Abstract

This investigation was carried out on the adoption of the e-money payment model with the application of a quantitative and qualitative approach (mixed methods). Online questionnaires, which included closed-ended questions on a Likert five-point scale and open-ended questions, were distributed through social media chat groups. Respondent samples were drawn from the population of adolescent customers in Indonesia. The collected questionnaires were verified for accuracy, reliability, and validity before the data were analyzed. Adequate data were used to test the relationship model between latent variables, and the relationship of latent variables in the model was tested using partial least squares by employing Smart-PLS 3.0 software and NVIVO 12 plus. The final analysis shows that the reasons for adopting e-money are practicality and convenience. The main reasons that customers adopt electronic money are its practicality, ease of use, efficient transaction time, faster payment, and the simplicity of the payment process. The final modeling formed good-fit inner and outer models. This model verifies the significant influence of social factors, effort expectancy, and facilitation conditions on e-money attitudes. Additionally, social factors, effort expectancy, and attitudes have a significant influence on e-money behavior.

1. Introduction

In the recent cashless era, the proliferation of mobile technology and the digitalization of financial services have developed significantly, marked by the birth of electronic money as an alternative mode of payment that is seen as part of a new and modern lifestyle [1,2,3,4]. These developments are forcing customers to deal with technology-based payment modes that are relatively unfamiliar to them. Such methods enable users to choose to pay in cash or use electronic money for their transactions [5]. Persuasive marketing is flooding various forms of media with the aim of convincing customers to use electronic money. Various advantages and conveniences are explained by the media to inspire customers to adopt the electronic money platform. Furthermore, support from authorities, the provision of facilities by merchants, the ease of obtaining application devices, social–economic factors, and the widespread use of smartphones encourage customers to adopt these high-technology payment methods [6,7,8,9,10,11,12]. There are many advantages and conveniences associated with making payments electronically, submitting mobile payments, or using e-money. However, studies on electronic, online, and mobile payments have revealed some typical security problems, which are one of the main obstacles to the adoption of e-money. Customers may be faced with the risk of failure to make payments due to inadequate infrastructure, the risk of misuse of personal data, the risk of fraud committed by malicious parties, and other risks [13]. Customers are faced with problems related to risk, a lack of e-money, and ease of possession; therefore, customers have not necessarily been using e-money in transactions.

E-money payment, as a meaningful new business model [14] innovation in business and economic life, has attracted great interest from academics and practitioners from multiple perspectives. There are several important points related to the emergence of electronic money as an innovation in the era of economic capitalism with limited capital. The platform or application is presented as a new technology [15], the result of engineering, or a creation by an entrepreneur in a company or through collaboration between entrepreneurs, that assumes that innovation is based on firms’ need to produce a successful innovation that creates added value for the firm [16,17]. The success of entrepreneurs creating innovations that create added value (in this case, e-money payment) is determined by at least three important parties, namely, innovators who are entrepreneurs, partners such as financial institutions or providers of internet facilities, and the user in the open innovation ecology [18]. Ecosystems that involve various parties can create an environment that supports and influences the success of open innovation. The use of technology is a crucial component that determines the success of innovation in society. What is thought, perceived, and done by innovators and entrepreneurs in the form of a platform design (for example, e-money) is not always in harmony and able to fulfill what the user wants. According to the innovator, some aspects of e-money (practicality, ease of use, and time-saving potential) are not necessarily the same as what is experienced and felt by the user. Customers are users of e-money technology, and are a determinant of the success of innovation in finance. Their behavior to be willing to use and continue to use a Financial Technology (Fintech) innovation is a determinant of its success or failure. Therefore, this paper is designed to show open innovations in finance from the user side, namely, customers. The results have implications for open innovation stakeholders and can be used as dimensions or indicators to measure the success of e-money payment application innovations.

The lack of customer willingness to adopt e-money as a medium of payment in transactions is a very interesting social business phenomenon that requires deeper study. Some previous research has addressed the adoption of e-money as a medium for payment. However, previous studies, generally using the technology adoption model, have not used theories in specific contexts. The traditional models—the Theory of Planned Behavior (TPB), the Technology Acceptance Model (TAM), and the Unified Theory of Acceptance and Use of Technology (UTAUT), as well as their extensions—form a framework of approaches that are considered appropriate [19], which continue to be studied and developed [20]. Some relevant studies have used these approaches to test the effect of attitudes on the intention to use smartphone-based e-money [21], examine the explanatory factors for the adoption of financial technology [22], explain the intentions of the electronic payment system (cashless) using UTAUT [23,24,25,26,27], and study electronic payment adoption specifically in Indonesia [28]. Studies have used TPB to explain the intention to use e-money [5] and the TAM model to test the factors that influence someone to buy sports tickets online [29] and to analyze mobile payment systems [30,31,32]. Other studies have combined TAM with TPB in internet banking [33]. The adoption of e-money as a transaction payment tool, from the perspective of TPB, is an action that is preceded by intention. The intention arises as a result of the attitude towards e-money and subjective norms that are supported by behavioral control. However, in this theory, the fulcrum lies in the actors whose behavior is being studied and external actors in the form of subjective norms and behavior control. Meanwhile, the TAM model illustrates that the adoption of the use of technology, as well as the e-money platform, is predicted by the perceived usefulness and perceived ease of use of technology. This means that whether someone is willing to adopt new technology, including a form of payment based on financial technology, is determined by their acceptance of the benefits and the ease of use associated with the technology.

