Abstract

Digital inclusive finance, as a vital engine for the country’s high-quality growth, provides new impetus and prospects for encouraging economic development during the looming economic downturn. SMEs play a significant role in economic growth and development, particularly in developing countries. However, value promoting financial inclusion for SMEs through digitalization is still understudied. The objectives aimed at by this investigation were: to study the impact of financial inclusion on SME performances, to observe the influence of digital financing on financial inclusion and SME performance association as a mediator and to examine how the Technology Acceptance Model (TAM) supports financial inclusion and SME performance. A well-structured questionnaire using a quantitative research approach was utilized to gather data from 366 owner-managers among Sri Lankan SMEs. The study’s findings are presented: financial inclusion, digital financing and TAM play influential roles in SME performance. More precisely, digital financing and TAM mediate positively the relationship between financial inclusion and performance in SMEs. The findings of this research endeavor to shed light on developing and popularizing digital financing by providing services which are cheap, secure and low risk from a supply-side perspective, as well as adopting and adjusting digital financing by enhancing financial literacy, which would be necessary from the demand-side perspective.

1. Introduction

In most nations, interest in how SMEs contribute to development is still at the center of policy discussions. While aiming at several advantages, Governments and their incorporated private sectors at all levels have begun to encourage the expansion of SMEs. Compared to large scale enterprises, small scale firms play a fundamental role in generating employment and advancing economic development globally [1]. However, SMEs are generally facing enormous challenges such as changes in technology, lack of capital, lack of access to resources, especially finance, constraints on access to business information, inadequate technology capacity and low usage, high expenses for transportation, difficulty in communicating, issues brought on by time-consuming and expensive bureaucratic processes and rules and regulations, increased competition, and capacity constraints relating to knowledge, innovation and creativity [1,2,3,4]. The bankruptcy of enterprising SMEs is also strongly and significantly correlated with economic restrictions, corruption, and management issues [5]. Among the several obstacles perceived by SMEs, access to finance is the most significant [6]. Financial constraints negatively affect firm sales and employment growth [7].

Greater Small Medium Enterprises Financial Inclusion (FI) would have potential macro-finance benefits, including economic growth [8], higher employment, poverty reduction, macroeconomic policy effectiveness and macro-financial stability [9]. An Enterprise Survey conducted by the World Bank showed that SMEs covered around 96% of all the registered companies in the world on average and represented about 50% of the labor force [10]. SMEs tend to dominate the corporate community in all countries in the Asian region and they cover more than 96% of all Asian businesses. Further, SMEs provide around 75% of the jobs in the area [10]. Inclusive growth in developing countries would result from one of the main fundamentals of SMEs in developing economies [11]. A close link exists between the presence of manufacturing and investment firms and improving living standards and the wellbeing of society [12]. Thus, most developing economies want to encourage financial inclusion, including greater access to financial services for low-income households and firms [1,13].

Digital transactions have been increasing gradually throughout the world [14]. Recently, as the economy transitions to a digital one, established players and newcomers are creating cutting-edge ways to fund SMEs. Digital transaction contains the growth of fintech credit, big tech providers and new initiatives in trade finance [15]. Rapid advancements in the digital payment system and the global rise of mobile communication are opening doors for connecting low-income people to dependable and affordable financial tools via mobile phones and other digital interfaces [16]. The National Financial Inclusion Strategy (NFIS) in Sri Lanka was released recently with the vision of “Better Quality Inclusion for Better Lives”, which aims to increase financial accessibility for SMEs with four policy pillars: Digital Finance (DF) and payments, MSME finance, consumer protection, and financial literacy and capacity building. Digitalization of activities is essential to enhance the quality and speed of the business [17].

Digitalization of financial activities of businesses leads towards reduced costs, transparency, standardization and decreased manpower usage [18]. Further, it would be beneficial to competitiveness. Currently, the COVID-19 pandemic is affecting the global and domestic economy, which has spread over to the financial sector of Sri Lanka. Adaptation of digital technology by individuals and small enterprises is crucial at this moment.

Traditionally, initiatives connected to digital finance have aided countries in reducing the adverse effects of the crisis and strengthening their resilience to future shocks. Financial literacy would be a vital prerequisite for FI. However, digital literacy will be a crucial component of the digitalization process. Previously unavailable or inaccessible to the unbanked, these facilities are now available to them due to the incorporation of digital technology into the financial sector. Digitalization of most financial products and services will require strengthening digital financial literacy, and would be on most countries’ global policy making agenda. Technology adoption of digital tools is especially beneficial to small and micro-businesses. Digital technology adaptations related to financial activities are limited mainly to large scale companies. However, the usage of digital technology is shallow, due to low digital financing literacy. Despite the role that technology plays in the growth of SMEs, adoption of technology by SMEs is still scarce [18] due to several barriers.

The present study has aimed at three elements: 1. An attempt to investigate how digital financing strengthens financial inclusion. 2. To study the financial inclusion and SME performance relationship. 3. To explore how TAM moderates the financial inclusion and SME performance relationship.

This research contributes to many aspects of the literature; firstly, research corresponding to digital financing and the Technology Acceptance Model (TAM) are performed jointly in technology related studies. However, applications of these concepts in financial related studies are sporadic and digital financing activities which have emerged in the world only very recently have not been studied sufficiently. Secondly, the inclusion of digital financing and TAM regarding digitalization was determined separately as preliminary determinations of SME performances in previous studies. Nevertheless, the combined effect of these concepts was less investigated. While filling this conceptual gap, the present study investigates the integration effect of DF and TAM on the SMEs’ performance regarding aspects in developing countries such as Sri Lanka. In addition, the findings of this research contribute to the SME sectors, as many SMEs cannot get access to credit due to less evidence of creditworthiness, transforming to digital financing activities through financial documentation, business plans, and collateral rather than conventional documentation, which banks often promote and prefer when lending credit. On the other hand, if the SMEs adopt digital technology for their business activities, it will reduce their reliance on manpower.

The remaining paper is organized as follows. Discussion on the theoretical background and development of the hypothesis are arranged in Section 2. Section 3 discusses the methodology, including the research approach and data collection techniques. Section 4 assembles the data analysis procedure and results of the analysis. Section 5 presents the discussion forum on the findings, implications, limitations and future research directions, and lastly the summary is included in Section 6.

2. Review of Literature and Hypothesis Development

2.1. Financial Inclusion Theories and Hypothesis Building

The three aspects of banking, access, availability and use of quality services, have been included in the multidimensional approach used to quantify financial inclusion [19]. The development and growth of SMEs depend primarily on access to capital, and the availability of external financing is favorably correlated with growth and productivity [20,21,22]. Much of the current economics research stresses that finance is beneficial to enhancing SMEs’ performance [23]. Financial inclusion could be measured as access to financial services from one aspect, as the community must participate in the economic system to improve its welfare [24,25,26,27]. More commonly, FI is essential for promoting SME expansion [28] and substantial employment growth [29]. Thus, it would lead the immediate and longtime benefits for the economy [30].

Accessibility has been encountered among the factors on the supply side, which is associated with the concepts of physical closeness and affordability. Access to financial services must have a significant constructive effect on the performances of business organizations [31,32]. However, most previous attempts have presented FI as the only global solution to SME growth and development [33,34]. In addition, the growth and development of SMEs are positively influenced by mobile banking, banking services and banking penetration as FI dimensions [35,36]. While considering further the relationship between accessibility and operations of the business sector, the ability to engage financial services assists in develop ping the firm, managing the financial and non-financial activities properly while reducing risk, and withstanding financial shocks to entrepreneurs and real sector business owners.

