Digital Literacy Level and Formal Credit Constraints: Probit Analysis of Farm Households’ Borrowing Behavior in China

Abstract

:1. Introduction

2. Theoretical Analyses

2.1. Digital Literacy Level and Formal Borrowing Behavior of Farm Households

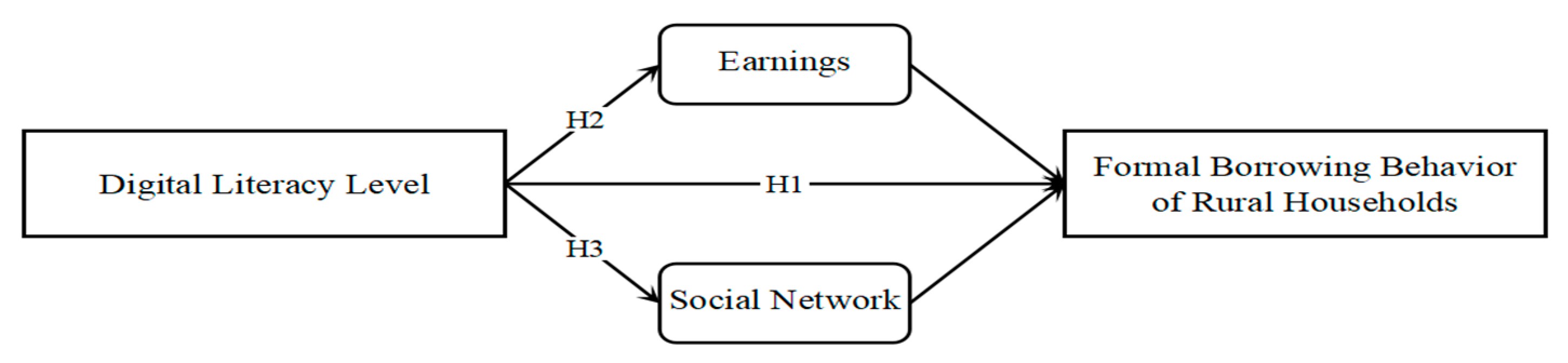

2.2. Digital Literacy Level, Earnings, Social Networks, and Farmers’ Formal Borrowing Behavior

3. Materials and Methods

3.1. Data Sources

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Primary Explanatory Variables

3.2.3. Mediator Variables

3.2.4. Control Variables

3.2.5. Descriptive Statistical Analysis

3.3. Model Construction

3.3.1. Benchmark Regression Model

3.3.2. Model for Assessing Mediation Effect

3.3.3. The KHB Model

4. Results

4.1. Analysis of Model Regression Results

4.2. Model Endogeneity Test

4.3. Model Robustness Tests

4.3.1. Replacement of the Model

4.3.2. Lagging a Period

4.4. Mechanism Tests

4.4.1. Mediated Effects Test

4.4.2. Analyzing the Direct and Indirect Effects Separately

4.5. Heterogeneity Analysis

5. Conclusions and Policy Implications

5.1. Conclusions

- The level of farmers’ digital literacy level makes a notable positive impact on their formal borrowing conduct. Subsequent examinations reveal that the basis of digital technology use makes the greatest contribution, whereas the extent of utilization of digital technology makes a comparatively lesser contribution. The outcomes of the regression analysis still show good robustness after the introduction of the Logit model, by lagging one period for the robustness test and using an instrumental variable method for the endogeneity test.

- Mechanistic analysis indicates that earnings and social network are the main pathways through which the digital literacy level affects the formal borrowing behavior of farmers, with both playing a partially mediating role, but the indirect effect of earnings is greater. Specifically, enhancing digital literacy level can notably boost farmers’ earnings and enhance their social connections, whereas earnings and social networks positively influence farmers’ adoption of formal borrowing practices. Meanwhile, among the indirect effects of digital literacy level affecting farmers’ formal borrowing behavior, the indirect effects of earnings and social networks account for 82.37% and 17.63%, respectively. This indicates that earnings are much stronger than social networks in mediating the effect.

