Polish Dairy Farm Transformations and Competitiveness 20 Years after Poland’s Accession to the European Union

Abstract

:Simple Summary

Abstract

1. Introduction

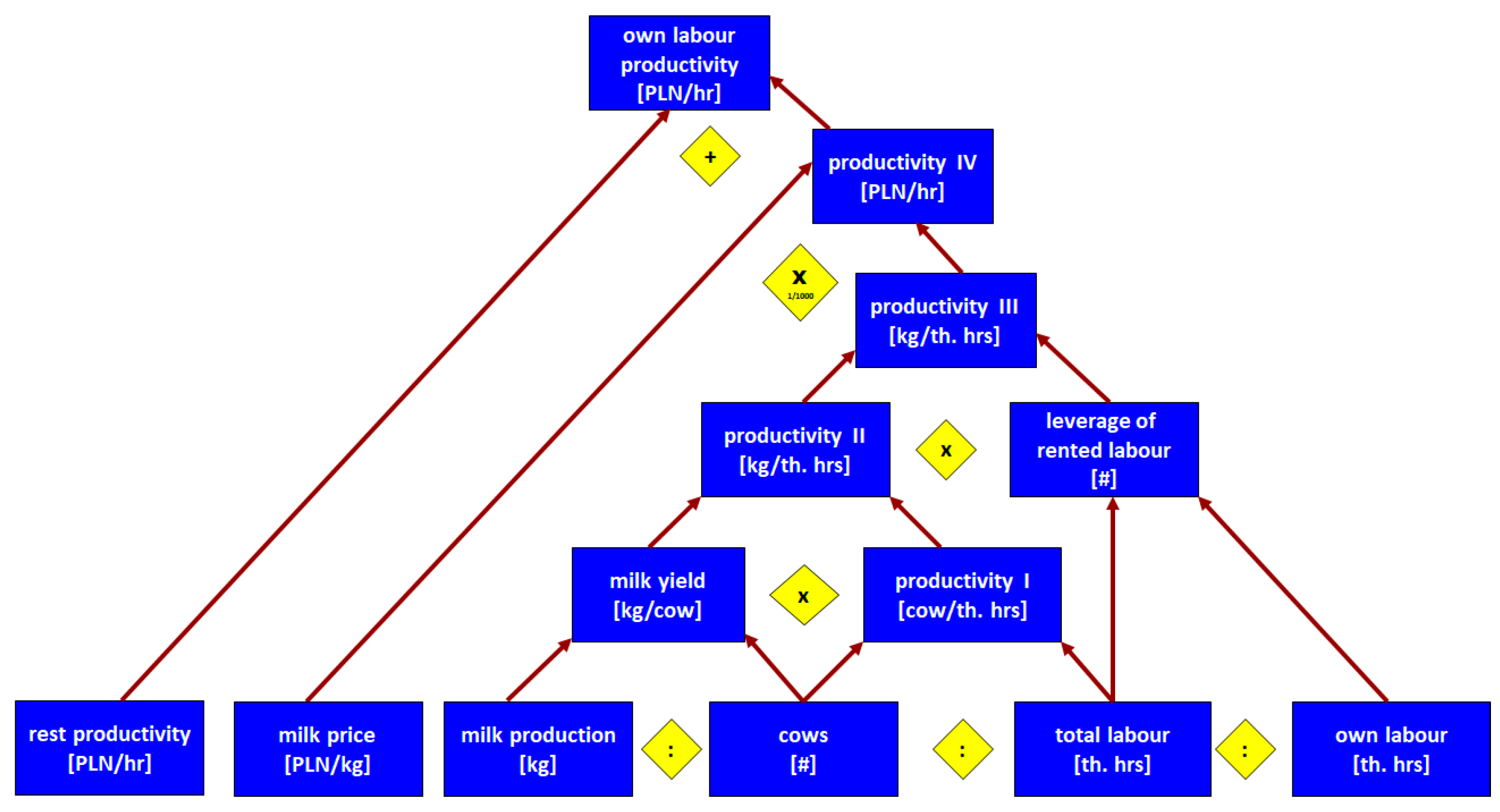

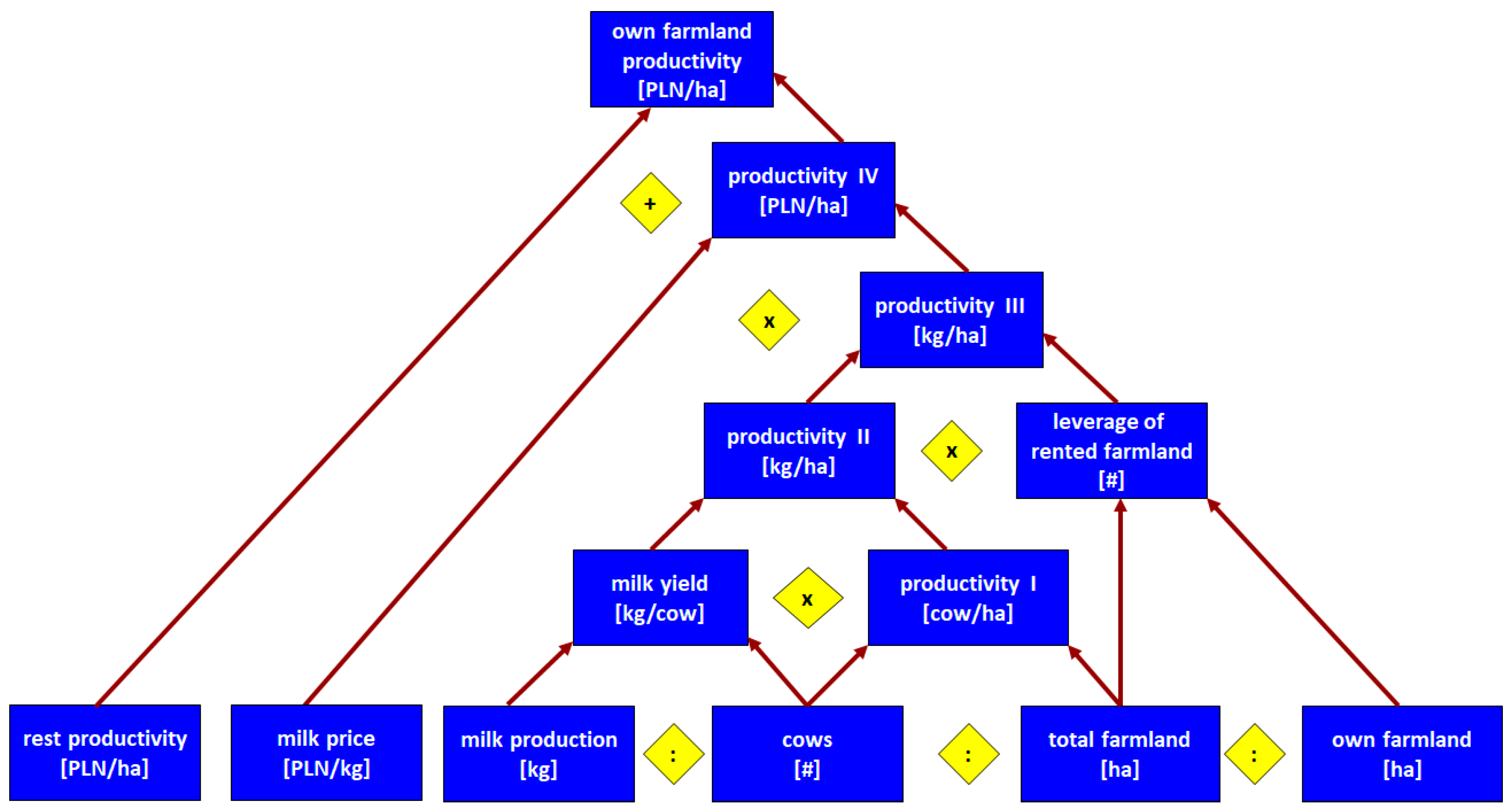

2. Conceptual Framework and Methodology

- CCI1—in the case of negative farm net income;

- CCI2—if partial coverage of opportunity costs of land and labour occurs, namely in the case when 0 ≤ CCI < 1;

- CCI3—if full coverage of opportunity costs of land and labour occurs, but when farm net income does not double up the such defined opportunity cost, namely in the case when 1 ≤ CCI < 2;

- CCI4—if full coverage of opportunity costs of land and labour occurs, and when farm net income at least double up the such defined opportunity cost, namely in the case when CCI ≥ 2.

- EUROSTAT (Statistical Office of European Union);

- The Central Statistical Office (in Poland);

- The Institute of Agricultural and Food Economics—National Research Institute database (Poland);

- Farm Accountancy Data Network Database—FADN (Poland).

