GIANN—A Methodology for Optimizing Competitiveness Performance Assessment Models for Small and Medium-Sized Enterprises

Abstract

:1. Introduction

2. GIANN Method

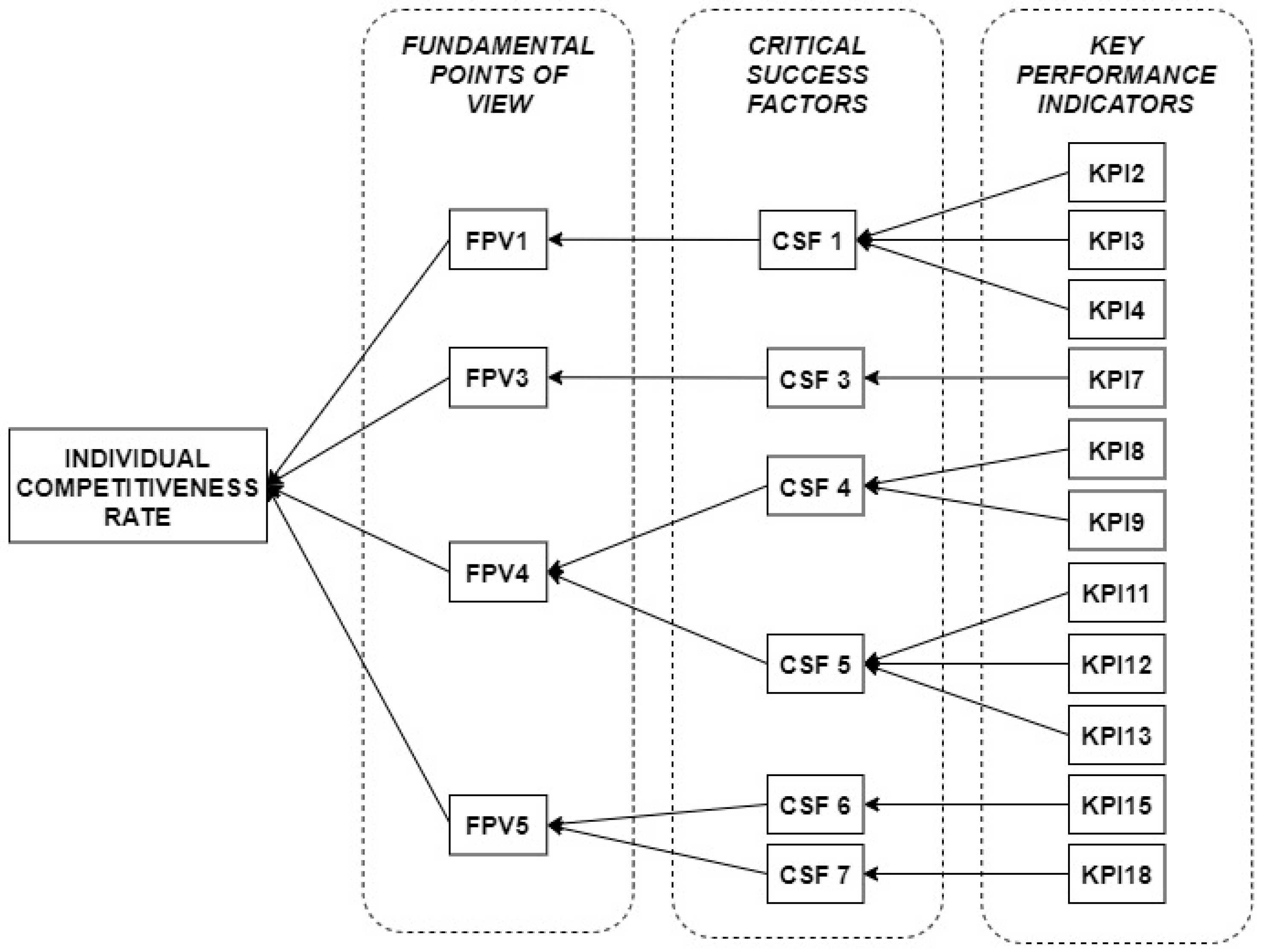

2.1. Stage 1—Integration of KPIs, CSfs, and FPVs

2.2. Stage 2—Data Collection

2.3. Stage 3—Calculation of Competitiveness Rates Using the MAUT Method

- LRRKPI: KPI local replacement rate;

- KPI: the value of KPI responses;

- k: number of KPIs within the CSF.