- The analysis of diversity demonstrates that the positive effect of increasing digital literacy levels is more significant on the formal borrowing behavior of male, middle-aged, and old farmers, and the impact is more pronounced among less-educated farmers in central and western areas, whereas its significance is reduced for formal borrowing behaviors among female, youthful, and highly educated farmers, as well as farmers in the eastern regions.

5.2. Policy Implications

5.3. Limitations and Perspectives

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Issahaku, H.; Mahama, I.; Addy-Morton, R. Agricultural labour productivity and credit constraints: Implications for consumption in rural Ghana. Afr. J. Econ. Manag. Stud. 2020, 11, 331–351. [Google Scholar] [CrossRef]

- Xu, J.; He, W.; Liu, Z.; Zhang, H. How do property rights affect credit restrictions? Evidence from China’s forest right mortgages. Small-Scale For. 2021, 20, 235–262. [Google Scholar] [CrossRef]

- Gong, M.; Wang, X.; Li, C. Research on the current situation of rural land transfer and its influencing factors under the background of the reform of “Three Rights Separation”. NingXia Soc. Sci. 2019, 1, 92–101. [Google Scholar]

- Zhang, W.; Wang, J. Analysis of rural households’ borrowing behavior and its influencing factors in western China. Procedia Comput. Sci. 2022, 199, 1074–1081. [Google Scholar] [CrossRef]

- Elias, H. Multiple credit constraints and borrowing behavior of farm households: Panel data evidence from rural Ethiopia. Ethiop. J. Econ. 2018, 27, 57–90. [Google Scholar]

- Binswanger, H.P.; Khandker, S.R. The impact of formal finance on the rural economy of India. J. Dev. Stud. 1995, 32, 234–262. [Google Scholar] [CrossRef]

- Pitt, M.M.; Khandker, S.R. The impact of group-based credit programs on poor households in Bangladesh: Does the gender of participants matter? J. Political Econ. 1998, 106, 958–996. [Google Scholar] [CrossRef]

- Choung, Y.; Chatterjee, S.; Pak, T.Y. Digital financial literacy and financial well-being. Financ. Res. Lett. 2023, 58, 104438. [Google Scholar] [CrossRef]

- Prieger, J.E. The broadband digital divide and the economic benefits of mobile broadband for rural areas. Telecommun. Policy 2013, 37, 483–502. [Google Scholar] [CrossRef]

- Wang, Y.; Luo, B.; Luo, J. Application of Internet information technology and farmer’ formal credit constraint—Taking the survey data of 915 farmer households in Shaanxi as an example. J. Nortuwest AF Univ. Soc. Sci. Ed. 2023, 23, 113–126. [Google Scholar]

- Li, X.; Huo, X. Impacts of land market policies on formal credit accessibility and agricultural net income: Evidence from China’s apple growers. Technol. Forecast. Soc. Chang. 2021, 173, 121132. [Google Scholar] [CrossRef]

- Chen, S.; Nie, F.; Luo, E.; Zeng, Y. The Impact of borrowing from formal, informal channel on farmers’ family income—An empirical evidence from the underdevelopment areas in western China. J. Agrotech. Econ. 2021, 5, 35–47. [Google Scholar]

- Guan, Z. Social capital, financial literacy and lending behaviour of farmers with different incomes: Evidence based on CHFS 2015 Data. J. Commer. Econ. 2020, 5, 5–8. [Google Scholar] [CrossRef]

- Sun, H.; Hartarska, V.; Zhang, L.; Nadolnyak, D. The influence of social capital on farm household’s borrowing behavior in Rural China. Sustainability 2018, 10, 4361. [Google Scholar] [CrossRef]

- Amanullah, L.; GR, C.; SA, M. Credit constraints and rural farmers’ welfare in an agrarian economy. Heliyon 2020, 6, e05252. [Google Scholar] [CrossRef]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, NY, USA, 1996. [Google Scholar] [CrossRef]

- Tian, H.; Wang, Y.; Zhu, Z. Digital empowerment: The impact of Internet usage on farmers’ credit and its heterogeneity. J. Agrotech. Econ. 2022, 4, 82–102. [Google Scholar]

