Investment Suitability Assessment Based on B&R Symbiotic System Theory: Location Choice of China’s OFDI

Abstract

:1. Introduction

1.1. Background

1.2. Literature Review

1.2.1. Research on China’s OFDI Location Choice in B&R Countries

1.2.2. Application of Symbiosis in Cooperation between China and B&R Countries

1.3. Objectives and Contributions

2. Theoretical Framework

2.1. Construction of B&R Symbiotic System

2.2. Theoretical Connotation of Investment Suitability

2.3. Assessment Framework for Suitability Index

2.3.1. Stability Index

2.3.2. Coordination Index

2.3.3. Sustainability Index

3. Materials and Methods

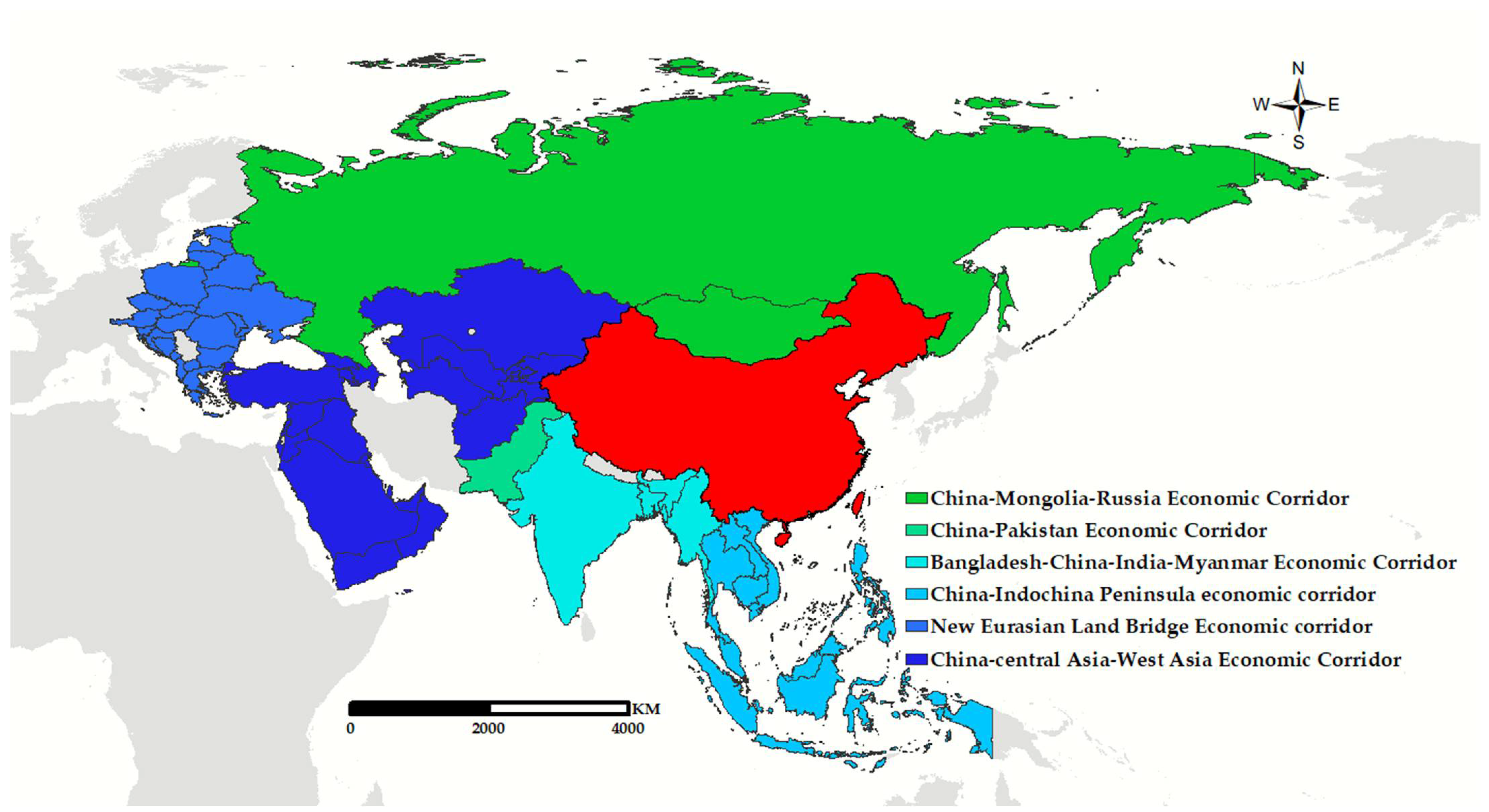

3.1. Study Area

3.2. Data Sources

3.3. Assessment Analysis

3.3.1. Indicator Standardization

3.3.2. Entropy Weight Method

3.3.3. TOPSIS Method

4. Results and Discussion

4.1. Stability, Coordination, and Sustainability of B&R Countries

4.1.1. Stability

4.1.2. Coordination

4.1.3. Sustainability

4.2. Investment Suitability of B&R Countries

4.3. Discussion

5. Conclusions and Implications

5.1. Conclusions

5.2. Implications

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Butzbach, O.; Fuller, D.B.; Schnyder, G. Manufacturing discontent: National institutions, multinational firm strategies, and anti-globalization backlash in advanced economies. Glob. Strategy J. 2020, 10, 67–93. [Google Scholar] [CrossRef]

- Dür, A.; Eckhardt, J.; Poletti, A. Global value chains, the anti-globalization backlash, and EU trade policy: A research agenda. J. Eur. Public Policy 2020, 27, 944–956. [Google Scholar] [CrossRef]

- Liao, H.; Yang, L.; Dai, S.; Van Assche, A. Outward FDI, industrial structure upgrading and domestic employment: Empirical evidence from the Chinese economy and the belt and road initiative. J. Asian Econ. 2021, 74, 101303. [Google Scholar] [CrossRef]

- Liu, H.; Jiang, J.; Zhang, L.; Chen, X. OFDI agglomeration and Chinese firm location decisions under the “Belt and Road” initiative. Sustainability 2018, 10, 4060. [Google Scholar] [CrossRef] [Green Version]