- LRRCSF: CSF local replacement rate;

- n: number of KPIs of the CSF;

- LRRKPI: KPIs’ local replacement rate;

- k: number of KPIs within the CSF;

- w: number of KPIs within the FPV.

- LRRFPV: FPV local replacement rate;

- n: number of CSFs within the FPV;

- LRRCSF: CSF local replacement rate;

- w: number of KPIs within the FPV;

- x: total number of KPIs.

- ICR: individual competitiveness rate;

- LRRFPV: FPV local replacement rate;

- n: number of FPVs.

2.4. Stage 4—Calculation of KPIs Information Gain

- E(S): general network entropy;

- n: number of elements;

- p: the probability of occurrence of the element p.

- G(S, A): attribute A information gain as a function of the set S;

- E(S): general network entropy;

- Sv: number of occurrences of the element p in attribute A;

- S: total number of occurrences in attribute A;

- E(Sv): individual element entropy.

2.5. Stage 5—Test Correlation by ANNs

- ICR: Individual competitiveness rate obtained by ANN;

- W0: Linear Node 0—Bias node 0;

- W: Linear Node—Node synaptic weight;

- S: Sigmoid Node—S function result.

- S: Node sigmoid—linear function result;

- w0: Node 1 sigmoid—Node 1 bias;

- wn: Node n sigmoid—Attribute xn synaptic weight;

- xn: x values (KPIs).

2.6. Stage 6—Withdraw the KPI with Less Information Gain

2.7. Stage 7—New Integration of KPIs, CSFs, and FPVs

2.8. Stage 8—Calculation of the New ICRs by MAUT

3. Case Study with Small and Medium-Sized Enterprises

3.1. KPIs’ Information Gain Ranking

3.2. Correlation Tests by ANN

3.3. New Integration of KPIs, CSFs, and FPVs

3.4. New Competitiveness Rates by MAUT

4. Discussion and Managerial Implications

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aktaş, Nadine, and Neslihan Demirel. 2021. A Hybrid Framework for Evaluating Corporate Sustainability Using Multi-Criteria Decision Making. Environment, Development and Sustainability 23: 15591–618. [Google Scholar] [CrossRef]

- Baierle, Ismael Cristofer, Jones Luis Schaefer, Miguel Afonso Sellitto, Leandro Pinto Fava, João Carlos Furtado, and Elpidio Oscar Benitez Nara. 2020. MOONA Software for Survey Classification and Evaluation of Criteria to Support Decision-Making for Properties Portfolio. International Journal of Strategic Property Management 24: 226–36. [Google Scholar] [CrossRef]

- Baierle, Ismael Cristofer, Julio Cezar Mairesse Siluk, Vinicius Jaques Gerhardt, Cláudia De Freitas Michelin, Álvaro Luiz Neuenfeldt, and Elpidio Oscar Benitez Nara. 2021. Worldwide Innovation and Technology Environments: Research and Future Trends Involving Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 229. [Google Scholar] [CrossRef]

- Baierle, Ismael Cristofer, Miguel Afonso Sellitto, Rejane Frozza, Jones Luís Schaefer, and Anderson Felipe Habekost. 2019. An Artificial Intelligence and Knowledge-Based System to Support the Decision-Making Process in Sales. South African Journal of Industrial Engineering 30: 17–25. [Google Scholar] [CrossRef]

- Bermudez-Edo, Maria, Payam Barnaghi, and Klaus Moessner. 2018. Analysing Real World Data Streams with Spatio-Temporal Correlations: Entropy vs. Pearson Correlation. Automation in Construction 88: 87–100. [Google Scholar] [CrossRef]

- Bhat, Shreeranga, E. V. Gijo, Anil Melwyn Rego, and Vinayambika S. Bhat. 2021. Lean Six Sigma Competitiveness for Micro, Small and Medium Enterprises (MSME): An Action Research in the Indian Context. TQM Journal 33: 379–406. [Google Scholar] [CrossRef]

- Carbone, Jared C., and Nicholas Rivers. 2020. The Impacts of Unilateral Climate Policy on Competitiveness: Evidence from Computable General Equilibrium Models. Review of Environmental Economics and Policy 11: 24–42. [Google Scholar] [CrossRef]

