Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market

Abstract

:1. Introduction

2. Background

2.1. Organic Farming and the Organic Food Market in the World

2.2. Price Premiums on the Organic Food Market

3. Materials and Methods

3.1. Data Collection

3.2. Methods

3.2.1. Geographic Variation and Change Trends in Organic Egg production in Poland and the EU

3.2.2. Price Analysis

3.2.3. Price Variability

3.2.4. Comparison of the Prices of Conventional and Organic Eggs

3.2.5. Analysis of Price Premiums

4. Results

4.1. Egg Markets in European Countries and Poland

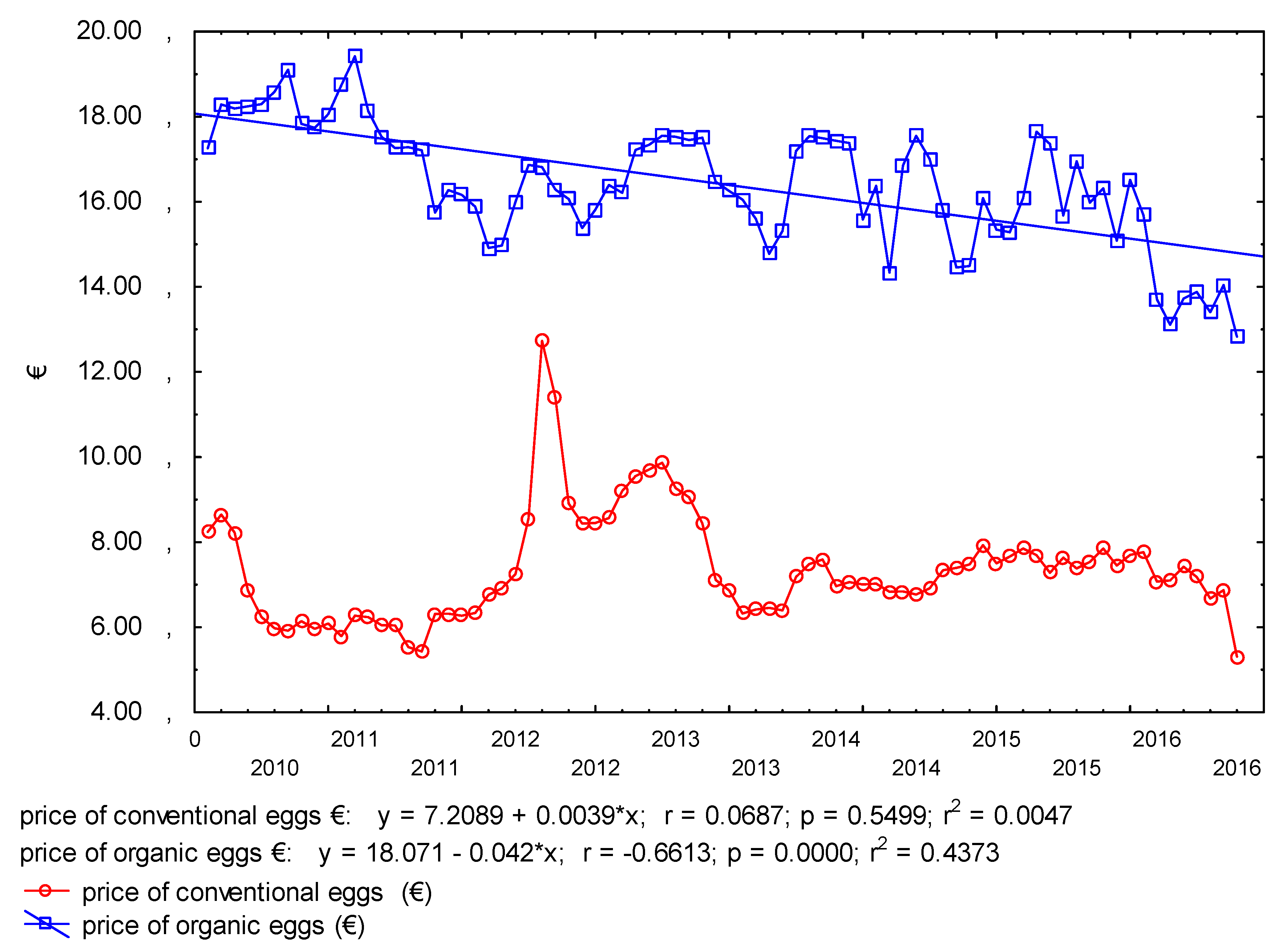

4.2. Egg Prices

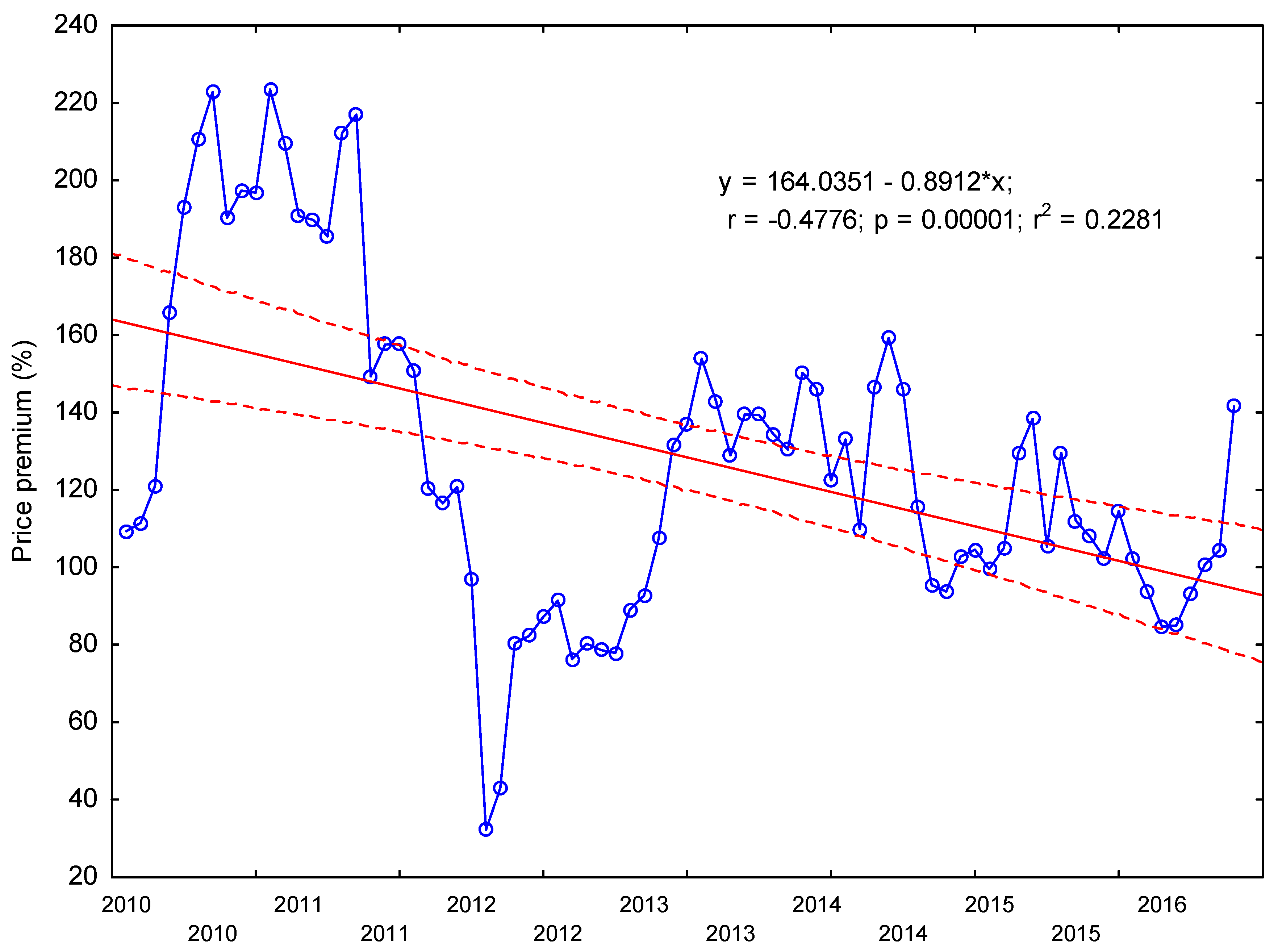

4.3. Price Premium on the Organic Egg Market

5. Discussion

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Williams, P.R.D.; Hammitt, J.K. Perceived risks of conventional and organic produce: Pesticides, pathogens, and natural toxins. Risk Anal. 2001, 21, 319–330. [Google Scholar] [CrossRef] [PubMed]

- Truong, T.T.; Yap, M.H.T.; Ineson, E.M. Potential Vietnamese consumers’ perceptions of organic foods. Br. Food J. 2012, 114, 529–543. [Google Scholar] [CrossRef]

- Goetzke, B.; Nitzko, S.; Spiller, A. Consumption of organic and functional food. A matter of well-being and health? Appetite 2014, 77, 96–105. [Google Scholar] [CrossRef] [PubMed]

- Zhang, B.; Zetian, F.; Jian, H.; Jieqiong, W.; Shuyao, X.; Lingxian, Z. Consumers’ perceptions, purchase intention, and willingness to pay a premium price for safe vegetables: A case study of Beijing, China. J. Clean. Prod. 2018, 197, 1498–1507. [Google Scholar] [CrossRef]

