A Study of the Impact of Executive Power and Employee Stock Ownership Plans on Corporate Cost Stickiness: Evidence from China A-Share Non-Financial Listed Companies

Abstract

1. Introduction

2. Institutional Background and Theoretical Analysis

2.1. Cost Reduction and Cost Stickiness

2.2. Executive Power and Cost Stickiness

2.3. Employee Stock Ownership Plan, Executive Power, and Cost Stickiness

3. Study Design

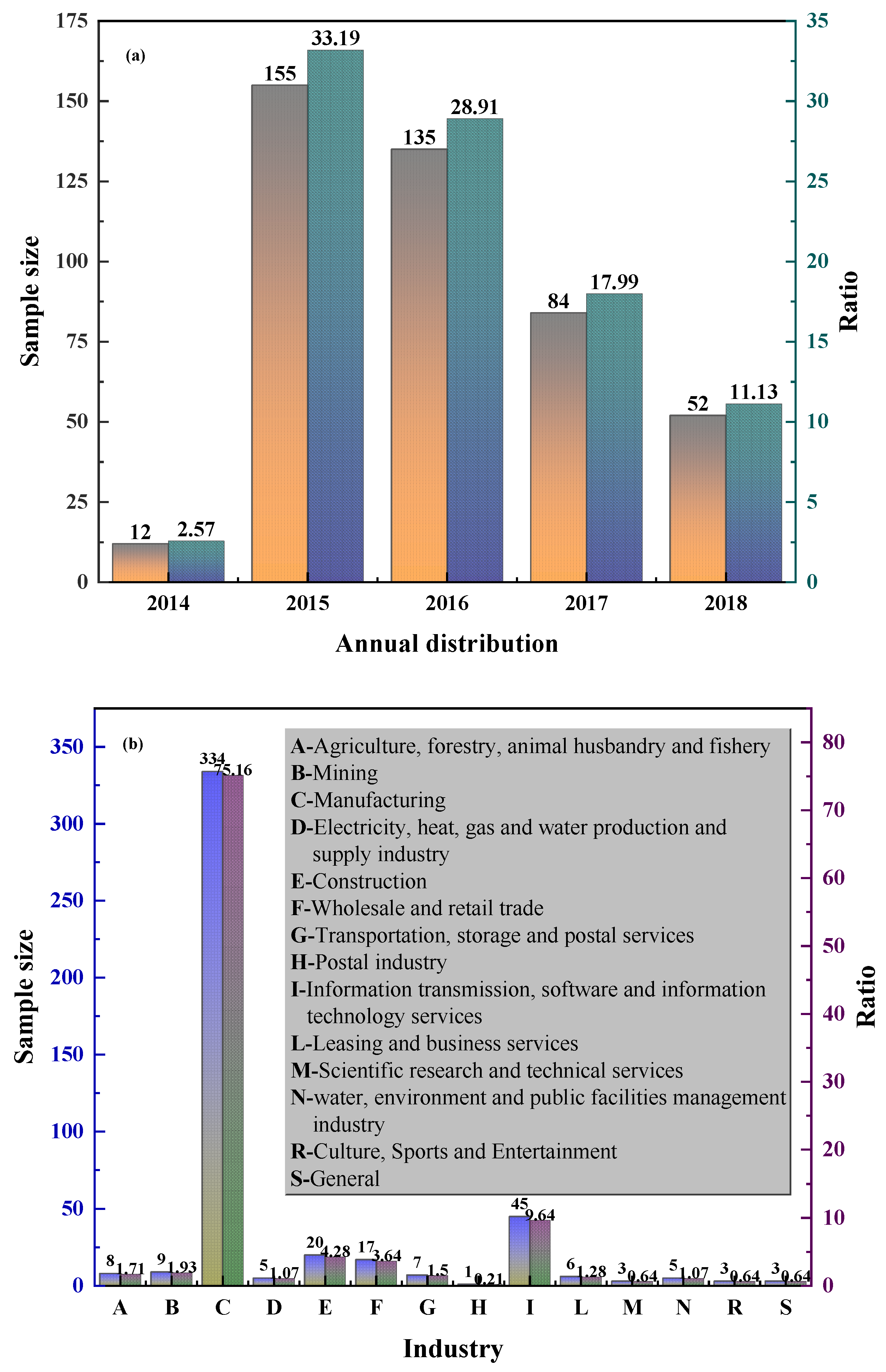

3.1. Sample Selection

3.2. Model Selection

3.2.1. Model of the Effect of Executive Power on Cost Stickiness

3.2.2. Testing the Moderating Effect of Employee Stock Ownership Plan on the Power Cost Effect of Executives

4. Empirical Results

4.1. Descriptive Statistics

4.1.1. Sample Distribution Statistics of Employee Stock Ownership Plans

4.1.2. Descriptive Statistics of the Main Variables

4.2. Analysis of Regression Results

5. Testing the Impact Mechanism

5.1. Adjustment Cost Mechanism Path

5.2. Management Optimistic Expectation Mechanism Path

5.3. Executive Compensation Performance Sensitivity Mechanism Path

5.4. Mechanism Path of Information Disclosure Quality

6. Subgroup Test Results

6.1. Moderating Effect of ESOP Once vs. Many Times

6.2. Equity Nature Regulation Effect

6.3. ESOP_ratio Moderation Effect

6.4. Moderating Effect of Institutional Investors’ Shareholding

6.5. Employee Turnover Regulation Effect

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cunningham, L.X. SMEs as motor of growth: A review of China’s SMEs development in thirty years (1978–2008). Hum. Syst. Manag. 2011, 30, 39–54. [Google Scholar] [CrossRef]

- Wang, J.H.; Mao, N. A study of economic policy uncertainty and firm cost stickiness in risk perspective. Manag. Sci. 2021, 34, 82–96. [Google Scholar]

- Banker, R.D.; Ciftci, M.; Mashruwala, R. Managerial optimism, prior sales changes, and sticky cost behavior. Working Paper 2008. [Google Scholar] [CrossRef]

- Chen, Y. A study on the implementation motivation and economic consequences of employee equity incentives. Manag. Rev. 2015, 27, 163–176. [Google Scholar]

