Abstract

The rise of internet platforms meets people’s needs for a better life. However, the platforms also pose the risk of ecological monopolies. Using the methodology of economic analysis of law, with the help of ANT theory, the laws governing the operation of the platform ecosystem are discovered, and the paper analyzes the life cycle of digital platform development and figures out that the regulatory strategy for platforms should be adjusted to follow its life cycle and adopt more intuitive evaluation criteria for assessing market power. Meanwhile, the regulatory strategy for plat-forms could fully guarantee the active participation of multiple subjects, such as operators and consumers, in the platform’s governance. With the continuous advancement of data and algorithm technology, new content service providers will continue to emerge, and a new industry is developing. Besides the dynamic track analysis of platforms’ life cycles, another static research outcome is also given in this research. To ensure that the algorithmic technologies developed by the platform truly contribute to economic and social development and the well-being of people, the right to interpret algorithms and the establishment of scenario-based regulation of algorithms should be established.

1. Introduction

One of the key features of the current digitalisation and informatisation process in China is the increasing rise of digital platforms. Although there is no consensus on the social impact of digital platforms, there is a convergence in the conceptual meaning: A digital platform is a programmable digital infrastructure that facilitates interaction between users through the aggregation of information and shapes the “platform ecology” in the information society [1]. The operation of a platform ecosystem relies on the coordination of multiple systems, including computing power, data, programming algorithms, payment systems, etc. Although the development of digital platforms has permeated every corner of society through mobile applications, their technical properties and social impacts are still debated.

Nonetheless, our current understanding of platform technology remains too narrow. Firstly, the infrastructural attributes of the ‘platform ecology’ have been neglected in previous studies, and the main emphasis has been on its digital technological attributes [2]. Although a platform consists of a collection of information in its presentation, it is not necessarily entirely virtual [3]. In China, there are physical elements in the rise of digital platforms, including the internet’s infrastructure and the support of societal aspects such as urbanisation, the enterprise system, and the labour force. This physical reality has enabled the digital expansion of the platforms and laid the material foundation for their development. Secondly, the exploration of platform technology is still dominated by macro- and meso-level grand narratives, ignoring the micro-level movements of platform development and operation [4,5]. Even though macro-level narratives enable structural and trend-based inquiries into platform development at the levels of corporate orientation, technological governance, government policies, etc., participants often become static and singular in their analytical perspectives. Hence, technology is detached from reality and incapable of explaining social contexts and their changing patterns.

This paper reconceptualizes technology as a “dispositif” with both physical and virtual attributes from the perspective of technology production [6], and explores the production, development, and evolution of algorithms through a microscopic and dynamic lens. Therefore, algorithms, as a media technology body in the information society, are both physical and discursive, with abundant extension and expressive power in micro-social production.

The research is grounded within Actor Network Theory (ANT)—the integration of humans and “non-humans” within analysis—to explore the “algorithmic production network” of digital platforms. It breaks down the virtual and the material, the intangible and the tangible, and the dichotomy between the infrastructure and the culture of consciousness and establishes a new perspective on the analysis of digital platforms. Taking the popular take-away food delivery platform as an example, this paper further reflects on the production logic of platform algorithms and the explanatory power and limitations of ANT theory in relation to digital platforms. The main research issues include how digital platforms are produced, shaped, and defined by the actor-networks from various social forces, how the algorithmic production networks of platforms have changed and developed during this period, and to what extent the spatial-temporal production and technological governance of digital platforms have enriched and developed the actor-network theory. While previous empirical studies on ANT have tended to focus on the production of social space [7,8], few studies have dealt with the manufacture and production of virtual technologies, perhaps due to ANT being subject to many technical challenges [9] (pp. 160–162). ANT has been misunderstood as a technical network and incorrectly compared to telephony, social media, the internet, etc. However, as Latour argues, ANT is not necessarily linked to the network society or internet technology, but is more of an ontological elaboration than a technical discourse. Nonetheless, the production and development of internet technology can still be included in its analytical framework [10]. In fact, this paper maintains that, with the increasing prominence of the social attribute of technology, ANT can offer new paths for interpreting the multifaceted social meaning of technology.

2. Digital Platforms and Algorithmic Production as Actor-Networks

ANT perceives digital platforms as information aggregation infrastructures coupled with technology, society, and economics. Using smartphones, mobile payments, and information distribution and delivery systems, digital platforms provide a virtual space for information sharing, the fulfilment of material needs, and communication. Working both online and offline, the spatial-temporal construction of digital platforms highlights the interplay of infrastructure and social relations. Mainly proposed by Bruno Latour, Michel Callon, and John Law, ANT offers a theoretical and methodological lens and advocates for the adoption of an association perspective insofar as that society is an association of heterogeneous things [11]. The participants in the network of relations can be both human and non-humans [9] (p. 120). ANT relies on three core concepts in the actor-network theory: Agency, mediator, and network. Actors are wide-ranging, including human and non-human heterogeneous actors, such as biology, technologies, information, ideas, etc., and have agency. Latour considers any actor a mediator that has agency, “anything that changes the state of affairs by making a difference can be called an ‘actor’” [12]. A mediator is an actor involved in the process of changing and translating the production of meaning. The term ‘mediator’ is opposed to the term ‘intermediary’, which refers to a participant with agency, while the latter is a black box of passive and undifferentiated transporting meaning. Translation consists of four stages: Problematisation, interestment, enrolment, and mobilisation [13]. During problematisation, the core actor creates an obligatory passage point (OPP) to establish relationships with potential participants by integrating them into the network system, through interestment and enrolment, and ensuring, through mobilization, that actors can represent their collective and exercise their rights. Both Calonne and Latour take a neutral and developmental perspective on translation within ANT, conceiving translation as a process of redistribution and re-transformation of power, which may result in either functioning or breakdown of the order. ANT, as an ontological cognition, can be regarded as a combination of a string of actions. Networks in ANT emphasize the participation of actors, becoming multi-dimensional nodes that form temporary, fluid, and uncertain associations [14] (pp. 8–10). In these networks, human and non-human mediators are involved and form traceable associations.

