Sustainability of Farms in EU Countries in the Context of Income Indicators: Regression Analysis Based on a New Classification

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

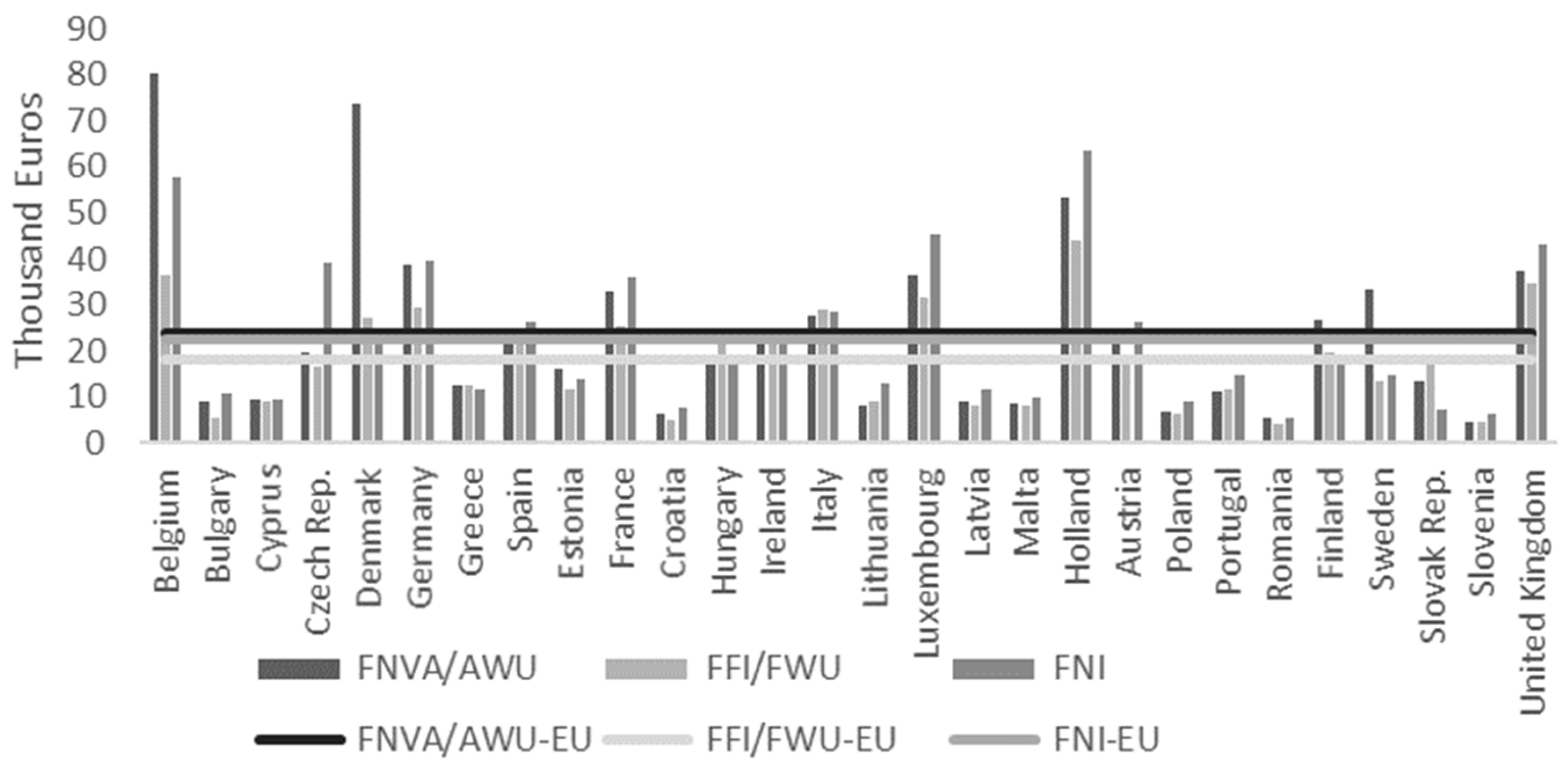

- FNVA/AWU—Farm net value added expressed per agricultural work unit;

- FFI/FWU—Family farm income expressed per family work unit;

- FNI—Farm net income.