- Song, F.X.; Liu, L. Employee stock ownership plans of listed companies: Implementation motivation, scheme design and its influencing factors. Reform 2018, 88–98. [Google Scholar]

- Gaur, S.S.; Bathula, H.; Singh, D. Ownership concentration, board characteristics and firm performance: A contingency framework. Manag. Decis. 2015, 53, 911–931. [Google Scholar] [CrossRef]

- Wang, J.; Wang, H.; Wang, D. Equity concentration and investment efficiency of energy companies in China: Evidence based on the shock of deregulation of QFIIs. Energy Econ. 2021, 93, 105032. [Google Scholar] [CrossRef]

- Balsmeier, B.; Czarnitzki, D. Ownership concentration, institutional development and firm performance in Central and Eastern Europe. MDE Manag. Decis. Econ. 2017, 38, 178–192. [Google Scholar] [CrossRef]

- Guerrero-Villegas, J.; Giráldez-Puig, P.; Pérez-Calero, S.L.; Hurtado-González, J.M. Ownership concentration and firm performance: The moderating effect of the monitoring and provision of resources board roles. Spanish J. Financ. Account. 2018, 47, 464–484. [Google Scholar]

- Yin, H.; Zhang, L.; Zhang, Y. The effect of ownership concentration and related diversification strategy of entrepreneurial enterprises on enterprise performance. Eurasia J. Math. Sci. Technol. Educ. 2017, 13, 8073–8087. [Google Scholar] [CrossRef]

- Ginglinger, E.; Megginson, W.; Waxin, T. Employee ownership, board representation, and corporate financial policies. J. Corp. Financ. 2011, 17, 868–887. [Google Scholar] [CrossRef]

- Kim, E.H.; Ouimet, P. Broad-based Employee Stock Ownership: Motives and Outcomes. J. Financ. 2014, 69, 1273–1319. [Google Scholar] [CrossRef]

- Fang, H.; Nofsinger, J.R.; Quan, J. The effects of employee stock option plans on operating performance in Chinese firms. J. Bank Financ. 2015, 54, 141–159. [Google Scholar] [CrossRef]

- Bova, F.; Dou, Y.; Hope, O.K. Employee Ownership and Firm Disclosure. Contemp. Account. Res. 2015, 32, 639–673. [Google Scholar] [CrossRef]

- Chang, X.; Fu, K.; Low, A.; Zhang, W. Non-executive Employee stock Options and Corporate Innovation. J. Financ. Econ. 2015, 115, 168–188. [Google Scholar] [CrossRef]

