Identification of Emerging Technological Hotspots from a Multi-Source Information Perspective: Case Study on Blockchain Financial Technology

Abstract

1. Introduction

2. Literature Review

2.1. Research on Identification Methods for Emerging Technologies

2.2. Research on Blockchain Financial Technology

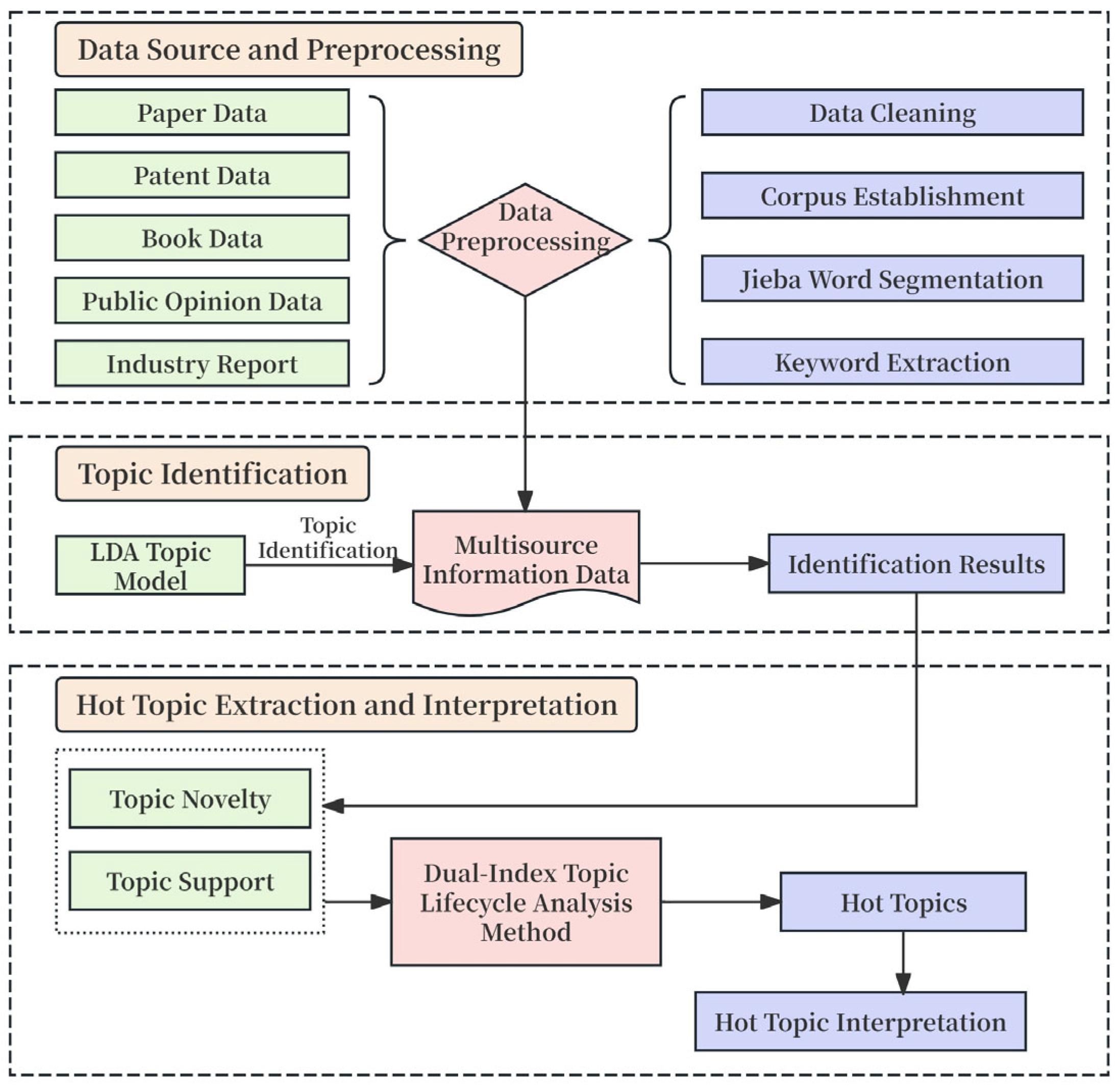

3. Emerging Technology Hot Topic Identification Method Based on Multi-Source Information