- Bryła, P. Organic food consumption in Poland: Motives and barriers. Appetite 2016, 105, 737–746. [Google Scholar] [CrossRef]

- McKay, S.M. Understanding Organic Prices: An Analysis of Organic Price Risk and Premiums. In Masters Theses; Virginia Polytechnic Institute and State University: Blacksburg, VA, USA, 2016; p. 59. [Google Scholar]

- Rana, J.; Paul, J. Consumer behavior and purchase intention for organic food: A review and research agenda. J. Retail. Consum. Serv. 2017, 38, 157–165. [Google Scholar] [CrossRef]

- Thompson, G.D. Consumer demand for organic foods: What we know and what we need to know. Am. J. Agric. Econ. 1998, 80, 1113–1118. [Google Scholar] [CrossRef]

- Millock, K.; Hansen, L.G.; Wier, M.; Mørch Andersen, L. Willingness to Pay for Organic Foods: A Comparison between Survey Data and Panel Data from Denmark. In Proceedings of the 12th Annual EAERE Conference, Monterey, CA, USA, 4–27 June 2002; p. 23. [Google Scholar]

- Zhou, Y.; Thøgersen, J.; Ruan, Y.; Huang, G. The moderating role of human values in planned behavior: The case of Chinese consumers’ intention to buy organic food. J. Consum. Mark. 2013, 30, 335–344. [Google Scholar] [CrossRef]

- Gelski, J. Sales Growth of Organic Foods Slips to 6.4% in 2017. Available online: https://www.foodbusinessnews.net/articles/11853-sales-growth-of-organic-foods-slips-to-64-in-2017 (accessed on 13 March 2019).

