Spillover Network among Economic Sentiment and Economic Policy Uncertainty in Europe

Abstract

:1. Introduction

2. Literature Review

3. Methodology

4. Sample Data

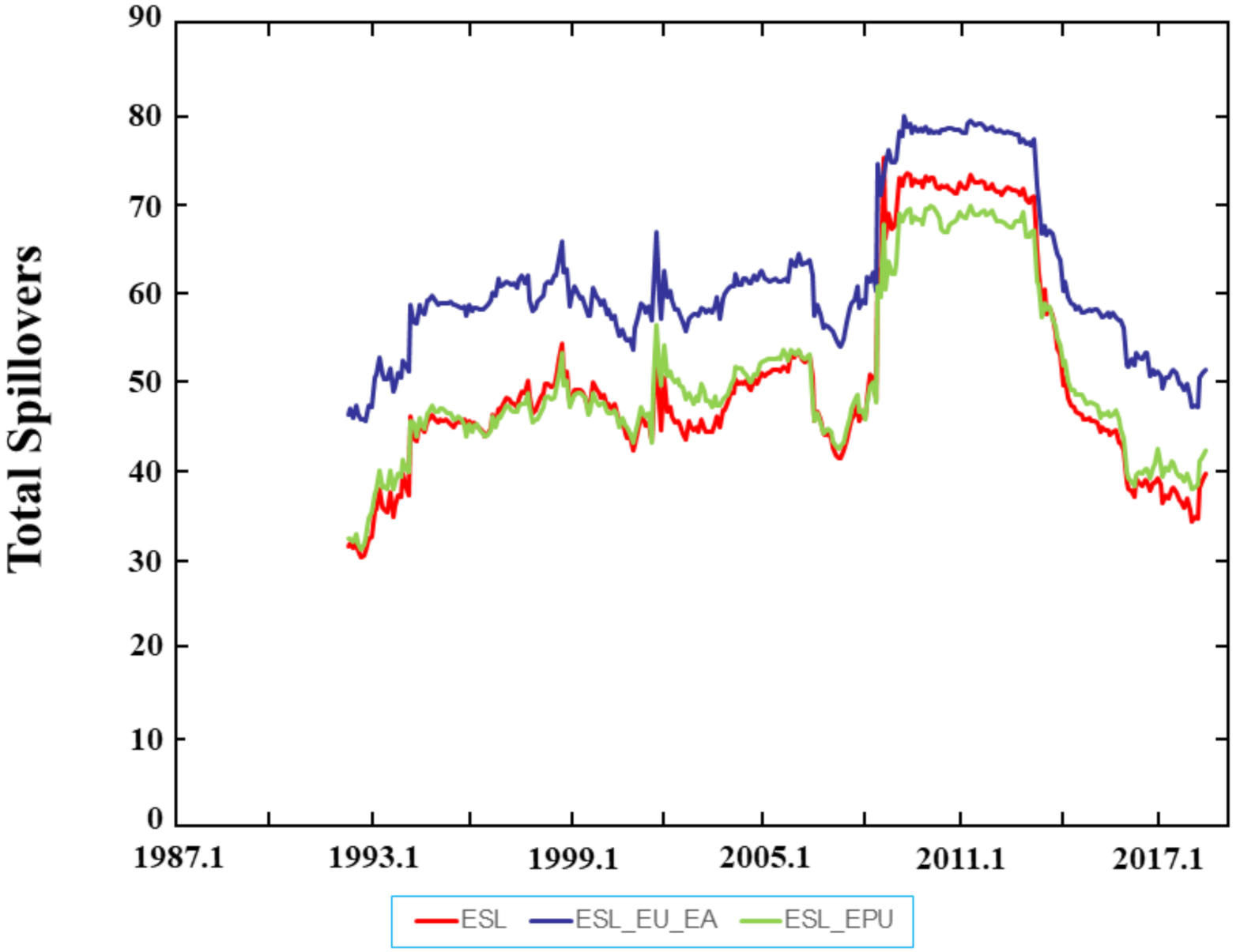

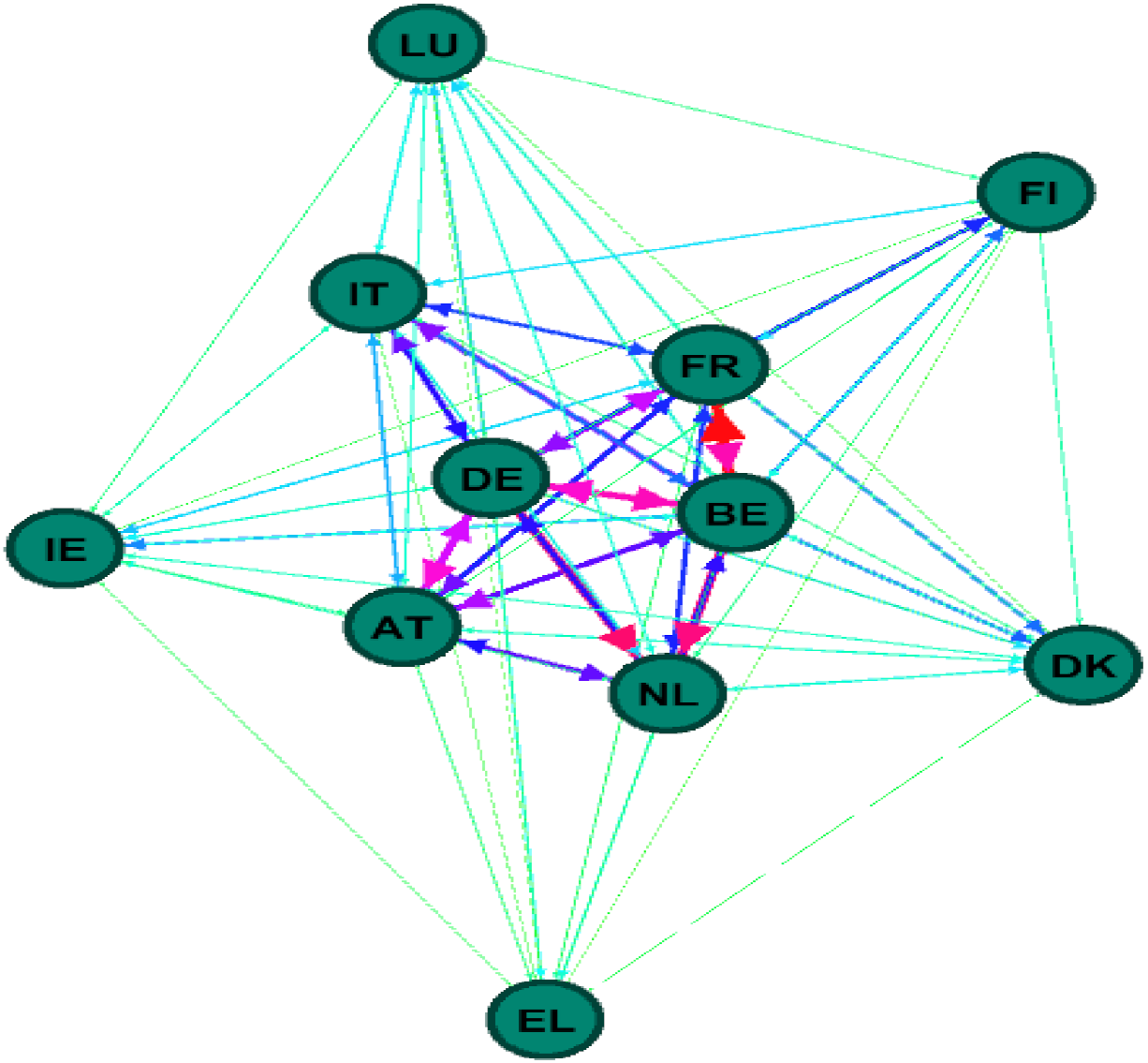

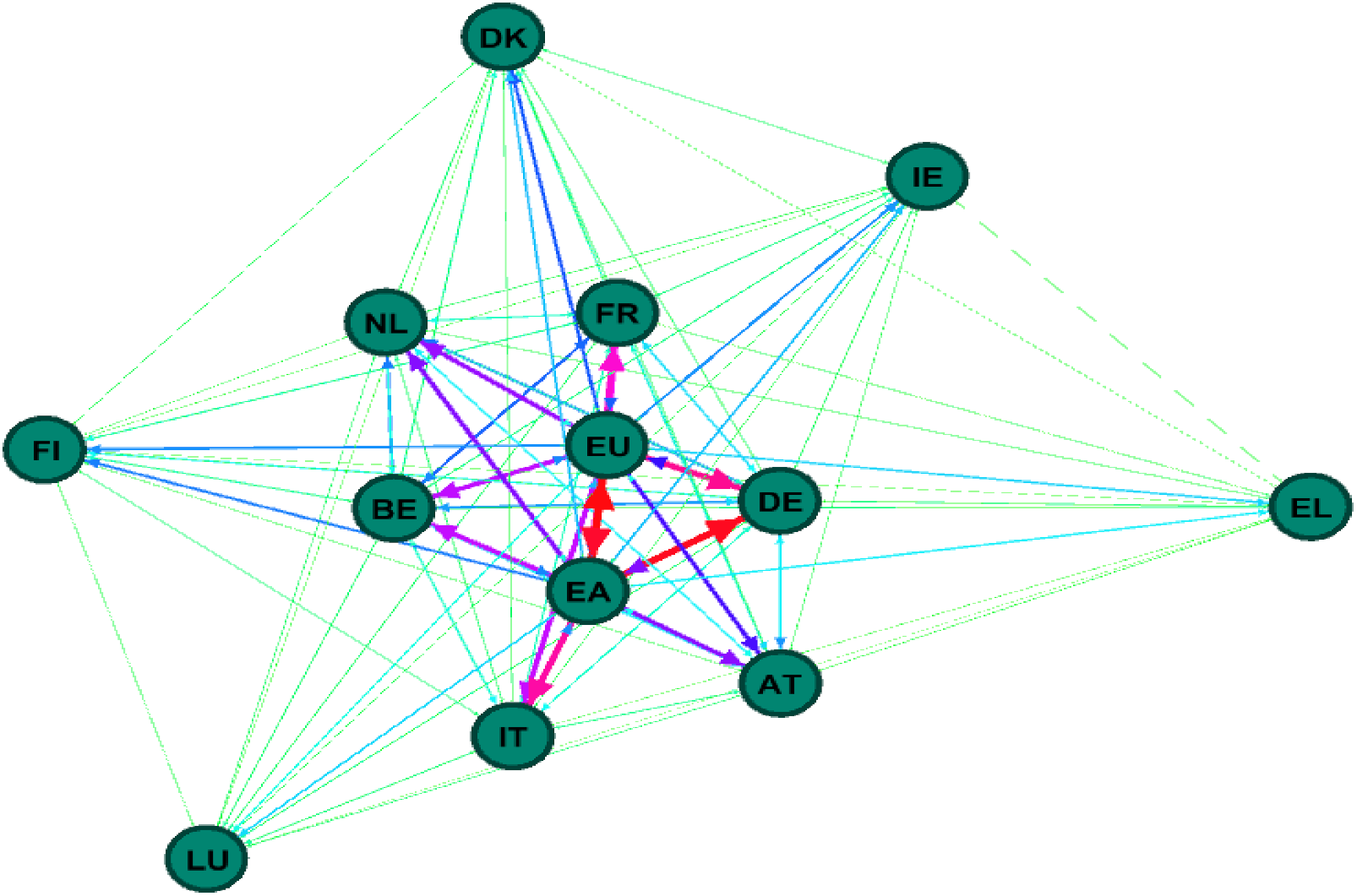

5. Empirical Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zouaoui, M.; Nouyrigat, G.; Beer, F. How does investor sentiment affect stock market crises? Evidence from panel data. Financ. Rev. 2011, 46, 723–747. [Google Scholar] [CrossRef] [Green Version]

- Chiu, J.; Chung, H.; Ho, K.-Y.; Wu, C.-C. Investor sentiment and evaporating liquidity during the financial crisis. Int. Rev. Econ. Financ. 2018, 55, 21–36. [Google Scholar] [CrossRef]

- Akerlof, G.A.; Shiller, R.J. Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Chicago Booth Research Paper 13–02; Stanford University Press: Stanford, UK, 2013. [Google Scholar]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef] [Green Version]

- Granger, C.W.J. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Patton, A. A review of copula models for economic time series. J. Multivar. Anal. 2012, 110, 4–18. [Google Scholar] [CrossRef] [Green Version]

- Acemoglu, D.; Scott, A. Consumer confidence and rational expectations: Are agents’ beliefs consistent with the theory? Econ. J. 1994, 104, 1–19. [Google Scholar] [CrossRef]

