The Tech-Enabled Shopper Impacting a Phygital Retail Complex System Stimulated by Adaptive Retailers’ Valorization of an Increasingly Complex E-Commerce

Abstract

:1. Introduction

2. An Extended Literature Review

2.1. Innovatively Using Data, While Going About Reaching Optichanneling, and Leveraging Disruptive Technologies Based on Applying Analysis Techniques

2.2. The Complex Nature of the Shopper Brain and Phygital Market Behavior: Challenges for Business Management in Addressing Complex Problems

3. Theoretical Framework

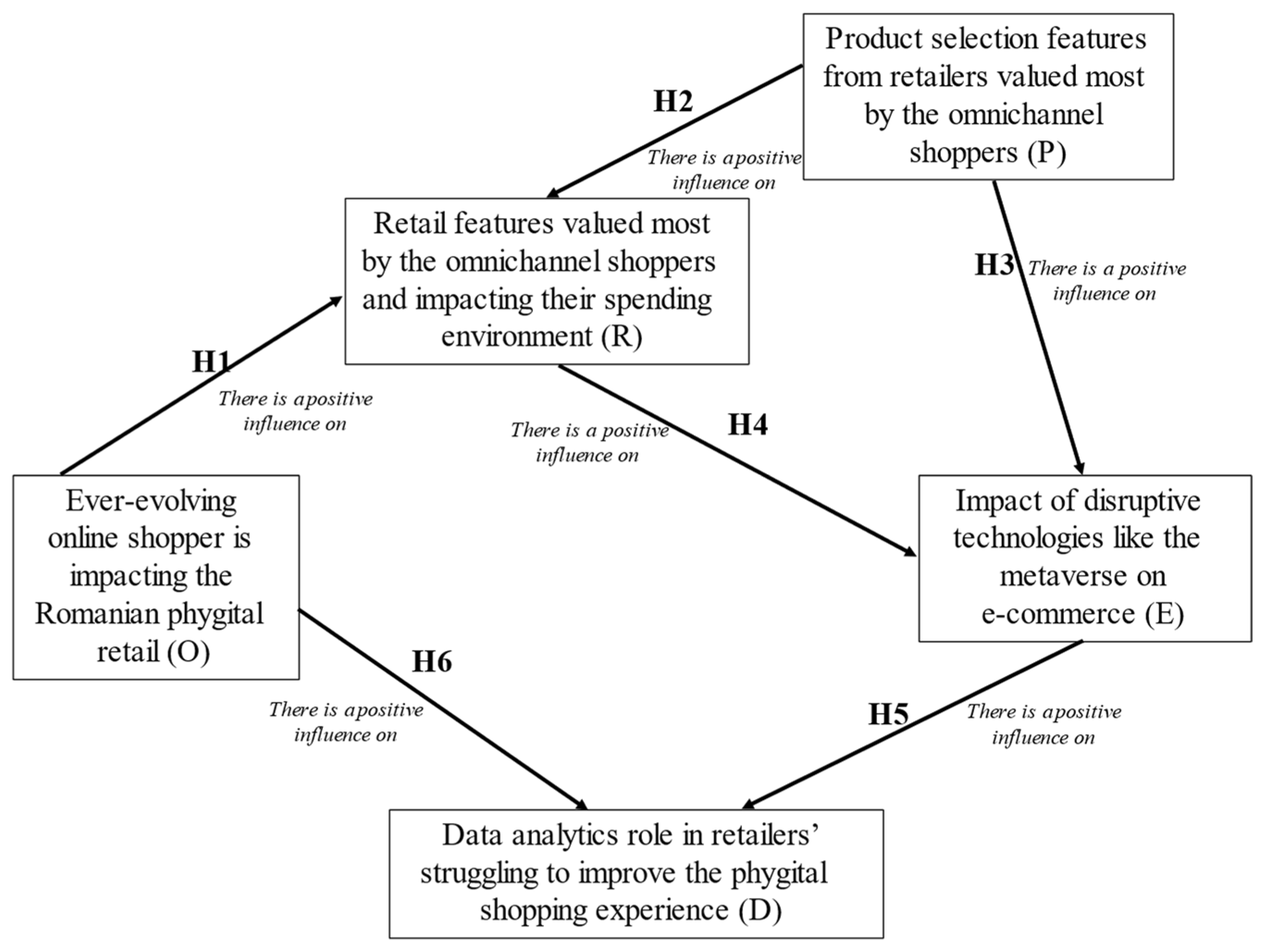

- O (Online Shopper Impact): Represents the evolving behavior and expectations of online shoppers and their influence on the phygital retail environment.

- P (Phygital Retail Dynamics): Captures the impact of disruptive technologies, such as the metaverse and AI, on e-commerce and the integration of physical and digital retail spaces.

- R (Retail Features and Shopper Valuation): Focuses on the retail features that omnichannel shoppers value and their influence on the retail spending environment.

- E (Disruptive Technology Impact): Integrates the role of advanced technologies, including extended reality (ER) and predictive analytics, in transforming retail practices.

- D (Data Analytics in Retail Strategy): Underlines the role of data analytics in enhancing the phygital shopping experience and building deeper customer insights.

4. Hypothesis Development

5. Research Methods

6. Results and Discussions

The Latent Variables

7. Key Findings and Recommendations

8. Conclusions and Implications

8.1. Theoretical Implications

- Facilitating product discovery and delivering meaningful interactions with the help of technologies like the metaverse, which digitizes real-life retail experiences.

- Addressing the challenge of increasing shopper engagement and retention by accelerating digital and technology-driven initiatives to deliver immersive experiences that meet or exceed expectations.

