Abstract

When carrying out construction work, identifying the best contractor is a critical component of the project life cycle in the construction industry. The investor must use effective and efficient strategies to create a competitive bidding environment in public projects. The research presented in this paper was conducted to demonstrate the competitive nature of public procurements, where contractors compete to present the best bid and win the contract. To award the contract, the best offer must be selected. Based on different strategies and multi-criteria decision-making approaches this study proposes a method for identifying the most suitable strategy out of eight bidding strategies on four different lots, resulting in the most suitable one for landslide rehabilitation in the Brčko district. The results reveal the optimal approach to follow to minimize time and financial losses in the case of landslide rehabilitation during periods of market instability. Such research findings validate the efficiency of the bidding strategies-based decision-making support. The proposed method allows for compromise on both the completion date and the lowest bid made by the winning contractor.

1. Introduction

Through the 2030 Agenda for Sustainable Development [1], the 17 Sustainable Development Goals (SDGs) are both a direct and indirect call to action for all economies [2]. The ninth of Agenda’s 17 SDGs focuses on creating a resilient infrastructure [3] by creating high-quality, dependable, sustainable, and resilient regional and transnational infrastructure to support economic growth and human well-being with a focus on equitable and affordable access for all. The eleventh SDG of the Agenda continues the narrative by emphasizing the importance of reducing the number of deaths and people caused by disasters, including water-related disasters [4], among other issues.

With a focus on SDG 9 and SDG 11, infrastructure services for communities are essential both during and immediately following different emergencies. Making sure that the supporting infrastructure is dependable even when disrupted is necessary to guarantee that basic resources such as food, water, and energy, as well as shelter, health services, and access to information and communication technologies, are available [5].

In the case of public procurement for landslide rehabilitation in four different lots of the Brčko district, knowledge of the risks that the landslide exposed to the community and of the potential solutions to address these involved a variety of stakeholders. As the process of deciding on a contractor is a fundamental part of the project life cycle in the construction industry, the investor must use effective and efficient strategies to create a competitive bidding environment in public projects. Due to the urgency of landslide rehabilitation and the economy’s periodic instabilities, investors must conduct thorough analyses and assessments to meet public procurement construction demands.

Since its initial inception in 1944, there have been numerous applications of game theory as a multi-criteria tool in a variety of fields such as public policy, economics, law, business, computer science, and engineering. The most likely or ideal outcomes can be determined by modeling and analyzing the strategic relationships, circumstances, and interactions between stakeholders [6]. Making assumptions about the game’s subject matter, i.e., constructor selection, the players’ strategies, and the gains and losses associated with each party’s attributes, is necessary to create a game [7,8].

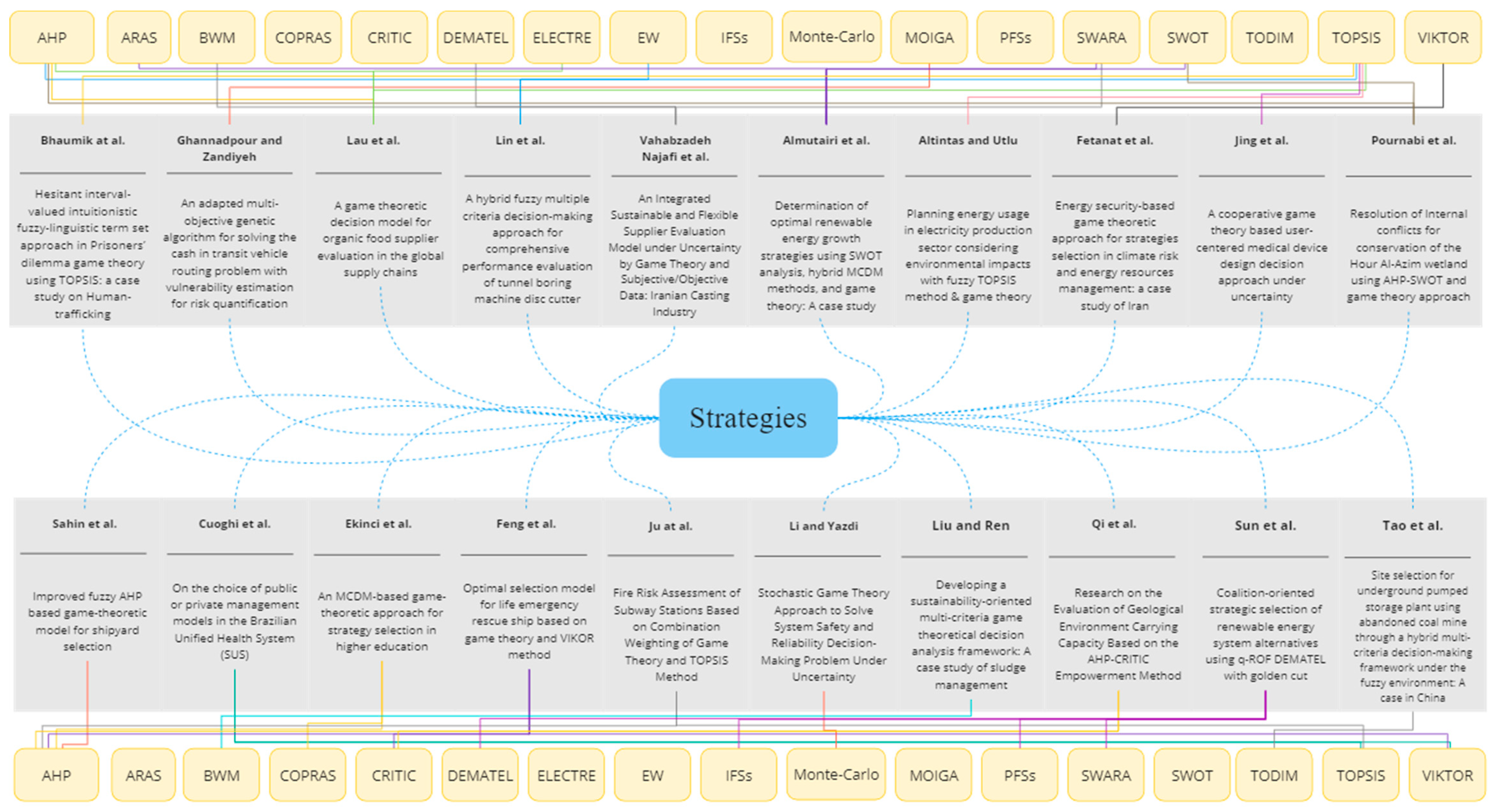

In order to address various selection issues, this paper delves into different publications to discover how various strategies could be used as a multi-criteria decision-making (MCDM) tool. Twenty of these publications are presented below, in order of the publishing year and lead author’s name (Figure 1).

