Abstract

This study examines the investigation of accounting factors through audited financial statements in businesses by analyzing the qualified staff and investment in technology for sustainable profit. Therefore, the main goal is to analyze whether qualified staff and investment in technology affect the sustainability of profit in businesses through the investigation of accounting factors in the audited financial statements toward a circular economy, more specifically in these financial items: total assets (TASS), and intangible assets (IASS), total liabilities (TLIA), total income (TREV), and net financial income (NFI), based on questions about which financial items businesses should take care of, as well as businesses that do not invest in technologies and skilled staff: does this hinder profit sustainability? Therefore, for this study, data are collected from the financial statements (balance sheet and income statement) of (N = 800) businesses according to their activity (manufacturing businesses = 256, service businesses = 192, and distribution businesses = 353) during the period (2020–2022). The results show that each of the variables and factors had a significant impact on sustainable profit through the circular economy in (N = 800) businesses. However, to have a sustainable profit in business, it is strongly recommended to pay attention to these findings: businesses should (a) be careful with total liabilities, (b) increase the performance of total assets, (c) increase the performance of net financial income, (d) increase the performance of total business income, and (e) increase and develop the skills of workers, as well as improve technology (equipment, machinery, etc.). With implications and limitations, it was difficult to access some of the financial statements; there are only a limited number of variables, so the same models can be analyzed for other businesses, variables, and countries.

1. Introduction

Day by day, the importance and impact of the investigation of accounting factors through audited financial statements are increasing based on qualified staff and investments in technology (equipment, machinery, etc.) toward a new approach in businesses. So, while changes in the global business environment have driven business transformation into more innovative businesses, they move toward profit sustainability by focusing on the efficiency of the costs recorded in the accounting financial statements. To see the importance of the circular economy in businesses, according to (Korhonen et al. 2018), the circular economy (CE) is currently one of the concepts most promoted by the EU, several national governments, and various businesses around the world. Where the (CE) is important for its power to attract both the business community and the policy-making community in terms of the sustainability of profits, there is still a need for other scientific research to ensure the actual effects of the (CE) on the sustainability of profit. The implementation of the (CE) for different disciplines includes practical errors and an increasing variety of technological procedures to meet the need for the support of interested parties, in addition to improved business models (Wiesmeth 2020). Regarding the circular economy in terms of manufacturing businesses according to (Balanay et al. 2022), other regions such as East and Southeast Asia, Japan, China, Germany, Finland, and the Philippines were also researched in the production, energy, and forestry sectors, where the importance is emphasized and the scientific information is necessary for the advancement of the circular economy for a sustainable sector of profit through innovations that must be brought by the businesses of different countries. Furthermore, regarding the impact of the circular economy on businesses according to (Wójcik-Karpacz et al. 2023), the reinforcing factors of sustainable profit in businesses are the right technologies and digitalization, as well as managerial skills. To see the consequences of the circular economy on businesses in developing markets, according to (Dantas et al. 2022), the consequences of the circular economy show that policymakers should reevaluate their business policies by promoting open innovation within the circular economy. To see the effects of circular economy innovation and business model innovations on the sustainability of business profit according to (Hysa et al. 2020; Rehman et al. 2022), innovations have positive effects on performance and the sustainability of profit. Furthermore, if we talk about circularity and innovation, we do not only discuss the micro-level impact it has in companies but also the micro-level dimension that is linked with social innovation, energy transition, environment, and related issues (Popescu et al. 2022).

1.1. Investigating Accounting Factors, Financial Statements, Auditing, Qualified Staff, and Investment on Technologies for Sustainable Profit in Businesses toward a Circular Economy

All the assessments so far are sending businesses to develop five important points, such as a fundamental evolution of financial reporting standards, the benefits of the connection of financial reporting and non-financial reporting as the main challenge to obtain holistic and coherent information, double materiality, and the effect of reversion to identify financial reporting in two perspectives: external–internal (how ESG factors affect the development, performance, position of the business—often identified as financial materiality) and internal–external (as business activity affects ESG factors—often identified as environmental and social materiality), and potential linkage approaches (direct linkage and indirect linkage); location of non-financial information is a central lever for integrating FI and NFI; the location of NFI is of prime importance (EFRAG 2021). According to (Karasioğlu et al. 2021), the impact of accounting ethics on the quality of financial reports is emphasized to make correct decisions for sustainable profit; businesses must have qualified and confident managers when making decisions, but, according to (Scapens 1990), there are few researched case studies as a research method can help the practice of accounting for the investigation of financial statements. To analyze the audit of financial statements according to (Waterhouse and Tiessen 1978), the organizational structure (evolution and emergence in human behavior) and the efficient design of accounting systems increase the sustainability of business profit. According to (Lucianetti et al. 2018), businesses must analyze unforeseen factors (decentralization and environmental uncertainty) as they play an important role in the sustainability of profit, while, related to the organizational strategy to have sustainability, future investigations should be done since there was no strong correlation. A similar opinion, but related to the research being done by academics, there are gaps caused by low research performance in this field and that the discipline is facing a continuous decline emphasized by (Argilés and Garcia-Blandon 2011) according to (Azudin and Mansor 2018) and (Merchant 2008), where there is a gap in the accounting literature from the perspective of a developing economy by elaborating the current stages of development of business and the impact of three factors (structure, potential, and technology) on business profit sustainability. However, according to (Robu and Istrate 2015), the issue of harmonizing national financial reporting standards with international financial reporting standards to guarantee homogeneity and comparability of reported information is mandatory. To investigate the impact of the timelines of the audited financial statements on business sustainability (Ha et al. 2018), it is pointed out that financial leverage and industry do not affect the timing of financial reports; it is also emphasized that there are differences between businesses at the time of publication of financial reports. To investigate the effect of financial reporting ambiguity and audit quality (Chae et al. 2020), a business with opaque (weak) financial reporting increases the risk of the volatility of a company’s profit and its prosperity. According to (De Villiers and Molinari 2022), (Mardi et al. 2020), and (Al-Ajmi 2008), it is pointed out that for businesses to have a sustainable profit, their financial statements must be clear, stable, reliable and open-access for everyone; on the contrary, hiding information, blaming others, refusing to admit that there are problems, and refusal to address problems affect profit volatility, so business leaders can apply these lessons to crisis management in their companies. To investigate the relationship between reliability, the complexity of audited financial statements, and market reactions, according to (Alduais et al. 2022), the most complex financial reports are associated with lower current returns, and they negatively affect sustainable earnings or the expectation of future returns. To investigate the impact of the work of auditors on the management of business profits between two periods of the global financial crisis and its consequences, according to (Ghafran et al. 2022), the workload of the auditor harms the quality of income, where it is suggested that auditors working in some companies are less effective and that they should consider the importance of jurisdiction related to governance to have sustainability of profit. According to (Ghafran et al. 2022), the main concerns for businesses are the lack of choice in audit firms and the issues related to their governance and accountability. A similar opinion regarding these concerns and especially in the audit fees of the financial statements is emphasized by (Goddard and Schmidt 2021), labeling the negative implications for the quality of the audit and the damage to the auditor–client relationship, but, according to (Humphrey and Moizer 1990), the professional behavior of the audit and the ability of the auditors serve the function of protecting the interests of the country.

1.2. Investigating Variables of Audited Financial Statements in Businesses (TASS, IASS, TLIA, TREV, and NFI) for Sustainable Profit in Businesses toward a Circular Economy

Regarding the investigation of audited financial statements in businesses, taking into account all the independent variables, contributions were made by many authors emphasizing their importance in the sustainability of profit. Therefore, the availability of electronic data, including (activators, smart devices, tags, integrated computers, and mobile devices), for accounting statements is of great importance, and every day their importance is increasing to make an audit of the highest quality (Tan et al. 2018). The study of (Kacani et al. 2022) took into consideration the benchmarking instrument, which indicated that those sub-industries performing better both in short- and long-term risk display a higher outsourcing potential and more opportunities for integration in global value chains. To investigate the impact of all variables on the sustainability of profit, the financial position of the business in the market, and the reforms in the financial statements through the accounting of the audited financial statements, according to (Lulaj 2021a), (Lulaj 2021b), the impact of accounting on the preparation of financial statements is becoming more and more necessary, that large businesses have a better financial position compared to small businesses, and that insolvency is greater among small businesses. Regarding the variable of intangible assets (IASS), according to (Hu et al. 2022), foreign ownership increases with the increase in intangible assets. According to (Uddin et al. 2022), intangible assets provide competitive advantages and increase business productivity and efficiency. However, corporate resilience to the shocks of COVID-19 highlights the critical role of intangible assets, whereas, according to (Lim et al. 2020), a significant and growing part of corporate assets consists of non-recourse assets; high risk of evaluation and the weak collateralization of some intangible assets (goodwill) may discourage debt financing. Furthermore, businesses that use recent changes in accounting rules are allowed to observe market-based valuations of intangible assets. Regarding the total assets variable (TASS), according to (Wang 2022), emphasizing that the optimal choice of the portfolio of risk-averse entrepreneurs in a costly state-verification framework, according to the analyzed model, it is concluded that opposite responses of the firm’s leverage and share are generated assets that are consistent with empirical evidence. So, the purpose and main objectives of this research are to find an analysis for improving the sustainability of business profit through the investigation of qualified staff and investments in technology (equipment, machinery, etc.) based on the variables obtained in the study. How much influence do these factors have on sustainability and where should businesses be careful of the circular economy?

2. Literature Review

To investigate the impact of profit sustainability in businesses for financial accounting items, according to (Caddy 2000), there has been a focus on the intellectual assets of the business and to some extent on an equivalence between intellectual assets and intellectual capital where, with each debit (in the sense of increase), the possibility of a loan (in the sense of a reduction) must be allowed. According to (Zambon et al. 2020), the financial value is related to the generation of net cash flows over time to have appreciable profit in businesses. According to (Ellis et al. 2022), financial reporting for general purposes has evolved to meet the needs of existing and potential investors, as well as creditors, providing information related to the evaluation and expected return, time, and uncertainty of future monetary flows, as well as the care of the management on the economic resources of the company. Financial reporting and ESG have also emerged to meet information needs in recognition of the fact that sound financial decisions are based on broader analyses than those derived from financial information. The research field of accounting information systems (AIS) emerged about 30 years ago as a subfield of accounting, but it is in danger of developing further as an isolated discipline, according to (Jans et al. 2023). According to (Haji et al. 2023), on balance, a significant number of questions remain on the net effects of CSR reporting regulations.

