Crude Oil Resources Under Climate Stringent Scenarios: Production Under Contract and Probabilistic Analyses of Exploratory Frontiers

Abstract

:1. Introduction

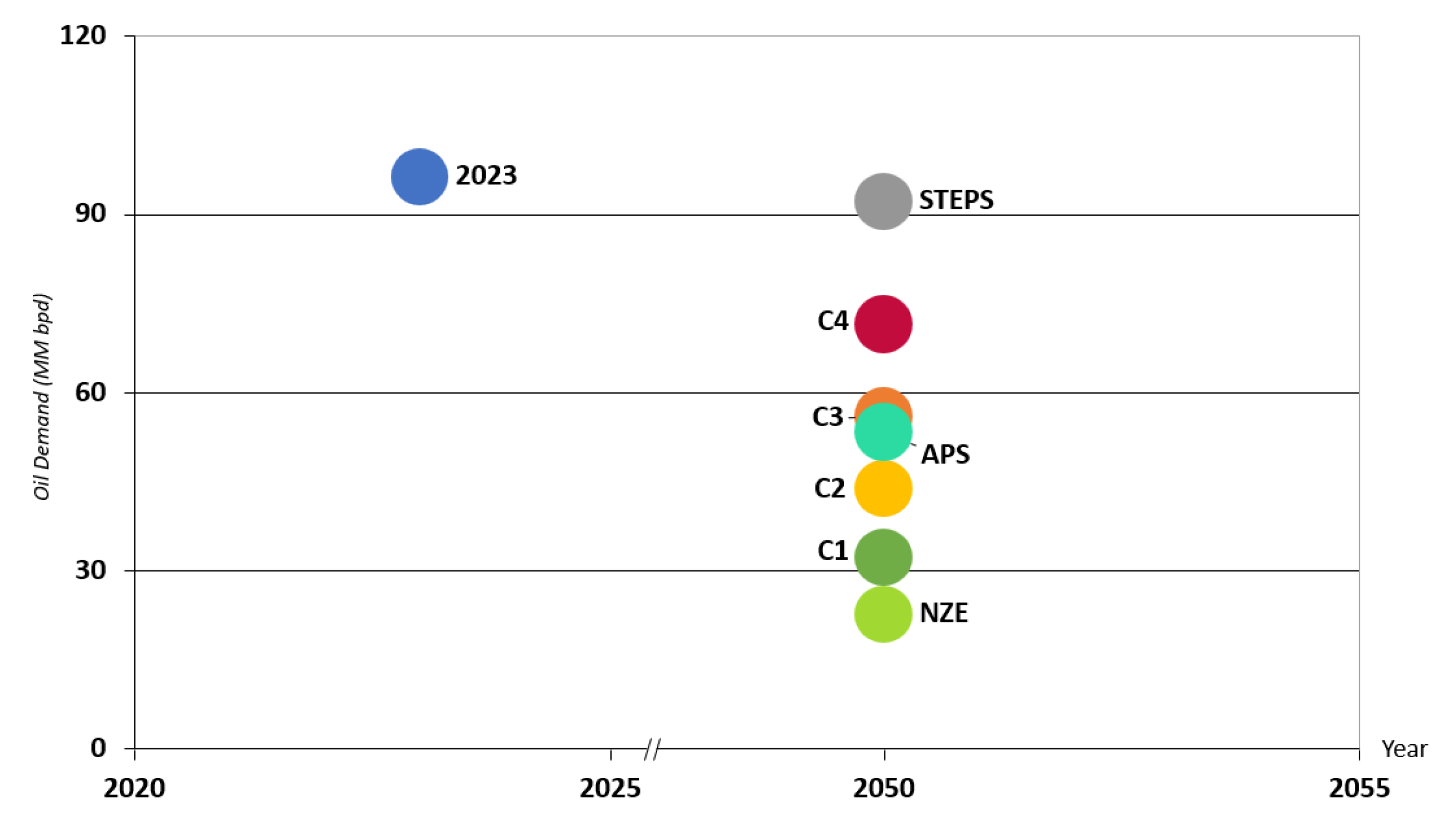

2. Oil Demand in IPCC and IEA Scenarios

3. Methodology

3.1. Contracted Production

- Field Type Category: Selected oil, gas, and gas condensate fields, excluding refinery gains.

- Oil and Gas Category: Included crude oil, condensate, and NGL.

- Life Cycle Category: Focused on assets currently in production, under development, or classified as discoveries.

- Year Filter: Selected data for 2030 and 2050.

3.1.1. Quality Classification

3.1.2. Cost Classification

3.1.3. Emission Intensity Classification

3.2. Exploratory Frontier

- 5.

- Stress Test or Robustness Test: The oil price projected for 2050 is applied uniformly across all years as a robustness test for long-term viability.

- 6.

- Simplified Price Trajectory: An interpolation between the 2023 oil price and the 2050 price projection creates a simplified trajectory for long-term analysis.

