Abstract

The paper examines the mediating effect of financial literacy on fintech and SMEs’ performance during COVID-19 recovery in Cameroon. The study collects 381 survey data from SMEs in Yaoundé and Douala, the country’s business hub, to determine how these financial technology innovations affect SMEs’ business performance. Similarly, the PLS-SEM model was used to test the proposed hypotheses. The study results show that the relationship between fintech and financial literacy was positive and significant. The findings also reveal that fintech has a positive and significant effect on SMEs performance. In addition, the results further indicate that financial literacy positively and significantly mediates the relationship between fintech services and the performance of SMEs. Therefore, the study concludes that financial literacy is an essential mechanism through which fintech services influence SMEs’ operational and financial performance in Cameroon. The study has provided a better understanding of how SMEs can improve their performance by leveraging fintech solutions through financial literacy.

1. Introduction

Financial technology (Fintech) presents a paradigm shift within the financial and business sectors. The literature described fintech as a dynamic concept as increasing technology entrepreneurs enter the industry, reshaping it and modifying it to social needs [1]. Fintech can be defined as a financial service that uses innovative technologies to meet tomorrow’s essential needs [2]. Scholars claim that SMEs can benefit from fintech through high efficiency, cost reduction, business process improvement, rapidity, flexibility, and innovation [2,3,4,5]. We are currently in the transition period from fintech 2.0 to fintech 3.0. Fintech produces financial technology products like SWIFT and ATMs [6]. Evidence suggests that the Internet and the Internet of Things were related technologies during fintech 2.0 [7]. Similarly, more and more data technologies will be developed during fintech 3.0 [6].

Fintech applies new technologies to financial services [6,8]. The foundation of this revolution is innovation in business models based on emerging technologies at the customer’s service [9,10]. These technology disruptions affect the micro and macro economy amid COVID-19 recovery, the effect of which disrupted the global economy [11]. The Central African Economic and Monetary Community (CEMAC) Region has an estimated 80% internet and mobile phone penetration rate [12]. According to a 2016 census of enterprises in Cameroon, 99.8% of the country’s enterprises are SMEs [13]. Similarly, in Cameroon, the value of mobile banking transactions as a percentage of GDP increased from 0.08% in 2013 to 4.50% in 2016, then to 30.24% in 2018; this shows the significance of this phenomenon and helps to explain the country’s growth rates [14,15].

However, the performance of small and medium-sized enterprises (SMEs) is critical to the economy and society as a whole [16,17,18,19]. Thus, it has been the subject of intense scholarly investigation [20]. As buttressed by Andrews et al. [21], academic research has focused on firm performance. Evidence shows that fintech is not a service offered by banks but rather a new business model that is immensely beneficial to the community; hence, it significantly improves the performance of SMEs [22,23,24]. Moreover, fintech offers financial transactions without having an account, as does traditional banking [25]. Similarly, fintech innovation creates long-term opportunities for the SME sector [26], and that literally improves their performance and sustainability. The global acceleration of technological growth has had an impact on fintech-based business strategies, particularly among SMEs [27]. Because of the rapid changes in the digital world and the COVID-19 pandemic, SMEs must enhance and strengthen dynamic capability activities to gain a competitive advantage in innovation performance among companies [28,29,30].

The COVID-19 pandemic worst hits the SME sector as it remains the engine of growth with a substantial percentage of the entire businesses in developing countries [31,32], like Cameroon. While many developed and leading emerging economies survived the COVID-19 lockdown and protocols through online transactions, the situation is different in developing countries, particularly in sub-Saharan Africa [33]. Instead, the period had witnessed a cut-off in supply chain and SME-customer interactions and transactions [34] due to poor implementation of fintech technologies, poor internet access and connectivity. Thus, many were out of business while customers were severely hit by the inability to acquire the necessities for daily needs. Therefore, SMEs must adopt fintech technologies to avoid a similar unfortunate situation in the future. Investigation shows that many countries in Sub-Saharan Africa and the entire continent are potential markets for fintech growth. The COVID-19 pandemic has exacerbated the economic environment, emphasizing the importance of sustainability [35].

Moreover, the pressure on emerging market supply chains, dominated by SMEs that support the country’s economy, impacts domestic economic stability [36]. However, the increased use of digital payment media is one of the positive effects on financial institutions and consumer adoption of fintech [37,38]. In the post-COVID-19 era, the fintech landscape is still considered competitive. Thus, organizations require proper strategic planning to manage changes in their business cycle. Moreover, literature established that financial education is critical in enhancing fintech awareness among teeming SME customers through financial literacy (FL) concepts. Several studies [39,40,41,42,43] have investigated the impact of FinTech on SMEs performance and found a positive and significant association between the predecessor and the outcome variables. Most of those studies on the direct relationship reported weak R-squared values which indicate that there is a missing link in the relationship. Therefore, introduction of a variable that can serve as the missing link in the relationship is necessary. Thus, a growing body of research indicates that financial literacy is one of the most significant influences on financial well-being. Scholars argued that making effective financial decisions requires making well-informed choices. Therefore, the study introduced the mediating effect of financial literacy on fintech and SMEs performance.

Thus, a growing body of research indicates that financial literacy is one of the most significant influences on financial well-being. Scholars argued that making effective financial decisions requires making well-informed choices. Therefore, the study introduced the mediating effect of financial literacy on fintech and SMEs performance. The objectives of the study are:

To investigate the effect of fintech on SMEs performance in Cameroon amid COVID-19 recovery;

To examine the mediating role of financial literacy in the relationship between fintech and SMEs performance;

Based on the preceding discussion, the study set to answer the following research question: what is the mediating effect of financial literacy in the relationship between fintech and SMEs performance in Cameroon?