The availability dimension under the FI concept determines the capabilities of a company in terms of technology choice, market access and access to necessary resources that significantly contribute to the enhancement of the business. Nkwede [37] showed a significant association between financial availability and business performance, especially in developing countries. Availability of various financial services assists in performance, sales growth and productivity, according to a study by Harrison et al. [38]. The spreading of bank financial services and SME’s financial performance are positively correlated, according to Turkmen and Yigit [39]. In addition, Ibor et al. [35], also presented a similar association

Moreover, it has been pointed out that greater distance in servicing providers physically would badly affect the operations and growth of SMEs. Further, a study by Simiyu and Oloko [40] has identified that the availability of ATMs, cash deposit machines and distribution of branches in rural areas will enhance the community’s financial services and support the growth, development, and competitiveness of SMEs. However, due to the absence of credit history, the vast number of participants, and the participants’ divergent viewpoints, it is challenging to choose beneficiaries in the financial inclusion sector in some countries [41].

The next category is the quality of usage, which measures how clients use financial services and the standard of the services. The frequency and duration of the service use over time, such as the average savings balances, the number of transactions per account, or the number of electronic payments made, might be considered as the quality of financial products and services [42]. According to Sarma [19], the number of bank branches and ATMs per 10,000 people has been used to gauge accessibility at an individual level. The quality of the financial services depends on accessibility and availability. The present study has focused on two types of financial services: deposits or transactional accounts of SMEs. According to Ombi et al. [43], financial services’ affordability positively impacts SMEs’ performance. Correspondingly, not only affordability but also improvement of availability of financial services in a country, under the dimension of financial inclusion, has a relationship with the performance expansion of firms [44,45]. Based on the evidence of a strong link presented earlier between financial inclusion and SME performance through access, availability and quality, the following hypotheses were planned for this study:

Hypothesis 1 (H1).

Performances (financial and non-financial) of SMEs are significantly impacted by accessibility to the financial services.

Hypothesis 2 (H2).

Performances (financial and non-financial) of SMEs are significantly impacted by availability of financial services.

Hypothesis 3 (H3).

Quality of Financial services has significant effect on the performances (financial and non-financial) of SMEs.

Hypothesis 4 (H4).

Financial inclusion has significant positive effect on SME performances.

2.2. Digital Finance Inclusion Theories and Hypothesis Development

The Technology Acceptance Model (TAM) is a model which describes under the DF theory the acceptance of several types of technology generally. It highlights the adoption of information technologies and related instruments such as the adoption of the microcomputer and the Internet. TAM is a theory that explains how the information system users receive and use technology with the ‘perceived usefulness’ and ‘perceived ease of use’ of the technology as the criteria for accepting or rejecting a particular technology [46,47]. Further, it may have distinguished between the success or failure of the acceptance of modern technologies [48]. Initially, this model was developed by several researchers when introducing the website to present factors of acceptance of the newly developed concept [32]. In the financial sector, it is more important to study the exploration of the elements of the use of e-banking by the service provider and its users in order to promote its adaptation. Several issues can be encountered while using newly developed techniques. The computer-based technology’s cognitive and emotional capability is also tested as a model. The intentions of using the system determine the stated grounds that were transforming to the digital system. TAM is also more valuable for SMEs since they expect to adapt to new technology instruments available in the surrounding environment.

Recent years have seen regulatory technology emerge as one of the primary study areas in financial stability regulation [49]. To achieve intelligent identification and early risk warning, artificial intelligence technologies are applied. To achieve intelligent identification and early risk warning, artificial intelligence technologies must be applied. In addition, the “wave” of online company promotion that is now evolving is via social media. To connect with customers and followers, marketers are starting to push the usage of social media as a component of their marketing strategy and campaigns [50]. Building a digital identity, creating a financial infrastructure and digital financial markets that promote sustainable, balanced development are all part of the DF transformation [51]. Presently, most bank customers have embraced the shift to digital banking from paper-intensive banking [52,53]. Digitalizing financial activities benefits the bank and its clients and suppliers [52]. As a result of banks going digital, less paper is used, less office space is needed, and fewer materials, resources, and other inputs are used, assuring environmental sustainability.

More recently, especially with the number of issues faced during the lockdown period, the development of new technology usage can be addressed for individuals, businesses, governments and economies using digital technology. Utilizing unique technology will undoubtedly give SME’s timely and vital information, expertise, improved relationships with suppliers and consumers, improved cooperation and increased production and efficiency [54]. According to Yang and Zhang [55], to attain sustainable growth, small scale and micro businesses, especially the private, high-tech industries and competitive markets, benefit from the development of digital FI. Utilizing Information Communication Technology (ICT) based services helps SMEs access external financial resources, thus increasing their financial inclusion [56]. Financial services offer the capital required for entrepreneurial endeavors, and technology is what propels the modernization and transformation of company models. Digital finance not only fits the needs of firms but also has a unique inherent benefit for fostering a thorough combination of digital technology and financial services. This includes analyzing credit risk assessment and control through reducing information asymmetry between service providers and business organizations. However, belief in the usage of digital marketing will be influenced by perceptions of its simplicity of use and usefulness, which will impact behaviour and actual use [50]. With these theories and reviewing the literature, the following hypotheses were developed:

Hypothesis 5 (H5).

Digital financial mediates the link between financial inclusion and SMEs’ performance (financial and non-financial).

Hypothesis 6 (H6).

Technology adaptation moderates the link between financial inclusion and SMEs’ performance.