In this case, to investigate the competition within the external market and the phenomena of the tendering of the audits of financial statements (Beattie and Fearnley 1998), the development of a competitive tender and the examination of the change of the auditor strengthen the stability of the business in the market. However, according to (He et al. 2016), poor audit quality and high fees harm the sustainability of business profit. To investigate the impact of technology on the sustainability of profit through the analysis of financial statements, according to (Türegün 2019), businesses have taken a step forward in the field of technology and accounting programs, while in the coming years financial reporting will become stronger thanks to learning (training and education of staff), artificial intelligence, blockchain, and the use of big data, showing the transformation of financial reporting with technological changes. A similar opinion was given by (Mohd and Khan 2021), emphasizing the importance of future research in this field. According to (Carcello and Neal 2003), it is very important that businesses do not pressure auditors to modify financial statements, regardless of ongoing issues, as well as not dismiss the auditors from their positions just because they refuse to issue unaltered reports. This is highlighted by (Ishak 2016), emphasizing the importance of responsibility and guidelines in business governance codes according to international accounting and financial reporting standards to have real and sustainable profits, and also in rules and principles (Cao and Coram 2020), as well as in standard No. 5 (Janvrin et al. 2020), as well as according to (Velte 2022), which emphasizes the importance of financial restatements and the usefulness of financial information (Lev 2018) to have profit consistency. To further investigate the impact of technology on the accounting and auditing of business financial statements, according to (Salijeni et al. 2021), technology facilitates the creation of opportunities to provide quality business reports, particularly for the stability of profit, but according to (Castka et al. 2020), technology improves the process of auditing financial statements. According to (Li 2019), the importance of technology at the time of financial reporting, the strengthening of the supervision of accounting statements, the application of technology, and, first of all, the verification of accounting transactions, are emphasized. According to (Mironiuc et al. 2015), the importance of the value of comprehensive income for net income is emphasized to ensure the sustainability of profit. To investigate the impact of human behavior on the production/service or distribution process, according to (Corrado et al. 2009), the productivity and income of workers have decreased significantly over the last 50 years, affecting the sustainability of profit in the business. According to (Iatridis 2016), changing the tone of financial reporting to pessimistic lowers the cost of capital. Furthermore, according to (Ahadiat and Mackie 1993), emphasizing ethics in accounting increases sustainable profit. To investigate the impact of human behavior on the sustainability of profit, according to (Kusnic and Davanzo 1986), businesses should not create income inequality for workers, increasing the need for greater care; furthermore (Allal-Chérif et al. 2023), businesses must make sustainable innovations to achieve excellence in simplicity (Agyei-Boapeah et al. 2022; Alfaro et al. 2019) by eliminating barriers (time or space), as well as by implementing sophisticated software that helps sustainable profit. According to (Macve 2015), accounting and auditing work in different ways within businesses in different countries and cultures. According to (Xu and Xuan 2021), in the current stage of business development, a high level of internal control can facilitate its effectiveness. By (Merello et al. 2022), the digitization process is affecting all markets and increasing consumer awareness of the sustainable behavior of companies to have a sustainable profit (Lin et al. 2021) through the implementation of a strategic attitude to profit-related opportunities based on the strategic systems audit (SSA), according to the authors’ research (Peecher et al. 2007). According to (Bakre 2008), the financial reporting of a heavy socioeconomic and political technology is emphasized for the colonial and post-colonial era of business globalization. Therefore, the emphasis on the business is complex, and, on speed changes (Hui and Fatt 2007), facing stationary challenges in the chain is related to changes in developing markets (Soundararajan et al. 2021), as well as more sustainability and integration in corporate culture, as well as in profit reporting for interested parties (Rezaee 2016). According to (Chams and García-Blandón 2019), businesses are becoming more and more aware of these aspects every day, based on the well-being of workers (Sun et al. 2020) and their ethical activities (human behavior) before entering the complex world of business (Low et al. 2008). According to (Al-Mana et al. 2020), privatization can lead to improved performance and sustainable profit efficiency as shareholder-owned businesses generally perform better than national players, so this is a topic of continuing interest regarding the relationship between corporate governance and managerial choices (Nazir and Afza 2018), as well as regarding to what extent financial reporting facilitates the allocation of capital to appropriate investment projects to have a sustainable profit (Roychowdhury et al. 2019). According to (Bebbington et al. 2007) and (Lulaj and Iseni 2018), profit sustainability assessment models should be proposed according to cost–volume–profit analysis. According to (Zhang et al. 2021), business solvency, profitability, and development ability are closely related to profit sustainability, fulfilling the intelligent demand for modern financial data analysis in the cloud servers (Bi 2022), and in recent years, businesses have paid more and more attention to business data in the cloud server (Yang 2021). According to (Chen 2022), the lines between financial and managerial accounting to investigate sustainable profit are constantly being mixed as a result of the new economic norm, which is bringing this relationship closer every day, but the continuous progress of economic globalization through science and technology for sustainable profit has become an important direction for the development of businesses to detect entrepreneurial problems and prevent risks (Hou 2022; Panait et al. 2022), since in the current competitive environment, businesses pay the market great importance on financial performance evaluation research, paying attention to workers’ talents to increase sustainable profit (Chen 2021). According to (Yang and Jiang 2020), the hybrid approach greatly improves the accuracy of the data in the accounting financial statements. Regarding the implications of the policy of total assets, according to (McDonough and Yan 2022), businesses must make capital investment decisions based on the state of the total assets of the business.

Regarding the total liabilities variable (TLIA), according to (Colovic et al. 2022), businesses that start operating in the informal sector and later move to the formal sector are less likely to directly receive profit sustainability in the global value chain. According to (Tang and Rowe 2022), the very close connection of the subsidiary to the main company can be potentially harmful to the sustainability of profit. According to (Dawid and Muehlheusser 2022), strict obligations can hinder business investments and their recognition by the market. Regarding the total revenue variable (TREV), according to (Gebauer et al. 2020), businesses with new digital offers are currently using new digital technologies such as the internet of things (IoT), artificial intelligence (AI), or big data (BD), but these offerings rarely increase total revenue as businesses are struggling with business dynamics (BD). According to (Kabir and Su 2022), income from contracts with customers affects the practice of recognizing income and financial statements of businesses, while profits use more the modified retrospective method than the full retrospective method. Regarding the variable of the net financial income (NFI), according to (Kabbach-de-Castro et al. 2022), productivity and hindered income jointly direct the distribution of capital within an internal capital market. According to (Villani 2021), various factors can change the values of the index of external financial dependence, and that stability finds less empirical support. To evaluate the circular economy model of a manufacturing company, according to (Chiarot et al. 2022), the reuse and recycling of material should be reduced by focusing on optimizing the performance of assets and helping to improve the sustainable performance of machinery and equipment. According to (Han et al. 2020), a business in a circular economy must be flexible to market changes in response to changes in technology, economy, and environment to achieve sustainability of profit. Regarding the determination of the factors that lead to a short-term orientation strategy to have business profit sustainability in a circular economy, according to (Gerlich 2023), it is very challenging for businesses to transform a long-term strategy into a short-term strategy for stable profit evaluation. According to (Milios 2018), to have sustainability of profit in businesses, one of the main areas of (CE) is repair and reproduction.

3. Methodology

3.1. The Purpose of the Paper

A study of the investigation of accounting factors through audited financial statements in businesses analyzing qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit toward a circular economy has not been conducted before; therefore, the main goal is to determine whether qualified staff and investment in technology affect the sustainability of profit in businesses through the investigation of accounting factors in the audited financial statements toward a circular economy—more specifically in these financial items: total assets (TASS), intangible assets (IASS), total liabilities (TLIA), total income (TREV), and net financial income (NFI)—based on questions about which financial items businesses should take care of, as well as businesses that do not invest in technologies and skilled staff. Does this hinder profit sustainability? In addition, where there is a difference, which of the factors has a greater impact on the sustainability of profit based on the sustainable profit factor (F1) and the two sub-factors, (F1.1 or investigation of accounting factors TASS, TLIA, TREV and NFI, and F1.2 or investigation of accounting factors TASS, TLIA, and IASS)? The objectives of this research are:

- (1)

- Investigation of empirically audited financial statements for 800 businesses regarding sustainable profit: which financial items are sustainable and of which financial items should companies be careful?

- (2)

- Businesses that do not invest in technology (equipment, machinery, etc.) and qualified staff—does this hinder the sustainability of profit?

Through these goals, based on the factors taken in the study, the hypotheses will be proven. Therefore, this research will (a) bring an approach to profit sustainability through audited financial statements, (b) investigate investments in technology and qualified staff by businesses for sustainable profit, and (c) learn something special about how to be careful about financial items that hinder the stability of profit.

