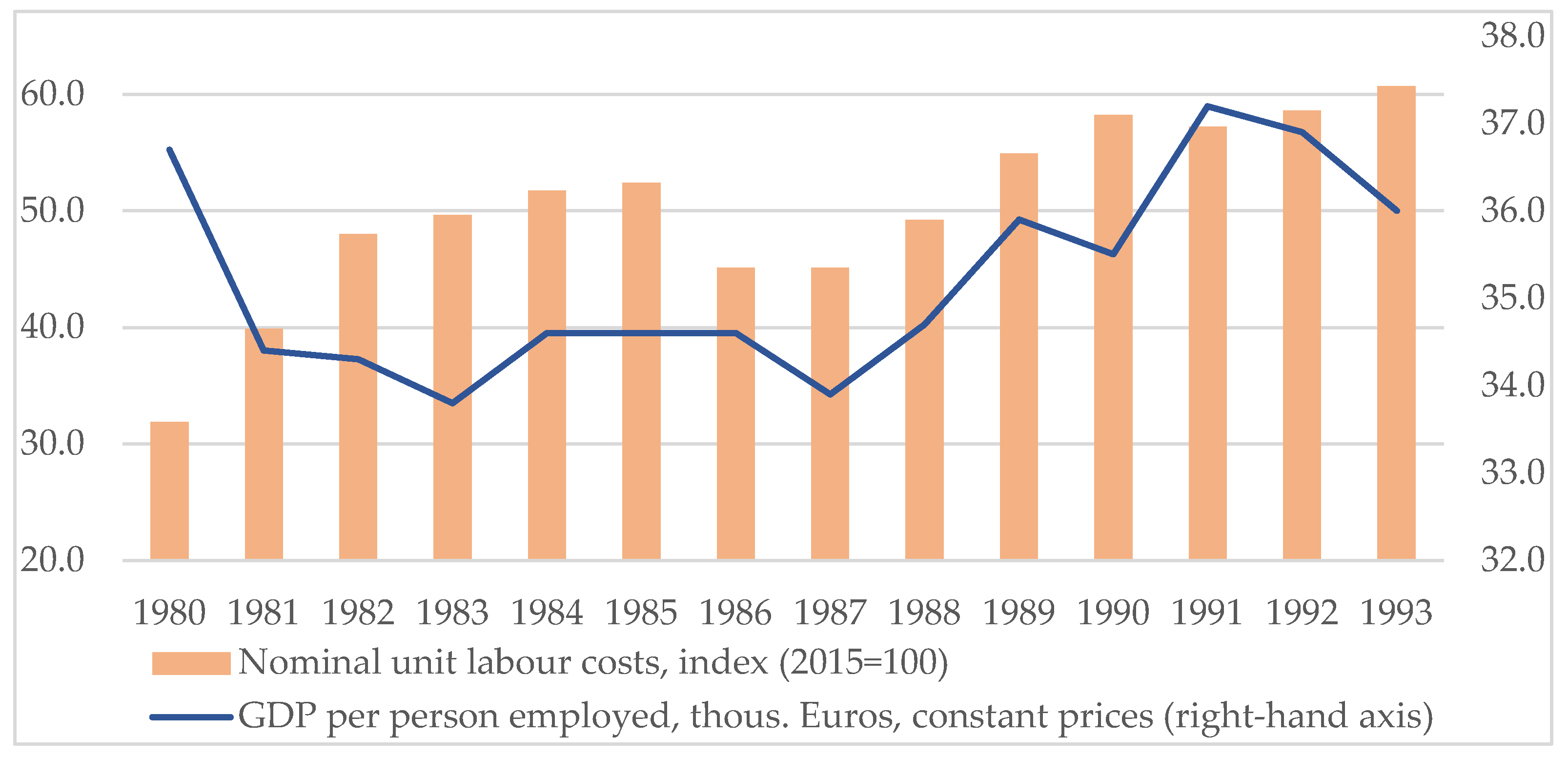

The new policy paradigm failed to produce growth. The average annual growth rate for the period 1981–1993 was below 1% (see Appendix A), even though during the same period, private and government consumption expenditure increased on average by 1% and 2% per year, respectively.5 On the other hand, this policy fueled the inflation rate, which during the 1981–1993 period averaged 18.48% (Appendix A). The new policy regime deepened the pressures on the Greek private sector, which was already in decline since the mid-1970s because of the international economic turmoil. The generous wage policy implemented by PASOK, which included, among other things, the increase of the minimum wage by 40% and the establishment of wage indexation, resulted in a significant increase in unit labor costs—more than 60% between 1980 and 1985 (Figure 2)—leading to bankruptcies of small and medium-sized businesses (Panagiotarea 2013). Return on equity turned negative for Greek manufacturing, and investment declined by 0.7% annually, on average, during this period (Appendix A). As a result, productivity deteriorated during the first half of the 1980s, and zero growth on average for the entire period was recorded (Figure 2).

Figure 2.

Nominal unit labor costs and productivity (1980–1993). Source: AMECO.

The state stepped in to contain failures in large manufacturing companies, engaging in a large nationalization program, which, by 1991, had brought under the state’s control 230 companies, either directly through a dedicated organization or indirectly through controlling shares of public banks (Liargovis and Patronis 2011). As a result, the state ended up controlling large parts of the Greek industry: 20% of the textile industry, 50% of the cement industry, 40% of the paper industry, 50% of the fertilizer industry, and 100% of the shipbuilding industry, among others (Kaloghirou and Liberaki (1996); Liargovis and Patronis 2011). The announced restructuring of these companies never materialized, and they ended up burdening the public budget even more, as most of them were loss-making.

The combination of traditional features of the Greek economy, such as the predominance of very small family businesses and the concentration of manufacturing in low value-added activities with expansionary policies, led to the deterioration of the current account (Appendix A), provoking a balance of payment crisis in 1985. This led to a European Commission-funded stabilization program, which included fiscal consolidation and a 15% devaluation of the drachma (on top of a 10% devaluation already implemented in 1983). The new policy paradigm reinforced the introversion of the Greek economy. Having to compete on price rather than product quality and characteristics and lacking cost-efficient size, Greek companies could not handle international competition and turned towards the domestic market. Restrictive regulation and barriers to entry (Vettas and Kourandi 2014), as well as weak competition authorities and policies (Katsoulacos et al. 2017), created a fragmented domestic market where incumbents could realize high profits in small, protected, and uncompetitive markets.

Similar fragmentation was observed in the labor market. Influential trade unions with political links to the governing parties, such as ADEDY (representing the public sector employees) or GSEE (representing employees of large private sector companies), pushed maximalist demands. Such practices created an inefficient and fragmented labor market as labor costs rose disproportionally to labor productivity, and the divisions between “insiders” from the influential labor unions and under-represented “outsiders” (e.g., employees of small and medium-sized private businesses and the self-employed) were deepened.

Table 1 summarizes the dynamics of the Greek economy, demonstrating the drivers of growth during this period. The decline of investment negatively affected growth, particularly during the early years of the 1980s and the 1990s; on average, the contribution of investment to GDP growth during this period was negative (−0.38%). The trade balance deteriorated despite the crawling peg exchange rate policy and two devaluations, negatively affecting GDP growth (−0.48%). The main engine of growth throughout this period was private consumption fueled by generous wage policies, the expansion of the welfare state, and the political budget cycle (private consumption shows a marked increase in 1988 and 1989, just before the prolonged multiple-elections period of 1989–1990).

Table 1.

GDP components: Contribution to GDP change (1980–1993). Source: AMECO.

4. Greece and the Eurozone

4.1. From Maastricht to EMU

The situation seemed to change with the decision to join the EMU. The undeniable failure of the country’s growth model and the dismal state of the Greek economy had led the domestic political and economic elites to an impasse. Missing the opportunity to join the EMU could lead to a permanent economic marginalization of the country, both internationally and within the EU, where even the Structural Funds lifeline would be contested in the future, in view of the forthcoming Eastern enlargement. In these circumstances, political elites were able to overcome polarization and form a broad consensus on the need to embark on the EMU course (Pagoulatos 2003).6

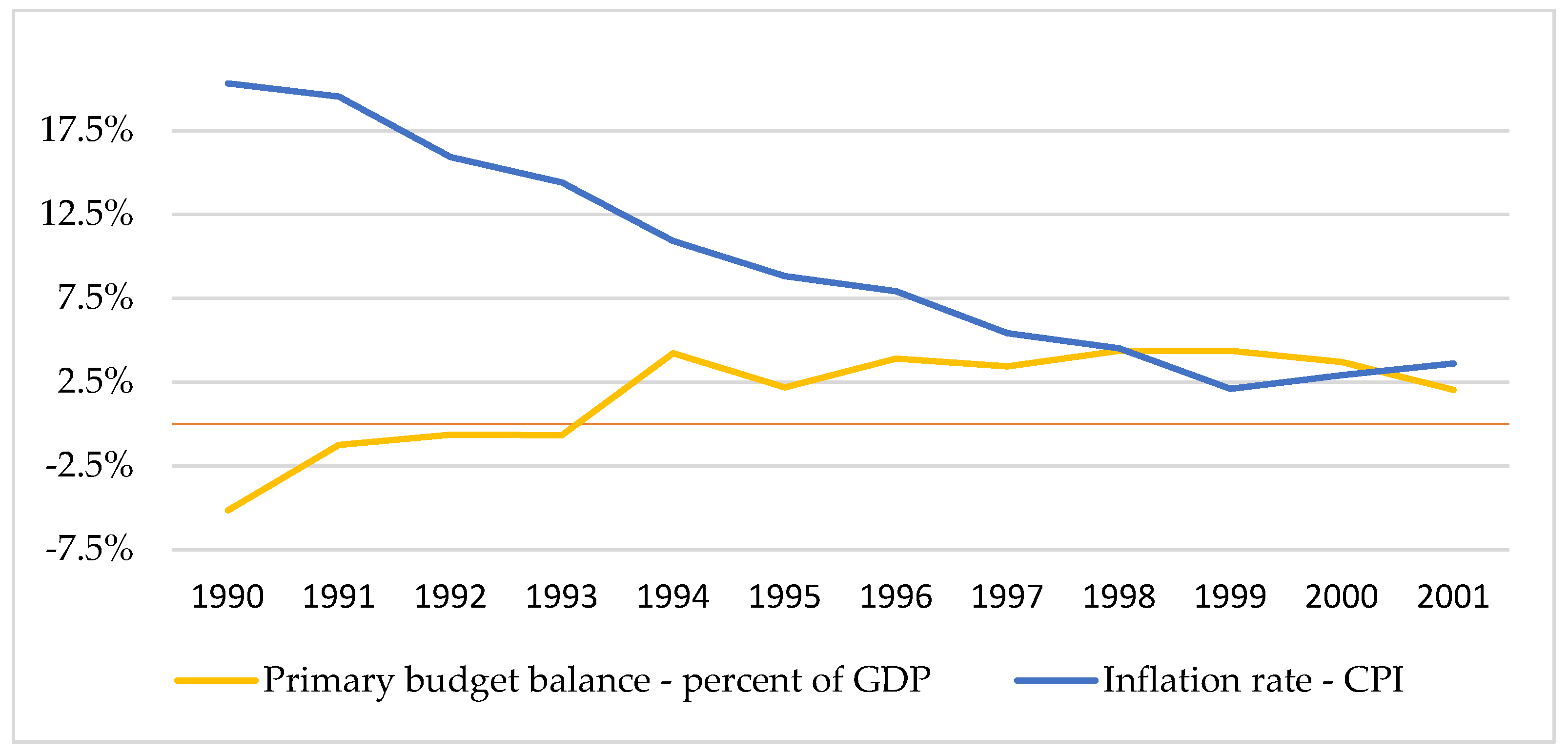

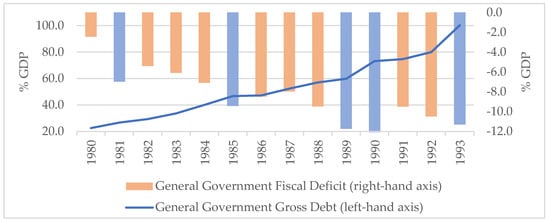

Given the performance of the metapolitefsi governments up to then, the implementation of the so-called economic convergence program from 1994 to 1999 was impressive and rather unexpected. The adoption of a “hard drachma” policy combined with a restrictive fiscal and monetary policy led to a spectacular reduction in inflation and budget deficits (Figure 3) and to debt consolidation (Appendix A).

Figure 3.

Government balance and inflation rate adjustment during the 1990s. Source: IMF.