3.2.1. Modeling an Exemplary Offshore Project in Brazil

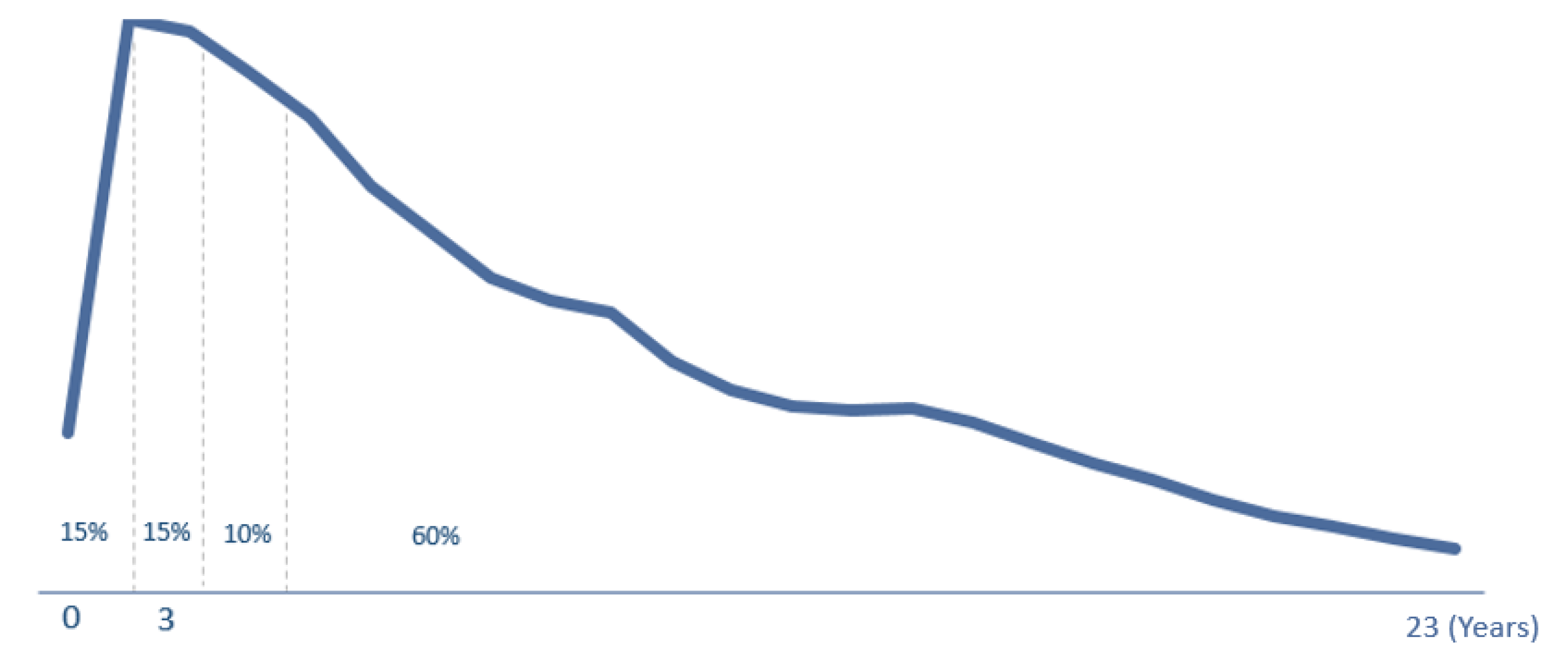

- Life Cycle: This simulation examines the project beginning at the development phase, excluding exploration, within a 27-year concession period [31,32]. Production is assumed to commence 5 years after the initial investment [32,33], with an economic cut-off occurring 23 years later [33]. Peak production is set at 150,000 barrels of oil per day (bpd), resulting in a cumulative production of 700 million barrels, based on the simulated production curve shown in Figure 1, where the peak output is achieved in the second year [33,34].

- Government Take: The applicable taxes in Brazil include income tax (34%), social contribution on net profit (9%), land occupancy tax (1% of gross revenue), royalties (10% of gross revenue), and special participation (SP). SP, calculated based on production levels, ranges from 0% to 40% of net revenue [35]. For simplicity, a constant rate of 30% was applied, reflecting the project’s large scale and production range.

- Hurdle Rate: Based on [36], the cost of capital for upstream projects in developing countries is 14.34% per annum. Adjusting for Brazil’s risk premium (5.19% per annum) results in a rate of 9.79% annually.

- Opex: Operating expenses were set at US$ 6 per barrel, consistent with [37] for pre-salt projects.

- Capex: An FPSO (floating production, storage, and offloading) unit with a 150,000-bpd capacity was assumed, with Capex set at US$ 4.75/boe. This value, calculated using Microsoft Excel’s solver tool, aligns the project’s breakeven price at US$ 30/bbl, making it US$ 5 more robust than the levels disclosed by [14,15] for long-term Brent resilience.

