Agricultural Risk Management Using Fuzzy TOPSIS Analytical Hierarchy Process (AHP) and Failure Mode and Effects Analysis (FMEA)

Abstract

:1. Introduction

- What are the main risks of agriculture plans?

- What are the proper measures for evaluating the risk of under-study agriculture plans risk?

- How can one evaluate and rank the identified risks based on the sensitivity of time, cost, and quality dimensions in each agriculture plan?

- How can one rank the identified risks considering all the agriculture plans?

- Identifying and classifying the risks of investment in agriculture projects in two categories of construction and exploitation.

- Developing the FMEA method by breaking the severity risk evaluation factor onto three sub-factors of severity on cost, the severity of time, and severity on quality.

- Weighting the developed risk evaluation factors through the FAHP method and capability to sensitivity analysis of the risks based on the important amount of time, cost, or quality in different projects.

- Implementing the FMEA method and multiple indices for analyzing the risks in agriculture domain for the first time.

1.1. Risk Assessment Tools

1.2. Risk Assessment Indicators

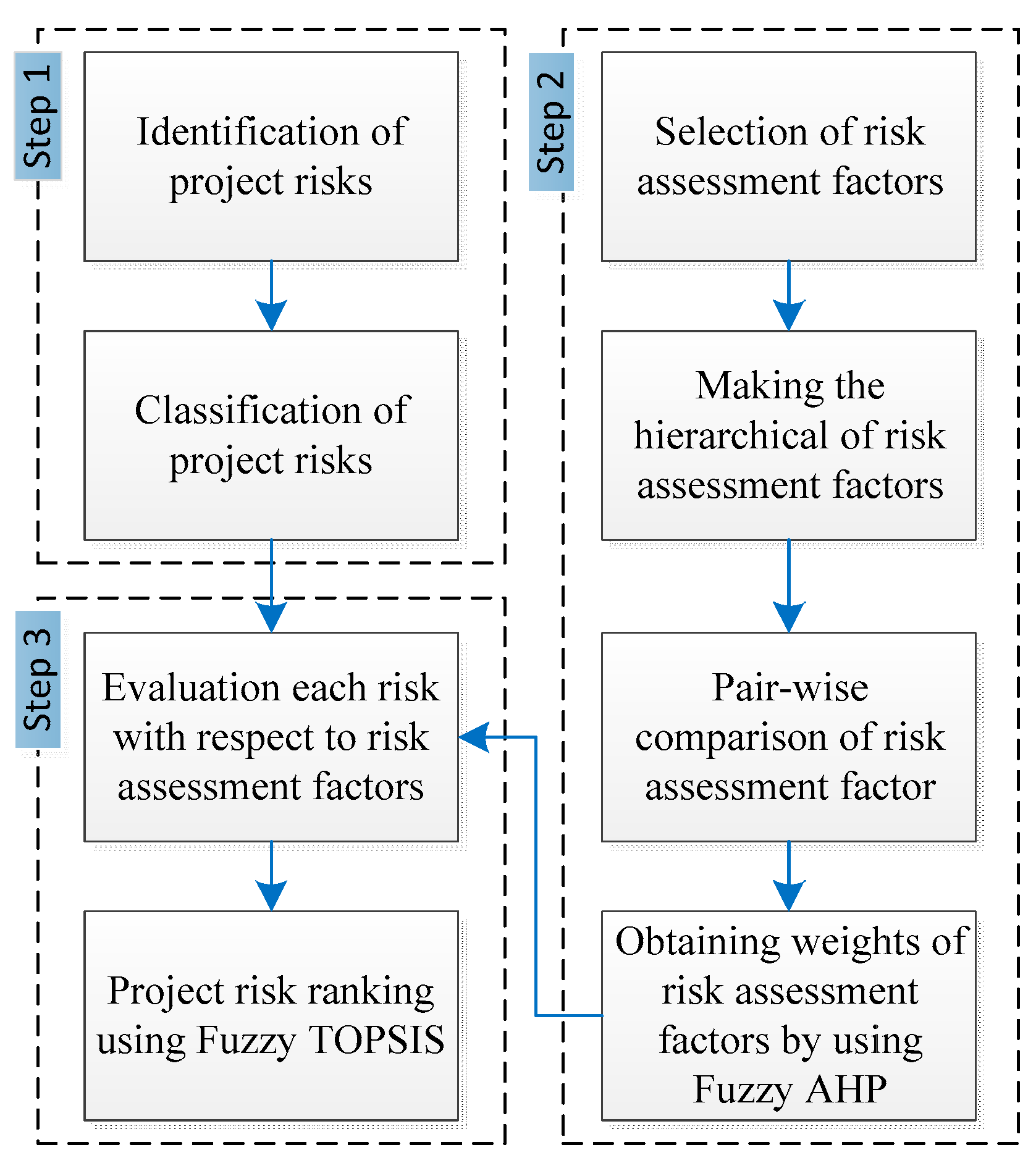

2. Materials and Methods

- Draw a hierarchical chart of risk assessment factors.

- Formation of a pair-wise matrix of risk assessment factors (S, O, and D) and sub-risk assessment factors (ST, SC, and SQ) using triangular fuzzy numbers.

- Calculate Si for each of the two-dimensional matrix rows.

- Calculate the magnitude of Si’s relative to each other

- Calculate factors weight and risk factors under the paired matrix.

- Calculate the final weight vector at the lowest level of hierarchical structure.

- Assessing the experts with regards to the risks identified in each of the risk assessment factors.

- Create a fuzzy decision matrix and normalize it.

- Create a normal fuzzy decision matrix.

- Ideal positive ideal and adverse ideal fuzzy determination.

- Calculate the distance between all risks from a fuzzy positive and negative ideal

- Determine the proximity risk factor and calculate it.

- Risk rating according to their near-range ratio.

