Abstract

This paper aims to design an inventory model for a retail enterprise with a profit maximization objective using the opportunity for a price discount facility given by a supplier. In the profit maximization objective, the demand should be increased. The demand can be boosted by lowering the selling price. However, lowering the selling price may not always give the best profit. Impreciseness plays a vital role during such decision-making. The decision-making and managerial activities may be imprecise due to some decision variables. For instance, the selling price may not be deterministic. A vague selling price will make the retail decision imprecise. To achieve this goal, the retailer must minimize impreciseness as much as possible. Learning through repetition may be a practical approach in this regard. This paper investigates the impact of fuzzy impreciseness and triangular dense fuzzy setting, which dilutes the impreciseness involved with managerial decisions. Based on the mentioned objectives, this article considers an inventory model with price-dependent demand and time and a purchasing cost-dependent holding cost in an uncertain phenomenon. This paper incorporates the all-units discount policy into the unit purchase cost according to the order quantity. In this paper, the sense of learning is accounted for using a dense fuzzy set by considering the unit selling price as a triangular dense fuzzy number to lessen the impreciseness in the model. Four fuzzy optimization methods are used to obtain the usual extreme profit when searching for the optimal purchasing cost and sale price. It is perceived from the numerical outcomes that a dense fuzzy environment contributes the best results compared to a crisp and general fuzzy environment. Managerial insights from this paper are that learning from repeated dealing activities contributes to enhancing profitability by diluting impreciseness about the selling price and demand rate and taking the best opportunity from the discount facility while purchasing.

Keywords:

EOQ model; price-dependent demand; discount; selling price; dense fuzzy; learning; optimization 1. Introduction

The inventory control problem is about the optimum control over the stock so that the maximum gain can be attained by the manufacturer, retailer, or those who maintain the stock of the items. Intelligent decision-making must ensure a smooth supply to the consumers in addition to favoring the supplier’s profitability. There needs to be more inventory to ensure continuity when dealing with customers. That means for uninterrupted supply flow to meet the consumers demand, sufficient stock is required. Although, surplus products in the stock must be inclined to the opposite of the decision-maker, making it difficult to reduce costs. Thus, the mathematical theory of inventory control problems is considered an adequate operation research tool.

In 1913, Haris [1] first incorporated a classical economic order quantity model (EOQ) in the field of the inventory control problem. Because it is intuitive and effective at capturing the dynamics of the model, lot sizing problems have attracted the interest of researchers and decision-makers more than other inventory control strategies. The classical EOQ model presented a fundamental problem under the presumptions of determinism, i.e., constant demand with no shortages. The research on lot sizing modeling progressively became more advanced and included more trustworthy assumptions that served a variety of applications [2,3]. The demand pattern is an essential aspect of a business scenario. It can be neither constant nor well predictable. The demand rate may be dependent on one or more decision variables (time [4], stock level [5], and selling price [6]). At the same time, it may be imprecise. On the other hand, the optimal pricing of items to be sold is a matter of great concern to retailers. The retail price has a great effect on the design of consumption. In a developing country, generally, the customer pays attention to a low-priced product. The retailers may offer a low price to boost consumer demand. The average turnover can be best at a high consumption rate. So, the average turnover is related to the selling price through demand. However, the relationship is not so straightforward because a low selling price can lessen the earned revenue, which may cause low average turnover. We can say that the demand is negatively proportional to the unit selling price. The ultimate impact of the selling price on profit is matter of concern. Therefore, the selling price is a very crucial decision variable.

In recent years, inventory models with a price discount feature have received much attention from academics. Customers receive a discount on each unit of the advertised product they purchase through the all-unit discount as long as their entire basket satisfies the minimum criterion. However, with an incremental discount, the consumer continues to pay full price for the first units until they hit the threshold and only pays the discounted price for the extra units they purchase after reaching that point. One of the alluring aspects of the modest commercial situation is the availability of all-unit discounts. All-unit discount facilities are crucial in competitive business because of the globalization of the marketing strategy. The purchasing cost is a vital factor in the lot-sizing policy. Demand and selling prices have essential impacts on the customers’ order size. Demand will increase due to lower selling prices, and the consumers will order more. In this case, retailers need to buy more products, and for this situation, an all-units discount facility will be a crucial aspect for retailers according to the size of the order. However, it will raise the risk of overstocking, mainly when the demand is still being determined. In an unpredictable environment, the linked ordering and pricing dilemma becomes increasingly tricky when quantity discount policies are offered since retailers must find a balance between ordering and selling. In this article, an all-unit discount facility on the unit purchase cost is discussed from a supplier or a manufacturer to his/her retailer.

Assume that in a recently opened inventory system, the rate of demand or another parameter for a specific product is still being determined because of a lack of experience and knowledge of the requirements of the typical community. Yet, as time goes on, the decision-maker will come to understand the reality and ultimately agree on a limited demand for that specific product. The notion of fuzzy concept has been extensively used in the analysis of numerous lot sizing problem throughout the years to deal with ambiguous situations, inadequate descriptions, and hazy data. As soon as an inventory system is implemented, there is a great deal of uncertainty because there are no data on consumer preferences, demand, order amount, product preferences, etc. When the frequency of turns (n) (frequency of negotiations to reach a final agreement or opinion) grows, more knowledge is gathered and analyzed, allowing for a more precise prediction and reduced uncertainty. Situations of this nature cannot be disregarded. By learning from the experience of repeated work, the degree of ambiguity regarding the demand pattern may be minimized, and the decision-makers’ judgments on the unit selling price can be made apparent. When making decisions, the densely fuzzy environment gives the impression of learning to lessen the degree of imprecision with repetition. In this paper, an optimal decision approach is used for an inventory model under learning phenomena in favor of the retailer’s goal of reducing cost and boosting turnover.

The following research questions encouraged the writers to introduce the concept in this paper based on the above inferences:

- What is the appropriate approach in a marketing scenario driven by the EOQ model where uncertain demands of the customers depend on the unit selling price?

- How does the uncertain demand pattern affect the decision-making process?

- How does the price discount facility affect the profit-optimizing policy?

- How much can the decision-maker benefit from learning by performing repetitive tasks to implement a more robust strategy to achieve his/her purpose?

- What are the immediate effects of the unit price discount policy and learning through experience on the economic order quantity model?

All the above insights on the decision-making approach are quantitatively illustrated and proven in this study. This paper focuses on the abovementioned insights by investigating an EOQ model with price-dependent demand and a unit discount policy under learning through experience using a triangular dense fuzzy set (TDFS) decision-making configuration.

This section precedes the following sections. Section 2 describes a detailed literature review on the topics concerned. Section 3 contains the mathematical preliminaries that are used in this paper. Section 4 presents the notations and hypotheses used to develop the inventory model in this paper. Section 5 discusses inventory models with respect to different fuzzy phenomena. Section 6 is about the numerical simulation. The discussion and managerial insights into the outcomes are given in Section 7. This paper ends with concluding remarks on the overall findings and future research scopes, which are presented in Section 8.

2. Theoretical Background

The basis of the theoretical foundation for this paper is detailed in the following subsections.

2.1. Recent Advancement in Inventory Modeling

Haris [1] introduced an inventory model. After that, numerous researchers have worked in this field. During the last decade, the theory of inventory modeling has extended more rapidly in various aspects. For instance, Roy [7] developed a lot size model using the demand function, unit holding cost, and deterioration rate as linear functions for the sale price, time, and time, respectively. Tripathy and Mishra [8] replaced the linear time-dependent deterioration rate with a Weibull-distributed function of time. Alfares and Ghaithan [9] added an excellent review article on inventory management policy studies with time-varying holding costs. Bhunia and Shaikh [10] introduced a lot-sizing model where the deterioration rate follows the Weibull distribution. Pal et al. [11] presented an inventory model, where the demand depends on the price rate and inventory stock level, considering that the items are deteriorating. Their paper also discussed the effect of inflation and delayed payments. Ghoreishi et al. [12] constructed a deteriorating EOQ model, where demands depend on the selling price and inflation rate and discussed the combined action of the customer return policy, delays in payment with permission, and inflation rate. Taleizadeh et al. [13] investigated numerous optimal coordinating policies in a supply chain to improve coordination in the supply chain. They identified the best order size and selling price for each supply chain member using the Stackelberg game-theoretic approach. Mishra et al. [14] created a lot-sizing in which they assume inventory level and unit selling price dependent demand, permitting shortages in two scenarios: partial backlogging and full backlogging. They discussed preservation technology in their paper to protect the items from deterioration. Panda et al. [15] incorporated a deteriorating inventory model, where the demand function depends on the frequency of advertisement, stock levels of the items, and the unit selling price and measures the effect of an alternative trade credit policy. They used the concept of two warehouses, i.e., the retailer stores his items in two different warehouses with different deterioration rates. A nonlinear stock level-dependent EOQ model was introduced by Cardenas-Barron et al. [16], which considers a trade credit policy and a nonlinear stock level-dependent holding cost. Alfares and Ghaithan [17] created an inventory model with stock and price-dependent demand and time and production cost-dependent carrying cost. The green level for a green manufacturing system was introduced by Akhtar et al. [18] into the demand and production cost function. Recently, Hakim et al. [19] studied an inventory model where the nonlinear demand rate depends on the green level and selling price.

2.2. Price Discount Policy-Based Inventory Model

In recent years, inventory models with price discount facility have been broadly examined by many researchers. The all-unit discount gives consumers a discount on every unit of the advertised product they buy as long as their entire basket matches the minimal requirement. However, with an incremental discount, the customer only pays the discounted price for the additional units they buy after reaching the threshold and continues to pay the full price for the original units up to that point. For instance, Shi et al. [20] presented a pricing model with price-depended demand where the supplier offers an all-unit quantity discount to the retailers in an application to the newsvendor problem. Chen and Ho [21] considered a fuzzy newsboy inventory problem with a quantity discount. Taleizadeh and Pentico [22] formulated an EOQ model with various back-ordering and all-unit discount policies. Taleizadeh et al. [23] discussed two EOQ models based on implementing an incremental discount policy in the different backlogging scenarios. Alfares [24] developed an EPQ model where demand is nonlinear stock dependent, with time and unit purchasing cost-dependent holding costs under a price discount facility. Later, Alfares and Ghaithan [25] contributed another work to the literature which replaces the price dependency of demand in the place stock along with time-sensitive stock cost and quantity discount policy. Huang et al. [26] deliberated an integrated EPQ model of unreliable processes with a price discount facility in an uncertain fuzzy environment. Sebatjane and Adetunji [27] also utilized the concept of the incremental discount policy while discussing an EOQ model considering constant demand and time-dependent holding costs. Considering the all-units discount facility, Shaikh et al. [28] added a pricing model with stock levels, price-dependent demand, and Weibull-distributed, time-dependent deterioration. Khan et al. [29] extend the work of Shaikh et al. [28] by considering linearly time-dependent holding costs and holding costs proportional to purchasing costs. Next, Mashud et al. [30] explored the concept of Khan et al. [29] by assuming a time-varying deterioration function with an expiration date. Then, Shaikh et al. [27], in a crisp sense, addressed interval phenomena, which was also addressed by Rahman et al. [31]. Kuppulakshmi et al. [32] recently addressed an EPQ model for a defective product, which included a price discount facility in a fuzzy environment. In this article, we considered an all-unit quantity discount from supplier. Table 1 represents a comparison among the recent literature on inventory models with a price discount policy.

Table 1.

List of inventory models with discount facility.

