Abstract

Increasing supply chain uncertainty due to market volatility has heightened the need for more flexible procurement strategies. While procurement through long-term forward contracts provides supply stability and cost predictability, it limits adaptability. Option contracts offer procurement flexibility, but require additional upfront premiums. Meanwhile, the spot market enables real-time purchasing without prior commitments, enhancing flexibility but exposing buyers to price volatility. Despite the growing adoption of portfolio procurement—combining forward contracts, option contracts, and spot market purchases—the existing research primarily examines these channels in isolation or in limited combinations, lacking an integrated perspective. This study addresses this gap by developing a comprehensive procurement model that simultaneously optimizes procurement decisions across all three channels under uncertain demand and fluctuating spot prices. Unlike prior studies, which often analyze one or two procurement channels separately, our model presents a novel, holistic framework that balances cost efficiency, risk mitigation, and adaptability. Our findings demonstrate that incorporating the spot market significantly enhances procurement flexibility and profitability, particularly in environments with high demand uncertainty and price volatility. Additionally, sensitivity analysis reveals how fluctuations in spot prices and demand uncertainty influence optimal procurement decisions. By introducing a new, practical approach to portfolio procurement, this study provides managerial insights that help businesses navigate complex and uncertain supply chain environments more effectively. However, this study assumes unlimited spot market capacity and reliable suppliers, highlighting a limitation that future research should address.

1. Introduction

Supply chains have become increasingly unstable due to international conflicts, natural disasters, price fluctuations, and pandemics. In this uncertain landscape, procurement strategies have become a critical business concern. They are especially crucial in manufacturing industries, where securing components in a stable and cost-effective manner is essential for maintaining quality, controlling costs, and ensuring seamless production. Traditionally, the primary form of procurement has been the wholesale forward contract, where businesses commit to purchasing goods or services from a supplier over an extended period at fixed terms and wholesale prices [1]. While this approach guarantees a stable supply at generally lower costs and protects the retailer from losses arising from price and supply fluctuations, it also limits adaptability in uncertain markets and limits emerging opportunities.

To address this limitation, companies are increasingly incorporating option contracts into their procurement strategies [2]. Option contracts offer greater flexibility, allowing businesses to secure the right, without the obligation, to purchase up to a certain amount of goods at a predetermined price within a specified period. This approach is particularly efficient in volatile markets where demand and prices are unstable. One key advantage of option-based procurement is supply assurance. Companies can reserve inventory without fully committing to purchasing, ensuring its availability during peak demand or supply shortages. However, option contracts incur additional costs, as buyers must pay an upfront premium to acquire the option, which may increase overall procurement expenses. If the option remains unused, the premium is lost as a sunk cost.

With the rapid growth of B2B (business-to-business) trading, the spot market has become an effective and flexible alternative for procurement. Purchasing goods in the spot market involves buying items at current prices for immediate delivery in a dynamic environment. Spot market procurement is widely used for a range of products, including grains, oil, chemicals, semiconductor chips, energy, etc. [3,4,5,6,7,8]. The primary advantage of spot market purchasing is flexibility. Unlike long-term forward and option contracts with fixed prices and predetermined order quantities, spot market procurement is highly dynamic, adjusting to real-time supply and demand conditions. Buyers can modify purchase quantities based on actual demand, making it particularly beneficial for industries with highly uncertain demand or short product life-cycles. Moreover, unlike forward and option contracts that lock-in prices in advance, businesses can capitalize on cost savings when market prices decline. Spot market transactions also require no upfront financial commitment, which helps to improve cash flow management. Despite these advantages, spot market purchasing entails significant risks, with price volatility being the most critical. Since spot prices fluctuate due to supply and demand dynamics, businesses may face sudden cost surges during peak demand periods, complicating financial planning and budgeting. Nonetheless, spot market procurement is gaining popularity, particularly with the rise of e-commerce. Table 1 summarizes the characteristics of forward/option contract-based procurement and spot market procurement.

Table 1.

Comparison of procurement strategies: forward/option contracts vs. spot market.

Companies have recently adopted portfolio procurement strategies that integrate traditional long-term contracts into the spot market, optimizing cost and flexibility. For instance, Hewlett-Packard (HP) successfully implemented a hybrid procurement strategy combining forward contracts, option contracts, and the spot market for semiconductor component sourcing. Specifically, HP procured 50% of its components through a forward contract, 35% via an option contract, and 15% from the spot market [9]. While existing research primarily examines one or two procurement channels in isolation, there are limited studies exploring portfolio procurement strategies that integrate forward, option, and spot markets. McKinsey & Company [10] have emphasized in their reports the importance of determining the optimal ratios between the long-term and the spot market for purchases.

This study aims to fill the research gap by developing a portfolio procurement framework that integrates forward contracts, option contracts, and spot trading into a unified model. Specifically, our contributions include: (1) formulating an optimal model that integrates these three procurement mechanisms; (2) analyzing procurement strategies under different procurement structures—forward contracts only, a combination of forward and option contracts, and a fully integrated portfolio approach; (3) providing an analytical solution under specific demand and price distributions to offer clear managerial insights; and (4) conducting a comprehensive sensitivity analysis of key factors such as spot price volatility, demand uncertainty, and cost structures. By addressing these aspects, our study provides a more holistic perspective on procurement strategy, filling the existing research gap and offering practical implications for supply chain decision-making.

This article is structured as follows: Section 2 reviews the relevant literature. Section 3 introduces an optimization model for portfolio procurement, with existing works used as benchmarks. Section 4 presents numerical examples to illustrate key findings and compare procurement strategies. Finally, Section 5 discusses the main conclusions and potential directions for future research.

2. Literature Review

With increasing supply chain risks, extensive research has been conducted from diverse perspectives to address these challenges. These include disruption mitigation approaches (e.g., resilience planning, redundancy, and dual sourcing) [11], sustainability and resilience strategies (e.g., circular economy models and green initiatives) [12], behavioral decision-making in procurement [13], and contractual strategies [14], to name a few. Among these, contractual strategies play a critical role in portfolio procurement, particularly in balancing cost stability and flexibility. To establish a foundation for our study, we first review the existing literature on forward contracts, option contracts, and spot markets, examining their applications and limitations in procurement decision-making.

A significant portion of forward contracts are based on the newsvendor model, where the optimal order quantity is determined under a wholesale contract framework for a short life-cycle product sold in a single selling period. In this model, a retailer (newsvendor) must decide how many units of a product to order before the selling season begins. Demand is assumed to be stochastic and characterized by a random variable x with the probability density function (pdf), f(x), and the cumulative distribution function (cdf), F(x). The key trade-off in the ordering decision is between two types of costs: the underage cost (), incurred when ordering too little (leading to missed profit opportunities), and the overage cost (), incurred when ordering too much (resulting in excess inventory). In the standard newsvendor model, these costs are defined as and , where p is the selling price, w is the purchase cost, and s is the salvage value. The optimal order quantity purchased by the retailer from the supplier is obtained by . Wholesale-based procurements in the newsvendor problem are extensively studied in the literature [15,16,17,18]. While forward contracts based on wholesale pricing provide stability and predictability in cost structure, their rigidity often limits their adaptability to fluctuating demand.