At the same time, the promotion of a series of reforms, largely imposed by the institutional prerequisites for EMU membership, such as the independence of the Central Bank and the liberalization of the financial sector, strengthened the credibility of the policy pursued and created optimism about the prospects for accession. The stabilization of the economy and the strengthening of confidence led to a substantial decline in interest rates and created a favorable investment climate reflected in the increase in investment, which averaged almost 7% annually during this period (Appendix A).

According to available data by AMECO, the increase in gross fixed capital formation was led by both private and public investment expenditure (both more than doubled during this period), with the level of private expenditure remaining much lower (roughly ¼) than public expenditure. As a result, and despite the restrictive policy pursued, from 1995, the Greek economy entered a period of high growth rates (Appendix A). Greece was able to meet the Maastricht criteria by 1999 and officially joined the Eurozone in 2001.

The success of the convergence program was due to several factors. First, while the convergence program was presented as an external constraint, it was part of a positive narrative as adjustment would lead to a new era of prosperity for Greece once inside the Eurozone. Moreover, meeting the Maastricht criteria became a national objective that united the country and allowed broader socio-economic pacts; this was facilitated by the establishment of the Cohesion Fund in the EU, designed to furnish convergence-related financial assistance (Featherstone et al. 2000). Implementation of the adjustment program was also facilitated by the fact that it relied on specific quantitative targets to be attained within a short, pre-defined period; this focused the efforts of the government and other domestic institutions towards achieving the necessary thresholds. In addition, the liberalization of the state-dominated and repressed financial sector unleashed a hitherto trapped growth potential, which boosted growth but also helped to overcome distributional conflicts over the adjustment (Pagoulatos 2000). Table 2 documents the growth of credit to the economy during this period. The amount of loans furnished to the private economy by the Greek financial system tripled; all loan categories show substantial increases, but the one that stands out is the category of consumer loans, which increased by a factor of 14.

Table 2.

Domestic financial system: Credit to the Economy, mil. Euros (1994–2000). Source: Bank of Greece.

More generally, the high growth rates after 1995 enabled economic adjustment with little short-term costs in terms of disposable income and employment. Even the public sector’s austerity, which formally had frozen the salaries of civil servants, was effectively bypassed through subsidies and “reforms”, resulting in an annual increase of the salary expenditure by 14% (Panagiotarea 2013, p. 92). At the same time, the very nature of the adjustment, which focused on the convergence of nominal price rates, did not require the country’s productive restructuring and, thus, left largely intact the interests of dominant interest groups in the private and public sectors.

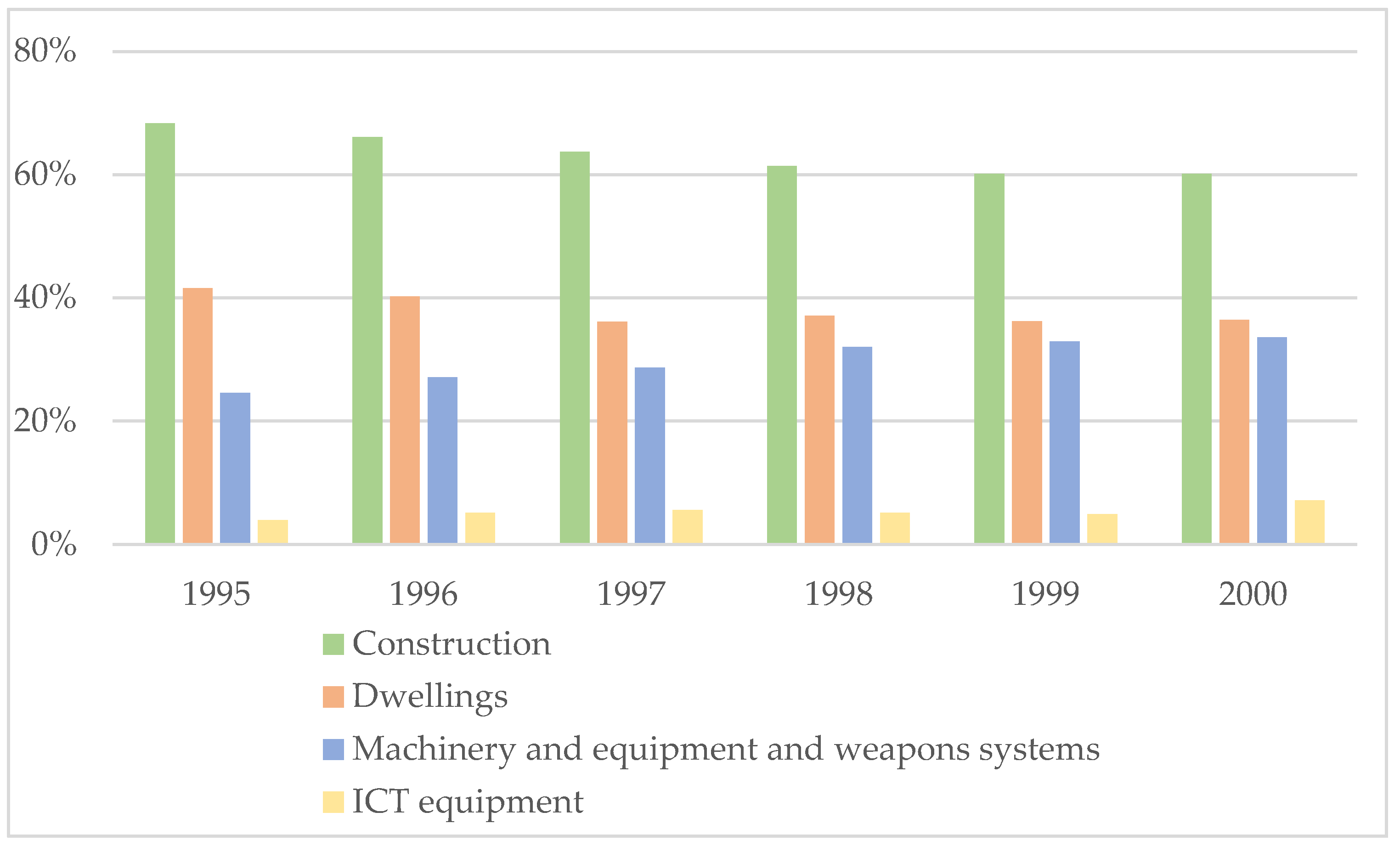

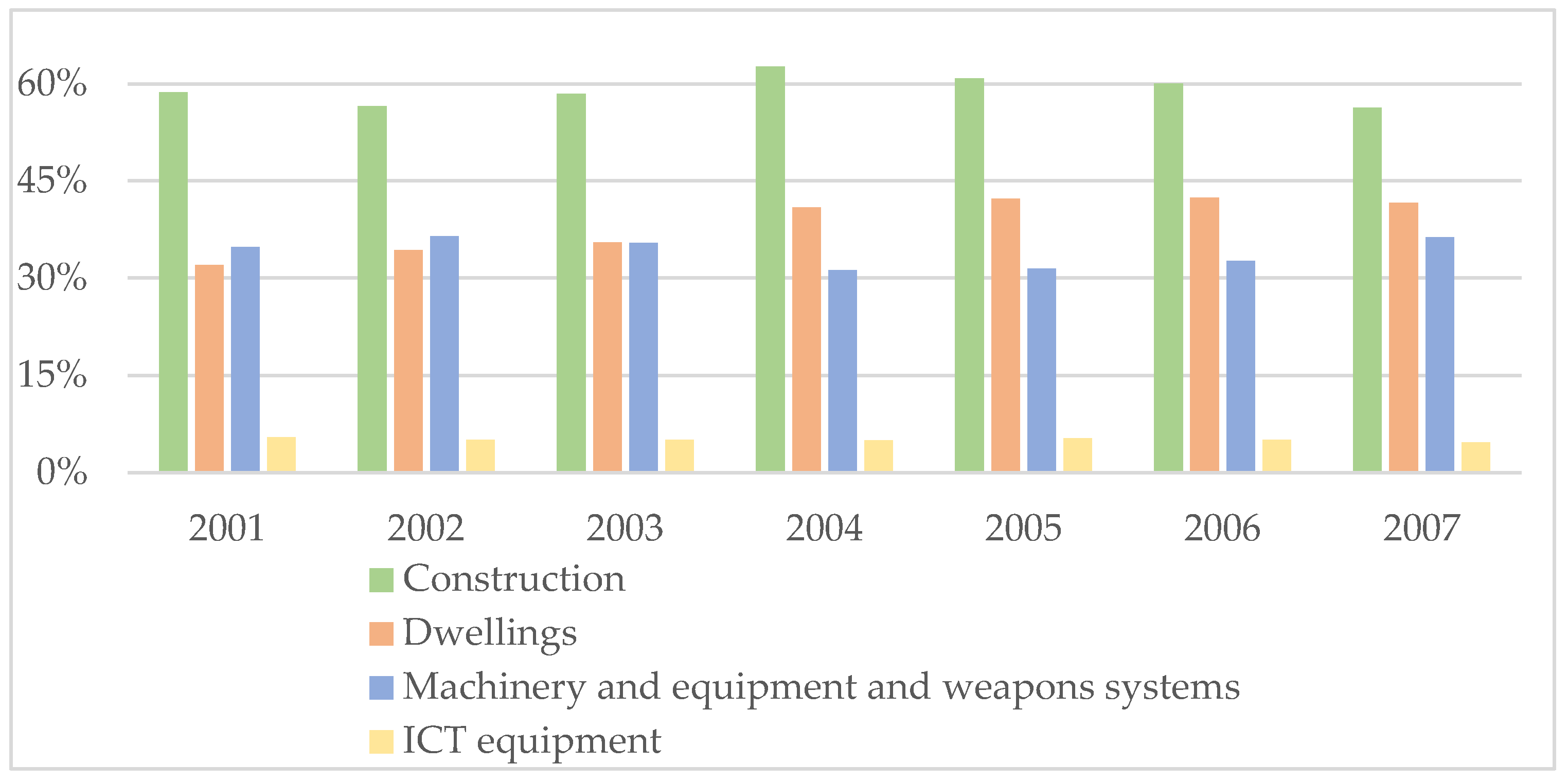

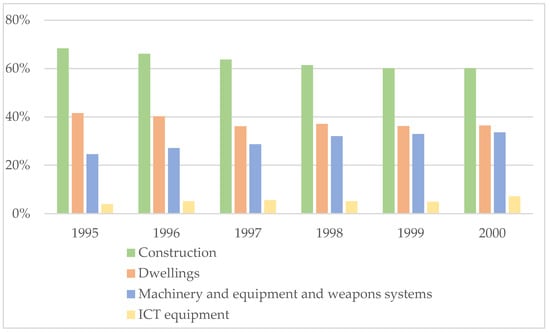

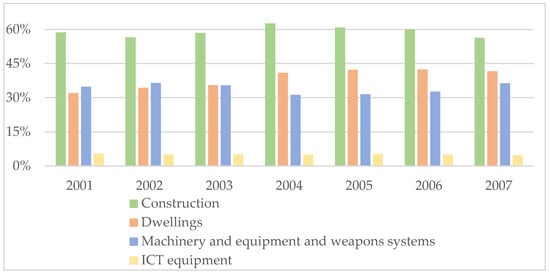

As a result, despite the significant increase in investment during this period, consumer demand continued to be the main driver of growth (Table 3). It is also worth noting that during a period of fiscal austerity, the contribution of government consumption is also significant. According to available data by AMECO, public consumer expenditure increased by 19% between 1994 and 2000. The negative contribution of net exports increased further during this period, reflecting the deterioration of the current account (Appendix A). The worsening of the Greek economy’s competitiveness during a period of rapid economic growth shows that the latter was not based on a re-orientation of the growth model despite the increase in investment. The breakdown of gross fixed capital formation (Figure 4) corroborates this interpretation. Investment in construction made up approximately 63% of total investment between 1995 and 2000, with investment in dwellings alone accounting for 38% of total investment. In comparison, investment in dwellings in the EU averaged 26% of the total during the same period, while the share of investment in machinery and equipment was, on average, more than 3 percentage points higher compared to Greece on an annual basis.

Table 3.

GDP components: Contribution to GDP change, 1994–2000. Source: AMECO.

Figure 4.

Breakdown of gross fixed capital formation, share of total (1994–2000). Source: AMECO.