Figure 1.

Combining different strategies and MCDM methods overview [9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28].

The contribution and originality of this paper, which focuses on selecting a contractor in public procurement for landslide rehabilitation, is to investigate how bidding strategies might influence the selection of the ideal contractor among 11 candidates for landslide rehabilitation in the Brčko district by utilizing eight different strategies across four different lots. This paper demonstrates how different strategies can be used in conjunction with multi-criteria decision-making (MCDM) methods to select a strategy that will result in winning the contract.

The benefit of this approach is that it can be used to select a successful strategy in other public procurements. A winning strategy can be selected, and a contract can be obtained using bidding strategies and MCDM methodologies. It is important to note that this strategy’s primary disadvantage lies in the fact that it is impossible to predict the strategy that the competitors will adopt; instead, it must be assumed. A strategy that will enable a win over competitors will not be chosen if the assumption is incorrect. That is why rational decision-making, as used in this study, is necessary.

Following Section 1 this research paper consists of four other sections, namely: Section 2, Section 3, Section 4, and Section 5. Through Section 2, the example of Brčko district’s LOT 1–4 will be addressed with a detailed multi-attributive border approximation area comparison (MABAC) approach. The selected strategies for the constructors to follow will be presented in Section 3. This research will conclude with Section 4 and Section 5 which offer limitations and instructions for future research.

2. Materials and Methods

The Department of Public Safety (Department) in Brčko district has launched a public procurement for landslide rehabilitation at four locations. The estimated value of this landslide rehabilitation is 80,000, 45,000, 23,000, and 800 euros, respectively. The Department starts a mini-tendering process based on a framework agreement to determine which supplier is the most favorable. The Department has 11 bidders at its disposal who are eligible to participate in this public procurement process based on the framework agreement, and each vendor competes with the others to win a contract for the execution of the works. In this process, the price is determined by applying the best available economic offer rather than using an electronic auction. The cost of the work makes up 95% of the basis for the creation of the ranking list of contractors when determining the most acceptable economic offer, while the deadline for the execution of the work makes up 5%. The lowest price is used to determine the offer that is most advantageous economically, and the percentage of other offers that differ from it is calculated. The same process is applied when determining how much other offers deviate from the lowest deadline for the completion of the work; this time, the lowest deadline is taken. Based on this, a percentage is calculated to determine the most acceptable economic offer. Based on these two factors, the best supplier is the one with the highest percentage.

The Department has established a minimum and maximum number of days that should apply to each lot in terms of the deadline for the completion of the works, namely: LOT 1 to 20 working days, LOT 2 and LOT 3 to 15 working days, and LOT 4 to 10 working days. Bidders will be penalized 1% of the contract’s total value per day, up to a maximum of 10%, if the work is not finished on schedule. In order to give the bidders a better understanding of the actual situation surrounding those landslides, the Department added the clause of a mandatory field visit into the contract.

This case study is viewed from the perspective of one of the bidders and his decision to select the best strategy for obtaining the contract. It should be noted that the bidder estimated his costs for the rehabilitation of these landslides to be 60,000, 35,000, 18,000, and 600 euros during the tour of the sites. The bidder’s estimate for the deadline for the execution of these works is 25 working days for LOT 1, 18 working days for LOT 2, 15 working days for LOT 3, and 5 working days for LOT 4. The bidder has several strategies at his disposal, namely:

- Selection of the value based on the bidder’s estimated value and selection of the maximum deadline for the execution of the works;

- Selection of a value slightly above the bidder’s estimated value and selection of a realistic deadline for the execution of works;

- Selection according to the assessment of the estimated value of the landslide rehabilitation and the maximum deadline for the execution of the works;

- Selecting a little below the estimated value of the landslide and a realistic deadline for the execution of the works;

- Selection of the middle price that is between the value estimated by the contractor and the bidder and the realistic deadline for the execution of the works;

- Selection of the actual cost price and the maximum deadline for the execution of works;

- Selection of the minimum price and a realistic deadline for the execution of works;

- Selection below the actual price and the minimum deadline for the execution of works.

In addition to these strategies, contractors have access to other strategies that fall in the middle of these options, but as there is no e-auction in this case, a prospective bidder must select one of the predetermined strategies. The aforementioned strategies were investigated using bidding strategies and MCDM methods.