3. Results

3.1. Changes in Milk Production, Number of Farms and Milk Yields

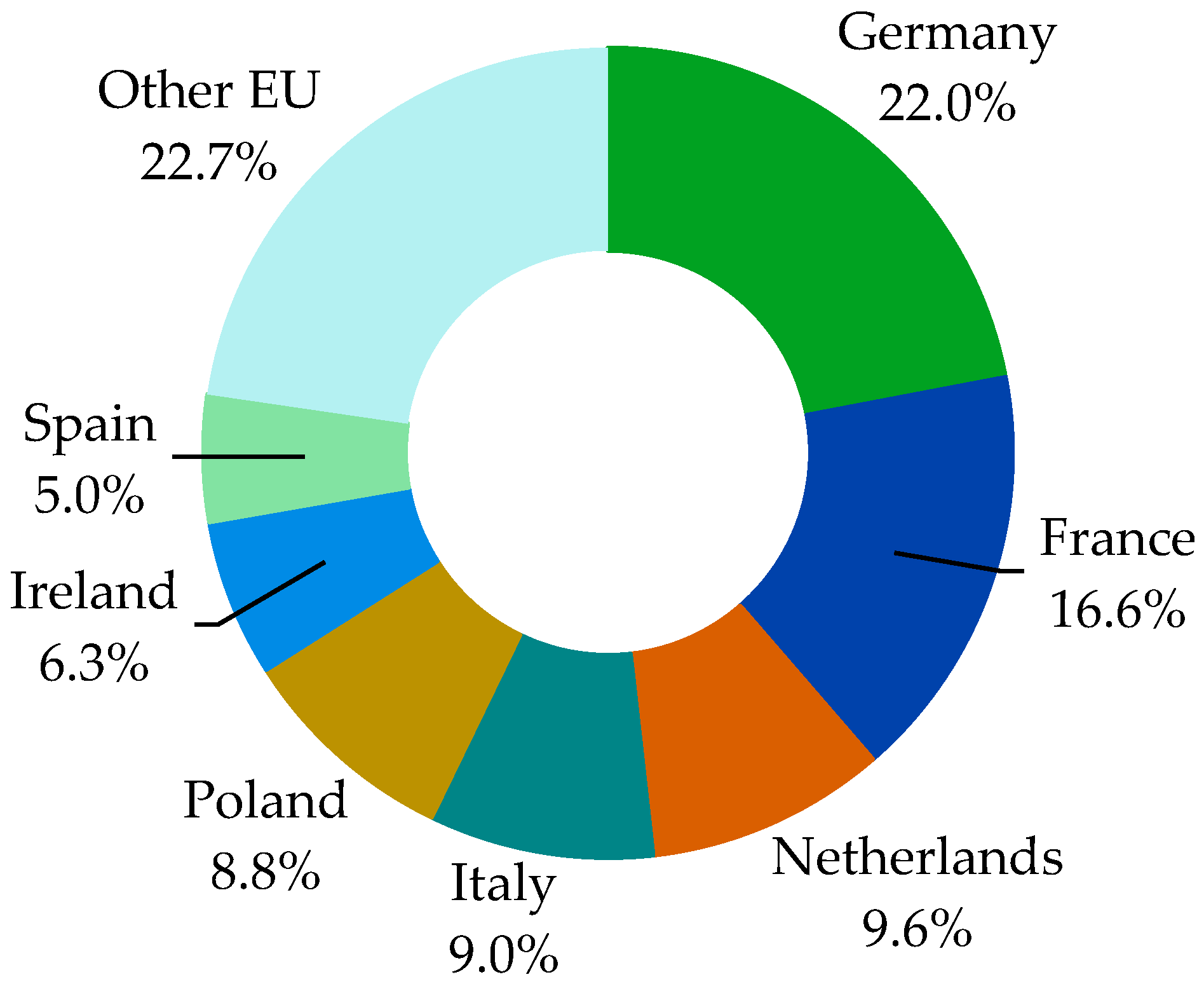

3.1.1. Production and Export

3.1.2. Number of Cows, Farms and Milk Yields

3.1.3. Costs of Production

3.2. Polish Dairy Farms’ Competitiveness by Size

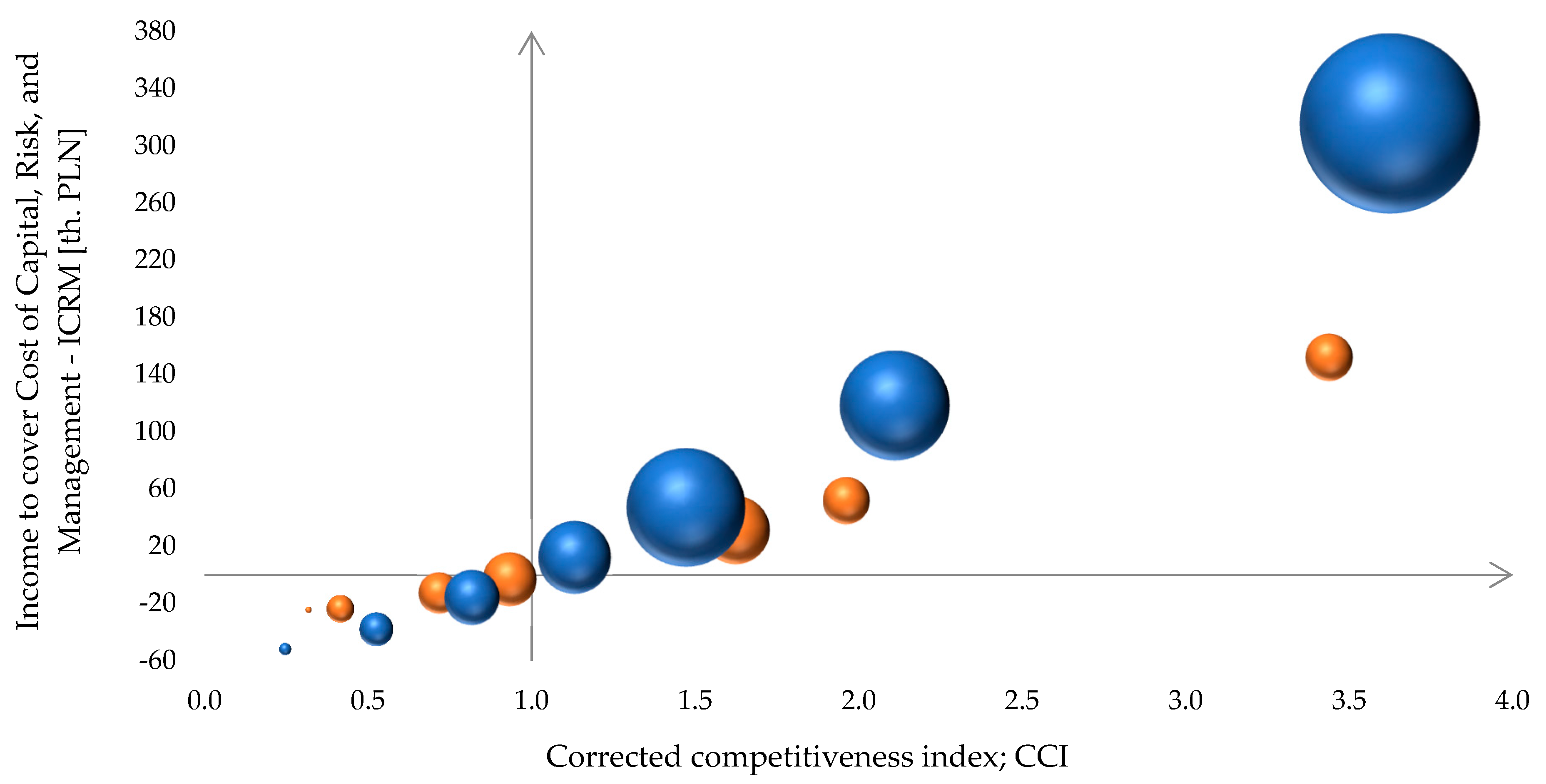

3.2.1. Corrected Competitiveness Index Results by Farm Size

- (1)—

- below 5 cows, (3.6 cows on average);

- (2)—

- from 5 to 9 cows, (7.5 cows on average);

- (3)—

- from 10 to 14 cows, (12.6 cows on average);

- (4)—

- from 15 to 19 cows, (17.4 cows on average);

- (5)—

- from 20 to 29 cows, (24.5 cows on average);

- (6)—

- from 30 to 39 cows; (34.7 cows on average);

- (7)—

- 40 and more cows, (62.8 cows on average).