8.2. Managerial Implications

8.3. Limitations and Further Research

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Ever-evolving online shopper is impacting the Romanian phygital retail (O) | O1 | Do you think that your online shopping priorities (channel preferences, payment methods, personal connection etc.) have evolved during the last 3 years? |

| O2 | Comparing to 2019, do you spend more time online per day thinking about shopping on channels, platforms? | |

| O3 | Do you think that playable shopping (using game-like techniques to motivate you towards a behavior the business targets and offer you rewards like a discount code for downloading its app or completing a challenge for your voluntary participation in an exclusive sale) is creating additional value for your ongoing customer engagement? | |

| O4 | Do you like to receive mobile promotions in real-time (regarding local products, inventory search etc.) when you are near a supermarket chain? | |

| O5 | Are you willing to make routine grocery purchases when you are offered auto-replenishment by retailers’ ecommerce platforms (turning to retailers’ subscription services) being motivated by savings, meal-types, ingredients, or seasonal items? | |

| O6 | As a consumer, could you say that your value perceptions (e-commerce store image, product quality, price, service quality, innovation) derived from online shopping may facilitate your purchase intention beyond the online channel context? | |

| O7 | As a consumer impacted by inflation, are you more likely to increase the use of digital price comparison and coupon tracking tools? | |

| O8 | Do you agree with the opinion that live shopping is now in vogue as livestream shopping (its digital version) is considered the main accepted trend in e-commerce? | |

| Retail features valued most by the omnichannel shoppers and impacting their spending environment (R) | R1 | As a shopper, do you like to combine offline channels (shopping in brick-and-mortar stores) and online channels (shopping from a desktop or mobile device, by smartphone or tablet) throughout your buyer journey, connecting your in-store experience with your digital shopping one? |

| R2 | Are you interested in improving your omnichannel experience (as a result of your increasing interaction with e-commerce stores, social selling, mobile applications, digital marketplaces), so as to be provided with a seamless shopping experience? | |

| R3 | Do you feel understood, heard, and observed by retailers as shopper? | |

| R4 | Do brands reflect the values (like consistent customer experience—CX, a relatable marketing message, an authentic image) which are important to you? | |

| R5 | Do you agree that now it’s the right time for an improved brand-retailer collaboration regarding product, shopper, and data analytics? | |

| R6 | Do you know an example of big technology company involved in omnichannel enablement leveraging technological advances to solve retail stores’ functions and operational issues, as well as improving CX by enabling more connected retail stores’ experience? | |

| Product selection features from retailers valued most by the omnichannel shoppers (P) | P1 | Taking into account the overall increase in prices (utilities, fuels, foodstuffs), do you have a more pronounced orientation towards discount stores? |

| P2 | If do you feel a decrease in your purchasing power, can you say that there is an increase of your interest in private label brands (sold under a retailer’s brand name, the product being acquired for sale through a particular provider)? | |

| P3 | As a shopper, do you think that a product detail page can make succeed an e-commerce brand/retailer? | |

| P4 | As a shopper, do you think that product selection is an important category of retail features? | |

| P5 | As a shopper, do you feel a certain degree of emotional attachment towards the products experienced prior to purchase? | |

| P6 | As a shopper, do you think that online reviews are a social proof when seeking out advice to purchase a product? | |

| P7 | Do you agree that the most important need for private labels is customer loyalty? | |

| P8 | Do you agree that the private labels’ market power will grow given the difficult nature of the present situation? | |

| P9 | Do you agree that retailers should proactively provide educational content about products sold in their stores? | |

| P10 | Do you agree that a smart return policy of online products you ordered (reverse logistics; an important metric is e-commerce return rate) is impacting your satisfaction as shopper, developing your positive perception of a brand/retailer regarding your overall shopper experience? | |

| Impact of disruptive technologies like the metaverse on e-commerce (E) | E1 | Do you think that COVID-19 pandemic activated shifts in your online shopping behavior likely to have lasting effects? |

| E2 | As a consumer, could you say that you perceive an impact of the disruptive technologies (such as: Artificial Intelligence—AI, Metaverse, Virtual and Augmented Reality—VR and AR, Internet of Things, Blockchain, Advanced Robotics, Quantum Computing, Batteries, Synthetic Biology) on ecommerce? | |

| E3 | Assuming that you are aware, as a shopper, of the importance of the metaverse retail experiences (livestreaming, chat commerce or targeted recommendations and other personalization technologies etc.) do you think that shopping will become more immersive | |

| E4 | Do you think that your shopping experience will be improved by the metaverse technologies (such as AR, NFTs, 3D content etc.)? | |

| E5 | Do you think that your more immersive shopping will be enabled by the try-on technology using your smartphone or tablet (via your devices’ camera)? | |

| E6 | Do you think, for instance, that the improvement of social buying capabilities (like recommendation engines, in-app buying, livestreaming, shoppable content etc.) motivate you more to shop and buy? | |

| Data analytics role in retailers’ struggling to improve the phygital shopping experience (D) | D1 | As a shopper, are you aware of the fact that your convenience is maximized by an appropriate omnichannel arrangement synchronizing your data and the product data across channels? |

| D2 | Are you aware of the fact that people, process, technology, and data are essential for retailers’ ability to improve their operational performance, including your shopper experience? | |

| D3 | Do you know that within their battle to transform efficiency and competitive advantage retailers are under pressure of valorizing investments in analytics and AI, increasing accordingly the contribution of their IT function to organizational performance, including increased product diversity and improved quality and customer satisfaction? | |

| D4 | Do you know that to improve the in-person experience more data on stores are needed by retailers under the pressure of e-commerce for which is simpler to track shopper behavior compared to physical retail? | |

| D5 | As a consumer paying attention to authentic content, do you engage with user-generated content (content created by other people, like written reviews, videos, customer imagery etc.) on your path to purchase (buyer’s journey) especially in the final stages of it? | |

| D6 | Do you think that there is a linkage between your shopper engagement with the user-generated content and social commerce (while using your preferred social media app within Meta/Facebook, Instagram, TikTok etc.) as a subset of e-commerce? | |

| D7 | Do you agree that to resolve your pain points within your buyer journey and provide relevant experiences to you retailers need your data to better fit your needs (how you prefer to interact with them, what products and services you are looking for etc.)? |

