This study was divided as follows: dependent variables and independent variables were prepared, two hypotheses were proposed in order to bebe refuted or co-confirmed based on the management of scientific research methods, and a survey methodology, i.e., questionnaire and interview, was used. The research objectives are presented as follows:

General objective: Studying the interest regarding sustainability when purchasing or utilizing mobile phones in the context of circular economy.

Objective 1: Observing consumers’ behaviors and habits regarding procurement and usage of mobile phone devices.

Objective 2: Understanding the degree of sustainability that consumers apply with regards to mobile phones.

In order to realize the two hypotheses, the method of empiricism was indispensable, i.e., the study of the theory, and the schematization of the elements useful for delimiting the research field.

3.1. Description of the Utilized Data

The questionnaire is the most widely used research method because it has many advantages such as short data collection in terms of time.

The survey itself includes all the questions embedded as items, with numbers from 1 to 12. The structure of the survey was as follows: 1 question with a nominal scale, and 11 questions with an ordinal scale.

In order to calculate the sample size, the formula of Mureșan P. was used:

where

is the volume of the representative sample;

the coefficient of the significance test;

the incidence of the phenomenon;

statistical totality; Δ maximum allowed error;

the incidence of the phenomenon [

41].

In the present research, the 95% probability of guaranteeing the survey results, for which

t = 1.95, and a margin of error of ±5%, were taken into account. The value recorded for p is 0.7. N represents the resident population of Romania of 19 414 458 inhabitants, according to the National Institute of Statistics of Romania (INS). Taking into account this information, a sample size of 319 respondents was obtained, by applying Mureșan’s formula:

To be representative, the sample must have 319 respondents. As mentioned above, the questionnaire was distributed to 1500 people at random, of which 363 responded.

The sample is significant because it takes into account Mureșan’s formula for n calculated at 319. The number of respondents is of 363 people.

According to the National Institute of Statistics [

42], the total number of persons living in Romania is 19,414,458, from whom, 10,455,362 live in the urban area, 8,959,096 live in the rural area, 9,914,008 are women, and 9,500,450 are men [

42]. The respondents’ data are in concordance with the details provided by the NIS (The National Institute of Statistics in Romania).

Interpreting the structure of the research sample by gender according to

Table 1, the respondents are distributed as follows: 53.2% belong to the female gender, 46.8% belong to the male gender, which indicates that both percentages are close to relatively 50%, with there being more female respondents. In numerical form, there were 193 responses from females and 170 responses from males.

With regards to the distribution of the sample by age groups, the highest percentage of 55.4%, or 201 respondents is given by the category of persons aged 25–34 years, followed by persons aged 18–24 years, percentage of 18.5% or 67 respondents, followed by the respondents aged 35–44 years, with 14.9% or 54 respondents, followed by the ones aged 45–54 years, with 5.8% or 21 respondents, followed by the respondents aged under 18 years, percentage of 2.8% or 10 respondents, and followed by the ones aged 55–64 years and more than 64 years with an equal percentage of 1.4% or five respondents. The distribution of the respondents in the age sample groups did not respect a unitary structure of the Romanian population.

Analyzing the sample regarding the area of residence, the highest percentage is given by the urban area, 93.1%, or the numerical value of 338, with the rural area having a percentage of just 6.9%, or the numerical value of 25. This is may be due to the migration from the rural to the urban areas where the diversity of the possibilities. Also, another reason could be the technological development and the dependence that people have on the urban environment.

Analyzing the sample regarding the professional status, it can be seen that the highest percentage, namely 5.6%, or the numerical value of 202 people, belongs to employees, followed by the freelancers/entrepreneurs, with 24.8% or 90 respondents, followed by pupils/students, with 16% or 58 respondents, followed by the unemployed, with 1.9% or seven respondents, and at the end the retired people, with 1.7% or six respondents.

Interpreting the sample with regards to the monthly average income, it can be noticed that the main percentage is held by the persons with an income between 3500.1–5000 RON, 39.9% or the numerical value of 145, followed by the ones with incomes over 5000 RON, with 27% or the numerical value of 98, followed by the persons with n income less than 2500 RON, with 18.2% or the numerical value of 66, followed by the respondents with an average income between 3000.1–3500 RON, with 8.5% or the numerical value of 31, and followed at the end by those with the income between 2500.1–3000 RON, with 6.3% or the numerical value of 23.

