The Price Difference and Trend Analysis of Yesso Scallop (Patinopecten yessoensis) in Changhai County, China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. Methodology

2.2.1. Non-Parametric Test

2.2.2. Exponential Smoothing Models

3. Results

3.1. Difference Comparison

3.1.1. Inter-Group Difference

3.1.2. Intra-Group Difference

3.2. Price Simulation

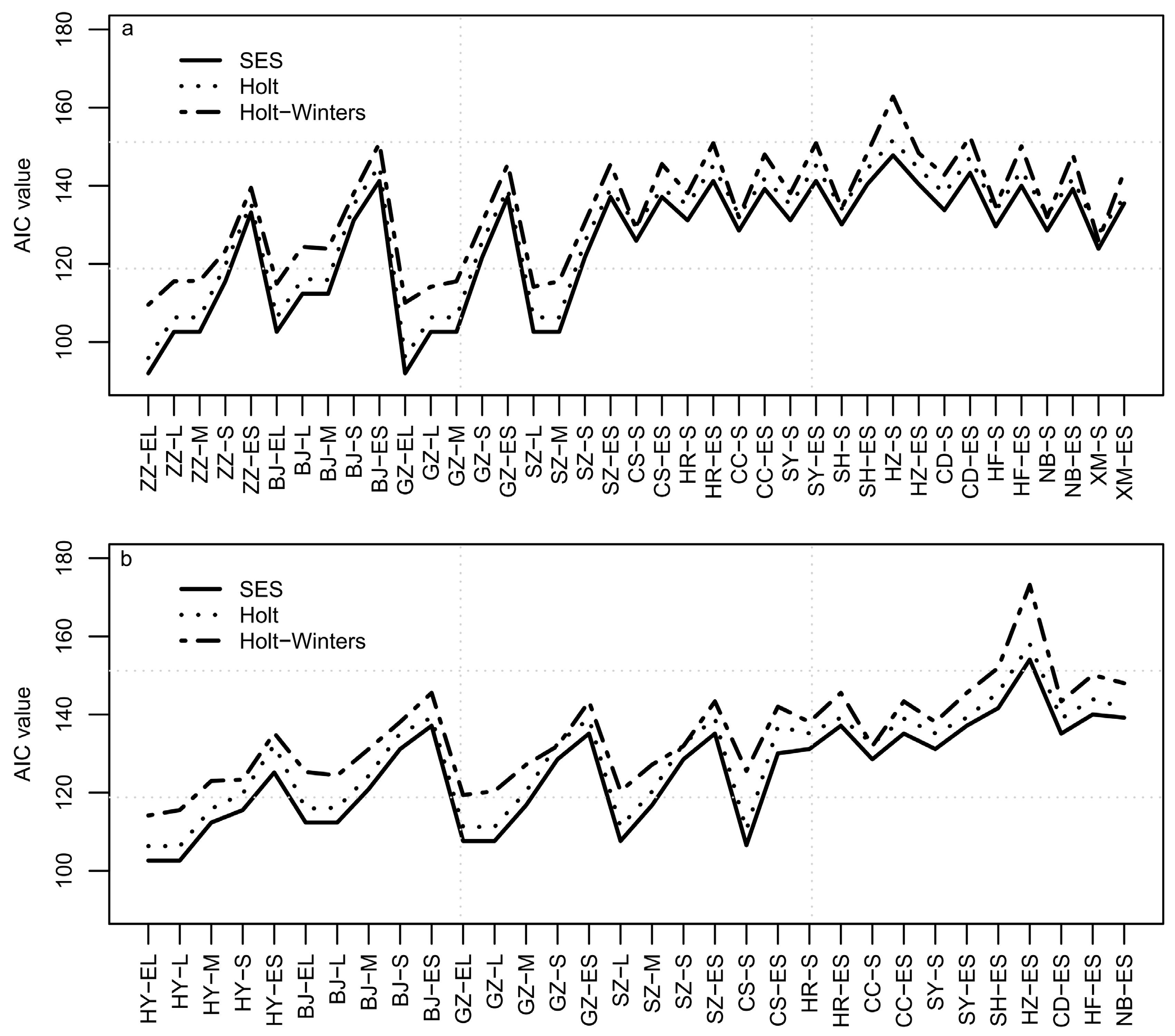

3.2.1. Model Selection

3.2.2. Simulated Results

4. Discussion and Conclusions

4.1. Discussion

4.2. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- FAO. FishStatJ-Software for Fishery and Aquaculture Statistical Time Series. Available online: http://www.fao.org/fishery/statistics/software/fishstatj/en (accessed on 28 June 2019).