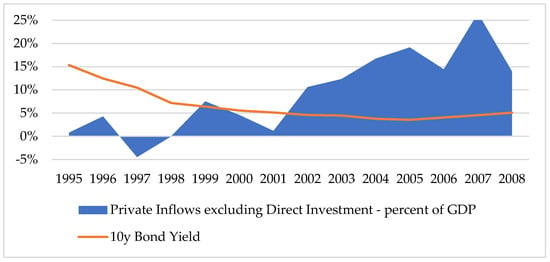

4.2. Inside the Eurozone

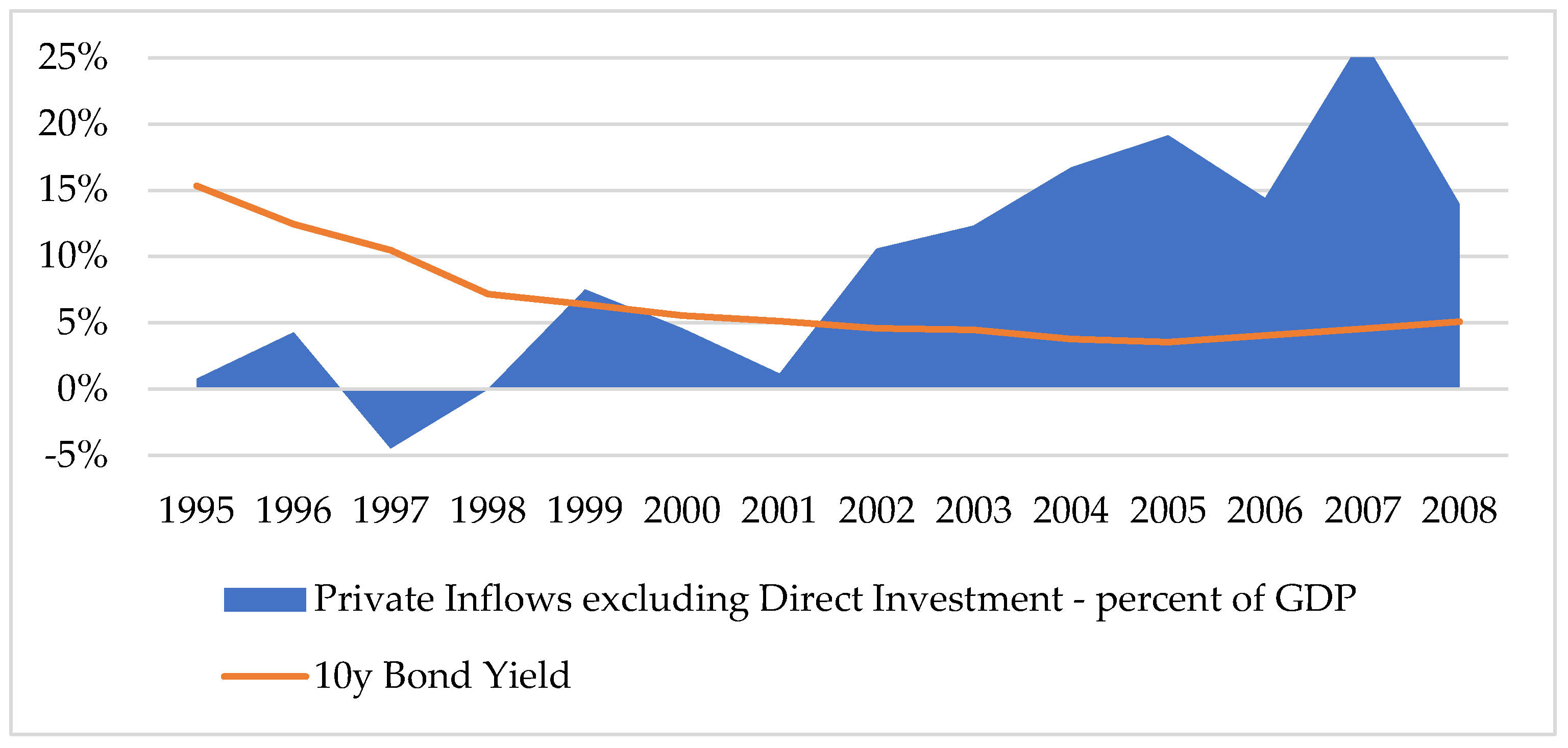

The entry into the Eurozone proved a watershed for Greece’s access to capital; the irreversible monetary link forged between European countries boosted confidence in the prospects of the Southern economies, Greece among them. The elimination of foreign exchange risk and the prospect of a low-inflation environment guaranteed by ECB’s mandate and policy capacity, at a time of unprecedented international liquidity in search of returns, inaugurated a period of large capital inflows to Greece’s economy, precipitating further decline in the cost of capital (Figure 5). The massive inflow of low-cost capital found its way into the Greek economy through two channels: (a) the public sector and (b) the domestic financial system.

Figure 5.

Capital inflows before and after EMU membership. Sources: IMF and Eurostat.

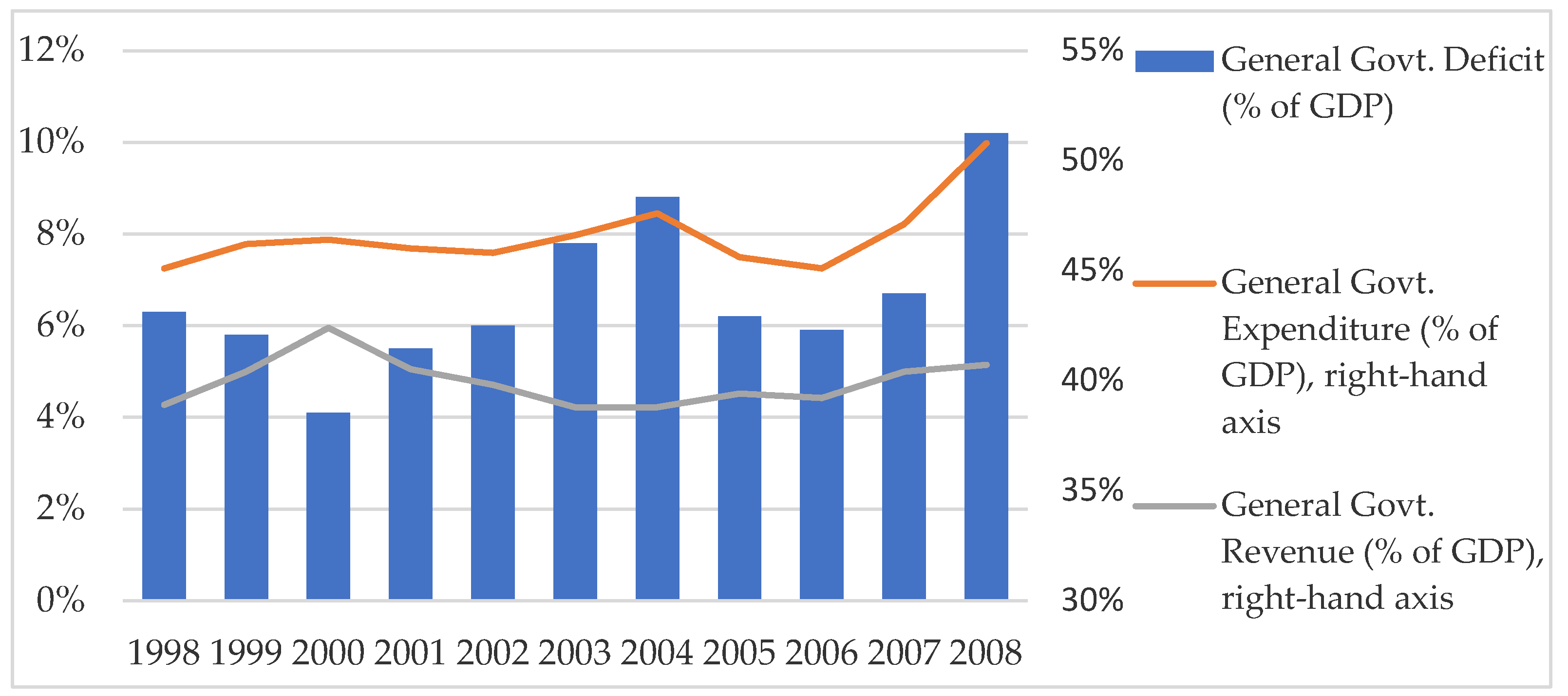

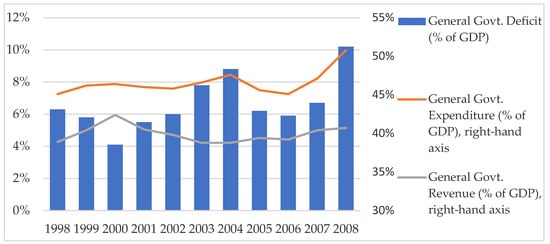

During this period, despite the constraints imposed by the Growth and Stability Pact, the fiscal balance of the Greek government deteriorated; the fiscal deficit grew substantially as public expenditure rose, and public revenues declined as a percentage of GDP (Figure 6). As a result, Greek governments borrowed heavily from the markets. Between 2001 and 2009, the Greek debt doubled in nominal terms, rising from EUR 152 to 300 billion. The funds were used to finance big projects, some of them related to the 2004 Olympic Games, but mostly were the result of a return to the policies and practices of the past.

Figure 6.

Fiscal derailment in the 2000s. Source: Eurostat.

More specifically, governments during this period engaged in a further expansion of the welfare state. The category of government expenditure that increased more than any other during this period was social protection; according to Eurostat data, government expenditure on social protection increased from 13.6% of GDP in 2001 to 15.7% of GDP by 2007. This corresponded to an average annual increase of approximately EUR 7.5 billion compared to 2001. The main component of this category was expenditure on pensions, which by 2007 accounted for 9.2% of GDP, substantially higher than the EU average, which stood at 8.1%. It is no accident that this increase in pensions (pension expenditure amounted to 7% of GDP in 1999) came after a period of political turmoil surrounding a proposed reform of the fiscally unsustainable pension system. The reform put forward by PASOK in 2000 met with fierce opposition from trade unions, pensioner associations, and political parties, as well as from members of the governing party itself, and was effectively abandoned (Tinios 2005; Featherstone and Papadimitriou 2008). The effects of this reform failure can be seen by the fact that during the period 2000–2009, public expenditure used to pay for the pensions of public servants and to cover the deficit of private social security funds amounted to approximately EUR 134 billion and accounted for 83% of the increase in public debt (Giannitsis 2016). The increased debt burden had a significant negative effect on the fiscal balance. The expenditure on debt interest between 2001 and 2007 averaged 5% of GDP for the Greek government, compared to 3.2% for the Euro area.

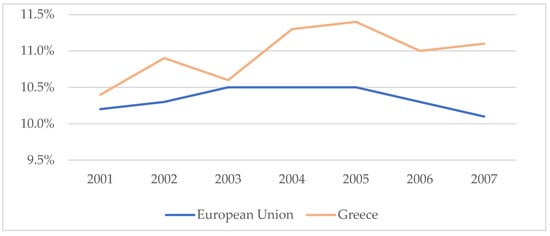

Another burden on the public budget was the high operational cost of the public sector. Beyond the well-documented inefficiency of the Greek public administration (Kickert 2011), its elevated cost was also related to the continuation of clientelist practices that sustained the balance of the politico-administrative apparatus. Thus, for example, the wage cost of public sector employees increased substantially during this period (Figure 7).

Figure 7.

General government wage cost, % of GDP (2001–2007). Source: Eurostat.

Measured in nominal terms, the annual wage bill in the public sector between 2001 and 2009 almost doubled, rising from EUR 16 to 30 billion. This increase was due to both the increase in the number of employees with temporary contracts (OECD 2010),7 and the increase in public sector employees’ compensation, particularly around election times. The EU fiscal rules did not stop political budget cycles. There is evidence that these continued to take place through changes in the composition of expenditures of the local or central government budgets, increasing the funds available for employee recruitment and compensation (Chortareas et al. 2016, 2018).

Analysis of the annual budgets and their implementation has shown that there were significant and systematic deviations from the budgetary targets throughout this period (Kaplanoglou and Rapanos 2011). This points to an obvious failure of the EU to monitor the Greek fiscal data and forecast accurately its fiscal deficits. The Greek case was not unique. According to estimates by the European Fiscal Council, compliance with fiscal rules in the Eurozone for the period 1998–2007 was 71% for the deficit rule and 41% for the structural balance rule (European Fiscal Board 2019).8

On the revenue side, between 2000 and 2005, there was a steady decline as the adjustment effort relaxed once inside the Eurozone (Figure 6). After 2005, there was a slight increase in revenues, as Greece was subject to an excessive deficit procedure under the corrective arm of the SGP, initiated by the European Commission in 2004 (this explains the slight decline in expenditure in 2005–2006). However, the increase was limited, and after 2007, expenditure rose significantly, widening the deficit further. The fiscal derailment peaked in 2009 when the fiscal deficit reached 15.2% of GDP; the revelations about its true size were the catalyst for the outbreak of the crisis.