The use of e-money in transactions can be seen as an adoption of new technology by the public. In this case, the customer operates the technology’s application system, which requires both hardware- and software-based devices on the payer’s side and receiving devices on the merchant’s side. Additionally, e-money is a relatively new financial service product, especially in certain regions, such as Indonesia. The theoretical perspectives and approaches used by previous researchers are relevant for explaining the e-money phenomenon, but further development studies are still required [34]. The behavior of someone using or willing to use a technological device, which includes hardware and software, is determined not only by the attributes inherent in the device system but also contextual factors and personal factors that exist in the individual. Therefore, integrating parts of the previous model is challenging work [20,35,36] but will be very useful theoretically and practically. Departing from the imperfections of the approach used by previous researchers, the study in this paper integrates TPB, TAM, and UTAUT adjusted to the e-money object. Furthermore, this study also explores the reasons that customers use these devices. Starting from these conditions, an intriguing question raised in this paper explores the main reasons that customers use e-money and the degree to which factors inherent in the actors, attributes inherent in e-money application devices, external conditions that facilitate the use of e-money, and social factors contribute to the adoption of e-money behavior in the transaction.

Previous studies related to electronic payment have not fully investigated both external and internal factors that influence customers’ intentional behavior to adopt and continue to use various e-money apps in a single study, approach, and relevant context. The significance of this paper is that academic empirical research using both qualitative and quantitative approaches is a relatively new method for studying electronic payment, and that there is a scarcity of published literature that explores electronic payment adoption in Indonesia from the customer behavioral perspective. Using a model based on TPB, TAM, and UTAUT, this study contributes to the research by assessing the relevance and effects of three independent variables, namely, social factors, effort expectancy, and facilitating conditions, on influencing the customer to use e-money in Indonesia, mediated by the customer’s attitudes towards e-money. This study assesses the reasons that adolescent customers use e-money as well. There are two basic questions that needed to be addressed: What are the factors that influence adolescent customers to use e-money? How do social factors, effort expectancy, and facilitating conditions influence the behavioral intentions of customers to adopt e-money in Indonesia, mediated by attitudes towards e-money? This paper is systematically arranged so that the reader can easily understand its content, starting from the introduction, which explains the necessity of the research and the issues to be studied. In the next section, the methodology is described and includes the approach, population, sample, data gathering technique, data analysis, and evaluation of the goodness-of-fit of the model. In the last part, the data processing results, the output data analysis, and discussion of results are presented. At the end of this paper, conclusions, limitations, and recommendations are presented.

2. Methodology

In this study, quantitative and qualitative survey approaches were used to gather data from adolescent customers with an age range of 15 to 25 years old. Primary data were obtained using a points-based questionnaire (closed-ended) on a Likert five-point scale (Strongly Agree, Agree, Neutral, Disagree, and Strongly Disagree), and some question items were open-ended, distributed through a social media chat group. The respondents were selected using non-probability convenience sampling. Respondent samples were drawn from the population of adolescent customers in Indonesia. The collected questionnaires were verified for completeness and validity by using the imputation technique, and respondents whose data were incomplete were excluded from the analysis stage. After the verification, 160 cases (96.96%) were retained. The amount of data has sufficient statistical power (0.99), which was calculated using G-Power software. The data from open-ended questions were analyzed by using NVIVO 12 Plus software, and demographic data were analyzed by using Jeffrey’s Amazing Statistics Program (JASP) software.

The Theory of Planned Behavior (TPB), as an extension of the Theory of Reason Action (TRA), has been widely applied to explain the interrelationship between attitude and behavior. In the theoretical model, the real behavior of a person is influenced by the intention of the behavior, while the intention to behave in a certain way is influenced by one’s attitude towards subjective objects and norms. On the other hand, the Technology Acceptance Model (TAM) was developed to explain how new technologies and various inherent aspects are accepted and used by users. Although many models have been proposed previously in the Information Systems field to describe relationships, this model has been widely recognized and used. In this model, the acceptance of new technology by users is based on two factors, namely, perceived usefulness, which refers to how much the user believes that technology will help improve performance/efficiency, and perceived ease of use, i.e., the extent to which users feel comfortable using technology features. These factors then determine the user’s attitude towards the use of technology. This model goes on to say that the perceived usefulness will also influence behavioral intentions to use. A person’s attitude will determine his or her behavior and, in turn, affect actual acceptance. The Unified Theory of Acceptance and Use of Technology (UTAUT) theoretical framework is widely used to predict behavioral intentions for technology adoption. The intention to use something is predicted by performance expectations (PE), business expectations (EE), social influence (SI), and facilitating conditions (FC). Some researchers, as mentioned in the introduction, have modified the model. Departing from various methods in the literature and from the three approaches, the three models were compiled or modified in this study by applying variables adjusted to the object of study, namely, e-money. The author deliberately employs the social influence variable, which is commensurate with the subjective norm and with the social factor terminology. Adequate data related to social factors, effort expectancy, and facilitating conditions in e-money attitude and behavioral intention were used to build structural models and measurements using Partial Least Square-Structural Equation Modeling (PLS-SEM) by employing Smart-PLS 3.0 software. The significance of the correlation between variables in the structural model (inner model) was tested by comparing the T-statistic values with the T-critical value (2.00). If the T-statistic value was greater than or equal to 2.00, the relationship of the variable was declared to be significant. Meanwhile, the significance of the indicators forming latent variables was tested in the same way. If the T-statistic value was greater than or equal to the T-critical indicator, it was deemed to be significant.