- Sultan, P.; Wong, H.Y.; Sigala, M. Segmenting the Australian organic food consumer market. Asia Pac. J. Mark. Logist. 2018, 30, 163–181. [Google Scholar] [CrossRef]

- Willer, H.; Schaack, D.; Lernoud, J. Organic farming and market development in Europe and the European Union. In The World of Organic Agriculture. Statistics and Emerging Trends 2019; Willer, H., Lernoud, J., Eds.; Research Institute of Organic Agriculture FiBL, IFOAM-Organics International: Bonn, Germany, 2019; pp. 217–254. [Google Scholar]

- Oberholtzer, L.; Dimitri, C.; Greene, C. Price Premiums Hold on as US Organic Produce Market Expands; US Department of Agriculture, Economic Research Service: Washington, DC, USA, 2005; p. 22.

- Poulston, J.; Yiu, A.Y.K. Profit or principles: Why do restaurants serve organic food? Int. J. Hosp. Manag. 2011, 30, 184–191. [Google Scholar] [CrossRef]

- Loke, M.K.; Xu, X.; Leung, P. Estimating organic, local, and other price premiums in the Hawaii fluid milk market. J. Dairy Sci. 2015, 98, 2824–2830. [Google Scholar] [CrossRef] [Green Version]

- Carlson, A.; Jaenicke, E. Changes in Retail Organic Price Premiums from 2004 to 2010; United States Department of Agriculture: Washington, DC, USA, 2016; p. 38.

- Jeong, E.; Jang, S. Price premiums for organic menus at restaurants: What is an acceptable level? Int. J. Hosp. Manag. 2019, 77, 117–127. [Google Scholar] [CrossRef]

- Asche, F.; Larsen, T.A.; Smith, M.D.; Sogn-Grundvåg, G.; Young, J.A. Pricing of eco-labels with retailer heterogeneity. Food Policy 2015, 53, 82–93. [Google Scholar] [CrossRef]

- Ankamah-Yeboah, I.; Nielsen, M.; Nielsen, R. Price premium of organic salmon in Danish retail sale. Ecol. Econ. 2016, 122, 54–60. [Google Scholar] [CrossRef]

- Van Loo, E.J.; Caputo, V.; Nayga Jr, R.M.; Meullenet, J.-F.; Ricke, S.C. Consumers’ willingness to pay for organic chicken breast: Evidence from choice experiment. Food Qual. Prefer. 2011, 22, 603–613. [Google Scholar] [CrossRef]

- Michelsen, J.; Hamm, U.; Wynen, E.; Roth, E. The European Market for Organic Products: Growth and Development; Universität Hohenheim: Stuttgart, Germany, 1999; Volume 7, p. 199. [Google Scholar]

- Mapusua, K. The Pacific Islands. In The World of Organic Agriculture. Statistics and Emerging Trends 2019; Willer, H., Lernoud, J., Eds.; Research Institute of Organic Agriculture FiBL; IFOAM-Organics International: Bonn, Germany, 2019; pp. 307–312. [Google Scholar]

- Łuczka-Bakuła, W.; Smoluk-Sikorska, J. Poziom cen ekologicznych owoców i warzyw a rozwój rynku żywności ekologicznej (The organic fruit and vegetables price level and the development of organic food market). J. Res. Appl. Agric. Eng. 2010, 55, 12–14. [Google Scholar]

- Pawlewicz, A.; Szamrowski, P. Funkcjonowanie i rozwój rynku ekologicznych surowców żywnościowych w nowej perspektywie finansowej w latach 2014–2020 (The Functioning and Development of the Organic Food Raw Materials Market under the New Financial Plan for 2014–2020). Wieś I Rol. 2014, 3, 175–188. [Google Scholar]

- Brodzińska, K. Problems of Biodiversity Conservation in Polish Agriculture. Agroecol. Sustain. Food Syst. 2015, 39, 155–169. [Google Scholar] [CrossRef]

- Szymona, J. Szanse i Zagrożenia Polskiego Rolnictwa Ekologicznego w Perspektywie lat 2014-2020 (Chances and Threats to Polish Organic Farming in the Perspective of 2014–2020); Dokumentacji, Z., Ed.; Kancelaria Senatu RP: Warszawa, Poland, 2013; Volume OE-210, p. 9. [Google Scholar]

- Chintakayala, P.K.; Young, W.; Barkemeyer, R.; Morris, M.A. Breaking niche sustainable products into the mainstream: Organic milk and free-range eggs. Bus. Strategy Environ. 2018, 27, 1039–1051. [Google Scholar] [CrossRef] [Green Version]

- Rakonjac, S.; Bogosavljevic-Boskovic, S.; Pavlovski, Z.; Skrbic, Z.; Doskovic, V.; Petrovic, M.D.; Petricevic, V. Laying hen rearing systems: A review of major production results and egg quality traits. Worlds Poult. Sci. J. 2014, 70, 93–104. [Google Scholar] [CrossRef]

- Oberholtzer, L.; Greene, C.; Lopez, E. Organic Poultry and Eggs Capture High Price Premiums and Growing Share of Specialty Markets; US Department of Agriculture, Economic Research Service: Washington, DC, USA, 2006; p. 18.