The majority of the respondents were women aged between 25–34 years, being employees. Most of them have a monthly average income of 3500.1–5000 RON and live in the urban area.

3.2. The Analysis of the Questionnaire Answers

The answers to the questions are presented below. A comparison between the independent variables (gender, professional status, age, monthly average income, and area) was done.

According to

Figure 1, the respondents who own one mobile phone are 44.35% women, 36.36% men, 47.66% employees, 15.15% pupils/students, 14.60% freelancers/entrepreneurs, 1.38% unemployed, and 1.93% retired. 2.20% have under 18 years, 1.10% more than 64 years, 17.91% are aged between 18–24 years, 44.08% are aged 25–34 years, 10.19% are aged 35–44 years, 3.86% are aged 45–54 years, and 1.38% are aged 55–64 years. Their average monthly income is less than 2500 RON for 17.08% of them, more than 5000 RON for 17.8%, between 2500.1–3000 RON for 5.79%, 3000.1–3500 RON for 6.61%, and 3500.1–5000 RON for 34.16% of them. Moreover, 5.79% of the respondents live in the rural area, and 74.93% in the urban one.

On the other hand, the respondents that own more than two mobile phones are 8.82% women, 10.47% men, 7.99% employees, 0.83% pupils/students, 10.19% freelancers/entrepreneurs, and 0.28% unemployed. Further, 0.55% have under 18 years, 0.28% more than 64 years, 0.55% are aged 18–24 years, 11.29% are aged 25–34 years, 4.68% are aged 35–44 years, and 1.93% are aged 45–54 years. There were no respondents aged 55–64 years for this category. Their average monthly income is less than 2500 RON for 1.10% of them, more than 5000 RON for 9.92%, between 2500.1 and 3000 RON for 0.55%, 3000.1–3500 RON for 1.93%, and 3500.1–5000 RON for 5.79% of them. Moreover, 1.10% of the respondents live in the rural area, and 18.18% in the urban one.

All percentages mentioned above are reported at 100%.

The number of predominant respondents were mostly women who own one mobile phone, who are employees, aged between 25–34 years, with a monthly average income between 3500, 1–5000 RON, and who live in the urban area. Most of the population migrated to the urban area due to the increased number of possibilities and better technological infrastructure. Mobile phones are the new trend because of their advantages, e.g., they incorporate all apps in one, being used for many things, resembling a personal secretary for each individual. The ones that own more than one mobile phone are usually freelancers or entrepreneurs that use them for their businesses. Although, the majority prefer to be more sustainable by using just one.

Pursuant to

Figure 2, the respondents who change their mobile phones annually are 5.79% women, 6.61% men, 3.03% employees, 1.65% pupils/students, and 7.71% freelancers/entrepreneurs. 0.83% have under 18 years, 1.10% are aged 18–24 years, 7.16% are aged 25–34 years, 2.75% are aged 35–44 years, and 0.55% are aged 45–54 years. Their average monthly income is less than 2500 RON for 1.38% of them, more than 5000 RON for 6.89%, between 2500.1–3000 RON for 0.28%, 3000.1–3500 RON for 0.28%, and 3500.1–5000 RON for 3.58% of them. 0.55% live in the rural area, and 11.85% live in the urban area.

The respondents who change their mobile phones every six months are 0.28% of women, 0.28% of men, and 0.55% of freelancers/entrepreneurs. They are aged 25–34 years, with 0.55%, and have an average monthly income of more than 5000 RON and between 3522.1 and 5000 RON, with an equal percentage of 0.28%. All 0.55% from this category live in the urban area.

On the other part, the respondents who change their mobile phones once every two years or less are 47.11% of women, 39.94% of men, 52.62% employees, 14.33% pupils/students, 16.53% freelancers/entrepreneurs, 1.65% unemployed and 1.93% retired. 1.93% have under 18 years, 1.38% more than 64 years, 17.36% are aged 18–24 years, 47.66% are aged 25–34 years, 12.12% are aged 35–44 years, 5.23% aged 45–54 years, and 1.38% are aged 55–64 years. Their average monthly income is less than 2500 RON for 16.80% of them, more than 5000 RON for 19.83%, between 2500.1–3000 RON for 6.06%, 3000.1–3500 RON for 8.26%, and 3500.1–5000 RON for 36.09% of them. 6.34% of the respondents live in the rural area, and 80.72% in the urban one.