- Chytilova, Ekaterina, Siyka Demirova, and Marie Jurova. 2019. Key Performance Indicators the Providers of Logistic Services: Experience of Selected Companies. Paper presented at 2019 II International Conference on High Technology for Sustainable Development (HiTech), Sofia, Bulgaria, October 10–11. [Google Scholar]

- de Almeida, Adiel Teixeira. 2013. Processo de Decisão Nas Organizações. São Paulo: Atlas. [Google Scholar]

- de Moraes, Jaqueline, Jones Luís Schaefer, Jacques Nelson Corleta Schreiber, Johanna Dreher Thomas, and Elpidio Oscar Benitez Nara. 2019. Algorithm Applied: Attracting MSEs to Business Associations. Journal of Business and Industrial Marketing 35: 13–22. [Google Scholar] [CrossRef]

- e Costa, Carlos A. Bana, Leonardo Ensslin, Émerson C. Cornêa, and Jean-Claude Vansnick. 1999. Decision Support Systems in Action: Integrated Application in a Multicriteria Decision Aid Process. European Journal of Operational Research 113: 315–35. [Google Scholar] [CrossRef]

- Ensslin, Leonardo, Ademar Dutra, and Sandra R. Ensslin. 2000. MCDA: A Constructivist Approach to the Management of Human Resources at a Governmental Agency. International Transactions in Operational Research 7: 79–100. [Google Scholar] [CrossRef]

- Fetene, Besufekad N., Rajkumar Shufen, and Uday S. Dixit. 2018. FEM-Based Neural Network Modeling of Laser-Assisted Bending. Neural Computing and Applications 29: 69–82. [Google Scholar] [CrossRef]

- Fishburn, Peter C. 1970. Utility Theory for Decision Making. McLean: Research Analysis Corp. [Google Scholar]

- Gilsing, Rick, Anna Wilbik, Paul Grefen, Oktay Turetken, Baris Ozkan, Onat Ege Adali, and Frank Berkers. 2021. Defining Business Model Key Performance Indicators Using Intentional Linguistic Summaries. Software and Systems Modeling 20: 965–96. [Google Scholar] [CrossRef]

- Gupta, Shivam, Subhas C. Misra, Ned Kock, and David Roubaud. 2018. Organizational, Technological and Extrinsic Factors in the Implementation of Cloud ERP in SMEs. Journal of Organizational Change Management 31: 83–102. [Google Scholar] [CrossRef]

- Hemmat Esfe, Mohammad, Sayyid Majid Motallebi, and Davood Toghraie. 2022. Investigation the Effects of Different Nanoparticles on Density and Specific Heat: Prediction Using MLP Artificial Neural Network and Response Surface Methodology. Colloids and Surfaces A: Physicochemical and Engineering Aspects 645: 128808. [Google Scholar] [CrossRef]

- Hope, Jeremy, and Robin Fraser. 2013. Beyond Budgeting: How Managers Can Break Free from the Annual Performance Trap. Boston: Harvard Business Press. [Google Scholar]

- Immawan, Taufiq, Annisa Indah Pratiwi, and Winda Nur Cahyo. 2019. The Proposed Dashboard Model for Measuring Performance of Small-Medium Enterprises (SME). International Journal of Integrated Engineering 11: 167–73. [Google Scholar] [CrossRef]

- Ishizaka, Alessio, and Philippe Nemery. 2013. Multi-Criteria Decision Analysis: Methods and Software. Hoboken: John Wiley & Sons. [Google Scholar]

- Kang, Ningxuan, Cong Zhao, Jingshan Li, and John A. Horst. 2016. A Hierarchical Structure of Key Performance Indicators for Operation Management and Continuous Improvement in Production Systems. International Journal of Production Research 54: 6333–50. [Google Scholar] [CrossRef]

- Kaplan, Robert S., and David P. Norton. 1996. The Balanced Scorecard: Translating Strategy into Action. Boston: Harvard Business Press. [Google Scholar]

- Keeney, R. L., and H. Raiffa. 1976. Decisions with Multiple Objectives: Preferences and Value Tradeoffs. Cambridge: Cambridge University Press. [Google Scholar]

- Kim, Doyeong, Wongyun Oh, Jiyeong Yun, Jongyoung Youn, Sunglok Do, and Donghoon Lee. 2021. Development of Key Performance Indicators for Measuring the Management Performance of Small Construction Firms in Korea. Sustainability 13: 6166. [Google Scholar] [CrossRef]

