The Need for Systems Awareness to Support Early-Phase Decision-Making—A Study from the Norwegian Energy Industry

Abstract

:1. Introduction

2. Background

2.1. The Norwegian Oil and Gas Industry

- From Capital Expenditures to Total Cost of Ownership. Traditionally, the industry’s focus has been on Capital Expenditures (CAPEX), that is, the cost of producing the system and commissioning it for operation. However, since the downturn, the focus has shifted towards the Total Cost of Ownership (TCO), including the Operational Expenditures (OPEX), which is the cost of operating the system through its life cycle.

- New business models and joint ventures. The subsea systems consist of the subsea production systems (SPS) and subsea umbilicals, risers, and flowlines (SURF). Traditionally, there has been a split between the contracts on SPS and SURF. Following the downturn, the suppliers have formed alliances and joint ventures to concentrate the market and reduce competition [13].

- Energy transition. The oil and gas industry plays an integral part in meeting the goals of reducing greenhouse gas emissions. All actors in the industry face increasing demands to clarify the implications of energy transitions for their operations and business models and explain the contributions they can make to achieving the goals of the Paris Agreement [14].

2.2. Systems Engineering in the Oil and Gas Industry

2.3. Clarification of Terms

3. Literature

3.1. Concept Evaluation in Early Phase of Oil and Gas Field Development

3.2. Challenges of Decision-Making in Early Phase of Multi-Disciplinary Projects

3.3. Use of Systems Engineering Approaches in Early Phase of Subsea Industry

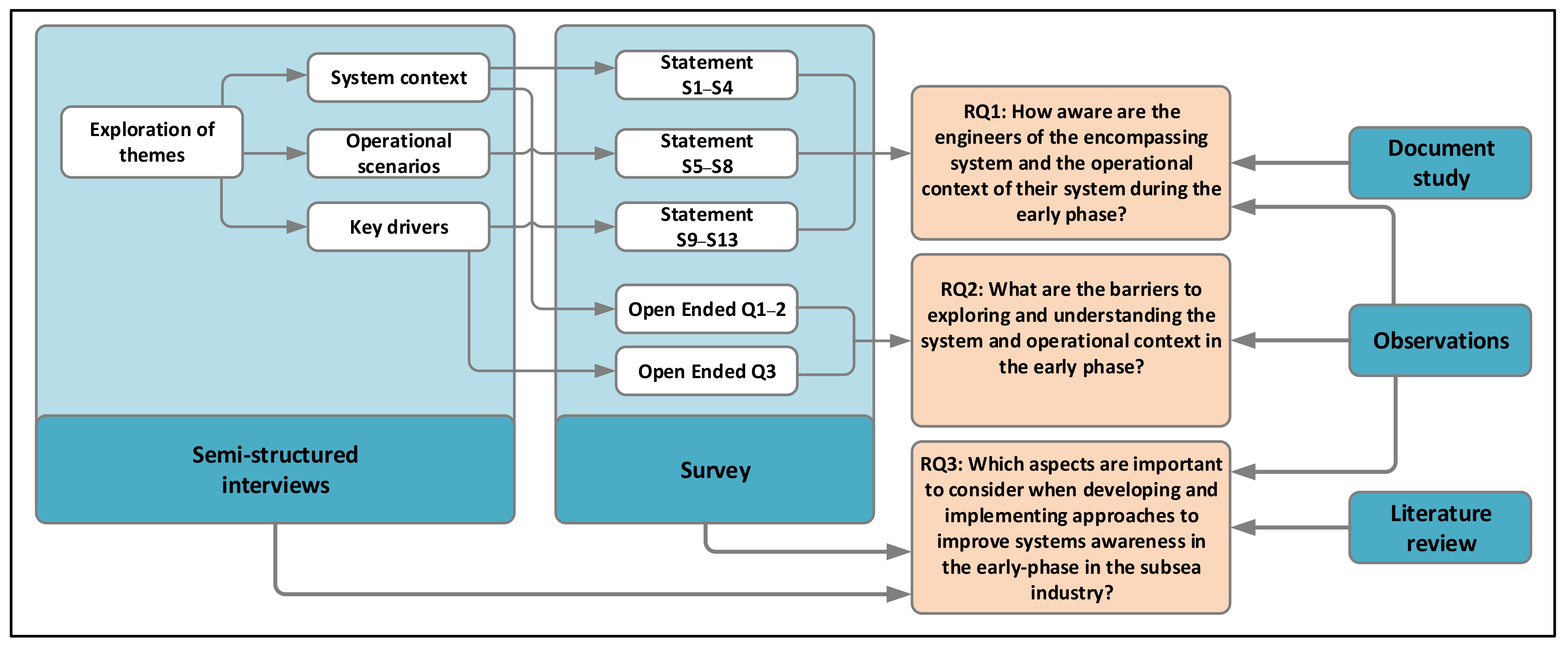

4. Research Method

4.1. Semi-Structured Interviews

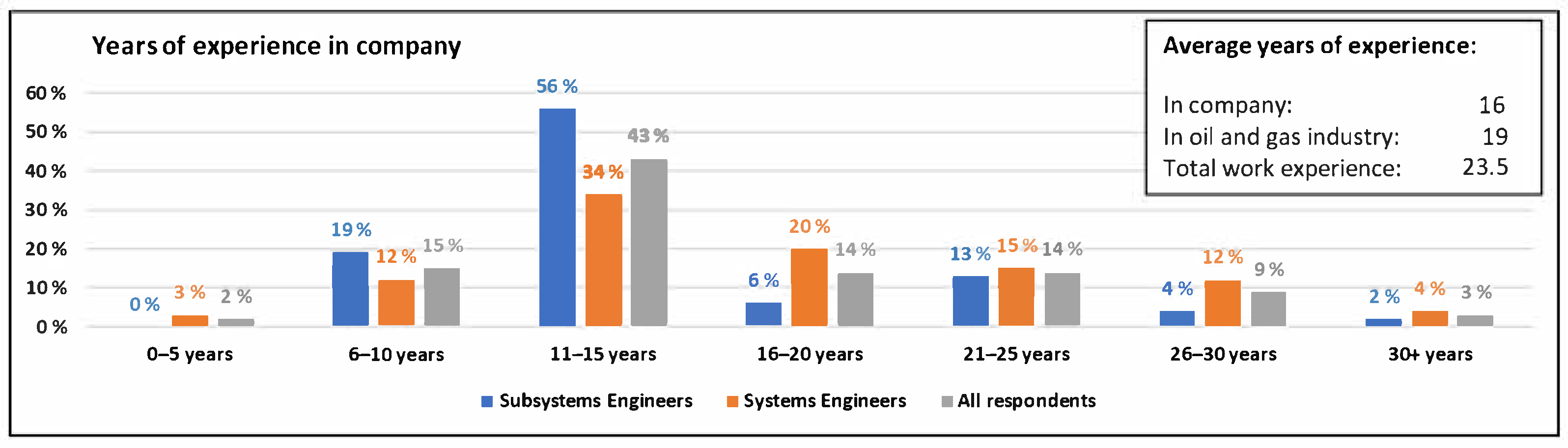

4.2. Survey

4.3. Literature Review

4.4. Observations and Document Study

4.5. Limitation of Research and Validity of Data

5. Results

5.1. Systems Awareness

5.1.1. System Context

5.1.2. Operational Scenarios

5.1.3. Key Driver Awareness

- An external key driver is the most important need of the customer,

- An internal key driver is the most important need of the company.

