Wheat Import Demand in Mexico: Evidence of Quantile Cointegration

Abstract

:1. Introduction

2. Theoretical Framework of International Trade

2.1. Classical Trade Theories

2.2. Theories of International Trade

- Trade in products that are substitutable in their consumption but differentiated in their inputs;

- Product differentiation;

- Economies of scale, as well as innovation and technological differences.

2.3. New Theoretical Developments

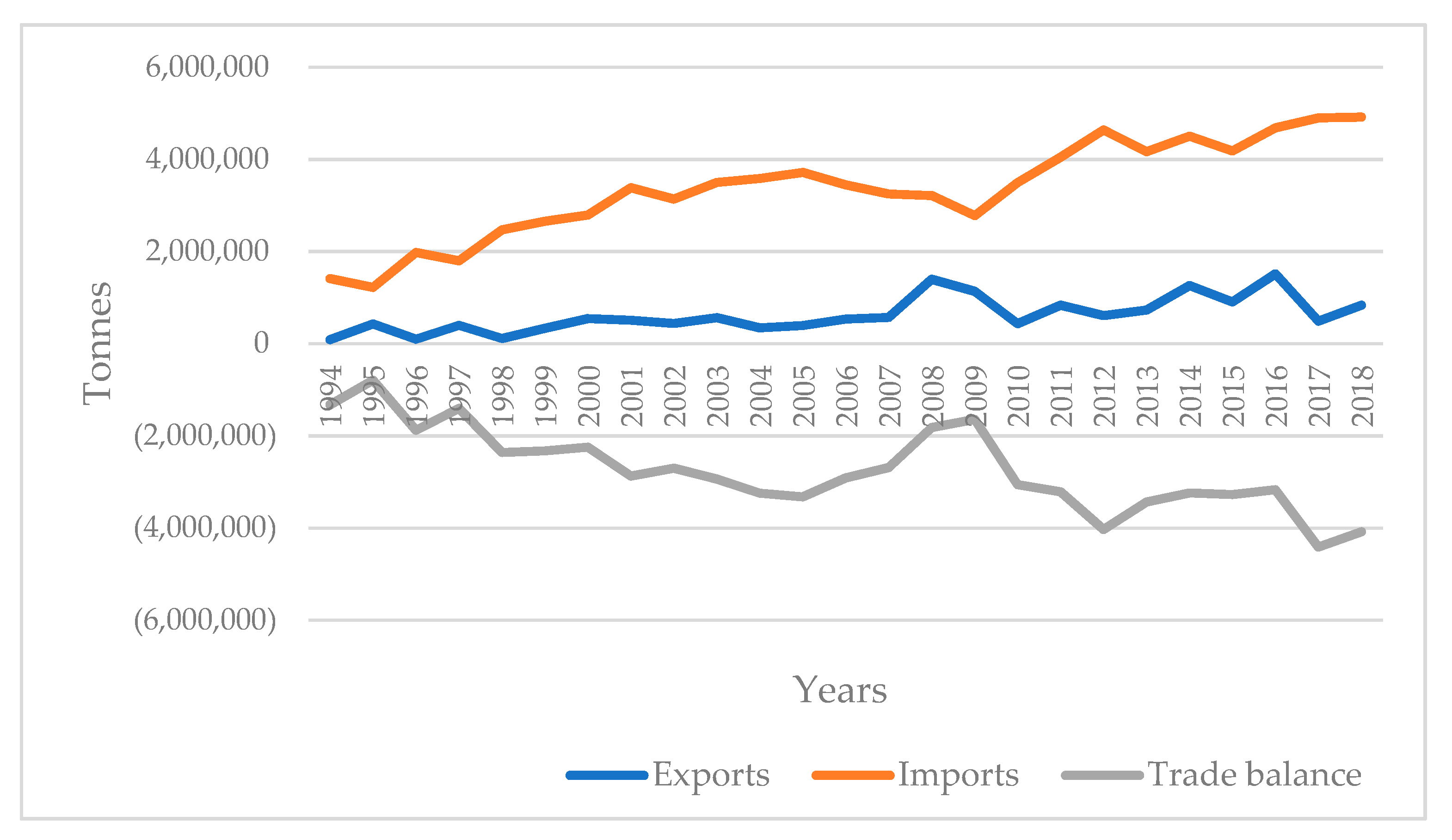

3. Wheat in Mexico

4. Materials and Methods

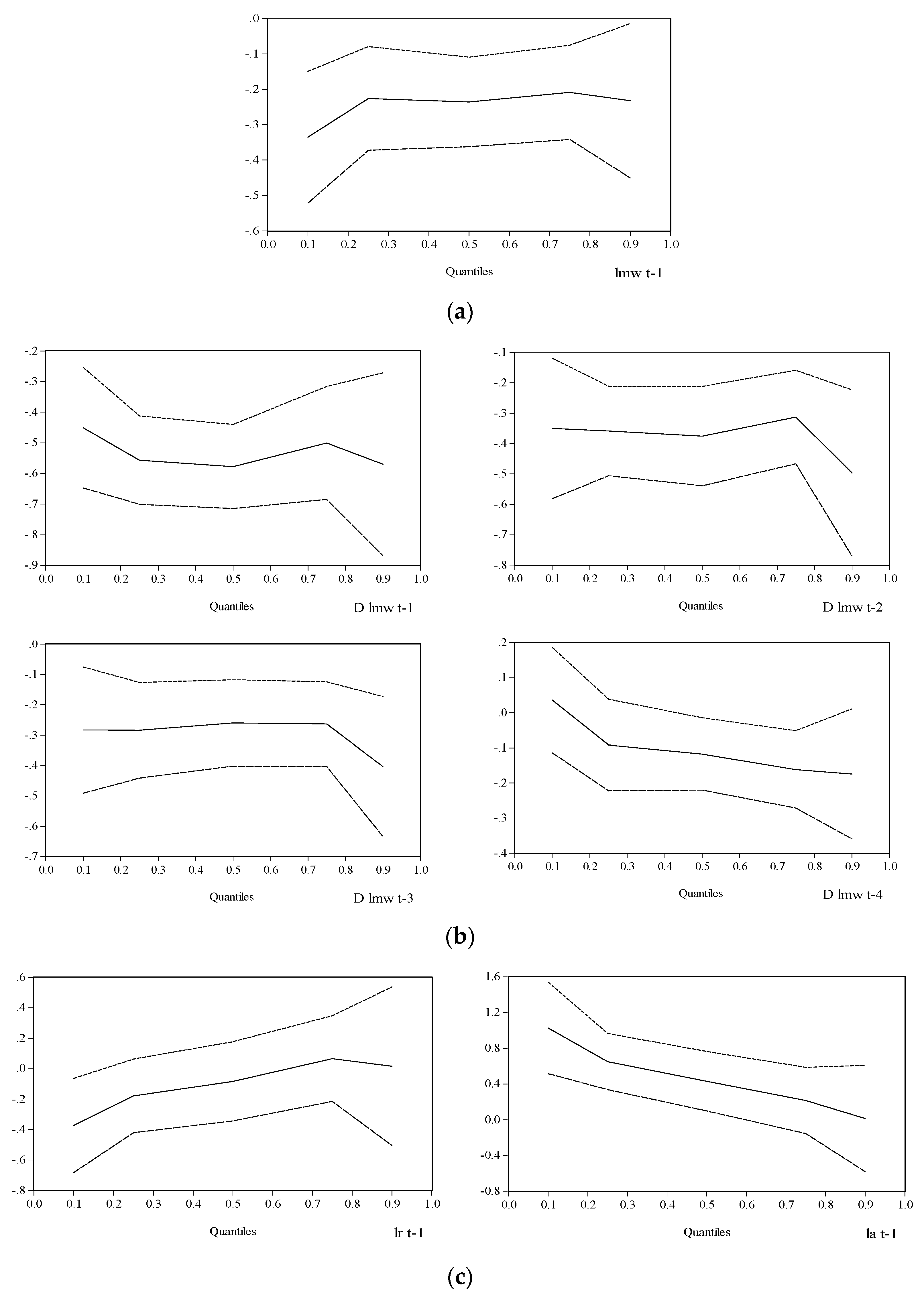

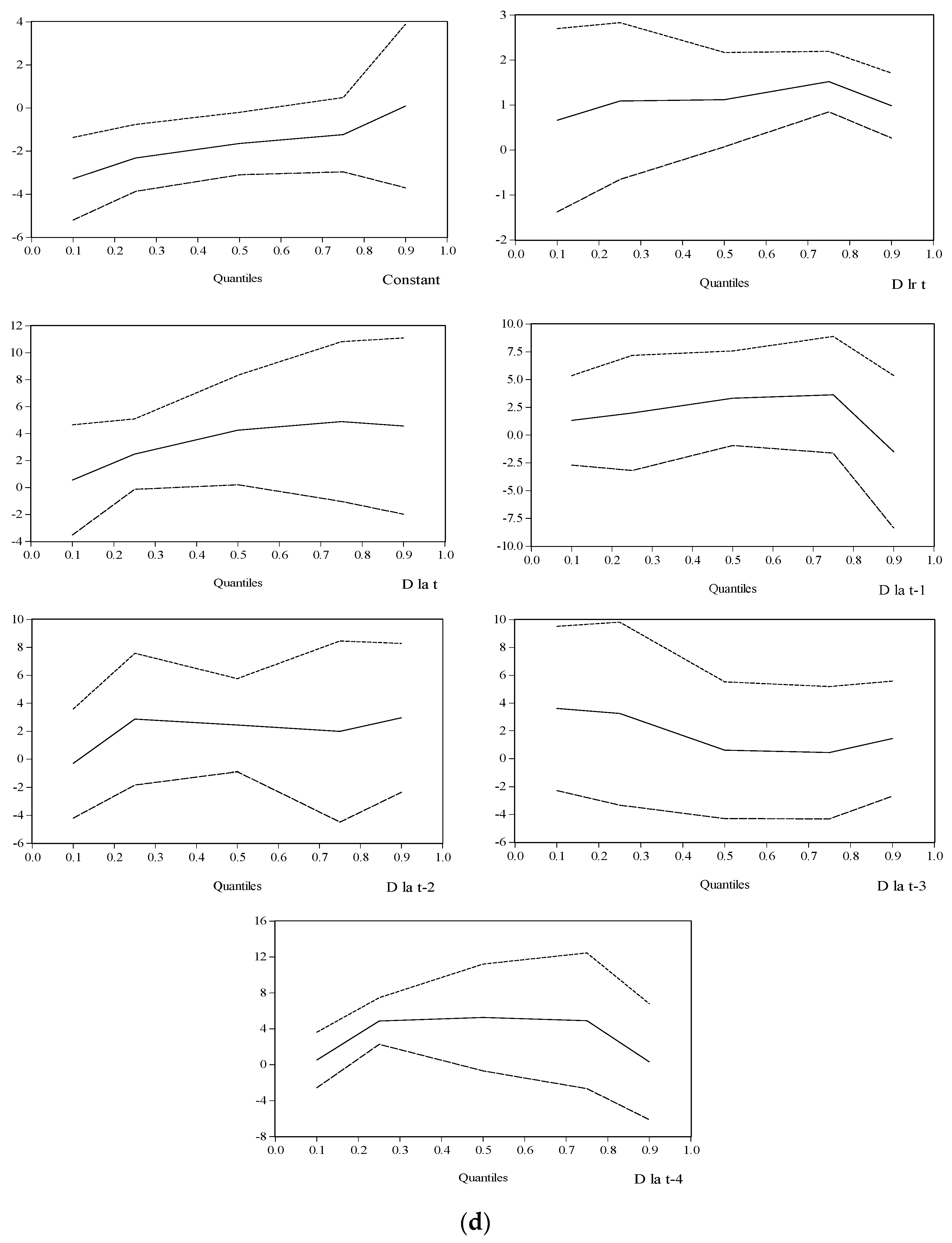

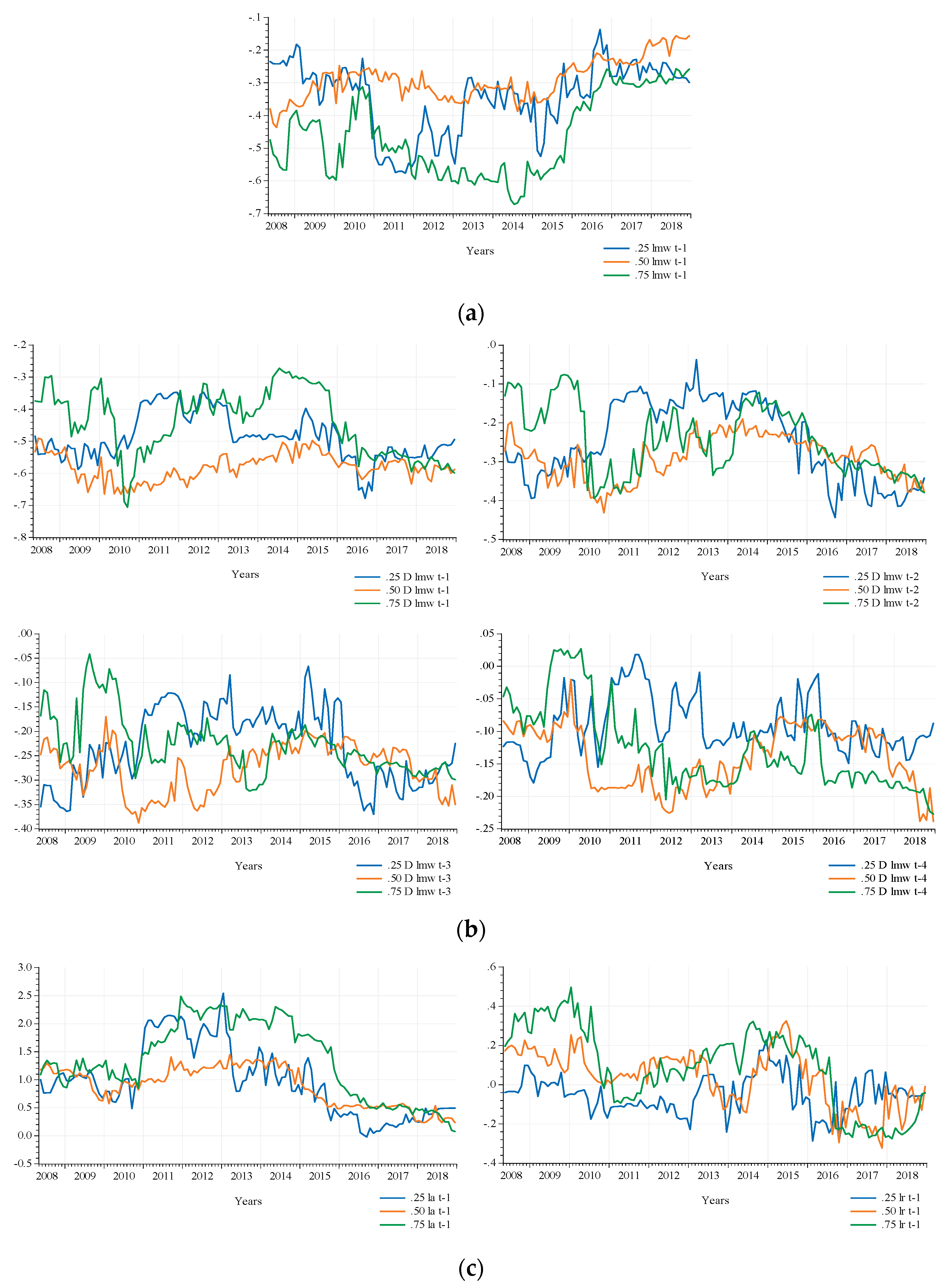

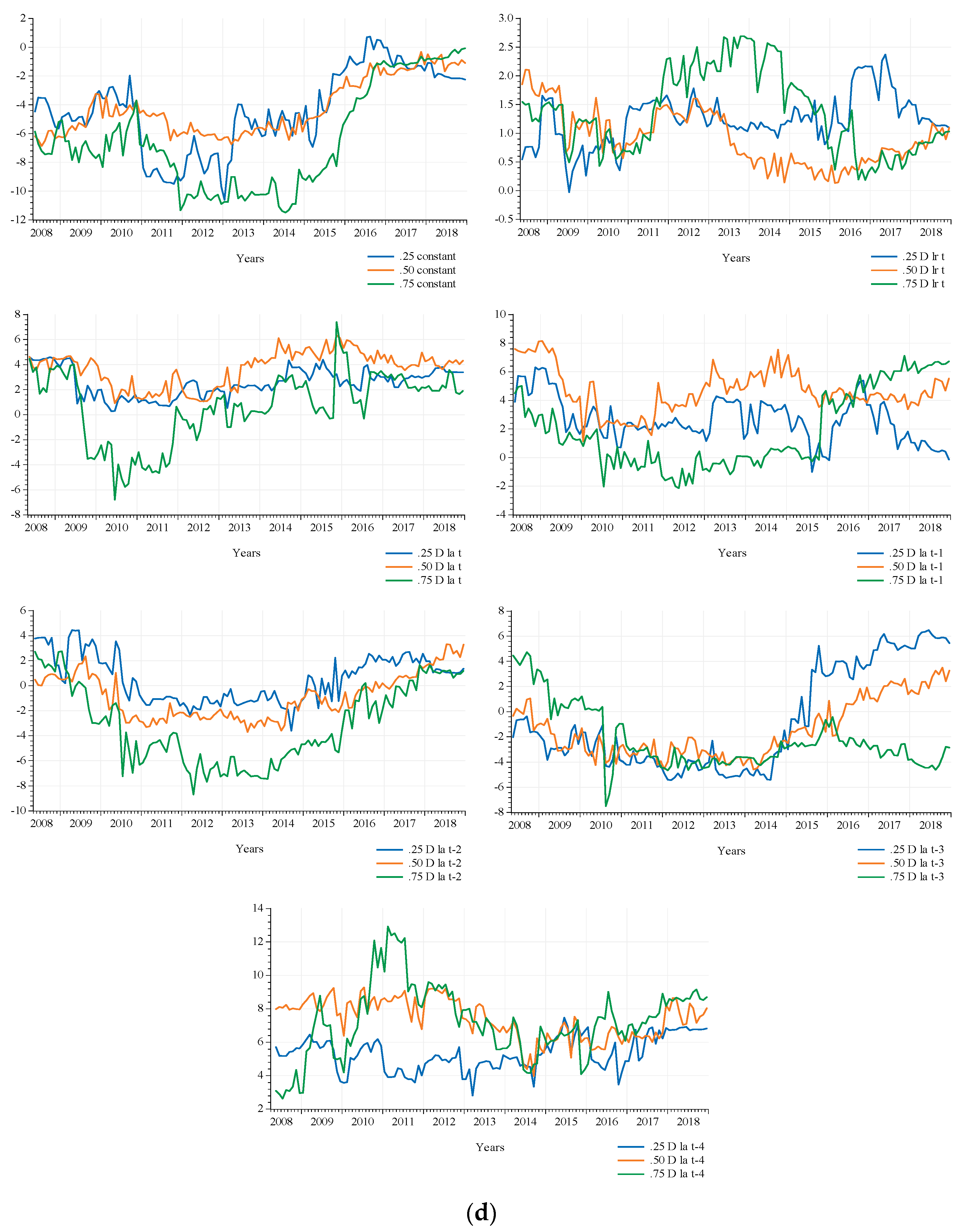

5. Results

6. Discussion

7. Conclusions

- In a sovereignty-focused setting (low import levels), government could affect the amount of wheat imported in the long term through the exchange rate and economic activity. In addition, policymakers in the Mexican government should increase the agriculture research and development