4. Results

Regression Analysis of Income Indicators

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bayramoglu, Z.; Oguz, C.; Karakayaci, Z.; Arısoy, H. Identification of the income level needed for agricultural enterprises to achieve economic sustainability. Econ. Res.-Ekon. Istraž. 2018, 31, 510–520. [Google Scholar] [CrossRef]

- Vrolijk, H.; Poppe, K. Impact of off-farm income and paid taxes on the composition and volatility of incomes and wealth of dairy farmers in the Netherlands. Stud. Agric. Econ. 2020, 122, 57–65. [Google Scholar]

- Shiri, N.; Motamedinia, Z.; Hashemi, S.M.K.; Asadi, A. Agricultural researchers’ attitudes toward sustainable agriculture and its determinants in Ilam Province, Iran. Int. J. Agric. Sci. Res. 2012, 2, 121–137. [Google Scholar]

- Thanh, N.V.; Sukprasert, P.; Yapwattanaphun, C. Farmers’ sustainable agriculture perception in the Vietnam uplands: The case of banana farmers in Quang Tri province. Res. J. Appl. Sci. Eng. Technol. 2015, 10, 960–967. [Google Scholar] [CrossRef]

- Röös, E.; Fischer, K.; Tidåker, P.; Nordström Källström, H. How well is farmers’ social situation captured by sustainability assessment tools? A Swedish case study. Int. J. Sustain. Dev. World Ecol. 2019, 26, 268–281. [Google Scholar] [CrossRef] [Green Version]

- Średzińska, J. Determinants of the Income of Farms in EU Countries. Stud. Oeconomica Posnaniensia 2018, 6, 54–65. [Google Scholar] [CrossRef]

- Pe’er, G.; Bonn, A.; Bruelheide, H.; Dieker, P.; Eisenhauer, N.; Feindt, P.H.; Hagedorn, G.; Hansjürgens, B.; Herzon, I.; Lomba, Â.; et al. Action needed for the EU Common Agricultural Policy to address sustainability challenges. People Nat. 2020, 2, 305–316. [Google Scholar] [CrossRef] [Green Version]

- EC—European Commission. CAP towards 2020 Impact Assessment: Greening–Results of Partial Analysis on Farm Income Using FADN; EC: Brussels, Belgium, 2011. [Google Scholar]

- Gallo, P.; Balogova, B.; Mihalcova, B. The Influence of Intercultural Management Factors as Elements of Management Innovation. Mark. Manag. Innov. 2021, 2, 65–73. [Google Scholar] [CrossRef]

- Gallo, P.; Balogová, B.; Čabinová, B.; Dobrovič, J. The perception of gender stereotypes in managerial positions of industrial companies. Pol. J. Manag. Stud. 2021, 23, 149–164. [Google Scholar] [CrossRef]

- Will, M. Promoting Value Chains of Neglected and Underutilised Species for Pro-Poor Growth and Biodiversity Conservation: Guidelines and Good Practices; Bioversity International: Rome, Italy, 2008; Available online: https://www.bioversityinternational.org/fileadmin/_migrated/uploads/tx_news/Promoting_value_chains_of_neglected_and_underutilized_species_for_pro-poor_growth_and_biodiversity_conservation_1294.pdf (accessed on 22 May 2021).