- Chen, C.; Chen, Y.; Hsu, P.H.; Podolski, E.J. Be nice to your innovators: Employee treatment and corporate innovation performance. J. Corp. Financ. 2016, 39, 78–98. [Google Scholar] [CrossRef]

- Zhou, D.H.; Huang, J.; Zhao, Y.J. Employee stock ownership plan and corporate innovation. Account. Res. 2019, 63–70. [Google Scholar]

- Meng, Q.B.; Li, X.Y.; Zhang, P. Can employee stock ownership plans promote corporate innovation?—Empirical evidence based on the perspective of corporate employees. Manag. World 2019, 35, 209–228. [Google Scholar]

- Anderson, M.C.; Banker, R.D.; Janakiraman, S.N. Are Selling, General, and Administrative costs sticky? J. Account. Res. 2003, 41, 47–63. [Google Scholar] [CrossRef]

- Subramaniam, C.; Weidenmier, M.L. Additional Evidence on the Sticky Behavior of Costs. Adv. Manag. Account. 2016, 26, 275–305. [Google Scholar]

- Banker, R.D.; Mack, C.J. Labor Market Characteristics and Cross-Country Differences in Cost Stickiness. SSRN Electron. J. 2006, 11, 102139. [Google Scholar] [CrossRef]

- Calleja, K.; Steliaros, M.; Thomas, D.C. A note on cost stickiness: Some international comparisons. Manag. Account. Res. 2006, 17, 127–140. [Google Scholar] [CrossRef]

- Gong, Q.F.; Liu, H.L.; Shen, H.H. Regional factor market development, state ownership and cost and expense stickiness. China Account. Rev. 2010, 8, 431–446. [Google Scholar]

- Cui, Y. Marketization, ownership nature and cost stickiness: Empirical data from A-share listed companies in China. Financ. Account. Monthly 2012, 11, 18–21. [Google Scholar]

- Liu, Y.; Liu, B. Labor protection, cost stickiness and firm response. Econ. Syst. Res. 2014, 5, 63–76. [Google Scholar]

- Jiang, W.; Yao, W.T.; Hu, Y.M. Implementation of Minimum Wage Regulation and Cost Stickiness of Enterprises. Account. Res. 2016, 10, 56–62. [Google Scholar]

- Geng, Y.; Wang, L. Cost stickiness, internal control quality and firm risk-empirical evidence from Chinese listed companies. Account. Res. 2019, 5, 75–81. [Google Scholar]

- Zhou, L.; Liu, H.; Zhang, H. How does board retention of former general managers affect firm resource alignment?—An empirical analysis based on cost stickiness perspective. Financ. Res. 2019, 2, 169–187. [Google Scholar]

- Yu, H.Y.; Wang, M.; Huang, B. Performance volatility, executive change and cost stickiness. Manag. Sci. 2019, 32, 135–147. [Google Scholar]

- Zhang, L.; Li, J.; Zhang, H.; Wang, H. Do managerial competencies affect firm cost stickiness? Account. Res. 2019, 3, 71–77. [Google Scholar]

- Liang, S. Managerial overconfidence, debt constraints and cost stickiness. Nankai Manag. Rev. 2015, 18, 122–131. [Google Scholar]

- Zhao, X.; Yang, S.C. Executive academic experience and corporate cost stickiness. Soft Sci. 2021, 35, 35–41. [Google Scholar]

- Quan, S.F.; Wu, S.N.; Wen, F. Management power, private earnings and compensation manipulation. Econ. Res. 2010, 45, 73–87. [Google Scholar]

- Zhang, L.P.; Yang, X.Q. Managerial power, management incentives and overinvestment. Soft Sci. 2012, 26, 107–112. [Google Scholar]

- Fang, J. Asymmetry of executive power and corporate compensation changes. Econ. Res. 2011, 4, 107–120. [Google Scholar]

- Bertrand, M.; Mullainathan, S. Enjoying the Quiet Life? Corporate Governance and Managerial Preferences. J. Polit. Econ. 2003, 111, 1043–1075. [Google Scholar] [CrossRef]

- Hope, O.K.; Thomas, W.B. Managerial Empire Building and Firm Disclosures. J. Account. Res. 2008, 46, 591–626. [Google Scholar] [CrossRef]