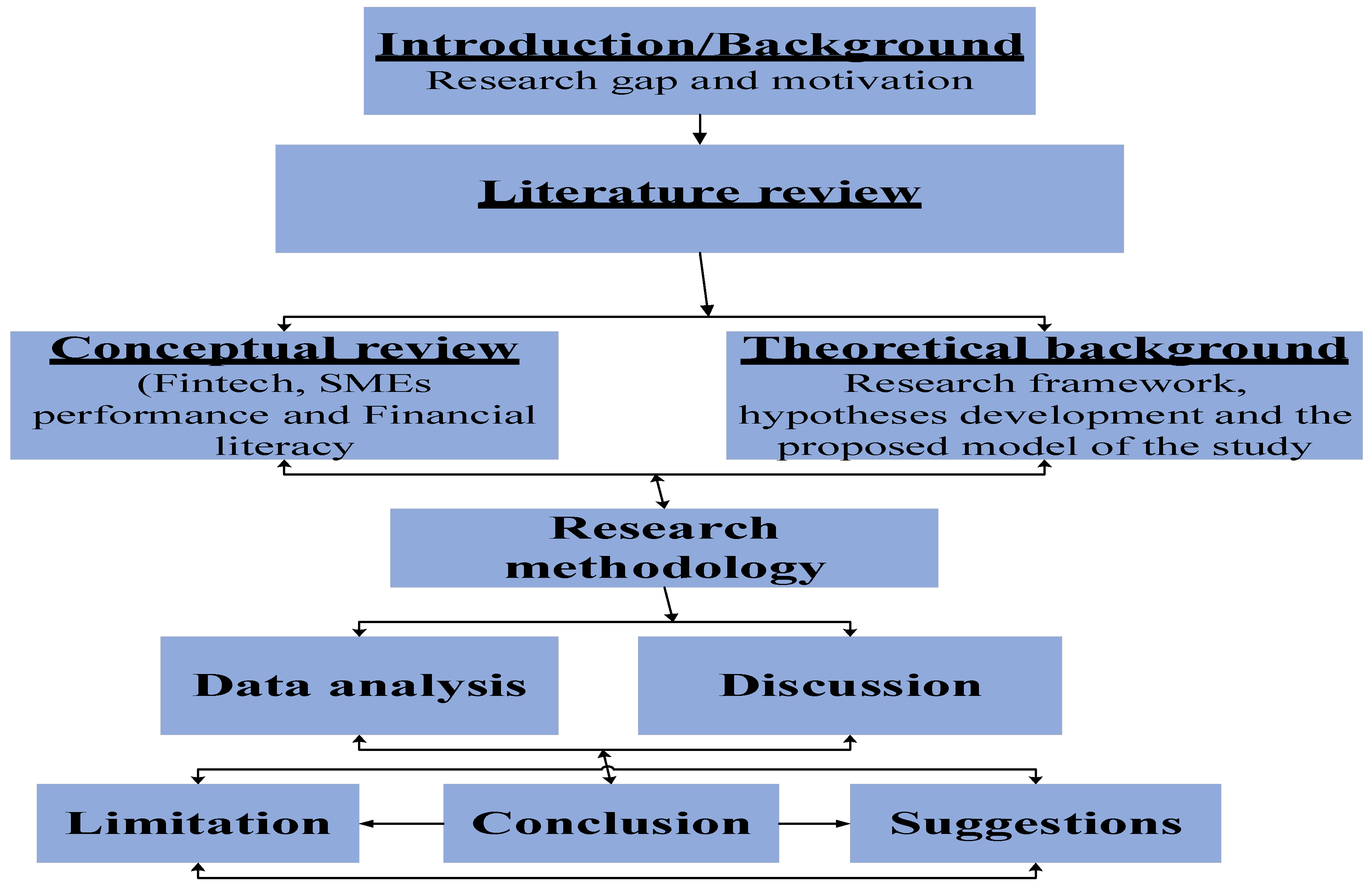

Moreover, the study is presented in the following flow chart diagram (Figure 1):

Figure 1.

Structure of the paper.

2. Literature Review

2.1. Financial Technology

Financial technology is transforming the financial services industry at an unprecedented rate [44]. Thus, fintech developments have influenced financial planning, financial well-being, and economic inequality, ranging from mobile payments to robo-advising and app-based investing platforms to online banking solutions [45,46]. Fintech is a term used to describe various services aided by different financial technologies [47] for different organizations primarily concerned with improving the quality of financial products and services supported by Information Technology (IT) solutions. Fintech is aided by developing cutting-edge technologies, the most important of which are those that can uncover hidden information from various sources and hence improve decision-making in SMEs, impact security, and allow easy communication with customers [48,49].

The rapid adoption of fintech has posed a significant challenge due to its multidisciplinary nature, improved use of integrated platforms, and enhanced demand for such services [50]. However, fintech developments may negatively impact financial well-being by inducing impulsive consumer behavior when interacting with financial technologies and platforms [51]. For example, mobile apps may appeal to impulsive and unsophisticated individuals who lack the expertise to forecast future preferences [52].

2.2. SMEs Performance

The literature described performance measurement as a complex construct, particularly in the SME sector [19], because it indicates whether or not the company is on the right track [53]. Manufacturing SMEs must regularly assess their performance to remain competitive [54]. Studies have indicated several performance indicators depending on their requirements. The performance of SMEs can be measured using firm size, firm age, skilled labor, location, manufacturing ownership type, collaborations, and foreign investment [55]. Similarly, financial services policies, credit facility and management policies, and marketing management policies all play a critical role in enhancing the performance of SMEs [56,57]. Amina and Yusof [58] argued that quality, cost, delivery, and flexibility are the most commonly used indicators to assess firm performance. Moreover, the performance measurement considers profitability, productivity, and market perceptions of SMEs’ owners/managers regarding the suitability of measures [55,59].

Many studies described a standard method of measuring performance by assessing the proficiency with which a reporting entity succeeds in achieving its objectives through the economic acquisition of resources and their efficient and effective deployment. Thus, financial and non-financial information may be used as performance measures [60]. Similarly, evidence shows that company performance is creating measurable indicators that can be systematically monitored to assess progress toward predetermined goals and using such indicators to assess progress toward these goals [61]. Based on the literature review and evidence from previous studies the current study used operational and financial performance to measure the SME performance.

2.3. Financial Literacy

Enhanced financial and other (technological, political, and environmental) literacy enables people to interact more effectively with artificial intelligence [62]. FL can be used broadly or narrowly and is associated with terms such as financial education, capability, and awareness, among others [63]. Thus, financial literacy is a set of capabilities that enables a person to make informed and effective decisions to improve their well-being and mitigate time and money losses [64]. Furthermore, the role of financial institutions, corporations, and entrepreneurs in developing supply-side solutions that improve financial literacy and reduce inequalities across demographic groups is critical [51]. According to Lusardi et al. [65], FL research and practice should seek to determine how to enhance the effectiveness of financial education through better design and delivery.

Financial literacy consists of various concepts, including financial product knowledge and awareness, financial institutions’ understanding and financial skills, and financial planning and management abilities [66]. Similarly, individuals with financial literacy can manage their money more effectively, make sound investment decisions, shift their behavior toward saving, and take advantage of newly available financial products and services [60]. Evidence suggests that financial literacy enables individuals to prepare their career path and retirement savings more effectively, whereas those with poor financial literacy and skills may have to borrow more [60].

However, financial illiteracy has a negative impact on people’s well-being as well as the financial sector as a whole. People in high-risk groups, for example, tend to go deeply into debt by taking out loans because they cannot manage their budgets. In support of the above point, Hundtofte and Gladstone [51] provide evidence that mobile users are more prone to impulsive buying and use payday loans. Mobile loan products are frequently too accessible and allow for the fulfilment of fleeting preferences. Evidence shows that cryptocurrency ownership is inversely related to financial literacy [67]. This suggests that few financially literate consumers have limited knowledge of the high-risk and reward trade-offs of cryptocurrencies compared to alternative asset classes [51].

2.4. Hypotheses Development

2.4.1. Fintech and SMEs’ Performance Relationship

According to research on the fintech-SMEs relationship, the most critical impact felt was enabling payment transactions, satisfying customers, and providing convenience in financial management [39]. Fintech benefits SMEs by automatically documenting sales transactions and providing weekly or monthly sales reports, enabling them to see their business performance [40,41]. Alimirruchi and Kiswara [42] analyze the operational and financial performance of the financial technology (fintech) firm. The results indicate that the operational and financial performance of Samsung Pay was significantly impacted due to fintech technology. Najaf Khakal et al. [43] examined the role of fintech in manufacturing efficiency and financial performance: in the industrial revolution 4.0. The findings show that the manufacturing efficiency of fintech companies is directly related to their market performance.

Similarly, Tsou and Chen [54] investigated how digital technology’s use improves firm performance, the mediating effect of digital transformation strategy and organizational innovation. According to the results, digital technology positively impacts digital transformation strategy and organizational innovation, influencing firm performance. Moreover, the findings of Purwantini et al. [68] indicate that using social media (information technology) positively impacts the performance of SMEs in areas such as customer service, marketing, internal operations, and, ultimately, sales performance. Based on the preceding discussion, the study suggests the following hypothesis:

H1.

Fintech is positively associated with SMEs’ performance.

2.4.2. Fintech and Financial Literacy Relationship

The literature reveals that using fintech has increased FL and public financial inclusion [69]. The two theories (perceptions of ease of use and perceptions of usefulness) also support the point that technology is accepted in society when people perceive benefits and convenience from its use [70,71]. Changes in the pattern of financial transactions offer new insights for people who are expected to be more knowledgeable and technologically literate [71]. Morgan [72] examined fintech and financial literacy in the Lao PDR. According to the findings, having a higher level of FL strongly and positively impacts an individual’s awareness of fintech products. Morgan and Trinh [73] investigated fintech and financial literacy in Viet Nam. The findings indicate that a greater level of FL significantly and positively affects customer awareness and acceptance of fintech products.

