1. Introduction

In recent times, continuing and accelerating environmental degradation has become a concern in society, politics, and business alike (

Revell et al. 2010). The rising consumer concern for environmental issues, especially in the younger generation, e.g., “Fridays for Future” (

von Wehrden et al. 2019) and stricter government regulations are creating a major challenge for businesses to become more responsible with their business operations (

Cabot et al. 2009).

Nonetheless, profitability is viewed as the primary output and concern for business (

Kolstad 2007). While the financial benefits of some sustainability topics are clear, e.g., reduction of costs by limiting energy demand, financial benefits of investments in green technology and processes are not as clear and underlie uncertainty (

Ball 2011).

As a result, managers are tasked with balancing trade-offs between profitability and sustainable value creation.

Epstein et al. (

2015) found that managers choose profitability over sustainability whenever they are in conflict (

Epstein et al. 2015). Moreover, a study analyzing 400 companies found that managers readily forego long-term value creation in order to meet short-term targets (

Graham et al. 2005). As such, short-term thinking in companies still has a big influence (

Bansal and DesJardine 2014) and is in apparent conflict with sustainability of which benefits accrue over the long-term (

Aragon-Correa et al. 2017).

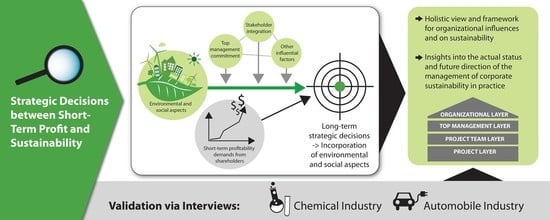

The question arises as to which factors influence sustainability in organizations and make them decide in favor of short-term profit or sustainability, respectively. As such, the following study sheds light on key factors that influence sustainability in an organization. As a tool for analysis, a conceptual framework mapping the factors to areas within an organization was developed and later validated and expanded using qualitative data analysis.