3.1. Research Approach

3.2. Research Methods

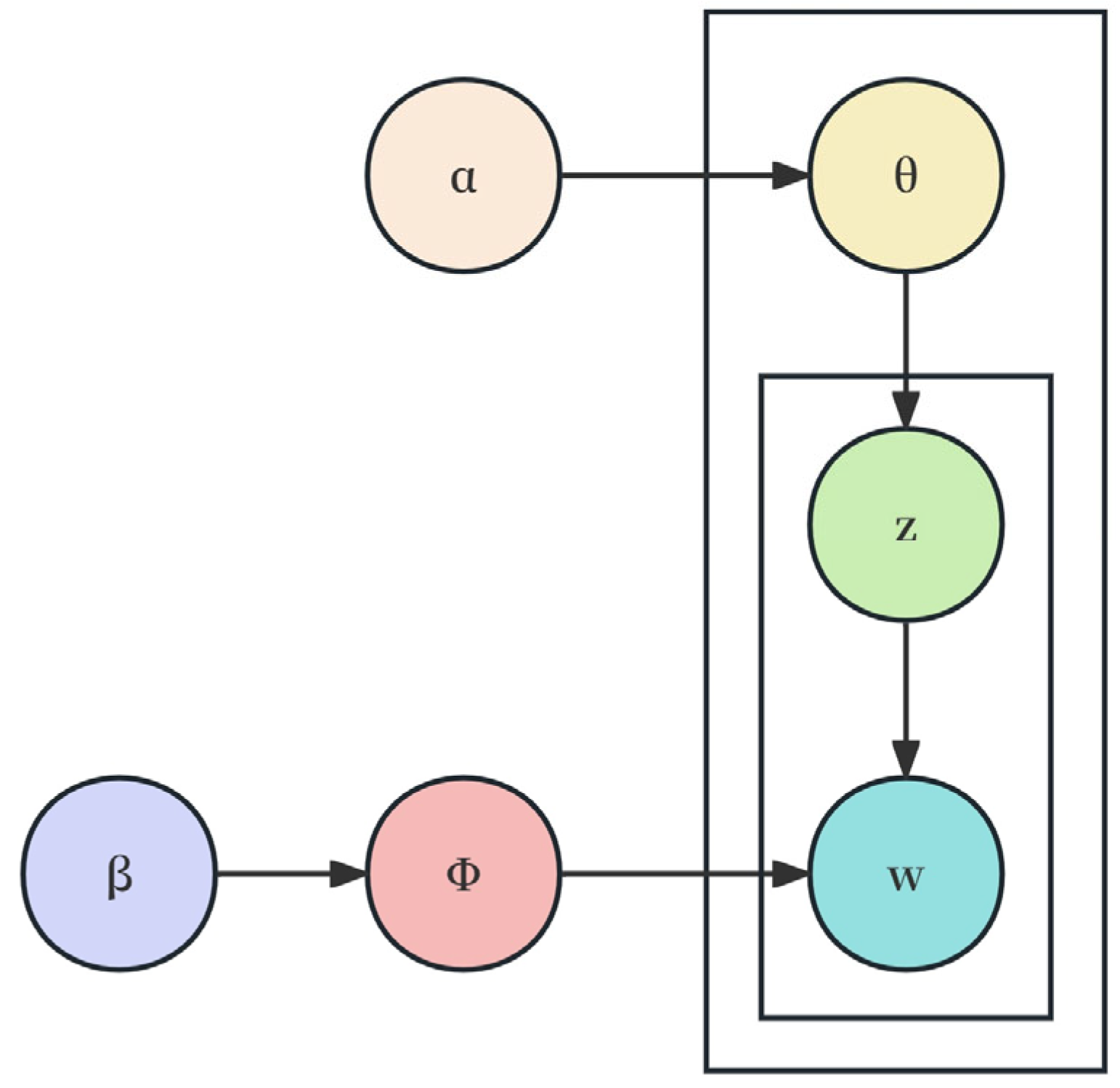

3.2.1. LDA Topic Model

3.2.2. Dual-Index Theme Lifecycle Analysis Method

4. Empirical Research

4.1. Multi-Source Information Acquisition

4.2. Multi-Source Information Preprocessing

4.3. Word Frequency Statistical Analysis

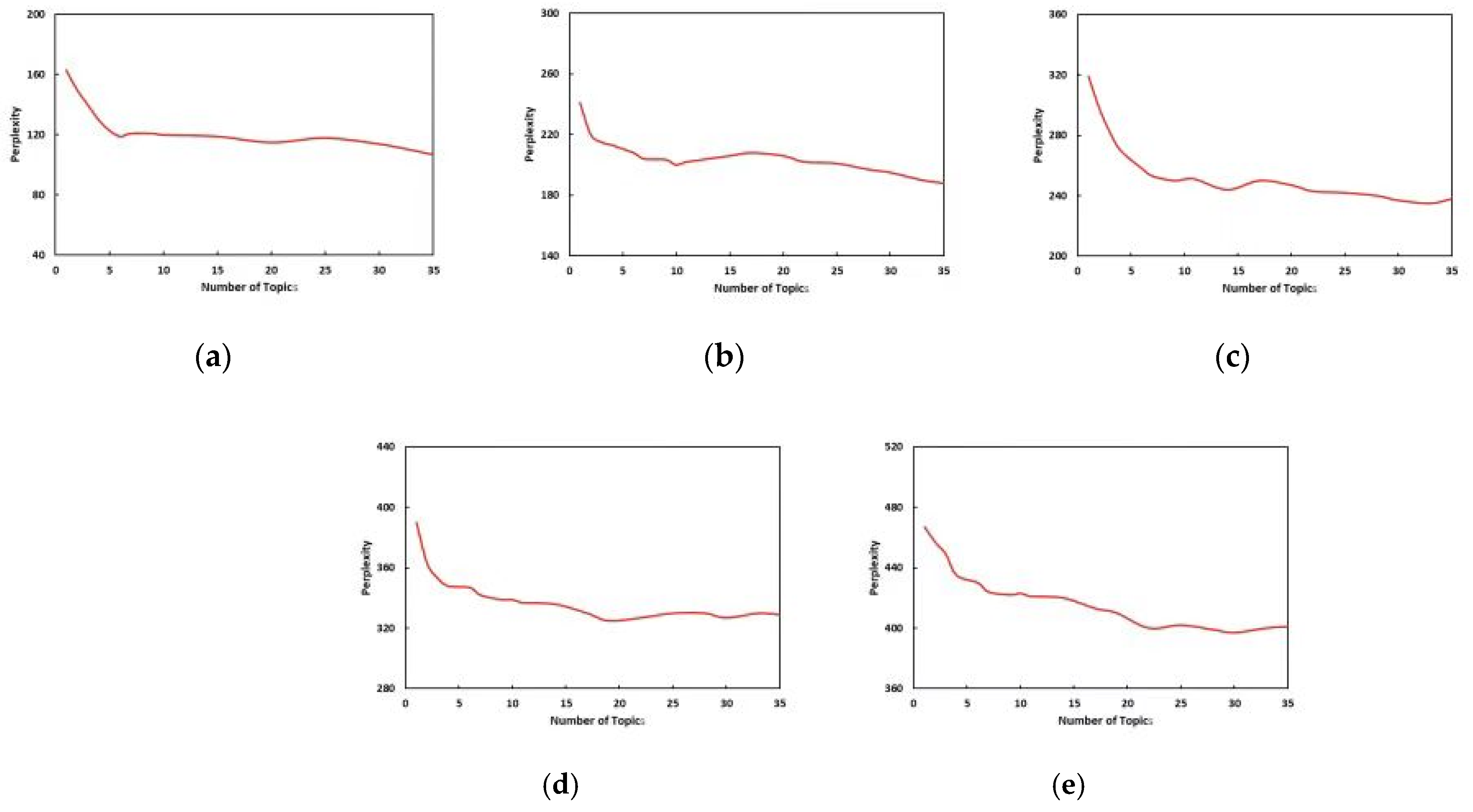

4.4. Theme Identification Based on Multi-Source Information

4.5. Hot Topic Extraction

4.6. Validity Analysis

4.7. Results Analysis

4.7.1. Topic 17: Fintech

4.7.2. Topic 4: Digital Invoices

4.7.3. Topic 2: Cross-Border Payments

4.7.4. Topic 6: Supply Chain Finance

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zamani, M.; Yalcin, H.; Naeini, A.B.; Zeba, G.; Daim, T.U. Developing metrics for emerging technologies: Identification and assessment. Technol. Forecast. Soc. Chang. 2022, 176, 121456. [Google Scholar] [CrossRef]