3. Construct and Indicator

The structural model illustrates the relationship between the influence of social factors, effort expectancy, and facilitating conditions on e-money attitude and the influence of e-money attitude on e-money intention behavior. Each of these latent variables is unobservable and measured by valid indicators. The results of validity testing of the measurement model show that the construct of latent variables is composed of valid indicators: the T-statistic value is greater than the critical value (1.96), and the loading value is greater than 0.60, indicating that all the construct indicators are valid. Indicators as a measure of each latent variable are detailed in Table 1.

Table 1.

Variables and Measurement.

4. Model Evaluation and Discussion

4.1. Demography

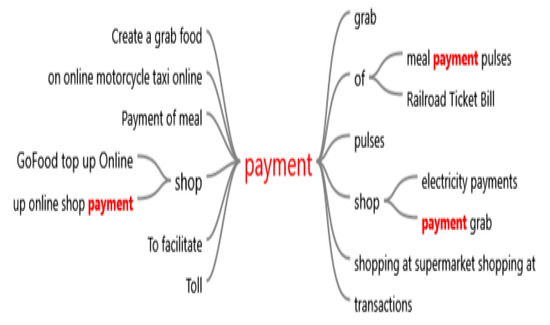

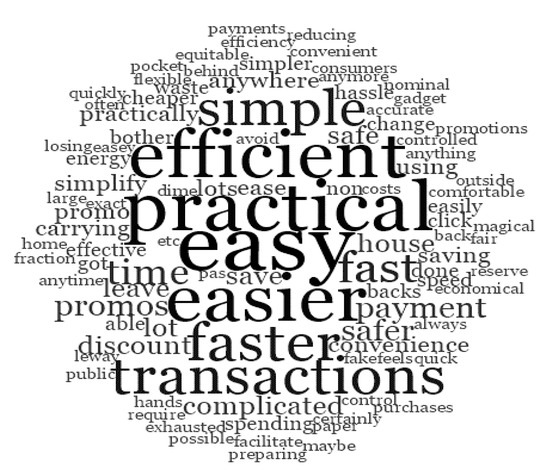

From the data that have been collected, the characteristics of respondents, including age, e-money ownership, and gender, were obtained. From the aspects of e-money technology ownership, most respondents owned and used Ovo (27.86%), Gopay (21.24%), Linkaja (13.17%), Mandiri “E-money” (6.18%), and Brizzi (5.11%), and 20.15% used other electronic money. The use of electronic money by respondents varies, ranging from online shopping, paying for online taxi services, paying for food delivery, buying movie tickets, and shopping for various daily needs. The data processed in NVIVO 12 plus can be visualized in Figure 1. The main reasons that customers reported using e-money in transactions are that using e-money is practical, easy, not time-consuming, and efficient, as detailed in Figure 2. The majority of respondents are female (101/63.13%) and the minority are male. This indicates that, compared with men, more women prefer to use electronic money. Aside from being very easy to apply, practical, and low-risk compared with carrying cash, electronic money is more suitable to women. Meanwhile, in terms of age, the majority of respondents (up to 84.38%) are in the age group of 16–20 years old. Only a small proportion is outside this age group. Psychologically, this age group consists of those who are still trying to define themselves and who adopt new things, including technology-based money. The group is a generation of people who are very literate in information technology, have adequate skills, are sensitive to technological changes, and are smartphone holders.

Figure 1.

Word tree NVivo result for e-money usage by customers.

Figure 2.

Word cloud NVivo result for the reasons for e-money usage.

4.2. Model Evaluation

The purpose of this investigation was to test the relationship model of the influence of latent variables (e-money behavior and e-money attitude), as assessed through social factors, effort expectancy, and facilitating conditions. These variables were taken from several models, namely, TPB, TAM, and UTAUT, and each factor was measured by valid indicators. The outer model is a formative measurement of latent variable models of the first order. The measurement model needs to be assessed for the reliability and validity of each latent variable. The validity can be assessed by using convergent validity, which describes the level of confidence in the goodness of the measurement of each indicator. Furthermore, the model needs to be assessed by using discriminant validity, which illustrates the differences or discrepancies between indicators in latent variables. Convergent validity was assessed by Average Variance Extracted (AVE) and Composite Reliability (CR). AVE measures the level of construct variation compared with the level of measurement error. AVE values above 0.70 indicate excellent measurements, and AVE values that can be accepted are at least 0.50. CR is a measure of reliability whose value is lower than Cronbach’s alpha; an acceptable CR value is at least 0.70 [41].