- Du, J.; Zhang, Y. Does one belt one road initiative promote Chinese overseas direct investment? China Econ. Rev. 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Liu, Y.; Yin, Y.; Zeng, X. Mutualism Effect of China’s Industrial Transfer to the Belt and Road Countries: Based on the Perspective of Bilateral Value Chain Upgrade. Econ. Geogr. 2020, 40, 136–146. [Google Scholar]

- Lin, Y.; Li, P.; Feng, Z.; Yang, Y.; You, Z.; Zhu, F. Climate Suitability Assessment of Human Settlements for Regions along the Belt and Road. Chin. Geogr. Sci. 2021, 31, 996–1010. [Google Scholar] [CrossRef]

- Huang, M.-X.; Li, S.-Y. The analysis of the impact of the Belt and Road initiative on the green development of participating countries. Sci. Total Environ. 2020, 722, 137869. [Google Scholar] [CrossRef]

- De Beule, F.; Zhang, H. The impact of government policy on Chinese investment locations: An analysis of the Belt and Road policy announcement, host-country agreement, and sentiment. J. Int. Bus. Policy 2022, 5, 194–217. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, C.; Zhang, Z. Pollution haven or porter? The impact of environmental regulation on location choices of pollution-intensive firms in China. J. Environ. Manag. 2019, 248, 109248. [Google Scholar] [CrossRef]

- Liang, Y.; Zhou, Z.; Liu, Y. Location choices of Chinese enterprises in Southeast Asia: The role of overseas Chinese networks. J. Geogr. Sci. 2019, 29, 1396–1410. [Google Scholar] [CrossRef]

- Huang, Y. Environmental risks and opportunities for countries along the Belt and Road: Location choice of China’s investment. J. Clean. Prod. 2019, 211, 14–26. [Google Scholar] [CrossRef]

- Shen, J.; Wei, Y.D.; Yang, Z. The impact of environmental regulations on the location of pollution-intensive industries in China. J. Clean. Prod. 2017, 148, 785–794. [Google Scholar] [CrossRef]