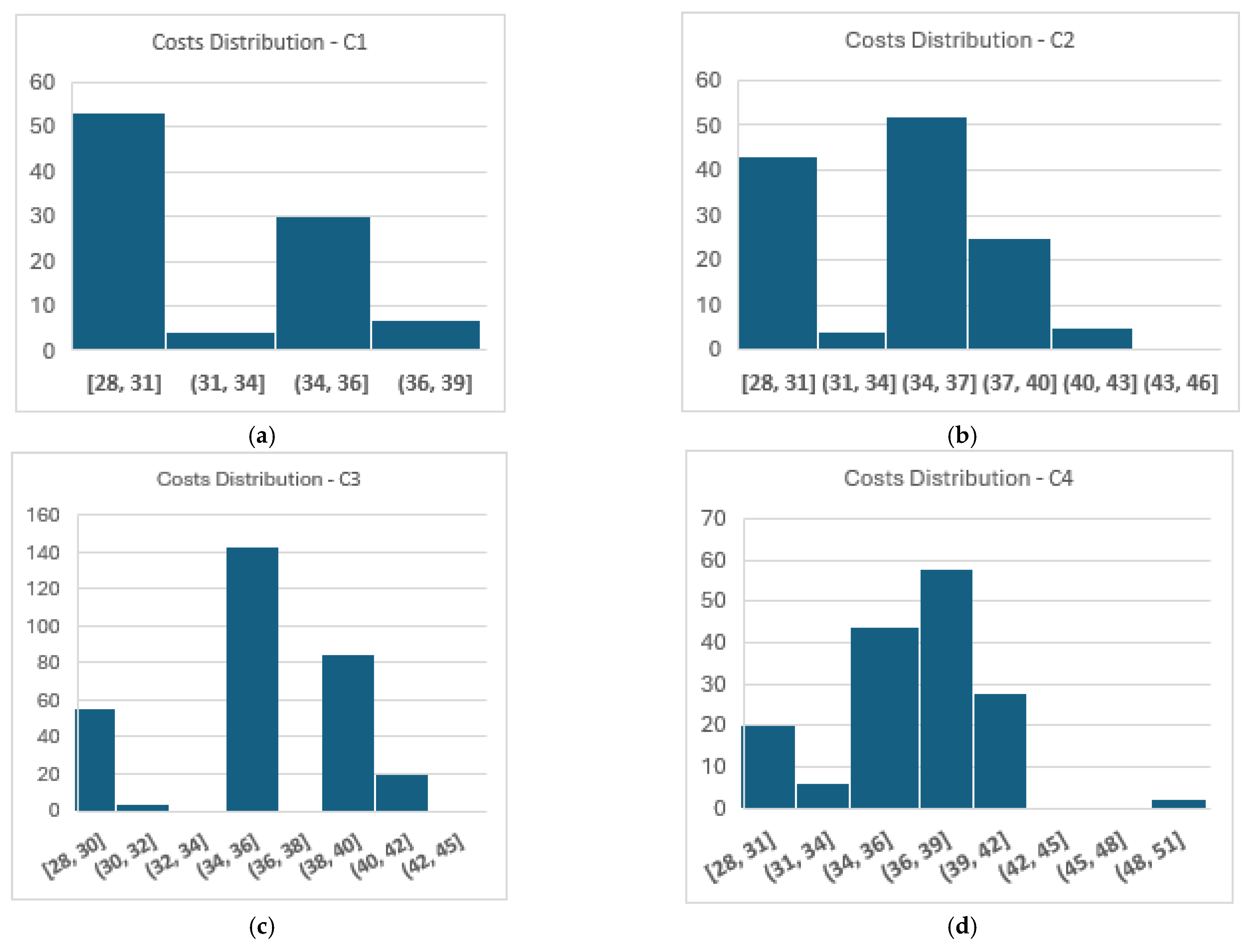

3.2.2. Oil Supply Curve by Production Cost

3.2.3. Marginal Cost of Production in 2050

3.2.4. Economic Analysis of the Project

4. Results and Discussion

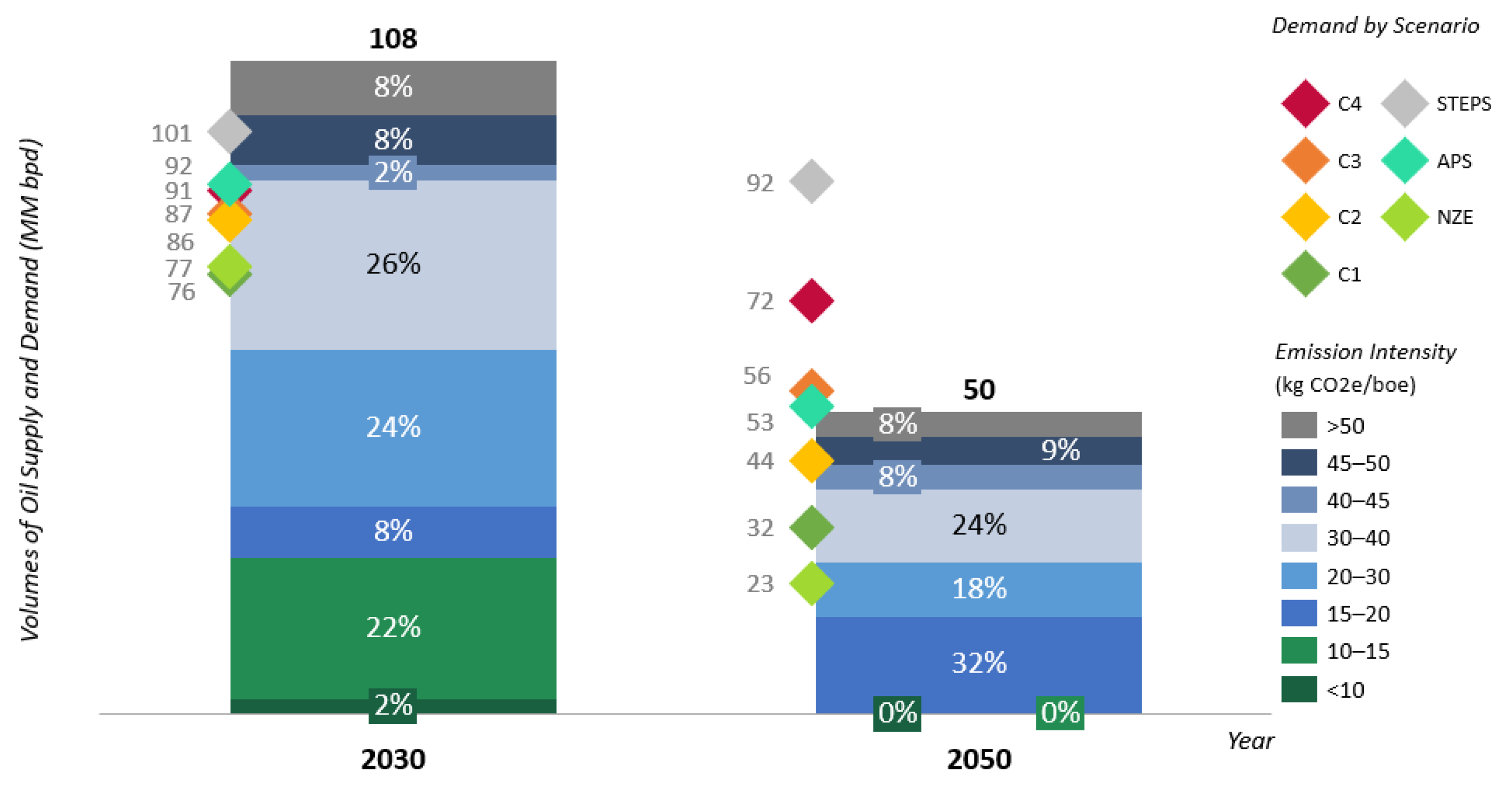

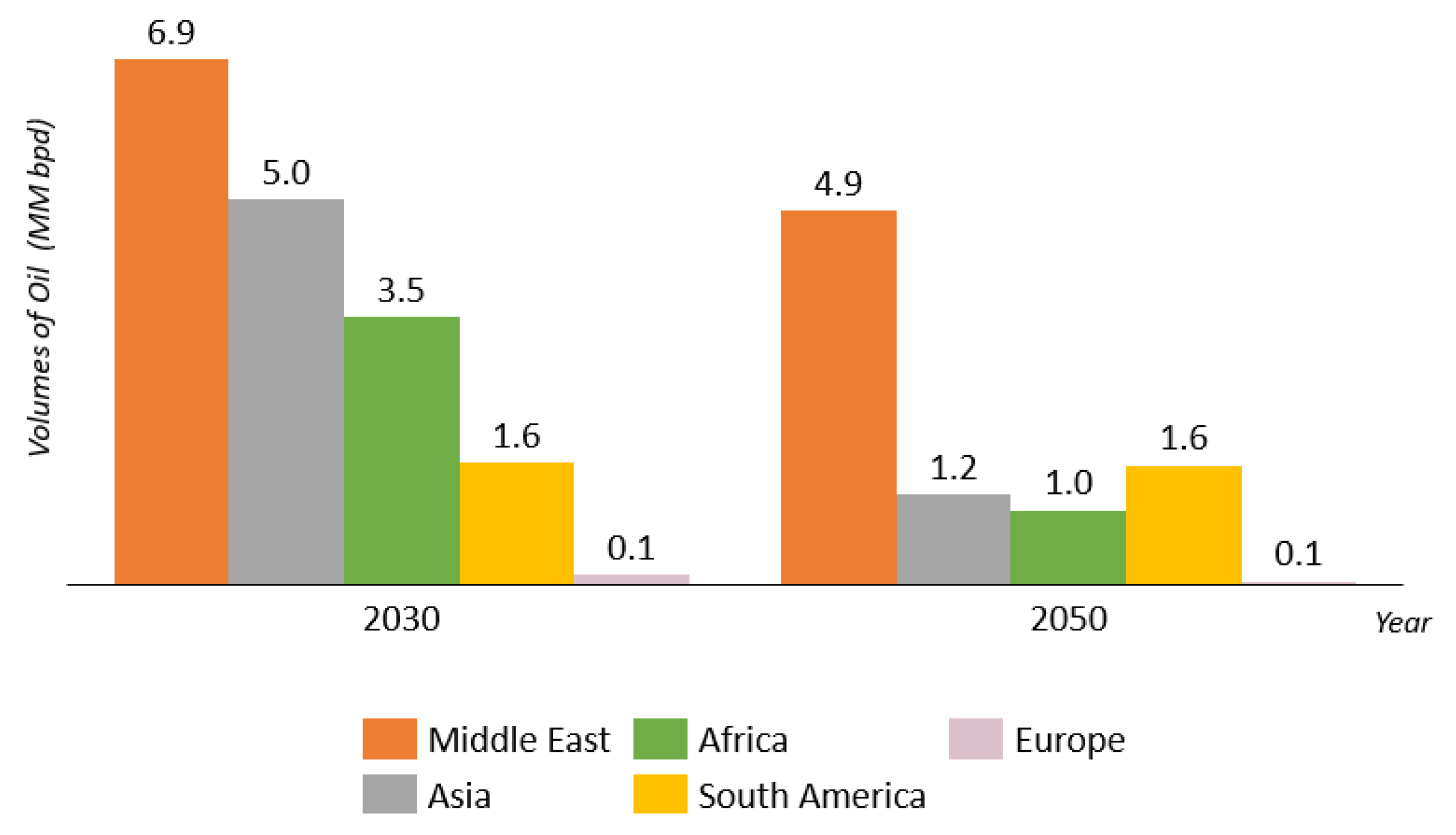

4.1. Implications of Climate Scenarios on Contracted Production

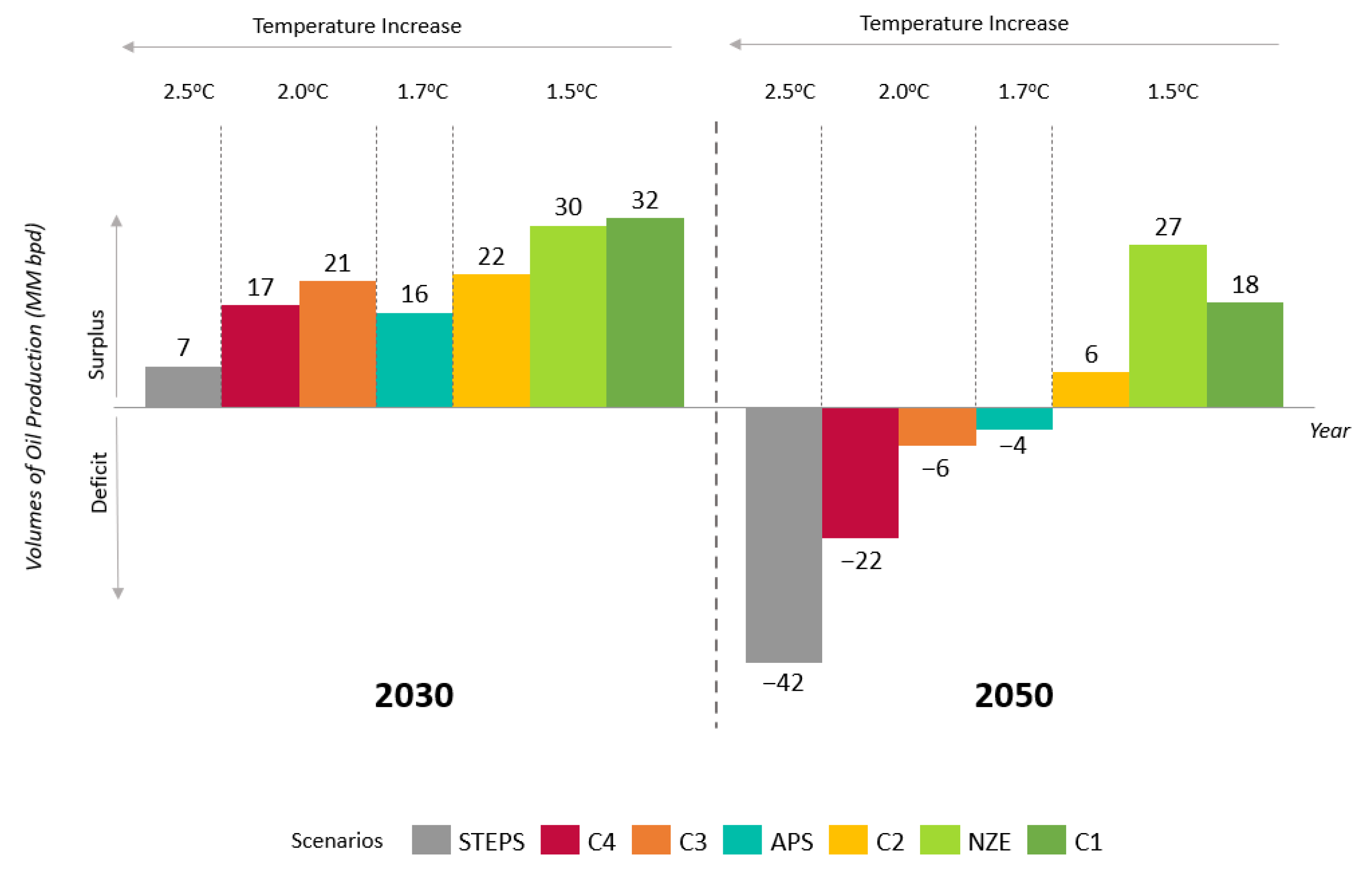

4.1.1. Supply Versus Demand Across Scenarios