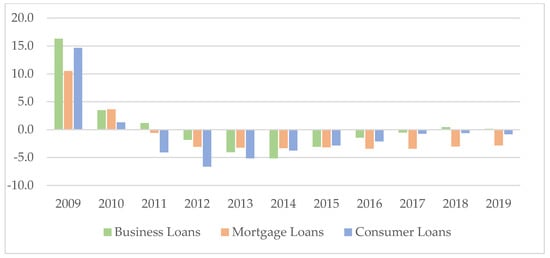

In the private economy, the inflows of capital were intermediated by the recently liberalized financial system, which more than tripled the provision of credit to the economy between 2002 and 2007 (Table 4). During this period, there was a six-fold increase in the amount of loans extended to individuals. This increase applied both to mortgages and consumer loans. As a result, loans to individuals had surpassed business loans by the end of this period (Table 4). Financing supported household consumption and the supply of non-tradables and services, with construction leading the way (Sklias et al. 2022).

Table 4.

Domestic financial system: Credit to the Economy, mil. Euros (2001–2007). Source: Bank of Greece.

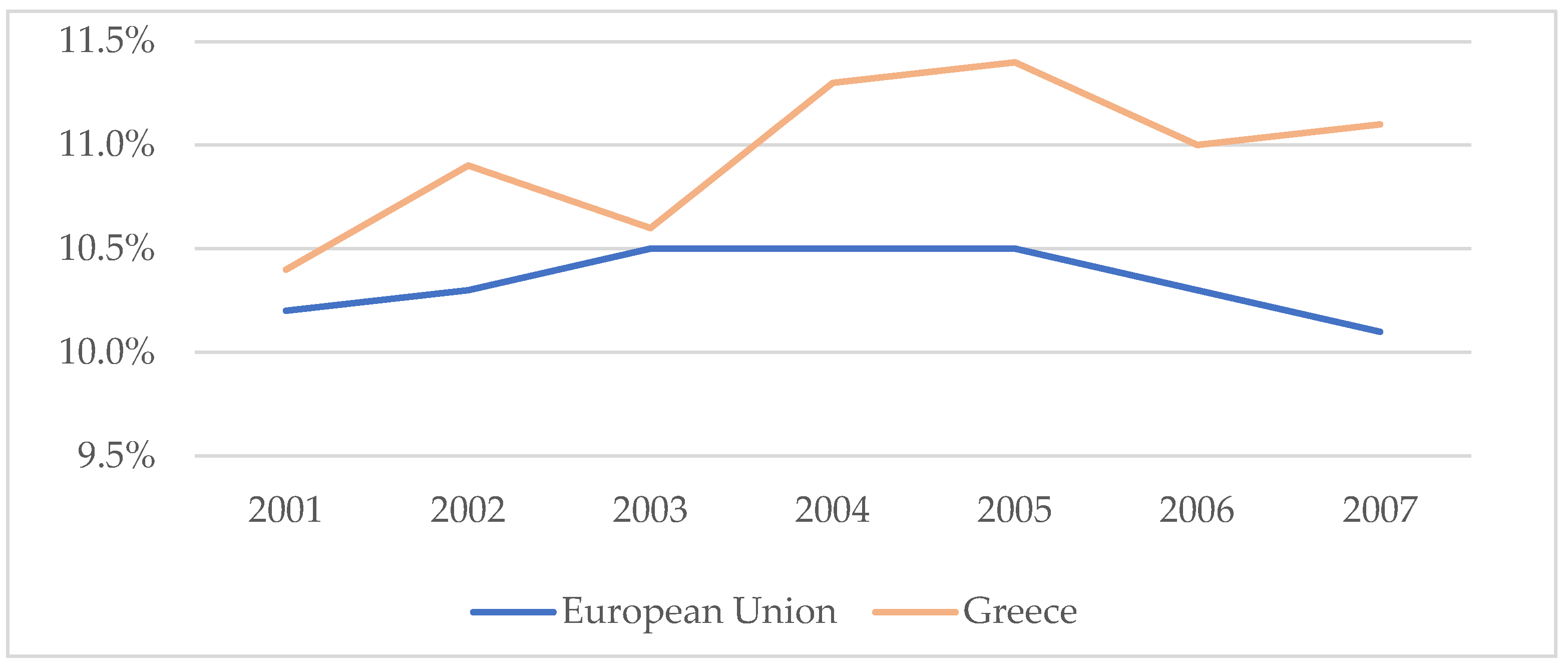

Rapid growth in these sectors resulted in increased wages and prices, which kept inflation relatively high (Appendix A). Given that inside the Eurozone, nominal interest rates were set uniformly for all member states by the ECB, the higher inflation rate in Greece resulted in lower real interest rates, further fueling credit growth and the bubble in the property market. The average long-term real interest rate in Greece during 2001–2007 was 1.2%; during the same period, the German real interest rate was 3%.

The increase in wages and prices in the non-tradable segment of the Greek economy was responsible for most of the loss of competitiveness during this period and for the further weakening of the productive capacity of the economy, as it led to a redirection of resources from export-oriented industries to sectors geared towards domestic consumption and services (Malliaropoulos 2011).

The easy access to low-cost capital relaxed the drive for reforms. The endorsement of adjustment policies and the promotion of liberal reforms during the convergence period did not survive following entry into the Eurozone. Without the accession’s positive narrative, PASOK found itself in an uneasy position; resistance to reforms was systematic within the party and the government itself, with many reforms being undermined by government officials (Featherstone and Papadimitriou 2008). Even when reforms had the support of the government, they often met with strong resistance from affected interest groups (e.g., trade unions, pensioners associations, etc.), which were usually very successful in mobilizing the media and the general public (Pelagidis 2005); political polarization grew and intensified resistance. Following two very public failures to promote flagship reforms in the pension system (discussed previously) and the labor market, all reform mood evaporated. The situation did not change after 2004, when New Democracy won the elections.

As a result, productivity and non-cost competitiveness continued to be hampered by an overbearing bureaucracy, the inefficient allocation of public resources (not least due to clientelist reasons and corruption), rigidities in the markets for production factors, and barriers to entry and competition to goods and services markets (Roukanas and Sklias 2016; Pagoulatos 2018). In these circumstances, it is no surprise that despite the high growth rates and the availability of credit, foreign companies did not want to invest in Greece; Foreign Direct Investment (FDI) remained very low at 0.66% of GDP in 2007 compared to 3.02% and 4.55% for OECD and EU, respectively. Beyond the adverse effect in terms of inward capital flows and economic activity, this development also meant that Greek companies were excluded from global value chains and the innovation and technological know-how advantages these offer, losing the opportunity to expand the economy’s limited export base, particularly in medium and high value-added industrial goods, and shed the disappointing designation of Greece as EU’s most closed economy (Böwer et al. 2014).

The consensus on adjustment and reform had dissolved. The Europeanization of the country during the period of convergence proved shallow; economic adjustment was limited and, to a certain extent, superficial; it had not altered the supply side of the economy, and it had not substantially affected the clientelist state-dependent system. The growth dynamics of the period demonstrate this clearly (Table 5). The contribution of consumption as the main driver of growth increased further during this period, as did the contribution of government consumption and investment.

Table 5.

GDP Components: Contribution to GDP change (2001–2007). Source: AMECO.

On the other hand, the negative contribution of net exports deteriorated further. This is reflected in the collapse of the current account balance, whose deficit surpassed the 10% threshold from 2006 onwards and peaked at almost 15% in 2008 (Appendix A). As was the case before, the high growth rates recorded during this period were not due to the transformation of Greece into an extrovert, competitive economy.

The breakdown of gross fixed capital formation (Figure 8) shows that access to ample and cheap credit was primarily directed to construction, which accounted, on average, for 60% of total investment during this period, most of it in housing. More specifically, investment in housing increased between 2001 and 2007 by 78% (in constant 2005 prices), accounting for 38.4% of total investment on average.

Figure 8.

Breakdown of gross fixed capital formation, share of total (2001–2007). Source: AMECO.

5. The Crisis

5.1. Handling the Crisis

The Greek crisis started in the autumn of 2009 when the newly elected PASOK government revealed that the fiscal deficit for the year would be over 12% of GDP, more than double the estimate announced by the previous New Democracy government only a few weeks earlier. As the global financial system was still reeling from the impact of the Global Financial Crisis (GFC), this revelation kickstarted an escalating confidence crisis. The delayed and unconvincing policy response of the government and the protracted discussions between the EMU member states for the appropriate reaction intensified the crisis to the point that Greece was effectively shut out of the markets and had to request official aid in April 2010.

The funding was accompanied by a Memorandum of Understanding (MoU), which stipulated the conditionality of the policy that Greece needed to implement in exchange for the loan. The MoU had three main objectives: to restore fiscal sustainability through a harsh austerity program, to restore the economy’s international competitiveness, mainly through internal devaluation, and to safeguard the stability of the financial system, which was under pressure given its significant exposure to Greek public debt. The MoU also included a very ambitious structural reforms program, which included public administration and an ambitious plan for privatization.9

The Greek bailout agreement served as a blueprint for the handling of the next crises that occurred in Ireland, Portugal, and Cyprus. The handling of the crisis through national bailout agreements and MoUs was a natural consequence of EMU’s economic governance and its underlying dynamics. The absence of supranational fiscal capacity and a crisis mechanism led to an ad hoc, inter-governmental, and increasingly political handling of the crisis (Schimmelfennig 2015; Henning 2017). In this context, political and economic considerations about the cost of adjustment dominated all other issues. Creditor countries did not want to foot the bill and invoked moral hazard arguments; facilitating the recovery of crisis-hit countries through generous supranational funding would ease the pressure for fiscal adjustment and reforms, producing a vicious cycle where crisis-hit economies would end up perpetually dependent on such funding, leading in effect to the much-dreaded “transfer union”. The result was crisis management along the same familiar approach: every country needed to get its house in order, which effectively meant that the cost of adjustment was borne entirely by the crisis-hit countries.

In this context, it is not surprising that the priority of the MoU was fiscal consolidation (Pisani-Ferry et al. 2013). This led to an extremely harsh austerity program with overly ambitious targets. It was a serious mistake; the policy was based on a miscalculation of the fiscal multiplier, which led to a gross underestimation of the impact of austerity on the Greek economy (Blanchard and Leigh 2013). The creditors had not adjusted the program to the features of Greece’s growth model; austerity deeply affected public spending and private consumption (through the reduction of disposable income), two main drivers of growth, deepening the crisis and leading to a vicious cycle of missing targets, more austerity and deeper recession.

Between 2008 and 2018, Greece lost 26% of its GDP, with an average negative annual GDP growth of −2.4%. From Table 6, it is obvious that the drop in private and public consumption contributed substantially to GDP’s reduction. This was accompanied by a collapse in investments, which contributed the most to the depression of economic activity.

Table 6.

GDP components: Contribution to GDP change (2008–2018). Source: AMECO.

