Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation

Abstract

:1. Introduction

2. Theoretical Background

2.1. Open Innovation

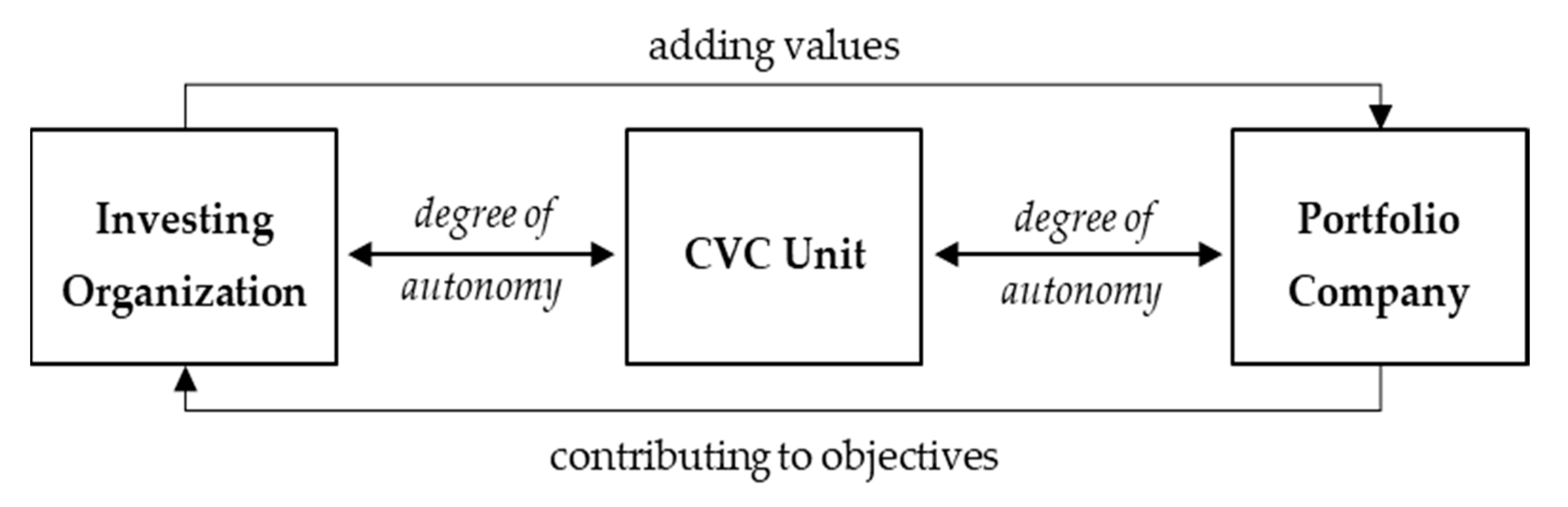

2.2. Corporate Venture Capital

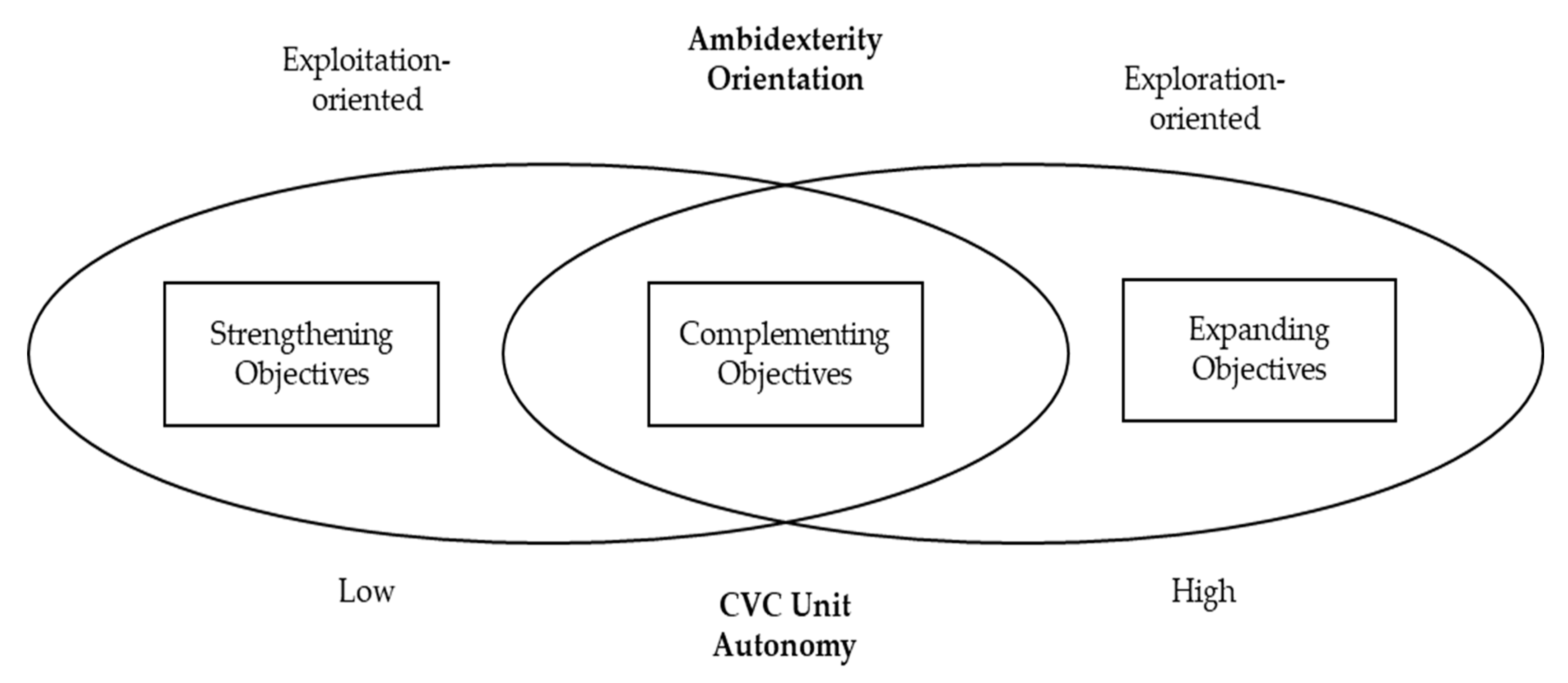

2.3. Ambidexterity of CVC

2.4. Framework Development

3. Methodology

4. Results

4.1. Strengthening Objectives

4.2. Complementing Objectives

4.3. Expanding Objectives

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

5.3. Limitations

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Kline, S.J.; Rosenberg, N. An Overview of Innovation. In Studies on Science and the Innovation Process: Selected Works; Rosenberg, N., Ed.; World Scientific Pub. Co.: Singapore; Hackensack, NJ, USA, 2010; pp. 173–203. ISBN 978-981-4273-58-9. [Google Scholar]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233. [Google Scholar] [CrossRef]

- Arrow, K.J.; Hurwicz, L. Competitive stability under weak gross substitutability: Nonlinear price adjustment and adaptive expectations. Int. Econ. Rev. 1962, 3, 233. [Google Scholar] [CrossRef]

- Salomo, S.; Weise, J.; Gemünden, H.G. NPD planning activities and innovation performance: The mediating role of process management and the moderating effect of product innovativeness. J. Prod. Innov. Manag. 2007, 24, 285–302. [Google Scholar] [CrossRef]

- Trott, P. Innovation Management and New Product Development, 5th ed.; Financial Times Prentice Hall: Harlow, UK, 2012; ISBN 9780273736561. [Google Scholar]

- Hippel, E. Democratizing innovation: The evolving phenomenon of user innovation. JfB 2005, 55, 63–78. [Google Scholar] [CrossRef]

- Kleinschmidt, E.J.; Brentani, U.; de Salomo, S. Performance of global new product development programs: A resource-based view. J. Prod. Innov. Manag. 2007, 24, 419–441. [Google Scholar] [CrossRef]

- Salomo, S.; Talke, K.; Strecker, N. Innovation field orientation and its effect on innovativeness and firm performance. J. Prod. Innov. Manag. 2008, 25, 560–576. [Google Scholar] [CrossRef]

- Henderson, R. Underinvestment and incompetence as responses to radical innovation: Evidence from the photolithographic alignment equipment industry. RAND J. Econ. 1993, 24, 248. [Google Scholar] [CrossRef] [Green Version]