expenditure (such as in innovative wheat varieties and bio-saline agriculture in the arid part of northern Mexico), as well as educating farmers to increase the absorptive ability of brand new technology and management of scarce resources such as water and fertilizers. All these measures are aimed at boosting domestic production, and thus indirectly reducing imports, as well as the existence of an optimal pricing mechanism established in markets in the country, in a way that guarantees a fair price for farmers and consumers alike.

- For its part, in a food-security-focused setting (high levels of imports), government would employ the exchange rate and the previous level of imports to determine the amount imported in the short term. Besides the QARDL model’s results, investment in transportation infrastructure (such as ports, roads, airport, etc.) is recommended, which will facilitate the supply of products from abroad. Needless to say, the price information has to be perfectly communicated along the supply chain.

Author Contributions

Funding

Conflicts of Interest

References

- Goldstein, M.; Khan, M.S. Income and price effects in foreign trade. Handb. Int. Econ. 1985, 2, 1041–1105. [Google Scholar] [CrossRef]

- Leamer, E.E.; Stern, R.M. Quantitative International Economics; Routledge: London, UK, 1970. [Google Scholar]

- Thirlwall, A.P. The Nature of Economic Growth. An Alternative Framework for Understanding the Performance of Nations; Edward Elgar Publishing: Cheltenham, UK, 2002; ISBN 1-84064-864-3. [Google Scholar]

- Cardero, M.E.; Galindo, L.M. La demanda de importaciones en México: Un enfoque de elasticidades. Comer. Exter. 1999, 49, 481–487. [Google Scholar]

- Loria Díaz, E. La restricción externa dinámica al crecimiento de México, a través de las propensiones del comercio, 1970–1999. Estud. Econ. 2001, 16, 227–251. [Google Scholar]

- Moreno-Brid, J.C. Liberalización Comercial y la Demanda de Importaciones en México. Investig. Econ. 2002, LXII, 13–50. [Google Scholar]