3. Game Theory Analysis for the Development and Regulation of Internet Content Platforms

3.1. Players and Game Theory Models

Internet platforms X, whose number is assumed to be nx, have two alternative strategies: Compliance operation and non-compliance operation. Compliance operation can obtain normal revenue R, while necessitating the payment of certain compliance costs C. Non-compliance operation does not require the payment of compliance costs but may be detected by the regulatory authorities. If so, platforms would not only lose all revenue but also face a fine F. Regulatory authorities G mainly refer to entities that retain jurisdiction over internet platforms, including the national internet information institutions. Although different regulatory authorities may have different directions, scopes of power, and levels of information, the overall objective remains the same. The establishment of a single regulatory authority will not substantially impact the outcome of games relying on equilibrium. In addition, users who are not players in the game but are stakeholders are included, assuming that the gains to users are U and the number of users is nu. The regulator also has two strategies: Weak regulation and strong regulation.

When weak regulation is implemented, the regulator does not face regulatory costs, but is also unable to detect violations promptly. This failure generates reputational damage H. When a strong regulation strategy is implemented, the regulator must pay certain regulatory costs Cg. However, if the internet platform has infringements and violations, the regulator can impose fines F. It should be noted that this paper does not distinguish between strong and weak regulatory strategies by the scale of penalties, but rather by whether it is possible to devote sufficient regulatory resources and thus more easily detect violations. In essence, in a mature regulatory framework, the institutional requirements should be sufficiently clear that strong regulation is reflected in an increased probability of detecting violations, rather than in the number of penalties imposed when violations are detected.

3.2. Content Service Payoff Function and Strategy Collection

3.2.1. Internet Platform

Regarding the compliance operation situation, when the regulator implements a weak regulatory strategy, the internet platform can obtain normal revenue R (R > 0), but at the same time, it must pay certain compliance costs C (C > 0). The content or service payoff function is Xac = R − C. When the regulator implements strong regulation, the internet platform can still obtain normal revenue R, but the cost of compliance increases to λ (markup coefficient) times that of the weakly regulated model, so the cost of compliance for the internet platform is λC, where λ > 1. The content or service payoff function is Xad = R − λC.

Secondly, concerning the case of non-compliance operation, when the regulator implements a weak regulatory strategy, the internet platform’s compliance costs are zero and the content or service payoff function is Xbc = R. When the regulator implements a strong regulatory strategy, the internet platform compliance costs are zero, but violations will be detected and lead to a fine F. The content or service payoff function is Xbd = R − F.

3.2.2. The Regulator

It is assumed that regulator G aims to maximise the overall social gain, which, alongside fine collection, consists of two major components: Users’ gains and the profit of internet platforms. When internet platforms operate in compliance with the regulations, users can obtain normal gains U. When internet platforms operate in violation of the law, it will bring certain losses θ to users, and users’ gains are U − θ. Serious violations of regulations may lead to U − θ < 0, i.e., users suffer absolute losses.

For the weak regulatory situation, when the internet platform operates in compliance, the content/service payoff function is Gca = nx (R − C) + nuU. When the internet platform chooses to operate in violation, the interests of users will be damaged, and the regulator will suffer a reputational loss H. The content/service payoff function is: Gcb = nxR + nu (U − θ) − H.

For the strong regulation strategy, when the internet platform chooses to operate in compliance, the regulator has to pay a certain regulatory cost Cg, and the internet platform compliance costs will rise. The content/service payoff function is Gda = nx (R − λC) + nuU − Cg. When the internet platform chooses to operate in violation, it will cause certain losses to users, and the regulator will find violations and impose penalties. The content/service payoff function is Gdb = nxR + nu (U − θ) − Cg. In summary, the internet platform and the regulator game strategies can be defined as shown in Table 1.

Table 1.

Internet platform and regulator gaming strategies.

3.2.3. Game Strategy Equilibrium Analysis

Pure Strategy Equilibrium Analysis

For internet platforms, when the regulator chooses weak regulation, non-compliance operation is a dominant strategy for internet platforms because Xbc − Xac = R − (R − C) = C > 0. When the regulator chooses strong regulation, Xbd − Xad = λC − F, if λC − F > 0, the internet platform chooses to operate in non-compliance; if λC − F < 0, the internet platform decides to comply with the regulations. Therefore, under a strong regulatory strategy, the non-compliant operation will dominate if the compliance costs λC that the internet platform needs to pay are higher than the penalty it may be subject to. For the regulator, when the internet platform operates in compliance, Gda − Gca = nx (1 − λ)C − Cg < 0 there is a dominant strategy of weak regulation. In contrast, when the internet platform operates in breach of the law, Gdb − Gcb = H − Cg and when H − Cg > 0, the regulator’s rational choice is strong regulation. When H − Cg < 0, the regulator’s rational choice is weak regulation. Therefore, the equilibrium point—“non-compliance operation, weak regulation”—exists between the internet platform and the regulator only when λC − F > 0 (condition 1) and H − Cg < 0 (condition 2). If the regulatory authorities punish the internet platform with a too low standard, it may strengthen the incentive for the internet platform to operate non-compliance and weaken the incentive for the regulatory authorities to regulate, while the users and society as a whole lose out. Therefore, this equilibrium point is not conducive to the healthy and sustainable development of internet platforms.

Mixed Strategy Equilibrium Analysis

When λC − F < 0 or H − Cg > 0, there is no pure strategy Nash equilibrium between the two sides of the game, and a mixed strategy analysis is needed based on the probability of specific behavioural strategies of the regulator and the internet platform. We assume that the probability of an internet platform choosing a compliance strategy is p and the probability of choosing a non-compliance strategy is 1 − p. The probability of a regulator choosing a weak regulatory strategy is q and the probability of choosing a strong regulatory strategy is 1 − q. The strategy matrix of the mixed game can be obtained as shown in Table 2.

Table 2.

Strategy matrix of the mixed game.

By derivation, the mixed strategy equilibrium of the internet platform and the regulator can be derived as , ). In terms of the factors affecting the optimal probability, on the internet platform side, =; the greater the number of market service providers, the smaller the probability of the internet platform operating in compliance. =, meaning the larger markup of compliance costs of internet platforms under a strong regulatory strategy, the lower the probability of internet platforms operating in compliance. =< 0, i.e., the higher the compliance costs of internet platforms, the lower the probability of compliance operation by the internet platforms. => 0, i.e., the greater the loss of the regulator’s reputation, the greater the probability that the internet platform will operate in compliance. = − , i.e., the higher the costs of regulatory implementation by the regulator, the lower the probability that the internet platform will operate in compliance. For regulators, = , i.e., the higher markup coefficient of the compliance costs of the internet platform when the regulator imposes strong regulation, the smaller the optimal probability of the regulator imposing weak regulation. = , i.e., the higher the compliance costs of the internet platform, the lower the optimal probability of the regulator imposing weak regulation. = , i.e., the greater the value of fines imposed by the regulator on the internet platform for non-compliance, the greater the optimal probability of the regulator imposing weak regulation.