Option contracts are widely adopted across industries to address the limitations of forward contracts. An option contract is a type of agreement that allows the buyer to adjust order quantities based on demand forecasts and actual sales. In an option contract, two key pricing components define the financial terms: the option price o and the exercise price e. The option price is the retailer’s upfront cost to acquire the contract, while the exercise price is the pre-agreed price at which the buyer can purchase the goods if they choose to exercise the option. The option price is non-refundable, meaning that even if the buyer decides not to exercise the option, the amount paid is not recovered. If demand is high, the buyer can exercise the option and secure the goods at the exercise price. Conversely, the buyer can forgo the option if demand is low, avoiding unnecessary inventory. Zhao et al. [19] introduced a supply chain coordination framework using an option contract, employing a game theory approach to resolve conflicts between manufacturers and retailers. They found that, compared to forward contracts, the supply chain can achieve coordination with Pareto improvement using option contracts. Since then, research on option contracts has been conducted across various contexts, including disruption risk [20], information asymmetry [21], smart factories [22], and bi-directional options [23]. For a comprehensive review of option contract literature, see Trigeorgis and Tsekrekos [2].

Existing studies on portfolio procurement problems mostly fall into three main streams: forward contract with option, forward contract with spot market, and option contract with spot market. Several studies examine a combined procurement model where a retailer utilizes both forward and option contracts. Wang and Tsao [24] develop a combined procurement model with both contract types. They show that optimal order quantities exist for both. Chen and Shen [25] examine the influence of option contracts and target service requirements on procurement decisions and performance. It is shown that as the target service requirement increases, the retailer’s optimal expected profit is non-increasing, and the supplier’s optimal expected profit is non-decreasing. Hu et al. [26] examine portfolio procurement policies for budget-constrained supply chains using wholesale and option contracts. It is shown that the wholesale-based forward contracts are preferable under tight budget constraints, while a combination of forward and option contracts can be a better choice under the relieved budget.

With the rapid growth of B2B trading, the spot market has become an increasingly viable procurement channel. Seifert et al. [3] propose a mathematical model to determine the optimal order quantity for forward contracts and spot market purchases. They demonstrate that incorporating the spot market into procurement decisions improves performance. Xing et al. [6] investigate how the B2B spot market affects the retailer’s strategic behavior and performance in a supply chain with price-sensitive demand. The study presents how the retailer should simultaneously make a procurement quantity decision from a forward contract and a selling price decision before spot trading. Xu et al. [27] study a portfolio procurement with a forward contract and an imperfect spot market, where transactions are subject to availability constraints and additional costs. Kleindorfer and Wu [28] develop a framework integrating long-term procurement (capacity options) with short-term spot trading, showing that manufacturers and retailers can increase profitability using option contracts. Fu et al. [29] explore procurement strategies for a multi-period inventory, considering that a firm can buy either through an option contract or a spot market under price-dependent demand. Zhao et al. [30] present a two-stage procurement model, considering a stochastic spot market and the updating of demand information. In the first stage, the retailer determines the option quantity based on the option contract and possible spot price. The demand information is updated in the second stage, and based on this new information, the retailer determines the exercised quantity of options and the quantity of purchasing items from the spot market. Hou et al. [31] develop a mathematical model to determine the retailer’s optimal procurement strategy, considering an imperfect spot market and fluctuating spot prices. They derive closed-form solutions for optimal order quantities and highlight the importance of a comprehensive portfolio procurement strategy that incorporates forward contracts alongside option contracts and the spot market.

While prior studies have explored procurement strategies involving forward contracts, option contracts, or the spot market, they have predominantly examined these mechanisms in isolation or in limited combinations. However, in today’s industrial environment, firms increasingly leverage multiple procurement channels to optimize supply chain performance. A more comprehensive procurement strategy is required—one that integrates forward contracts, option contracts, and the spot market to effectively balance cost, flexibility, and risk. Despite the increasing recognition of these challenges, most research assumes that firms rely on either a single dominant procurement channel or a combination of two mechanisms. This limited scope often fails to capture the full strategic potential of an integrated portfolio approach, where all three mechanisms can be leveraged to optimize procurement outcomes. This paper aims to bridge this gap by developing a portfolio procurement framework that integrates forward contracts, option contracts, and spot trading simultaneously. Specifically, we identify the conditions under which each mechanism should be used, evaluate the trade-offs between cost efficiency and flexibility, and provide insights into optimal procurement decisions under uncertain markets.

3. Model Description

We consider a single risk-neutral retailer procuring products from a supplier for resale. The procurement process is characterized by long lead times and a limited sales period. The retailer faces uncertain demand x, which follows a probability density function (pdf) f(x), a cumulative distribution function (cdf) F(x), and has a mean μx. Table 2 lists the notations and their descriptions used throughout this paper.

Table 2.

Notations.

Procurement can be made through either a forward contract (FW) or an option contract (OP), where the contract parameters are exogenously determined in the market. In the FW contract, the retailer commits to a committed order Q with the supplier at a predetermined wholesale price w. The supplier then produces and delivers the ordered quantity to the retailer at the start of the selling season. In the option (OP) contract, two key parameters are involved: the option price o and the exercise price e. The option price is paid by the retailer to the supplier in advance to reserve a specific quantity q before the selling season begins. The exercise price is paid only when the retailer chooses to exercise the reserved options at the time of contract execution. The retailer has the right, but not the obligation, to purchase any portion of the reserved quantity, and the supplier is obligated to fulfill all exercised quantities. A distinctive feature of this study is the incorporation of a spot market (SP) into procurement decisions. The retailer can procure additional units from the spot market if the quantities ordered through the FW and OP contracts fall short of realized demand. This study focuses on developing an optimal procurement strategy by determining the optimal order quantities for FW and OP contracts.

Under the combined FW and OP contract without a spot market, the retailer orders Q units through the FW contracts and reserves q units via the OP contract. Therefore, the maximum quantity the retailer can procure from a supplier is Q + q. The unmet demand is lost if the demand is higher than Q + q. Under the combined FW and OP contract with the spot market, the retailer procures all the unmet demand from the spot market with unlimited capacity. The spot market price r is uncertain and is estimated using distribution with pdf g(r), cdf G(r), and the mean μr. The spot market price may be higher or lower than the option exercise price as it fluctuates over time. If the spot market price is lower than the option exercise price, the retailer does not need to exercise the option and instead procures the intended option quantity from the spot market. At the end of the selling season, any unsold inventory retains a salvage value s. We assume that the spot market is always available when needed. Additionally, the supplier is reliable, ensuring that the retailer can receive the agreed-upon supply. The retailer is assumed to have a risk-neutral disposition, making decisions to maximize expected profit. We also assume that the selling price, wholesale price, option price, and salvage value are given by the market. The following assumptions are made to avoid trivial or unrealistic scenarios: .

We investigate the optimal procurement models for the retailer without the spot market in Section 3.1 and Section 3.2, and then present the optimal ordering decisions with the spot market in Section 3.3.

