Overcoming Uncertainty in Novel Technologies: The Role of Venture Capital Syndication Networks in Artificial Intelligence (AI) Startup Investments in Korea and Japan

Abstract

:1. Introduction

2. Theoretical Background and Hypothesis Development

2.1. VC Network Reachability and AI Startup Investments

2.2. VC Network Brokerage and AI Startup Investments

3. Methods

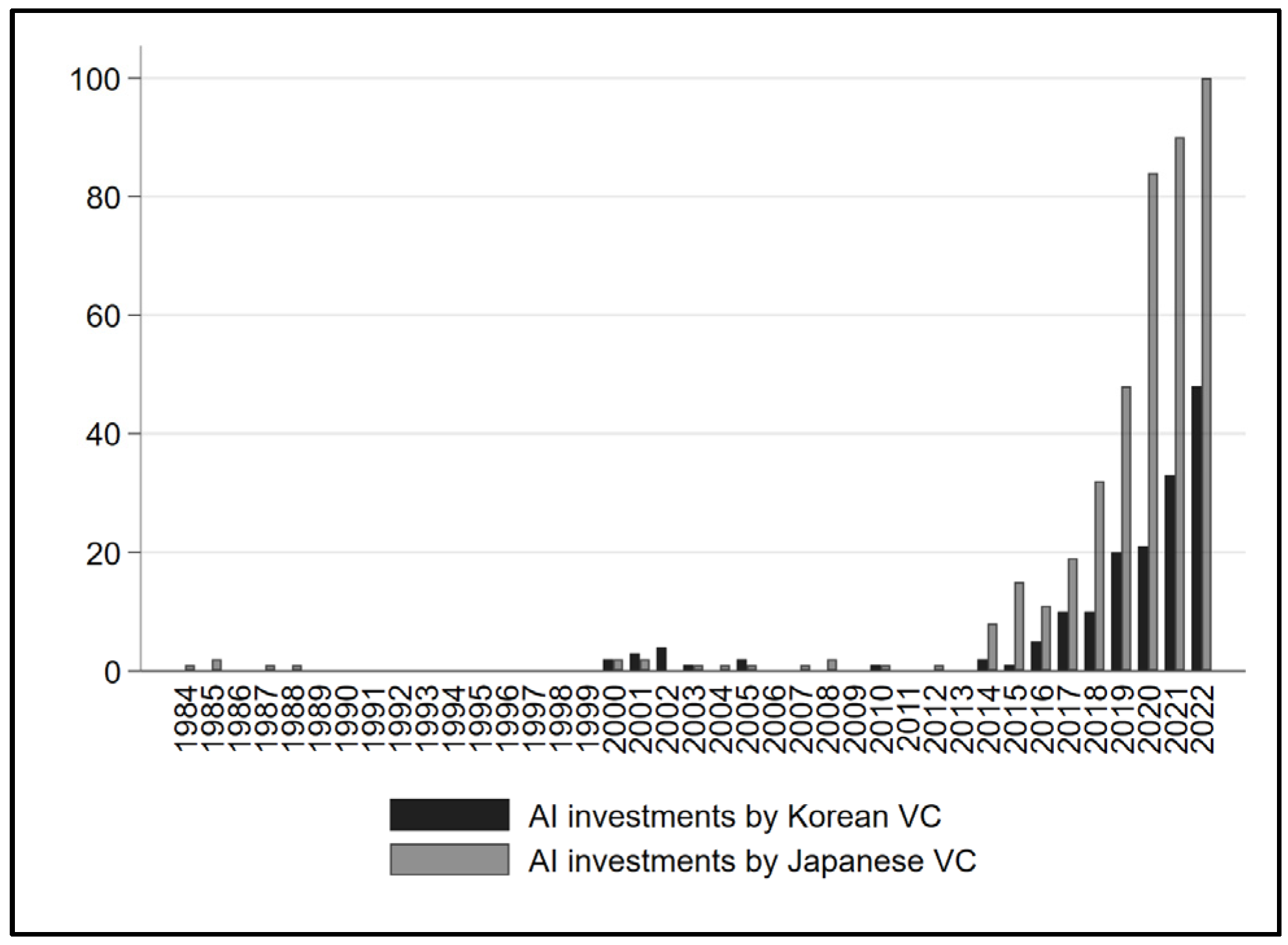

3.1. Data and Sample

3.2. Dependent Variable and Model Specification

3.3. Independent Variables

3.4. Control Variables

3.5. Robustness Checks

4. Results

5. Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gompers, P.; Lerner, J. The Venture Capital Revolution. J. Econ. Perspect. 2001, 15, 145–168. [Google Scholar] [CrossRef]

- Samila, S.; Sorenson, O. Venture Capital as a Catalyst to Commercialization. Res. Policy 2010, 39, 1348–1360. [Google Scholar] [CrossRef]

- Hellmann, T.; Puri, M. Venture Capital and the Professionalization of Start-up Firms: Empirical Evidence. J. Financ. 2002, 57, 169–197. [Google Scholar] [CrossRef]

- Fraser, S.; Bhaumik, S.K.; Wright, M. What Do We Know about Entrepreneurial Finance and Its Relationship with Growth? Int. Small Bus. J. 2015, 33, 70–88. [Google Scholar] [CrossRef]

- Amit, R.; Brander, J.; Zott, C. Why Do Venture Capital Firms Exist? Theory and Canadian Evidence. J. Bus. Ventur. 1998, 13, 441–466. [Google Scholar] [CrossRef]