- The budding period

In 2004, Alipay separated from Taobao and became independent, gradually evolving into the largest internet service platform in China. In terms of internet platform development, the number of platforms nx in the nascent period was relatively small, the products and businesses were not mature, and the overall market size was small. Meanwhile, the regulatory policies were more relaxed, the compliance costs C for internet platforms were relatively small, and the markup coefficient λ was not particularly high. With fewer regulation objectives, the costs Cg for regulators to implement strong regulation would also be lower. The loss of reputation H of the regulator would not have been a significant consideration in the strategy of the internet platform. Based on the conclusions of the previous analysis, , , the regulator q* will be larger when both λ and C are relatively small. From the perspective of the regulator, the compliance costs C for internet platforms are also smaller due to the relatively small markup coefficient λ. Moreover, the likelihood of the regulator imposing penalties during the nascent period would be relatively low, even if the penalties mostly manifest in business rectification rather than fines. Thus, the value of fines F would not have a substantial impact on the regulator’s choice of strategy. Therefore, we can create the formula, , , where the regulator q* will be larger if λ and C are both relatively small.

- Growth period

Since the development of internet platforms, the overall number nx has grown significantly, the complexity of business has increased, innovations have emerged, and the regulatory costs Cg to the regulators have increased. At the same time, the costs of compliance C for internet platforms have also grown due to the gradual increase in regulatory requirements while the markup coefficient λ has further increased. As the impact of internet platforms on social welfare is generally positive, the potential loss of reputation H suffered by the regulator is relatively small. Since , , ,., , the optimal probability p* of an internet platform would decrease. From the perspective of the regulators, λ began to increase and the costs of compliance C for internet platforms continued to grow. Furthermore, as internet platform violations began to increase, the regulators began to impose fines in the form of fines, but the value of F is still relatively small and far from being a deterrent relative to the revenue gained from the violations. Due to < 0,.,., the regulator’s optimal probability q* will be lower compared to the budding period.

- Maturity period

Once China’s internet platform market enters a mature period of regulated development, new entities will continue to enter the market. Meanwhile, poorly run institutions would exit the market and nx will remain relatively stable. However, regulatory costs Cg further increase with the scale and complexity of businesses, and the compliance costs C for internet platforms also further increase alongside, a growing markup coefficient λ.

At the same time, however, internet platforms in the maturity period already have a huge social impact, and the public demands on the regulator are so high that the potential loss of reputation H suffered by the regulator will rise rapidly. Since 0, , , , the trend of the optimal probability p* of internet platforms will be uncertain, i.e., the strategic choice of internet platforms may be differentiated. The possibility of some small and medium-sized internet platforms with weak operational capacity and insufficient compliance capability choosing to operate in violation of the law further increase while the possibility of some institutions with larger market shares, stronger operational capacity, and higher compliance capability choosing to operate in compliance will be greater.

From the perspective of the regulator, the costs of compliance C for internet platforms will further increase and the markup coefficient λ will continue to grow; according to , , the regulator’s optimal probability q* will decrease because of this. As the number of non-compliance internet platforms and businesses starts to increase and the damage caused to the public increases, the value of fines F for the regulator will also rise further, according to , and the regulator’s optimal probability q* will rise again as a result of this. Therefore, in the maturity period, the regulator’s optimal strategy will be influenced by both positive and negative factors, and the direction of change of its final optimal probability q* will be fairly uncertain.

- Decline period

In 2021, the “Internet Platform Regulations (Draft for Public Comments)” was officially published, strengthening the regulatory regime for China’s internet content platforms. In the future, the infrastructure role of internet platforms will become more prominent, and the decline period of China’s internet industry is not forthcoming. However, from a life-cycle perspective, the profitability of the internet platform industry will further decline during the recession, and the number of internet platforms nx is expected to decline further as mergers, restructuring and the exiting of poorly run corporations become more common. As internet platforms have formed more stable expectations of regulatory policies, the compliance costs C, markup coefficient λ, and regulatory costs Cg of internet platforms will also decline. However, at the same time, the public, having experienced the painful lessons brought about by the brutal growth of internet platforms, will demand more from the regulators, and the loss of reputation H of the regulators will further rise. Due to , , , , , the optimal probability p* of an internet platform will keep rising. From the regulator’s point of view, although the number of institutions choosing to operate in compliance is rising, the social impact of non-compliance will be so great that heavy fines will be necessary to maintain deterrence as the remaining internet platforms are large in terms of both numbers of users and market share. As a result, the number of fines imposed by the regulator, F, will rise further and, together with the decrease in compliance costs, C, and the markup coefficient, λ, according to , , , the regulator’s optimal probability q* will increase.