- Blanchard, O. Consumption and the recession of 1990–1991. Am. Econ. Rev. 1993, 83, 270–274. [Google Scholar]

- Mueller, E. Ten years of consumer attitude surveys: Their forecasting record. J. Am. Stat. Assoc. 1963, 58, 899–917. [Google Scholar] [CrossRef]

- Adams, F.G. Consumer attitudes, buying plans, and purchases of durable goods: A principal components, time series approach. Rev. Econ. Stat. 1964, 46, 347–355. [Google Scholar] [CrossRef]

- Adams, F.G. Prediction with consumer attitudes: The time-series cross-section paradox. Rev. Econ. Stat. 1965, 47, 367–378. [Google Scholar] [CrossRef]

- Mueller, E. Effects of consumer attitudes on purchases. Am. Econ. Rev. 1957, 47, 946–965. [Google Scholar]

- Barber, B.M.; Odean, T. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Rev. Financ. Stud. 2008, 21, 785–818. [Google Scholar] [CrossRef] [Green Version]

- Bollen, J.; Mao, H.; Zeng, X. Twitter mood predicts the stock market. J. Comput. Sci. 2011, 2, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Gabrovšek, P.; Aleksovski, D.; Mozetič, I.; Grčar, M. Twitter sentiment around the Earnings Announcement events. PLoS ONE 2017, 12, e0173151. [Google Scholar] [CrossRef] [PubMed]