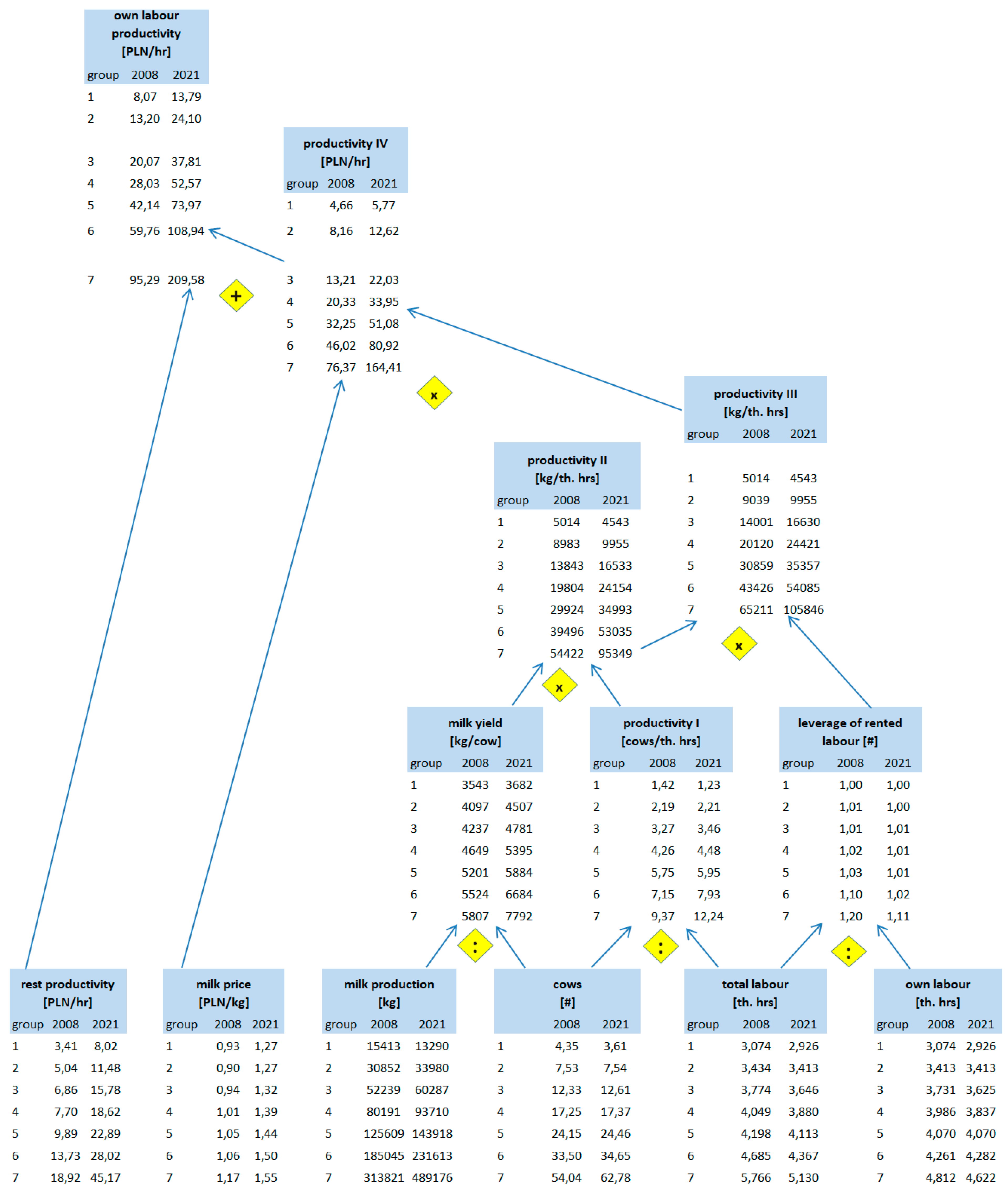

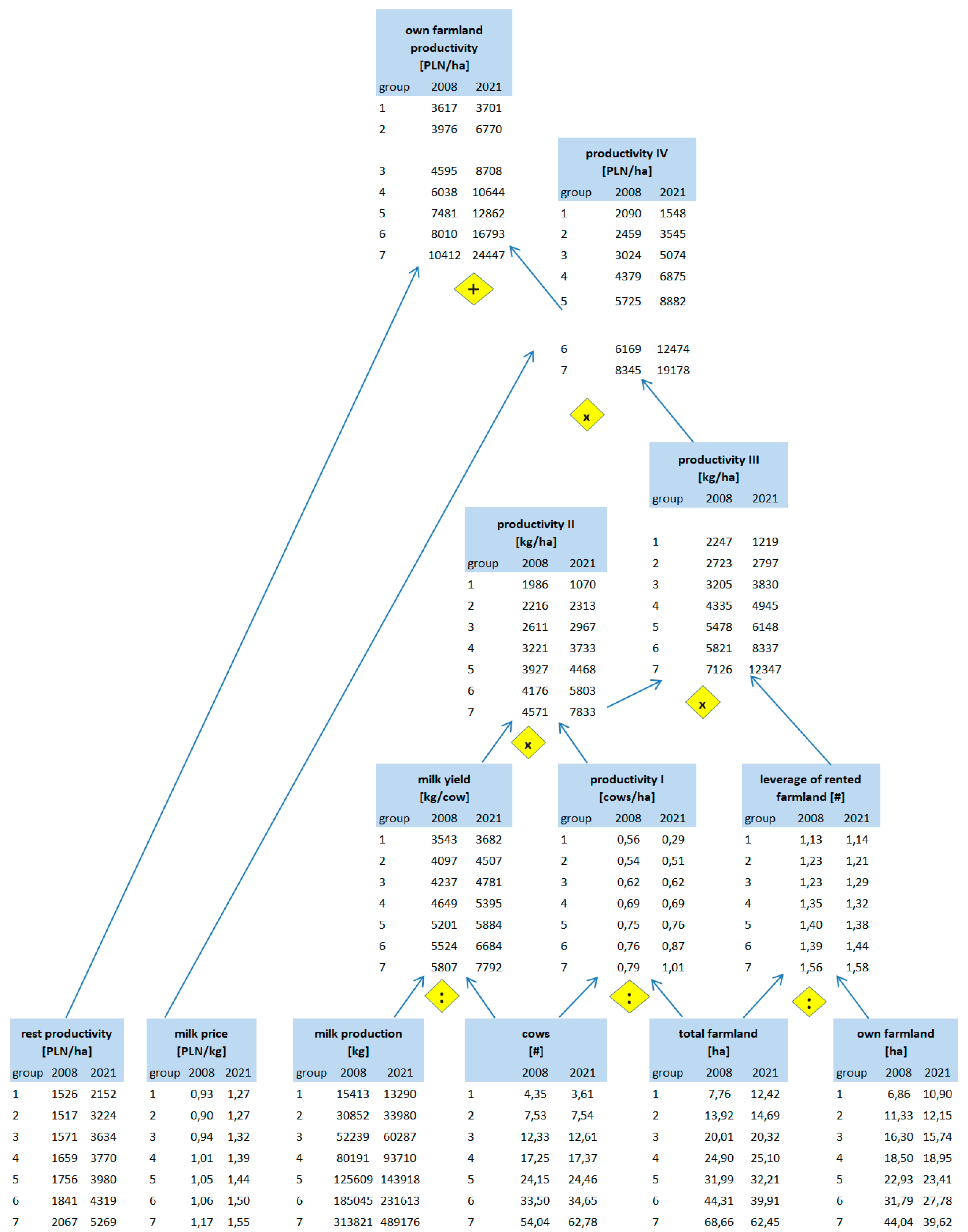

3.2.2. Root Causes of the Differences in Corrected Competitiveness Index between Farms

4. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Roman, M. Spatial Integration of the Milk Market in Poland. Sustainability 2020, 12, 1471. [Google Scholar] [CrossRef]

- Klopčič, M.; Kuipers, A.; Malak-Rawlikowska, A.; Stalgiene, A.; Ule, A.; Erjavec, K. Dairy farmers’ strategies in four European countries before and after abolition of the milk quota. Land Use Policy 2019, 88, 104169. [Google Scholar] [CrossRef]

- Milczarek-Andrzejewska, D.; Malak-Rawlikowska, A.; Fałkowski, J.; Wilkin, J. Regoverning the dairy sector in Poland. Soc. Econ. 2008, 30, 29–77. [Google Scholar] [CrossRef]

- Kiryluk-Dryjska, E.; Baer-Nawrocka, A. Regional Differences in Benefits from the EU Common Agricultural Policy in Poland and Their Policy Implications. Agriculture 2021, 11, 288. [Google Scholar] [CrossRef]

- Pisulewski, A.; Marzec, J. The Impact of Subsidies on Persistent and Transient Technical Inefficiency: Evidence from Polish Dairy Farms. J. Agric. Appl. Econ. 2022, 54, 561–582. [Google Scholar] [CrossRef]

- Zhu, X.; Demeter, R.M.; Lansink, A.O. Competitiveness of dairy farms in three countries: The role of CAP subsidies. In Proceedings of the European Association of Agricultural Economists (EAAE) > 2008 International Congress, Ghent, Belgium, 26–29 August 2008; pp. 1–15. Available online: https://ageconsearch.umn.edu/record/44143 (accessed on 30 May 2024).