2.1. Fuzzy Logic

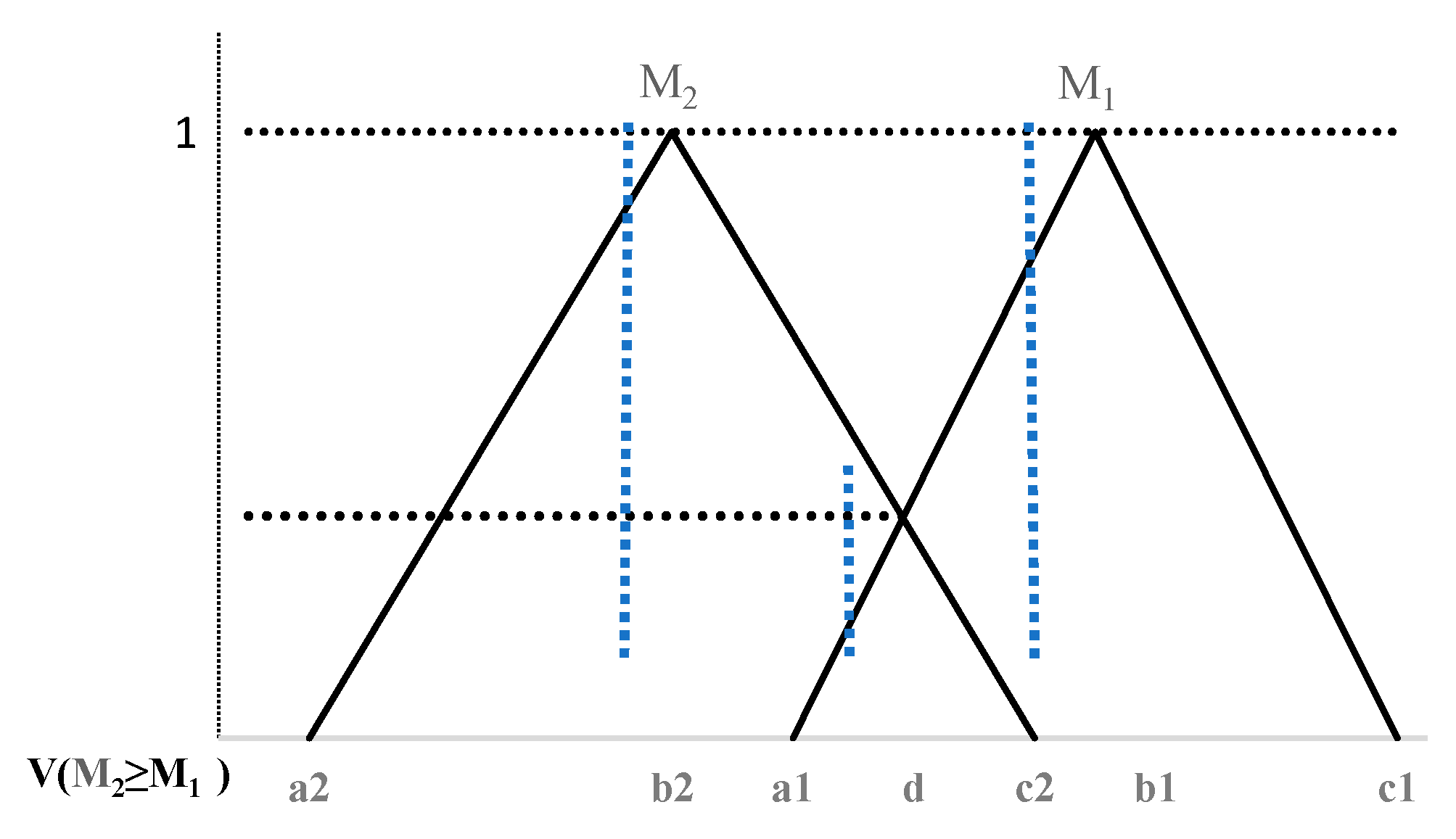

2.2. Fuzzy AHP

2.3. Fuzzy TOPSIS

2.4. Identification and Classification of Investment Risks

2.5. Investment Risk Assessment

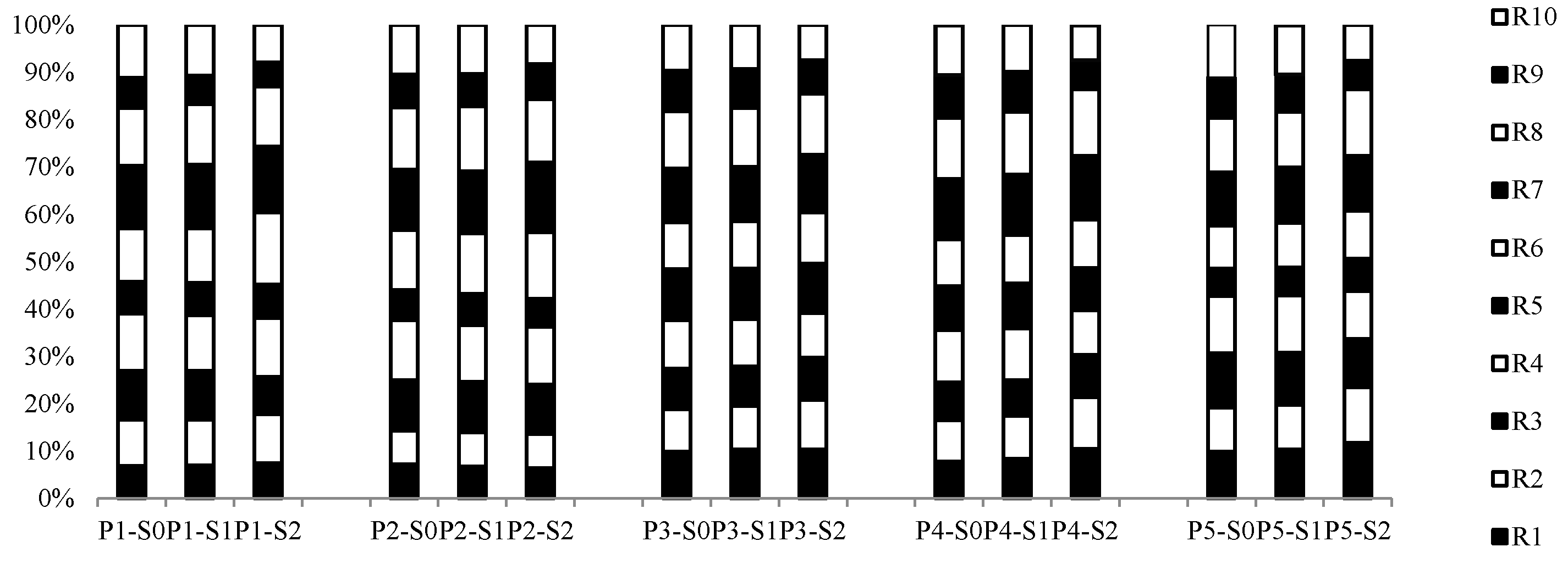

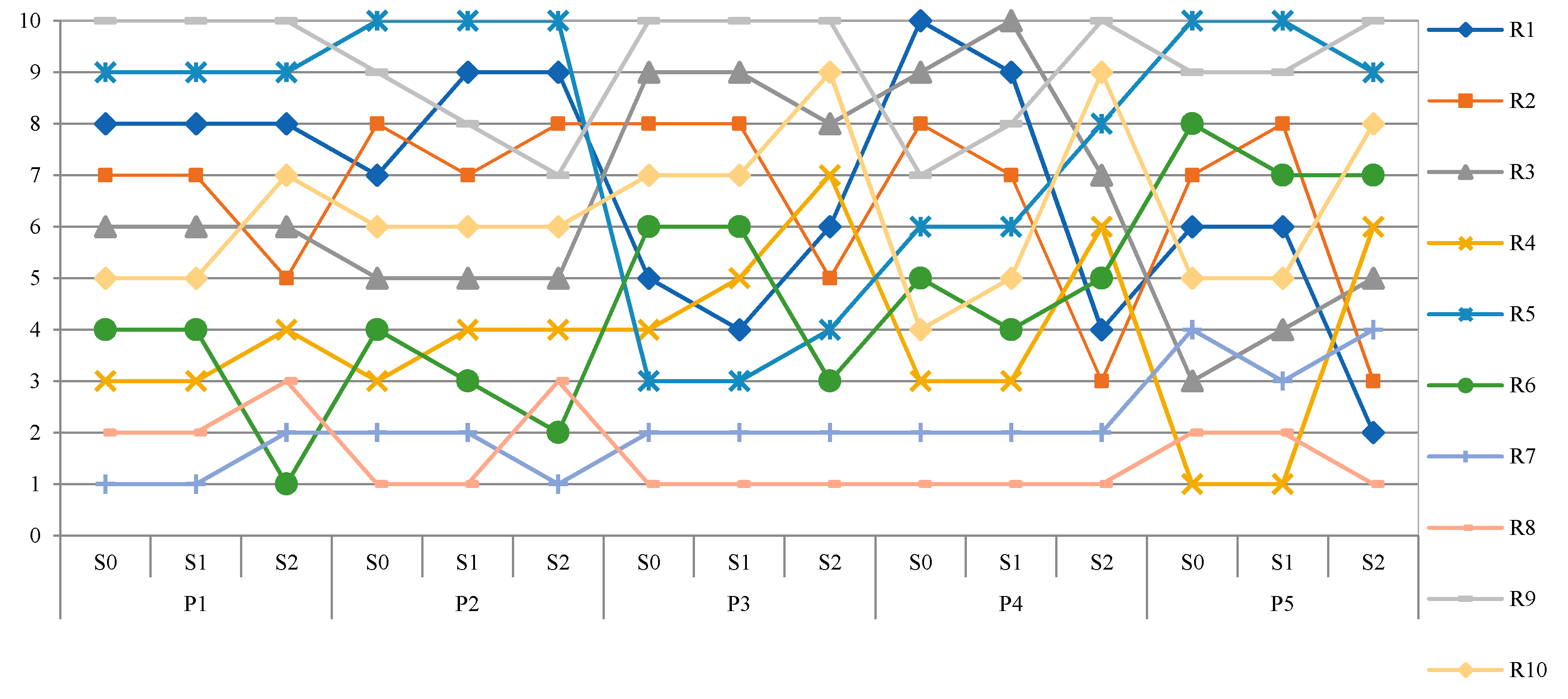

3. Results and Discussion

Controlling the Risks in the Agricultural Sector

- On-farm strategies including: Selection of low risk exposure products, selection of short production cycles products, production programs diversification, and self-insurance or stabilization funds.

- Strategies of risk-sharing including: Marketing and production contracts, futures markets hedging, or the participating in insurance, mutual insurance or mutual regional schemes.

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Acronyms

| FMEA | Failure mode and effects analysis |

| RPN | Risk priority number |

| TOPSIS | Technique for order preference by similarity to ideal solution |

| AHP | Analytical hierarchy process |

| ETA | Event tree analysis |

| FTA | Fault tree analysis |

| MCDM | Multi-criteria decision-making |

| ANP | Analytic network process |

| LINMAP | Linear programming technique for multidimensional analysis of preference |

| FAHP | Fuzzy analytic hierarchy process |

| FTOPSIS | Fuzzy technique for order of preference by similarity to ideal solution |

| BN | Bayesian network |

| GST | Grey system theory |

| DSS | Decision support system |

| VIKOR | VlseKriterijuska Optimizacija I Komoromisno Resenje |

| COPRAS | Complex proportional assessment |

| MADM | Multi-attribute decision making |

| CR | Consistency ration |

Appendix A

| Project | ID | Probability | Severity | Discover and Control | ||

|---|---|---|---|---|---|---|

| P | (Time) ST | (cost) SC | (Quality) SQ | D | ||

| The second project | R1 | L-L-M | L-VL-VL | M-M-M | VL-VL-VL | M-M-H |

| R2 | L-L-VL | VL-VL-VL | L-L-M | L-M-M | L-L-M | |

| R3 | M-M-M | M-VL-L | VH-L-VH | H-L-L | VL-VL-L | |

| R4 | H-H-M | L-M-H | VH-VH-VH | M-VL-VL | M-L-L | |

| R5 | M-L-L | L-L-L | L-VL-L | VL-VL-L | H-H-M | |

| R6 | M-H-M | L-M-L | VH-H-VH | VH-VH-VH | L-VL-L | |

| R7 | H –H- M | M-M-M | VH-VH-H | VH-VH-VH | H-L-L | |

| R8 | VH-VH-H | L-L-M | VH-H-M | VH-VH-VH | M-VL-L | |

| R9 | VL-L-M | VL-L-M | L-M-M | VL-L-VL | H-VH-H | |

| R10 | H-M-VH | VL-VL-VL | L-H-M | VL-VL-L | L-VL-M | |

| The third project | R1 | H-M-L | VH-H-H | VH-H-H | H-VH-L | H-M-L |

| R2 | H-M-VH | H-VH-M | VH-H-M | H-H-M | H-VH-H | |

| R3 | H-H-H | H-VLVL | L-H-L | L-VL-M | M-L-L | |

| R4 | VH-VH-H | L-H-M | VH-M-H | L-VL-L | VL-VL-VL | |