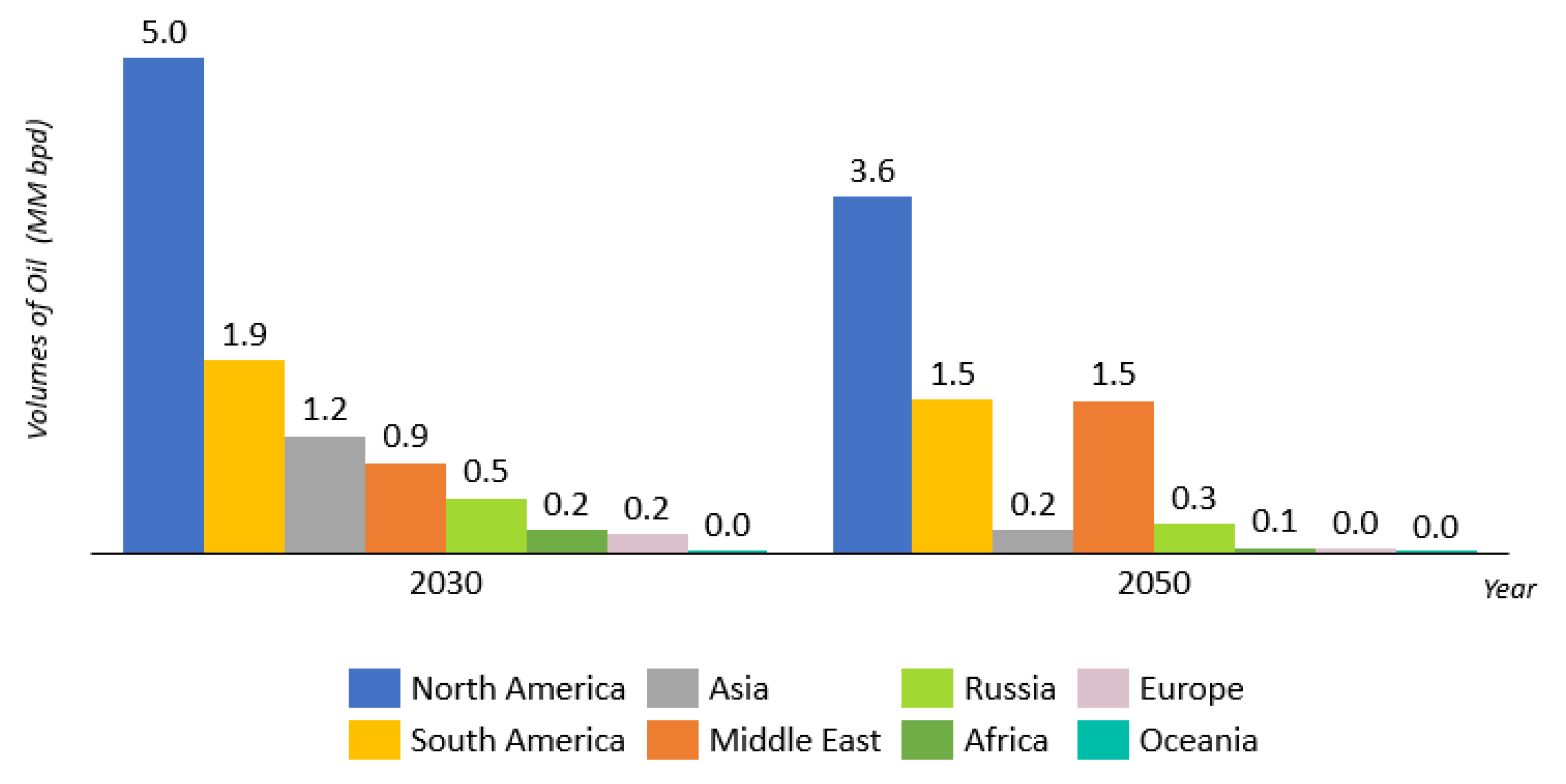

4.1.2. Oil Quality Analysis

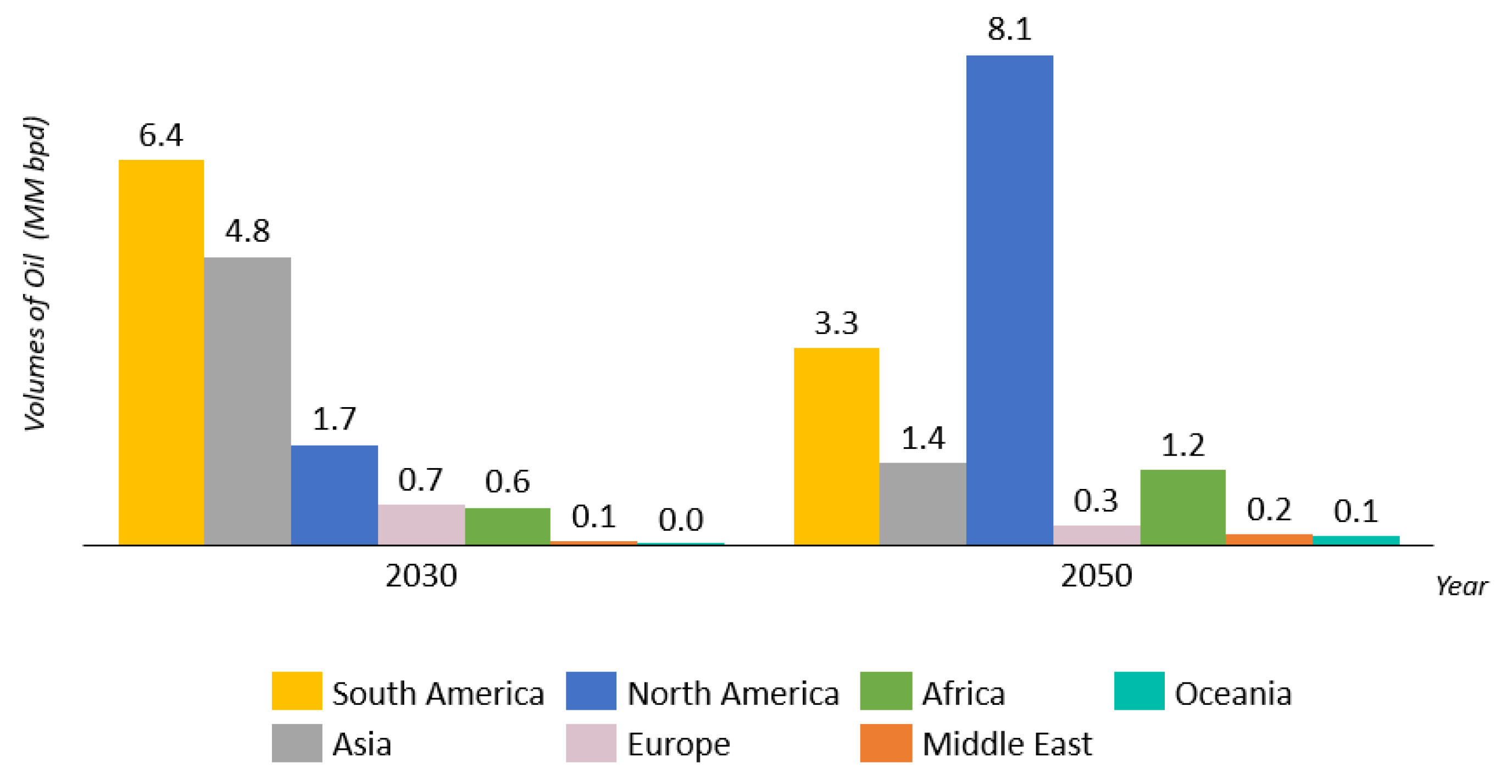

4.1.3. Analysis of Production Costs

4.1.4. Analysis of Greenhouse Gas Emission Intensity

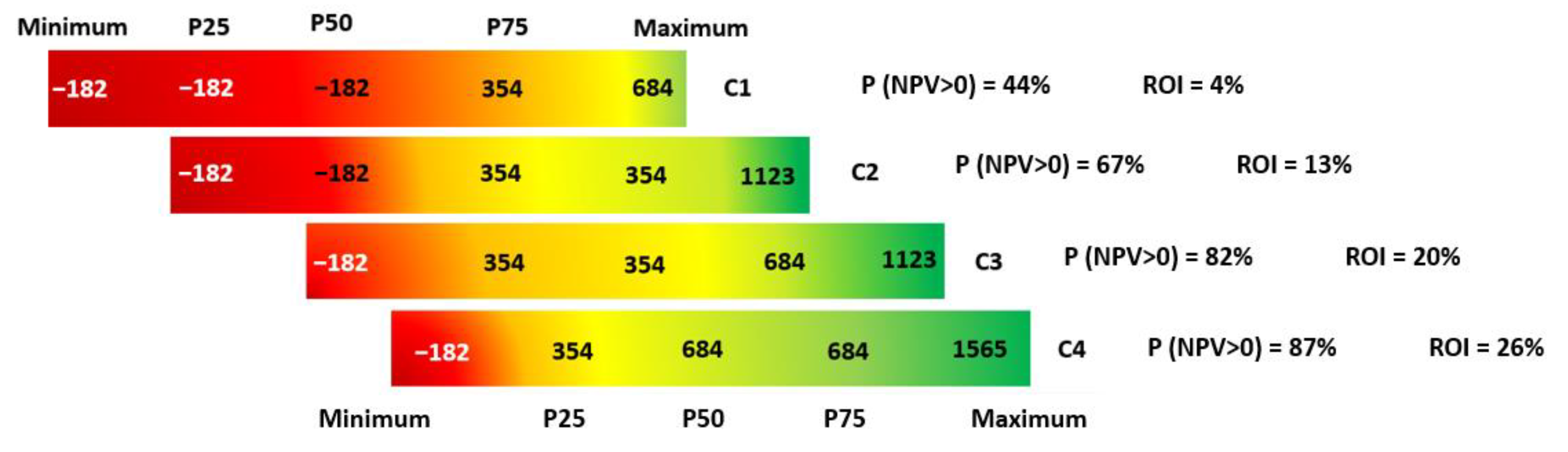

4.2. Implications of Climate Scenarios on the Feasibility of Developing an Exploratory Frontier

4.2.1. Implications of Scenarios on the Trajectory of Oil Prices

4.2.2. Implications on the Economic Results of the Upstream Project

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hubbert, M.K. Nuclear Energy and the Fossil Fuels; Shell Development Company, Exploration and Production Research Division: Houston, TX, USA, 1956. [Google Scholar]

- Campbell, C.J.; Laherrère, J.H. The End of Cheap Oil. Sci. Am. 1998, 278, 78–83. [Google Scholar] [CrossRef]

- Arps, J.J. Estimation of Primary Oil Reserves. Trans. AIME 1956, 207, 182–191. [Google Scholar]

- Al-Fattah, S.M. Non-OPEC conventional oil: Production decline, supply outlook and key implications. J. Pet. Sci. Eng. 2020, 189, 107049. [Google Scholar] [CrossRef]

- United Nations. COP28 Ends with Call to “Transitions Away” from Fossil Fuels; UN Chief Says Phaseout Is Inevitable. Available online: https://unsdg.un.org/latest/stories/cop28-ends-call-%E2%80%98transition-away%E2%80%99-fossil-fuels-un-chief-says-phaseout-inevitable (accessed on 24 June 2024).