5.2. Barriers for Systems Awareness

5.2.1. Coding to Identify Barriers

5.2.2. Lack of a Holistic Mindset

“I have the feeling that we have had a too long period with silo thinking, and products and subsystems have too low focus on integrations into a total system.”Specialist System Engineer, 15+ years of experience

“Sometimes it is difficult to communicate the system perspective.”System Engineer, 10+ years of experience

5.2.3. Challenge of Balancing Internal and External Key Drivers

“We have a strong focus in proposing Solution X without considering the needs and drivers from the customers. This Solution X is not necessarily suitable for the customer and can cause a conflict in the choice of solution.”Chief Engineer, 25+ years of experience

“Parameters affecting the drivers are often buried in a number of specifications referencing other specifications. Often there are conflicting requirements. Clarifications are done early but do not always capture all.”System Engineer, 13 years of experience

5.2.4. Organizational Factors

5.2.5. System and Operational Knowledge

“We are far more fragmented than before. The number of people that know the overall system is decreasing.”Chief Engineer, 35+ years of experience

5.3. Challenges with Existing Tools and Work Processes in Early Phase

6. Discussion

7. Conclusions

Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Category | Sub-Categories |

|---|---|

| Lack of a holistic mindset | Lack of contextual/overall focus Lack of focus on systems understanding Focus on subsystems/parts Need for more system thinking |

| Balancing internal and external key drivers | Challenges related to strategy Conflicting interest in company Lack of customer focus Balance of internal and external needs |

| Organizational factors | Distribution of personnel geographically Distribution of personnel in organization Technical silos Poor manning |

| Lack of system knowledge | Detailed focus Subsystem and part knowledge Too few know the overall system |

| Availability of operational knowledge | Availability of data Lack of focus on operational knowledge Poor knowledge transfer between phases |

| Statement | NPS All Respondents | NPS Systems Engineer | NPS Subsystems Engineer |

|---|---|---|---|

| S1—We understand the context of our system in operation | 37 | 36 | 38 |

| S2—We understand how our system affects the other systems in operation | −10 | −7 | −14 |

| S3—We understand how the other systems in operation affect our system | −27 | −26 | −29 |

| S4—We have sufficient focus on the system context | −21 | −15 | −31 |

| S5—We have sufficient focus on the commissioning scenarios | −72 | −66 | −81 |

| S6—We have sufficient focus on the installation scenarios | −34 | −33 | −34 |

| S7—We have sufficient focus on the operational scenarios | −49 | −47 | −55 |

| S8—We have sufficient focus on flow assurance scenarios | −14 | 0 | −42 |

| S9—We have sufficient focus on the external key drivers | −32 | −30 | −36 |

| S10—We have sufficient focus on the internal key drivers | −21 | −16 | −30 |

| S11—We understand how the internal key drivers affect the proposed system | −19 | −13 | −30 |

| S12—We understand how the external key drivers affect the proposed system | −33 | −25 | −42 |

| S13—We are good at balancing the internal and external key drivers | −60 | −62 | −57 |

References

- Gonzales, J.S. Cost-Cutting as and Innovation Driver Among Suppliers During an Industry Downturn. In Petroleum Industry Transformation: Lessons from Norway and Beyond; Thune, T., Engen, O.A., Wicken, O., Eds.; Routledge: Oxfordshire, UK, 2018; pp. 70–83. [Google Scholar] [CrossRef]

- Honour, E.C. Systems Engineering Return on Investment. INCOSE Int. Symp. 2014, 20, 1422–1439. [Google Scholar] [CrossRef]

- Rechtin, E.; Maier, M. The Art of Systems Architecting, 2nd ed.; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar] [CrossRef]

- Crawley, E.; Week, O.L.D.; Eppinger, S.D.; Magee, C.; Moses, J.; Seering, W.; Schindall, J.; Wallace, D.; Whitney, D. The Influence of Architecture in Engineering Systems. MIT Eng. Syst. Monogr. 2004, 1, 1–24. [Google Scholar]

- Maier, M.W. Architecting a Portfolio of Systems. Syst. Eng. 2019, 22, 335–347. [Google Scholar] [CrossRef]

- Tranøy, E.; Muller, G. Reduction of Late Design Changes Through Early Phase Need Analysis. INCOSE Int. Symp. 2014, 24, 570–582. [Google Scholar] [CrossRef]

