Information Application of the Regional Development: Strategic Couplings in Global Production Networks in Jiangsu, China

Abstract

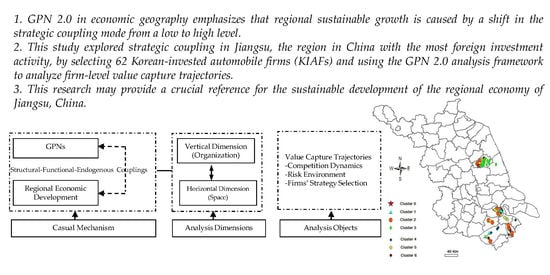

:1. Introduction

2. Theoretical Issues and Research Framework

2.1. Consideration of the Causal Mechanism of GPNs and Regional Economic Development

2.2. Consideration of the GPN 2.0 Analysis Framework

3. Differences between the Economic Growth Trajectories of South and North Jiangsu

4. Empirical Analysis and Results

4.1. Methodology

4.2. K-means Cluster Analysis and Empirical Result

- According to the specified number of classifications n, some observation samples are selected and set to {Z1, Z2, ... Zn}, which are the initial centers.

- The Euclidean distance of each observation sample to the convergence is calculated using Equation (1).According to the principle of proximity, each observation sample is attributed to a class, and the central position of each class is then calculated as the new center.

- The new center is used to reclassify the observation samples, and the center of each class is then recalculated and updated. The updated operation is then repeated until one of the conditions is met—either the maximum change in the distance between the centers of two adjacent iterations is more minor than the multiple of the minimum distance between the initial centers, or the upper limit of the number of iterations is reached. When one of these conditions is met, the iteration is halted.

5. Discussion

5.1. Firm-Level Value Capture Trajectories in North and South Jiangsu

5.1.1. Value Capture Trajectories in North Jiangsu

5.1.2. Value Capture Trajectories in South Jiangsu

- (1)

- Multi-directivity first-tier suppliers

- (2)

- Single-directivity first-tier supplier

5.2. Strategic Coupling Modes in North and South Jiangsu

6. Conclusions and Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Yueng, H.W.-C.; Coe, N.M. Towards a dynamic theory of global production networks. Econ. Geogr. 2015, 91, 29–58. [Google Scholar] [CrossRef] [Green Version]

- Dicken, P.; Kelly, P.; Olds, K.; Yeung, H.W.-C. Chains and networks, territories and scales: Towards a relational framework for analyzing the global economy. Glob. Netw. 2001, 1, 89–112. [Google Scholar] [CrossRef]

- Henderson, J.; Dicken, P.; Hess, M.; Coe, N.; Yeung, H.W.-C. Global production networks and the analysis of economic development. Rev. Int. Political Econ. 2002, 9, 436–464. [Google Scholar] [CrossRef]

- Coe, N.M.; Hess, M.; Yeung, H.W.; Dicken, P.; Henderson, J. ‘Globalizing’regional development: A global production networks perspective. Trans. Inst. Br. Geogr. 2004, 29, 468–484. [Google Scholar] [CrossRef]

- Coe, N.M.; Yeung, H.W.-C. Global Production Networks: Theorizing Economic Development in an Interconnected World; Oxford University Press: Oxford, UK, 2015. [Google Scholar]

- Sunley, P. Relational economic geography: A partial understanding or a new paradigm. Econ. Geogr. 2008, 84, 1–26. [Google Scholar] [CrossRef]

- Coe, N.M.; Yeung, H.W.-C. Global Production Networks; Oxford University Press: Oxford, UK, 2015; pp. 178–188. [Google Scholar]

- Yeung, G. The operation of global production networks (gpns) 2.0 and methodological constraints. Geoforum 2016, 75, 265–269. [Google Scholar]

- Xu, H.; Hsu, W.-L.; Meen, T.-H.; Zhu, J.H. Can higher education, economic growth and innovation ability improve each other? Sustainability 2020, 12, 2515. [Google Scholar] [CrossRef] [Green Version]

