How Does Economic Resilience Enhance the Innovation Capability of the High-Tech Industry? Evidence from China

Abstract

:1. Introduction

- (1)

- (2)

- Economic resilience may also have a negative impact on the innovation capability of high-tech industries. For example, systems with strong resilience may hinder innovation behavior or be adverse to high-tech industry agglomeration [11].

- (3)

- Different from the situations in (1) and (2), some studies have pointed out that there is an inverted U-shaped relationship between resilience strength and innovation output, i.e., the impact on innovation output is greatest when resilience strength is moderate. Resilience strength under low innovation output is negatively correlated with innovation output, and the impact of resilience strength on innovation output is minimal under moderate R&D investment [12].

2. Literature Review

2.1. Government Technology Competition and Innovation Capability of the High-Tech Industry

2.2. Technology Market and Innovation Capability of the High-Tech Industry

2.3. Technology Talent Agglomeration and Innovation Capability of the High-Tech Industry

2.4. Regional Economic Factors and Innovation Capability of the High-Tech Industry

2.5. Integration of Factors Based on Configuration Analysis

3. Methods and Data

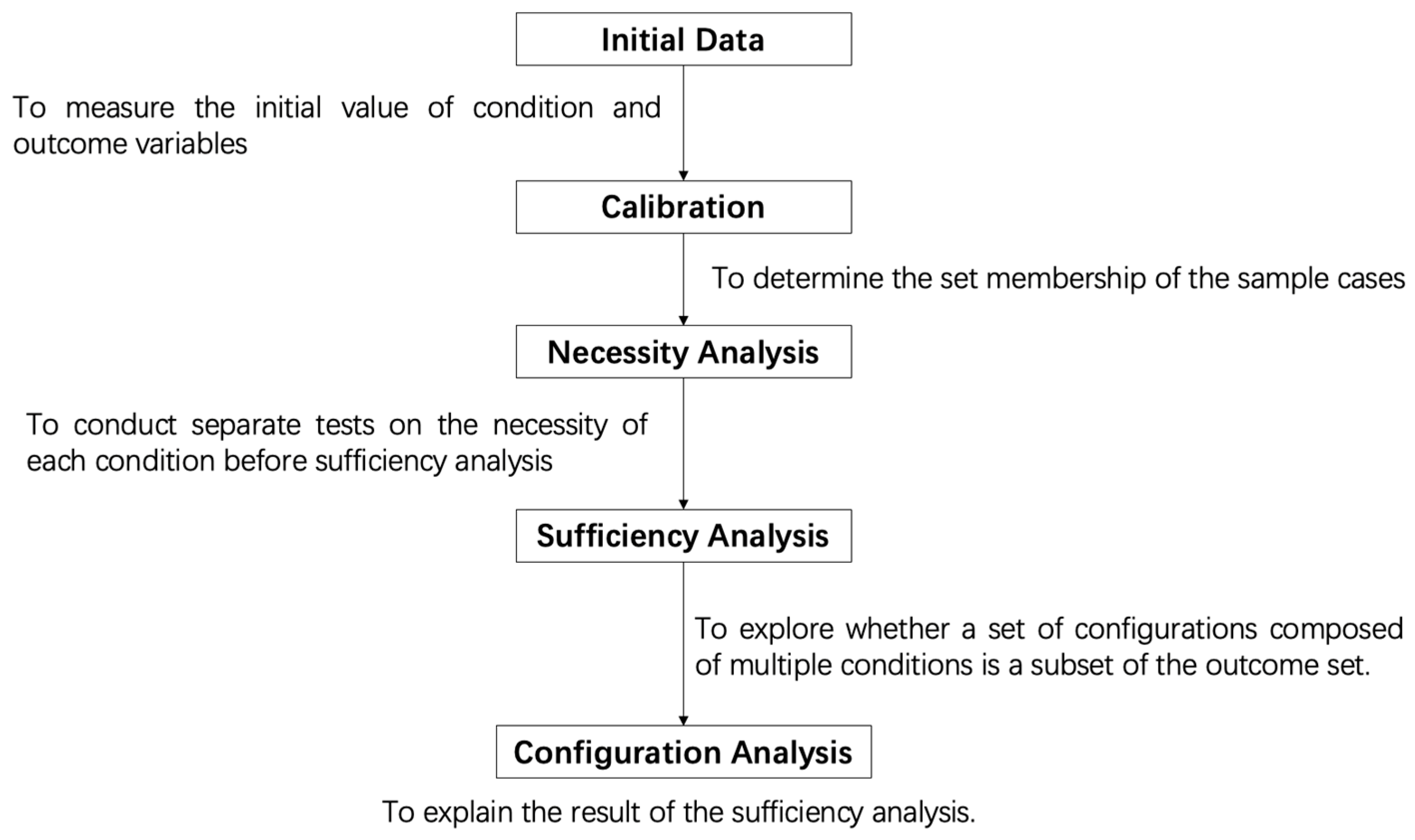

3.1. Fuzzy-Set Qualitative Comparative Analysis Approach

3.2. Data Source and Measuring Method

- (1)

- Initial economic resilience: According to the literature [7], this study uses the change rate of GDP for measurements, and the calculation formula is “Initial economic resilience = [(GDPi,t − GDPi,t−1)/GDPi, t−1 − (GDPt − GDPt−1)/GDPt−1]/|(GDPt − GDPt−1)/GDPt−1|”. GDPi, t is the gross domestic product of region i in year t; GDPi, t−1 is the gross domestic product of region i in year t − 1; GDPt is China’s gross domestic product in year t; and GDPt−1 is China’s gross domestic product in year t − 1. The data are sourced from the China Statistical Yearbook.

- (2)

- Other economic factors: The data on FDI are sourced from the statistical yearbooks of 30 provinces in China. This study uses the Digital Economy Development Index to measure the digital economy in various provinces, which is sourced from the 2019 China Digital Economy Development Index White Paper (https://www.ccidgroup.com/info/1096/21833.htm, accessed on 13 April 2023.), an authoritative report released by the China Electronic Information Industry Development Research Institute, a subsidiary of the Ministry of Industry and Information Technology of China. The data on regional GDP and urbanization are sourced from the China Statistical Yearbook, where urbanization is measured by the proportion of the regional urban population to the total population.