| MEAN | SD | R | MEAN | SD | |||

| R1 | 3.929032 | 1.38083 | |||||

| O | O1 | 4.506452 | 0.864602 | R2 | 4.105376 | 1.238803 | |

| O2 | 4.441935 | 0.886063 | R3 | 3.707527 | 1.433844 | ||

| O3 | 3.578495 | 1.54473 | R4 | 3.747312 | 1.420903 | ||

| O4 | 3.096774 | 1.686166 | R5 | 3.763441 | 1.463572 | ||

| O5 | 3.919355 | 1.479298 | R6 | 3.739785 | 1.444722 | ||

| O6 | 3.344086 | 1.59719 | MEAN | SD | |||

| O7 | 4.348387 | 0.977201 | E | E1 | 4.153763 | 1.152996 | |

| O8 | 3.139785 | 1.113489 | E2 | 3.732258 | 1.346499 | ||

| MEAN | SD | E3 | 3.878495 | 1.266981 | |||

| E4 | 4.105376 | 1.176407 | |||||

| P | P1 | 4.543011 | 0.921446 | E5 | 4.017204 | 1.250931 | |

| P2 | 4.435484 | 0.920189 | E6 | 3.519355 | 1.430918 | ||

| P3 | 4.106452 | 1.093311 | MEAN | SD | |||

| P4 | 4.031183 | 1.122284 | D | D1 | 2.616129 | 1.108708 | |

| P5 | 4.253763 | 1.002747 | D2 | 4.362366 | 0.99886 | ||

| P6 | 4.310753 | 0.919349 | D3 | 3.262366 | 1.124147 | ||

| P7 | 4.405376 | 0.928077 | D4 | 3.872043 | 1.268044 | ||

| P8 | 4.421505 | 0.923774 | D5 | 4.455914 | 0.928378 | ||

| P9 | 4.047312 | 1.114499 | D6 | 3.944086 | 1.177056 | ||

| P10 | 4.101075 | 1.09628 | D7 | 2.968817 | 1.22764 | ||

| Scale | α Cronbach | Number of Items | |

|---|---|---|---|

| O. Ever-evolving online shopper is impacting the Romanian phygital retail (O) | 1–5 | 0.774 | 8 |

| R. Retail features valued most by the omnichannel shoppers and impacting their spending environment (R) | 1–5 | 0.815 | 6 |

| P. Product selection features from retailers valued most by the omnichannel shoppers (P) | 1–5 | 0.921 | 10 |

| E. Impact of disruptive technologies like the metaverse on e-commerce (E) | 1–5 | 0.792 | 6 |

| D. Data analytics role in retailers’ struggling to improve the phygital shopping experience (D) | 1–5 | 0.694 | 7 |

| Hypothesis | Relation | β | p-Value | Decision |

|---|---|---|---|---|

| H1 | R←O | 0.175 | 0.021 | Valid model |

| H2 | R←P | 0.144 | 0.000 | Valid model |

| H3 | E←P | 0.286 | 0.014 | Valid model |

| H4 | E←R | 0.390 | 0.000 | Valid model |

| H5 | D←E | 0.220 | 0.041 | Valid model |

| H6 | D←O | 0.407 | 0.145 | Risk of 15% |

| Construct | CR (Composite Reliability) | AVE | √AVE | MSV | Max r | Number of Items |

|---|---|---|---|---|---|---|

| O | 0.908 | 0.553 | 0.744 | 0.50 | 0.50 | 8 |

| R | 0.914 | 0.640 | 0.800 | 0.52 | 0.52 | 6 |

| P | 0.953 | 0.671 | 0.819 | 0.60 | 0.60 | 10 |

| E | 0.906 | 0.618 | 0.786 | 0.52 | 0.52 | 6 |

| D | 0.861 | 0.497 | 0.686 | 0.40 | 0.40 | 7 |

References

- Morin, E. La méthode de La Méthode. Le Manuscrit Perdu. Actes Sud. 2024. 24 avril, Avant-Propos. p. 12. Available online: https://cdurable.info/wp-content/uploads/2024/07/La-methode-de-la-methode.pdf (accessed on 27 November 2024).

- Estrada, E. What is a Complex System, After All? Found. Sci. 2024, 29, 1143–1170. [Google Scholar] [CrossRef]

- Hendrycks, D. Introduction to AI Safety, Ethics and Society; Taylor & Francis: New York, NY, USA, 2024; pp. 241–265. Available online: https://www.aisafetybook.com/textbook/introduction-to-complex-systems (accessed on 27 November 2024).

- Pennacchioli, D.; Coscia, M.; Rinzivillo, S.; Giannotti, F.; Pedreschi, D. The retail market as a complex system. EPJ Data Sci. 2014, 3, 33. [Google Scholar] [CrossRef]

- Madanchian, M. The Role of Complex Systems in Predictive Analytics for E-Commerce Innovations in Business Management. Systems 2024, 12, 415. [Google Scholar] [CrossRef]

- Burke, D.; O’Brien, C.; Aylor, B.; Brunelli, J.; Kouvela, A.; Datta, B.; Pathak, A.; Barnett, M. Building the Supply Chain of the Future; Boston Consulting Group: Boston, MA, USA, 2023; Available online: https://www.bcg.com/publications/2023/building-the-supply-chain-of-the-future (accessed on 4 November 2023).

- Avasant Research. E-Commerce Complexity Causes Customer Experience Challenges. 2022. Available online: https://avasant.com/report/e-commerce-complexity-causes-customer-experience-challenges/ (accessed on 27 November 2023).

- Ravikant, N. David Deutsch: Knowledge Creation and The Human Race. Naval, Interview, David Deutsch, Physicist and Author of The Beginning of Infinity, Part 1, 11 February 2023. Available online: https://nav.al/david-deutsch (accessed on 28 November 2024).

- Kirk, V. Neuromarketing—Predicting Consumer Behavior to Drive Purchasing Decisions. Harvard Division of Continuing Education, Marketing, 31 May 2024. Available online: https://professional.dce.harvard.edu/blog/marketing/neuromarketing-predicting-consumer-behavior-to-drive-purchasing-decisions/ (accessed on 28 November 2024).

- Wei, Z. A Survey on Investigating the Customer Experience of Samsung Mobile Phones in China. J. Appl. Econ. Policy Stud. 2024, 13, 1–19. [Google Scholar] [CrossRef]

- Artusi, F.; Magistretti, S.; Bellini, E.; Dell’Era, C. Technology-Aided Customer Experience Innovation: Implementation Modes in Retail. Creat. Innov. Manag. 2024, 1–13. [Google Scholar] [CrossRef]

- Warikoo, S. 5 Retail Trends Shaping the Experience Economy. Total Retail 29 July 2024. Available online: https://www.mytotalretail.com/article/5-retail-trends-shaping-the-experience-economy/ (accessed on 28 November 2024).