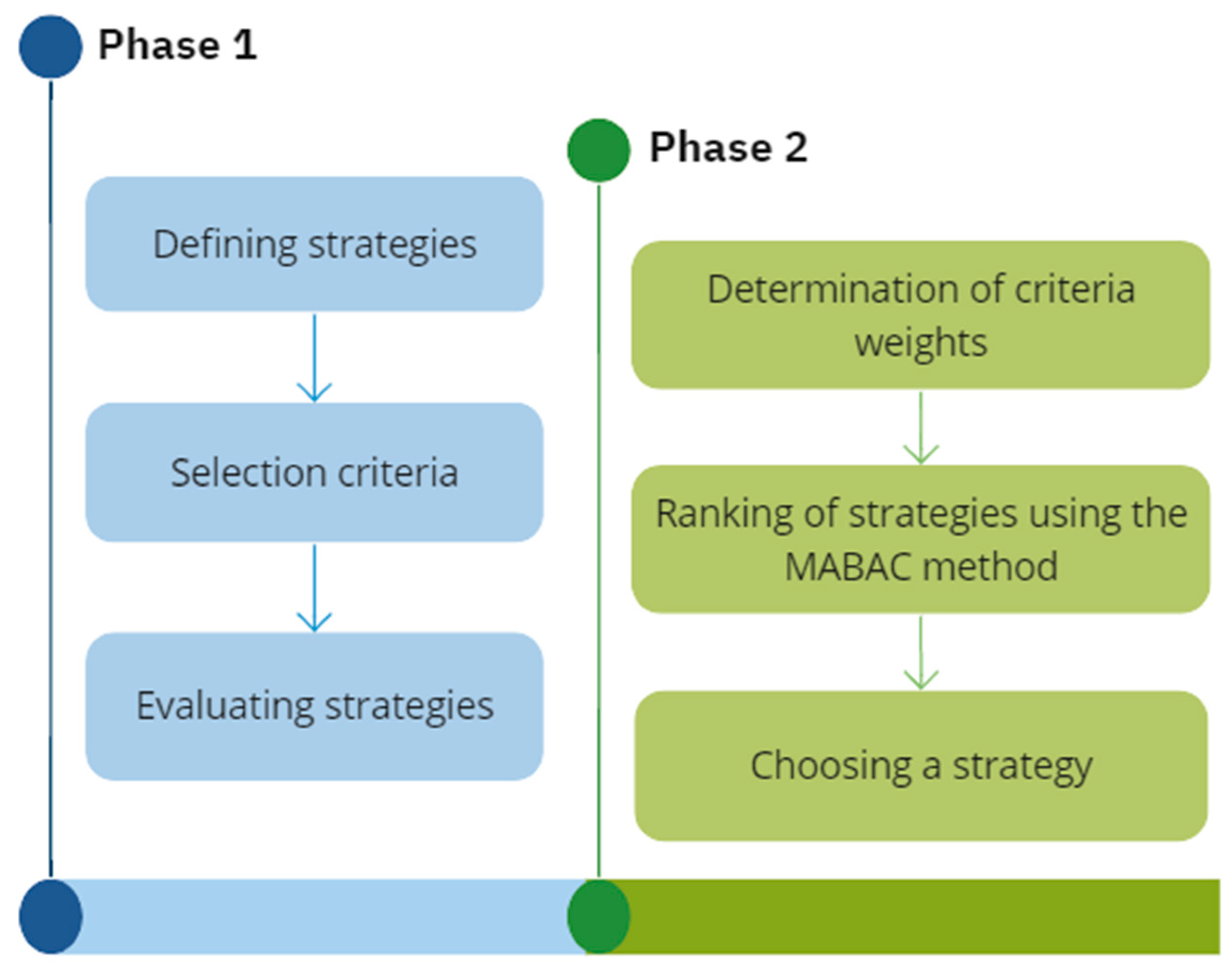

The phases used by the research methodology are as follows (Figure 2):

Figure 2.

Flow chart of research methodology.

Phase 1. Developing and accessing strategies. As this phase progresses, strategies for each lot were developed in accordance with the bidders’ strategies, and the indicators required for evaluating these strategies were calculated in the MCDM environment. The selection of criteria was required before evaluating a strategy [29,30,31]. Given that the value of the work and the delivery date are considered when conducting mini-tendering, it makes sense to consider these two factors when assessing strategies. Since the costs of the works are the same for all of the strategies, the criterion is profit, which represents the difference between the value and the costs of the works. Additionally, it is important to evaluate the possibility of risk in order to determine the appropriate penalty for the late completion of the work. The works are expected to take 25, 18, 15, and 5 days to complete, depending on the lot. The risk is lower if a deadline is offered that is above this estimate, and higher if it is below this estimate. In this manner, this criterion is formed. The likelihood of a potential bidder winning the mini-tender is the final and most important criterion used to select contractors. Lower chances of landing the contract are associated with higher values and longer deadlines for the completion of the work, and vice versa. Which presents the basis for this criterion? From all of the above, the following criteria were selected: the value of the works (C1—Value), the deadline for the completion of the works (C2—Deadline), profit (C3—Profit), the risk for the completion of the works (C4—Risk), and the probability of winning the contract (C5—Win). The type of criterion, whether cost- or benefit-related, as well as whether it should be maximized or minimized, must then be determined. The above stands to reason when considering the cost, profit, and probability of winning the contract; however, in the case of the bidder’s execution deadline, a longer deadline is preferable given that he would avoid incurring penalties.

Phase 2. Ranking the strategies. After the strategies were developed and evaluated, and the weights of the criteria were determined, the best strategy had to be selected. The weighting of the criteria was determined in such a way that the decision-maker could determine the importance of each criterion, each expressed as a percentage. These percentages were then transformed into weight coefficients that represent their rational numbers. Since it is debatable which strategy of the competitors to use, it is impossible to say with absolute certainty which of the strategies would be successful. As a result, it is imperative to assess strategic alternatives and select the best strategy in order to outperform the competition and win the contract. The goal, however, was to select the one with the best indicators, which would be accomplished using Pamučar and Ćirović’s [32] MABAC method. The selection of the MABAC method was motivated by its limited utilization within game theory in previous studies, despite its widespread application in other domains. Importantly, the MABAC method aligns with conventional MCDM approaches and can be effectively employed across various fields. A notable advantage of this method lies in its normalization technique, which accommodates negative data values without necessitating preliminary data adjustments. In contrast, alternative normalization approaches require data correction prior to normalization. Since some criteria values are negative, it is necessary to choose a complex linear normalization. The MABAC method is a rational choice since it employs the aforementioned normalization, as opposed to other methods that must be modified to be used in this setting. The purpose of the MABAC method is to rank the alternatives in accordance with their deviation from the average value [33,34], by following six steps [2,35,36].