3.3. Calibration

4. Results

4.1. Necessity Analysis

4.2. Sufficiency Analysis

4.3. Configuration Analysis

4.3.1. Configurations for ICHI

4.3.2. Configurations for ~ICHI

5. Discussions

5.1. The Configuration Mechanism of the Impact of ER on the ICHI

- (1)

- The impact of a high ER on the ICHI: Configuration H2 indicates that the effective synergy among high ER, high GTC, high TTA, and high ED can generate a high ICHI. Configuration L4 indicates that the combination of high ER, low GTC, low TM, and low TTA will lead to low ICHI.

- (2)

- The impact of low ER on the ICHI: Configuration H1 indicates that the combination of low ER with high TM, high TTA, and high ED can generate high ICHI. Configuration L2 and L3 indicate that the combination of low ER with low GTC, low TM, and low ED, as well as the combination of low ER with low GTC, low TTA, and high TM, all lead to low ICHI.

5.2. Equivalent Configuration and Substitution Effects of the ICHI

- (1)

- By comparing the similarities and differences between equivalent configurations H1 and H2, the following is observed:

- Although configurations H1 and H2 are composed of different condition variables, they can both achieve high ICHI.

- With the same condition, combinations of “TTA * ED”, “TM *~ER”, and “GTC * ER” can be substituted for each other.

- (2)

- By comparing the similarities and differences of equivalent configurations L1, L2, L3, and L4, the following is observed:

- The four configurations composed of different conditions all lead to low ICHI.

- With the same condition combination “~TM *~TTA”, condition “~ED”, and condition combination “~GTC * ER” in configurations L1 and L4, they can be substituted for each other.

- With the same condition combination “~GTC *~ER”, condition combinations “~TM *~ED” and “TM *~TTA” in L2 and L3 can be substituted for each other.

5.3. Causal Asymmetry of the Configurations of ICHI

- (1)

- It is directly observed that two configurations lead to high ICHI, while four configurations lead to low ICHI.

- (2)

- GTC, TM, TTA, and ED are the core conditions for high ICHI, while ~TM, ~TTA, and ~ER are the core conditions for low ICHI.

