ERP Quality and the Organizational Performance: Technical Characteristics vs. Information and Service

Abstract

:1. Introduction

2. Literature Review

- ERP information quality;

- ERP system quality;

- ERP service quality.

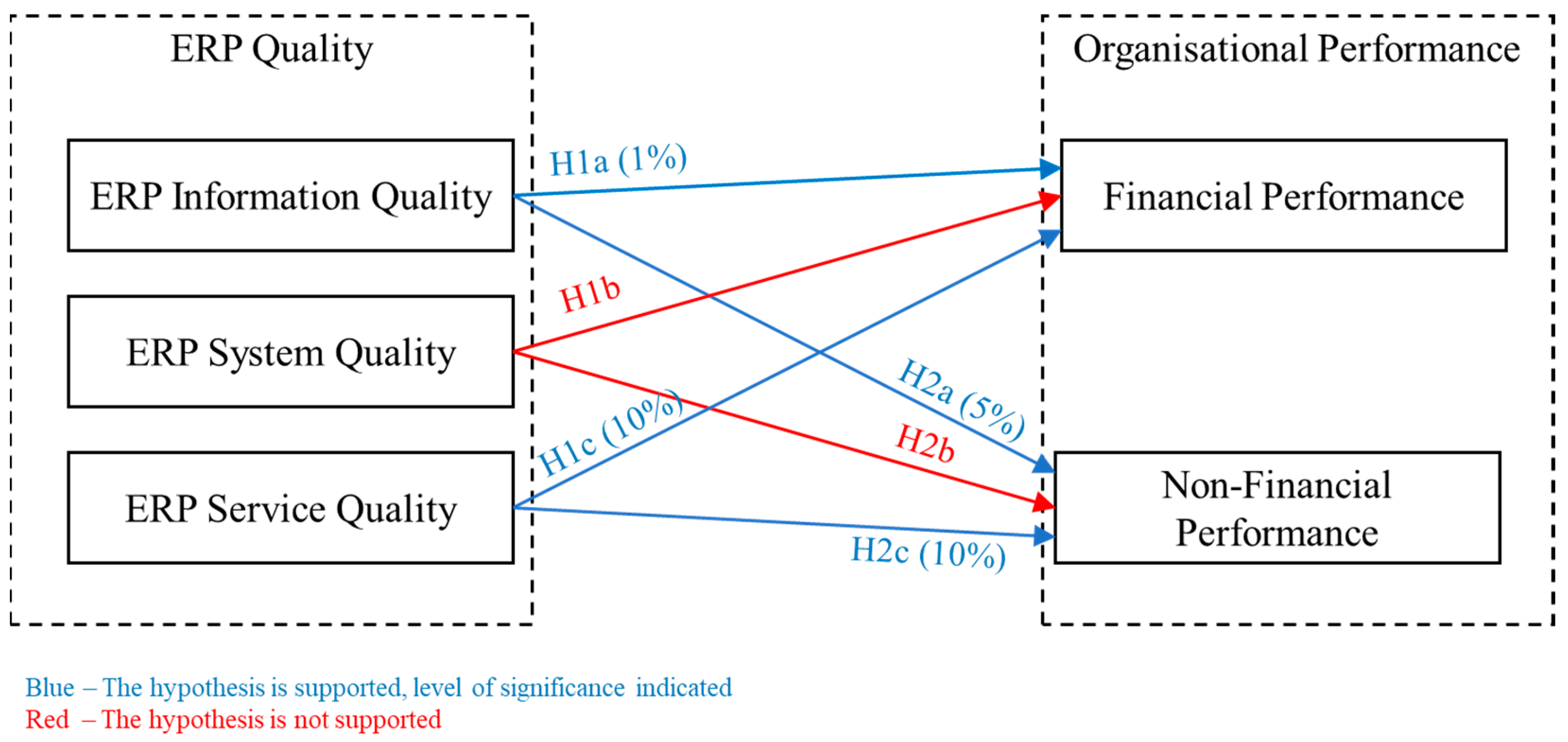

3. Hypotheses Development

3.1. ERP Quality and Organizational Financial Performance

3.2. ERP Quality and Organizational Non-Financial Performance

4. Methodology

4.1. Research Instrument

4.2. Data and Sample

4.3. Statistical Analysis

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Bryde, D.J.; Giannakis, M.; Foropon, C.; Roubaud, D.; Hazen, B.T. Big data analytics and artificial intelligence pathway to operational performance under the effects of entrepreneurial orientation and environmental dynamism: A study of manufacturing organisations. Int. J. Prod. Econ. 2020, 226, 107599. [Google Scholar] [CrossRef]

- Barna, L.-E.; Ionescu, B.; Ionescu-Feleagă, L. The relationship between the implementation of erp systems and the financial and non-financial reporting of organizations. Sustainability 2021, 13, 11566. [Google Scholar] [CrossRef]

