1. Introduction

In modern business, companies are confronted with environmental changes while attempting to sustain their business [

1] in terms of market structures, competitive advantages, public policies, and technological foresight [

2,

3]. Platform business, explained originally by the theory of two-sided markets [

4,

5,

6], has currently taken center stage as the newest value stream that aims to help firms overcome these changes and grow sustainably. This is because it is capable of a variety of open innovation deliverables, which ensure a corporate’s sustainable growth. A platform business aims to strengthen corporate competitiveness with various value streams’ open innovation tools [

7,

8,

9,

10,

11]: it builds market momentum [

12,

13] and enables adaption to unanticipated changes in the external environment [

14].

Nevertheless, there is a lack of systematic studies on a platform’s value streams [

15]. It is imperative that platform businesses have several participants; thus, it is difficult to succeed in the market without a clear understanding of platform styles. Hence, this study develops a conceptual framework that integrates the most relevant features of value streams in the platform business. It analyzes the different types of platform business models with an accurate understanding of complicated value chains and streams and provides information vital for platform providers seeking to understand the characteristics of platform service—from their own perspective and that of other participants.

In this study, a concept model is built by first analyzing previous research and then brainstorming about value streams in the platform business. This is done because a variety of value streams and creations exist (due to the nature of two-sided markets) [

16,

17] and because understanding value streams is an important element of competitive advantage strategy [

18,

19]. This study contributes to the literature by illustrating how various value stream changes in platforms have distinct implications for different types of platform business. The authors conducted cross-case synthesis by conducting in-depth interviews and analyzing documents sequentially in two phases, finally resulting in three core models.

3. Methods and Data Collections

Theories and methodologies strongly support a research project by enabling the evaluation of a study’s validity. Systematically designed research challenges old beliefs and produces new theories [

64]. The research objectives are presented here in detail, including the epistemological and philosophical presumptions that constitute the origin of the research questions. The case selection was conducted as outlined below. First, this study classified representative platform services in the market into four kinds based on the type of platform, as proposed by Evans et al. [

33] and Evans and Schmalensee [

4]: exchanges, advertiser-supported media, transaction system, and software platforms. This classification describes the two-sided market in detail by departmentalizing the demand-coordinator who plays a role in establishing the cross-side network effects (or externalities). Next, to understand and analyze general platform issues, platforms from numerous fields were selected. Finally, to establish public confidence, I chose not only those platform companies that posted good results, but a diverse range—from rapidly growing startups to big enterprises—depending on their platform type. In this study, therefore, 21 platforms (see

Appendix A) were targeted for a multiple-case analysis via in-depth interviews with their employees. Besides this, a meeting was held with advisory groups who have worked for platform companies indirectly to check the platform business from an outside perspective.

All the data in this research are novel. We used archival records and documents to gather the secondary data; for the primary data, we conducted interviews and created focus groups with industrial managers and specialists between August 2014 and January 2015. The data collection was performed using a snowball sampling method that selected new data collection units derived from already-chosen data collection units. Interviews lasting 1.5 h were conducted—and recorded—with each of the 30 interviewees (see

Appendix B). Two focus group interviews were also conducted. Semi-structured interviews were used to draw the various thoughts and opinions of interviewees about the research theme in as much detail as possible. The interviews were divided into Phase 1 and Phase 2, with 15 interviewees in each phase (see

Figure 1). A focus group interview was conducted when each phase was completed. The data was analyzed in the intervals between the interviews. The participants in the two focus group interviews were asked to evaluate the interview and share their opinions about it in the hope of mitigating the weaknesses of interview data by minimizing bias and preventing data loss and also by analyzing the data more thoroughly through triangulation [

65]. We also checked the enterprise founders through snowball sampling, in which interviewees are asked to recommend other interviewees. Snowball sampling allows us to discover characteristics about data which we are not aware of. Furthermore, it allows researchers to reach populations that are difficult to sample when using other sampling methods [