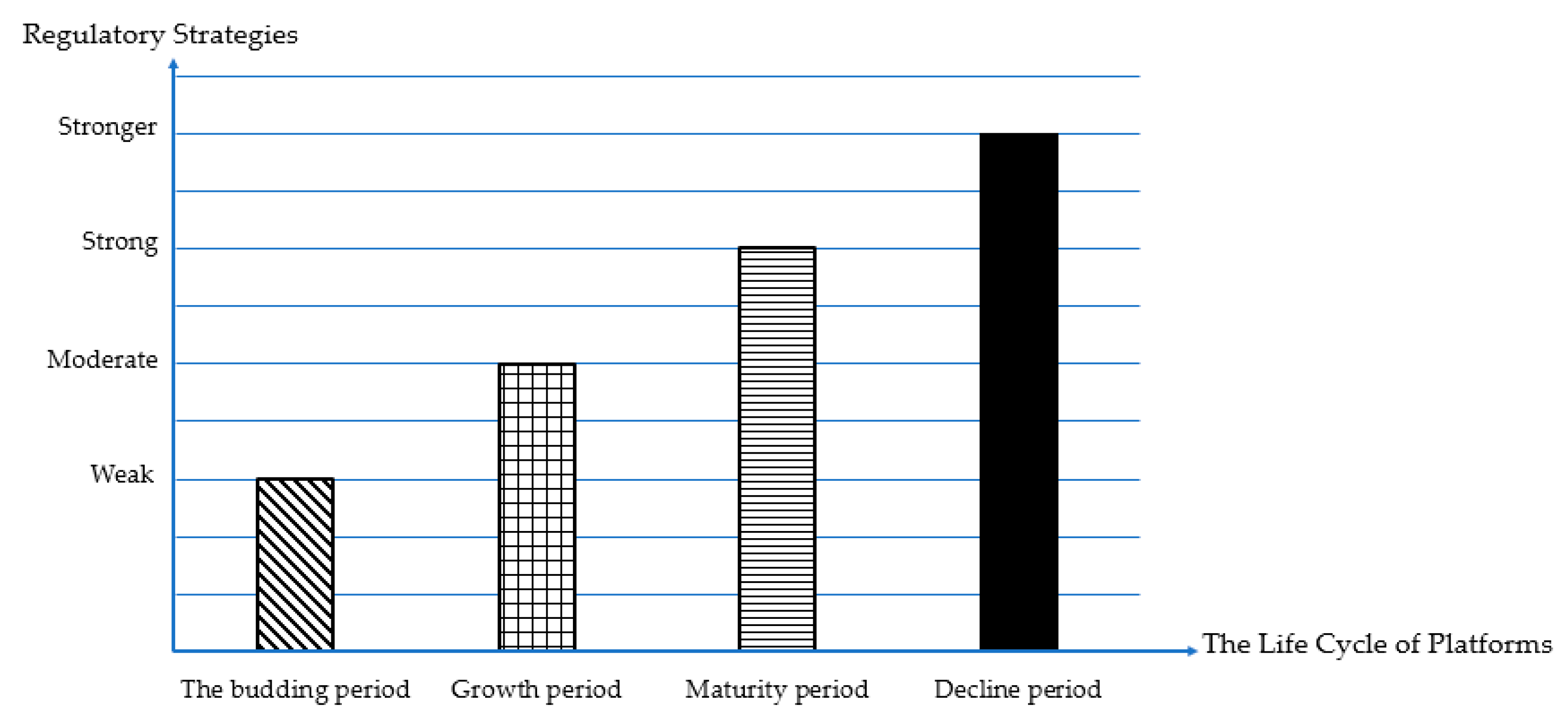

Finally, to aid reader understanding, the relationship between the life cycle of platforms and regulatory strategies is depicted in Figure 1.

Figure 1.

The relationship between the life cycle of platforms and regulatory strategies.

4. Risks Associated with Platform Ecosystem-Based Monopoly

4.1. Risk of Market Concentration Caused by Ecosystem Expansion

During development, the platform ecosystem absorbs goods and services from other fields through acquisitions and mergers, thus expanding the ecosystem. This process is not only the process of concentration of operators but also the process of data and technology aggregation. Since the platform ecosystem not only gains control over other operators but also aggregates a large amount of user data and advanced technology, it achieves a large aggregation of production factors, leading to the following two risks.

Firstly, the market becomes overly saturated with a centralized and structured pattern. “Ecological monopoly” is a process of transferring monopoly power to other fields through data and algorithms. Once formed, an ecological monopoly will threaten the monopoly in multiple markets. Moreover, these markets become controlled by a dominant platform. Compared with traditional monopolies, “ecological monopolies” have a greater impact on the market structure as well as a broader scope of influence.

Secondly, the “ecological monopoly” brings all factors under the dominant platform, creating excessive market concentration and high barriers to entry [15]. Although new enterprises’ hardware and software costs are not high in the platform economy, the dominant platform has a great deal of data, algorithms, and capital, enabling new companies to enter the market effectively. Especially in the case of a lack of initial users, new enterprises cannot obtain enough data and capital support so they can easily be eliminated from the market. As it is difficult for new platform companies to obtain data and algorithms to compete with the platform ecosystem, new entrants fail to enter the market effectively and eventually close. The market structure gradually solidifies after going through centralization, which negatively impacts the order of market competition. The lack of effective competition constraints causes the market to become less competitive. The ecosystem centred around the head platform may lose the incentive to further improve the quality of goods or lower prices, which will lead to the market losing its “competitive dividend”.

4.2. Anti-Competitive Risks Arising from the Dual Identity of Platforms

In the platform ecosystem, the dominant platform often has a dual identity: A “manager” and an “operator”. The dual identity can enable the dominant platform to better control the operation of the ecosystem, but at the same time, it may also damage the openness of the ecosystem. As an “operator”, the platform’s fundamental goal is to maximize profits, so it may use its power as a “manager” to improperly interfere with competitors.

The dominant platform’s status as an “operator” makes it difficult to remain neutral. As the dominant platform crosses borders into other areas with its affiliated businesses, it may restrict its competitors by engaging in self-interested, anti-competitive behaviour. Since the platform ecosystem has many users and massive data resources, it may block or exclude competitors’ access to similar data to hinder development [16]. Moreover, the dominant platform’s status as a “manager” makes it a rule-setter in the ecosystem. Other operators within the platform ecosystem are subject to the rules they set, and these regulations are often based on the interests of the dominant platform, possibly at the expense of other operators.

4.3. The Aggregation of Production Factors and the Lack of Competitive Constraints Trigger the Risk of Inhibiting Innovation

The formation of the platform ecological monopoly will likely inhibit the innovation of operators inside and outside the ecosystem. Firstly, the platform ecological monopoly will inhibit innovation outside the ecosystem. Under the platform ecological monopoly, it is difficult for other competitors to carry out effective innovation due to two external reasons, market structure and interference in competitive behaviour. Data, capital, and other factors will continue to gather in the platform ecosystem. Thus, other operators will be restricted from obtaining the necessary resources for innovation. They also have difficulties obtaining sufficient data and capital for innovative R&D. Moreover, the platform ecosystem performs acquisitions and mergers in an expansion process, eliminating the threat posed by innovative platforms. Ioannis Lianos points out that current “killer acquisitions” are acquisitions of startups by platforms to acquire more advanced algorithms and different kinds of data, which kill potential “disruptive innovation” in the cradle [17].

Secondly, platform ecosystem monopolies can also inhibit innovation within the ecosystem. When a platform-ecological monopoly is formed, the platform ecosystem can make large profits without maintaining a competitive advantage through innovation due to the market’s lack of effective competitive constraints. At the same time, other cooperative enterprises in the ecosystem are often restricted in their innovation activities because they are controlled by the dominant platform as the “manager”. Once the dominant platform finds the innovation activities of a cooperative company, it may threaten the platform ecosystem, and the platform will take action to punish the enterprise. Even if an enterprise successfully conducts innovation research and development, its achievements will likely be annexed or stolen by the dominant platform.

4.4. Risk of Algorithmic Discrimination Due to Misuse of Algorithmic Technology

The problem of algorithmic discrimination arising from the misuse of algorithmic technology has been a cause for concern. When an “ecological monopoly” is formed, the harm caused by algorithmic discrimination will be more serious. Discriminatory algorithmic technologies may be widely applied to various ecosystem components, leading to multi-dimensional, multi-group, and multi-scenario algorithmic discrimination, which, if not taken seriously, may cause irreversible damage to consumer welfare.