3.2. Methods

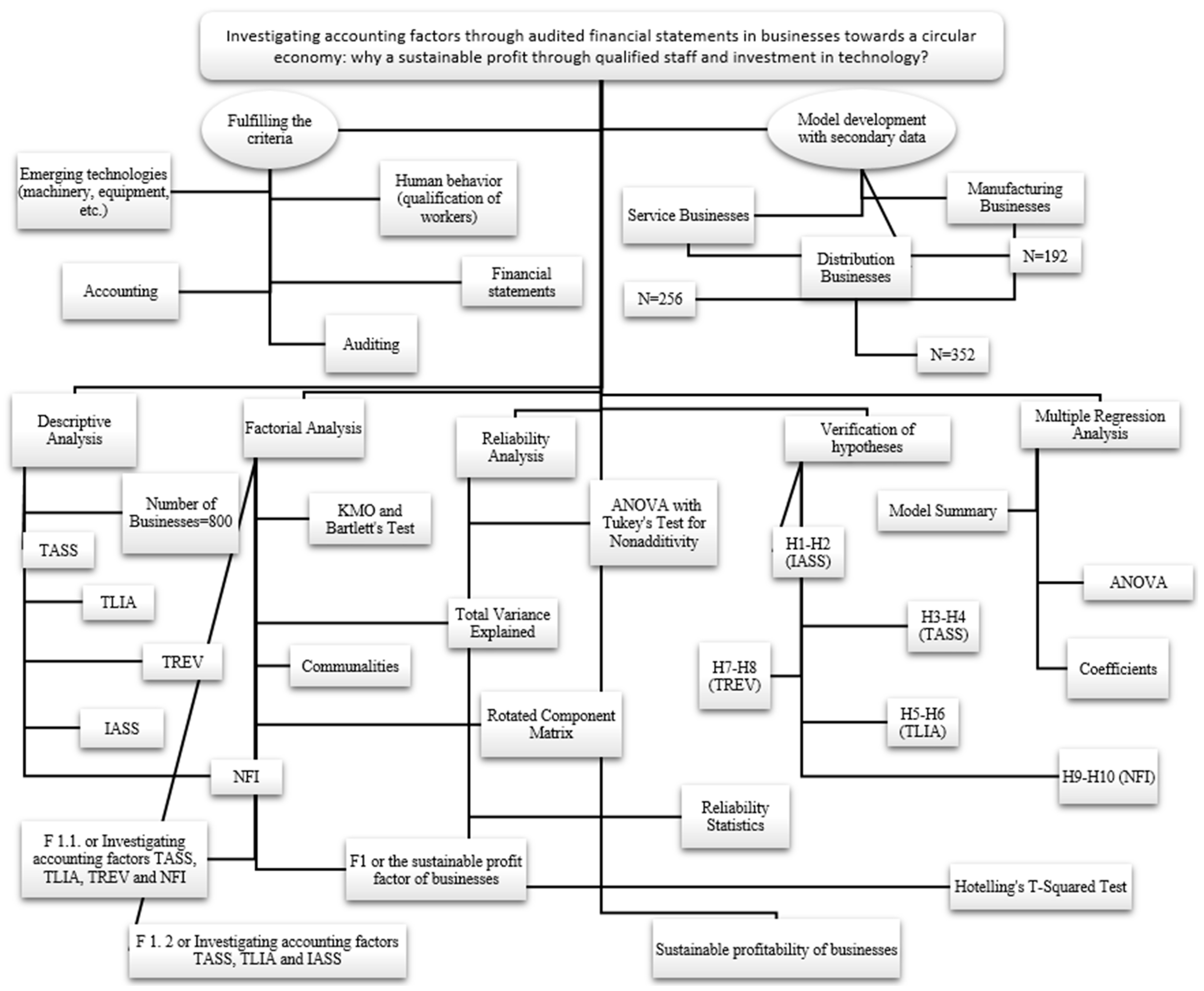

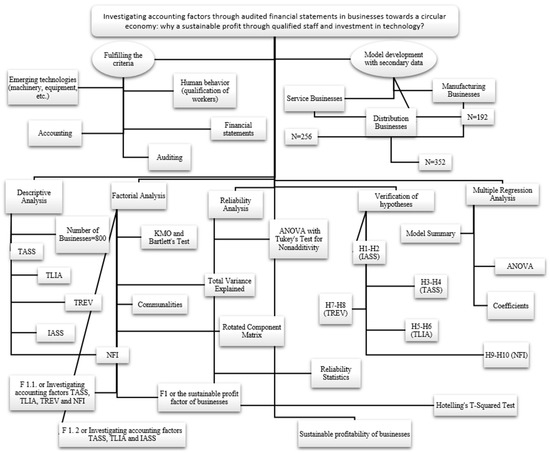

For this study, data were collected based on audited financial statements for businesses (N = 800) according to their activity (manufacturing businesses = 256, service businesses = 192, and distribution businesses = 353) to investigate the qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit. A total of five variables divided into three sessions were analyzed through four analyses, namely descriptive analysis, factor analysis, data reliability analysis, and multiple regression analysis using SPSS version 23.0 for Windows. The research was conducted during the years (2020–2022), but the audited financial statements for 2020 were analyzed as they were reported and published by (the Ministry of Finance and the General Audit Office). The analyses included several processes in which some of the factors were deleted to make the model acceptable, in which case, as stated in the conceptual model, the purpose of these analyses is to obtain reliable data (KMO above the value of 0.600, alpha above the value of 0.700, and R2 above the 0.800 value, as elaborated in (Lulaj et al. 2022)). To investigate the influence of factor analysis, according to (Cudeck 2000) and (Goretzko et al. 2021), factor analysis aims to determine the number of fundamental influences based on a domain of variables in this research to analyze sustainable profit and determine the extent to which each variable is related to the factors of obtaining information on businesses for (qualified staff, investments in technology (equipment, machinery, etc.), accounting, financial statements, and auditing). While regarding the reliability analysis, according to (Taber 2018), this analysis is used to demonstrate that the tests and scales that have been built or approved for research are suitable for the purpose. In this case, five variables, two financial statements, and 800 businesses with three types of activities were tested, creating one factor with two sub-factors. Therefore, for this study to be as qualitative and reliable as possible, methods and tests adapted to this research were used, as presented in Figure 1.

Figure 1.

Research procedure/outline followed to conduct research to investigate sustainable profitability in 800 businesses. Data processing by the authors.

3.2.1. Data Collection

Data collection was carried out from the results of descriptive, factorial analysis (KMO, Barlet test, PCA, etc.), reliability analysis (alpha, etc.), and multiple regression analysis (R, R2, adjusted R2, Std. error of the estimate, F, Sig. F, Durbin-Watson, Anova), as elaborated in Figure 1.

3.2.2. Hypotheses

While the investigation of sustainable profit for all variables was analyzed according to the following equations elaborated by (Carroll and Green 1997):

It is a linear equation for predicting values of Y that minimizes the sum of squared errors associated with investigating accounting factors through audited financial statements to achieve sustainable business profitability.

Or H0 = β1 = β2 = 0

HA = β1 ≠ 0- and not all parameters are equal to zero

The hypotheses raised in this research are based on the above equations for sustainable business profit and are elaborated as follows.

Hypotheses for the IASS Variable

H1.

Independent variables have a significant impact on the variable of intangible assets (IASS).

H2.

There is a difference between the importance of the independent variables in the intangible assets variable (IASS).

The purpose of this hypothesis was to see the impact of independent variables on (IASS) and determine which had a greater positive or negative impact for sustainable profit.

Hypotheses for the TASS Variable

H3.

The independent variables have a significant impact on the total assets variable (TASS).

H4.

There is a difference between the importance of the independent variables on the total assets variable (TASS).

The purpose of this hypothesis was to see the impact of the independent variables on (TASS) and determine which had a greater positive or negative impact for sustainable profit.

Hypotheses for the TLIA Variable

H5.

The independent variables have a significant impact on the total liabilities variable (TLIA).

H6.

There is a difference between the importance of the independent variables on the total liabilities variable (TLIA).

The purpose of this hypothesis was to see the impact of the independent variables on (TLIA) and determine which had a greater positive or negative impact for sustainable profit.

Hypotheses for the TREV Variable

H7.

The independent variables have a significant impact on the total revenue variable (TREV).

H8.

There is a difference between the importance of the independent variables on the total revenue variable (TREV).

The purpose of this hypothesis was to see the impact of the independent variables on (TREV) and determine which had a greater positive or negative impact for sustainable profit.

Hypotheses for the NFI Variable

H9.

Independent variables have a significant impact on the variable of net financial income (NFI).

H10.

There is a difference between the importance of independent variables in the variable of net financial income (NFI).

The purpose of this hypothesis was to see the impact of the independent variables on (NFI) and determine which had a greater positive or negative impact for sustainable profit.

Figure 1 presents the research procedure related to the investigation of accounting factors through audited financial statements in businesses, considering qualified staff and investment in technologies for sustainable profit. Initially, the fulfillment of the research criteria emphasized new technologies, qualified staff, accounting, financial statements, auditing, sustainable profit, etc., while the development of models was carried out through secondary data reported for financial periods for 800 businesses in Kosovo divided according to their activity (production, servicing, and distribution). In this research, analyses (descriptive, factorial, multiple regression, and reliability) were used, validating the raised hypotheses (H1, H2, H3, H4, H5, H6, H7, H8, H9, and H10) for all sessions and all variables (TASS, TLIA, TREV, IASS, and NFI), investigating how many businesses have sustainable profit.

4. Empirical Results

In this research, as discussed in the methodology, four econometric analyses are included: descriptive analysis, factorial analysis, data reliability analysis, and multiple regression analysis as follows.

- Descriptive analysis for the investigation of accounting factors through audited financial statements for sustainable profit in businesses;

- Factor analysis and reliability analysis for investigating accounting factors through audited financial statements for sustainable profit in businesses;

- Multiple regression analysis for investigating accounting factors through audited financial statements for sustainable profit in businesses;

- Validating hypothesis for investigating accounting factors through audited financial statements by analyzing qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit in business.

4.1. Descriptive Analysis for the Investigation of Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

Table 1 presents the descriptive analysis related to the investigation of accounting factors through audited financial statements for 800 businesses (manufacturing, service, and distribution), analyzing qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit based on all the variables of this research such as total assets (TASS), intangible assets (IASS), total liabilities (TLIA), total revenues (TREV), and net financial income (NFI). Therefore, there was no lack of data after analyzing the audited financial statements.

Table 1.

Descriptive analysis of the number of the investigated businesses.

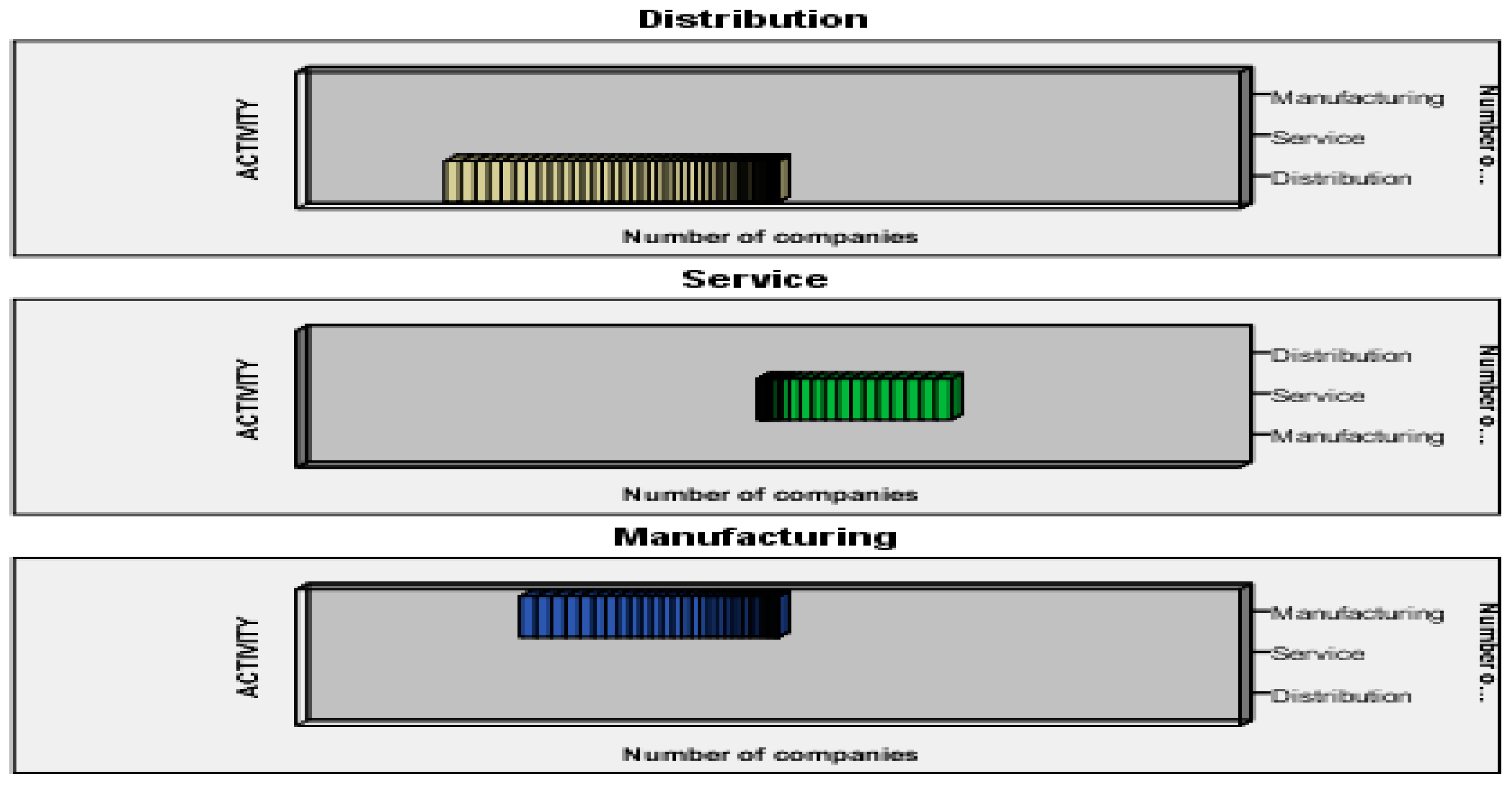

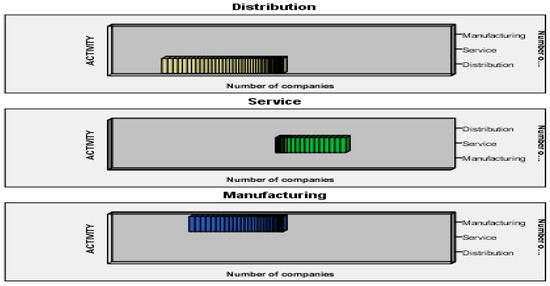

Table 2 presents the descriptive analysis related to the activity or type of businesses that were researched in this study. In total, three business activities were included according to their participation in this research, such as 256 manufacturing businesses or percentage (32%), 192 service businesses or percentage (24%), as well as 352 distribution businesses or percentage (44%).