All percentages mentioned above are reported at 100%.

The most respondents were women who change their phones once every two years or less, with the professional status of employee, aged 25–34 years, having an average monthly income between 3500.1 and 5000 RON, and living in the urban area. Again, the respondents from this category choose sustainability by changing their mobile phones rarely. As well, their level of income is medium, thus the possibility of changing their phones more often lessens.

According to

Figure 3, the respondents that prefer iPhone are 24.79% of women, 22.04% of men, 25.62% of employees, 6.06% of pupils/students, 14.05% of freelancers/entrepreneurs, 0.83% of the unemployed, and 0.28% of the retired ones. 0.83% are aged under 18 years, 0.83% have more than 64 years, 7.16% are aged between 18–24 years, 28.37% are aged 25–34 years, 6.34% are aged 35–44 years, 2.75% are aged 45–54 years, and 0.55% are aged 55–64 years. Their average monthly income is less than 2500 RON for 6.06%, more than 5000 RON for 16.53%, 2500.1–3000 RON for 1.65%, 3000.1–3500 RON for 2.48%, and 3500.1–5000 RON for 20.11%. Moreover, 1.93% of the respondents live in the rural area, and 44.90% live in the urban one.

The respondents that prefer Samsung are 17.91% of women, 17.63% of men, 21.49% of employees, 3.86% of pupils/students, 9.09% of freelancers/entrepreneurs, 0.28 of the unemployed, and 0.83% of the retired. 0.83% are aged under 18 years, 0.28% are aged more than 65 years, 5.23% are aged 18–24 years, 20.66% are aged 25–34 years, 5.79% are aged 35–44 years, 2.20% are aged 45–54 years, and 0.55% are aged 55–64 years. Their average monthly income is less than 2500 RON for 4.41%, more than 5000 RON for 8.82%, 2500.1–3000 RON for 2.20%, 3000.1–3500 RON for 4.96%, and 3500.1–5000 RON for 15.15%. Moreover, 2.75% of the respondents live in the rural area, and 32.78% live in the urban one.

The respondents that prefer Huawei are 7.16% of women, 3.03% of men, 6.06% of employees, 2.48% of pupils/students, 1.10% of freelancers/entrepreneurs, and 0.55% of the retired. 1.10% are aged under 18 years, 1.93% are aged 18–24 years, 5.51% are aged 25–34 years, 0.83% are aged 35–44 years, and 0.83% are aged 45–54 years. Their average monthly income is less than 2500 RON for 3.86%, more than 5000 RON for 1.38%, 2500.1–3000 RON for 0.83%, 3000.1–3500 RON for 0.55%, and 3500.1–5000 RON for 3.58%. Moreover, 1.10% of the respondents live in the rural area, and 9.09% live in the urban one.

The respondents that prefer Nokia are 0.55% of women, 1.10% of men, 1.10% of employees, and 0.55% of the unemployed. 0.28% are aged more than 64 years, 1.10% are aged 35–44 years, and 0.28% are aged 55–64 years. Their average monthly income is less than 2500 RON for 0.28%, more than 5000 RON for 0.28%, 2500.1–3000 RON for 0.55%, 3000.1–3500 RON for 0.28%, and 3500.1–5000 RON for 0.28%. Moreover, 0.28% of the respondents live in the rural area, and 1.38% live in the urban one.

The respondents that prefer Allview are 1.10% of women, 0.83% of men, 0.55% of employees, 0.55% of pupils/students, 0.55% of freelancers/entrepreneurs, and 0.28% of the retired. 0.55% are aged 18–24 years, 0.55% are aged 25–34 years, and 0.83% are aged 35–44 years. Their average monthly income is less than 2500 RON for all 0.83%, 3000.1–3500 RON for 0.28%, and 3500.1–5000 RON for 0.83%. Moreover, 0.28% of the respondents live in the rural area, and 1.65% live in the urban one.

The respondents that prefer other mobile phones, such as Lenovo, Ihunt, Xiaomi, Doogee, Meizu, Myria, Cubot etc., are 1.65% of women, 2.20% of men, 0.83% of employees, and 3.03% of pupils/students. 3.58% are aged 18–24 years, and 0.28% are aged 25–34 years. Their average monthly income is less than 2500 RON for all 2.75%, and between 2500.1–3000 RON for 1.10%. Moreover, 0.55% of the respondents live in the rural area, and 3.31% in the urban area.