Step 1. Formation of the initial decision matrix, which consists of the values of the strategies according to the observed criteria.

Step 2. Normalization of the initial decision matrix. The expressions for calculating the normalization were as follows:

For the benefit criteria

For the cost criteria

where represents the highest value of the alternative for a certain criterion, while represents the lowest value of the alternative for a certain criterion.

Step 3. Calculation of indicators of the weighted matrix (V) elements. Here, the normalized data were multiplied with the corresponding weight increased by that weight:

Step 4. Determination of border approximate area matrix (G). In this step, the matrix G was calculated using the geometric mean formula:

Step 5. Calculating the distance of the elements of the weighted matrix (V) from the value of the approximate border area matrix (G). In this step, the deviation of matrix V from matrix G was calculated:

Step 6. Ranking alternatives. The alternatives were ranked according to the MABAC method’s value, with the best alternative having the greatest MABAC method value:

Using the MABAC method, a ranking of strategies was formed and the strategy that shows the best results was chosen.

Based on the aforementioned steps, it can be inferred that the MABAC method is characterized by its user-friendly nature. As a result, this method has garnered successful applications across diverse domains, as demonstrated in Ebadi Torkayesh’s [37] paper. Notably, within the realm of game theory, the MABAC method has been employed on two occasions to date.

3. Results

The contractor should keep in mind that there were a total of 11 competitors who were essential to carrying out this work when deciding which of the aforementioned strategies to use. The contractor had to make an effort to minimize the number of competitors before deciding on a strategy for a specific lot. A planned outing on the site was used to carry out this task. Each bidder chose whether or not to participate in site visits, even though the contractor required a site visit. A bidder was not obligated to submit an offer if he went to the site visits, but if he did not, the offer would not be accepted. The prospective bidder was able to determine how many rivals have arrived this way, allowing him to determine the approach he would take to win the contract. There were six bidders who visited the site in question, although there was a likelihood that a few more would do so afterward. It was anticipated that a total of eight bidders would take part in the game. Based on this, the LOT 1 strategy was developed (Table 1).

Table 1.

The initial decision-making matrix for the selection of strategies for LOT 1.

If there were no other bidders, strategy 1 would be the best solution. However, with this strategy, the likelihood of winning the contract was the lowest, as was the risk that the work would not be completed on time. This is because competitors are most interested in this landslide since its rehabilitation is the most alluring because it generates the highest possible profit. Since the offer should be less than rival offers, the likelihood of winning the contract for the job rises when the offer’s value was reduced. The winning bidder would ultimately be determined by the bids of other bidders, so none of the strategies can assure that a particular bidder would be awarded the contract. There would be no opportunity for analysis and interpretation when conducting an e-auction, as all bidders would use strategy 1 and lower their offers as needed. This issue, where there is no possibility to conduct an e-auction, is a common one in public procurement. After evaluating the strategies and values with the potential supplier based on the observed criteria, it was necessary to determine how important these criteria were for the bidder, and the weights of these criteria had to therefore be determined. This weight was determined as a percentage and depended on the bidder’s preferences since there was only one bidder and a limited number of criteria. The observed bidder rated the probability of winning the contract as the most crucial criterion, giving it a 40% weighting. The profit came in second with a 25% weighting, followed by the risk associated with the completion of the works with a 15% weighting, and value and deadline are both given 10% weightings. These weightings were obtained through direct estimation. Subsequently, the selected contractor was presented with these criteria and tasked with allocating percentages in such a way that their cumulative value equaled 100%. Based on this requirement, the percentages were selected and subsequently adjusted to ensure they corresponded to rational values. As a result, the total sum of these weights equated to one (1). Importantly, it should be noted that, on this occasion, no other methods were utilized to determine the criterion weights; instead, they were directly assigned.

Ranking the strategies is necessary in order to select the one that would be most acceptable to the bidder given the weights of the criteria that have been established [37,38]. The MABAC method was used to rank the strategies due to the normalization it provides. Contrary to some other normalizations, this normalization permitted the use of negative data values. As a result, the next step in strategy selection was to normalize the data for the observed strategies (Table 2). In this case, only criterion C4 used the cost criteria formula (Expression (3)), whereas the other criteria used benefit normalization (Expression (2)).

Table 2.

Normalized decision matrix for LOT 1.

After normalizing the data for the strategies, the weighting of the criteria (Expression (4)) and the determination of the border approximate area matrix (Expression (5)) were performed. Next, it was calculated how far the data deviated from the G matrix. The final ranking of the strategies was formed based on this deviation. According to the study results (Table 3), the most effective strategy was number 6, which chose the least profitable option and the longest possible deadline for the work. In this way, the bidder selected strategy S6 if he wanted to win the contract without taking any chances. It was interesting that S1, the strategy with the highest profit and longest execution time, was ranked second. Although this approach was rated the best across all four criteria, it was the least likely to result in winning the contract. Thus, it was rejected as the best strategy. The S8 strategy, which had a minimum delivery time and a value that was below its cost, received the lowest ranking.

Table 3.

Ranking strategies for LOT 1.

These calculations led to the conclusion that when selecting strategies, a compromise had to be made as no single strategy could have the highest profits or the highest probability of winning a contract. If probability and risk were not considered, bidders would select the strategy that maximized their profit. These findings demonstrated how the market economy operates. In scenarios where there were more competitors, it was necessary to compromise for an offer with the lowest profit possible. The bidder’s chances of winning the contract were reduced if he chose a higher profit margin, and as a result of the offer being less than the estimated value, the Department was able to save €15,000.