- Parzonko, A.; Bórawski, P. Pozycja Konkurencyjna Polskich Gospodarstw Mlecznych w UE: Stan, Uwarunkowania i Przewidywania na Przyszłość; Wydawnictwo SGGW: Warsaw, Poland, 2021. [Google Scholar]

- Parzonko, A.; Parzonko, A.J.; Bórawski, P. Economic Competitiveness of Dairy Farms from the Top Milk-Producing Countries in the EU: Assessment in 2014–2021. Agriculture 2024, 14, 123. [Google Scholar] [CrossRef]

- Skarżyńska, A. Results of dairy farms in poland compared to the largest milk producers in the european union. Probl. Agric. Econ. 2017, 353, 24–49. [Google Scholar] [CrossRef]

- Wilczyński, A.; Kołoszycz, E. Economic Resilience of EU Dairy Farms: An Evaluation of Economic Viability. Agriculture 2021, 11, 510. [Google Scholar] [CrossRef]

- Kusz, B.; Kusz, D.; Bąk, I.; Oesterreich, M.; Wicki, L.; Zimon, G. Selected Economic Determinants of Labor Profitability in Family Farms in Poland in Relation to Economic Size. Sustainability 2022, 14, 13819. [Google Scholar] [CrossRef]

- Marzec, J.; Pisulewski, A. Analiza działalności ekonomicznej gospodarstw mlecznych w Polsce—Wyniki uzyskane na podstawie krótkookresowej funkcji kosztu. Rocz. Kol. Anal. Ekon. Szkoła Główna Handlowa 2015, 39, 167–181. [Google Scholar]

- Świtłyk, M.; Sompolska-Rzechuła, A.; Kurdyś-Kujawska, A. Measurement and Evaluation of the Efficiency and Total Productivity of Dairy Farms in Poland. Agronomy 2021, 11, 2095. [Google Scholar] [CrossRef]

- Adamski, M. Efficiency of polish dairy farms compared to selected farms from other countries of the europe an union. Ann. Pol. Assoc. Agric. Agribus. Econ. 2018, XX, 9–14. [Google Scholar] [CrossRef]

- Poczta, W.; Średzińska, J.; Chenczke, M. Economic Situation of Dairy Farms in Identified Clusters of European Union Countries. Agriculture 2020, 10, 92. [Google Scholar] [CrossRef]

- Sobczyński, T.; Klepacka, A.M.; Revoredo-Giha, C.; Florkowski, W.J. Dairy farm cost efficiency in leading milk-producing regions in Poland. J. Dairy. Sci. 2015, 98, 8294–8307. [Google Scholar] [CrossRef]

- Baer-Nawrocka, A.; Barczak, W. Production potential of holdings specializing in cow milk production in macroregions of the european union—A typological analysis. Ann. Pol. Assoc. Agric. Agribus. Econ. 2020, XXII, 11–19. [Google Scholar] [CrossRef]

- Makieła, K.; Marzec, J.; Pisulewski, A. Productivity change analysis in dairy farms following Polish accession to the EU—An output growth decomposition approach. Outlook Agric. 2017, 46, 295–301. [Google Scholar] [CrossRef]

- Gallardo, R.K.; Ramos, F.; Ramos, E.; The Farm Strategy Approach Towards Competitiveness under the CAP Reforms. The Case of Andalusia in Southern Spain. AgEconSearch. 2002, pp. 1–17. Available online: https://ageconsearch.umn.edu/record/24963 (accessed on 14 May 2024).

- Kleinhanss, W. Competitiveness of the Major Types of Agricultural Holdings in Germany. Probl. Agric. Econ. 2015, 342, 25–41. [Google Scholar] [CrossRef]

- Hatzichronoglou, T. Globalisation and Competitiveness: Relevant Indicators; OECD Publishing: Paris, France, 1996. [Google Scholar]

- European Commission. Enterprise and Industry European Competitiveness Report 2008 European Commission Enterprise and Industry. 2009. Available online: http://ec.europa.eu/ (accessed on 14 May 2024).

- Latruffe, L. Competitiveness. In Productivity and Efficiency in the Agricultural and Agri-Food Sectors; OECD Publishing: Paris, France, 2010; No. 30. [Google Scholar]

- Flejterski, S. Istota i mierzenie konkurencyjności międzynarodowej. Gospod. Plan. 1984, 39, 390–394. [Google Scholar]

- Kamerschen, D.R.; McKenzie, R.B.; Nardinelli, C. Economics; Houghton Mifflin Co.: Boston, MA, USA, 1989. [Google Scholar]

- Nowakowski, M.K. Biznes Międzynarodowy—Obszary Decyzji Strategicznych; Key Text: Warszawa, Poland, 2000. [Google Scholar]

- Pietrzak, M. Strategie Konkurencji Przodujących Przedsiębiorstw w Sektorze Przetwórstwa Mleka; Wydawnictwo SGGW: Warsaw, Poland, 2002. [Google Scholar]

- Fischer, C.; Schornberg, S. Assessing the competitiveness situation of EU food and drink manufacturing industries: An index-based approach. Agribusiness 2007, 23, 473–495. [Google Scholar] [CrossRef]

- Wijnands, J.H.M.; Bremmers, H.J.; van der Meulen, B.M.J.; Poppe, K.J. An economic and legal assessment of the EU food industry’s competitiveness. Agribusiness 2008, 24, 417–439. [Google Scholar] [CrossRef]

- Ball, V.E.; Butault, J.; Juan, C.S.; Mora, R. Productivity and international competitiveness of agriculture in the European Union and the United States. Agric. Econ. 2010, 41, 611–627. [Google Scholar] [CrossRef]

- Hallam, D.; Machado, F. Efficiency analysis with panel data: A study of Portuguese dairy farms. Eur. Rev. Agric. Econ. 1996, 23, 79–93. [Google Scholar] [CrossRef]

- Jansik, C.; Irz, X.; Kuosmanen, N. Competitiveness of Northern European Dairy Chains; MTT Economic Research, Agrifood Research Finland: Helsinki, Finland, 2014. [Google Scholar]

- Pietrzak, M.; Domagała, J.; Chlebicka, A. Competitiveness, productivity, and efficiency of farmers’ cooperatives: Evidence from the polish dairy industry. Zagadnienia Ekon. Rolnej/Probl. Agric. Econ. 2023, 376, 1–25. [Google Scholar] [CrossRef]

- Coelli, T.J.; Rao, D.S.P.; O’Donnell, C.J.; Battese, G.E. An Introduction to Efficiency and Productivity Analysis; Springer: New York, NY, USA, 2005. [Google Scholar] [CrossRef]

- Depperu, D.; Cerrato, D. Analyzing International Competitiveness at the Firm Level: Concepts and Measures. Business Economics. 2005. Available online: https://dipartimenti.unicatt.it/dicdr-dipartimenti/dises-wp_azzurra_05_32.pdf (accessed on 30 May 2024).

- Samuelson, P.A.; Nordhaus, W.D. Economics, 19th ed; McGraw-Hill: New York, NY, USA, 2010. [Google Scholar]

- Weber, J.; Schäffer, U. Einführung in das Controlling; Schäffer-Poeschel: Stuttgart, Germany, 2020. [Google Scholar] [CrossRef]

- Eurostat (Database). Cows’milk Collection and Products Obtained—Annual Data. Available online: https://data.europa.eu/data/datasets/aa1ucgmbua0cgflz2fodq?locale=en (accessed on 14 May 2024).