- Mackinnon, D.; Cumbers, A. An introduction to economic geography: Uneven development and place. N. J. 2007, 8, 59–81. [Google Scholar]

- Coe, N.W.; Dicken, P.; Hess, M. Global production networks realizing the potential. Econ. Geogr. 2008, 8, 271–295. [Google Scholar] [CrossRef]

- Miao, C.H.; H., W.Y.; Lv, L.C. New Economic Geography; Science Press: Beijing, China, 2011; pp. 78–79. [Google Scholar]

- Liu, Y. Theoretical thread and problems of strategic coupling. Geogr. Res. 2018, 37, 1421–1434. [Google Scholar]

- Nilsen, T. Global production networks and strategic coupling in value chains entering peripheral regions. Extr. Ind. Soc. 2019, 6, 815–822. [Google Scholar] [CrossRef]

- Wang, Y.; Jun, H.; Jian, Z. From gpn 1.0 to 2.0: Review and progress in the study of the global production networks. Geogr. Geo Inf. Sci. 2017, 33, 87–93. [Google Scholar]

- Yueng, H.W.-C. Global production network, value capture trajectories and regional development. Trop. Geogr. 2017, 37, 628. [Google Scholar]

- Grunsven, L.; Hutchinson, F.E. The evolution of the electronics industry in johor (malaysia): Strategic coupling, adaptiveness, adaptation, and the role of agency. Geoforum 2016, 74, 74–87. [Google Scholar] [CrossRef]

- Sanz-Ibáñez, C.; Clavé, S.A. Strategic coupling evolution and destination upgrading. Ann. Tour. Res. 2016, 56, 1–15. [Google Scholar]

- He, C. Global production network and the development in the eastern area. China Ind. Econ. 2017, 11, 50–57. [Google Scholar]

- Neilson, J.; Dwiartama, A.; Fold, N.; Permadi, D. Resource-based industrial policy in an era of global production networks: Strategic coupling in the indonesian cocoa sector. World Dev. 2020, 135, 105045. [Google Scholar] [CrossRef]

- Nilson, J.; Pritchard, B.; Fold, N.; Pritchard, B. Lead firms in cocoa-chocolate global production network: An assessment of the deductive capabilities of gpn 2.0. Econ. Geogr. 2018, 94, 400–424. [Google Scholar] [CrossRef]

- Yang, C. Restructuring the cross-borber production networks of taiwanese investment in china: Relocation of personal computer firms from pearl river delta to yangtze river delta. Delta. Acta Geogr. Sin. 2011, 66, 1343–1354. [Google Scholar]

- Coe, N.M.; Lee, Y.S. ‘We’ve learnt how to be local’: The deepening territorial embeddedness of samsung–tesco in south korea. J. Econ. Geogr. 2013, 13, 327–356. [Google Scholar] [CrossRef]

- Wei, Y.D.; Liao, F.F. The embeddedness of transnational corporations in chinese cities: Strategic coupling in global production networks? Habitat Int. 2013, 40, 82–90. [Google Scholar] [CrossRef]

- Luo, Q.; He, C.F.; Guo, Q. Interaction between the spatial dynamics of foreign direct investment and domestic industrial change in chinese prefecture-level cities. Prog. Geogr. 2016, 35, 1369–1380. [Google Scholar]

- Wei, Y.D. Network linkages and local embeddedness of foreign ventures in china: The case of suzhou municipality. Reg. Stud. J. Reg. Stud. Assoc. 2015, 49, 287–299. [Google Scholar] [CrossRef]

- Wei, Y.D.; Zhou, Y.; Sun, Y.; Lin, G.C. Production and r&d networks of foreign ventures in china: Implications for technological dynamism and regional development. Appl. Geogr. 2012, 32, 106–118. [Google Scholar]