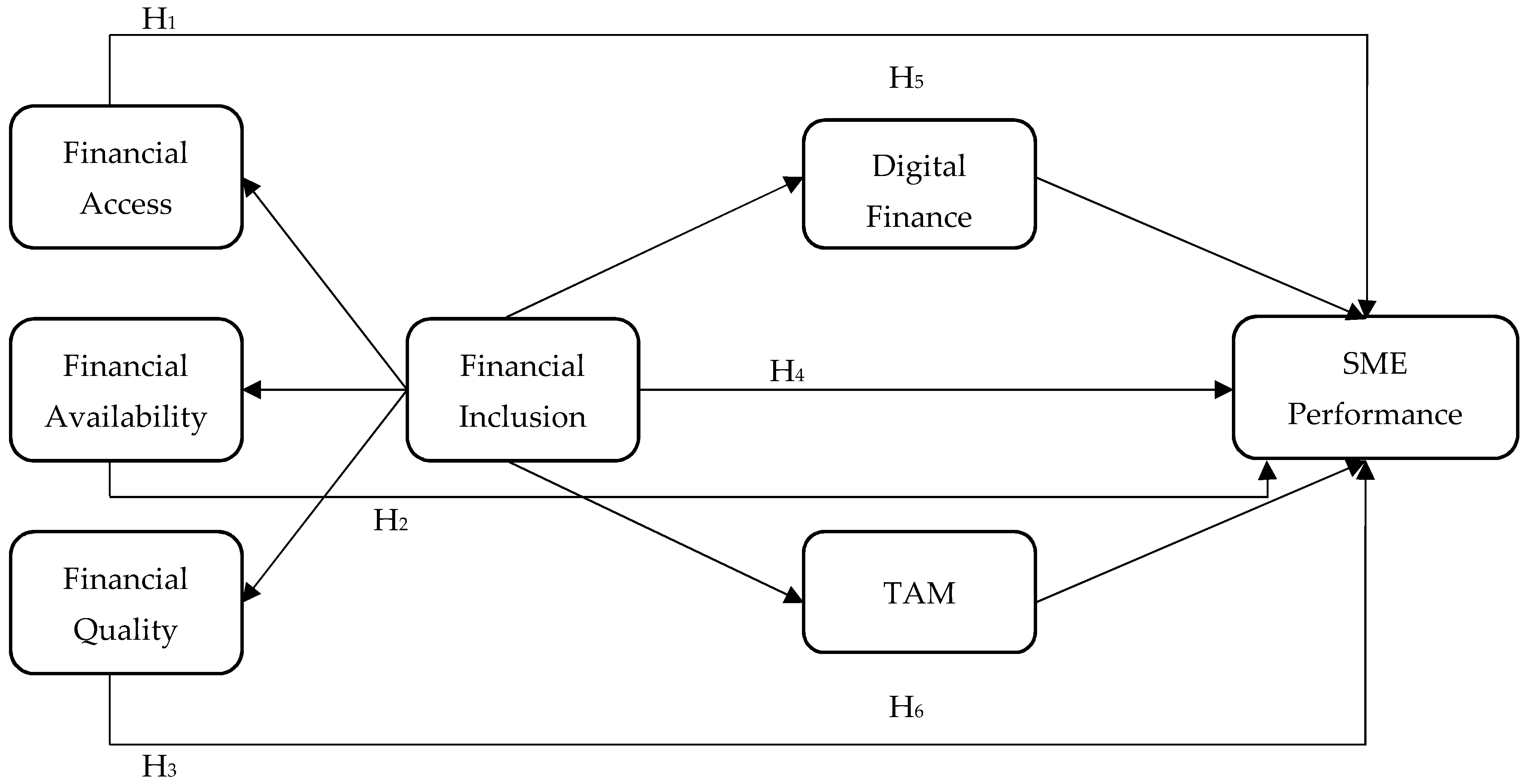

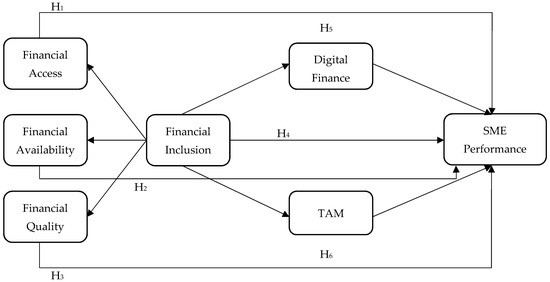

The derived hypothesized relationship for the present study is presented in the following conceptual framework (Figure 1).

Figure 1.

Conceptual framework.

3. Methods

3.1. Research Approach and Data Collection

This research employs the positivism paradigm because a well-defined conceptual framework has been used with possible and straightforward relationships. The positivist paradigm is mainly linked with the quantitative methodology commonly used in the deductive process [57]. Further, belief about the truth in science can be observed, measured and described [58]. The quantitative research approach has been used, since the study is based on survey research [57,59].

Financial inclusion, digital financing and performance related information on SMEs have not previously been collected in a single survey as a secondary data source in Sri Lanka. Hence, the primary survey is the most appropriate technique for data collection. The present study centered on two provinces, namely the Western and Sabaragamuwa Provinces of Sri Lanka, as the study area, since these regions account for 50% of the total enterprises of the country, according to a report by the Department of Census and Statistics [60]. The population of this study consisted of Small Medium Enterprises in Sri Lanka, with all the SMEs in Sri Lanka being taken as the population. Initially, stratified random sampling was employed to allocate the samples to each province. The final sample was drawn according to the number of firms registered in each district proportionally.

The survey initially started on 4 September 2021 and the process continued until the end of January 2022. A total of 487 questionnaires were distributed online (WhatsApp), with field and telephone as the primary surveys. Out of the 380 questionnaires returned, only 366 responses could be used for further analysis, making the valid response rate 75%. Internal consistency and construct validity of the survey was established before analysis. The questionnaire used in this study measured knowledge of finance and digital financial studies and was a valid and reliable tool. Results indicated that the study’s overall internal reliability was adequate, with a score of 0.739 (Cronbach’s alpha).

3.2. Questionnaire and Variable Selection

The questionnaire consisted of five sections. Section A included the demographic background of the respondents and general information regarding the SME. A Likert scale from 1 (strongly disagree) to 5 (strongly agree) was used for responses to each item.

Financial inclusion (FI): This is considered as the increasing spread of SMEs’ easy electronic access to financial services and facilities. An overview of the state of retail networks, including branches and ATMs, is discussed [61,62]. Moreover, the affordability and usefulness of financial services for SMEs, and the quality of the financial services, such as cost, satisfaction, security and protection, were also discussed.

SME performances (Per): Financial performance is the degree to which a firm has achieved financial success which can be directly measured. It covers increments of profit, net income, assets, sales savings and investments [63]. Meanwhile, non-financial performance denotes performances of SMEs non-financially, including increases in employment, staff, reputation, customer relationship, service quality and social networking, which cannot be measured directly as financial performance. This construct has been measured using the owner-manager’s valuation of the firm performance by using the measurement scale developed by previous researchers [63,64,65].

Digital finance (DF): This is discussed with three sub-components: access, usage and quality. Firstly, access to digital financial services in far-reaching technologies is available with financial assistance from a wide range of providers. Generally, this includes the digital use of remote electronic money which is well-known as E-money, money transactions through mobile phones, digital card usage for payments, and electronic fund transfers. Secondly, the use of DF services includes adaptability, familiarity, assistance, convenience and satisfaction. Lastly, risk-related questions arise due to the quality of technology usedfinancial activities. This question included reliability, transactions’ safety, and service providers’ confidence. DF for this research has mainly utilized the measurement used by Ozili [66] and Xie and Liu [66].

TAM: This is based mainly on the theoretical concepts known as “perceived usefulness” and “perceived ease of use”. The present study has discussed the potential risk-related questions arising from using technology for financial activities through this model. The question included reliability, the safety of transactions and the confidence of service providers, covered by eight questions. Perceived usefulness and perceived ease of use are abbreviated as PU and PE, respectively.

3.3. Analyzing Techniques

In this study, the Structural Equation Modeling (SEM) method with Partial Least Squares (SEM-PLS) approach was employed as the analytical methodology, because this research is exploratory of existing theories and seeks to discover the key determinant variables utilizing predicted constructs. Smart PLS 3.0 was the statistical software employed in the current investigation. Firstly, the assumptions regarding multivariate normality, multivariate outliers, and missing data were tested as the corresponding assumptions in order to perform the path analysis. The second step was performance of model assets. Secondly, measurement of model assets was performed. The third phase included testing the hypothesis. The fourth and fifth steps were the analysis of the mediation and testing of the model’s validation, respectively.

4. Results

4.1. Sample Profile

The descriptive statistics of the respondents are presented in Table 1 for the categorical type respondents and Table 2 for continuous type responses. The literature review findings demonstrated that the most common metrics used by researchers to assess demographic characteristics are age, experience, education, and gender [67]. Further, entrepreneurial sustainability is significantly impacted by environmental, business, and behavior factors [68]. Therefore, as shown in Table 1 and Table 2, the current study also used several associated parameters to measure the behavior of SMEs. Results revealed that owners manage 58.5% of the firms, whereas managers manage 41.5%. For firms, the highest percentage (73%) were headed by males, while females headed 27%. When considering the education level of the owner-manager of SMEs, most have completed at least a business oriented diploma or certificate course (36%). The majority of the SMEs were in the manufacturing sector (58%) while 25% and 17% of firms represented the trade and service sectors, respectively. Regarding the locations of the establishments, most respondents, 241 (65.8%), were operating in urban areas, and 112 (30.6%) in rural areas.

Table 1.

Sample profile for categorical variable responses.

Table 2.

Sample profile for continuous variable responses.