Table 2.

Descriptive analysis for the activity of the investigated businesses.

Figure 2 presents the descriptive data for the researched businesses according to the number and types of businesses related to the investigation of accounting factors through audited financial statements, analyzing qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit according to the number of businesses (N = 800), according to the financial statements (FS = 2 or balance of condition (TASS, IASS, and TLIA), and balance of success (TREV and NFI), as well as according to the activity of businesses (production, service, and distribution). In addition, according to the results of the figure, the largest number of businesses in this research were distribution businesses—in percentage, (N = 352 or 44%).

Figure 2.

Descriptive analysis according to the number and activity of investigated businesses. Data processing by the authors.

4.2. Factor Analysis and Reliability Analysis for Investigating Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

In this session, the results of factorial and reliability analysis were analyzed for all variables related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit, then a factor with two sub-factors was created as follows:

- -

- F1 or sustainable profit factor in businesses;

- -

- F 1.1 or investigation of TASS, TLIA, TREV, and NFI accounting factors;

- -

- F 1.2 or investigation of TASS, TLIA, and IASS accounting factors.

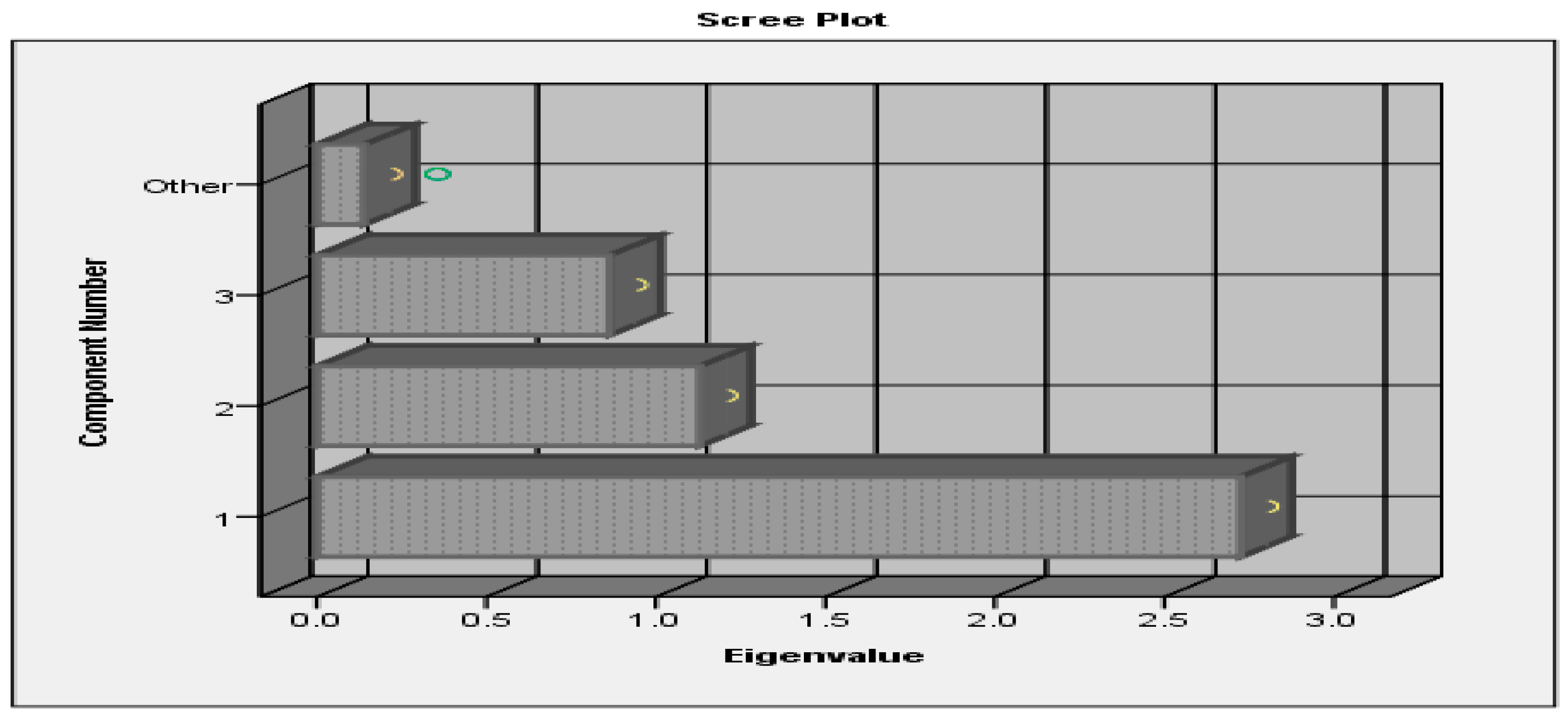

4.2.1. The Results of the Sustainable Profit Factor in Businesses

Table 3 presents the results of the sustainable profit factor in businesses for all the variables obtained in this study. According to the KMO test, the data are suitable for factorial analysis related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit (KMO = 0.803 or 80%), while according to Bartlett’s test of sphericity, the data are important enough to measure the analysis of qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit (Sig. = 0.000). According to communalities, the variables that have the highest common variance are (NFI and TASS). According to total variance explained, two larger factors with a value of 1 were created, which together explain the variance of 77%. According to the rotated components matrix, it is noted that two sub-factors (F1.1 and F1.2) have been created. While in the first sub-factor, the variable that has greater weight for the sustainable profit of businesses through human behavior or the work of employees and emerging technologies is (TREV = 0.883), in the second sub-factor, the variables that have a weight greater are (TLIA = 0.695 and TASS = 0.685).

Table 3.

Results of sustainable profit factor in business through factor analysis.

Table 4 presents the results of the sustainable profit factor through reliability analysis for all variables of this study. According to Cronbach’s alpha, the data have very high reliability (α = 0.961 or 91%). According ANOVA with Tukey’s test for non-additivity, the difference between the variables related to the sustainable profit in businesses through audited financial statements is statistically significant (p = 0.000), while according to Hotelling’s T-squared test, there is a difference important among the variables for sustainable profit in businesses.

Table 4.

Results of sustainable profit factor in business through reliability analysis.

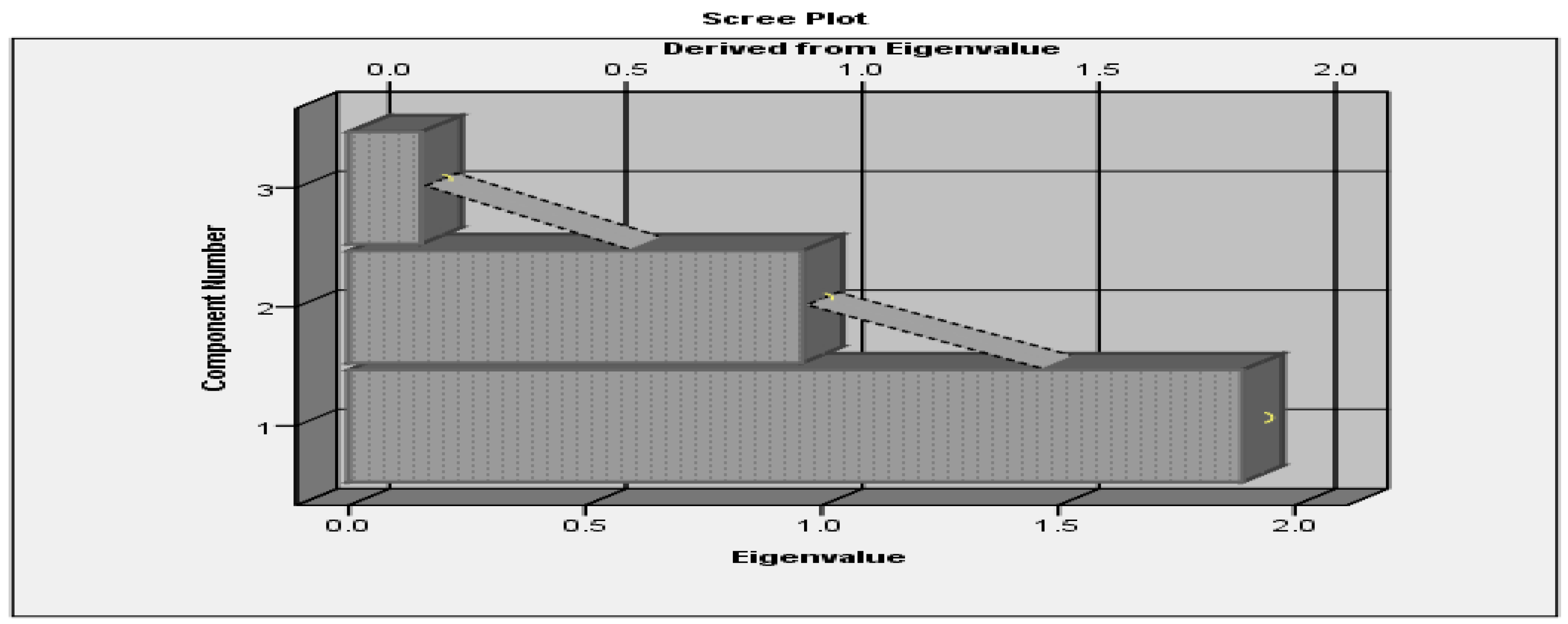

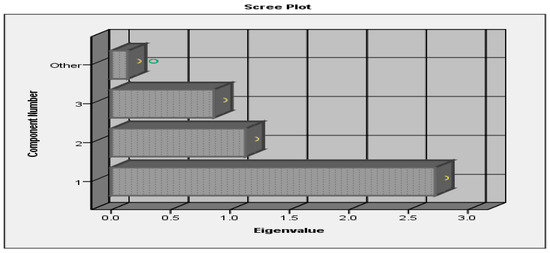

Figure 3 presents the results of sustainable profit through the audited financial statements in businesses, taking into account the analysis of qualified staff and investments in technology (equipment, machinery, etc.) through the studied variables where the importance of two sub-factors is emphasized: F1.1 (investigation of TASS, TLIA, TREV, and NFI accounting factors) and F 1.2 (investigation of TASS, TLIA, and IASS accounting factors).