2.3. Fuzzy Differential Equation in Inventory Model

During the authentic decision-making progression, a decision-maker must face uncertainties. A decision-maker must consider uncertainties in the parameters since they significantly influence decision-making. A fuzzy set is considered one of the best methods for defining, describing, and measuring uncertainty in the parameters. Zadeh [33] presented the notion of a fuzzy set in 1965. After that, many researchers developed the fuzzy theory concept. The idea of fuzzy differential equations is given by Kaleva [34]. The economic order quantity model using a fuzzy differential equation was first developed by Park [35] under fuzzy uncertainty. After that, several novel ideas helped to improve practical theory on fuzzy inventory models, both for inventory modeling and optimization methods. Debnath et al. [36] examined a multi-objective inventory model with non-linear demand by applying the generalized Hukuhara derivative technique in a fuzzy environment. Several works [37,38] have worked on the inventory problem using fuzzy differential equations. Very recently, Manna et al. [39] discussed a production inventory model for imperfect items by considering an imperfect rate and the demand function as a generalized fuzzy number using the fuzzy differential and fuzzy integral approach.

2.4. Learning-Based Decision-Making Using the Inventory Model

An essential aspect of human intelligence is the ability to learn by repeating the same kind of tasks. A person’s performance improves because of experiences gathered through habits. From the decision-maker’s perspective, experience-based learning always grows the decision. Wright [40] was the first person to recognize this learning phenomenon in an industrial environment. After that, several researchers investigated the impact of learning on different inventory characteristics that expanded the works. By applying the concept of uncertainty learning to an EOQ model, Glock et al. [41] discovered how fuzziness is reduced by learning, as well as how this reduction affects the ordering strategy. Mahato [42] discussed the effect of learning on an inventory control problem with imperfect production in a fuzzy uncertain arena. Kumar et al. [43] introduced the notion of learning into an EPQ model considering partial backlogging in a fuzzy random situation to find a defective product in the production process. To explore an EOQ model using backorder policy under fuzzy uncertainty, Kazemi et al. [44] included the notion of human learning. Moreover, Shekarian et al. [45] discussed an EOQ model for objects of inferior quality while considering fuzzy uncertainty and learning. Kazemi et al. [46] applied the two-stage human learning curve (named the Jaber–Glock learning curve), i.e., motor, and cognitive abilities of human beings in a backorder EOQ model in a fuzzy environment. Soni et al. [47] also considered lowering vagueness concerning the fuzzy uncertain demand, thus enabling learning abilities in the continuous review inventory model. De and Beg [48] addressed incorporating the effects of learning experiences into fuzzy sets, precisely the triangular dense fuzzy set (TDFS), as well as new defuzzification techniques. Using the property of the Cauchy sequence, they showed that in TDFS, fuzziness, described by sequential representation, can be reduced over time by executing a repetitive task. In TDFS, De [49] added a key and lock capability in terms of the triangular dense fuzzy lock set (TDFLS) to further enhance the idea of experience-based learning. Maity et al. [50] discussed an EOQ model under daytime by considering holding cost, demand rate, setup cost, and idle time cost as TDFLS. Rahaman et al. [51] introduced the EOQ model with price-sensitive demand considering the effect of memory and experience-based learning with TDFLS. Recently, memory and learning affecting inventory problems have been discussed by Rahaman et al. [52] using the fractional derivative and TDFS, respectively. In this article we applied the learning effect to the selling price per unit and purchase cost per unit with an all-unit discount using TDFS. Table 2 summarizes the literature on the learning based investigations of inventory problems.

Table 2.

Literature review on learning-based inventory problems.

2.5. Research Gaps and Novelty of This Paper

Suppose a retail enterprise is set to sell commodities after purchasing in an all-unit discount facility availed by the supplier. The supplier sets the purchasing price per unit for the retailers based on the discrete intervals of order size. The purchasing and retailing scenario may not always be precise and deterministic. Impreciseness in such a decision-making scenario is almost unavoidable due to fluctuations in the real-world market situation. However, the manager should optimize his/her decision with learning. By analyzing the literature review on the keywords such as all-unit discount facility, retail inventory in imprecise environments, learning impact on decision-making for inventory control, the following points were identified:

- A beneficial approach to examine the ambiguous decision-making scenario under self-optimization involves the scientific measurement of experience-based learning undertaking repetitive tasks using dense fuzzy sets [46,48,49,50]. The outcomes of experience-based learning might be more realistic.

- Apart from the papers [49,50], we have yet to come across many works in the literature that use learning as a dense fuzzy set to define an EOQ model. The fuzzy setup in this study incorporates the concept of learning in terms of TDFS and uncertainty with related factors and variables. The TDFS theory explains how the degree of ambiguity regarding demand patterns decreases over time (because of repeated experiences with similar types of decision-making phenomena).

- The selling price has a great impact on the design of consumption. The retailers may offer a low price to boost consumer demand and thus the average turnover. However, the loosely supervised decisions to lower the selling price may cause high demand locally. Therefore, the demand is negatively proportionate to the unit retailing price.

- The demand, as well as the retail price, may not always be accurate to the retailer. As a result, we considered the unit selling price and hence the demand pattern of the customer as a triangular dense fuzzy number to maximize the average turnover.

- Another critical point is the all-units discount policy. All-unit discount facilities are crucial for competitive business because of the globalization of the marketing strategy. Until now, almost all the works [20,21,22,24,25,28,29,30] considering this fact have been completed in a crisp environment.

- It is noticed that in the literature, no studies (except [26,32]) have discussed the price discount facility in a fuzzy uncertain environment. This study considers the price discount facility offered from the supplier’s perspective as a triangular dense fuzzy number.

To fulfill the mentioned gaps, this article considers an inventory model with price-dependent demand, time-dependent purchase costs, and holding cost dependence in an uncertain situation. The unit purchase cost according to the order amount in this article incorporates the all-units discount policy. In this study, treating the unit selling price as a triangular dense fuzzy number allows for learning through a dense fuzzy set, which reduces the model’s imprecision. Here, four fuzzy optimization techniques are used to find the best purchase cost and selling price to get the typical extreme profit. The scenario of buying and selling cannot always be exact and predictable. Due to changes in the actual market condition, imprecision in this decision-making scenario is probably inevitable. Although, the management should learn to make better decisions. This paper implies that learning through repetitions dilutes the impreciseness as well as fits the optimal discount opportunity while purchasing. Thus, learning scenarios on the retail price and purchasing cost per unit produces the best profit compared to the deterministic and learning-free uncertain scenarios. This paper does not address a specific business. Most of the retail enterprises experience the selling price dependency of the demand rate. Discount on purchasing costs for a large order is also very frequent in supply–retail scenarios. This study will present a creative decision-making process that generates the most significant gain in an imprecise management scenario. This is the main contribution of the proposed study.

3. Preliminaries

This section contains useful definitions and formulae for the proposed model. The notion of the dense fuzzy number is discussed briefly.

Definition 1 ([33]).

A set is said to be a fuzzy set when is expressed as , where is a point in the universe of discourse and denotes the membership, i.e., grade of belongingness of in with .

Definition 2 ([33]).

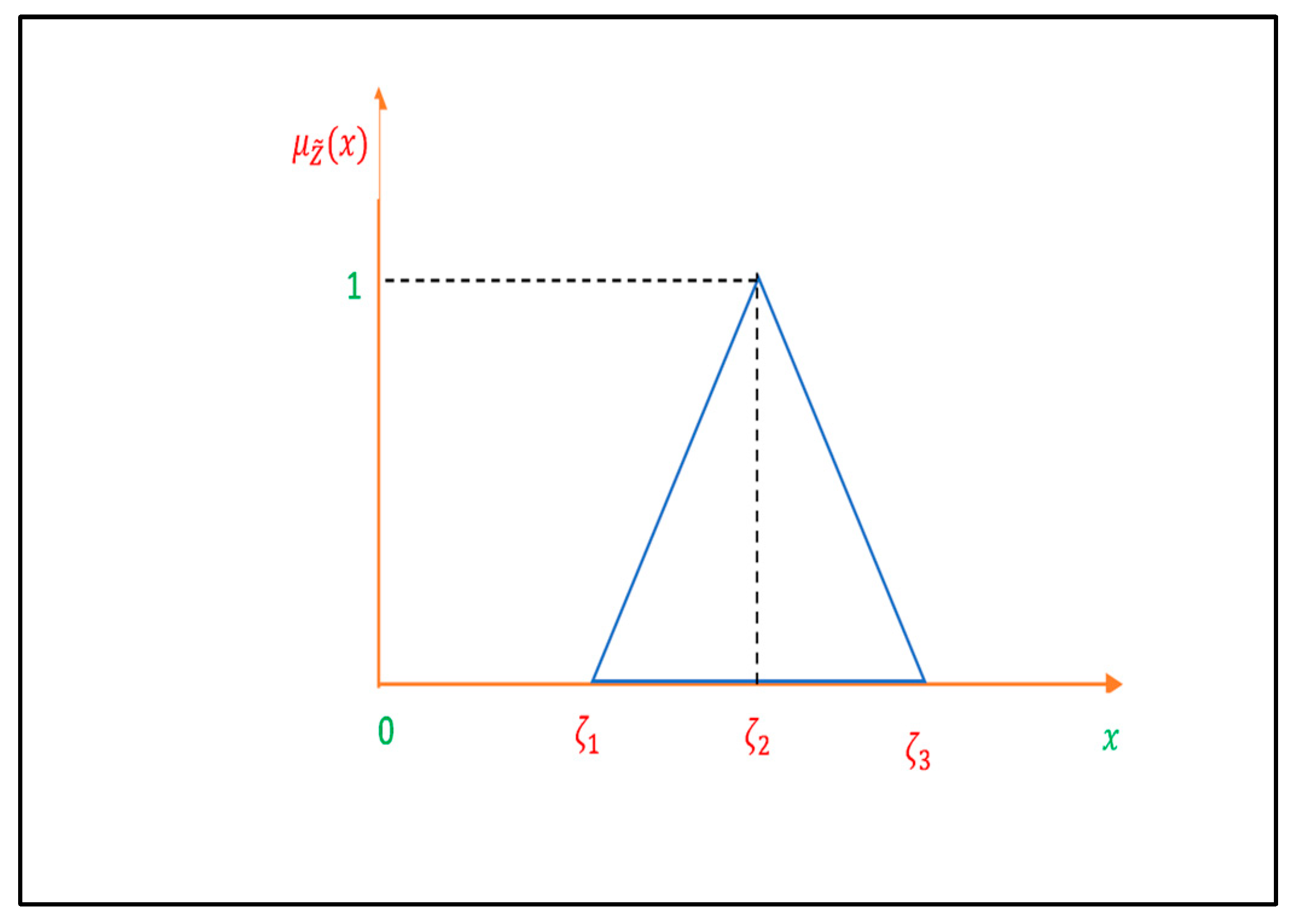

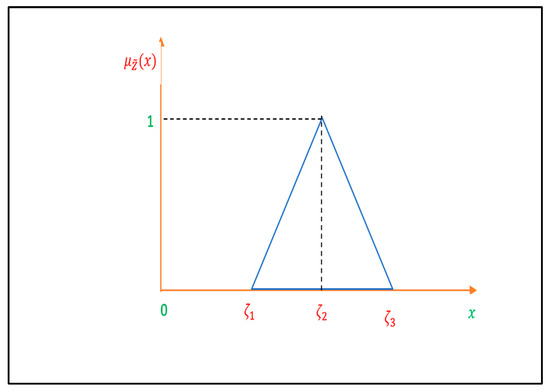

A Triangular fuzzy number is represented by the triplet with , and the membership function is defined as follows:

Figure 1 represents the membership function for a triangular fuzzy set on a graph. The existing literature on fuzzy theory contains a graph of fuzzy membership functions in a different context. However, we used the graph in Figure 1 as it is need for the discussion in this manuscript.

Figure 1.

Membership function for a triangular fuzzy number.

Definition 3 ([53]).

The of a triangular fuzzy number is given by , where and for . Then, the ranking index of is defined as:

Definition 4 ([48]).