- Rahman, S.M.; Chowdhury, N.H.; Bowden, J.L.-H.; Carlson, J. Metaverse platform attributes and customer experience measurement. J. Retail. Consum. Serv. 2024, 83, 104159. [Google Scholar] [CrossRef]

- Kinzinger, A.; Steiner, W.J.; Tatzgern, M.; Vallaster, C. Interactive product presentation in an immersive environment: The influence of functional control on hedonic aspects. J. Retail. Consum. Serv. 2025, 83, 104156. [Google Scholar] [CrossRef]

- SSON Research; Analytics. Creating 360 Degree CX Awareness with Purpose-Built AI. Shared Services & Outsourcing Network (SSON) 2024, Market Report sponsored by NICE, 2024, November. pp. 1–17. Available online: https://www.ssonetwork.com/customer-experience/reports/creating-360-degree-cx-awareness-with-purpose-built-ai? (accessed on 29 November 2024).

- Bryant, L. The Future of Tech: Embracing Modular Commerce and AI-Driven Personalization. 2024. Available online: https://composable.com/insights/the-future-of-tech-embracing-modular-commerce-and-ai-driven-personalization? (accessed on 21 November 2024).

- Grewal, D.; Gauri, D.K.; Das, G.; Agarwal, J.; Spence, M.T. Retailing and emergent technologies. J. Bus. Res. 2021, 134, 198–202. [Google Scholar] [CrossRef]

- Dowling, G. The Art and Science of Marketing; Oxford University Press: Oxford, UK, 2004; p. 2. [Google Scholar]

- Purcarea, T. Expo Milano 2015, TUTTOFOOD 2015, and SHOP 2015. Rom. Distrib. Comm. Mag. 2015, 6, 18–35. [Google Scholar]

- Hagedorn, R. CGF’s End-to-End Value Chain Director Ruediger Hagedorn Co-Hosts Academic & Business Partnership SCM for ECR Conference. Consumer Goods Forum 5 November 2020. Available online: https://www.theconsumergoodsforum.com/news_updates/cgfs-end-to-end-value-chain-director-ruediger-hagedorn-co-hosts-academic-business-partnership-scm-for-ecr-conference/ (accessed on 5 November 2020).

- Maskor, M.; Steffens, N.K.; Peters, K.; Haslam, A. Discovering the secrets of leadership success: Comparing commercial and academic preoccupations. Aust. J. Manag. 2022, 47, 79–104. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Jeyaraj, A.; Hughes, L.; Davies, G.H.; Ahuja, M.; Albashrawi, M.A.; Al-Busaidi, A.S.; Al-Sharhan, S.; Al-Sulaiti, K.I.; Altinay, L.; et al. Real impact: Challenges and opportunities in bridging the gap between research and practice—Making a difference in industry, policy, and society. Int. J. Inf. Manag. 2024, 78, 102750. [Google Scholar] [CrossRef]

- Mamakos, M.; Bodenhausen, G.V. Motivational drivers of costly information search. Cognition 2024, 244, 105715. [Google Scholar] [CrossRef] [PubMed]

- Stone, E. How Much Evidence Do You Need to Make a Decision? Depends on Your Mindset. Kellogg Insight 2024, Northwestern University, Apr 22. Available online: https://insight.kellogg.northwestern.edu/article/how-much-evidence-do-you-need-to-make-a-decision? (accessed on 28 April 2024).

- Anderson, L.; Ostrom, A.L. Transformative Service Research: Advancing Our Knowledge About Service and Well-Being. J. Serv. Res. 2015, 18, 243–249. [Google Scholar] [CrossRef]

- Schlag, M.; Rocchi, M.; Turnbull, R. Adam Smith’s Virtue of Prudence in E-Commerce: A Conceptual Framework for Users in the E-Commercial Society. Bus. Soc. 2023, 63, 1462–1502. [Google Scholar] [CrossRef]

- Cheng, Y.; Xie, B.; An, K. Analysis of Omni-Channel Evolution Game Strategy for E-Commerce Enterprises in the Context of Online and Offline Integration. Systems 2023, 11, 321. [Google Scholar] [CrossRef]

- Christensen, C. Disruptive Innovation. Concepts. 2023. Available online: https://claytonchristensen.com/key-concepts/ (accessed on 4 May 2023).

- Faccia, A.; Le Roux, C.L.; Pandey, V. Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study. Sustainability 2023, 15, 3419. [Google Scholar] [CrossRef]

- Bernstein, A. Disruptive Innovation in the Era of Big Tech. HBR on Strategy 2024, Episode 54, April 17. Available online: https://hbr.org/podcast/2024/04/disruptive-innovation-in-the-era-of-big-tech? (accessed on 3 May 2024).

- Shi, L.; Ren, Z.; Feng, Q.; Qiu, J. Individualized prediction of online shopping addiction from whole-brain functional connectivity. Neuropsychologia 2024, 202, 108967. [Google Scholar] [CrossRef]

- Frith, C.D.; Frith, U. The mystery of the brain–culture interface. Trends Cogn. Sci. 2022, 26, 1023–1025. [Google Scholar] [CrossRef]

- Sporns, O. The complex brain: Connectivity, dynamics, information. Trends Cogn. Sci. 2022, 26, 1066–1067. [Google Scholar] [CrossRef]

- CGF’s Product Data Coalition of Action. 1OO·HORIZON CGF’s Annual Data and Supply Chain Conference Explores the Intersection of Data, Sustainability and Supply Chain Transformation. Consumer Goods Forum 2024, 5th October. Available online: https://www.theconsumergoodsforum.com/news_updates/ioo%C2%B7horizon-cgfs-annual-data-and-supply-chain-conference-explores-the-intersection-of-data-sustainability-and-supply-chain-transformation/ (accessed on 17 November 2024).

- Gartner. Customer Analytics. Gartner for Information Technology Executives 2022, Glossary. Available online: https://www.gartner.com/en/information-technology/glossary/customer-analytics (accessed on 21 August 2022).

- Sallam, R.; Friedman, T. Top Trends in Data and Analytics. Gartner. 2022. Available online: https://www.gartner.com/doc/reprints? (accessed on 21 April 2022).

- Gartner. Gartner Data & Analytics Summit 2022 Orlando: Day 1 Highlights. Conference Updates. 2022. Available online: https://www.gartner.com/en/newsroom/press-releases/2022-08-22-gartner-data-analytics-summit-2022-orlando-day-1-highlights (accessed on 25 September 2022).