- Pan, L.; Feng, Q.; Li, J.; Wang, L. Determinants of China’s OFDI Location Choices: A Comparison Study Between BRI Countries and Non-BRI Countries. J. Syst. Sci. Inf. 2022, 10, 1–18. [Google Scholar] [CrossRef]

- Sun, X.; Gao, J.; Liu, B.; Wang, Z. Big data-based assessment of political risk along the belt and road. Sustainability 2021, 13, 3935. [Google Scholar] [CrossRef]

- Duan, F.; Ji, Q.; Liu, B.-Y.; Fan, Y. Energy investment risk assessment for nations along China’s Belt & Road Initiative. J. Clean. Prod. 2018, 170, 535–547. [Google Scholar]

- Liu, H.; Wang, Y.; Jiang, J.; Wu, P. How green is the “Belt and Road Initiative”?—Evidence from Chinese OFDI in the energy sector. Energy Policy 2020, 145, 111709. [Google Scholar] [CrossRef]

- Cheng, S.; Qi, S. The potential for China’s outward foreign direct investment and its determinants: A comparative study of carbon-intensive and non-carbon-intensive sectors along the Belt and Road. J. Environ. Manag. 2021, 282, 111960. [Google Scholar] [CrossRef]

- Kunrong, S.; Gang, J. China’s belt and road initiative and large-scale outbound investment. China Political Econ. 2018, 2, 219–240. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y. Research on the Location Choice of Chinese Enterprises’ Overseas Investment under the Motivation for Seeking natural resources in Host Country. In Proceedings of the E3S Web of Conferences; 2020; p. 01001. [Google Scholar]

- Razzaq, A.; An, H.; Delpachitra, S. Does technology gap increase FDI spillovers on productivity growth? Evidence from Chinese outward FDI in Belt and Road host countries. Technol. Forecast. Soc. Change 2021, 172, 121050. [Google Scholar] [CrossRef]

- Sutherland, D.; Anderson, J.; Bailey, N.; Alon, I. Policy, institutional fragility, and Chinese outward foreign direct investment: An empirical examination of the Belt and Road Initiative. J. Int. Bus. Policy 2020, 3, 249–272. [Google Scholar] [CrossRef]

- Bashir, M.F.; Ma, B.; Shahzad, L.; Liu, B.; Ruan, Q. China’s quest for economic dominance and energy consumption: Can Asian economies provide natural resources for the success of One Belt One Road? Manag. Decis. Econ. 2021, 42, 570–587. [Google Scholar] [CrossRef]

- Yuan, J.; Li, X.; Xu, C.; Zhao, C.; Liu, Y. Investment risk assessment of coal-fired power plants in countries along the Belt and Road initiative based on ANP-Entropy-TODIM method. Energy 2019, 176, 623–640. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Ji, S.; Song, Z. Renewable energy investment risk assessment for nations along China’s Belt & Road Initiative: An ANP-cloud model method. Energy 2020, 190, 116381. [Google Scholar]

- Hashemizadeh, A.; Ju, Y.; Bamakan, S.M.H.; Le, H.P. Renewable energy investment risk assessment in belt and road initiative countries under uncertainty conditions. Energy 2021, 214, 118923. [Google Scholar] [CrossRef]

- Adams, D.G. Symbiotic interactions. In The Ecology of Cyanobacteria; Springer: Berlin/Heidelberg, Germany, 2000; pp. 523–561. [Google Scholar]

- Ahmdajina, V. Symbiosis: An Introduction to Biological Association; University Press of New England: Lebanon, NH, USA, 1986. [Google Scholar]

- Hu, S. A Theory of Social Symbiosis, 2nd ed.; Fudan University Press: Shanghai, China, 2006; pp. 5–22. [Google Scholar]

- Sun, Q.; Wang, C.; Zhou, Y.; Zuo, L.; Tang, J. Dominant platform capability, symbiotic strategy and the construction of “Internet + WEEE collection” business ecosystem: A comparative study of two typical cases in China. J. Clean. Prod. 2020, 254, 120074. [Google Scholar] [CrossRef]

- Yoon, C.; Moon, S.; Lee, H. Symbiotic Relationships in Business Ecosystem: A Systematic Literature Review. Sustainability 2022, 14, 2252. [Google Scholar] [CrossRef]