1.1. Aim and Approach

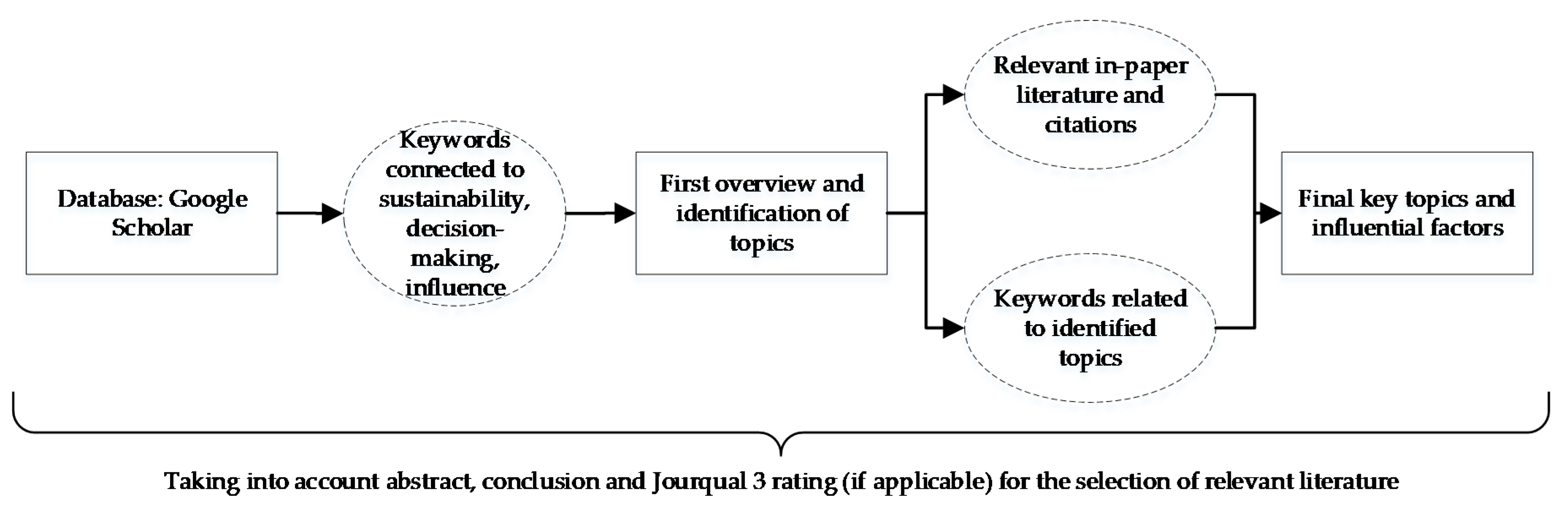

Current sustainability literature predominantly research areas that deal with explaining the benefits of sustainability and their measurement, the strategic role in organizations and managerial practices as well as other factors that influence decisions and sustainable performance. Research has identified several factors that might impact sustainable decision-making and analyzed them individually. Therefore, the following study aims to decrease the research gap and draw existing literature together to form a holistic view on influential factors.

For this purpose, the central research question that is answered is how managers and companies are perceiving key influential factors on sustainability. Whenever possible, first impulses and results toward management of these factors and their inter-relationships are provided.

The first step is to lay the conceptual groundwork regarding sustainability. During this step, a basic understanding of sustainability and the underlying challenge of short-term profit and sustainability consolidation is established. Furthermore, influential factors are outlined and briefly described. Moreover, the analysis framework will be set up concluding the theoretical background.

Hereafter, with the help of semi-structured expert interviews in selected companies from the chemical and automotive industry, influential factors on sustainability will be analyzed in a qualitative study. The chemical and automobile industry were chosen due to their relevance in the context of sustainability. Due to the increased importance of environmental developments (

Revell et al. 2010) the underlying study will mainly focus on environmental sustainability in organizations. However, sustainability also encompasses the social dimension and as such, it will not be left out here.

Interview analysis is based on an approach consisting of descriptive coding as well as pattern coding. Subsequently, findings are compared to each other as well as cross-industry, where applicable. Afterwards, the findings are discussed and analyzed within the context of the existing literature. The identified influential factors are highlighted using the developed framework.

Finally, the study concludes by highlighting main influencing factors for sustainability and related decision-making in organizations. Furthermore, limitations of the study and recommendations for future research are given.

1.2. Research Significance

The term “sustainability” has become the business term of the 21st century. To prosper in the 21st century, businesses must enhance and at the same time balance their economic, social, and environmental performance. The same holds true for academic research. Numerous studies on the topic of sustainability and CSR have been conducted (

Galpin et al. 2015). While most of them have dealt with analyzing the link between sustainability and financial performance (

Epstein and Roy 2003) as well as benefits and motivations of sustainability (

Berns et al. 2009), recent research has aimed at analyzing how companies can integrate sustainability into their decision-making (

Alexander et al. 2014).

Some studies highlight the role of “Stakeholder Theory” in decision-making and the importance of stakeholders in the management of sustainability (

Hörisch et al. 2014), while others postulate new models to evaluate the benefits of sustainability and create a business case for sustainability (

Cabot et al. 2009). Furthermore, it is suggested that top-managerial commitment plays a vital role for greater sustainable performance (

Walker et al. 2015). However, while the studies are certainly correct in researching these areas as they are evidently relevant for sustainability, research must look at influential factors in an integrative way since they have a combined effect on sustainability rather than considering them in isolation.

Consequently, there is a need to develop a conceptual framework that summarizes and gives a holistic view on influential factors for sustainability in organizations. The existing literature has hardly explored such a holistic view. Thus, this research is a novel contribution to academic research and managerial practice and supports the understanding of sustainability from a company’s perspective. However, it should be noted that the sample size is limited and thus only a limited generalizability is possible.

3. Results

The following section will present the main results from the interviews and will primarily follow the logic of the developed framework and the four layers.

The results will be separated according to industries and highlighted with the help of figures and tables. It should be noted again that responses are mainly from the chemical industry. This gives us a well-founded basis for this industry whereas the two responses from the automotive industry mainly serve as a comparison.