66]. For instance, to increase variation in the data, we triggered recommendations by asking “Who do you know who sees things differently?” [

67]. In 15 out of 21 cases (eBay, Kakao Mobile store, Korea Telecom(KT) app store, Hyundai Home Shopping, LG U+ app store, Samsung Wallet, Daum Map, SK Telecom(SKT) T-Phone, Yahoo! Answers, Microsoft (Windows and MS Office), Naver, Webtoon, Samsung AdHub, Google AdWords, RecordFarm, and YouTube), I interviewed industrial managers in charge of relevant services. In the remaining six cases (Nintendo games consoles, Amazon Kindle, Dell PC, Kickstarter, Instagram, and Blogger), secondary data was mainly used, and additional complementary data was acquired through interviews with people who worked on projects for these companies.

All interviewees were asked semi-structured questions, which were complemented by follow-up questions [

68]. Questions addressed the following topics: (1) directors’ experiences in platform corporates, including how they came upon their service offerings and how they got involved in a variety of products; (2) the directors’ business backgrounds; (3) their experiences of running the platform corporates; (4) their reactions against competing firms; and (5) their relationships with other stakeholders. First, interviews were recorded, and a database constructed based on these recordings (compilation phase). Then, the data were analyzed in three phases (description phase, classification phase, and connection phase) based on the model of qualitative analysis as a circular process proposed by Dey [

69]. In particular, the first-stage case study explained the characteristics of platform business models by matching them with a theoretical pattern and an observed pattern using the pattern-matching technique of Yin [

70]. The results are classified into three types in accordance with the analysis results; classification was carried out based on the analytical procedures suggested by Tesch [

71]. Before the typology, the database and descriptions were prepared. In particular, core meaning was given more weight over information contents. Then, a list of all the subjects was prepared, grouping related subjects into one category and indicating them in a chart. They were organized as a primary subject, a unique subject, or other subjects. Collected data were then prepared with this list. Subjects were coded, and the codes were recorded next to the relevant text. Following this procedure, we confirmed if it was possible to derive new categories and new codes. Then, the words that could best express the subject were determined, and a category was prepared. Related subjects were categorized to reduce the number of categories in the list. Related categories were connected in a way that ultimately decreased the number of categories; this code was arranged in accordance with the theoretical propositions. Lastly, a preliminary analysis was conducted by collecting data from each of the categories.

4. Research Design: Theoretical Propositions and Multiple-Case Studies

This study is based on theoretical propositions known as the evaluability hypothesis. Theoretical propositions help a researcher to know which data to focus on and which to ignore [

72]. In addition, they configure the overall framework of the case study and encourage the researcher to derive alternative explanations. In other words, theoretical propositions explain the cause-and-effect relationship and answer the questions of “how” and “why,” thus streamlining the analysis [

65,

73]. Therefore, propositions were derived according to each of the central questions before proceeding with the case study (see

Table 1).

This study aimed to analyze the value streams of platform companies through the case study of many companies as well as of the business models from a dynamic approach. In addition, it aimed to identify how value streams are different in each model. For this, value creation and network effects were focused on as a sub-analysis unit. Thus, it analyzed various types of cases using a multiple-case design. The logic of replication that occurs in multiple-case design enables a path to more solid research [

74], and is more persuasive and elaborate [

75]. Thus, this research chose the multiple-case study method to uncover meaningful research findings through 21 robust case studies. In particular, this study endeavored to select various platform businesses depending on diverse categories, from business year to platform size. To conduct the multiple-case analysis, the study developed theoretical propositions first (see

Table 2), after which cases were classified and selected. On completion, a comprehensive conclusion was reached by comparing all the cases. During the process, the theories were consistently updated and developed. Finally, conceptual frameworks were derived.