Moreover, Yoshino, Morgan and Trinh examined Japan’s financial literacy and fintech adoption. The empirical findings indicate that those with greater FL use fintech services more frequently, especially electronic money. Studies reveal that the public must better understand and awareness the use of fintech in managing finances. Thus, the awareness and understanding are financial literacy. Based on the preceding discussion, the study suggests the following hypothesis:

H2.

Fintech is positively associated with financial literacy.

2.4.3. The Mediating Effect of Financial Literacy on Fintech and SMEs’ Performance

According to the description, research was conducted on understanding fintech, which millennials now widely used in transactions, particularly financial transactions. However, there is a dearth of research on the influence of fintech on financial literacy and the influence of fintech on SMEs’ performance, with indicators that are not yet specific. Thus, researchers are interested in examining the effect of fintech on SMEs performance with financial literacy as a mediating variable. Similarly, many studies recently adopted financial literacy as a mediating variable to link the relationships using similar variables like fintech, investment decision, financial inclusion, and financial behavior [74,75]. Lo Prete [76] examined digital and financial FL as digital payments and personal finance determinants. The findings of these preliminary analyses showed that when assessing the impacts of digitalization on individual investors who can access digital financial products and markets without financial literacy, digital and financial literacy should be recognized jointly. The study by Winarsih et al. [77] reveals that fintech has significantly affected financial literacy.

Moreover, many studies have confirmed the effect of FL on SMEs’ performance. For example, Adomako and Danso [78] reveal that financial literacy enhances firm performance, especially when resources are flexible and entrepreneurs have easy access to financing. Chepngetich [79] revealed that financial literacy is closely related to business performance. Financial data helps assess previous decisions’ success and determine the current business position, which enhances firm performance. Similarly, Dahmen and Rodríguez [80] discover a link between financial literacy and business performance. Based on the preceding evidence, the study proposed the following hypothesis:

H3.

Financial literacy positively mediates the relationship between Fintech and SMEs’ performance.

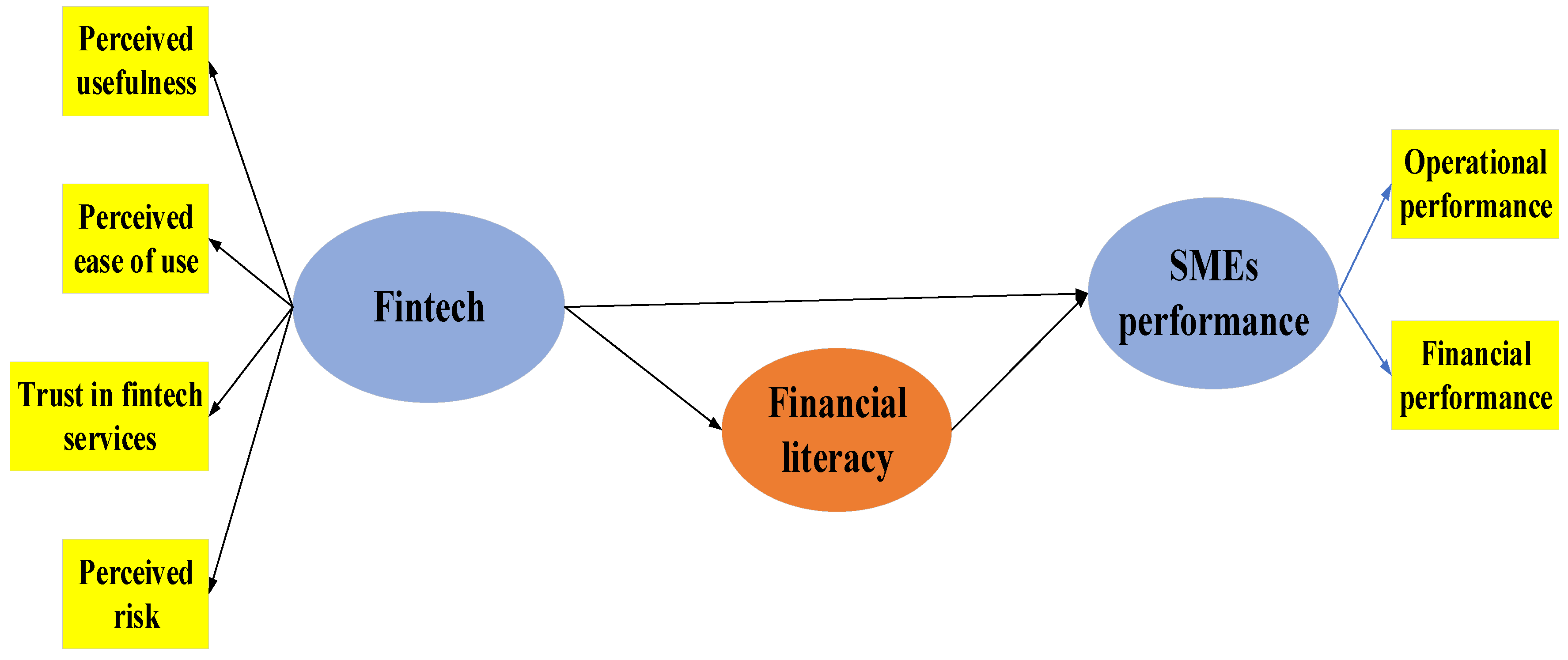

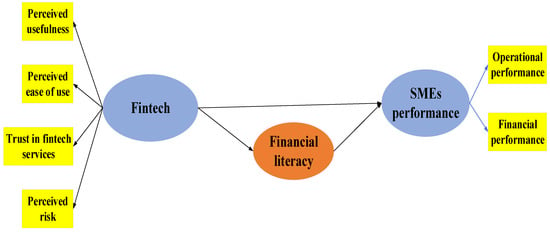

Based on the preceding literature review and hypotheses developed, the study proposed the research model in Figure 2.

Figure 2.

Proposed model.

Figure 2 presents the proposed model for the relationship between fintech (independent variable) and SMEs performance (dependent variable). The model illustrates the mediating effect of financial literacy between fintech and SME performance. The independent variable which is fintech was operationalized in four dimensions: perceived usefulness, perceived ease, trust in fintech services and perceived risk. The arrow from fintech points to SMEs performance which is the dependent variable and it indicates that fintech can predict performance. The dependent variable has two dimensions: operational performance and financial performance. Similarly, the arrow from fintech points to financial literacy which means that fintech can lead to performance through financial literacy.

3. Methodology

3.1. Research Design, Sampling Technique and Procedures

This research design is classified as quantitative descriptive research, which explains empirical phenomena with statistical data, characteristics, and patterns of relationships between variables [71,81,82]. Measurement items were used (see Appendix A). The current study’s population consists of SMEs in Yaoundé and Douala, Cameroon, the administrative and commercial hub in the country. However, it was challenging to determine the actual number of SMEs in manufacturing without a database containing complete and up-to-date information on SMEs in the two study areas. Hence the study adopted a more recent report that revealed 209,482 SMEs in Cameroon [83], with a high concentration in Yaoundé and Douala. Thus, it enables the researchers to have a higher sample, as suggested by Gall, Borg and Gall [84]; the greater the sample, the more accurate the result. The study used Krejcie and Morgan [85] to determine the sample size and, thus, gives 377. Moreover, 10% was added to compensate for non-response, as Israel [76] suggested, which gives 414.

However, 396 were returned after the survey, and 15 were dropped because they were not filled correctly. Thus, 381 is obtained for analysis with a 92% response rate. The unit of analysis are the SMEs in the two study areas, while the respondents are the production/innovation managers or their equivalent, who are familiar with the innovation and SME performance. Again, the study used snowball to identify the targeted SMEs. Evidence suggests that snowballs can identify hard-to-reach or difficult-to-ask populations, allowing members of the hidden population to recruit on the researcher’s behalf [86]. Similarly, the purposive sampling technique was used to determine the respondents. Purposive sampling describes the deliberate selection of a participant based on the individual’s characteristics and qualities [87].