The aforementioned approach was common in lots where profit potential was the greatest. The same applied to evaluating strategies when submitting an offer for LOT 2. The estimated value of the works in LOT 2 was less than the costs to perform them, and the works could not be finished in the minimum amount of time required. The risk evaluation for the execution period and the likelihood of winning the contract were thus comparable to those for LOT 1. Following the formation of the initial decision-making matrix for the selection of strategies for LOT 2 (Table 4), these strategies were ranked using the MABAC method in the same manner as for LOT 1.

Table 4.

The initial decision-making matrix for the selection of strategies for LOT 2.

The obtained results (Table 5) were similar to those of LOT 1 since the implementation of these strategies was constrained by the same limitations, and strategy S6 was chosen as the best strategy for making an offer. Bidders were therefore aiming for a low-profit margin and a realistic deadline for completing the work. The results show that strategy S1 improved its performance and came very close to being better than strategy S6. This is due to the fact that, with this strategy, profit was maximized and there was no risk in meeting the work deadlines. However, with seven other bidders vying for the position, the likelihood of winning the contract was low. The eighth and final ranking strategy in this case, S8, was predicated on the notion that there was a risk during the completion of the work and a high risk of potential contractual penalties.

Table 5.

Ranking strategies for LOT 2.

The estimated time for completing these works was equal to the minimum required time, so there was a change when selecting a strategy for Lot 3. As a result, the risk associated with the application of contractual penalties was reduced. Therefore, the risk of missing the deadline was lower than in the previous two analyses, ranging between 10 and 20% (Table 6).

Table 6.

The initial decision-making matrix for the selection of strategies for LOT 3.

The same outcome (Table 7) regarding the best strategy being S6 as with the prior lots was obtained, despite a few differences regarding the risk at the execution stage. This is because, with this lot, more bidders would make offers that are just slightly below the estimated value. As a result, strategies S1, S2, and S3 would not result in winning the contract because there was a low probability of employment with these strategies. With this lot, too, the bidder had to aim for the lowest possible profit while meeting a reasonable deadline for completion.

Table 7.

Ranking strategies for LOT 3.

The strategies chosen for LOT 4 (Table 8) were distinct in that the work could be completed in less time than the specified minimum period and at a lower cost than the estimated value. In this case, all strategies had the same execution time frame and had the same risk. Additionally, given that there was little competition due to the low value of these works, the probability of winning the contract changed.

Table 8.

The initial decision-making matrix for the selection of strategies for LOT 4.

The MABAC method was used to select the strategy here, as it was with the other lots. Since all alternatives in criteria C2 and C4 had the same values after normalization, all alternatives in these criteria were assigned the value one (1), as each of these values was both the best and the worst at the same time. Given this information, these criteria were assigned the value of zero (0) when the MABAC method’s steps were followed. The results obtained in this manner (Table 9) revealed that the S4 strategy is the best for LOT 4, as it assumes that the value falls slightly below the estimated value and that the number of days for completion of works is kept to a minimum. This explains why the ranking of the strategies is different in this case.

Table 9.

Ranking strategies for LOT 4.

These findings were obtained due to the fact that this lot’s profit margin was much lower than those of other lots, which will cause bidders to show less interest in it. To maximize the profit, the bids, if made, were slightly below the estimated value and similar to those of the observed bidder. The only issue was that it is impossible to predict how much the rivals would lower the offer, so we chose €50 as the estimated value instead.

4. Discussion

According to the law on public procurement [38], public procurement must be used by all public administration bodies. This law governs the procedures to be followed when conducting specific public procurements for public administration and in order to obtain the best offer from bidders, public procurements must be carried out [39]. The mini-tethering procedure was applied in this study, and the 11 final bidders were used in the process while the strategy selection process was observed through the eyes of one of the bidders. In this research, there were four different landslide lots that were open to all prospective bidders.

Since decisions are made based on strategies [40], they form the foundation of game theory. In this particular case, to select strategies, the fundamentals of game theory were applied. The bidder had access to a large number of strategies, but they were narrowed down to eight, and on lots 1–4, these specific strategies were put into practice. A multi-criteria decision-making approach known as MABAC was used in this research paper to select the best one of eight strategies. Based on the data for individual strategies, this method selected one of them as a potentially winning strategy. As it is impossible to predict which strategies will be successful, a certain amount of uncertainty must always be integrated into every decision, as it is impossible to predict what the competitor might do or even if all of them would make an offer [41]. This approach aims to reduce uncertainty and, as a result, identifies the strategy with the greatest likelihood of success.

The development of bidding strategies was motivated by these uncertainties [39]. In this case, the bidder had only one move, which was to select a single strategy for obtaining the offer, but as long as the call for bids was active, bid changes were accepted. Therefore, bidders in public procurements tried to gather as much information as possible, and with other bidders, they frequently attempted to reach an agreement on offers [42]. Since prices are determined by bidder agreement rather than supply and demand, these agreements distort the market economy [43]. As stipulated by this, expected offers would be lower if there were more independent bids [44]. In this example, the principles of the market economy and the law of supply and demand were applied [45], resulting in no agreement among the bidders, and the observed bidder having no knowledge of the bids of others.

Due to the uniqueness of mini-tendering in public procurement procedures, this approach is novel and has not been used in practice earlier. Although there are approaches that are comparable to those in the book chapter by Halonen [46], multi-criteria analysis methods were not used in this approach. Determining the criteria to be used was necessary in order to evaluate the strategies that were chosen. Since bidders were selected based on the most economically acceptable offer based on the offer’s value and delivery deadlines, these two criteria were considered. In addition to these criteria, the profit was taken into account, which represents the difference between the value of the offer and the costs, as well as the risk for the completion of the work and the probability of winning the contract. Each bidder aimed to win the contract with the highest profit margin possible. To achieve this, he had to present the most competitive bid [47]. The issue that arose was the deadline for the work’s completion. Contractual penalties, which lowered the profit, were calculated for the bidder if the work was not finished by the deadline. He had to therefore consider the risk when determining the completion date for the work [48].