- Ferdows, K. Relating the firm’s global production network to its strategy. In International Operations Networks; Springer: Berlin/Heidelberg, Germany, 2004; pp. 1–11. [Google Scholar]

- Drahokoupil, J.; McCaleb, A.; Pawlicki, P.; Szunomár, Á. Huawei in europe: Strategic integration of local capabilities in a global production network. In Chinese Investment in Europe:Corporate Strategies and Labor Relations; European Trade Union Institute: Brussels, Belgium, 2017; pp. 59–65. [Google Scholar]

- Bing-qing, C.H.E.; Chuan-geng, Z.H.U.; Zhao-yi, M.E.N.G.; Yan, D.U.; Zheng-ping, S.H.E.N. The process, structure and mechanisms of coordinated development between economy and society in jiangsu. Geogr. Res. 2012, 13, 797–803. [Google Scholar]

- Ou, X.J. Analysis on the differences on regional development of jiangsu province. Areal Res. Dev. 2006, 25, 18–27. [Google Scholar]

- Wang, W. A comparison of the impact of fdi and domestic capital on economic development in jiangsu province. Jiangsu Stat. 2003, 1, 19–20. [Google Scholar]

- Kent, A. Through thick or thin? The performance and operation of firms and the institutional thickness model. Space Polity 2014, 18, 269–284. [Google Scholar] [CrossRef]

- Beer, A.; Lester, L. Institutional thickness and institutional effectiveness: Developing regional indices for policy and practice in australia. Reg. Stud. Reg. Sci. 2015, 2, 205–228. [Google Scholar] [CrossRef] [Green Version]

- Zhu, H.Y.; Wang, J.C. The form and mechanism of firms delocalization in the global production network. Sci. Geogr. Sin. 2014, 87, 416–426. [Google Scholar]

- Zhang, G.; Li, Y.; Deng, X. K-means clustering-based electrical equipment identification for smart building application. Information 2020, 11, 27. [Google Scholar] [CrossRef] [Green Version]

- Chen, G.; Liu, Y.; Ge, Z. K-means bayes algorithm for imbalanced fault classification and big data application. J. Process. Control. 2019, 81, 54–64. [Google Scholar] [CrossRef]

- Qi, Y.D.; Zhang, R.Z. A review of the research on the implementing effect of overseas industrial policies. Econ. Inf. 2017, 5, 142–150. [Google Scholar]

- Landesmann, M.A.; Stöllinger, R. Structural change, trade and global production networks: An ‘appropriate industrial policy’ for peripheral and catching-up economies. Struct. Change Econ. Dyn. 2018, 48, 73–87. [Google Scholar] [CrossRef]

- Xu, H.Y. Strategic Coupling between Global Production Network and Regional Development; Nanjing University Press: Nanjing, China, 2013; pp. 32–34. [Google Scholar]

- Xu, J.W. Transformation, upgrading and restructuring of automobile industry in central plains economic zone. Jiangxi Soc. Sci. 2017, 2, 75–82. [Google Scholar]

- Zhang, Z.D.; He, W.Y. Cluster spillover between finance and automobile industry in the yangtze river economic belt: Integration or extrusion. Guizhou Soc. Sci. 2017, 4, 125–130. [Google Scholar]

- Xu, N.; Li, X.; LI, W. The spatial pattern and underlying factors of exited automobile ventures in China. Geogr. Res. 2020. in Press (In Chinese) [Google Scholar]