- Żakowska-Biemans, S.; Tekień, A. Free Range, Organic? Polish Consumers Preferences Regarding Information on Farming System and Nutritional Enhancement of Eggs: A Discrete Choice Based Experiment. Sustainability 2017, 9, 1999. [Google Scholar] [CrossRef] [Green Version]

- KIPDiP. W Strukturze Chowu Jaj W Polsce Zajdą Zmiany, ale Nie Tak duże Jak Chcieliby Ekolodzy (There will be Changes in the Structure of Egg Farming in Poland, but not as Big as Environmentalists would Like). Available online: http://www.portalspozywczy.pl/mieso/wiadomosci/kipdip-w-strukturze-chowu-jaj-w-polsce-zajda-zmiany-ale-nie-tak-duze-jak-chcieliby-ekolodzy,155886.html (accessed on 13 March 2019).

- Chang, J.B.; Lusk, J.L.; Norwood, F.B. The Price of Happy Hens: A Hedonic Analysis of Retail Egg Prices. J. Agric. Resour. Econ. 2010, 35, 406–423. [Google Scholar]

- Andersen, L.M. Animal Welfare and Eggs–Cheap Talk or Money on the Counter? J. Agric. Econ. 2011, 62, 565–584. [Google Scholar] [CrossRef] [Green Version]

- Kowalczuk, I.; Gutkowska, K.; Sajdakowska, M.; Zakowska-Biemans, S.; Kozlowska, A.; Olewnik-Mikolajewska, A. Innowacyjny konsument żywności pochodzenia zwierzęcego (Innovative Consumer of Food of Animal Origin). Żywność Nauka Technol. Jakość 2013, 20. [Google Scholar]

- FiBL. European and Global Organic Farming Statistics 2000–2017; The Statistics.FiBL.org website maintained by the Research Institute of Organic Agriculture (FiBL): Frick, Switzerland; Available online: https://statistics.fibl.org/ (accessed on 31 March 2019).

- IJHARS. Powierzchnia Ekologicznych Użytków Rolnych w Polsce w 2017 r. (The Area of Organic Farmland in Poland in 2017). Available online: https://ijhars.gov.pl/raporty-i-analizy.html (accessed on 27 July 2019).

- Lowder, S.K.; Skoet, J.; Singh, S. What do We Really Know about the Number and Distribution of Farms and Family Farms in the World; FAO: Rome, Italy, 2014; Volume 14, p. 45. [Google Scholar]

- Graeub, B.E.; Chappell, M.J.; Wittman, H.; Ledermann, S.; Kerr, R.B.; Gemmill-Herren, B. The state of family farms in the world. World Dev. 2016, 87, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Lowder, S.K.; Skoet, J.; Raney, T. The number, size, and distribution of farms, smallholder farms, and family farms worldwide. World Dev. 2016, 87, 16–29. [Google Scholar] [CrossRef] [Green Version]

- IJHARS. Liczba Producentów Ekologicznych w Polsce, wg Stanu na 31 grudnia 2017 r. (The Number of Organic Producers in Poland, as at 31 December 2017). Available online: https://ijhars.gov.pl/raporty-i-analizy.html (accessed on 27 July 2019).

- Pawlewicz, A. Regional diversity of organic food sales in the European Union. In Proceedings of the Economic Science for Rural Development, Jelgava, Latvia, 9–10 May 2019; pp. 360–366. [Google Scholar]

- DH. Rynek żywności Ekologicznej w Polsce to 0,3 Proc. Rynku Spożywczego (The Organic Food Market in Poland is 0.3 Percent. Food Market). Available online: http://www.dlahandlu.pl/e-commerce/wiadomosci/rynek-zywnosci-ekologicznej-w-polsce-to-0-3-proc-rynku-spozywczego,69178.html (accessed on 27 July 2019).

- Lernoud, J.; Willer, H. Current Statistics on Organic Agriculture Worldwide:Area, Operators, and Market. In The World of Organic Agriculture. Statistics and Emerging Trends 2019; Willer, H., Lernoud, J., Eds.; Research Institute of Organic Agriculture FiBL; IFOAM-Organics International: Bonn, Germany, 2019; pp. 34–128. [Google Scholar]

- Seufert, V.; Ramankutty, N.; Mayerhofer, T. What is this thing called organic? – How organic farming is codified in regulations. Food Policy 2017, 68, 10–20. [Google Scholar] [CrossRef] [Green Version]

- Wier, M.; Hansen, L.G.; Andersen, L.M.; Millock, K. Consumer preferences for organic foods. In Organic Agriculture: Sustainability, Markets and Policies; OECD: Paris, France, 2003; pp. 257–271. [Google Scholar]

- Torjusen, H.; Sangstad, L.; O’Doherty Jensen, K.; Kjærnes, U. European Consumers’ Conceptions of Organic Food: A Review of Available Research; National institute for consumer research: Oslo, Norway, 2004; p. 147. [Google Scholar]

- Dunn, J.W.; Bórawski, P.; Pawlewicz, A. Development of Organic Farming in the USA. Acta Sci. Pol. Oeconomia 2014, 13, 55–68. [Google Scholar]

- McCullough, E.B.; Pingali, P.L.; Stamoulis, K.G. Small farms and the transformation of food systems: An overview. In Looking East, Looking West: Organic and Quality Food Marketing in Asia and Europe; Haas, R., Canavari, M., Slee, B., Tong, C., Anurugsa, B., Eds.; Wageningen Academic Publishers: Wageningen, The Netherlands, 2010; pp. 47–83. [Google Scholar]