Table 2 shows the AVE, CR, Rho-A, and Cronbach’s alpha for the latent variables (e-money attitude, e-money behavior), effort expectancy, facilitating conditions, and social factors. All latent variables were found to be constructively valid according to Cronbach’s alpha, Rho-A, and composite reliability values, with values above the critical value (0.70). Likewise, with the AVE value, all latent variables were greater than 0.50. Additionally, discriminant validity was also measured using Heterotrait–Monotrait Ratio (HTMT) criteria. Many authors have suggested that a latent variable construct is valid if the HTMT value is below 0.90, and some authors even recommend that it be below 0.85. A HTMT value of 1 indicates that the variable is invalid [42,43]. In Table 3, we can see the HTMT value of e-money attitude with e-money behavior is 0.877, while others are below 0.85, and that of the facilitating conditions variable with social factors is 0.570. If the cut-off is 0.90, it can be said that the latent construct in the model meets the requirements.

Table 2.

Indicators of latent construct validity.

Table 3.

Heterotrait–Monotrait Ratio (HTMT).

Cross-loading was used to detect discriminant validity. An indicator has a higher correlation with itself compared with other variables. Table 4 shows the cross-loading values. All indicators that use a latent variable indicator in the cross-loading value model of each indicator are greater than the latent variable itself (bolded numbers) compared with other variables (smaller and non-bolded numbers). For example, in the first row, A-Att1 is an indicator measuring the variable e-money attitude, and written in the second column is 0.822, which is greater than the values in the other columns (0.589, 0.686, 0.625, and 0.465). This indicates that A-Att1 is a valid indicator as a measure of the e-money attitude variable compared with its effectiveness as a measure of other variables. For indicators of other variables, the value is greater than the variable itself compared with other variables. This also indicates that the indicators measuring these latent variables are valid.

Table 4.

Cross-loading latent variable indicators.

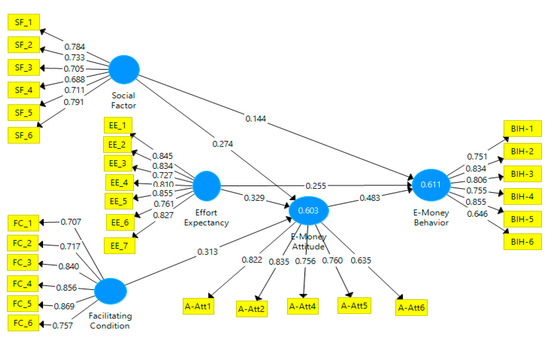

Table 5 shows the values of R-squared and adjusted R-squared, which describe the ability of the social factors, facilitating conditions, and effort expectancy to explain the e-money attitude and e-money behavior variables. For the e-money attitude, R-squared is 0.603, which means that the e-money attitude variable is explained by the two independent variables at 60.3%, and the rest (39.7%) is influenced by other variables. The R-squared of e-money behavior variables is 0.611, which means that the influence of social factors and effort expectancy in e-money attitude on e-money behavior is 61.1%, while 39.9% is influenced by other variables.

Table 5.

Multiple correlation endogenous variables.

Multicollinearity occurs when two or more independent variables in a model correlate, resulting in redundant information and responses. Multicollinearity is measured by variance inflation factors (VIFs) and tolerance. If the VIF value exceeds 4.0, or if it has a tolerance of less than 0.2, this indicates that there is a multicollinearity problem in the model. Table 6 shows that the values of VIFs for the independent variables on e-money attitude and e-money behavior are smaller than 0.4. This indicates that the tested model is free of multicollinearity problems [41].

Table 6.

Inner Variance Inflation Factor (VIF) Values.

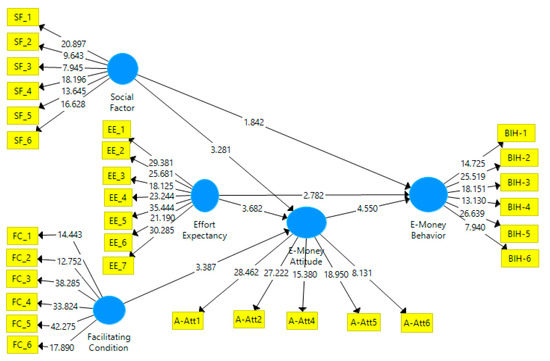

Figure 3 and Figure 4 show the structural and measurement models. The measurement model shows the validity of the construct of latent variables composed of valid indicators, where the T-statistic value is greater than the critical value (1.96), and the loading value is greater than 0.60, indicating that all the construct indicators are valid. In the structural model (Table 7), which describes the path of the relationship between the latent variables, the T-statistic values from 2.591 to 4.758 are greater than T-critical (1.96) at a significance of 5%, except for the social factor pathway to e-money behavior, for which the T-statistic is only 1.861, significant at the 10% level. The coefficients of all paths in the inner model (original sample) range from 0.144 to 0.483, with a standard deviation from 0.078 to 0.101. The coefficient indicates the magnitude of the effect of latent variables on other latent variables. All coefficients are positive, which means that the relationship between these variables is unidirectional. If the independent latent variable changes, then the dependent latent variable will increase. For example, the e-money attitude to e-money behavior path coefficient is 0.483, reflecting the magnitude of the change that will occur if the e-money attitude changes. The interpretation of the meaning of changes in variables depends on the measurement and scale used. Not every change can be interpreted quantitatively.

