The Microcosmic Mechanism and Empirical Test of Uncertainty on the Non-Linear Fluctuation of Chinese Grain Prices-Based on the Perspective of Global Economic Policy Uncertainty

Abstract

:1. Introduction

2. Data Analysis

3. Theoretical Analysis

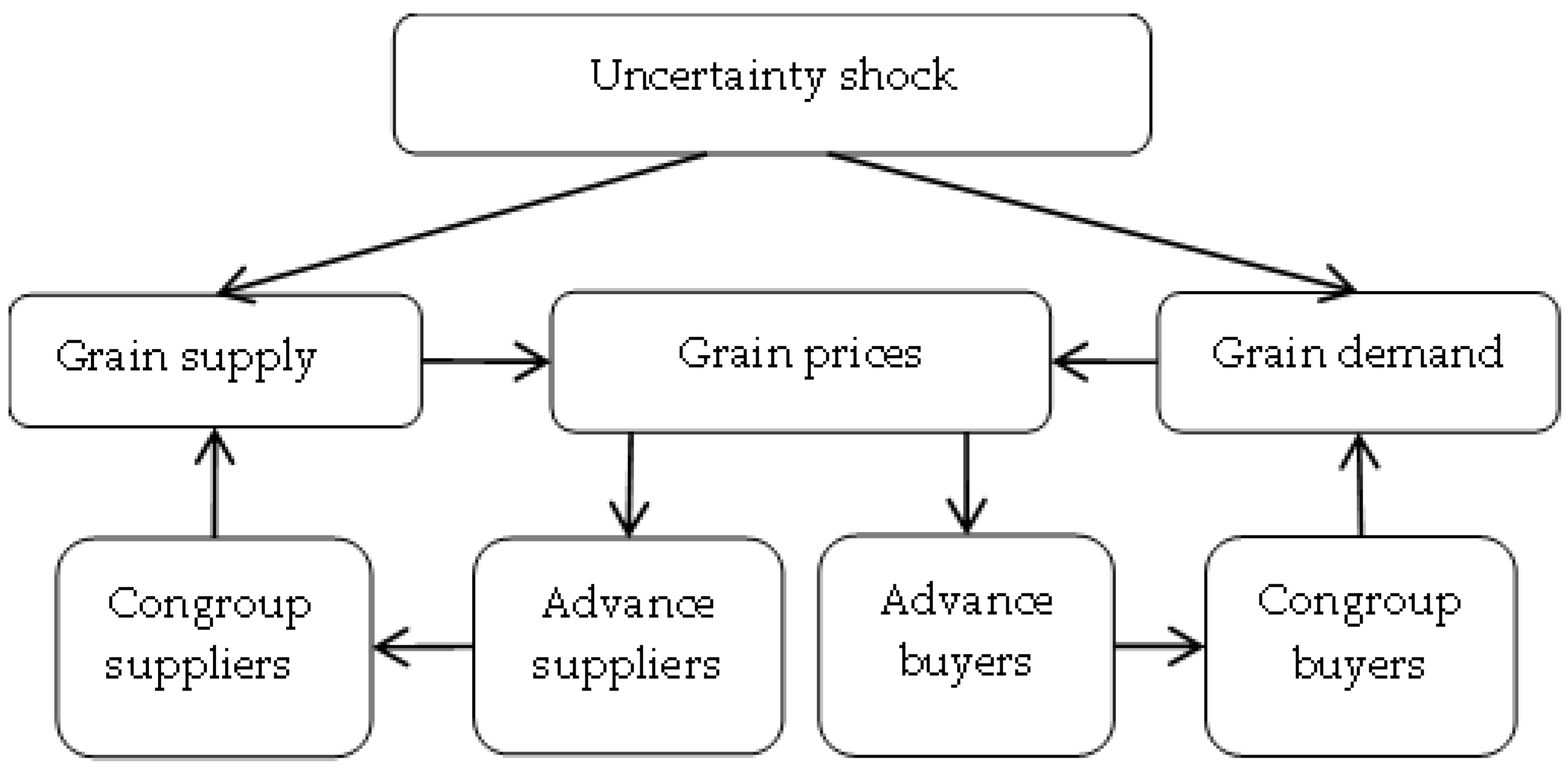

3.1. The Transmission Path of Grain Price Fluctuation Caused by Uncertain Factors

3.2. The Micro-Mechanism of Grain Price Fluctuation Caused by Uncertain Factors

3.2.1. Micro Drivers of Non-Linear Price Fluctuation in Response to Shocks on the Supply Side of Grain

3.2.2. Micro Drivers of Non-Linear Price Fluctuation in Response to Shocks on the Demand Side of Grain

4. Empirical Test

4.1. Variable Selection and Data Sources

- (1)