- Bollazzi, F.; Risalvato, G.; Venezia, C. Asymmetric Information and Deal Selection: Evidence from the Italian Venture Capital Market. Int. Entrep. Manag. J. 2019, 15, 721–732. [Google Scholar] [CrossRef]

- Kerr, W.R.; Nanda, R.; Rhodes-Kropf, M. Entrepreneurship as Experimentation. J. Econ. Perspect. 2014, 28, 25–48. [Google Scholar] [CrossRef]

- Haessler, P.; Giones, F.; Brem, A. The Who and How of Commercializing Emerging Technologies: A Technology-Focused Review. Technovation 2023, 121, 102637. [Google Scholar] [CrossRef]

- Rotolo, D.; Hicks, D.; Martin, B.R. What Is an Emerging Technology? Res. Policy 2015, 44, 1827–1843. [Google Scholar] [CrossRef]

- Strickland, E. The Turbulent Past and Uncertain Future of AI: Is There a Way out of AI’s Boom-and-Bust Cycle? IEEE Spectr. 2021, 58, 26–31. [Google Scholar] [CrossRef]

- Ameye, N.; Bughin, J.; van Zeebroeck, N. How Uncertainty Shapes Herding in the Corporate Use of Artificial Intelligence Technology. Technovation 2023, 127, 102846. [Google Scholar] [CrossRef]

- Kaggwa, S.; Akinoso, A.; Dawodu, S.O.; Uwaoma, P.U.; Akindote, O.J.; Osawaru, S.E. Entrepreneurial Strategies for AI Startups: Navigating Market and Investment Challenges. Int. J. Manag. Entrep. Res. 2023, 5, 1085–1108. [Google Scholar] [CrossRef]

- Lee, B.; Kim, B.; Ivan, U.V. Enhancing the Competitiveness of AI Technology-Based Startups in the Digital Era. Adm. Sci. 2024, 14, 6. [Google Scholar] [CrossRef]

- Weber, M.; Moritz, B.; Jörg, W.; Böhm, M.; Helmut, K. AI Startup Business Models. Bus. Inf. Syst. Eng. 2022, 64, 91–109. [Google Scholar] [CrossRef]