The results of continuous variables are summarized in Table 2. Regarding the age of the owner-manager, 19 years was the minimum age recorded for the owner of the SME and 62 was the maximum age of the respondents. The average number of employees of SMEs was 24 and varied from five to 97 employees within a firm. At least one paid, unpaid, part-time worker and manager worked in the firm, while some SMEs exceeded more than ten workers under the above category. When considering the number of years that the enterprise has existed, the average years of a firm’s operations were recorded as 8 and varied from 6 months to 30 years for the entire sample. Concerning accessibility to formal financial services including banks, ATMs and formal financial services providers, it took 6 min to access the nearest bank and formal financial service providers and 2 min to access the nearest ATM. However, access to the nearest formal bank service provider varied between 1 and 23 min.

4.2. Measurement Model Assessment

The first step in Structural Equation Modeling (SEM) was to estimate the measurement model (outer model). The present study is based on the two-stage reflective-reflective model. The Lower Order Construct (LOC) consisted of ten constructs and the Higher Oder Construct (HOC) included four main concepts. The validation of a reflective measurement model can be established by examining its internal consistency (Cronbach Alpha (CA) and Composite Reliability (CR)), indicator reliability, convergent validity (average variance extracted (AVE)) and discriminant validity (Fornell-Larcker criterion) [69].

Normality of data checked while based on the skewness and kurtosis values confirmed that there were no serious issues regarding the violation of normality for the data set since the skewness and kurtosis were up to the absolute value of 1 [70]. A common rule of thumb is that a Variance Inflation Factor (VIF) of more than 10 provides evidence of severe multicollinearity [71]. There were no severe multicollinearity issues in the present study.

To identify the indicator reliability, the reflective indicator loadings reached in an SEM should be higher than 0.700 as a threshold [72,73]. Three variables (DFA3, FPer and PE1) were dropped due to low loadings, thus increasing the construct reliability and validity. Table 3, corresponding to the LOC and Table 4, corresponding to the HOC, showed that the constructs had adequate reliability, 0.70, as a satisfactory level of an instrument [70], except SEM performance and TAM constructs in HOC. The CR values were higher than the threshold of 0.7 [74], whereas AVE was higher than 0.5 [72] for all the LOC and HOC. Results summarized in Table 3 and Table 4 showed that the results corresponded to the present study’s reliability, internal consistency and convergent validity.

Table 3.

Results of reliability, internal consistency, and convergent validity of LOC.

Table 4.

Results of reliability, internal consistency, and convergent validity of HOC.

The discriminant validity was evaluated based on the Fornel-Larcker criterion as the first approach, testing the square root of each AVE loaded along the diagonal by off-diagonal elements. According to Table 5, the Digital Financial Quality (DFQ) construct was a little disputable under the LOC. However, the difference with the square root of the corresponding AVE value was too low at 0.05 and hence can be ignored [75]. Apart from this condition, overall, the measuring model’s discriminant validity was acceptable and supported the validity between the constructs under the Fornel-Larcker criterion. Further, HOC also confirmed the discriminant validity’s precision (See Table 6).

Table 5.

Discriminate validity for LOC.

Table 6.

Discriminant validity for HOC.

4.3. Testing the Hypothesis with the Structural Model

To assess the structural model, Hair et al. [69] suggested the bootstrapping approach with a resample of 5000 and evaluating at the R2, beta and corresponding t-values where the criterion is (t-value ≥ 1.96 and p-value < 0.05).

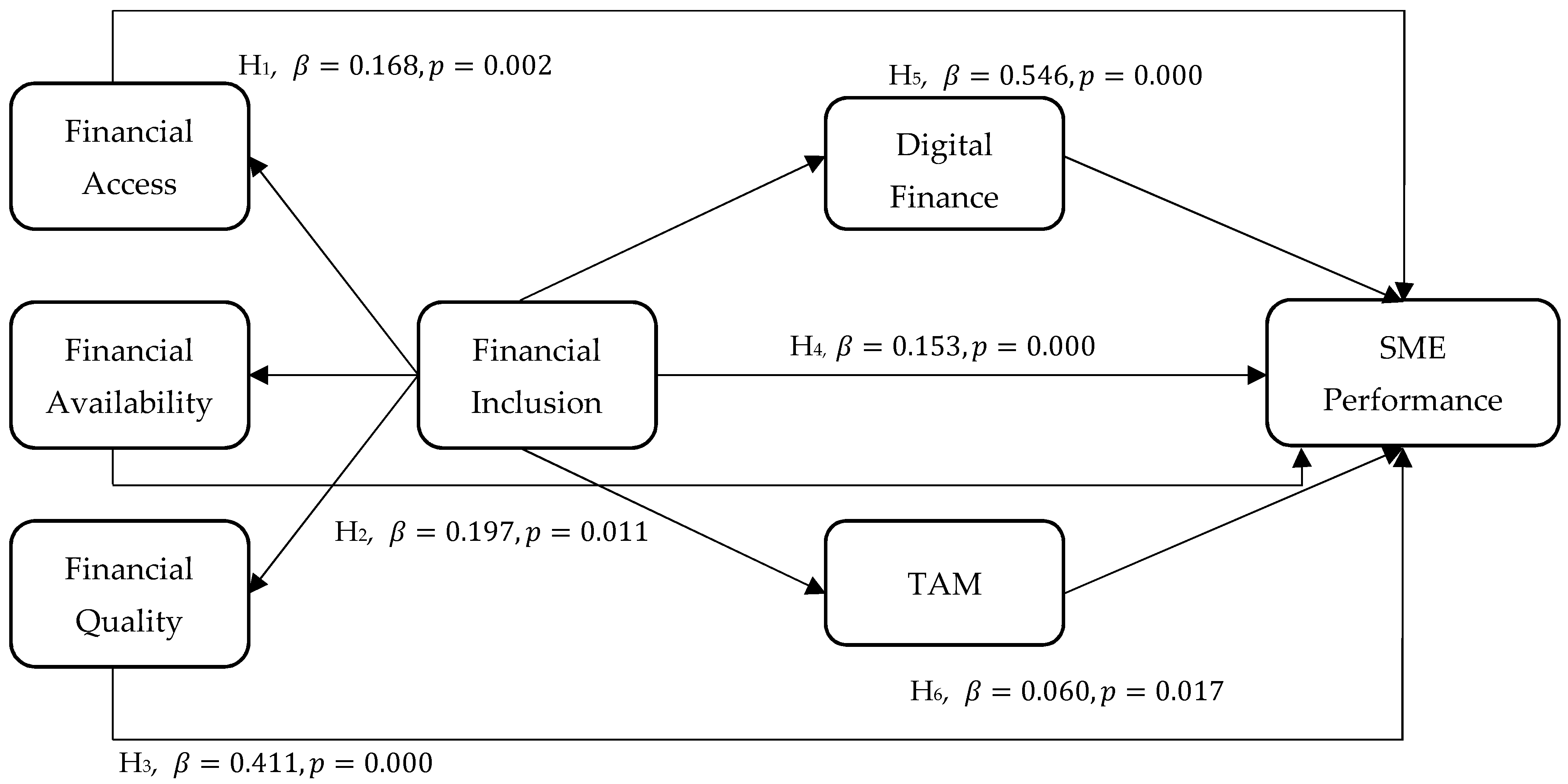

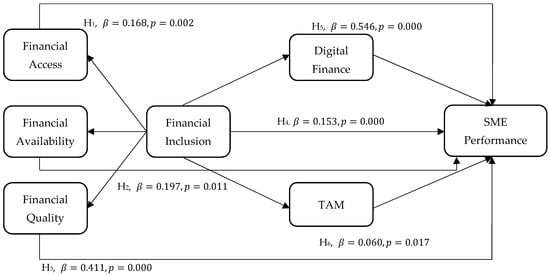

Further, in addition to those fundamental measures for testing the model’s goodness of fit, the predictive relevance (Q2) and effect sizes (f2) are also used. As an initial step, main direct relationships including Financial Access (β = 0.168, t = 3.126, p = 0.0020), Financial Usage (β = 0.197, t = 2.254, p = 0.011), Financial Quality (β = 0.411, t = 6.044, p = 0.000) and overall Financial inclusion (FI; β = 0.153, t = 2.253, p = 0.00) had positive association with SME performance; thus, H1, H2, H3 and H4 were supported by the model. In addition, Digital financial inclusion (DFI; β = 0.546, t = 9.714, p = 0.000) and Technology Acceptance Model (TAM; β = 0.060, t = 2.404, p =0.017) also positively and significantly affected SME performance, leadings to H5 and H6 being accepted.