| R5 | VH-H-VH | L-M-M | VH-H-VH | H-M-H | M-L-L | |

| R6 | H-H-M | M-M-M | M-M-VH | VH-VH-H | M-L-L | |

| R7 | VH-H-VH | H-M-M | VH-H-VH | VH-VH-H | L-VL-M | |

| R8 | M-H-VH | VH-H-H | VH-VH-VH | VH-VH-VH | M-VL-L | |

| R9 | M-H-M | L-VL-L | M-H-M | L-VL-VL | M-VL-VL | |

| R10 | H-H-VH | L-VL-L | H-VH-VH | VL-VL-VL | M-M-L | |

| The fourth project | R1 | L-VL-L | VH-H-H | L-M-M | H-VH-H | L-M-L |

| R2 | L-VL-H | VH-VH-M | H-H-M | H-H-VH | M-M-H | |

| R3 | L-VL-L | H-M-M | H-H-VH | L-VL-L | M-H-L | |

| R4 | H-VH-H | L-L-L | VH-VH-H | H-M-L | L-VL-L | |

| R5 | M-H-M | L-M-L | M-M-M | M-M-H | M-L-L | |

| R6 | M-H-M | L-L-M | H-M-VH | VH-VH-H | M-L-L | |

| R7 | H-H-VH | L-L-M | H-H-H | VH-VH-H | L-VL-M | |

| R8 | H-H-VH | VH-H-H | VH-VH-VH | VH-VH-VH | L-VL-L | |

| R9 | M-H-M | VL-VL-VL | VH-H-M | VL-VL-VL | L-VL-VL | |

| R10 | VH-H-VH | VL-VL-L | H-VH-VH | VL-VL-VL | VL-M-L | |

| The fifth project | R1 | L-M-L | VH-H-H | H-M-M | VH-VH-H | L-M-L |

| R2 | L-VL-M | VH-VH-H | H-H-VH | H-M-VH | M-M-H | |

| R3 | H-VH-H | H-VH-H | H-H-VH | L-VL-L | M-M-L | |

| R4 | VH-VH-H | L-L-L | VH-VH-H | H-M-H | L-VL-L | |

| R5 | VL-L-VL | VL-M-L | L-M-L | L-M-L | M-H-VH | |

| R6 | M-M-M | M-L-M | H-M-VH | H-VH-H | M-H-H | |

| R7 | M-H-M | L-L-M | H-H-H | VH-VH-VH | H-M-M | |

| R8 | L-M-M | VH-H-H | VH-VH-VH | VH-VH-VH | L-VL-L | |

| R9 | L-M-M | VL-VL-VL | VH-H-M | VL-VL-VL | L-VL-VL | |

| R10 | H-H-VH | VL-VL-L | H-VH-VH | VL-VL-VL | M-M-L | |

References

- Williams, T. A classified bibliography of recent research relating to project risk management. Eur. J. Oper. Res. 1995, 85, 18–38. [Google Scholar] [CrossRef]

- Castro, N.R.; Swart, J. Building a roundtable for a sustainable hazelnut supply chain. J. Clean. Prod. 2017, 168, 1398–1412. [Google Scholar] [CrossRef]

- Mateos-Ronco, A.; Izquierdo, R.J.S. Risk Management Tools for Sustainable Agriculture: A Model for Calculating the Average Price for the Season in Revenue Insurance for Citrus Fruit. Agronomy 2020, 10, 198. [Google Scholar] [CrossRef] [Green Version]

- Nadezda, J.; Dusan, M.; Stefania, M. Risk factors in the agriculture sector. Agric. Econ. 2017, 63, 247–258. [Google Scholar] [CrossRef] [Green Version]

- Zulfiqar, F.; Ullah, R.; Abid, M.; Hussain, A. Cotton production under risk: A simultaneous adoption of risk coping tools. Nat. Hazards 2016, 84, 959–974. [Google Scholar] [CrossRef]

- EC. Risk Management Tools for EU Agriculture, with a Special Focus on Insurance. Working Document, Directorate General. 2001. Available online: http://ec.europa.eu/agriculture/publi/insurance/index_en.htm (accessed on 2 December 2011).