All percentages mentioned above are reported at 100%.

According to the values in

Figure 4, the majority of the respondents, regardless of gender, professional status, age, monthly income, area, tend towards using iPhone, Samsung, and Huawei due to their popularity and performance. Also, the most respondents that have chosen iPhone were women, with the professional status of employee, aged 25–34 years, having an average monthly income between 3500.1–5000 RON, and living in the urban area. The iPhone is produced by Apple, and it is famous for its performance, security, and apps.

According to

Figure 5, the majority of the respondents, 36.6%, totally agree with purchasing second-hand phones, meaning that they tend towards sustainability. They are followed by the ones that are neutral, having a percentage of 32.5%, being indifferent, followed by the respondents who totally disagree, having a percentage of 19.8%. Last positions are occupied with those who disagree with 6.9%, followed by the ones who agree with 4.1%.

All percentages mentioned above are reported at 100%.

The respondents that agree with the purchasing of second-hand mobile phone are predominant, followed by the ones which are neutral, opened to try. These results further accentuate the trend towards sustainability and responsibility. More and more people acknowledge that they can reuse certain things in order to preserve the environment and reduce some costs.

The respondents who want to buy a phone in the next 12 months are 14.05% of women, 11.57% of men, 11.85% of employees, 6.06% of pupils/students, 7.44% of freelancers/entrepreneurs, and 0.28% of the unemployed. 1.65% of them have less than 18 years, 6.34% are aged 18–24 years, 11.85% are aged 25–34 years, 3.03% are aged 35–44 years, 2.48% are aged 45–54 years, and 0.28% are aged 55–64%. Their average monthly income is less than 2500 RON for 5.51% of them, more than 5000 RON for 9.92%, between 2500.1 and 3000 RON for 2.20%, 3000.1–3500 RON for 1.10%, and 3500.1–5000 RON for 6.89%. Moreover, 1.38% live in the rural area, and 24.24% in the urban one.

In the opposite direction, the respondents who do not want to buy a phone in the next 12 months are 39.12% of women, 35.26% of men, 43.80% of employees, 9.92% of pupils/students, 17.36% of freelancers/entrepreneurs, 1.38% of the unemployed, and 1.93% of the retired. 1.10% of them have less than 18 years, 1.38% of them have more than 64 years, 12.12% are aged 18–24 years, 43.53% are aged 25–34 years, 11.85% are aged 35–44 years, 3.31% are aged 45–54 years, and 1.10% are aged 55–64%. Their average monthly income is less than 2500 RON for 12.67% of them, more than 5000 RON for 17.08%, between 2500.1 and 3000 RON for 4.13%, 3000.1–3500 RON for 7.44%, and 3500.1–5000 RON for 33.06%. Moreover, 5.51% live in the rural area, and 68.87% in the urban one.

All percentages mentioned above are reported at 100%.

Most respondents do not think of buying a mobile phone in the next 12 months. The predominant values are among the employed women, aged 25–34 years, with an average monthly income between 3500.1–5000 RON, and who live in the urban area.

According to the values presented in

Figure 6, the most utilized device is the mobile phone, preferred by 46.56% of women, 41.05% of men, 50.14% of employees, 15.98% of pupils/students, 19.01% of freelancers/entrepreneurs, 0.83% of the unemployed, and 1.65% of the retired people. 2.75% of the respondents in this category are less than 18 years old, 0.55% are more than 64 years old, 18.18% are 18–24 years old, 47.66% are 25–34 years old, 12.67% are 35–44 years old, 4.68% are 45–54 years old, and 1.10% of them are 55–64 years old. 17.91% earn less than 2500 RON, 22.31% earn more than 5000 RON, 5.79% earn between 2500.1 and 3000 RON, 7.44% earn between 3000.1–3500 RON, and 34.16% earn between 3500.1–5000 RON. Moreover, 6.06% live in the rural area, and 81.54% live in the urban area.