3.2. Measurement of Variables

The fintech construct measures were adapted from the study of Mainardes et al. [88]: it consists of perceived usefulness (PUN) four items, perceived ease (PCE) four items, trust in fintech services (TFS) three items and perceived risk (PCR) three items. The SMEs’ performance construct consisted of operational performance (OP) five items and financial performance (FP) four items adapted from [89,90,91]. Similarly, financial literacy (one-dimension) is adapted from Rieger [92] and Vieira et al. [93], represented by seven items. A five-point Likert scale was used to measure the items, ranging from strongly agree (1) to strongly disagree (5).

4. Data Analysis

4.1. Measurement Model

Before the hypotheses test, the measurement model assessed the reliability of the individual items measuring each potential structure and the internal consistency reliability (construct reliability, discriminant validity, and convergence validity) [94]. Hair et al. [95,96] recommended that external loadings between 0.40 and 0.70 be reliable and acceptable. An item should only be deleted if it will increase the reliability of constructs AVE or Composite reliability. In addition, discriminant validity refers to the extent to which a construct differs from one another empirically. Therefore, the study evaluates the discriminant validity by using Heterotrait-monotrait (HTMT) ratio. The Heterotrait-monotrait (HTMT) ratio of correlation was used to assess the discriminant validity of the constructs.

Table 1 shows the Heterotrait-monotrait (HTMT) ratio for all the latent variables. The criteria state that if the HTMT value is greater than the predefined threshold, it can be concluded that there is an absence of discriminant validity. Many authors recommend a threshold of 0.85 Kline [97] and 0.90 Henseler et al. [98] as the acceptable threshold. Based on this criterion, all the latent constructs of this study have met the discriminant validity as they are below 0.90.

Table 1.

HTMT criterion.

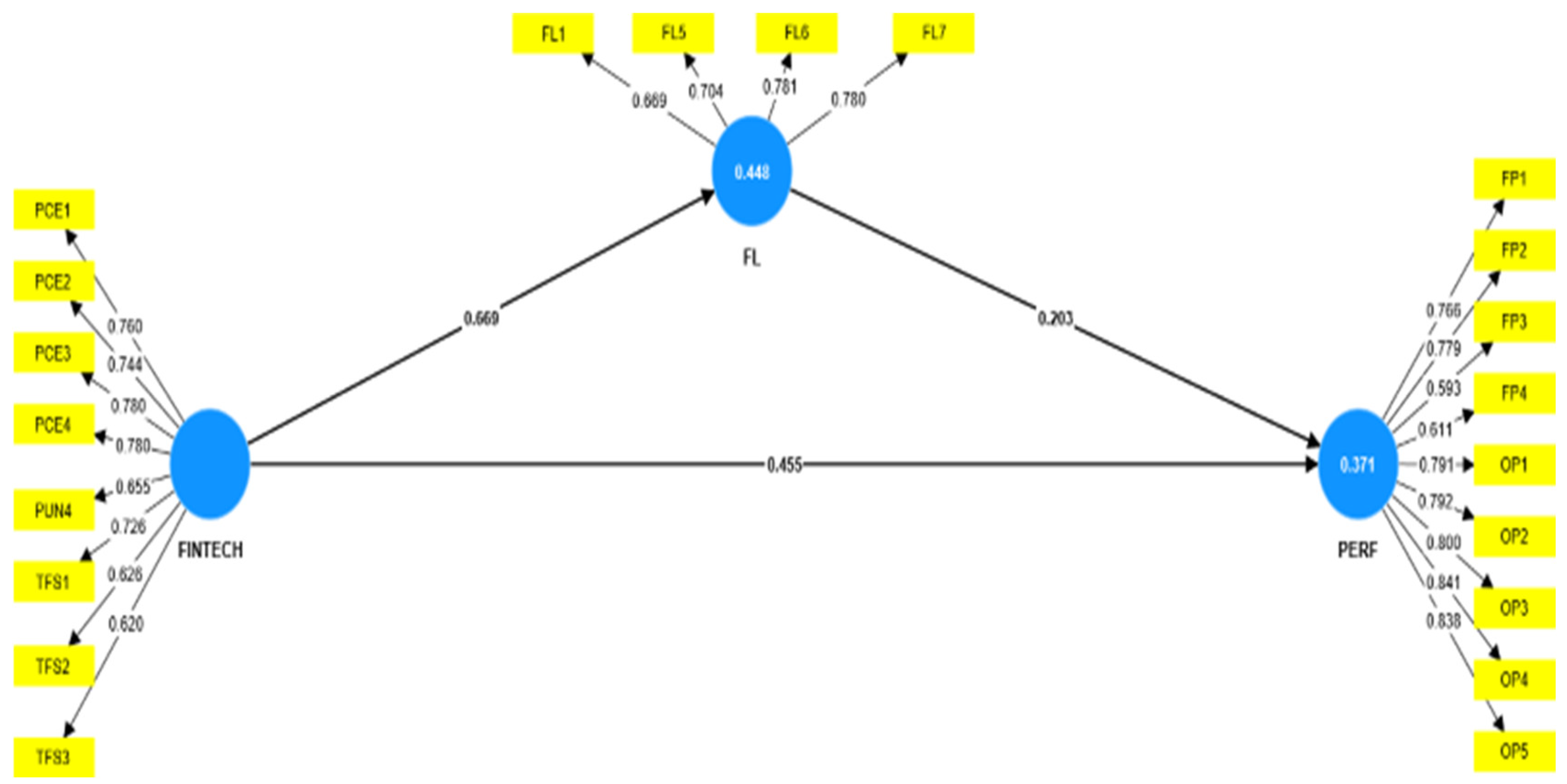

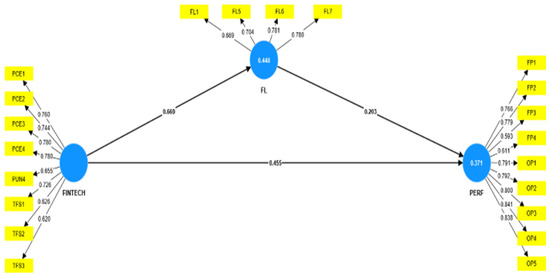

Figure 3 shows that three items (FL2, FL3, and FL4) were deleted from financial literacy indicators because their loadings were less than the acceptable threshold. Similarly, six items (PUN1, PUN2, PUN3, PCR1, PCR2 and PCR3) were deleted from the fintech construct to enhance its reliability and validity. The loading must be between 0.40 and 0.70 to retain a specific indicator; hence, the deletion is subject to the AVE and CR increment.

Figure 3.

PLS Algorithm.

4.2. Assessment of the Structural Model

The researchers analyzed the data using structural equation modelling for direct and indirect relationships. The standard bootstrap procedure was adopted on a sample of 381 to evaluate the importance of path coefficients for the study model. The results of the structural model were used to test the study’s hypotheses.