The introductory questions (1–5) aimed at clarifying the position of the interviewee and analyzing the general situation of CS in the respective company while the concluding questions 16 and 17 aimed at getting last feedback on the discussed factors. Detailed results will not be presented here, but can be viewed in the

Supplementary Materials (see

Tables S1–S3). Generally, the interview partners are holding various sustainability-related functions in their companies. The majority of interview partners confirm that sustainability is both aligned with company strategy and important for top management, but only a minority report on generated competitive advantages from sustainability.

3.1. Organizational Layer

The organizational level covers factors that act on a higher level and impact the whole organization (questions 6 and 7).

Question 6 addressed the biggest drivers of sustainability. Several different drivers within the chemical industry were mentioned and are detailed in

Figure 3.

Overall, many drivers for sustainability were mentioned. Meeting sustainability business opportunities and economic performance were mentioned most but only four times overall. Interview partners also mentioned broad conceptual topics such as company culture or responsibility, as well as many other important drivers.

The automotive industry results are shown in

Figure 4. Both interviewees see customer demands as the most important drivers.

Question 7 addressed the influence of the financial situation of the company and the influence of local politics or regulatory framework differences on sustainability. Detailed results are presented in

Table 5.

Most companies consistently do not perceive a dependence of sustainability on the financial situation of the company. Some argue that sustainability is a core competence and as such, it contributes to company success to a great degree and cannot be ignored even in times of lower economic growth or decline. CS projects should also always be economically attractive.

Companies 4, 7, 10, and 13 see a small dependence of sustainability on the financial situation of the company, e.g., for products in very competitive fields or for projects with limited financial return. In these cases, sustainability projects might be discarded due to financial reasons.

Company 2 (similar statements were made by companies 7 and 10) sees a stronger dependence on the financial situation stating that it is hard to take decisions for sustainability when it is about the survival of the company and short-term profits are needed. Company 7 and 10 agree to this.

Regarding the influence of local politics and regulatory frameworks, most companies state that they either see no influence or only small influences on a local level, e.g., in specific local solutions or decision-making. Most companies state that they have global sustainability targets and strategy is uniform across countries and outweigh local conditions. The methodology of how each region arrives at their targets might be different due to local conditions.

Company 1, 4, and 14 see an influence of local politics on sustainability. They e.g., state that politics need to act carefully to not tax companies in Europe regarding CO

2 too strongly to prevent them from moving to other regions. Company 14 states that new sustainable processes are implemented in favorable regulation frameworks first (see

Table 5).

3.2. Top Management Layer

The top management level is covered by question 8 (see the

Supplementary Materials) with three sub-questions on commitment, functional diversity, and long-term view of top management.

Across industries and interview partners, the awareness for the importance of top management commitment and engagement and its positive impact on sustainability is high.

With respect to functional diversity of top management, almost all interview partners stated that their TMT is functionally diverse. Most companies state that functional diversity has a very positive effect on sustainability because it enables interdisciplinary discussions, is good for innovation and is required for sustainability.

Nonetheless, company 10 and 12 state that while TMT diversity is important eventually it is about the mindset of the people working for the company. Company 12 even gives an example of a sustainable company without functional diversity in the TMT. Furthermore, company 9 states that it is most important how diversity is employed, e.g., by selecting specific people for specific tasks and using different skills to the fullest degree.

Also, nearly all companies (except company 1) state that their TMT has a long-term view benefiting sustainability. Companies 7, 9, 10 and 11 explicitly state that both short-term and long-term views need to be balanced.

During the interviews, the factors in

Table 6 that influence the long-term perspective of the TMT on sustainability were mentioned.

3.3. Project Team Layer

The project team layer covers the aspect of employees and managers following the principle of profit maximization and how this principle could compromise longer-term sustainability targets.

Table 7 shows the interview results on the related question 9 (see the

Supplementary Materials).

Overall, companies recognize that seeking profit maximization as a principle can negatively influence sustainability targets and companies and their project teams need to address it.