Figure 3.

Structural model with weights (coefficients).

Figure 4.

Measurement model of latent variable (t-statistics).

Table 7.

Path Coefficient Mean, Standard Deviation (STDEV), T-Values, and p-Values.

The basic framework of the model includes one or several TPB, TAM, and UTAUT domains. The focus of the model is the integration of the three models lying in the domain that is positioned at the far right of the model, namely, e-money behavioral intention. Within various associated study contexts, the model has been widely applied, either portraying intention as a mediator or without mediation. The results show that behavior towards an object is consistently predicted by attitude. Likewise, the results of data analysis show that the intentions and behavior regarding the use of e-money are significantly predicted by attitudes towards e-money. These results support previous research applied in a variety of contexts. For example, in the case of online shopping, it was stated that shopping behavior online or through the internet was influenced by a person’s attitude towards the shopping system [44,45] in the context of mobile banking adoption [46], use of non-cash systems [27], and adoption of smart home technology [47]. More specifically, it supports research carried out in the context of the use of electronic payments, mobile payments, the use of e-money, and similar topics [48,49].

More specifically, the e-money behavioral intention domain is a construct that is measured through the following indicators: application installation, continuity of use, plan to use in the short term going forward, familiarization, the user’s intentions to not reinstall, immediately top up, and recommend that others use e-money for payment transactions, as well as whether it is the main means of payment when making transactions. The composite intention and behavior are explained by the subjects’ attitudes towards e-money, as measured by the following indicators: good ideas, fun, knowledgeable, modern, and top class. This means that customers intend to use and actually use e-money in transactions because of their attitude about it. For example, customers will continue to use and get used to e-money for payment transactions because they feel that using e-money is a good idea, modern, not old-fashioned, and fun. This indicates that the attitude towards a particular object is a prediction of a person’s behavior related to the object, consistent with the TPB framework and the previous research that forms the basis of this paper.

Besides being influenced by attitude, one’s behavior in using e-money is significantly influenced by effort expectancy and social factors. The two predictors are domains commensurate with social influences taken from the UTAUT framework [50] and subjective norms in the TPB framework [51]. This indicates that one or several domains from an established and widely applied basic framework, in this case, TPB and UTAUT, still provide consistent results. Analysis in the context of the use of e-money as a means of payment transactions consistently supports previous research results, i.e., that social factors and effort expectancy are predictors of behavior [26,27,44,47,48,52]. This means that customers will continue to use e-money, make it the first choice of payment, and keep the installed e-money application on smart devices because of external persuasion such as shops that they visit and close friends or family as social factors.

Analysis based on available data shows statistically significant results, indicating that the behavior and intention to use e-money are positively influenced by the existence of outsiders who provide useful and practical assessments of their attributes in a meaningful way. The significance of these findings supports previous research that applied TPB and UTAUT as a whole in the context of non-cash transaction payments [26,27,46,53]. Attitudes towards e-money are the closest explanatory variable in the hypothesis model tested in this paper. The attitude domain is taken from the TPB framework [51,54,55] as an explanation of intentions of behavior. As an explanation, the formation of attitude is influenced by external factors, namely, factors external to the performer. In this study, the attitude that is being optimized is influenced by social factors and facilitating conditions. External factors are parties, close people, or sellers that exist externally to the customer, while facilitating conditions are more focused on the available infrastructure that allows customers to make transactions using e-money. This concept is taken from the UTAUT framework, whereas the TPB framework is more directed towards behavior control. Some valid measures of these variables include the availability of facilities at merchants, internet connection support, adequate smartphone, user skills, financial institution support, and the possibility of payment default. The analysis shows that customer attitudes towards e-money are significantly predicted by these two domains. That is, positive customer attitudes related to the measures used are caused by the condition of infrastructure as a support and also by the persuasion of social factors. The existence of internet connection, support by adequate devices, and user skills, coupled with the encouragement of external parties such as shops, financial institutions, and the people closest to the individuals, will make users of e-money have a positive attitude. The positive attitude is reflected by feeling happy, feeling unworried about personal data being misused, and feeling up to date. This finding does not contradict and instead strengthens previous studies that tried to take part of the domain or apply the TPB and UTAUT approaches completely in various contexts, for example, the context of payment transactions that do not use cash [50,55,56,57,58].

5. Conclusions and Recommendation

From the findings above, it can be concluded that the frameworks of the TPB, TAM, and UTAUT models are consistent and can be extended in various contexts, specifically in explaining the social phenomenon of the adoption of e-money as a means of payment by customers in Indonesia. Constructing an integrated model by applying one or more domains taken from several theoretical frameworks can be more useful for explaining recent social phenomena. Reconstruction of a model that is considered well-established by using a domain that might apply is not the same as the basic model. For example, in this paper, the attitude variable, without applying the intention variable before the behavior variable, enriches the existing model.