After the criteria was established, the strategies were assessed using these criteria. To select one of the strategies, the weights, or the importance of certain criteria for the bidder had to be defined first. The most important criterion for the bidder was the probability of winning the contract, followed by the possible profit. The criteria of the offer’s value and the deadline for completion of the works were rated as the least important to the bidder. Using the MABAC method, the strategies were ranked in order to determine which would produce the best outcomes and lead to winning the contract. The alternative data could have a negative value owing to the complex linear normalization [49] that the MABAC method uses as its foundation.

Based on the outcomes for the first three lots, a strategy was selected for the bidder to follow, named strategy S6, which called for the bidder to go with the lowest profit and a reasonable deadline for the completion of the works. With a realistic deadline for the completion of the works and a value that was less than the estimated value, strategy S4 was used in the case of the fourth lot. The contractor’s objective was to secure the lowest possible price for the work, which was accomplished by using the same strategy for the first three lots and a different strategy for Lot 4. On these grounds, the research presented in this paper demonstrated that the issues associated with selecting contractors in public procurement can be resolved by using different bidding strategies supported by MCDM techniques.

5. Conclusions

The purpose of this study was to demonstrate the feasibility of using bidding strategies in conjunction with MCDM methods in the context of public procurement. The peculiarity of this problem was that there were a limited number of players and that different strategies in the form of games were available to them. The observed bidder’s role was to win the contract or to provide the terms under which he would successfully complete the public procurement process, and eight strategies were put to use. Those strategies were evaluated using five criteria, and the MABAC method was employed to select the strategies that should lead to the bidder winning the contract in the case of the public procurement procedure for LOT 1–4, in the Brčko district. The findings demonstrated that the bidder must adopt the S6 strategy, follow the lower profit margin, and set a reasonable deadline for the completion of the work if he wants to win the contract. This strategy, however, can be used when there is a high level of interest from other bidders, as interest increases as more money circulates. If these are projects with a small profit and small value, bidders will choose a strategy of offering a value slightly below the estimated value and selecting a realistic deadline for the completion of the works (S4).

Following the public procurement procedure, it was demonstrated that all four strategies would opt for the best offer. Using these strategies, the contractor would outperform the competition in the landslide rehabilitation work. This analysis demonstrates that the utilization of bidding strategies in public procurement extends beyond its specific context and can be applied to other scenarios where outperforming competitors is a desired outcome. Deviating from established strategies could lead to varied outcomes for the contractor. Opting for a strategy that favors their own interests may result in the failure to secure the job, while selecting a less favorable strategy could secure the job but yield lower profits. This could be considered the primary advantage of applying MCDM techniques, since selecting a winning strategy would be challenging without them. This is because the possible number of scenarios and criteria increases the problem’s complexity. Future research must employ MCDM methods to select a strategy, but for these methods to be effective, game-theoretic approach must also be used, as it would be difficult to identify and evaluate the strategies without game theory.

The number of strategies implemented is one of the research’s limitations. However, given the circumstances, there could be a plethora of strategies that would only complicate the decision-making process. Eight strategies were chosen, and the process was subsequently simplified. Five criteria were chosen as a result of which the strategies were evaluated, and this represents yet another limitation of this research. This research also demonstrated how the implementation of specific MCDM methods could be constrained by the strategies’ values. However, this limitation is overcome by employing complex linear normalization, allowing other MCDM methods to be used.

Future research must show the applicability of additional MCDM methods to these and other problems by applying the proposed normalization process, followed by using game theory to observe other public procurement processes. This will aid bidders in making decisions about the strategy they will use to win the contracts over their competitors.

Author Contributions

Conceptualization, A.P., A.Š. and D.B.; methodology, A.P. and D.B.; software, A.P. and D.T.; validation, A.P., A.Š., D.B. and D.T.; formal analysis, A.P., A.Š. and D.T.; investigation, A.P., A.Š., D.B. and D.T.; resources, A.P. and D.B.; data curation, A.P., A.Š. and D.T.; writing—original draft preparation, A.P., A.Š. and D.T.; writing—review and editing, A.P., A.Š. and D.B.; visualization, A.P. and A.Š.; supervision, A.P. and D.B.; project administration, A.Š. and D.T.; funding acquisition, D.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development (A/RES/70/1); UN General Assembly: New York, NY, USA, 2015; Available online: https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf (accessed on 10 December 2022).

- Horne, J.; Recker, M.; Michelfelder, I.; Jay, J.; Kratzer, J. Exploring Entrepreneurship Related to the Sustainable Development Goals—Mapping New Venture Activities with Semi-Automated Content Analysis. J. Clean. Prod. 2020, 242, 118052. [Google Scholar] [CrossRef]

- Caldera, S.; Mostafa, S.; Desha, C.; Mohamed, S. Exploring the Role of Digital Infrastructure Asset Management Tools for Resilient Linear Infrastructure Outcomes in Cities and Towns: A Systematic Literature Review. Sustainability 2021, 13, 11965. [Google Scholar] [CrossRef]

- Ranjan, R.; Mohammed, F.C.; Rajendran, L.P. Sustainable Development Goals. In The Palgrave Encyclopedia of Urban and Regional Futures; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 1–13. [Google Scholar] [CrossRef]

- Chester, M.; El Asmar, M.; Hayes, S.; Desha, C. Post-Disaster Infrastructure Delivery for Resilience. Sustainability 2021, 13, 3458. [Google Scholar] [CrossRef]

- Collins, B.; Kumral, M. Environmental Sustainability, Decision-Making, and Management for Mineral Development in the Canadian Arctic. Int. J. Sustain. Dev. World Ecol. 2020, 27, 297–309. [Google Scholar] [CrossRef]

- Kuzmanović, M. Behavioral Influences on Strategic Interactions Outcomes in Game Theory Models. Yugosl. J. Oper. Res. 2020, 31, 3–22. [Google Scholar] [CrossRef]