Interview partners 6 and 10, state that profit maximization and sustainability is not necessarily a contradiction, even in the short-term. Sustainability always must be economical and thus, if the right projects are selected, profitability and sustainability go hand in hand. Similarly, company 1 sees a healthy exchange between profitability and sustainability views that contribute to overall success.

3.4. Project Layer

The project layer covers questions 10 to 13 (see the

Supplementary Materials) and addresses the project assessment and respective tools, timing of integration of sustainability aspects into projects and competition for resources.

Answers to those questions varied to a great degree regarding depth and as such only general results and interesting findings will be presented.

In general, project assessments are done via multiple different criteria of which sustainability aspects are one part. The detailed project assessment process depends on the project and company. In general, it can be said that financial factors are important, as well as meeting different sustainability criteria.

Overall, companies employ classic financial tools such as NPV or CBA to assess financials of a project. Interview partners state that assessing the financial benefits of sustainability is very difficult and companies usually only use calculation methods related to CO

2 emissions and energy consumption for which concrete numbers are easier to derive. Interview results varied to a great degree, for detailed results see

Table 8.

The business case of a project in the chemical industry is often not impacted directly but rather through a variety of qualitative sustainability criteria and sustainability assessments to meet boundary conditions and analysis of the specific situation. Companies also often employ sustainability-related portfolio management of at least the innovation portfolio. In the two responses from the automotive industry the business case is not influenced by sustainability in a particular way, but there are efforts to integrate sustainability more in the future.

With respect to competition between sustainability and other projects, interview partners from the chemical industry consistently stated that competition between projects is a general concept and sustainability is not in an especially advantageous or disadvantageous position as sustainability is an integral part of the majority of projects anyway.

Company 9 and 10 state that sustainability considerations facilitate taking better decisions overall. Company 4 states that the importance of sustainability is increasing and a high contribution to sustainability might be the reason for a project to be selected. For companies 9, 11 and 12, sustainability is just a given factor in many projects and interview partner 11 states that the competition is healthy between all projects.

On the other hand, company 8 states that sustainability projects might even be in a favorable position, which was not the case only one year ago.

The last question on the project layer covered the question on whether sustainability considerations are integrated already at the beginning of a project. All companies usually integrate sustainability considerations early in their project management processes. However, there are differences in which projects these considerations are integrated into (see also

Table 9). Consensus in the chemical industry is that sustainability aspects are integrated rather early in all projects, whereas for the two examples from the automotive industry this is done for mostly sustainability projects only.

3.5. Superordinate Influences

Superordinate influences are covered in questions 14 and 15 and address the general concepts of stakeholders and uncertainty. These concepts apply to multiple layers of the framework.

All interview partners are generally aware of the concept of stakeholders and the influence that stakeholders have on the organization. No significant differences between industries were detected. Most companies (9) conduct stakeholder analyses, e.g., materiality analyses to identify key topics and stakeholders. Three interview partners state that stakeholders are project or topic specific.

Regarding stakeholder importance, two companies perform in-depth analyses to identify the most important topics and stakeholders and three other companies do not conduct concrete stakeholder rankings. Another company plans to rate importance in leadership discussions in the future.

Table 10 gives an overview of received answers on most important stakeholders and their connection to the financial area and of existing different views on stakeholders between top management and other organizational levels (questions 14b and 14c).

The interview partners mostly state that stakeholders in and outside of the financial area are seen as equally important whereas in the two examples from the automotive industry, stakeholders are connected to the financial area to a greater degree.

There are also no or little differences in how the most important stakeholders are seen by different organizational levels in the company. These small differences could result from the TMT being closer to investors and shareholders, while operational departments are closer to customers, business partners and the external public.

Interestingly, interview partner 13 states that the majority of employees still consider the company primarily focused on generating profits, while the TMT has recognized sustainability as a success factor. This might result in a higher top-level commitment to sustainability as compared to the whole organization, a difference that has to be addressed and leveled out.

