A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies

Abstract

:1. Introduction

2. Theoretical Background

3. Methodology

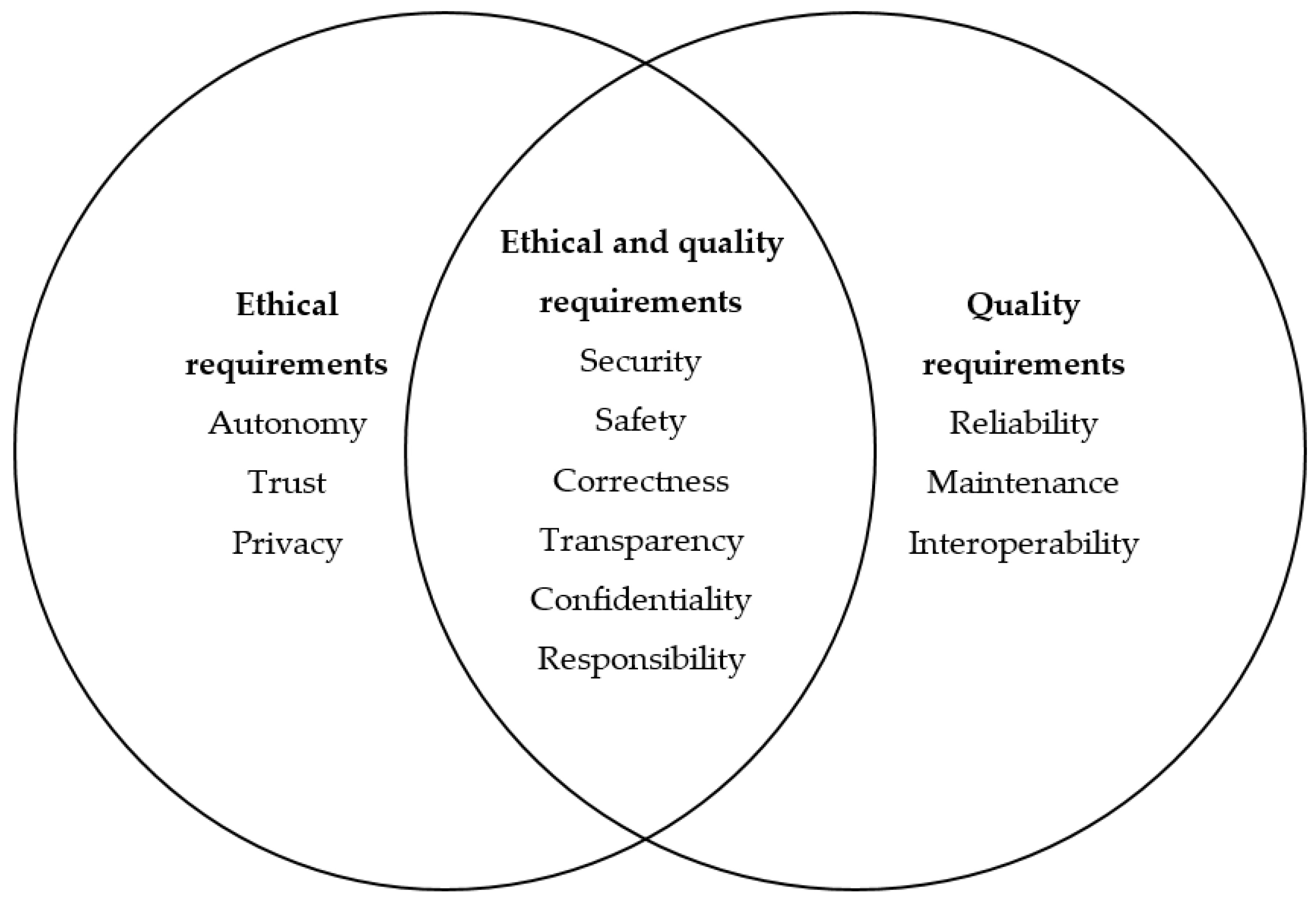

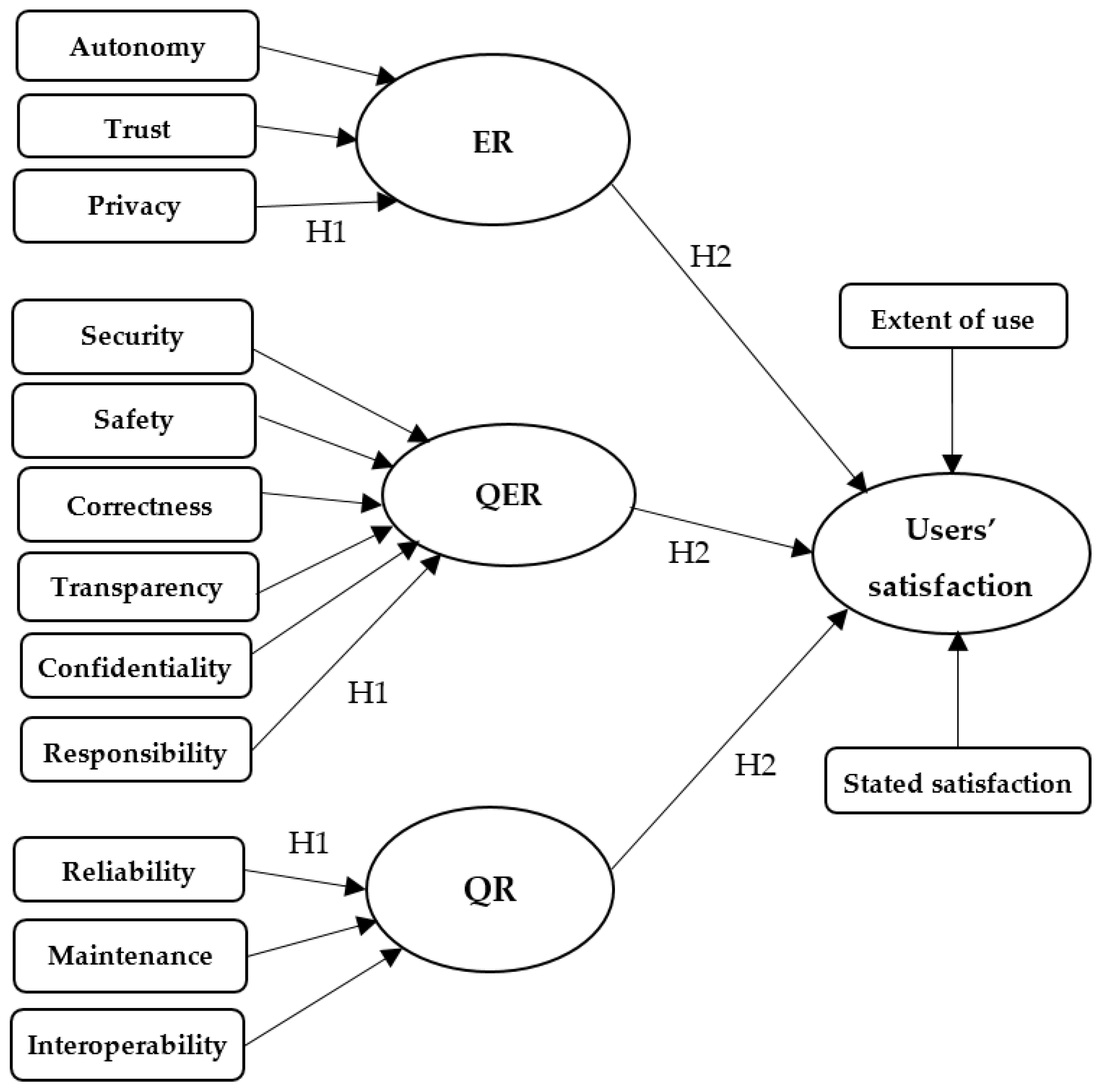

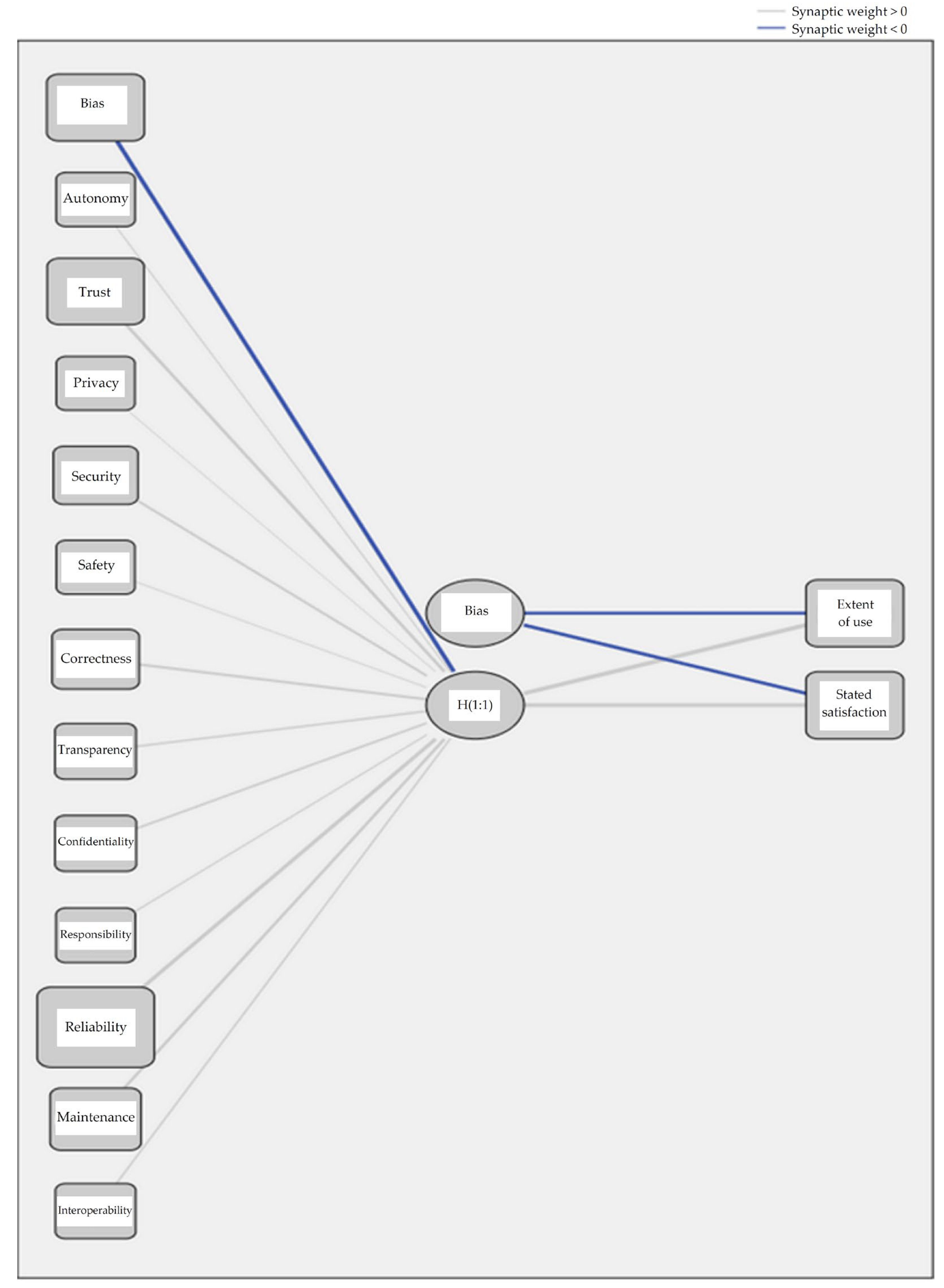

3.1. Selected Variables, Hypotheses, and Methods

3.2. Selected Sample

4. Results

5. Discussion

6. Conclusions

6.1. Empirical and Practical Implications

6.2. Theoretical Implications

6.3. Limitations and Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Items | Scales |

|---|---|---|

| Demographic variables | Gender | Male (1), Female (2) |

| Age | 18–30 years (1), 31–45 years (2), 46–65 years (3) | |

| ER | Autonomy | 1 to 5 (1—not important, 5—most important) |

| Trust | ||

| Privacy | ||

| QER | Security | |

| Safety | ||

| Correctness | ||

| Transparency | ||