- Liu, X.Y.; Hu, L.P.; Li, L.; Xu, X.Y.; Chen, W.; Zhang, L.; Zhang, W.; Sun, J.R.; Shi, W.K. Development strategies of scallop fishery from the perspective of ecological civilization. Chin. Fish. Qual. Stand. 2018, 8, 26–31. [Google Scholar]

- Peng, D.M.; Hou, X.M.; Li, Y.; Mu, Y.T. The difference in development level of marine shellfish industry in 10 major producing countries. Mar. Policy 2019, 106, 103516. [Google Scholar] [CrossRef]

- Peng, D.M.; Zhang, S.C.; Zhang, H.Z.; Pang, D.Z.; Yang, Q.; Jiang, R.H.; Lin, Y.T.; Mu, Y.T.; Zhu, Y.G. The oyster fishery in China: Trend, concerns and solutions. Mar. Policy 2021, 129, 104524. [Google Scholar] [CrossRef]

- Yu, L.; Ma, L.N.; Lam, V.; Guan, X.M.; Zhao, Y.J.; Wang, S.; Mu, Y.T.; Sumaila, R. Local marine policy whacking the national Zhikong scallop fishery. Mar. Policy 2021, 124, 104352. [Google Scholar] [CrossRef]

- Li, C.L.; Song, A.H.; Hu, W.; Li, Q.C.; Zhao, B.; Zhu, R.J.; Zhang, Y.; Ma, D.P. Status analyzing and developing counter-measure of cultured scallop industry in Shandong province. Mar. Sci. 2011, 35, 92–98. [Google Scholar]

- Yu, Z.A.; Li, D.C.; Wang, X.Y.; Wang, Q.Z.; Li, H.L.; Teng, W.M.; Liu, D.F.; Zhou, Z.C. Reason of massive mortality of Japanese scallop Pationopecten yessoenisis in raft cultivation in coastal Changhai county. Fish. Sci. 2019, 38, 420–427. [Google Scholar]

- Wang, Q.C. The introduction of Japanese scallop Patinopecten yessoensis and its farming prospect in Northern China. Fish. Sci. 1984, 3, 24–27. [Google Scholar]

- Wang, Y.; Zhou, L. Bottom sowing of proliferation of Patinopecten yessoensis yield research: Case in Zhangzidao. Chin. Fish. Econ. 2014, 32, 104–109. [Google Scholar]

- Li, W.J.; Xue, Z.F. Healthy sustainable proliferation and cultivation of scallop Patinopecten yessoensis. Fish. Sci. 2005, 24, 49–51. [Google Scholar]

- Zhou, J.H. Preliminary Study on Structure and Characteristic of Yesso Scallop industry in Liaoning. Master’s Thesis, Ocean University of China, Qingdao, China, 2012. [Google Scholar]

- Wang, Z. Study on the Water Quality and Food Sources of Japanese Scallop Mizuhopecten yessoensis in Changhai County. Master’s Thesis, Dalian Ocean University, Dalian, China, 2018. [Google Scholar]

- Shi, B.W. The Construction and Application of the Wholesale Index of Aquatic Productions of China. Master’s Thesis, Zhejiang University, Hangzhou, China, 2015. [Google Scholar]

- Zhang, Y.; Zhu, Y.G. Prediction on price of aquatic products and sustainable development of fishery: With the prices of aquatic products in Shandong province as research samples. J. Xiamen Univ. (Arts Soc. Sci.) 2017, 70, 57–64. [Google Scholar]

- Nam, J.; Sim, S. Forecast accuracy of abalone producer prices by shell size in the Republic of Korea: Modified Diebold–Mariano tests of selected autoregressive models. Aquacult. Econ. Manag. 2017, 21, 1–16. [Google Scholar] [CrossRef]

- Gordon, D.V. Price modelling in the Canadian fish supply chain with forecasts and simulations of the producer price of fish. Aquacult. Econ. Manag. 2017, 21, 105–124. [Google Scholar]