Firstly, under the ecological monopoly, the platform’s discriminatory algorithms will increase the “exploitation” of consumers and users. Platforms have accumulated massive amounts of data and high-quality algorithms, which can grasp the actual needs of consumers, even down to the needs of individuals for specific products. In order to maximize profits, platforms may use price discrimination and other means to develop personalized pricing strategies based on individual consumer characteristics, leading to a reduction in consumer surplus. Once the “ecological monopoly” is formed, consumers and users will be affected by the lock-in effect of switching costs and user stickiness in a feedback loop with increasing effects. Even if users are dissatisfied with the “exploitation” of discriminatory algorithms, they are often forced to continue using the original platform due to the lock-in effect or the fact that there are no choices of equivalent quality in the market.

Secondly, algorithmic discrimination harms other operators. Dominant platforms can impose discriminatory restrictions on platforms that affect their interests. This discrimination may affect both operators and outside of the ecosystem. For operators inside the platform, when the dominant platform intends to develop services in a new area, it may, through its algorithm, impose certain restrictions on other operators inside the platform system involved in that area. For example, when the algorithm allocates resources, it may locate the target of discrimination and impose restrictions on the allocation of resources to the target or raise the threshold. In the case of an “ecological monopoly”, the platform ecosystem is an important channel for insiders to gain access to trading opportunities. It means internal operators often accept discrimination in silence. For operators outside the platform, the dominant platform will set certain conditions or operational mechanisms for the algorithm based on its interests, blocking or shielding companies that may pose a competitive threat to its platform ecosystem.

5. Strategies for Regulating Platform Ecological Monopolies

Driven by the two wheels of “data plus algorithm”, the market power of the platform ecosystem will continue to be amplified by the market mechanism and network effect. It may eventually turn the platform ecosystem into a monopoly in a single market and transfer it to adjacent markets to form second or even multiple rounds of an ecological monopoly. Once the platform ecosystem monopoly is formed, the risk to the market competition and entities within the market is multifaceted and may produce irreversible and substantial damage. Therefore, based on the systemic concept of grasping the platform ecosystem’s operation rules and analysing its ecological monopoly’s formation mechanism, it is necessary to update the current competition law governance system; that is, to carry out multi-dimensional governance of the data and algorithm elements and their two-wheel-drive model to avoid the platform ecosystem from tending to monopolistic and disorderly expansion. At the same time, multiple subjects in the ecosystem, including consumers and operators, should actively cooperate to achieve multi-governance and maintain the healthy and orderly development of the platform ecosystem.

5.1. Improve the Legal Identification and Recognition Method of Platform Ecological Monopoly

The platform ecosystem is based on “data + algorithms”. It achieves the linkage operation and development of various non-competitive goods and services, which subverts the approach to identifying and determining the relevant markets in traditional competition law. According to the current Anti-monopoly Law, the relevant market is the market consisting of goods or services with substitutability. When analysing whether the ecosystem has a dominant position, it is only possible to define the market power in the area where the dominant platform or the associated business of the ecosystem is located, which tends to underestimate the power of the overall platform. Therefore, the existing competition law identification method needs to be optimized based on the platform ecosystem’s characteristics and the development trend.

Currently, China is improving its scientific and reasonable regulatory system that responds to the new development of the platform economy. On 7 February 2021, the Antimonopoly Committee of the State Council issued the “Platform Economy Antimonopoly Guidelines” (Guidelines). Starting from the characteristics and operation rules of the platform economy, the Guidelines further build on Article 11 of the Interim Provisions on the Prohibition of Abuse of Market Dominance issued by the State Administration of Market Supervision and Administration on 26 June 2019. To determine the dominant market position of operators in new economic sectors such as the internet stipulated in Article 11, Guidelines focus more on the impact of the dynamic process of data behaviour on assessing the market power of platforms. For example, subsections 1 and 2 of Article 11 of the Guidelines “Determination of market dominance” provide that “the number of active users”, “clicks”, “using hours”, and “ability to control the market” can be considered to determine whether a platform has a dominant market position. However, the existing legal provisions are still weak in operability and lack clarity. It not only prevents the regulatory and enforcement authorities from effectively regulating the platform ecological monopoly but also may “misplace” the normal functioning of the platform ecosystem and frustrate its development momentum. Therefore, the current ecosystem formed by aggregating multiple non-competitive goods and services on the platform can be considered a cluster market and uses tools that directly assess market powers. It has been noted that platform ecosystems form markets not because of high cross-elasticity of demand among various goods and services but because of significant customer convenience and preferences in aggregation or joint provisioning economic models and because aggregation is difficult to replicate [18]. Hence, simply defining the relevant market and assessing market share does not quantify the market power that platform ecosystems have. Taking differentiated goods into account would expand the relevant market scope and underestimate the platform ecosystem’s market power. Conversely, not taking these commodities into account may overestimate the market power of the platform. Therefore, a tool that more directly assesses market power could be used for this assessment.

More intuitive assessment criteria can be used to directly assess market power. The specific assessment criteria can be combined with identifying gatekeepers in the EU Digital Markets Act [19], i.e., when analysing and assessing the market power, the multiple factors of the areas covered and dominated by the dominant platform are assessed. Especially based on the operation rule of the platform ecosystem, the dominant platform’s ability to control the market can be assessed by accounting for the components of its platform ecosystem and their relationship. Among others, user stickiness can also be measured by analysing the number of multi-attributed users of the ecosystem and the length of their usage [20]. For example, Taobao’s control over the upstream and downstream markets was considered in the administrative penalty decision of the State Administration of Market Supervision and Administration against Alibaba for “two-for-one”. It is in line with the vertical integration of Alibaba’s ecosystem and the two-wheeled operation of “data + algorithm”. In summary, the optimization of the market dominance identification criteria should be based on the operation mode and the operation rules of the ecosystem. It will further refine and supplement the existing competition law and enable the competition law to effectively identify the market power of the platform ecosystem and intervene through a legal approach before the “platform ecosystem monopoly” takes shape.

In practice, there is an abundance of behaviours that use algorithmic technology to achieve improper purposes. As stated in Article 28 of the Data Security Law, data processing activities and research and development of new data technologies should promote economic and social development, enhance people’s welfare, and conform to social morality and ethics. The development and application of algorithm technology in the platform ecosystem should also be based on the optimal allocation of the ecosystem and the promotion of consumer welfare, rather than excluding competitors or exploiting consumer surplus through algorithms. In this regard, certain regulatory measures are needed to ensure that algorithmic technologies in the ecosystem are on the right path to promote economic and social development and enhance people’s welfare.