| Confidentiality | ||

| Responsibility | ||

| QR | Reliability | |

| Maintenance | ||

| Interoperability | ||

| Users’ satisfaction | Extent of use | 1 to 5 (1—minimal, 5—maximal extent) |

| Stated satisfaction | 1 to 5 (1—very poor, 5—very good) |

References

- Bhimani, A. Digital data and management accounting: Why we need to rethink research methods. J. Manag. Control. 2020, 31, 9–23. [Google Scholar] [CrossRef]

- Goyal, P.; Sahoo, A.K.; Sharma, T.K.; Singh, P.K. Internet of Things: Applications, security, and privacy: A survey. Mater. Today Proc. 2021, 34, 752–759. [Google Scholar] [CrossRef]

- Gonçalves, M.J.A.; da Silva, A.C.F.; Ferreira, C.G. The Future of Accounting: How Will Digital Transformation Impact the Sector? Informatics 2022, 9, 19. [Google Scholar] [CrossRef]

- Sherif, S.; Mohsin, H. The effect of emergent technologies on accountant’s ethical blindness. Int. J. Dig. Account. Res. 2021, 21, 61–94. [Google Scholar] [CrossRef]

- Issa, H.; Sun, T.; Vasarhelyi, M.A. Research ideas for artificial intelligence in auditing: The formalization of audit and workforce supplementation. J. Emerg. Techn. Account. 2016, 13, 1–20. [Google Scholar] [CrossRef]

- Moll, J.; Yigitbasioglu, O. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. Br. Account. Rev. 2019, 51, 100833. [Google Scholar] [CrossRef]

- Rezaei, M.; Jafari-Sadeghi, V.; Cao, D.; Amoozad Mahdiraji, H. Key indicators of ethical challenges in digital healthcare: A combined Delphi exploration and confirmative factor analysis approach with evidence from Khorasan province in Iran. Technol. Forecast. Soc. Change 2021, 167, 120724. [Google Scholar] [CrossRef]