In this study, the theoretical replication of cases, conducted with dependent variables, was used as a pattern [

65,

76]. In other words, two contradicting cases were selected in terms of independent variables. Afterwards, predicted patterns were derived if specific independent variables were found. Conversely, if no such independent variables were found, the results were deemed to be inconsistent with the predicted patterns. Therefore, it was possible to draw a strong conclusion about the effect of independent variables [

65]. Such a comparison method is known as congruence testing, which describes combinations of congruent sides and angles [

77]. In addition, both theoretical patterns and observed patterns were limited to either “fit” or “misfit” in the pattern matching, with the intention of using simple patterns where possible. Attempts were made to improve the persuasive power of the analysis results through comparison of extreme cases and clarification of apparent patterns. The concept of fit is based on an underlying theory in which, without referring to any particular outcome, a “strategy-structure fit” between the strategies and structures can be indicated as either “0” or “1.” Such a result or inference can be verified by the external criterion of future performance [

78]. In this study, the concept of “fit as matching” was applied to make theoretical inferences about fitness. The inferences were verified by analyzing the interview or documentary data (see

Figure 2). The pattern-matching procedure, which consists of fundamental comparisons between observed and predicted patterns, is neither a measurement method nor a statistical category [

65]. Statistical techniques were thus not used in this study, as mentioned above. Fitness was measured based on the secondary data or answers from respondents.

5. Data Coding and Analysis

This study conceptualized data by interpreting the specific statements of interviewees in terms of their background, context, and meaning. The process of “reading and interpreting” was repeated several times to encode and analyze the data. The concept is an abstract expression referring to incidence, object, behavior, or interaction, and thus is defined as the “named phenomena” [

79]. This research utilized the terms used by the interviewees for some concepts, although others were named arbitrarily based on a contextual interpretation of the terms used by the interviewees. It allowed for the creation of sub-categories that could bind the deduced concepts more meaningfully. Furthermore, this study deduced a hierarchical structure of categories by first identifying the relationship between them and then finding the highest-level categories which encompassed the sub-categories.

To deduce the different types of platform business models, this study first classified the strategy type for each company or institution by reading and interpreting information regarding the platform model types being pursued by the companies or institutions to which the interviewees belonged. It confirmed the classification of the platform model types when there were repeated respondents from the corresponding companies or institutions. The strategy types were then classified with their relevant companies or institutions by reading and interpreting the information provided by the respondents. These classifications were checked for consistency with the platform model strategies of other companies which were deduced in the previous stage. When consistent, they were classified as the same type, and when inconsistent, they were classified as a new type. The study reconfirmed the classification of the platform models by performing the same analysis when there were repeated respondents from the corresponding companies or institutions. When necessary, new strategy types were added. These tasks were repeated until all the responses had been reviewed and the three models summarized above had been deduced.

Whether there would be a “fit” or “misfit” was determined based on the value stream, value creation, and network effect of the platform. The value stream became the most crucial classification criterion in this study. Understanding the value stream and chain are an important element of competitive advantage strategies [

41,

61]. Accurate understanding of value streams and business strategies in growth is essential for corporations that aspire to become platform providers, as they undertake competitive advantage strategies to create a successful platform business. Thus, the confirmation of value creation and a significant network effect would take place within each value stream. In analyzing and interpreting the data, this study found that the platform types forming a platform business model would also represent some characteristic information apart from the strategy types above. That is, even though each service is different, similar types of platform business models demonstrated similarity in terms of their support systems, components, and relationship with stakeholders. For example, eBay’s open market platform and KT’s app store platform leverage show that although the platform business model has the same type of value stream, they have a different service type. Therefore, they have a similar configuration direction of support system.

