Neuromarketing and Big Data Analysis of Banking Firms’ Website Interfaces and Performance

Abstract

:1. Introduction

2. Literature Background

2.1. Banking Firms, Digital Marketing, and User Engagement

2.2. Metrics and KPIs of Friendly Website User Interface (UI)

2.3. Neuromarketing and Big Data Analysis Implications on Website Interface and Performance

2.4. Hypotheses Development

3. Materials and Methods

3.1. Methodological Concept

- The research started with the collection of data on website customers and digital marketing activities from banking firm websites. A website’s user behavioral data (pages per visit, bounce rate, time on site, etc.) were sourced from the website platform Semrush [61], which enables the extraction of big data from corporate webpages.

- The next step involved statistical analysis using methods such as descriptive statistics, correlation, and linear regression. By analyzing the coefficients obtained, researchers can determine the impact of banking firms’ website customer data on their digital marketing and interface performance metrics, including purchase conversion, display ads, organic traffic, and bounce rate.

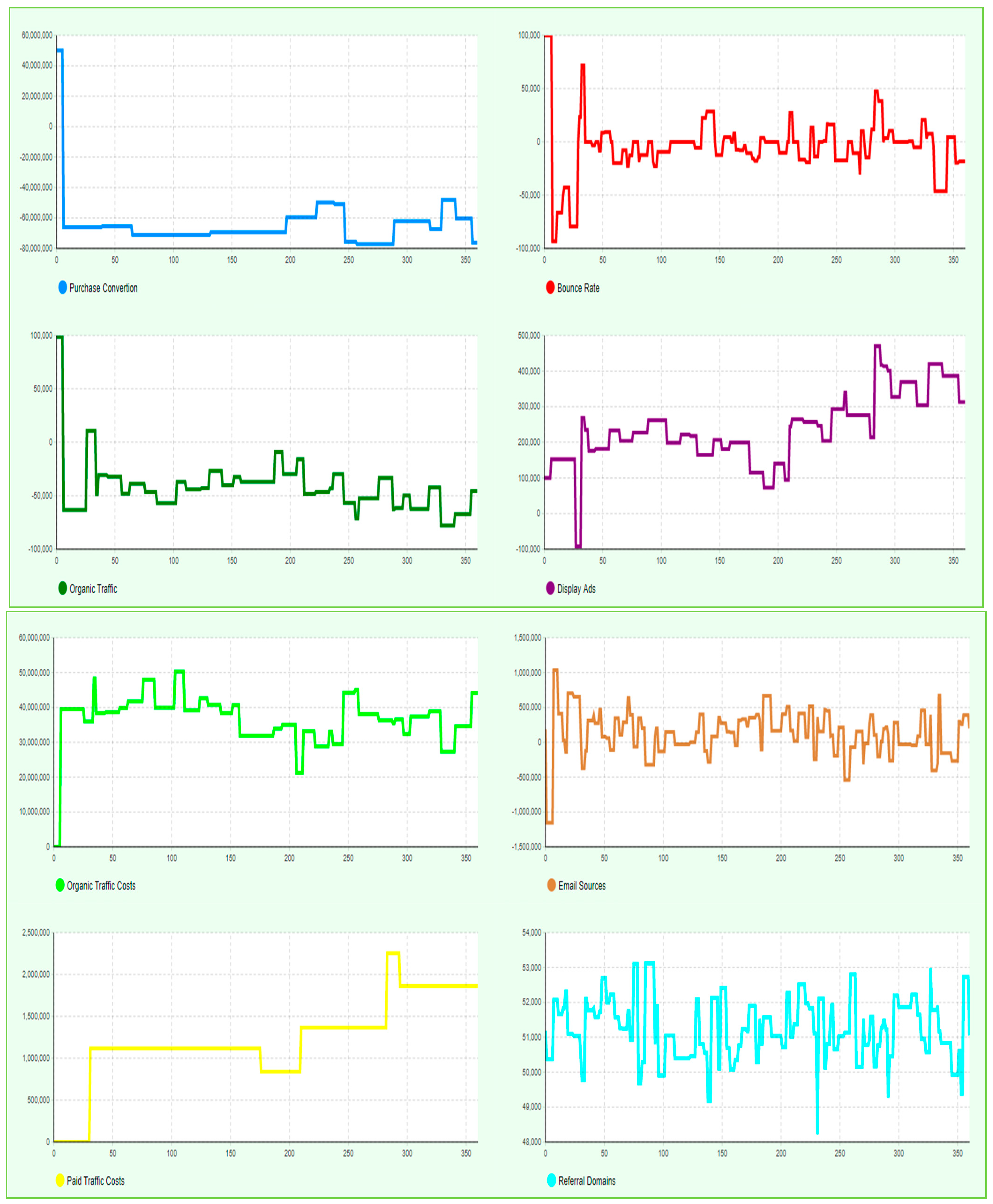

- After statistical analysis, a hybrid model (HM) incorporating agent-based models (ABMs) and System Dynamics (SD) was used for the simulation. The software AnyLogic (version 8.9.1) [62] was employed to create a hybrid model that simulates the relationships between the study’s dependent and independent variables over 360 days. This model aims to represent the dynamic interaction between banking firms’ website interface metrics and key metrics of their digital marketing strategies.