- Buiten, M.C. Towards Intelligent Regulation of Artificial Intelligence. Eur. J. Risk Regul. 2019, 10, 41–59. [Google Scholar] [CrossRef]

- Hoenig, D.; Henkel, J. Quality Signals? The Role of Patents, Alliances, and Team Experience in Venture Capital Financing. Res. Policy 2015, 44, 1049–1064. [Google Scholar] [CrossRef]

- Colombo, O. The Use of Signals in New-Venture Financing: A Review and Research Agenda. J. Manag. 2021, 47, 237–259. [Google Scholar] [CrossRef]

- Chen, H.; Gompers, P.; Kovner, A.; Lerner, J. Buy Local? The Geography of Venture Capital. J. Urban Econ. 2010, 67, 90–102. [Google Scholar] [CrossRef]

- Cumming, D.; Dai, N. Local Bias in Venture Capital Investments. J. Empir. Financ. 2010, 17, 362–380. [Google Scholar] [CrossRef]

- Gulati, R.; Gargiulo, M. Where Do Interorganizational Networks Come From? Am. J. Sociol. 1999, 104, 1439–1493. [Google Scholar] [CrossRef]

- Hochberg, Y.V.; Ljungqvist, A.; Lu, Y. Whom You Know Matters: Venture Capital Networks and Investment Performance. J. Financ. 2007, 62, 251–301. [Google Scholar] [CrossRef]

- Sullivan, B.N.; Tang, Y. Small-World Networks, Absorptive Capacity and Firm Performance: Evidence from the US Venture Capital Industry. Int. J. Strateg. Chang. Manag. 2012, 4, 149–175. [Google Scholar] [CrossRef]

- Khavul, S.; Deeds, D. The Evolution of Initial Co-Investment Syndications in an Emerging Venture Capital Market. J. Int. Manag. 2016, 22, 280–293. [Google Scholar] [CrossRef]

- Meuleman, M.; Jääskeläinen, M.; Maula, M.V.J.; Wright, M. Venturing into the Unknown with Strangers: Substitutes of Relational Embeddedness in Cross-Border Partner Selection in Venture Capital Syndicates. J. Bus. Ventur. 2017, 32, 131–144. [Google Scholar] [CrossRef]

- Antretter, T.; Sirén, C.; Grichnik, D.; Wincent, J. Should Business Angels Diversify Their Investment Portfolios to Achieve Higher Performance? The Role of Knowledge Access through Co-Investment Networks. J. Bus. Ventur. 2020, 35, 106043. [Google Scholar] [CrossRef]

- Mou, X. Artificial Intelligence: Investment Trends and Selected Industry Uses. IFC EMCompass Emerg. Mark. 2019, 71, 1–8. [Google Scholar]

- Tricot, R. Venture Capital Investments in Artificial Intelligence: Analysing Trends in VC in AI Companies from 2012 through 2020; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Freeman, L.C. A Set of Measures of Centrality Based on Betweenness. Sociometry 1977, 40, 35–41. [Google Scholar] [CrossRef]

- Burt, R.S. Structural Holes and Good Ideas. Am. J. Sociol. 2004, 110, 349–399. [Google Scholar] [CrossRef]

- Valente, T.W.; Foreman, R.K. Integration and Radiality: Measuring the Extent of an Individual’s Connectedness and Reachability in a Network. Soc. Netw. 1998, 20, 89–105. [Google Scholar] [CrossRef]

- Doreian, P. On the Connectivity of Social Networks. J. Math. Sociol. 1974, 3, 245–258. [Google Scholar] [CrossRef]

- Borgatti, S.P. Centrality and Network Flow. Soc. Netw. 2005, 27, 55–71. [Google Scholar] [CrossRef]

- Schilling, M.A.; Phelps, C.C. Interfirm Collaboration Networks: The Impact of Large-Scale Network Structure on Firm Innovation. Manag. Sci. 2007, 53, 1113–1126. [Google Scholar] [CrossRef]