3.1. Procurement Model for Forward Contract (FW)

A forward contract is an agreement between two parties to purchase a quantity of goods at a predetermined price on a future date. Procurement through wholesale price-based forward contracts is a widely used procurement method in the industry. The retailer’s profit function can be expressed as follows:

where . The first term represents the total revenue, the second term accounts for the purchase cost incurred, and the third term reflects the salvage value for the leftover inventory. Then, the retailer’s expected profit, , can be represented as follows:

Note that and . The first and second derivatives of with respect to are and . With the assumption of , holds, indicating that is concave with respect to . The first-order condition indicates that the optimal order quantity for the retailer, , is as follows:

3.2. Procurement Model for Combined Forward and Option Contract (FO)

This strategy combines the FW and OP models, where the retailer utilizes both FW and OP contracts. The retailer profit function can be expressed as follows:

The first term represents the total revenue from the sales, the second term accounts for the purchase cost incurred under the FW contract, and the third term signifies the salvage value. The fourth and final term account for the option and exercise prices, respectively. The retailer’s expected profit can be represented as follows:

Note that . Chen and Shen [25] showed that is jointly concave with respect to Q and q. Then, the first-order condition provides the following expression (see [25] for the proof):

The optimal order quantity for the FW contract quantity is determined as follows:

In terms of the relationship between and , we have two cases: (i) and (ii) In case (i), and are obtained by expressions (6) and (7) and the option quantity is . On the other hand, in case (ii), has a negative value. Due to the concavity of the objective function, the optimal value must be at the boundary, where , leading to = . In this case, no option is purchased.

3.3. Procurement Model for Forward, Option, and Spot Market (FOS)

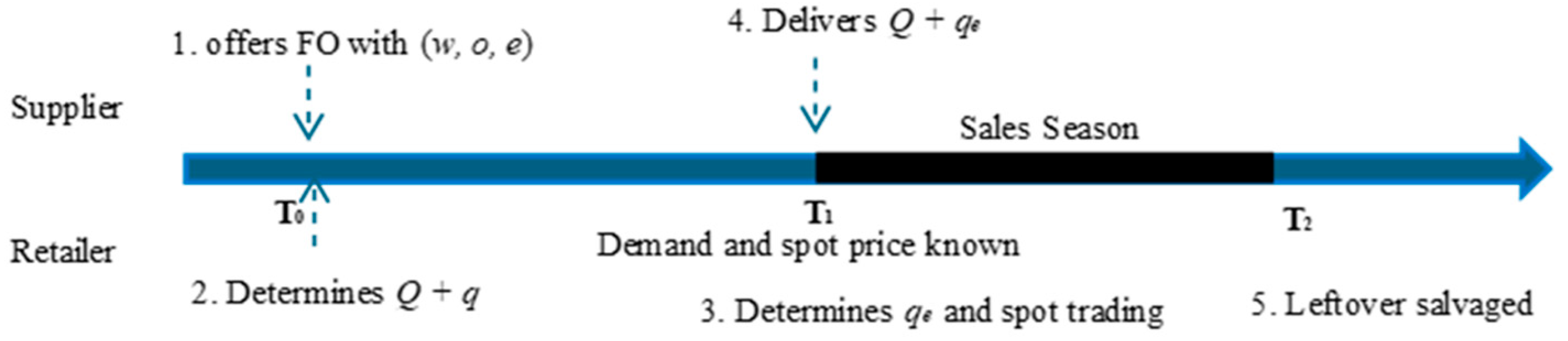

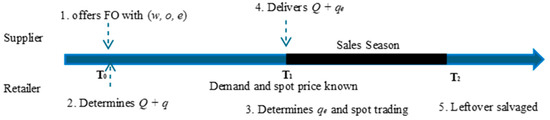

This strategy combines forward contracts, options, and the spot market, which is the focus of our study. The FOS procurement process is illustrated in Figure 1.

Figure 1.

The sequence of events in the FOS procurement strategy.

The portfolio procurement model has three steps, detailed as follows:

- Stage T0: This is long before the selling season begins, since the procurement lead time is assumed to be long. At this stage, the retailer has a unit price for the forward contract, and a per-unit option price and exercise price for the option contract. The retailer has uncertain information about the demand with pdf f(x) and cdf F(x), and the spot price with pdf g(r) and cdf G(r). Based on the information on hand, the retailer determines the committed quantity Q for the forward contract and the option quantity q for the option contract. The retailer pays to the supplier.

- Stage T1: This is the stage when the selling season starts, and demand x and spot price r are realized. At this stage, the retailer decides whether to exercise the option contract and/or procure products from the spot market. The decision depends on three market conditions: (1) , (2) and , and (3) and .

- (1)

- : No option is exercised, and no spot purchase is made. The procurement is made only through the FW contract.

- (2)

- and : The retailer does not exercise the option quantity. Instead, the demand not covered by the committed quantity Q is procured from the spot market because the spot price is lower than the option exercise price. The purchase amount from the spot market is .

- (3)

- and : The retailer exercises the option quantity where the exercise quantity is . The retailer may purchase the extra quantity needed from the spot market, where the purchase amount is . The supplier delivers units to the retailer.

- Stage T2: At the end of the season at T2, the remaining products after sale are salvaged at a price of s per unit.

Based on the descriptions above, the retailer’s profit can be formulated as follows, with forward quantity Q and option quantity q:

Then, the expected profit of the retailer is obtained as follows:

Proposition 1.

The retailer’s expected profit under the FOS contract is jointly concave with respect to Q and q.

Proof.

The retailer’s expected profit stated in expression (8) can be restated as follows:

The first and second derivatives of expression (9) with respect to Q and q are as follows:

The determinant of the Hessian Matrix in terms of Q and q is as follows:

With the assumptions that and , it follows that , , and . Therefore, is concave with respect to Q and q. □

From Proposition 1, the values of Q and q that satisfy the first-order conditions, and , yield the retailer’s maximum profit. Let represent the optimal order quantity that maximizes the retailer’s profit. According to expression (13), the retailer’s optimal order quantity is determined as follows:

Substituting into the first derivative from expression (10) yields the following:

which leads to the following results:

For the expressions (17) and (20) to be well defined, should hold. Hence, the following proposition is derived:

Proposition 2.

The retailer’s optimal ordering decisions for Q and q are as follows:

- Case (i) : , ,

- Case (ii) : ,

Proof.

In terms of the relationship between and , we have two cases: (i) and (ii) . In case (i), it is straightforward to obtain and by using expressions (17) and (20). In this scenario, the option quantity has a positive value, allowing the retailer to utilize the option contract, i.e., . In case (ii), the option quantity is negative, making it infeasible in a real-world setting. Due to the concavity of the expected profit function, the optimal value must be at the boundary with . In this case, the retailer considers only two procurement sources: the forward contract and spot market (FS). From this procurement scenario, the retailer’s profit is as follows:

Then, the expected profit is

It is easy to show that is concave with respect to Q. The first-order condition produces the optimal forward order quantity to maximize the expected profit, as follows:

Finally, in case (ii), we have and . □

3.4. A Solution Form for the Specific Distribution Case

For the proposed FOS contract, we create an analytical solution for a specific case where demand x and spot price r follow uniform distributions and , respectively. With r following a uniform distribution, the equation holds. Then, expressions (17) and (20) can be restated as follows:

The optimal option quantity is determined by following the same procedure as in Section 3.3, depending on the relationship between and . The analytical solutions are utilized in the next section where numerical studies are performed.

4. Numerical Studies

This section presents numerical studies to demonstrate the performance of the model presented in this paper. The illustrative example draws on the frameworks of Mathur and Shah [32] and Tao and Koo [33]. The demand x during the sales season is assumed to follow a uniform distribution, with a mean of 200. The cost parameters are as follows: p = 60, w = 32, o = 6, e = 30, s = 10, and the spot price r is assumed to follow a uniform distribution with a mean of 40. Numerical experiments are conducted using MS Excel 2016 with the help of R programming (version 4.3.1) on a desktop computer.