- (3)

- By comparing configurations H1, H2, L2, L3, and L4, it can be found that high ER and low ER can both lead to high (low) ICHI. The causal relationship logic between ER and ICHI does not follow the linear assumption. Similarly, the presence or absence of GTC is irrelevant for the formation of high ICHI in configuration H1, while the absence of GTC becomes an important condition leading to low ICHI in configurations L2, L3, and L4.

5.4. Policy Implications and Research Prospects

- (1)

- High-tech industry technology talents and regional economic development are the core conditions for enhancing the innovation capability of the high-tech industry. However, it is worth noting that these two conditions are not sufficient, and decision-makers must further enhance the synergy between these two conditions and other conditions.

- (2)

- Enhancing the innovation capability of high-tech industry is feasible by enhancing economic resilience, but simultaneously enhancing government support for science and technology, increasing the training of technological talents, and promoting economic development are necessary. Strategically, the synergistic effect of these factors should be enhanced to form configurations that are conducive to generating high innovation capability within the high-tech industry.

- (3)

- For regions where the innovation capability of the high-tech industry has been at a low level for a long period of time, decision makers not only need to conduct in-depth evaluations of conditional endowments, such as technology fiscal expenditure, technology markets, technology talents, economic development, and economic resilience, but also need to conduct in-depth investigations on the factors that hinder the synergistic effect of these conditions in order to find a suitable path for improving the innovation capability of high-tech industries in local areas in accordance with local conditional endowments.

- (4)

- In practice, decision-makers related to these conditions in our study come from different government departments, and the essence of achieving conditional synergy is to achieve decision-making collaboration among different departments. That is to say that the overall effect of enhancing the innovation capability of high-tech industries at the system level is achieved through decision-making collaboration. Therefore, it is necessary to introduce the logic of collaborative governance into the decision-making process. Specifically, it is needed for the following processes: establishing a collaborative governance program in the decision-making process; requiring decision-makers from various departments to participate in discussions; jointly identifying problems; and developing collaborative action, supervision, and evaluation plans.

6. Conclusions

- (1)

- Technological talent and economic development are necessary conditions for explaining the high innovation capability of the high-tech industry.

- (2)

- The combination of economic resilience and different factors constitutes the equivalent configuration of two high innovation capabilities and four low innovation capabilities.

- (3)

- Under the configuration of high-intensity technological competition between governments, the increased agglomeration of technological talents, and high-quality economic development, the strengthening of economic resilience is conducive to enhancing the innovation capability of high-tech industries.

- (4)

- Under the configuration of low-intensity technological competition among governments, a well-developed technology market, and the increased agglomeration of technological talents, the strengthening of economic resilience is averse to enhancing the innovation capability of the high-tech industry.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Province | ICHI | GTC | TM | TTA | ED | ER |