5.1. Value Stream Starts from the Supply Side: ‘Supplier’ Type

The first model of the platform business model based on value stream is the “producer-oriented platform.” In this model, the producers (supply side) deliver certain products and services to the consumers (demand side) through the platform. A producer-centered approach in which the producers supply products or services using the platform is thus required. This study named this model the “supplier type.” As a result of pattern matching, a normal value stream emerged for the supplier type. However, there was no reverse flow value stream because the producers created and delivered values to the consumers through a platform. The most prominent cases of supplier-type platforms were eBay’s open market, Microsoft Windows, LG U+ app store or KT’s app store, Nintendo’s games consoles, Amazon’s Kindle e-reader, the SKT T-Phone, the Kakao mobile store, Hyundai home shopping, and the Samsung Wallet, to name a few. Sellers deliver products and services to the consumers through eBay’s open market platform. Google and KT’s app store platforms enable app developers (or content providers) to develop applications and sell them to users via the platform. Kindle, the most prominent e-book platform, also allows e-book content providers to deliver content to consumers. The Samsung Wallet platform allows a large number of partners to provide their products and services to consumers through its wallet.

The most noticeable difference between a platform and a traditional value stream is that platforms expand the value stream, which was previously within an organization, to include the outside world. Platform companies have concentrated on linking the processes between the organizations from a competitive strategy perspective, while involving a variety of third parties through the two-sided market. With a conventional value stream, a closed system forms the basis of an organization, and the value stream is only internal. However, overall competition has intensified due to the expansion of networks and the emergence of more companies, so it is now impossible to achieve competitive advantages based only on an internal value stream. Competitive advantages can only be achieved by adopting an inter-organizational value stream that includes suppliers located at the rear and consumers at the front. This allows these stakeholders to be linked in a mega process that includes the company’s own value stream, the rear-side service/product suppliers’ value stream, and the front-side channel participants’ value stream (distributor, purchaser, and consumer). Platforms represent the new paradigm and have emerged out of necessity. As an open system based on a two-sided market, platforms have led to the external expansion of the value stream, allowing various participants to expand it. For instance, Nintendo expanded its value stream by encouraging the participation of third-party game developers.

Moreover, it could secure even more customers by providing more diverse services. In the end, it could complete a business ecosystem, based on a virtuous cycle structure and network effects. Such an expansion of the value stream is caused by a platform, and it not only increases the number of suppliers and consumers, but also substantially reduces process, inventory, and transaction costs by sharing information in real time while maximizing synergies through cooperation between the related organizations. In supplier-type value streams, although value creation takes place, value co-creation does not, because supplier-type value streams are producer-centered. However, there are both direct and indirect network effects in the supplier type. Mr. Cho, Principal Engineer of Samsung Electronics, stated that Samsung Wallet continuously tried to secure credit card companies and end users to produce direct and indirect network effects. They installed Samsung Wallet on all Samsung smartphone devices as a native app—an app installed directly on a mobile device—to secure enough end users in a short period. This high number of users makes their platform business attractive to credit card companies, and the participation of the credit card companies attracts more Samsung mobile users as well as users of other companies’ smartphones. In other words, having many end users on the Samsung Wallet platform attracts more new users, and a large number of end users also induces more credit card companies to engage with the platform. This study confirmed that there was direct (same-side) and indirect (cross-side) network effects in these platforms as a result of the observed pattern. A platform company acquiring a profit model and monopolistic market dominance depends on its ability to facilitate a significant volume of transactions between the supply and demand sides, which are the two customer groups of a platform. Therefore, a platform provider can have the basis to form a two-sided market only by securing both a direct and indirect network (see

Table 2).

5.2. Value Stream Starts from the Demand Side: ‘Tailor’ Type

The second platform business model based on value streams is the “consumer-oriented platform.” In this model, consumers request products or services of producers through a platform, and then producers deliver products and services to consumers through the platform. Therefore, it is necessary to leverage a consumer-centered approach. We named this a “Tailor” type because consumers lead the use of the platform; products are thus “tailor-made” for consumers. They are also named thus because producers supply goods and services back to consumers through a platform when consumers request producers for their desired products or services via this means. Tailor type does not mean that sellers customize a specific part for buyers, but that consumers have a significant impact on the product or service as a whole.