Suppose denotes a fuzzy set and the components of are the elements of the ordered pair ( denotes the set of real numbers and denotes the set of natural number). Furthermore, let be the membership grade for the member of . Fuzzy set is said to be a dense fuzzy set if as for some and . It is said to be a triangular dense fuzzy set if is a triangular fuzzy set. Again, TDFS is said to be a “Normalised Triangular Dense Fuzzy set (NTDFS)” if gives its maximum membership grade of 1 for some .

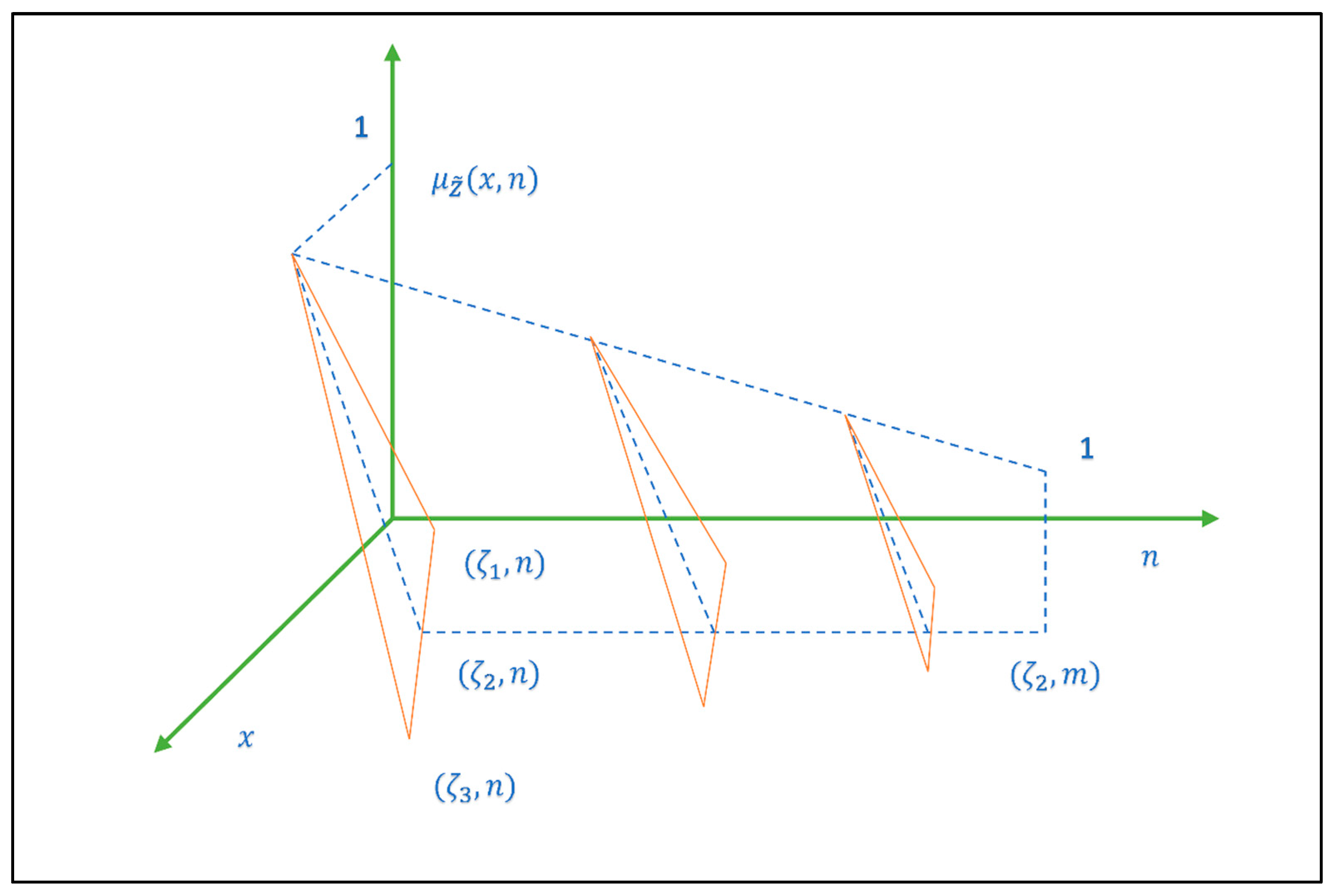

Definition 5 ([48]).

Suppose there is a fuzzy number in which and are taken as and where and are a sequence of functions. We take and in such a way that both tend to 1, corresponding to , and in this case, converges to the set . This type of fuzzy set is known as a triangular dense fuzzy set. Figure 2 depicts a normalized triangular fuzzy set. Figure 2 is adopted from De and Beg [46].

Figure 2.

Pictorial representation showing a normalized TDFS.

Example 1.

If we assume a TDFS as , where and is a positive integer, then the membership function of is as follows:

Defuzzification of TDFS [48]

The parametric representation (i.e., ) of a TDFS is given by , where and . Then, the defuzzification value, i.e., index value of is given as:

Therefore:

Remark 1.

as and then converges to the crisp value . This is the actual implication of a dense fuzzy number. In TDFS, we assume the degree of fuzziness varies with , the number of turn overs (shift, quality, and process time), and using knowledge gained through learning experiences, the system’s final degree of uncertainty starts to vanish as increases. That is, performing the same activity repeatedly can help someone perceive a judgement on a set of parameters more clearly than they might otherwise. The system moves closer to a clear decision with zero variation as it learns more.

4. Different Notations and Assumptions

The model was developed using the notations and presumptions that are listed below:

4.1. Notations

The notations for different parameters and decision variables are listed in Table 3.

Table 3.

Notations and their corresponding descriptions.

4.2. Assumptions

The following are the assumptions regarding the proposed EOQ model:

- (a)

- We consider straightforward fact while formulating the demand function. The demand rate () is dependent on the unit selling price . Generally, the demand for certain commodities can be boosted by lowering the retail price. In a retail market with fluctuations in demand and the retail price, the uncertainty can be adjusted by using a fuzzy equation as follows. Thus, mathematically, the uncertain fuzzy demand can be viewed as, i.e., , where is taken as triangular dense fuzzy number, is the fixed demand, and is the coefficient of price in the demand function. We assume a decision-making phenomenon where the unit selling price becomes precise gradually due to learning experience gained through repeating the same kind of tasks. Thus, we consider the uncertain unit selling price as a triangular dense fuzzy number. As the number of repetitions increase, more information is collected, and the analysis will provide a more precise prediction, and thus, the uncertainty will start to disappear.

- (b)

- We consider that the discount facility is available while the retailer is purchasing from a supplier. The discount is availing on the order quantity of the purchasing commodities, and the interacting situation contains impreciseness. The purchasing cost per unit decreases as the order size increases. To trace the uncertainty, we assume a fuzzy unit purchase cost as a discrete step function for the fuzzy ordering quantities as follows: , for and . In above equations, represents the number of repetitions required to lessen the fuzzy uncertainty regarding the purchasing cost per unit through repetitive tasks. In addition, represents the number of repetitions required to adjust perfect combinations of the purchasing cost and order size, since discretely related combinations of them are available in the purchasing scenario.

- (c)

- The carrying cost per unit increases as time increases, as the maintenance ability of the carrying machineries deteriorate over time. In addition, carrying costs depend on order size and thus on the purchasing cost per unit. Therefore, the holding cost is proportional the unit purchasing cost and it is also linear function of time. Thus, the unit holding cost is .

- (d)

- The lead time is zero.

- (e)

- Shortages are not allowed.

- (f)

- Replenishment is instantaneous.

5. Mathematical Modeling of the Fuzzy EOQ Model

This section describes the model formulation and analysis of the proposed model in different fuzzy setups. We fragmented this section into the following subsections.

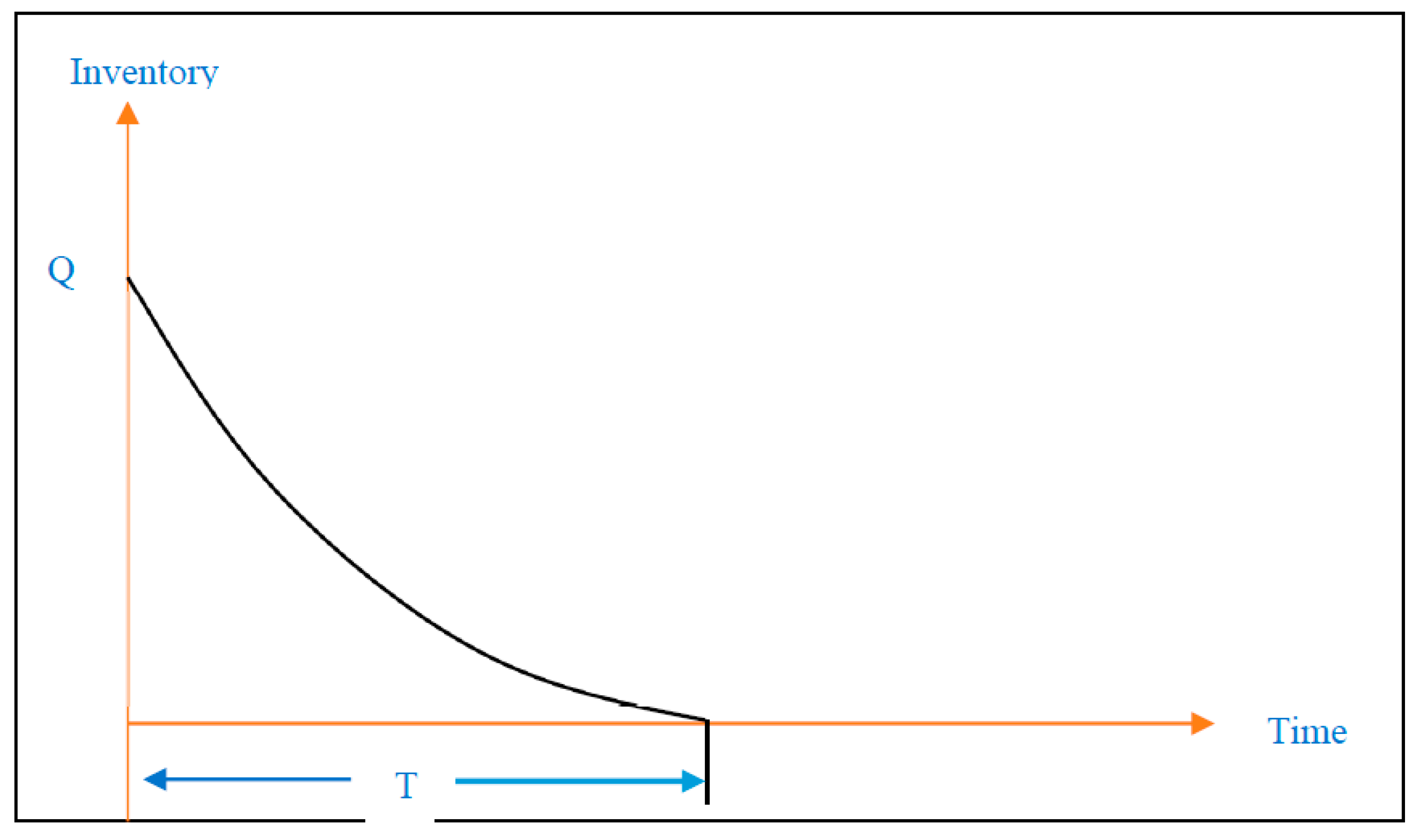

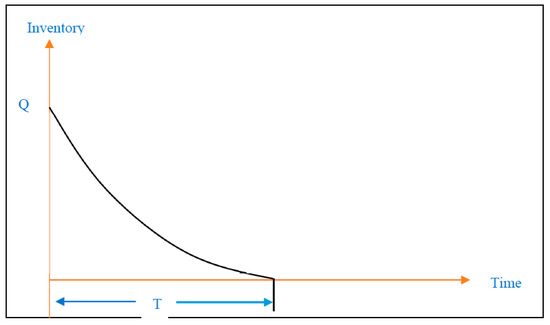

5.1. Crisp Model

Before describing the fuzzy environment-based analysis, let us describe the EOQ model in a crisp environment. The retailing scheme starts with the lot size , and with meeting the customer demand at the rate , the stock is going through gradual decay. The retailing cycle is ended at time , fulfilling the total demand during the span of the retailing cycle without any shortage. In the literature on inventory models, there are similar types of schematic diagrams depicting the inventory level across the retail cycle or manufacturing cycle. The whole lot sizing procedure is presented in Figure 3. We designed this figure to illustrates the scenario approximately. Then, the inventory level at any time in the retailing time interval is given as follows:

Figure 3.