- Gemünden, H.G.; Salomo, S.; Hölzle, K. Role models for radical innovations in times of open innovation. Creat. Innov. Manag. 2007, 16, 408–421. [Google Scholar] [CrossRef]

- Hauschildt, J.; Salomo, S.; Schultz, C.; Kock, A. Innovationsmanagement, 6., Vollständig Aktualisierte und Überarbeitete AUFLAGE; Verlag Franz Vahlen: München, Germany, 2016; ISBN 9783800647286. [Google Scholar]

- Talke, K.; Salomo, S.; Mensel, N. A competence-based model of initiatives for innovations. Creat. Innov. Manag. 2006, 15, 373–384. [Google Scholar] [CrossRef]

- Arrow, K.J. The Limits of Organization, 1st ed.; Norton: New York, NY, USA, 1974; ISBN 9780393093230. [Google Scholar]

- Tushman, M.L.; Anderson, P. Technological discontinuities and organizational environments. Adm. Sci. Q. 1986, 31, 439. [Google Scholar] [CrossRef] [Green Version]

- Cohen, W.M.; Levinthal, D. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128. [Google Scholar] [CrossRef]

- Li-Ying, J.; Wang, Y.; Salomo, S. An inquiry on dimensions of external technology search and their influence on technological innovations: Evidence from Chinese firms. RD Manag. 2014, 44, 53–74. [Google Scholar] [CrossRef] [Green Version]

- Yang, Y.; Narayanan, V.K.; Zahra, S.A. Developing the selection and valuation capabilities through learning: The case of corporate venture capital. J. Bus. Ventur. 2009, 24, 261–273. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation. The New Imperative for Creating and Profiting from Technology; [Nachdr.]; Harvard Business School Press: Boston, MA, USA, 2010; ISBN 9781422102831. [Google Scholar]

- Benson, D.; Ziedonis, R.H. Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups. Organ. Sci. 2009, 20, 329–351. [Google Scholar] [CrossRef]

- Kortum, S.; Lerner, J. Assessing the contribution of venture capital to innovation. RAND J. Econ. 2000, 31, 674. [Google Scholar] [CrossRef] [Green Version]

- Keil, T.; Autio, E.; George, G. Corporate venture capital, disembodied experimentation and capability development. J. Manag. Stud. 2008, 45, 1475–1505. [Google Scholar] [CrossRef]

- Rohrbeck, R.; Hölzle, K.; Gemünden, H.G. Opening up for competitive advantage—How Deutsche Telekom creates an open innovation ecosystem. RD Manag. 2009, 39, 420–430. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Lenox, M.J. When do incumbents learn from entrepreneurial ventures? Res. Policy 2005, 34, 615–639. [Google Scholar] [CrossRef]

- Gompers, P.; Lerner, J. The Venture Capital Cycle, 2nd ed.; 1st Paperback ed.; MIT Press: Cambridge, MA, USA, 2006; ISBN 9780262572385. [Google Scholar]

- Chesbrough, H.W. Making sense of corporate venture capital. Harv. Bus. Rev. 2002, 80, 90–99, 133. [Google Scholar]

- Hill, S.A.; Birkinshaw, J. Strategy–organization configurations in corporate venture units: Impact on performance and survival. J. Bus. Ventur. 2008, 23, 423–444. [Google Scholar] [CrossRef]

- Narayanan, V.K.; Yang, Y.; Zahra, S.A. Corporate venturing and value creation: A review and proposed framework. Res. Policy 2009, 38, 58–76. [Google Scholar] [CrossRef]

- Schween, K. Corporate Venture Capital. Risikokapitalfinanzierung deutscher Industrieunternehmen; Gabler Verlag: Wiesbaden, Germany, 1996; ISBN 9783409142229. [Google Scholar]

- Chesbrough, H.W.; Bogers, M. Explicating open innovation: Clarifying an emering paradigm for understanding innovation. In New Frontiers in Open Innovation; Chesbrough, H.W., Vanhaverbeke, W., West, J., Eds.; Oxford University Press: Oxford, UK, 2014. [Google Scholar]

- Herskovits, R.; Grijalbo, M.; Tafur, J. Understanding the main drivers of value creation in an open innovation program. Int. Entrep. Manag. J. 2013, 9, 631–640. [Google Scholar] [CrossRef] [Green Version]