- Yi, B.; Zhang, J. Study on Cooperative Symbiotic System of the“One Belt and One Road” in Northeast Asia. Northeast. Asia Forum 2015, 22, 65–74. [Google Scholar]

- Yu, X.; Luo, X. “The Belt and Road” Energy Symbiosis Cooperation: Framework Analysis and Promotion Path. Gansu Soc. Sci. 2021, 40, 198–206. [Google Scholar] [CrossRef]

- Zhang, H.; Liang, S. Model Analysis and Mechanism Construction of International Production Capacity Cooperation from the Perspective of Symbiosis Theory: Taking China-Kazakhstan Production Capacity Cooperation as an Example. Macroeconomics 2015, 35, 121–128. [Google Scholar]

- Hussain, J.; Zhou, K.; Guo, S.; Khan, A. Investment risk and natural resource potential in “Belt & Road Initiative” countries: A multi-criteria decision-making approach. Sci. Total Environ. 2020, 723, 137981. [Google Scholar] [PubMed]

- Yuan, C. Symbiosis Theory—On Small-Scale Economy. People’s Publ. House Beijing 1998, 55, 150–152. [Google Scholar]

- Han, Z.; Ma, H. Adaptability Assessment and Analysis of Temporal and Spatial Differences of Water-Energy-Food System in Yangtze River Delta in China. Sustainability 2021, 13, 13543. [Google Scholar] [CrossRef]

- Hirzel, A.H.; Le Lay, G. Habitat suitability modelling and niche theory. J. Appl. Ecol. 2008, 45, 1372–1381. [Google Scholar] [CrossRef]

- Hirzel, A.H.; Le Lay, G.; Helfer, V.; Randin, C.; Guisan, A. Evaluating the ability of habitat suitability models to predict species presences. Ecol. Model. 2006, 199, 142–152. [Google Scholar] [CrossRef]

- Malczewski, J. GIS-based land-use suitability analysis: A critical overview. Prog. Plan. 2004, 62, 3–65. [Google Scholar] [CrossRef]

- Collins, M.G.; Steiner, F.R.; Rushman, M.J. Land-use suitability analysis in the United States: Historical development and promising technological achievements. Environ. Manag. 2001, 28, 611–621. [Google Scholar] [CrossRef]

- VanDerWal, J.; Shoo, L.P.; Johnson, C.N.; Williams, S.E. Abundance and the environmental niche: Environmental suitability estimated from niche models predicts the upper limit of local abundance. Am. Nat. 2009, 174, 282–291. [Google Scholar] [CrossRef] [Green Version]

- Messina, J.P.; Kraemer, M.U.; Brady, O.J.; Pigott, D.M.; Shearer, F.M.; Weiss, D.J.; Golding, N.; Ruktanonchai, C.W.; Gething, P.W.; Cohn, E. Mapping global environmental suitability for Zika virus. Elife 2016, 5, e15272. [Google Scholar] [CrossRef]

- Irimia, L.M.; Patriche, C.V.; Roșca, B. Climate change impact on climate suitability for wine production in Romania. Theor. Appl. Climatol. 2018, 133, 1–14. [Google Scholar] [CrossRef]

- Boudier-Bensebaa, F. Agglomeration economies and location choice: Foreign direct investment in Hungary 1. Econ. Transit. 2005, 13, 605–628. [Google Scholar] [CrossRef]

- Coskun, R. Determinants of direct foreign investment in Turkey. Eur. Bus. Rev. 2001, 13, 221–227. [Google Scholar] [CrossRef]

- Raluca, D.A.; Alecsandru, S.V. Main determinants of Foreign Direct Investments in Romania-A quantitative view of the regional characteristics involved in the investment strategies of foreign companies. Procedia Soc. Behav. Sci. 2012, 58, 1193–1203. [Google Scholar] [CrossRef] [Green Version]

- Mohsin, A.; Lei, H.; Tushar, H.; Hossain, S.F.A.; Hossain, M.E.; Sume, A.H. Cultural and institutional distance of China’s outward foreign direct investment toward the “Belt and Road” countries. Chin. Econ. 2021, 54, 176–194. [Google Scholar] [CrossRef]