- Kumar Pal, Ajay, and Saurabh Pal. 2013. International Journal of Computer Science and Mobile Computing Evaluation of Teacher’s Performance: A Data Mining Approach. International Journal of Computer Science and Mobile Computing 2: 359–69. [Google Scholar]

- Kwon, He Boong, Jooh Lee, and Kristyn N. White Davis. 2018. Neural Network Modeling for a Two-Stage Production Process with Versatile Variables: Predictive Analysis for above-Average Performance. Expert Systems with Applications 100: 120–30. [Google Scholar] [CrossRef]

- Laforest, Valérie, Gaëlle Raymond, and É. Piatyszek. 2013. Choosing Cleaner and Safer Production Practices through a Multi-Criteria Approach. Journal of Cleaner Production 47: 490–503. [Google Scholar] [CrossRef]

- Li, Pengpeng, Jiping Liu, An Luo, Yong Wang, Jun Zhu, and Shenghua Xu. 2022. Deep Learning Method for Chinese Multisource Point of Interest Matching. Computers, Environment and Urban Systems 96: 101821. [Google Scholar] [CrossRef]

- Liu, Zheming, Saixing Zeng, Daxin Sun, and Chi Ming Tam. 2022. How Does Transport Infrastructure Shape Industrial Competitiveness? A Perspective from Industry Dynamics. IEEE Transactions on Engineering Management 69: 1378–93. [Google Scholar] [CrossRef]

- Lu, Renzhi, Ruichang Bai, Zhe Luo, Junhui Jiang, Mingyang Sun, and Hai Tao Zhang. 2022. Deep Reinforcement Learning-Based Demand Response for Smart Facilities Energy Management. IEEE Transactions on Industrial Electronics 69: 8554–65. [Google Scholar] [CrossRef]

- Ly, Alexander, Maarten Marsman, and Eric Jan Wagenmakers. 2018. Analytic Posteriors for Pearson’s Correlation Coefficient. Statistica Neerlandica 72: 4–13. [Google Scholar] [CrossRef]

- Mendes, R. R. A., A. P. Paiva, R. S. Peruchi, P. P. Balestrassi, R. C. Leme, and M. B. Silva. 2016. Multiobjective Portfolio Optimization of ARMA–GARCH Time Series Based on Experimental Designs. Computers & Operations Research 66: 434–44. [Google Scholar] [CrossRef]

- Monte, Madson B.S., and Adiel T. de Almeida-Filho. 2016. A Multicriteria Approach Using MAUT to Assist the Maintenance of a Water Supply System Located in a Low-Income Community. Water Resources Management 30: 3093–106. [Google Scholar] [CrossRef]

- Nara, Elpidio Oscar Benitez, Diane Cristina Sordi, Jones Luís Schaefer, Jaques Nélson Corleta Schreiber, Ismael Cristofer Baierle, Miguel Afonso Sellitto, and João Carlos Furtado. 2019. Prioritization of OHS Key Performance Indicators That Affecting Business Competitiveness—A Demonstration Based on MAUT and Neural Networks. Safety Science 118: 826–34. [Google Scholar] [CrossRef]

- Ozkaya, Gokhan, Mehpare Timor, and Ceren Erdin. 2021. Science, Technology and Innovation Policy Indicators and Comparisons of Countries through a Hybrid Model of Data Mining and MCDM Methods. Sustainability 13: 694. [Google Scholar] [CrossRef]

- Rockart, John Fralick. 1982. The Changing Role of the Information Systems Executive: A Critical Success Factors Perspective. Sloan School of Management 24: 3–13. [Google Scholar]

- Rodrigues, Diogo, Radu Godina, and Pedro Espadinha da Cruz. 2021. Key Performance Indicators Selection through an Analytic Network Process Model for Tooling and Die Industry. Sustainability 13: 13777. [Google Scholar] [CrossRef]

- Santos, Murilo R., Luis C. Dias, Maria C. Cunha, and João R. Marques. 2022. Multicriteria Decision Analysis Addressing Marine and Terrestrial Plastic Waste Management: A Review. Frontiers in Marine Science 8: 2041. [Google Scholar] [CrossRef]

- Sarkar, Sobhan, Sammangi Vinay, Rahul Raj, Jhareshwar Maiti, and Pabitra Mitra. 2019. Application of Optimized Machine Learning Techniques for Prediction of Occupational Accidents. Computers and Operations Research 106: 210–24. [Google Scholar] [CrossRef]