Figure 3.

Scree plot of the sustainable profit factor in businesses.

4.2.2. The Results of the First Sub-Factor (F1.1) of Sustainable Profit through the Investigation of TASS, TLIA, TREV, and NFI Accounting Factors

Table 5 presents the results of the first sub-factor (F1.1) of sustainable profit in business for all variables obtained in this study. According to the KMO test, the data are suitable for factorial analysis related to the investigation of TASS, TLIA, TREV, and NFI accounting factors for sustainable profit (KMO = 0.818 or 82%), while according to Bartlett’s test of sphericity, the data are important enough to analyze qualified staff and investments in technology (equipment, machinery, etc.) to remain stable in the variables of the first factors (Sig. = 0.000). According to communalities, the change that has the highest common variance is (NFI). According to total variance explained, a larger factor of 1 value has been created, which explains the variance of 68%. According to the rotated component matrix, a factor (F1.1) is created, where the variable that has the greatest weight for the sustainable profit of businesses through human activities or labor work and developing technology is (NFI = 0.854).

Table 5.

Results of the first sub-factor (F1.1) of sustainable profit through factor analysis.

Table 6 presents the results of the first sub-factor (F1.1) through reliability analysis for all variables of this study. According to Cronbach’s alpha, the data have very high reliability (α = 0.837 or 84%). According to ANOVA with Tukey’s test for non-additivity, the difference between variables related to the sustainable profit of businesses through audited financial statements is statistically significant (p = 0.000), while according to Hotelling’s T-squared test, there is an important difference among the variables under the first factor (F1.1) for sustainable profit in businesses.

Table 6.

The results of the first sub-factor (F1.1) of sustainable profit in businesses through reliability analysis.

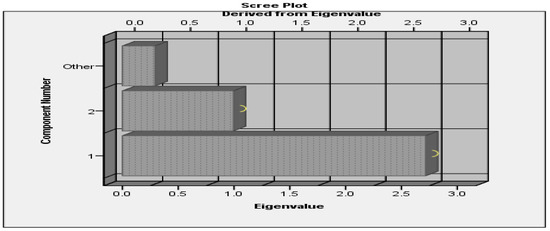

Figure 4 presents the results of sustainable profit through the audited financial statements of businesses, taking into account the analysis of qualified staff and investments in technology (equipment, machinery, etc.) through the variables studied, where the importance of the first sub-factor (F1.1) is emphasized or the investigation of TASS, TLIA, TREV, and NFI accounting factors

Figure 4.

Scree plot of the first sub-factor (F1.1) of sustainable profit in business.

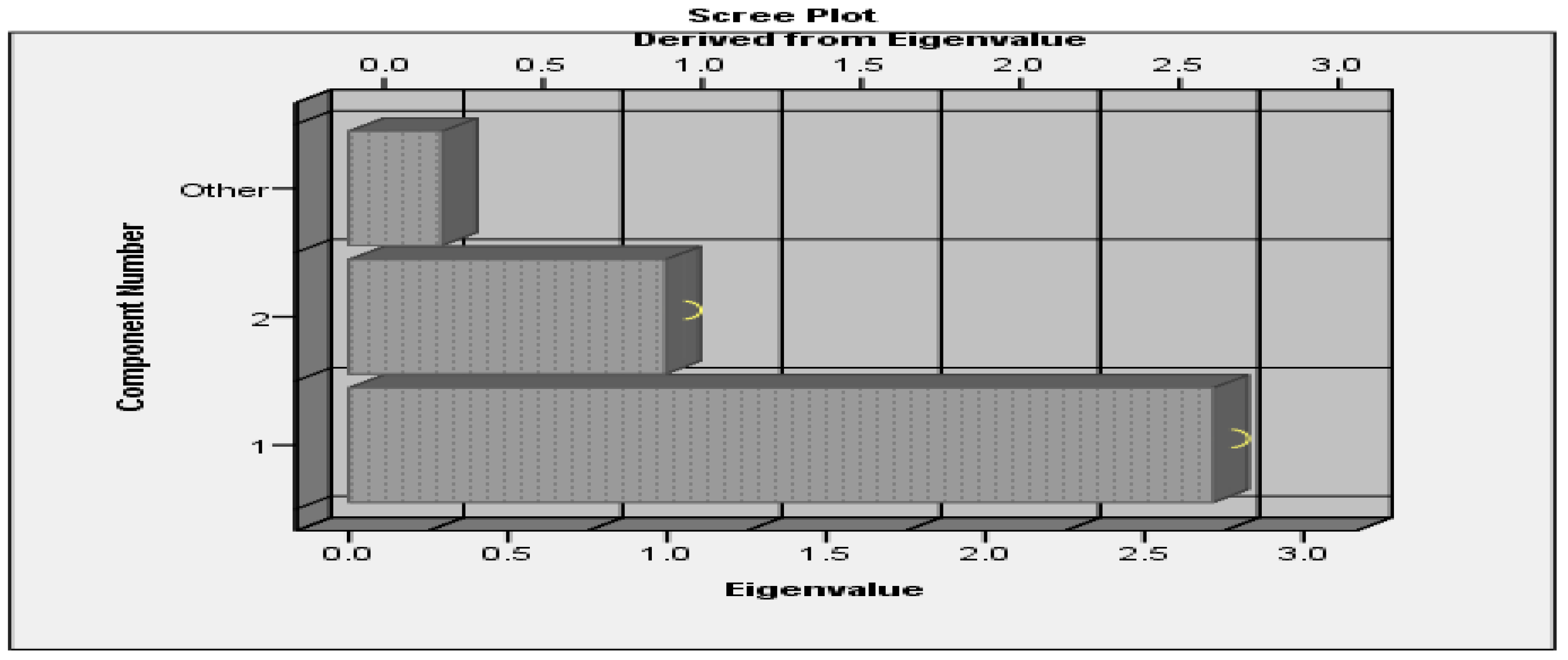

4.2.3. The Results of the Second Sub-Factor (F1.2) of Sustainable Profit through the Investigation of TASS, TLIA, and IASS Accounting Factors

Table 7 presents the results of the second sub-factor (F1.2) of sustainable profit for all variables obtained in this study. According to the KMO test, the data are suitable for factorial analysis related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit (KMO = 0.713 or 71%), while according to Bartlett’s test of sphericity, the data are important enough to measure the analysis of qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit based on the variables under the second factor (Sig. = 0.000). According to communalities, the variables that have the highest common variance are (TASS and TLIA). According to total variance explained, a factor greater than 1 has been created, which explains the variance of 63%. According to the rotated component matrix, a sub-factor (F1.2) has been created, where the variables that have the greatest weight for the sustainable profit of businesses through human behavior or the work of employees and emerging technologies are (TASS = 0.951 and TLIA = 0.949).

Table 7.

Results of the second sub-factor (F1.2) of sustainable profit through factor analysis.

Table 8 presents the results of the second sub-factor (F1.2) as stable through reliability analysis for all variables of this study. According to Cronbach’s alpha, the data have very high reliability (α = 0.873 or 87%). According to ANOVA with Tukey’s test for non-additivity, the difference between variables related to the sustainable profit of businesses through audited financial statements is statistically significant (p = 0.000), while according to Hotelling’s T-squared test, there is an important difference between the variables of the second sub-factor (F1.2) for sustainable profit in business.

Table 8.

Results of the second sub-factor (F1.2) of sustainable profit through reliability analysis.

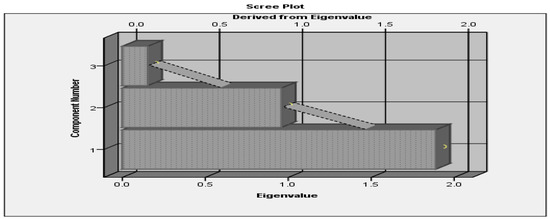

Figure 5 presents the results of sustainable profit through the audited financial statements of businesses, taking into account the analysis of qualified staff and investments in technology (equipment, machinery, etc.) through the variables studied, where the importance of the second sub-factor (F1.2) or the investigation of TASS, TLIA, and IASS accounting factors.

Figure 5.

Scree plot of the second sub-factor (F1.2) of sustainable profit.

4.3. Multiple Regression Analysis for Investigating Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

In this session, through multiple regression analysis, all the variables obtained in this study (TASS, IASS, TLIA, TREV, and NFI) were analyzed for the investigation of accounting factors through audited financial statements for sustainable profit in businesses by considering qualified staff and investments in technology (equipment, machinery, etc.).

Table 9 presents the multiple regression analysis for the factor (IASS) related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit including model summary, ANOVA, and coefficients. According to R square, 78% of the change in the dependent variable is explained by the independent variables (TASS, TLIA, TREV, and NFI), while the remaining 22% is explained by other variables that are not included in the model by random error. According to the Durbin–Watson test, there is no autocorrelation (1.833) between the variables. According to the ANOVA analysis, the model is significant at every significance level (Sig. = 0.000), while according to the beta coefficient, the independent variable that affects the model the most is (NFI = −519 or −52%). Therefore, the hypotheses are accepted (H1 and H2).

Table 9.

Multiple regression analysis for factor (IASS).

The p-value is less than the 5% significance level; H0 is rejected and accepted, ( ≠ 0.

Table 10 presents the multiple regression analysis for the factor (TASS) related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit including model summary, ANOVA, and coefficients. According to R square, 73% of the change in the dependent variable is explained by the independent variables (IASS, TLIA, TREV, and NFI), while the remaining 27% is explained by other variables that are not included in the model by random error. According to the Durbin–Watson test, there is no autocorrelation (1.917) between the variables. According to the ANOVA analysis, the model is significant at every significance level (Sig. = 0.000), while according to the beta coefficient, the independent variable that affects the model the most is (TLIA = 0.777 or 78%). Therefore, the hypotheses are accepted (H3 and H4).

Table 10.

Multiple regression analysis for factor (TASS).

The p-value is less than the 5% significance level, H0 is rejected and accepted, ( ≠ 0.

Table 11 presents the multiple regression analysis for the factor (TLIA) related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit including model summary, ANOVA, and coefficients. According to R square, 72% of the change in the dependent variable is explained by the independent variables (TASS, IASS, TREV, and NFI), while the remaining 28% is explained by other variables that are not included in the model by random error. According to the Durbin–Watson test, there is no autocorrelation (1.954) between the variables. According to the ANOVA analysis, the model is significant at every significance level (Sig. = 0.000), while according to the beta coefficient, the independent variable that affects the model the most is (TASS = 0.812 or 81%). Therefore, the hypotheses are accepted (H5 and H6).