- Zhang, P.; Li, T.; Wang, G.; Luo, C.; Chen, H.; Zhang, J.; Wang, D.; Yu, Z. Multi-source information fusion based on rough set theory: A review. Inf. Fusion 2021, 68, 85–117. [Google Scholar] [CrossRef]

- Nti, I.K.; Adekoya, A.F.; Weyori, B.A. A novel multi-source information-fusion predictive framework based on deep neural networks for accuracy enhancement in stock market prediction. J. Big Data 2021, 8, 17. [Google Scholar] [CrossRef]

- Javed, A.R.; Shahzad, F.; ur Rehman, S.; Zikria, Y.B.; Razzak, I.; Jalil, Z.; Xu, G. Future smart cities: Requirements, emerging technologies, applications, challenges, and future aspects. Cities 2022, 129, 103794. [Google Scholar] [CrossRef]

- Jiang, L.; Zhang, T.; Huang, T. Empirical research of hot topic recognition and its evolution path method for scientific and technological literature. J. Adv. Comput. Intell. Intell. Inform. 2022, 26, 299–308. [Google Scholar] [CrossRef]

- Haleem, A.; Javaid, M.; Singh, R.P.; Suman, R.; Rab, S. Blockchain technology applications in healthcare: An overview. Int. J. Intell. Netw. 2021, 2, 130–139. [Google Scholar] [CrossRef]

- Rahmani, A.; Vaziri Nezhad, R.; Ahmadi Nia, H.; Rezaeian, M. Methodological principles and applications of the Delphi method: A narrative review. J. Rafsanjan Univ. Med. Sci. 2020, 19, 515–538. [Google Scholar] [CrossRef]

- de Liaño, B.G.G.; Pascual-Ezama, D. The Delphi Method as a technique to study Validity of Content. An. Psicol. 2012, 28, 1011–1020. [Google Scholar]

- Zhai, Y.; Ye, Q.; Lu, S.; Jia, M.; Ji, R.; Tian, Y. Multiple expert brainstorming for domain adaptive person re-identification. In Proceedings of the Computer Vision–ECCV 2020: 16th European Conference, Glasgow, UK, 23–28 August 2020; Proceedings, Part VII 16. pp. 594–611. [Google Scholar]

- Zhang, K. The evaluation about options of innovation method application enterprise’s demand. Economist 2011, 1, 45–50. [Google Scholar]

- Zhang, H.; Daim, T.; Zhang, Y.P. Integrating patent analysis into technology roadmapping: A latent dirichlet allocation based technology assessment and roadmapping in the field of Blockchain. Technol. Forecast. Soc. Chang. 2021, 167, 120729. [Google Scholar] [CrossRef]

- Galvin, R. Science Roadmaps. Science 1998, 280, 803. [Google Scholar] [CrossRef]

- Phaal, R.; Farrukh, C.J.P.; Probert, D.R. Technology roadmapping—A planning framework for evolution and revolution. Technol. Forecast. Soc. Chang. 2004, 71, 5–26. [Google Scholar] [CrossRef]

- Wang, H.; Wang, J.; Zhang, Y.; Wang, M.; Mao, C. Optimization of Topic Recognition Model for News Texts Based on LDA. J. Digit. Inf. Manag. 2019, 17, 257. [Google Scholar] [CrossRef]

- Breitzman, A.; Thomas, P. The Emerging Clusters Model: A tool for identifying emerging technologies across multiple patent systems. Res. Policy 2015, 44, 195–205. [Google Scholar] [CrossRef]

- Rotolo, D.; Hicks, D.; Martin, B.R. What is an emerging technology? Res. Policy 2015, 44, 1827–1843. [Google Scholar] [CrossRef]

- Brady, S.R. Utilizing and adapting the Delphi method for use in qualitative research. Int. J. Qual. Methods 2015, 14, 1609406915621381. [Google Scholar] [CrossRef]

- Armacost, R.L.; Hosseini, J.C.; Pet-Edwards, J. Using the Analytic Hierarchy Process as a Two-phase Integrated Decision Approach for Large Nominal Groups. Group Decis. Negot. 1999, 8, 535–555. [Google Scholar] [CrossRef]

- Shen, Y.-C.; Chang, S.-H.; Lin, G.T.; Yu, H.-C. A hybrid selection model for emerging technology. Technol. Forecast. Soc. Chang. 2010, 77, 151–166. [Google Scholar] [CrossRef]