- Vanhaverbeke, W.; van de Vrande, V.; Chesbrough, H.W. Understanding the advantages of open innovation practices in corporate venturing in terms of real options. Creat. Innov. Manag. 2008, 17, 251–258. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and macro-dynamics of open innovation with a quadruple-helix model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef] [Green Version]

- Yun, J.J.; Kim, D.; Yan, M.-R. Open innovation engineering—preliminary study on new entrance of technology to market. Electronics 2020, 9, 791. [Google Scholar] [CrossRef]

- Antons, D.; Piller, F.T. Opening the black box of “not invented here”: Attitudes, decision biases, and behavioral consequences. AMP 2015, 29, 193–217. [Google Scholar] [CrossRef]

- Hannen, J.; Antons, D.; Piller, F.; Salge, T.O.; Coltman, T.; Devinney, T.M. Containing the Not-Invented-Here Syndrome in external knowledge absorption and open innovation: The role of indirect countermeasures. Res. Policy 2019, 48, 103822. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The culture for open innovation dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- West, J.; Bogers, M. Leveraging external sources of innovation: A review of research on open innovation. J. Prod. Innov. Manag. 2014, 31, 814–831. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strat. Mgmt. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Poetz, M.K.; Prügl, R. Crossing domain-specific boundaries in search of innovation: Exploring the potential of pyramiding*. J. Prod. Innov. Manag. 2010, 27, 897–914. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Rossi, M.; Festa, G.; Papa, A.; Scorrano, P. Corporate venture capitalists’ ambidexterity: Myth or truth? IEEE Trans. Eng. Manag. 2020, 1–12. [Google Scholar] [CrossRef]

- Van de Vrande, V.; Vanhaverbeke, W.; Duysters, G. Additivity and complementarity in external technology sourcing: The added value of corporate venture capital investments. IEEE Trans. Eng. Manag. 2011, 58, 483–496. [Google Scholar] [CrossRef] [Green Version]

- Kang, S.; Hwang, J. Moderating factors in distant investment of corporate venture capital. J. Open Innov. 2019, 5, 19. [Google Scholar] [CrossRef] [Green Version]

- Gaba, V.; Bhattacharya, S. Aspirations, innovation, and corporate venture capital: A behavioral perspective. Strat. Entrep. J. 2012, 6, 178–199. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Tucci, C.L. Corporate venture capital in the context of corporate innovation. In Proceedings of the DRUID Summer Conference 2004, Elsinore, Denmark, 14–16 June 2004. [Google Scholar]

- Basu, S.; Phelps, C.C.; Kotha, S. Towards understanding who makes corporate venture capital investments and why. J. Bus. Ventur. 2011, 26, 153–171. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Lenox, M.J. When does corporate venture capital investment create firm value? J. Bus. Ventur. 2006, 21, 753–772. [Google Scholar] [CrossRef]

- Baierl, R.; Anokhin, S.; Grichnik, D. Coopetition in corporate venture capital: The relationship between network attributes, corporate innovativeness, and financial performance. IJTM 2016, 71, 58. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Hill, S.A. Corporate Venturing Units. Organ. Dyn. 2005, 34, 247–257. [Google Scholar] [CrossRef]

- Anokhin, S.; Peck, S.; Wincent, J. Corporate venture capital: The role of governance factors. J. Bus. Res. 2016, 69, 4744–4749. [Google Scholar] [CrossRef]

- Hill, S.A.; Birkinshaw, J. Ambidexterity and survival in corporate venture units. J. Manag. 2014, 40, 1899–1931. [Google Scholar] [CrossRef] [Green Version]

- O’Reilly, C.; Tushman, M.L. Ambidexterity as a dynamic capability: Resolving the innovator’s dilemma. Res. Organ. Behav. 2008, 28, 185–206. [Google Scholar] [CrossRef]

- Gibson, C.B.; Birkinshaw, J. The antecedents, consequences, and mediating role of organizational ambidexterity. AMJ 2004, 47, 209–226. [Google Scholar] [CrossRef] [Green Version]

- He, Z.-L.; Wong, P.-K. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Cao, Q.; Gedajlovic, E.; Zhang, H. Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organ. Sci. 2009, 20, 781–796. [Google Scholar] [CrossRef]

- O’Reilly, C.; Tushman, M.L. Organizational ambidexterity: Past, present, and future. AMP 2013, 27, 324–338. [Google Scholar] [CrossRef] [Green Version]