- Antoniou, C.; Doukas, J.A.; Subrahmanyam, A. Cognitive dissonance, sentiment, and momentum. J. Financ. Quant. Anal. 2013, 48, 245–275. [Google Scholar] [CrossRef] [Green Version]

- Baker, M.; Wurgler, J. Investor sentiment and the cross-section of stock returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef] [Green Version]

- Barberis, N.; Shleifer, A.; Vishny, R. A model of investor sentiment. J. Financ. Econ. 1998, 49, 307–343. [Google Scholar] [CrossRef]

- Daniel, K.; Hirshleifer, D.; Subrahmanyam, A. Investor psychology and security market under-and overreactions. J. Financ. 1998, 53, 1839–1885. [Google Scholar] [CrossRef] [Green Version]

- Hong, H.; Stein, J.C. A unified theory of underreaction, momentum trading, and overreaction in asset markets. J. Financ. 1999, 54, 2143–2184. [Google Scholar] [CrossRef] [Green Version]

- Lemmon, M.; Portniaguina, E. Consumer confidence and asset prices: Some empirical evidence. Rev. Financ. Stud. 2006, 19, 1499–1529. [Google Scholar] [CrossRef]

- Yoon, S.-M.; Kang, S.-H. Weather effects on returns: Evidence from the Korean stock market. Phys. A 2009, 388, 682–690. [Google Scholar] [CrossRef]

- Kang, S.H.; Jiang, Z.; Lee, Y.; Yoon, S.-M. Weather effects on the returns and volatility of the Shanghai stock market. Phys. A 2010, 389, 91–99. [Google Scholar] [CrossRef]