- Sun, H.; Wang, B. Management power, internal control and cost stickiness. Ind. Tech. Econ. 2021, 40, 71–76. [Google Scholar]

- Zhang, H.; Zhao, J.; Lu, Z. Employee compensation competitiveness and employee stock ownership in listed companies. Financial Res. 2021, 169–187. [Google Scholar]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Chen, D.; Shi, X.; Lu, Y.; Li, Z. Employee stock ownership plan and financial information quality. Nankai Manag. Rev. 2019, 22, 166–180. [Google Scholar] [CrossRef]

- Song, C.; Wang, L.; Wang, M. Employee stock ownership plans and audit fees—Empirical evidence based on A-share listed companies in China. Audit. Res. 2020, 51–58, 67. [Google Scholar]

- Faleye, O.; Mehrotra, V.; Morck, R. When labor has a voice in corporate governance. JFQA 2006, 41, 48–510. [Google Scholar] [CrossRef]

- Meng, R.; Ning, X.; Zhou, X.; Zhu, H. Do ESOPs Enhance Firm Performance? Evidence from China’s Reform Experiment. J. Bank. Financ. 2011, 35, 1541–1551. [Google Scholar] [CrossRef]

- Pugh, W.N.; Oswald, S.L.; Jahera, J.S., Jr. The Effect of ESOP Adoptions on Corporate Performance: Are There Really Performance Changes. MDE Manag. Decis. Econ. 2000, 21, 167–180. [Google Scholar] [CrossRef]

- Hao, Y.L.; Jin, X.; Zhang, Y.J. Employee stock ownership plans under the fog of shareholding reduction--a comparative analysis based on equity incentives. Manag. Rev. 2019, 31, 164–177. [Google Scholar]

- Shen, H.; Hua, L.; Xu, J. Business performance of state-owned enterprises implementing employee stock ownership plans: Incentive compatibility or incentive insufficiency. Manag. World 2018, 34, 121–133. [Google Scholar]

- Fu, C.; Wang, X.; Lu, J. Analysis of management power, executive compensation changes and corporate M&A behavior. Account. Res. 2014, 11, 30–37. [Google Scholar]

- Williamson, O.E. Corporate finance and corporate governance. J. Financ. 1988, 43, 567–591. [Google Scholar] [CrossRef]

- Wang, Z.; Duan, B.; Wang, Y.; Chen, G. Capital mismatch, asset specificity and firm value—A perspective based on reclassification of business activities. China Ind. Econ. 2017, 3, 120–138. [Google Scholar]

- Shen, H.; Wu, L. The nature of equity, environmental uncertainty and the governance effect of accounting information. Account. Res. 2012, 8, 8–16, 96. [Google Scholar]

- Xia, D. Fiduciary responsibility, decision usefulness and investor protection. Account. Res. 2015, 1, 25–31, 96. [Google Scholar]

- Zhou, X.; Wu, X. A study on the influence of robustness on corporate disclosure behavior-based on the perspective of accounting information transparency. Nankai Manag. Rev. 2013, 16, 89–100. [Google Scholar]

- Yi, Z.; Jiang, F.; Qin, Y. Product market competition, corporate governance and information disclosure quality. Manag. World 2010, 1, 133–141, 161, 188. [Google Scholar]

- Yang, H.; Wei, D.; Sun, J. Can institutional investors’ shareholding improve the quality of accounting information of listed companies?—Discussing the differences of different types of institutional investors. Account. Res. 2012, 9, 16–23. [Google Scholar]

- Liang, S. Does institutional investors’ shareholding affect the stickiness of corporate expenses? Manag. World 2018, 34, 133–148. [Google Scholar]

- Lin, Y.P. What Drives Employee Stock Options Programs? Safeguarding Human Capital and Recruiting Wanted Skills. J. Appl. Bus. Econ. 2013, 14, 53–69. [Google Scholar]

- Wei, C. A study on the influencing factors of equity incentives in GEM companies. Account. Res. 2019, 7, 51–58. [Google Scholar]

- Zhang, G. Market Valuation and Employee Stock Options. Manag. Sci. 2006, 52, 1377–1393. [Google Scholar] [CrossRef]

- Sun, X.; Liu, Y. Equity pledges, employee stock ownership plans and self-interest of major shareholders. Account. Res. 2021, 4, 117–129. [Google Scholar]