- Uhl-Bien, M.; Arena, M. Leadership for organizational adaptability: A theoretical synthesis and integrative framework. Leadersh. Q. 2018, 29, 89–104. [Google Scholar] [CrossRef]

- Schulze, J.H.; Pinkow, F. Leadership for organisational adaptability: How enabling leaders create adaptive space. Adm. Sci. 2020, 10, 37. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Gibson, C.B. Building an ambidextrous organisation. SSRN J. 2004. [Google Scholar] [CrossRef]

- Mom, T.J.M.; Chang, Y.-Y.; Cholakova, M.; Jansen, J.J.P. A multilevel integrated framework of firm HR practices, individual ambidexterity, and organizational ambidexterity. J. Manag. 2019, 45, 3009–3034. [Google Scholar] [CrossRef] [Green Version]

- Raisch, S.; Birkinshaw, J.; Probst, G.; Tushman, M.L. Organizational ambidexterity: Balancing exploitation and exploration for sustained performance. Organ. Sci. 2009, 20, 685–695. [Google Scholar] [CrossRef] [Green Version]

- Mirow, C.; Hoelzle, K.; Gemuenden, H.G. The ambidextrous organization in practice: Barriers to innovation withing research and development. Acad. Manag. Proc. 2008, 2008, 1–6. [Google Scholar] [CrossRef]

- Kang, S.; Hwang, J. an investigation into the performance of an ambidextrously balanced innovator and its relatedness to open innovation. J. Open Innov. 2019, 5, 23. [Google Scholar] [CrossRef] [Green Version]

- Rothaermel, F.T.; Alexandre, M.T. Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organ. Sci. 2009, 20, 759–780. [Google Scholar] [CrossRef]

- Hill, S.A.; Birkinshaw, J. Ambidexterity in corporate venturing: Simultaneously using existing and building new capabilities. AMPROC 2006, 2006, C1–C6. [Google Scholar] [CrossRef]

- Chemmanur, T.J.; Loutskina, E.; Tian, X. Corporate venture capital, value creation, and innovation. Rev. Financ. Stud. 2014, 27, 2434–2473. [Google Scholar] [CrossRef]

- Weber, B.; Weber, C. Corporate venture capital as a means of radical innovation: Relational fit, social capital, and knowledge transfer. J. Eng. Technol. Manag. 2007, 24, 11–35. [Google Scholar] [CrossRef]

- Maula, M.; Autio, E.; Murray, G.C. Corporate venture capital and the balance of risks and rewards for portfolio companies. J. Bus. Ventur. 2009, 24, 274–286. [Google Scholar] [CrossRef]

- Ernst, H.; Witt, P.; Brachtendorf, G. Corporate venture capital as a strategy for external innovation: An exploratory empirical study. RD Manag. 2005, 35, 233–242. [Google Scholar] [CrossRef]

- Asel, P.; Park, H.D.; Velamuri, S.R. Creating values through corporate venture capital programs: The choice between internal and external fund structures. JPE 2015, 19, 63–72. [Google Scholar] [CrossRef]

- Yang, Y.; Chen, T.; Zhang, L. Corporate venture capital program autonomy, corporate investors’ attention and portfolio diversification. J. Strategy MGT 2016, 9, 302–321. [Google Scholar] [CrossRef]

- Yang, Y. Bilateral inter-organizational learning in corporate venture capital activity. Manag. Res. Rev. 2012, 35, 352–378. [Google Scholar] [CrossRef]

- Lee, S.U.; Park, G.; Kang, J. The double-edged effects of the corporate venture capital unit’s structural autonomy on corporate investors’ explorative and exploitative innovation. J. Bus. Res. 2018, 88, 141–149. [Google Scholar] [CrossRef]

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Wong, G.; Greenhalgh, T.; Westhorp, G.; Buckingham, J.; Pawson, R. RAMESES publication standards: Meta-narrative reviews. BMC Med. 2013, 11, 20. [Google Scholar] [CrossRef] [Green Version]

- Hossain, M.; Islam, K.Z.; Sayeed, M.A.; Kauranen, I. A comprehensive review of open innovation literature. J. Sci. Tech Policy Manag. 2016, 7, 2–25. [Google Scholar] [CrossRef]