The respondents which are using the tablet are 2.48% women, 0.83% men, 1.65% employed and 1.65% freelancers/entrepreneurs. 0.28% are aged 18–24 years, 2.75% are aged 25–34 years, and 0.28% are aged 35–44 years. 1.10% earn more than 5000 RON, 0.28% earn between 3000.1–3500 RON, and 1.93% earn between 3500.1–5000 RON. All 3.31% from this category live in the urban area.

The respondents who use the laptop are 3.03% of women, 4.68% of men, 3.03% of employees, 3.86% of the freelancers/entrepreneurs, and 0.83% of the unemployed. 0.83% are aged more than 64 years, 4.68% are aged 25–34 years, 1.65% are aged 35–44 years, 0.28% are aged 45–54 years, and 0.28% are aged 55–64 years. 3.58% earn more than 5000 RON, 0.55% earn between 2500.1–3000 RON, 0.55% earn between 3000.1–3500 RON, and 3.03% earn between 3500.1 and 5000 RON. Moreover, 0.55% live in the rural area, and 1.10% live in the urban area.

The respondents who use the PC are 1.10% of women, 0.28% of men, 0.83% employed, 0.28% of the freelancers/entrepreneurs, and 0.28% of the retired. 0.28% are aged 25–34 years, 0.28% are aged 35–44 years, and 0.83% are aged 45–54 years. 0.28% earn less than 2500 RON, 0.28% earn between 3000.1 and 3500 RON, and 0.83% earn between 3500.1 and 5000 RON. Moreover, 0.28% live in the rural area, and 1.10% live in the urban area.

All percentages mentioned above are reported at 100%.

Most of the respondents prefer the mobile phones for accessing the social media networks due to the ease of use, and to the fact that they are at hand anytime. As well, the worldwide internet availability facilitates the usage of social media networks through mobile devices. Freelancers and entrepreneurs prefer the laptop because it is more facile for them to promote their business in this manner. On the other hand, the ones that have online businesses could easily advertise by accessing mobile phones from anywhere in the world, though maintaining a higher degree of sustainability because of the reduced energy consumption of the phones. In this case, most of the respondents are employed women and men, aged 25–34 years, with an average monthly income of 3500.1–5000 RON, living in the urban area.