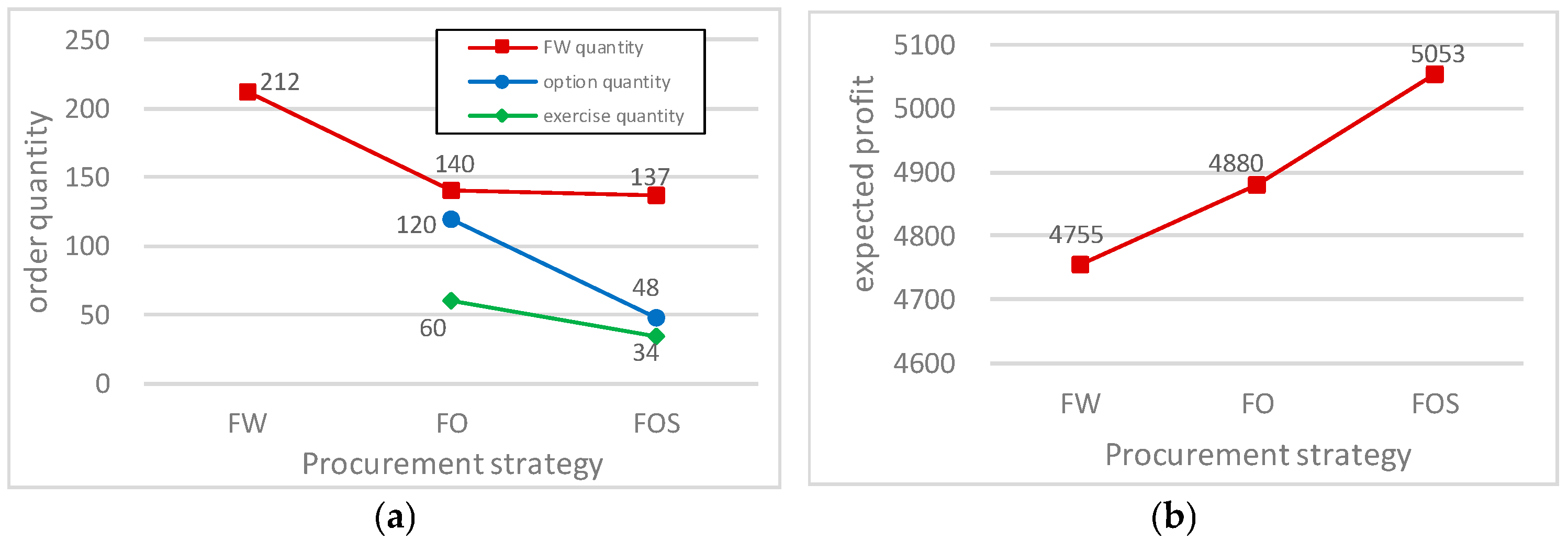

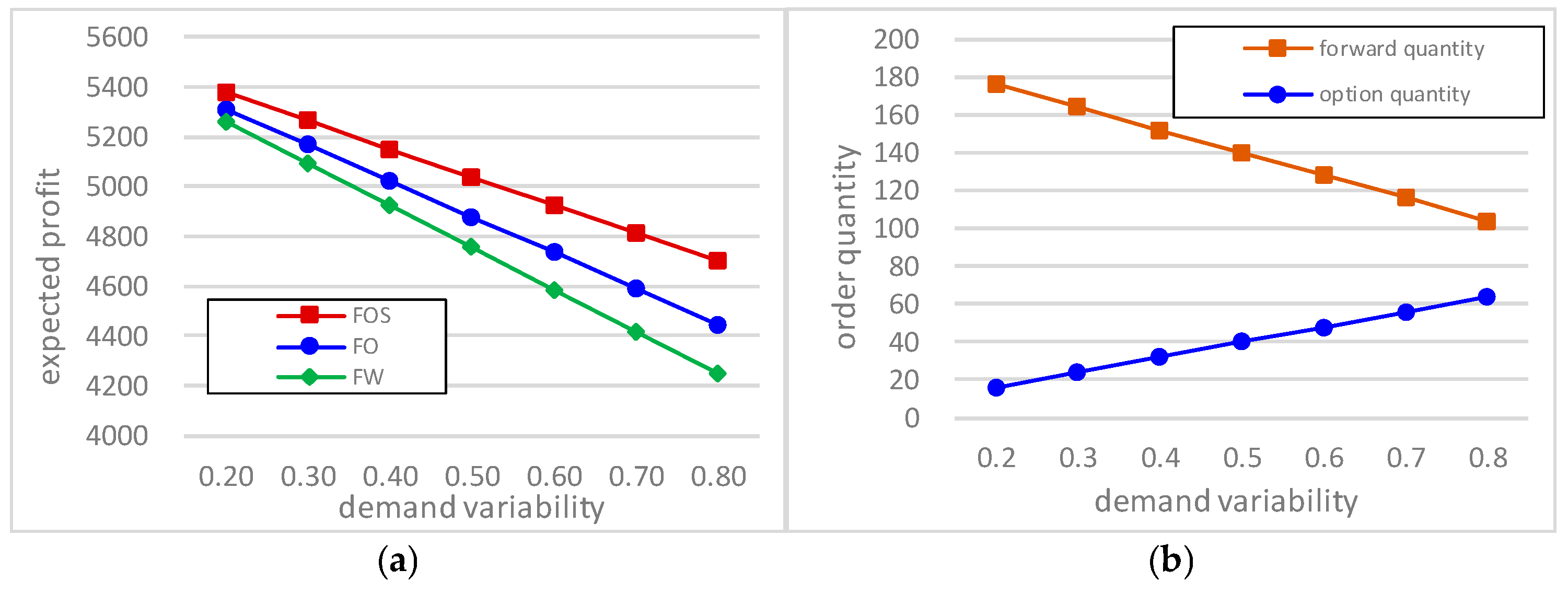

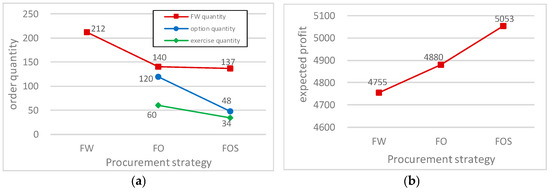

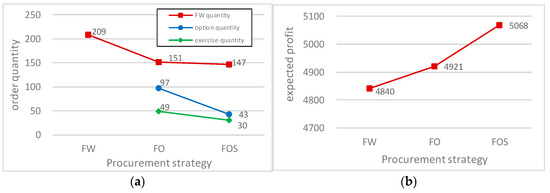

Three procurement strategies are analyzed: forward contract (FW), forward and option contract (FO), and forward, option, and spot market contract (FOS). Figure 2 presents the order quantity and the corresponding expected profit for each strategy. The results indicate that in the FO and FOS strategies, the optimal forward order quantity is lower than in the FW strategy, and the option order quantity in the FOS strategy is smaller than in the FO strategy. Since unmet demand from options can be procured through the spot market, it is reasonable that the option order quantity in the FOS strategy decreases.

Figure 2.

The order quantity and the expected profit of each procurement strategy. (a) Optimal order (exercise) quantity; and (b) retailer’s expected profit.