This paper examines subjects who are mostly in the same age group in Indonesia and who have relatively similar characteristics, so if the tested model is applied in a different population context, it will produce different results but become more meaningful. Therefore, there is a great opportunity for future researchers to apply this model to different social contexts. Although the sample in this study can be considered statistically adequate, the model should be tested on a larger number of samples so that the results are more robust. This study was conducted on samples taken from populations using non-probability techniques, which have low generalizability, compared with using probability sampling techniques. The next researchers should take their sample using probability techniques so that their results have a high generalization power. As practical managerial recommendations, especially for electronic money-based service providers, if companies want to increase the penetration of electronic money users, they can pursue this goal by strengthening social factors through e-money education, providing incentives for merchants, educating family and close friends as social factors, and increasing the availability of adequate infrastructure. Furthermore, in regard to the implications of this study, the factors that influence e-money payment adoption, such as practicality, time efficiency, and ease of operation supported by supporting facilities from supporting stakeholders, the banking sector, and internet service providers, can be used by the entrepreneur and open innovation stakeholders as dimensions or indicators to measure the success of e-money payment application innovations.

Author Contributions

W.W. conceived, designed and reviewed the survey, managed the literature design and the online questionnaire, prepared and analyzed data, and drafted the paper; I.M. verified the results of the analysis, and reviewed the draft and final paper; N.R.S. collected the data through the online questionnaire, and validated collected data. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Directorate of Research and Community Service, University of Muhammadiyah Malang, Indonesia, through the Development of Scientific Work scheme, 2020 fiscal year budget.

Acknowledgments

With much appreciation, I would like to thank all those who supported me during my journey with this research. First, I’d like to thank Allah for giving me the ability, strength, and guidance for the successful completion of this manuscript. Thank you to the chancellor and vice-chancellor, the Director of the Directorate of Research and Community service Dean of the faculty of economics and business, the University of Muhammadiyah Malang, and those who helped with the research.

Conflicts of Interest

The authors declare that there was no conflict of interest.

References

- Dávid, V. Fintech, the new era of financial services. Vez.-Bp. Manag. Rev. 2017, 48, 22–32. [Google Scholar] [CrossRef]

- Engert, W.; Fung, B.S.C.; Hendry, S. Is a Cashless Society Problematic? Bank of Canada: Toronto, ON, Canada, 2018. [Google Scholar]

- Gofe, T.; Tulu, D. Determinants of Customers E-Payment Utilization in Commercial Bank of Ethiopia the Case of Nekemte Town. Int. J. Econ. Bus. Manag. Stud. 2019, 6, 378–391. [Google Scholar] [CrossRef]

- Jain, P.; Singhal, S. Digital Wallet Adoption: A Literature Review. Int. J. Manag. Stud. 2019, 6. [Google Scholar] [CrossRef]

- Ayudya, A.C.; Wibowo, A. The Intention to Use E-Money using Theory of Planned Behavior and Locus of Control. J. Keuang. Perbank. 2018, 22, 335–349. [Google Scholar] [CrossRef]

- Lin, X. Factors Influencing the Chinese Customers’ Usage Intention of Korean Mobile Payment. In Proceedings of the 2019 3rd International Conference on E-commerce, E-Business and E-Government—ICEEG 2019, Lyon, France, 18–21 June 2019; pp. 40–44. [Google Scholar] [CrossRef]

- Shanthini, J.S.; Nallathmbi, J.I. A Study On Customer’s Perception Regarding Cashless Transaction in Peikulam Area. Int. J. Bus. Adm. Res. Rev. 2018, 21, 101–108. [Google Scholar]

- Sivasakthi, N.R.D.; Nandhini, M. Cashless transaction: Modes, advantages and disadvantages. Int. J. Appl. Res. 2017, 3, 122–125. [Google Scholar]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Sarika, P.; Vasantha, S. Impact of mobile wallets on cashless transaction. Int. J. Recent Technol. Eng. 2019, 7, 1164–1171. [Google Scholar]

- Roy, S.; Sinha, I. Factors affecting Customers’ adoption of Electronic Payment: An Empirical Analysis. IOSR J. Bus. Manag. 2017, 19, 76–90. [Google Scholar] [CrossRef]

- Moslehi, F.; Haeri, A.; Gholamian, M.r. Investigation of effective factors in expanding electronic payment in Iran using datamining techniques. J. Ind. Syst. Eng. 2019, 12, 61–94. [Google Scholar]

- Coppolino, L.; Romano, L.; D’Antonio, S.; Formicola, V.; Massei, C. Use of the dempster-shafer theory for fraud detection: The mobile money transfer case study. In Intelligent Distributed Computing VIII; Springer: Cham, Switzerland, 2015; pp. 465–474. [Google Scholar]