The biggest obstacle to regulating algorithms is the secrecy of the algorithm itself, the “algorithmic black box”. Meanwhile, the algorithm’s function may change according to specific scenarios, thus making it more difficult to regulate algorithms. Therefore, we can start from the following two aspects.

5.1.1. Establish the Right to Explanation

The metaphor of the “algorithmic black box” expresses the concern that humans risk losing control over the decision-making process due to the opacity of algorithms. Humans devolving decisions that affect their rights and obligations to a black box that they cannot understand implies that algorithmic transparency is difficult, if not impossible [21] (p. 165). However, algorithmic transparency does not require platform companies to disclose algorithmic code to be “transparent”. The algorithm itself is highly technical and professional. As the algorithm relates to the company’s core competitiveness, requiring full disclosure of the underlying algorithm code or mechanism would be difficult for consumers and regulators to understand. It may also result in competitors’ algorithm parsing, causing the company to lack competitiveness. The implementation of algorithm transparency should be realized through the right to explanation. ‘The right to explanation’ was clarified in the EU General Data Protection Regulation, which came into force on 25 May 2018, and became an actualized right. This right has been widely recognized within the EU and implemented in each member state through policy standards. Because of the inscrutability and non-intuitive nature of algorithms [21] (p. 169), the platform needs to articulate the basic rules and criteria by which algorithms make decisions. For example, when the takeaway platform is asked to explain a product’s price differentiation, the platform can publish the factors that lead to the algorithm’s pricing differentiation. For example, the price of the takeaway product is determined by the delivery distance and delivery time without providing the actual algorithm’s calculation process. Based on the explanation of the algorithm, the regulator should also verify the consistency of the algorithm explanation with the actual results. Because the possibility of platforms providing false explanations cannot be ruled out, at this time, the algorithm sandbox technology can be used to conduct the actual algorithm by controlling the variables and comparing whether there are deviations between the theoretical results and the actual results. At the same time, it is also possible to improve the situation of individual consumers and operators against the abuse of ecosystem algorithms. This occurs through rights allocation, establishing the right to explanation, and the right to be forgotten while giving data subjects the option to oppose automated decision-making and establishing and improving algorithms’ attribution and punishment mechanism.

5.1.2. Establishing the Scenario-Based Regulation of Algorithms

Even for the same algorithm, very different results may arise due to the differences in input variables and data in different scenarios. Therefore, it is important to establish the scenario-based regulation of algorithms. It is necessary to classify and grade the algorithm technology and the specific scenarios of algorithm technology application. For example, when the algorithm is used to optimize resource allocation within the platform ecosystem, the risk of algorithm abuse is small if it only involves allocating resources within the platform and does not involve other operators not under the platform. However, involving both operators within and not the platform is a high-risk scenario and requires focused regulation. In terms of specific regulatory schemes, the 2020 EU White Paper on AI proposes that a five-level risk-based regulatory system should be established in five dimensions: Application scenarios, deployment purposes, security protection, consumer interests, and fundamental rights; thus, clearly distinguishing the assessment criteria for various AI applications and implementing differentiated regulation [22] (p. 105). Platform algorithms cannot be regulated generally but should distinguish specific scenarios to avoid the rhetoric of filtering undesirable information to exclude competition, especially the situation of algorithms in key scenarios, such as shopping and information filtering scenarios of social platforms. Adopting the ideas of scenario governance and precise governance, the evaluation index system based on the impact dimension should be established based on the impact subject, the scope and the degree of impact. In setting the impact dimension indicators, every country’s legislation also embedded the core social values to be maintained by the algorithmic governance practice. Around the core values of transparency, legitimacy, fairness, and justice, an assessment indicator system based on the algorithmic accountability dimension should be established. In addition to drawing on the above system, the regulatory thinking for algorithms can be further optimized. In the platform ecosystem, algorithms are constantly and dynamically changing due to the real-time and large amount of data “feeding” them. Therefore, there is an urgent need to develop and experiment with new ideas, set reasonable regulatory thresholds, and find a good balance between technological innovation and risk control. We should set up an intelligent supervision system to regulate, from ex-ante to ex-post, in a full cycle. At the same time, we should strengthen the accountability mechanism of algorithms, clarify the blacklist of algorithms, and require enterprises to avoid discrimination when setting up algorithms and set up certain redress and punishment mechanisms. In addition, in the regulatory strategy and technology, human supervision finds it difficult to cope with the high dynamics of algorithms. Thus, algorithms can be supervised by algorithms through algorithmic technology to collect the decision-making of the platform ecosystem in high-risk scenarios to identify whether there are violations.

5.2. Build a Multifaceted Synergy between the Inner and Outer Circles of the Platform Ecosystem

5.2.1. Dominant Platform

The dominant platform in the platform ecosystem has both corporate and market duality. When it manages platform affairs as a manager, it may harm the interests of users on the platform based on its interests. Therefore, platform autonomy is crucial, and only when the platform is autonomous can it guarantee competition compliance. Since the dominant platform controls the data and algorithms of the platform ecosystem, to avoid data security risks, the dominant platform needs to strengthen the compliance review of relevant laws, including the Data Security Law, and build a classification and grading management system for data in the platform ecosystem. It also needs to strengthen the technical protection measures in safe data transmission and flow, regularly conduct a risk assessment, and establish a data security emergency plan. For ecosystem algorithm technology, the dominant platform should regularly examine algorithms within the platform and assess the risk points of the non-compliance of algorithms in a scenario-specific manner to prevent the algorithm’s elements in the self-learning process from violating relevant laws. At the same time, the dominant platform, as the rule setter of the platform ecosystem, should ensure rules do not distort market competition within the platform. In the absence of reasonable objective efficiency reasons, it cannot use its rule-making power to influence and distort the competition among operators within the platform and exploit the legitimate interests of operators or third-party partners [23] (p. 46).

5.2.2. Operators

Operators may be subject to undue interference by the dominant platform or suffer “data hegemony” detrimental to their interests. In this regard, there is an urgent need to further clarify the responsibilities and obligations of the “managers” of the ecosystem so that the cooperative operators in the platform ecosystem can have a justifiable basis and rules to appeal to the relevant authorities when they are unduly restricted.