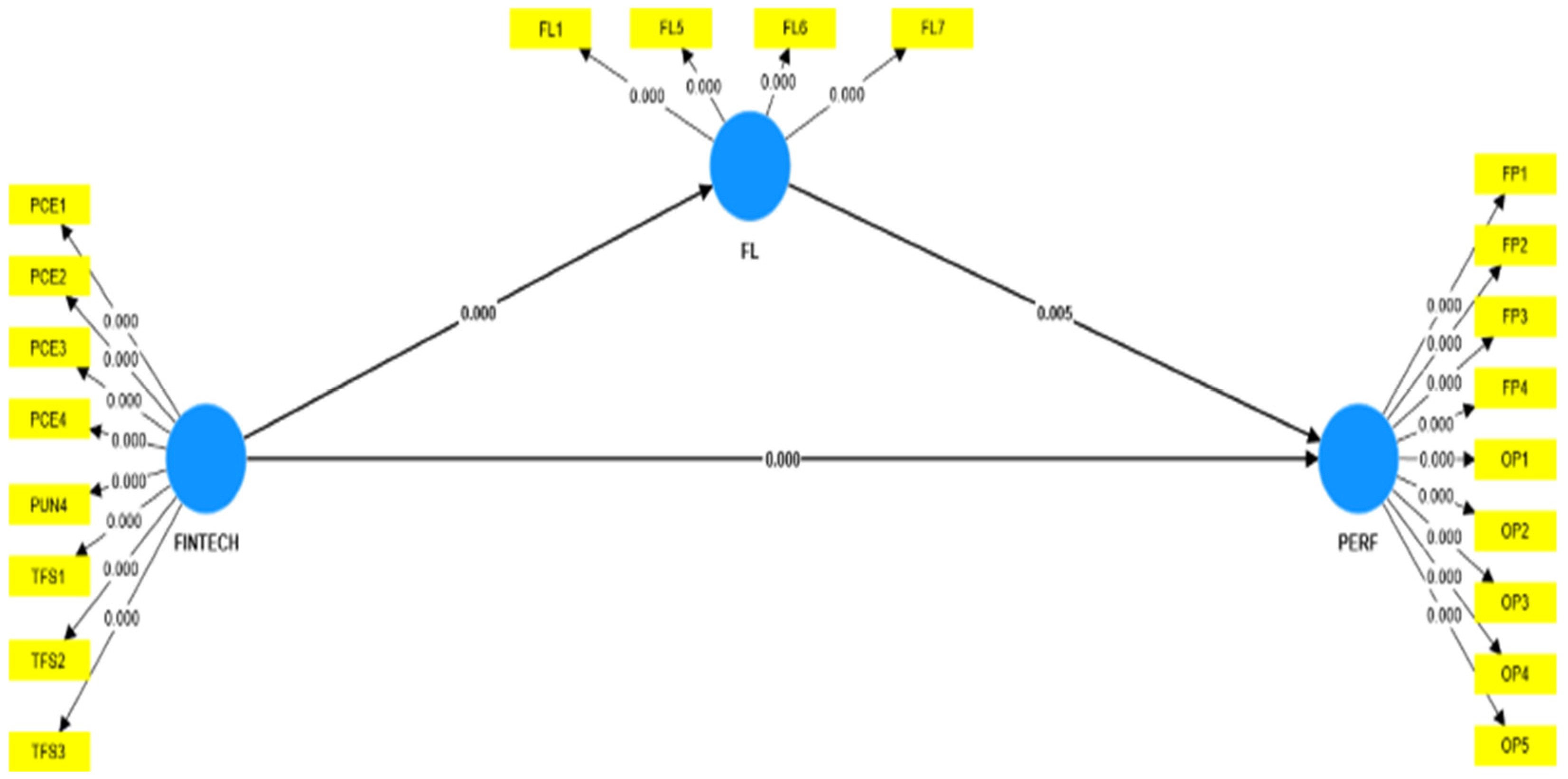

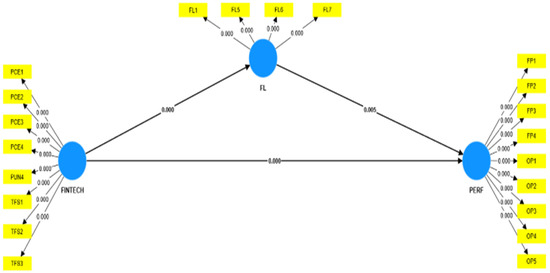

Figure 4 and Table 2 present the results of the structural model for the test of hypotheses. The results show that the relationship between fintech and financial literacy is positive and significant (beta value = 0.039 t-value = 17.309 and p-value = 0.000). The finding is consistent with previous studies [73,99]. Also, the results reveal that financial literacy and fintech are positively and significantly related to performance (beta value = 0.203 t-value = 2.779, p-value = 0.005 and beta value = 0.455 t-value = 5.836, p-value = 0.000 respectively). The findings also corroborate previous studies [42,43].

Figure 4.

PLS Bootstrapping result.

Table 2.

Structural Model-path coefficient.

Furthermore, the results reveal that financial literacy positively and significantly mediates the relationship between fintech and the performance of SMEs in Cameroon. This finding is in line with Adomako and Danso [78], who revealed that financial literacy enhances firm performance, especially when resources are flexible and entrepreneurs have easy access to financing. The mediation is complementary because both the direct and indirect relationships are significant. All the alternate hypotheses were supported empirically for all the direct and indirect relationships.

4.3. Coefficient of Determination for the Relationships

Apart from assessing the significance and relevance of the path model, another essential tool commonly used to evaluate the structural model relationships is the R-square or coefficient of determination, which measures the model’s predictive accuracy [100]. The R-square (R2) for this study is shown in Table 3.

Table 3.

Coefficient of Determination: R-Squared.

The R square stood at 0.371, indicating that the study’s independent variables explained about 37.1 SMEs performance in Cameroon.

4.4. Effect Size (ƒ2), VIF and Predictive Relevance (Q2)

The ƒ2 value provides an overview of an exogenous construct’s effect on the endogenous latent variable. The values are 0.02, 0.15, and 0.35 for small, medium, and large effect sizes respectively [101].

From Table 4, going by the criteria mentioned above, Fintech has a large effect on SMEs performance, while financial literacy has a small effect on SMEs performance. The VIF for the two exogeneous constructs indicate no multicollinearity problem as none has a value greater than 4 finally, the model has predictive relevance because the Q2 value is greater than zero, as suggested by Duarte and Raposo [102].

Table 4.

Effect size (ƒ2), VIF and Predictive relevance (Q2).

4.5. Implications

The study results show that the relationship between fintech and financial literacy was positive and significant. The finding implies that fintech could lead to financial literacy, meaning that innovations in financial products and services would push SMEs to familiarize themselves with those innovations. The findings also reveal a positive and significant relationship between financial literacy and the performance of SMEs. This means that firms and individuals’ knowledge about various financial products and services significantly promotes performance.

The findings also reveal that fintech positively and significantly affects SMEs’ performance. This suggests that fintech services such as mobile payments, app-based investing platforms, and online banking solutions could help SMEs improve their performance because fintech has the potential to improve the quality of products and services, which in turn enhance both the financial and operational performance of SMEs. If SMEs can embrace cutting-edge technologies, especially those that can uncover hidden information from diverse sources to improve SMEs’ decision-making and allow for easy communication with customers, they could significantly improve their performance.

In addition, the results further indicate that financial literacy positively and significantly mediates the relationship between fintech services and the performance of SMEs. This finding implies that SMEs that are knowledgeable about recent financial innovations and leveraged them to enhance the quality of products and services were better able to improve their operational and financial performance. Further, it suggests that SMEs can use financial literacy as a conduit through which fintech services promote performance. Therefore, for SMEs to boost their performance using fintech services, they should be familiar with the different financial technology solutions.

5. Conclusions and Limitations

The study concludes that financial literacy is an essential mechanism through which fintech services influence SMEs’ operational and financial performance in Cameroon. It is also concluded that knowledge of various financial technology solutions by SMEs across Cameroon significantly promotes their performance. Therefore, financial literacy becomes an essential conduit through which financial technologies can trigger SME performance in Cameroon. Thus, the study has provided empirical evidence to the literature regarding the mediating role of financial literacy on the relationship between fintech and SMEs performance. Additionally, the findings of this study have provided practical implications for SMEs to leverage fintech solutions through financial literacy to improve their performance. It is therefore recommended that SMEs should embrace financial technology solutions to improve their performance. This can be achieved by training employees on financial management skills to be able to achieve better performance.

The study is limited to only Cameroon, so generalization to other African countries may be difficult. Therefore, a cross-country examination of this nature should be undertaken by future research to generalize the findings. The study was also cross-sectional, and a longitudinal approach may be needed to ascertain the impacts of fintech services on SMEs’ performance over different periods.