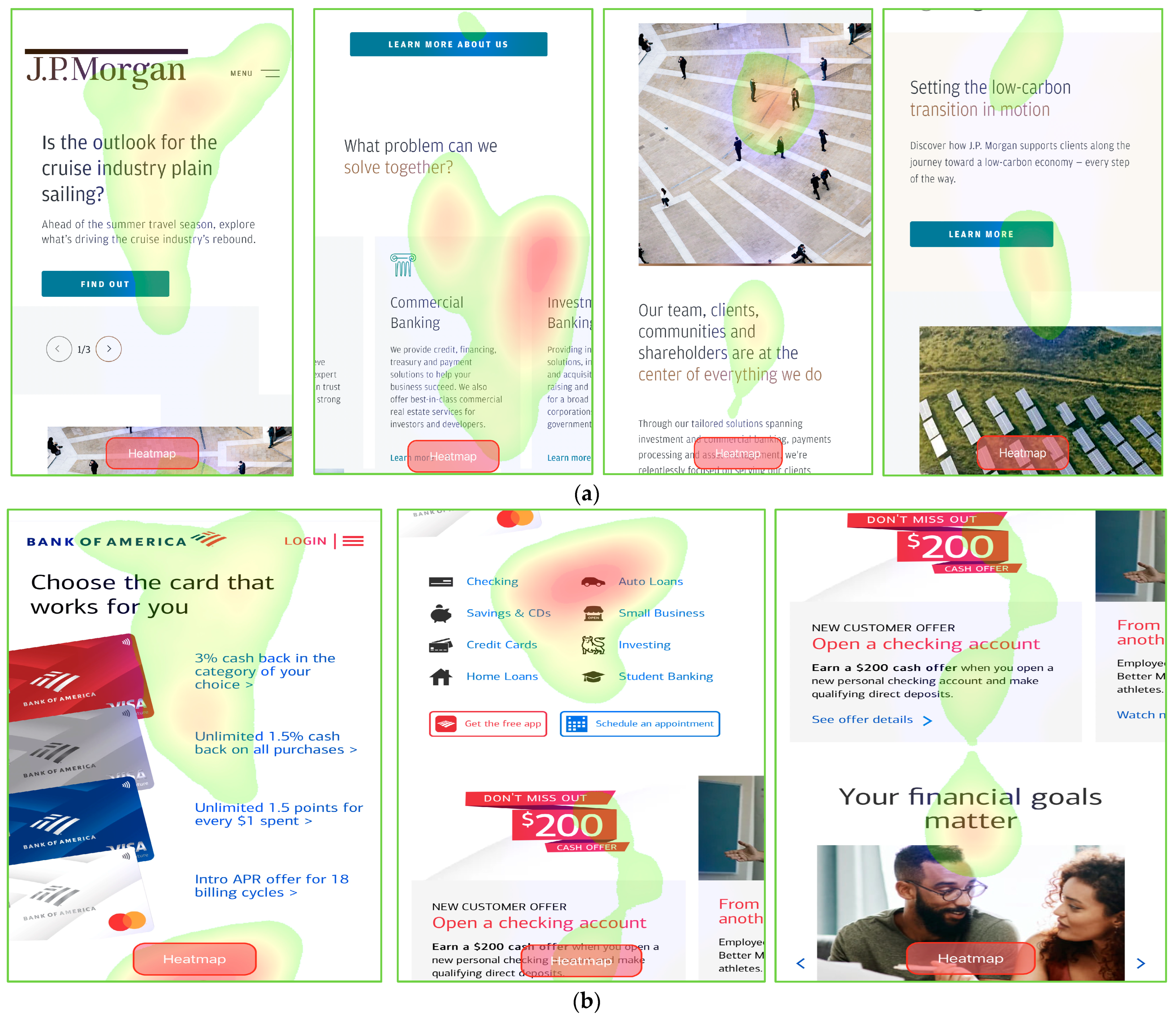

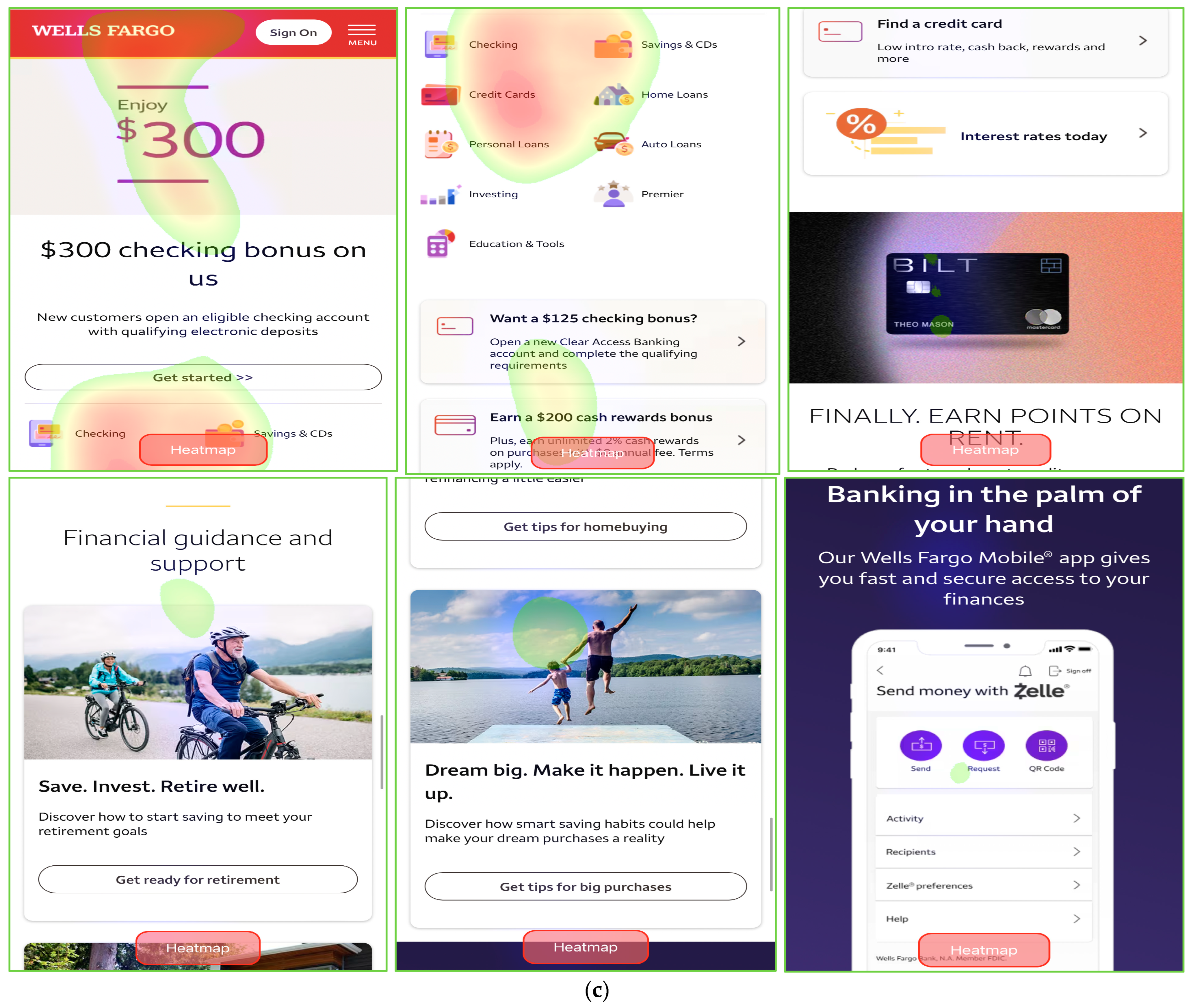

- The final stage included a neuromarketing approach to gain deeper insights from 26 participants who viewed the websites of the selected banking firms. They were instructed to search and observe, in 20 s, the selected banking firm websites and their provided financial products and services. Eye-tracking and heatmap analysis were conducted using the SeeSo Web Analysis platform (Eyedid SDK) [63]. This method seeks to extract additional information about the onsite activity and engagement of the participants from the qualitative methodological concept.

3.2. Fuzzy Cognitive Mapping (FCM) Framework

3.3. Research Sample

4. Results

4.1. Statistical Analysis

4.2. Simulation Model

4.3. Neuromarketing Applications

5. Discussion

6. Conclusions

6.1. Theoretical, Practical, and Managerial Implications

6.2. Future Work and Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Java Code of AnyLogic Simulation |

|---|

| @AnyLogicInternalCodegenAPI private void enterState(statechart_state self, boolean_destination) { switch( self ) { case Potential_Bank_Customers: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Potential_Bank_Customers); transition1.start(); transition2.start(); return; case Return_Visitors: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Return_Visitors); { return_Visitors++; pages_per_Visit = normal(0.97, 3.43); visit_Duration = normal(128.25/60, 519.40/60); referral_Domains = normal(794.22, 51,181.91); email_Sources = normal(300,170.77, 184,876.14) ;} transition3.start(); transition5.start(); return; case Bounce_Rate: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Bounce_Rate); { bounce_Rate = organic_Traffic*(1.045) + paid_Costs*(0.025) + referral_Domains*(0.334) + email_Sources*(−0.043) ;} transition.start(); return; case Visitors_To_Traffic: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Visitors_To_Traffic); transition7.start(); transition8.start(); return; case