Figure 2b shows that the expected profit increases when an option contract is added to the forward contract, and incorporating the spot market into the procurement decision-making process can lead to even greater profits. For a fair comparison, it is assumed that any demand unmet through forward and option procurement is procured from the spot market, even in the FW and FO contracts. It is observed that the procurement strategy considering the spot market (FOS contract) yields higher profits compared to the procurement strategies that do not consider the spot market (FW, FO). These results have important implications for supply chain management. Specifically, applying a portfolio procurement strategy that incorporates futures, options, and the spot market can enhance the retailer’s expected profit. In this case, considering procurement from the spot market, the retailer should allocate lower quantities to futures and options than when the spot market is not taken into account.

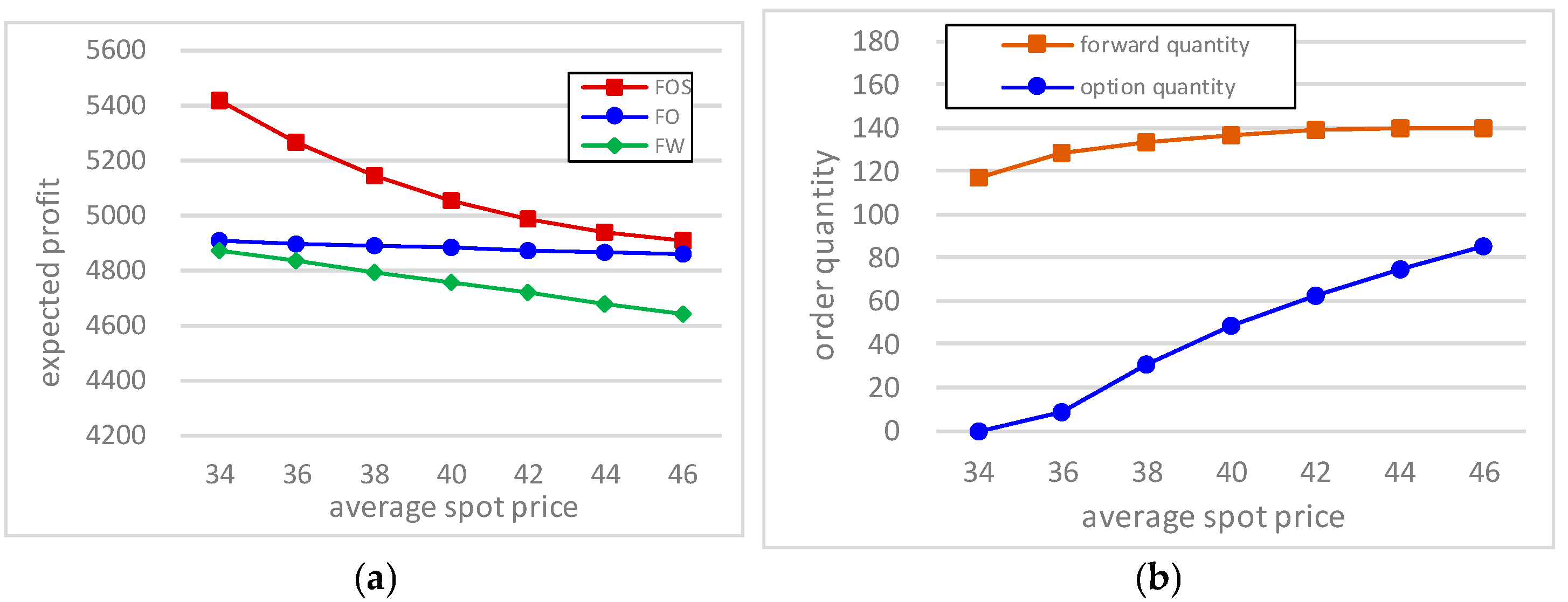

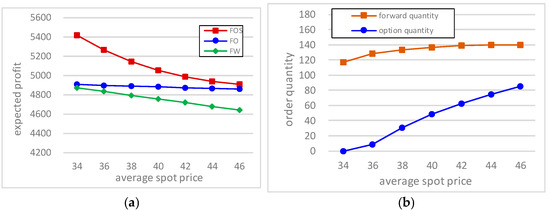

We conduct a sensitivity analysis to examine how the supply chain environment affects procurement strategies. The impact of spot market prices on the performance of the procurement strategies is illustrated in Figure 3. As expected, when the average spot price is low, the benefits of increased flexibility in spot market procurement outweigh the additional costs, leading to the FOS strategy outperforming the other two procurement strategies. On the other hand, when the expected spot price is high, the increased procurement cost from the spot market diminishes the benefits of flexibility, resulting in the FOS strategy yielding a similar expected profit to the FO strategy. Figure 3b shows that the optimal option quantity increases as average spot price rises. When the average spot price is low and close to option price, the optimal option quantity is very low. This result is expected, as there is little incentive to enter into an option contract when the option price is comparable to the spot price.

Figure 3.

Influence of spot price on the performance of the procurement strategies. (a) Spot price vs. expected profit; and (b) spot price vs. optimal option quantity.

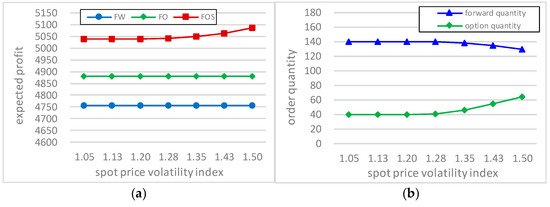

The influence of spot price volatility on expected profit under different procurement strategies is presented in Figure 4. The x-axis represents the spot price volatility index, defined as the ratio of the maximum spot price to the mean spot price. For example, a volatility index of 1.2 means that the minimum and maximum spot prices are 32 and 48, respectively, while the mean spot price remains at 40. As shown in Figure 4a, the expected profit remains unchanged over different volatility indices in the FW and OP strategies, as their decisions do not consider the spot market. However, the FOS strategy performs particularly well when spot price volatility is high. When spot price volatility is high, the probability of the spot price falling below the option exercise price increases. In this case, the retailer is more likely to procure from the spot market instead of exercising the option contract, leading to lower purchasing costs and higher profits. Figure 4b illustrates the influence of spot price volatility on the procurement portfolio under the FOS contract. As the spot price volatility increases, the forward order quantity decreases while the option quantity increases. This finding suggests that when a high fluctuation in spot prices is expected, firms should increase their option quantity to enhance procurement flexibility while reducing the strictly committed forward order.

Figure 4.

Performance of the procurement strategies over different spot price volatilities. (a) Spot price volatility vs. expected profit; and (b) spot price volatility vs. optimal option quantity.