- Kryszak, Ł. Profit Efficiency in EU FADN Farms under Different Types of Agriculture. Probl. World Agric. Probl. Rol. Światowego 2018, 18, 196–207. [Google Scholar] [CrossRef]

- Gocht, A.; Britz, W.; Ciaian, P.; Paloma, S.G.Y. Farm type effects of an EU-wide direct payment harmonisation. J. Agric. Econ. 2013, 64, 1–32. [Google Scholar] [CrossRef]

- Mishra, A.K.; Sandretto, C.L. Stability of farm income and the role of nonfarm income in US agriculture. Appl. Econ. Perspect. Policy 2002, 24, 208–221. [Google Scholar]

- Kráľ, P.; Kanderová, M.; Kaščáková, A.; Nedelová, G.; Valenčáková, V. Viacrozmerné Štatistické Metódy so Zameraním na Riešenie Problémov Ekonomickej Praxe; UMB: Banská Bystrica, Slovakia, 2009; pp. 1–175. [Google Scholar]

- Matthews, A. How Might the EU’s Common Agricultural Policy Affect Trade and Development after 2013: An Analysis of the European Commission’s November 2010 Communication; Issue paper No. 29; ICTSD: Geneva, Switzerland, 2010; pp. 1–22. [Google Scholar]

- Tangermann, S. Risk Management in Agriculture and the Future of the EU’s Common Agricultural Policy; Issue paper No. 34; ICTSD: Geneva, Switzerland, 2011; pp. 1–50. [Google Scholar]

- El Benni, N.; Finger, R.; Mann, S. Effects of agricultural policy reforms and farm characteristics on income risk in Swiss agriculture. Agric. Financ. Rev. 2012, 72, 301–324. [Google Scholar] [CrossRef]

- Vargová Dzurov, T.; Gallo, P.; Matušíková, D.; Švédová, M.; Gburová, J. Quality Management System as a Non-Financial Indicator in Tourism Enterprises. Qual.-Access Success 2020, 21, 69–73. [Google Scholar]

- Severini, S.; Tantari, A.; Di Tommaso, G. The instability of farm income. Empirical evidences on aggregation bias and heterogeneity among farm groups. Bio-Based Appl. Econ. 2016, 5, 63–81. [Google Scholar]

- Kołoszko-Chomentowska, Z. Selected effects of financing of agricultural holdings in new member states of the European Union. Finans. Kwart. Internetowy e-Finans. 2014, 10, 65–72. [Google Scholar]

- Galluzzo, N. Preliminary findings in Italian farms part of FADN dataset by the PLS-SEM. Bulg. J. Agric. Sci. 2018, 24, 927–932. [Google Scholar]

- Podruzsik, S.; Hubbard, C.; Keszthelyi, S.; Hubbard, L.J. Farm income variability in Hungary: A comparison with the EU based on FADN records. In Proceedings of the 108th Seminar, Warszaw, Poland, 8–9 February 2008; European Association of Agricultural Economists: Madrid, Spain, 2008. [Google Scholar]

- Špička, J. The economic disparity in european agriculture in the context of the recent EU enlargement. J. Econ. Sustain. Dev. 2013, 4, 125–133. [Google Scholar]

- Dobrovič, J.; Čabinová, V.; Gallo, P.; Partlová, P.; Váchal, J.; Balogová, B.; Orgonáš, J. Application of the DEA Model in Tourism SMEs: An Empirical Study from Slovakia in the Context of Business Sustainability. Sustainability 2021, 13, 7422. [Google Scholar] [CrossRef]

- Kočišová, K. Application of the DEA on the measurement of efficiency in the EU countries. Agric. Econ. 2015, 61, 51–62. [Google Scholar] [CrossRef] [Green Version]

- Hill, S.B.; MacRae, R.J. Conceptual framework for the transition from conventional to sustainable agriculture. J. Sustain. Agric. 1996, 7, 81–87. [Google Scholar] [CrossRef]

- Juríčková, Z.; Lušňáková, Z.; Hallová, M.; Horská, E.; Hudáková, M. Environmental impacts and attitudes of agricultural enterprises for environmental protection and sustainable development. Agriculture 2020, 10, 440. [Google Scholar] [CrossRef]