- Gartner. Gartner Data & Analytics Summit 2022 Orlando: Day 2 Highlights. Conference Updates. 2022. Available online: https://www.gartner.com/en/newsroom/press-releases/2022-08-23-gartner-data-analytics-summit-2022-orlando-day-2-highlights (accessed on 25 September 2022).

- Pointillist. The Definitive Guide to Customer Journey Analytics for Financial Services, eBook. 2020. Available online: http://myjourney.pointillist.com/rs/837-MZM-862/images/Pointillist-Definitive-Guide-Customer-Journey-Analytics-FinServ-eBook.pdf (accessed on 21 August 2022).

- Treasure Data. Treasure Data Customer Experience 2022 Survey. Study conducted by Forbes Insights in partnership with Treasure Data 2022, pp. 2, 11, 21. Available online: https://get.treasuredata.com/rs/714-XIJ-402/images/forbes-insights-td-customer-experience-2022-survey.pdf? (accessed on 5 September 2022).

- Cornell, J. 10 Best Customer Satisfaction Metrics in 2022. ProProfs Survey Maker. 2022. Available online: https://www.proprofssurvey.com/blog/customer-satisfaction-metrics/ (accessed on 21 August 2022).

- Ellmer, K.; Weinstein, S.; Bozic Mazzi, A.; Catchlove, P.; DeJong, E. Elevate Performance with a Chief Transformation Officer; Boston Consulting Group: Boston, MA, USA, 2024; Available online: https://www.bcg.com/publications/2024/elevate-performance-with-cto? (accessed on 5 May 2024).

- Berg, H.; Nilsson, E.; Liljedal, K.T. Consumer-facing technology in retailing: How technology shapes customer experience in physical and digital stores. Int. Rev. Retail. Distrib. Consum. Res. 2024, 34, 123–127. [Google Scholar] [CrossRef]

- Frank, D.-A.; Peschel, A.O.; Otterbring, T.; DiPalma, J.; Steinmann, S. Does metaverse fidelity matter? Testing the impact of fidelity on consumer responses in virtual retail stores. Int. Rev. Retail. Distrib. Consum. Res. 2024, 34, 251–284. [Google Scholar] [CrossRef]

- Kotler, P.; Stigliano, G.; Mondalek, A. Author Talks: Philip Kotler and Giuseppe Stigliano on Retail’s Next Chapter; McKinsey & Company: New York, NY, USA, 2024; Available online: https://www.mckinsey.com/featured-insights/mckinsey-on-books/author-talks-philip-kotler-and-giuseppe-stigliano-on-retails-next-chapter? (accessed on 23 March 2024).

- Chen, Y.-M.; Hsu, T.-H.; Lu, Y.-J. Impact of flow on mobile shopping intention. J. Retail. Consum. Serv. 2018, 41, 281–287. [Google Scholar] [CrossRef]

- Shaw, N.; Eschenbrenner, B.; Brand, B.M. Towards a Mobile App Diffusion of Innovations model: A multinational study of mobile wallet adoption. J. Retail. Consum. Serv. 2021, 64, 102768. [Google Scholar] [CrossRef]

- Jiang, Y.; Sun, Y.; Tu, S. Economic implications of emotional marketing based on consumer loyalty of mobile phone brands: The sequential mediating roles of brand identity and brand trust. Technol. Econ. Dev. Econ. 2023, 29, 1318–1335. [Google Scholar] [CrossRef]

- Cavalinhos, S.; de Fátima Salgueiro, M.; Henriques Marques, S. Mobile devices usage in retail settings: Gender and generation preferences. Int. J. Retail Distrib. Manag. 2023, 51, 64–80. [Google Scholar] [CrossRef]

- Purcărea, T.; Ioan-Franc, V.; Ionescu, S.A.; Purcărea, I.M. The Profound Nature of Linkage Between the Impact of the Use of Artificial Intelligence in Retail on Buying and Consumer Behavior and Consumers’ Perceptions of Artificial Intelligence on the Path to the Next Normal. Amfiteatru Econ. 2021, 23, 9–32. [Google Scholar] [CrossRef]

- Brandtner, P.; Darbanian, F.; Falatouri, T.; Udokwu, C. Impact of COVID-19 on the Customer End of Retail Supply Chains: A Big Data Analysis of Consumer Satisfaction. Sustainability 2021, 13, 1464. [Google Scholar] [CrossRef]

- Gao, W.; Fan, H. Omni-Channel Customer Experience (In)Consistency and Service Success: A Study Based on Polynomial Regression Analysis. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1997–2013. [Google Scholar] [CrossRef]

- Yin, C.-C.; Chiu, H.-C.; Hsieh, Y.-C.; Kuo, C.-Y. How to retain customers in omnichannel retailing: Considering the roles of brand experience and purchase behavior. J. Retail. Consum. Serv. 2022, 69, 103070. [Google Scholar] [CrossRef]

- Riaz, H.; Baig, U.; Meidute-Kavaliauskiene, I.; Ahmed, H. Factors Effecting Omnichannel Customer Experience: Evidence from Fashion Retail. Information 2022, 13, 12. [Google Scholar] [CrossRef]

- Batat, W. How Phygital Is Humanizing the Customer Experience. Inc. Magazine. 2021. Available online: https://www.inc.com/wided-batat/how-phygital-is-humanizing-customer-experience.html (accessed on 22 March 2024).

- Cui, X.; Xie, Q.; Zhu, J.; Shareef, M.A.; Goraya, M.A.S.; Akram, M.S. Understanding the omnichannel customer journey: The effect of online and offline channel interactivity on consumer value co-creation behavior. J. Retail. Consum. Serv. 2022, 65, 102869. [Google Scholar] [CrossRef]

- Borden, K.; Huntington, M.; Kamat, M.; Roper, W. The AI Revolution Will Be ‘Virtualized’; McKinsey & Company: New York, NY, USA, 2024; Available online: https://www.mckinsey.com/capabilities/operations/our-insights/the-ai-revolution-will-be-virtualized? (accessed on 15 April 2024).