- Kiiza, B.; Pederson, G. ICT-based market information and adoption of agricultural seed technologies: Insights from Uganda. Telecommun. Policy 2012, 36, 253–259. [Google Scholar] [CrossRef]

- Tadesse, G.; Bahiigwa, G. Mobile phones and farmers’ marketing decisions in Ethiopia. World Dev. 2015, 68, 296–307. [Google Scholar] [CrossRef]

- Tinmaz, H.; Lee, Y.T.; Fanea-Ivanovici, M.; Baber, H. A systematic review on digital literacy. Smart Learn. Environ. 2022, 9, 21. [Google Scholar] [CrossRef]

- Eshet, Y. Digital literacy: A conceptual framework for survival skills in the digital era. J. Educ. Multimed. Hypermedia 2004, 13, 93–106. [Google Scholar]

- Eshet, Y. Thinking in the digital era: A revised model for digital literacy. Issues Informing Sci. Inf. Technol. 2012, 9, 267–276. [Google Scholar]

- Martin, A.; Grudziecki, J. DigEuLit: Concepts and tools for digital literacy development. Innov. Teach. Learn. Inf. Comput. Sci. 2006, 5, 249–267. [Google Scholar] [CrossRef]

- Wang, J.; Cai, Z.; Ji, X. Digital literacy, farmer entrepreneurship, and relative poverty alleviation. E-Government 2022, 8, 15–31. [Google Scholar]

- Sun, Z.; Gong, S.; Yu, Z. Influence of digital literacy on farmers’ green production technology adoption behavior. J. China Agric. Univ. 2024, 29, 12–26. [Google Scholar]

- Magesa, M.; Jonathan, J.; Urassa, J. Digital literacy of smallholder farmers in Tanzania. Sustainability 2023, 15, 13149. [Google Scholar] [CrossRef]

- Park, H.; Kim, H.S.; Park, H.W. A scientometric study of digital literacy, ICT literacy, information literacy, and media literacy. J. Data Inf. Sci. 2021, 6, 116–138. [Google Scholar] [CrossRef]

- Zhao, Q.; Pan, Y.; Xia, X. Internet can do help in the reduction of pesticide use by farmers: Evidence from rural China. Environ. Sci. Pollut. Res. 2021, 28, 2063–2073. [Google Scholar] [CrossRef]

- Hu, X.; Meng, H. Digital literacy and green consumption behavior: Exploring dual psychological mechanisms. J. Consum. Behav. 2023, 22, 272–287. [Google Scholar] [CrossRef]

- König, L.; Kuhlmey, A.; Suhr, R. Digital health literacy of the population in Germany and its association with physical health, mental health, life satisfaction, and health behaviors: Nationally representative survey study. JMIR Public Health Surveill. 2024, 10, e48685. [Google Scholar] [CrossRef]

- Polizzi, G. Internet users’ utopian/dystopian imaginaries of society in the digital age: Theorizing critical digital literacy and civic engagement. New Media Soc. 2023, 25, 1205–1226. [Google Scholar] [CrossRef]

- Guess, A.; Munger, K. Digital literacy and online political behavior. Political Sci. Res. Methods 2023, 11, 110–128. [Google Scholar] [CrossRef]

- Reddy, P.; Sharma, B.; Chaudhary, K. Digital literacy: A review of literature. Int. J. Technoethics (IJT) 2020, 11, 65–94. [Google Scholar] [CrossRef]

- Gigler, B.S. Informational Capabilities: The missing link for understanding the impact of ICT on development. Closing Feedback Loop 2014, 17, 17–42. [Google Scholar]

- Bach, A.; Shaffer, G.; Wolfson, T. Digital human capital: Developing a framework for understanding the economic impact of digital exclusion in low-income communities. J. Inf. Policy 2013, 3, 247–266. [Google Scholar] [CrossRef]

- Wang, H. Digital literacy and rural household income: The formation of digital inequality. Chin. Rural Econ. 2024, 3, 86–106. [Google Scholar]