The next step was evaluation of the structural model. The Coefficient of determination (R2) illustrates the percentage of the variance in the endogenous variables described by the endogenous variables collectively [75]. R2 values of 0.67, 0.33 or 0.19 are described as substantial, moderate, or weak for the path model as the criteria [70]. The R2 value of 0.604 indicated that 60.4% of the variation in SME performance occurred because of FI impacts. SME performance explained 63.9% of the variation in digital financial inclusion and 49.9% of the variance in the technology acceptance model (Figure 2).

Figure 2.

Direct path coefficient in SME. Source: Author’s calculation.

Next, the assessment for the goodness of fit model was Q2, calculated via the blindfolding procedure. A Q2 larger than 0 suggests that the model has predictive relevance, while a Q2 lower than 0 illustrates that the model lacks predictive relevance [76]. According to Table 7, the results support the model’s predictive relevance regarding the endogenous latent variables.

Table 7.

Coefficient of determination (R2) and predictive relevance (Q2) results.

4.4. Mediation Analysis

Partial Least Square (PLS) is regularly characterized by complex path models including one or more independent variables, one or more mediator variables or one or more dependent variables. The present analysis focused on two mediation analyses. The first was the mediation role of digital financing on the linkage between FI and SMEs’ performance. Table 8 summarizes the output of the indirect relationships of the final model.

Table 8.

Indirect effect.

The results of H5 (β = 0.441, t = 9.831, p =0.000) and H6 (β = 0.102, t = 2.324, p = 0.021) present digital financing and TAM as mediators of the relationship between financial inclusion and SME performances.

5. Discussion

5.1. Results

The main aim of this study was to explore the influence of digital financing on the association between financial inclusion SME performances.

Firstly, a significant positive association could be observed with the pillars of financial inclusion, such as access, usage and quality, with financial performance. The results showed that access to finance enhanced the SME performance, further confirming previous studies in the Sri Lankan context [77] and in other countries [78]. However, this finding contradicted the conclusion of Ritaa & Hurutab [79], which suggested that SMES in Indonesia tried to manage finance through funding and investments. Moreover, the present study revealed that the usage and quality of the available financial products and services also provided evidence of SMEs’ profitability and growth [28,80]. Not only the physical accessibility but the more significant usage of financial services and products can facilitate competition within the markets, where contestability is high, since service providers are restrained from exercising monopoly powers. The quality of the financial institutions and availability of services determined the level of financial inclusiveness, which included convenience of transactions, easy access to the service providers and ability to move from one service provider to another.

Secondly, it was evident from this study and the outcomes that FI played an essential role in increasing SMEs’ financial and non-financial performances. The part played by existing financial service providers is enhanced due to FI and thus leads to faster financial services for the unbanked community. Significantly, the SMEs would gain an opportunity to overcome finance-related issues. Ratnawati [80] found explicit confirmation regarding increased access to financial services, including access to credits, leading to the growth of market share, sales and the number of workers for micro, small and medium companies. Similar findings could be seen in other studies where Le et al. [81], and Yang & Zhang [54] generalized that the FI determined a company’s positive growth and performance. However, some scholars had inconsistent findings [81] to the present study, stating that FI does not influence SMEs. However, FI aims to offer financial services and products through safe, affordable and community-wide accessibility to alleviate poverty and inequality.

Thirdly, the growth of digital financial inclusion and sophisticated technology allows users to utilize devices including computers and mobile phones to expand their business requirements. In addition, using such devices would benefit the speeding up of financial services, reduce the burden of complicated documentation processes, and finally make the startup of a business quicker while following market demand. The findings of this study showed that inclusion of digital finance in the process of FI significantly positively impacted the SMEs’ financial and non-financial performances. Moreover, digital financing is a financial intermediation to the association of FI and SME performances through innovations [82]. Using digital financing would facilitate easier transactions and a smooth cash flow.

Further, the use of digital financing was reflected as an invisible hand towards financial access, the usage and quality of financial services and products in SMEs, where most owner-managers were reluctant to accept traditional banking facilities. Additionally, in a digitalized business environment, technological literacy is a crucial and effective instrument to assure organizational effectiveness through the decision-making. Thus, technological finance literacy is also a significant determinant of firms’ performances [83]. The findings of the present study are in line with previous studies. According to Muganyi et. al. [84], financial technology supported the development of the financial sector as it resulted in access to loan facilities, deposits and savings for financial institutions.

Finally, conventional business models with paper-based manual transactions and processing systems have changed into contemporary business models, where transactions for buying, selling, borrowing and others were made through digitalization. Adaptation of digital technology to the SMEs system is required. Both perceived usefulness and perceived ease of use under the TAM were needed, while adapting digital financing to business activities. Our findings presented that the TAM worked as a mediator to the association between FI and SME performances, which is paralleled by the conclusion of Purnamasari et al. [85], and Chin et al. [86], which showed that PU had a significantly positive influence on digitalization, as well as with the existing literature [87,88]. The mediating role of TAM in line with financial inclusion and SME performance is consistent with the finding of Zhou et al. [89], who presented that the quality of the website and familiarity could impact the perceived ease of use and perceived usefulness, which ultimately influence the continuance intentions of e-finance. Moreover, PU and PE, cost of services, and security significantly affected mobile banking adoption [90]. Our finding was also in line with the results of Yang and Zhang [55]. They promoted the strengthening of digitalization for the sustainable development of SMEs through competitive markets by including digital financing. Financial technology is also categorized under digitalization [91], enhancing FI through banking digitalization, to provide easier access in applying for funds, especially for the non-bankable. Not only that, innovation of new financial services through digitalization would also have access to various financial services and products.

5.2. Implications

This research article emphasized several implications, so that the findings and propositions can be easily translated into practice. Firstly, digital financial inclusion enhances the accessibility and convenience of services. SMEs lag behind in obtaining such services due to several constraints. With the development of digital financial inclusion, even short term functions through digital services in SMEs’ activities will add advantages over traditional financial activities. Moreover, services rendered by the financial institution should promote the transformation of modern technology. Secondly, FI is a process that mainly targets vulnerable groups in society. In the Sri Lankan context, while women head many SMEs, most are rural. Hence, when considering the policy implications regarding such weaker and low income sections, such services should be rendered fairly and transparently at reasonable prices. Thirdly, service providers should encourage their clientele to provide secure and risk averse financial services with well-established facilities under supply-side perceptions, as lack of comprehension and technical understanding of their employees, including managers of SMEs, make them reluctant to adopt new technology. Thus, the project’s effort to enhance the SMEs’ technical capacities for technology adoption is significant even from demand-side perception. Finally, the government should consider implementing a new mechanism to attract formal financing rather than informal financing for business activities. The establishment of regulatory frameworks to improve relevance is substantial even in the public sector. Providing infrastructure facilities, training, and mentoring of technical and managerial competencies is essential as a support service. Moreover, educational and awareness programs at the bottom level of society, including education in schools, will improve society’s public awareness and financial literacy.