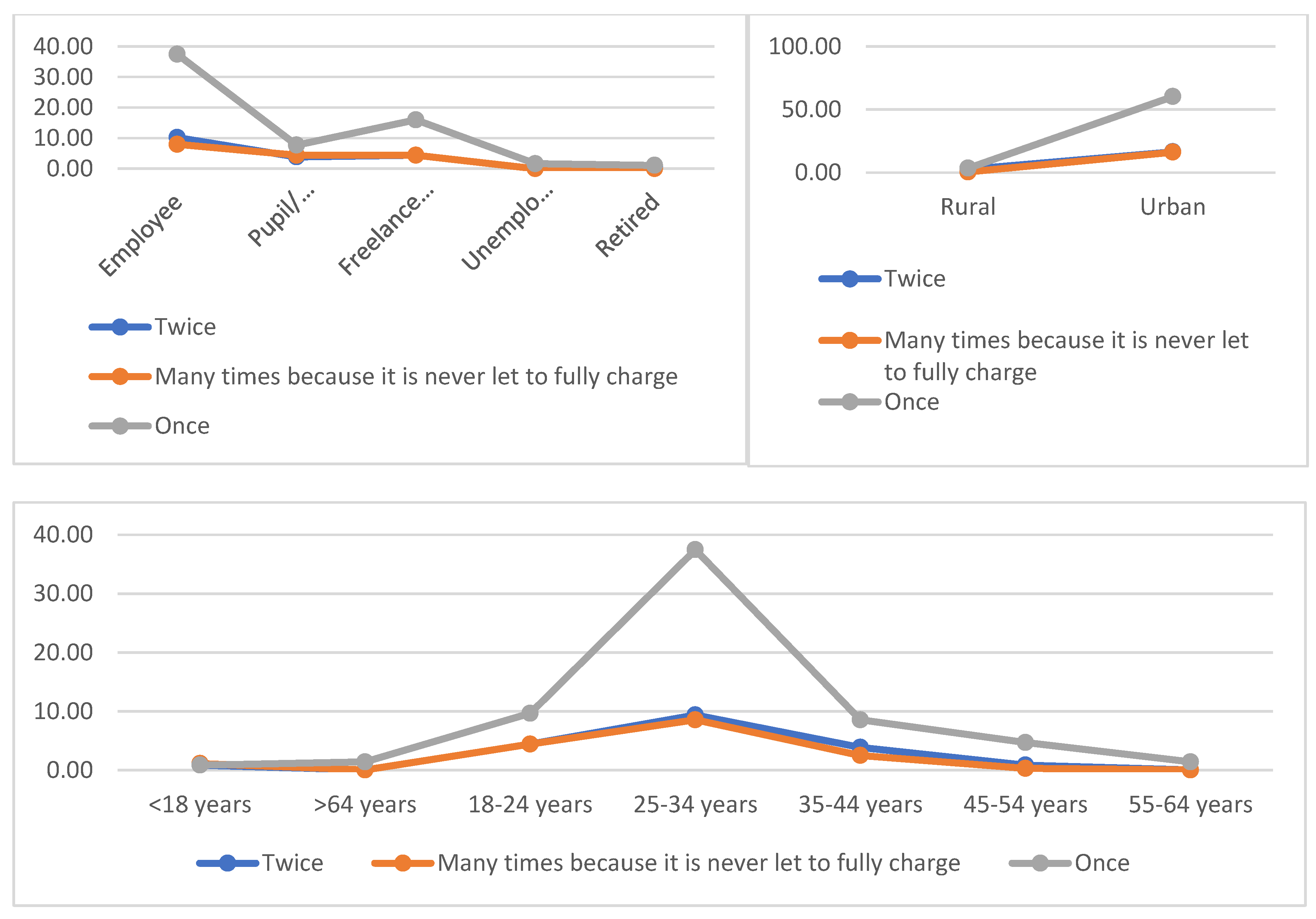

The respondents which charge their phones once within 24h are 37.47% of employees, 7.71% of the pupils/students, 15.98% of the freelancers/entrepreneurs, 1.65% of the unemployed, and 1.10% of the retired. 0.83% are less than 18 years old, 1.38% are more than 64 years old, 9.64% are 18–24 years old, 37.47% are 25–34 years old, 8.54% are 35–44 years old, 4.68% are 45–54 years old, and 1.38% are 55–64 years old. Moreover, 3.58% live in the rural area, and 60.33% live in the urban area.

The respondents which charge their phones many times within 24h are 7.99% of employees, 4.41% of the pupils/students, and 4.41% of the freelancers/entrepreneurs. Moreover, 1.10% have less than 18 years, 4.41% are 18–24 years old, 8.54% are 25–34 years old, 2.48% are 35–44 years old, and 0.28% are 45–54 years old. 0.55% live in the rural area, and 16.25% live in the urban area.

The respondents which charge their phones twice within 24h are 10.19% of employees, 3.86% of the pupils/students, 4.41% of the freelancers/entrepreneurs, and 0.83% of the retired. Further, 0.83% are less than 18 years old, 4.41% are 18–24 years old, 9.37% are 25–34 years old, 3.86% are 35–44 years old, and 0.83% are 45–54 years old. Moreover, 2.75% live in the rural area, and 16.53% live in the urban area.

All percentages mentioned above are reported at 100%.

According to

Figure 7, the majority of respondents were women and men which charge their phones once within 24h, most are employed, aged 25–34 years, with an average monthly income between 3500.1 and 5000 RON, and which live in the urban area.

3.3. The Interview Answers

The following interview was created in order to complete the answers of the questionnaire and for more clarity.

The qualitative study measures the psychological phenomena that cannot be operationalized. In this sense, in order to accurately estimate how purchasing influences the environment in the context of sustainability, it was considered appropriate to use the qualitative research method of interview, by forming a focus group.

The qualitative analysis was first put into practice in the 1930s by Kurt Lewin to examine small groups. Robert Merton and Paul Lazarfeld are the founders of the qualitative method. They applied the focus group to study the characteristics of propaganda and radio programs audience during World War II. The qualitative method has been increasingly used to examine people’s behavior and attitudes in the 1950s. Since the 1970s, it has been fully accepted by researchers as a qualitative method [

43]. The focus group has become the basic tool for marketing studies, being defined as a qualitative research, group interview where social information can be extracted, which cannot result from a quantitative analysis such as a survey. In this research, the focus group was applied to complete the quantitative research in order to remove possible errors and resume the hypotheses at the end of the study. Therefore, the working hypotheses are taken into account from a qualitative point of view. The organizers of the focus group must know very well the concepts and notions of the current stage of knowledge for the current topic of the three questions, have a good skill in communicating, and have knowledge about the dynamics of small groups.