- Fang, C.; Shi, Q. Public pension and borrowing behavior: Evidence from rural China. China Financ. Rev. Int. 2023, 13, 63–78. [Google Scholar] [CrossRef]

- Adams, D.W.; Hunter, R.E. (Eds.) Informal Finance in Low-Income Countries; Routledge: New York, NY, USA, 2019. [Google Scholar] [CrossRef]

- Navajas, S.; Schreiner, M.; Meyer, R.L.; Gonzalez-Vega, C.; Rodriguez-Meza, J. Microcredit and the poorest of the poor: Theory and evidence from Bolivia. World Dev. 2000, 28, 333–346. [Google Scholar] [CrossRef]

- Kass-Hanna, J.; Lyons, A.C.; Liu, F. Building financial resilience through financial and digital literacy in South Asia and Sub-Saharan Africa. Emerg. Mark. Rev. 2022, 51, 100846. [Google Scholar] [CrossRef]

- Wyckhuys, K.A.; Bentley, J.W.; Lie, R.; Nghiem, L.T.P.; Fredrix, M. Maximizing farm-level uptake and diffusion of biological control innovations in today’s digital era. BioControl 2018, 63, 133–148. [Google Scholar] [CrossRef]

- Tchamyou, V.S.; Erreygers, G.; Cassimon, D. Inequality, ICT and financial access in Africa. Technol. Forecast. Soc. Chang. 2019, 139, 169–184. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Ogutu, S.O.; Okello, J.J.; Otieno, D.J. Impact of information and communication technology-based market information services on smallholder farm input use and productivity: The case of Kenya. World Dev. 2014, 64, 311–321. [Google Scholar] [CrossRef]

- Liu, B.; Zhou, J. Digital literacy, farmers’ income increase and rural Internal income gap. Sustainability 2023, 15, 11422. [Google Scholar] [CrossRef]

- Baiyegunhi, L.J.S.; Fraser, G.C.G.; Darroch, M.A.G. Credit constraints and household welfare in the Eastern Cape Province, South Africa. Afr. J. Agric. Res. 2010, 5, 2243–2252. [Google Scholar]

- Portes, A. Social capital: Its origins and applications in modern sociology. Annu. Rev. Sociol. 1998, 24, 1–24. [Google Scholar] [CrossRef]

- Burt, R. Structural holes versus network closure as social capital. In Social Capital; Routledge: New York, NY, USA, 2017; pp. 31–56. [Google Scholar]

- Stern, M.J.; Adams, A.E. Do rural residents really use the internet to build social capital? An empirical investigation. Am. Behav. Sci. 2010, 53, 1389–1422. [Google Scholar] [CrossRef]

- Zeng, H.; Chen, J.; Gao, Q. The impact of digital technology use on farmers’ land transfer-in: Empirical evidence from Jiangsu, China. Agriculture 2024, 14, 89. [Google Scholar] [CrossRef]

- Yaméogo, T.B.; Fonta, W.M.; Wünscher, T. Can social capital influence smallholder farmers’ climate-change adaptation decisions? Evidence from three semi-arid communities in Burkina Faso, West Africa. Soc. Sci. 2018, 7, 33. [Google Scholar] [CrossRef]

- Biggart, N.W.; Castanias, R.P. Collateralized social relations: The social in economic calculation. Am. J. Econ. Sociol. 2001, 60, 471–500. [Google Scholar] [CrossRef]

- Zhang, H.; Luo, J.; Luo, T.; Wang, L. Social capital, income level and rural household’s borrowing responses—Evidence from 784 rural households in apple production sites. Res. Econ. Manag. 2018, 39, 82–94. [Google Scholar]

- Feng, D.; Gao, M.; Zhou, L. Religion and household borrowing: Evidence from China. Int. Rev. Econ. Financ. 2023, 88, 60–72. [Google Scholar] [CrossRef]

- Liu, Y.; Li, H.; Fang, X. Who should the elderly borrow money from under formal financial exclusion? Evidence from China. Econ. Anal. Policy 2024, 81, 964–982. [Google Scholar] [CrossRef]