- Kim, J.S.; Ryu, D.; Seo, S.W. Investor sentiment and return predictability of disagreement. J. Bank. Financ. 2014, 42, 166–178. [Google Scholar] [CrossRef]

- Lee, Y.-H.; Tucker, A.L.; Wang, D.K.; Pao, H.-T. Global contagion of market sentiment during the US subprime crisis. Glob. Financ. J. 2014, 25, 17–26. [Google Scholar] [CrossRef]

- Yacob, N.; Mahdzan, N.S. The predictive ability of consumer sentiment’s volatility to the Malaysian stock market’s volatility. Afro-Asian J. Financ. Account. 2014, 4, 460–476. [Google Scholar] [CrossRef]

- Ryu, D.; Kim, H.; Yang, H. Investor sentiment, trading behavior and stock returns. Appl. Econ. Lett. 2017, 24, 826–830. [Google Scholar] [CrossRef]

- Yang, H.; Ryu, D.; Ryu, D. Investor sentiment, asset returns and firm characteristics: Evidence from the Korean stock market. Invest. Anal. J. 2017, 46, 132–147. [Google Scholar] [CrossRef]

- Jiang, Z.; Kang, S.H.; Cheong, C.; Yoon, S.-M. The effects of extreme weather conditions on Hong Kong and Shenzhen stock market returns. Int. J. Financ. Stud. 2019, 7, 70. [Google Scholar] [CrossRef] [Green Version]

- Pan, W.-F. Does investor sentiment drive stock market bubbles? Beware of excessive optimism! J. Behav. Financ. 2020, 21, 27–41. [Google Scholar] [CrossRef]

- Choi, K.-H.; Yoon, S.-M. Investor sentiment and herding behavior in the Korean stock market. Int. J. Financ. Stud. 2020, 8, 34. [Google Scholar] [CrossRef]

- Jiang, Z.; Gupta, R.; Subramaniam, S.; Yoon, S.-M. The effect of air quality and weather on the Chinese stock: Evidence from Shenzhen Stock Exchange. Sustainability 2021, 13, 2931. [Google Scholar] [CrossRef]

- Bahloul, W.; Bouri, A. The impact of investor sentiment on returns and conditional volatility in U.S. futures markets. J. Multinatl. Financ. Manag. 2016, 36, 89–102. [Google Scholar] [CrossRef]

- Eom, C.; Kaizoji, T.; Kang, S.H.; Pichl, L. Bitcoin and investor sentiment: Statistical characteristics and predictability. Phys. A 2019, 514, 511–521. [Google Scholar] [CrossRef]

- Balcilar, M.; Bonato, M.; Demirer, R.; Gupta, R. The effect of investor sentiment on gold market return dynamics: Evidence from a nonparametric causality-in-quantiles approach. Resour. Policy 2017, 51, 77–84. [Google Scholar] [CrossRef]

- Białowolski, P. Economic sentiment as a driver for household financial behavior. J. Behav. Exp. Econ. 2019, 80, 59–66. [Google Scholar] [CrossRef]

- Ludvigson, S.C. Consumer confidence and consumer spending. J. Econ. Perspect. 2004, 18, 29–50. [Google Scholar] [CrossRef] [Green Version]

- Mehra, Y.P.; Martin, E.W. Why does consumer sentiment predict household spending? Econ. Q. 2003, 89, 51–67. [Google Scholar]

- Vuchelen, J. Consumer sentiment and macroeconomic forecasts. J. Econ. Psychol. 2004, 25, 493–506. [Google Scholar] [CrossRef]

- Aromi, J.D.; Clements, A. Facial expressions and the business cycle. Econ. Model. 2021, 102, 105563. [Google Scholar] [CrossRef]

- Claveria, O.; Monte, E.; Torra, S. Economic forecasting with evolved confidence indicators. Econ. Model. 2020, 93, 576–585. [Google Scholar] [CrossRef]

- Guo, Y.; He, S. Does confidence matter for economic growth? An analysis from the perspective of policy effectiveness. Int. Rev. Econ. Financ. 2020, 69, 1–19. [Google Scholar] [CrossRef]

- Kotz, M.; Wenz, L.; Stechemesser, A.; Kalkuhl, M.; Levermann, A. Day-to-day temperature variability reduces economic growth. Nat. Clim. Chang. 2021, 11, 319–325. [Google Scholar] [CrossRef]

- Kanas, A.; Zervopoulos, P.D. Systemic risk, real GDP growth, and sentiment. Rev. Quant. Financ. Account. 2021, 57, 461–485. [Google Scholar] [CrossRef]

- Niţoi, M.; Pochea, M.M. Time-varying dependence in European equity markets: A contagion and investor sentiment driven analysis. Econ. Model. 2020, 86, 133–147. [Google Scholar] [CrossRef]

- Qi, X.-Z.; Ning, Z.; Qin, M. Economic policy uncertainty, investor sentiment and financial stability—an empirical study based on the time varying parameter-vector autoregression model. J. Econ. Interact. Coord. 2022, 17, 779–799. [Google Scholar] [CrossRef]

- Dragouni, M.; Filis, G.; Gavriilidis, K.; Santamaria, D. Sentiment, mood and outbound tourism demand. Ann. Tour. Res. 2016, 60, 80–96. [Google Scholar] [CrossRef]

- Baker, S.R.; Blooms, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Davis, S.J. An Index of Global Economic Policy Uncertainty; NBER: Cambridge, MA, USA, 2016. [Google Scholar]