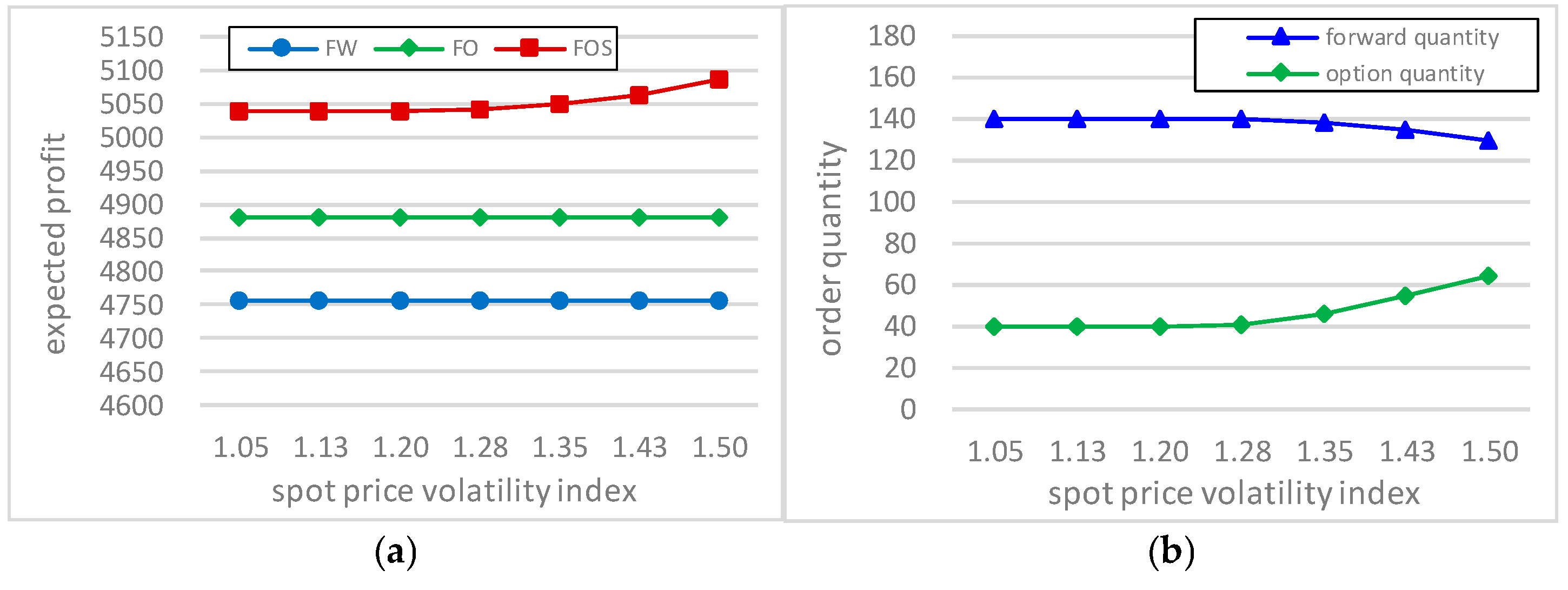

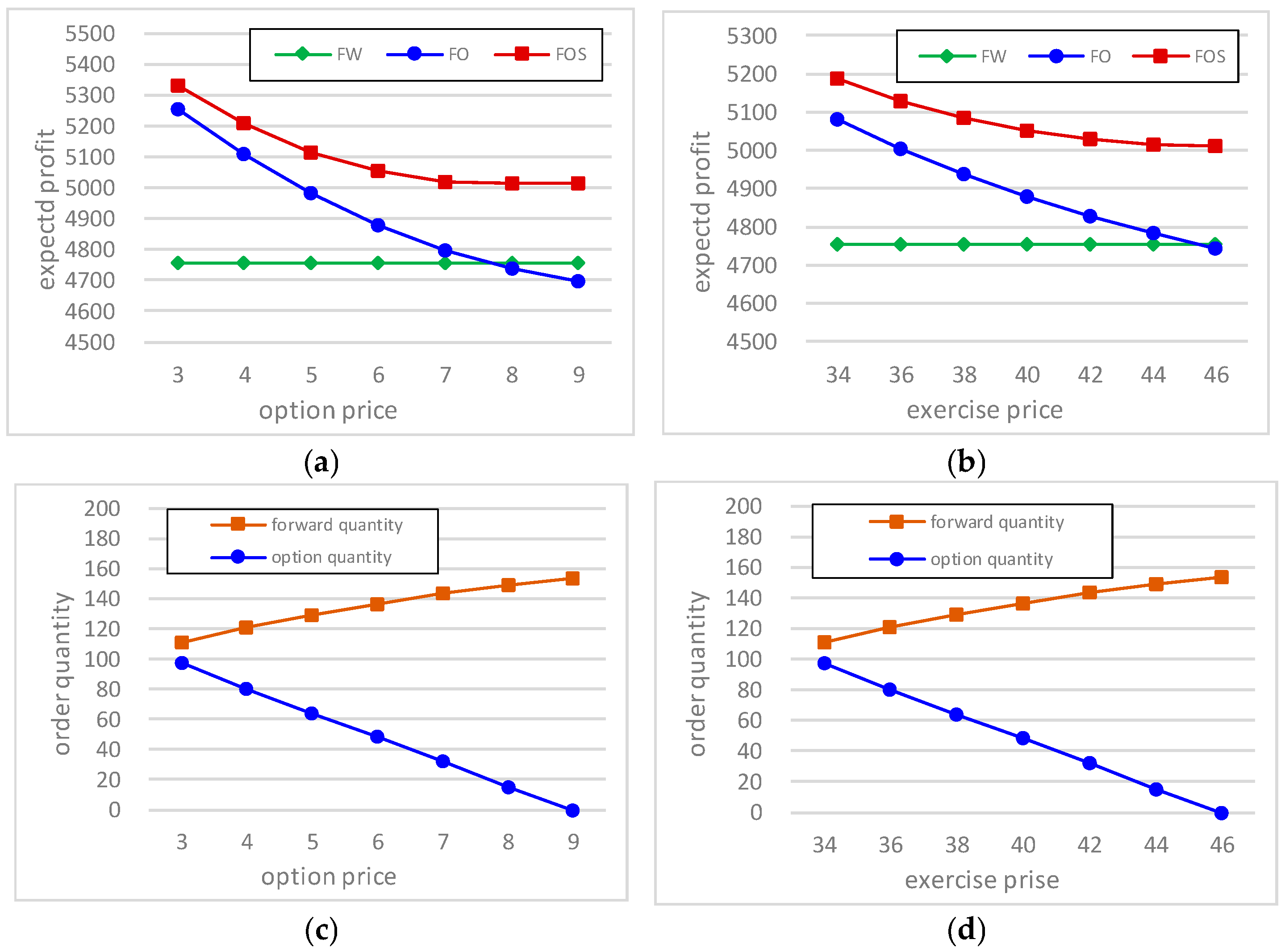

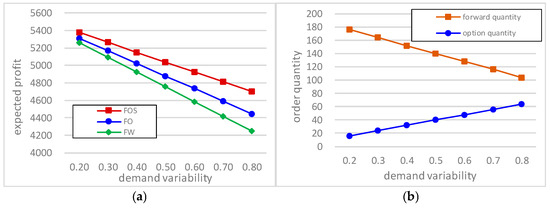

Figure 5 illustrates the influence of demand variability on the performance of different procurement strategies. The demand distribution is adjusted so that demand varies between 20% and 80% of the mean, allowing us to analyze the impact of demand volatility. For example, a demand variability of 20% indicates that the demand follows with a mean of 200. Figure 5a shows that the FW strategy exhibits the steepest decline in expected profit with increasing demand variability, indicating a greater vulnerability to demand fluctuations. In comparison, the FO strategy performs better than the FW, as it provides greater flexibility to adapt to market demand. The FOS procurement strategy outperforms the other two strategies across all levels of demand variability. In particular, the greater the demand volatility, the more significantly the FOS strategy outperforms the other two. Therefore, supply chain managers should actively adopt the FOS procurement strategy, especially in supply chain environments with high demand variability.

Figure 5.

Effect of different demand variabilities on procurement strategies. (a) Demand variability vs. expected profit; and (b) demand variability vs. optimal order quantity.