- Kaus, W. Beyond Engel’s law-A cross-country analysis. J. Socio-Econ. 2013, 47, 118–134. [Google Scholar] [CrossRef]

- Kim, S.-W.; Lusk, J.L.; Brorsen, B.W. “Look at Me, I’m Buying Organic”: The Effects of Social Pressure on Organic Food Purchases. J. Agric. Resour. Econ. 2018, 43, 364–387. [Google Scholar] [CrossRef]

- Amfo, B.; Ansah, I.G.K.; Donkoh, S.A. The effects of income and food safety perception on vegetable expenditure in the Tamale metropolis, Ghana. J. Agribus. Dev. Emerg. Econ. 2019, 9, 276–293. [Google Scholar] [CrossRef]

- Kiatkawsin, K.; Han, H. What drives customers’ willingness to pay price premiums for luxury gastronomic experiences at michelin-starred restaurants? Int. J. Hosp. Manag. 2019, 82, 209–219. [Google Scholar] [CrossRef]

- Wier, M.; Jensen, K.O.D.; Andersen, L.M.; Millock, K. The character of demand in mature organic food markets: Great Britain and Denmark compared. Food Policy 2008, 33, 406–421. [Google Scholar] [CrossRef] [Green Version]

- Golijan, J.; Popović, A. Basic characteristics of the organic agriculture market. In Proceedings of the Fifth International Conference Competitiveness of Agro-Food and Environmental Economy, Bucharest, Romania, 10–11 November 2016; pp. 236–244. [Google Scholar]

- Napolitano, F.; Braghieri, A.; Piasentier, E.; Favotto, S.; Naspetti, S.; Zanoli, R. Effect of information about organic production on beef liking and consumer willingness to pay. Food Qual. Prefer. 2010, 21, 207–212. [Google Scholar] [CrossRef] [Green Version]

- Ricke, S.C.; Van Loo, E.J.; Johnson, M.G.; O’Bryan, C.A. Organic Meat Production and Processing; John Wiley & Sons: Hoboken, NJ, USA, 2012; Volume 53, p. 446. [Google Scholar]

- Van der Veen, M. When is food a luxury? World Archaeol. 2003, 34, 405–427. [Google Scholar] [CrossRef]

- Halberg, N.; Peramaiyan, P.; Walaga, C. Is organic farming an unjustified luxury in a world with too many hungry people? In The World of Organic Agriculture. Statistics & Emerging Trends 2009; FiBL and IFOAM: Frick, Switzerland, 2009; pp. 95–100. [Google Scholar]

- Zhang, B.; Kim, J.-H. Luxury fashion consumption in China: Factors affecting attitude and purchase intent. J. Retail. Consum. Serv. 2013, 20, 68–79. [Google Scholar] [CrossRef]

- Salem, S.F.; Chaichi, K. Investigating causes and consequences of purchase intention of luxury fashion. Manag. Sci. Lett. 2018, 8, 1259–1272. [Google Scholar] [CrossRef]

- Rao, A.R.; Bergen, M.E. Price premium variations as a consequence of buyers’ lack of information. J. Consum. Res. 1992, 19, 412–423. [Google Scholar] [CrossRef]

- Farris, P.W.; Bendle, N.T.; Pfeifer, P.E.; Reibstein, D.J. Marketing Metrics: The Definitive Guide to Measuring Marketing Performance; Pearson Education, Inc.: Upper Saddle River, NJ, USA, 2010; p. 416. [Google Scholar]

- Macias, W.; Rodriguez, K. Brand Valuation by Price Premium: Theoretical Explanation and Practical Application Using Conjoint Analysis. Knowl. Manag. Int. J. 2018, 17, 13–27. [Google Scholar] [CrossRef]

- Siderer, Y.; Maquetb, A.; Anklam, E. Need for research to support consumer confidence in the growing organic food market. Trends Food Sci. Technol. 2005, 16, 332–343. [Google Scholar] [CrossRef]

- Brown, C.; Sperow, M. Examining the cost of an all-organic diet. J. Food Distrib. Res. 2005, 36, 20. [Google Scholar]

- Kremen, A.; Greene, C.; Hanson, J. Organic Produce, Price Premiums, and Eco-Labeling in US Farmers’ Markets; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2010; pp. 191–202. [Google Scholar]

- Hatch, E.M.; Lazaraton, A. The Research Manual: Design and Statistics for Applied Linguistics; Newbury House Publishers: New York, NY, USA, 1991. [Google Scholar]

- Mishra, S.K. Median as a weighted arithmetic mean of all sample observations. SSRN Electron. J. 2004, 6. [Google Scholar] [CrossRef] [Green Version]

- Nowak, E. Metody Taksonomiczne W Klasyfikacji Obiektów SpołEczno-Gospodarczych (Taxonomic Methods in the Classification of Socio-Economic Objects); Państwowe Wydaw. Ekonomiczne: Wrocław, Poland, 1990. [Google Scholar]

- Walczak, B.; Massart, D.L. Dealing with missing data: Part I. Chemom. Intell. Lab. Syst. 2001, 58, 15–27. [Google Scholar] [CrossRef]

- Twisk, J.; de Vente, W. Attrition in longitudinal studies: How to deal with missing data. J. Clin. Epidemiol. 2002, 55, 329–337. [Google Scholar] [CrossRef]