The number of participants in the group was 15. They access the internet from their mobile phones on a daily basis for various purposes: to socialize, to find out about various topics of interest, to purchase products/services etc. The recruitment of the participants was carried out by selection, taking into account the relevant questions in the questionnaire about how many people are interested in adopting sustainable behaviors when purchasing or utilizing mobile phones.

The selection started from the type of device that people are using to access the internet, being chosen 35 people who marked the “mobile phone” parameter. Out of the 35 people, 15 people were selected following the answers to the questionnaire. The focus group participants range in age from 20 to 45 years. The interview was conducted online on Skype and was led by a moderator who previously exposed the participants to organizational training. They were informed that they would answer three open-ended questions about the purchasing and utilization of mobile phones with regards to sustainability. They were also specified the definition of the notions investigated in the interview. The focus group was conducted in August 2020. The duration of the interview was 60 min. In order to accommodate the participants, the moderator considered it useful to start the interview by self-presentation of each participant. For an increased degree of sincerity on the part of the participants, it was specified in the discussion that there are no right or wrong answers. The tool used to record the conversations was Camtasia. The detailed analysis of the answers of the interview is presented below. The answers provided below are the most relevant for this research.

(a) What are the main reasons that determine you to change your mobile phone?

The people we interviewed have different reasons when they decide to change their mobile phones. The main reasons concern things that may happen to the one they are currently possessing, like functionality problems or if it gets lost, but the general trend in this question was more linked to the practicability rather than to promote and or live in a sustainable way.

For instance, one of the participants responded that the main reason for changing his mobile phone is that it is no longer functional. ”I am a practical person, I like to use things, especially devices till they don’t work anymore. I also expect that they have a longer degree of usage because I prefer better quality, in general. Also, the degree of sustainability is important to me.”, while other participant responded that “I want a better and newer model. I really like to be in trend with technology. I am aware that it evolves at rapid pace, but it does not bother me. I also use my mobile phone for business matters, it’s easier to advertise through the device in your pocket.” The same participant said that the new technologies have innovative features that help in terms of business. A good marketing strategy coming from a mobile supplier represents a reason as well to take into consideration the idea of changing the mobile phone, choosing the best offer even if it means that they should also change their number. There was however one participant who mentioned that he keeps his phones for long period of times and considers his behavior a sustainable one.

The majority of the participants mentioned that most of the times they get carried away by the beautiful commercials and offers that persuade them to make new smartphone purchases without actually needing them. The women admitted that family, friends, and acquaintances have a big influence, determining them to get newer and better smartphones in order not to feel inferior. They said that it’s like “being in some kind of competition, feeling the desire to stand out of the crowd and feed their self-esteem.” The men affirmed that they cannot refrain from the new technological improvements that are being presented in the commercials or offers, even though, in many cases there are no visible changes between newer and older models in terms of performance or novelty.

(b) What exactly do you keep in mind when you want to buy a new mobile phone?

The overall opinion on this subject was the fact that nowadays the quality of the phones it is not similar to the one that used to be, devices are made to last 2–3 years, so the technological characteristics, the notoriety of the brand, the design, the price, and sometimes the country of origin represent the main aspects which are taken into consideration by our participants.

Answering this question, most male participants referred to the technological features, performance, and costs. On the other hand, the majority of the women participants were committed to the design, aspect, and brand of the desired smartphones. Both genders mentioned that the quality level of the photos is important. A small part of the participants takes into account the companies’ sustainability practices, but all get excited about sustainability and are more open towards it.

(c) What is your approach with regards to an old phone that you will no longer use?

The interviewed people answered that depending on the age of the phone and if it is still functioning, they will consider giving it to a close relative/friend or donate it in order to give their phone a new life. In other cases, if the quality of the phone is not so good anymore, they will first of all use it for a buyback program or sell it, or they might send it to a recycling center. Most of the interview participants have a sustainable approach when it comes to their old phones but not necessarily for the good reasons, only a small part of them are actually understanding the damage that their devices could do to the environment by throwing them away. Some of the participants just keep all their old phones without using them again or throw them away if they do not find any of the other options convenient.