|---|---|---|---|---|---|---|

| Beijing | 0.55 | 0.96 | 0.99 | 0.5 | 0.95 | 0.27 |

| Tianjin | 0.32 | 0.66 | 0.62 | 0.72 | 0.58 | 0.03 |

| Hebei | 0.5 | 0.08 | 0.51 | 0.28 | 0.31 | 0.35 |

| Shanxi | 0.06 | 0.49 | 0.25 | 0.08 | 0.18 | 0.45 |

| Inner Mongolia | 0.06 | 0.03 | 0.06 | 0.06 | 0.24 | 0.3 |

| Liaoning | 0.28 | 0.26 | 0.57 | 0.26 | 0.53 | 0.38 |

| Jilin | 0.07 | 0.19 | 0.53 | 0.11 | 0.04 | 0.08 |

| Heilongjiang | 0.07 | 0.12 | 0.29 | 0.07 | 0.11 | 0.15 |

| Shanghai | 0.55 | 0.95 | 0.75 | 0.6 | 0.93 | 0.18 |

| Jiangsu | 0.79 | 0.64 | 0.7 | 0.87 | 0.94 | 0.49 |

| Zhejiang | 0.67 | 0.72 | 0.6 | 0.88 | 0.88 | 0.52 |

| Anhui | 0.55 | 0.87 | 0.52 | 0.6 | 0.66 | 0.97 |

| Fujian | 0.56 | 0.36 | 0.12 | 0.71 | 0.74 | 0.75 |

| Jiangxi | 0.53 | 0.72 | 0.18 | 0.68 | 0.56 | 0.87 |

| Shandong | 0.56 | 0.29 | 0.66 | 0.65 | 0.8 | 0.39 |

| Henan | 0.51 | 0.37 | 0.25 | 0.48 | 0.63 | 0.8 |

| Hubei | 0.57 | 0.73 | 0.74 | 0.56 | 0.68 | 0.9 |

| Hunan | 0.52 | 0.5 | 0.51 | 0.6 | 0.6 | 0.57 |

| Guangdong | 0.99 | 0.89 | 0.77 | 0.99 | 0.94 | 0.74 |

| Guangxi | 0.08 | 0.34 | 0.09 | 0.06 | 0.15 | 0.83 |

| Hainan | 0.05 | 0.32 | 0.05 | 0.15 | 0.12 | 0.4 |

| Chongqing | 0.49 | 0.42 | 0.36 | 0.57 | 0.34 | 0.18 |

| Sichuan | 0.56 | 0.51 | 0.7 | 0.64 | 0.52 | 0.89 |

| Guizhou | 0.13 | 0.74 | 0.31 | 0.3 | 0.12 | 0.81 |

| Yunnan | 0.07 | 0.3 | 0.13 | 0.08 | 0.07 | 0.76 |

| Shaanxi | 0.49 | 0.5 | 0.73 | 0.6 | 0.46 | 0.85 |

| Gansu | 0.05 | 0.32 | 0.34 | 0.07 | 0.06 | 0.89 |

| Qinghai | 0.05 | 0.57 | 0.12 | 0.06 | 0.07 | 0.49 |

| Ningxia | 0.05 | 0.85 | 0.05 | 0.17 | 0.1 | 0.34 |

| Xinjiang | 0.05 | 0.47 | 0.05 | 0.04 | 0.13 | 0.93 |

Appendix B

| Configurations | Raw Coverage | Unique Coverage | Consistency | |

|---|---|---|---|---|

| ICHI | ||||

| Complex solution | TM * TTA * ED *~ER | 0.561 | 0.146 | 0.938 |

| GTC * TTA * ED * ER | 0.702 | 0.287 | 0.969 | |

| solution coverage: 0.848 solution consistency: 0.938 | ||||

| Parsimonious solution | GTC * TTA | 0.855 | 0.006 | 0.890 |

| TM * TTA | 0.821 | 0.058 | 0.908 | |

| GTC * ED | 0.850 | 0.008 | 0.836 | |

| solution coverage: 0.921 solution consistency: 0.792 | ||||

| Intermediate solution | TM * TTA * ED *~ER | 0.561 | 0.146 | 0.938 |

| GTC * TTA * ED * ER | 0.702 | 0.287 | 0.969 | |

| solution coverage: 0.848 solution consistency: 0.938 | ||||

| ~ICHI | ||||

| Complex solution | ~TM *~TTA *~ED | 0.719 | 0.160 | 1 |

| ~GTC *~TM *~ED *~ER | 0.413 | 0.007 | 0.985 | |

| ~GTC *TM *~TTA *~ER | 0.290 | 0.013 | 0.998 | |

| ~GTC *~TM *~TTA * ER | 0.457 | 0.008 | 0.997 | |

| solution coverage: 0.758 solution consistency: 0.989 | ||||

| Parsimonious solution | ~TTA | 0.895 | 0.435 | 0.979 |

| ~TM *~ER | 0.486 | 0.026 | 0.948 | |

| solution coverage: 0.921 solution consistency: 0.953 | ||||

| Intermediate solution | ~TM *~TTA *~ED | 0.719 | 0.160 | 1 |

| ~GTC *~TM *~ED *~ER | 0.413 | 0.007 | 0.985 | |

| ~GTC *TM *~TTA *~ER | 0.290 | 0.013 | 0.998 | |

| ~GTC *~TM *~TTA * ER | 0.457 | 0.008 | 0.997 | |

| solution coverage: 0.758 solution consistency: 0.989 | ||||

References

- Chen, X.; Liu, X.; Zhu, Q. Comparative analysis of total factor productivity in China’s high-tech industries. Technol. Forecast. Soc. Chang. 2022, 175, 1–14. [Google Scholar] [CrossRef]