- Jia, J.; Bradbury, M.E. Risk management committees and firm performance. Aust. J. Manag. 2020, 8, 122–140. [Google Scholar] [CrossRef]

- Miller, A.; Dobbins, C.L.; Pritchett, J.G.; Boehlje, M.; Ehmke, C. Risk Management for Farmers; Staff Paper 4–11; Department of Agricultural Economics, Purdue University: West Lafayette, IN, USA, 2004; pp. 1–27. [Google Scholar]

- Hardaker, J.B.; Huirne, R.B.M.; Anderson, J.R.; Lien, G. Coping with Risk in Agriculture, 2nd ed.; Chapter 1; CABI Publishing: Wallingford, UK, 2004. [Google Scholar]

- Miceikiene, A.L. Risk Management at Lithuanian Farms. In Entrepreneurship, Business and Economics—Vol. 1; Eurasian Studies in Business and Economics 3/1; Bilgin, M., Danis, H., Eds.; Springer: Cham, Switzerland, 2016; Volume 1. [Google Scholar]

- Khanian, M.; Marshall, N.; Zakerhaghighi, K.; Salimi, M.; Naghdi, A. Transforming agriculture to climate change in Famenin County, West Iran through a focus on environmental, economic and social factors. Weather. Clim. Extrem. 2018, 21, 52–64. [Google Scholar] [CrossRef]

- Fund, C. European Agricultural Fund for Rural Development (EAFRD); European Maritime & Fisheries Fund (EMFF): Hamburg, Germany, 2019. [Google Scholar]

- Sharma, R.; Kamble, S.S.; Gunasekaran, A.; Kumar, V.; Kumar, A. A systematic literature review on machine learning applications for sustainable agriculture supply chain performance. Comput. Oper. Res. 2020, 11, 104926. [Google Scholar] [CrossRef]

- Iyer, P.; Bozzola, M.; Hirsch, S.; Meraner, M.; Finger, R. Measuring Farmer Risk Preferences in Europe: A Systematic Review. J. Agric. Econ. 2019, 71, 3–26. [Google Scholar] [CrossRef] [Green Version]

- Meuwissen, M.P.; De Mey, Y.; Van Asseldonk, M. Prospects for agricultural insurance in Europe. Agric. Financ. Rev. 2018, 78, 174–182. [Google Scholar] [CrossRef]

- Ali, S.M.; Nakade, K. Optimal ordering policies in a multi-sourcing supply chain with supply and demand disruptions-a CVaR approach. Int. J. Logist. Syst. Manag. 2017, 28, 180–199. [Google Scholar] [CrossRef]

- Singh, A.; Shukla, N.; Mishra, N. Social media data analytics to improve supply chain management in food industries. Transp. Res. Part E Logist. Transp. Rev. 2018, 114, 398–415. [Google Scholar] [CrossRef]

- De Oliveira, U.R.; Marins, F.A.S.; Rocha, H.M.; Salomon, V.A.P. The ISO 31000 standard in supply chain risk management. J. Clean. Prod. 2017, 151, 616–633. [Google Scholar] [CrossRef] [Green Version]

- Mangla, S.K.; Kumar, P.; Barua, M.K. An integrated methodology of FTA and fuzzy AHP for risk assessment in green supply chain. Int. J. Oper. Res. 2016, 25, 77. [Google Scholar] [CrossRef] [Green Version]

- Govindan, K. Sustainable consumption and production in the food supply chain: A conceptual framework. Int. J. Prod. Econ. 2018, 195, 419–431. [Google Scholar] [CrossRef]

- Özilgen, S.; Özilgen, M. General Template for the FMEA Applications in Primary Food Processing. In Measurement, Modeling and Automation in Advanced Food Processing; Springer: Cham, Switzerland, 2016; pp. 29–69. [Google Scholar]

- Rohmah, D.U.M.; Dania, W.A.P.; Dewi, I.A. Risk Measurement of Supply Chain Organic Rice Product Using Fuzzy Failure Mode Effect Analysis in MUTOS Seloliman Trawas Mojokerto. Agric. Agric. Sci. Procedia 2015, 3, 108–113. [Google Scholar] [CrossRef] [Green Version]

- AbdelGawad, M.; Fayek, A.R. Risk Management in the Construction Industry Using Combined Fuzzy FMEA and Fuzzy AHP. J. Constr. Eng. Manag. 2010, 136, 1028–1036. [Google Scholar] [CrossRef]

- Pritchard, C.L. Advanced Risk—How Big is Your CrystalBall? In Proceedings of the Project Management Institute Annual Seminars & Symposium, Houston, TX, USA, 7–16 September 2000. [Google Scholar]

- Carbone, T.A.; Tippett, D.D. Project Risk Management Using the Project Risk FMEA. Eng. Manag. J. 2004, 16, 28–35. [Google Scholar] [CrossRef]

- U.S. Department of Defense. Military Standard—Procedures Forperforming a Failure Mode Effects and Criticality Analysis. 2; MILSTD-1929A; U.S. Department of Defense: Washington, DC, USA, 1980.

- Keskin, G.A.; Özkan, C. An alternative evaluation of FMEA: Fuzzy ART algorithm. Qual. Reliab. Eng. Int. 2009, 25, 647–661. [Google Scholar] [CrossRef]

- Pillay, A.; Wang, J. Modified failure mode and effects analysis using approximate reasoning. Reliab. Eng. Syst. Saf. 2003, 79, 69–85. [Google Scholar] [CrossRef]

- Bowles, J.B. An assessment of PRN prioritization in a failure modes effects and criticality analysis. J. IEST 2004, 47, 51–56. [Google Scholar] [CrossRef]

- Liu, H.-C.; Liu, L.; Liu, N.; Mao, L.-X. Risk evaluation in failure Failure Mode and Effects Analysis Using Fuzzy Measure and Fuzzy Integral. Symmetry 2017, 9, 162. [Google Scholar] [CrossRef] [Green Version]

- Kumru, M.; Kumru, P.Y. Fuzzy FMEA application to improve purchasing process in a public hospital. Appl. Soft Comput. 2013, 13, 721–733. [Google Scholar] [CrossRef]

- Stamatis, D.H. Failure Mode and Effect Analysis: FMEA from Theory to Execution; ASQC Quality Press: Milwaukee, WI, USA, 1995. [Google Scholar]

- Wang, Y.-M.; Chin, K.-S.; Poon, G.K.K.; Yang, J.-B. Risk evaluation in failure mode and effects analysis using fuzzy weighted geometric mean. Expert Syst. Appl. 2009, 36, 1195–1207. [Google Scholar] [CrossRef]