- Allaverdi, D.; Browning, T.R. A Methodology for Identifying Flexible Design Opportunities in Large-Scale Systems. Syst. Eng. 2020, 23, 534–556. [Google Scholar] [CrossRef]

- Dahmann, J.; Baldwin, K. Implications of Systems of Systems on System Design and Engineering. In Proceedings of the 2011 6th International Conference on System of Systems Engineering, Albuquerque, NM, USA, 27–30 June 2011; pp. 131–136. [Google Scholar] [CrossRef]

- Muller, G. Are Stakeholders in the Constituent Systems SoS Aware? Reflecting on the Current Status in Multiple Domains. In Proceedings of the 2016 11th System of Systems Engineering Conference (SoSE), Kongsberg, Norway, 12–16 June 2016; pp. 1–5. [Google Scholar] [CrossRef]

- INCOSE. System Engineering Handbook-A Guide for System Life Cycle Process and Activities, 4th ed.; Walden, D.D., Roedler, G.J., Forsberg, K., Hamelinn, K., Shortell, T., Eds.; Wiley: Hoboken, NJ, USA, 2015. [Google Scholar] [CrossRef]

- Ssb.No. Så Mye har Petroleumsinntektene Falt. Available online: https://www.ssb.no/offentlig-sektor/artikler-og-publikasjoner/fall-i-petroleumsinntektene (accessed on 2 April 2021).

- OG21. G21 TTA4 Report Subsea Cost Reduction. 2015. Available online: https://www.og21.no/contentassets/f826df43db324d79b148a14cfcf912c4/tta4-subsea-cost-report.pdf (accessed on 2 April 2021).

- Rystad Energy. Offshore Review Subsea Market. Available online: https://www.rystadenergy.com/newsevents/news/press-releases/offshore-review-subsea-market/ (accessed on 3 January 2020).

- International Energy Agency. The Oil and Gas Industry in Energy Transitions. 2020. Available online: https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions (accessed on 15 April 2021).

- Engen, S.; Falk, K. Application of a System Engineering Framework to the Subsea Front-End Engineering Study. INCOSE Int. Symp. 2018, 28, 79–95. [Google Scholar] [CrossRef]

- Haugland, R.S.; Engen, S. Application of A3 Architecture Overviews in Subsea Front-End Engineering Studies: A Case Study. INCOSE Int. Symp. 2021. accepted. [Google Scholar]

- Helle, K.; Engen, S.; Falk, K. Towards Systemic Handling of Requirements in the Oil and Gas Industry–A Case Study. INCOSE Int. Symp. 2020, 30, 1–17. [Google Scholar] [CrossRef]

- Mjånes, J.O.; Haskins, C.; Piciaccia, L.A. Closing the Loop for Lifecycle Product Management in Norwegian Subsea Systems. INCOSE Int. Symp. 2013, 23, 490–501. [Google Scholar] [CrossRef]

- Kauppinen, M.; Vartiainen, M.; Kontio, J.; Kujala, S.; Sulonen, R. Implementing Requirements Engineering Processes throughout Organizations: Success Factors and Challenges. Inf. Softw. Technol. 2004, 46, 937–953. [Google Scholar] [CrossRef]

- Chami, M.; Bruel, J. A Survey on MBSE Adoption Challenges. In Proceedings of the INCOSE EMEA Sector Systems Engineering Conference (INCOSE EMEASEC 2018), Berlin, Germany, 5–7 November 2018. [Google Scholar]

- Muller, G.; Falk, K. What Can (Systems of) Systems Engineering Contribute to Oil and Gas ? An Illustration with Case Studies from Subsea. In Proceedings of the 13th IEEE Annual Conference on System of Systems Engineering (SoSE), Paris, France, 18–22 June 2018; pp. 629–635. [Google Scholar] [CrossRef]

- Leffler, W.L.; Pattarozzi, R.; Sterling, G. Deepwater Petroleum Exploration & Production: A Nontechnical Guide, 2nd ed.; PennWell Corporation: Tulsa, OK, USA, 2011. [Google Scholar]