- Rozkrut, D. (Ed.) Statistical Yearbook of Agriculture and Rural Areas, Central Statistical Office; Statistical Publishing Establishment, Zakład Wydawnictw Statystycznych: Warszawa, Poland, 2023; ISSN 2080-8798. [Google Scholar]

- Dmochowska, H. (Ed.) Statistical Yearbook of Agriculture and Rural Areas, Central Statistical Office, 2008th ed.; Zakład Wydawnictw Statystycznych, Statistical Publishing Establishment: Warszawa, Poland, 2008; ISSN 1895-121X. [Google Scholar]

- Szajner, P. Rynek Mleka—Stan i Perspektywy nr 35, Analizy Rynkowe, IERiGŻ, 2006; IERiGŻ-PIB: Warszawa, Poland, 2006; Volume 35. [Google Scholar]

- Szajner, P. Rynek Mleka—Stan i Perspektywy nr 65, Analizy Rynkowe, IERiGŻ, 2023; IERiGŻ-PIB: Warszawa, Poland, 2023; Volume 65. [Google Scholar]

- Szajner, P. Rynek Mleka—Stan i Perspektywy nr 63, Analizy Rynkowe, IERiGŻ, 2022; IERiGŻ-PIB: Warszawa, Poland, 2022; Volume 63. [Google Scholar]

- Szajner, P. Rynek Mleka—Stan i Perspektywy nr 51, Analizy Rynkowe; IERiGŻ-PIB: Warszawa, Poland, 2016; Volume 51. [Google Scholar]

- Litwińczuk, Z.; Grodzki, H. The state of cattle breeding and raising in Poland and factors determining the development of this sector. Przegląd Hod. 2014, 82, 1–5. [Google Scholar]

- Jarosz, D. The Collectivization of Agriculture in Poland. In The Collectivization of Agriculture in Communist Eastern Europe Comparison and Entanglements; Iordachi, C., Bauerkamper, A., Eds.; Central European University Press: Budapest, Hungary, 2014; pp. 113–146. [Google Scholar]

- Banski, J. Changes in agricultural land ownership in Poland in the period of the market economy. Agric. Econ. (Zemědělská Ekon.) 2011, 57, 93–101. [Google Scholar] [CrossRef]

- Dries, L.; Fałkowski, J.; Malak-Rawlikowska, A.; Milczarek-Andrzejewska, D. Public policies and private initiatives in transition: Evidence from the Polish dairy sector. Postcommunist Econ. 2011, 23, 219–236. [Google Scholar] [CrossRef]

- Chloupkova, J.; Svendsen, G.L.H.; Svendsen, G.T. Building and destroying social capital: The case of cooperative movements in Denmark and Poland. Agric. Human. Values 2003, 20, 241–252. [Google Scholar] [CrossRef]

- Kołodziejczak, A. Changes in Ownership and Production Structure of Agriculture. In Three Decades of Polish Socio-Economic Transformations; Economic Geography; Churski, P., Kaczmarek, T., Eds.; Springer Nature: Cham, Switzerland, 2022; pp. 171–196. [Google Scholar] [CrossRef]

- Szymańska, E.J. Zmiany struktury agrarnej na polskiej wsi w latach 1918–2018. Zesz. Wiej. 2021, 27, 31–58. [Google Scholar] [CrossRef]

- Dmochowska, H. (Ed.) Rocznik Statystyczny Rolnictwa i Obszarów Wiejskich, 2009.; Zakład Wydawnictw Statystycznych, Statistical Publishing Establishment: Warszawa, Poland, 2009; ISSN 2080-8798. [Google Scholar]

- Ziętara, W. Szanse i zagrożenia rozwoju wielkoobszarowych przedsiębiorstw rolnych. In Przekształcenia Własnościowe w Rolnictwie, 30 Lat Doświadczeń i Perspektywy; CEDEWu: Warszawa, Poland, 2023. [Google Scholar]

- Bórawski, P.; Gotkiewicz, W.; Bełdycka-Bórawska, A.; Szymańska, E.; Brelik, A.; Harper, J.; Dunn, J. Changes in Grassland and Their Impact on Milk Production in Poland in the Context of Environmental Protection. Pol. J. Environ. Stud. 2020, 29, 1567–1578. [Google Scholar] [CrossRef]

- Bortacki, P. Impact of milking frequency on yield, chemical composition and quality of milk in high producing dairy herd. Mljekarstvo 2017, 67, 226–230. [Google Scholar] [CrossRef]

- Brzozowski, M.P.; Piwczyński, D.; Sitkowska, B.; Bogucki, M.; Sawa, A. The impact of introduction of an automatic milking system on production traits in polish holstein-friesian cows. Anim. Sci. Pap. Rep. 2020, 37, 49–59. [Google Scholar]

- Litwińczuk, Z.; Barłowska, J. Populacja bydła mlecznego w Polsce i jej przydatność dla mleczarstwa. Przegląd Hod. 2015, 4, 3–10. [Google Scholar]

- Łączyński, A.; Główny Urząd Statystyczny (GUS). Powszechny Spis Rolny 2020: Charakterystyka Gospodarstw Rolnych w 2020 r. = The Agricultural Census 2020: Characteristics of Agricultural Holdings in 2020; Główny Urząd Statystyczny: Warsaw, Poland, 2022. [Google Scholar]

- Bocian, M.; Osuch, D.; Smolik, A. Parametry Techniczno-Ekonomiczne Parametry Techniczno-Ekonomiczne Według Grup Gospodarstw Rolnych Uczestniczących w Polskim FADN w 2021 Roku; IERIGŻ-PIB: Warsaw, Poland, 2023; Available online: https://fadn.pl/wp-content/uploads/2023/06/PTE_2021.pdf (accessed on 1 May 2024).

- Goraj, L.; Bocian, M.; Osuch, D.; Smolik, A. Parametry Techniczno-Ekonomiczne Według Grup Gospodarstw Rolnych Uczestniczących w Polskim FADN w 2008 Roku; IERIGŻ: Warsaw, Poland, 2010. [Google Scholar]

- Szajner, P. Rynek Mleka—Stan i Perspektywy nr 66. Analizy Rynkowe, IERiGŻ, 2006; IERiGŻ-PIB: Warszawa, Poland, 2024; Volume 66. [Google Scholar]

- Drews, J.; Czycholl, I.; Junge, W.; Krieter, J. An evaluation of efficiency in dairy production using structural equation modelling. J. Agric. Sci. 2018, 156, 996–1004. [Google Scholar] [CrossRef]

- Paudyal, S.; Maunsell, F.P.; Richeson, J.T.; Risco, C.A.; Donovan, D.A.; Pinedo, P.J. Rumination time and monitoring of health disorders during early lactation. Animal 2018, 12, 1484–1492. [Google Scholar] [CrossRef]

- Ambriz-Vilchis, V.; Jessop, N.S.; Fawcett, R.H.; Shaw, D.J.; Macrae, A.I. Comparison of rumination activity measured using rumination collars against direct visual observations and analysis of video recordings of dairy cows in commercial farm environments. J. Dairy. Sci. 2015, 98, 1750–1758. [Google Scholar] [CrossRef]