- Bowles, J.B.; Peláez, C. Fuzzy logic prioritization of failures in a system failure mode, effects and criticality analysis. Reliab. Eng. Syst. Saf. 1995, 50, 203–213. [Google Scholar] [CrossRef]

- Braglia, M. MAFMA: Multi-attribute failure mode analysis. Int. J. Qual. Reliab. Manag. 2000, 17, 1017–1033. [Google Scholar] [CrossRef] [Green Version]

- Tay, K.M.; Lim, C.P. Fuzzy FMEA with a guided rules reduction system for prioritization of failures. Int. J. Qual. Reliab. Manag. 2006, 23, 1047–1066. [Google Scholar] [CrossRef]

- Markowski, A.S.; Mannan, M.S.; Bigoszewska, A. Fuzzy logic for process safety analysis. J. Loss Prev. Process. Ind. 2009, 22, 695–702. [Google Scholar] [CrossRef]

- Islam, M.S.; Nepal, M.P.; Skitmore, M.; Attarzadeh, M. Current research trends and application areas of fuzzy and hybrid methods to the risk assessment of construction projects. Adv. Eng. Inform. 2017, 33, 112–131. [Google Scholar] [CrossRef]

- Puertas, R.; Martí, L.; Álvarez-Coque, J.M.G. Food Supply without Risk: Multicriteria Analysis of Institutional Conditions of Exporters. Int. J. Environ. Res. Public Health 2020, 17, 3432. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Mosavi, A.; Lakner, Z. Food Supply Chain and Business Model Innovation. Foods 2020, 9, 132. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, S.-M. Forecasting enrollments based on fuzzy time series. Fuzzy Sets Syst. 1996, 81, 311–319. [Google Scholar] [CrossRef]

- Kahvand, M.; Gheitarani, N.; Khanian, M.; Ghadarjani, R. Urban solid waste landfill selection by SDSS. Case study: Hamadan. Environ. Prot. Eng. 2015, 41. [Google Scholar] [CrossRef]

- Elmar, K.; Mark, H. Deliberate ignorance in project risk management. Int. J. Proj. Manag. 2010, 28, 245–255. [Google Scholar]

- Prasanta, K.D. Managing project risk using combined analytic hierarchy process and risk map. Appl. Soft Comput. 2010, 990–1000. [Google Scholar] [CrossRef]

- Lee, E.; Park, Y.; Shin, J.G. Large engineering project risk management using a Bayesian belief network. Expert Syst. Appl. 2009, 36, 5880–5887. [Google Scholar] [CrossRef]

- Rahmani, A.; Khanian, M.; Mosalsal, A. Prioritize and location finding land for housing development in the satellite cities of using the AHP model (case study: Bahar city in Hamadan province). J. Basic Appl. Sci. Res. 2013, 3, 148–160. [Google Scholar]

- Sharma, R.K.; Kumar, D.; Kumar, P. Systematicfailure mode effect analysis (FMEA) using fuzzy linguistic modeling. Int. J. Qual. Reliab. Manag. 2005, 22, 986–1004. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Raouf, A. A revised failure mode and effects analysis model. Int. J. Qual. Reliab. Manag. 1996, 13, 43–47. [Google Scholar] [CrossRef]

- Miler, J. A method of Software Project Risk Identification and Analysis. Ph.D. Thesis, Gdansk University of Technology, Faculty of Electronics, Telecommunications and Informatics, Gdansk, Poland, 2005. [Google Scholar]

- Datta, S.; Mukherjee, S.K. Developing a risk management matrix for effective project planning—An empirical study. Project Manag. J. 2000, 32, 45–57. [Google Scholar] [CrossRef]

- Gheitarani, N.; El-Sayed, S.; Cloutier, S.; Budruk, M.; Gibbons, L.; Khanian, M. Investigating the Mechanism of Place and Community Impact on Quality of Life of Rural-Urban Migrants. Int. J. Community Well Being 2019, 3, 21–38. [Google Scholar] [CrossRef] [Green Version]

- Xiaoping, W. Food Supply Chain Safety Risk Evaluation Based on AHP Fuzzy Integrated Evaluation Method. Int. J. Secur. Its Appl. 2016, 10, 233–244. [Google Scholar] [CrossRef]

- Yet, B.; Constantinou, A.C.; Fenton, N.; Neil, M.; Luedeling, E.; Shepherd, K.D. A Bayesian network framework for project cost, benefit and risk analysis with an agricultural development case study. Expert Syst. Appl. 2016, 60, 141–155. [Google Scholar] [CrossRef]

- Song, C.; Zhuang, J. Modeling a Government-Manufacturer-Farmer game for food supply chain risk management. Food Control. 2017, 78, 443–455. [Google Scholar] [CrossRef] [Green Version]

- Nakandala, D.; Lau, H.; Zhao, L. Development of a hybrid fresh food supply chain risk assessment model. Int. J. Prod. Res. 2016, 55, 4180–4195. [Google Scholar] [CrossRef]

- Sang, A.J.; Tay, K.M.; Lim, C.P.; Nahavandi, S. Application of a Genetic-Fuzzy FMEA to Rainfed Lowland Rice Production in Sarawak: Environmental, Health, and Safety Perspectives. IEEE Access 2018, 6, 74628–74647. [Google Scholar] [CrossRef]

- Ali, S.M.; Moktadir, A.; Kabir, G.; Chakma, J.; Rumi, J.U.; Islam, T. Framework for evaluating risks in food supply chain: Implications in food wastage reduction. J. Clean. Prod. 2019, 228, 786–800. [Google Scholar] [CrossRef]

- Zamani, R.; Ali, A.M.A.; Roozbahani, A. Evaluation of Adaptation Scenarios for Climate Change Impacts on Agricultural Water Allocation Using Fuzzy MCDM Methods. Water Resour. Manag. 2020, 34, 1093–1110. [Google Scholar] [CrossRef]

- Wu, J.-Y.; Hsiao, H.-I. Food quality and safety risk diagnosis in the food cold chain through failure mode and effect analysis. Food Control. 2021, 120, 107501. [Google Scholar] [CrossRef]

- Kabir, G.; Tesfamariam, S.; Francisque, A.; Sadiq, R. Evaluating risk of water mains failure using a Bayesian belief network model. Eur. J. Oper. Res. 2015, 240, 220–234. [Google Scholar] [CrossRef]

- Spath, P.L. Using failure mode and effects analysis to improve patient safety. AORN J. 2003, 78, 15–37. [Google Scholar] [CrossRef]

- Chin, K.-S.; Chan, A.; Yang, J.-B. Development of a fuzzy FMEA based product design system. Int. J. Adv. Manuf. Technol. 2007, 36, 633–649. [Google Scholar] [CrossRef]

- Kutlu, A.C.; Ekmekçioğlu, M. Fuzzy failure modes and effects analysis by using fuzzy TOPSIS-based fuzzy AHP. Expert Syst. Appl. 2012, 39, 61–67. [Google Scholar] [CrossRef]

- Taylan, O.; Bafail, A.O.; Abdulaal, R.M.; Kabli, M.R. Construction projects selection and risk assessment by fuzzy AHP and fuzzy TOPSIS methodologies. Appl. Soft Comput. 2014, 17, 105–116. [Google Scholar] [CrossRef]

- Naghdi, A.; Khanian, M.; Rueentan, M. The urban dilemmas in Iran marginal urban area; A case study of Kermanshah city. J. Civil Eng. Urban. 2016, 1, 16–23. [Google Scholar]