5.2.3. Consumers

For consumers, educational activities such as consumer data security should be actively organized to raise consumers’ awareness of protecting themselves and their rights. Since consumers’ strengths are weak, it is necessary to streamline the consumer complaint and reporting mechanism. Furthermore, it is necessary to improve the consumer public interest litigation system and provide certain protections for those who report and complain, concerning the provisions of Article 12 of the Data Security Law, so that consumers can mitigate concerns, and form effective supervision and deterrence against illegal acts on the platform ecosystem. The external circle of the platform ecosystem contains governance subjects such as enforcement departments, judicial departments, and social organisations. For states, the focus of their regulation is to prevent the platform ecosystem from threatening market competitors, operators, consumers, and other subjects. However, the current enforcement and justice of anti-monopoly in the platform economy face problems of high professionalism and large workload, and there are unbalanced and insufficient problems in the allocation of staff and enforcement resources, so there are considerable difficulties in the process of enforcement and justice.

For this reason, it is necessary to further strengthen the training of relevant law enforcement and judicial staff and hire more personnel with professional technical knowledge to provide technical guidance for enforcement and judicial work. In addition, relevant organizations are also the external governance subjects of the platform ecosystem. As stipulated in Article 10 of the Data Security Law, relevant industry organizations, following their charters, formulate data security codes of conduct and group standards under the law and strengthen industry self-regulation. Therefore, there is an urgent need to enhance social organizations’ participation in the platform’s governance. Without a clear legal basis, social organizations such as industry associations can be encouraged to play a positive self-regulatory management function. They can maintain a fair, competitive order in the market by formulating industry norms, especially for multiple links, such as collecting and using data in the platform ecosystem. They can also effectively protect the legitimate rights and interests of consumers by formulating a code of conduct for the application of algorithm technology.

The emergence of the platform ecosystem is not an accident but a result of the choice of platform economy and market operation mechanism. The original platform development models based on capital gathering and initial traffic attraction are unable to break through the development bottleneck. However, the platform ecosystem based on the two-wheel drive of “data + algorithm” can realize the collection of diversified data, the diversified needs of consumers and users, and the deep excavation of consumer data and attention. It can also build a sustainable platform ecosystem around consumers’ needs and realize the economy of scope to create a sustainable platform ecosystem around consumer needs and achieve economies of scope. However, with the feedback loop formed by the network effect, user lock-in effect, and transmission effect, the platform ecosystem can obtain competitive advantages through data and algorithm advantages. The relative advantages of its dual identity of “manager” and “producer” enable it to gain market dominance and economies of scope. It can gain dominant power over the market and transmit it to multiple markets, eventually forming an “ecological monopoly”. To effectively regulate the ecological monopoly of the platform, a two-pronged approach based on the laws governing the operation of the platform ecosystem as a whole must be taken concerning the data and algorithms that drive the development of the platform ecosystem and that catalyse its evolution towards an “ecological monopoly”. Existing competition laws should also be updated to strengthen the identification of dominant forces in the ecosystem. In addition, based on the shape of the platform ecosystem operation, it is possible to achieve all-around regulation of the platform ecosystem both inside and outside the dual circle of the platform ecosystem and the multi-subject governance model. However, in strengthening the prevention and regulation of platform ecosystem monopoly, it is necessary to grasp the intensity of intervention and avoid overkill because, combined with the operation mechanism of the platform ecosystem, the platform ecosystem, driven by data and algorithms, aggregates diverse goods and services to form an ecosystem. It not only improves the operational efficiency of the system and each component but also provides many trading opportunities for other operators, satisfies the diverse needs of consumers, and enhances their service experience.

Given this, in the regulation process, it is necessary to correct the “big is bad” mindset and correctly understand the consistency and synergy between the healthy development of the platform ecosystem and the promotion of the platform economy. The purpose of effective regulation and scientific law enforcement is not to restrict the innovative development of the platform ecosystem but to prevent it from falling into the ecological monopoly, the “development trap”. After falling into this trap, the platform’s innovation momentum will be suppressed. The seemingly stable growth of platform benefits over time is at the expense of the long-term growth of innovation benefits for the industry. It will eventually force the dominant platform companies to reduce their innovation benefits as they become unsustainable. However, to guarantee the effective functioning of the platform ecosystem’s positive relevance, enforcement departments should be cautious of using structural means, such as splitting the company to affect the structural advantages of the platform ecosystem. Moreover, they should not overly raise the threshold of user data collection without emphasizing data security in any scenario. This is because it may inhibit the optimization of the platform ecosystem based on the effective supply of data, which will objectively lead to the continued healthy operation of the platform ecosystem. Article 7 of the Data Security Law clearly states that the state protects the rights and interests of individuals and organizations related to data. Additionally, it encourages the reasonable and effective use of data following the law, guarantees the orderly and free flow of data under the law, and promotes the development of the digital economy with data as a key element. Finally, it should be pointed out that “scientifically regulating the realistic risks and potential hazards of platform ecological monopoly, guaranteeing fair competition, and safeguarding the legitimate rights and interests of operators and consumers” does not contradict “optimizing the operation of the platform ecosystem”. Promoting the legal use of data and algorithms can improve market competition efficiency and stimulate the high level of innovation and development of platforms. It is ultimately conducive to the long-term welfare of consumers and is a win–win situation for multiple subjects in the platform economy.

6. Main Conclusions and Insights

6.1. Main Conclusions

During the budding period, as the regulators, the public, and others are not too familiar with the products and services of internet platforms, the regulatory policy requirements are relatively relaxed, and the probability of internet platforms operating in compliance and weak regulation by the regulators is higher. As the payment market continues to develop, more and more internet platforms participate in the market competition, the profit level begins to decline, the rate of internet platforms that choose to operate in violation of the law begins to rise, and the number, frequency, and strength of the regulators begin to rise. In the maturity period, the operating ability of small and medium-sized internet platforms is constantly tested. The phenomenon of mergers and acquisitions increases, the overall number of internet platforms tends to stabilize, and the new platform content market enters the stock competition. The strategies of different internet platforms will be differentiated, and the optimal strategy level of the regulators will be affected by both positive and negative aspects. The change in their strategy choice tends to slow down. Entering the recession period, after experiencing the big wave and the elimination of the best, most of the remaining internet platforms will be large enterprises with strength and scale. The probability of choosing to operate in compliance will rise greatly. The probability of regulators choosing weak regulation will also increase. However, it should be noted that the “rules” and “discipline” in “compliance” will be improved with the development of the market, and the standard of weak supervision by the regulatory department will be constantly improved with the improvement of the regulatory system requirements.