- Dependent variable. Achieving “basic self-sufficiency in grains and absolute safety in rations” is the strategic goal of China’s grain industry. From the statistical data, wheat as a ration control effect is better, and the price is relatively stable. Corn is used for feed production and industrial raw materials, which is greatly affected by downstream industries. It is a net import category, and its price fluctuates wildly. The external dependence on soybean is extremely high, as high as 90%, and international trade is an important factor of external impact. Therefore, this paper selects the SOYB (soybean market price) and the CORN (corn market price) as the research objects, and the data come from the Brick Agricultural Database.

- (2)

- Independent variable. The GEPU (Global Economic Policy Uncertainty Index) is mainly calculated based on the ratio of each monthly EPU (Economic Policy Uncertainty Index) value of each country to the share of newspapers discussing economic policy uncertainty in the current month. The data come from the Economic Policy Uncertainty Website.

- (3)

- Control variables. Improving the national economic level will inevitably stimulate domestic demand and then promote the price increase [42]. This paper selects the GDP (gross domestic product) to measure the level of economic growth as the macroeconomic factor affecting grain prices. The data come from the National Bureau of Statistics. Petroleum has a solid industrial purpose and is closely related to economic activities [5]. This paper selects the international crude price as a proxy variable for OIL (oil price). The data come from the World Bank Website. Seed price is an important part of planting cost. In this paper, SSEE (soybean seed price) and CSEE (corn seed price) are selected as important factors to measure planting cost. Grain production and imports directly affect grain prices from the supply side. This paper selects SYIE (soybean yield), SIMP (soybean import volume), CYIE (corn yield), and CIMP (corn import volume) to measure the level of grain supply in the domestic market. The data come from the Forward-Looking Database.

4.2. Model Settings

4.3. Stationarity Test

4.4. Nonlinear Test

4.5. Determination of Lag Periods and Thresholds

4.6. Threshold Regression Results

- (1)

- The coefficient of GEPU for zone 2 is greater than that of GEPU for zone 1. In the threshold model for soybean and corn, the value of the coefficient of GEPU for the high zone system is higher than that for the low zone system, which indicates that GEPU rapidly raises the price of soybean and corn after moving from zone 1 to zone 2. On the other hand, while traveling from zone 2 to zone 1, the coefficient and price both drop rapidly.

- (2)

- In general, the coefficients of the lag terms in zone 2 are larger than those in zone 1, and all of the significant lag terms in zone 2 have larger coefficients. SOYB and CORN are more volatile within zone 2 than in zone 1. In other words, when SOYB and CORN are above the threshold, GEPU has a greater impact on them, and they move at a faster rate of change, whereas when fluctuations are lower, GEPU has less impact, and SOYB and CORN exhibit a more stable dynamic equilibrium.

- (3)

- The sum of the coefficients in zone 2 is greater than that in zone 1. For the SOYB in zone 2 and zone 1 models, the sums of the coefficients are 2.145 and 1.062, respectively. The total coefficients for the CORN in zone 2 and zone 1 models are 2.033 and 0.803, respectively. The sum of the coefficients for the zone 2 model is greater, indicating that SOYB and CORN has a greater impact on later periods in the early part of zone 2. If SOYB and CORN exceeds the threshold, i.e., when in zone 2, SOYB and CORN produces fluctuations under the influence of GEPU, which has a greater impact on later prices, resulting in large fluctuations in SOYB and CORN in later periods. In contrast, under zone 1, i.e., below the threshold, SOYB and CORN fluctuate but have a smaller impact on later prices, resulting in smaller SOYB and CORN fluctuations in later periods. Furthermore, in zone 2, both the positive effects of GDP and OIL on SOYB and CORN are more prominent, demonstrating that soybean, as an agricultural product with higher reliance on imports, is more vulnerable to the influence of global factors. Corn, as an industrial feedstock and feed grain, is more sensitive to domestic economic growth. Overall, under the influence of global economic policy uncertainty and price cycles, the fluctuations of SOYB and CORN show non-linear characteristics, and the impact in zone 2 is greater than that in zone 1.