- Aziz, R. Risk assessment influencing factors for Arabian construction projects using analytic hierarchy process. Alex. Eng. J. 2018, 57, 4207–4218. [Google Scholar] [CrossRef]

- Rakesh, D.R.; Bhaskar, B.G.; Manoj, K.; Balkrishna, N. Modeling the drivers of post-harvest losses—MCDM approach. Comput. Electron. Agric. 2018, 154, 426–433. [Google Scholar]

- Allaoui, H.; Guo, Y.; Choudhary, A.; Bloemhof, J.M. Sustainable agro-food supply chain design using two-stage hybrid multi-objective decision-making approach. Comput. Oper. Res. 2018, 89, 369–384. [Google Scholar] [CrossRef] [Green Version]

- Thun, J.-H.; Hoenig, D. An empirical analysis of supply chain risk management in the German automotive industry. Int. J. Prod. Econ. 2011, 131, 242–249. [Google Scholar] [CrossRef]

- Ritchie, B.; Brindley, C. Disintermediation, disintegration and risk in the SME global supply chain. Manag. Decis. 2000, 38, 575–583. [Google Scholar] [CrossRef]

- Norrman, A.; Jansson, U. Ericsson’s proactive supply chain risk management approach after a serious sub-supplier accident. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 434–456. [Google Scholar] [CrossRef]

- Barghoth, M.E.; Salah, A.; Ismail, M.A. A Comprehensive Software Project Management Framework. J. Comput. Commun. 2020, 8, 86–110. [Google Scholar] [CrossRef] [Green Version]

- Jia, F.; Rutherford, C. Mitigation of supply chain relational risk caused by cultural differences between China and the West. Int. J. Logist. Manag. 2010, 21, 251–270. [Google Scholar] [CrossRef]

- Chapman, C.B.; Ward, S.C. Project Risk Management: Processes, Techniques and Insights, 2nd ed.; John Wiley and Sons Ltd.: Chichester, UK, 2003. [Google Scholar]

- Pipattanapiwong, J. Development of Multi-Party Risk and Uncertainty Management Process for an Infrastructure Project. Ph.D. Thesis, Kochi University of Technology, Kochi, Japan, 2004. [Google Scholar]

- McDermott, R.E.; Mikulak, R.J.; Beauregard, M.R. The Basics of FMEA; Quality Resources: New York, NY, USA, 1996. [Google Scholar]

- Klein, J.H.; Cork, R.B. An approach to technical risk assessment. Int. J. Proj. Manag. 1998, 16, 345–351. [Google Scholar] [CrossRef]

- Serpoush, B.; Khanian, M.; Shamsai, A. Hydropower plant site spotting using geographic information system and a MATLAB based algorithm. J. Clean. Prod. 2017, 152, 7–16. [Google Scholar] [CrossRef]

- Waterland, L.R.; Venkatesh, S.; Unnasch, S. Safety and Performance Assessment of Ethanol/Diesel Blends (E-Diesel); National Renewable Energy Laboratory: Golden, CO, USA, 2003.

- Baccarini, D.; Archer, R. The risk ranking of projects: A methodology. Int. J. Proj. Manag. 2001, 19, 139–145. [Google Scholar] [CrossRef]

- Pertmaster Software. Pertmaster Project Risk v7.5: Tutorial, Manual and Help. 2002. Available online: http://www.pertmaster.com (accessed on 2 December 2011).

- Xu, L.; Liu, G. The study of a method of regional environmental risk assessment. J. Environ. Manag. 2009, 90, 3290–3296. [Google Scholar] [CrossRef] [PubMed]

- Sayadi, A.; Monjezi, M.; Sharifi, M. An Approach for Risk Assessment in Open Pit Mines Using FAHP & Fuzzy TOPSIS Methods. J. Aalytical Numer. Methods Min. Eng. 2013, 3, 45–58. [Google Scholar]

- Yu, C.-S. A GP-AHP method for solving group decision-making fuzzy AHP problems. Comput. Oper. Res. 2002, 29, 1969–2001. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Zimmermann, H.J. Fuzzy Set Theory and Its Application; International Thomson Publishing: Norwell, MA, USA, 2001. [Google Scholar]

- Deng, H. Multi criteria analysis with fuzzy pair-wise comparison. Int. J. Approx. Reason. 1999, 21, 215–231. [Google Scholar] [CrossRef] [Green Version]

- Kahraman, C.; Cebeci, U.; Ulukan, Z. Multi-criteria supplier selection using fuzzy AHP. Logist. Inf. Manag. 2003, 16, 382–394. [Google Scholar] [CrossRef]

- Van Laarhoven, P.J.M.; Pedrycz, W. A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst. 1983, 11, 229–241. [Google Scholar] [CrossRef]

- Buckley, J. Fuzzy hierarchical analysis. Fuzzy Sets Syst. 1985, 17, 233–247. [Google Scholar] [CrossRef]

- Chang, D.Y. Extent Analysis and Synthetic Decision, Optimization Techniques and Applications. J. Software Eng. Appl. 1992, 1, 352–355. [Google Scholar]

- Triantaphyllou, E.; Lin, C.T. Development and evaluation of five fuzzy multi-attribute decision-making methods. Int. J. Approx. Reason. 1996, 14, 281–310. [Google Scholar] [CrossRef] [Green Version]

- Kaya, T.; Kahraman, C. Multicriteria decision making in energy planning using a modified fuzzy TOPSIS methodology. Expert Syst. Appl. 2011, 38, 6577–6585. [Google Scholar] [CrossRef]

- Chen, S.J.; Hwang, C.L. Fuzzy Multi Attribute Decision Making; Lecture Notes in Economics and Mathematical System Series; Springer: New York, NY, USA, 1992; Volume 375. [Google Scholar]

- Yong, D. Plant location selection based on fuzzy TOPSIS. Int. J. Adv. Manuf. Technol. 2005, 28, 839–844. [Google Scholar] [CrossRef]

- Chen, C.-T.; Lin, C.-T.; Huang, S.-F. A fuzzy approach for supplier evaluation and selection in supply chain management. Int. J. Prod. Econ. 2006, 102, 289–301. [Google Scholar] [CrossRef]

- Banaeian, N.; Mobli, H.; Fahimnia, B.; Nielsen, I.E.; Omid, M. Green supplier selection using fuzzy group decision making methods: A case study from the agri-food industry. Comput. Oper. Res. 2018, 89, 337–347. [Google Scholar] [CrossRef]

- Kahraman, C.; Çevik, S.; Ates, N.Y.; Gülbay, M. Fuzzy multi-criteria evaluation of industrial robotic systems. Comput. Ind. Eng. 2007, 52, 414–433. [Google Scholar] [CrossRef]

- Cho, H.-N.; Choi, H.-H.; Kim, Y.-B. A risk assessment methodology for incorporating uncertainties using fuzzy concepts. Reliab. Eng. Syst. Saf. 2002, 78, 173–183. [Google Scholar] [CrossRef]

- Chen, C.-T. Extensions of the TOPSIS for group decision-making under fuzzy environment. Fuzzy Sets Syst. 2000, 114, 1–9. [Google Scholar] [CrossRef]

- Hillson, D. Using a Risk Breakdown Structure in project management. J. Facil. Manag. 2003, 2, 85–97. [Google Scholar] [CrossRef] [Green Version]

- Hillson, D. Developing Effective Risk Response. In Proceedings of the 30th Annual Project Management Institute, Seminar and Symposium, Philadelphia, PA, USA, 10–16 October 1999. [Google Scholar]