- Zerbino, P.; Aloini, D.; Dulmin, R.; Mininno, V. Why enterprise resource planning initiatives do succeed in the long run: A case-based causal network. PLoS ONE 2021, 16, e0260798. [Google Scholar] [CrossRef] [PubMed]

- Ouiddad, A.; Okar, C.; Chroqui, R.; Beqqali Hassani, I. Assessing the impact of enterprise resource planning on decision-making quality: An empirical study. Kybernetes 2020, 50, 1144–1162. [Google Scholar] [CrossRef]

- Raoof, R.; Basheer, M.F.; Javeria, S.; Ghulam Hassan, S.; Jabeen, S. Enterprise resource planning, entrepreneurial orientation, and the performance of SMEs in a South Asian economy: The mediating role of organizational excellence. Cogent Bus. Manag. 2021, 8, 1973236. [Google Scholar] [CrossRef]

- Cañizares, S.M.S.; Ángel, M.; Muñoz, A.; Guzmán, T.L. The relationship between benefits of ERP systems implementation and its impacts on firm performance of SCM. J. Enterp. Inf. Manag. 2009, 22, 722–752. [Google Scholar]

- Beheshti, H.M.; Beheshti, C.M. Improving productivity and firm performance with enterprise resource planning. Enterp. Inf. Syst. 2010, 4, 445–472. [Google Scholar] [CrossRef]

- Ruivo, P.; Johansson, B.; Sarker, S.; Oliveira, T. The relationship between ERP capabilities, use, and value. Comput. Ind. 2020, 117, 103209. [Google Scholar] [CrossRef]

- Alghorbany, A.; Che-Ahmad, A.; Abdulmalik, S.O. IT investment and corporate performance: Evidence from Malaysia. Cogent Bus. Manag. 2022, 9, 2055906. [Google Scholar] [CrossRef]

- Velcu, O. Exploring the effects of ERP systems on organizational performance: Evidence from Finnish companies. Ind. Manag. Data Syst. 2007, 107, 1316–1334. [Google Scholar] [CrossRef]

- Elsayed, N.; Ammar, S.; Mardini, G.H. The impact of ERP utilisation experience and segmental reporting on corporate performance in the UK context. Enterp. Inf. Syst. 2021, 15, 61–86. [Google Scholar] [CrossRef] [Green Version]

- Gupta, S.; Meissonier, R.; Drave, V.A.; Roubaud, D. Examining the impact of Cloud ERP on sustainable performance: A dynamic capability view. Int. J. Inf. Manag. 2020, 51, 102028. [Google Scholar] [CrossRef]

- Jayeola, O.; Sidek, S.; Abdul-Samad, Z.; Hasbullah, N.N.; Anwar, S.; An, N.B.; Nga, V.T.; Al-Kasasbeh, O.; Ray, S. The Mediating and Moderating Effects of Top Management Support on the Cloud ERP Implementation–Financial Performance Relationship. Sustainability 2022, 14, 5688. [Google Scholar] [CrossRef]

- Galy, E.; Sauceda, M.J. Post-implementation practices of ERP systems and their relationship to financial performance. Inf. Manag. 2014, 51, 310–319. [Google Scholar] [CrossRef]

- Gorla, N.; Somers, T.M.; Wong, B. Organizational impact of system quality, information quality, and service quality. J. Strateg. Inf. Syst. 2010, 19, 207–228. [Google Scholar] [CrossRef]

- Hsu, P.F.; Yen, H.J.R.; Chung, J.C. Assessing ERP post-implementation success at the individual level: Revisiting the role of service quality. Inf. Manag. 2015, 52, 925–942. [Google Scholar] [CrossRef]

- Al-Dhaafri, H.; Alosani, M. Integration of TQM and ERP to enhance organizational performance and excellence: Empirical evidence from public sector using SEM. World J. Entrep. Manag. Sustain. Dev. 2021, 17, 822–845. [Google Scholar] [CrossRef]

- Putra, D.G.; Rahayu, R.; Putri, A. The Influence of Enterprise Resource Planning (ERP) Implementation System on Company Performance Mediated by Organizational Capabilities. J. Account. Invest. 2021, 22, 221–241. [Google Scholar] [CrossRef]

- Fernandez, D.; Zainol, Z.; Ahmad, H. The impacts of ERP systems on public sector organizations. Procedia Comput. Sci. 2017, 111, 31–36. [Google Scholar] [CrossRef]

- Sislian, L.; Jaegler, A. ERP implementation effects on sustainable maritime balanced scorecard: Evidence from major European ports. Supply Chain Forum 2020, 21, 237–245. [Google Scholar] [CrossRef]

- Wieder, B.; Booth, P.; Matolcsy, Z.P.; Ossimitz, M.L. The impact of ERP systems on firm and business process performance. J. Enterp. Inf. Manag. 2006, 19, 13–29. [Google Scholar] [CrossRef] [Green Version]