- Schaefer, Jones Luís, Ismael Cristofer Baierle, Miguel Afonso Sellitto, Julio Cezar Mairesse Siluk, João Carlos Furtado, and Elpidio Oscar Benitez Nara. 2020. Competitiveness Scale as a Basis for Brazilian Small and Medium-Sized Enterprises. EMJ—Engineering Management Journal 33: 255–71. [Google Scholar] [CrossRef]

- Schaefer, Jones Luís, Julio Cezar Mairesse Siluk, and Patrícia Stefan de Carvalho. 2021. An MCDM-Based Approach to Evaluate the Performance Objectives for Strategic Management and Development of Energy Cloud. Journal of Cleaner Production 320: 128853. [Google Scholar] [CrossRef]

- Schaefer, Jones Luís, Julio Cezar Mairesse Siluk, and Patrícia Stefan de Carvalho. 2022. Critical Success Factors for the Implementation and Management of Energy Cloud Environments. International Journal of Energy Research 46: 13752–68. [Google Scholar] [CrossRef]

- Silva, Lucas Borges Leal da, Marcelo Hazin Alencar, and Adiel Teixeira de Almeida. 2022. A Novel Spatiotemporal Multi-Attribute Method for Assessing Flood Risks in Urban Spaces under Climate Change and Demographic Scenarios. Sustainable Cities and Society 76: 103501. [Google Scholar] [CrossRef]

- Silva Júnior, Claudio Roberto, Julio Cezar Mairesse Siluk, Alvaro Neuenfeldt Júnior, Matheus Francescatto, and Cláudiade Michelin. 2022. A Competitiveness Measurement System of Brazilian Start-Ups. International Journal of Productivity and Performance Management. ahead-of-print. [Google Scholar] [CrossRef]

- Soni, Gunjan, Satish Kumar, Raj V. Mahto, Sachin K. Mangla, M. L. Mittal, and Weng Marc Lim. 2022. A Decision-Making Framework for Industry 4.0 Technology Implementation: The Case of FinTech and Sustainable Supply Chain Finance for SMEs. Technological Forecasting and Social Change 180: 121686. [Google Scholar] [CrossRef]

- Swarnakar, Vikas, Amit Raj Singh, Jiju Antony, Anil Kr Tiwari, Elizabeth Cudney, and Sandra Furterer. 2020. A Multiple Integrated Approach for Modelling Critical Success Factors in Sustainable LSS Implementation. Computers and Industrial Engineering 150: 106865. [Google Scholar] [CrossRef]

- Villa, Agostino, and Teresa Taurino. 2018. From Industrial Districts to SME Collaboration Frames. International Journal of Production Research 56: 974–82. [Google Scholar] [CrossRef]

- WEKA. 2022. “WEKA”. Available online: https://www.cs.waikato.ac.nz/ml/weka/ (accessed on 29 December 2022).

- Wong, T. C., and Alan H. S. Chan. 2015. A Neural Network-Based Methodology of Quantifying the Association between the Design Variables and the Users Performances. International Journal of Production Research 53: 4050–67. [Google Scholar] [CrossRef]

- Wu, Zheng, Gerardo Flintsch, Adelino Ferreira, and Luís de Picado-Santos. 2012. Framework for Multiobjective Optimization of Physical Highway Assets Investments. Journal of Transportation Engineering 138: 1411–21. [Google Scholar] [CrossRef]

- Wu, Yunna, Yiming Ke, Ting Zhang, Fangtong Liu, and Jing Wang. 2018. Performance Efficiency Assessment of Photovoltaic Poverty Alleviation Projects in China: A Three-Phase Data Envelopment Analysis Model. Energy 159: 599–610. [Google Scholar] [CrossRef]

- Xu, Lu, Hai Yan Fu, Mohammad Goodarzi, Chen Bo Cai, Qiao Bo Yin, Ya Wu, Bang Cheng Tang, and Yuan Bin She. 2018. Stochastic Cross Validation. Chemometrics and Intelligent Laboratory Systems 175: 74–81. [Google Scholar] [CrossRef]