- Meredith, J.R.; Mantel, S.J., Jr. Project Management: A Managerial Approach, 3rd ed.; Wiley: New York, NY, USA, 1995. [Google Scholar]

- Gardas, B.B.; Raut, R.D.; Narkhede, B. Modeling causal factors of post-harvesting losses in vegetable and fruit supply chain: An Indian perspective. Renew. Sustain. Energy Rev. 2017, 80, 1355–1371. [Google Scholar] [CrossRef]

- Ahoa, E.; Kassahun, A.; Tekinerdogan, B. Configuring Supply Chain Business Processes Using the SCOR Reference Model. In Proceedings of the International Symposium on Business Modeling and Software Design, BMSD 2018, Vienna, Austria, 2–4 July 2018; Springer: Cham, Switzerland, 2018; pp. 338–351. [Google Scholar]

- Kamble, S.S.; GunasekaranKamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Sustainable Industry 4.0 framework: A systematic literature review identifying the current trends and future perspectives. Process. Saf. Environ. Prot. 2018, 117, 408–425. [Google Scholar] [CrossRef]

- Naik, G.; Suresh, D. Challenges of creating sustainable agri-retail supply chains. IIMB Manag. Rev. 2018, 30, 270–282. [Google Scholar] [CrossRef]

- Luthra, S.; Mangla, S.K.; Chan, F.T.; Venkatesh, V.G. Evaluating the Drivers to Information and Communication Technology for Effective Sustainability Initiatives in Supply Chains. Int. J. Inf. Technol. Decis. Mak. 2018, 17, 311–338. [Google Scholar] [CrossRef]

- Sachin, S.K.; Angappa, G.; Shradha, A.G. Achieving Sustainable Performance in a Data-driven Agriculture Supply Chain: A Review for Research and Applications. Int. J. Prod. Econ. 2019, 219. [Google Scholar] [CrossRef]

- Correia, E.; Carvalho, H.; Azevedo, S.G.; Govindan, K. Maturity Models in Supply Chain Sustainability: A Systematic Literature Review. Sustainability 2017, 9, 64. [Google Scholar] [CrossRef] [Green Version]

| Fuzzy Number | Description Term |

|---|---|

| (7,9,9) | Absolutely strong (AS) |

| (5,7,9) | Very strong (VS) |

| (3,5,7) | Fairly strong (FS) |

| (1,3,5) | Slightly strong (SS) |

| (1,1,1) | Equal (E) |

| (1/5,1/3,1) | Slightly weak (SW) |

| (1/7,1/5,1/3) | Fairly weak (FW) |

| (1/9,1/7,1/5) | Very weak (VW) |

| (1/9,1/9,1/7) | Absolutely weak (AW) |

| Fuzzy Number | Description Term | Probability of Occurrence | Severity On | Detection/Control | ||

|---|---|---|---|---|---|---|

| Cost | Time | Quality | ||||

| (1,1,3) | Very low (VL) | Chance is < 1% | Increased costs < 1% | Increased time < 1% | Quality degradation is not noticeable. | Not capable of detecting and controlling the risk event |

| (1,3,5) | Low (L) | Chance is ≥ 1% and < 10% | ≥1% and<4% | ≥1% and <4% | Few areas of quality are affected. | Low chance of detecting and controlling the risk event |

| (3,5,7) | Moderate (M) | Chance is ≥ 10% and < 33% | ≥4% and <7% | ≥4% and <7% | Major areas of quality are affected. | Moderate chance of detecting and controlling the risk event |

| (5,7,9) | High (H) | Chance is ≥ 33% and < 67% | ≥7% and <10% | ≥7% and <10% | Quality are unacceptable to project sponsor. | High chance of detecting and controlling the risk event |

| (7,9,9) | Very high (VH) | Chance is ≥ 67% | ≥10% | ≥10% | Project quality does not meet business expectations. | High effectiveness in detecting and controlling the risk event |

| Risk Category | ID | Type of Risk |

|---|---|---|

| Construction risks | R1 | Risk of project manager and human resources |

| R2 | Risk of project planning and implementation | |

| R3 | Financial risk | |

| R4 | Risk of increasing costs | |

| R5 | The risk of access to technology and knowledge | |

| Operational risks | R6 | The supply of raw materials (fluctuations in the prices of agricultural raw materials, including seeds, fertilizers, etc.) |

| R7 | Risk energy and water resources | |

| R8 | The risk of climate fluctuations and pests | |

| R9 | Marketing and sales risk at home and abroad | |

| R10 | Limitations on product sales price (due to government regulations, competitive market, etc.) |

| S | O | D | Weight Vector | |

|---|---|---|---|---|

| Severity (S) | SS- SS –FW (0.52, 1.22, 2.03) | FS-VS-SW (1.44, 2.27, 3.98) | 0.425 | |

| Occurrence (O) | SS-SS-E (1, 2.08, 2.92) | 0.390 | ||

| Detection (D) | 0.185 |

| ST | SC | SQ | Weight Vector | |

|---|---|---|---|---|

| Severity on Time (ST) | FW-SS-SW (0.31, 0.58, 1.19) | E-SS-E (1, 1.44, 1.71) | 0.309 | |