5. Results and Discussion

5.1. Results

5.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nechaeva, M.; Nechaev, V.; Larinina, T.; Kulakov, V. Agricultural Machinery Market Development for Ensuring Food Security. IOP Conf. Ser. Earth Environ. Sci. 2019, 403, 12167. [Google Scholar] [CrossRef]

- Lv, F.; Deng, L.Y.; Zhang, Z.T.; Wang, Z.Y.; Wu, Q.Y.; Qiao, J.M. Multiscale Analysis of Factors Affecting Food Security in China, 1980–2017. Environ. Sci. Pollut. Res. Int. 2021, 29, 6511–6525. [Google Scholar] [CrossRef]

- Luo, P.F.; Tanaka, T. Food Import Dependency and National Food Security: A Price Transmission Analysis for the Wheat Sector. Foods 2021, 10, 1715. [Google Scholar] [CrossRef] [PubMed]

- Porkka, M.; Guillaume, J.H.A.; Siebert, S.; Schaphoff, S.; Kummu, M. The Use of Food Imports to Overcome Local Limits to Growth. Earths Future 2017, 5, 393–407. [Google Scholar] [CrossRef]

- Liu, L.; Chen, L.Y.; Li, Y.S. Global Economic Policy Uncertainty and China’s Grain Price Volatility—Based on the Perspective of Asymmetry Analysis. J. Agrotech. Econ. 2020, 5, 17–31. [Google Scholar] [CrossRef]

- Li, Y.; Li, J. How Does China’s Economic Policy Uncertainty Affect the Sustainability of Its Net Grain Imports? Sustainability 2021, 13, 6899. [Google Scholar] [CrossRef]

- Frimpong, S.; Gyamfi, E.N.; Ishaq, Z.; Agyei, S.K.; Agyapong, D.; Adam, A.M. Can Global Economic Policy Uncertainty Drive the Interdependence of Agricultural Commodity Prices? Evidence from Partial Wavelet Coherence Analysis. Complexity 2021, 2021, 8848424. [Google Scholar] [CrossRef]

- Stokey, N.L. Wait—And—See: Investment Options under Policy Uncertainty. Rev. Econ. Dyn. 2016, 21, 246–265. [Google Scholar] [CrossRef]

- Li, D.N. Analysis of the Impact of Global Economic Policy Uncertainty and RMB Exchange Rate on Chinese Economic Growth and Price Level—A Theoretical and Empirical Study Based on Asymmetric Perspective. Master’s Thesis, Qingdao University, Qingdao, China, 2020. [Google Scholar] [CrossRef]

- Zhang, Z.H. Does Economic Policy Uncertainty Undermine Stability of Agricultural Imports? Evidence from China. PLoS ONE 2022, 17, e0265279. [Google Scholar] [CrossRef]

- Wu, F.W.; Shen, Y.F.; Zhang, J.H.; Xu, Q. Analysis of the Impact of Biofuel Ethanol Development on Chinese grain security from the Perspective of “Competition with Grain for Land”. J. Agrotech. Econ. 2009, 1, 21–29. [Google Scholar]

- Yu, S.; Li, G.S. Agricultural Production and Grain Consumption in China: A long-term projection. China Econ. Rev. 2019, 53, 15–29. [Google Scholar] [CrossRef]

- Wang, X.S.; Xie, S.X. How Do Prices of Foreign Agricultural Products Affect Prices of Chinese Agricultural Products? Econ. Res. J. 2012, 47, 141–153. [Google Scholar]

- Li, G.S.; Cao, B.M.; Ma, X.L. China’s Grain Market Opening and International Grain Price Fluctuation—An Analysis Based on Spillover Effects of Grain Price Fluctuation. Chin. Rural. Econ. 2015, 8, 44–52. [Google Scholar]

- Wei, C.J.; Zhang, B.B. The Shock of Global Economic Policy Uncertainty and International Grain Price Fluctuation: Theoretical and Empirical Analysis. Econ. Probl. 2018, 3, 90–95. [Google Scholar]

- Yang, G.L.; Zheng, M.R.; Liu, J. An Empirical Analysis of the Impact of Global Economic Policy Uncertainty on China’s Grain Price Volatility. Sci. Technol. Cereals Oils Foods 2020, 28, 1–10. [Google Scholar] [CrossRef]