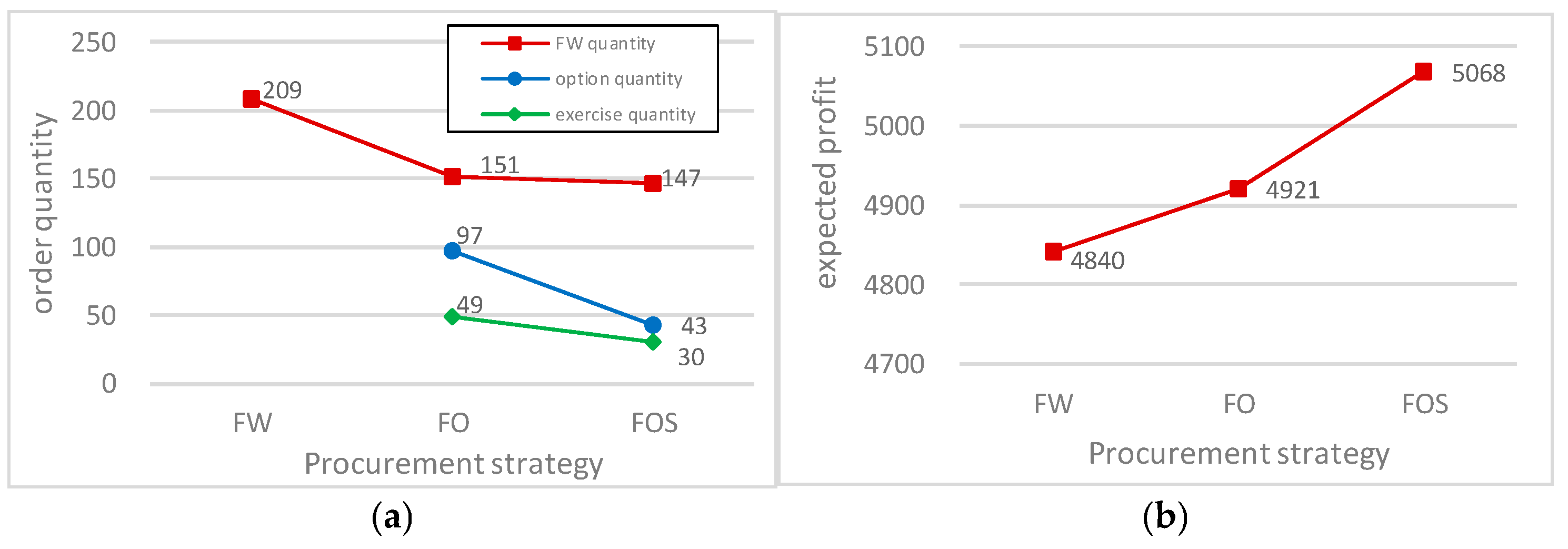

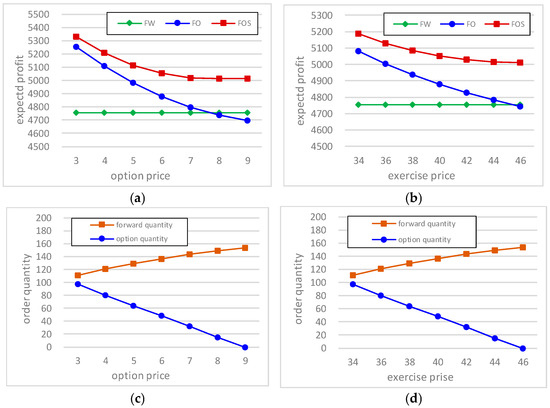

Figure 6a,b illustrate how changes in option price and exercise price affect different procurement strategies. Increases in both option price and exercise price have similar effects on each strategy. As option costs rise, the expected profits of both the FO and FOS strategies decrease. However, the rate of decline is more gradual for the FOS strategy than for the FO strategy. Additionally, the FOS strategy consistently yields higher expected profits than the other two strategies. Figure 6c,d show the optimal order quantity as option price and exercise price change. When the option costs rise, the FW order quantity increases while the option order quantity declines, leading to an overall reduction in total order quantity. This suggests that as option costs rise, procurement shifts towards the spot market, resulting in a decrease in total order quantity. These findings highlight the importance of supply chain managers carefully considering option costs when determining the volume of forward and option contracts.

Figure 6.

Effect of different option and exercise prices on procurement strategies. (a) Option price vs. expected profit; (b) exercise price vs. expected profit; (c) option price vs. optimal order quantity; and (d) exercise price vs. optimal order quantity.

In our numerical experiments, we assume that demand and spot price follow a uniform distribution. This choice is made not only for the convenience of deriving analytical results through simple calculations but also to ensure the reproducibility and to enhance the clarity of our findings for readers. We also conduct experiments under scenarios where demand and spot price follow a normal distribution. The results are presented in Figure 7. Comparing Figure 2 and Figure 7, we observe no significant differences between the results in both cases, suggesting that assuming a uniform distribution does not undermine the ability to derive meaningful managerial insights. This indicates that the insights gained from our previous experiments under a uniform distribution remain valid and practically useful.

Figure 7.

Experimental results with spot price and demand following normal distributions. (a) Optimal order (exercise) quantity; and (b) retailer’s expected profit.

5. Conclusions

Portfolio procurement is widely adopted across industries and plays a crucial role in helping businesses adapt to market conditions, demand fluctuation, and price volatility. This study explores portfolio procurement strategies involving forward and option contracts in a setting where a spot market exists. We develop an optimal ordering model in portfolio procurement that incorporates the spot market and analyzes its implications. Our findings indicate that the retailer’s optimal order quantity is lower when a spot market is available than when it is not. Moreover, incorporating the spot market into procurement decisions can enhance the retailer’s expected profit. The effectiveness of the proposed model depends on the supply chain environment. Specifically, the model proves more efficient when the expected procurement cost in the spot market does not significantly differ from the cost of the forward or option contracts, and the spot price volatility is high. Furthermore, for industries facing high demand variability, the FOS (forward, option, and spot) procurement strategy emerges as the most effective procurement strategy, as it balances flexibility and profitability. Firms operating under unpredictable demand and highly volatile spot prices—such as those in the fast-moving consumer goods sector—should consider prioritizing the FOS strategy to ensure optimal profitability and adaptability.

While our study provides valuable insights, it has certain limitations that warrant further investigation. We assume that the retailer is risk-neutral, meaning that procurement decisions are made to maximize expected profit. In contrast, when a supply chain participant is risk-averse, procurement decisions should account for profit variability in the performance measure. We also assume that spot market capacity is unlimited and suppliers are fully reliable, whereas, in reality, supply disruptions or market volatility may impose constraints. Future research could explore supply chain coordination mechanisms by relaxing these assumptions.

Author Contributions

Conceptualization, N.A.T. and P.-H.K.; methodology, P.-H.K.; software, N.A.T.; validation, N.A.T. and P.-H.K.; formal analysis, N.A.T.; investigation, N.A.T.; resources, P.-H.K.; data curation, N.A.T.; writing—original draft preparation, N.A.T.; writing—review and editing, P.-H.K.; visualization, P.-H.K.; supervision, P.-H.K.; project administration, P.-H.K.; funding acquisition, P.-H.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Basic Science Research Program through the National Research Foundation of Korea (NRF) funded by the Ministry of Education, Korea (No. 2022R1I1A3070919).