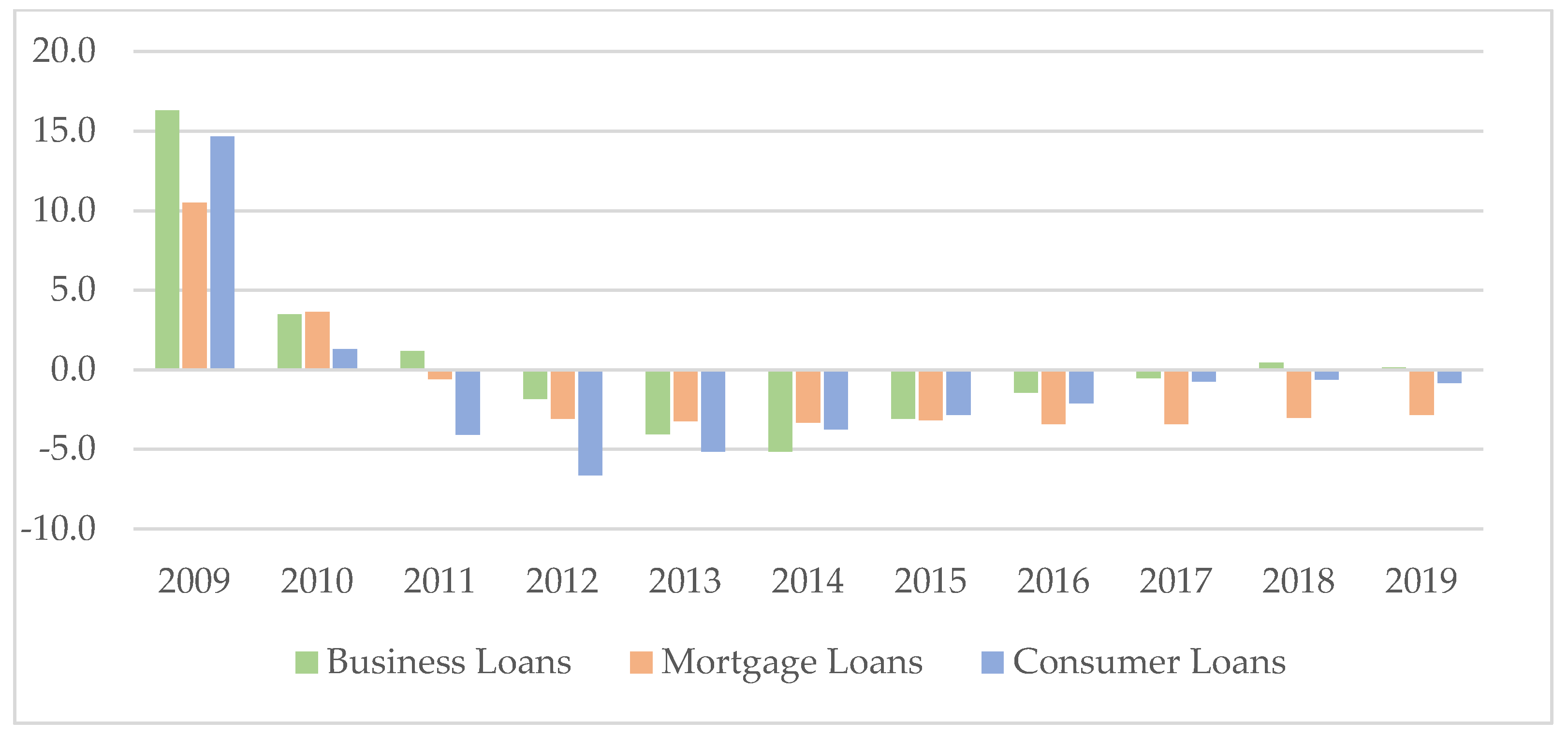

The retrenchment of private consumption and, particularly, the collapse of investment were related to another feature of the Greek growth model that was not adequately considered by the creditors: the dependence of the economy on the Greek banking system. Given the banks’ high exposure to Greek public debt and their undiversified business model, the impact of the sovereign debt crisis on them was tremendous. Losses from the public debt restructuring in 2012, lack of access to the interbank market, a dramatic increase in Non-Performing Loans (NPLs) as the economy deteriorated,10 and a massive outflow of deposits as savings were increasingly used by people who had lost their jobs or a large part of their income, to service their debts and pay off their obligations towards the state (Pagoulatos 2018), brought the banking system to the brink of collapse. The result was a credit crunch from 2011, and for the rest of the decade, credit expansion turned negative (Figure 9).

Figure 9.

Credit to the private economy by the financial system, annual percentage change. Source: Bank of Greece.

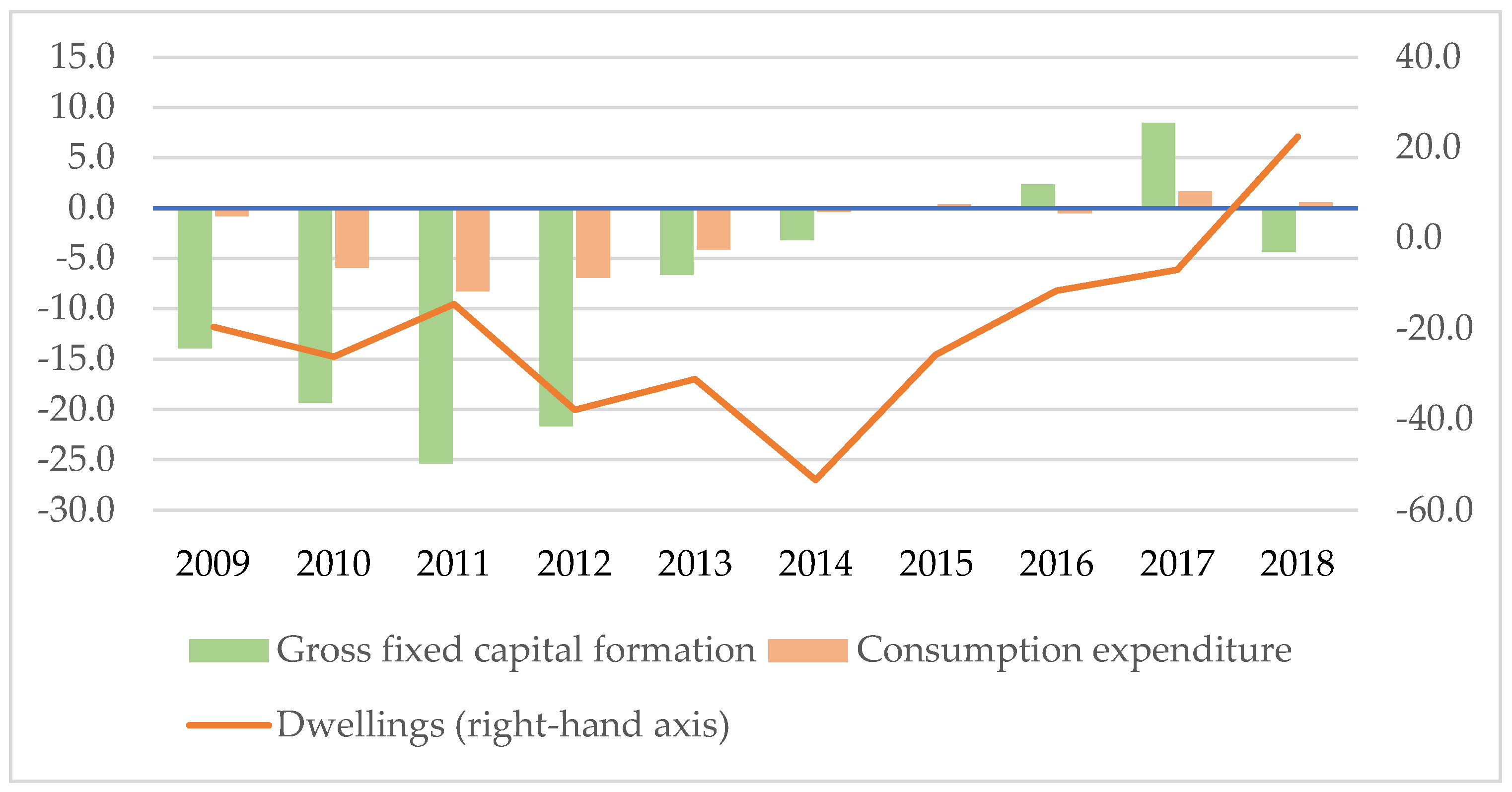

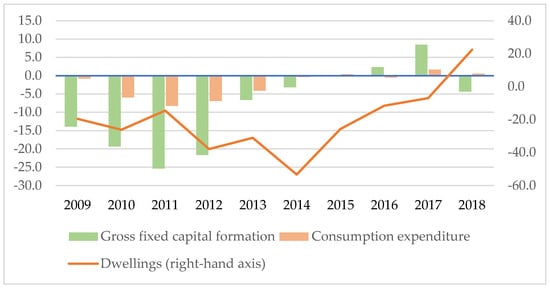

The credit crunch led to the deterioration of private investment, particularly in credit-dependent sectors, like construction, which, as we have seen, was one of the growth engines in the pre-crisis period. Overall, between 2009 and 2018, gross fixed capital formation declined by 55%, while investment in housing declined by an astounding 90%. During the same period, consumption fell by 22% (Figure 10).

Figure 10.

Gross fixed capital formation, investment in dwellings and consumption expenditure, annual percentage change (2009–2018). Source: OECD.

Design problems were also evident in structural reforms, with creditors failing again to take into consideration the characteristics of the Greek growth model. Thus, for example, there was a sequencing error in the design of labor and product market reforms, with the former implemented very early at the beginning of the program and the latter coming much later, contrary to the consensus in the literature (e.g., Blanchard and Giavazzi 2003; Fiori et al. 2007). Given the constraints of the business environment and the very small size of the export sector in Greece, the early deregulation of the labor market during the depression raised the number of laid-off employees who had nowhere to go. The result was an explosion of unemployment (Appendix A) and a brain drain wave that led an estimated half a million Greeks to exit the country.

In addition, the Big Bang approach to reforms that were attempted did not consider the limitations of the Greek public administration and the impact of these reforms on the economy and the political system (Rodrik 2016), particularly when these were implemented at the same time as a harsh austerity program (Petralias et al. 2018).

These mistakes, notwithstanding the duration of the crisis and the fact that Greece alone, of all the crisis-hit countries, had to sign three consecutive bailout agreements, also hint at failures on the domestic front. First, Greece had no plan of its own; the use of public administration as a clientelist instrument had left it with underdeveloped mechanisms for policy development and implementation and an almost complete lack of strategic planning capacity (OECD 2010). Policymaking had always been reactive and geared towards problem-solving, mainly through political compromise; technocratic, forward-looking planning was alien to the public administration and its political leadership (Dimitrakopoulos and Passas 2004).

The lack of a national plan had two important implications; first, it allowed the creditors to decide single-handedly the priorities of the program, which proved problematic. Second, it undermined the ownership of the program and allowed Greek politicians to play the “IMF/creditors as a scapegoat” card, absolving themselves from any responsibility (Vreeland 1999). This rhetoric helped shape an explosive political climate, fueling populist and Eurosceptic narratives and contributing to the formation of the “Memorandum/anti-Memorandum” divide, which dominated Greek society during the crisis (Katsikas 2020).

Political polarization and popular reactions were, of course, primarily fueled by the devastating effects of the crisis and the policies that were being implemented (Pagoulatos 2018). However, the divide was also actively sustained by political parties, which saw an opportunity to benefit from the anger and frustration of the people with the dominant parties. An array of hitherto marginal parties from the far right and the left embraced the anti-Memorandum cause and engaged in fierce opposition, employing typical populist tactics (Katsikas and Tsatsanis 2024). The strategy paid off; SYRIZA, a radical left party, rose to the position of major opposition in the twin elections of 2012, which changed dramatically the Greek political system. PASOK, which had handled the crisis until then, collapsed at the polls, losing more than 30 percentage points, while New Democracy recorded its worst electoral result in the metapolitefsi era. Independent Greeks (AN.EL.), a populist, nationalist right-wing party, and Golden Dawn, a far-right party with neo-Nazi connections, also entered the parliament, taking a substantial part of the vote. Success made these parties even more aggressive; political instability prevailed, and there was no room for consensus on policies and reforms, which set Greece apart from other crisis-hit countries (Manasse and Katsikas 2018).