- Bloznelis, D. Short-term salmon price forecasting. J. Forecast. 2018, 37, 151–169. [Google Scholar] [CrossRef]

- Hasan, M.R.; Dey, M.M.; Engle, C.R. Forecasting monthly catfish (Ictalurus punctatus.) pond bank and feed prices. Aquacult. Econ. Manag. 2019, 23, 86–110. [Google Scholar] [CrossRef]

- Zhang, J.Y.; Yang, H.Y. Short prediction and research prospect on Macrobrachium rosenbergii price in Shanghai. Agr. Outlook 2018, 14, 31–35, 40. [Google Scholar]

- He, Y.H.; Yuan, Y.M.; Zhang, H.Y.; Gong, Y.C.; Wang, H.W. Research on prediction model of aquatic production price based on artificial neural network. Agr. Netw. Inform. 2010, 36, 20–24. [Google Scholar]

- Li, H.W.; Gao, X.X.; Cheng, K.J. Research on price forecasting of fish based on wavelet neural network method. Chin. Fish. Econ. 2014, 32, 61–66. [Google Scholar]

- Purcell, S.W.; Williamson, D.H.; Ngaluafe, P. Chinese market prices of beche-de-mer: Implications for fisheries and aquaculture. Mar. Policy 2018, 91, 58–65. [Google Scholar] [CrossRef]

- Zhang, X.S.; Hu, T.; Brain, R.; Fu, Z.T. A forecasting support system for aquatic products price in China. Expert Syst. Appl. 2005, 28, 119–126. [Google Scholar]

- Garza-Gil, M.D.; Varela-Lafuente, M.; Caballero-Miguez, G. Price and production trends in the marine fish aquaculture in Spain. Aquac. Res. 2008, 40, 274–281. [Google Scholar] [CrossRef]

- Zhou, C.S.; Zhang, L.L.; Mu, Y.T. A study on risk early warning of abnormal fluctuations in oyster price based on catastrophe grey model. J. Ocean. Univ. Chin. Soc. Sci. 2017, 34, 1–4. [Google Scholar]

- Zhong, Z.G. Talking about the risk management of aquatic products price in China. Price Theory Pract. 2010, 5, 34–35. [Google Scholar]

- Zhu, J.Z.; Liu, H.B. Analysis of Chinese aquatic product price fluctuation based on ARCH model. South. Chin. Rural Area 2012, 28, 66–69. [Google Scholar]

- Ying, Y. Research on volatility of various food price indexes in China based on ARCH model. J. Commer. Econ. 2016, 40, 171–173. [Google Scholar]

- Nguyen, G.V.; Hanson, T.R.; Jolly, C.M. A demand analysis for crustaceans at the U.S. retail store level. Aquacult. Econ. Manag. 2013, 17, 212–227. [Google Scholar]

- Asche, F.; Dahl, R.E.; Steen, M. Price volatility in seafood markets: Farmed vs. wild fish. Aquacult. Econ. Manag. 2015, 19, 316–335. [Google Scholar] [CrossRef]

- Hu, J.; Yan, X.; Sun, Y.Z.; Ouyang, H.Y.; Chen, B.S.; Bao, S.C. Staple freshwater fishes: Price lluctuations in Beijing from 2007 to 2016. Chin. Agr. Sci. Bull. 2018, 34, 105–110. [Google Scholar]

- Huang, Q.L.; Zhou, L.; Chen, Q. Analysis of temporal and spatial characteristics of price lluctuation in Chinese aquatic products market. Jiangsu Agr. Sci. 2018, 46, 340–344. [Google Scholar]

- Hoshino, E.; Gardner, C.; Jennings, S.; Hartmann, K. Examining the long-run relationship between the prices of imported abalone in Japan. Mar. Resour. Econ. 2015, 30, 179–192. [Google Scholar] [CrossRef]

- Wakamatsu, H.; Miyata, T. A demand analysis for the Japanese cod markets with unknown structural changes. Fish. Sci. 2015, 81, 393–400. [Google Scholar] [CrossRef]

- Singh, K. Price transmission among different Atlantic salmon products in the U.S. import market. Aquacult. Econ. Manag. 2016, 20, 253–271. [Google Scholar]