Pictorial representation showing the proposed EOQ model.

Since shortages are not permissible, the lot size is equal to the total consumptions of the product during the whole retail cycle. Therefore, the lot size is given as follows:

Then, the cost and earned revenue will be obtained as follows:

- (i)

- The replenishment cost is constant and is taken to be .

- (ii)

- Suppose the purchase cost per unit is a crisp number fitted for the ordering size (). Then, the total purchase cost for lot size is obtained as:

- (iii)

- The holding cost per unit is a function of the purchase cost per unit and time. Therefore, the total holding cost during all the retail activities is obtained as:

- (iv)

- Suppose the selling price per unit is also a crisp number. Then, the total earned revenue can be calculated multiplying the consumed amount of product by the selling price per unit. Therefore, the earned revenue from the retail activities is obtained as:

- (v)

- The total profit is the difference between the earned revenue and the sum of all possible costs. The total average profit is obtained dividing the total profit by the cycle time as follows:

In this model, the total average profit is the required function to be maximized. Thus, the optimization problem with constraints will be of following form:

5.2. Fuzzification of the Crisp Objective Function Implementing TDFS in Decision-Making

The demand, unit selling price, or any other parameter for a specific item is unfamiliar because of non-experience and ignorance of the customer’s needs. Yet, as time goes on, the decision-maker will realize the reality. The notion of fuzzy sets has been used in inventory models throughout the years to deal with uncertainty. As soon as an inventory system is implemented, there is much uncertainty due to the need for knowledge on consumer demand, lot size, product preferences, etc. When the number of turnovers (n) (frequency of negotiations to reach a concluding agreement) rises, more information is gathered and examined, leading to a more precise prediction and reduced ambiguity. So, we consider a triangular dense fuzzy set (TDFS) to tackle the system’s uncertainty. To consider the proposed model in fuzzy form, we replace the crisp quantity with , , , and with , , , , and , respectively.

In this subsection, we discuss different methods to obtain optimal results from the system given by Equation (12).

5.2.1. Using the Direct Index Value of Each Fuzzy Parameter (Method 1)

We analyzed the above model in a dense fuzzy environment by putting the defuzzified value of each dense fuzzy parameter , and directly into the fuzzy optimization model (4). The index value of the following three fuzzy quantities is obtained as:

- (i)

- The -cut of a TDFS is given by

and the index value of is obtained as follows:

- (ii)

- The -cut of a TDFS is given by

- (iii)

- The -cut of a TDFS is given by and the index value of is obtained as follows:

So, the optimization problem (12) takes the form as mentioned below:

5.2.2. Using Fuzzy Arithmetic Operation and the Index Value Concept (Method 2)

In this subsection, we discuss the model using fuzzy arithmetic operation after taking the parametric representation of each fuzzy parameter and variable , , and instead of using the defuzzified value directly.

The parametric representation, i.e., the -cut of the total average profit are given as:

i.e.,

Therefore, the defuzzified value of the total average profit (see Appendix A) is:

That is:

The -cut of the order quantity is given as:

i.e.,

i.e.,

Therefore, the defuzzified value of the order quantity (see Appendix A) is:

The defuzzified value of the fuzzy optimization model (12) is given by:

5.3. Fuzzy Differential Equation Approach

In this section, we solve the above EOQ model using the fuzzy Laplace transform method instead of using fuzzification of the optimization model. The following fuzzy differential equation and its boundary conditions represent the mathematical counterpart of the fuzzy EOQ model:

i.e.,

Now, the parametric representation of the fuzzy parameters and variables , and are given as:

; and .

Since , the components of are and .

After using the fuzzy Laplace transform, Equation (25) becomes:

Depending upon the fuzzy differentiability of the inventory level , we get two different cases:

- Case I: when is (1)-gH differentiable.

The discussion under Case I is named method 3. In this case, we used the generalized Hukuhara derivative of of type 1. Then, Equation (26) becomes:

The parametric representation is given as follows:

Using the inverse Laplace transform on each of the equations in (28), we get:

Using the initial condition i.e., and we get:

Hence, Equation (29) becomes:

Then, the cost and earned revenue will be obtained as follows:

Holding Cost: We denote the parametric form of the fuzzy holding cost during a whole cycle by , where:

Purchase Cost: We denote the parametric value of the purchasing cost during a whole cycle by , where:

Sales Revenue: The parametric value of the total earned revenue is given by , where:

Then, the total average profit , where:

and:

Therefore:

Therefore, the index value of the order quantity (see Appendix A) is:

The defuzzified value of the fuzzy optimization model is given by:

Remark 2.

The expressions for the decisions variable, associated constraints, and objective functions in method 2 (using fuzzy arithmetic operation and the index value concept) and method 3 regarding the dynamical solution by Laplace transform using the generalized Hukuhara derivative of of type 1((1)-gH derivative) approach is same. So, we discuss only method 2 in the remainder this paper.

- Case II: when is (2)-gH differentiable.

The discussion under Case II is named as method 4. In this case, we used the generalized Hukuhara derivative of of type 2. Then, Equation (26) becomes:

The parametric representation is:

Using the inverse Laplace transform on each of the equations in (24) we get:

Using the initial condition i.e., and we get:

Hence, Equation (29) becomes:

Then, the cost and earned revenue will be obtained as follows:

Holding Cost: We denote the parametric form of the fuzzy holding cost during a whole cycle by , where:

Purchase Cost: We denote the parametric value of the purchasing cost during a whole cycle by , where:

Sales Revenue: The parametric value of the total earned revenue is given by , where:

The total average profit , where:

Therefore:

Therefore, the index value of the order quantity (see Appendix A) is:

The defuzzified value of the fuzzy optimization model is given by:

6. Numerical Exploration

The impact of experience-based learning in decision-making for an inventory control problem, where demand depends on the selling price and the supplier offers a price discount facility on lot size, is examined in this part using the analysis of numerical instances.

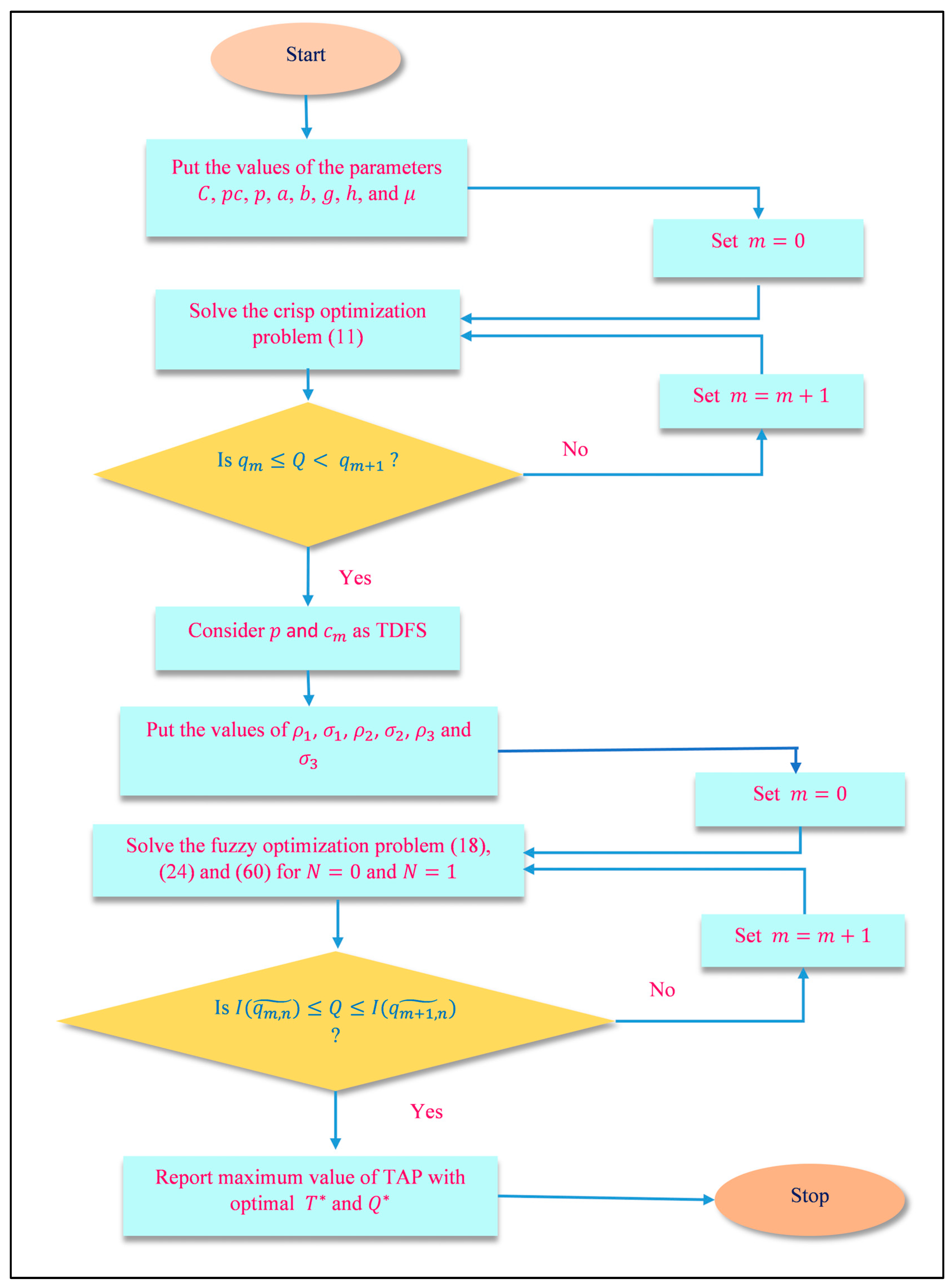

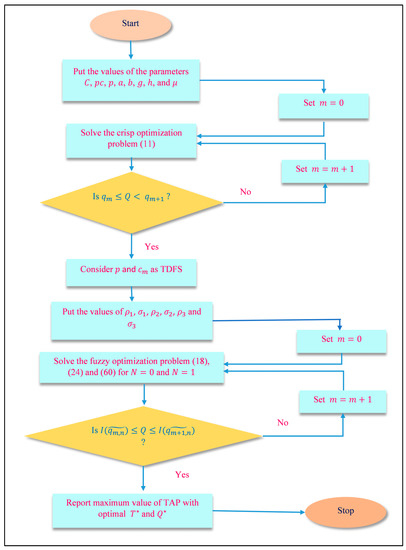

6.1. Solution Algorithm

The impact of learning experiences is measured using the Algorithm 1. Algorithm 1 is visualized by flowchart in Figure 4.

Figure 4.