Besides the influence of external stakeholders, uncertainty in decision-making in complex fields is another overarching factor influencing sustainability in companies. Within both industries, uncertainty is a recognized and important topic. Five companies stated that projects with low risks are normally preferred, whereas the other interview partners stated that this is not necessarily the case and uncertain projects are conducted as well.

Both industries, chemical and automotive, work on options to mitigate uncertainty (see

Figure 5). Predominantly mentioned were a good balance between lower and higher risk projects as well as defining a long-term strategy with respective long-term strategic objectives. Other efforts include a change in approach by trying to implement a start-up mindset (company 5), adding specific higher risk projects, or efforts to quantify uncertainties e.g., by assuming future CO

2 prices (Company 9).

Initially, there was not a high awareness among the interviewees with respect to cognitive limitations and biases under uncertainty. After mentioning the status quo bias (preference for the current state under uncertainty) during the interview, three interview partners state that management is generally aware of this bias. In most cases, more detailed discussions revealed that in fact several measures are already in place to overcome cognitive biases (see

Figure 6).

Management skills and teamwork are mentioned as most important mitigation factors for uncertainty and were mentioned as countermeasures to cognitive limitations in general and the status quo bias specifically.

4. Discussion

Purpose of this study was to gain insights into the perception of relevant influential factors on sustainability and related decision-making in organizations. The interviewed sustainability managers confirmed that all factors identified in the previous sections were relevant and only very few additional factors were suggested. The following section will focus on the discussion of the interview results while keeping in mind limitations of this study and give suggestions for future research opportunities.

The discussion of the findings from

Section 4 with existing literature will mainly focus on the organizational, the project team and project layer within the framework, as well as discuss how companies are viewing and dealing with uncertainty as a relevant superordinate influence.

Influential factors like top management, cognitive limitations in general and stakeholders are identified as relevant topics in the context of sustainability also by the interview partners. These topics, however, already have a vast theoretical background and in most areas, results do not indicate new findings beyond information already contained in the literature.

Table 11 gives an overview of the responses on these factors that will not be discussed in detail here.

Initial interview questions analyzed the integration of sustainability in the companies of the interview partners. Results suggest that the chemical industry has already developed a strong focus on sustainability with well-established sustainability processes. Possibly, the long-term experience with focused safety, health and environmental management has supported this development (

Darkow and Gracht 2013).

As response to questions on relevant sustainability drivers a multitude of important drivers was mentioned. In line with theory, the external drivers, customers, investors, and politics were mentioned frequently as important drivers (

Lozano 2015). Interview partners in the chemical industry, however, frequently mention internal drivers as most important for their companies. Theory states that internal drivers elicit a more proactive view on CS (

Lozano 2015) suggesting that the chemical industry takes a more proactive stance on CS in comparison to the other industries which mainly consider external drivers (see examples from the automotive industry in this study). This can be also linked to the chemical industry in general facing strict government regulations, for example in the area of safety in large scale chemical production which has been a crucial topic and “license to operate” for the chemical industry for decades and will continue to be critical (

Darkow and Gracht 2013). On the other hand, the automotive industry has just recently been faced with stricter government regulation in the wake of the transition to electric mobility (

Verband der Automobilindustrie 2018). Theory suggests that once companies learned to keep up with regulations, the approach to CS becomes more proactive (

Nidumolu et al. 2009). This suggests that the chemical industry has become used to keeping up with regulation. Overall, external and internal drivers are highly important for sustainability in companies, but awareness and priorities seem to vary between industries.

Remarkably, the interview partners’ consensus is that sustainability does not critically depend on the financial situation the company is facing which is in contrast to theory which suggests a positive correlation between CSP and profitability (

Margolis et al. 2011;

Artiach et al. 2010). Companies in general state that in times of high profitability, companies continue investing into the most beneficial projects, while even in times of lower profitability sustainability is still seen as a success factor. Only two companies see disadvantages for sustainability projects in the case of very competitive markets and very high cost-pressure making further investments difficult and in the case of projects which are less optimal only looking at ROI.