5.3. Limitations and Future Research Direction

Despite this study providing a healthier and broader consideration of digital financing, financial inclusion and TAM in SMEs, it also encountered several limitations. Firstly, several Sri Lankan provinces have discussed the nexus between financial inclusion and SME performance. This study’s findings will be limited to a particular geographical context. It would be better to elaborate further in future studies by considering larger samples. Secondly, depending on the owner’s financial literacy, the SME’s management will determine the discussed association differently. Thus the validity of the conclusion need not be restricted to a particular aspect. Future research can be expanded to overcome this limitation by considering a higher order construct with control variables. Thirdly, the adoption of digital content by the individual or as a firm makes diffusion innovation relevant. Moreover, technology is advancing and changing continuously; hence, the cross-sectional design used in this study would not precisely measure such diverse technology. Thus, future researchers can investigate the longitudinal panel design in which a sample is collected in a one-time period, the necessary information observed in subsequent times for the same group, and the variables measured.

6. Conclusions

Digitalization of the economy has created a new business environment where businesses can operate and offer services online and through digital platforms. Financial inclusion provides a broader scope of facilities including savings, loans, payments, leasing, insurances, investments, remittances, etc., with access for everyone. SMEs are the crucial beneficiaries of such inclusiveness to increase income, create assets, domestic demand and control risks. The emergence of digital financing has changed the traditional models into modern models in which the financing gap is bridged. In summary, our results have highlighted three crucial factors in financing small and medium sized businesses in Sri Lanka. Firstly, our results have revealed that financial inclusion pillars, including access, usage and quality of financial services and products, had a favorable impact on SME performances. Secondly, it has shown that inclusion of digital financing modified the relationship between financial inclusion and SME performances. Thirdly, the perceived ease of use and perceived usefulness of technology also moderated the access to finance and SME performances. Strengthening the digital economy is essential for developing Sri Lanka, and policy intervention should move towards this.

Author Contributions

U.S.T. designed the study, collected data and completed the data analysis. W.J. conceptualized and supervised the study. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data generated or analyzed during this study can be obtained upon request from the corresponding author.

Conflicts of Interest

The authors declare that they have no competing interests.

References

- Yoshino, N.; Taghizadeh-Hesary, F. Major Challenges Facing Small and Medium-Sized Enterprises in Asia and Solutions for Mitigating Them; Asian Development Bank Institute: Tokyo, Japan, 2016. [Google Scholar]

- Prasanna, R.P.I.R.; Jayasundara, J.M.S.B.; Gamage, S.K.N.; Ekanayake, E.M.S.; Rajapakshe, P.S.K.; Abeyrathne, G.A.K.N.J. Sustainability of SMEs in the Competition: A Systemic Review on Technological Challenges and SME Performance. J. Open Innov. Technol. Mark. Complex. 2019, 5, 100. [Google Scholar] [CrossRef]

- Chouki, M.; Talea, M.; Okar, C.; Chroqui, R. Barriers to Information Technology Adoption within Small and Medium Enterprises: A Systematic Literature Review. Emerg. Issues Trends Innov. Technol. Manag. 2022, 17, 369–412. [Google Scholar] [CrossRef]

- Moscalu, M.; Girardone, C.; Calabrese, R. SMEs’ Growth under Financing Constraints and Banking Markets Integration in the Euro Area. J. Small Bus. Manag. 2020, 58, 707–746. [Google Scholar] [CrossRef]

- Khan, M.A. Barriers Constraining the Growth of and Potential Solutions for Emerging Entrepreneurial SMEs. Asia Pac. J. Innov. Entrep. 2022. [Google Scholar] [CrossRef]

- Wang, Y. What Are the Biggest Obstacles to Growth of SMEs in Developing Countries?—An Empirical Evidence from an Enterprise Survey. Borsa Istanbul Rev. 2016, 16, 167–176. [Google Scholar] [CrossRef]

- Ullah, B. Financial Constraints, Corruption, and SME Growth in Transition Economies. Q. Rev. Econ. Financ. 2020, 75, 120–132. [Google Scholar] [CrossRef]

- Manzoor, F.; Wei, L.; Siraj, M. Small and Medium-Sized Enterprises and Economic Growth in Pakistan: An ARDL Bounds Cointegration Approach. Heliyon 2021, 7, E06340. [Google Scholar] [CrossRef]

- Ahmed, V.; Wahab, M.A.; Mahmood, H. Effectiveness of HRD for Developing SMEs in South Asia; SAARC Human Resource Development Centre: Munich, Germany, 2011; pp. 1–92. [Google Scholar]

- Ayyagari, M.; Demirgüç-Kunt, A.; Maksimovic, V. SME Finance, World Bank Policy Research Working Paper, No. 8241. SSRN. 2017. Available online: https://ssrn.com/abstract=3070705 (accessed on 26 June 2022).

- Khoury, T.A.; Prasad, A. Entrepreneurship Amid Concurrent Institutional Constraints in Less Developed Countries. Bus. Soc. 2015, 55, 934–969. [Google Scholar] [CrossRef]

- Erdin, C.; Ozkaya, G. Contribution of Small and Medium Enterprises to Economic Development and Quality of Life in Turkey. Heliyon 2020, 6, E03215. [Google Scholar] [CrossRef]

- Morgan, P.J.; Pontines, V. Fnancial Stability and Financial Inclusion: The Case of Sme Lending. Singap. Econ. Rev. 2018, 63, 111–124. [Google Scholar] [CrossRef]

- Sahi, A.M.; Khalid, H.; Abbas, A.F.; Zedan, K.; Khatib, S.F.A.; Al Amosh, H. The Research Trend of Security and Privacy in Digital Payment. Informatics 2022, 9, 32. [Google Scholar] [CrossRef]

- Cornelli, G.; Davidson, V.; Frost, J.; Gambacorta, L.; Oishi, K. SME Finance in Asia: Recent Innovations in Fintech Credit, Trade Finance, and Beyond; Asian Development Bank Institute: Tokyo, Japan, 2019. [Google Scholar]

- Bezhovski, Z. The Future of the Mobile Payment as Electronic Payment System. Eur. J. Bus. Manag. 2016, 8, 127–132. [Google Scholar]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and Its Influence on Business Model Innovation. J. Manuf. Technol. Manag. 2019, 30, 1741–1779. [Google Scholar] [CrossRef]

- Sharma, N.; Shastri, S. From Cash to Digital Wage Payments in Vietnam Win-Win for Enterprises and Women Workers. 2020. Available online: https://www.ilo.org/wcmsp5/groups/public/---ed_emp/documents/publication/wcms_748337.pdf (accessed on 5 July 2022).