- Castelo-Branco, I.; Cruz-Jesus, F.; Oliveira, T. Assessing Industry 4.0 readiness in manufacturing: Evidence for the European Union. Comput. Ind. 2019, 107, 22–32. [Google Scholar] [CrossRef]

- Gusc, J.; Bosma, P.; Jarka, S.; Biernat-Jarka, A. The Big Data, Artificial Intelligence, and Blockchain in True Cost Accounting for Energy Transition in Europe. Energies 2022, 15, 1089. [Google Scholar] [CrossRef]

- Koh, L.; Orzes, G.; Jia, F. The fourth industrial revolution (Industry 4.0): Technologies disruption on operations and supply chain management. Int. J. Oper. Prod. Man. 2019, 39, 817–828. [Google Scholar] [CrossRef]

- Coman, D.M.; Ionescu, C.A.; Duica, A.; Coman, M.D.; Uzlau, M.C.; Stanescu, S.G.; State, V. Digitization of Accounting: The Premise of the Paradigm Shift of Role of the Professional Accountant. Appl. Sci. 2022, 12, 3359. [Google Scholar] [CrossRef]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Matzler, K.; von den Eichen, S.F.; Anschober, M.; Kohler, T. The crusade of digital disruption. J. Bus. Strategy 2018, 39, 13–20. [Google Scholar] [CrossRef]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and its influence on business model innovation. J. Manuf. Technol. Manag. 2019, 30, 1143–1160. [Google Scholar] [CrossRef]

- Lichtenthaler, U.C. Digitainability: The Combined Effects of the Megatrends Digitalization and Sustainability. J. Innov. Manag. 2021, 9, 64–80. [Google Scholar] [CrossRef]

- Stoica, O.C.; Ionescu-Feleagă, L. Digitalization in Accounting: A Structured Literature Review. In Proceedings of the 4th International Conference on Economics and Social Sciences: Resilience and Economic Intelligence through Digitalization and Big Data Analytics, Bucharest, Romania, 10–11 June 2021; pp. 453–464. [Google Scholar] [CrossRef]

- Bhimani, A.; Willcocks, L. Digitisation, Big Data and the transformation of accounting information. Account. Bus. Res. 2014, 44, 469–490. [Google Scholar] [CrossRef]

- Kakavand, H.; Kost De Sevres, N.; Chilton, B. The Blockchain Revolution: An analysis of Regulation and Technology Related to Distributed Ledger Technologies. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2849251. (accessed on 15 April 2022).

- Dai, J.; Wang, Y.; Vasarhelyi, M.A. Blockchain: An emerging solution for fraud prevention. CPA J. 2017, 87, 12–14. [Google Scholar]

- Bible, W.; Raphael, J.; Riviello, M.; Taylor, P.; Valiente, I.O. Blockchain Technology and its Potential Impact on the Audit and Assurance Profession. 2017. Available online: https://us.aicpa.org/content/dam/aicpa/interestareas/frc/assuranceadvisoryservices/downloadabledocuments/blockchain-technology-and-its-potential-impact-on-the-audit-and-assurance-profession.pdf (accessed on 25 April 2022).

- ICAEW. Blockchain and the Future of Accountancy. Available online: https://www.icaew.com/technical/technology/blockchain/blockchain-articles/blockchain-and-the-accounting-perspective (accessed on 22 March 2022).

- Andersen, N. Blockchain technology: A Game-Changer in Accounting 2016 (Deloitte, March, Issue). Available online: https://www2.deloitte.com/content/dam/Deloitte/de/Documents/Innovation/Blockchain_A%20game-changer%20in%20accounting.pdf (accessed on 1 April 2022).

- Brandon, D. The blockchain: The future of business information systems. Int. J. Acad. Bus. World 2016, 10, 33–40. Available online: https://jwpress.com/Journals/IJABW/BackIssues/IJABW-Fall-2016.pdf#page=28 (accessed on 1 May 2022).

- Vaidyanathan, N. Divided We Fall, Distributed We Stand. The Professional Accountant’s Guide to Distributed Ledgers and Blockchain. 2017. Available online: https://www.accaglobal.com/my/en/technical-activities/technical-resources-search/2017/april/divided-we-fall-distributed-we-stand.html (accessed on 13 April 2022).