This finding suggests that sustainability might have evolved as a core concept in industrial practice that is not compromised on even in times of less profitability.

Political frameworks in general are seen as an influential factor by the interview partners in line with theory. The mainly in Europe headquartered companies however mostly state that local political conditions only have a small influence on decision-making for sustainability as a global concept. One of the three companies suggesting a higher influence of local politics is from the Middle East, possibly suggesting that this might be viewed differently by companies headquartered in other regions and having their main assets there. Europe is a leader on environmental law with stringent policies in place (

Kelemen and Knievel 2015). As such, European companies are accustomed to these policies and comply with European law globally.

Another factor discussed with the interview partners were possible conflicts between short-term profit expectations and long-term sustainability targets which might hinder the implementation of sustainability projects (

Alexander 2007). Most interview partners mentioned this factor as relevant where two interviewees stated that when only the right projects are chosen this conflict would disappear.

To reconcile the compromise between short-term profitability and sustainability, theory suggests changing the selection criteria of projects to a more integrative view on environmental and social aspects (

Alexander 2007). Interestingly, the interviewed companies rating sustainability in generally very high do not yet mention that environmental or social dimensions for projects have been elevated on par with financial value.

The primary goal of companies is still generating profit, but many companies have developed several at least qualitative methods to integrate sustainability in an increasing variety of business processes. Furthermore, it is important to show long-term sustainability-related benefits being greater than short-term value. In this respect, an interesting factor mentioned by one interview is the importance of timing of sustainability projects to be closely linked to financial considerations. Researching the timing of integration of sustainability into financial frameworks could be an important contribution further progressing in the field of sustainability.

Dealing with uncertainty is perceived as an important topic by managers in the context of sustainability, its influence being evident by companies preferring certain projects over uncertain ones. Initiatives that have a high impact on CS tend to be longer-term and thus more uncertain in nature, interview partner 12 even calls it “bets on the future”. In line with theory, decision-making is more difficult in such long-term cases (

Retief et al. 2013).

According to theory, the most obvious choice in coping with uncertainty lies in gathering additional data (

Lipshitz and Strauss 1997). However, only interview partner 7 suggests this solution for sustainability. In contrast, it is argued that the data collection approach for sustainability is very resource intensive and needs to be selected well. In general, gathering additional data might not be the ideal method of reducing uncertainty in the context of CS, as the field itself and related uncertainties might be broader than in other projects. Any effort in data collection for CS must be well planned, focused and fit to the setup and direction of the company.

Companies most often mention a necessary balance between low-risk and high-risk projects and a long-term strategy (see

Figure 5). In theory, employing risk management to balance projects is crucial (

Olsson 2008). For example,

Collis (

1992) recommends four distinct approaches to handling uncertainty of which one approach is the “Insurance” approach, committing resources to multiple investments that would together bring a return under all possible outcomes (

Collis 1992). Results suggest that companies are in general certain that CS is increasing in importance and align their project portfolios according to sustainability. However, they are generally not sure in what way exactly and how fast sustainability developments will occur due to the high number of external contingencies. As such, companies indeed seem to take an “Insurance” approach in managing their project portfolios. This is also in line with interviewees stating that defining a long-term strategy is vital in managing uncertainty. Companies have recognized that sustainability will become a major factor for their business, but not yet how exactly and when they will be impacted.

In this regard, also prediction can play an important role, especially if it is founded on a realistic understanding of the future (

Collis 1992). Company 9, e.g., uses this approach by making assumptions on future CO

2 prices in different time-horizon projects and scenarios.

Uncertainty is also always present in transformations (

Perminova et al. 2008). Therefore, companies that are under (sustainability) transformations have to deal with uncertainties. Dealing with uncertainty is a key element of the sustainability management that must be accounted for during the setting of overall priorities but also on a lower working level, e.g., during project assessments.