6.2. Main Inspiration

Firstly, we should take a rational view of the development of the internet platform and the existence of risks. As a new type of content service provider, the birth and development of the internet platform met the actual needs of social and economic development in the era of e-commerce, which is inevitable and of great significance to meet people’s needs for a better life. However, the risks brought about in the process of its development are inevitable and cannot be ignored. The internet platforms and the regulatory authorities should maintain an objective and rational understanding of this. Secondly, the regulatory system should adapt to the industry development life cycle to avoid regulatory mismatch. The social benefits and risks associated with an industry vary greatly depending on its life cycle. Thus, accurately grasping the specific life cycle of the industry’s development stage and taking the regulatory policy adapted to it can maximize the overall social and economic benefits based on the healthy development of the internet platform and meet the objective needs. Thirdly, forward-looking theoretical research will reserve the regulatory toolbox for new content service providers such as digital industry operators. With the continuous advancement of data and algorithm technology, new content service providers will continue to emerge, and a new industry will develop. Therefore, relevant experts and scholars should carry out forward-looking research, clarify the rights and responsibilities of all relevant stakeholders, and provide institutional safeguards for the healthy and sustainable development of the industry.

Author Contributions

Conceptualization, C.X.; methodology, C.X.; software, C.X. and Y.-M.W.; validation, C.X.; formal analysis, C.X.; investigation, C.X.; resources, C.X.; data curation, C.X.; writing—original draft preparation, C.X.; writing—review and editing, C.X. and Y.-M.W.; supervision, C.X.; project administration, C.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research is supported by “Strategy on China’s participation in the global governance of intellectual property rights” (21&ZD165), the Major Projects of the National Social Science Fund in China.

Data Availability Statement

Not applicable.

Acknowledgments

The authors are grateful to the editor and anonymous referees for their constructive comments and suggestions, which sufficiently help the authors to improve the presentation of this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Van Dijck, J.; Poell, T.; De Waal, M. The Platform Society: Public Values in a Connective World; Oxford University Press: Oxford, UK, 2018; p. 9. [Google Scholar]

- Kittler, F.A.; Griffin, M. The city is a medium. New Lit. Hist. 1996, 27, 717–729. [Google Scholar]

- Sun, P. How to Understand the Materiality of Algorithm—An exploration of platform economy and digital. Sci. Soc. 2019, 3, 50–66. [Google Scholar] [CrossRef]

- Liu, Z.M.; Zou, W. Digital entrepreneurship ecosystem: Theoretical framework and policy thinking. Soc. Sci. Guangdong 2020, 4, 5–14. [Google Scholar]

- Ren, T.H.; Cao, X.J. From Technology to Architecture: Driving Effects of Network Media Evolution on Social Platformization. J. Xi’an Jiaotong Univ. (Soc. Sci. Ed.) 2020, 5, 144–152. [Google Scholar] [CrossRef]

- Foucault, M. From Torture to Cellblock. In Foucault Live: Collected Interviews (1961–1984); Lotringer, S., Ed.; Hochroth, L.; Johnston, J., Translators; Semiotext(e): New York, NY, USA, 1996; pp. 146–149. [Google Scholar]

- Shan, L. Making the Ark of the Sea: The Production of Memorial Spaces for Jewish Refugees in Shanghai since the 1990s—A Perspective Based on a Network of Actors. Chin. J. J. Commun. 2019, 9, 105–126. [Google Scholar] [CrossRef]

- Chen, Y.S.; Wu, S.T. An exploration of actor-network theory and social affordance for the development of a tourist attraction: A case study of a Jimmy-related theme park, Taiwan. Tour. Manag. 2021, 82, 104206. [Google Scholar] [CrossRef]

- Latour, B. Reassembling the Social: An Introduction to Actor Network Theory; Oxford University Press: Oxford, UK, 2007; pp. 120–162. [Google Scholar]

- Latour, B. Factures/fractures: From the concept of network to the concept of attachment. Res. Anthropol. Aesthet. 1999, 36, 20–31. [Google Scholar] [CrossRef]

- Latour, B. On Actor—Network Theory: A Few Clarifications Plus More Than a Few Complications. Philos. Lit. J. Logos 1996, 25, 47–64. [Google Scholar]

- Borvil, A.D.; Natalie Kishchuk, N.; Potvin, L. Typology of actors’ influence strategies in intersectoral governance process in Montreal, Canada. Health Promot. Int. 2022, 37, 4. [Google Scholar] [CrossRef] [PubMed]

- Callon, M. Some Elements of a Sociology of Translation: Domestication of the Scallops and the Fishermen of St Brieuc Bay. Sociol. Rev. 1984, 32, 196–233. [Google Scholar] [CrossRef]

- Latour, B. Science in Action: How to Follow Scientists and Engineers in Society; Liu, W.X.; Zheng, K., Translators; Oriental Press: Beijing, China, 2005; pp. 8–10. [Google Scholar]

- Evans, D.S. The antitrust economics of multi-sided platform markets. Yale J. Regul. 2003, 20, 325–382. [Google Scholar]

- Grunes, A.P.; Stucke, M.E. No mistake about it: The important role of antitrust in the era of big data. The Antitrust Source 2015, 14, 1–14. [Google Scholar]

- Lianos, I. The Future of Competition Policy in Europe–Some Reflections on the Interaction between Industrial Policy and Competition Law. CLES Policy Pap. Ser. 2019, 1, 5–26. [Google Scholar] [CrossRef]

- Hovenkamp, H. Digital Cluster Markets. Columbia Bus. Law Rev. 2022, 2022, 1–34. [Google Scholar] [CrossRef]

- Zhang, X.B. On Imposing Obligations on the “Gatekeepers” of the Ecology of the Internet in the Protection of Personal Information. J. Comp. Law 2021, 3, 11–24. [Google Scholar]

- The Website of the State Administration of Market Supervision. Available online: http://www.samr.gov.cn/xw/zj/202104/P020210410285606356273.docx (accessed on 16 July 2022).

- Wang, Q.H. The Multiple Dimensions of Algorithmic Transparency and Algorithmic Accountability. J. Comp. Law 2020, 6, 163–173. [Google Scholar]

- Zhang, X. The Construction Mechanism of the Algorithmic Impact Assessment System and the Chinese Solution. Stud. Law Bus. 2021, 2, 102–115. [Google Scholar] [CrossRef]

- Tang, Y.J. Research on Economic Nature and Regulatory Policy System of Digital Platform. Econ. Rev. J. 2021, 4, 43–51. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).