- Yun, J.H.J.; Zhao, X.; Wu, J.; Yi, J.C.; Park, K.B.; Jung, W.Y. Business model, open innovation, and sustainability in car sharing industry-Comparing three economies. Sustainability 2020, 12, 1883. [Google Scholar] [CrossRef]

- Yun, J.J.; Kim, D.; Yan, M.R. Open innovation engineering—Preliminary study on new entrance of technology to market. Electronics 2020, 9, 791. [Google Scholar] [CrossRef]

- Marques, J.P.C. Closed versus Open Innovation: Evolution or Combination? Int. J. Bus. Manag. 2014, 9. [Google Scholar] [CrossRef]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Ortiz, J.; Ren, H.; Li, K.; Zhang, A. Construction of open innovation ecology on the internet: A case study of Xiaomi (China) using institutional logic. Sustainability 2019, 11, 3225. [Google Scholar] [CrossRef]

- Taherdoost, H. A review of technology acceptance and adoption models and theories. Procedia Manuf. 2018, 22, 960–967. [Google Scholar] [CrossRef]

- Momani, A.; Jamous, M. The Evolution of Technology Acceptance Theories. Int. J. Contemp. Comput. Res. 2017, 1, 51–58. [Google Scholar]

- Friadi, H.; Sumarwan, U. Kirbrandoko Integration of Technology Acceptance Model and Theory of Planned Behaviour of Intention to Use Electronic Money. Int. J. Sci. Res. 2018, 7. [Google Scholar] [CrossRef]

- Lee, W. Understanding Customer Acceptance of Fintech Service: An Extension of the TAM Model to Understand Bitcoin. IOSR J. Bus. Manag. 2018, 20, 34–37. [Google Scholar] [CrossRef]

- Hussain, M.; Mollik, A.T.; Johns, R.; Rahman, M.S. M-payment adoption for bottom of pyramid segment: An empirical investigation. Int. J. Bank Mark. 2019, 37, 362–381. [Google Scholar] [CrossRef]

- Sobti, N. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. J. Adv. Manag. Res. 2019, 16, 472–497. [Google Scholar] [CrossRef]

- Lee, J.M.; Lee, B.; Rha, J.Y. Determinants of mobile payment usage and the moderating effect of gender: Extending the UTAUT model with privacy risk. Int. J. Electron. Commer. Stud. 2019, 10, 43–64. [Google Scholar] [CrossRef]

- Junadi, S. A Model of Factors Influencing Customer’s Intention to Use E-payment System in Indonesia. Procedia Comput. Sci. 2015, 59, 214–220. [Google Scholar] [CrossRef]

- Oktariyana, M.D.; Ariyanto, D.; Ratnadi, N.M.D. Implementation of UTAUT and D&M Models for Success Assessment of Cashless System. Res. J. Financ. Account. 2019, 10, 127–137. [Google Scholar] [CrossRef]

- Andre, G.V.; Baptista, P.T.; Setiowati, R. The Determinants Factors of Mobile Payment Adoption in DKI Jakarta. J. Res. Mark. 2019, 10, 823–831. [Google Scholar]

- Pool, J.K.; Kazemi, R.V.; Amani, M.; Lashaki, J.K. An extension of the technology acceptance model for the E-Repurchasing of sports match tickets. Int. J. Manag. Bus. Res. 2016, 6, 1–12. [Google Scholar]

- Liébana-Cabanillas, F.; Muñoz-Leiva, F.; Sánchez-Fernández, J. A global approach to the analysis of user behavior in mobile payment systems in the new electronic environment. Serv. Bus. 2018, 12, 25–64. [Google Scholar] [CrossRef]

- Acheampong, P.; Zhiwen, L.; Antwi, H.A.; Akai, A.; Otoo, A.; Mensah, W.G. Hybridizing an Extended Technology Readiness Index with Technology Acceptance Model (TAM) to Predict E-Payment Adoption in Ghana. Am. J. Multidiscip. Res. 2017, 5, 172–184. [Google Scholar]

- Bailey, A.A.; Pentina, I.; Mishra, A.S.; Mimoun, M.S.B. Mobile payments adoption by US customers: An extended TAM. Int. J. Retail Distrib. Manag. 2017, 45, 626–640. [Google Scholar] [CrossRef]

- Safeena, R.; Date, H.; Hundewale, N.; Kammani, A. Combination of TAM and TPB in Internet Banking Adoption. Int. J. Comput. Theory Eng. 2013, 146–150. [Google Scholar] [CrossRef]

- Wisdom, J.P.; Suite, E.S.; Horwitz, S.M. Innovation Adoption: A Review of Theories and Constructs Jennifer. Adm. Policy Ment. Health 2014, 41, 480–502. [Google Scholar] [CrossRef]

- Pal, A.; Herath, T.; Rao, H.R. A review of contextual factors affecting mobile payment adoption and use. J. Bank. Financ. Technol. 2019, 3, 43–57. [Google Scholar] [CrossRef]

- Lai, P. the Literature Review of Technology Adoption Models and Theories for the Novelty Technology. J. Inf. Syst. Technol. Manag. 2017, 14, 21–38. [Google Scholar] [CrossRef]