- Sarma, M. Index of Financial Inclusion; Working Paper No. 215; Indian Council for Research on International Economic Relations (ICRIER): New Delhi, India, 2008. [Google Scholar]

- Butler, A.W.; Cornaggia, J. Does Access to External Finance Improve Productivity? Evidence from a Natural Experiment. J. Financ. Econ. 2011, 99, 184–203. [Google Scholar] [CrossRef]

- Mbuva, M.D.; Wachira, K. Effect of Access to Finance on Financial Perfomance of Processing Smes in Kitui County, Kenya. Int. J. Financ. Account. 2019, 4, 75–89. [Google Scholar] [CrossRef]

- Myint, M.O. The Effect of Financial Access on Performance of SMEs in Myanmar. Int. J. Sci. Res. Publ. 2020, 10, 244–254. [Google Scholar] [CrossRef]

- Beck, T.; Demirguc-Kunt, A. Small and Medium-Size Enterprises: Access to Finance as a Growth Constraint. J. Bank. Financ. 2006, 30, 2931–2943. [Google Scholar] [CrossRef]

- Terzi, N. Financial Inclusion and Turkey. Acad. J. Interdiscip. Stud. 2015, 4, 269–276. [Google Scholar] [CrossRef][Green Version]

- Khan, R.U.; Salamzadeh, Y.; Kawamorita, H.; Rethi, G. Entrepreneurial Orientation and Small and Medium-Sized Enterprises’ Performance; Does “Access to Finance” Moderate the Relation in Emerging Economies? Vision 2021, 25, 88–102. [Google Scholar] [CrossRef]

- Johnpaul, E. Financial Inclusion and Growth of Small and Medium Enterprises in Plateau State. Afr. J. Bus. Econ. Dev. 2021, 1, 69–81. [Google Scholar]

- Alaaraj, H.; Bakri, A. The Effect of Financial Literacy on Investment Decision Making in Southern Lebanon. Int. Bus. Account. Res. J. 2020, 4, 37–43. [Google Scholar] [CrossRef]

- Eton, M.; Mwosi, F.; Okello-Obura, C.; Turyehebwa, A.; Uwonda, G. Financial Inclusion and the Growth of Small Medium Enterprises in Uganda: Empirical Evidence from Selected Districts in Lango Sub-Region. J. Innov. Entrep. 2021, 10, 1–23. [Google Scholar] [CrossRef]

- Ghassibe, M.; Appendino, M.; Mahmoudi, S.E. SME Financial Inclusion for Sustained Growth in the Middle East and Central Asia. IMF Work. Pap. 2019, 2019, 19. [Google Scholar] [CrossRef]

- Thathsarani, U.; Wei, J.; Samaraweera, G. Financial Inclusion’s Role in Economic Growth and Human Capital in South Asia: An Econometric Approach. Sustainability 2021, 13, 4303. [Google Scholar] [CrossRef]

- Konte, M.; Tetteh, G.K. Mobile Money, Traditional Financial Services and Firm Productivity in Africa. Small Bus. Econ. 2022, 1–25. [Google Scholar] [CrossRef]

- Chuttur, M. Overview of the Technology Acceptance Model: Origins, Developments and Future Directions. All Sprouts Content 2009, 9. Available online: http://aisel.aisnet.org/sprouts_all/290 (accessed on 3 July 2022).

- Mago, S.; Chitokwindo, S. The Impact of Mobile Banking on Financial Inclusion in Zimbabwe: A Case for Masvingo Province. Mediterr. J. Soc. Sci. 2014, 5, 221–230. [Google Scholar] [CrossRef]

- Gupta, P.; Singh, B. Role of Literacy Level in Financial Inclusion in India: Empirical Evidence. J. Econ. Bus. Manag. 2013, 1, 272–276. [Google Scholar] [CrossRef]

- Ina Ibor, B.; Offiong, A.I.; Mendie, E.S. Financial Inclusion and Performance of Micro, Small and Medium Scale Enterprises in Nigeria. Int. J. Res.–Granthaalayah 2017, 5, 104–122. [Google Scholar] [CrossRef]

- Chika Anastesia, A.; Hillary Chijindu, E.; Emeka Steve, E. Effect of Financial Inclusion on Entrepreneurial Growth in Retail and Wholesale Sub-Sectors: Evidence from Nigeria. Bus. Manag. Rev. 2020, 11, 295–304. [Google Scholar] [CrossRef]

- Nkwede, F. Financial Inclusion and Economic Growth in Africa: Insight from Nigeria. Aust. J. Bus. Sci. Des. Lit. 2015, 7, 71–80. [Google Scholar]

- Harrison, A.E.; Lin, J.Y.; Xu, L.C. Explaining Africa’s (Dis)Advantage. World Dev. 2014, 63, 59–77. [Google Scholar] [CrossRef]

- Turkmen, S.Y.; Yigit, I. Diversification in Banking and Its Effect on Banks’ Performance: Evidence from Turkey. Am. Int. J. Contemp. Res. 2012, 2, 111–119. [Google Scholar]

- Simiyu, C.N.; Oloko, M. Mobile Money Transfer and the Growth of Small and Medium Sized Enterprises in Kenya. Int. J. Econ. Commer. Manag. UK 2015, III, 1056–1081. [Google Scholar]

- Chao, X.; Kou, G.; Peng, Y.; Viedma, E.H. Large-Scale Group Decision-Making with Non-Cooperative Behaviors and Heterogeneous Preferences: An Application in Financial Inclusion. Eur. J. Oper. Res. 2021, 288, 271–293. [Google Scholar] [CrossRef]

- World Bank SME Finance: Development News, Research, Data. Available online: https://www.worldbank.org/en/topic/smefinance (accessed on 26 June 2022).

- Ombi, N.; Ambad, S.N.A.; Bujang, I. The Effect of Business Development Services on Small Medium Enterprises (SMEs) Performance. Int. J. Acad. Res. Bus. Soc. Sci. 2018, 8, 114–127. [Google Scholar] [CrossRef]

- Williams, H.T.; Adegoke, A.J.; Dare, A. Role of Financial Inclusion in Economic Growth and Poverty Reduction in a Developing Economy. Intern. J. Res. Econ. Soc. Sci. 2017, 7, 265–271. [Google Scholar]

- Okoye, L.U.; Adetiloye, K.A. Journal of Internet Banking and Commerce Special Issue: Mobile Banking: A Service Provider Perspective Edited by: Mihail N. Dudin Financial Inclusion as a Stratergy for Enhanced Economic Groeth and Development. J. Internet Bank. Commer. 2017, 22, 1–14. [Google Scholar]

- Aburahmah, L.; Alrawi, H.; Izz, Y.; Syed, L. Online Social Gaming and Social Networking Sites. Procedia Comput. Sci. 2016, 82, 72–79. [Google Scholar] [CrossRef]

- Tahar, A.; Riyadh, H.A.; Sofyani, H.; Purnomo, W.E. Perceived Ease of Use, Perceived Usefulness, Perceived Security and Intention to Use E-Filing: The Role of Technology Readiness. J. Asian Financ. Econ. Bus. 2020, 7, 537–547. [Google Scholar] [CrossRef]

- Ajibade, P. Technology Acceptance Model Limitations and Criticisms: Exploring the Practical Applications and Use in Technology-Related Studies, Mixed-Method, and Qualitative Researches. Libr. Philos. Pract. 2018. Available online: http://digitalcommons.unl.edu/libphilprac/1941 (accessed on 3 July 2022).

- Chao, X.; Ran, Q.; Chen, J.; Li, T.; Qian, Q.; Ergu, D. Regulatory Technology (Reg-Tech) in Financial Stability Supervision: Taxonomy, Key Methods, Applications and Future Directions. Int. Rev. Financ. Anal. 2022, 80, 102023. [Google Scholar] [CrossRef]

- Nistor, G.C. An Extended Technology Acceptance Model for Marketing Strategies in Social Media. Rev. Econ. Bus. Stud. 2019, 12, 127–136. [Google Scholar] [CrossRef][Green Version]

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A.; Veidt, R. Sustainability, FinTech and Financial Inclusion. SSRN Electron. J. 2019. University of Luxembourg Law Working Paper No. 006-2019, UNSW Law Research Paper No. 19-63. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3387359 (accessed on 3 July 2022). [CrossRef]

- Yip, A.W.H.; Bocken, N.M.P. Sustainable Business Model Archetypes for the Banking Industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Allwood, J.M. Strategies to Reduce the Carbon Footprint of Consumer Goods by Influencing Stakeholders. J. Clean. Prod. 2012, 35, 118–129. [Google Scholar] [CrossRef]

- Ensari, M.Ş.; Karabay, M.E. What Helps to Make SMEs Successful in Global Markets? Procedia-Soc. Behav. Sci. 2014, 150, 192–201. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Y. Digital Financial Inclusion and Sustainable Growth of Small and Micro Enterprises—Evidence Based on China’s New Third Board Market Listed Companies. Sustainability 2020, 12, 3733. [Google Scholar] [CrossRef]

- Agyekum, F.K.; Reddy, K.; Wallace, D.; Wellalage, N.H. Does Technological Inclusion Promote Financial Inclusion among SMEs? Evidence from South-East Asian (SEA) Countries. Glob. Financ. J. 2021, 53, 100618. [Google Scholar] [CrossRef]

- Bhattacherjee, A. Social Science Research: Principles, Methods, and Practices. Textb. Collect. 2012. Available online: https://digitalcommons.usf.edu/oa_textbooks/3/ (accessed on 3 July 2022).