- Pham, T.A.N.; Meuwissen, M.P.M.; Le, T.C.; Bosma, R.H.; Verreth, J.; Lansink, A.O. Price transmission along the Vietnamese pangasius export chain. Aquaculture 2018, 493, 416–423. [Google Scholar] [CrossRef]

- Nielsen, M.; Ankamah-Yeboah, I.; Staahl, L.; Nielsen, R. Price transmission in the trans-atlantic northern shrimp value chain. Mar. Policy 2018, 93, 71–79. [Google Scholar] [CrossRef]

- Fernández-Polanco, J.; Llorente, I. Price transmission and market integration: Vertical and horizontal price linkages for gilthead seabream (Sparus aurata) in the Spanish market. Aquaculture 2019, 506, 470–474. [Google Scholar] [CrossRef]

- Thong, N.T.; Ankamah-Yeboah, I.; Bronnmann, J.; Nielsen, M.; Roth, E.; Schulze-Ehlers, B. Price transmission in the pangasius value chain from Vietnam to Germany. Aquacult. Rep. 2020, 16, 100266. [Google Scholar] [CrossRef]

- Bauer, D.F. Constructing confidence sets using rank statistics. J. Am. Stat. Assoc. 1972, 67, 687–690. [Google Scholar] [CrossRef]

- Hollander, M.; Wolfe, D.A. Nonparametric Statistical Methods; John Wiley & Sons: New York, NY, USA, 1973. [Google Scholar]

- Holm, S. A simple sequentially rejective multiple test procedure. Scand. J. Stat. 1979, 6, 65–70. [Google Scholar]

- Kabacoff, R.I. R in Action: Data Analysis and Graphics with R, 2nd ed.; Manning Publications: Greenwich, CT, USA, 2015. [Google Scholar]

- Hyndman, R.J.; Koehler, A.B.; Ord, J.K.; Snyder, R.D. Forecasting with Exponential Smoothing: The State Space Approach; Springer: Berlin, Germany, 2008. [Google Scholar]

- Xue, Y.; Chen, L.P. Application of R Language in Statistics; Posts & Telecom Press: Beijing, China, 2017. [Google Scholar]

- Hyndman, R.J.; Athanasopoulos, G. Forecasts: Principles and Practice, 2nd ed.; Otexts: Melbourne, Australia, 2018. [Google Scholar]

- Burnham, K.P.; Anderson, D.R. Model Selection and Inference: A Practical Information-Theoretic Approach; Springer: New York, NY, USA, 2002. [Google Scholar]

- Song, X.F.; Li, J.P.; Hu, X.Y. Model Selection Criterion AIC and its Application in ANOVA. J. NW A F Univ. Nat. Sci. Ed. 2009, 37, 88–92. [Google Scholar]

- Yu, Z.A.; Tan, K.F.; Zhang, M.; Li, D.C.; Li, H.L.; Wang, X.Y. The analysis of growth and economic benefit at different density in the cultivation period of raft cultural scallop Patinopecten yessoensis. J. Fish. Chin. 2016, 40, 1624–1633. [Google Scholar]

- Li, H.L.; Yu, Z.A.; Zhang, M.; Li, D.C.; Fu, Z.Y.; Liu, X.F.; Wang, X.Z. Discussion on growth factors of raft cultural scallop Patinopecten yessoensis. Hebei Fish. 2021, 3, 24–26. [Google Scholar]

- Bondoc, I. The Veterinary Sanitary Control of Fish and Fisheries Products. Control of Products and Food of Animal Origin; Controlul produselor și alimentelor de origine animală-Original Title; Ion Ionescu de la Brad Iași Publishing: Iași, Romania, 2014; pp. 264–346. [Google Scholar]

- Bondoc, I. European Regulation in the Veterinary Sanitary and Food Safety Area, a Component of the European Policies on the Safety of Food Products and the Protection of Consumer Interests: A 2007 Retrospective; Universul Juridic: Bucureşti, Romania, 2016; pp. 12–27. [Google Scholar]

- Zhou, H.X.; Han, L.M. Research on the traceability system construction problem of quality and safety of seafood in our country. Chin. Fish. Econ. 2013, 31, 70–74. [Google Scholar]

- Tian, T.; Wen, J.H.; Zeng, X.L.; Huang, W.J. Research status and prospect of quality and safety risk monitoring and assessment of fresh aquatic products. J. Food Saf. Qual. 2019, 10, 8524–8530. [Google Scholar]