- Alexopoulos, M.; Cohen, J. The power of print: Uncertainty shocks, markets, and the economy. Int. Rev. Econ. Financ. 2015, 40, 8–28. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Saint Akadiri, S.; Rjoub, H. On the relationship between economic policy uncertainty, geopolitical risk and stock market returns in South Korea: A quantile causality analysis. Ann. Financ. Econ. 2022, 17, 2250008. [Google Scholar] [CrossRef]

- Das, D.; Kannadhasan, M.; Bhattacharyya, M. Do the emerging stock markets react to international economic policy uncertainty, geopolitical risk and financial stress alike? N. Am. J. Econ. Financ. 2019, 48, 1–19. [Google Scholar] [CrossRef]

- Fang, L.; Chen, B.; Yu, H.; Xiong, C. The effect of economic policy uncertainty on the long-run correlation between crude oil and the U.S. stock markets. Financ. Res. Lett. 2018, 24, 56–63. [Google Scholar] [CrossRef]

- Ftiti, Z.; Hadhri, S. Can economic policy uncertainty, oil prices, and investor sentiment predict Islamic stock returns? A multi-scale perspective. Pac.-Basin Financ. J. 2019, 53, 40–55. [Google Scholar] [CrossRef]

- Karnizova, L.; Li, J. Economic policy uncertainty, financial markets and probability of US recessions. Econ. Lett. 2014, 125, 261–265. [Google Scholar] [CrossRef] [Green Version]

- Kido, Y. The transmission of US economic policy uncertainty shocks to Asian and global financial markets. N. Am. J. Econ. Financ. 2018, 46, 222–231. [Google Scholar] [CrossRef]

- Ko, J.-H.; Lee, C.-M. International economic policy uncertainty and stock prices: Wavelet approach. Econ. Lett. 2015, 134, 118–122. [Google Scholar] [CrossRef]

- Li, X.-M. New evidence on economic policy uncertainty and equity premium. Pac.-Basin Financ. J. 2017, 46, 41–56. [Google Scholar] [CrossRef]

- Li, X.; Balcilar, M.; Gupta, R.; Chang, T. The causal relationship between economic policy uncertainty and stock returns in China and India: Evidence from a bootstrap rolling window approach. Emerg. Mark. Financ. Trade 2016, 52, 674–689. [Google Scholar] [CrossRef] [Green Version]

- Liow, K.H.; Liao, W.-C.; Huang, Y. Dynamics of international spillovers and interaction: Evidence from financial market stress and economic policy uncertainty. Econ. Model. 2018, 68, 96–116. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, T. Economic policy uncertainty and stock market volatility. Financ. Res. Lett. 2015, 15, 99–105. [Google Scholar] [CrossRef] [Green Version]

- Raza, S.A.; Zaighum, I.; Shah, N. Economic policy uncertainty, equity premium and dependence between their quantiles: Evidence from quantile-on-quantile approach. Phys. A 2018, 492, 2079–2091. [Google Scholar] [CrossRef]

- Gong, Y.; He, Z.; Xue, W. EPU spillovers and stock return predictability: A cross-country study. J. Int. Financ. Mark. Inst. Money 2022, 78, 101556. [Google Scholar] [CrossRef]

- Demir, E.; Gozgor, G.; Lau, C.K.M.; Vigne, S.A. Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Financ. Res. Lett. 2018, 26, 145–149. [Google Scholar] [CrossRef] [Green Version]

- Mokni, K. When, where, and how economic policy uncertainty predicts Bitcoin returns and volatility? A quantiles-based analysis. Q. Rev. Econ. Financ. 2021, 80, 65–73. [Google Scholar] [CrossRef]

- Choi, S.; Shin, J. Bitcoin: An inflation hedge but not a safe haven. Financ. Res. Lett. 2022, 46, 102379. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Econ. 2014, 44, 433–447. [Google Scholar] [CrossRef] [Green Version]

- Yang, L. Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Econ. 2019, 80, 219–233. [Google Scholar] [CrossRef]

- You, W.; Guo, Y.; Zhu, H.; Tang, Y. Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ. 2017, 68, 1–18. [Google Scholar] [CrossRef]

- Yuan, D.; Li, S.; Li, R.; Zhang, F. Economic policy uncertainty, oil and stock markets in BRIC: Evidence from quantiles analysis. Energy Econ. 2022, 110, 105972. [Google Scholar] [CrossRef]

- Raza, S.A.; Shah, N.; Shahbaz, M. Does economic policy uncertainty influence gold prices? Evidence from a nonparametric causality-in-quantiles approach. Resour. Policy 2018, 57, 61–68. [Google Scholar] [CrossRef]

- Chiang, T.C. The effects of economic uncertainty, geopolitical risk and pandemic upheaval on gold prices. Resour. Policy 2022, 76, 102546. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Raza, N.; Balcilar, M.; Ali, S.; Shahbaz, M. Can economic policy uncertainty and investors sentiment predict commodities returns and volatility? Resour. Policy 2017, 53, 208–218. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, B.; Diao, X.; Wu, C. Commodity price changes and the predictability of economic policy uncertainty. Econ. Lett. 2015, 127, 39–42. [Google Scholar] [CrossRef]

- Antonakakis, N.; Gupta, R.; André, C. Dynamic co-movements between economic policy uncertainty and housing market returns. J. Real Estate Portf. Manag. 2015, 21, 53–60. [Google Scholar] [CrossRef]