- Yadav, Sanjeev, Dixit Garg, and Sunil Luthra. 2020. Development of IoT Based Data-Driven Agriculture Supply Chain Performance Measurement Framework. Journal of Enterprise Information Management 34: 292–327. [Google Scholar] [CrossRef]

| Fundamental Point of View | Critical Success Factor | Key Performance Indicator |

|---|---|---|

| FPV1 RELIABILITY | CSF1 ORGANIZATIONAL STRATEGY | KPI1—Customer satisfaction indicator |

| KPI2—Indicator of the existence of price strategies of products according to the market | ||

| KPI3—Percentage of active customers indicator | ||

| KPI4—Customer loyalty indicator | ||

| FPV2 COST | CSF2 RESOURCES | KPI5—Reinvestment of profits in the enterprise indicator |

| KPI6—Raw material cost indicator | ||

| FPV3 FLEXIBILITY | CSF3 TRAINING AND EDUCATION | KPI7—Indicator of the use, by employees, of the personal protective equipment indicated for their function |

| FPV4 QUALITY | CSF4 MANAGEMENT AND LEADERSHIP | KPI8—Control of the enterprise working capital indicator |

| KPI9—Attracting new customers indicator | ||

| CSF5 PROCESSES | KPI10—Quality of products indicator | |

| KPI11—Indicator of warranty products returned by defects | ||

| KPI12—Machine availability indicator | ||

| KPI13—Production capacity utilization indicator | ||

| FPV5 SPEED | CSF6 PERFORMANCE MEASUREMENT | KPI14—Indicator of the order delivered in the combined period with the customer |