Flowchart showing the solution algorithm for the numerical exploration in the proposed model.

| Algorithm 1. Algorithm for optimal feasible solution in different scenarios. | |

| 1: | Inputs: the value of the parameters . |

| 2: | Outputs: total average profit (TAP), optimal order size (Q), and total cycle length (T). |

| 3: | Step 1. Set . |

| 4: | Step 2. Solve the crisp optimization problem (11). |

| 5: | Step 3. If , this solution is infeasible. Set and go to step 2. Otherwise, go to step 4. |

| 6: | Step 4. If , this solution is feasible. Set , and for a crisp problem and go to step 5. |

| 7: | Step 5. Consider the unit selling price and unit purchase cos as a triangular dense fuzzy number. |

| 8: | Step 6. Input . |

| 9: | Step 7. Set . |

| 10: | Step 8. Solve the fuzzy optimization problem (18), (24), and (60) for N = 0 and N = 1. |

| 11: | Step 9. If , then the solution is feasible. Go to step 11. Otherwise, go to step 10. |

| 12: | Step 10. Set , and go to step 7. |

| 13: | Step 11. Obtain the maximum TAP among the optimization problem (18), (24), and (60), and corresponding to this TAP, set TAP = TAP*, Q = Q*, and T = T*. |

| 14: | Step 12. End |

6.2. Numerical Simulation of the Crisp Model

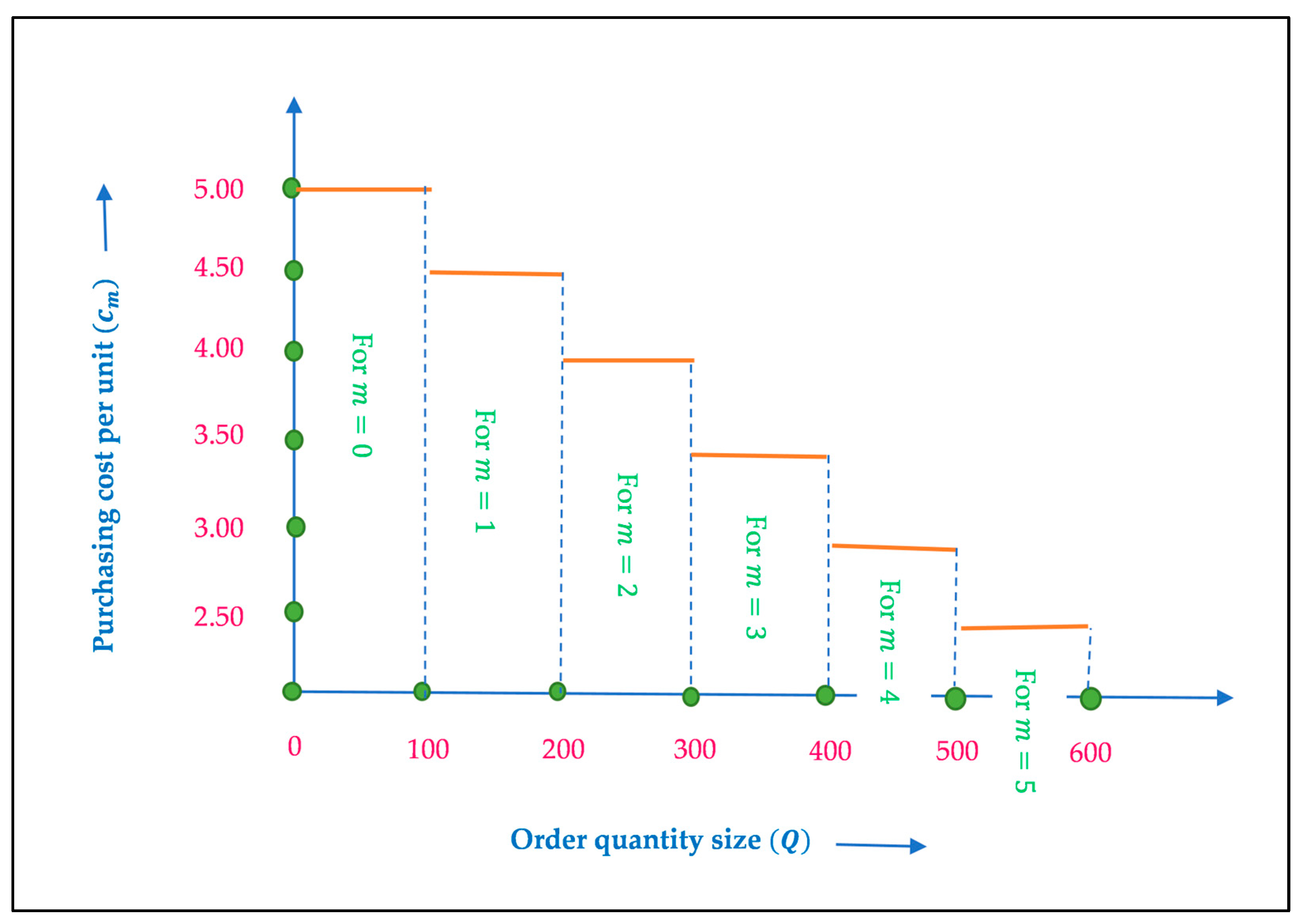

For the numerical illustration of the above discussed crisp model, we use the following inputs $/unit/month, $/unit/month, $/month, and . Then, the purchasing cost per unit, . Therefore, the permissible combination order quantity size and purchasing cost per unit for different is given in Table 4.

Table 4.

Permissible combination of order quantity size and purchasing cost.

Figure 5 shows different purchasing costs per unit in different intervals of associated order size. The figure shows that the purchasing cost per unit is a decreasing discrete function of order size. The optimization problem is solved using LINGO 17.0 software, and the results are presented in Table 5. On the other hand, the supplier is offering a quantity discount to the retailer, so price breaks are calculated for different values of i.e., for .

Figure 5.

Dependence of the purchasing cost per unit on the order quantity size.

Table 5.

Optimal crisp solution for the chosen values of m using the trial-and-error method.

Our objective is to find the best average profit for the proposed model. The results in Table 5 suggest that average profit increases as the numeric values of the trial increase. However, the purchase cost per unit is closed with order quantity breaks. So, the maximum average profit is feasible only if the order quantity size lies in the permissible range. It is clear from Table 5 that the solution is feasible for as the corresponding value of the lot size belongs to the range of the quantity break [300, 400]. Although TAP is maximum for and may increase for higher values of , we cannot take this value because, in that case, does not lie in the quantity break. If we take these results, it may create various problems such as over stocking. Therefore, the optimal and feasible solution for the decision variables and the objective function in the crisp EOQ model are , months, and units.

6.3. Numerical Simulation of the Fuzzy Model

Here, we take the selling price and purchase cost as triangular dense fuzzy numbers as:

In the case of a supplier quantity discount, quantity breaks are also taken as triangular dense fuzzy numbers as:

where represents the degree of experience-based learning. When increases, the decision-maker will obtain more knowledge about the uncertain parameter selling price, purchase cost demand pattern, etc., which will reduce the fuzziness in the model. Particularly, when , the dense fuzzy number becomes a general fuzzy number. We use similar inputs as crisp. Additionally, we consider the fuzzy inputs ; . In the case of the triangular dense fuzzy model, the ends of each order quantity interval are triangular dense fuzzy numbers and the purchasing cost per unit is a triangular dense fuzzy number. The fundamental relationship between purchasing cost per unit and order quantity for the fuzzy case is similar to the crisp model. Here, we used the defuzzified value for the triangular dense fuzzy valued ends of the intervals for the order quantity and purchasing cost. The permissible range for the purchasing cost per unit and ranges of order quantity are contrasted with the obtained order quantity in the optimal results after numerical optimization in terms of the defuzzified values. The optimal result is taken as an optimal feasible solution when its purchasing cost per unit and order quantity are in acceptable ranges. The triangular dense fuzzy set is displayed in Figure 2. After defuzzification, it is turned into a crisp quantity. Now, the details of all unit discount facilities are described in Table 4 and Figure 5. So, the details are not repeated in the case of the fuzzy model. However, the trials for optimal feasible solutions are also executed in the fuzzy models, and the defuzzified results are displayed in Table 6. Then, the problem is solved for three methods using the above-said software. The optimal results are listed in Table 6.

Table 6.

Learning through m in different environments and methods.

Table 6 reveals the following facts:

- The feasible solution cannot be obtained before the trial for . For , we obtain feasible as well as non-feasible solutions using different methods. The crisp solution and the solution for method 1 of the fuzzy model is not feasible for . Method 2 shows different results on feasibility for the general and dense fuzzy case. After that, all the results in Table 6 are feasible.

- As the repetition of the trial to fix the purchase cost–order quantity combination advances, the total average profit in the respective methods and fuzzy environments increase initially and again decrease for trials after . The best results for profit maximization goal are obtained for .

- The ordering of the best phenomena for maximizing average profit for every choice of is as follows:

- The dense fuzzy is perceived to be superior to the general fuzzy as decision-making phenomena to maximize the average profit irrespective of the methods and choices of .

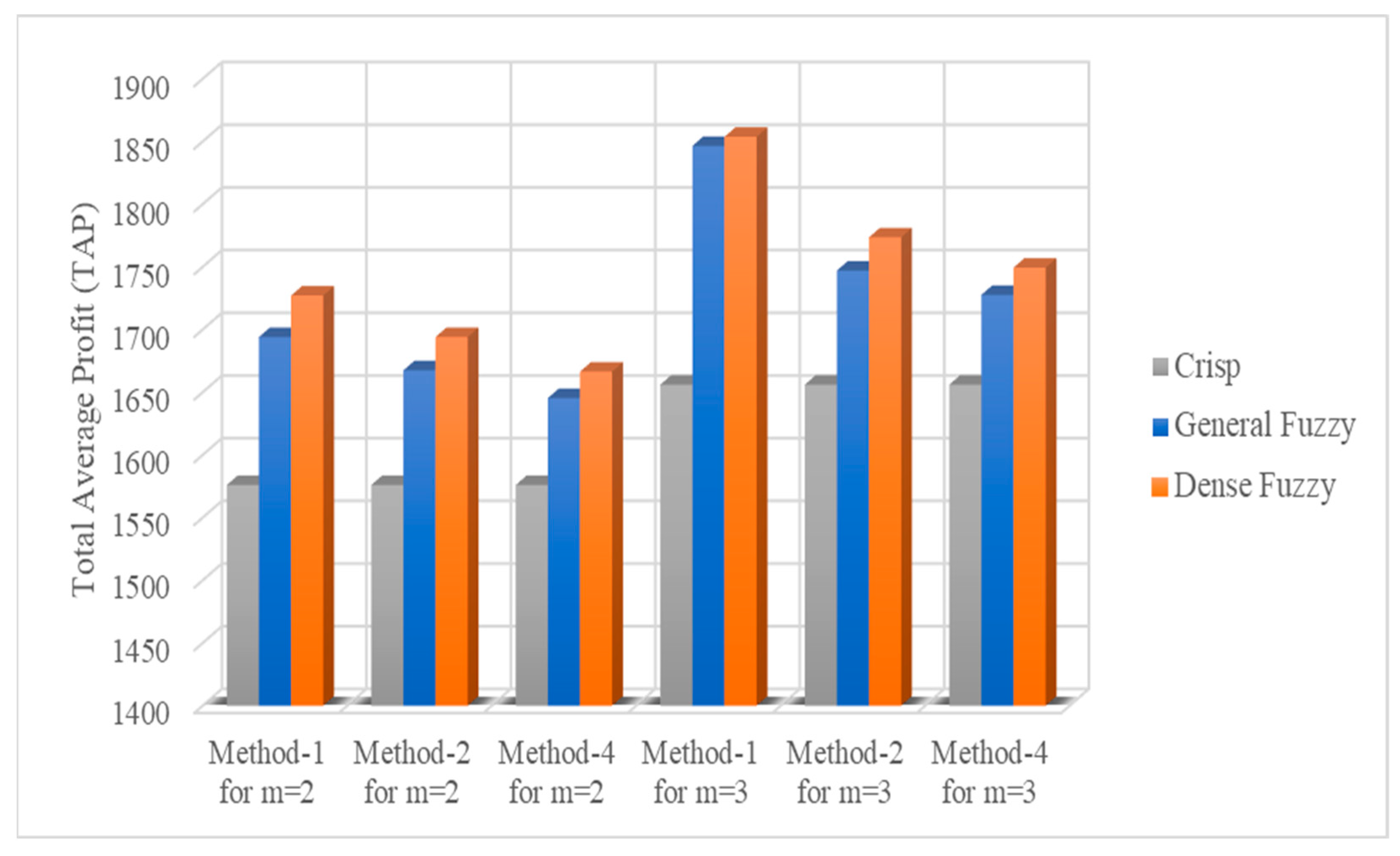

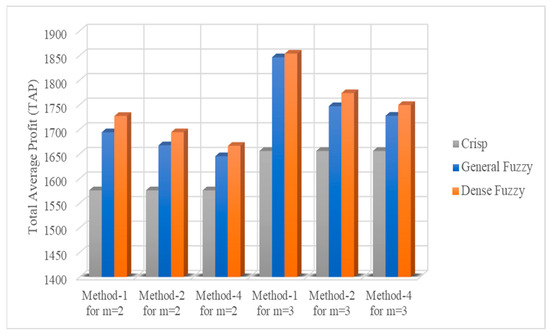

Figure 6 is the graphical representation of Table 6. The bar diagram shows total average profits in the different decision-making phenomena and adopted methods.