- Schilling, M.A. Technology Shocks, Technological Collaboration, and Innovation Outcomes. Organ. Sci. 2015, 26, 668–686. [Google Scholar] [CrossRef]

- Crafts, N. Artificial Intelligence as a General-Purpose Technology: An Historical Perspective. Oxf. Rev. Econ. Policy 2021, 37, 521–536. [Google Scholar] [CrossRef]

- Rasskazov, V. Financial and Economic Consequences of Distribution of Artificial Intelligence as a General-Purpose Technology. Financ. Theory Pract. 2020, 24, 120–132. [Google Scholar] [CrossRef]

- Königstorfer, F.; Thalmann, S. Applications of Artificial Intelligence in Commercial Banks—A Research Agenda for Behavioral Finance. J. Behav. Exp. Financ. 2020, 27, 100352. [Google Scholar] [CrossRef]

- Jiang, F.; Jiang, Y.; Zhi, H.; Dong, Y.; Li, H.; Ma, S.; Wang, Y.; Dong, Q.; Shen, H.; Wang, Y. Artificial Intelligence in Healthcare: Past, Present and Future. Stroke Vasc. Neurol. 2017, 2, 230–243. [Google Scholar] [CrossRef] [PubMed]

- Abduljabbar, R.; Dia, H.; Liyanage, S.; Bagloee, S.A. Applications of Artificial Intelligence in Transport: An Overview. Sustainability 2019, 11, 189. [Google Scholar] [CrossRef]

- Jha, K.; Doshi, A.; Patel, P.; Shah, M. A Comprehensive Review on Automation in Agriculture Using Artificial Intelligence. Artif. Intell. Agric. 2019, 2, 1–12. [Google Scholar] [CrossRef]

- Han, S. AI, Culture Industries and Entertainment. In The Routledge Social Science Handbook of AI; Routledge: London, UK, 2021; pp. 295–312. [Google Scholar]

- Bughin, J.; Hazan, E.; Ramaswamy, S.; Chui, M.; Allas, T.; Dahlström, P.; Henke, N.; Trench, M. Artificial Intelligence the Next Digital Frontier; McKinsey Global Institute: New York, NY, USA, 2017. [Google Scholar]

- Yang, Y.; Fang, Y.; Wang, N.; Su, X. Mitigating Information Asymmetry to Acquire Venture Capital Financing for Digital Startups in China: The Role of Weak and Strong Signals. Inf. Syst. J. 2023, 33, 1312–1342. [Google Scholar] [CrossRef]

- Zhelyazkov, P.I. Interactions and Interests: Collaboration Outcomes, Competitive Concerns, and the Limits to Triadic Closure. Adm. Sci. Q. 2018, 63, 210–247. [Google Scholar] [CrossRef]

- Sorenson, O.; Stuart, T.E. Syndication Networks and the Spatial Distribution of Venture Capital Investments. Am. J. Sociol. 2001, 106, 1546–1588. [Google Scholar] [CrossRef]

- Wang, D.; Pahnke, E.C.; Mcdonald, R.M. The Past Is Prologue? Venture-Capital Syndicates’ Collaborative Experience and Start-up Exits. Acad. Manag. J. 2022, 65, 371–402. [Google Scholar] [CrossRef]

- Bellavitis, C.; Rietveld, J.; Filatotchev, I. The Effects of Prior Co-Investments on the Performance of Venture Capitalist Syndicates: A Relational Agency Perspective. Strateg. Entrep. J. 2020, 14, 240–264. [Google Scholar] [CrossRef]

- Bruton, G.D.; Ahlstrom, D. An Institutional View of China’s Venture Capital Industry: Explaining the Differences between China and the West. J. Bus. Ventur. 2003, 18, 233–259. [Google Scholar] [CrossRef]