- Tang, Y.; Xiong, J.; Becerril-Arreola, R.; Iyer, L. Ethics of blockchain. J. Inform. Technol. People 2019, 33, 602–632. [Google Scholar] [CrossRef]

- Kokina, J.; Mancha, R.; Pachamanova, D. Blockchain: Emergent industry adoption and implications for accounting. J. Emerg. Technol. Account. 2017, 14, 91–100. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification, and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Dai, J.; Vasarhelyi, M.A. Imagineering Audit 4.0. J. Emerg. Technol. Account. 2016, 13, 1–15. [Google Scholar] [CrossRef]

- Lindqvist, U.; Neumann, P.G. The future of the Internet of Things. Commun. ACM 2017, 60, 26–30. [Google Scholar] [CrossRef]

- Mistry, I.; Tanwar, S.; Tyagi, S.; Kumar, N. Blockchain for 5G-enabled IoT for industrial automation: A systematic review, solutions, and challenges. Mech. Syst. Signal. Processing 2020, 135, 106382. [Google Scholar] [CrossRef]

- Krahel, J.P.; Titera, W.R. Consequences of Big Data and formalization on accounting and auditing standards. Account. Horiz. 2015, 29, 409–422. [Google Scholar] [CrossRef]

- Schuh, G.; Potente, T.; Wesch-Potente, C.; Weber, A.R.; Prote, J.-P. Collaboration Mechanisms to increase Productivity in the Context of Industry 4.0. Procedia Cirp 2014, 19, 51–56. [Google Scholar] [CrossRef]

- Li, F.; Lam, K.Y.; Li, X.; Sheng, Z.; Hua, J.; Wang, L. Advances and Emerging Challenges in Cognitive Internet-of-Things. IEEE Trans. Ind. Inform. 2020, 16, 5489–5496. [Google Scholar] [CrossRef]

- Mohanta, B.K.; Jena, D.; Satapathy, U.; Patnaik, S. Survey on IoT security: Challenges and solution using machine learning, artificial intelligence, and blockchain technology. Internet Things 2020, 11, 100227. [Google Scholar] [CrossRef]

- Brous, P.; Janssen, M.; Herder, P. The dual effects of the Internet of Things (IoT): A systematic review of the benefits and risks of IoT adoption by organizations. Int. J. Inf. Manag. 2020, 51, 101952. [Google Scholar] [CrossRef]

- Shaw, J. Artificial intelligence and Ethics. Harv. Mag. 2019, 30. Available online: https://scholar.harvard.edu/people_analytics/publications/artificial-intelligence-and-ethics (accessed on 22 April 2022).

- Lam, M. Neural network techniques for financial performance prediction: Integrating fundamental and technical analysis. Decis. Support Syst. 2004, 37, 567–581. [Google Scholar] [CrossRef]

- Fanning, K.M.; Cogger, K.O. Neural network detection of management fraud using published financial data. Intell. Syst. Account. Financ. Manag. 1998, 7, 21–41. [Google Scholar] [CrossRef]

- Galeshchuk, S.; Mukherjee, S. Deep networks for predicting direction of change in foreign exchange rates. Intell. Syst. Account. Financ. Manag. 2017, 24, 100–110. [Google Scholar] [CrossRef]

- Parot, A.; Michell, K.; Kristjanpoller, W.D. Using Artificial Neural Networks to forecast Exchange Rate, including VAR-VECM residual analysis and prediction linear combination. Intell. Syst. Account. Financ. Manag. 2019, 26, 3–15. [Google Scholar] [CrossRef]

- KPMG. Rise of the Humans: The Integration of Digital and Human Labor. Available online: https://advisory.kpmg.us/articles/2017/rise-of-the-humans-1.html (accessed on 15 April 2022).

- PwC. Sizing the Prize What’s the Real Value of AI for Your Business, and How Can You Capitalise? Available online: https://www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html (accessed on 15 April 2022).

- Paschen, U.; Pitt, C.; Kietzmann, J. Artificial intelligence: Building blocks and an innovation typology. Bus. Horiz. 2020, 63, 147–155. [Google Scholar] [CrossRef]

- Kokina, J.; Kozlowski, S. The next frontier in data analytics. J. Account. 2016, 222, p. 58. Available online: https://ssrn.com/abstract=3334728 (accessed on 23 March 2022).

- Ionescu, B.S.; Prichici, C.; Tudoran, L. Cloud Accounting—A Technology That May Change the Accounting Profession in Romania. Audit. Financ. J. 2018, 12, 3–15. Available online: https://www.cafr.ro/uploads/AF%202%202014-e16d.pdf (accessed on 5 May 2022).

- Huang, N. Discussion on the Application of Cloud Accounting in Enterprise Accounting Informatization. In Proceedings of the International Conference on Economics, Social Science, Arts, Education, and Management Engineering, Huhhot, China, 30–31 July 2016; pp. 136–139. [Google Scholar] [CrossRef]

- Zhang, C. Challenges and Strategies of Promoting Cloud Accounting. Manag. Eng. 2014, 17, 79–82. [Google Scholar] [CrossRef]

- Kinkela, K.; College, I. Practical and ethical considerations on the use of cloud computing in accounting. J. Financ. Account. 2013, 11, 1. Available online: https://www.aabri.com/manuscripts/131534.pdf (accessed on 20 April 2022).