Figure 6.

Bar graph showing for different methods through m.

The facts revealed by Table 6 are also reflected in Figure 6. Figure 6 shows that the optimal feasible is , units and months, which corresponds to method 1 in the dense fuzzy environment for . In the preceding subsection, we discussed the sensitivity of the optimal results with respect to the intensity of the dense sense and how learning impacts the decision-making for the price discount facility in the proposed model.

6.4. Learning Sensitivity in the Dense Fuzzy Environment

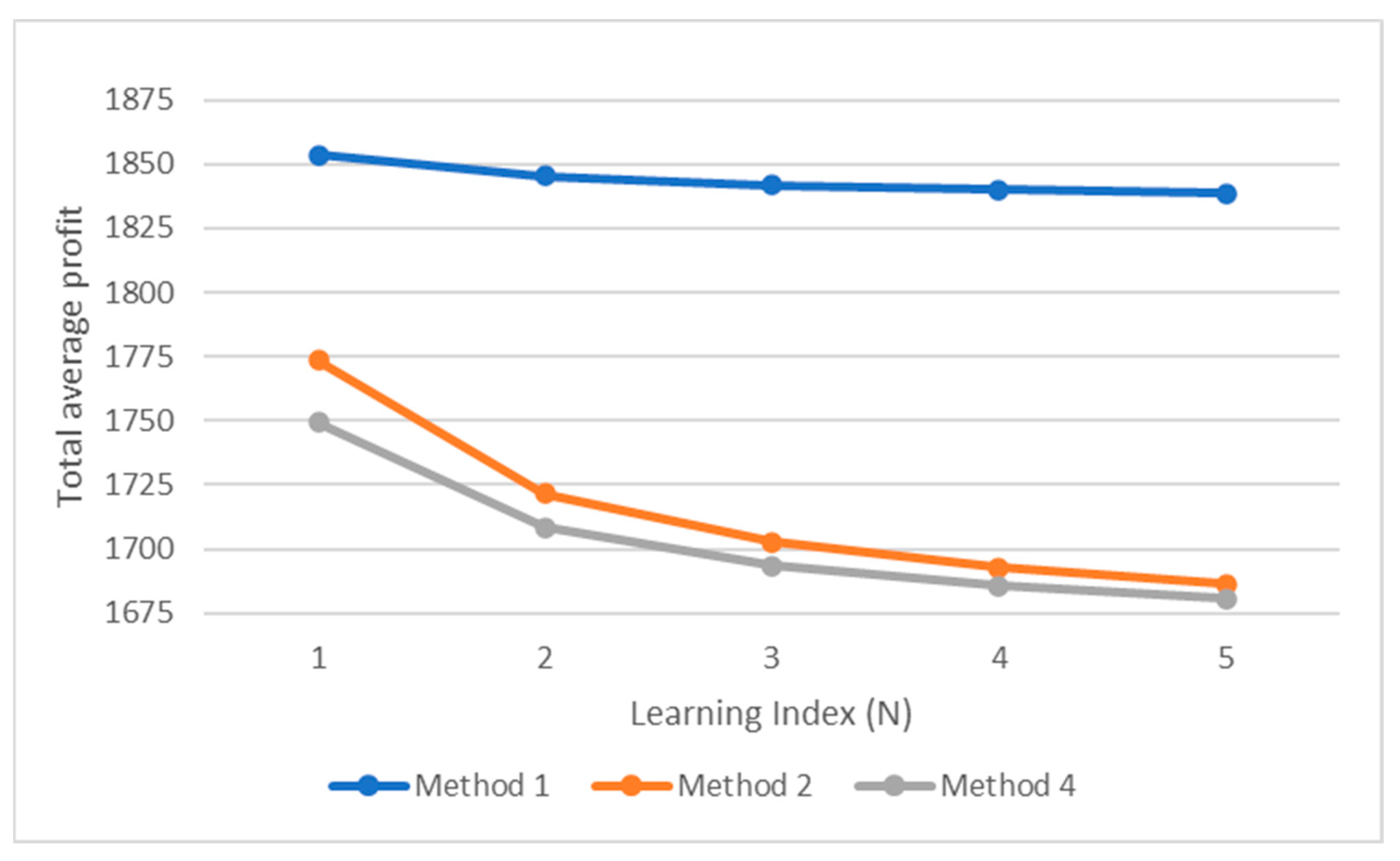

Learning through experience is an essential concept in inventory control policy. Uncertainty over the demand pattern can be decreased by repeating the same task and predicting uncertain measures. In this section, we discuss how the learning experience affects the inventory model. The optimal solutions for all the methods are feasible corresponding to . Now, the impacts of learning are examined using three different methods corresponding to through a triangular dense fuzzy number with the learning index . Table 7 presents the learning sensitivity with respect to the learning index for method 1, method 2, and method 4.

Table 7.

Sensitivity of the optimal results to learning through a dense fuzzy environment.