- Bazhair, A.; Sandhu, K. Factors for the Acceptance of Enterprise Resource Planning (ERP) Systems and Financial Performance. J. Econ. Bus. Manag. 2015, 3, 1–10. [Google Scholar] [CrossRef] [Green Version]

- Pattanayak, S.; Roy, S. Synergizing Business Process Reengineering with Enterprise Resource Planning System in Capital Goods Industry. Procedia—Soc. Behav. Sci. 2015, 189, 471–487. [Google Scholar] [CrossRef] [Green Version]

- Hendricks, K.B.; Singhal, V.R.; Stratman, J.K. The impact of enterprise systems on corporate performance: A study of ERP, SCM, and CRM system implementations. J. Oper. Manag. 2007, 25, 65–82. [Google Scholar] [CrossRef]

- Lorenc, A.; Szkoda, M. Customer logistic service in the automotive industry with the use of the SAP ERP system. In Proceedings of the 2015 4th International Conference on Advanced Logistics and Transport (ICALT), Valenciennes, France, 20–22 May 2015; pp. 18–23. [Google Scholar] [CrossRef]

- Nicolaou, A.I.; Bhattacharya, S. Organizational performance effects of ERP systems usage: The impact of post-implementation changes. Int. J. Account. Inf. Syst. 2006, 7, 18–35. [Google Scholar] [CrossRef]

- Elgohary, E. The Role of ERP Capabilities in Achieving Competitive Advantage: An Empirical Study on Dakahlia Governorate Companies, Egypt. Electron. J. Inf. Syst. Dev. Ctries. 2019, 85, e12085. [Google Scholar] [CrossRef] [Green Version]

- Eckartz, S.; Daneva, M.; Wieringa, R.; van Hillergersberg, J. A Conceptual Framework for ERP Benefit Classification: A Literature Review; University of Twente: Enschede, The Netherlands, 2009; p. 16. [Google Scholar]

- De Loo, I.; Bots, J.; Louwrink, E.; Meeuwsen, D.; Van Moorsel, P.; Rozel, C. The effects of ERP-implementations on the non-financial performance of small and medium-sized enterprises in the Netherlands. Electron. J. Inf. Syst. Eval. 2013, 16, 101–113. [Google Scholar]

- HassabElnaby, H.R.; Hwang, W.; Vonderembse, M.A. The impact of ERP implementation on organizational capabilities and firm performance. Benchmarking 2012, 19, 618–633. [Google Scholar] [CrossRef]

- Gupta, S.; Qian, X.; Bhushan, B.; Luo, Z. Role of cloud ERP and big data on firm performance: A dynamic capability view theory perspective. Manag. Decis. 2019, 57, 1857–1882. [Google Scholar] [CrossRef]

- Chen, J.-S.; Tsou, H.T.; Huang, A.Y.-H. Service Delivery Innovation. J. Serv. Res. 2009, 12, 36–55. [Google Scholar] [CrossRef]

- Campbell, D.T. The Informant in Quantitative Research Author. Am. J. Sociol. 1955, 60, 339–342. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 8th ed.; Cengage: Andover, Hampshire, UK, 2019. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Anderson, J.C. An approach for confirmatory measure- ment and structural equation modeling of organizational properties. Manag. Sci. 1987, 3, 525–541. [Google Scholar] [CrossRef]

- Kocaaga, A.S.; Ervural, B.C.; Demirel, O.F. Analysis of the Relationship between Enterprise Resource Planning Implementation and Firm Performance: Evidence from Turkish SMEs. In Proceedings of the International Symposium for Production Research; Springer: Cham, Switzerland, 2018; pp. 724–736. [Google Scholar]

| Characteristic | n | % |

|---|---|---|

| Size | ||

| Micro | 14 | 6.5% |

| Small | 71 | 32.7% |

| Medium | 91 | 41.9% |

| Large | 37 | 17.1% |

| N/A | 4 | 1.8% |

| Industry | ||

| Manufacturing | 61 | 28.1% |

| Wholesale and retail trade | 47 | 21.7% |

| IT | 26 | 12.0% |

| Other | 72 | 33.2% |

| N/A | 11 | 5.1% |

| Export activities | ||

| YES | 127 | 58.5% |

| NO | 77 | 35.5% |

| N/A | 13 | 6.0% |

| Code | Item | λ | t-Value |

|---|---|---|---|

| Financial performance (PRF) | |||

| Generally speaking, for the past few years… | |||

| PRF1 | we have enhanced the sales and profitability of the firm | 0.780 | 24.679 *** |