- Yuan, S.; Yu, L.; Zhong, C.; Chen, Y. Does the innovation policy promote innovation quantity or innovation quality? China Soft Sci. 2020, 3, 32–45. [Google Scholar]

- Liang, Z.; Xu, H.; Hu, D. The conditional configuration of stagnation in the value chain upgrading of China’s high-tech industry: A qualitative comparative analysis based on 19 sub-industries. Sci. Technol. Prog. Policy 2022, 39, 72–80. [Google Scholar]

- Holling, C.S. Resilience and stability of ecological systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Walker, B.; Gunderson, L.; Kinzig, A.; Folke, C.; Carpenter, S.; Schultz, L. A handful of heuristics and some propositions for understanding resilience in social-ecological systems. Ecol. Soc. 2006, 11, 709–723. [Google Scholar] [CrossRef]

- Meerow, S.; Newell, J.P.; Stults, M. Defining urban resilience: A review. Landsc. Urban Plan. 2016, 147, 38–49. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2014, 15, 1–42. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How Regions React to Recessions: Resilience and the Role of Economic Structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Liu, H.; Lu, C. The impact of innovation ecosystem resilience on high-tech economic development. Forum Sci. Technol. China 2023, 321, 48–57. [Google Scholar]

- Wu, C.; Tan, Q. The influence of industrial related variety on regional economic resilience: An explanation from innovation ecosystem symbiosis. Sci. Technol. Prog. Policy 2023, 40, 72–80. [Google Scholar]

- Xie, Y.; Chen, R. Innovation failure, failure recovery and continuous innovation behavior of the innovation team: The moderating effect of team innovation passion. Sci. Res. Manag. 2020, 43, 63–71. [Google Scholar]

- Hu, J.; Yu, L. Research on the influence mechanism and characteristics of innovation resilience on high-tech industry innovation. Sci. Technol. Prog. Policy 2022, 39, 49–59. [Google Scholar]

- Du, Y.; Jia, L. Configuration perspective and qualitative comparative analysis: A new way of management research. J. Manag. World 2017, 6, 155–167. [Google Scholar]

- Xiao, R.; Chen, Z.; Qian, L. China’s high-tech manufacturing industries’ innovation efficiency: Technology heterogeneity perspective. J. Manag. Sci. 2018, 31, 48–68. [Google Scholar]

- Gu, Y.; Wang, Z.; Guo, T.; Chen, H. The configuration effect of sci-tech financial investment on innovation performance of high-tech industry: A fuzzy-set QCA approach. Sci. Technol. Prog. Policy 2023, 40, 60–68. [Google Scholar]

- Hu, J.; Yu, L.; Hong, J. Research on the impact of digital economy on high-tech industry under double cycle. Stud. Sci. Sci. 2022, 40, 2173–2186. [Google Scholar]

- Ren, J.; Zhao, R.; Ren, J. Digital finance, high-tech industrial agglomeration and regional innovation performance. Stat. Decis. 2023, 39, 86–91. [Google Scholar]

- Li, S.; Xu, M.; Lin, Z. Research on the impact of international knowledge spillovers on the innovation performance of high-tech industries under the effection of R&D human capital. Chin. J. Manag. 2021, 18, 1354–1362. [Google Scholar]

- Han, B. FDI and the efficiency of high-tech industries: The mediating effect of technological innovation and market competition. Soc. Sci. 2022, 2, 88–97. [Google Scholar]

- Ren, Y.; Wang, C. Empirical study on impact of urbanization on regional green economic efficiency in China. Technol. Econ. 2017, 36, 72–78. [Google Scholar]

- Ragin, C.C.; Fiss, P.C. Net Effects Analysis versus Configurational Analysis: An Empirical Demonstration. In Redesining Social Inquiry: Fuzzy Set and Beyond; Ragin, C.C., Ed.; University of Chicago Press: Chicago, IL, USA, 2008; pp. 190–212. [Google Scholar]

- Fiss, P.C. A Set-Theoretic Approach to Organizational Configurations. Acad. Manag. Rev. 2007, 32, 1180–1198. [Google Scholar] [CrossRef]

- Edin, M. State capacity and local agent control in China: CCP cadre management from a township perspective. China Q. 2003, 173, 35–52. [Google Scholar] [CrossRef]

- Ma, L. Diffusion and assimilation of government microblogging: Evidence from Chinese cities. Public Manag. Rev. 2014, 16, 274–295. [Google Scholar] [CrossRef]