- Dwivedi, Y.K.; Hughes, L.; Baabdullah, A.M.; Ribeiro-Navarrete, S.; Giannakis, M.; Al-Debei, M.M.; Wamb, S.F. Metaverse beyond the hype: Multidisciplinary perspectives on emerging challenges, opportunities, and agenda for research, practice and policy. Int. J. Inf. Manag. 2022, 66, 102542. [Google Scholar] [CrossRef]

- Weinberger, M. What Is Metaverse?—A Definition Based on Qualitative Meta-Synthesis. Future Internet 2022, 14, 310. [Google Scholar] [CrossRef]

- Agarwal, A.; Alathur, S. Metaverse revolution and the digital transformation: Intersectional analysis of Industry 5.0. Transform. Gov. People Process Policy 2023, 17, 688–707. [Google Scholar] [CrossRef]

- Wheeler, T. AI Makes Rules for the Metaverse Even More Important; The Brookings Institution: Washington, DC, USA, 2023; Available online: https://www.brookings.edu/articles/ai-makes-rules-for-the-metaverse-even-more-important/? (accessed on 19 July 2023).

- Stăiculescu, A.R.; Nadoleanu, G.; Bran, E. Autopoiesis and sacredness in the digital society: The birth of the metaverse. Ann. Acad. Rom. Sci. Ser. Philos. Psychol. Theol. 2023, 11, 62–74. [Google Scholar] [CrossRef]

- Batat, W. Phygital customer experience in the metaverse: A study of consumer sensory perception of sight, touch, sound, scent, and taste. J. Retail. Consum. Serv. 2024, 78, 103786. [Google Scholar] [CrossRef]

- Prashar, A.; Prashar, A. Digital fashion and metaverse platforms: Do platform attributes drive shopper’s purchase intention? Aust. J. Manag. 2024. First published online April 19. [Google Scholar] [CrossRef]

- Mehrotra, A.; Agarwal, R.; Khalil, A.; Alzeiby, E.A.; Agarwal, V. Nitty-gritties of customer experience in metaverse retailing. J. Retail. Consum. Serv. 2024, 79, 103876. [Google Scholar] [CrossRef]

- Souidena, N.; Ladharia, R.; Chiadmib, N.-E. New trends in retailing and services. J. Retail. Consum. Serv. 2019, 50, 286–288. [Google Scholar] [CrossRef]

- Sarmento, M.; Marquesc, S.; Ladero, M.G. Consumption dynamics during recession and recovery: A learning journey. J. Retail. Consum. Serv. 2019, 50, 226–234. [Google Scholar] [CrossRef]

- Han, M.S.; Hampson, D.P.; Wang, Y. Consumer confidence and green purchase intention: An application of the stimulus-organism-response model. J. Retail. Consum. Serv. 2022, 68, 103061. [Google Scholar] [CrossRef]

- Wang, J.; Jiang, X. The Impact of Omnichannel Shopping Experience and Channel Integration on Customer Retention: Empirical Evidence from China. J. Asian Financ. Econ. Bus. 2022, 9, 229–242. [Google Scholar] [CrossRef]

- Griva, A. I can get no e-satisfaction. What analytics say? Evidence using satisfaction data from e-commerce. J. Retail. Consum. Serv. 2022, 66, 102954. [Google Scholar] [CrossRef]

- Sachdev, H.; Sauber, M.H. Employee–customer identification: Effect on Chinese online shopping experience, trust, and loyalty. Cogent Bus. Manag. 2023, 10, 2275369. [Google Scholar] [CrossRef]

- Agarwal, R.; Mehrotra, A.; Misra, D. Customer happiness as a function of perceived loyalty program benefits—A quantile regression approach. J. Retail. Consum. Serv. 2022, 64, 102770. [Google Scholar] [CrossRef]

- Liao, H.; Yang, Q.; Wu, X. Customer preference analysis from online reviews by a 2-additive choquet integral-based preference disaggregation model. Technol. Econ. Dev. Econ. 2023, 29, 411–437. [Google Scholar] [CrossRef]

- Furquim, T.S.G.; da Veiga, C.P.; Veiga, C.R.P.; Silva, W.V. The Different Phases of the Omnichannel Consumer Buying Journey: A Systematic Literature Review and Future Research Directions. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 79–104. [Google Scholar] [CrossRef]

- Natarajan, T.; Veera Raghavan, D.R. Does integrated store service quality determine omnichannel customer lifetime value? Role of commitment, relationship proneness, and relationship program receptiveness. TQM J. 2024, 37, 800–830. [Google Scholar] [CrossRef]

- Kim, J.; Choi, G. Assessing the Impact of Generative Artificial Intelligence on Customer Engagement in Business-to-Customer Scenarios. Asia-Pac. J. Converg. Res. Interchange 2024, 10, 89–104. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From Multi-Channel Retailing to Omni-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Johnson, M.; Barlow, R. Defining the Phygital Marketing Advantage. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2365–2385. [Google Scholar] [CrossRef]

- Lehrer, C.; Trenz, M. Omnichannel Business. Electron. Mark. 2022, 32, 687–699. [Google Scholar] [CrossRef]

- Pangarkara, A.; Arorab, V.; Shuklac, Y. Exploring phygital omnichannel luxury retailing for immersive customer experience: The role of rapport and social engagement. J. Retail. Consum. Serv. 2022, 68, 103001. [Google Scholar] [CrossRef]

- Maurya, M.; Dixit, S.; Zaidi, N.; Dharwal, M. The Phygital Dimension: Redefining Rules of Retail Success Through Technological Convergence. In Evolution of Digitized Societies Through Advanced Technologies. Advanced Technologies and Societal Change; Choudhury, A., Singh, T.P., Biswas, A., Anand, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2022; pp. 101–112. [Google Scholar] [CrossRef]

- Purcărea, T.; Ioan-Franc, V.; Ionescu, Ş.-A.; Purcărea, I.M.; Purcărea, V.L.; Purcărea, I.; Mateescu-Soare, M.C.; Platon, O.-E.; Orzan, A.-O. Major Shifts in Sustainable Consumer Behavior in Romania and Retailers’ Priorities in Agilely Adapting to It. Sustainability 2022, 14, 1627. [Google Scholar] [CrossRef]

- Nagy, I.D.; Dabija, D.-C.; Cramarenco, R.E.; Burcă-Voicu, M.I. The Use of Digital Channels in Omni-Channel Retail—An Empirical Study. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 797–817. [Google Scholar] [CrossRef]