- Pacheco-López, P. The effect of trade liberalization on exports, imports, the balance of trade, and growth: The case of Mexico. J. Post Keynes. Econ. 2005, 27, 595–617. [Google Scholar]

- Valencia-Romero, R. El modelo de crecimiento con restricción de balanza de pagos con incorporación de las remesas. El caso de México. Comer. Exter. 2008, 58, 17–26. [Google Scholar]

- Romero, J. Evolución de la demanda mexicana de importaciones: 1940–2009. Econoquantum 2012, 9, 7–34. [Google Scholar] [CrossRef]

- Cermeño, R.S.; Rivera Ponce, H. La demanda de importaciones y exportaciones de México en la era del TLCAN. Trimest. Econ. 2016, 83, 127–147. [Google Scholar] [CrossRef]

- INEGI. Indicador Global de la Actividad Económica (IGAE). Base 2013. Available online: https://www.inegi.org.mx/programas/igae/2013/ (accessed on 23 November 2019).

- Granger, C.W.J. Some properties of time series data and their use in econometric model specification. J. Econom. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251. [Google Scholar] [CrossRef]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Econom. Theory; Oxford Academic: Oxford, UK, 1995. [Google Scholar] [CrossRef]

- United States-Mexico-Canada Agreement. Available online: https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement (accessed on 15 April 2020).

- González Blanco, R. Diferentes teorías del comercio internacional. ICE Rev. Econ. Econ. 2011, 858, 103–118. [Google Scholar]

- Smith, A. Investigación Sobre la Naturaleza y Causas de la Riqueza de las Naciones; Fondo de Cultura Económica: Mexico City, Mexico, 1958; ISBN 9786071650764. [Google Scholar]

- Ricardo, D. Principios de Economía Política y Tributación; Fondo de Cultura Económica: Mexico City, Mexico, 1959; ISBN 9789681618902. [Google Scholar]

- Heckscher, E. The effects of foreign trade on the distribution of income. In Readings in the Theory of International Trade; Ellis, H., Metzler, L.A., Eds.; Blackiston: Filadelfia, PA, USA, 1919; pp. 272–300. [Google Scholar]

- Ohlin, B. Interregional and International Trade, 2nd ed.; Harvard University Press: Cambridge, MA, USA, 1935. [Google Scholar]