Organic_Traffic: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Organic_Traffic); { organic_Costs = normal(5,822,486.64, 37,155,781.98); organic_Traffic = paid_Costs*(−0.024) + referral_Domains*(−0.319) + email_Sources*(0.041) ;} transition13.start(); return; case Display_Ads: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Display_Ads); { display_Ads = paid_Costs*(0.198) + referral_Domains*(−0.065) + email_Sources*(−0.135) ;} transition10.start(); transition11.start(); return; case Purchase_Convertion: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Purchase_Convertion); { purchase_Convertion = organic_Costs*(−1.670) + paid_Costs*(−1.369) + referral_Domains*(1.696) + email_Sources*(0.167) ;} transition9.start(); return; case Paid_Traffic: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(Paid_Traffic); { paid_Costs = normal(406,005.96, 1,514,463.27); paid_Traffic = normal(666.9666, 3378.9857) ;} transition14.start(); return; case New_Visitors: logToDBEnterState(statechart, self); // (Simple state (not composite)) statechart.setActiveState_xjal(New_Visitors); { new_Visitors++; pages_per_Visit = normal(0.97, 3.43); visit_Duration = normal(128.25/60, 519.40/60); referral_Domains = normal(794.22, 51,181.91); email_Sources = normal(300,170.77, 184,876.14) ;} transition4.start(); transition6.start(); return; default: return; } } |

References

- Hennig-Thurau, T.; Malthouse, E.C.; Friege, C.; Gensler, S.; Lobschat, L.; Rangaswamy, A.; Skiera, B. The impact of new media on customer relationships. J. Serv. Res. 2010, 13, 311–330. [Google Scholar] [CrossRef]

- Broby, D. Financial technology and the future of banking. Financ. Innov. 2021, 7, 1–19. [Google Scholar] [CrossRef]

- Ding, Q.; He, W. Digital transformation, monetary policy and risk-taking of banks. Financ. Res. Lett. 2023, 55, 103986. [Google Scholar] [CrossRef]

- Shukla, S. Analyzing customer engagement through e-CRM: The role of relationship marketing in the era of digital banking in Varanasi banks. J. Commer. Econ. Comput. Sci. 2021, 7, 57–65. [Google Scholar]