- Heinrichs, A.J.; Heinrichs, B.S.; Cavallini, D.; Fustini, M.; Formigoni, A. Limiting total mixed ration availability alters eating and rumination patterns of lactating dairy cows. JDS Commun. 2021, 2, 186–190. [Google Scholar] [CrossRef]

- Cavallini, D.; Mammi, L.M.E.; Biagi, G.; Fusaro, I.; Giammarco, M.; Formigoni, A.; Palmonari, A. Effects of 00-rapeseed meal inclusion in Parmigiano Reggiano hay-based ration on dairy cows’ production, reticular pH and fibre digestibility. Ital. J. Anim. Sci. 2021, 20, 295–303. [Google Scholar] [CrossRef]

- Buonaiuto, G.; Palmonari, A.; Ghiaccio, F.; Visentin, G.; Cavallini, D.; Campidonico, L.; Formigoni, A.; Mammi, L.M.E. Effects of complete replacement of corn flour with sorghum flour in dairy cows fed Parmigiano Reggiano dry hay-based ration. Ital. J. Anim. Sci. 2021, 20, 826–833. [Google Scholar] [CrossRef]

- Cavallini, D.; Mammi, L.M.E.; Buonaiuto, G.; Palmonari, A.; Valle, E.; Formigoni, A. Immune-metabolic-inflammatory markers in Holstein cows exposed to a nutritional and environmental stressing challenge. J. Anim. Physiol. Anim. Nutr. 2021, 105, 42–55. [Google Scholar] [CrossRef]

- Felini, R.; Cavallini, D.; Buonaiuto, G.; Bordin, T. Assessing the impact of thermoregulatory mineral supplementation on thermal comfort in lactating Holstein cows. Vet. Anim. Sci. 2024, 24, 100363. [Google Scholar] [CrossRef]

- Hogan, C.; Kinsella, J.; O’Brien, B.; Markey, A.; Beecher, M. Estimating the effect of different work practices and technologies on labor efficiency within pasture-based dairy systems. J. Dairy. Sci. 2022, 105, 5109–5123. [Google Scholar] [CrossRef] [PubMed]

| Levels | Structure of Factors | |||

|---|---|---|---|---|

| Level 1 | Nation’s competitiveness | |||

| Level 2 | industry competitiveness | other factors | ||

| Level 3 | firm or farm competitiveness | other factors | ||

| Level 4 | firm or farm productivity and efficiency | other factors | ||

| Specification | Years | ||||

|---|---|---|---|---|---|

| 2005 | 2010 | 2015 | 2020 | 2022 | |

| Agricultural market output total [mln PLN] | 42,907.0 | 59,357.1 | 74,202.7 | 92,499.5 | 143,049.7 |

| Index (2005 = 100) | 100.0 | 138.3 | 172.9 | 215.6 | 333.4 |

| Crop production [mln PLN] | 16,605.6 | 26,116.3 | 30,815.4 | 37,670.0 | 58,037.2 |

| Index (2005 = 100) | 100.0 | 157.3 | 185.6 | 226.9 | 349.5 |

| Animal production [mln PLN] | 26,301.4 | 33,240.8 | 43,387.3 | 54,828.7 | 85,012.4 |

| Index (2005 = 100) | 100.0 | 126.4 | 165.0 | 208.5 | 323.2 |

| Cows’ milk output [mln PLN] | 8475.3 | 10,691.1 | 12,212.4 | 16,911.4 | 29,088.9 |

| Index (2005 = 100) | 100.0 | 126.1 | 144.1 | 199.5 | 343.2 |

| Share of animal output in total output. [%] | 61.3 | 56.0 | 58.5 | 58.8 | 59.4 |

| Share of cows’ milk output in animal output [%] | 32.2 | 32.1 | 28.1 | 30.8 | 34.2 |

| Specification | Years | ||||

|---|---|---|---|---|---|

| 2005 | 2010 | 2015 | 2020 | 2022 | |

| In the volume of milk equivalent [thousand tones] | |||||

| Export | 2435.4 | 2314.2 | 3984.0 | 4730.0 | 4785.0 |

| Import | 259.0 | 870.6 | 1587.0 | 2100.0 | 2225.0 |

| Net saldo | 2176.4 | 1443.6 | 2397.0 | 2630.0 | 2560.0 |

| Share of export in production (%) | 18.1 | 16.9 | 30.2 | 31.8 | 31.3 |

| Self-sufficiency ratio (%) | 120.1% | 112.6 | 122.2 | 121.5 | 120.2 |

| In value [mln euro] | |||||

| Export | 899.6 | 1208.1 | 1650.4 | 2316.9 | 3611.3 |

| Import | 146.9 | 430.3 | 793.9 | 1113.7 | 1774.3 |

| Net saldo | 752.7 | 777.8 | 856.5 | 1203.2 | 1837.0 |

| Index of export in value, 2005 = 100 | 100.0 | 134.3 | 183.4 | 257.5 | 401.4 |

| Index of trade saldo in value, 2005 = 100 | 100.0 | 103.3 | 113.8 | 159.8 | 244.1 |

| Countries | Size of Dairy Cow Herd per Farm (Units) | Index 2005 = 100 | Av. Milk Yield per Cow kg/Year | Index 2005 = 100 | ||||

|---|---|---|---|---|---|---|---|---|

| 2005 | 2010 | 2016 | 2020 | 2005 | 2020 | |||

| Germany | 38.4 | 46.4 | 61.8 | 72.4 | 188.7 | 6717 | 8853 | 116 |

| France | 37.4 | 45.0 | 57.1 | 62.0 | 165.9 | 6353 | 6860 | 108 |

| Netherlands | 60.9 | 74.6 | 97.5 | 101.3 | 166.3 | 7567 | 8323 | 110 |

| Italy | 30.5 | 35.2 | 37.7 | 53.7 | 176.1 | 5900 | 6324 | 107 |

| Poland | 3.9 | 5.9 | 9.0 | 12.7 | 325.6 | 4178 | 6788 | 162 |

| Austria | 9.8 | 11.3 | 17.6 | 19.3 | 197.1 | 5811 | 6784 | 117 |

| Czech Rep. | 65.0 | 122.9 | 128.6 | 158.1 | 243.3 | 6385 | 8853 | 139 |

| Slovakia | 14.4 | 24.5 | 30.9 | 39.3 | 274.1 | 5693 | 7188 | 126 |

| Group by Cows Number | 2008 | 2021 | ||||||

|---|---|---|---|---|---|---|---|---|

| Farm Income [th. PLN] | Opportunity Cost of Own Labour [th. PLN] | Opportunity Cost of Own Land [th. PLN] | Corrected Competitiveness Index | Farm Income [th. PLN] | Opportunity Cost of Own Labour [th. PLN] | Opportunity Cost of Own Land [th. PLN] | Corrected Competitiveness Index | |