- Yang, Y.; Chen, L. Is real estate considered a safe asset in East Asia? Appl. Econ. Lett. 2022, 29, 604–614. [Google Scholar] [CrossRef]

- Balcilar, M.; Gupta, R.; Kyei, C.; Wohar, M.E. Does economic policy uncertainty predict exchange rate returns and volatility? Evidence from a nonparametric causality-in-quantiles test. Open Econ. Rev. 2016, 27, 229–250. [Google Scholar] [CrossRef] [Green Version]

- Kido, Y. On the link between the US economic policy uncertainty and exchange rates. Econ. Lett. 2016, 144, 49–52. [Google Scholar] [CrossRef]

- Bernal, O.; Gnabo, J.-Y.; Guilmin, G. Economic policy uncertainty and risk spillovers in the Eurozone. J. Int. Money Financ. 2016, 65, 24–45. [Google Scholar] [CrossRef]

- Li, X.-M.; Zhang, B.; Gao, R. Economic policy uncertainty shocks and stock–bond correlations: Evidence from the US market. Econ. Lett. 2015, 132, 91–96. [Google Scholar] [CrossRef]

- Bordo, M.D.; Duca, J.V.; Koch, C. Economic policy uncertainty and the credit channel: Aggregate and bank level U.S. evidence over several decades. J. Financ. Stab. 2016, 26, 90–106. [Google Scholar] [CrossRef] [Green Version]

- Danisman, G.O.; Demir, E.; Ozili, P. Loan loss provisioning of US banks: Economic policy uncertainty and discretionary behavior. Int. Rev. Econ. Financ. 2021, 71, 923–935. [Google Scholar] [CrossRef]

- Biljanovska, N.; Grigoli, F.; Hengge, M. Fear thy Neighbor: Spillovers from Economic Policy Uncertainty; Working Paper No. 17/240; IMF: Washington, DC, USA, 2017. [Google Scholar]

- Wang, Y.; Chen, C.R.; Huang, Y.S. Economic policy uncertainty and corporate investment: Evidence from China. Pac. Basin Financ. J. 2014, 26, 227–243. [Google Scholar] [CrossRef]

- Balcilar, M.; Gupta, R.; Jooste, C. Long memory, economic policy uncertainty and forecasting US inflation: A Bayesian VARFIMA approach. Appl. Econ. 2017, 49, 1047–1054. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Figueres, J.M. Economic policy uncertainty spillovers in booms and busts. In Proceedings of the 2017 Annual Meeting, Chicago, IL, USA, 6–8 January 2017. [Google Scholar]

- Colombo, V. Economic policy uncertainty in the US: Does it matter for the Euro area? Econ. Lett. 2013, 121, 39–42. [Google Scholar] [CrossRef] [Green Version]

- Istiak, K.; Serletis, A. Economic policy uncertainty and real output: Evidence from the G7 countries. Appl. Econ. 2018, 50, 4222–4233. [Google Scholar] [CrossRef]

- Trung, N.B. The spillover effects of US economic policy uncertainty on the global economy: A global VAR approach. N. Am. J. Econ. Financ. 2019, 48, 90–110. [Google Scholar] [CrossRef]

- Houari, O. Uncertainty shocks and business cycles in the US: New insights from the last three decades. Econ. Model. 2022, 109, 105762. [Google Scholar] [CrossRef]

- Gozgor, G.; Ongan, S. Economic policy uncertainty and tourism demand: Empirical evidence from the USA. Int. J. Tour. Res. 2017, 19, 99–106. [Google Scholar] [CrossRef]

- Balli, F.; Uddin, G.S.; Mudassar, H.; Yoon, S.-M. Cross-country determinants of economic policy uncertainty spillovers. Econ. Lett. 2017, 156, 179–183. [Google Scholar] [CrossRef]

- Luk, P.; Cheng, M.; Ng, P.; Wong, K. Economic policy uncertainty spillovers in small open economies: The case of Hong Kong. Pac. Econ. Rev. 2020, 25, 21–46. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Financial and Macroeconomic Connectedness: A Network Approach to Measurement and Monitoring; Oxford University Press: Oxford, NY, USA, 2015. [Google Scholar]

| Region and Countries | ||||

|---|---|---|---|---|

| European Union (EU) | 0.0248 | 1.6972 | 2.6474 | −53.8544 |

| Euro area (EA) | 0.0271 | 1.6280 | 2.7417 | −66.8804 |

| France (FR) | 0.0289 | 2.0694 | 3.0368 | −55.0148 |

| Belgium (BE) | 0.0600 | 2.6199 | 1.5022 | −18.7913 |

| Germany (DE) | 0.0311 | 1.7011 | 1.8669 | −35.3646 |

| Italy (IT) | 0.0256 | 2.6803 | 0.6132 | −14.2798 |

| Netherlands (NL) | 0.0507 | 2.1895 | 5.7345 | −84.0602 |

| Luxembourg (LU) | 0.0760 | 3.5933 | 1.2300 | −3.7932 |

| Austria (AT) | 0.0726 | 2.6169 | 1.6005 | 11.2576 |

| Greece (EL) | 0.0402 | 2.5024 | 2.2225 | −10.2550 |

| Ireland (IE) | 0.0997 | 3.4383 | 0.3740 | 3.4844 |

| Denmark (DK) | 0.0973 | 3.6469 | 1.9691 | 4.7634 |

| Finland (FI) | 0.0354 | 3.0878 | 2.9165 | 42.2523 |

| European EPU | 0.04 | 0.32 | 7.72 | 2.03 |

| FR | BE | DE | IT | NL | LU | AT | EL | IE | DK | FI | From | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FR | 45.43 | 13.45 | 9.31 | 5.94 | 6.28 | 2.43 | 6.47 | 0.79 | 3.83 | 2.33 | 3.72 | 54.6 |