- Bildosola, I.; Río-Bélver, R.M.; Garechana, G.; Cilleruelo, E. TeknoRoadmap, an approach for depicting emerging technologies. Technol. Forecast. Soc. Chang. 2017, 117, 25–37. [Google Scholar] [CrossRef]

- Huang, L.; Lu, W. Study on the Identification of Emerging Technology by an Attribute Synthetic Measure Model. Sci. Res. Manag. 2009, 30, 190–194. [Google Scholar]

- Kleinberg, J. Bursty and hierarchical structure in streams. In Proceedings of the Eighth ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, Edmonton, AB, Canada, 23–26 July 2002; pp. 91–101. [Google Scholar]

- CiteSpace, C.C., II. Detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inf. Sci. Technol. 2006, 57, 359–377. [Google Scholar]

- Liang, Y.; Liu, Z.; Yang, Z. Analysis of knowledge flow theory in citation analysis. Stud. Sci. Sci. 2010, 28, 668–674. [Google Scholar]

- Li, B.; Chen, X. Identification of emerging technologies in nanotechnology based on citing coupling clustering of patents. J. Intell. 2015, 34, 35–40. [Google Scholar]

- Li, X.; Wang, J.; Yang, Z. Identifying emerging technologies based on subject–action-object. J. Intell. 2016, 35, 80–84. [Google Scholar]

- Yang, C.; Zhu, D.; Wang, X.; Zhu, F.; Heng, X. Technical topic analysis in patents: SAO-based LDA modeling. Libr. Inf. Serv. 2017, 61, 86–96. [Google Scholar]

- Zhijun, R.; Xiaodong, Q.; Jiangtao, Z. Discover Emerging Technologies with LDA Model. Data Anal. Knowl. Discov. 2016, 32, 60–69. [Google Scholar]

- Dong, F.; Liu, Y.; Zhou, Y. Prediction of emerging technologies based on LDA SVM multi class abstract of paper classification. J. Intell. 2017, 36, 40–45. [Google Scholar]

- Gong, S.; Guo, J. Research on Innovation of Technology Finance Model Based on Blockchain. Sci. Manag. Res. 2016, 34, 110–113. [Google Scholar]

- Ding, X. From Internet finance to digital finance: Development trend, characteristics and ideas. J. Nanjing Univ. (Philos. Humanit. Soc. Sci.) 2021, 58, 28–44+162. [Google Scholar]

- Han, J.; Han, M. Research on Innovation of Supply Chain Finance Based on Blockchain Technology. Qilu J. 2022, 2, 131–141. [Google Scholar]

- Liu, Y.; Feng, L. Blockchain Supply Chain Finance and Bank Run Risk. Syst. Sci. Math. 2024, 1–22. [Google Scholar]

- Han, J.; Han, H.; Zhou, Q. Risk Regulation of Digital Finance Based on Blockchain Technology. Sci. Manag. Res. 2024, 42, 137–145. [Google Scholar]

- Su, G. Empowering Digital Innovation in Enterprises with Financial Technology: Theoretical Mechanisms and Empirical Tests. Stat. Decis. Mak. 2024, 40, 161–166. [Google Scholar]

- He, Z. The Impact and Optimization of Electronic Invoices and Digital Payments on the Financial and Tax System. Bus. News 2024, 7, 167–170. [Google Scholar]

- Zheng, D. Data Risk and Governance Path of Cross border Financial Services in the Digital Economy Era. Res. Financ. Issues 2024, 8, 64–74. [Google Scholar]

- Mao, J.; Xie, J.; Gao, Y.; Tang, Q.; Li, Z.; Zhang, B. Navigating Growth: The Nexus of Supply Chain Finance, Digital Maturity, and Financial Health in Chinese A-Share Listed Corporations. Sustainability 2024, 16, 5418. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, S.; Chen, M.; Wu, Y.; Chen, Z. The Sustainable Development of Financial Topic Detection and Trend Prediction by Data Mining. Sustainability 2021, 13, 7585. [Google Scholar] [CrossRef]

- Goghie, A.S. Tokenization and the banking system: Redefining authority in the blockchain era. Compet. Chang. 2024, 10245294241258255. [Google Scholar] [CrossRef]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Tu, Y.-N.; Seng, J.-L. Indices of novelty for emerging topic detection. Inf. Process. Manag. 2012, 48, 303–325. [Google Scholar] [CrossRef]