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Norrman, A.; Naslund, D. Supply chain incentive alignment: The gap between perceived importance and actual practice. Oper. Supply Chain. Manag. 2019, 12, 129–142. [Google Scholar] [CrossRef]

- Trigeorgis, L.; Tsekrekos, A.E. Real options in operations research: A review. Eur. J. Oper. Res. 2018, 270, 1–24, ISSN 0377-2217. [Google Scholar] [CrossRef]

- Seifert, R.W.; Thonemann, U.W.; Hausman, W.H. Optimal procurement strategies for online spot markets. Eur. J. Oper. Res. 2004, 152, 781–799. [Google Scholar] [CrossRef]

- Chen, S.L.; Liu, C.L. Procurement strategies in the presence of the spot market-An analytical framework. Prod. Plan. Control 2007, 18, 297–309. [Google Scholar] [CrossRef]

- Ganeshan, R.; Aggarwal, P. Optimal procurement portfolios when using B2Bs: A model and analysis. Int. J. Prod. Econ. 2009, 118, 146–151. [Google Scholar] [CrossRef]

- Xing, W.; Wang, S.; Liu, L. Optimal ordering and pricing strategies in the presence of a B2B spot market. Eur. J. Oper. Res. 2012, 221, 87–98. [Google Scholar] [CrossRef]

- Xu, J.; Feng, G.Z.; Jiang, W.; Wang, S.Y. Optimal procurement of long-term contracts in the presence of imperfect spot market. Omega 2015, 52, 42–52. [Google Scholar] [CrossRef]

- Merzifonluoglu, Y. Risk-averse supply portfolio selection with supply, demand and spot market volatility. Omega 2015, 57, 40–53. [Google Scholar] [CrossRef]

- Simchi-Levi, D.; Kaminsky, P.; Simchi-Levi, E. Designing and Managing the Supply Chain: Concepts, Strategies and Case Studies, 3rd ed.; McFraw-Hill Education: NewYork, NY, USA, 2008. [Google Scholar]

- McKinsey & Company. A Balancing Act: How Trucking Companies Can Find the Optimal Spot-Contract Mix. White Paper. 2023. Available online: https://www.mckinsey.com/industries/logistics/our-insights/a-balancing-act-how-trucking-companies-can-find-the-optimal-spot-contract-mix (accessed on 5 November 2024).

- Hou, J. Backup souring with capacity reservation under uncertain disruption risk and minimum order quantity. Comput. Ind. Eng. 2017, 103, 216–226. [Google Scholar] [CrossRef]

- Corbos, R.-A.; Bunea, O.-I.; Jiroveanu, D.-C. The effects of strategic procurement 4.0 performance on organizational competitiveness in the circular economy. Logistics 2023, 7, 13. [Google Scholar] [CrossRef]

- Kull, T.J.; Ellis, S.C. Coping with dependence: A logistics strategy based on interorganizational learning for managing supply chain disruption risks. J. Bus. Logist. 2016, 37, 346–364. [Google Scholar] [CrossRef]

- Cachon, G.P. Handbooks in Operations Research and Management Science: Chapter 6; Supply Chain Management: North Holland/Amsterdam, The Nederland, 2003; pp. 229–340. [Google Scholar]

- Lariviere, M.A.; Porteus, E.L. Selling to the newsvendor: An analysis of price-only contracts. Manuf. Serv. Oper. Manag. 2001, 3, 293–305. [Google Scholar] [CrossRef]

- Li, L.; Liu, K. Coordination contract design for the newsvendor model. Eur. J. Oper. Res. 2019, 283, 380–389. [Google Scholar] [CrossRef]

- Lu, F.; Zhang, X.; Tang, W. Wholesale price contract versus consignment contract in a supply chain considering dynamic advertising. Int. Trans. Oper. Res. 2019, 26, 1977–2003. [Google Scholar] [CrossRef]

- Liu, C.; Letchford, A.N.; Svetunkov, I. Newsvendor problems: An integrated method for estimation and optimization. Eur. J. Oper. Res. 2022, 300, 590–601. [Google Scholar] [CrossRef]

- Zhao, Y.; Wang, S.; Cheng, T.C.E.; Yang, X.; Huang, Z. Coordination of supply chains by option contracts: A cooperative game theory approach. Eur. J. Oper. Res. 2010, 207, 668–675. [Google Scholar] [CrossRef]

- Köle, H.; Bakal, I.S. Value of information through options contract under disruption risk. Comput. Ind. Eng. 2017, 103, 85–97. [Google Scholar] [CrossRef]

- Basu, P.; Liu, Q.; Stallaert, J. Supply chain management using put option contracts with information asymmetry. Int. J. Prod. Res. 2019, 57, 1772–1796. [Google Scholar] [CrossRef]

- Wang, Q.; Liu, X.; Liu, Z.; Xiang, Q. Option-based supply contracts with dynamic information sharing mechanism under the background of smart factory. Int. J. Prod. Econ. 2020, 220, 107458. [Google Scholar] [CrossRef]

- Meng, Q.; Kao, Z.; Guo, Y.; Bao, C. An emergency supplies procurement strategy based on a bidirectional option contract. Socio-Econ. Plan. Sci. 2023, 87, 101515. [Google Scholar] [CrossRef]

- Wang, Q.; Tsao, D.B. Supply contract with bidirectional options: The buyer’s perspective. Int. J. Prod. Econ. 2006, 101, 30–52. [Google Scholar] [CrossRef]

- Chen, X.; Shen, Z.J. An analysis of a supply chain with options contracts and service requirements. IIE Trans. 2012, 44, 805–819. [Google Scholar] [CrossRef]

- Hu, B.; Chen, X.; Chan, F.T.S.; Meng, C. Portfolio procurement policies for budget-constrained supply chains with option contracts and external financing. J. Ind. Manag. Optim. 2018, 14, 1105–1122. [Google Scholar] [CrossRef]

- Xu, J.; Feng, G.; Chin, K.-S.; Jiang, W. Supply chain decisions and coordination in the presence of an imperfect spot market. J. Manag. Sci. Eng. 2023, 8, 32–48. [Google Scholar] [CrossRef]

- Kleindorfer, P.R.; Wu, D.J. Integrating Long-and short-term contracting via business-to-business exchanges for capital-intensive industries. Manag. Sci. 2003, 49, 1597–1615. [Google Scholar] [CrossRef]

- Fu, Q.; Zhou, S.X.; Chao, X.; Lee, C.Y. Combined pricing and portfolio option procurement. Prod. Oper. Manag. 2012, 21, 361–377. [Google Scholar] [CrossRef]

- Zhao, Y.; Choi, T.M.; Cheng, T.C.E.; Wang, S. Supply option contracts with spot market and demand information updating. Eur. J. Oper. Res. 2018, 266, 1062–1071. [Google Scholar] [CrossRef]

- Hou, X.; Xu, X.; Chen, H. Optimal ordering policy for supply option contract with spot market. Math. Probl. Eng. 2020, 1, 6672088. [Google Scholar] [CrossRef]

- Mathur, P.P.; Shah, J. Supply chain contracts with capacity investment decision: Two-way penalties for coordination. Int. J. Prod. Econ. 2008, 114, 56–70. [Google Scholar] [CrossRef]

- Tao, Z.J.; Koo, P.H. A coordinated supply contract for a two-echelon supply chain considering learning effects. Appl. Sci. 2024, 14, 14041513. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).