- Ouyang, Z.G.; Qian, L. Non-linear Transmission Effects of International Factors on Inflation in China. Econ. Res. J. 2015, 50, 89–102. [Google Scholar]

- Wang, E.P.; An, N.; Gao, Z.F.; Kiprop, E.; Geng, X.H. Consumer food stockpiling behavior and willingness to pay for food reserves in COVID-19. Food Secur. 2020, 12, 739–747. [Google Scholar] [CrossRef]

- Ke, B.S. Chinese Farmers’ Grain Stock and Its Effect on Market. China Rural. Surv. 1996, 6, 8–13. [Google Scholar]

- Xie, J.Z.; Ye, S.; Tu, X.J. An Analysis of the Effect and Influence of Food Financialization on Food Price Fluctuation—Based on GARCH and EGARCH models. J. Southwest Univ. Soc. Sci. Ed. 2018, 44, 19–25. [Google Scholar] [CrossRef]

- Paul, R.K.; Karak, T. Asymmetric Price Transmission: A Case of Wheat in India. Agriculture 2022, 12, 410. [Google Scholar] [CrossRef]

- Carlos, A.; Bryce, C.; Fred, G. Agricultural Price Transmission: China Relationships with World Commodity Markets. J. Commod. Mark. 2017, 7, 28–40. [Google Scholar] [CrossRef]

- Zhang, X.Y.; Liu, Y.F. The Dynamic Impact of International Agricultural Commodity Price Fluctuation on Chinese Agricultural Commodity Prices. Int. Grain Agribus. Manag. Rev. 2020, 23, 391–409. [Google Scholar] [CrossRef]

- Wang, J.T.; Zheng, Y.J. Economic Policy Uncertainty and Grain Prices Fluctuation. Front. Soc. Sci. Technol. 2019, 1, 37–64. [Google Scholar] [CrossRef]

- Nilavongse, R.; Rubaszekł, M.; Uddin, G.S. Economic policy uncertainty shocks, economic activity, and exchange rateadjustments. Econ. Lett. 2020, 186, 108765. [Google Scholar] [CrossRef]

- Kido, Y. The Transmission of US Economic Policy Uncertainty Shocks to Asian and Global Financial Markets. N. Am. J. Econ. Financ. 2018, 46, 222–231. [Google Scholar] [CrossRef]

- Tan, Y.; Hu, H.T.; Li, D.S. The lmpact of Economic Uncertainty on the Price of Agricultural Products from Perspective of lndustrial Chain. J. Agrotech. Econ. 2018, 7, 80–92. [Google Scholar] [CrossRef]

- Wen, J.; Khalid, S.; Mahmood, H.; Zakaria, M. Symmetric and Asymmetric Impact of Economic Policy Uncertainty on Grain Prices in China: A new evidence. Resour. Policy 2021, 74, 102247. [Google Scholar] [CrossRef]

- Long, S.; Li, J.; Luo, T. The Asymmetric Impact of Global Economic Policy Uncertainty on International Grain Prices. J. Commod. Mark. 2022, 78, 101570. [Google Scholar] [CrossRef]

- Zhu, H.M.; Huang, R.; Wang, N.L.; Hau, L.Y. Does Economic Policy Uncertainty Matter for Commodity Market in China? Evidence from Quantile Regression. Appl. Econ. 2020, 52, 2292–2308. [Google Scholar] [CrossRef]

- Zhang, J.H.; Hua, J.G.; Tang, H.C.; Wu, Y.P. Economic Policy Uncertainty and Price Fluctuation of Agricultural Products. J. Agrotech. Econ. 2019, 5, 110–122. [Google Scholar] [CrossRef]

- Xiao, X.Y.; Tian, Q.S.; Hou, S.X.; Li, C.G. Economic Policy Uncertainty and Grain Futures Price Fluctuation: Evidence from China. China Agric. Econ. Rev. 2019, 11, 642–654. [Google Scholar] [CrossRef]

- Paul, R.K.; Garai, S. Performance Comparison of Wavelets-based Machine Learning Technique for Forecasting Agricultural Commodity Prices. Soft Comput. 2021, 25, 12857–12873. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Choi, M.J.; Hwang, S.; Im, H. Cross-border Trade Credit and Trade Flows during the Global Financial Crisis. Int. Rev. Econ. Financ. 2022, 82, 497–510. [Google Scholar] [CrossRef]