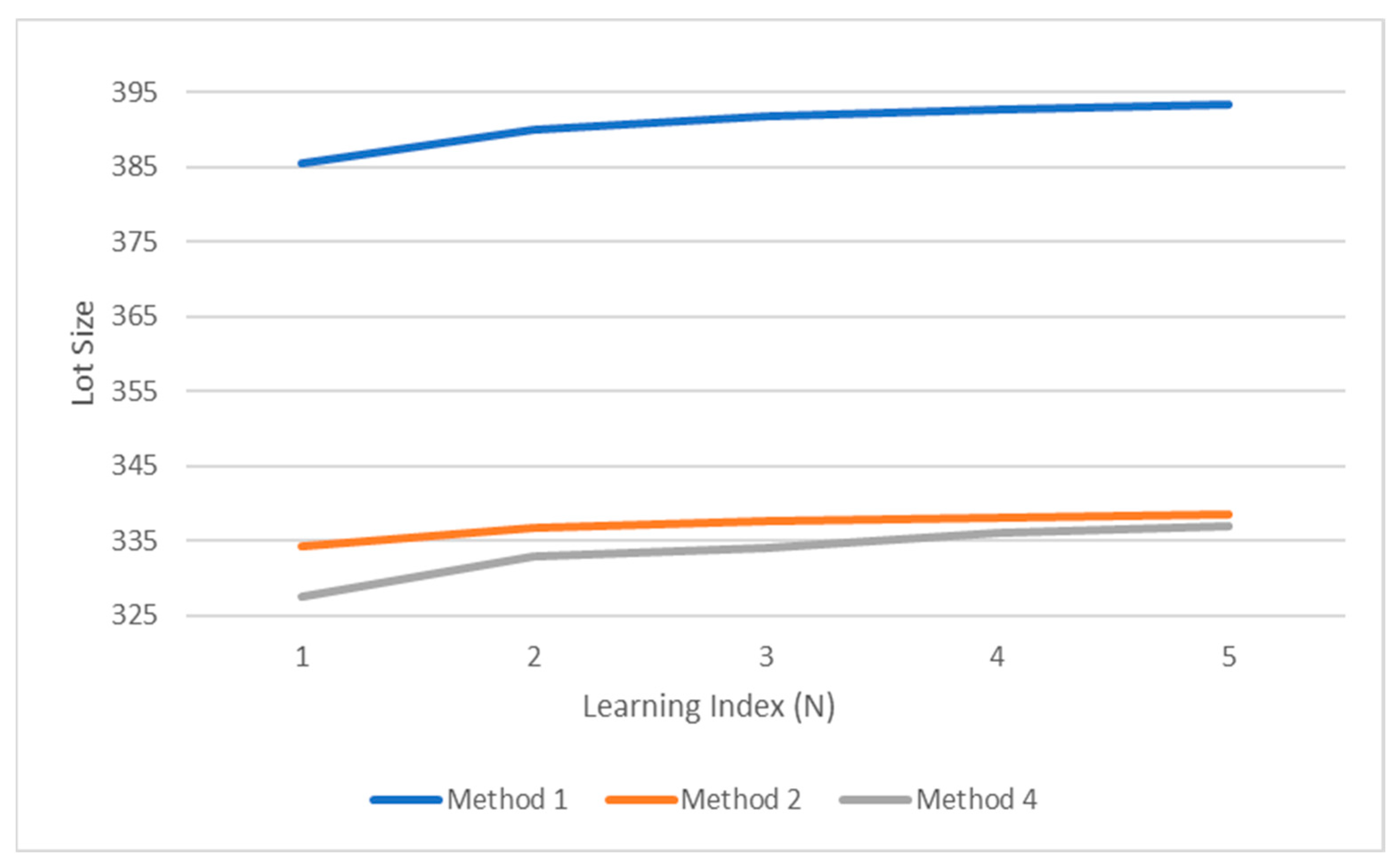

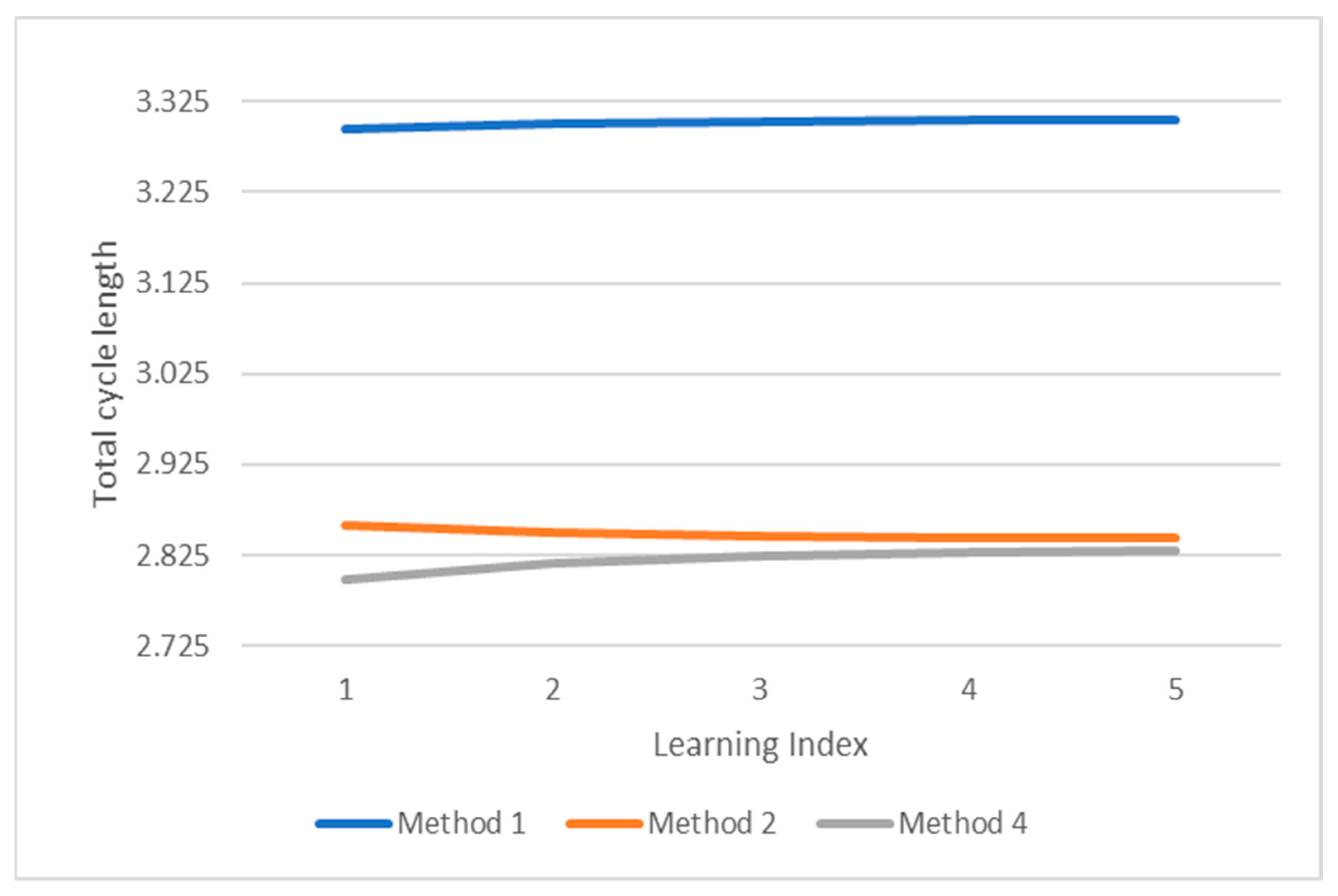

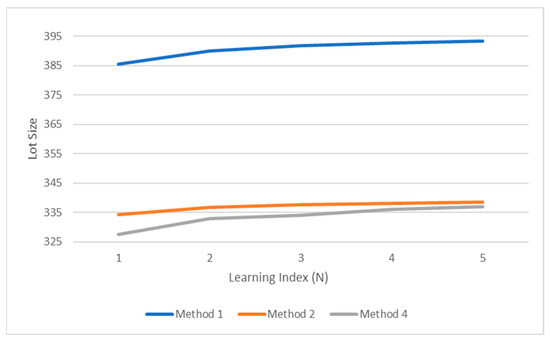

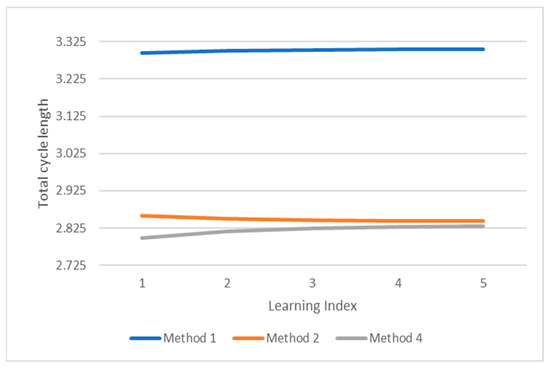

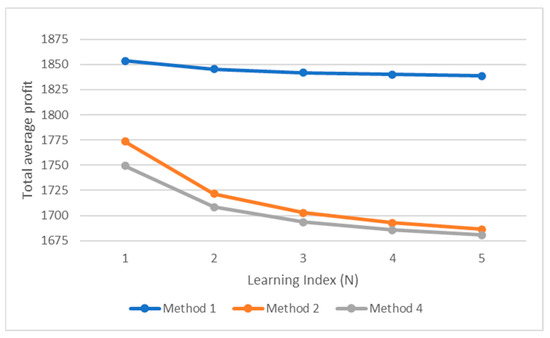

Figure 7, Figure 8 and Figure 9 present the variance in method 1, method 2, and method 4 for the lot size, total cycle time, and total average profit, respectively, with respect to the experience indexes.

Figure 7.

Impact of the learning index on lot size using different fuzzy methods.

Figure 8.

Impact of the learning index (N) on total cycle length using different fuzzy methods.

Figure 9.

Impact of the learning index (N) on total average profit using different fuzzy methods.

- The lot increases with the learning index when using each method. The largest lot size is obtained using method 1, while the smallest corresponds to method 4.

- The total cycle length increases with the learning index when using method 1 and method 4. The graph of the total cycle length shows the reverse pattern for method 2. The largest lot size is obtained using method 1, while the smallest corresponds to method 4.

- The total average profit decreases with the learning index when using each method. The best result corresponds to method 1.

7. Discussion on Numerical Results and Their Managerial Insights

This section revisits the research objectives and hypotheses involved in the proposed model before mentioning the numerical outcomes with their managerial insights. The following research objectives inspired the authors to propose the concept in this paper:

- To design a strategy that should be used in an EOQ-driven marketing situation where consumers’ unpredictable demands rely on the unit selling price.

- To measure the impact of the unpredictable demand pattern on the decision-making process.

- To trace the sensitivity of the profit-maximizing policy on the all-unit price discount facility during purchasing.

- To address the question: how much can the decision-maker learn by doing repetitive tasks to implement a more effective plan and accomplish his/her goal?

The uncertainty regarding the selling price dependency of the demand rate was fixed by assuming the selling price per unit to be fuzzy numbers. This makes the demand a fuzzy-valued function of price. The next step questioned the impact of fuzzy demand on the profit maximization objective. To address this question, we discussed four different fuzzy models associated with the hypotheses. An all-unit discount facility while purchasing is assumed in this paper. A discrete relevance between the purchasing cost per unit and the order size is taken into the fuzzy environment to address the indeterminacy. To incorporate the learning effect on the profitability due to repetitive tasks, we utilized a triangular dense fuzzy environment. We assumed the selling price and purchasing cost per unit were triangular dense fuzzy numbers.

Next, some significant observations from the numerical analysis in the other sub-sections of this present section are interpreted as follows:

- The purchase cost per unit is connected to lot size. It is observed that the lot size increases as the purchase cost per unit decrease. The decision-maker can be successfully persuaded to place larger orders using the planned all-unit discount policy on the purchase price per unit. As a result, the decision-maker should select the supplier that permits a plan for all-unit discounts on the purchase price. A trial to fix the purchase cost–order quantity combination using repetition is necessary for the feasible optimal solution. Feasibility does not occur before a specific trial. The decision-maker must first complete trial-and-error tasks to obtain a viable solution.

- After obtaining feasible solutions, the decision-makers will find the best one favoring their goal. As the number of trials increases, the average profit increases initially and, after reaching a peak, it then decreases. So, there will be an optimal choice for the trial number for profit maximization.

- The demand pattern of an item is not at all predictable, and uncertainties are involved with it. Fuzzy decision-making techniques are preferable to predict the demand pattern as well. The decision-makers must self-learn by performing repetitive tasks in a specific retailing cycle to pursue precision in the optimal retailing policy. Because the tasks are repeated frequently, the decision-maker can more precisely understand the demand rate. Thus, the dense fuzzy phenomenon is superior to the general fuzzy phenomenon for the profit maximization objective.

- However, the total cycle length and lot size increase with the learning index. That is, too much repetition causes the decision cycle to be unnecessarily large, which results in a deduction in the average profit. So, learning through repetition is necessary, but uncontrolled exercises may cause a backlash.

This paper does not address a specific business. Most of the retail enterprises experience the selling price dependency of the demand rate. Discount on purchasing costs for large order is also very frequent in supply–retail scenarios. This paper enlightens an innovative decision-making procedure that obtains the best profit in an uncertain managerial situation. The managerial implications of the obtained results are as follows.

Insight 1: The retailer can reduce costs by lowering purchasing and holding costs. The purchasing cost per unit can be reduced by making the order large. Furthermore, large orders can earn more revenue for retailing commodities. Thus, more profit can be reached by making large orders. However, the purchasing cost per unit and order quantity are constrained by a given discrete chart from the supplier. In this situation, the decision-maker can utilize the trial-and-error method as prescribed in this paper to make a feasible choice for the duo that provides the optimal profit.

Insight 2: A low retail price per unit can create demand, and consumer demand leads toward profitability. However, the relationship is not transitive well. A low retail price harms the earning revenue from retailing. So, the best profit may not be obtained at a lower retail price. The direct impact of retail price on the earned revenue is more sensitive compared to that of the demand rate in this model. The manager should consider this fact while strategizing to increase customer demand.

Insight 3: The numerical results in this paper reveal that learning through repetitive tasks can provide better profit by diluting the impreciseness involved in the decision-making process. Earned managerial experiences by handling similar tasks can boost the retailer’s profitability.

8. Conclusions and Future Research Scopes

This study had the following objectives. First, the demand variability on the selling price has to be traced. Second, the purchasing cost dependency on the order size must be analyzed. Several previous papers had the same objectives. The present investigation differs from existing works as uncertainties are considered during such deals, and a policy that can dilute such uncertainty by learning is designed. Finally, the ultimate objective was to find the best profit in uncertain environments. With the mentioned objectives, this study developed a learning-based EOQ model under the assumption of price-dependent demand with a price discount facility. The experience of learning is incorporated into the theory regarding triangular dense fuzzy numbers. The selling price is a triangular dense fuzzy set that includes learning experience and decision-making. Three methods were proposed to solve the problem: directly inputting the index value of the fuzzy parameters, using the parametric representation (-cut approach) of the undefined parameter, and lastly, an analytical approach using fuzzy Laplace transform. The critical outcomes of this investigation are as follows. First, through more learning experience, the decision will be matured, and thus it will lead the system toward more profits. Second, excessive repetition to gain experience about vague data may reduce profit by enlarging the cycle and lot size. Furthermore, the decision-maker can be persuaded to place larger orders using the planned all-unit discount policy on the purchase price per unit. This study illuminates an intelligent decision-making process that generates the most significant profit in a hazy management scenario. The majority of retail businesses encounter selling price dependence on a demand rate. In supply–retail contexts, discounts on purchase expenses for large orders are also reasonably typical. The scenario of buying and selling could only sometimes be exact and deterministic. Due to changes in the actual market condition, imprecision in this decision-making scenario is probably inevitable. However, the manager should discover how to use their choice best. This study claims that practice makes perfect and provides the best potential for a purchasing discount. This is the main usefulness of the proposed study.

Learning through trials and repetitive tasks is used in an economic order quantity model in this paper. The approach is new. However, the limitation of this study is that the analysis was performed on mathematical results and artificial data. Raw data from real retail bodies can be used to examine the theory accurately. So, we recommend scopes to complete data-specific research following the proposed approach. The future research scopes in this direction are as follows.

First, the introduced formula depicting the discrete relationship between purchasing cost per unit and order quantity can be modified in the future to address the dependency more accurately.

Second, the carrying cost per unit is considered an increasing function of time for an owned warehouse. In the case of a rented warehouse, the phenomena should be changed. The owner of the rented warehouse may offer discounts on carrying costs for inventory size and long-time deals. So, the present study can be extended in this direction.

Third, the diluteness of impreciseness through repetition is addressed in this study using the concept of triangular dense fuzzy numbers. The dense fuzzy number is formulated in terms of repetition number discretely. A better decision-making scenario may be obtained to deal with such an inventory model, where time can be included in the fuzzy function and can be interpreted as the diluteness of impreciseness as time increases.

Fourth, the learning-based decision-making scenario for all unit discount policies may be replaced with memory-based decision-making using fractional calculus.

Author Contributions

All authors contributed equally to every section. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by funding from the Prince Sattam Bin Abdulaziz University project number PSAU/2023/R/1444.

Data Availability Statement

The used data are already is in this manuscript. The data sources are also clearly mentioned.

Acknowledgments

The authors are very grateful to all the reviewers and journals editor for accepting the article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Again,

Or,

and

Therefore, and .