| Severity on Cost (SC) | FS-E-SS (1.44, 2.47, 3.27) | 0.532 | ||

| Severity on Quality (SQ) | 0.159 |

| Occurrence | Severity | Detection | ||

|---|---|---|---|---|

| 0.390 | 0.425 | 0.185 | ||

| Severity on Time | Severity on Cost | Severity on Quality | ||

| 0.309 | 0.532 | 0.159 | ||

| 0.131 | 0.226 | 0.068 | ||

| Category | Risks | O | ST | SC | SQ | D |

|---|---|---|---|---|---|---|

| Max | Max | Max | Max | Min | ||

| 0.390 | 0.131 | 0.226 | 0.068 | 0.185 | ||

| Construction risks | R1 | M-L-L | H-VH-L | L-VL-L | VL-VL-L | H-M-M |

| R2 | H-H-M | H-H-M | H-M-M | L-L-M | H-VH-H | |

| R3 | H-H-VH | H-M-H | VL-L-L | VL-VLVL | M-L-L | |

| R4 | M-M-H | M-VL-L | VH-VH-VH | M-H-M | VL-VL-L | |

| R5 | VL-L-VL | VL-VL-VL | M-L-M | L-M-M | L-L-L | |

| Operational risks | R6 | M-M-L | VH-VH-H | VH-VH-H | VH-VH-VH | M-L-L |

| R7 | VH-H-VH | M-M-L | VH-H-VH | VH-VH-VH | L-VL-L | |

| R8 | VH-H-VH | L-L-M | M-H-M | VH-VH-VH | M-VL-L | |

| R9 | M-L-M | VL-VL-VL | M-L-M | VL-VL-VL | M-H-H | |

| R10 | H-VH-VH | VL-VL-VL | H-H-M | VL-VL-L | L-VL-L |

| Risk ID | O | ST | SC | SQ | D |

|---|---|---|---|---|---|

| R1 | 1, 3.7, 7 | 1, 6.3, 9 | 1, 2.3, 5 | 1, 1.7, 5 | 3, 5.67, 9 |

| R2 | 3, 6.3, 9 | 3, 6.3, 9 | 3, 5.7, 9 | 1, 2.3, 7 | 5, 7.67, 9 |

| R3 | 5, 7.7, 9 | 3, 6.3, 9 | 1, 2.3, 5 | 1, 1, 3 | 1, 3.67, 7 |

| R4 | 3, 5.7, 9 | 1, 3, 7 | 7, 9, 9 | 3, 5.7, 9 | 1, 1.67, 5 |

| R5 | 1, 1.7, 5 | 1, 1, 3 | 1, 4.3, 7 | 1, 4.3, 7 | 1, 3, 5 |

| R6 | 1, 4.3, 7 | 5, 8.3, 9 | 5, 8.3, 9 | 7, 9, 9 | 1, 3.67, 7 |

| R7 | 5, 8.3, 9 | 1, 4.3, 7 | 5, 8.3, 9 | 7, 9, 9 | 1, 2.33, 5 |

| R8 | 5, 8.3, 9 | 1, 3.7, 7 | 3, 5.7, 9 | 7, 9, 9 | 1, 3, 7 |

| R9 | 1, 4.3, 7 | 1, 1, 3 | 1, 4.3, 7 | 1, 1, 3 | 3, 6.33, 9 |

| R10 | 5, 8.3, 9 | 1, 1, 3 | 3, 6.3, 9 | 1, 1.7, 5 | 1, 2.33, 5 |

| Risk ID | O | ST | SC | SQ | D | - Score | Rank | ||

|---|---|---|---|---|---|---|---|---|---|

| R1 | 0.04, 0.16, 0.30 | 0.01, 0.09, 0.13 | 0.03, 0.06, 0.13 | 0.01, 0.01, 0.04 | 0.02, 0.03, 0.06 | 0.39 | 0.20 | 0.340 | 8 |

| R2 | 0.13, 0.27, 0.39 | 0.04, 0.09, 0.13 | 0.08, 0.14, 0.23 | 0.01, 0.02, 0.05 | 0.02, 0.02, 0.04 | 0.30 | 0.29 | 0.490 | 7 |

| R3 | 0.22, 0.33, 0.39 | 0.04, 0.09, 0.13 | 0.03, 0.06, 0.13 | 0.01, 0.01, 0.02 | 0.03, 0.05, 0.19 | 0.29 | 0.30 | 0.514 | 6 |

| R4 | 0.13, 0.25, 0.39 | 0.01, 0.04, 0.10 | 0.18, 0.23, 0.23 | 0.02, 0.04, 0.07 | 0.04, 0.11, 0.19 | 0.24 | 0.36 | 0.603 | 3 |

| R5 | 0.04, 0.07, 0.22 | 0.01, 0.01, 0.04 | 0.03, 0.11, 0.18 | 0.01, 0.03, 0.05 | 0.04, 0.06, 0.19 | 0.4 | 0.2 | 0.335 | 9 |

| R6 | 0.04, 0.19, 0.30 | 0.07, 0.12, 0.13 | 0.13, 0.21, 0.23 | 0.05, 0.07, 0.07 | 0.03, 0.05, 0.19 | 0.26 | 0.34 | 0.562 | 4 |

| R7 | 0.22, 0.36, 0.39 | 0.01, 0.06, 0.10 | 0.13, 0.21, 0.23 | 0.05, 0.07, 0.07 | 0.04, 0.08, 0.19 | 0.2 | 0.39 | 0.655 | 1 |

| R8 | 0.22, 0.36, 0.39 | 0.01, 0.05, 0.10 | 0.08, 0.14, 0.23 | 0.05, 0.07, 0.07 | 0.03, 0.06, 0.19 | 0.24 | 0.37 | 0.609 | 2 |

| R9 | 0.04, 0.19, 0.30 | 0.01, 0.01, 0.04 | 0.03, 0.11, 0.18 | 0.01, 0.01, 0.02 | 0.02, 0.03, 0.06 | 0.40 | 0.19 | 0.319 | 10 |

| R10 | 0.22, 0.36, 0.39 | 0.01, 0.01, 0.04 | 0.08, 0.16, 0.23 | 0.01, 0.01, 0.04 | 0.04, 0.08, 0.19 | 0.27 | 0.33 | 0.552 | 5 |

| 0.39 | 0.13 | 0.23 | 0.07 | 0.19 | |||||

| 0.04 | 0.01 | 0.03 | 0.01 | 0.02 |

| Risk ID | Project 1 | Project 2 | Project 3 | Project 4 | Project 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Score | Rank | Score | Rank | Score | Rank | Score | Rank | Score | Rank | |

| R1 | 0.340 | 8 | 0.342 | 7 | 0.584 | 5 | 0.429 | 10 | 0.511 | 6 |

| R2 | 0.490 | 7 | 0.333 | 8 | 0.524 | 8 | 0.482 | 8 | 0.481 | 7 |

| R3 | 0.514 | 6 | 0.502 | 5 | 0.506 | 9 | 0.445 | 9 | 0.592 | 3 |

| R4 | 0.603 | 3 | 0.592 | 3 | 0.601 | 4 | 0.610 | 3 | 0.624 | 1 |

| R5 | 0.335 | 9 | 0.304 | 10 | 0.639 | 3 | 0.512 | 6 | 0.299 | 10 |

| R6 | 0.562 | 4 | 0.591 | 4 | 0.579 | 6 | 0.548 | 5 | 0.470 | 8 |

| R7 | 0.655 | 1 | 0.599 | 2 | 0.671 | 2 | 0.700 | 2 | 0.583 | 4 |

| R8 | 0.609 | 2 | 0.617 | 1 | 0.712 | 1 | 0.716 | 1 | 0.594 | 2 |

| R9 | 0.319 | 10 | 0.330 | 9 | 0.500 | 10 | 0.498 | 7 | 0.436 | 9 |

| R10 | 0.552 | 5 | 0.487 | 6 | 0.568 | 7 | 0.582 | 4 | 0.573 | 5 |

| Factors of Risk Assessment | Status 0 (S0) | Status 1 (S1) | Status 2 (S2) |

|---|---|---|---|

| O | 0.390 | 0.390 | 0.300 |

| ST | 0.131 | 0.141 | 1.333 |

| SC | 0.226 | 0.141 | 1.333 |

| SQ | 0.068 | 0.141 | 1.333 |

| D | 0.185 | 0.185 | 0.300 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zandi, P.; Rahmani, M.; Khanian, M.; Mosavi, A. Agricultural Risk Management Using Fuzzy TOPSIS Analytical Hierarchy Process (AHP) and Failure Mode and Effects Analysis (FMEA). Agriculture 2020, 10, 504. https://doi.org/10.3390/agriculture10110504

Zandi P, Rahmani M, Khanian M, Mosavi A. Agricultural Risk Management Using Fuzzy TOPSIS Analytical Hierarchy Process (AHP) and Failure Mode and Effects Analysis (FMEA). Agriculture. 2020; 10(11):504. https://doi.org/10.3390/agriculture10110504

Chicago/Turabian StyleZandi, Peyman, Mohammad Rahmani, Mojtaba Khanian, and Amir Mosavi. 2020. "Agricultural Risk Management Using Fuzzy TOPSIS Analytical Hierarchy Process (AHP) and Failure Mode and Effects Analysis (FMEA)" Agriculture 10, no. 11: 504. https://doi.org/10.3390/agriculture10110504

APA StyleZandi, P., Rahmani, M., Khanian, M., & Mosavi, A. (2020). Agricultural Risk Management Using Fuzzy TOPSIS Analytical Hierarchy Process (AHP) and Failure Mode and Effects Analysis (FMEA). Agriculture, 10(11), 504. https://doi.org/10.3390/agriculture10110504