- Santos, S.M.G.; Gaspar, A.T.F.S.; Schiozer, D.J. Managing Reservoir Uncertainty in Petroleum Field Development: Defining a Flexible Production Strategy from a Set of Rigid Candidate Strategies. J. Pet. Sci. Eng. 2018, 171, 516–528. [Google Scholar] [CrossRef]

- Angert, P.F.; Isebor, O.; Litvak, M. Early Life Cycle Field Development Optimization of a Complex Deepwater Gulf of Mexico Field. Presented at the Offshore Technology Conference, Rio de Janeiro, Brazil, 4–6 October 2011. OTC-22252-MS. [Google Scholar] [CrossRef]

- Bratvold, R.B.; Begg, S.H. I Would Rather Be Vaguely Right than Precisely Wrong: A New Approach to Decision Making in the Petroleum Exploration and Production Industry. AAG Bull. 2008, 92, 1373–1392. [Google Scholar] [CrossRef]

- Valbuena, G. Decision Making Process-A Value-Risk Trade-off Practical Applications in the Oil & Gas Industry. Management 2013, 3, 142–151. [Google Scholar] [CrossRef]

- Allaverdi, D.; Herberg, A.; Lindemann, U. Identification of Flexible Design Opportunities (FDO) in Offshore Drilling Systems by Market Segmentation. In Proceedings of the DESIGN 2014 13th International Design Conference, Dubrovnik, Croatia, 19–22 May 2014; pp. 1451–1462. [Google Scholar]

- Åslie, Ø.J.-C.; Falk, K. Exploring the Concept Selection Process in Subsea Field Development Projects. Annu. Conf. Syst. Syst. Eng. 2021, accepted. [Google Scholar]

- Pugh, S. Total Design: Integrated Methods for Successful Product Engineering; Addison-Wesley: Cornwall, UK, 1990. [Google Scholar]

- Saaty, T.L. How to Make a Decision: The Analytic Hierarchy Process. Interfaces 1994, 24, 19–43. [Google Scholar] [CrossRef] [Green Version]

- Broniatowski, D.A. Do Design Decisions Depend on “Dictators”? Res. Eng. Des. Vol. 2018, 29, 67–85. [Google Scholar] [CrossRef]

- Yasseri, S. Subsea Technologies Selection Using Analytic Hierarchy Process. Underw. Technol. 2012, 30, 151–164. [Google Scholar] [CrossRef]

- Rodriguez-Sanchez, J.E.; Godoy-Alcantar, J.M.; Ramirez-Antonio, I. Concept Selection for Hydrocarbon Field Development Planning. Engineering 2012, 4, 794–808. [Google Scholar] [CrossRef] [Green Version]

- Lønmo, L.; Muller, G. Concept Selection-Applying Pugh Matrices in the Subsea Processing Domain. INCOSE Int. Symp. 2014, 24, 583–598. [Google Scholar] [CrossRef] [Green Version]

- Solli, H.; Muller, G. Evaluation of Illustrative ConOps and Decision Matrix as Tools in Concept Selection. INCOSE Int. Symp. 2016, 26, 2361–2375. [Google Scholar] [CrossRef]

- Muller, G. A Multi-View Method for Embedded Systems Architecting; Balancing Genericity and Specificity; Technische Universiteit Delf: Delft, The Netherlands, 2004. [Google Scholar]

- Topcu, T.G.; Mesmer, B.L. Incorporating End-User Models and Associated Uncertainties to Investigate Multiple Stakeholder Preferences in System Design. Res. Eng. Des. 2018, 29, 411–431. [Google Scholar] [CrossRef]

- Griendling, K.; Salmon, J.; Mavris, D. Elements of a Decision-Making Framework for Early- Phase System of Systems Acquisition. In Proceedings of the 2012 IEEE International Systems Conference SysCon, Vancouver, BC, Canada, 19–22 March 2012; pp. 1–8. [Google Scholar] [CrossRef]