- Brown, C.E. Coefficient of variation. In Applied Multivariate Statistics in Geohydrology and Related Sciences; Springer: Berlin, Germany, 1998; pp. 155–157. [Google Scholar]

- Sobczyk, M. Jednorównaniowe modele ekonometryczne w prognozowaniu (Single equation econometric models in forecasting). In Prognozowaniegospodarcze. Metody, Modele, Zastosowania, Przykłady; Nowak, E., Ed.; Agencja Wydawnicza Placet: Warszawa, Poland, 1998; pp. 97–119. [Google Scholar]

- Kuropka, I. Prognozowanie na podstawie modelu ekonometrycznego (Forecasting based on an econometric model). In Prognozowanie Gospodarcze. Metody i Zastosowanie; Cieślik, M., Ed.; PWN: Warszawa, Poland, 2001; pp. 104–139. [Google Scholar]

- Kuszewski, T.; Tomczyk, E. Jednorównaniowy liniowy model ekonometryczny. Metoda najmniejszych kwadratów (Single equation linear econometric model. Least squares method). In Ekonometria i Badania Operacyjne: Podręcznik dla Studiów Licencjackich; Gruszczyński, M., Kuszewski, T., Podgórska, M., Eds.; PWN: Warszawa, Poland, 2009; pp. 13–49. [Google Scholar]

- GUS. Miesięczne Wskaźniki cen Towarów i Usług Konsumpcyjnych od 1982 Roku (Monthly Price Indices of Consumer Goods and Services Since 1982). Available online: https://stat.gov.pl/obszary-tematyczne/ceny-handel/wskazniki-cen/wskazniki-cen-towarow-i-uslug-konsumpcyjnych-pot-inflacja-/miesieczne-wskazniki-cen-towarow-i-uslug-konsumpcyjnych-od-1982-roku/ (accessed on 31 March 2019).

- Jang, Y.J.; Kim, W.G.; Bonn, M.A. Generation Y consumers’ selection attributes and behavioral intentions concerning green restaurants. Int. J. Hosp. Manag. 2011, 30, 803–811. [Google Scholar] [CrossRef]

- Moser, A.K. Thinking green, buying green? Drivers of pro-environmental purchasing behavior. J. Consum. Mark. 2015, 32, 167–175. [Google Scholar] [CrossRef]

- Würriehausen, N.; Ihle, R.; Lakner, S. Price relationships between qualitatively differentiated agricultural products: Organic and conventional wheat in Germany. Agric. Econ. 2015, 46, 195–209. [Google Scholar] [CrossRef]

- Łuczka-Bakuła, W. Rynek żywności Ekologicznej: Wyznaczniki i Uwarunkowania Rozwoju (Organic Food Market: Determinants and Conditions for Development); PWE: Warszawa, Poland, 2007. [Google Scholar]

- Windhorst, H.-W. Development of Organic Egg Production and Marketing in the EU. Worlds Poult. Sci. J. 2005, 61, 451–462. [Google Scholar] [CrossRef]

- Eurostat. Organic Farming Statistics. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Organic_farming_statistics (accessed on 31 March 2019).

- Pavlicevic, A.; Yoon, J.; Pavlović, I. The fipronil affair, pesticides in eggs-why it happened and can it be prevented from happening again. Invent. J. Res. Technol. Eng. Manag. 2018, 2, 30–35. [Google Scholar]

- Stafford, E.G.; Tell, L.A.; Lin, Z.; Davis, J.L.; Vickroy, T.W.; Riviere, J.E.; Baynes, R.E. Consequences of fipronil exposure in egg-laying hens. J. Am. Vet. Med Assoc. 2018, 253, 57–60. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- BIP. Jaja Tanieją (The Eggs are Cheaper). Available online: https://businessinsider.com.pl/finanse/handel/jaja-ceny-i-prognoza-na-2018-rok/ttln9tq (accessed on 13 March 2019).

- Burgos, S.; Burgos, S.A. Avian influenza outbreaks in southeast Asia affects prices, markets and trade: A short case study. Int. J. Poult. Sci. 2007, 6, 1006–1009. [Google Scholar] [CrossRef] [Green Version]

- Paukett, M.R.; Dharmasena, S.; Bessler, D. Revenue Impacts of the 2015 Avian Influenza Virus Outbreak on the United States Table Egg Wholesalers. Ssrn Electron. J. 2018, 1–43. [Google Scholar] [CrossRef] [Green Version]

- Pijnacker, R.; Dallman, T.J.; Tijsma, A.S.L.; Hawkins, G.; Larkin, L.; Kotila, S.M.; Amore, G.; Amato, E.; Suzuki, P.M.; Denayer, S.; et al. An international outbreak of Salmonella enterica serotype Enteritidis linked to eggs from Poland: A microbiological and epidemiological study. Lancet Infect. Dis. 2019, 19, 778–786. [Google Scholar] [CrossRef]

- Polityka. Ceny Jaj Gwałtownie Rosną (Egg Prices are Rising Rapidly). Available online: https://www.polityka.pl/tygodnikpolityka/rynek/1725600,1,ceny-jaj-gwaltownie-rosna-z-trzech-powodow.read (accessed on 31 March 2019).