| (1) <5 | 11.28 | 34.27 | 1.33 | 0.32 | 16.85 | 62.93 | 5.74 | 0.25 |

| (2) 5–9 | 16.75 | 38.17 | 2.20 | 0.41 | 41.86 | 73.41 | 6.40 | 0.52 |

| (3) 10–14 | 32.09 | 41.60 | 3.16 | 0.72 | 70.72 | 78.22 | 8.30 | 0.82 |

| (4) 15–19 | 44.96 | 44.58 | 3.59 | 0.93 | 105.18 | 82.96 | 9.99 | 1.13 |

| (5) 20–29 | 81.16 | 45.52 | 4.45 | 1.62 | 147.14 | 87.62 | 12.34 | 1.47 |

| (6) 30–39 | 105.76 | 47.73 | 6.17 | 1.96 | 225.25 | 92.10 | 14.64 | 2.11 |

| (7) ≥40 | 214.36 | 53.80 | 8.54 | 3.44 | 435.94 | 99.41 | 20.88 | 3.62 |

| Farm Groups by Number of Cows | 2008 | 2021 | ||||||

|---|---|---|---|---|---|---|---|---|

| Total Production [th. PLN] | Subsidies [th. PLN] | Subsidies [% of Production] | ICRM * [th. PLN] | Total Production [th. PLN] | Subsidies [th. PLN] | Subsidies [% of Production] | ICRM * [th. PLN] | |

| (1) <5 | 24.8 | 8.1 | 33% | −24.3 | 40.3 | 18.8 | 47% | −51.8 |

| (2) 5–9 | 45.1 | 13.3 | 29% | −23.6 | 82.3 | 28.2 | 34% | −38.0 |

| (3) 10–14 | 74.9 | 17.6 | 24% | −12.7 | 137.1 | 39.4 | 29% | −15.8 |

| (4) 15–19 | 111.7 | 21.7 | 19% | −3.2 | 201.7 | 45.5 | 23% | 12.2 |

| (5) 20–29 | 171.5 | 27.5 | 16% | 31.2 | 301.1 | 58.6 | 19% | 47.2 |

| (6) 30–39 | 254.6 | 35.4 | 14% | 51.9 | 466.5 | 70.3 | 15% | 118.5 |

| (7) ≥40 | 458.6 | 64.4 | 14% | 152.0 | 968.6 | 98.1 | 10% | 315.7 |

| Farm Groups by Number of Cows | 2008 | 2021 | ||||||

|---|---|---|---|---|---|---|---|---|

| Total Labour [h] | Rented Labour [h] | Own Labour [h] | Own Labour [h/Person *] | Total Labour [h] | Rented Labour [h] | Own Labour [h] | Own Labour [h/Person *] | |

| (1) <5 | 3074 | 0 | 3074 | 1593 | 2926 | 0 | 2926 | 1407 |

| (2) 5–9 | 3434 | 21 | 3413 | 1504 | 3413 | 0 | 3413 | 1544 |

| (3) 10–14 | 3774 | 42 | 3731 | 1548 | 3646 | 21 | 3625 | 1626 |

| (4) 15–19 | 4049 | 64 | 3986 | 1601 | 3880 | 42 | 3837 | 1705 |

| (5) 20–29 | 4198 | 127 | 4070 | 1590 | 4113 | 42 | 4070 | 1754 |

| (6) 30–39 | 4685 | 424 | 4261 | 1658 | 4367 | 85 | 4282 | 1784 |

| (7) ≥40 | 5766 | 954 | 4812 | 1683 | 5130 | 509 | 4622 | 1812 |

| Farm Group by Number of Cows | 2008 | 2021 | ||||||

|---|---|---|---|---|---|---|---|---|

| Total Farmland [ha] | Rented Farmland [ha] | Own Farmland [ha] | Own Farmland per Person [ha/Person *] | Total Farmland [ha] | Rented Farmland [ha] | Own Farmland [ha] | Own Farmland per Person [ha/Person *] | |

| (1) <5 | 7.76 | 0.90 | 6.86 | 3.55 | 12.42 | 1.52 | 10.90 | 5.24 |

| (2) 5–9 | 13.92 | 2.59 | 11.33 | 4.99 | 14.69 | 2.54 | 12.15 | 5.50 |

| (3) 10–14 | 20.01 | 3.71 | 16.30 | 6.76 | 20.32 | 4.58 | 15.74 | 7.06 |

| (4) 15–19 | 24.90 | 6.40 | 18.50 | 7.43 | 25.10 | 6.15 | 18.95 | 8.42 |

| (5) 20–29 | 31.99 | 9.06 | 22.93 | 8.96 | 32.21 | 8.80 | 23.41 | 10.09 |

| (6) 30–39 | 44.31 | 12.52 | 31.79 | 12.37 | 39.91 | 12.13 | 27.78 | 11.58 |

| (7) ≥40 | 68.66 | 24.62 | 44.04 | 15.40 | 62.45 | 22.83 | 39.62 | 15.54 |

| Group by Cows Number | Estimated Share (2021) | Own Labour Productivity vs. Opportunity Cost of Labour | Own Farmland Productivity vs. Opportunity Cost of Farmland | |||

|---|---|---|---|---|---|---|

| In Milk Production | In Milk Deliveries to Dairies | 2008 | 2021 | 2008 | 2021 | |

| (1) <5 | ~10% | ~3–5% | 0.7 | 0.6 | 18.6 | 7.0 |

| (2) 5–9 | 1.2 | 1.1 | 20.5 | 12.8 | ||

| (3) 10–14 | ~30% | ~25–27% | 1.8 | 1.8 | 23.7 | 16.5 |

| (4) 15–19 | 2.5 | 2.4 | 31.1 | 20.2 | ||

| (5) 20–29 | 3.8 | 3.4 | 38.6 | 24.4 | ||

| (6) 30–39 | ~60% | ~70% | 5.3 | 5.1 | 41.3 | 31.9 |

| (7) ≥40 | 8.5 | 9.7 | 53.7 | 46.4 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ziętara, W.; Pietrzak, M.; Malak-Rawlikowska, A. Polish Dairy Farm Transformations and Competitiveness 20 Years after Poland’s Accession to the European Union. Animals 2024, 14, 2013. https://doi.org/10.3390/ani14132013

Ziętara W, Pietrzak M, Malak-Rawlikowska A. Polish Dairy Farm Transformations and Competitiveness 20 Years after Poland’s Accession to the European Union. Animals. 2024; 14(13):2013. https://doi.org/10.3390/ani14132013

Chicago/Turabian StyleZiętara, Wojciech, Michał Pietrzak, and Agata Malak-Rawlikowska. 2024. "Polish Dairy Farm Transformations and Competitiveness 20 Years after Poland’s Accession to the European Union" Animals 14, no. 13: 2013. https://doi.org/10.3390/ani14132013