Table 11.

Multiple regression analysis for factor (TLIA).

The p-value is less than the 5% significance level, H0 is rejected and accepted, ( ≠ 0.

Table 12 presents the multiple regression analysis for the factor (TREV) related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit including model summary, ANOVA, and coefficients. According to R square, 75% of the change in the dependent variable is explained by the independent variables (IASS, NFI, TASS, and TLIA), while the remaining 25% is explained by other variables that are not included in the model by random error. According to the Durbin–Watson test, there is no autocorrelation (1.701) between the variables. According to the ANOVA analysis, the model is significant at every significance level (Sig. = 0.000), while according to the beta coefficient, the independent variable that affects the model the most is (NFI = 0.890 or 89%). Therefore, the hypotheses are accepted (H7 and H8).

Table 12.

Multiple regression analysis for factor (TREV).

The p-value is less than the 5% significance level, H0 is rejected and accepted, ( ≠ 0.

Table 13 presents the multiple regression analysis for the factor (NFI) related to the investigation of accounting factors through audited financial statements in businesses for sustainable profit including model summary, ANOVA, and coefficients. According to R square, 78% of the change in the dependent variable is explained by the independent variables (TASS, IASS, TLIA, and TREV), while the remaining 22% is explained by other variables that are not included in the model by random error. According to the Durbin–Watson test, there is no autocorrelation (2.033) between the variables. According to the ANOVA analysis, the model is significant at every significance level (Sig. = 0.000), while according to the beta coefficient, the independent variable that affects the model the most is (TREV = 0.777 or 78%). Therefore, the hypotheses are accepted (H9 and H10).

Table 13.

Multiple regression analysis for factor (NFI).

The p-value is less than the 5% significance level, H0 is rejected and accepted, ( ≠ 0.

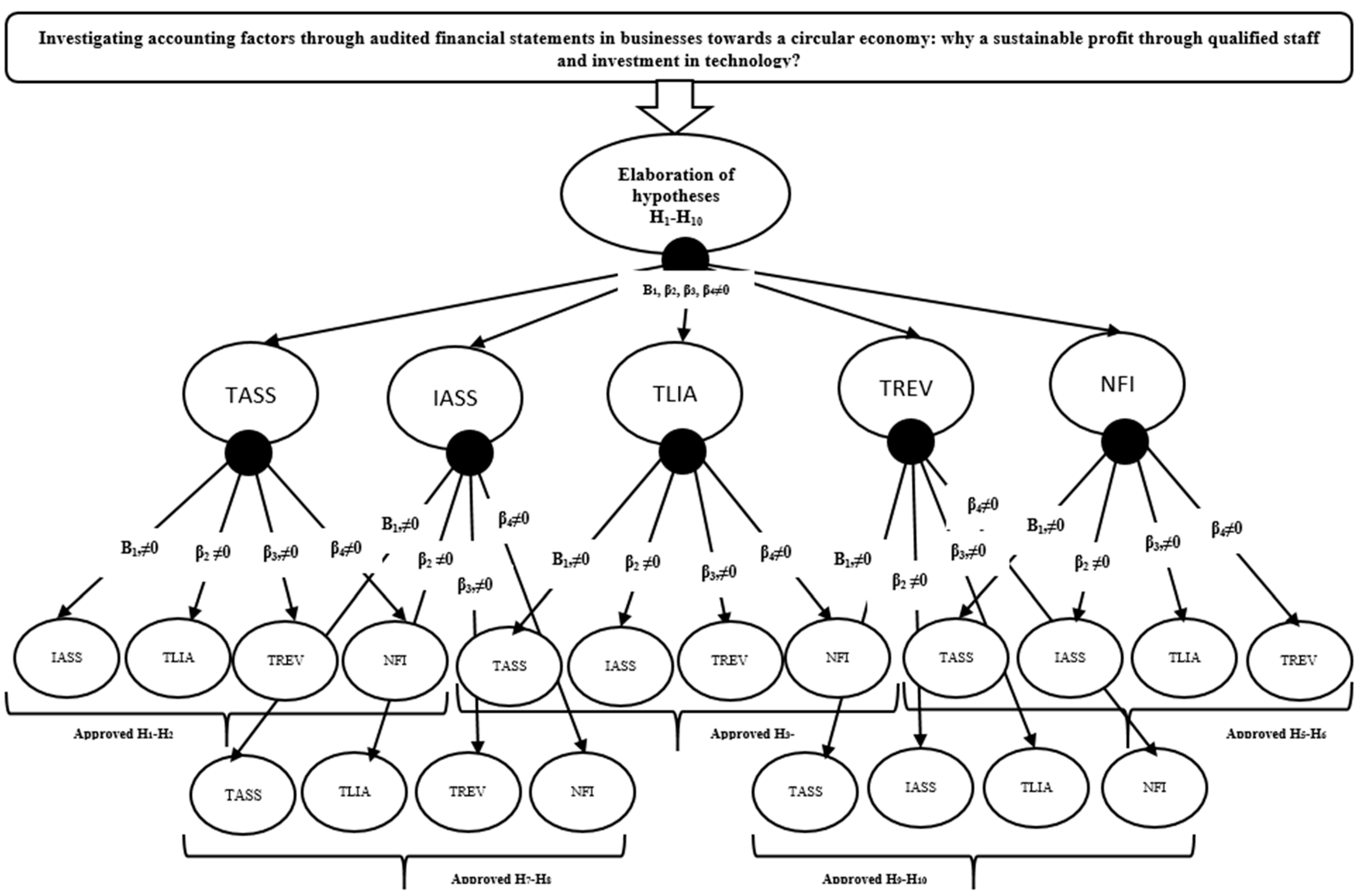

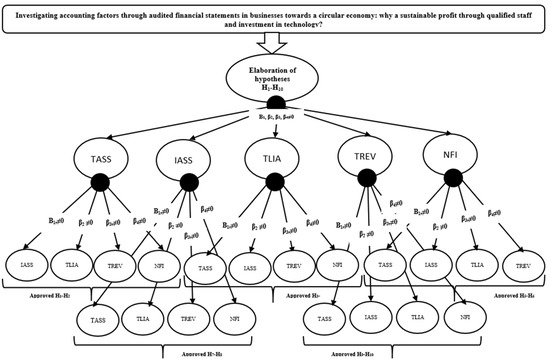

4.4. Validating Hypothesis for Investigating Accounting Factors through Audited Financial Statements by Analyzing Qualified Staff and Investments in Technology (Equipment, Machinery, etc.) for Sustainable Profit in Business

Table 14 presents the validation of hypotheses (H1–H10) for all sessions and all analyses. According to this table, the regression analysis proves the importance of each independent factor and variable and their influence on the dependent variables related to the investigation of the accounting factors through the audited financial statements to see the sustainable profit given to the qualified staff and investments in technology (equipment, machinery, etc.). According to the results of the factor (IASS), the hypotheses (H1 and H2) are verified, where the influence of independent variables on intangible assets to have sustainable profit is emphasized. According to the results of the factor (TASS), the hypotheses (H3 and H4) are verified, where the influence of the independent variables on the total assets to have a sustainable profit is emphasized. According to the results of the factor (TLIA), the hypotheses (H5 and H6) are verified, where the influence of the independent variables on the total liabilities is emphasized to have a stable profit. According to the results of the factor (TREV), the hypotheses (H7 and H8) are verified, where the influence of the independent variables on the total income is emphasized to have a stable profit. According to the results of the factor (NFI), the hypotheses (H9 and H10) are verified, where the influence of the independent variables on the net financial income to have a sustainable profit is emphasized.

Table 14.

Approval of hypotheses for all analyses.

Figure 6 presents the model of the investigation of accounting factors through audited financial statements (IAAFSBCS) to verify the hypotheses raised for all variables (TASS, IASS, TLIA, TREV, and NFI) through the analyses and sessions of this study. Therefore, through the validation of the hypotheses (H1–H10), all variables have a significant impact on the sustainable profit in businesses (N = 800), as detailed in Table 14.

Figure 6.

Elaboration of the hypotheses of the IAAFSBCS model. Data processing by the authors.

5. Discussion

To analyze the findings of this study by making comparisons with the discussions of other authors, the contribution was made to the findings of each variable in each included analysis. According to (Rossi et al. 2020), smart assets can support the circular economy in the design, evaluation, and comparison of circular initiatives for products, materials, assets, and processes to monitor circular efficiency and to have sustainability of profit. Regarding the variable of intangible assets (IASS), according to (Labidi and Gajewski 2019), businesses can increase the liquidity of the stock market around new capital offers by increasing the level of a declaration of their intangible assets, indicating that some French businesses provide insufficient information on their intangible assets. To investigate how the determinants of investment in intangible assets (IASS) in Europe, (Thum-Thysen et al. 2019) explore these barriers and their drivers, concluding that assets are tangible and intangible in that they are affected somewhat differently by some key determinants tested such as (regulatory framework and external financing), while according to the results of this analysis, to have a sustainable profit, businesses must increase the performance of net financial income, taking into account technology (equipment and advanced machines), as well as qualified staff, in a circular economy. Regarding the variable of total assets (TASS), according to (Le et al. 2022), when business growth becomes more aggressive, their restructuring should focus on increasing total assets by merging and buying smaller businesses to stabilize their financial sustainability. Therefore, to investigate the development of a new multi-period asset-liability management model, according to (Hosseininesaz and Jasemi 2022), a portfolio of four assets ((investment in the stock exchange, bonds, three foreign currencies (euro, dollar, and yen) and gold) is the best investment strategy. According to the results of this analysis, to have a stable profit, businesses must be careful about total liabilities in a circular economy. Regarding the total liabilities variable (TLIA) to investigate the auditor’s liability and price of excess cash holdings for foreign businesses, according to (Smith et al. 2021), it is noted that auditors require a fee premium for foreign-incorporated businesses with large cash holdings. According to (Chambers and Reckers 2022), other analyses should be made regarding the effects of the auditor’s choices in order not to cause liabilities. While investigating whether governments support businesses through the distribution of public revenues and expenditures in the form of subsidies, grants, and taxes to have sustainability of profit, according to (Lulaj and Dragusha 2022) and (Lulaj 2022), the country must support businesses through the fair distribution of expenses or public revenues for businesses to have stability in cases of financial crises. While according to the results of this analysis, to have a sustainable profit, businesses must be careful in increasing the performance of the total assets of the business in a circular economy. Regarding the total revenue variable (TREV) to investigate the interaction between revenue logic, revenue model, and business model concepts, according to (Sainio and Marjakoski 2009), the revenue logic analysis consists of evaluating software-industry-level determinants and exploring alternative pricing principles and revenue models that impact revenue generation. According to (Gebauer and Fleisch 2007), employee motivation increases the sustainability of business income and profit, leading to more investments. While according to the results of this analysis, it is emphasized to have a stable profit, businesses must increase the performance of net financial income in a circular economy. Regarding the variable of net financial income (NFI) to investigate how the level of exposure to fair value accounting moderates the changes in the importance of the accounting value of net capital and net income during a crisis period, according to (Adwan et al. 2020), the importance of the accounting value of capital increases, while that of net income decreases during the financial crisis. According to (Balli et al. 2020), borrowing and investment are the main channels for smoothing out a large number of fluctuations in net financial income, while according to the results of this analysis, to have a sustainable profit, businesses must increase the performance of the total business income in a circular economy.