- Aftab, M.; Phylaktis, K. Economic Integration and Exchange Market Pressure in a Policy Uncertain World. J. Int. Money Financ. 2022, 128, 102701. [Google Scholar] [CrossRef]

- Liu, Q.D. Study on the Impact of the China-U.S. Trade War on China and the World Economy. J. Asia Soc. Sci. 2021, 2, 109–129. [Google Scholar] [CrossRef]

- Hu, G.H.; Liu, S. Economic Policy Uncertainty (EPU) and China’s Export Fluctuation in the Post-pandemic Era: An Empirical Analysis based on the TVP-SV-VAR Model. Front. Public Health 2021, 9, 788171. [Google Scholar] [CrossRef]

- Yao, H.Z.; Zuo, X.X.; Zuo, D.X.; Lin, H.; Huang, X.M.; Zhang, C.F. Study on Soybean Potential Productivity and Grain Security in China under the Influence of COVID-19 Outbreak. Geogr. Sustain. 2020, 1, 163–171. [Google Scholar] [CrossRef]

- Mei, D.X.; Xie, Y.T. US Grain Commodity Futures Price Fluctuation: Does Trade Policy Uncertainty Matter? Financ. Res. Lett. 2022, 48, 103028. [Google Scholar] [CrossRef]

- Falkendal, T.; Otto, C.; Schewe, J.; Jägermeyr, J.; Konar, M.; Kummu, M.; Watkins, B.; Puma, M.J. Grain Export Restrictions during COVID-19 Risk Food Insecurity in Many Low- and Middle-Income Countries. Nat. Food 2021, 2, 11–14. [Google Scholar] [CrossRef]

- Yang, J.; Jiang, H.M. Analysis of Fluctuations and Influential Factors for Pork Price in Jilin Province. Chin. J. Anim. Sci. 2015, 51, 39–43. [Google Scholar]

- Tong, H. Threshold Models in Nonlinear Time Series Analysis. In Lecture Notes in Statistics; Springer: Berlin/Heidelberg, Germany, 1983. [Google Scholar] [CrossRef]

- Hansen, B. Sample Splitting and Threshold Estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Joets, M.; Mignon, V.; Razafindrabe, T. Does the Fluctuation of Commodity Prices Reflect Macroeconomic Uncertainty? Energy Econ. 2017, 68, 313–326. [Google Scholar] [CrossRef] [Green Version]

| Variable | ADF | p |

|---|---|---|

| GEPU | −18.089 | <0.0001 |

| SOYB | −4.154 | 0.006 |

| CORN | −3.729 | 0.021 |

| GDP | −9.217 | <0.0001 |

| OIL | −11.885 | <0.0001 |

| SYEI | −15.844 | <0.0001 |

| SIMP | −15.929 | <0.0001 |

| CYEI | −15.536 | <0.0001 |

| CIMP | −16.267 | <0.0001 |

| SSEE | −9.254 | <0.0001 |

| CSEE | −10.782 | <0.0001 |

| SOYB, CORN | SOYB | CORN | ||||||

|---|---|---|---|---|---|---|---|---|

| Dimension | p | Bootstrap Sampling-p | BDS Statistics | Standard Quantity | Z Statistics | BDS Statistics | Standard Quantity | Z Statistics |

| 2 | <0.0001 | <0.0001 | 0.054 | 0.007 | 7.962 | 0.032 | 0.006 | 5.246 |

| 3 | <0.0001 | <0.0001 | 0.108 | 0.011 | 9.949 | 0.054 | 0.010 | 5.612 |

| 4 | <0.0001 | <0.0001 | 0.144 | 0.013 | 11.179 | 0.062 | 0.011 | 5.835 |

| 5 | <0.0001 | <0.0001 | 0.160 | 0.013 | 11.873 | 0.063 | 0.012 | 6.009 |

| 6 | <0.0001 | <0.0001 | 0.170 | 0.013 | 13.068 | 0.078 | 0.012 | 6.040 |

| Threshold Variable | Threshold Determination | F Statistic | S-F Statistic | Critical Value | Sequential Value | Split Value |