As a result of pattern matching, it was confirmed that a reverse flow value stream emerged in the case of the tailor type of value stream. This was because the consumers first requested products or services through a platform and producers then produced and delivered them back to the consumers via the platform. The most prominent examples of the tailor type were Dell Computer’s PC ordering platform, Samsung AdHub, Google AdWords, Daum Map platform, and Quirky’s idea platform, to name a few. When consumers (demand side) make a request through Dell’s PC ordering platform, Dell provides details of their desired products to the computer parts suppliers (supply side). Quirky’s idea platform also produces their products via the suppliers (supply side) only when the users (demand side) present their idea through the Quirky platform, and then sells the products back to the users. Similarly, the Naver Ad platform provides adequate advertising to the consumers based on their Internet usage patterns and search keywords (demand side). Ms. Lee, an assistant manager for the Daum Map platform, said that due to the characteristics of map data, many users lead to more users (direct network effects) as well as more map content providers (indirect network effects). Map content providers add attractive contents to the map such as dining tips, travel guides, and mobile yellow pages to increase profit, and this various content attracts more users to the Daum Map platform and vice versa.

The value stream has a reverse flow when its starting point shifts from suppliers to customers, based on the fact that the source of value creation is the customer. This kind of value stream is often found in a two-sided market. It makes it possible to implement a business model based on the on-demand economy and focuses on processing related tasks simultaneously by making it possible for all the entities involved in the business process to cooperate by sharing information in real time. Dell’s computer platform, which shows the value stream’s reverse flow, allows for real-time cooperation by sharing ordering information in real time with PC parts suppliers, monitor manufacturers, and shipping companies, rather than sending order information to relevant organizations sequentially. This model also applies to advertising network platforms. In the Samsung AdHub platform, advertisers (supply side) deliver advertising to end users through the ad network platform when end users (demand side) request advertising through the ad network platform. In the case of tailor-type value streams, value creation and value co-creation take place because of their consumer-centered approach. In other words, value is co-created with the stakeholders. It is crucial to research and analyze the business value on such platforms because they allow value to be co-created [

57,

59]. Both direct and indirect network effects occur on tailor type platforms just as they do on supplier-type platforms. That is, platform providers generate economic effectiveness through both same-side (direct) network and cross-side (indirect) network (see

Table 3).

5.3. Value Stream Starts from Both Sides: ‘Facilitator’ Type

The third platform business model based on the value stream is the “both-oriented platform.” In this model, the platform participants become a kind of “prosumer” who acts as both a producer and a consumer. This model leverages both the producer- and consumer-centered approaches. Both parties produce and consume products and services directly through the platform. The boundary between producers and consumers is therefore blurred and the platform facilitates the activities of the prosumers. This type of value stream is named the “facilitator type.” Pattern matching confirmed that value stream integration occurs for the facilitator type because products or services are produced and consumed through the platform from the perspective of a prosumer, rather than with a clear distinction between consumers and producers. Some prominent cases of facilitator type platforms are Yahoo! Answers, Instagram, RecordFarm social audio, Naver Challenge webtoon, Google YouTube, and Blogger, to name a few. Users can view desired user-created content (UCC) through YouTube (demand side), and they can create and upload their own UCC (supply side) to the platform. Similarly, users of Facebook and Blogger upload their own content to the platform (supply side) and also consume the content of other users (demand side) at the same time. In the case of Yahoo! Answers—the most prominent knowledge search platform—users pose questions (demand side) and also answer them (supply side) in the same platform, again both producing and consuming content.