- Verdoon, P.J. The Intra-Block Trade of Benelux. In Economic Consequences of the Size of Nations; Robinson, E.A.G., Ed.; Palgrave Macmillan: London, UK, 1960; pp. 291–321. [Google Scholar]

- Balassa, B. Tariff Reductions and Trade in Manufactures among the Industrial Countries. Am. Econ. Rev. 1966, 56, 466–473. [Google Scholar]

- Brander, J.; Krugman, P. A ‘reciprocal dumping’ model of international trade. J. Int. Econ. 1983, 15, 313–321. [Google Scholar] [CrossRef]

- Krugman, P.R. Increasing returns, monopolistic competition, and international trade. J. Int. Econ. 1979, 9, 469–479. [Google Scholar] [CrossRef]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Bernard, A.B.; Jensen, J.B. Exporters, Jobs, and Wages in U.S. Manufacturing: 1976–1987. Brook. Pap. Econ. Act. 1995, 26, 67–119. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S.; Kramarz, F. An Anatomy of International Trade: Evidence from French Firms; NBER Working paper; National Bureau of Economic Research: Cambridge, MA, USA, 2008. [Google Scholar]

- Bernard, A.B.; Redding, S.J.; Schott, P.K. Comparative Advantage and Heterogeneous Firms. Rev. Econ. Stud. 2007, 74, 31–66. [Google Scholar] [CrossRef]

- Yeaple, S.R. A simple model of firm heterogeneity, international trade, and wages. J. Int. Econ. 2005, 65, 1–20. [Google Scholar] [CrossRef]

- Rosenweing, A. El debate sobre el sector agropecuario mexicano en el TLCAN. Comer. Exter. 2005, 56, 8. [Google Scholar]

- Puyana, A.; Romero, J. El sector agropecuario mexicano bajo el Tratado de Libre Comercio de América del Norte. La pobreza y la desigualdad se intensifican, crece la migración. In Retos para la Integración Social de los Pobres en América Latina; Barba Solano, C., Ed.; CLACSO: Bueno Aires, Argentina, 2009; pp. 187–214. [Google Scholar]

- SAGARPA. Planeacion Agricola Nacional 2017–2030. Segunda Parte, 1st ed.; Gobierno de México: Ciudad de México, Mexico, 2017. [Google Scholar]

- INEGI. Encuesta Nacional de Gastos de los Hogares. Available online: http://www3.inegi.org.mx/rnm/index.php/catalog/132 (accessed on 12 October 2019).

- FAO. FAOSTAT. Available online: http://www.fao.org/faostat/es/#data (accessed on 30 April 2021).

- Rubio, B. La soberanía alimentaria en México: Una asignatura pendiente. Mundo Siglo XXI 2015, X, 55–70. [Google Scholar]

- Wise, T. El impacto de las políticas agropecuarias de los Estados Unidos sobre los productos mexicanos. In Subsidios para la Desigualdad. Las Políticas Públicas del Maíz en México a Partir del Libre Comercio; Fox, J., Haight, L., Eds.; Woodrow Wilson International Center for Scholar, CIDE y University of California: Santa Cruz, México, 2010; pp. 175–184. [Google Scholar]

- Otero, G. Neoliberal Globalization, NAFTA, and Migration: Mexico’s Loss of Food and Labor Sovereignty. J. Poverty 2011, 15, 384–402. [Google Scholar] [CrossRef]

- Bada, X.; Fox, J. Patrones migratorios en contextos de ruralidad y marginacion en el campo mexicano, 2000–2010: Cambios y continuidades. Rev. Asoc. Latinoam. Sociol. Rural. 2014, 10, 277–296. [Google Scholar]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium; Strøm, S., Ed.; Cambridge University Press: Cambridge, UK, 1999; pp. 371–413. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Hassler, U.; Wolters, J. Autoregressive distributed lag models and cointegration. Allg. Stat. Arch. 2006, 90, 59–74. [Google Scholar] [CrossRef]

- Cho, J.S.; Kim, T.H.; Shin, Y. Quantile cointegration in the autoregressive distributed-lag modeling framework. J. Econom. 2015, 188, 281–300. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G. Regression Quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Brooks, C. Introductory Econometrics for Finance; Cambridge University Press: Cambridge, UK, 2019; ISBN 9781108524872. [Google Scholar]

- BANXICO. Sistema de Información Económica. Available online: http://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=6&accion=consultarCuadro&idCuadro=CR60&locale=es (accessed on 10 November 2019).

- INEGI. Banco de Información Económica. Available online: https://www.inegi.org.mx/sistemas/bie/ (accessed on 3 November 2019).