- Bruton, G.; Ahlstrom, D.; Yeh, K.S. Understanding Venture Capital in East Asia: The Impact of Institutions on the Industry Today and Tomorrow. J. World Bus. 2004, 39, 72–88. [Google Scholar] [CrossRef]

- Lerner, J. Venture Capitalists and the Decision to Go Public. J. Financ. Econ. 1994, 35, 293–316. [Google Scholar] [CrossRef]

- Piacentino, G. Venture Capital and Capital Allocation. J. Financ. 2019, 74, 1261–1314. [Google Scholar] [CrossRef]

- Lyu, Y.; Zhu, Y.; Han, S.; He, B.; Bao, L. Open Innovation and Innovation “Radicalness”—The Moderating Effect of Network Embeddedness. Technol. Soc. 2020, 62, 101292. [Google Scholar] [CrossRef]

- Hargadon, A.B. Brokering Knowledge: Linking Learning and Innovation. Res. Organ. Behav. 2002, 24, 41–85. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration Networks, Structural Holes, and Innovation: A Longitudinal Study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Cockburn, I.M.; Henderson, R.; Stern, S. The Impact of Artificial Intelligence on Innovation: An Exploratory Analysis. In The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2018; pp. 115–146. [Google Scholar]

- Giczy, A.V.; Pairolero, N.A.; Toole, A.A. Identifying Artificial Intelligence (AI) Invention: A Novel AI Patent Dataset. J. Technol. Transf. 2022, 47, 476–505. [Google Scholar] [CrossRef]

- Aggarwal, R.; Kryscynski, D.; Singh, H. Evaluating Venture Technical Competence in Venture Capitalist Investment Decisions. Manag. Sci. 2015, 61, 2685–2706. [Google Scholar] [CrossRef]

- Petkova, A.P.; Wadhwa, A.; Yao, X.; Jain, S. Reputation and Decision Making Under Ambiguity: A Study of U.s. Venture Capital Firms’ Investments in the Emerging Clean Energy Sector. Acad. Manag. J. 2014, 57, 422–448. [Google Scholar] [CrossRef]

- Le Mens, G.; Hannan, M.T.; Pólos, L. Age-Related Structural Inertia: A Distance-Based Approach. Organ. Sci. 2015, 26, 756–773. [Google Scholar] [CrossRef]

- Le Mens, G.; Hannan, M.T.; Pólos, L. Founding Conditions, Learning, and Organizational Life Chances: Age Dependence Revisited. Adm. Sci. Q. 2011, 56, 95–126. [Google Scholar] [CrossRef]

- Lee, P.M.; Pollock, T.G.; Jin, K. The Contingent Value of Venture Capitalist Reputation. Strateg. Organ. 2011, 9, 33–69. [Google Scholar] [CrossRef]

- Bacon-Gerasymenko, V. When Do Organisations Learn from Successful Experiences? The Case of Venture Capital Firms. Int. Small Bus. J. 2019, 37, 450–472. [Google Scholar] [CrossRef]

- Matusik, S.F.; Fitza, M.A. Diversification in the Venture Capital Industry: Leveraging Knowledge under Uncertainty. Strateg. Manag. J. 2012, 33, 407–426. [Google Scholar] [CrossRef]

- Elango, B.; Fried, V.H.; Hisrich, R.D.; Polonchek, A. How Venture Capital Firms Differ. J. Bus. Ventur. 1995, 10, 157–179. [Google Scholar] [CrossRef]

- Wang, S.; Wareewanich, T.; Chankoson, T. Factors Influencing Venture Capital Performance in Emerging Technology: The Case of China. Int. J. Innov. Stud. 2023, 7, 18–31. [Google Scholar] [CrossRef]

- Anokhin, S.; Wincent, J.; Oghazi, P. Strategic Effects of Corporate Venture Capital Investments. J. Bus. Ventur. Insights 2016, 5, 63–69. [Google Scholar] [CrossRef]