- Yu, J.; Zhou, L.; Zhu, G. Strategic interaction in political competition: Evidence from spatial effects across Chinese cities. Reg. Sci. Urban Econ. 2016, 57, 23–37. [Google Scholar] [CrossRef]

- Zhou, L. Governing China’s local officials: An analysis of promotion tournament model. Econ. Res. J. 2007, 7, 35–71. [Google Scholar]

- Liu, J. An analysis on Chinese political tournament. J. Public Manag. 2008, 3, 29–34. [Google Scholar]

- Yu, X. Official promotion tournament: Political logic of economic growth-Based on sorting and analysis of the relevant literature. East China Econ. Manag. 2016, 30, 88–95. [Google Scholar]

- Bian, Y.; Wu, L.; Bai, J. Economic Growth, S&T innovation and promotion: The evidence from China’s provincial governments. Sci. Res. Manag. 2019, 40, 53–61. [Google Scholar]

- Ni, J.; Li, H. Market segmentation and high-tech industries’ development: From the perspective of institutional logics. Stud. Sci. Sci. 2021, 39, 1584–1592. [Google Scholar]

- Cheng, G.; Hou, L. Research on local government competition models and regional technological innovation from the perspective of fiscal decentralization. Mod. Econ. Res. 2021, 6, 28–37. [Google Scholar]

- Wan, Q.; Yuan, L.; Wang, B. R&D factor flow and high-tech industries’ innovation ability. Forum Sci. Technol. China 2021, 297, 106–116. [Google Scholar]

- Seok, B.I.; Han, M.S. Effects of network utilization for enterprise technology trading activities on technology commercialization capacity and innovation performance. Glob. Bus. Adm. Rev. 2018, 15, 69–89. [Google Scholar] [CrossRef]

- Zheng, F.; Jiao, H.; Cai, H. Reappraisal of outbound open innovation under the policy of China’s ‘Market for Technology’. Technol. Anal. Strateg. Manag. 2018, 30, 1–14. [Google Scholar] [CrossRef]

- Zhou, J.; Xi, Y.; Zhou, Y. Regional technology market, government support and technological innovation. China Soft Sci. 2021, 371, 80–90. [Google Scholar]

- Zhao, Q.; Liu, Z.; Cui, H. Internet development, technology market and technological innovation efficiency of high-tech industry of China: Empirical analysis based on SBM-Entropy-Tobit model. J. Technol. Econ. 2022, 41, 1–10. [Google Scholar]

- Shi, J.; Lai, W. Incentive factors of talent agglomeration: A case of high-tech innovation in China. Int. J. Innov. Sci. 2019, 11, 561–582. [Google Scholar] [CrossRef]

- Wan, Q.; Yuan, L.; Tan, Z. The influence of the sci-tech talents agglomeration, market competition and interaction on innovation performance of high-tech industry. Soft Sci. 2021, 35, 7–12. [Google Scholar]

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Krugman, P.R. Increasing returns and economic geography. J. Political Econ. Hist. 1991, 58, 659–683. [Google Scholar] [CrossRef]

- Pei, L. Interactive relationships between talents agglomeration and high-tech industry development. Stud. Sci. Sci. 2018, 36, 813–824. [Google Scholar]

- Li, L.; Liu, H. A study on the impact of technology talent agglomeration on regional innovation ability: An empirical analysis based on the Chengdu Chongqing double city economic circle. West. China 2022, 2, 72–83. [Google Scholar]

- Modica, M.; Reggiani, A. Spatial economic resilience: Overview and perspectives. Netw. Spat. Econ. 2015, 15, 211–233. [Google Scholar] [CrossRef]

- Martin, R. Roepke lecture in economic geography-rethinking regional path dependence: Beyond lock-in to evolution. Econ. Geogr. 2015, 86, 1–27. [Google Scholar] [CrossRef]

- Filippetti, A.; Gkotsis, P.; Vezzani, A.; Zinilli, A. Are innovative regions more resilient? Evidence from Europe in 2008–2016. Econ. Politica 2020, 37, 807–832. [Google Scholar] [CrossRef]

- Chen, C.; Ye, A. Digital economy, innovation capacity and regional economic resilience. Stat. Decis. 2021, 37, 10–15. [Google Scholar]