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Rojas, O.; Li, Y.; Cumani, R. Understanding the Drought Impact of El Niño on the Global Agricultural Areas: An Assessment Using FAO’s Agricultural Stress Index (ASI); Food and Agriculture Organization of the United Nations: Rome, Italy, 2014; ISBN 9789251086711. [Google Scholar]

- Marquez Berber, S.R.; Almaguer Vargas, G.; Schwentesius Rindermann, R.; Ayala Garay, A.V. Trigo en Sonora y su Contexto Nacional e Internacional; Gámez, E.L., Ed.; Centro de Estudios para el Desarrollo Rural Sustentable y la Soberanía Alimentaria: Mexico City, Mexico, 2014; ISBN 978-607-9423-53-7. [Google Scholar]

- Domínguez, J. Revisión histórica de las sequías en México: De la explicación divina a la incorporación de la ciencia. Tecnol. Cienc. Agua 2016, 7, 77–93. [Google Scholar]

- Mishra, S.; Sharif, A.; Khuntia, S.; Meo, S.A.; Rehman Khan, S.A. Does oil prices impede Islamic stock indices? Fresh insights from wavelet-based quantile-on-quantile approach. Resour. Policy 2019, 62, 292–304. [Google Scholar] [CrossRef]

- Huang, W.H. The determinants of household electricity consumption in Taiwan: Evidence from quantile regression. Energy 2015, 87, 120–133. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G., Jr. Robust Tests for Heteroscedasticity Based on Regression Quantiles. Econometrica 1982, 50, 43–61. [Google Scholar] [CrossRef]

- Catherwood, K.; Henneberry, D. The NAFTA Wheat Import Market: Implications of Chilean Accession into the Agreement. J. Int. Food Agribus. Mark. 1997, 9, 35–55. [Google Scholar] [CrossRef]

- Martínez González, S. La seguridad alimentaria de México y la renegociación del TLCAN: Oportunidad para una estrategia de desarrollo rural y de combate a la pobreza. PORTES Rev. Mex. Estud. Sobre Cuenca Pacífico 2019, 13, 27–60. [Google Scholar]

- Noori, N.S.; Al-Hiyali, A.D.K. An economic analysis of determinants of wheat production support in Iraq for the period 1990–2016. Iraqi J. Agric. Sci. 2019, 50, 1028–1036. [Google Scholar] [CrossRef]

- Almas, L.K.; Usman, M. Determinants of wheat consumption, irrigated agriculture, and food security challenges in Egypt. WSEAS Trans. Environ. Dev. 2021, 17, 696–712. [Google Scholar] [CrossRef]

- Shaheen, S.; Almas, L.K.; Usman, M. Wheat Consumption Determinants and Food Security Challenges: Evidence from Pakistan. WSEAS Trans. Environ. Dev. 2022, 18, 427–441. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. SSRN 2011, 1–61. [Google Scholar] [CrossRef]

| Variable | Augmented Dickey–Fuller | Phillips–Perron | ||||

|---|---|---|---|---|---|---|

| CT | C | NCT | CT | C | NCT | |

| lmw | −3.659 ** | −2.367 | −2.307 ** | −10.551 * | −5.385 * | −3.843 * |

| ∆lmw | −10.165 * | −10.163 * | −10.129 * | −37.675 * | −37.542 * | −37.391 * |

| ∆∆lmw | −14.308 * | −14.329 * | −14.354 * | −79.581 * | −79.764 * | −79.922 * |