- Kalantonis, P.; Schoina, S.; Kallandranis, C. The impact of corporate governance on earnings management: Evidence from Greek listed firms. Corp. Ownership Control 2021, 18, 140–153. [Google Scholar] [CrossRef]

- Ibrahim, A.E.A.; Ali, H.; Aboelkheir, H. Cost stickiness: A systematic literature review of 27 years of research and a future research agenda. J. Int. Account 2022, 46, 100439. [Google Scholar] [CrossRef]

- Zhong, T.; Sun, F.; Zhou, H.; Lee, J.Y. Business Strategy, State-Owned Equity and Cost Stickiness: Evidence from Chinese Firms. Sustainability 2020, 12, 1850. [Google Scholar] [CrossRef]

- Prabowo, R.; Hooghiemstra, R.; Van Veen-Dirks, P. State ownership, socio-political factors, and labor cost stickiness. Eur. Account Rev. 2018, 27, 771–796. [Google Scholar] [CrossRef]

| Variables | Definition |

|---|---|

| Natural logarithm of the ratio of company’s SG&A expenses in year t to SG&A expenses in year t − 1 | |

| Natural logarithm of the ratio of company’s sales revenue in year t to sales revenue in year t − 1 | |

| Dummy variable, company’s sales revenue in period t is less than sales revenue in period t − 1, takes the value of 1. Otherwise, it is 0. | |

| Refer to the measure of Chip Fu et al. [49]. | |

| Dummy variable, company’s implementation of employee stock ownership plan in year t takes the value of 1. Otherwise, it is 0. | |

| The ratio of the share of equity of the company’s employee stock ownership plan implemented in year t to the share of all A shares of the company in year t. | |

| GDP growth rate of China in year t. | |

| The ratio of the number of employees to business revenue at the end of year t of the company. | |

| Ratio of total assets to operating revenue at the end of year t. | |

| Dummy variable, takes the value of 1 when company’s in year t and in year t − 1 are both 1, otherwise takes the value of 0. | |

| The natural logarithm of the total assets of the company at the end of year t. | |

| Company’s net income at the end of year t divided by total assets. | |

| Total liabilities divided by total assets at the end of company t. | |

| The ratio of the number of independent directors to the number of board of directors at the end of year t of the company. | |

| Company’s sales revenue at the end of year t divided by the average total assets of the year. |

| Variables | Sample Size | Mean Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| 12168 | 0.1255 | 0.2588 | −0.5579 | 1.2358 | |