- Wang, P.; Zhong, Y.; Yan, Y. Interactive analysis of the efficiency of technological innovation and regional economic resilience: The empirical evidence of the Pearl River Delta. Sci. Technol. Prog. Policy 2022, 39, 48–58. [Google Scholar]

- Caro, P.D. Recessions, recoveries and regional resilience: Evidence on Italy. Camb. J. Reg. Econ. Soc. 2015, 8, 273–291. [Google Scholar] [CrossRef]

- Ito, B.; Yashiro, N.; Xu, Z.; Chen, X.; Wakasugi, R. How do Chinese industries benefit from FDI spillovers? China Econ. Rev. 2012, 23, 342–356. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, K.H. Absorptive capacity and benefits from FDI: Evidence from Chinese manufactured exports. Int. Rev. Econ. Financ. 2016, 42, 423–429. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, Z. The effects of FDI on innovative entrepreneurship: A regional-level study. Technol. Forecast. Soc. Chang. 2023, 186, 122159. [Google Scholar] [CrossRef]

- Wang, L.; Yu, J.; Shao, Y. Foreign direct investment and regional green total factor efficiency. Financ. Trade Res. 2019, 10, 17–30. [Google Scholar]

- Shao, H.; Lu, J.; Yang, J. Influences of FDI on productivity of domestic firms: Empirical evidence from China’s high-tech industry. Int. Bus. 2015, 4, 36–44. [Google Scholar]

- Görg, H.; Greenaway, D. Much Ado about Nothing? Do Domestic Firms Really Benefit from Foreign Direct Investment? World Bank Res. Obs. 2004, 19, 171–197. [Google Scholar] [CrossRef]

- Ren, S.; Zuo, H. The impact of bidirectional FDI and regional innovation efficiency on China’s green total factor productivity: An empirical analysis based on provincial panel data. Stat. Manag. 2021, 36, 42–46. [Google Scholar]

- Cheng, S.; Ma, W.; Luo, L.; Li, Y. Can the development of digital economy improve the quality of regional investment?—Empirical evidence from Chinese cities. Econ. Anal. Policy 2023, 80, 214–221. [Google Scholar] [CrossRef]

- Guo, B.; Wang, Y.; Zhang, H.; Liang, C.; Feng, Y.; Hu, F. Impact of the digital economy on high-quality urban economic development: Evidence from Chinese cities. Econ. Model. 2023, 120, 106194. [Google Scholar] [CrossRef]

- Yang, B. Digital economy, intellectual property protection and innovation efficiency of high-tech industry. J. Tech. Econ. Manag. 2023, 7, 6–11. [Google Scholar]

- Yuan, H.; Gao, B. The development of digital economy and the improvement of high-tech industry innovation efficiency: Empirical test based on China’s provincial panel data. Sci. Technol. Prog. Policy 2022, 39, 61–71. [Google Scholar]

- Feng, X.; Wang, F. Research on performance improvement path of high-tech industry innovation efficiency from the perspective of configuration: A fuzzy-set qualitative comparative analysis. Sci. Technol. Prog. Policy 2021, 38, 54–60. [Google Scholar]

- Ren, B. Theoretical interpretation and practical orientation of China’s economy from high-speed growth to high quality development in New Era. Acad. Mon. 2018, 50, 66–74. [Google Scholar]

- Tang, J.; Ni, Y.; Zhang, Y. Urbanization, science and education policy and technological innovation capability: An empirical analysis at the provincial level in China. Technol. Innov. Manag. 2021, 42, 144–153. [Google Scholar]

- Hu, X.; Chen, M. Research on the synergistic effect of manufacturing agglomeration and urbanization development for urban green total factor productivity: Empirical evidence from 261 prefecture-level cities and above in China. Sci. Technol. Prog. Policy 2019, 36, 70–79. [Google Scholar]

- Zhang, M.; Du, Y. Qualitative comparative analysis in management and organization research: Position, tactics and directions. Chin. J. Manag. 2019, 9, 1312–1323. [Google Scholar]

- Peng, X.; Zhang, Z. Spatial difference and dynamic evolution of regional innovation system efficiency of China. Sci. Technol. Manag. Res. 2023, 14, 1–15. [Google Scholar]