- Verhoeven, D.; Bakker, J.; Veugelers, R. Measuring technological novelty with patent-based indicators. Res. Policy 2016, 45, 707–723. [Google Scholar] [CrossRef]

- Wu, X.; Li, H.; Zhang, Z.; Wu, Z. A review of semantic novelty research in scientific literature evaluation. Data Anal. Knowl. Discov. 2024, 8, 29–40. [Google Scholar]

- Mann, G.S.; Mimno, D.; McCallum, A. Bibliometric impact measures leveraging topic analysis. In Proceedings of the 6th ACM/IEEE-CS Joint Conference on Digital Libraries, Chapel Hill, NC, USA, 11–15 June 2006; pp. 65–74. [Google Scholar]

- Bai, J.; Yan, D.; Chen, Q. Trend Prediction of Emerging Topics Based on Topic Model and Curve Fitting. Inf. Stud. Theory Appl. 2020, 7, 130–136. [Google Scholar]

- Treleaven, P.; Brown, R.G.; Yang, D. Blockchain technology in finance. Computer 2017, 50, 14–17. [Google Scholar] [CrossRef]

- Fanning, K.; Centers, D.P. Blockchain and Its Coming Impact on Financial Services. J. Corp. Account. Financ. 2016, 27, 53–57. [Google Scholar] [CrossRef]

- Pedregosa, F.; Varoquaux, G.; Gramfort, A.; Michel, V.; Thirion, B.; Grisel, O.; Blondel, M.; Prettenhofer, P.; Weiss, R.; Dubourg, V.; et al. Scikit-learn: Machine Learning in Python. J. Mach. Learn. Res. 2011, 12, 2825–2830. [Google Scholar]

- Wang, Q.; Wang, J. Improved Collaborative Filtering Recommendation Algorithm. Comput. Sci. 2010, 37, 226–228+243. [Google Scholar]

- Song, B.; Suh, Y. Identifying convergence fields and technologies for industrial safety: LDA-based network analysis. Technol. Forecast. Soc. Chang. 2019, 138, 115–126. [Google Scholar] [CrossRef]

- Li, Q.; Liu, L.; Xu, M.; Wu, B.; Xiao, Y. GDTM: A Gaussian Dynamic Topic Model for Forwarding Prediction Under Complex Mechanisms. IEEE Trans. Comput. Soc. Syst. 2019, 6, 338–349. [Google Scholar] [CrossRef]

| Data Type | Data Source | Data Retrieval Scope | Data Count |

|---|---|---|---|

| Paper Data | CNKI Database | Core Journals, CSSCI Journals, CSCD Journals (2014–2021) | 1447 |

| Patent Data | CNKI Database | China Invention Patents, China Utility Model Patents, China Design Patents (2014–2021) | 2444 |

| Book Data | National Library Catalog Search System | Chinese and Special Collection Database, Chinese General Book Database | 99 |

| Public Opinion Data | Weibo Super Topics | Keyword “Blockchain Finance” | 654 |

| Industry Report | Chinese Internet Data Information Network | Keyword “Blockchain Finance” | 29 |