Author Contributions

Conceptualization, C.B.L., B.Y. and K.M.S.; Methodology, C.B.L., B.Y. and K.M.S.; Validation, B.Y.; Data curation, C.B.L. and K.M.S.; Writing—original draft, C.B.L. and K.M.S.; Supervision, B.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by NSFC, Grant No.7217010477.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors acknowledge the support of NSFC. Similarly, the research assistants’ efforts during the field survey despite the enormous challenges amid COVID-19 restrictions. The authors also appreciate the reviewers’ and editor’s comments during the review process.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Measurement items

- Fintech

- Perceived usefulness of fintech services

- The fintech services meet my needs

- The fintech services save me time

- The fintech services improve the efficiency of the financial transactions that I carry out

- Generally, fintech services are useful to me

- Perceived ease of fintech services

- My interaction with the application that I use to access the fintech services is clear and understandable

- I easily learned to use the fintech application

- I have the ability to use the fintech application

- I find it easy to use the fintech application

- Trust in fintech services

- Generally, the fintech is reliable

- Generally, the fintech keeps its promises and commitments

- Generally, the fintech is reliable for the electronic transactions and procedures offered

- Perceived risk in fintech services

- I believe that it is easy to steal my money using the services of the fintech

- I believe that my personal privacy will be disclosed using the services of the fintech

- In general, the fintech services are risky

- SME performance

- Operational performance

- Our enterprise has generally reduced manufacturing costs per unit.

- Our enterprise has decreased the defect rate of products.

- Our enterprise has generally shortened the lead time and new product development cycle.

- Our enterprise has improved flexibility in product design changes and production fluctuations.

- Our enterprise has introduced modern techniques to improve our operational performance

- Financial performance

- Our enterprise has increased its sales.

- Our enterprise has increased its operating profit rate.

- Our enterprise has increased its return on investment.

- Our enterprise has reduced its production and logistics costs.

- Financial literacy

- A high-return investment will also be high-risk.

- The cost of living rises as inflation rises.

- I save some part of the money I receive monthly for future needs.

- I regularly save money in order to achieve long-term financial goals, such as educating my children, purchasing a home, retiring.

- I find it more rewarding to spend money than to save for the future.

- I tend to live today and let tomorrow happen

- I’ve been able to save money over the last year.

References

- Liudmila, Z.; Mateusz, D.; Gerhard, S. FinTech—What’s in a Name. In Proceedings of the Thirty Seventh International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016. [Google Scholar]

- Dapp, T.; Slomka, L.; Hoffmann, R. Fintech–The digital (r) evolution in the financial sector. Dtsch. Bank Res. 2014, 11, 1–39. [Google Scholar]

- Cassetta, E.; Monarca, U.; Dileo, I.; Di Berardino, C.; Pini, M. The relationship between digital technologies and internationalisation. Evidence from Italian SMEs. Ind. Innov. 2020, 27, 311–339. [Google Scholar] [CrossRef]

- Rialp-Criado, A.; Komochkova, K. Innovation strategy and export intensity of Chinese SMEs: The moderating role of the home-country business environment. Asian Bus. Manag. 2017, 16, 158–186. [Google Scholar] [CrossRef]

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

- Leong, K.; Sung, A. FinTech (Financial Technology): What is it and how to use technologies to create business value in fintech way? Int. J. Innov. Manag. Technol. 2018, 9, 74–78. [Google Scholar] [CrossRef]

- Mohamed, H.Y.; Hamdan, A.; Karolak, M.; Razzaque, A.; Alareeni, B. FinTech in Bahrain: The role of FinTech in empowering women. In Proceedings of the International Conference on Business and Technology, Istanbul, Turkey, 6–7 November 2021; pp. 757–766. [Google Scholar]

- Imerman, M.B.; Fabozzi, F.J. Cashing in on innovation: A taxonomy of FinTech. J. Asset Manag. 2020, 21, 167–177. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. Financial information systems and the fintech revolution. J. Manag. Inf. Syst. 2018, 35, 12–18. [Google Scholar] [CrossRef]

- Bisong, A.; Ahairwe, P.E.; Njoroge, E. The Impact of COVID-19 on Remittances for Development in Africa; European Centre for Development Policy Management: Maastricht, The Netherlands, 2020. [Google Scholar]

- Gautier, T.T.; Luc, N.N. Dynamic Analysis of Determinants of Financial Inclusion in Cameroon; FSEG, University of Dschang: Dschang, Cameroon, 2020. [Google Scholar]

- Talom, F.S.G.; Tengeh, R.K. The impact of mobile money on the financial performance of the SMEs in Douala, Cameroon. Sustainability 2019, 12, 10183. [Google Scholar] [CrossRef]

- Mehry, E.-B.; Ashraf, S.; Marwa, E. The impact of financial inclusion on unemployment rate in developing countries. Int. J. Econ. Financ. Issues 2021, 11, 79. [Google Scholar] [CrossRef]

- El Bourainy, M.; Salah, A.; El Sherif, M. Assessing the impact of financial inclusion on inflation rate in developing countries. Open J. Soc. Sci. 2021, 9, 397–424. [Google Scholar] [CrossRef]

- Kim, N.; Shim, C. Social capital, knowledge sharing and innovation of small-and medium-sized enterprises in a tourism cluster. Int. J. Contemp. Hosp. Manag. 2018, 30, 2417–2437. [Google Scholar] [CrossRef]

- Ciemleja, G.; Lace, N. The model of sustainable performance of small and medium-sized enterprise. Eng. Econ. 2011, 22, 501–509. [Google Scholar] [CrossRef]

- Ramirez, H.; Lim, T.S. Performance of SMEs: Literature synthesis of contingency models. Probl. Perspect. Manag. 2021, 19, 276. [Google Scholar] [CrossRef]

- Shuaib, K.M.; He, Z. Impact of organizational culture on quality management and innovation practices among manufacturing SMEs in Nigeria. Qual. Manag. J. 2021, 28, 98–114. [Google Scholar] [CrossRef]

- Halabí, C.E.; Lussier, R.N. A model for predicting small firm performance: Increasing the probability of entrepreneurial success in Chile. J. Small Bus. Enterp. Dev. 2014, 21, 4–25. [Google Scholar] [CrossRef]

- Andrews, R.; Boyne, G.; Mostafa, A.M.S. When bureaucracy matters for organizational performance: Exploring the benefits of administrative intensity in big and complex organizations. Public Adm. 2017, 95, 115–139. [Google Scholar] [CrossRef]

- Rahma, T.I.F. Persepsi Masyarakat Kota Medan Terhadap Penggunaan Financial Technology. At-Tawassuth J. Ekon. Islam 2018, 3, 184–203. [Google Scholar] [CrossRef]

- Varga, D. Fintech, the new era of financial services. Vez. Manag. Rev. 2017, 48, 22–32. [Google Scholar] [CrossRef]

- Lee, D.K.C.; Teo, E.G.S. Emergence of FinTech and the LASIC Principles. J. Financ. Perspect. 2015, 3, 1–29. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Klapper, L.; Singer, D.; Ansar, S. The Global Findex Database 2017: Measuring Financial Inclusion and The Fintech Revolution; World Bank Publications: Washington, DC, USA, 2018. [Google Scholar]

- Lu, L. Promoting SME finance in the context of the fintech revolution: A case study of the UK’s practice and regulation. Bank. Financ. Law Rev. 2018, 33, 317–343. [Google Scholar]

- Herdinata, C.; Pranatasari, F.D. Impact of COVID-19 on Organizational Support in Financial Technology. Economies 2022, 10, 183. [Google Scholar] [CrossRef]