- Davis, S.J.; Lewis, N.S.; Shaner, M.; Aggarwal, S.; Arent, D.; Azevedo, I.L.; Benson, S.M.; Bradley, T.; Brouwer, J.; Chiang, Y.-M.; et al. Net-zero emissions energy systems. Science 2018, 360, eaas9793. [Google Scholar] [CrossRef]

- IPCC. Summary for Policymakers. In Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC: Geneva, Switzerland, 2023. [Google Scholar]

- IEA. World Energy Outlook 2021; IEA: Paris, France, 2021. [Google Scholar]

- Green, F.; von Kursk, O.B.; Muttitt, G.; Pye, S. No new fossil fuel projects: The norm we need A social-moral norm against new fossil fuel projects has strong potential to contribute to achieving global climate goals. Science 2024, 384, 954–957. [Google Scholar] [CrossRef]

- Tienhaara, K.; Thrasher, R.; Simmons, B.A.; Gallagher, K.P. Investor-state disputes threaten the global green energy transition. Science 2022, 376, 701–703. [Google Scholar] [CrossRef]

- Welsby, D.; Price, J.; Pye, S.; Ekins, P. Unextractable fossil fuels in a 1.5 °C world. Nature 2021, 597, 230–234. [Google Scholar] [CrossRef]

- Sanchez, F.; Linde, L. Turning out the light: Criteria for determining the sequencing of countries phasing out oil extraction and the just transition implications. Clim. Policy 2023, 23, 1182–1196. [Google Scholar] [CrossRef]

- Coutinho, L.C.; Império, M.; Angelkorte, G.; da Silva, G.N.; Bergman-Fonte, C.; Draeger, R.; Cunha, B.S.L.; Rochedo, P.R.R.; Szklo, A.; Schaeffer, R. Climate strategies for oil and gas production under the lens of an Integrated Assessment Model: The case of Brazil. Int. J. Greenh. Gas Control 2024, 137, 104231. [Google Scholar] [CrossRef]

- Petrobras. Petrobras—Strategic Plan 2050 and Business Plan 2025–2029; Petrobras: Rio de Janeiro, Brazil, 2024. [Google Scholar]

- Equinor. Energy Transition Plan; Equinor: Stavanger, Norway, 2022. [Google Scholar]

- Exxon Mobil. Annual Report 2021; Exxon Mobil: Houston, TX, USA, 2022. [Google Scholar]

- McGlade, C.; Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 2015, 517, 187–190. [Google Scholar] [CrossRef]

- Draeger, R.; Cunha, B.S.L.; Müller-Casseres, E.; Rochedo, P.R.R.; Szklo, A.; Schaeffer, R. Stranded crude oil resources and just transition: Why do crude oil quality, climate ambitions and land-use emissions matter. Energy 2022, 255, 124451. [Google Scholar] [CrossRef]

- Naef, A. The impossible love of fossil fuel companies for carbon taxes. Ecol. Econ. 2024, 217, 108045. [Google Scholar] [CrossRef]

- Paletta, J.; Cunha, B.S.; Draeger, R.; Schaeffer, R.; Szklo, A. Stranded assets and compensation in oil and gas upstream projects: Conceptual and practical issues. Energy Clim. Change 2025, 6, 100178. [Google Scholar] [CrossRef]

- May, E.F.; Marsh, K.N.; Goodwin, A.R.H. Chapter 4—Frontier Oil and Gas: Deep-Water and the Arctic. In Future Energy, 2nd ed.; Letcher, T.M., Ed.; Elsevier: Boston, MA, USA, 2014; pp. 75–93. [Google Scholar]

- IPCC. Climate Change 2022—Mitigation of Climate Change; Cambridge University Press: Cambridge, UK, 2022. [Google Scholar]

- IEA. World Energy Outlook 2024; IEA: Paris, France, 2024. [Google Scholar]

- Energy Institute. Statistical Review of World Energy 2024; Energy Institute: Houston, TX, USA, 2024. [Google Scholar]

- Xu, T.; Tian, H.; Zhu, H.; Cai, J. China actively promotes CO2 capture, utilization and storage research to achieve carbon peak and carbon neutrality. Adv. Geo-Energy Res. 2022, 6, 1–3. [Google Scholar] [CrossRef]

- IEA. Carbon Capture, Utilisation and Storage; IEA: Paris, France, 2024. [Google Scholar]

- Wen, Z.; Wang, J.; Wang, Z.; He, Z.; Song, C.; Liu, X.; Zhang, N.; Ji, T. Analysis of the world deepwater oil and gas exploration situation. Pet. Explor. Dev. 2023, 50, 1060–1076. [Google Scholar] [CrossRef]

- Hallack, L.N.; Kaufmann, R.K.; Szklo, A. The effect of productivity and country risk on development in the Brazilian Pre-salt Province. Energy Sources Part B Econ. Plan. Policy 2019, 14, 80–97. [Google Scholar] [CrossRef]

- d’Almeida, K.S.; de Souza, M.F.F.; de Castro, N.O.; Vilela, P.C.; Leggieri, R.F.; Fernandes, R.F.; Cardoso, R.d.A. Exploratory Potential of the Brazilian Equatorial Margin. In Proceedings of the Paper presented at the Offshore Technology Conference Brasil, Rio de Janeiro, Brazil, 29–31 October 2019. [Google Scholar]

- Pindyck, R.; Rubinfeld, D. Microeconomy; São Paulo. 2007. Available online: https://novi.uciteljneznalica.org/PDF/arhiva%20autora/642_Pindyck,%20Robert,%20S,%20Rubinfeld,%20Daniel,%20L,%20Microeconomics%20(Prvi%20deo),%20Prentice-Hall,%202000.pdf (accessed on 28 January 2025).