- Hendriyani, C.; Raharja, S.J. Analysis building customer engagement through eCRM in the era of digital banking in Indonesia. Int. J. Econ. Policy Emerg. Econ. 2018, 11, 479–486. [Google Scholar]

- Vivek, S.D.; Beatty, S.E.; Morgan, R.M. Customer engagement: Exploring customer relationships beyond purchase. J. Mark. Theory Pract. 2012, 20, 122–146. [Google Scholar] [CrossRef]

- Lee, D.; Hosanagar, K.; Nair, H.S. Advertising content and consumer engagement on social media: Evidence from Facebook. Manag. Sci. 2018, 64, 5105–5131. [Google Scholar] [CrossRef]

- Lin, K.-Y.; Lu, H.-P. Why people use social networking sites: An empirical study integrating network externalities and motivation theory. Comput. Hum. Behav. 2011, 27, 1152–1161. [Google Scholar] [CrossRef]

- Lee, M.; Wang, Y.R.; Huang, C.F. Design and development of a friendly user interface for building construction traceability system. Microsyst. Technol. 2021, 27, 1773–1785. [Google Scholar] [CrossRef]

- Faghih, B.; Azadehfar, M.; Katebi, S. User interface design for E-learning software. Int. J. Soft Comput. Softw. Eng. 2014, 3, 786–794. [Google Scholar] [CrossRef]

- Cheng, S.; Yang, Y.; Xiu, L.; Yu, G. Effects of prior experience on the user experience of news aggregation app’s features—Evidence from a behavioral experiment. Int. J. Hum.-Comput. Interact. 2022, 39, 1271–1279. [Google Scholar] [CrossRef]

- Nielsen, J.; Norman, D. The Definition of User Experience (UX); Nielsen Norman Group N N/g.: Fremont, CA, USA, 2018; Available online: https://www.nngroup.com/articles/definition-user-experience/ (accessed on 20 June 2024).

- He, W.; Hung, J.-L.; Liu, L. Impact of big data analytics on banking: A case study. J. Enterp. Inf. Manag. 2023, 36, 459–479. [Google Scholar] [CrossRef]

- Kalaganis, F.P.; Georgiadis, K.; Oikonomou, V.P.; Laskaris, N.A.; Nikolopoulos, S.; Kompatsiaris, I. Unlocking the Subconscious Consumer Bias: A Survey on the Past, Present, and Future of Hybrid EEG Schemes in Neuromarketing. Front. Neuroergonomics 2021, 2, 672982. [Google Scholar] [CrossRef]

- Walker, P.R. How Does Website Design in the e-Banking Sector Affect Customer Attitudes and Behaviour? Ph.D. Thesis, University of Northumbria, Newcastle upon Tyne, UK, 2021. Available online: https://nrl.northumbria.ac.uk/id/eprint/5849/7/walker.philip_phd_(VOLUME_1of2).pdf (accessed on 12 June 2024).

- Manser Payne, E.H.; Peltier, J.; Barger, V.A. Enhancing the value co-creation process: Artificial intelligence and mobile banking service platforms. J. Res. Interact. Mark. 2021, 15, 68–85. [Google Scholar] [CrossRef]

- Diener, F.; Špacek, M. Digital transformation in banking: A managerial perspective on barriers to change. Sustainability 2021, 13, 2032. [Google Scholar] [CrossRef]

- Khattak, M.A.; Ali, M.; Azmi, W.; Rizvi, S.A.R. Digital transformation, diversification and stability: What do we know about banks? Econ. Anal. Policy 2023, 78, 122–132. [Google Scholar] [CrossRef]

- Giannakis-Bompolis, C.; Boutsouki, C. Customer Relationship Management in the Era of Social Web and Social Customer: An Investigation of Customer Engagement in the Greek Retail Banking Sector. Procedia Soc. Behav. Sci. 2014, 148, 67–78. [Google Scholar] [CrossRef]

- Mogaji, E. Redefining banks in the digital era: A typology of banks and their research, managerial and policy implications. Int. J. Bank Mark. 2023, 41, 1899–1918. [Google Scholar] [CrossRef]

- Salvi, A.; Petruzzella, F.; Raimo, N.; Vitolla, F. Transparency in the digitalization choices and the cost of equity capital. Qual. Res. Financ. Mark. 2023, 15, 630–646. [Google Scholar] [CrossRef]

- Carmona, J.; Cruz, C. Banks’ social media goals and strategies. J. Bus. Res. 2018, 91, 31–41. [Google Scholar] [CrossRef]

- Kosiba, J.P.; Boateng, H.; Okoe, A.F.; Hinson, R. Trust and customer engagement in the banking sector in Ghana. Serv. Ind. J. 2018, 40, 960–973. [Google Scholar] [CrossRef]

- Del Sarto, N.; Bocchialini, E.; Gai, L.; Ielasi, F. Digital banking: How social media is shaping the game. Qual. Res. Financ. Mark. 2024. ahead of print. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Trivellas, P. Exploring affiliate marketing’s impact on customers’ brand engagement and vulnerability in the online banking service sector. Int. J. Bank Mark. 2023, 42, 1282–1312. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kamperos, I.D.G.; Kanellos, N. What is the connection between Fintechs’ video marketing and their vulnerable customers’ brand engagement during crises? Int. J. Bank Mark. 2023, 42, 1313–1347. [Google Scholar] [CrossRef]

- Mbama, C.I.; Ezepue, P.O. Digital banking, customer experience and bank financial performance: UK customers’ perceptions. Int. J. Bank Mark. 2018, 36, 230–255. [Google Scholar] [CrossRef]

- Khandelwal, R.; Kapoor, D. The Use of Digital Tools for Customer Engagement in the Financial Services Sector. In Revolutionizing Customer-Centric Banking through ICT; IGI Global: Hershey, PA, USA, 2024; pp. 29–55. [Google Scholar]