- Van der Veen, H.B.; Van der Meulen, H.A.B.; Van Bommel, K.H.M.; Doorneweert, R.B. Exploring Agricultural Taxation in Europe; LEI: The Hague, The Netherlands, 2007; pp. 1–207. [Google Scholar]

- EC—European Commission. Tax Policies in the European Union 2017 Survey; EC: Brussels, Belgium, 2017; ISBN 978-92-79-72282-0. [Google Scholar]

- Wrzaszcz, W.; Zegar, J.S. Economic sustainability of Farms in Poland. Eur. J. Sustain. Dev. 2014, 3, 165. [Google Scholar]

- Kulawik, J.; Płonka, R. Subsidies, financial and economic efficiency and the type of farming of the agricultural holdings of natural persons. Zagadnienia Ekon. Rolnej 2014, 340, 3–19. [Google Scholar]

- Bertoni, D.; Cavicchioli, D.; Donzelli, F.; Ferrazzi, G.; Frisio, D.G.; Pretolani, R.; Ricci, E.C.; Ventura, V. Recent contributions of agricultural economics research in the field of sustainable development. Agriculture 2018, 8, 200. [Google Scholar] [CrossRef] [Green Version]

- Grzelak, A.; Kiełbasa, B. Assessment of the use of the European union funds to support investments on polish farms in the regional perspective. Acta Sci. Pol. Oeconomia 2014, 13, 49–60. [Google Scholar]

- Inkabova, M.; Andrejovska, A.; Glova, J. The Impact of Environmental Taxes on Agriculture—The Case of Slovakia. Pol. J. Environ. Stud. 2021, 4, 3085–3097. [Google Scholar] [CrossRef]

- Gradzewicz, M.; Growiec, J.; Kolasa, M.; Postek, Ł.; Strzelecki, P. Poland’s Exceptional Performance during the World Economic Crisis: New Growth Accounting Evidence. September 2014. Available online: https://ssrn.com/abstract=2646562 (accessed on 10 June 2021).

- Da-Rocha, J.M.; Restuccia, D. The role of agriculture in aggregate business cycles. Rev. Econ. Dyn. 2006, 9, 455–482. [Google Scholar] [CrossRef]

- Wojciechowska-Solis, J.; Barska, A. Exploring the preferences of consumers’ organic products in aspects of sustainable consumption: The case of the Polish consumer. Agriculture 2021, 11, 138. [Google Scholar] [CrossRef]

- Rizov, M.; Oskam, A.; Walsh, P. Is there a limit to agglomeration? Evidence from productivity of Dutch firms. Reg. Sci. Urban Econ. 2012, 42, 595–606. [Google Scholar] [CrossRef] [Green Version]

- Markechová, D.; Tirpáková, A.; Stehlíková, B. Základy Štatistiky Pre Pedagógov; FPV UK: Nitra, Slovakia, 2011; pp. 1–405. [Google Scholar]

- Chrastinová, Z.; Burianová, V. Economic development in Slovak agriculture. Agric. Econ. 2009, 55, 67–76. [Google Scholar] [CrossRef]

- Chrastinová, Z.; Krížová, S.; Zbranek, P. Comparison of production performance of agriculture in EU countries. Ekon. Poľnohospodárstva 2017, 1, 53–76. [Google Scholar]

- Argilés, J.M. Accounting information and the prediction of farm non-viability. Eur. Account. Rev. 2001, 10, 73–105. [Google Scholar] [CrossRef]

- EC—European Commission. Common Monitoring and Evaluation Framework. Common Agricultural Policy 2014–2020. 2017. Available online: https://agriculture.ec.europa.eu/common-agricultural-policy/cap-overview/cmef_en (accessed on 22 September 2021).