| BE | 11.10 | 45.05 | 10.98 | 5.49 | 7.15 | 2.62 | 7.74 | 0.99 | 3.09 | 2.74 | 3.05 | 55.0 |

| DE | 8.53 | 10.66 | 49.14 | 6.95 | 7.06 | 1.55 | 9.48 | 1.36 | 2.60 | 1.17 | 1.51 | 50.9 |

| IT | 6.41 | 8.38 | 8.00 | 58.14 | 2.88 | 3.06 | 4.45 | 0.59 | 2.51 | 1.82 | 3.76 | 41.9 |

| NL | 6.51 | 11.82 | 12.08 | 4.00 | 46.4 | 2.93 | 7.86 | 1.69 | 1.99 | 2.76 | 1.94 | 53.6 |

| LU | 3.58 | 3.91 | 4.00 | 3.81 | 2.07 | 75.19 | 2.85 | 0.37 | 1.86 | 0.67 | 1.69 | 24.8 |

| AT | 8.10 | 8.95 | 10.54 | 4.50 | 6.84 | 2.64 | 52.09 | 0.36 | 1.91 | 2.51 | 1.56 | 47.9 |

| EL | 2.25 | 3.37 | 3.32 | 1.05 | 2.80 | 0.54 | 2.10 | 81.87 | 1.13 | 1.21 | 0.34 | 18.1 |

| IE | 4.24 | 5.01 | 3.49 | 2.28 | 2.97 | 1.65 | 1.98 | 1.43 | 73.49 | 2.60 | 0.85 | 26.5 |

| DK | 5.44 | 5.63 | 3.77 | 2.47 | 3.67 | 1.28 | 3.27 | 1.43 | 2.86 | 67.84 | 2.32 | 32.2 |

| FI | 5.53 | 5.48 | 6.43 | 1.92 | 1.44 | 2.12 | 2.40 | 0.87 | 1.40 | 0.85 | 71.56 | 28.4 |

| To | 61.7 | 76.7 | 71.9 | 38.4 | 43.2 | 20.8 | 48.6 | 9.9 | 23.2 | 18.7 | 20.8 | 433.8 |

| All | 107.1 | 121.7 | 121.1 | 96.6 | 89.6 | 96.0 | 100.7 | 91.8 | 96.7 | 86.5 | 92.3 | 39.4% |

| Net | 7.1 | 21.7 | 21.0 | −3.5 | −10.4 | −4.0 | 0.7 | −8.2 | −3.3 | −13.5 | −7.6 |

| FR | BE | DE | IT | NL | LU | AT | EL | IE | DK | FI | EU | EA | From | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FR | 31.31 | 8.78 | 5.96 | 3.95 | 4.03 | 1.57 | 4.19 | 0.42 | 2.52 | 1.42 | 2.36 | 16.24 | 17.25 | 68.7 |