- Islam, J.U.; Shahid, S.; Rasool, A.; Rahman, Z.; Khan, I.; Rather, R.A. Impact of website attributes on customer engagement in banking: A solicitation of stimulus-organism-response theory. Int. J. Bank Mark. 2020, 38, 1279–1303. [Google Scholar] [CrossRef]

- Lestari, D.M.; Hardianto, D.; Hidayanto, A.N. Analysis of user experience quality on responsive web design from its informative perspective. Int. J. Softw. Eng. Appl. 2014, 8, 53–62. [Google Scholar] [CrossRef]

- Almeida, F.; Monteiro, J. Approaches and principles for UX web experiences: A case study approach. Int. J. Inf. Technol. Web Eng. 2017, 12, 49–65. [Google Scholar] [CrossRef]

- Walsh, T.A.; Kapfhammer, G.M.; McMinn, P. Automated layout failure detection for responsive web pages without an explicit oracle. In Proceedings of the 26th ACM SIGSOFT International Symposium on Software Testing and Analysis, Santa Barbara, CA, USA, 10–14 July 2017. [Google Scholar] [CrossRef]

- Rogers, Y.; Sharp, H.; Preece, J. Interaction Design: Beyond Human-Computer Interaction, 6th ed.; John Wiley & Sons Ltd.: New York, NY, USA, 2023. [Google Scholar]

- ISO9241-11; Ergonomics of Human-System Interaction–Part 11: Usability for Definition and Concept. ISO: Geneva, Switzerland, 2018.

- Hussain, I.; Khan, I.A.; Jadoon, W.; Jadoon, R.N.; Khan, A.N.; Shafi, M. Touch or click friendly: Towards adaptive user interfaces for complex applications. PLoS ONE 2024, 19, e0297056. [Google Scholar] [CrossRef] [PubMed]

- Kim, S.; Cho, D. Technology Trends for UX/UI of Smart Contents. Korea Contents Assoc. Rev. 2016, 14, 29–33. [Google Scholar] [CrossRef]

- Joo, H.S. A Study on UI/UX and Understanding of Computer Major Students. Int. J. Adv. Smart Converg. 2017, 6, 26–32. [Google Scholar]

- Von Saucken, C.; Michailidou, I.; Lindemann, U. How to Design Experiences: Macro UX versus Micro UX Approach. Lect. Notes Comuter Sci. 2013, 8015, 130–139. [Google Scholar]

- Instatus. Our Comprehensive List of Website Performance Metrics to Monitor. 2024. Available online: https://instatus.com/blog/website-performance-metrics (accessed on 20 June 2024).

- Levrini, G.R.; Jeffman dos Santos, M. The influence of Price on purchase intentions: Comparative study between cognitive, sensory, and neurophysiological experiments. Behav. Sci. 2021, 11, 16. [Google Scholar] [CrossRef] [PubMed]

- Gabriel, D.; Merat, E.; Jeudy, A.; Cambos, S.; Chabin, T.; Giustiniani, J.; Haffen, E. Emotional effects induced by the application of a cosmetic product: A real-time electrophysiological evaluation. Appl. Sci. 2021, 11, 4766. [Google Scholar] [CrossRef]

- Filipović, F.; Baljak, L.; Naumović, T.; Labus, A.; Bogdanović, Z. Developing a web application for recognizing emotions in neuromarketing. In Marketing and Smart Technologies; Springer: Berlin/Heidelberg, Germany, 2020; pp. 297–308. [Google Scholar]

- Lee, Ν.; Broderick, A.J.; Chamberlain, L. What is ‘neuromarketing’? A discussion and agenda for future research. Int. J. Psychophysiol. 2007, 63, 199–204. [Google Scholar] [CrossRef] [PubMed]

- Rawnaque, F.; Rahman, K.; Anwar, S.; Vaidyanathan, R.; Chau, T.; Sarker, F.; Mamun, K. Technological advancements and opportunities in Neuromarketing: A systematic review. Brain Inform. 2020, 7, 10. [Google Scholar] [CrossRef] [PubMed]

- Ariely, D.; Berns, G. Neuromarketing: The hope and hype of neuroimaging in business. Nat. Rev. Neurosci. 2010, 11, 284–292. [Google Scholar] [CrossRef]

- Sousa, J. Neuromarketing and Big Data Analytics for Strategic Consumer Engagement: Emerging Research and Opportunities; IGI Global: Hershey, PA, USA, 2017. [Google Scholar] [CrossRef]

- Šola, H.M.; Qureshi, F.H.; Khawaja, S. Exploring the Untapped Potential of Neuromarketing in Online Learning: Implications and Challenges for the Higher Education Sector in Europe. Behav. Sci. 2024, 14, 80. [Google Scholar] [CrossRef]

- Berčík, J.; Neomániová, K.; Gálová, J. Using neuromarketing to understand user experience with the website (UX) and interface (UI) of a selected company. In The Poprad Economic and Management Forum 2021, Conference Proceedings from International Scientific Conference, Poprad, Slovak Republic, 14 October 2021; Madzík, P., Janošková, M., Eds.; VERBUM: Ružomberok, Slovakia, 2021; pp. 246–254. [Google Scholar]

- Golnar-Nik, P.; Farashi, S.; Safari, M. The application of EEG power for the prediction and interpretation of consumer decision-making: A neuromarketing study. Physiol. Behav. 2019, 207, 90–98. [Google Scholar] [CrossRef]

- Uygun, Y.; Oguz, R.F.; Olmezogullari, E.; Aktas, M.S. On the Large-scale Graph Data Processing for User Interface Testing in Big Data Science Projects. In Proceedings of the 2020 IEEE International Conference on Big Data (Big Data), Atlanta, GA, USA, 10–13 December 2020; pp. 2049–2056. [Google Scholar] [CrossRef]

- Li, L.; Zhang, J. Research and Analysis of an Enterprise E-Commerce Marketing System under the Big Data Environment. J. Organ. End User Comput. 2021, 33, 1–19. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kanellos, N.; Liontakis, A. Digital Transformation Management of Supply Chain Firms Based on Big Data from DeFi Social Media Profiles. Electronics 2023, 12, 4219. [Google Scholar] [CrossRef]

- Bala, M.; Verma, D. A Critical Review of Digital Marketing. Int. J. Manag. IT Eng. 2018, 8, 321–339. Available online: https://ssrn.com/abstract=3545505 (accessed on 20 July 2024).