In a platform business model, value stream integration can only be horizontal or vertical because the value stream constantly flows in one direction, regardless of whether it is reversed. The conventional supply side is responsible only for producing products or services, whereas the conventional demand side is responsible only for requesting or consuming products or services. With a facilitator type model, both the supply and demand sides produce and consume products and services at the same time. This creates a facilitator type value stream in both directions and allows for exponential business growth, as demonstrated by Instagram and YouTube. The webtoon challenge platform of Naver’s web-comic service does not distribute existing cartoons to consumers; rather, it is a way for people to create and upload their own cartoons freely and read the cartoons of others simultaneously. Readers in this model no longer consume comics in one direction: they are now also content providers. Thanks to this facilitator type method, Naver has developed a new market in the published cartoon industry, which was widely in decline. Furthermore, it achieved substantial growth by integrating the value stream. As of June 1, 2014, 139,789 cartoonists had participated in Naver’s platform, and their work had been viewed 29,243,054,984 times. Some accessible content has been made into motion pictures, TV dramas, books, or games. Ms. Hong of Naver, the biggest Internet content service company as well as a parent company of LINE, said that Naver’s webtoon challenge platform made a valuable deviation from traditional cartoon media. In other words, it grew by allowing its participants to create and upload their own content, whereas traditional cartoon media produced content or purchased it externally. Moreover, the platform helps generate advertising income by inserting advertisements at the bottom of the challenge webtoons using Naver’s Ad platform. In the case of facilitator type models, normal and reverse value streams and consumer- and producer-centered approaches occur simultaneously, causing both value creation and value co-creation to take place. In other words, platform providers create and co-create business value with other firms by encouraging complementary invention and facilitating network effects in their platform ecosystems [

59]. Both same-side (direct) network and cross-side (indirect) network effects can be seen, similar to the other two platform business models (see

Table 4).