- Borches Juzgado, P.D. A3 Architecture Overviews. A Tool for Effective Communication in Product Evolution. Ph.D. Thesis, University of Twente, Enschede, The Netherlands, 2010. [Google Scholar] [CrossRef] [Green Version]

- Boucher, M.; Houlihan, D. System Design: New Product Development for Mechatronics; Aberdeen Group: Boston, MA, USA, 2008. [Google Scholar]

- Tomiyama, T.; D’amelio, V.; Urbanic, J.; Elmaraghy, W. Complexity of Multi-Disciplinary Design. CIRP Ann. 2007, 56, 185–188. [Google Scholar] [CrossRef]

- Heemels, W.P.M.H.; Van De Waal, E.H.; Muller, G.J. A Multi-Disciplinary and Model-Based Design Methodology for High-Tech Systems. In Proceedings of the 2006 Conference on Systems Engineering Research (CSER), Los Angeles, CA, USA, 7–8 April 2006. [Google Scholar]

- Delicado, B.A.; Salado, A.; Mompó, R. Conceptualization of a T-Shaped Engineering Competency Model in Collaborative Organizational Settings: Problem and Status in the Spanish Aircraft Industry. Syst. Eng. 2018, 21, 534–554. [Google Scholar] [CrossRef]

- McLachlan, D. Systems Thinking to Value Protection. In Proceedings of the Offshore Technology Conference, Houston, TX, USA, 4–7 May 2020. [Google Scholar] [CrossRef]

- Muller, G.; Wee, D.; Moberg, M. Creating an A3 Architecture Overview; a Case Study in SubSea Systems. INCOSE Int. Symp. 2015, 25, 448–462. [Google Scholar] [CrossRef]

- Frøvold, K.; Muller, G.; Pennotti, M. Applying A3 Reports for Early Validation and Optimization of Stakeholder Communication in Development Projects. INCOSE Int. Symp. 2017, 27, 322–338. [Google Scholar] [CrossRef]

- Løndal, S.; Falk, K. Implementation of A3 Architectural Overviews in Lean Product Development Teams—A Case Study in the Subsea Industry. INCOSE Int. Symp. 2018, 28, 1737–1752. [Google Scholar] [CrossRef]

- Boge, T.; Falk, K. A3 Architecture Views—A Project Management Tool? INCOSE Int. Symp. 2019, 29, 971–987. [Google Scholar] [CrossRef]

- Checkland, P.; Holwell, S. Action Research: Its Nature and Validity. Syst. Pract. Action Res. 1998, 11, 9–21. [Google Scholar] [CrossRef]

- Potts, C. Software-Engineering Research Revisited. IEEE Softw. 1993, 10, 19–28. [Google Scholar] [CrossRef]

- Likert, R. A Techniqe for the Measurement of Attitudes. Arch. Psychol. 1932, 22, 1–55. [Google Scholar]

- Reichheld, F.F. The One Number You Need to Grow. Harv. Bus. Review. 2003, 81, 46–55. [Google Scholar] [CrossRef]

- Valerdi, R.; Davidz, H.L. Emperical Research in System Engineering: Challanges and Opportunities of a New Frontier. Syst. Eng. 2009, 12, 169–181. [Google Scholar] [CrossRef]

- Engen, S.; Falk, K.; Muller, G. Conceptual Models to Support Reasoning in Early Phase Concept Evaluation-A Subsea Case Study. Annu. Conf. Syst. Syst. Eng. 2021. accepted. [Google Scholar]

| Role | Years of Experience in the Company |

|---|---|

| Specialist Field Development Engineer | 15+ |

| Specialist Field Development Engineer | 10+ |

| Senior Field Development Engineer | 30+ |

| Senior Field Development Engineer | 30+ |

| Senior Systems Engineer | 10+ |

| Specialist Systems Engineer | 15+ |

| Chief Engineer | 20+ |

| Group | Description |

|---|---|

| Systems Engineer | Systems engineers, engineering managers, and chief engineers from the field development organization. This group also includes systems engineers from technical disciplines involved in field development studies, including material, technical safety and reliability, and flow assurance |