- Liang, J.; Gao, Q. Analysis of influencing factors of traceable seafood purchase behavior: Based on consumer micro survey data. Chin. Fish. Econ. 2020, 38, 80–88. [Google Scholar]

- Liu, J.R.; Zhang, C.H.; Jiang, H.S.; Chen, S.P.; Qin, X.M.; Lei, J.W. EU food safety management system, special reference to Chinese marine bivalve industry. J. Dalian Ocean. Univ. 2010, 25, 442–449. [Google Scholar]

- Mu, Y.T. A Research Report on Shellfish Trade and Production Policy. Unpublished. 2014; 1–10. [Google Scholar]

- Mu, Y.T. A Review of 10-year Research on the Economics of Shellfish Industry. Unpublished. 2018; 1–13. [Google Scholar]

| Specification | Code | The Number of Scallops per Kilogram (kg) |

|---|---|---|

| Extra Large | EL | 4–5 |

| Large | L | 6–8 |

| Middle | M | 9–10 |

| Small | S | 11–12 |

| Extra Small | ES | 13–16 |

| Market Name | Code | Source | |

|---|---|---|---|

| ZZ | HY | ||

| Beijing | BJ | EL, L, M, S, ES | EL, L, M, S, ES |

| Guangzhou | GZ | EL, L, M, S, ES | EL, L, M, S, ES |

| Shenzhen | SZ | L, M, S, ES | L, M, S, ES |

| Changsha | CS | S, ES | S, ES |

| Harbin | HR | S, ES | S, ES |

| Changchun | CC | S, ES | S, ES |

| Shenyang | SY | S, ES | S, ES |

| Shanghai | SH | S, ES | ES |

| Hangzhou | HZ | S, ES | ES |

| Chengdu | CD | S, ES | ES |

| Hefei | HF | S, ES | ES |

| Ningbo | NB | S, ES | ES |

| Xiamen | XM | S, ES | — |

| Name | Group.1 | Group.2 | W-Stat | p-Value |

|---|---|---|---|---|

| Farm-gate (n = 240) | HY | ZZ | 7064.5 | 0.8006 |

| BJ (n = 240) | HY | ZZ | 7035 | 0.7584 |

| GZ (n = 240) | HY | ZZ | 6746 | 0.3976 |

| SZ (n = 192) | HY | ZZ | 4332 | 0.4725 |

| CS (n = 96) | HY | ZZ | 1092.5 | 0.6535 |

| HR (n = 96) | HY | ZZ | 1230.5 | 0.5589 |

| CC (n = 96) | HY | ZZ | 1233.5 | 0.5480 |

| SY (n = 96) | HY | ZZ | 1230.5 | 0.5589 |

| SH (n = 48) | HY | ZZ | 257.5 | 0.5272 |

| HZ (n = 48) | HY | ZZ | 307.5 | 0.6924 |

| CD (n = 48) | ZZ | HY | 212.5 | 0.1131 |

| HF (n = 48) | HY | ZZ | 288 | 1.0000 |

| NB (n = 48) | HY | ZZ | 288 | 1.0000 |

| Name | Group.1 | Group.2 | W-Stat |

|---|---|---|---|

| Farm-gate (n = 240) | ES | S | 268 |

| ES | M | 6 | |

| ES | L | 0 | |

| ES | EL | 0 | |

| S | M | 145 | |

| S | L | 0 | |

| S | EL | 0 | |

| M | L | 238 | |

| M | EL | 0 | |

| L | EL | 161 | |

| BJ (n = 240) | ES | S | 560 |

| ES | M | 26 | |

| ES | L | 0 | |

| ES | EL | 0 | |

| S | M | 300 | |

| S | L | 0 | |

| S | EL | 0 | |

| M | L | 458 | |

| M | EL | 33 | |

| L | EL | 348 | |

| GZ (n = 240) | ES | S | 374 |

| ES | M | 12 | |

| ES | L | 0 | |

| ES | EL | 0 | |

| S | M | 185 | |

| S | L | 0 | |