| 12168 | 0.1094 | 0.2908 | −0.7118 | 1.3407 | |

| 12168 | 0.2951 | 0.4561 | 0 | 1 | |

| 12168 | 1.2346 | 0.8631 | 0 | 3 | |

| 12168 | 0.1456 | 0.3527 | 0 | 1 | |

| 12168 | 0.2314 | 0.7819 | 0 | 9.27 | |

| 12168 | 0.0875 | 0.0165 | 0.0703 | 0.1147 | |

| 12168 | −13.8362 | 0.8317 | −16.4675 | −12.0719 | |

| 12168 | 0.6889 | 0.6490 | −0.9171 | 2.5661 | |

| 12168 | 0.1043 | 0.3056 | 0 | 1 | |

| 12168 | 9.7401 | 0.5569 | 7.7362 | 12.4367 | |

| 12168 | 3.6080 | 6.0789 | −23.5162 | 21.0117 | |

| 12168 | 42.8104 | 19.7207 | 5.9485 | 88.5521 | |

| 12168 | 0.3743 | 0.0540 | 0.3 | 0.5714 | |

| 12168 | 0.6497 | 0.4443 | 0.0822 | 2.6324 |

| Model (1) | Model (2) | Model (2) | |

|---|---|---|---|

| 0.6014 *** (33.07) | 0.6013 *** (33.08) | 0.6013 *** (33.08) | |

| −0.8520 * (−1.84) | −0.7819 * (−1.70) | −0.8316 * (−1.80) | |

| −0.0511 * (−1.69) | −0.0673 ** (−2.19) | −0.0591 * (−1.93) | |

| 0.0866 *** (4.12) | |||

| 0.0272 ** (2.05) | |||

| 0.0054 (1.18) | 0.0054 (1.19) | 0.0053 (1.17) | |

| −0.0079 (−0.84) | |||

| −0.0040 (−0.98) | |||

| 12.2196 *** (7.64) | 11.6686 *** (7.33) | 11.8762 *** (7.43) | |

| 0.0874 *** (7.40) | 0.0876 *** (7.40) | 0.0879 *** (7.19) | |

| 0.0586 *** (2.81) | 0.0638 *** (3.06) | 0.0600 *** (2.87) | |

| 0.00005 (0.01) | 0.0003 (0.03) | 0.0003 (0.03) | |

| 0.2152 *** (8.92) | 0.2147 *** (8.84) | 0.2153 *** (8.86) | |

| −0.0040 *** (−6.24) | −0.0041 *** (−6.47) | −0.0040 *** (−6.30) | |

| 0.0017 *** (4.19) | 0.0017 *** (4.22) | 0.0017 *** (4.24) | |

| −0.0255 (−0.37) | −0.0221 (−0.32) | −0.0233 (−0.34) | |

| 0.1739 *** (6.57) | 0.1825 *** (6.68) | 0.1767 *** (6.63) | |

| 0.0648 (1.17) | 0.0743 (1.34) | 0.0688 (1.24) | |

| −0.0243 (−0.74) | −0.0225 (−0.69) | −0.0241 (−0.73) | |

| −0.1032 ** (−2.13) | −0.1045 ** (−2.18) | −0.1041 ** (−2.16) | |

| 0.0000 * (1.89) | 0.0000 (1.61) | 0.0000 * (1.78) | |

| Year | Control | Control | Control |

| Firm fixed effects | Yes | Yes | Yes |

| Sample size | 12168 | 12168 | 12168 |

| F | 134.147 | 124.532 | 123.920 |

| p | 0.001 *** | 0.001 *** | 0.001 *** |

| Adjusted | 0.390 | 0.382 | 0.369 |

| ASI Strong | ASI Weak | High Environmental Uncertainty | Low Environmental Uncertainty | High Executive Compensation Performance Sensitivity | Executive Compensation Performance Sensitivity Weak | High Quality of Information Disclosure | Low Quality of Information Disclosure | |

|---|---|---|---|---|---|---|---|---|

| 0.6125 *** (19.66) | 0.5971 *** (26.72) | 0.6652 *** (20.64) | 0.5643 *** (25.17) | 0.6003 *** (22.49) | 0.5976 *** (22.43) | 0.6319 *** (28.29) | 0.4687 *** (6.19) | |

| −0.9078 (−1.17) | −1.3911 ** (−2.24) | −0.4825 (−0.43) | −1.0881 * (−1.91) | −0.4566 (−0.59) | −0.0316 (−0.04) | −1.0824 (−1.17) | −0.1503 (−0.14) | |

| −0.1546 *** (−2.78) | −0.0287 (−0.72) | 0.0037 (0.05) | −0.0834 ** (−2.40) | −0.1206 ** (−2.47) | −0.0366 (−0.76) | −0.0736 (−1.49) | −0.1318 (−1.29) | |

| 0.1676 *** (2.59) | 0.0470 * (1.84) | 0.1078 *** (4.02) | 0.0458 (1.26) | 0.0847 (1.47) | 0.1141 *** (4.14) | 0.0108 (0.21) | 0.2099 *** (3.05) | |

| 0.0020 (0.29) | 0.0065 (1.01) | −0.0033 (−0.27) | 0.0062 (1.24) | 0.0013 (0.19) | 0.0090 (1.30) | 0.0022 (0.36) | 0.0340 (1.63) | |

| −0.0225 (−1.41) | 0.0046 (0.38) | −0.0362 (−1.46) | 0.0013 (0.12) | −0.0136 (−0.99) | −0.0045 (−0.28) | −0.0113 (−1.02) | 0.0197 (0.31) | |

| Control | Control | Control | Control | Control | Control | Control | Control | |

| Year | Control | Control | Control | Control | Control | Control | Control | Control |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 5355 | 6813 | 2318 | 9850 | 6101 | 6067 | 6693 | 1109 |