- Yu, G.; Xiang, H. Rural E-commerce development and farmers’ digital credit behavior: Evidence from China family panel studies. PLoS ONE 2021, 16, e0258162. [Google Scholar] [CrossRef]

- Tang, H.; Xu, Y. Social capital, individual characteristics of farmers and lending behavior—Evidence from China Family Tracking Survey (CFPS) Data. J. Henan Norm. Univ. Philos. Soc. Sci. 2023, 3, 88–93. [Google Scholar]

- Chen, Q.; Dong, X. Women’s empowerment in family decision-making and farmers’ lending behavior—Empirical research based on CFPS. J. Agrotech. Econ. 2020, 12, 94–108. [Google Scholar]

- Yang, Q.; Xu, Q.; Lu, Y.; Liu, J. The impact of public health insurance on household credit availability in rural China: Evidence from NRCMS. Int. J. Environ. Res. Public Health 2020, 17, 6595. [Google Scholar] [CrossRef]

- Chen, C.; Liu, B.; Wang, Z. Can land transfer relax credit constraints? Evidence from China. Econ. Model. 2023, 122, 106248. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, H.; Zhou, J.; Li, G.; Zang, D.; Sow, Y.; Shen, Q. Digital literacy and farmers’ entrepreneurial behavior—Empirical analysis based on CHFS2019 micro data. PLoS ONE 2023, 18, e0288245. [Google Scholar] [CrossRef]

- Yi, X.; Zhang, B.; Yang, R.; Yang, B. Family social networks and saving behavior of farm households: An empirical study based on rural China. J. Manag. World 2012, 5, 43–51+187. [Google Scholar]

- Zhu, S.; Xiong, F.; Zhu, J. The impact of Internet use on rural households’ income: An analysis of the mediating effect based on social capital. J. Agro-For. Econ. Manag. 2022, 21, 518–526. [Google Scholar]

- Ogouvide, T.; Adegbola, Y.; Zossou, R.; Zannou, A.; Biaou, G. Farmers’ preferences and willingness to pay for microcredit in Benin: Results from in-the-field choice experiments in Benin. Agric. Financ. Rev. 2020, 80, 665–692. [Google Scholar] [CrossRef]

- Ding, Z.; Abdulai, A. Smallholder preferences and willingness-to-pay measures for microcredit: Evidence from Sichuan province in China. China Agric. Econ. Rev. 2018, 10, 462–481. [Google Scholar] [CrossRef]

- Mbam, B.; Nwibo, S.; Nwofoke, C.; Egwu, P.; Odoh, N. Analysis Of Smallholder Farmers Repayment Of Bank Of Agriculture Loan In Ezza South Local Government Area Of Ebonyi State, Nigeria. Int. J. 2021, 8, 198–208. [Google Scholar]

- Ouattara, N.; Xiong, X.; Bakayoko, M.; Bi, T.; Sedebo, D.; Ballo, Z. What influences rice farmers’ choices of credit sources in Côte d’Ivoire? An econometric analysis using the multinomial conditional logit model. Prog. Dev. Stud. 2022, 22, 149–173. [Google Scholar] [CrossRef]

- Kong, R.; Peng, Y.; Meng, N.; Fu, H.; Zhou, L.; Zhang, Y.; Turvey, C. Heterogeneous choice in the demand for agriculture credit in China: Results from an in-the-field choice experiment. China Agric. Econ. Rev. 2021, 13, 456–474. [Google Scholar] [CrossRef]

- Balana, B.; Mekonnen, D.; Haile, B.; Hagos, F.; Yimam, S.; Ringler, C. Demand and supply constraints of credit in smallholder farming: Evidence from Ethiopia and Tanzania. World Dev. 2022, 159, 106033. [Google Scholar] [CrossRef]

- Visser, M.; Jumare, H.; Brick, K. Risk preferences and poverty traps in the uptake of credit and insurance amongst small-scale farmers in South Africa. J. Econ. Behav. Organ. 2020, 180, 826–836. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Karlson, K.B.; Holm, A.; Breen, R. Comparing regression coefficients between same-sample nested models using logit and probit: A new method. Sociol. Methodol. 2012, 42, 286–313. [Google Scholar] [CrossRef]