- Bertrand, M.; Glebova, E. Digital Transformation Impacts Customer Experience in the Hard Luxury Industry: Consensus on Omnichannel Strategy. Athens J. Bus. Econ. 2024, 10, 183–216. [Google Scholar] [CrossRef]

- Banik, S. Exploring the involvement-patronage link in the phygital retail experiences. J. Retail. Consum. Serv. 2021, 63, 102739. [Google Scholar] [CrossRef]

- Purcarea, T. The Future of Retail Impacted by the Smart Phygital Era. Rom. Distrib. Comm. Mag. 2018, 9, 34–46. [Google Scholar]

- Mele, C.; Di Bernardo, I.; Ranieri, A.; Russo Spena, T. Phygital customer journey: A practice-based approach. Qual. Mark. Res. 2024, 27, 388–412. [Google Scholar] [CrossRef]

- Hamdan, J.; Heintzeler, C.; Nading, J.; Reasor, E. How the Apparel Industry Can ADAPT to Inflation; McKinsey & Company: New York, NY, USA, 2022; Available online: https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/how-the-apparel-industry-can%20adapt-to-inflation? (accessed on 19 September 2022).

- Hunsaker, L. Chief Customer Officers Can Stop Shrinkflation and Skimpflation; CustomerThink: Coronado, CA, USA, 2022; Available online: https://customerthink.com/chief-customer-officers-can-stop-shrinkflation-and-skimpflation/? (accessed on 8 August 2022).

- Scarpa, P.F.; Leon, H.; Moiño, J.P. Accelerating AI-Driven Marketing Maturity; Boston Consulting Group: Boston, MA, USA, 2024; Available online: https://www.bcg.com/publications/2024/accelerating-ai-driven-marketing-maturity (accessed on 3 May 2024).

- Dixon, M.; McKenna, T. Stop Losing Sales to Customer Indecision; Harvard Business Review: Brighton, MA, USA, 2022; Available online: https://hbr.org/2022/06/stop-losing-sales-to-customer-indecision (accessed on 20 August 2022).

- Roggeveen, A.L.; Rosengren, S. From customer experience to human experience: Uses of systematized and non-systematized knowledge. J. Retail. Consum. Serv. 2022, 67, 102967. [Google Scholar] [CrossRef]

- Bieliai, M. How Fintech Breaks Into the Metaverse; European Business Review: London, UK, 2022; Available online: https://www.europeanbusinessreview.com/how-fintech-breaks-into-the-metaverse/ (accessed on 10 August 2022).

- Liao, S.-H.; Hu, D.-C.; Liu, H.-L. Offline-to-online and online-to-offline (a reciprocal O2O model): Re-patronage in an omni-channel. Int. J. Retail. Distrib. Manag. 2024, 52, 341–354. [Google Scholar] [CrossRef]

- CB Insights. AR/VR Trends to Watch in 2022 and Beyond. 15 September 2022. Available online: https://www.cbinsights.com/research/report/ar-vr-trends-to-watch-2022/? (accessed on 21 September 2022).

- Peters, R. Digital Customer Experience Drives E-Commerce Profitability; CustomerThink: Coronado, CA, USA, 2022; Available online: https://customerthink.com/digital-customer-experience-drives-e-commerce-profitability/? (accessed on 18 July 2022).

- Yeh, C.-H.; Lin, H.-H.; Gau, Y.-L.; Wang, Y.-S. What drives customers’ purchase behavior in a click-and-mortar retailing context: A value transfer perspective. J. Enterp. Inf. Manag. 2020, 35, 1658–1677. [Google Scholar] [CrossRef]

- Flores-Marquez, P. Gen Zers Are the Most Adventurous and Active Digital Participants; Insider Intelligence: New York, NY, USA, 2024; Available online: https://www.insiderintelligence.com/content/gen-zers-most-adventurous-active-digital-participants? (accessed on 5 January 2024).

- Videowise. UCG is gone? Ebook 2024. Available online: https://videowise.com/is-ugc-gone? (accessed on 28 March 2024).

- Dimitriu, B.; Filip, A.; Tisler, O. The Z Factor: Can Gen Z Fulfill Romania’s Economic Potential? McKinsey & Company: Bucharest, Romania, 2023; Available online: https://www.mckinsey.com/ro/overview/the-z-factor-can-gen-z-fulfill-romanias-economic-potential (accessed on 13 February 2024).

- Lee, A. Walmart and Roblox Are Teaming up to Make Virtual E-Commerce a Reality; Digiday: New York, NY, USA, 2024; Available online: https://digiday.com/marketing/walmart-and-roblox-are-teaming-up-to-make-virtual-e-commerce-a-reality/ (accessed on 30 April 2024).

- Berthiaume, D. Walmart Makes Roblox History with ‘Real-World’ Sales; Chain Store Age: Chicago, IL, USA, 2024; Available online: https://chainstoreage.com/walmart-makes-roblox-history-real-world-sales? (accessed on 30 April 2024).

- Nielsen. Balancing the Need for Innovation and Continuity in Audience Measurement; Insights: New York, NY, USA, 2024; Available online: https://www.nielsen.com/insights/2024/balancing-the-need-for-innovation-and-continuity-in-audience-measurement/? (accessed on 30 November 2024).

- eMarketer. The AI Advantage: Scaling Ecommerce Success with Actionable Customer Insights. AI and Ecommerce. 18 November 2024. Available online: https://content-naf.emarketer.com/why-large-businesses-positioned-ai-success-using-customer-data-effectively-sponsored-content (accessed on 30 November 2024).