| F | 48.52 | 65.90 | 64.07 | 70.44 | 58.67 | 55.67 | 84.41 | 14.96 |

| p | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.003 *** |

| Adjusted | 0.370 | 0.396 | 0.564 | 0.315 | 0.395 | 0.395 | 0.413 | 0.389 |

| ESOP Once vs. not Implemented | ESOP Multiple Times vs. not Implemented | State-Owned Enterprises | Private Enterprises | ESOP_ratio Greater | ESOP_ratio Smaller | High Institutional Shareholding Ratio | Low Institutional Shareholding Ratio | High Employee Turnover Rate | Low Employee Turnover Rate | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.5976 *** (55.63) | 0.5922 *** (51.65) | 0.6296 *** (36.74) | 0.5813 *** (41.51) | 0.6955 *** (17.70) | 0.5912 *** (28.60) | 0.6295 *** (25.47) | 0.5578 *** (19.89) | 0.6223 *** (25.10) | 0.4068 *** (12.20) | |

| −0.7797 ** (−2.37) | −0.7880 ** (−2.25) | −0.3616 (−0.75) | −0.9741 ** (−2.01) | −0.0464 (−0.03) | −0.8904 * (−1.78) | −0.0006 (−0.00) | −1.3585 ** (−2.14) | 1.9838 (1.36) | −1.0248 ** (−1.98) | |

| −0.0784 *** (−3.34) | −0.0556 ** (−2.25) | −0.1255 *** (−3.42) | −0.0807 ** (−2.27) | −0.1696 * (−1.72) | −0.0542 * (−1.66) | −0.0300 (−0.64) | −0.0913 ** (−2.03) | −0.1873 * (−1.91) | −0.0371 (−1.11) | |

| 0.0720 (2.23) | 0.1529 *** (2.66) | 0.3237 * (1.86) | 0.0743 *** (3.07) | 0.1283 * (1.96) | 0.0730 *** (5.05) | 0.1090 *** (5.69) | 0.0723 * (1.71) | 0.0025 (0.02) | 0.0681 *** (2.78) | |

| 0.0050 (1.21) | 0.0060 (1.33) | −0.0062 (−1.04) | 0.0133 ** (2.26) | 0.0208 * (1.68) | 0.0038 (0.74) | 0.0009 (0.14) | 0.0068 (0.90) | 0.0068 (0.80) | 0.0035 (0.57) | |

| −0.0103 (−0.99) | −0.0099 (−0.52) | −0.0183 (−0.80) | 0.0129 (1.15) | −0.0433 (−1.25) | 0.0067 (0.26) | −0.0133 (−0.89) | −0.0021 (−0.16) | 0.0044 (0.30) | −0.0116 (−0.84) | |

| Control | Control | Control | Control | Control | Control | Control | Control | Control | Control | |

| Year | Control | Control | Control | Control | Control | Control | Control | Control | Control | Control |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample size | 12168 | 12168 | 5025 | 6455 | 2181 | 9987 | 6445 | 5723 | 4942 | 7226 |

| F | 124.532 | 123.920 | 120.971 | 145.414 | 38.27 | 97.87 | 84.01 | 46.52 | 74.14 | 28.10 |

| p | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 ** | 0.005 ** | 0.001 *** | 0.001 *** | 0.003 ** | 0.001 *** | 0.007 * |

| 0.390 | 0.390 | 0.270 | 0.270 | 0.445 | 0.396 | 0.428 | 0.345 | 0.478 | 0.210 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhai, D.; Zhao, X.; Bai, Y.; Wu, D. A Study of the Impact of Executive Power and Employee Stock Ownership Plans on Corporate Cost Stickiness: Evidence from China A-Share Non-Financial Listed Companies. Systems 2023, 11, 238. https://doi.org/10.3390/systems11050238

Zhai D, Zhao X, Bai Y, Wu D. A Study of the Impact of Executive Power and Employee Stock Ownership Plans on Corporate Cost Stickiness: Evidence from China A-Share Non-Financial Listed Companies. Systems. 2023; 11(5):238. https://doi.org/10.3390/systems11050238

Chicago/Turabian StyleZhai, Dongxue, Xuefeng Zhao, Yanfei Bai, and Delin Wu. 2023. "A Study of the Impact of Executive Power and Employee Stock Ownership Plans on Corporate Cost Stickiness: Evidence from China A-Share Non-Financial Listed Companies" Systems 11, no. 5: 238. https://doi.org/10.3390/systems11050238

APA StyleZhai, D., Zhao, X., Bai, Y., & Wu, D. (2023). A Study of the Impact of Executive Power and Employee Stock Ownership Plans on Corporate Cost Stickiness: Evidence from China A-Share Non-Financial Listed Companies. Systems, 11(5), 238. https://doi.org/10.3390/systems11050238