- Madhavan, R.; Koka, B.R.; Prescott, J.E. Networks in Transition: How Industry Events (Re) Shape Interfirm Relationships. Strateg. Manag. J. 1998, 19, 439–459. [Google Scholar] [CrossRef]

- Burt, R.S.; Kilduff, M.; Tasselli, S. Social Network Analysis: Foundations and Frontiers on Advantage. Annu. Rev. Psychol. 2013, 64, 527–547. [Google Scholar] [CrossRef] [PubMed]

- Zacharakis, A.L.; Meyer, G.D. The Potential of Actuarial Decision Models: Can They Improve the Venture Capital Investment Decision? J. Bus. Ventur. 2000, 15, 323–346. [Google Scholar] [CrossRef]

- Park, G.; Shin, S.R.; Choy, M. Early Mover (Dis)Advantages and Knowledge Spillover Effects on Blockchain Startups’ Funding and Innovation Performance. J. Bus. Res. 2020, 109, 64–75. [Google Scholar] [CrossRef]

- Gaddy, B.E.; Sivaram, V.; Jones, T.B.; Wayman, L. Venture Capital and Cleantech: The Wrong Model for Energy Innovation. Energy Policy 2017, 102, 385–395. [Google Scholar] [CrossRef]

| Query | Keywords in Query |

|---|---|

| General keywords (Query 1) | “AI” OR “A.I.” OR “Artificial intelligence” OR “artificial-intelligence” OR “machine learning” OR “machine-learning” |

| Keywords related to AI techniques (Query 2) | “deep learning” OR “deep-learning” OR “neural network” OR “natural language processing” OR “NLP” OR “predictive analytics” OR “reinforcement learning” OR “evolutionary comput*” OR “knowledge processing” OR “speech recognition” OR “voice recognition” OR “pattern recognition” OR “computer vision” OR “genetic program*” OR “genetic algorithm” |

| Final query | Query 1 OR Query 2 |

| AI Startup Country | # of Investments | AI Startup Industry | # of Investments | |

|---|---|---|---|---|

| Investments by Korean VCs | Domestic (Korea) | 185 (64.69%) | Prepackaged Software | 184 (64.34%) |

| U.S.A. | 66 (23.08%) | Semiconductors and related devices | 18 (6.64%) | |

| China | 9 (3.15%) | Catalog and mail-order houses | 15 (5.24%) | |

| Israel | 9 (3.15%) | Data processing services | 12 (4.20%) | |

| Singapore | 4 (1.40%) | Computer programming services | 6 (2.80%) | |

| Investments by Japanese VCs | Domestic (Japan) | 460 (67.25%) | Prepackaged Software | 329 (48.10%) |

| U.S.A. | 124 (18.13%) | Computer programming services | 90 (13.16%) | |

| Singapore | 25 (3.65%) | Computer integrated systems design | 73 (10.67%) | |

| India | 19 (2.78%) | Information retrieval services | 42 (6.14%) | |

| Israel | 14 (2.05%) | Data processing services | 2 (3.22%) |

| VC Name | # of Investments in: | ||

|---|---|---|---|

| AI Startups | Non-AI Startups | ||

| Korean VCs | Samsung Venture Investment Corp | 23 | 260 |

| Mirae Asset Venture Investment Co., Ltd. | 16 | 175 | |

| Kakao Ventures Corp | 14 | 38 | |

| Intervest Co., Ltd. | 11 | 98 | |

| KB Investment Co., Ltd. | 10 | 443 | |

| Japanese VCs | Global Brain Corp | 45 | 258 |

| Sony Innovation Fund | 23 | 81 | |

| Mizuho Capital Co., Ltd. | 22 | 195 | |

| SMBC Venture Capital Co., Ltd. | 22 | 180 | |

| Sbi Investment Co., Ltd. | 22 | 227 | |

| Variable Name | Mean | S.D. | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|---|---|