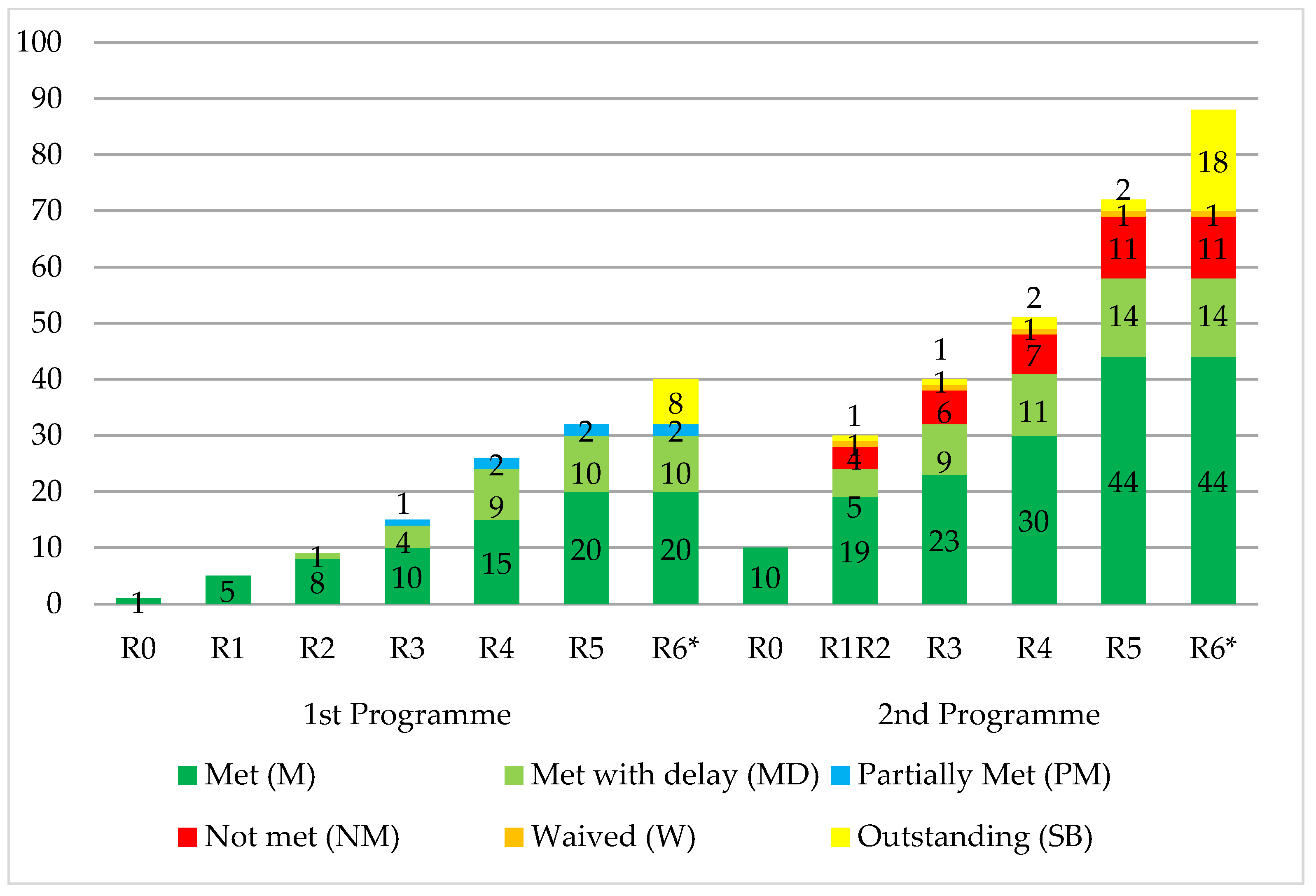

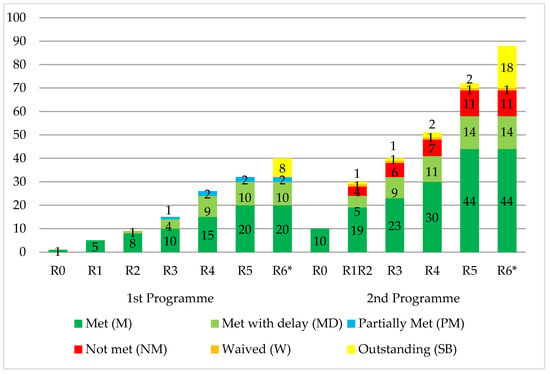

On the other hand, the governments handling the crisis could not free themselves from the shackles of clientelism (Sklias and Maris 2013). Domestic interest groups poised to lose from the implementation of reforms sought to delay and modify reforms that affected them to minimize their losses. Forced to implement austerity policies, politicians sought to safeguard what they could from their clientelist networks by accommodating, when possible, their requests. As a result, several reforms in the public sector (Katsikas et al. 2018; Spanou 2018), in product markets (Petralias 2017), and in the financial sector (Avgouleas 2015), among others, were delayed, modified, abandoned, or even reversed. Gradually, as reform fatigue took over, it became more difficult to implement reforms (Figure 11).11

Figure 11.

Number of reforms per review. Source: IMF MONA Database. Author’s calculations. Note: R6* denotes the last reviews of the 1st and 2nd program which were not completed as the programs were interrupted.

5.2. The Impact of the Crisis on the Greek Growth Model

Although it came at an unacceptably high economic and social cost, progress was achieved in several respects. The twin deficits were offset, as Greece achieved the biggest and fastest fiscal consolidation in recent decades (Petralias et al. 2018), and the current account balance was largely restored. In the area of reforms, progress was recorded as well, particularly with regard to the so-called fiscal-structural reforms, i.e., reforms related to the preparation and implementation of the public budget (Spanou 2018; Anastasatou and Tsakloglou 2019). Positive changes were also made in certain aspects of the business environment, such as the simplification of the procedures for setting up new businesses, while the reform of product markets continued at a slow pace. Finally, a more modest privatization plan was gradually implemented, with some success. Since 2017, the Greek economy has started a recovery that has gradually gathered pace, and Greece has also been able to return to the markets.

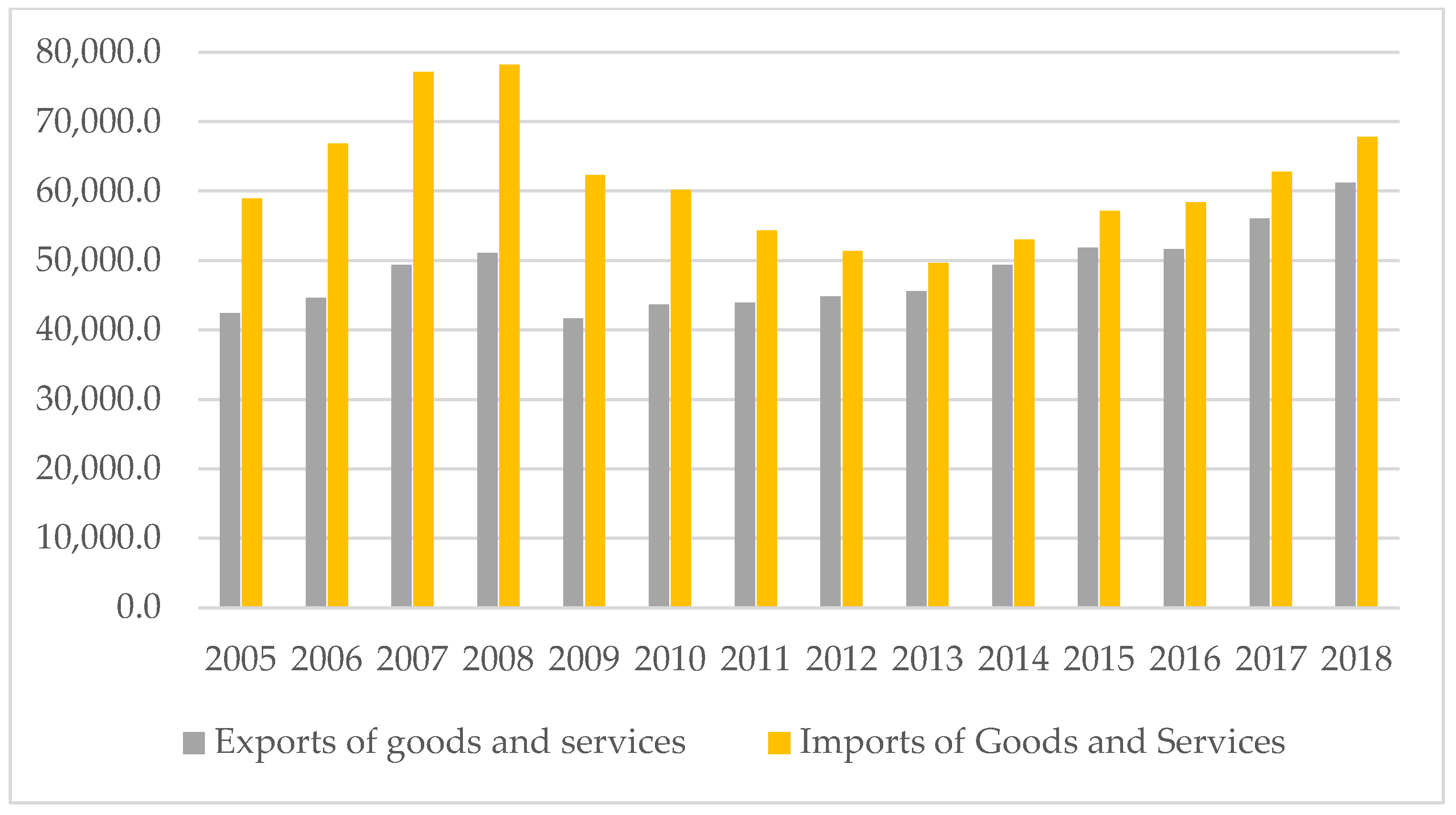

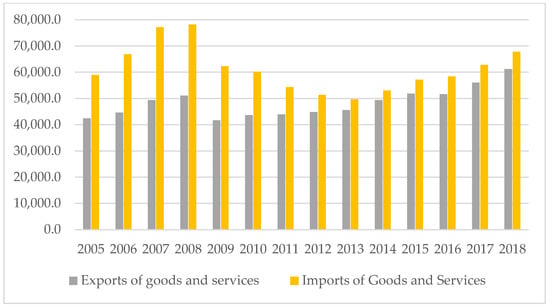

On the other hand, the recovery of the Greek economy cannot be said to be the result of an adjustment of its growth model. The improvement in the current account was not due to a re-orientation of the economy towards exports but rather due to the dramatic decline of imports because of the reduction in disposable income and consumption (Figure 12). Despite the substantial reduction of unit labor costs, exports remained subdued during most of this period and recovered to their 2008 level only in 2016. Since then, there has been a modest increase in exports, which, however, has been accompanied by an even larger increase in imports, leading to a new widening of the current account balance in recent years (Appendix A).

Figure 12.

Exports and Imports of Goods and Services (chain linked volumes, mil. Euros, 2005). Source: Eurostat.

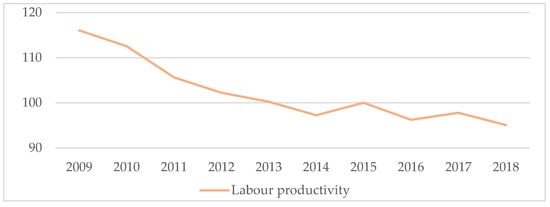

As already noted, during the crisis, private investment collapsed. According to Eurostat data, Greece in 2019 had the lowest level of fixed capital formation as a percentage of GDP in the EU. This investment gap resulted in a dramatic decline in productivity (Figure 13).

Figure 13.

Real labor productivity per person, index (2015 = 100). Source: Eurostat.