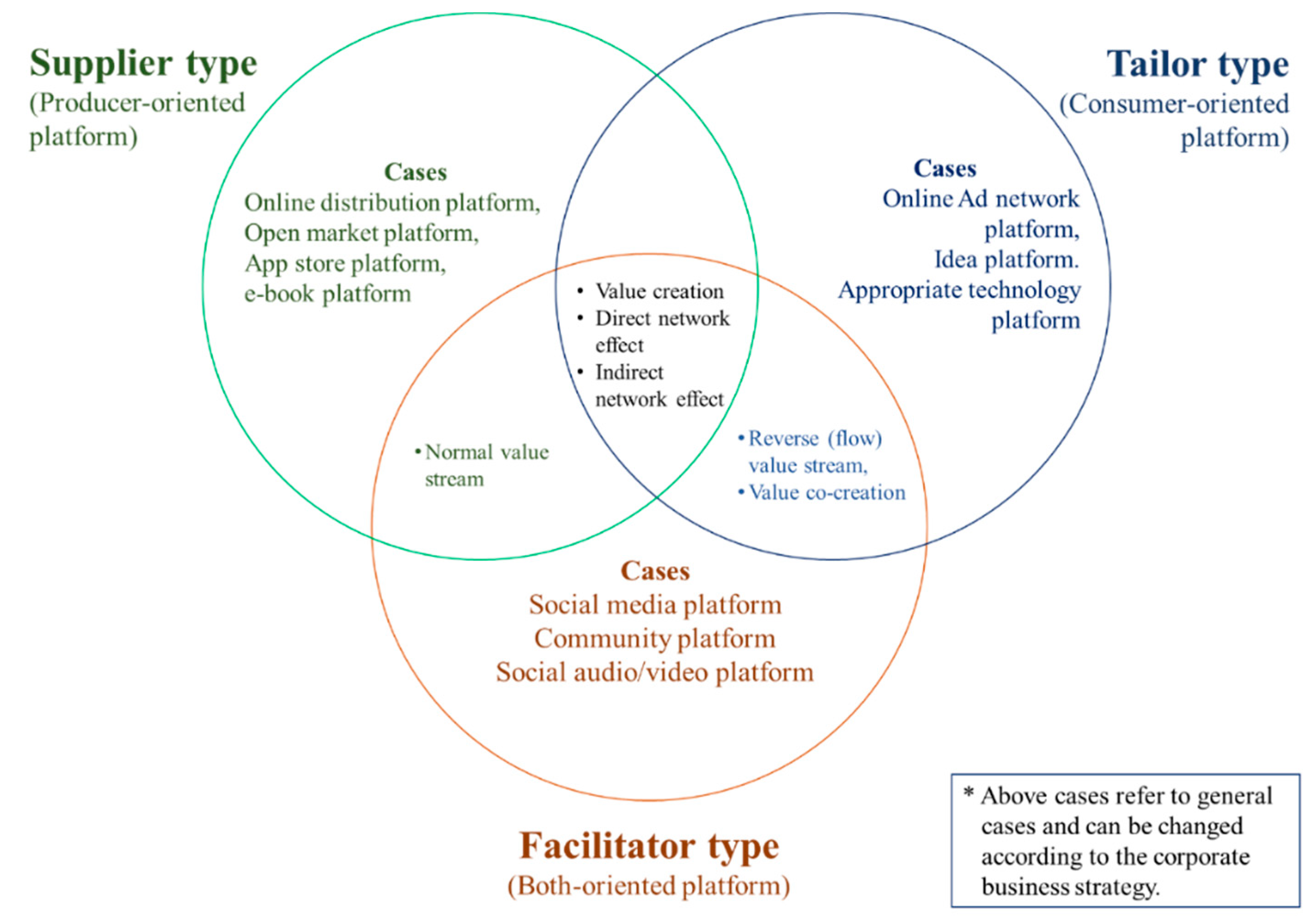

6. Findings: Three Types of Platform Business Models

The results are distinguished based on the three major types of platform business models in accordance with the value stream analysis (see

Appendix C). A summary of the study outcomes in each platform business model, in accordance with the analysis procedure, is shown in

Figure 3. The first model of the platform business model based on the value stream is the “producer-oriented platform.” In this model, the producers deliver certain products and services to the consumers through the platform. The most important feature of this model is that its value stream has expanded to become external. This is known as a value stream’s eternal extension. Platform providers have focused on interconnecting organizational processes as a competitive strategy by making various third parties participate in two-sided markets. For existing value streams, the closed system of traditional supply stream management is a critical component of an organization, and the value stream was therefore only internal. However, it became impossible to gain a competitive advantage by only expanding networks and intensifying competition, implying that it is now necessary for organizations to leverage inter-organizational value streams that cover not only suppliers but also end users. In the case of supplier type, value creation takes place. However, this is a producer-centered approach; thus, value co-creation does not take place. In contrast, both direct (same-side) network effects and indirect (cross-side) network effects took place.

The second platform business model based on value stream is the “consumer-oriented platform.” In this model, consumers request products or services from producers through platforms. Producers then deliver these products and services to consumers through platforms. This model requires a consumer-centered approach. The biggest attribute of this model is the reverse flow of the value stream, which shifts the starting point of the value creation process from the supplier to the customer. Value creation is indeed based on the fact that there are customers. Such reverse thinking of value streams is a unique concept that is often found in two-sided markets. That is, it makes it possible to implement an on-demand economy from a business model perspective. It is about processing relevant tasks simultaneously by allowing all the participating subjects of the business process to cooperate with each other through sharing information in real time based on the market (customer). The tailor type is a consumer-centered approach; thus, it facilitates value co-creation in addition to value creation. In the case of the network effect, both direct (same-side) network effects and indirect (cross-side) network effects took place, similar to the supplier type.