| 1 | # of investments in AI startups | 0.236 | 0.778 | 1 | |||

| 2 | Network reachability | 0.282 | 0.136 | 0.158 | 1 | ||

| 3 | Betweenness centrality | 0.014 | 0.042 | 0.289 | 0.323 | 1 | |

| 4 | VC age | 19.943 | 22.443 | −0.021 | 0.108 | 0.048 | 1 |

| 5 | VC track record | 1.808 | 1.064 | 0.291 | 0.423 | 0.532 | 0 |

| 6 | VC portfolio diversity | 0.327 | 0.283 | 0.158 | 0.257 | 0.237 | 0.019 |

| 7 | % of 1st round investments | 0.574 | 0.352 | −0.025 | −0.355 | −0.125 | −0.185 |

| 8 | # of exited startups | 0.328 | 0.601 | 0.028 | 0.265 | 0.395 | 0.106 |

| 9 | Country’s annual # of investments in AI | 2.346 | 1.972 | 0.292 | 0.065 | −0.058 | −0.1 |

| 10 | Is a Korean VC | 0.38 | 0.485 | −0.029 | −0.208 | 0.014 | −0.156 |

| 11 | Is a corporate VC | 0.308 | 0.462 | −0.029 | 0.087 | 0.051 | 0.217 |

| 5 | 6 | 7 | 8 | 9 | 10 | ||

| 6 | VC portfolio diversity | 0.652 | 1 | ||||

| 7 | % of 1st round investments | −0.084 | 0.021 | 1 | |||

| 8 | # of exited startups | 0.539 | 0.3 | −0.152 | 1 | ||

| 9 | Annual # of investments in AI startups | 0.044 | 0.103 | 0.073 | −0.262 | 1 | |

| 10 | Is a Korean VC | 0.02 | 0.045 | 0.09 | 0.084 | −0.127 | 1 |

| 11 | Is a corporate VC | −0.004 | −0.069 | −0.145 | 0.038 | −0.1 | −0.013 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Network reachability | 3.601 *** | 3.309 *** | 2.907 ** | ||

| (0.967) | (0.930) | (1.026) | |||

| Betweenness centrality | 3.143 *** | 2.475 ** | 3.935 *** | ||

| (0.952) | (0.936) | (1.086) | |||

| Network reachability X Korean VC | 1.145 | ||||

| (1.639) | |||||

| Betweenness centrality X Korean VC | −3.112 * | ||||

| (1.393) | |||||

| VC age | −0.006 + | −0.005 + | −0.006 * | −0.005 + | −0.006 + |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| VC track record | 0.917 *** | 0.768 *** | 0.800 *** | 0.685 *** | 0.681 *** |

| (0.060) | (0.071) | (0.071) | (0.077) | (0.077) | |

| VC portfolio diversity | −0.072 | −0.089 | 0.077 | 0.024 | 0.034 |

| (0.255) | (0.250) | (0.262) | (0.256) | (0.259) | |

| % of 1st round investments | −0.229 | 0.040 | −0.196 | 0.044 | 0.055 |

| (0.191) | (0.209) | (0.187) | (0.205) | (0.205) | |

| # of exited startups | −0.156 | −0.164 + | −0.191 * | −0.191 * | −0.188 * |

| (0.099) | (0.096) | (0.095) | (0.093) | (0.095) | |

| Annual # of investments in AI startups | 0.368 *** | 0.350 *** | 0.370 *** | 0.353 *** | 0.353 *** |