- Breen, R.; Karlson, K.; Holm, A. Total, direct, and indirect effects in logit and probit models. Sociol. Methods Res. 2013, 42, 164–191. [Google Scholar] [CrossRef]

- Morgan, S. Models of college entry in the United States and the challenges of estimating primary and secondary effects. Sociol. Methods Res. 2012, 41, 17–56. [Google Scholar] [CrossRef]

- Baek, J.; Choi, J.; Kim, H.; Hong, S.; Kim, Y.; Choi, S.; Kim, E. Digital literacy and associated factors in community-dwelling older adults in South Korea: A qualitative study. Innov. Aging 2022, 6, 587. [Google Scholar] [CrossRef]

- Li, P.; Song, X.; Li, J. Research on farmers’ households credit behavior and social capital acquisition. Front. Psychol. 2022, 13, 961862. [Google Scholar]

- Chandio, A.A.; Jiang, Y.; Wei, F.; Rehman, A.; Liu, D. Famers’ access to credit: Does collateral matter or cash flow matter?—Evidence from Sindh, Pakistan. Cogent Econ. Financ. 2017, 5, 1369383. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, X. The impact of Internet use on the decision-making of farmland transfer and its mechanism: Evidence from the CFPS data. Chin. Rural Econ. 2020, 3, 57–77. [Google Scholar]

- Li, F.; Zang, D.; Chandio, A.A.; Yang, D.; Jiang, Y. Farmers’ adoption of digital technology and agricultural entrepreneurial willingness: Evidence from China. Technol. Soc. 2023, 73, 102253. [Google Scholar] [CrossRef]

- Gong, S.; Sun, Z.; Wang, B.; Yu, Z. Could digital literacy contribute to the improvement of green production efficiency in agriculture? SAGE Open 2024, 14, 21582440241232789. [Google Scholar] [CrossRef]

- Hao, Y.; Zhang, B. The impact of digital financial usage on resident’s income inequality in China: An empirical analysis based on CHFS data. J. Asian Econ. 2024, 91, 101706. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Definition | Mean | Standard Deviation |

|---|---|---|---|---|

| Dependent Variable | Y | Whether to borrow through formal channels (Yes = 1, No = 0) | Not | Not |

| Primary Explanatory Variables | Inuse | The utilization of mobile devices for Internet access (Yes = 1, No = 0) | ||

| Instudy | Whether to use spare time to study online (Yes = 1, No = 0) | |||

| Information | The significance of the Internet as a channel for information (Very unimportant = 1, relatively unimportant = 2, moderately important = 3, relatively important = 4, very important = 5) | 3.474 | 1.495 | |

| Mediator Variables | Earnings | The logarithm of per capita household net income over a 12 month period is recorded (RMB) | 9.528 | 0.810 |

| Social Network | The logarithm of the 12 months favors the expenditure of the farmer household (RMB) | 7.113 | 2.363 | |

| Individual Characteristics | Age | Age of respondents (Age under 30 = 1, 30–50 = 2, over 50 = 3) | 2.141 | 0.759 |

| Gender | Gender of respondent (Male = 1, Female = 0) | Not | Not | |

| Education | Maximum years of education of the respondents (Year) | 9.236 | 2.980 | |

| Health | Physical health status of respondents (Unfit = 1, moderate = 2, well = 3, relatively well = 4, very healthy = 5) | 2.800 | 1.202 | |

| Marriage | The respondents’ marital status (1 = married, 0 = unmarried) | Not | Not | |

| Family Characteristics | Family | Family size (person) | 4.662 | 2.024 |

| Assets | Logarithm of the total value of consumer durables (RMB) | 8.956 | 2.724 | |

| House | Whether family members own individual property rights in the home (Yes = 1, No = 0) | Not | Not | |

| Land | Whether to lease land (Yes = 1, No = 0) | |||

| Agric | Whether engaged in agricultural production or business activities (Yes = 1, No = 0) | |||