| KPI15—Customer complaints indicator | ||

| KPI16—Sales results indicator | ||

| KPI17—Employee productivity indicator | ||

| CSF7 MOTIVATION | KPI18—Employee attendance indicator |

| POSITION | KPI | INFORMATION GAIN AVERAGE |

|---|---|---|

| 1º | KPI11 | 1.072 ± 0.046 |

| 2º | KPI4 | 1.039 ± 0.038 |

| 3º | KPI15 | 0.935 ± 0.057 |

| 4º | KPI3 | 0.914 ± 0.034 |

| 5º | KPI18 | 0.900 ± 0.071 |

| 6º | KPI2 | 0.889 ± 0.035 |

| 7º | KPI7 | 0.888 ± 0.035 |

| 8º | KPI12 | 0.886 ± 0.040 |

| 9º | KPI8 | 0.880 ± 0.044 |

| 10º | KPI13 | 0.874 ± 0.052 |

| 11º | KPI9 | 0.815 ± 0.057 |

| 12º | KPI1 | 0.756 ± 0.055 |

| 13º | KPI6 | 0.738 ± 0.052 |

| 14º | KPI5 | 0.745 ± 0.041 |

| 15º | KPI17 | 0.731 ± 0.033 |

| 16º | KPI16 | 0.705 ± 0.040 |

| 17º | KPI14 | 0.563 ± 0.039 |

| 18º | KPI10 | 0.451 ± 0.059 |

| RANK | SME | ICR | SME | NEW ICR | RANK | SME | ICR | SME | NEW ICR |

|---|---|---|---|---|---|---|---|---|---|

| 1º | E67 | 5.000 | E67 | 5.000 | 35º | E1 | 4.000 | E4 | 3.818 |

| 2º | E60 | 4.944 | E60 | 4.909 | 36º | E35 | 4.000 | E29 | 3.818 |

| 3º | E65 | 4.722 | E65 | 4.727 | 37º | E42 | 4.000 | E53 | 3.818 |

| 4º | E45 | 4.722 | E10 | 4.636 | 38º | E61 | 4.000 | E30 | 3.818 |

| 5º | E54 | 4.667 | E45 | 4.636 | 39º | E47 | 3.944 | E33 | 3.818 |

| 6º | E10 | 4.611 | E62 | 4.636 | 40º | E4 | 3.944 | E55 | 3.818 |

| 7º | E68 | 4.611 | E9 | 4.545 | 41º | E34 | 3.944 | E72 | 3.818 |

| 8º | E62 | 4.556 | E68 | 4.455 | 42º | E20 | 3.889 | E1 | 3.636 |

| 9º | E46 | 4.500 | E54 | 4.455 | 43º | E29 | 3.889 | E20 | 3.636 |

| 10º | E52 | 4.500 | E7 | 4.364 | 44º | E49 | 3.889 | E23 | 3.636 |

| 11º | E56 | 4.500 | E46 | 4.364 | 45º | E64 | 3.889 | E24 | 3.636 |

| 12º | E9 | 4.444 | E52 | 4.364 | 46º | E69 | 3.889 | E39 | 3.636 |

| 13º | E51 | 4.444 | E56 | 4.364 | 47º | E11 | 3.889 | E43 | 3.636 |

| 14º | E57 | 4.444 | E57 | 4.364 | 48º | E33 | 3.833 | E47 | 3.636 |

| 15º | E27 | 4.389 | E27 | 4.273 | 49º | E32 | 3.833 | E50 | 3.636 |

| 16º | E22 | 4.333 | E5 | 4.182 | 50º | E18 | 3.833 | E11 | 3.545 |

| 17º | E7 | 4.278 | E22 | 4.182 | 51º | E39 | 3.833 | E18 | 3.545 |

| 18º | E38 | 4.278 | E51 | 4.182 | 52º | E43 | 3.833 | E3 | 3.545 |

| 19º | E12 | 4.222 | E2 | 4.091 | 53º | E8 | 3.778 | E64 | 3.545 |

| 20º | E26 | 4.222 | E16 | 4.091 | 54º | E14 | 3.778 | E8 | 3.455 |

| 21º | E59 | 4.222 | E38 | 4.091 | 55º | E25 | 3.778 | E17 | 3.455 |

| 22º | E5 | 4.222 | E59 | 4.091 | 56º | E50 | 3.778 | E69 | 3.364 |

| 23º | E63 | 4.222 | E63 | 4.091 | 57º | E31 | 3.667 | E13 | 3.364 |

| 24º | E53 | 4.167 | E70 | 4.091 | 58º | E3 | 3.611 | E14 | 3.364 |

| 25º | E2 | 4.167 | E12 | 4.000 | 59º | E15 | 3.611 | E21 | 3.364 |

| 26º | E16 | 4.167 | E26 | 4.000 | 60º | E21 | 3.611 | E25 | 3.364 |

| 27º | E41 | 4.111 | E41 | 4.000 | 61º | E48 | 3.611 | E15 | 3.273 |

| 28º | E70 | 4.111 | E42 | 4.000 | 62º | E13 | 3.556 | E31 | 3.273 |

| 29º | E72 | 4.111 | E61 | 4.000 | 63º | E17 | 3.500 | E19 | 3.273 |

| 30º | E23 | 4.056 | E34 | 4.000 | 64º | E19 | 3.444 | E71 | 3.273 |

| 31º | E24 | 4.056 | E32 | 3.909 | 65º | E71 | 3.444 | E48 | 3.091 |

| 32º | E30 | 4.056 | E35 | 3.909 | 66º | E66 | 3.389 | E66 | 3.091 |

| 33º | E40 | 4.056 | E40 | 3.909 | 67º | E44 | 3.333 | E44 | 3.000 |

| 34º | E55 | 4.056 | E49 | 3.909 |

| Initial Model | Optimized Model | |

|---|---|---|

| MAUT GCR | 4.066 | 3.893 |

| MAUT standard deviation | 0.376 | 0.459 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schaefer, J.L.; Tardio, P.R.; Baierle, I.C.; Nara, E.O.B. GIANN—A Methodology for Optimizing Competitiveness Performance Assessment Models for Small and Medium-Sized Enterprises. Adm. Sci. 2023, 13, 56. https://doi.org/10.3390/admsci13020056

Schaefer JL, Tardio PR, Baierle IC, Nara EOB. GIANN—A Methodology for Optimizing Competitiveness Performance Assessment Models for Small and Medium-Sized Enterprises. Administrative Sciences. 2023; 13(2):56. https://doi.org/10.3390/admsci13020056

Chicago/Turabian StyleSchaefer, Jones Luís, Paulo Roberto Tardio, Ismael Cristofer Baierle, and Elpidio Oscar Benitez Nara. 2023. "GIANN—A Methodology for Optimizing Competitiveness Performance Assessment Models for Small and Medium-Sized Enterprises" Administrative Sciences 13, no. 2: 56. https://doi.org/10.3390/admsci13020056

APA StyleSchaefer, J. L., Tardio, P. R., Baierle, I. C., & Nara, E. O. B. (2023). GIANN—A Methodology for Optimizing Competitiveness Performance Assessment Models for Small and Medium-Sized Enterprises. Administrative Sciences, 13(2), 56. https://doi.org/10.3390/admsci13020056