- Pongpaew, W.; Speece, M.; Tiangsoongnern, L. Social presence and customer brand engagement on Facebook brand pages. J. Prod. Brand Manag. 2017, 26, 262–281. [Google Scholar] [CrossRef]

- Chaffey, D.; Ellis-Chadwick, F. Digital Marketing; Pearson: London, UK, 2019. [Google Scholar]

- Dodson, I. The Art of Digital Marketing: The Definitive Guide to Creating Strategic, Targeted, and Measurable Online Campaigns; John Wiley & Sons: New York, NY, USA, 2016. [Google Scholar]

- Chawla, Y.; Chodak, G. Social media marketing for businesses: Organic promotions of web-links on Facebook. J. Bus. Res. 2021, 135, 49–65. [Google Scholar] [CrossRef]

- McIlwain, C.D. Algorithmic Discrimination: A Framework and Approach to Auditing & Measuring the Impact of Race-Targeted Digital Advertising. PolicyLink Rep. 2023, 1–50. [Google Scholar] [CrossRef]

- Mladenović, D.; Rajapakse, A.; Kožuljević, N.; Shukla, Y. Search engine optimization (SEO) for digital marketers: Exploring determinants of online search visibility for blood bank service. Online Inf. Rev. 2023, 47, 661–679. [Google Scholar] [CrossRef]

- Wedel, M.; Kannan, P.K. Marketing analytics for data-rich environments. J. Mark. 2016, 80, 97–121. [Google Scholar] [CrossRef]

- Semrush. 2024. Available online: https://www.semrush.com/ (accessed on 12 April 2024).

- Anylogic. 2024. Available online: https://www.anylogic.com/ (accessed on 12 April 2024).

- SeeSo Web Analysis (Eyedid SDK). 2024. Available online: https://sdk.eyedid.ai/ (accessed on 20 April 2024).

- MentalModeler. 2024. Available online: https://dev.mentalmodeler.com/ (accessed on 10 April 2024).

- Migkos, S.P.; Sakas, D.P.; Giannakopoulos, N.T.; Konteos, G.; Metsiou, A. Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies 2022, 10, 178. [Google Scholar] [CrossRef]

- Mpelogianni, V.; Groumpos, P.P. Re-approaching fuzzy cognitive maps to increase the knowledge of a system. AI Soc. 2018, 33, 175–188. [Google Scholar] [CrossRef]

- Forbes India. The 10 Largest Banks in the World in 2024. 2024. Available online: https://www.forbesindia.com/article/explainers/the-10-largest-banks-in-the-world/86967/1 (accessed on 6 January 2024).

- Nugroho, S.; Uehara, T. Systematic Review of Agent-Based and System Dynamics Models for Social-Ecological System Case Studies. Systems 2023, 11, 530. [Google Scholar] [CrossRef]

- McGarraghy, S.; Olafsdottir, G.; Kazakov, R.; Huber, É.; Loveluck, W.; Gudbrandsdottir, I.Y.; Čechura, L.; Esposito, G.; Samoggia, A.; Aubert, P.-M.; et al. Conceptual System Dynamics and Agent-Based Modelling Simulation of Interorganisational Fairness in Food Value Chains: Research Agenda and Case Studies. Agriculture 2022, 12, 280. [Google Scholar] [CrossRef]

- Wang, H.; Shi, W.; He, W.; Xue, H.; Zeng, W. Simulation of urban transport carbon dioxide emission reduction environment economic policy in China: An integrated approach using agent-based modelling and system dynamics. J. Clean. Prod. 2023, 392, 136221. [Google Scholar] [CrossRef]

- Nguyen, L.K.N.; Howick, S.; Megiddo, I. A framework for conceptualising hybrid system dynamics and agent-based simulation model. Eur. J. Oper. Res. 2024, 315, 1153–1166. [Google Scholar] [CrossRef]

- Ezquerra, A.; Agen, F.; Bogdan Toma, R.; Ezquerra-Romano, I. Using facial emotion recognition to research emotional phases in an inquiry-based science activity. Res. Sci. Technol. Educ. 2023, 1–24. [Google Scholar] [CrossRef]

- Chen, Y.; Qin, X.; Xu, X. Visual Analysis and Recognition of Virtual Reality Resolution Based on Pupil Response and Galvanic Skin Response. In Proceedings of the 4th International Conference on Intelligent Computing and Human-Computer Interaction (ICHCI) 2023, Guangzhou, China, 4–6 August 2023; pp. 74–83. [Google Scholar] [CrossRef]

- Muke, P.Z.; Kozierkiewicz, A.; Pietranik, M. Investigation and Prediction of Cognitive Load During Memory and Arithmetic Tasks. In Computational Collective Intelligence. ICCCI 2023. Lecture Notes in Computer Science; Nguyen, N.T., Botzheim, J., Gulyás, L., Núñez, M., Treur, J., Vossen, G., Kozierkiewicz, A., Eds.; Springer: Cham, Switzerland, 2023; Volume 14162. [Google Scholar] [CrossRef]