- Li, J.; Liu, B.; Qian, G. The belt and road initiative, cultural friction and ethnicity: Their effects on the export performance of SMEs in China. J. World Bus. 2019, 54, 350–359. [Google Scholar] [CrossRef]

- Chen, Y.; Chao, Y.; Liu, W.; Tao, K.; Lian, P. Make friends, not money: How Chinese enterprises select transport infrastructure investment locations along the Belt and Road. Transp. Policy 2021, 101, 119–132. [Google Scholar] [CrossRef]

- Liu, H.Y.; Tang, Y.K.; Chen, X.L.; Poznanska, J. The determinants of Chinese outward FDI in countries along “One Belt One Road”. Emerg. Mark. Financ. Trade 2017, 53, 1374–1387. [Google Scholar] [CrossRef]

- Warsame, A.S. The Location Choice of Foreign Direct Investment and Economic Development in Africa. Int. J. Econ. Financ. 2021, 13, 1–69. [Google Scholar] [CrossRef]

- Hwang, C.-L.; Yoon, K. Methods for multiple attribute decision making. In Multiple Attribute Decision Making; Springer: Berlin/Heidelberg, Germany, 1981; pp. 58–191. [Google Scholar]

- Ahmed, Z.S. Impact of the China–Pakistan Economic Corridor on nation-building in Pakistan. J. Contemp. China 2019, 28, 400–414. [Google Scholar] [CrossRef]

| Aspect | Dimension | Indicators | Source | Sign |

|---|---|---|---|---|

| Symbiotic unit (Stability) | Infrastructure level | Electricity rate (percentage of population) | 2020 1 | + |

| Mobile cellular subscriptions (per 100 people) | 2020 1 | + | ||

| Air traffic, global departures of registered carriers | 2020 1 | + | ||

| Number of internet security servers (per million people) | 2020 1 | + | ||

| Electricity generated from renewable sources, excluding hydropower (percentage of total electricity generation) | 2015 1 | + | ||

| Resource potential | Forest area (percentage of land area) | 2020 1 | + | |

| Agricultural land (percentage of land area) | 2018 1 | + | ||

| Fuel exports (percentage of commodity exports) | 2020 1 | + | ||

| Renewable energy consumption (percentage of total final energy consumption) | 2019 1 | + | ||

| Total renewable inland freshwater resources (billion cubic metres) | 2018 1 | + | ||

| Workforce level | Total labor force | 2021 1 | + | |

| Labor force with basic education (percentage of working-age population with basic education) | 2018 1 | + | ||

| R&D researchers (per million) | 2020 1 | + | ||

| Total wage earners (percentage of total employment) | 2019 1 | + | ||

| Symbiotic relationship (Coordination) | Industrial relations | Total trade volume in intermediate goods | 2019 2 | + |

| Number of industrial cooperation park | 2020 3 | + | ||

| Technical relations | High-tech products import and export volume | 2019 2 | + | |

| Number of co-authored papers | 2021 4 | + | ||

| Market relations | Total volume of import and export trade | 2019 2 | + | |

| Total trade volume as a percentage of global trade | 2019 2 | + | ||

| Cultural relations | Number of Confucius institutes | 2018 5 | + | |

| Number of international students in China | 2018 6 | + | ||

| Political relations | Number of visits by heads of government | 2018 7 | + | |

| Number of sister cities | 2020 8 | + | ||

| Symbiotic environment (Sustainability) | Economic system | GDP growth rate | 2019 1 | + |

| Per capital GDP | 2019 1 | + | ||

| Industrial value added (percentage of GDP) | 2019 1 | + | ||

| Inflows of foreign direct investment | 2019 1 | + | ||

| Social system | Total population | 2021 1 | + | |

| Total public expenditure on education (percentage of GDP) | 2021 1 | + | ||

| Government effectiveness | 2020 9 | + | ||

| Regulatory quality | 2020 9 | + | ||

| Control of corruption | 2020 9 | + | ||

| Environmental system | Species of mammals under threat | 2018 1 | - | |

| CO2 emissions (metric tons per capita) | 2019 1 | - | ||

| Particulate emission damage (percentage of GNI) | 2020 1 | - | ||

| PM2.5 air pollution, mean annual exposure (micrograms per cubic meter) | 2017 1 | - |