- Gocht, A.; Britz, W. EU-wide farm type supply models in CAPRI—How to consistently disaggregate sector models into farm type models. J. Policy Model. 2011, 33, 146–167. [Google Scholar] [CrossRef]

- Trnkova, G.; Mala, Z.; Vasilenko, A. Analysis of the effects of subsidies on the economic behavior of agricultural businesses focusing on animal production. Agris-Line Pap. Econ. Inform. 2012, 4, 115–126. [Google Scholar]

- Parsche, R.; Radulescu, D.M. Taxing means of agricultural production in Germany: A relatively high tax burden compared to other important EU competitors. CESifo DICE Rep. 2004, 2, 48–54. [Google Scholar]

- Dziemianowicz, R.; Budlewska, R. Preferencje podatkowe jako instrument polityki rolnej–na przykładzie wybranych państw Unii Europejskiej Tax expenditures as an instrument of the agriculture policy—An example of selected European Union Member States. In Problemy Rolnictwa Światowego; SGGW: Warszawa, Poland, 2014; pp. 43–58. [Google Scholar]

- Wasilewski, M.; Ganc, M. Funkcjonowanie systemu podatkowego w rolnictwie oraz propozycje zmian w opinii rolników indywidualnych. Zesz. Nauk. Uniw. Szczec. Finans. Rynk. Finans. Ubezpieczenia 2012, 50, 725–734. [Google Scholar]

| Variable | Description |

|---|---|

| FNVA/AWU (model 1) * | Farm net value added expressed per agricultural work unit |

| FFI/FWU (model 2) * | Family farm income expressed per family work unit |

| FNI (model 3) * | Farm net income |

| EC1 | Tangible assets/total assets |

| EC2 | Liabilities/total assets |

| ENV1 | Fertilisers/total agricultural area in hectares |

| ENV2 | Energy (fuels, gas, electricity)/total agricultural area in hectares |

| ENV3 | Permanent grassland and pastures/total agricultural area in hectares |

| ENV4 | Total livestock units/total agricultural area in hectares |

| Size | Economic size of enterprise, expressed in European size units |

| Tsubh | Total subsidies/total agricultural area in hectares |

| DEPREC | Depreciation of long-term fixed assets and intangible assets |

| TAXES | Income tax, property tax, and other commission |

| wages_empl | (Wages + levies)/total workforce |

| Estimate | Std. Error | t-Value | Pr (>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | −4998.2085 | 4202.6503 | −1.189 | 0.247596 | |

| ENV2 | −97.6577 | 14.5159 | −6.728 | 1.18 × 10−6 | *** |

| Tsubh | 37.0574 | 10.6052 | 3.494 | 0.002161 | ** |

| Size | 208.9745 | 34.6173 | 6.037 | 5.44 × 10−6 | *** |

| DEPREC | −0.8758 | 0.1873 | −4.677 | 0.000129 | *** |

| ENV4 | 18,525.0682 | 3510.3454 | 5.277 | 3.12 × 10−5 | *** |

| EC2 | 3924.7217 | 1288.3027 | 3.046 | 0.006134 | ** |

| Standard codes of significance: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1; the stars flag level of significance. If a p-value is less than 0.05 (*); if a p-value is less than 0.01 (**); and if a p-value is less than 0.001 (***). | |||||

| Results of the statistically significant income indicator FNVA/AWU: | |||||

| Autocorrelation: Durbin–Watson test, p-value > α; | |||||

| Heteroscedasticity: studentised Breusch–Pagan test, p-value > α; | |||||

| Multicollinearity: VIF value < 10 for all variables. | |||||

| The statistical significance of the income model was confirmed by the F-statistic, p-value < α (3.537 × 10−9 < 0.05), and by the REST test, p-value > α (0.831 > 0.05). The Jarque–Bera normality test confirmed that the residuals were normally distributed, p-value = 0.921. Based on the determination coefficient , the income model explained 89.36% of the total variability. In this case, 89.36% correctly explained the dependent variable, i.e., the income indicator FNVA/AWU; the remaining 10.64% explained a random variable. | |||||