- Singh, S.K.; Rathore, S.; Park, J.H. Blockiotintelligence: A blockchain-enabled intelligent IoT architecture with artificial intelligence. Future Gener. Comput. Syst. 2020, 110, 721–743. [Google Scholar] [CrossRef]

- Moin, S.; Karim, A.; Safdar, Z.; Safdar, K.; Ahmed, E.; Imran, M. Securing IoTs in distributed blockchain: Analysis, requirements and open issues. Fut. Gen. Comp. Sys. 2019, 100, 325–343. [Google Scholar] [CrossRef]

- Bostrom, N.; Yudkowsky, E. The ethics of artificial intelligence. Camb. Handb. Artif. Intell. 2014, 1, 316–334. [Google Scholar] [CrossRef]

- Heber, D.; Groll, M. Towards a digital twin: How the blockchain can foster E/E-traceability in consideration of model-based systems engineering. In Proceedings of the 21st International Conference on Engineering Design (ICED 17) Volume 3: Product, Services and Systems Design, Vancouver, Canada, 21–25 August 2017; pp. 321–330. [Google Scholar]

- Lu, Q.; Xu, X. Adaptable blockchain-based systems: A case study for product traceability. IEEE Softw. 2017, 34, 21–27. [Google Scholar] [CrossRef]

- Lu, H.; Li, Y.; Chen, M.; Kim, H.; Serikawa, S. Brain intelligence: Go beyond artificial intelligence. Mob. Netw. Appl. 2018, 23, 368–375. [Google Scholar] [CrossRef]

- Gordon, L.; Loeb, M. Managing Cybersecurity Resources: A Cost-Benefit Analysis, 1st ed.; McGraw Hill: New York, NY, USA, 2005. [Google Scholar]

- Yau-Yeung, D.; Yigitbasioglu, O.; Green, P. Cloud accounting risks and mitigation strategies: Evidence from Australia. Account. Forum. 2020, 44, 421–446. [Google Scholar] [CrossRef]

- Haapamaki, E.; Sihvonen, J. Cybersecurity in accounting research. Manag. Audit. J. 2019, 34, 808–834. [Google Scholar] [CrossRef]

- Demirkan, S.; Demirkan, I.; McKee, A. Blockchain technology in the future of business cyber security and accounting. J. Manag. Anal. 2020, 7, 189–208. [Google Scholar] [CrossRef]

- Shah, T.; Patel, S.V. A review of requirement engineering issues and challenges in various software development methods. Int. J. Comput. Appl. 2014, 99, 36–45. [Google Scholar] [CrossRef]

- Biable, S.E.; Garcia, N.M.; Midekso, D.; Pombo, N. Ethical Issues in Software Requirements Engineering. Software 2022, 1, 31–52. [Google Scholar] [CrossRef]

- Borras, C. Overexposure of radiation therapy patients in Panama: Problem recognition and follow-up measures. Rev. Panam. Salud Pública 2006, 20, 173–187. [Google Scholar] [CrossRef]

- Wong, W.E.; Debroy, V.; Surampudi, A.; Kim, H.; Siok, M.F. Recent Catastrophic Accidents: Investigating How Software Was Responsible. In Proceedings of the Fourth International Conference on Secure Software Integration and Reliability Improvement, Singapore, 9–11 June 2010; pp. 14–22. [Google Scholar] [CrossRef]

- Nazanin, M. A case study of Volkswagen unethical practice in diesel emission test. Int. J. Sci. Eng. Appl. 2016, 5, 211–216. [Google Scholar] [CrossRef]

- Phillip, L. Requirements Engineering for Software and Systems, 2nd ed.; CRC Press: Boca Raton, FL, USA; Taylor & Francis Group: London, UK, 2014. [Google Scholar]

- Darwish, N.R.; Megahed, S. Requirements engineering in scrum framework. J. Comp. Appl. 2016, 149, 24–29. [Google Scholar] [CrossRef]

- Bowen, W.R. Engineering Ethics. Challenges and Opportunities; Springer International Publishing: Cham, Switzerland, 2014. [Google Scholar]

- Balasubramaniam, N. Using Ethical Guidelines for Defining Critical Quality Requirements of AI Solutions. Espoo: Aalto University School of Science. Available online: https://aaltodoc.aalto.fi/bitstream/handle/123456789/40895/master_Balasubramaniam_Nagadivya_2019.pdf?sequence=1&isAllowed=y (accessed on 10 May 2022).