| Region | Country |

|---|---|

| China–Pakistan Economic Corridor (CPEC) | Pakistan (1 country) |

| China–Mongolia–Russia Economic Corridor (CMREC) | Mongolia, Russia (2 countries) |

| Bangladesh–China–India–Myanmar Economic Corridor (BCIMEC) | Bangladesh, India, Myanmar (3 countries) |

| China–Indochina Peninsula Economic Corridor (CIPEC) | Brunei, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Vietnam, Thailand (9 countries) |

| China–Central Asia–West Asia Economic Corridor (CCAWAEC) | Afghanistan, Georgia, Armenia, Azerbaijan, Bahrain, Iraq, Israel, Kazakhstan, Jordan, Kuwait, Kyrgyzstan, Lebanon, Oman, Qatar, Saudi Arabia, Syria, Turkey, Turkmenistan, Uzbekistan, Tajikistan, United Arab Emirates (UAE), Yemen (22 countries) |

| New Eurasian Land Bridge Economic Corridor (NELBEC) | Albania, Austria, Bosnia and Herzegovina, Bulgaria, Belarus, Croatia, Czech Republic, Estonia, Greece, Hungary, Latvia, Lithuania, Malta, Moldova, Montenegro, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Ukraine, Macedonia (23 countries) |

| Region | Country | Stability | Coordination | Sustainability | |||

|---|---|---|---|---|---|---|---|

| Score | Rank | Score | Rank | Score | Rank | ||

| CMREC | Russia | [0.506] | 1 | [0.694] | 1 | 0.137 | 12 |

| Mongolia | 0.109 | 42 | 0.141 | 16 | 0.092 | 36 | |

| CPEC | Pakistan | 0.117 | 39 | 0.346 | 8 | 0.166 | 5 |

| BCIMEC | India | 0.478 | 2 | 0.470 | 4 | [0.821] | 1 |

| Bangladesh | 0.113 | 41 | 0.133 | 18 | 0.134 | 13 | |

| Myanmar | 0.186 | 23 | 0.125 | 21 | 0.082 | 45 | |

| CIPEC | Singapore | 0.358 | 3 | 0.378 | 7 | 0.208 | 2 |

| Indonesia | 0.318 | 4 | 0.408 | 6 | 0.199 | 3 | |

| Brunei | 0.223 | 12 | 0.028 | 45 | 0.155 | 8 | |

| Malaysia | 0.172 | 28 | 0.441 | 5 | 0.111 | 25 | |

| Vietnam | 0.172 | 27 | 0.492 | 3 | 0.110 | 26 | |

| Philippines | 0.190 | 22 | 0.261 | 9 | 0.109 | 27 | |

| Thailand | 0.178 | 25 | 0.492 | 2 | 0.095 | 33 | |

| Cambodia | 0.137 | 36 | 0.150 | 15 | 0.068 | 53 | |

| Laos | 0.148 | 33 | 0.183 | 11 | 0.065 | 54 | |

| NELBEC | Hungary | 0.182 | 24 | 0.109 | 24 | 0.159 | 7 |

| Austria | 0.244 | 8 | 0.090 | 27 | 0.150 | 9 | |

| Estonia | 0.262 | 7 | 0.023 | 46 | 0.131 | 15 | |

| Malta | 0.114 | 40 | 0.020 | 51 | 0.123 | 16 | |

| Slovenia | 0.194 | 20 | 0.034 | 44 | 0.123 | 17 | |

| Czech | 0.173 | 26 | 0.167 | 14 | 0.120 | 18 | |

| Poland | 0.214 | 16 | 0.127 | 20 | 0.120 | 19 | |

| Portugal | 0.298 | 6 | 0.068 | 34 | 0.116 | 20 | |

| Lithuania | 0.299 | 5 | 0.018 | 53 | 0.113 | 23 | |

| Latvia | 0.199 | 18 | 0.037 | 43 | 0.107 | 28 | |

| Slovakia | 0.148 | 34 | 0.041 | 42 | 0.106 | 29 | |

| Croatia | 0.148 | 32 | 0.018 | 52 | 0.097 | 31 | |