- Palmeira Braga, L.; Bentes David, O. Why the unitization process is an important issue when dealing with the Brazilian Pre-salt Polygon. J. World Energy Law Bus. 2018, 11, 17–33. [Google Scholar] [CrossRef]

- Nogueira Hallack, L.; Salem Szklo, A.; Olímpio Pereira Júnior, A.; Schmidt, J. Curve-fitting variants to model Brazil’s crude oil offshore post-salt production. J. Pet. Sci. Eng. 2017, 159, 230–243. [Google Scholar] [CrossRef]

- ANP. Painéis Dinâmicos de Produção de Petróleo e Gás Natural; Agência Nacional do Petróleo, Gás Natural e Biocombustíveis: Rio de Janeiro, Brazil, 2024.

- Sällh, D.; Wachtmeister, H.; Tang, X.; Höök, M. Offshore oil: Investigating production parameters of fields of varying size, location and water depth. Fuel 2015, 139, 430–440. [Google Scholar] [CrossRef]

- ANP. Participações Governamentais. 2020. Available online: https://www.gov.br/anp/pt-br/canais_atendimento/imprensa/kits-de-imprensa-1/participacoes-governamentais (accessed on 8 January 2025).

- Damodaran, A. Damodaran on Line. Available online: https://pages.stern.nyu.edu/~adamodar/ (accessed on 8 January 2025).

- Petrobras. Deep Dive Petrobras 2024. Available online: https://www.investidorpetrobras.com.br/apresentacoes-relatorios-e-eventos/apresentacoes/ (accessed on 5 January 2025).

- EIA. U.S. Energy Information Administration. Short-Term Energy Outlook. Available online: https://www.eia.gov/outlooks/steo/ (accessed on 21 December 2024).

- Rystad Energy. Rystad Energy Cube Browser. Available online: https://www.rystadenergy.com/downloads (accessed on 21 December 2024).

- IEA. Emissions from Oil and Gas Operations in Net Zero Transitions; IEA: Paris, France, 2023. [Google Scholar]

- World Bank. Zero Routine Flaring by 2030 (ZRF) Initiative. Available online: https://www.worldbank.org/en/programs/zero-routine-flaring-by-2030/about#:~:text=Launched%20in%202015%2C%20the%20ZRF,by%2Dproduct%20of%20oil%20production (accessed on 5 January 2025).

- GMP. Global Methane Pledge. Available online: https://www.globalmethanepledge.org/ (accessed on 5 January 2025).

- IEA. The Oil and Gas Industry in Net Zero Transitions; IEA: Paris, France, 2023. [Google Scholar]

- Masnadi, M.S.; El-Houjeiri, H.M.; Schunack, D.; Li, Y.; Englander, J.G.; Badahdah, A.; Monfort, J.-C.; Anderson, J.E.; Wallington, T.J.; Bergerson, J.A.; et al. Global carbon intensity of crude oil production. Science 2018, 361, 851–853. [Google Scholar] [CrossRef]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investments; Yale University Press: New Haven, CT, USA, 2008. [Google Scholar]

- Mutavdzic, M.; Maybee, B. An extension of portfolio theory in selecting projects to construct a preferred portfolio of petroleum assets. J. Pet. Sci. Eng. 2015, 133, 518–528. [Google Scholar] [CrossRef]

- IPCC: Climate Change 2022: Impacts—Adaptation, and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. 2022. Available online: https://www.researchgate.net/publication/362431678_Climate_Change_2022_Impacts_Adaptation_and_Vulnerability_Working_Group_II_Contribution_to_the_Sixth_Assessment_Report_of_the_Intergovernmental_Panel_on_Climate_Change (accessed on 28 January 2025).

| Description | Warming Level and Probabilities | Number of Scenarios | Oil Demand in 2030 and 2050 (Median) (MM bpd) |

|---|---|---|---|

| C4: below 2 °C | <2 °C peak warming with >50% chance | 159 | 90.7–71.6 |

| C3: likely below 2 °C | <2 °C peak warming with >67% chance | 311 | 86.7–56.1 |

| C2: below 1.5 °C with high overshoot * | <1.5 °C peak warming with <33% chance and <1.5 °C end of century with >50% chance | 133 | 85.5–43.9 |

| C1: below 1.5 °C with no or limited overshoot | <1.5 °C peak warming with ≥33% chance and <1.5 °C end of century with >50% chance | 97 | 76.2–32.3 |

| Description | Warming Level and Probabilities | Oil Demand in 2030 and 2050 (MM bpd) |

|---|---|---|

| STEPS (Stated Policies Scenario) | 2.4 °C with 50% chance | 100.8–92.2 |

| APS (Announced Pledges Scenario) | 1.7 °C with 50% chance | 91.9–53.4 |

| NZE (Net Zero Emissions by 2050) * | 1.5 °C with ≥ 50% chance | 77.4–22.7 |

| Scenarios | C1 | C2 | C3 | C4 | NZE | APS | STEPS |

|---|---|---|---|---|---|---|---|

| Cumulative Demand | 623 | 731 | 775 | 929 | 606 | 817 | 1045 |

| Scheme 1. | C1 | C2 | C3 | C4 |

|---|---|---|---|---|

| Mean | 30.90 | 33.3 | 34.92 | 36.52 |

| Mode and Median | 27.77 | 34.50 | 34.50 | 38.64 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pantoja, S.; Rochedo, P.R.R.; Szklo, A. Crude Oil Resources Under Climate Stringent Scenarios: Production Under Contract and Probabilistic Analyses of Exploratory Frontiers. Resources 2025, 14, 54. https://doi.org/10.3390/resources14040054

Pantoja S, Rochedo PRR, Szklo A. Crude Oil Resources Under Climate Stringent Scenarios: Production Under Contract and Probabilistic Analyses of Exploratory Frontiers. Resources. 2025; 14(4):54. https://doi.org/10.3390/resources14040054

Chicago/Turabian StylePantoja, Silvia, Pedro R. R. Rochedo, and Alexandre Szklo. 2025. "Crude Oil Resources Under Climate Stringent Scenarios: Production Under Contract and Probabilistic Analyses of Exploratory Frontiers" Resources 14, no. 4: 54. https://doi.org/10.3390/resources14040054

APA StylePantoja, S., Rochedo, P. R. R., & Szklo, A. (2025). Crude Oil Resources Under Climate Stringent Scenarios: Production Under Contract and Probabilistic Analyses of Exploratory Frontiers. Resources, 14(4), 54. https://doi.org/10.3390/resources14040054