In line with theory, companies are mainly still using classic financial appraisal tools. They state that quantifying sustainability benefits remains difficult and a challenge. Calculations in this area are mostly based on measurable factors such as CO

2 emission and energy consumption (see

Table 8). However, these factors are closely related to costs. In contrast there are benefits such as increased talent hiring, chances for higher margins, higher employee productivity that might be sustainability-related but are not accounted for in company business cases as of now. Companies increasingly recognize that sustainability benefits such as increased customer loyalty or reputation exist (

Aragon-Correa et al. 2017) and do play a role for their business.

Theory has outlined the need for new tools for assessing such business cases (

Epstein and Wisner 2001). In interviewed companies the business case is mostly influenced through a non-financial sustainability-related analysis, e.g., by product or product portfolio assessments or supplier reviews. Noteworthy to mention is that company 12 states that financial benefits of sustainability while complex can be measured and integrated into the business case, e.g., as energy cost or downstream savings; however, they still do not take employee satisfaction and similar factors into account in a financial way.

Business cases for sustainability have to be created and stronger links between ecological, social value and financial value established (

Schaltegger et al. 2012). Business must see CS as an opportunity with wide ranging benefits but must be able to communicate these cases effectively in the form of financial benefits to decision-makers. Companies are increasingly moving into this direction, especially in the chemical industry. Achieving a stronger link between sustainability and financials could substantially contribute to decreasing uncertainty of CS. How to achieve this best should be a topic of further research and is likely industry dependent. A study in the Brazilian beef industry was able to link qualitative benefits to a monetary value and could be an impulse for further research (

Whelan et al. 2017) and application in other industries.

One topic spanning multiple questions is the possible different status or perception between industries, for example in the case of drivers, stakeholder focus, the influence on business case, or in which projects sustainability considerations get integrated. This effect is not necessarily related to the industry itself but can rather be traced back to CSP where we see the chemical industry as a frontrunner based on the feedback we received on the introductory questions. This is also demonstrated by a great percentage of interviewed chemical companies represented in the FTSE4GOOD Europe index (

FTSE Russell n.d.). Furthermore, company 10 even states that the chemical industry has the role of an “enabler” that enables sustainable solutions in other market segments (see

Table 7, company 10).

Based on the input from the interview partners it is also possible to expand the initial conceptual framework (see

Figure 2) into the modified framework depicted in

Figure 7. The red squares indicate additional suggestions from the interview partners (

Table S3). The modified framework contains changes on organizational layer but also regarding counteracting on uncertainty of the project teams and project assessments. These changes show that sustainability integration and decision-making in industry has evolved beyond a theoretical approach and entered industrial practice.

Although it is very difficult to ascertain the relative strength of each factor it can be stated that interview partners find the top management layer and the organizational layer as most influential, which makes sense since the interplay of both sets the strategic course of the company.

The adapted framework gives further input for managerial application. It is possible to identify key topics and focus points relevant when managing CS in practice. The outlined dependencies might give valid information for CS strategy and the status of individual factors reflects current state and development of CS management. The following success factors for CS derived from results, discussion and theory can be outlined:

- -

Leading companies see CS from an opportunity’s perspective

- -

Sustainability needs to be a part of all business processes; the whole organization needs to be committed to and comfortable with CS including all employees

- -

CS needs to be tangible, expressed in concrete KPIs ideally with a direct connection to financials but also in the mind of people, e.g., comfortability with change

- -

Sustainability as a vital component of company strategy, even in times of economic downturn or lower profitability

- -

Managing the uncertainty surrounding long-term CS strategies by creating awareness and driving quantification in management processes is important

- -

Application of a holistic approach to CS

The developed framework can also give directions for managers especially in an early stage of CS. Companies in this study have already advanced in integrating sustainability in industrial practice.

Like any study, this study has inherent limitations. Firstly, overall completeness of the framework cannot be ensured since no completeness check was conducted in the literature search.

Moreover, as interview partners mainly come from large chemical companies, the results are relevant for this industry. The chemical industry seems highly influenced by sustainability considerations and to be a frontrunner in CS. The two interviews with the automotive industry give indications but are too few to allow for a comparison between industries. An extension of this study to other industries and smaller chemical companies (in comparison to the large companies interviewed in this study) is recommended.