- Cheng, J.-H.; Chen, M.-C.; Huang, C.-M. Assessing inter-organizational innovation performance through relational governance and dynamic capabilities in supply chains. Supply Chain Manag. Int. J. 2014, 19, 173–186. [Google Scholar] [CrossRef]

- Dyduch, W.; Chudziński, P.; Cyfert, S.; Zastempowski, M. Dynamic capabilities, value creation and value capture: Evidence from SMEs under COVID-19 lockdown in Poland. PLoS ONE 2021, 16, e0252423. [Google Scholar] [CrossRef]

- Shuaib, K.M.; He, Z.; Song, L. Effect of organizational culture and quality management on innovation among Nigerian manufacturing companies: The mediating role of dynamic capabilities. Qual. Manag. J. 2021, 28, 223–247. [Google Scholar] [CrossRef]

- Barua, B.; Barua, S. COVID-19 implications for banks: Evidence from an emerging economy. SN Bus. Econ. 2021, 1, 1–28. [Google Scholar] [CrossRef]

- Aneja, R.; Ahuja, V. An assessment of socioeconomic impact of COVID-19 pandemic in India. J. Public Aff. 2021, 21, e2266. [Google Scholar] [CrossRef]

- Chirisa, I.; Mutambisi, T.; Chivenge, M.; Mabaso, E.; Matamanda, A.R.; Ncube, R. The urban penalty of COVID-19 lockdowns across the globe: Manifestations and lessons for Anglophone sub-Saharan Africa. GeoJournal 2022, 87, 815–828. [Google Scholar] [CrossRef]

- Rawindaran, N.; Jayal, A.; Prakash, E.; Hewage, C. Cost Benefits of Using Machine Learning Features in NIDS for Cyber Security in UK Small Medium Enterprises (SME). Future Internet 2021, 13, 186. [Google Scholar] [CrossRef]

- Pirasteh-Anosheh, H.; Parnian, A.; Spasiano, D.; Race, M.; Ashraf, M. Haloculture: A system to mitigate the negative impacts of pandemics on the environment, society and economy, emphasizing COVID-19. Environ. Res. 2021, 198, 111228. [Google Scholar] [CrossRef]

- Gereffi, G.; Sturgeon, T. Global value chain-oriented industrial policy: The role of emerging economies. In Global Value Chains in a Changing World; World Trade Organization: Geneva, Switzerland, 2013; pp. 329–360. [Google Scholar]

- Sahay, M.R.; von Allmen, M.U.E.; Lahreche, M.A.; Khera, P.; Ogawa, M.S.; Bazarbash, M.; Beaton, M.K. The Promise Of Fintech: Financial Inclusion in the Post COVID-19 Era; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Tut, D. FinTech and the COVID-19 pandemic: Evidence from electronic payment systems. Emerg. Mark. Rev. 2023, 54, 100999. [Google Scholar] [CrossRef]

- Moran, N. Bank Versus Fintech: Can Traditional Banks Protect Market Share from Fintech Start-Ups in the Area of Corporate Payment Services? Ph.D. Thesis, National College of Ireland, Dublin, Ireland, 2020. [Google Scholar]

- Rubini, A. Fintech in a Flash: Financial Technology Made Easy; Walter de Gruyter GmbH & Co KG: Berlin, Germany, 2018. [Google Scholar]

- Hau, H.; Huang, Y.; Shan, H.; Sheng, Z. FinTech credit and entrepreneurial growth. Swiss Financ. Inst. Res. Pap. 2021, 21–47. [Google Scholar] [CrossRef]

- Alimirruchi, W.; Kiswara, E. Analyzing Operational and Financial Performance on The Financial Technology (Fintech) Firm (Case Study on Samsung Pay). Ph.D. Thesis, Fakultas Ekonomika dan Bisnis, Semarang, Indonesia, 2017. [Google Scholar]

- Dhiaf, M.M.; Khakan, N.; Atayah, O.F.; Marashdeh, H.; El Khoury, R. The role of FinTech for manufacturing efficiency and financial performance: In the era of industry 4.0. J. Decis. Syst. 2022, 1–22. [Google Scholar] [CrossRef]

- Giudici, P. Fintech risk management: A research challenge for artificial intelligence in finance. Front. Artif. Intell. 2018, 1, 1. [Google Scholar] [CrossRef]

- Anthony, M.; Sabri, M.F.; Shazana, A.; Magli, H.A.R.; Sufian, N.A. The Financial Health and The Usage of Financial Technology among Young Adults. Int. J. Acad. Res. Bus. Soc. Sci. 2021, 11, 45–62. [Google Scholar] [CrossRef]

- Bartholomae, S.; Fox, J.J. Overview of financial education. In The Routledge Handbook of Financial Literacy; Routledge: Abingdon-on-Thames, UK, 2021; pp. 173–186. [Google Scholar]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Polit. Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Marrara, S.; Pejic-Bach, M.; Seljan, S.; Topalovic, A. FinTech and SMEs: The Italian case. In Research Anthology on Small Business Strategies for Success and Survival; IGI Global: Hershey, PA, USA, 2021; pp. 667–688. [Google Scholar]

- Pejic-Bach, M.; Marrara, S.; Seljan, S.; Topalovic, A. FinTech and SMEs-The Italian Case. In FinTech as a Disruptive Technology for Financial Institutions; IGI Global: Hershey, PA, USA, 2019. [Google Scholar]

- Gai, K.; Qiu, M.; Sun, X. A survey on FinTech. J. Netw. Comput. Appl. 2018, 103, 262–273. [Google Scholar] [CrossRef]

- Panos, G.A.; Wilson, J.O.S. Financial literacy and responsible finance in the FinTech era: Capabilities and challenges. Eur. J. Financ. 2020, 26, 297–301. [Google Scholar] [CrossRef]

- Ren, H.; Huang, T. Modeling customer bounded rationality in operations management: A review and research opportunities. Comput. Oper. Res. 2018, 91, 48–58. [Google Scholar] [CrossRef]

- Yadav, S.K.; Tripathi, V. Market orientation and SMEs performance. J. Entrep. Manag. 2014, 3, 27–34. [Google Scholar]

- Thanki, S.; Govindan, K.; Thakkar, J. An investigation on lean-green implementation practices in Indian SMEs using analytical hierarchy process (AHP) approach. J. Clean. Prod. 2016, 135, 284–298. [Google Scholar] [CrossRef]

- Perwitasari, A.W. The Effect of Perceived Usefulness and Perceived Easiness towards Behavioral Intention to Use of Fintech by Indonesian MSMEs. Winners 2022, 23, 1–9. [Google Scholar] [CrossRef]

- Aremu, M.A.; Adeyemi, S.L. Small and medium scale enterprises as a survival strategy for employment generation in Nigeria. J. Sustain. Dev. 2011, 4, 200. [Google Scholar]

- Anand, B. Reverse globalization by internationalization of SME’s: Opportunities and challenges ahead. Procedia-Social Behav. Sci. 2015, 195, 1003–1011. [Google Scholar] [CrossRef]

- Amrina, E.; Yusof, S.M. Key performance indicators for sustainable manufacturing evaluation in automotive companies. In Proceedings of the 2011 IEEE International Conference on Industrial Engineering and Engineering Management, Changchun, China, 3–5 September 2011; pp. 1093–1097. [Google Scholar]

- Mjongwana, A.; Kamala, P.N. Non-financial performance measurement by small and medium sized enterprises operating in the hotel industry in the city of Cape Town. African J. Hosp. Tour. Leis. 2018, 7, 1–26. [Google Scholar]

- Alshebami, A.S.; Aldhyani, T.H.H. The interplay of social influence, financial literacy, and saving behaviour among Saudi youth and the moderating effect of self-control. Sustainability 2022, 14, 48780. [Google Scholar] [CrossRef]

- House, L. CIMA Official Terminology; 2005 Edition; CIMA: Oxford, UK, 2005. [Google Scholar]