| BE | 7.99 | 32.69 | 7.46 | 3.87 | 4.81 | 1.81 | 5.33 | 0.52 | 2.12 | 1.75 | 1.99 | 14.79 | 14.88 | 67.3 |

| DE | 5.17 | 6.12 | 30.21 | 4.19 | 4.06 | 0.85 | 5.52 | 0.64 | 1.57 | 0.61 | 0.82 | 18.77 | 21.48 | 69.8 |

| IT | 4.25 | 5.33 | 5.12 | 40.02 | 1.78 | 2.01 | 2.81 | 0.31 | 1.63 | 1.08 | 2.39 | 14.97 | 18.30 | 60.0 |

| NL | 4.80 | 8.26 | 8.53 | 2.94 | 35.04 | 2.06 | 5.48 | 0.98 | 1.47 | 1.81 | 1.29 | 13.90 | 13.43 | 65.0 |

| LU | 3.09 | 3.31 | 3.43 | 3.42 | 1.72 | 68.08 | 2.29 | 0.30 | 1.68 | 0.54 | 1.36 | 4.71 | 6.06 | 31.9 |

| AT | 5.99 | 6.45 | 7.71 | 3.39 | 4.91 | 1.83 | 39.62 | 0.24 | 1.49 | 1.80 | 0.98 | 12.03 | 13.56 | 60.4 |

| EL | 1.91 | 2.63 | 2.65 | 0.99 | 2.14 | 0.40 | 1.84 | 73.57 | 0.99 | 0.89 | 0.26 | 6.19 | 5.55 | 26.4 |

| IE | 3.72 | 3.85 | 2.66 | 1.89 | 2.29 | 1.45 | 1.65 | 1.03 | 64.47 | 2.02 | 0.67 | 7.67 | 6.64 | 35.5 |

| DK | 4.59 | 4.33 | 2.80 | 1.99 | 2.80 | 1.10 | 2.73 | 0.99 | 2.37 | 58.58 | 1.85 | 9.12 | 6.74 | 41.4 |

| FI | 4.52 | 4.25 | 5.33 | 1.58 | 1.16 | 1.67 | 1.82 | 0.71 | 1.15 | 0.61 | 61.23 | 7.79 | 8.19 | 38.8 |

| EU | 9.00 | 7.95 | 11.60 | 6.84 | 4.76 | 1.22 | 4.72 | 0.77 | 2.68 | 1.60 | 1.72 | 25.25 | 21.89 | 74.7 |

| EA | 8.78 | 8.07 | 13.40 | 7.88 | 4.50 | 1.37 | 5.05 | 0.69 | 2.42 | 1.16 | 1.64 | 21.13 | 23.92 | 76.1 |

| To | 63.8 | 69.3 | 76.7 | 42.9 | 39.0 | 17.3 | 43.4 | 7.6 | 22.1 | 15.3 | 17.3 | 147.3 | 154.0 | 716.0 |

| All | 95.1 | 102.0 | 106.9 | 82.9 | 74.0 | 85.4 | 83.1 | 81.2 | 86.5 | 73.9 | 78.5 | 172.6 | 177.9 | 55.1% |

| Net | −4.9 | 2.0 | 6.9 | −17.1 | −26.0 | −14.6 | −17.0 | −18.8 | −13.4 | −26.1 | −21.5 | 72.6 | 77.9 |

| FR | BE | DE | IT | NL | LU | AT | EL | IE | DK | FI | EPU | From | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FR | 45.19 | 13.35 | 9.07 | 5.67 | 6.03 | 2.19 | 6.25 | 0.83 | 3.75 | 2.25 | 3.54 | 1.89 | 54.8 |

| BE | 10.93 | 45.05 | 10.77 | 5.25 | 6.92 | 2.41 | 7.55 | 1.02 | 3.03 | 2.68 | 2.91 | 1.48 | 55.0 |

| DE | 8.35 | 10.60 | 48.76 | 6.54 | 6.66 | 1.25 | 9.22 | 1.42 | 2.57 | 1.07 | 1.40 | 2.17 | 51.2 |

| IT | 6.26 | 8.30 | 7.68 | 57.70 | 2.74 | 2.76 | 4.31 | 0.62 | 2.45 | 1.75 | 3.66 | 1.74 | 42.3 |

| NL | 6.32 | 11.78 | 11.84 | 3.81 | 46.2 | 2.70 | 7.63 | 1.74 | 1.96 | 2.68 | 1.84 | 1.50 | 53.8 |

| LU | 3.53 | 3.86 | 3.96 | 3.36 | 1.91 | 74.8 | 2.63 | 0.41 | 1.78 | 0.63 | 1.53 | 1.61 | 25.2 |

| AT | 7.97 | 8.91 | 10.34 | 4.31 | 6.62 | 2.41 | 52.10 | 0.39 | 1.89 | 2.45 | 1.46 | 1.12 | 47.9 |

| EL | 2.20 | 3.33 | 3.25 | 0.99 | 2.73 | 0.48 | 2.04 | 81.40 | 1.13 | 1.19 | 0.32 | 0.99 | 18.6 |

| IE | 4.11 | 4.98 | 3.41 | 2.14 | 2.90 | 1.50 | 1.88 | 1.45 | 73.60 | 2.59 | 0.79 | 0.68 | 26.4 |

| DK | 5.34 | 5.59 | 3.67 | 2.35 | 3.55 | 1.17 | 3.17 | 1.45 | 2.82 | 67.80 | 2.24 | 0.84 | 32.2 |

| FI | 5.38 | 5.41 | 6.48 | 1.76 | 1.35 | 1.94 | 2.29 | 0.89 | 1.37 | 0.80 | 71.50 | 0.87 | 28.5 |

| EPU | 1.66 | 1.31 | 0.27 | 1.62 | 0.10 | 0.12 | 0.60 | 0.90 | 0.54 | 0.66 | 0.11 | 92.11 | 7.9 |

| To | 62.1 | 77.4 | 70.7 | 37.8 | 41.5 | 18.9 | 47.6 | 11.1 | 23.3 | 18.7 | 19.8 | 14.9 | 443.8 |

| All | 107.2 | 122.5 | 119.5 | 95.5 | 87.7 | 93.7 | 99.7 | 92.5 | 96.9 | 86.5 | 91.2 | 107.0 | 37.0% |

| Net | 7.3 | 22.4 | 19.5 | −4.5 | −12.3 | −6.3 | −0.3 | −7.5 | −3.1 | −13.5 | −8.7 | 7.0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arreola Hernandez, J.; Kang, S.H.; Jiang, Z.; Yoon, S.-M. Spillover Network among Economic Sentiment and Economic Policy Uncertainty in Europe. Systems 2022, 10, 93. https://doi.org/10.3390/systems10040093

Arreola Hernandez J, Kang SH, Jiang Z, Yoon S-M. Spillover Network among Economic Sentiment and Economic Policy Uncertainty in Europe. Systems. 2022; 10(4):93. https://doi.org/10.3390/systems10040093

Chicago/Turabian StyleArreola Hernandez, Jose, Sang Hoon Kang, Zhuhua Jiang, and Seong-Min Yoon. 2022. "Spillover Network among Economic Sentiment and Economic Policy Uncertainty in Europe" Systems 10, no. 4: 93. https://doi.org/10.3390/systems10040093