| Romania | 0.166 | 29 | 0.109 | 25 | 0.096 | 32 | |

| Greece | 0.208 | 17 | 0.076 | 32 | 0.092 | 35 | |

| Serbia | 0.140 | 35 | 0.052 | 37 | 0.091 | 37 | |

| Bulgaria | 0.161 | 30 | 0.064 | 35 | 0.090 | 38 | |

| Belarus | 0.093 | 45 | 0.117 | 22 | 0.087 | 39 | |

| Moldova | 0.074 | 50 | 0.011 | 54 | 0.086 | 41 | |

| Ukraine | 0.080 | 48 | 0.084 | 30 | 0.086 | 42 | |

| Montenegro | 0.123 | 38 | 0.020 | 50 | 0.080 | 46 | |

| Albania | 0.085 | 46 | 0.007 | 59 | 0.077 | 49 | |

| Macedonia | 0.085 | 47 | [0.006] | 60 | 0.071 | 52 | |

| Bosnia and Herzegovina | 0.097 | 43 | 0.011 | 55 | 0.063 | 55 | |

| CCAWAEC | Qatar | 0.224 | 11 | 0.047 | 40 | 0.184 | 4 |

| United Arab Emirates | 0.221 | 13 | 0.171 | 12 | 0.163 | 6 | |

| Kuwait | 0.229 | 10 | 0.079 | 31 | 0.146 | 10 | |

| Saudi Arabia | 0.191 | 21 | 0.260 | 10 | 0.145 | 11 | |

| Israel | 0.057 | 54 | 0.090 | 28 | 0.132 | 14 | |

| Bahrain | 0.132 | 37 | 0.011 | 56 | 0.114 | 21 | |

| Oman | 0.194 | 19 | 0.085 | 29 | 0.114 | 22 | |

| Turkey | 0.215 | 14 | 0.129 | 19 | 0.113 | 24 | |

| Georgia | 0.094 | 44 | 0.045 | 41 | 0.097 | 30 | |

| Uzbekistan | 0.049 | 57 | 0.097 | 26 | 0.093 | 34 | |

| Iraq | 0.234 | 9 | 0.110 | 23 | 0.087 | 40 | |

| Kazakhstan | 0.161 | 31 | 0.167 | 13 | 0.086 | 43 | |

| Tajikistan | 0.078 | 49 | 0.072 | 33 | 0.082 | 44 | |

| Azerbaijan | 0.214 | 15 | 0.023 | 47 | 0.077 | 47 | |

| Jordan | 0.047 | 59 | 0.021 | 49 | 0.077 | 48 | |

| Armenia | 0.062 | 53 | 0.022 | 48 | 0.076 | 50 | |

| Kyrgyzstan | 0.067 | 52 | 0.139 | 17 | 0.076 | 51 | |

| Afghanistan | 0.071 | 51 | 0.056 | 36 | 0.062 | 56 | |

| Turkmenistan | 0.055 | 55 | 0.048 | 39 | 0.061 | 57 | |

| Lebanon | 0.048 | 58 | 0.010 | 57 | 0.055 | 58 | |

| Yemen | [0.035] | 60 | 0.051 | 38 | 0.055 | 59 | |

| Syria | 0.050 | 56 | 0.010 | 58 | [0.030] | 60 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yin, Y.; Liu, Y. Investment Suitability Assessment Based on B&R Symbiotic System Theory: Location Choice of China’s OFDI. Systems 2022, 10, 195. https://doi.org/10.3390/systems10060195

Yin Y, Liu Y. Investment Suitability Assessment Based on B&R Symbiotic System Theory: Location Choice of China’s OFDI. Systems. 2022; 10(6):195. https://doi.org/10.3390/systems10060195

Chicago/Turabian StyleYin, Yanzhao, and Youjin Liu. 2022. "Investment Suitability Assessment Based on B&R Symbiotic System Theory: Location Choice of China’s OFDI" Systems 10, no. 6: 195. https://doi.org/10.3390/systems10060195

APA StyleYin, Y., & Liu, Y. (2022). Investment Suitability Assessment Based on B&R Symbiotic System Theory: Location Choice of China’s OFDI. Systems, 10(6), 195. https://doi.org/10.3390/systems10060195