- Okoniewska, E. Wielkanoc 2012: Wzrosła Cena Jaj (Easter 2012: The Price of Eggs has Increased). Available online: https://dziennikbaltycki.pl/wielkanoc-2012-wzrosla-cena-jaj-ile-trzeba-zaplacic-za-jedno-jajko/ar/533513 (accessed on 31 March 2019).

- Butler, G.; Newton, H.; Bourlakis, M.; Leifert, C. Factors influencing supply and demand for organic foods. Food Supply Chain Manag. (Blackwell Publ. Oxf.) 2004, 199–210. [Google Scholar] [CrossRef]

- Giraud, G. Consumer perception and marketing of origin and organic labelled food products in Europe. In Marketing Trends for Organic Food in the 21st Century; World Scientific: Singapore, 2004; pp. 191–203. [Google Scholar]

- Ankamah-Yeboah, I.; Nielsen, M.; Nielsen, R. Does Organic Supply Growth Lead to Reduced Price Premiums? The Case of Salmonids in Denmark. Mar. Resour. Econ. 2019, 34, 105–121. [Google Scholar] [CrossRef]

- Next Generation Organics; No price (spiral); Datamonitor Europe: New York, NY, USA; London, UK, 2001.

- Brodzińska, K.H. Determinanty środowiskowe i Gospodarcze Wdrażania Programu Rolnośrodowiskowego (Environmental and Economic Determinants for Implementation of the Agri-Environmental Programme); Wyd. UWM: Olsztyn, Poland, 2013. [Google Scholar]

- Pawlewicz, A. Importance of Horizontal Integration in Organic Farming. Econ. Sci. Rural Dev. Prod. Co-Oper. Agric. 2014, 112–120. [Google Scholar]

- Gadomska, J.; Sadowski, T.; Buczkowska, M. Ekologiczna żywność jako czynnik sprzyjający zdrowiu (Ecological food as a health-promoting factor). Probl. Hig. I Epidemiol. 2014, 95, 556–560. [Google Scholar]

- Mickiewicz, A.; Mickiewicz, B.; Prus, P.; Wawrzyniak, B.M. Miejsce i rola jednostek certyfikujących oraz inspektorów w systemie rolnictwa ekologicznego w Polsce (The place and role of certifying authorities and inspectors in the organic farming system). Zagadnienia Doradz. Rol. 2015, 3, 42–61. [Google Scholar]

| Region | Organic Agr. Land | Share | Share of Total Agri. Land | Numbers of Producers | Retail Sales | Per Capita Consumption |

|---|---|---|---|---|---|---|

| ha | % | % | no | Million € | € | |

| Africa | 2,056,571 | 3.12 | 0.4 | 1,144,263 | 16 | - |

| Asia | 6,116,834 | 8.47 | 0.3 | 815,070 | 9601 | 2.1 |

| Europe | 14,558,246 | 23.36 | 2.9 | 455,749 | 37,351 | 47 * |

| Latin America | 8,000,888 | 12.34 | 1,1 | 397,509 | 810 | 1.3 |

| North America | 3,223,057 | 5.41 | 0.8 | 26,750 | 43,012 | 119.1 |

| Oceania | 35,894,365 | 47.30 | 8.5 | 19,017 | 1293 | 31.8 |

| World | 69,845,243 | 100 | 1,4 | 2,858,358 | 92,074 | 12,2 |

| Poland | 494,979 | 0.71 | 2.6 | 21,400 | 219.7 | 6 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| million eggs | per capita | |||||||