- Amiri, S.S.; Masoudi, M.; Asadi, S.; Karan, E.P. A Quantitative Way for Measuring the Building User Design Feedback and Evaluation. In Proceedings of the 16th International Conference on Computing in Civil and Building Engineering (ICCCBE2016), Osaka, Japan, 6–8 July 2016; pp. 1–7. [Google Scholar]

- Wilson, L. 30-Minute Conversion Rate Optimisation Actions. In 30-Minute Website Marketing; Emerald Publishing Limited: Leeds, UK, 2019; pp. 131–141. [Google Scholar] [CrossRef]

- Sood, S. Leveraging Web Analytics for Optimizing Digital Marketing Strategies. In Big Data Analytics; Chaudhary, K., Alam, M., Eds.; CRC Press (Auerbach Publications): Boca Raton, FL, USA, 2022; pp. 173–188. [Google Scholar]

- Drivas, I.C.; Sakas, D.P.; Giannakopoulos, G.A. Display Advertising and Brand Awareness in Search Engines: Predicting the Engagement of Branded Search Traffic Visitors. In Business Intelligence and Modelling. IC-BIM 2019. Springer Proceedings in Business and Economics; Sakas, D.P., Nasiopoulos, D.K., Taratuhina, Y., Eds.; Springer: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Hari, H.; Iyer, R.; Sampat, B. Customer Brand Engagement through Chatbots on Bank Websites–Examining the Antecedents and Consequences. Int. J. Hum. Comput. Interact. 2023, 38, 1212–1227. [Google Scholar] [CrossRef]

- Makrydakis, N. SEO mix 6 O’s model and categorization of search engine marketing factors for websites ranking on search engine result pages. Int. J. Res. Mark. Manag. Sales 2024, 6, 18–32. [Google Scholar] [CrossRef]

- Shankar, B. Strategies for Deep Customer Engagement. In Nuanced Account Management; Palgrave Macmillan: Singapore, 2018; pp. 53–99. [Google Scholar] [CrossRef]

- Chakrabortty, K.; Jose, E. Relationship Analysis between Website Traffic, Domain Age and Google Indexed Pages of E-commerce Websites. IIM Kozhikode Soc. Manag. Rev. 2018, 7, 171–177. [Google Scholar] [CrossRef]

- Müller, O.; Fay, M.; vom Brocke, J. The Effect of Big Data and Analytics on Firm Performance: An Econometric Analysis Considering Industry Characteristics. J. Manag. Inf. Syst. 2018, 35, 488–509. [Google Scholar] [CrossRef]

- Pejić Bach, M.; Krstić, Ž.; Seljan, S.; Turulja, L. Text Mining for Big Data Analysis in Financial Sector: A Literature Review. Sustainability 2019, 11, 1277. [Google Scholar] [CrossRef]

- Gupta, S.; Justy, T.; Kamboj, S.; Kumar, A.; Kristoffersen, E. Big data and firm marketing performance: Findings from knowledge-based view. Technol. Forecast. Soc. Change 2021, 171, 120986. [Google Scholar] [CrossRef]

- Ravi, V.; Kamaruddin, S. Big Data Analytics Enabled Smart Financial Services: Opportunities and Challenges. In Big Data Analytics. BDA 2017. Lecture Notes in Computer Science; Reddy, P., Sureka, A., Chakravarthy, S., Bhalla, S., Eds.; Springer: Cham, Switzerland, 2017; Volume 10721, pp. 15–39. [Google Scholar] [CrossRef]

- Tichindelean, M.T.; Cetină, I.; Orzan, G. A Comparative Eye Tracking Study of Usability—Towards Sustainable Web Design. Sustainability 2021, 13, 10415. [Google Scholar] [CrossRef]

- Bajaj, R.; Syed, A.A.; Singh, S. Analysing applications of neuromarketing in efficacy of programmatic advertising. J. Consum. Behav. 2023, 23, 939–958. [Google Scholar] [CrossRef]

- Tirandazi, P.; Bamakan, S.M.H.; Toghroljerdi, A. A review of studies on internet of everything as an enabler of neuromarketing methods and techniques. J. Supercomput. 2022, 79, 7835–7876. [Google Scholar] [CrossRef]

- Slijepčević, M.; Popović Šević, N.; Radojević, I.; Šević, A. Relative Importance of Neuromarketing in Support of Banking Service Users. Marketing 2022, 53, 131–142. [Google Scholar] [CrossRef]

| Mean | Min | Max | Std. Deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|

| Organic Traffic | 9,868,004.17 | 9,486,121.00 | 10,700,067.60 | 351,366.56 | 1.342 | 1.651 |

| Organic Keywords | 987,820.46 | 889,059.20 | 1,193,079.60 | 76,418.52 | 1.592 | 1.851 |

| Organic Traffic Costs | 37,155,781.98 | 28,929,891.40 | 44,660,727.20 | 5,822,486.64 | −0.188 | −1.627 |

| Paid Traffic | 337,898.57 | 232,588.80 | 487,373.40 | 66,696.66 | 0.396 | 1.333 |

| Paid Keywords | 6510.47 | 1815.20 | 9700.60 | 2624.74 | −0.757 | −0.580 |

| Paid Traffic Costs | 1,514,463.27 | 992,316.60 | 2,491,839.60 | 406,005.96 | 0.998 | 1.667 |