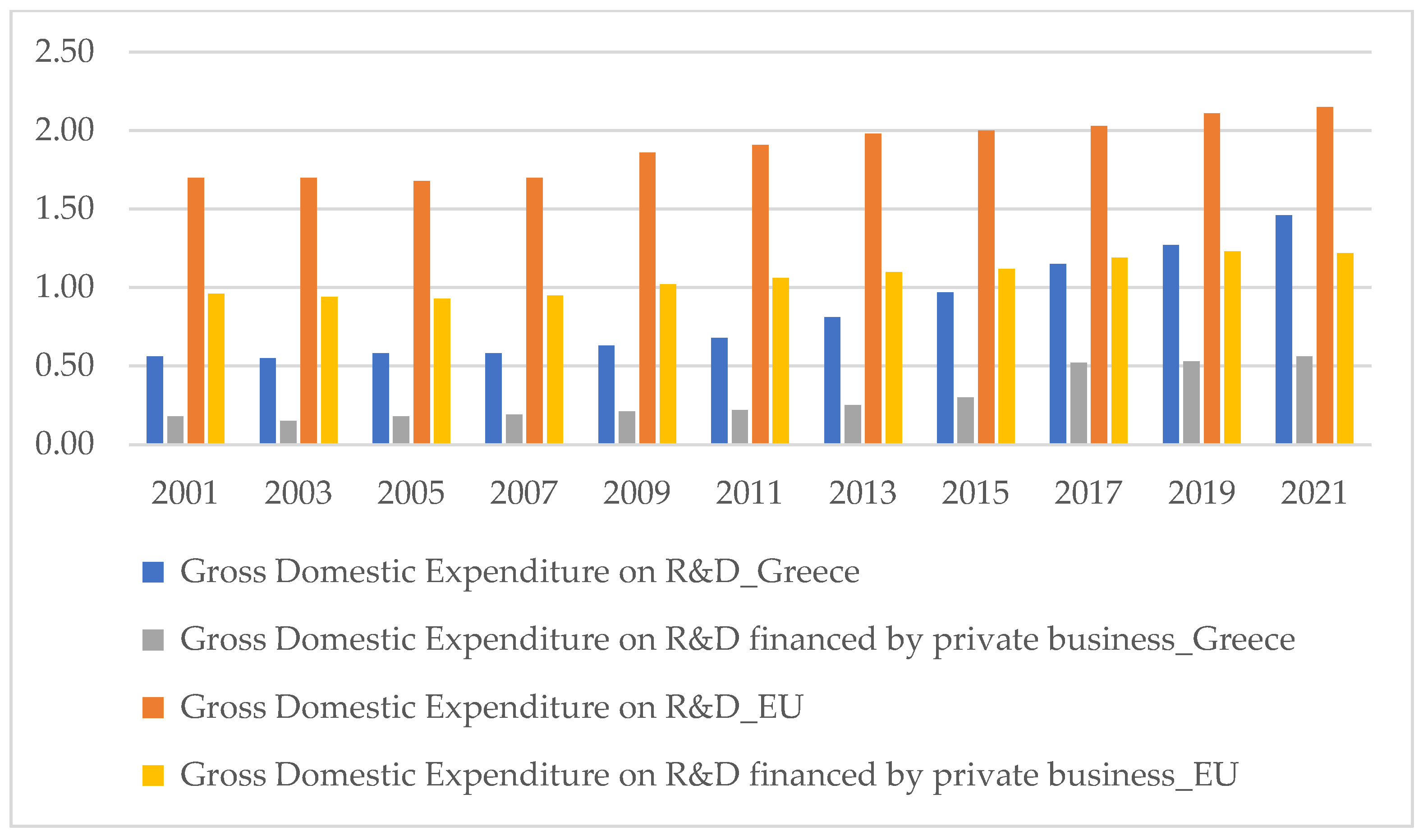

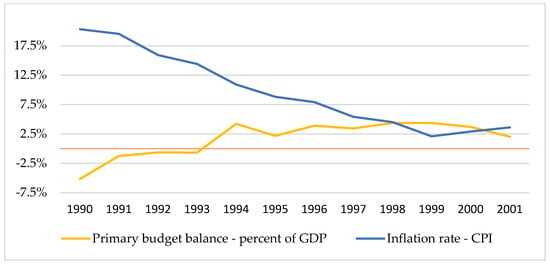

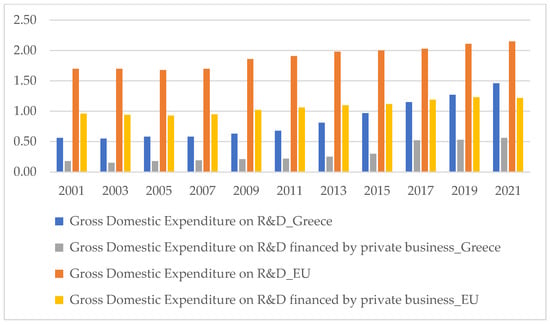

In these circumstances, the upgrading of the economy’s productive capacity, which was necessary for the transition to a more export-led model, was not possible (Myrodias 2024). This problem was compounded given other key features of the Greek economy, like the very high share of self-employed and the very small size of Greek companies; in 2019, Greece ranked first among EU member states in the share of both these categories in total employment (Katsikas et al. 2021). At the same time, she ranked last in the productivity of labor in very small businesses. More generally, a look at qualitative aspects of Greek entrepreneurship shows that the Greek economy still ranks substantially below the EU average in most aspects. Indicative of the difficulty of improving its productivity and international competitiveness is the level of investment in research and development (Figure 14). Despite some improvement in recent years, the Greek economy still lacks adequate funding and public policy mechanisms to support research and development (Pissarides et al. 2020).

Figure 14.

Expenditure on research and Development, % of GDP (2001–2021). Source: OECD.

These features are related to other weaknesses, such as the low employment levels, particularly among women and the young, which declined even more during the crisis. According to the Hellenic Statistical Authority’s data for 2019, the employment rate of women aged 20–64 stood at just 51%, which was the lowest level in the EU. During the crisis, the employment of young people also fell dramatically, reducing their contribution to total employment to just 4% (Filinis et al. 2018). These problems indicate the structural nature of the challenges facing the Greek labor market; addressing them requires a program of wide-ranging reforms that go well beyond its deregulation; although increased flexibility has allowed unemployment to come down during the recent recovery phase, this was achieved primarily through the increase of atypical employment (part-time, temporary, etc.). To produce full-time, stable, and well-paying jobs, deeper reforms are required to raise the capacity of the Greek economy to produce high-value-added goods and services. The policy program promoted during the crisis was not able to achieve this objective (Sklias et al. 2022).

6. The Pandemic Challenge

In 2020, the Greek economy was expected to continue its recovery, growing for the first time since the crisis by more than 2%. There were signs of rising inward investment flows, and the yields of Greek government bonds were recording new lows. All that came to an abrupt stop with the outbreak of the pandemic; lockdowns impacted hard the Greek economy due to its over-reliance on tourism and domestic non-tradable goods and services; in 2020, Greece recorded a negative growth rate of −9.3%. The pandemic-induced economic crisis arrested the recovery of private and foreign investment, halted the reduction in unemployment, and led to new sizable fiscal deficits as a result of public policies designed to support workers and businesses. The amount of funds required to deal with the humanitarian and economic effects of the pandemic posed a major challenge for countries with a high level of debt like Greece; within weeks of the pandemic outbreak, the spreads for 10-year Greek government bonds had already doubled. Uncertainty about the future had returned.

Fortunately, this time, the EU response was very different. The European Central Bank (ECB) acted fast; it added EUR 120 billion to its existing Asset Purchasing Program (APP), launched a new emergency refinancing operation to provide liquidity to the banking sector, and on 18 March announced a EUR 750 billion Pandemic Emergency Purchase Program (PEPP). This was enough to calm the markets and reduce spreads. At the same time, the EU introduced a number of policy changes that allowed member states to furnish the necessary fiscal support to their economies; state aid rules were relaxed, and the so-called “general escape clause” of the SGP was activated.

On the fiscal front, things moved slower; after an initial déjà vu of the previous crisis confrontation between fiscal conservatives and supporters of fiscal solidarity, an initial agreement was reached at the Eurogroup on 9 April for a multi-pronged response, which included European Commission’s Temporary Support to mitigate Unemployment Risks in an Emergency (SURE) program, a European Investment Bank (EIB) scheme for private sector loans, and new credit lines from the ESM, altogether totaling EUR 540 billion. The most important break with the past, however, came with the decision on 21 July to establish the Next Generation EU. At the core of the Fund lies the Recovery and Resilience Facility (RRF), with EUR 672.5 billion, 312.5 of which are in the form of grants. The RRF is meant to support European economies in their efforts to manage the pandemic crisis and to facilitate the dual transition to a digital and green economy.

The Greek government submitted its National Recovery and Resilience Plan (NRRP) early to access the RFF funds. The Greek NRRP was one of the first 12 NRRPs approved on 13 July 2021 by the Economic and Financial Affairs Council (ECOFIN), opening the way for the payment of up to 13% of the funds in pre-financing. The plan is comprehensive and puts forward a long-term strategy design to address structural weaknesses of the economy and support the dual transition; in this context, investments are often accompanied by reforms. In total, there were 104 investments and 62 reforms outlined in the original plan.12 The NRRP draws on the Pissarides Report, named after the Nobel Laureate Christopher A. Pissarides, who headed a team of well-known economists tasked to produce a comprehensive national plan for sustainable growth. The primary objective of the plan is the reform of the Greek growth model.

The EU’s different reaction to the pandemic crisis offers some hope for the future despite the deep recession in 2020 and the pressure felt by workers and businesses so soon after a decade of crisis. Indeed, the different EU reactions and the monetary and fiscal policy instruments made available, as well as the common procurement and distribution of vaccines, helped the EU economy overcome the pandemic crisis relatively quickly. In Greece, the recovery was spectacular as the economy grew by 8.4% and 5.6% in 2021 and 2022, respectively. Both labor cost and price competitiveness have improved, exports have been growing steadily (driven mainly by services but also recording significant growth in traded goods), and investment has picked up as a percentage of GDP, particularly since 2019 (European Commission 2024). Moreover, after the crisis, the fiscal management of successive governments has been much more cautious; a gradual fiscal adjustment is pursued, and the GDP-to-debt ratio, while still high, has been declining markedly in recent years (Appendix A).

Having said that, major challenges remain for the Greek growth model. Private sector savings remain in negative territory and well below the EU average (−0.5% vs. 5.8% of GDP in the Euro area during 2017–2022, European Commission 2024, p. 22), while NPLs, although removed from the banking system, continue to burden Greek companies. As a result, despite its improvement, investment as a percentage of GDP remains well below the pre-crisis levels, with predictable implications for productivity, which continues to be one of the lowest in the EU (European Commission 2024). Productivity and non-cost competitiveness continue to be hampered by the pathologies of the state bureaucracy and the structural features of the Greek corporate sector, which continues to be dominated by micro businesses and the production of low-tech goods and non-tradable services, which tend to be less capital-intensive.

This complex picture, which includes some positive developments on the background of continued structural weaknesses, is reflected in Table 7. On the one hand, the data clearly demonstrates the continuity of the Greek growth model; even after the crisis, private consumption continues to be the principal driver of growth, and public consumption also makes a significant contribution. Net exports continue to affect growth substantially and negatively. On the other hand, investment has made a strong positive contribution during this period. Furthermore, while investment in construction and dwellings has picked up—with the latter doubling during this period, albeit starting from a very low point—investment in equipment and ICT present robust growth as well. In 2022, investment in dwellings accounted for 11.7% of gross fixed capital formation, compared to 47.9% for investment in machinery, equipment, and weapons and 12.5% for investment in ICT (AMECO).

Table 7.

GDP components: Contribution to GDP change (2019–2022). Source: AMECO.

7. Discussion and Conclusions

The aim of this article is to determine whether Greece’s EMU membership has affected its growth model and, if so, in what ways. The preceding analysis demonstrated that EMU membership has been crucial for the performance of the Greek economy during different periods of time but less so for the transformation of its growth model.

Following the restoration of democracy, Greece adopted a new demand-led growth model supported by fiscal policy and the expansion of the welfare state, which focused on redistribution. This economic doctrine was underpinned by a new politics of populism and mass clientelism, with the state apparatus at its center. It failed to produce growth and led to major imbalances in the fiscal and external balances. In the 1990s, the prospect of EMU incentivized Greek governments to revise parts of this economic doctrine to meet the Maastricht criteria. The new policies improved several macroeconomic indices and helped produce high growth rates from the mid-1990s. However, the EMU conditionality was all about the nominal convergence of production factors and goods prices and did not affect the structure of the Greek economy or the politico-economic role of the state. As a result, and given the political and institutional constraints of EMU governance, once inside the Eurozone, the adjustment efforts relaxed. On the fiscal front, expansionary policies and old clientelist practices continued unabated; in the private economy, the inflow of ample and cheap credit from abroad intermediated through a liberalized financial system fueled a construction bubble and the increased consumption of non-tradable services. The resulting twin deficits left the Greek economy particularly vulnerable when the GFC hit. The conditionality imposed by EMU and the IMF during the crisis also did not address the structural weaknesses of the Greek economy as a matter of priority; the focus was on fiscal consolidation. Austerity deeply affected the drivers of growth—private and public consumption and construction investment—leading to an unprecedented and long-lasting depression; also, it undermined the effect of structural reforms when these were implemented partially and with delay. Following the crisis, exports and productive investment have been on the rise, but the main features of the Greek economy remain the same; in 2023, as was the case in 2010, consumption still makes up 70% of Greek GDP, with public consumption adding another 20% (ELSTAT 2024).

In conclusion, while the performance of the economy in terms of macroeconomic variables and growth rates has been significantly affected at times by the EMU rules and conditionality, the structural characteristics of the supply side of the economy and the politico-economic role of the state have not been substantially affected. The evidence presented here has shown that the Greek economy has been consistently driven by private and, to a lesser degree, public consumption during the last 40 years; when investment had a strong contribution, it typically boosted the construction sector, particularly housing.

This narrative supports the recent turn in comparative political economy, which seeks to integrate the analyses of the demand and supply sides of the economy. In contrast to accounts that seek to propose fiscal policy and domestic demand as the main long-term drivers of growth, the evidence of the Greek case demonstrates that the temporary improvement of macroeconomic indices does not guarantee sustainable long-term growth unless accompanied by structural reforms in the supply side of the economy to promote innovation, productivity, and international competitiveness. Moreover, it reveals the dangers of discretionary fiscal policy as the dominant, through-the-cycle economic policy tool, particularly in countries whose politico-economic system is characterized by populism and clientelism. On the other hand, the Greek experience demonstrates the crucial importance of anti-cyclical fiscal policy during a crisis and the need to support domestic demand as a barrier against economic deterioration, particularly in economies with small export sectors and low international competitiveness. Finally, the preceding narrative also supports the view that the financial system needs to be regulated and supervised much more effectively in an era of free, global capital flows to prevent the building of bubbles in asset markets.