| Estimate | Std. Error | t-Value | Pr (>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | 14,876.558 | 10,157.297 | 1.465 | 0.156561 | |

| ENV1 | 109.958 | 34.471 | 3.190 | 0.004076 | ** |

| wages_empl | 1.204 | 0.254 | 4.741 | 8.87 × 10−5 | *** |

| ENV3 | 32,086.590 | 7435.506 | 4.315 | 0.000257 | *** |

| EC1 | −31,434.240 | 14,798.893 | −2.124 | 0.044631 | * |

| Standard codes of significance: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1; the stars flag level of significance. If a p-value is less than 0.05 (*); if a p-value is less than 0.01 (**); and if a p-value is less than 0.001 (***). | |||||

| Results of the statistically significant income indicator FFI/FWU: | |||||

| Autocorrelation: Durbin–Watson test, p-value > α; | |||||

| Heteroscedasticity: studentised Breusch–Pagan test, p-value > α; | |||||

| Multicollinearity: VIF value < 2 for all variables. | |||||

| The statistical significance of the income model was confirmed by the F-statistic, p-value < α (2.64 × 10−5 < 0.05), and by the REST test, p-value > α (0.7132 > 0.05). The Jarque–Bera normality test confirmed that the residuals were distributed normally, p-value = 0.493. Based on the determination coefficient R2, the income model explains 66.87% of the total variability. In this case, 66.87% correctly explained the dependent variable, i.e., the income indicator FFI/FWU; the remaining 33.13% explained a random variable. | |||||

| Estimate | Std. Error | t-Value | Pr (>|t|) | ||

|---|---|---|---|---|---|

| (Intercept) | 23,359.170 | 15,061.442 | 1.551 | 0.13519 | |

| ENV1 | 120.044 | 49.757 | 2.413 | 0.02462 | * |

| Size | 166.686 | 35.765 | 4.661 | 0.00012 | *** |

| TAXES | −9.152 | 2.837 | −3.226 | 0.00389 | ** |

| ENV3 | 30,014.673 | 10,834.292 | 2.770 | 0.01116 | * |

| EC1 | −41,580.213 | 22,014.773 | −1.889 | 0.07218 | . |

| Standard codes of significance: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1; the stars flag level of significance. If a p-value is less than 0.05 (*); if a p-value is less than 0.01 (**); and if a p-value is less than 0.001 (***). | |||||

| Results of the statistically significant income indicator FNI. | |||||

| Autocorrelation: Durbin–Watson test, p-value > α. | |||||

| Heteroscedasticity: studentised Breusch–Pagan test, p-value > α. | |||||

| Multicollinearity: VIF value < 7 for all variables. | |||||

| The statistical significance of the income model was confirmed by the F-statistic, p-value < α (1.67 × 10−5 < 0.05), and by the REST test, p-value > α (0.381 > 0.05). The Jarque–Bera normality test confirmed that the residuals were normal distributed, p-value = 0.728. Based on the determination coefficient R2, the income model explained 72.07% of the total variability. In this case, 72.07% correctly explained the dependent variable, i.e., the income indicator FNI; the remaining 27.93% explained a random variable. | |||||

| Country | Correlation coefficient | Country | Correlation coefficient | Country | Correlation coefficient |

|---|---|---|---|---|---|

| Belgium | 0.837 | Croatia | 0.239 | Poland | 0.918 |

| Bulgaria | 0.160 | Hungary | 0.778 | Portugal | 0.932 |

| Cyprus | 0.788 | Ireland | −0.181 | Romania | 0.976 |

| Czech Republic | −0.353 | Italy | 0.402 | Finland | 0.953 |

| Denmark | −0.410 | Lithuania | −0.205 | Sweden | 0.445 |

| Germany | 0.469 | Luxemburg | 0.883 | Slovak Republic | −0.231 |

| Greece | 0.789 | Latvia | 0.848 | Slovenia | −0.271 |

| Spain | 0.880 | Malta | −0.240 | United Kingdom | −0.471 |

| Estonia | 0.936 | The Netherlands | 0.276 | ||

| France | 0.634 | Austria | 0.530 |

| Variables | Recent Empirical Studies | Results of Analysis | ||||

|---|---|---|---|---|---|---|

| Author | Year | Relationship between Income and Variable | Expected Correlation | Identified Correlation | Interpretation | |