- Huang, L.; Gao, B.; Gao, M. Value Realization in the Phygital Reality Market; Kobe University Monograph Series in Social Science Research; Springer: Singapore, 2023; pp. 1–199. [Google Scholar] [CrossRef]

- Nair, A.J.; Manohar, S.; Chaudhry, R. Securing the Metaverse: Exploring the Role of Artificial Intelligence in Mitigating Emerging Trends in Manufacturing and Service Industries. In Augmenting Retail Reality, Part B: Blockchain, AR, VR, and AI; Verma, B., Mittal, A., Raman, M., Sindhav, B., Eds.; p. 81. [CrossRef]

- Jaakkola, E.; Kaartemo, V.; Siltaloppi, J.; Vargo, S.L. Advancing service-dominant logic with systems thinking. J. Bus. Res. 2024, 177, 114592. [Google Scholar] [CrossRef]

- Liu, L.; Lee, S.H. Do People Really Care if it’s Phygital Retail? Exploring the Relationship Between Customer Experiences and Customer Behaviors. Asia Mark. J. 2024, 26, 185–200. [Google Scholar] [CrossRef]

- Batat, W. Guest editorial: The phygital research paradigm: Philosophical foundations for examining consumer experiences and behaviors in hybrid physical-digital realms. Qual. Mark. Res. Int. J. 2024, 27, 357–365. [Google Scholar] [CrossRef]

- Liu, C. Understanding Electronic Commerce Adoption at Organizational Level: Literature Review of TOE Framework and DOI Theory. Int. J. Sci. Bus. 2019, 3, 179–195. Available online: https://ijsab.com/wp-content/uploads/336.pdf (accessed on 22 May 2023).

- Gârdan, D.A.; Epuran, G.; Paştiu, C.A.; Gârdan, I.P.; Jiroveanu, D.C.; Tecău, A.S.; Prihoancă, D.M. Enhancing Consumer Experience through Development of Implicit Attitudes Using Food Delivery Applications. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2858–2882. [Google Scholar] [CrossRef]

- Förster, K. Extending the technology acceptance model and empirically testing the conceptualised consumer goods acceptance model. Heliyon 2024, 10, e27823. [Google Scholar] [CrossRef]

- Roslan, M.A.A.; Nasharuddin, N.A.; Murad, M.A.A. Understanding Technology Acceptance and Use in Social Media Platforms: A Systematic Literature Review and the Development of Research Framework. J. Soc. Comput. 2024, 5, 261–291. [Google Scholar] [CrossRef]

- Tang, L.; Jiang, J. Enhancing the Combined-TAM-TPB model with trust in the sharing economy context: A meta-analytic structural equation modeling approach. J. Clean. Prod. 2024, 442, 141168. [Google Scholar] [CrossRef]

- Purcărea, I.M. The Impact of Disruptive Technologies on E-Commerce; Publishing House: Economic Information and Documentation Center (CIDE), CIDE Books: “SED VITAE DISCIMUS” Collection; Romanian Academy: Bucharest, Romania, 2024; pp. 250–259. [Google Scholar]

- Barrett, H.C. Towards a Cognitive Science of the Human: Cross-Cultural Approaches and Their Urgency. Trends Cogn. Sci. 2020, 24, 620–638. [Google Scholar] [CrossRef] [PubMed]

- Rajagopal. Consumer Behavior and Cognitive Theories. In Crowd-Based Business Models; Palgrave Macmillan: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Qiu, R.; Ao, J.H. Reflections and Explorations on the Future Path of Human-Computer Interaction Design. Voice Publ. 2024, 10, 199–212. [Google Scholar] [CrossRef]

- Mandal, S.; Dubey, R.K.; Basu, B.; Tiwari, A. Exploring the orientation towards metaverse gaming: Contingent effects of VR tools usability, perceived behavioural control, subjective norms and age. J. Innov. Knowl. 2024, 10, 100632. [Google Scholar] [CrossRef]

- Agrawal, A.; McHale, J.; Oettl, A. Superhuman Science: How Artificial Intelligence May Impact Innovation; Working Paper; The Center on Regulation and Markets at Brookings: Washington, DC, USA, 2022; Available online: https://www.brookings.edu/articles/superhuman-science-how-artificial-intelligence-may-impact-innovation (accessed on 26 April 2022).

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: New York, NY, USA, 2009. [Google Scholar]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modelling (PLS-SEM), 2nd ed.; SAGE: Washington, DC, USA, 2017. [Google Scholar]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R. A Workbook; Springer: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- McDonald, R. Test Theory: A Unified Treatment; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1999. [Google Scholar]

- Woodhouse, B.; Jackson, P.H. Lower bounds for the reliability of the total score on a test composed of non-homogeneous items. II: A search procedure to locate the greatest lower bound. Psychometrika 1977, 42, 579–591. [Google Scholar] [CrossRef]

- Moltner, A.; Revelle, W. Find the Greatest Lower Bound to Reliability. The Personality Project 2015. Available online: https://personality-project.org/r/psych/help/glb.algebraic.html (accessed on 25 September 2021).

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Rizopoulos, D. Latent Trait Models Under IRT Version 1.1-1. CRAN.R-Project.org. 17 April 2018. Available online: https://cran.r-project.org/web/packages/ltm/ltm.pdf (accessed on 27 August 2021).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Purcărea, T.V.; Ionescu, Ş.-A.; Purcărea, I.M.; Purcărea, I.; Ionescu, A.G. The Tech-Enabled Shopper Impacting a Phygital Retail Complex System Stimulated by Adaptive Retailers’ Valorization of an Increasingly Complex E-Commerce. Systems 2025, 13, 152. https://doi.org/10.3390/systems13030152

Purcărea TV, Ionescu Ş-A, Purcărea IM, Purcărea I, Ionescu AG. The Tech-Enabled Shopper Impacting a Phygital Retail Complex System Stimulated by Adaptive Retailers’ Valorization of an Increasingly Complex E-Commerce. Systems. 2025; 13(3):152. https://doi.org/10.3390/systems13030152

Chicago/Turabian StylePurcărea, Theodor Valentin, Ştefan-Alexandru Ionescu, Ioan Matei Purcărea, Irina Purcărea, and Alexandra Georgiana Ionescu. 2025. "The Tech-Enabled Shopper Impacting a Phygital Retail Complex System Stimulated by Adaptive Retailers’ Valorization of an Increasingly Complex E-Commerce" Systems 13, no. 3: 152. https://doi.org/10.3390/systems13030152

APA StylePurcărea, T. V., Ionescu, Ş.-A., Purcărea, I. M., Purcărea, I., & Ionescu, A. G. (2025). The Tech-Enabled Shopper Impacting a Phygital Retail Complex System Stimulated by Adaptive Retailers’ Valorization of an Increasingly Complex E-Commerce. Systems, 13(3), 152. https://doi.org/10.3390/systems13030152