On a slightly different but not unrelated debate, accounts that interpret the Greek crisis as solely a symptom of global and European macroeconomic and financial imbalances cannot account for the depth and duration of the Greek crisis, which differentiates it from those of other Southern European economies. On the other hand, accounts that focus solely on the politico-economic weaknesses of the Greek growth model cannot explain the fact that a number of other EMU member states experienced crises, which displayed many common features with the crisis in Greece.

Following the narrative in this article, the Greek crisis is the result of a “mutual failure” on the European and domestic fronts. On the one hand, the economic governance agreed upon at Maastricht was clearly inadequate to support the operation of a monetary union comprising many widely diverse economies; on the other hand, given EMU’s economic and institutional architecture, Greece was clearly ill-prepared and unwilling to undertake the necessary adjustments to survive in the Eurozone. The mishandling of the crisis by the EMU member states and institutions was unsurprising. Northern Europe’s member states, led by Germany, were not prepared to share in the cost of adjustment or to agree to new supranational institutions that could alleviate part of it. Given the design failures in the MoUs and the weaknesses of the Greek political economy, the result was an unnecessarily deep and prolonged crisis, which devasted the Greek economy and led to political instability.

The pandemic halted the return to normalcy but was followed by a strong recovery as the EU’s reaction was very different compared to that of the Eurozone crisis and inaugurated a new phase in the interaction between the Greek political economy and the EU. The crucial point, which may lead to a different outcome this time, is that there are positive incentives for reform offered at the EU level, which alter the cost-benefit analysis of domestic elites and provide an opportunity for a paradigm shift. The stakes are high. Greece continues to be in a monetary union with more advanced and competitive economies. The lessons of a decade-long crisis and the prospects of a growth-friendly adjustment may prove a catalyst for reform.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Greece, Main Economic Variables (1980–2023).

Table A1.

Greece, Main Economic Variables (1980–2023).

| GDP Growth Rate (%) | Inflation Rate (%) | Unemployment Rate (Percent of Labor Force) 1 | Gross Fixed Capital Formation (Annual Change, %) | Current Account Balance (% of GDP) 1 | General Government Gross Debt (% of GDP) 1 | |

|---|---|---|---|---|---|---|

| 1980 | - | 24.68 | 2.66 | - | −3.85 | 22.53 |

| 1981 | −1.55 | 24.51 | 4.00 | −9.75 | −4.55 | 26.68 |

| 1982 | −1.13 | 20.99 | 5.80 | −3.22 | −3.44 | 29.31 |

| 1983 | −1.08 | 20.18 | 7.90 | 6.36 | −3.79 | 33.59 |

| 1984 | 2.01 | 18.46 | 8.10 | −16.24 | −4.41 | 40.06 |

| 1985 | 2.51 | 19.31 | 7.80 | 9.35 | −6.83 | 46.62 |

| 1986 | 0.52 | 23.02 | 7.40 | 0.11 | −2.97 | 47.14 |

| 1987 | −2.26 | 16.40 | 7.40 | −5.63 | −1.86 | 52.41 |

| 1988 | 4.29 | 13.53 | 7.70 | 2.57 | −1.25 | 57.07 |

| 1989 | 3.80 | 13.66 | 7.50 | 6.11 | −3.23 | 59.82 |

| 1990 | 0.00 | 20.43 | 7.00 | 4.46 | −3.61 | 73.16 |

| 1991 | 3.10 | 19.46 | 7.70 | 4.25 | −1.49 | 74.68 |

| 1992 | 0.70 | 15.88 | 8.70 | −3.49 | −1.84 | 79.97 |

| 1993 | −1.60 | 14.41 | 9.70 | −3.99 | −0.69 | 100.29 |

| Period average | 0.72 | 18.48 | 7.44 | −0.70 | −3.07 | 53.09 |

| 1994 | 2.00 | 10.87 | 9.60 | −3.08 | −0.13 | 98.30 |

| 1995 | 2.10 | 8.93 | 10.00 | 4.13 | −2.35 | 98.99 |

| 1996 | 2.86 | 8.19 | 10.30 | 9.05 | −3.49 | 101.34 |

| 1997 | 4.48 | 5.54 | 10.30 | 3.50 | −3.72 | 99.45 |

| 1998 | 3.89 | 4.77 | 11.20 | 22.59 | −2.62 | 97.43 |

| 1999 | 3.07 | 2.64 | 12.13 | 7.40 | −3.58 | 98.91 |

| 2000 | 3.92 | 3.15 | 11.35 | 2.86 | −5.93 | 104.93 |

| Period average | 3.19 | 6.30 | 10.70 | 6.64 | −3.12 | 99.91 |

| 2001 | 4.13 | 3.37 | 10.78 | 5.37 | −6.89 | 107.08 |

| 2002 | 3.92 | 3.63 | 10.35 | −0.33 | −6.25 | 104.86 |

| 2003 | 5.79 | 3.53 | 9.78 | 15.10 | −6.30 | 101.46 |

| 2004 | 5.06 | 2.90 | 10.60 | 2.96 | −5.53 | 102.87 |

| 2005 | 0.60 | 3.55 | 10.00 | −11.88 | −7.35 | 107.40 |

| 2006 | 5.65 | 3.20 | 9.00 | 19.39 | −10.86 | 103.61 |

| 2007 | 3.27 | 2.90 | 8.40 | 15.89 | −13.92 | 103.10 |

| Period average | 4.06 | 3.30 | 9.84 | 6.64 | −8.16 | 104.34 |

| 2008 | −0.34 | 4.15 | 7.75 | −7.19 | −14.48 | 109.42 |

| 2009 | −4.30 | 1.21 | 9.60 | −13.93 | −10.87 | 126.75 |

| 2010 | −5.48 | 4.71 | 12.73 | −19.35 | −10.04 | 147.49 |

| 2011 | −10.15 | 3.33 | 17.85 | −25.37 | −10.15 | 175.22 |

| 2012 | −7.09 | 1.50 | 24.43 | −21.68 | −2.56 | 162.12 |

| 2013 | −2.52 | −0.92 | 27.48 | −6.62 | −2.58 | 178.84 |

| 2014 | 0.48 | −1.31 | 26.50 | −3.19 | −2.49 | 181.75 |

| 2015 | −0.20 | −1.74 | 24.90 | 0.17 | −1.48 | 179.08 |

| 2016 | −0.49 | −0.83 | 23.55 | 2.33 | −2.37 | 183.70 |

| 2017 | 1.09 | 1.12 | 21.45 | 8.46 | −2.58 | 183.21 |

| 2018 | 1.67 | 0.63 | 19.30 | −4.34 | −3.58 | 190.67 |

| Period average | −2.48 | 1.08 | 19.59 | −8.25 | −5.74 | 165.29 |

| 2019 | 1.88 | 0.25 | 17.33 | −2.19 | −2.23 | 185.54 |

| 2020 | −9.32 | −1.25 | 16.33 | 2.02 | −7.35 | 213.15 |

| 2021 | 8.38 | 1.22 | 14.78 | 19.26 | −7.10 | 201.13 |

| 2022 | 5.56 | 9.65 | 12.43 | 11.66 | −10.74 | 179.49 |

| Period average | 1.63 | 2.47 | 15.21 | 7.69 | −6.86 | 194.83 |

Source: OECD and IMF (1).

Notes

| 1 | Baccaro et al. (2022) also identify a balanced model, which combines elements of export-led and consumption-led growth and commodity-led and peripheral models, which effectively are variants of the export-led model. |

| 2 | The previous growth regime, which lasted from the early 1950s to the early 1970s, was based on the industrialization of the economy in an environment of stable and low inflation, sustained, among other things, by a hard peg to the dollar. |

| 3 | In its early years, PASOK was closer to the left than to social democracy. Gradually, it moved towards the center. |

| 4 | Metapolitefsi is the term used in Greece to denote the period after the restoration of democracy in 1974. |

| 5 | Calculated based on AMECO data, constant prices. |

| 6 | It is worth noting that all political parties in parliament, except for the communist party, voted for the ratification of the Maastricht Treaty. |

| 7 | Hiring employees on temporary contracts was a typical way to bypass regular recruitment procedures, which since the mid-1990s have been under the auspices of an independent authority. According to data from the public sector census, in 2009, temporary employees made up 17% of total employees in the general government. |

| 8 | The structural aspects of the balanced budget rule were introduced with the 2005 SGP reform. |

| 9 | The economic adjustment program was not completed due to a governmental crisis over the promoted policies. A second bailout agreement, in early 2012, was also not completed, as the opposition parties used the election of the President to provoke a new parliamentary election in 2015. Syriza, a radical left-wing party, won the elections and formed a coalition government with Independent Greeks (AN.EL.), a populist, nationalist right-wing party. Following an unsuccessful six-month negotiation with the country’s creditors to revise the MoU framework, SYRIZA eventually capitulated in the summer and, in August 2015, signed a third bailout agreement, which was the only one to be completed as scheduled. |

| 10 | In September 2016, NPLs peaked at 49.1% of the entire loan portfolio of Greek banks; this amounted to EUR 107 billion (Bank of Greece). |

| 11 | There is no data available for the third economic adjustment program in the IMF’s MONA database, as the IMF did not participate in the third bailout with funds. The European Commission does not have a database on structural reforms. |

| 12 | The original plan submitted has undergone revisions during its implementation. |

References

- Alogoskoufis, George. 1995. The Two Faces of Janus: Institutions, Policy Regimes and Macroeconomic Performance in Greece. Economic Policy 10: 147–84. [Google Scholar] [CrossRef]

- Anastasatou, Marianthi, and Panos Tsakloglou. 2019. Structural Reforms in the Field of Fiscal Policy in the Years of the Crisis. Athens: Crisis Observatory/Hellenic Foundation of European and Foreign Policy (ELIAMEP). (In Greek) [Google Scholar]

- Andreou, George, and Napoleon Maravegias. 2018. The Greek economy in the context of European integration (1962–2018). In Greece and European Integration: The History of a Volatile Relationship 1962–2018. Edited by Napoleon Maravegias and Theodoros Sakellaropoulos. Athens: Dionicos Publications. (In Greek) [Google Scholar]

- Avgouleas, Emilios. 2015. The Greek Banking System and Economic Development. A Brief Anatomy of a (Partially) Preventable Disaster. Crisis Observatory/Hellenic Foundation of European and Foreign Policy (ELIAMEP). Available online: https://crisisobs.gr/2015/10/to-elliniko-trapeziko-sistima-ke-i-ikonomiki-anaptixi-sintomi-anatomia-mias-en-meri-apotrepsimis-katastrofis/ (accessed on 1 June 2024). (In Greek).

- Baccaro, Lucio, and Fabio Bulfone. 2022. Growth and stagnation in Southern Europe: The Italian and Spanish growth models compared. In Diminishing Returns: The New Politics of Growth and Stagnation. Edited by Lucio Baccaro, Mark Blyth and Jonas Pontusson. Oxford: Oxford University Press. [Google Scholar]

- Baccaro, Lucio, and Jonas Pontusson. 2016. Rethinking comparative political economy: The growth model perspective. Politics and Society 44: 175–207. [Google Scholar] [CrossRef]

- Baccaro, Lucio, Mark Blyth, and Jonas Pontusson. 2022. Diminishing Returns: The New Politics of Growth and Stagnation. Oxford: Oxford University Press. [Google Scholar]

- Blanchard, Olivier, and Daniel Leigh. 2013. Growth Forecast Errors and Fiscal Multipliers. American Economic Review 103: 117–20. [Google Scholar] [CrossRef]

- Blanchard, Olivier, and Francesco Giavazzi. 2003. The Macroeconomic Effects of Regulation and Deregulation in Goods and Labor Markets. Quarterly Journal of Economics 118: 879–909. [Google Scholar] [CrossRef]

- Blyth, Mark, and Matthias Matthijs. 2017. Black swans, lame ducks, and the mystery of IPE’s missing macroeconomy. Review of International Political Economy 24: 203–31. [Google Scholar] [CrossRef]

- Böwer, Uwe, Vasiliki Michou, and Christoph Ungerer. 2014. The Puzzle of the Missing Greek Exports. European Economy, European Commission Economic Papers 518. Brussles: European Commission June. [Google Scholar]

- Chortareas, Ceorgios, Vasileios E. Logothetis, and Andreas A. Papandreou. 2016. Political Budget Cycles and Reelection Prospects in Greece’s Municipalities. European Journal of Political Economy 43: 1–13. [Google Scholar] [CrossRef]

- Chortareas, Ceorgios, Vasileios E. Logothetis, and Andreas A. Papandreou. 2018. Elections and Opportunistic Budgetary Policies in Greece. Managerial and Decision Economics 39: 854–62. [Google Scholar] [CrossRef]