- Jangid, V.; Kumar, G. A Novel Technique for Solving Two-Person Zero-Sum Matrix Games in a Rough Fuzzy Environment. Yugosl. J. Oper. Res. 2022, 32, 251–278. [Google Scholar] [CrossRef]

- Bhaumik, A.; Roy, S.K.; Weber, G.W. Hesitant Interval-Valued Intuitionistic Fuzzy-Linguistic Term Set Approach in Prisoners’ Dilemma Game Theory Using TOPSIS: A Case Study on Human-Trafficking. Cent. Eur. J. Oper. Res. 2020, 28, 797–816. [Google Scholar] [CrossRef]

- Ghannadpour, S.F.; Zandiyeh, F. An Adapted Multi-Objective Genetic Algorithm for Solving the Cash in Transit Vehicle Routing Problem with Vulnerability Estimation for Risk Quantification. Eng. Appl. Artif. Intell. 2020, 96, 103964. [Google Scholar] [CrossRef]

- Lau, H.; Shum, P.K.C.; Nakandala, D.; Fan, Y.; Lee, C. A Game Theoretic Decision Model for Organic Food Supplier Evaluation in the Global Supply Chains. J. Clean. Prod. 2020, 242, 118536. [Google Scholar] [CrossRef]

- Lin, L.; Xia, Y.; Wu, D. A Hybrid Fuzzy Multiple Criteria Decision-Making Approach for Comprehensive Performance Evaluation of Tunnel Boring Machine Disc Cutter. Comput. Ind. Eng. 2020, 149, 106793. [Google Scholar] [CrossRef]

- Vahabzadeh Najafi, N.; Arshadi Khamseh, A.; Mirzazadeh, A. An Integrated Sustainable and Flexible Supplier Evaluation Model under Uncertainty by Game Theory and Subjective/Objective Data: Iranian Casting Industry. Glob. J. Flex. Syst. Manag. 2020, 21, 309–322. [Google Scholar] [CrossRef]

- Almutairi, K.; Hosseini Dehshiri, S.J.; Hosseini Dehshiri, S.S.; Mostafaeipour, A.; Hoa, A.X.; Techato, K. Determination of Optimal Renewable Energy Growth Strategies Using SWOT Analysis, Hybrid MCDM Methods, and Game Theory: A Case Study. Int. J. Energy Res. 2021, 46, 6766–6789. [Google Scholar] [CrossRef]

- Altintas, E.; Utlu, Z. Planning Energy Usage in Electricity Production Sector Considering Environmental Impacts with Fuzzy TOPSIS Method & Game Theory. Clean. Eng. Technol. 2021, 5, 100283. [Google Scholar] [CrossRef]

- Fetanat, A.; Khorasaninejad, E.; Shafipour, G. Energy Security-Based Game Theoretic Approach for Strategies Selection in Climate Risk and Energy Resources Management: A Case Study of Iran. Int. J. Energy Environ. Eng. 2021, 12, 705–723. [Google Scholar] [CrossRef]

- Jing, L.; Jiang, S.; Li, J.; Peng, X.; Ma, J. A Cooperative Game Theory Based User-Centered Medical Device Design Decision Approach under Uncertainty. Adv. Eng. Inform. 2021, 47, 101204. [Google Scholar] [CrossRef]

- Pournabi, N.; Janatrostami, S.; Ashrafzadeh, A.; Mohammadi, K. Resolution of Internal Conflicts for Conservation of the Hour Al-Azim Wetland Using AHP-SWOT and Game Theory Approach. Land Use Policy 2021, 107, 105495. [Google Scholar] [CrossRef]

- Sahin, B.; Yazir, D.; Soylu, A.; Yip, T.L. Improved Fuzzy AHP Based Game-Theoretic Model for Shipyard Selection. Ocean Eng. 2021, 233, 109060. [Google Scholar] [CrossRef]

- Cuoghi, K.G.; Leoneti, A.B.; Passador, J.L. On the Choice of Public or Private Management Models in the Brazilian Unified Health System (SUS). Socio-Econ. Plan. Sci. 2022, 84, 101422. [Google Scholar] [CrossRef]

- Ekinci, Y.; Orbay, B.Z.; Karadayi, M.A. An MCDM-Based Game-Theoretic Approach for Strategy Selection in Higher Education. Socio-Econ. Plan. Sci. 2021, 81, 101186. [Google Scholar] [CrossRef]

- Feng, Y.; Lang, K.; Zhang, Y.; Xing, S. Optimal Selection Model for Life Emergency Rescue Ship Based on Game Theory and VIKOR Method. In Proceedings of the Sixth International Conference on Electromechanical Control Technology and Transportation (ICECTT 2021), Chongqing, China, 14–16 May 2021. [Google Scholar] [CrossRef]

- Ju, W.; Wu, J.; Kang, Q.; Jiang, J.; Xing, Z. Fire Risk Assessment of Subway Stations Based on Combination Weighting of Game Theory and TOPSIS Method. Sustainability 2022, 14, 7275. [Google Scholar] [CrossRef]

- Li, H.; Yazdi, M. Stochastic Game Theory Approach to Solve System Safety and Reliability Decision-Making Problem under Uncertainty. In Advanced Decision-Making Methods and Applications in System Safety and Reliability Problems. Studies in Systems, Decision and Control; Springer: Cham, Switzerland, 2022; pp. 127–151. [Google Scholar] [CrossRef]

- Liu, Y.; Ren, J. Developing a Sustainability-Oriented Multi-Criteria Game Theoretical Decision Analysis Framework: A Case Study of Sludge Management. J. Clean. Prod. 2022, 354, 131807. [Google Scholar] [CrossRef]

- Qi, J.; Zhang, Y.; Zhang, J.; Chen, Y.; Wu, C.; Duan, C.; Cheng, Z.; Pan, Z. Research on the Evaluation of Geological Environment Carrying Capacity Based on the AHP-CRITIC Empowerment Method. Land 2022, 11, 1196. [Google Scholar] [CrossRef]