The third platform business model based on value stream is “both-oriented platform.” In this model, platform participants become a “prosumer” who has the attributes of both the producer and consumer. Thus, it needs to have both a producer-centered and a consumer-centered approach. Value stream integration in the platform business model represents a horizontally/vertically integrated value stream while a unidirectional flowing value stream flows in from both directions, regardless of whether it flows in a forward or reverse direction. Previously, the supply side supplied products or services, whereas the demand side requested or consumed products or services. In the facilitator type, however, both supply and demand sides produce and consume products or services. In the facilitator type, the normal value and reverse value streams exist; thus, value creation and value co-creation also occur. Meanwhile, network effects were found on both direct (same-side) networks and indirect (cross-side) networks, as per the aforementioned platform business models.

7. Conclusions

This study tested the following proposition: according to the unique nature of two-sided markets, there are three significant typologies of platform business models. This proposition was analyzed by pattern-matching logic, as suggested by Yin [

65] and Trochim [

76]. It then examined whether the predicted patterns (acquired by the analysis in the literature) and the previous secondary data and patterns observed from the consistent data matched. The characteristics of each model were analyzed in accordance with the value stream using six core categories (normal value stream, reverse (flow) value stream, value creation, value co-creation, direct network effects, and indirect network effects). This study examined the phenomena inductively using a pattern-matching analytic technique to analyze and deduce the value stream and types of platform. To this end, this study investigated multiple cases and analyzed the data through coding and pattern matching. It examined the direction of the value stream under a platform business model, the occurrence of value creation and co-creation, and the creation process resulting from direct and indirect network effects in accordance with the multiple-case study analysis approach of Yin [

65]. In addition, this study attempted to classify the types of platform business models in accordance with the characteristic patterns of their respective value streams and also examined the platform strategies based on the value stream; the implicit acknowledgment was that the strategic content to be chosen would vary depending on the type of value stream and value chain.

This study extends the understanding of the value stream and identifies it as a critical strategic element of a platform business. More specifically, it illustrates how various value chains have distinct implications for different types of platform business models. There have not been many studies on platform businesses, with most focusing on the business model’s value chains and streams rather than on its elements, leadership, and policies. Although understanding value chains is an important element of competitive advantage strategies, relatively little attention has been placed on value streams in the platform business model, in which various value streams occur according to the unique nature of the two-sided market. Therefore, this study complements the gap in the literature and makes a theoretical contribution. This study verified whether the prediction pattern deduced based on the literature review was consistent with the pattern observed from the primary data in six main areas: normal value chain, reverse (flow) value chain, value creation, value co-creation, direct network effects, and indirect network effects. It then analyzed the characteristics of each platform business model type. Therefore, using in-depth multiple case studies, this study explored three types of platform business models in accordance with the value streams. Furthermore, it analyzed and traced how each platform business model shows different value chains, value creations, and network effects. That is, this study proposes three types of platform business models which will serve as a frame of reference for analyzing the impact of the different value chains in platform businesses. This study makes a research contribution by illustrating how various value stream changes in platforms have distinct implications for different types of platform business models.

Under the characteristics of two-sided market theory, platforms have different types of value stream models. For this reason, it is necessary to understand value streams within the platforms. An accurate understanding of value streams is a core factor for firms which provide platform business to create a competitive advantage strategy. In other words, the platform changes the rules of the competition and the market paradigm. Thus, this study also contributes to the practical field by offering suggestions on how business performance could be substantially improved through platform strategy. It is imperative that a platform business has many participants [

80], so it would be difficult for them to succeed without a clear vision and good leadership. One cannot succeed by going it alone in the world of platforms. A fruitful outcome will result when one cooperates with various stakeholders for value creation based on the two-sided market. This is because a variety of as-yet unknown innovations are created spontaneously by the platform. By this account, it is important for corporations that leverage their platforms to create value and analyze their value streams; development, manufacturing, and sales remain equally important for them. Due to this, platform providers need to recognize which of the three types of platform business models their platform fits to ensure their business grows successfully. However, a research limitation is that the platform business model was analyzed using a static approach in this research. In future research, therefore, we will examine each type of platform business model; Supplier type, Tailor type, and Facilitator type, with a dynamic approach and step-by-step business strategy.