- Schwab, K. The Fourth Industrial Revolution; Currency Press: Redfern, Australia, 2017. [Google Scholar]

- Sudakova, A. Financial literacy: From theory to practice. In Proceedings of the International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, 2–8 July 2018; Volume 18, pp. 75–82. [Google Scholar]

- Kefela, G. Implications of financial literacy in developing countries. African J. Bus. Manag. 2011, 5, 3699. [Google Scholar]

- Lusardi, A.; Tufano, P. Debt literacy, financial experiences, and overindebtedness. J. Pension Econ. Financ. 2015, 14, 332–368. [Google Scholar] [CrossRef]

- Seraj, A.H.A.; Fazal, S.A.; Alshebami, A.S. Entrepreneurial Competency, Financial Literacy, and Sustainable Performance—Examining the Mediating Role of Entrepreneurial Resilience among Saudi Entrepreneurs. Sustainability 2022, 14, 10689. [Google Scholar] [CrossRef]

- Panos, G.A.; Karkkainen, T.; Atkinson, A. Financial literacy and attitudes to cryptocurrencies. Work. Pap. Responsible Bank. Financ. 2020, 18, 306–312. [Google Scholar] [CrossRef]

- Purwantini, A.H.; Anisa, F. Analisis Penggunaan Media Sosial Bagi UKM dan Dampaknya Terhadap Kinerja. In Proceeding of The 7th URECOL, Yogyakarta, Indonesia, 10 February 2018; pp. 304–314. [Google Scholar]

- Mulasiwi, C.M.; Julialevi, K.O. Optimization of Financial Technology (Fintech) to Improve Financial Literacy and Inclusion of Purwokerto Medium Enterprises. Perform. J. Pers. Financ. Oper. Mark. Inf. Syst. 2020, 27, 12–20. [Google Scholar]

- Sulistiyarini, S. Pengaruh minat individu terhadap penggunaan mobile banking: Model kombinasi Technology Acceptance Model (TAM) dan Theory of Planned Behavior (TPB). J. Ilm. Mhs. FEB 2012, 1, 1689–1699. [Google Scholar]

- Martini, M.; Sardiyo, S.; Septian, R.; Nurdiansyah, D. Understanding of Financial Literacy as a Moderating Variable on the Effect of Financial Technology on Financial Inclusion in Lubuklinggau City, Indonesia. J. Econ. Financ. Account. Stud. 2021, 3, 140–151. [Google Scholar] [CrossRef]

- Morgan, P.; Trinh, L.Q. Fintech and financial literacy in the Lao PDR; Asian Development Bank Institute: Tokyo, Japan, 2019. [Google Scholar] [CrossRef]

- Morgan, P.J.; Trinh, L.Q. Fintech and Financial Literacy in Viet Nam; ADBI Working Paper Series; ADBI: Tokyo, Japan, 2020. [Google Scholar]

- Anand, S.; Mishra, K.; Verma, V.; Taruna, T. Financial literacy as a mediator of personal financial health during COVID-19: A structural equation modelling approach. Emerald Open Res. 2021, 2, 59. [Google Scholar] [CrossRef]

- Asmara, I.P.W.P.; Wiagustini, L.P. The Role of Financial Literacy in Mediation of Sociodemographic Effects on Investment Decisions. Int. J. Bus. Manag. Econ. Rev. 2021, 4, 133–146. [Google Scholar] [CrossRef]

- Prete, A.L. Digital and financial literacy as determinants of digital payments and personal finance. Econ. Lett. 2022, 213, 110378. [Google Scholar] [CrossRef]

- Winarsih, M.; Mutoharoh, M.; Tahar, E.; Aziz, I.A. The Role of Fintech and Financial Literacy on SMEs Sustainability. In Proceedings of the 1st International Conference on Islamic Civilization, ICIC 2020, Semarang, Indonesia, 27 August 2020; p. 168. [Google Scholar]

- Adomako, S.; Danso, A. Financial Literacy and Firm performance The moderating role of financial capital availability and resource flexibility. Int. J. Manag. Organ. Stud. 2014, 3, 1–15. [Google Scholar]

- Chepngetich, P. Effect of financial literacy and performance SMEs. Evidence from Kenya. ABRJ 2016, 5, 26. [Google Scholar]

- Dahmen, P.; Rodríguez, E. Financial Literacy and the Success of Small Businesses: An Observation from a Small Business Development Center. Numer. Adv. Educ. Quant. Lit. 2014, 7, 3. [Google Scholar] [CrossRef]

- Williams, C. Research methods. J. Bus. Econ. Res. 2007, 5, 2532. [Google Scholar] [CrossRef]

- Yilmaz, K. Comparison of quantitative and qualitative research traditions: Epistemological, theoretical, and methodological differences. Eur. J. Educ. 2013, 48, 311–325. [Google Scholar] [CrossRef]

- Belyaeva, Z.S.; Levis, P.N. Post-COVID Business Transformation: Organizational Constraints and Managerial Implications for SMEs in Cameroon. In Business Under Crisis; Springer: Berlin/Heidelberg, Germany, 2022; Volume 2, pp. 245–266. [Google Scholar]

- Gall, M.D.; Borg, W.R.; Gall, J.P. Educational Research: An Introduction, 6th ed.; Longman Publishing: London, UK, 1996. [Google Scholar]

- Krejcie, R.V.; Morgan, D.W. Determining sample size for research activities. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Casteel, A.; Bridier, N.L. Describing Populations and Samples in Doctoral Student Research. Int. J. Dr. Stud. 2021, 16, 339–362. [Google Scholar] [CrossRef] [PubMed]

- Etikan, I.; Musa, S.A.; Alkassim, R.S. Comparison of convenience sampling and purposive sampling. Am. J. Theor. Appl. Stat. 2016, 5, 1–4. [Google Scholar] [CrossRef]

- Mainardes, E.W.; Costa, P.M.F.; Nossa, S.N. Customers’ satisfaction with fintech services: Evidence from Brazil. J. Financ. Serv. Mark. 2022, 1–18. [Google Scholar] [CrossRef]

- Afshan, N.; Mandal, P.; Gunasekaran, A.; Motwani, J. Mediating role of immediate performance outcomes between supply chain integration and firm performance. Asia Pacific J. Mark. Logist. 2021, 34, 669–687. [Google Scholar] [CrossRef]

- Hendijani, R.; Saeidi Saei, R. Supply chain integration and firm performance: The moderating role of demand uncertainty. Cogent Bus. Manag. 2020, 7, 1760477. [Google Scholar] [CrossRef]

- Lee, R. The effect of supply chain management strategy on operational and financial performance. Sustainability 2021, 13, 95138. [Google Scholar] [CrossRef]

- Rieger, M.O. How to Measure Financial Literacy? J. Risk Financ. Manag. 2020, 13, 324. [Google Scholar] [CrossRef]

- Vieira, K.M.; Júnior, F.D.J.M.; Potrich, A.C.G. Measuring financial literacy: Proposition of an instrument based on the Item Response Theory. Ciência E Nat. 2020, 42, 38. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. In New Challenges to International Marketing; Emerald Group Publishing Limited: Bingley, UK, 2009. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror, mirror on the wall: A comparative evaluation of composite-based structural equation modeling methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage Publications Inc: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 3rd ed.; Guilford: New York, NY, USA, 2011. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Morgan, P.J.; Trinh, L.Q. Determinants and impacts of financial literacy in Cambodia and Viet Nam. J. Risk Financ. Manag. 2019, 12, 19. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Selya, A.S.; Rose, J.S.; Dierker, L.C.; Hedeker, D.; Mermelstein, R.J. A practical guide to calculating Cohen’s f2, a measure of local effect size, from PROC MIXED. Front. Psychol. 2012, 3, 111. [Google Scholar] [CrossRef]

- Duarte, P.A.O.; Raposo, M.L.B. A PLS model to study brand preference: An application to the mobile phone market. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 449–485. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).