- Sun, L.; Peng, J.; Dinçer, H.; Yüksel, S. Coalition-Oriented Strategic Selection of Renewable Energy System Alternatives Using Q-ROF DEMATEL with Golden Cut. Energy 2022, 256, 124606. [Google Scholar] [CrossRef]

- Tao, Y.; Luo, X.; Zhou, J.; Wu, Y.; Zhang, L.; Liu, Y. Site Selection for Underground Pumped Storage Plant Using Abandoned Coal Mine through a Hybrid Multi-Criteria Decision-Making Framework under the Fuzzy Environment: A Case in China. J. Energy Storage 2022, 56, 105957. [Google Scholar] [CrossRef]

- Božanić, D.; Tešić, D.; Marinković, D.; Milić, A. Modeling of neuro-fuzzy system as a support in decision-making processes. Rep. Mech. Eng. 2021, 2, 222–234. [Google Scholar] [CrossRef]

- Đalić, I.; Stević, Ž.; Ateljevic, J.; Turskis, Z.; Zavadskas, E.K.; Mardani, A. A novel integrated MCDM-SWOT-TOWS model for the strategic decision analysis in transportation company. Facta Univ. Ser. Mech. Eng. 2021, 19, 401–422. [Google Scholar] [CrossRef]

- Simić, V.; Lazarević, D.; Dobrodolac, M. Picture fuzzy WASPAS method for selectinglast-mile delivery mode: A case study of Belgrade. Eur. Transp. Res. Rev. 2021, 13, 43. [Google Scholar] [CrossRef]

- Pamučar, D.; Ćirović, G. The Selection of Transport and Handling Resources in Logistics Centers Using Multi-Attributive Border Approximation Area Comparison (MABAC). Expert Syst. Appl. 2015, 42, 3016–3028. [Google Scholar] [CrossRef]

- Biswas, S. Measuring Performance of Healthcare Supply Chains in India: A Comparative Analysis of Multi-Criteria Decision Making Methods. Decis. Mak. Appl. Manag. Eng. 2020, 3, 162–189. [Google Scholar] [CrossRef]

- Chattopadhyay, R.; Das, P.P.; Chakraborty, S. Development of a Rough-MABAC-DoE-based Metamodel for Supplier Selection in an Iron and Steel Industry. Oper. Res. Eng. Sci. Theory Appl. 2022, 5, 20–40. [Google Scholar] [CrossRef]

- Kushwaha, D.K.; Panchal, D.; Sachdeva, A. Risk Analysis of Cutting System under Intuitionistic Fuzzy Environment. Rep. Mech. Eng. 2020, 1, 162–173. [Google Scholar] [CrossRef]

- Pamučar, D.S.; Dimitrijević, S.R. Multiple-criteria model for optimal Anti Tank Ground missile weapon system procurement. Mil. Tech. Cour. 2021, 69, 792–827. [Google Scholar] [CrossRef]

- Ebadi Torkayesh, A.; Babaee Tirkolaee, E.; Bahrini, A.; Pamučar, D.; Khakbaz, A. A Systematic Literature Review of MABAC Method and Applications: An Outlook for Sustainability and Circularity. Informatica 2023, 34, 415–448. [Google Scholar] [CrossRef]

- Law on Public Procurement|Zakon o Javnim Nabavkama BiH|Paragraf Lex BA. Available online: https://www.paragraf.ba/propisi/bih/zakon-o-javnim-nabavkama.html (accessed on 17 December 2022).

- Verma, V.; Bisht, P.; Joshi, S. Sustainable Supply chain Systems of Food and Beverages SMEs: Analyzing sustainable performance using Structured Equation Modeling. J. Decis. Anal. Intell. Comput. 2022, 2, 53–68. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Jokić, Ž.; Božanić, D.; Pamučar, D. Selection of fire position of mortar units using LBWA and fuzzy MABAC model. Oper. Res. Eng. Sci. Theory Appl. 2021, 4, 115–135. [Google Scholar] [CrossRef]

- Rimšaitė, L. Corruption risk mitigation in energy sector: Issues and challenges. Energy Policy 2019, 125, 260–266. [Google Scholar] [CrossRef]

- Biswas, S.; Joshi, N. A Performance based Ranking of Initial Public Offerings (IPOs) in India. J. Decis. Anal. Intell. Comput. 2023, 3, 15–32. [Google Scholar] [CrossRef]

- Bellinaso, L.V.; Carvalho, E.L.; Cardoso, R.; Michels, L. Price-Response Matrices Design Methodology for Electrical Energy Management Systems Based on DC Bus Signalling. Energies 2021, 14, 1787. [Google Scholar] [CrossRef]

- Boğa, S.; Topcu, M. Creative economy: A literature review on relational dimensions, challanges, and policy implications. Econ.-Innov. Econ. Res. J. 2020, 8, 149–169. [Google Scholar] [CrossRef]

- Halonen, K.-M. Central purchasing bodies in Finland. In Centralising Public Procurement; Edward Elgar Publishing: Cheltenham, UK, 2021; pp. 154–169. [Google Scholar] [CrossRef]

- Topić-Pavković, B.; Kovačević, S.; Kurušić, D. The impact of innovative financial and banking development on the economic growth of Bosnia and Herzegovina. Econ.-Innov. Econ. Res. J. 2022, 11, 9–26. [Google Scholar] [CrossRef]

- Fabris, N. Impact of Covid-19 Pandemic on Financial Innovation, Cashless Society, and Cyber Risk. Econ.-Innov. Econ. Res. J. 2022, 10, 73–86. [Google Scholar] [CrossRef]

- Biswas, S.; Bandyopadhyay, G.; Guha, B.; Bhattacharjee, M. An Ensemble Approach for Portfolio Selection in a Multi-Criteria Decision Making Framework. Decis. Mak. Appl. Manag. Eng. 2020, 2, 138–158. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).