- Pérez, S.E.; Llopis, A.S.; Llopis, J.A.S. The determinants of survival of spanish manufacturing firms. Rev. Ind. Organ. 2004, 25, 251–273. [Google Scholar] [CrossRef]

| Cluster | Position in GPN | Spatial Structure of Buyers | Spatial Structure of Suppliers | Supplier Ownership | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Global | China | Jiangsu | Local | Global | China | Jiangsu | Local | |||

| Cluster1 | 1 | 0.00 | 0.00 | 0.60 | 0.40 | 0 | 0.05 | 0.00 | 0.95 | 1 |

| Cluster2 | 1 | 0.00 | 0.05 | 0.95 | 0.00 | 0 | 0.00 | 0.00 | 1.00 | 3 |

| Cluster3 | 1 | 0.00 | 0.00 | 0.05 | 0.95 | 1 | 0.00 | 0.00 | 0.00 | 4 |

| Cluster4 | 2 | 1.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 1.00 | 3 |

| Cluster5 | 2 | 1.00 | 0.00 | 0.00 | 0.00 | 1 | 0.00 | 0.00 | 0.00 | 4 |

| Cluster6 | 2 | 1.00 | 0.00 | 0.00 | 0.60 | 1 | 0.00 | 0.00 | 0.00 | 1 |

| Cluster | Position in GPN | Spatial Structure of Buyers | Spatial Structure of Suppliers | Supplier Ownership | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Global | China | Jiangsu | Local | Global | China | Jiangsu | Local | |||

| Cluster1 | 1 | 0.01 | 0.18 | 0.34 | 0.50 | 0.04 | 0.02 | 0.00 | 0.94 | 2 |

| Cluster2 | 1 | 0.07 | 0.25 | 0.38 | 0.30 | 0.07 | 0.01 | 0.02 | 0.96 | 3 |

| Cluster3 | 1 | 0.00 | 0.19 | 0.00 | 0.81 | 0.00 | 0.00 | 0.90 | 0.10 | 3 |

| Cluster4 | 2 | 0.19 | 0.00 | 0.00 | 0.81 | 0.00 | 0.00 | 0.00 | 1.00 | 3 |

| Cluster5 | 2 | 0.51 | 0.06 | 0.02 | 0.41 | 0.99 | 0.00 | 0.00 | 0.10 | 4 |

| Cluster6 | 2 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 1 |

| Cluster | Number | Firm Code |

|---|---|---|

| Cluster0 | 1 | F13. |

| Cluster1 | 8 | F22, F23, F24, F31, F47, F48, F49, F52. |

| Cluster2 | 14 | F10, F11, F12, F33, F34, F38, F39, F40, F43, F44, F54, F58, F61. |

| Cluster3 | 14 | F1, F3, F4, F6, F7, F8, F9, F14, F15, F16, F17, F18, F19, F20. |

| Cluster4 | 10 | F27, F28, F29, F35, F36, F37, F41, F42, F45, F46. |

| Cluster5 | 13 | F2, F5, F21, F25, F30, F32, F50, F51, F53, F56, F57, F59, F60. |

| Cluster6 | 2 | F26, F62. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, H.; Hsu, W.-L.; Lee, Y.-C.; Chern, T.-Y.; Luo, S.-W. Information Application of the Regional Development: Strategic Couplings in Global Production Networks in Jiangsu, China. Information 2020, 11, 420. https://doi.org/10.3390/info11090420

Xu H, Hsu W-L, Lee Y-C, Chern T-Y, Luo S-W. Information Application of the Regional Development: Strategic Couplings in Global Production Networks in Jiangsu, China. Information. 2020; 11(9):420. https://doi.org/10.3390/info11090420

Chicago/Turabian StyleXu, Haiying, Wei-Ling Hsu, Yee-Chaur Lee, Tian-Yow Chern, and Shr-Wei Luo. 2020. "Information Application of the Regional Development: Strategic Couplings in Global Production Networks in Jiangsu, China" Information 11, no. 9: 420. https://doi.org/10.3390/info11090420

APA StyleXu, H., Hsu, W.-L., Lee, Y.-C., Chern, T.-Y., & Luo, S.-W. (2020). Information Application of the Regional Development: Strategic Couplings in Global Production Networks in Jiangsu, China. Information, 11(9), 420. https://doi.org/10.3390/info11090420