| S | EL | 0 | |

| M | L | 291 | |

| M | EL | 0 | |

| L | EL | 214 | |

| SZ (n = 192) | ES | S | 374 |

| ES | M | 12 | |

| ES | L | 0 | |

| S | M | 185 | |

| S | L | 0 | |

| M | L | 291 | |

| CS (n = 96) | ES | S | 540 |

| HR (n = 96) | ES | S | 560 |

| CC (n = 96) | ES | S | 470 |

| SY (n = 96) | ES | S | 560 |

| Name | Group.1 | Group.2 | W-Stat | p-Value |

|---|---|---|---|---|

| EL (n = 72) | ZZ | BJ | 91 | 0.0000 **** |

| ZZ | GZ | 25.5 | 0.0000 **** | |

| BJ | GZ | 206.5 | 0.0601 * | |

| L (n = 96) | ZZ | BJ | 146 | 0.0100 ** |

| ZZ | GZ | 64 | 0.0000 **** | |

| ZZ | SZ | 64 | 0.0000 **** | |

| M (n = 96) | ZZ | BJ | 146 | 0.0100 ** |

| ZZ | GZ | 64 | 0.0000 **** | |

| ZZ | SZ | 64 | 0.0000 **** | |

| S (n = 336) | ZZ | XM | 100.5 | 0.0085 *** |

| ZZ | GZ | 108 | 0.0140 ** | |

| ZZ | SZ | 108 | 0.0140 ** | |

| ES (n = 336) | ZZ | HZ | 129.5 | 0.0873 * |

| ZZ | SH | 129.5 | 0.0873 * | |

| ZZ | HF | 129.5 | 0.0873 * | |

| ZZ | CC | 129.5 | 0.0873 * | |

| ZZ | NB | 129.5 | 0.0873 * | |

| ZZ | CS | 104.5 | 0.0111 ** | |

| ZZ | GZ | 104.5 | 0.0111 ** | |

| ZZ | SZ | 104.5 | 0.0111 ** | |

| ZZ | XM | 79.5 | 0.0014 *** |

| Name | Group.1 | Group.2 | W-Stat | p-Value |

|---|---|---|---|---|

| EL (n = 72) | HY | BJ | 146 | 0.0050 *** |

| HY | GZ | 95 | 0.0002 **** | |

| L (n = 96) | HY | BJ | 146 | 0.0100 ** |

| HY | GZ | 95 | 0.0003 **** | |

| HY | SZ | 95 | 0.0003 **** | |

| M (n = 96) | HY | BJ | 179 | 0.0902 * |

| HY | GZ | 161 | 0.0487 ** | |

| HY | SZ | 161 | 0.0487 ** | |

| ES (n = 312) | HY | BJ | 133 | 0.0712 * |

| HY | HR | 133 | 0.0712 * | |

| HY | SY | 133 | 0.0712 * | |

| HY | CC | 99 | 0.0057 *** | |

| HY | CD | 99 | 0.0057 *** | |

| HY | GZ | 99 | 0.0057 *** | |

| HY | SZ | 99 | 0.0057 *** | |

| HY | CS | 72 | 0.0003 **** |

| Time | ZZ-EL | ZZ-L | ZZ-M | ZZ-S | ZZ-ES | BJ-EL | BJ-L | BJ-M | BJ-S | BJ-ES |

| Jan-19 | 68.000 | 64.000 | 60.000 | 48.001 | 40.003 | 72.000 | 68.000 | 64.000 | 50.001 | 42.001 |

| Feb-19 | 68.000 | 64.000 | 60.000 | 48.001 | 40.003 | 72.000 | 68.000 | 64.000 | 50.001 | 42.001 |

| Mar-19 | 68.000 | 64.000 | 60.000 | 48.001 | 40.003 | 72.000 | 68.000 | 64.000 | 50.001 | 42.001 |

| Time | GZ-EL | GZ-L | GZ-M | GZ-S | GZ-ES | SZ-L | SZ-M | SZ-S | SZ-ES | CS-S |

| Jan-19 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 | 68.000 | 64.000 | 50.001 | 42.002 | 50.002 |

| Feb-19 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 | 68.000 | 64.000 | 50.001 | 42.002 | 50.002 |

| Mar-19 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 | 68.000 | 64.000 | 50.001 | 42.002 | 50.002 |