| Rank | Label Word | Frequency | Rank | Label Word | Frequency |

|---|---|---|---|---|---|

| 1 | Blockchain | 8438 | 11 | Technology | 836 |

| 2 | Technology | 4915 | 12 | Intelligent | 831 |

| 3 | Finance | 2489 | 13 | Model | 822 |

| 4 | Regulation | 1426 | 14 | Risk | 812 |

| 5 | Data | 1399 | 15 | Mechanism | 798 |

| 6 | Digital | 1342 | 16 | Transaction | 766 |

| 7 | Currency | 1190 | 17 | Contract | 721 |

| 8 | Information | 1042 | 18 | Internet | 646 |

| 9 | Innovation | 937 | 19 | Economy | 645 |

| 10 | Supply Chain | 893 | 20 | Decentralization | 550 |

| Rank | Label Word | Frequency | Rank | Label Word | Frequency |

|---|---|---|---|---|---|

| 1 | Blockchain | 21762 | 11 | Storage | 3272 |

| 2 | Data | 17478 | 12 | Intelligent | 2863 |

| 3 | Information | 13140 | 13 | Management | 2853 |

| 4 | Transaction | 10748 | 14 | Payment | 2507 |

| 5 | System | 6187 | 15 | Service | 2096 |

| 6 | Business | 5549 | 16 | Encryption | 2048 |

| 7 | Finance | 4176 | 17 | Consensus | 2008 |

| 8 | Network | 3826 | 18 | Digital | 1869 |

| 9 | Contract | 3493 | 19 | Financing | 1404 |

| 10 | Assets | 3344 | 20 | Supply Chain | 1055 |

| Parameter | Parameter Meaning | Value |

|---|---|---|

| α | Prior distribution parameter for topic distribution θ | 50/K |

| β | Prior distribution parameter for topic-word distribution φ | 0.01 |

| I | The maximum number of iterations allowed for LDA convergence | 100 |

| K | Number of latent topics | - |

| Time Period | Number of Topics | Mining Results |

|---|---|---|

| 2014–2017 | 6 | Topic1: Decentralization; Topic2: Digital Currency; Topic3: Mobile Payment; Topic4: Online Credit; Topic5: Securities Trading; Topic6: Supply Chain Finance |

| 2018 | 10 | Topic1: Artificial Intelligence; Topic2: Audit; Topic3: Decentralization; Topic4: Supply Chain Finance; Topic5: Cross-border Payment; Topic6: Insurance Management; Topic7: Financial Technology; Topic8: Digital Bills; Topic9: Digital Currency; Topic10: Securities Trading |

| 2019 | 14 | Topic1: Audit; Topic2: Securities Trading; Topic3: Financial Technology; Topic4: Cross-border Payment; Topic5: Artificial Intelligence; Topic6: Data Provenance; Topic7: Data Security; Topic8: Insurance Management; Topic9: Digital Currency; Topic10: Decentralization; Topic11: Digital Bills; Topic12: Library and Archives Management; Topic13: Supply Chain Finance; Topic14: Consensus Mechanism |

| 2020 | 19 | Topic1: Insurance Management; Topic2: Decentralization; Topic3: Digital Bills; Topic4: Taxation; Topic5: Identity Authentication; Topic6: Library and Archives Management; Topic7: Supply Chain Finance; Topic8: Machine Learning; Topic9: Social Governance; Topic10: Financial Credit Reporting; Topic11: Mobile Payment; Topic12: Consensus Mechanism; Topic13: Public Trust; Topic14: Financial Technology; Topic15: Digital Currency; Topic16: Audit; Topic17: Securities Trading; Topic18: Inclusive Finance; Topic19: Cross-border Payment |

| 2021 | 22 | Topic1: Decentralization; Topic2: Cross-border Payment; Topic3: Digital Currency; Topic4: Digital Bills; Topic5: Taxation; Topic6: Library and Archives Management; Topic7: Machine Learning; Topic8: Social Governance; Topic9: Insurance Management; Topic10: Data Security; Topic11: Financial Credit Reporting; Topic12: Public Trust; Topic13: Mobile Payment; Topic14: Consensus Mechanism; Topic15: Smart Contracts; Topic16: Supply Chain Finance; Topic17: Financial Technology; Topic18: Audit; Topic19: Securities Trading; Topic20: Inclusive Finance; Topic21: Contract Security and Identity Authentication; Topic22: Loan Trading |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, R.; Bao, Z.; Jia, J.; Lv, K. Identification of Emerging Technological Hotspots from a Multi-Source Information Perspective: Case Study on Blockchain Financial Technology. Information 2024, 15, 581. https://doi.org/10.3390/info15090581

Hu R, Bao Z, Jia J, Lv K. Identification of Emerging Technological Hotspots from a Multi-Source Information Perspective: Case Study on Blockchain Financial Technology. Information. 2024; 15(9):581. https://doi.org/10.3390/info15090581

Chicago/Turabian StyleHu, Ruiyu, Zemenghong Bao, Juncheng Jia, and Kun Lv. 2024. "Identification of Emerging Technological Hotspots from a Multi-Source Information Perspective: Case Study on Blockchain Financial Technology" Information 15, no. 9: 581. https://doi.org/10.3390/info15090581

APA StyleHu, R., Bao, Z., Jia, J., & Lv, K. (2024). Identification of Emerging Technological Hotspots from a Multi-Source Information Perspective: Case Study on Blockchain Financial Technology. Information, 15(9), 581. https://doi.org/10.3390/info15090581