- Pieters, W. Explanation and trust: What to tell the user in security and AI? Ethics Inf. Technol. 2011, 13, 53–64. [Google Scholar] [CrossRef]

- Doyle, T.; Veranas, J. Public anonymity, and the connected world. Ethics Inf. Technol. 2014, 16, 207–218. [Google Scholar] [CrossRef]

- Jones, S.; Hara, S.; Augusto, J.C. eFRIEND: An ethical framework for intelligent environment development. Ethics Inf. Technol. 2015, 17, 11–25. [Google Scholar] [CrossRef]

- Rahwan, I. Society-in-the-loop: Programming the algorithmic social contract. Ethics Inf. Technol. 2018, 20, 5–14. [Google Scholar] [CrossRef]

- Royakkers, L.; Timmer, J.; Kool, L.; Est, R.V. Societal and ethical issues of digitization. Ethics Inf. Technol. 2018, 20, 127–142. [Google Scholar] [CrossRef]

- Mairiza, D.; Zowghi, D.; Nurmuliani, N. An Investigation into the Notion of Non-Functional Requirements. In Proceedings of the SAC ’10: The 2010 ACM Symposium on Applied Computing, Sierre, Switzerland, 22–26 March 2010; pp. 311–317. [Google Scholar] [CrossRef]

- Mahmoud, A.; Williams, G. Detecting, classifying and tracing non-functional software requirements. Requir. Eng. 2016, 21, 357–381. [Google Scholar] [CrossRef]

- Ameller, D.; Galster, M.; Avgeriou, P.; Franch, X. A survey on quality attributes in service-based systems. Softw. Qual. J. 2016, 24, 271–299. [Google Scholar] [CrossRef]

- Glinz, M. On Non-Functional Requirements. In Proceedings of the IEEE International Requirements Engineering Conference, Delhi, India, 15–19 October 2007; pp. 21–26. [Google Scholar]

- Cysneiros, L.M.; Raffi, M.A.; Leite, J.C.S.P. Software Transparency as a Key Requirement for Self-Driving Cars. In Proceedings of the 2018 IEEE 26th International Requirements Engineering Conference (RE), Banff, AB, Canada, 20–24 August 2018; pp. 382–387. [Google Scholar] [CrossRef]

- Ngubelanga, A.; Duffett, R. Modeling Mobile Commerce Applications’ Antecedents of Customer Satisfaction among Millennials: An Extended TAM Perspective. Sustain. 2021, 13, 5973. [Google Scholar] [CrossRef]

- Dillman, D.A. Mail, and Internet Surveys: The Tailored Design Method; John Wiley & Sons: New York, NY, USA, 2000. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psych. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.A. Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- IBM. SPSS—Neural Networks. 2012. Available online: https://www.ibm.com/downloads/cas/N7LLA2LB (accessed on 15 May 2022).

- Kelly, K.; Murphy, P.R. Reducing Accounting Aggressiveness with General Ethical Norms and Decision Structure. J. Bus. Ethics 2021, 170, 97–113. [Google Scholar] [CrossRef]

- Shawver, T.J.; Miller, W.F. Moral intensity revisited: Measuring the benefit of accounting ethics interventions. J. Bus. Ethics 2017, 141, 587–603. [Google Scholar] [CrossRef]

- Vladu, A.B.; Amat, O.; Cuzdriorean, D.D. Truthfulness in accounting: How to discriminate accounting manipulators from non-manipulators. J. Bus. Ethics 2017, 140, 633–648. [Google Scholar] [CrossRef]

- Zhang, Y.; Xiong, F.; Xie, Y.; Fan, X.; Gu, H. The Impact of Artificial Intelligence and Blockchain on the Accounting Profession. IEEE Access 2020, 8, 110461–110477. [Google Scholar] [CrossRef]

- Tarmidi, M.; Rasid, S.Z.A.; Alrazi, B.; Roni, R.A. Cloud Computing Awareness and Adoption among Accounting Practitioners in Malaysia. Procd. Soc. Behav. 2014, 164, 569–574. [Google Scholar] [CrossRef]

- Özdemir, S.; Elitas, C. The risks of cloud computing in accounting field and the solution offers: The case of Turkey. J. Bus. Res. Turk. 2015, 7, 43–59. [Google Scholar] [CrossRef]

| Ethical Requirement | Description |

|---|---|

| Transparency | Provides real-time information [70] to all stakeholders on accounting operations and decisions |

| Confidentiality | Proper and correct management of information [70] |

| Privacy | Ensuring non-intrusion into privacy through the use of AI solutions [69] |

| Safety | Safety of users using DT results [68] |

| Security | Security of information prior to DT implementation, as well as those arising from the adoption of the DT [72] |

| Correctness | Adoption of a fair decision in the event of conflicting requirements [70] |

| Responsibility | Explicit determination of shared responsibility between user and DT [70] |

| Autonomy | The ability of computers to make real-time decisions based on data without human involvement [67] |

| Trust | Ways to provide users with enhanced reliability by eliminating the risks of using DT [68] |

| Variable | Min | Max | Mean | Standard Deviation | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| Sex | 1 | 2 | 1.46 | 0.499 | 0.155 | −1.990 |