| (0.058) | (0.059) | (0.058) | (0.059) | (0.058) | |

| Is a Korean VC | 0.365 ** | 0.363 *** | 0.307 ** | 0.316 ** | 0.038 |

| (0.115) | (0.109) | (0.116) | (0.112) | (0.530) | |

| Is a corporate VC | −0.094 | −0.128 | −0.107 | −0.135 | −0.117 |

| (0.111) | (0.110) | (0.109) | (0.109) | (0.107) | |

| 1991–2000 | −1.658 + | −1.139 | −1.568 + | −1.119 | −1.090 |

| (0.881) | (0.882) | (0.860) | (0.858) | (0.854) | |

| 2001–2010 | −2.271 *** | −1.635 * | −2.114 *** | −1.591 ** | −1.608 ** |

| (0.658) | (0.638) | (0.641) | (0.617) | (0.607) | |

| 2011–2015 | −0.812 | −0.153 | −0.672 | −0.115 | −0.137 |

| (0.632) | (0.623) | (0.614) | (0.603) | (0.588) | |

| 2016- | 0.360 | 0.960 | 0.445 | 0.964 | 0.941 |

| (0.625) | (0.614) | (0.609) | (0.597) | (0.585) | |

| Constant | −4.450 *** | −5.956 *** | −4.399 *** | −5.770 *** | −5.650 *** |

| (0.594) | (0.693) | (0.579) | (0.673) | (0.683) | |

| ln(alpha) | −0.333 | −0.400 + | −0.361 + | −0.414 * | −0.439 * |

| (0.210) | (0.214) | (0.204) | (0.207) | (0.216) | |

| Observation | 4508 | 4508 | 4508 | 4508 | 4508 |

| Log-likelihood | −1741.793 | −1727.502 | −1736.365 | −1724.142 | −1722.234 |

| Chi-square | 834.304 | 856.350 | 998.880 | 980.612 | −2334.453 |

| Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|

| Network reachability | 3.469 *** | 2.991 *** | ||

| (0.962) | (0.905) | |||

| Betweenness centrality | 3.874 *** | 3.107 ** | ||

| (0.989) | (0.967) | |||

| Control variables included | ||||

| Constant | −3.910 *** | −5.443 *** | −3.688 *** | −5.030 *** |

| (0.612) | (0.719) | (0.595) | (0.689) | |

| ln(alpha) | −0.631 * | −0.701 ** | −0.713 ** | −0.749 ** |

| (0.265) | (0.264) | (0.227) | (0.233) | |

| Inflation factors | ||||

| VC track record | −1.151 *** | −0.973 *** | −1.386 *** | −1.196 *** |

| (0.307) | (0.226) | (0.275) | (0.229) | |

| Constant | 0.679 | 0.307 | 1.253 * | 0.857 |

| (0.577) | (0.661) | (0.488) | (0.546) | |

| Observation | 4508 | 4508 | 4508 | 4508 |

| Log-likelihood | −1737.505 | −1724.811 | −1728.569 | −1719.256 |

| Chi-square | 523.224 | 564.677 | 557.532 | 576.293 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hyun, E.-j.; Kim, B.T.-S. Overcoming Uncertainty in Novel Technologies: The Role of Venture Capital Syndication Networks in Artificial Intelligence (AI) Startup Investments in Korea and Japan. Systems 2024, 12, 72. https://doi.org/10.3390/systems12030072

Hyun E-j, Kim BT-S. Overcoming Uncertainty in Novel Technologies: The Role of Venture Capital Syndication Networks in Artificial Intelligence (AI) Startup Investments in Korea and Japan. Systems. 2024; 12(3):72. https://doi.org/10.3390/systems12030072

Chicago/Turabian StyleHyun, Eun-jung, and Brian Tae-Seok Kim. 2024. "Overcoming Uncertainty in Novel Technologies: The Role of Venture Capital Syndication Networks in Artificial Intelligence (AI) Startup Investments in Korea and Japan" Systems 12, no. 3: 72. https://doi.org/10.3390/systems12030072

APA StyleHyun, E.-j., & Kim, B. T.-S. (2024). Overcoming Uncertainty in Novel Technologies: The Role of Venture Capital Syndication Networks in Artificial Intelligence (AI) Startup Investments in Korea and Japan. Systems, 12(3), 72. https://doi.org/10.3390/systems12030072