| Email Sources | 184,876.14 | 0.00 | 720,314.00 | 300,170.77 | 1.379 | 0.219 |

| Display Ads | 4199.57 | 0.00 | 20,892.00 | 7636.02 | 1.982 | 1.927 |

| Purchase Conversion | 7.71 | 7.00 | 8.00 | 0.49 | −1.230 | −0.840 |

| Referral Domains | 51,181.91 | 49,694.40 | 52,457.40 | 794.22 | −0.360 | −0.317 |

| Visit Duration | 519.40 | 368.00 | 737.00 | 128.25 | 0.658 | −0.174 |

| Bounce Rate | 0.45 | 0.42 | 0.49 | 0.02 | 0.606 | −1.361 |

| Pages per Visit | 3.43 | 2.00 | 5.00 | 0.97 | 0.277 | 0.042 |

| New Visitors | 15,149,188.40 | 14,150,098.00 | 16,212,804.00 | 801,388.14 | 0.025 | −1.625 |

| Returning Visitors | 47,056,175.89 | 44,705,979.00 | 51,410,725.00 | 2,301,015.96 | 1.103 | 1.599 |

| Organic Traffic | Organic Traffic Costs | Paid Keywords | Paid Traffic Costs | Email Sources | Display Ads | Purchase Conversion | Referral Domains | Visit Duration | Bounce Rate | Pages per Visit | New Visitors | Return Visitors | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Organic Traffic | 1 | 0.604 * | 0.264 | 0.037 | 0.174 | −0.013 | 0.619 | 0.545 | 0.529 | 0.905** | 0.068 | 0.796* | 0.469 |

| Organic Traffic Costs | 0.604 * | 1 | 0.037 | 0.000 | 0.607 | 0.413 | 0.206 | 0.830 ** | 0.124 | 0.242 | 0.657 | 0.489 | 0.628 |

| Paid Traffic | −0.122 | −0.052 | 0.533 | 0.889 ** | −0.220 | −0.304 | −0.521 | 0.249 | −0.705 | −0.298 | −0.022 | −0.587 | −0.539 |

| Paid Traffic Costs | 0.037 | 0.000 | 0.379 | 1 | −0.371 | −0.315 | −0.547 | 0.241 | −0.549 | −0.193 | −0.070 | −0.458 | −0.524 |

| Email Sources | 0.174 | 0.607 | −0.257 | −0.371 | 1 | 0.590 | 0.344 | 0.424 | 0.145 | 0.002 | 0.709 | 0.356 | 0.698 |

| Display Ads | −0.013 | 0.413 | −0.456 | −0.315 | 0.590 | 1 | 0.160 | 0.299 | 0.635 | −0.316 | 0.843 * | 0.554 | 0.857 * |

| Purchase Conversion | 0.619 | 0.206 | −0.555 | −0.547 | 0.344 | 0.160 | 1 | 0.175 | 0.224 | 0.600 | 0.300 | 0.539 | 0.485 |

| Referral Domains | 0.545 | 0.830 ** | 0.249 | 0.241 | 0.424 | 0.299 | 0.175 | 1 | −0.223 | 0.179 | 0.737 * | 0.269 | 0.394 |

| Visit Duration | 0.529 | 0.124 | −0.748 | −0.549 | 0.145 | 0.635 | 0.224 | −0.223 | 1 | 0.163 | 0.309 | 0.804 * | 0.717 |

| Bounce Rate | 0.905 ** | 0.242 | −0.542 | −0.193 | 0.002 | −0.316 | 0.600 | 0.179 | 0.163 | 1 | −0.051 | 0.581 | 0.192 |

| Pages per Visit | 0.068 | 0.657 | −0.410 | −0.070 | 0.709 | 0.843 * | 0.300 | 0.737 * | 0.309 | −0.051 | 1 | 0.558 | 0.830 * |

| New Visitors | 0.796 * | 0.489 | −0.904 ** | −0.458 | 0.356 | 0.554 | 0.539 | 0.269 | 0.804 * | 0.581 | 0.558 | 1 | 0.856 * |

| Returning Visitors | 0.469 | 0.628 | −0.773 * | −0.524 | 0.698 | 0.857 * | 0.485 | 0.394 | 0.717 | 0.192 | 0.830 * | 0.856 * | 1 |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Organic Traffic Costs | −1.670 | 1.000 | - | 0.000 ** |

| Paid Traffic Costs | −1.369 | 0.000 ** | ||

| Referral Domains | 1.696 | 0.000 ** | ||

| Email Sources | 0.167 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Paid Traffic Costs | 0.198 | 1.000 | - | 0.000 ** |

| Referral Domains | −0.065 | 0.000 ** | ||

| Email Sources | −0.135 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Paid Traffic Costs | −0.024 | 1.000 | - | 0.000 ** |

| Referral Domains | −0.319 | 0.000 ** | ||

| Email Sources | 0.041 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Paid Traffic Costs | 0.025 | 0.000 ** | ||

| Referral Domains | 0.334 | 0.000 ** | ||

| Email Sources | −0.043 | 0.000 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Giannakopoulos, N.T.; Sakas, D.P.; Migkos, S.P. Neuromarketing and Big Data Analysis of Banking Firms’ Website Interfaces and Performance. Electronics 2024, 13, 3256. https://doi.org/10.3390/electronics13163256

Giannakopoulos NT, Sakas DP, Migkos SP. Neuromarketing and Big Data Analysis of Banking Firms’ Website Interfaces and Performance. Electronics. 2024; 13(16):3256. https://doi.org/10.3390/electronics13163256

Chicago/Turabian StyleGiannakopoulos, Nikolaos T., Damianos P. Sakas, and Stavros P. Migkos. 2024. "Neuromarketing and Big Data Analysis of Banking Firms’ Website Interfaces and Performance" Electronics 13, no. 16: 3256. https://doi.org/10.3390/electronics13163256