| Subsystems Engineer | Systems engineers and lead engineers from the product organization with technical responsibility for subsystem level |

| Group | Invited | Reponses | Response Rate |

|---|---|---|---|

| Systems Engineer | 123 | 74 | 60% |

| Subsystems Engineer | 118 | 52 | 44% |

| Total | 241 | 126 | 52% |

| Case | Scope of Field Development Study | No. of Documents | Type of Documents |

|---|---|---|---|

| Case 1 | Concept for expansion of existing field outside coast of Norway. | 4 | Internal presentations, Study report, System drawings |

| Case 2 | Concept for subsea system for new field development outside of Canada. | 6 | Internal presentations, Customer presentation, Study report, System drawings |

| Case 3 | Concept for subsea system for new field development outside coast of Norway. | 4 | Study reports, System drawings |

| Potential Bias | Mitigating Actions |

|---|---|

| Questionnaire design | Pilot-testing questionnaire in two iterations: First with 2 external, second with 2 company employees to remove ambiguously and poorly worded questions. |

| The survey responses were collected for a brief period to reduce risk changes in the external environment during the survey. The survey was open in a total of 38 days. | |

| Sampling | Initial recruitment based on the organization chart. The group managers checked the recruitment group to ensure all relevant personnel were included. |

| Participants understand nature of research | Everyone who was invited to interviews and the survey received a mail presenting the research’s purpose before participating. Before recruiting, we also conducted face-to-face meetings or phone meetings with group managers to ensure clarity in the scope. |

| Internal validity | Use of triangulation to bypass personal bias of researchers. |

| ID | Question |

|---|---|

| Q1 | Do you have anything to add about the company’s focus on the context and interactions with the other systems, operators, and suppliers? |

| Q2 | Do you have anything to add about the system understanding in the company? |

| Q3 | Do you have any comments about the company’s understanding of key drivers or the balance between external and internal drivers? |

| Category | No of Comments |

|---|---|

| Lack of a holistic mindset | 27 |

| Balancing internal and external key drivers | 19 |

| Organizational factors | 13 |

| Lack of system knowledge | 11 |

| Availability of operational knowledge | 9 |

| ID | Quote |

|---|---|

| [A] | Time is often a limiting factor on how much we can consider [in the studies]. |

| [B] | If we have had 100% success in our studies, we could have documented better. However, when we don’t, when we lose many of the studies we perform, it is not justifiable to make so much documentation in early-phase. |

| [C] | Some of the tools have an extremely high user threshold, making it challenging to get into every time you need it. |

| [D] | We need to quickly get to a level that “it is good enough.” |

| [E] | I believe we need smaller tools, making it more lightweight and giving the possibility to skip some parts. |

| [F] | Often, we have too much functionality in tools, so they get too rigid that you no longer actually can use them. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Engen, S.; Falk, K.; Muller, G. The Need for Systems Awareness to Support Early-Phase Decision-Making—A Study from the Norwegian Energy Industry. Systems 2021, 9, 47. https://doi.org/10.3390/systems9030047

Engen S, Falk K, Muller G. The Need for Systems Awareness to Support Early-Phase Decision-Making—A Study from the Norwegian Energy Industry. Systems. 2021; 9(3):47. https://doi.org/10.3390/systems9030047

Chicago/Turabian StyleEngen, Siv, Kristin Falk, and Gerrit Muller. 2021. "The Need for Systems Awareness to Support Early-Phase Decision-Making—A Study from the Norwegian Energy Industry" Systems 9, no. 3: 47. https://doi.org/10.3390/systems9030047

APA StyleEngen, S., Falk, K., & Muller, G. (2021). The Need for Systems Awareness to Support Early-Phase Decision-Making—A Study from the Norwegian Energy Industry. Systems, 9(3), 47. https://doi.org/10.3390/systems9030047