- Lim, S.H.; Kim, D.J.; Hur, Y.; Park, K. An Empirical Study of the Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services. Int. J. Hum. Comput. Interact. 2019, 35, 886–898. [Google Scholar] [CrossRef]

- Sivathanu, B. Adoption of digital payment systems in the era of demonetization in India: An empirical study. J. Sci. Technol. Policy Manag. 2019, 10, 143–171. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender. Electron. Commer. Res. Appl. 2019, 33, 100823. [Google Scholar] [CrossRef]

- Alademomi, R.O.; Rufai, O.H.; Teye, E.T.; Sunguh, K.K.; Ashu, H.A.; Oludu, V.O.; Mbugua, C.W. Usage of E-Payment on Bus Rapid Transit (BRT): An Empirical Test, Public Acceptance and Policy Implications in Lagos, Nigeria. Int. J. Bus. Soc. Sci. 2019, 10, 115–126. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Hamid, M.R.A.; Sami, W.; Sidek, M.H.M. Discriminant Validity Assessment: Use of Fornell & Larcker criterion versus HTMT Criterion. J. Phys. Conf. Ser. 2017, 890. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef]

- Ilham, S.; Nik, N.M.K. Examining a Theory of Planned Behavior (TPB) and Technology Acceptance Model (TAM) in Internetpurchasing Using Structural Equation Modeling. Int. Ref. Res. J. 2012, 2, 62–77. [Google Scholar]

- Widayat, W. E-Consumer Behavior: The Roles of Attitudes, Risk Perception on Shopping Intention-Behavior; Atlantis Press: Amsterdam, The Netherland, 2018. [Google Scholar] [CrossRef]

- Xu, Y.; Ghose, A.; Xiao, B. Mobile Payment Adoption: An Empirical Investigation on Alipay. Manag. Sci. 2018, 1–52. [Google Scholar] [CrossRef]

- Salimon, G.M.; Goronduste, H.A.; Abdullah, H. User adoption of Smart Homes Technology in Malaysia: Integration TAM 3,TPB, UTAUT 2 and extension of their constructs for a better prediction. J. Bus. Manag. 2018, 20, 60–69. [Google Scholar] [CrossRef]

- Giri, R.R.W.; Apriliani, D.; Sofia, A. Behavioral Intention Analysis on E-Money Services in Indonesia: Using the modified UTAUT model. In Proceedings of the 1st International Conference on Economics, Business, Entrepreneurship, and Finance (ICEBEF 2018), Bandung, Indonesia, 19 September 2018. [Google Scholar]

- Meuthia, R.; Ananto, R.; Afni, Z.; Setiawan, L. Understanding Millenials’ Intention to Use E-Money: A Study of Students’ University in Padang. ICO-ASCNITY 2019 2020. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Unified Theory of Acceptance and Use of Technology: A Synthesis and the Road Ahead. J. Assoc. Inf. Syst. 2016, 17, 328–376. [Google Scholar] [CrossRef]

- Ajzen, I. Customer attitudes and behavior: The theory of planned behavior applied to food consumption decisions. Ital. Rev. Agric. Econ. 2015, 70, 121–138. [Google Scholar] [CrossRef]

- Yu, C.S. Factors affecting individuals to adopt mobile banking: Empirical evidence from the UTAUT model. J. Electron. Commer. Res. 2012, 13, 105–121. [Google Scholar]

- Khatimah, H.; Halim, F. The Intention to Use E-Money Transaction In Indonesia: Conceptual Framework. In Proceedings of the Conference on Business Management Research 2013, Sintok, Malaysia, 11 December 2013. [Google Scholar]

- de Abrahão, R.S.; Moriguchi, S.N.; Andrade, D.F. Intention of adoption of mobile payment: An analysis in the light of the Unified Theory of Acceptance and Use of Technology (UTAUT). RAI Rev. Adm. Inovação 2016, 13, 221–230. [Google Scholar] [CrossRef]

- Paul, J.; Modi, A.; Patel, J. Predicting green product consumption using theory of planned behavior and reasoned action. J. Retail. Consum. Serv. 2016, 29, 123–134. [Google Scholar] [CrossRef]

- Chiemeke, S.C.; Evwiekpaefe, A.E. A conceptual framework of a modified unified theory of acceptance and use of technology (UTAUT) Model with Nigerian factors in E-commerce adoption. Int. Res. J. Rev. 2011, 2, 1719–1726. [Google Scholar]

- Larasati, I.; Havidz, H.; Aima, M.H.; Ali, H.; Iqbal, M.K. Intention to adopt WeChat mobile payment innovation toward Indonesia citizenship based in China. Int. J. Appl. Innov. Eng. Manag. 2018, 7, 105–117. [Google Scholar]

- Mat Shafie, I.S.; Mohd Yusof, Y.L.; Mahmood, A.N.; Mohd Ishar, N.I.; Jamal, H.Z.; Abu Kasim, N.H.A. Factors Influencing the Adoption of E-Payment: An Empirical Study in Malaysia. Adv. Bus. Res. Int. J. 2018, 4, 53–62. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).