- Luan, S. Impact of COVID-19 on China’s macro-economy and suggestions. China Mark. 2023, 2, 8–10. [Google Scholar]

- Acs, Z.J.; Anselin, L.; ßVarga, A. Patents and innovation counts as measures of regional production of new knowledge. Res. Policy 2002, 31, 1069–1085. [Google Scholar] [CrossRef]

- Liu, G.; Liu, J. FDI knowledge spillover, absorptive capacity and innovation output of high-tech industries: An empirical analysis based on threshold effect model. Technol. Innov. Manag. 2022, 43, 649–660. [Google Scholar]

- Hong, Y.; Chen, L.; Cao, Y. Does local government competition hinder the improvement of local government debt performance? J. Financ. Res. 2020, 4, 70–90. [Google Scholar]

- Yu, L.; Wang, B. Research on the influence of technology market on collaborative innovation under the theory of market design: Take high-tech enterprises as an example. Sci. Res. Manag. 2022, 43, 144–153. [Google Scholar]

| Variable Type | Indicators, Year | Abbreviation |

|---|---|---|

| Outcomes | Innovation Capability of the High-Tech Industry, 2019 | ICHI |

| Conditions | Government Technology Competition, 2018 | GTC |

| Technology Market, 2018 | TM | |

| Technology Talent Agglomeration, 2018 | TTA | |

| Economic Resilience, 2018 | ER | |

| Economic Development, 2018 | ED |

| Outcomes and Conditions | Fully in | Crossover | Fully Out |

|---|---|---|---|

| ICHI | 85,986.950 | 4053.500 | 131.400 |

| GTC | 2.334 | 0.612 | 0.321 |

| TM | 29,820,013.000 | 2,321,684.500 | 55,820.600 |

| TTA | 0.431 | 0.104 | 0.013 |

| ED | 2.027 | −0.218 | −1.128 |

| ER | 1.126 | 0.194 | −2.514 |

| Conditions | ICHI | ~ICHI |

|---|---|---|

| Consistency | Consistency | |

| GTC | 0.864 | 0.593 |

| ~GTC | 0.650 | 0.695 |

| TM | 0.852 | 0.472 |

| ~TM | 0.677 | 0.825 |

| TTA | 0.967 | 0.446 |

| ~TTA | 0.641 | 0.895 |

| ED | 0.954 | 0.453 |

| ~ED | 0.560 | 0.836 |

| ER | 0.789 | 0.649 |

| ~ER | 0.621 | 0.581 |

| Conditions | ICHI | ~ICHI | ||||

|---|---|---|---|---|---|---|

| H1 | H2 | L1 | L2 | L3 | L4 | |

| GTC | ● |  |  |  | ||

| TM | ● | ⊗ | ⊗ | 🞄 | ⊗ | |

| TTA | ● | ● | ⊗ | ⊗ | ⊗ | |

| ED | ● | ● |  |  | ||

| ER |  | 🞄 | ⊗ | ⊗ | 🞄 | |

| Raw coverage | 0.561 | 0.702 | 0.719 | 0.413 | 0.290 | 0.457 |

| Unique coverage | 0.146 | 0.287 | 0.160 | 0.007 | 0.013 | 0.008 |

| Consistency | 0.938 | 0.969 | 1 | 0.985 | 0.998 | 0.997 |

| Solution coverage | 0.848 | 0.758 | ||||

| Solution consistency | 0.938 | 0.989 | ||||

” means the absence of the edge condition; and blank either indicates the presence or absence of the condition.

” means the absence of the edge condition; and blank either indicates the presence or absence of the condition.Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, Z.; Hou, B. How Does Economic Resilience Enhance the Innovation Capability of the High-Tech Industry? Evidence from China. Systems 2023, 11, 531. https://doi.org/10.3390/systems11110531

Huang Z, Hou B. How Does Economic Resilience Enhance the Innovation Capability of the High-Tech Industry? Evidence from China. Systems. 2023; 11(11):531. https://doi.org/10.3390/systems11110531

Chicago/Turabian StyleHuang, Zhenyu, and Bowen Hou. 2023. "How Does Economic Resilience Enhance the Innovation Capability of the High-Tech Industry? Evidence from China" Systems 11, no. 11: 531. https://doi.org/10.3390/systems11110531