| Time | CS-ES | HR-S | HR-ES | CC-S | CC-ES | SY-S | SY-ES | SH-S | SH-ES | HZ-S |

| Jan-19 | 42.002 | 50.001 | 42.001 | 50.002 | 42.004 | 50.001 | 42.001 | 50.001 | 42.002 | 42.011 |

| Feb-19 | 42.002 | 50.001 | 42.001 | 50.002 | 42.004 | 50.001 | 42.001 | 50.001 | 42.002 | 42.011 |

| Mar-19 | 42.002 | 50.001 | 42.001 | 50.002 | 42.004 | 50.001 | 42.001 | 50.001 | 42.002 | 42.011 |

| Time | HZ-ES | CD-S | CD-ES | HF-S | HF-ES | NB-S | NB-ES | XM-S | XM-ES | |

| Jan-19 | 42.002 | 50.002 | 42.003 | 50.001 | 42.003 | 50.002 | 42.004 | 50.001 | 42.019 | |

| Feb-19 | 42.002 | 50.002 | 42.003 | 50.001 | 42.003 | 50.002 | 42.004 | 50.001 | 42.019 | |

| Mar-19 | 42.002 | 50.002 | 42.003 | 50.001 | 42.003 | 50.002 | 42.004 | 50.001 | 42.019 |

| Time | HY-EL | HY-L | HY-M | HY-S | HY-ES | BJ-EL | BJ-L | BJ-M | BJ-S | BJ-ES |

| Jan-19 | 68.000 | 64.000 | 60.000 | 48.001 | 47.167 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 |

| Feb-19 | 68.000 | 64.000 | 60.000 | 48.001 | 47.167 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 |

| Mar-19 | 68.000 | 64.000 | 60.000 | 48.001 | 47.167 | 72.000 | 68.000 | 64.000 | 50.001 | 42.002 |

| Time | GZ-EL | GZ-L | GZ-M | GZ-S | GZ-ES | SZ-L | SZ-M | SZ-S | SZ-ES | CS-S |

| Jan-19 | 72.000 | 68.000 | 64.000 | 50.002 | 42.001 | 68.000 | 64.000 | 50.002 | 42.001 | 52.500 |

| Feb-19 | 72.000 | 68.000 | 64.000 | 50.002 | 42.001 | 68.000 | 64.000 | 50.002 | 42.001 | 52.500 |

| Mar-19 | 72.000 | 68.000 | 64.000 | 50.002 | 42.001 | 68.000 | 64.000 | 50.002 | 42.001 | 52.500 |

| Time | CS-ES | HR-S | HR-ES | CC-S | CC-ES | SY-S | SY-ES | SH-ES | HZ-ES | CD-ES |

| Jan-19 | 51.084 | 50.001 | 42.002 | 50.002 | 42.001 | 50.001 | 42.002 | 42.002 | 42.003 | 42.001 |

| Feb-19 | 51.084 | 50.001 | 42.002 | 50.002 | 42.001 | 50.001 | 42.002 | 42.002 | 42.003 | 42.001 |

| Mar-19 | 51.084 | 50.001 | 42.002 | 50.002 | 42.001 | 50.001 | 42.002 | 42.002 | 42.003 | 42.001 |

| Time | HF-ES | NB-S | ||||||||

| Jan-19 | 42.003 | 42.004 | ||||||||

| Feb-19 | 42.003 | 42.004 | ||||||||

| Mar-19 | 42.003 | 42.004 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, D.; Yang, Q.; Mu, Y.; Zhang, H. The Price Difference and Trend Analysis of Yesso Scallop (Patinopecten yessoensis) in Changhai County, China. J. Mar. Sci. Eng. 2021, 9, 696. https://doi.org/10.3390/jmse9070696

Peng D, Yang Q, Mu Y, Zhang H. The Price Difference and Trend Analysis of Yesso Scallop (Patinopecten yessoensis) in Changhai County, China. Journal of Marine Science and Engineering. 2021; 9(7):696. https://doi.org/10.3390/jmse9070696

Chicago/Turabian StylePeng, Daomin, Qian Yang, Yongtong Mu, and Hongzhi Zhang. 2021. "The Price Difference and Trend Analysis of Yesso Scallop (Patinopecten yessoensis) in Changhai County, China" Journal of Marine Science and Engineering 9, no. 7: 696. https://doi.org/10.3390/jmse9070696