| Age | 1 | 3 | 2.04 | 0.753 | −0.069 | −1.227 |

| Autonomy | 1 | 5 | 3.79 | 0.998 | −0.435 | −0.670 |

| Trust | 1 | 5 | 3.63 | 1.057 | −0.425 | −0.433 |

| Privacy | 1 | 5 | 3.93 | 0.882 | −0.519 | −0.271 |

| Security | 1 | 5 | 3.70 | 1.036 | −0.591 | −0.163 |

| Safety | 2 | 5 | 3.92 | 0.881 | −0.401 | −0.619 |

| Correctness | 1 | 5 | 3.86 | 0.940 | −0.542 | −0.314 |

| Transparency | 1 | 5 | 3.70 | 0.862 | −0.048 | −0.589 |

| Confidentiality | 1 | 5 | 3.78 | 0.903 | −0.479 | −0.076 |

| Responsibility | 2 | 5 | 3.99 | 0.951 | −0.514 | −0.780 |

| Reliability | 1 | 5 | 3.80 | 0.964 | −0.473 | −0.394 |

| Maintenance | 1 | 5 | 3.58 | 0.972 | −0.169 | −0.654 |

| Interoperability | 1 | 5 | 3.81 | 0.878 | −0.561 | 0.037 |

| Extent of use | 2 | 5 | 3.84 | 0.928 | −0.305 | −0.827 |

| Stated satisfaction | 1 | 5 | 3.41 | 1.212 | −0.307 | −0.810 |

| Cronbach’s Alpha | Composite Reliability | Average Variance Extracted | |

|---|---|---|---|

| ER | 0.782 | 0.873 | 0.698 |

| QER | 0.881 | 0.910 | 0.627 |

| QR | 0.875 | 0.923 | 0.800 |

| Users’ satisfaction | 0.888 | 0.947 | 0.899 |

| Category | Requirement | Outer Loadings |

|---|---|---|

| ER | Autonomy | 0.867 |

| Trust | 0.912 | |

| Privacy | 0.714 | |

| QER | Security | 0.850 |

| Safety | 0.789 | |

| Correctness | 0.798 | |

| Transparency | 0.731 | |

| Confidentiality | 0.798 | |

| Responsibility | 0.791 | |

| QR | Reliability | 0.920 |

| Maintenance | 0.898 | |

| Interoperability | 0.865 |

| Path | Original Sample | Standard Deviation | T Statistics | p Values |

|---|---|---|---|---|

| ER - > Users’ satisfaction (H2) | 0.215 | 0.056 | 3.856 | 0.000 |

| QER - > Users’ satisfaction (H2) | 0.236 | 0.046 | 5.087 | 0.000 |

| QR - > Users’ satisfaction (H2) | 0.525 | 0.058 | 9.042 | 0.000 |

| Predictor | Predicted Values | |||||

|---|---|---|---|---|---|---|

| Hidden Layer 1 | Output Layer | Importance | Normalized Importance | |||

| H(1:1) | Extent of Use | Stated Satisfaction | ||||

| Input Layer | (Bias) | −0.733 | ||||

| Autonomy | 0.014 | 0.009 | 2.3% | |||

| Trust | 0.260 | 0.191 | 47.7% | |||

| Privacy | 0.006 | 0.004 | 1.0% | |||

| Security | 0.097 | 0.066 | 16.5% | |||

| Safety | 0.008 | 0.005 | 1.3% | |||

| Correctness | 0.134 | 0.093 | 23.3% | |||

| Transparency | 0.047 | 0.031 | 7.8% | |||

| Confidentiality | 0.049 | 0.033 | 8.3% | |||

| Responsibility | 0.021 | 0.014 | 3.5% | |||

| Reliability | 0.518 | 0.400 | 100.0% | |||

| Maintenance | 0.185 | 0.131 | 32.9% | |||

| Interoperability | 0.034 | 0.023 | 5.7% | |||

| Hidden Layer 1 | (Bias) | −0.351 | −0.366 | |||

| H(1:1) | 5.000 | 4.632 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bocean, C.G.; Vărzaru, A.A. A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies. Systems 2022, 10, 121. https://doi.org/10.3390/systems10040121

Bocean CG, Vărzaru AA. A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies. Systems. 2022; 10(4):121. https://doi.org/10.3390/systems10040121

Chicago/Turabian StyleBocean, Claudiu George, and Anca Antoaneta Vărzaru. 2022. "A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies" Systems 10, no. 4: 121. https://doi.org/10.3390/systems10040121

APA StyleBocean, C. G., & Vărzaru, A. A. (2022). A Two-Stage SEM–Artificial Neural Network Analysis of Integrating Ethical and Quality Requirements in Accounting Digital Technologies. Systems, 10(4), 121. https://doi.org/10.3390/systems10040121