References

- Harris, F.W. How many parts to make at once. Fact.-Mag. Manag. 1913, 10, 135–136. [Google Scholar] [CrossRef]

- Hadley, G.; Whitin, T.M. Analysis of Inventory Systems; Prentice-Hall: Englewood Cliffs, NJ, USA, 1963. [Google Scholar]

- Naddor, E. Inventory Systems; John Wiley: New York, NY, USA, 1966. [Google Scholar]

- Silver, E.A.; Meal, H.C. A heuristic for selecting lot size quantities for the case of a deterministic time varying demand rate and discrete opportunities for replenishment. Prod. Inventory Manag. 1973, 14, 64–74. [Google Scholar]

- Giri, B.C.; Pal, S.; Goswami, A.; Chaudhuri, K.S. An inventory model for deteriorating items with stock-dependent demand rate. Eur. J. Oper. Res. 1996, 95, 604–610. [Google Scholar] [CrossRef]

- Kim, J.; Hwang, H.; Shinn, S. An optimal credit policy to increase supplier’s profits with price-dependent demand functions. Prod. Plan. Control 1995, 6, 45–50. [Google Scholar] [CrossRef]

- Roy, A. An inventory model for deteriorating items with price dependent demand and time varying holding cost. Adv. Model. Optim. 2008, 10, 25–37. [Google Scholar]

- Tripathy, C.K.; Mishra, U. An inventory model for Weibull deteriorating items with price dependent demand and time-varying holding cost. Appl. Math. Sci. 2010, 4, 2171–2179. [Google Scholar]

- Alfares, H.K.; Ghaithan, A.M. EOQ and EPQ production inventory models with variable holding cost: State-of-the-art review. Arab. J. Sci. Eng. 2019, 44, 1737–1755. [Google Scholar] [CrossRef]

- Bhunia, A.; Shaikh, A. A deterministic inventory model for deteriorating items with selling price dependent demand and three-parameter Weibull distributed deterioration. Int. J. Ind. Eng. Comput. 2014, 5, 497–510. [Google Scholar] [CrossRef]

- Pal, S.; Mahapatra, G.S.; Samanta, G.P. An inventory model of price and stock dependent demand rate with deterioration under inflation and delay in payment. Int. J. Syst. Assur. Eng. Manag. 2014, 5, 591–601. [Google Scholar] [CrossRef]

- Ghoreishi, M.; Weber, G.W.; Mirzazadeh, A. An inventory model for non-instantaneous deteriorating items with partial backlogging, permissible delay in payments, inflation- and selling price-dependent demand and customer returns. Ann. Oper. Res. 2015, 226, 221–238. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Noori-Daryan, M.; Govindan, K. Pricing and ordering decisions of two competing supply chains with different composite policies: A Stackelberg game-theoretic approach. Int. J. Prod. Res. 2016, 54, 2807–2836. [Google Scholar] [CrossRef]

- Mishra, U.; Barron, L.E.C.; Tiwari, S.; Shaikh, A.A.; Graza, G.T. An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment. Ann. Oper. Res. 2017, 254, 165–190. [Google Scholar] [CrossRef]

- Panda, G.C.; Khan, M.A.A.; Shaikh, A.A. A credit policy approach in a two-warehouse inventory model for deteriorating items with price- and stock-dependent demand under partial backlogging. J. Ind. Eng. Int. 2019, 15, 147–170. [Google Scholar] [CrossRef]

- Barron, L.E.C.; Shaikh, A.A.; Tiwari, S.; Garza, G.T. An EOQ inventory model with nonlinear stock dependent holding cost, nonlinear stock dependent demand and trade credit. Comput. Ind. Eng. 2020, 139, 105557. [Google Scholar] [CrossRef]

- Alfares, H.K.; Ghaithan, A.M. A Generalized Production-Inventory Model with Variable Production, Demand, and Cost Rates. Arab. J. Sci. Eng. 2022, 47, 3963–3978. [Google Scholar] [CrossRef]

- Akhtar, M.; Duary, A.; Manna, A.K.; Shaikh, A.A.; Bhunia, A.K. An application of tournament differential evolution algorithm in production inventory model with green level and expiry time dependent demand. Artif. Intell. Rev. 2022, 56, 4137–4170. [Google Scholar] [CrossRef]

- Hakim, M.A.; Hezam, I.M.; Alrasheedi, A.F.; Gwak, J. Pricing Policy in an Inventory Model with Green Level Dependent Demand for a Deteriorating Item. Sustainability 2022, 14, 4646. [Google Scholar] [CrossRef]

- Shi, J.; Zhang, G.; Lai, K.K. Optimal ordering and pricing policy with supplier quantity discounts and price-dependent stochastic demand. Optimization 2012, 61, 151–162. [Google Scholar] [CrossRef]

- Chen, S.P.; Ho, Y.H. Optimal inventory policy for the fuzzy newsboy problem with quantity discounts. Inf. Sci. 2013, 228, 75–89. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Pentico, D.W. An economic order quantity model with partial backordering and all-units discount. Int. J. Prod. Econ. 2014, 155, 172–184. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Stojkovska, I.; Pentico, D.W. An economic order quantity model with partial backordering and incremental discount. Comput. Ind. Eng. 2015, 82, 21–32. [Google Scholar] [CrossRef]

- Alfares, H.K. Maximum-profit inventory model with stock-dependent demand, time dependent holding cost, and all-units quantity discounts. Math. Model. Anal. 2015, 20, 715–736. [Google Scholar] [CrossRef]

- Alfares, H.K.; Ghaithan, A.M. Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. Comput. Ind. Eng. 2016, 94, 170–177. [Google Scholar] [CrossRef]

- Huang, T.S.; Yang, M.F.; Chao, Y.S.; Kei, E.S.Y.; Chung, W.H. Fuzzy Supply Chain Integrated Inventory Model with Quantity Discounts and Unreliable Process in Uncertain Environments. In Proceedings of the International MultiConference of Engineers and Computer Scientists, Hong Kong, China, 14–16 March 2018; Volume 2, pp. 14–16. [Google Scholar]

- Sebatjane, M.; Adetunji, O. Economic order quantity model for growing items with incremental quantity discounts. J. Ind. Eng. Int. 2019, 15, 545–556. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Khan, M.A.A.; Panda, G.C.; Konstantaras, I. Price discount facility in an EOQ model for deteriorating items with stock-dependent demand and partial backlogging. Int. Trans. Oper. Res. 2019, 26, 1365–1395. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Ahmed, S.; Babu, M.S.; Sultana, N. Optimal lot-size decision for deteriorating items with price-sensitive demand, linearly time-dependent holding cost under all-units discount environment. Int. J. Syst. Sci. Oper. Logist. 2020, 9, 61–74. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Roy, D.; Daryanto, Y.; Wee, H.M. Joint pricing deteriorating inventory model considering product life cycle and advance payment with a discount facility. RAIRO-Oper. Res. 2021, 55, S1069–S1088. [Google Scholar] [CrossRef]

- Rahman, M.S.; Duary, A.; Khan, M.A.A.; Shaikh, A.A.; Bhunia, A.K. Interval valued demand related inventory model under all-units discount facility and deterioration via parametric approach. Artif. Intell. Rev. 2022, 55, 2455–2494. [Google Scholar] [CrossRef]

- Kuppulakshmi, V.; Sugapriya, C.; Kavikumar, J.; Nagarajan, D. Fuzzy Inventory Model for Imperfect Items with Price Discount and Penalty Maintenance Cost. Math. Probl. Eng. 2023, 2023, 1246257. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Kaleva, O. Fuzzy differential equations. Fuzzy Sets Syst. 1987, 24, 301–317. [Google Scholar] [CrossRef]

- Park, K.S. Fuzzy-set theoretic interpretation of economic order quantity. IEEE Trans. Syst. Man Cybern. 1987, 17, 1082–1084. [Google Scholar] [CrossRef]

- Debnath, B.K.; Majumder, P.; Bera, U.K.; Maiti, M. Inventory model with demand as type-2 fuzzy number: A fuzzy differential equation approach. Iran. J. Fuzzy Syst. 2018, 15, 1–24. [Google Scholar]

- Guchhait, P.; Maiti, M.K.; Maiti, M. A production inventory model with fuzzy production and demand using fuzzy differential equation: An interval compared genetic algorithm approach. Eng. Appl. Artif. Intell. 2013, 26, 766–778. [Google Scholar] [CrossRef]

- Mahata, G.C.; De, S.K.; Bhattacharya, K.; Maity, S. Three-echelon supply chain model in an imperfect production system with inspection error, learning effect, and return policy under fuzzy environment. Int. J. Syst. Sci. Oper. Logist. 2021, 10, 1962427. [Google Scholar] [CrossRef]

- Manna, A.K.; Barron, L.E.C.; Dey, J.K.; Mondal, S.K.; Shaikh, A.A.; Mota, A.C.; Garza, G.T. A fuzzy imperfect production inventory model based on fuzzy differential and fuzzy integral method. J. Risk Financ. Manag. 2022, 15, 239. [Google Scholar] [CrossRef]

- Wright, T.P. Factors affecting the cost of airplanes. J. Aeronaut. Sci. 1936, 3, 122–128. [Google Scholar] [CrossRef]

- Glock, C.H.; Schwindl, K.; Jaber, M.Y. An EOQ model with fuzzy demand and learning in fuzziness. Int. J. Serv. Oper. Manag. 2012, 12, 90–100. [Google Scholar] [CrossRef]

- Mahata, G.C. A production-inventory model with imperfect production process and partial backlogging under learning considerations in fuzzy random environments. J. Intell. Manuf. 2014, 28, 883–897. [Google Scholar] [CrossRef]

- Kumar, R.S.; Goswami, A. EPQ model with learning consideration, imperfect production and partial backlogging in fuzzy random environment. Int. J. Syst. Sci. 2015, 46, 1486–1497. [Google Scholar] [CrossRef]

- Kazemi, N.; Shekarian, E.; Barron, L.E.C. Incorporating human learning into a fuzzy EOQ inventory model with backorders. Comput. Ind. Eng. 2015, 87, 540–542. [Google Scholar] [CrossRef]

- Shekarian, E.; Olugu, E.U.; Rashid, S.H.A.; Kazemi, N. An economic order quantity model considering different holding costs for imperfect quality items subject to fuzziness and learning. J. Intell. Fuzzy Syst. 2016, 30, 2985–2997. [Google Scholar] [CrossRef]

- Kazemi, N.; Rashid, S.H.A.; Shekarian, E.; Bottani, E.; Montanari, R. A fuzzy lot-sizing problem with two stage composite human learning. Int. J. Prod. Res. 2016, 54, 5010–5025. [Google Scholar] [CrossRef]

- Soni, H.N.; Sarkar, B.; Joshi, M. Demand uncertainty and learning in fuzziness in a continuous review inventory model. J. Intell. Fuzzy Syst. 2017, 33, 2595–2608. [Google Scholar] [CrossRef]

- De, S.K.; Beg, I. Triangular dense fuzzy sets and new defuzzification methods. J. Intell. Fuzzy Syst. 2016, 31, 469–477. [Google Scholar] [CrossRef]

- De, S.K. Triangular dense fuzzy lock sets. Soft Comput. 2018, 22, 7243–7254. [Google Scholar] [CrossRef]

- Maity, S.; De, S.K.; Mondal, S.P. A Study of an EOQ Model under Lock Fuzzy Environment. Mathematics 2019, 7, 75. [Google Scholar] [CrossRef]

- Rahaman, M.; Mondal, S.P.; Alam, S. An estimation of effects of memory and learning experience on the EOQ model with price dependent demand. RAIRO-Oper. Res. 2021, 55, 2991–3020. [Google Scholar] [CrossRef]

- Rahaman, M.; Mondal, S.P.; Alam, S.; Goswami, A. Synergetic study of inventory management problem in uncertain environment based on memory and learning effects. Sadhana 2021, 46, 39. [Google Scholar] [CrossRef]

- Yager, R.R. A procedure for ordering fuzzy subsets of the unit interval. Inf. Sci. 1981, 24, 143–161. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).