| la | −2.891 | −0.621 | 2.696 | −2.648 | −0.748 | 3.382 |

| ∆la | −6.266 * | −6.277 * | −5.717 * | −17.087 * | −17.108 * | −16.556 * |

| ∆∆la | −13.000 * | −13.024 * | −13.047 * | −45.835 * | −45.928 * | −46.018 * |

| lr | −2.495 | −2.490 | 0.220 | −2.395 | −2.397 | 0.378 |

| ∆lr | −9.891 * | −9.908 * | −9.918 * | −13.975 * | −14.000 * | −14.016 * |

| ∆∆lr | −15.253 * | −15.280 * | −15.306 * | −35.092 * | −35.154 * | −35.226 * |

| Section | Variable | ARDL Equation (3) |

|---|---|---|

| 1. Adjustment | lmwt−1 | −0.26 |

| [0.062] ** | ||

| 2. Autoregressive | Δlmwt−1 | −0.50 |

| [0.074] ** | ||

| Δlmwt−2 | −0.34 | |

| [0.075] ** | ||

| Δlmwt−3 | −0.25 | |

| [0.070] ** | ||

| Δlmwt−4 | −0.09 | |

| [0.057] | ||

| 3. Long term | lrt−1 | −0.05 |

| [0.100] | ||

| lat−1 | 0.53 | |

| [0.172] ** | ||

| 4. Short term | Constant | −2.24 |

| [0.905] ** | ||

| Δlrt | 1.18 | |

| [0.434] ** | ||

| Δlat | 3.42 | |

| [1.711] ** | ||

| Δlat−1 | 2.81 | |

| [1.764] | ||

| Δlat−2 | 3.18 | |

| [1.723] * | ||

| Δlat−3 | 1.23 | |

| [1.742] | ||

| Δlat−4 | 4.24 | |

| [1.746] ** |

| Tests | p-Value | |||

| FC | 6.14 | |||

| tC | −4.18 | |||

| R2 | 0.42 | |||

| Adjusted R2 | 0.39 | |||

| Heteroscedasticity | ||||

| White uncrossed terms | 18.82 | (0.129) | ||

| Serial Correlation | ||||

| Breusch–Godfrey | 10.26 | (0.593) | ||

| Functional Form | ||||

| Ramsey’s RESET | 0.26 | (0.609) | ||

| Normality | ||||

| Jarque–Bera | 10.67 | (0.005) | ||

| Significance | Critical Value Bounds | |||

| F-Statistic | t-Statistic | |||

| I(0) | I(1) | I(0) | I(1) | |

| 10% | 3.17 | 4.14 | −2.57 | −3.21 |

| 5% | 3.79 | 4.85 | −2.86 | −3.53 |

| 1% | 5.15 | 6.36 | −3.43 | −4.1 |

| Section | Variable | QARDL Equation (5) | ||||

|---|---|---|---|---|---|---|

| τ = 0.10 | τ = 0.25 | τ = 0.5 | τ = 0.75 | τ = 0.90 | ||

| 1. Adjustment | lmwt−1 | −0.34 | −0.23 | −0.24 | −0.21 | −0.23 |

| [0.113] ** | [0.088] ** | [0.076] ** | [0.080] ** | [0.132] * | ||

| 2. Autoregressive | Δlmwt−1 | −0.45 | −0.56 | −0.58 | −0.50 | −0.57 |

| [0.119] ** | [0.087] ** | [0.083] ** | [0.111] ** | [0.181] ** | ||

| Δlmwt−2 | −0.35 | −0.36 | −0.38 | −0.31 | −0.50 | |

| [0.140] ** | [0.089] ** | [0.099] ** | [0.093] ** | [0.166] ** | ||

| Δlmwt−3 | −0.28 | −0.28 | −0.26 | −0.26 | −0.40 | |

| [0.126] ** | [0.095] ** | [0.086] ** | [0.084] ** | [0.140] ** | ||

| Δlmwt−4 | 0.04 | −0.09 | −0.12 | −0.16 | −0.17 | |

| [0.091] | [0.079] | [0.062] * | [0.066] ** | [0.112] | ||

| 3. Long term | lrt−1 | −0.37 | −0.18 | −0.08 | 0.07 | 0.02 |

| [0.188] ** | [0.147] | [0.158] | [0.171] | [0.316] | ||

| lat−1 | 1.03 | 0.65 | 0.43 | 0.22 | 0.01 | |

| [0.311] ** | [0.190] ** | [0.202] ** | [0.225] | [0.361] | ||

| 4. Short term | Constant | −3.28 | −2.32 | −1.65 | −1.24 | 0.09 |

| [1.164] ** | [0.944] ** | [0.880] * | [1.049] | [2.307] | ||

| Δlrt | 0.66 | 1.09 | 1.12 | 1.52 | 0.99 | |

| [1.239] | [1.059] | [0.637] * | [0.409] ** | [0.438] ** | ||

| Δlat | 0.56 | 2.48 | 4.26 | 4.89 | 4.56 | |

| [2.484] | [1.587] | [2.471] * | [3.602] | [3.973] | ||

| Δlat−1 | 1.33 | 1.99 | 3.32 | 3.63 | −1.49 | |

| [2.445] | [3.147] | [2.587] | [3.188] | [4.159] | ||

| Δlat−2 | −0.31 | 2.87 | 2.44 | 1.98 | 2.96 | |

| [2.366] | [2.860] | [2.021] | [3.933] | [3.231] | ||

| Δlat−3 | 3.62 | 3.25 | 0.61 | 0.43 | 1.45 | |

| [3.587] | [3.998] | [2.983] | [2.890] | [2.512] | ||

| Δlat−4 | 0.52 | 4.87 | 5.26 | 4.89 | 0.33 | |

| [1.877] | [1.578] ** | [3.613] | [4.593] | [3.925] | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valencia-Romero, R.; Trejo-García, J.C.; Ríos-Bolívar, H. Wheat Import Demand in Mexico: Evidence of Quantile Cointegration. Agriculture 2023, 13, 980. https://doi.org/10.3390/agriculture13050980

Valencia-Romero R, Trejo-García JC, Ríos-Bolívar H. Wheat Import Demand in Mexico: Evidence of Quantile Cointegration. Agriculture. 2023; 13(5):980. https://doi.org/10.3390/agriculture13050980

Chicago/Turabian StyleValencia-Romero, Ramón, José C. Trejo-García, and Humberto Ríos-Bolívar. 2023. "Wheat Import Demand in Mexico: Evidence of Quantile Cointegration" Agriculture 13, no. 5: 980. https://doi.org/10.3390/agriculture13050980