| Regional Characteristics | Region | The eastern region = 1, the central and western regions = 0 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Inuse | 0.171 *** | |||

| (0.045) | ||||

| Instudy | 0.126 ** | 0.108 ** | ||

| (0.053) | (0.053) | |||

| Information | 0.060 *** | 0.057 *** | ||

| (0.014) | (0.014) | |||

| Age | −0.095 *** | −0.135 *** | −0.104 *** | −0.101 *** |

| (0.034) | (0.032) | (0.033) | (0.033) | |

| Gender | 0.008 | 0.008 | 0.009 | 0.009 |

| (0.037) | (0.036) | (0.037) | (0.037) | |

| Education | 0.017 ** | 0.018 ** | 0.017 ** | 0.014 * |

| (0.007) | (0.007) | (0.007) | (0.007) | |

| Health | 0.047 *** | 0.046 *** | 0.049 *** | 0.050 *** |

| (0.016) | (0.016) | (0.016) | (0.016) | |

| Marriage | 0.160 *** | 0.187 *** | 0.151 *** | 0.164 *** |

| (0.054) | (0.055) | (0.054) | (0.055) | |

| Family | 0.066 *** | 0.065 *** | 0.066 *** | 0.066 *** |

| (0.009) | (0.009) | (0.009) | (0.009) | |

| Assets | 0.075 *** | 0.077 *** | 0.075 *** | 0.074 *** |

| (0.009) | (0.009) | (0.009) | (0.009) | |

| House | −0.448 *** | −0.449 *** | −0.457 *** | −0.457 *** |

| (0.070) | (0.069) | (0.070) | (0.069) | |

| Land | −0.225 *** | −0.222 *** | −0.224 *** | −0.223 *** |

| (0.050) | (0.049) | (0.050) | (0.050) | |

| Agric | −0.071 | −0.070 | −0.071 | −0.071 |

| (0.044) | (0.044) | (0.044) | (0.044) | |

| _cons | −1.483 *** | −1.345 *** | −1.547 *** | −1.541 *** |

| (0.158) | (0.154) | (0.161) | (0.160) | |

| Region Effect | Yes | Yes | Yes | Yes |

| Pseudo R2 | 0.055 | 0.054 | 0.056 | 0.057 |

| N | 6253 | 6253 | 6253 | 6253 |

| Var | IV-Probit | CMP | ||

|---|---|---|---|---|

| (5) | (6) | (7) | (8) | |

| Inuse | 6.232 *** | 0.256 *** | ||

| (1.919) | (0.061) | |||

| Inphone | 0.030 *** | 0.122 *** | ||

| (0.008) | (0.028) | |||

| Control Variable | Yes | Yes | Yes | Yes |

| Region Effect | Yes | Yes | Yes | Yes |

| Wald Chi2 | 39.34 *** | |||

| Atanhrho_12 | −0.307 *** | |||

| (0.091) | ||||

| Observations | 4154 | 4154 | 4154 | 4154 |

| Var | Change the Model Form (9) | Delayed Onephase Regression (10) |

|---|---|---|

| Inuse | 0.287 *** | 0.211 *** |

| (0.078) | (0.040) | |

| Control Variable | Yes | Yes |

| Region Effect | Yes | Yes |

| Obs | 6253 | 8331 |

| Pseudo R2 | 0.056 | 0.047 |

| Effect | Inuse → Earnings → Y (Path 1) | Inuse → Social Network → Y (Path 2) | ||||

|---|---|---|---|---|---|---|

| Coef | The Level of Confidence Interval Is Set at 95% | Coef | The Level of Confidence Interval Is Set at 95% | |||