Moreover, it was not possible to ensure that all interview partners held similar positions, which might contribute to an individually different perception of factors. In addition, due to the limited sample size results are not representative for complex organizational topics such as corporate sustainability.

Furthermore, the topic of CS is a much-researched topic and ensuring completeness of all relevant factors is almost impossible. Although the most relevant factors have been identified, it is likely that still additional factors exist (or might come up in the future) in the literature that was not discovered here. A continuous monitoring of influencing factors on sustainability in the literature is mandatory for this complex field.

Furthermore, the underlying study did not deal with any form of quantitative measurement of sustainable value in organizations. As such, a concrete number to compare between companies and industries is missing.

Another limitation is that the underlying study focused on the organization and business of a company from a project perspective. While results indicate that project structures are increasingly important, the analysis should still be applied also to non-project-based business processes with some interviewees even indicating that existing operations are also important.

The study identified some important avenues for research. As stated above, research should be expanded to cover the limitations in industry, company size and integrate the perspective of standard operations as well as investigate the suggestions by interview partners (marked red in

Figure 7). Especially interesting would be a full comparison to an industry with a lower CSP and establish learnings for less sustainable companies as well as avenues for improvement. Furthermore, expanding upon the qualitative results would be a quantitative study further cementing the role of the identified factors.

This study entails the discussion of which factors impact CS; however, it does not deal with concrete decision-making, which would ideally complement the existing framework as an additional layer or spanning through all layers. Researching this topic and integrating it into the framework would make for a substantial contribution to the framework and expand its managerial use significantly.

5. Conclusions

This study applies a holistic view on influential factors on sustainability in organizations using a framework approach aiming at analyzing how managers in industrial companies view key influential factors on sustainability. Previous literature was lacking a comprehensive and integrative view of sustainability in organizations linking all influential factors in a framework.

Regarding the research question on how managers and companies perceive key influential factors on sustainability, no simple answer can be given. There seems to be little disagreement between the interviewed companies about the relevance of identified influential factors. Although weight and relevance of the factors vary between companies influences on the organizational and top management layer stand out in terms of impact on sustainability. Moreover, this study was able to establish links between influential factors and its effect on framework layers. For example, on the organizational layer, the study revealed that the financial situation of the company is only relevant in very competitive markets, and that the influence of local regulation and perception of main sustainability drivers can depend on the geographic region and approach to CS, respectively.

Furthermore, perception of influential factors can be different between industries. This could trace back to the underlying CSP. The introductory questions suggest that overall sustainability seems to be a highly important topic in the chemical industry. Frontrunners have recognized that sustainability needs to play a role in all projects and stakeholders beyond the financial area need to be addressed. Furthermore, the perception of factors can of course vary between companies of the same industry.

One of the key topics identified in the context of sustainability is the management of uncertainty. Inherent to sustainability is its long-term scope and uncertainty which company 12 even calls “bets on the future”. There must be measures in place to mitigate uncertainty. In this regard, companies are currently lacking concrete KPIs to measure the benefits of sustainability and employ mostly qualitative tools or calculations for easily measurable KPIs for CO2 and energy usage to create business cases. There is potential in using more quantitative methods to better connect ecological and social value to classic financial value in order to reduce uncertainty and create business cases for sustainability that public companies need to advance their sustainability efforts.

In the context of this study, two contributions can be made. First, a framework was established and after the interviews expanded which underlines the importance of the influential factors in practice and provides necessary focal points for CS managers. In addition, the analysis of the results of the interviews provides helpful insights into the actual status and direction of sustainability management in multinational companies. In particular, for new sustainability managers the framework can give direction for the orientation of sustainability management and give indications which factors need to be addressed early and how they interrelate with each other.

Overall, sustainability and factors influencing it are becoming increasingly important for today’s business world as proven by the high perceived relevance of the influential factors for the interview partners. It is likely that perception and relevance of these factors will significantly broaden, gain further weight and continue to evolve together with further integration of sustainability as a business driver in organizations.