|---|---|---|---|---|---|---|

| GEPU (-5) | 0 vs. 1 * | 2.745 | 38.443 | 27.03 | 19.995 | 19.995 |

| 1 vs. 2 | 1.204 | 16.858 | 29.24 | — | — |

| Threshold Variable | Threshold Determination | F Statistic | S-F Statistic | Critical Value | Sequential Value | Split Value |

|---|---|---|---|---|---|---|

| GEPU (-5) | 0 vs. 1 * | 2.708 | 40.623 | 27.03 | 19.995 | 19.995 |

| 1 vs. 2 | 1.042 | 15.629 | 29.24 | — | — |

| Variables | Linear Regression | p | Threshold Regression (Zone 1) GEPU (−5) < 19.995 | p | Threshold Regression (Zone 2) 19.995 ≤ GEPU (−5) | p |

|---|---|---|---|---|---|---|

| GEPU (−5) | −0.044 | 0.499 | −0.099 * | 0.063 | 0.165 *** | 0.010 |

| SSEE | 0.082 ** | 0.015 | 0.109 * | 0.089 | 0.246 *** | 0.001 |

| GDP | 0.381 | 0.781 | 0.089 | 0.842 | 0.124 * | 0.067 |

| OIL | −0.313 ** | 0.015 | −0.065 *** | 0.004 | 1.801 ** | 0.031 |

| SYIE | 0.981 * | 0.096 | 0.082 ** | 0.015 | −0.182 ** | 0.040 |

| SIMP | −0.291 * | 0.076 | 0.853 | 0.103 | −0.041 | 0.663 |

| C | 0.089 | 0.351 | −0.007 | 0.203 | 0.032 ** | 0.019 |

| Sum of variable coefficients | 0.885 | 1.062 | 2.145 | |||

| F-statistic | 2.966 | 106.232 | ||||

| R2 | 0.660 | 0.789 | ||||

| Adjusted R2 | 0.635 | 0.731 | ||||

| Variables | Linear Regression | p | Threshold Regression (Zone 1) GEPU (−5) < 19.995 | p | Threshold Regression (Zone 2) 19.995 ≤ GEPU (−5) | p |

|---|---|---|---|---|---|---|

| GEPU (−5) | −0.002 | 0.981 | −0.061 ** | 0.021 | 0.117 ** | 0.036 |

| CSEE | 0.985 *** | 0.003 | 0.003 ** | 0.010 | 0.066 *** | 0.002 |

| GDP | 0.445 | 0.752 | 0.457 | 0.915 | 0.648 ** | 0.019 |

| OIL | −0.322 ** | 0.011 | −0.177 *** | 0.003 | 0.203 * | 0.080 |

| CYIE | 0.106 | 0.874 | 0.643 * | 0.088 | 1.532 | 0.558 |

| CIMP | −0.017 * | 0.078 | −0.114 | 0.102 | −0.631 ** | 0.019 |

| C | −0.585 | 0.394 | 0.052 | 0.248 | 0.098 *** | 0.000 |

| Sum of variable coefficients | 0.604 | 0.803 | 2.033 | |||

| F-statistic | 1.961 | 106.232 | ||||

| R2 | 0.651 | 0.891 | ||||

| Adjusted R2 | 0.625 | 0.785 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hua, J.; Li, H.; He, Z.; Ding, J.; Jin, F. The Microcosmic Mechanism and Empirical Test of Uncertainty on the Non-Linear Fluctuation of Chinese Grain Prices-Based on the Perspective of Global Economic Policy Uncertainty. Agriculture 2022, 12, 1526. https://doi.org/10.3390/agriculture12101526

Hua J, Li H, He Z, Ding J, Jin F. The Microcosmic Mechanism and Empirical Test of Uncertainty on the Non-Linear Fluctuation of Chinese Grain Prices-Based on the Perspective of Global Economic Policy Uncertainty. Agriculture. 2022; 12(10):1526. https://doi.org/10.3390/agriculture12101526

Chicago/Turabian StyleHua, Junguo, Hui Li, Zejun He, Jing Ding, and Futong Jin. 2022. "The Microcosmic Mechanism and Empirical Test of Uncertainty on the Non-Linear Fluctuation of Chinese Grain Prices-Based on the Perspective of Global Economic Policy Uncertainty" Agriculture 12, no. 10: 1526. https://doi.org/10.3390/agriculture12101526