| Lower | Upper | Lower | Upper | |||

| Indirect effect | 0.014 *** | 0.010 | 0.018 | 0.004 *** | 0.002 | 0.006 |

| (0.002) | (0.001) | |||||

| Direct effect | 0.032 *** | 0.007 | 0.057 | 0.043 *** | 0.016 | 0.069 |

| (0.013) | (0.013) | |||||

| Path | Decomposition | |

|---|---|---|

| Inuse → Earnings → Y (Path 3) | Total effect | 0.305 *** |

| (0.078) | ||

| Direct effect | 0.219 *** | |

| (0.078) | ||

| Indirect effect | 0.087 *** | |

| (0.014) | ||

| Indirect effect proportion | 82.37% | |

| Inuse → Social Network → Y (Path 4) | Total effect | 0.295 *** |

| (0.077) | ||

| Direct effect | 0.269 *** | |

| (0.077) | ||

| Indirect effect | 0.027 *** | |

| (0.008) | ||

| Indirect effect proportion | 17.63% | |

| Category of Variables | Mode | Frequency | Relative Frequency | |

|---|---|---|---|---|

| Gender | Female | 1.00 | 2697 | 43.13% |

| male | 3556 | 56.87% | ||

| Age | Age under 45 | 0.00 | 3220 | 51.50% |

| 45 years old and above | 3033 | 48.50% | ||

| Education | Inferior Education | 2.00 | 1606 | 25.68% |

| Secondary Education | 3988 | 63.78% | ||

| Higher Education | 659 | 10.54% | ||

| Region | Central and western regions | 0.00 | 4627 | 74.00% |

| East Region | 1626 | 26.00% | ||

| Var | Female | Male | Young People | Middleaged and Senior People | ||||

|---|---|---|---|---|---|---|---|---|

| (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | |

| Inuse | 0.103 | 0.221 *** | 0.079 | 0.196 *** | ||||

| (0.069) | (0.060) | (0.076) | (0.057) | |||||

| Instudy | −0.011 | 0.189 *** | 0.051 | 0.341 *** | ||||

| (0.084) | (0.069) | (0.060) | (0.112) | |||||

| Information | 0.053 ** | 0.060 *** | 0.055 ** | 0.049 *** | ||||

| (0.022) | (0.018) | (0.023) | (0.017) | |||||

| Control Variable | Yes | Yes | Yes | Yes | ||||

| Region Effect | Yes | Yes | Yes | Yes | ||||

| N | 2697 | 3556 | 3220 | 3033 | ||||

| Var | Inferior Education | Secondary Education | Higher Education | Central and Western Regions | Eastern Region | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| (19) | (20) | (21) | (22) | (23) | (24) | (25) | (26) | (27) | (28) | |

| Inuse | 0.239 *** | 0.126 ** | 0.227 | 0.154 *** | 0.228 ** | |||||

| (0.079) | (0.055) | (0.282) | (0.051) | (0.099) | ||||||

| Instudy | 0.450 * | 0.113 * | 0.025 | 0.146 ** | −0.031 | |||||

| (0.232) | (0.064) | (0.106) | (0.060) | (0.117) | ||||||

| Information | 0.030 | 0.069 *** | 0.040 | 0.048 *** | 0.087 *** | |||||

| (0.023) | (0.017) | (0.065) | (0.016) | (0.028) | ||||||

| Control Variable | Yes | Yes | Yes | Yes | Yes | |||||

| Region Effect | Yes | Yes | Yes | Yes | Yes | |||||

| Obs | 1606 | 3988 | 659 | 4627 | 1626 | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Z.; Li, Z.; Chen, G.; Zou, J.; Du, M.; Wang, F. Digital Literacy Level and Formal Credit Constraints: Probit Analysis of Farm Households’ Borrowing Behavior in China. Agriculture 2024, 14, 832. https://doi.org/10.3390/agriculture14060832

Zhou Z, Li Z, Chen G, Zou J, Du M, Wang F. Digital Literacy Level and Formal Credit Constraints: Probit Analysis of Farm Households’ Borrowing Behavior in China. Agriculture. 2024; 14(6):832. https://doi.org/10.3390/agriculture14060832

Chicago/Turabian StyleZhou, Ziyang, Ziwei Li, Guangyan Chen, Jinpeng Zou, Mingling Du, and Fang Wang. 2024. "Digital Literacy Level and Formal Credit Constraints: Probit Analysis of Farm Households’ Borrowing Behavior in China" Agriculture 14, no. 6: 832. https://doi.org/10.3390/agriculture14060832