6. Conclusions

Based on the literature review and the findings of this study, it is observed that the investigation of accounting factors through audited financial statements in businesses, considering qualified staff and investments in technology (equipment, machinery, etc.), for sustainable profit is increasing day by day and some of the research pointed out that there is still a need for continuous analysis to see the impact of financial factors on the sustainability of profit. In the findings of this research, the factors (accounting, auditing, financial statements, financial items, qualified staff, investments in technology (equipment, machinery, etc.)) were elaborated, emphasizing where businesses should be careful to have sustainability of profit. In the descriptive analysis section, the financial statements of 800 businesses (manufacturing, service, and distributors) were analyzed, where the largest percentage of businesses were distributor businesses (352 businesses or 44%). In the factor analysis section, one factor (sustainable profit) and two sub-factors were created for human behavior and emerging technologies related to the investigation of sustainable profit factors (TASS, TLIA, TREV, NFI, and IASS), where the data were adequate and significant enough to measure sustainable profit analysis. The rotation matrix highlights the significance of the factors (F1.1: TREV = 0.883, TLIA = 0.695, TASS = 0.685, NFI = 0.854, and F1.2: TASS = 0.951 & TLIA = 0.949). In the reliability analysis section, according to Cronbach’s alpha data, the data have high reliability for each factor (α = 0.961 or 91%, α = 0.837 or 84%, α = 0.873 or 87%). In the multiple regression analysis section, all factors have a significant impact on the model, and there is a difference between the impact of the independent variables on the dependent variable. Regarding the factor (IASS), the variable that had the most impact was (NFI = −519 or −52%), where businesses should take into account investments in technology (advanced equipment and machinery) and have qualified staff. Regarding the factor (TASS), the variable that affected it the most was (TLIA = 0.777 or 78%), where businesses should be careful about total liabilities. Regarding the factor (TLIA), the variable that influenced it the most was (TASS = 0.812 or 81%), where businesses should be careful about total assets. Regarding the factor (TREV), the variable that had the most impact was (NFI = 0.890 or 89%), where businesses should be careful about net financial income. Regarding the factor (NFI), the variable that influenced it the most was (TREV = 0.777 or 78%), where businesses should be careful with the total income. Considering all the factors and variables of this study, it is strongly recommended that businesses pay attention to total liabilities, total assets, net financial income, and total income. This paper can help not only businesses in the state of Kosovo but can also help businesses in all countries of the world in terms of sustainability of profit, taking into account the factors (accounting, auditing, financial statements, financial items, technology, and qualified staff). As implications and limitations, it was difficult to access some of the financial statements and there are only a limited number of variables; therefore, the same models can be analyzed for other businesses, variables, and other countries.

Author Contributions

Conceptualization, E.L. and B.D.; methodology, E.L., B.D. and E.H.; software, E.L. and B.D.; validation, E.L. and B.D.; investigation, E.L., B.D. and E.H.; data curation, E.L., B.D. and E.H.; writing—original draft, E.L. and B.D.; writing—review and editing, E.L., B.D. and E.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki, and ethical review and approval were waived for this study, for the reason that this study was conducted individually and independently by the institution where they work, respecting the anonymity of the interviewer.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data used to support and prove the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adwan, Sami, Alaa Alhaj-Ismail, and Claudia Girardone. 2020. Fair value accounting and value relevance of equity book value and net income for European financial firms during the crisis. Journal of International Accounting, Auditing and Taxation 39: 100320. [Google Scholar] [CrossRef]

- Agyei-Boapeah, Henry, Richard Evans, and Tahir MNisar. 2022. Disruptive innovation: Designing business platforms for new financial services. Journal of Business Research 150: 134–46. [Google Scholar] [CrossRef]

- Ahadiat, Nasrollah, and James Jay Mackie. 1993. Ethics education in accounting: An investigation of the importance of ethics as a factor in the recruiting decisions of public accounting firms. Journal of Accounting Education 11: 243–57. [Google Scholar] [CrossRef]

- Al-Ajmi, Jasim. 2008. Audit and reporting delays: Evidence from an emerging market. Advances in Accounting 24: 217–26. [Google Scholar] [CrossRef]

- Alduais, Fahd, Nashat Ali Almasria, Abeer Samara, and Ali Masadeh. 2022. Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies. International Journal of Financial Studies 10: 104. [Google Scholar] [CrossRef]

- Alfaro, Emigdio, Fei Yu, Naqeeb Ur Rehman, Eglantina Hysa, and Patrice Kandolo Kabeya. 2019. Strategic management of innovation. In The Routledge Companion to Innovation Management. Abingdon: Routledge, pp. 107–68. [Google Scholar]

- Allal-Chérif, Oihab, Juan Costa Climent, and Klaus Jurgen Ulrich Berenguer. 2023. Born to be sustainable: How to combine strategic disruption, open innovation, and process digitization to create a sustainable business. Journal of Business Research 154: 113379. [Google Scholar] [CrossRef]

- Al-Mana, Ali A., Waqas Nawaz, Athar Kamal, and Muammer Koҫ. 2020. Financial and operational efficiencies of national and international oil companies: An empirical investigation. Resources Policy 68: 101701. [Google Scholar] [CrossRef]

- Argilés, Josep M., and Josep Garcia-Blandon. 2011. Accounting Research: A Critical View Of The Present Situation And ProspectsInvestigación En Contabilidad: Una Visión Crítica De La Situación Actual Y Perspectivas. Revista de Contabilidad 14: 9–34. [Google Scholar] [CrossRef]

- Azudin, Afirah, and Noorhayati Mansor. 2018. Management accounting practices of SMEs: The impact of organizational DNA, business potential and operational technology. Asia Pacific Management Review 23: 222–26. [Google Scholar] [CrossRef]

- Bakre, Owolabi M. 2008. Financial reporting as technology that supports and sustains imperial expansion, maintenance and control in the colonial and post-colonial globalisation: The case of the Jamaican economy. Critical Perspectives on Accounting 19: 487–522. [Google Scholar] [CrossRef]

- Balanay, Raquel M., Rowena P. Varela, and Anthony B. Halog. 2022. Chapter 25—Circular economy for the sustainability of the wood-based industry: The case of Caraga Region, Philippines. In Circular Economy and Sustainability. Volume 2: Environmental Engineering. Amsterdam: Elsevier, pp. 447–62. [Google Scholar] [CrossRef]

- Balli, Faruk, Anne De Bruin, Hatice Ozer Balli, and Jamshid Karimov. 2020. Corporate net income and payout smoothing under Shari’ah compliance. Pacific-Basin Finance Journal 60: 101265. [Google Scholar] [CrossRef]

- Beattie, Vivien, and Stella Fearnley. 1998. Audit Market Competition: Auditor Changes And The Impact Of Tendering. The British Accounting Review 30: 261–89. [Google Scholar] [CrossRef]

- Bebbington, Jan, Judy Brown, and Bob Frame. 2007. Accounting technologies and sustainability assessment models. Ecological Economics 61: 224–36. [Google Scholar] [CrossRef]

- Bi, Yulin. 2022. Financial Accounting Information Data Analysis System Based on Internet of Things. Mathematical Problems in Engineering 2022: 6162504. [Google Scholar] [CrossRef]

- Caddy, Ian. 2000. Intellectual capital: Recognizing both assets and liabilities. Journal of Intellectual Capital 1: 129–46. [Google Scholar] [CrossRef]

- Cao, June, and Paul J. Coram. 2020. Auditors’ Response to Different Reporting Environments: Experimental Evidence From the Quantity and Quality of Auditors’ Evidence Demands in China. Internationa Journal of Auditing 24: 73–89. [Google Scholar] [CrossRef]

- Carcello, Joseph V., and Terry L. Neal. 2003. Audit Committee Characteristics and Auditor Dismissals Following “New” Going-Concern Reports. The Accounting Review 78: 95–117. [Google Scholar] [CrossRef]

- Carroll, J. Douglas, and Paul E. Green. 1997. CHAPTER 6—Applying the Tools to Multivariate Data. In Mathematical Tools for Applied Multivariate Analysis (Revised Edition). Cambridge: Academic Press, pp. 259–94. [Google Scholar] [CrossRef]

- Castka, Pavel, Cory Searcy, and Jakki Mohr. 2020. Technology-enhanced auditing: Improving veracity and timeliness in social and environmental audits of supply chains. Journal of Cleaner Production 258: 20773. [Google Scholar] [CrossRef]

- Chae, Soo-Joon, Makoto Nakano, and Ryosuke Fujitani. 2020. Financial Reporting Opacity, Audit Quality and Crash Risk: Evidence from Japan. The Journal of Asian Finance, Economics and Business 7: 9–17. [Google Scholar] [CrossRef]

- Chambers, Valerie A., and Philip M. J. Reckers. 2022. Auditor interventions that reduce auditor liability judgments. Advances in Accounting 58: 100614. [Google Scholar] [CrossRef]

- Chams, Nour, and Josep García-Blandón. 2019. On the importance of sustainable human resource management for the adoption of sustainable development goals. Resources, Conservation and Recycling 141: 109–22. [Google Scholar] [CrossRef]

- Chen, Xiaowei. 2022. The Fusion Model of Financial Accounting and Management Accounting Based on Neural Networks. Mobile Information Systems 2022: 1587274. [Google Scholar] [CrossRef]

- Chen, Ziyue. 2021. Research on Accounting Intelligence System Modeling of Financial Performance Evaluation. Security and Communication Networks 2021: 5550382. [Google Scholar] [CrossRef]

- Chiarot, Christian, Robert Eduardo Cooper Ordoñez, and Carlos Lahura. 2022. Evaluation of the Applicability of the Circular Economy and the Product-Service System Model in a Bearing Supplier Company. Sustainability 14: 12834. [Google Scholar] [CrossRef]

- Colovic, Ana, Bisrat A. Misganaw, and Dawit Z. Assefa. 2022. Liability of informality and firm participation in global value chains. Journal of World Business 57: 101279. [Google Scholar] [CrossRef]

- Corrado, Carol, Charles Hulten, and Daniel Sichel. 2009. Intangible capital and u.s. economic growth. The Review of Income and Wealth 55: 661–85. [Google Scholar] [CrossRef]

- Cudeck, Robert. 2000. 10—Exploratory Factor Analysis. In Handbook of Applied Multivariate Statistics and Mathematical Modeling. Amsterdam: Elsevier, pp. 265–96. [Google Scholar] [CrossRef]

- Dantas, Rui Miguel, Aamar Ilyas, José Moleiro Martins, and João Xavier Rita. 2022. Circular Entrepreneurship in Emerging Markets through the Lens of Sustainability. Journal of Open Innovation: Technology, Market, and Complexity 8: 211. [Google Scholar] [CrossRef]

- Dawid, Herbert, and Gerd Muehlheusser. 2022. Smart products: Liability, investments in product safety, and the timing of market introduction. Journal of Economic Dynamics and Control 134: 104288. [Google Scholar] [CrossRef]

- De Villiers, Charl, and Matteo Molinari. 2022. How to communicate and use accounting to ensure buy-in from stakeholders: Lessons for organizations from governments’ COVID-19 strategies. Accounting, Auditing & Accountability Journal 35: 20–34. [Google Scholar] [CrossRef]

- EFRAG. 2021. Interconnection between Financial and Non-Financial Information. Brussels: European Financial Reporting Advisory Group. Available online: https://www.efrag.org/ (accessed on 20 February 2021).