- Park, Y.S.; Konge, L.; Artino, A.R. The Positivism Paradigm of Research. Acad. Med. 2020, 95, 690–694. [Google Scholar] [CrossRef]

- Qualitative vs.Quantitative Data: What’s the Difference? And Why They’re So Valuable. Available online: https://www.fullstory.com/blog/qualitative-vs-quantitative-data/ (accessed on 3 July 2022).

- Department of Census and Statistics. Available online: http://www.statistics.gov.lk/ (accessed on 3 July 2022).

- Ardic, O.P.; Heimann, M.; Mylenko, N. Access to Financial Services and the Financial Inclusion Agenda around the World A Cross-Country Analysis with a New Data Set. Policy Res. Work. Pap. 2011, 5537, 1–55. [Google Scholar]

- Oshora, B.; Desalegn, G.; Gorgenyi-Hegyes, E.; Fekete-Farkas, M.; Zeman, Z. Determinants of Financial Inclusion in Small and Medium Enterprises: Evidence from Ethiopia. J. Risk Financ. Manag. 2021, 14, 286. [Google Scholar] [CrossRef]

- Al-Matari, E.M.; Al-Swidi, A.K.; Fadzil, F.H.B. The Measurements of Firm Performance’s Dimensions. Asian J. Financ. Account. 2014, 6, 24–49. [Google Scholar] [CrossRef]

- Pham, T.M.D. On the Relationship between Total Quality Management Practices and Firm Performance in Vietnam: The Mediating Role of Non-Financial Performance. Manag. Sci. Lett. 2020, 10, 1743–1754. [Google Scholar] [CrossRef]

- Nguyen, A.D.; Pham, C.H.; Pham, L. Total Quality Management and Financial Performance of Construction Companies in Ha Noi. Int. J. Financ. Res. 2016, 7, 41–53. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Chaniago, H. Demographic Characteristics and Small Business Success: Evidence from Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 399–409. [Google Scholar] [CrossRef]

- Abdelwahed, N.A.A.; Soomro, B.A.; Shah, N. The Role of Environment, Business and Human Behavior towards Entrepreneurial Sustainability. Sustainability 2022, 14, 2517. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. An Introduction to Structural Equation Modeling. In Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R; Springer: Cham, Switzerland, 2021; pp. 1–29. [Google Scholar] [CrossRef]

- Orcan, F. Parametric or Non-Parametric: Skewness to Test Normality for Mean Comparison. Int. J. Assess. Tools Educ. 2020, 7, 255–265. [Google Scholar] [CrossRef]

- Cohen, P.; Stephen, G.W.; Leona, S.A. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Psychology Press: New York, NY, USA, 2013. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Habibi, A.; Yusop, F.D.; Razak, R.A. The Dataset for Validation of Factors Affecting Pre-Service Teachers’ Use of ICT during Teaching Practices: Indonesian Context. Data Brief 2019, 28, 104875. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror, Mirror on the Wall: A Comparative Evaluation of Composite-Based Structural Equation Modeling Methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Plann. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Akter, S.; D’Ambra, J.; Ray, P. An Evaluation of PLS Based Complex Models: The Roles of Power Analysis, Predictive Relevance and GoF Index. Fac. Commer.—Pap. 2011, 2, 1313–1319. [Google Scholar]

- Kalaieesan, K. The Relationship between Access to Finance and Growth of SMEs in the Northern Province of Sri Lanka: Financial Literacy as a Moderator. Manag. Stud. 2021, 9. [Google Scholar] [CrossRef]

- Fowowe, B. Access to Finance and Firm Performance: Evidence from African Countries. Rev. Dev. Financ. 2017, 7, 6–17. [Google Scholar] [CrossRef]

- Rita, M.R.; Dolfriandra Huruta, A. Financing Access and SME Performance: A Case Study from Batik SME in Indonesia. Int. J. Innov. Creat. Chang. 2020, 12, 203. [Google Scholar]

- Owusu, J.; Owusu Ansah, W.; Ohene Djan, K.; Anin, E.K. Impact of Financial Resource Building Effort on Financial Resource Availability among Small and Medium Enterprises. Cogent Bus. Manag. 2021, 8, 1. [Google Scholar] [CrossRef]

- Nizam, R.; Karim, Z.A.; Sarmidi, T.; Rahman, A.A. Financial Inclusion and Firms Growth in Manufacturing Sector: A Threshold Regression Analysis in Selected Asean Countries. Economies 2020, 8, 80. [Google Scholar] [CrossRef]

- Yao, L.; Yang, X. Can Digital Finance Boost SME Innovation by Easing Financing Constraints?: Evidence from Chinese GEM-Listed Companies. PLoS ONE 2022, 17, e0264647. [Google Scholar] [CrossRef]

- Kulathunga, K.M.M.C.B.; Ye, J.; Sharma, S.; Weerathunga, P.R. How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices. Information 2020, 11, 297. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Yin, Y.; Sun, H.; Gong, X.; Taghizadeh-Hesary, F. Fintech, Regtech, and Financial Development: Evidence from China. Financ. Innov. 2022, 8, 1–20. [Google Scholar] [CrossRef]

- Purnamasari, P.; Pramono, I.P.; Haryatiningsih, R.; Ismail, S.A.; Shafie, R. Technology Acceptance Model of Financial Technology in Micro, Small, and Medium Enterprises (MSME) in Indonesia. J. Asian Financ. Econ. Bus. 2020, 7, 981–988. [Google Scholar] [CrossRef]

- Chin, W.W.; Marcelin, B.L.; Newsted, P.R. A Partial Least Squares Latent Variable Modeling Approach for Measuring Interaction Effects: Results from a Monte Carlo Simulation Study and an Electronic-Mail Emotion/Adoption Study. Inf. Syst. Res. 2003, 14, 127–219. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The Determinants of Digital Payment Systems’ Acceptance under Cultural Orientation Differences: The Case of Uncertainty Avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- Singh, S.; Srivastava, R.K. Predicting the Intention to Use Mobile Banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

- Zhou, W.; Tsiga, Z.; Li, B.; Zheng, S.; Jiang, S. What Influence Users’ e-Finance Continuance Intention? The Moderating Role of Trust. Ind. Manag. Data Syst. 2018, 118, 1647–1670. [Google Scholar] [CrossRef]

- Yu, C. Factors Affecting Individuals to Adopt Mobile Banking: Empirical Evidence from the UTAUT Model. J. Electron. Commer. Res. JECR 2012, 13, 104. [Google Scholar]

- Nurohman, Y.A.; Kusuma, M.; Narulitasari, D. Fin-Tech, Financial Inclusion, and Sustainability: A Qualitative Approach of Muslims SMEs. IJIBE Int. J. Islam. Bus. Ethics 2021, 6, 54–67. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).