| Belgium | 97.2 | 121.9 | 8.59 | 10.74 | ||||

| Czechia | 3.0 | 3.5 | 2.3 | 3.4 | 3.3 | 3.7 | 0.32 | 0.35 |

| Denmark | 170.4 | 175.0 | 196.1 | 233.4 | 269.9 | 307.9 | 47.28 | 53.57 |

| Germany | 1293.8 | 1293.8 | 15.74 | 15.68 | ||||

| Estonia | 1.4 | 1.6 | 2.5 | 2.5 | 2.8 | 3.4 | 2.13 | 2.60 |

| Ireland | 17.3 | 19.6 | 20.9 | 23.6 | 4.43 | 4.93 | ||

| Greece | 25.7 | 8.2 | 13.6 | 13.2 | 13.1 | 13.1 | 1.22 | 1.22 |

| Spain | 11.2 | 17.6 | 16.2 | 48.3 | 46.3 | 76.1 | 1.00 | 1.64 |

| France | 700.0 | 900.0 | 1285.4 | 1383.0 | 19.29 | 20.70 | ||

| Croatia | 0.0 | 0.1 | 0.1 | 0.1 | 0.2 | 0.2 | 0.06 | 0.05 |

| Italy | 209.5 | 461.9 | 494.6 | 494.6 | 8.15 | 8.16 | ||

| Cyprus | 0.7 | 1.2 | 0.9 | 1.5 | 2.3 | 1.76 | 2.64 | |

| Latvia | 0.6 | 0.6 | 1.2 | 1.5 | 1.9 | 0.76 | 0.96 | |

| Lithuania | 0.4 | 0.6 | 0.6 | 1.2 | 1.4 | 0.42 | 0.51 | |

| Luxembourg | 2.5 | 3.0 | 2.8 | 2.8 | 3.9 | 3.9 | 6.77 | 6.67 |

| Hungary | 3.5 | 3.3 | 5.5 | 5.1 | 2.7 | 5.1 | 0.27 | 0.52 |

| Netherlands | 583.0 | 574.6 | 628.4 | 708.0 | 773.1 | 883.0 | 45.53 | 51.69 |

| Austria | 78.2 | 77.7 | 105.2 | 131.7 | 12.10 | 15.02 | ||

| Poland | 20.7 | 33.9 | 21.8 | 22.6 | 19.9 | 20.3 | 0.53 | 0.53 |

| Romania | 13.2 | 14.5 | 22.7 | 12.3 | 14.9 | 0.62 | 0.76 | |

| Slovenia | 3.7 | 4.1 | 4.6 | 6.3 | 6.9 | 8.7 | 3.36 | 4.19 |

| Slovakia | 0.9 | 0.2 | 0.4 | 0.03 | 0.07 | |||

| Finland | 42.3 | 47.1 | 52.2 | 55.5 | 64.7 | 10.12 | 11.76 | |

| Sweden | 265.1 | 263.6 | 328.7 | 394.9 | 380.1 | 40.08 | 38.03 | |

| United Kingdom | 238.3 | 219.6 | 225.9 | 237.0 | 250.1 | 255.7 | 3.82 | 3.88 |

| Norway | 32.5 | 35.5 | 44.8 | 50.2 | 52.3 | 65.9 | 10.03 | 12.52 |

| Montenegro | 0.1 | 0.19 | 0.19 | |||||

| Serbia | 0.0 | 0.1 | 0.3 | 0.2 | 0.04 | 0.03 | ||

| Turkey | 48.0 | 64.9 | 58.9 | 147.6 | 161.3 | 1.87 | 2.02 | |

| Total | 1,109,950,588 | 1,388,675,236 | 2,496,657,538 | 3,199,013,757 | 3,915,325,395 | 5,053,904,046 | ||

| per capita | 2.22 | 2.77 | 4.96 | 6.34 | 7.74 | 9.96 | ||

| Descriptive statistics | per capita | |||||||

| Valid N | 16 | 19 | 24 | 25 | 29 | 29 | 29 | 29 |

| % N | 55.2 | 65.5 | 82.8 | 86.2 | 100 | 100 | 100 | 100 |

| CV (%) | 220.6 | 191.5 | 178.0 | 181.1 | 194.4 | 196.3 | 157.77 | 155.60 |

| Arithmetic mean | 69.4 | 75.6 | 106.7 | 130.3 | 150.5 | 193.2 | 8.50 | 9.37 |

| Median | 7.4 | 8.2 | 16.8 | 22.6 | 19.9 | 20.3 | 2.13 | 2.64 |

| Minimum | 0.0 | 0.0 | 0.1 | 0.1 | 0.2 | 0.1 | 0.03 | 0.03 |

| Maximum | 583.0 | 574.6 | 700.0 | 900.0 | 1285.4 | 1383.0 | 47.28 | 53.57 |

| SD | 153.0 | 144.8 | 190.0 | 236.1 | 292.6 | 379.1 | 13.41 | 14.57 |

| CI of the SD (-95%) | 113.0 | 109.4 | 147.7 | 184.3 | 230.4 | 298.6 | 10.64 | 11.57 |

| CI of the SD (95%) | 236.8 | 214.2 | 266.5 | 328.4 | 401.0 | 519.6 | 18.14 | 19.71 |

| R | p-Value | |

|---|---|---|

| Number of all organic operators (registered at the end of the year) | * 0.574 | p = 0.002 |

| Total fully converted and under conversion to organic farming (ha) | ** 0.5143 | p = 0.007 |

| Area under organic farming (% of utilized agricultural area (UAA)) | −0.0641 | p = 0.756 |

| Retail sales (Million €) | * 0.9189 | p = 0.000 |

| Retail sales (€ per capita) | 0.3655 | p = 0.066 |

| Population | * 0.7255 | p = 0.000 |

| Main GDP aggregates per capita (€ per capita) | 0.1922 | p = 0.347 |

| Final consumption expenditure of households (Million €) | * 0.7553 | p = 0.000 |

| Final consumption expenditure of households (€ per capita) | 0.3341 | p = 0.095 |

| Specification | Nominal Prices | Real Prices | Difference at Real Prices (€) | Price Premium (%) | ||

|---|---|---|---|---|---|---|

| Price of Conventional Eggs (€) | Price of Organic Eggs (€) | Price of Conventional Eggs (€) | Price of Organic Eggs (€) | |||

| Arithmetic mean | 7.363 | 16.413 | 14.308 | 31.231 | 16.923 | 128.831 |

| Median | 7.147 | 16.384 | 15.995 | 33.114 | 16.286 | 120.936 |

| Minimum | 5.311 | 12.830 | 6.529 | 17.256 | 7.351 | 32.118 |

| Maximum | 12.727 | 19.421 | 22.888 | 41.036 | 25.210 | 223.499 |

| SD | 1.283 | 1.439 | 4.385 | 6.831 | 3.879 | 42.289 |

| CV (%) | 17.430 | 8.765 | 30.647 | 21.872 | 22.923 | 32.825 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pawlewicz, A. Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market. Agriculture 2020, 10, 35. https://doi.org/10.3390/agriculture10020035

Pawlewicz A. Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market. Agriculture. 2020; 10(2):35. https://doi.org/10.3390/agriculture10020035

Chicago/Turabian StylePawlewicz, Adam. 2020. "Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market" Agriculture 10, no. 2: 35. https://doi.org/10.3390/agriculture10020035

APA StylePawlewicz, A. (2020). Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market. Agriculture, 10(2), 35. https://doi.org/10.3390/agriculture10020035