| Economic indicators | Vrolijk and Poppe [2] | 2020 | Positive | + | − + | The higher proportion of tangible assets decreases income. Indebtedness contributes to income growth. |

| Kołoszko-Chomentowska [21] | 2014 | None | ||||

| Mishra and Sandretto [14] | 2002 | Negative | ||||

| Environmental indicators | Wrzaszcz and Zegar [31] | 2014 | Positive | + | + − | Environmental indicators (e.g., fertilisers/ha, grasslands/ha, livestock units/ha) contribute to income growth. On the other hand, the growth of energy consumption per hectare decreases the level of income. |

| Gocht and Britz [45] | 2011 | Positive | ||||

| Severini, Tantari and Di Tommaso [20] | 2016 | Positive | ||||

| Galluzo [22] | 2018 | Positive | ||||

| Średzińska [6] | 2018 | Positive | ||||

| Podruzsik et al. [23] | 2008 | Positive | ||||

| Subsidies | Kulawik and Płonka [32] | 2014 | Negative | + | + | Subsidies contribute to farm income growth. |

| Gocht et al. [13] | 2013 | Positive | ||||

| Vrolijk and Poppe [2] | 2020 | Positive | ||||

| Severini, Tantari and Di Tommaso [20] | 2016 | Positive | ||||

| Kołoszko-Chomentowska [21] | 2014 | Positive | ||||

| Galluzo [22] | 2018 | Positive | ||||

| Podruzsik et al. [23] | 2008 | Positive | ||||

| Trnková et al. [46] | 2012 | Negative | ||||

| Size | Gocht and Britz [45] | 2011 | Positive | + | + | As the size of the enterprise increases, the farm’s income increases. |

| Vrolijk and Poppe [2] | 2020 | Positive | ||||

| Severini, Tantari and Di Tommaso [20] | 2016 | Positive | ||||

| Średzińska [6] | 2018 | Positive | ||||

| Van Der Veen et al. [29] | 2007 | Positive | ||||

| Tax burden | Vrolijk and Poppe [2] | 2020 | None | - | − | As the tax burden increases, the level of income decreases. |

| Van Der Veen et al. [29] | 2007 | Negative | ||||

| Parsche and Radulescu [47] | 2004 | Negative | ||||

| Kulawik and Płonka [32] | 2014 | None | ||||

| Dziemianovicz and Budlewska [48] | 2014 | Negative | ||||

| Wasilewski and Ganc [49] | 2012 | Negative | ||||

| Wages | Vrolijk and Poppe [2] | 2020 | Positive | + | + | Wage growth contributes to income growth. |

| Średzińska [6] | 2018 | Positive | ||||

| Špička [24] | 2013 | Positive | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Andrejovská, A.; Glova, J. Sustainability of Farms in EU Countries in the Context of Income Indicators: Regression Analysis Based on a New Classification. Agriculture 2022, 12, 1884. https://doi.org/10.3390/agriculture12111884

Andrejovská A, Glova J. Sustainability of Farms in EU Countries in the Context of Income Indicators: Regression Analysis Based on a New Classification. Agriculture. 2022; 12(11):1884. https://doi.org/10.3390/agriculture12111884

Chicago/Turabian StyleAndrejovská, Alena, and Jozef Glova. 2022. "Sustainability of Farms in EU Countries in the Context of Income Indicators: Regression Analysis Based on a New Classification" Agriculture 12, no. 11: 1884. https://doi.org/10.3390/agriculture12111884