- Ellis, Charles, Eu-Lin Fang, Katharina Baudouin-Goerlitz, Ruoyu Wen, Fengying Ye, Shi Li, and C. A. Jyoti Singh. 2022. ESG Reporting White Paper. Australia: Division 3 of the Copyright Act 1968 (Cth). Available online: https://www.cpaaustralia.com.au/-/media/project/cpa/corporate/documents/tools-and-resources/environmental-social-governance/esg-reporting-white-paper-2022.pdf?icid=copy-internal-page-banner (accessed on 12 January 2023).

- Gebauer, Heiko, Alexander Arzt, Marko Kohtamäki, Claudio Lamprecht, Vinit Parida, Lars Witell, and Felix Wortmann. 2020. How to convert digital offerings into revenue enhancement—Conceptualizing business model dynamics through explorative case studies. Industrial Marketing Management 91: 429–41. [Google Scholar] [CrossRef]

- Gebauer, Heiko, and Elgar Fleisch. 2007. An investigation of the relationship between behavioral processes, motivation, investments in the service business and service revenue. Industrial Marketing Management 36: 337–48. [Google Scholar] [CrossRef]

- Gerlich, Michael. 2023. How Short-Term Orientation Dominates Western Businesses and the Challenges They Face—An Example Using Germany, the UK, and the USA. Administrative Sciences 13: 25. [Google Scholar] [CrossRef]

- Ghafran, Chaudhry, Noel O’Sullivan, and Sofia Yasmin. 2022. When does audit committee busyness influence earnings management in the UK? Evidence on the role of the financial crisis and company size. Journal of International Accounting 47: 100467. [Google Scholar] [CrossRef]

- Goddard, Francis, and Martin Schmidt. 2021. Exploratory insights into audit fee increases: A field study into board member perceptions of auditor pricing practices. International Journal of Auditing 25: 637–60. [Google Scholar] [CrossRef]

- Goretzko, David, Trang Thien Huong Pham, and Markus Bühner. 2021. Exploratory factor analysis: Current use, methodological developments and recommendations for good practice. Current Psychology 40: 3510–21. [Google Scholar] [CrossRef]

- Ha, Hoang Thi Viet, Dang Ngoc Hung, and Nguyen Thi Thanh Phuong. 2018. The Study of Factors Affecting the Timeliness of Financial Reports: The Experiments on Listed Companies in Vietnam. Asian Economic and Financial Review 8: 294–307. [Google Scholar] [CrossRef]

- Haji, Abdifatah Ahmed, Paul Coram, and Indrit Troshani. 2023. Consequences of CSR reporting regulations worldwide: A review and research agenda. Accounting, Auditing & Accountability Journal 36: 177–208. [Google Scholar] [CrossRef]

- Han, Junghee, Almas Heshmati, and Masoomeh Rashidghalam. 2020. Circular Economy Business Models with a Focus on Servitization. Sustainability 12: 8799. [Google Scholar] [CrossRef]

- He, Xianjie, Jeffrey A. Pittman, and Oliver M. Rui. 2016. Do Social Ties between External Auditors and Audit Committee Members Affect Audit Quality? Available online: https://ssrn.com/abstract=2868205 (accessed on 14 November 2016). [CrossRef]

- Hosseininesaz, Hamid, and Milad Jasemi. 2022. Development of a new asset liability Management model with liquidity and inflation risks based on the Lower Partial Moment. Expert Systems with Applications 210: 118427. [Google Scholar] [CrossRef]

- Hou, Xuechen. 2022. Design and Application of Intelligent Financial Accounting Model Based on Knowledge Graph. Mobile Information Systems 2022: 8353937. [Google Scholar] [CrossRef]

- Hu, Tiancheng, Rui Guo, and Lutao Ning. 2022. Intangible assets and foreign ownership in international joint ventures: The moderating role of related and unrelated industrial agglomeration. Research in International Business and Finance 61: 101654. [Google Scholar] [CrossRef]

- Hui, Loi Teck, and Quek Kia Fatt. 2007. Strategic organizational conditions for risks reduction and earnings management: A combined strategy and auditing paradigm. Accounting Forum 31: 179–201. [Google Scholar] [CrossRef]

- Humphrey, Christopher, and Peter Moizer. 1990. From techniques to ideologies: An alternative perspective on the audit function. Critical Perspectives on Accounting 1: 217–38. [Google Scholar] [CrossRef]

- Hysa, Eglantina, Alba Kruja, Naqeeb Ur Rehman, and Rafael Laurenti. 2020. Circular economy innovation and environmental sustainability impact on economic growth: An integrated model for sustainable development. Sustainability 12: 4831. [Google Scholar] [CrossRef]

- Iatridis, George Emmanuel. 2016. Financial reporting language in financial statements: Does pessimism restrict the potential for managerial opportunism? International Review of Financial Analysis 45: 1–17. [Google Scholar] [CrossRef]

- Ishak, Suhaimi. 2016. Going-concern Audit Report: The Role of Audit Committee. International Journal of Economics and Financial Issues 6: 36–39. Available online: http://www.econjournals.com/ (accessed on 1 May 2016).

- Jans, Mieke, Banu Aysolmaz, Maarten Corten, Anant Joshi, and Mathijs van Peteghem. 2023. Digitalization in accounting–Warmly embraced or coldly ignored? Accounting, Auditing & Accountability Journal 36: 61–85. [Google Scholar] [CrossRef]

- Janvrin, Diane J., Maureen Francis Mascha, and Melvin A. Lamboy-Ruiz. 2020. SOX 404(b) Audits: Evidence from Auditing the Financial Close Process of the Accounting System. Journal of Information Systems 34: 77–103. [Google Scholar] [CrossRef]

- Kabbach-de-Castro, Luiz Ricardo, Guilherme Kirch, and Rafael Mattac. 2022. Do internal capital markets in business groups mitigate firms’ financial constraints? Journal of Banking & Finance 143: 106573. [Google Scholar] [CrossRef]

- Kabir, Humayun, and Li Su. 2022. How did IFRS 15 affect the revenue recognition practices and financial statements of firms? Evidence from Australia and New Zealand. Journal of International Accounting, Auditing and Taxation 49: 100507. [Google Scholar] [CrossRef]

- Kacani, Jolta, Lindita Mukli, and Eglantina Hysa. 2022. A framework for short- vs. long-term risk indicators for outsourcing potential for enterprises participating in global value chains: Evidence from Western Balkan countries. Journal of Risk and Financial Management 15: 401. [Google Scholar] [CrossRef]

- Karasioğlu, Fehmi, Humayun Humta, and Ibrahim Emre Göktürk. 2021. Investigation of Accounting Ethics Effects on Financial Report Quality & Decision Making: Evidence from Kabul-based Logistic Corporations. International Journal of Management, Accounting and Economics 8: 122–42. [Google Scholar] [CrossRef]

- Korhonen, Jouni, Antero Honkasalo, and Jyri Seppälä. 2018. Circular Economy: The Concept and its Limitations. Ecological Economics, Elsevier 143: 37–46. [Google Scholar] [CrossRef]

- Kusnic, Michael W., and Julie Davanzo. 1986. Accounting for non-market activities in the distribution of income: An empirical investigation. Journal of Development Economics 21: 211–27. [Google Scholar] [CrossRef]

- Labidi, Manel, and Jean François Gajewski. 2019. Does increased disclosure of intangible assets enhance liquidity around new equity offerings? Research in International Business and Finance 48: 426–37. [Google Scholar] [CrossRef]

- Le, Huong Nguyen Quynh, Thai Vu Hong Nguyen, and Christophe Schinckus. 2022. The role of strategic interactions in risk-taking behavior: A study from asset growth perspective. International Review of Financial Analysis 82: 02127. [Google Scholar] [CrossRef]

- Lev, Baruch. 2018. The deteriorating usefulness of financial report information and how to reverse it. Accounting and Business Research 48: 465–93. [Google Scholar] [CrossRef]

- Li, Jun. 2019. Research on Limitations of Financial Statement Analysis Based on Data of Listed Companies. In Advances in Economics, Business and Management Research, Volume 110. 5th International Conference on Economics, Management, Law and Education (EMLE 2019). Dordrecht: Atlantis Press SARL. [Google Scholar]

- Lim, Steve C., Antonio J. Macias, and Thomas Moeller. 2020. Intangible assets and capital structure. Journal of Banking & Finance 118: 105873. [Google Scholar] [CrossRef]

- Lin, Han, Lu Chen, Mingchuan Yu, Chao Li, Joseph Lampel, and Wan Jiang. 2021. Too little or too much of good things? The horizontal S-curve hypothesis of green business strategy on firm performance. Technological Forecasting and Social Change 172: 121051. [Google Scholar] [CrossRef]

- Low, Mary, Howard Daveya, and Keith Hooper. 2008. Accounting scandals, ethical dilemmas and educational challenges. Critical Perspectives on Accounting 19: 222–54. [Google Scholar] [CrossRef]

- Lucianetti, Lorenzo, Charbel Jose Chiappett Jabbour, Angappa Gunasekaran, and Hengky Latan. 2018. Contingency factors and complementary effects of adopting advanced manufacturing tools and managerial practices: Effects on organizational measurement systems and firms’ performance. International Journal of Production Economics 200: 318–28. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021a. Accounting, Reforms and Budget Responsibilities in the Financial Statements. Accounting and Finance/Oblik i Finansi 21: 61–69. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021b. Quality and reflecting of financial position: Anenterprises model through logistic regression andnatural logarithm. Journal of Economic Development, Environment and People 10: 26–50. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2022. An unstoppable and navigating journey towards development reform in complex financial-economic systems: An interval analysis of government expenses (past, present, future). Business, Management and Economics Engineering 20: 329–57. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Blerta Dragusha. 2022. Incomes, Gaps and Well-Being: An Exploration of Direct Tax Income Statements Before and During Covid-19 Through the Comparability Interval. International Journal of Professional Business Review 7: e0623. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Etem Iseni. 2018. Role of Analysis CVP (Cost-Volume-Profit) as Important Indicator for Planning and Making Decisions in the Business Environment. European Journal of Economics and Business Studies 4: 99–114. [Google Scholar] [CrossRef]