| PRF2 | we have been profitable | 0.762 | 23.217 *** |

| PRF3 | we have achieved profit objectives | 0.834 | 33.392 *** |

| PRF4 | we have achieved sales objectives | 0.916 | 55.114 *** |

| PRF5 | we have achieved market share objectives | 0.836 | 33.139 *** |

| Non-financial performance (NPR) | |||

| Generally speaking, for the past few years… | |||

| NPR1 | we have improved the loyalty of existing customers | 0.654 | 14.955 *** |

| NPR2 | we have attracted a significant number of new customers | 0.608 | 12.500 *** |

| NPR3 | we have had an important competitive advantage | 0.653 | 14.516 *** |

| NPR4 | we have had a well-perceived image | 0.894 | 40.541 *** |

| NPR5 | we have had a good reputation | 0.877 | 37.985 *** |

| ERP quality (ERP) | |||

| ERP information quality (INF) | |||

| INF1 | The information provided by the ERP system is accurate | 0.922 | 75.312 *** |

| INF2 | Information from the ERP system is always timely | 0.939 | 91.084 *** |

| INF3 | Information from the ERP system is easy to understand | 0.918 | 72.525 *** |

| INF4 | Information from the ERP system is important for decision making | 0.855 | 42.818 *** |

| ERP system quality (SYS) | |||

| SYS1 | The ERP system is always up and running as necessary | 0.888 | 52.927 *** |

| SYS2 | The ERP system responds quickly enough | 0.913 | 65.319 *** |

| SYS3 | Our ERP is easy to use | 0.826 | 34.890 *** |

| SYS4 | Our ERP is stable | 0.910 | 63.557 *** |

| ERP service quality (SRV) | |||

| SRV1 | Employees of the IT department are always available to all employees of the company for all issues related to ERP systems | 0.824 | 34.666 *** |

| SRV2 | The information we receive from the IT department is accurate | 0.928 | 75.005 *** |

| SRV3 | The training provided by the IT department improves the quality of work of our employees | 0.874 | 47.841 *** |

| SRV4 | IT department solves employee problems (related to the company’s information system) | 0.906 | 61.513 *** |

| SRV5 | The IT department delivers what it promises to deliver | 0.861 | 43.036 *** |

| CR | AVE | PRF | NPR | INF | SYS | SRV | |

|---|---|---|---|---|---|---|---|

| PRF | 0.915 | 0.685 | 0.827 | ||||

| NPR | 0.860 | 0.558 | 0.725 | 0.747 | |||

| INF | 0.950 | 0.826 | 0.544 | 0.450 | 0.909 | ||

| SYS | 0.935 | 0.783 | 0.475 | 0.405 | 0.878 | 0.885 | |

| SRV | 0.945 | 0.773 | 0.482 | 0.417 | 0.755 | 0.822 | 0.879 |

| Hypothesis | Independent | Dependent | β | t-Value | p-Value | Hypothesis |

|---|---|---|---|---|---|---|

| Financial performance (PRF) | ||||||

| H1a | INF | → PRF | 0.523 | 3.536 | 0.000 *** | ✔ (1%) |

| H1b | SYS | → PRF | −0.174 | −0.957 | 0.339 | ∅ (not significant) |

| H1c | SRV | → PRF | 0.231 | 1.921 | 0.055 * | ✔ (10%) |

| Non-financial performance (NPR) | ||||||

| H2a | INF | → NPR | 0.384 | 2.401 | 0.016 ** | ✔ (5%) |

| H2b | SYS | → NPR | −0.115 | −0.589 | 0.556 | ∅ (not significant) |

| H2c | SRV | → NPR | 0.222 | 1.724 | 0.085 * | ✔ (10%) |

| χ2[220] = 584.620 (p = 0.000), CFI = 0.924, RMSEA = 0.087, SRMR = 0.061, TLI = 0.912 | ||||||

| R2 [PRF] = 31.3% | ||||||

| R2 [NPR] = 21.9% | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Balić, A.; Turulja, L.; Kuloglija, E.; Pejić-Bach, M. ERP Quality and the Organizational Performance: Technical Characteristics vs. Information and Service. Information 2022, 13, 474. https://doi.org/10.3390/info13100474

Balić A, Turulja L, Kuloglija E, Pejić-Bach M. ERP Quality and the Organizational Performance: Technical Characteristics vs. Information and Service. Information. 2022; 13(10):474. https://doi.org/10.3390/info13100474

Chicago/Turabian StyleBalić, Amer, Lejla Turulja, Emina Kuloglija, and Mirjana Pejić-Bach. 2022. "ERP Quality and the Organizational Performance: Technical Characteristics vs. Information and Service" Information 13, no. 10: 474. https://doi.org/10.3390/info13100474

APA StyleBalić, A., Turulja, L., Kuloglija, E., & Pejić-Bach, M. (2022). ERP Quality and the Organizational Performance: Technical Characteristics vs. Information and Service. Information, 13(10), 474. https://doi.org/10.3390/info13100474