- Spender, J.-C.; Corvello, V.; Grimaldi, M.; Rippa, P. Startups and open innovation: A review of the literature. Eur. J. Inn. Manag. 2017, 20, 4–30. [Google Scholar] [CrossRef]

- Basu, S.; Phelps, C.C.; Kotha, S. Search and integration in external venturing: An inductive examination of corporate venture capital units. Strat. Entrep. J. 2016, 10, 129–152. [Google Scholar] [CrossRef]

- Baldi, F.; Baglieri, D.; Corea, F. Balancing risk and learning opportunities in corporate venture capital investments: Evidence from the biopharmaceutical industry. Entrep. Res. J. 2015, 5, 1546. [Google Scholar] [CrossRef]

- Fulghieri, P.; Sevilir, M. Organization and financing of innovation, and the choice between corporate and independent venture capital. J. Financ. Quant. Anal. 2009, 44, 1291–1321. [Google Scholar] [CrossRef] [Green Version]

- Gutmann, T.; Schmeiss, J.; Stubner, S. Unmasking smart capital. Res. Technol. Manag. 2019, 62, 27–36. [Google Scholar] [CrossRef]

- Keil, T.; Maula, M.; Schildt, H.A.; Zahra, S.A. The effect of governance modes and relatedness of external business development activities on innovative performance. Strat. Manag. J. 2008, 29, 895–907. [Google Scholar] [CrossRef]

- Sykes, H.B. Corporate venture capital: Strategies for success. J. Bus. Ventur. 1990, 5, 37–47. [Google Scholar] [CrossRef]

- Yang, Y.; Narayanan, V.K.; de Carolis, D.M. The relationship between portfolio diversification and firm value: The evidence from corporate venture capital activity. Strat. Manag. J. 2014, 35, 1993–2011. [Google Scholar] [CrossRef]

- Smith, S.W.; Shah, S.K. Do innovative users generate more useful insights? An analysis of corporate venture capital investments in the medical device industry. Strat. Entrep. J. 2013, 7, 151–167. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Lenox, M.J. When do firms undertake R&D by investing in new ventures? Strat. Manag. J. 2005, 26, 947–965. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Shaver, J.M. Limitations to interorganizational knowledge acquisition: The paradox of corporate venture capital. Strat. Manag. J. 2009, 30, 1045–1064. [Google Scholar] [CrossRef]

- Kim, J.Y.; Steensma, H.K.; Park, H.D. The influence of technological links, social ties, and incumbent firm opportunistic propensity on the formation of corporate venture capital deals. J. Manag. 2019, 45, 1595–1622. [Google Scholar] [CrossRef]

- Titus, V.K.; Anderson, B.S. Firm structure and environment as contingencies to the corporate venture capital-parent firm value relationship. Entrep. Theory Pract. 2018, 42, 498–522. [Google Scholar] [CrossRef]

- Cirillo, B. External learning strategies and technological search output: Spinout strategy and corporate invention quality. Organ. Sci. 2019, 30, 361–382. [Google Scholar] [CrossRef]

- Gaba, V.; Dokko, G. Learning to let go: Social influence, learning, and the abandonment of corporate venture capital practices. Strat. Manag. J. 2016, 37, 1558–1577. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.M.; Kim, T.; Jang, S.H. Inter-organizational knowledge transfer through corporate venture capital investment. Manag. Decis. 2015, 53, 1601–1618. [Google Scholar] [CrossRef]

- Schildt, H.A.; Maula, M.; Keil, T. Explorative and exploitative learning from external corporate ventures. Entrep. Theory Pract. 2005, 29, 493–515. [Google Scholar] [CrossRef]

- Roberts, E.B.; Berry, C.A. Entering new business: Selecting strategies for success. Sloan Manag. Rev. 1985, 26, 3–17. [Google Scholar]

- Sahaym, A.; Steensma, H.K.; Barden, J.Q. The influence of R&D investment on the use of corporate venture capital: An industry-level analysis. J. Bus. Ventur. 2010, 25, 376–388. [Google Scholar] [CrossRef]

- Belderbos, R.; Jacob, J.; Lokshin, B. Corporate venture capital (CVC) investments and technological performance: Geographic diversity and the interplay with technology alliances. J. Bus. Ventur. 2018, 33, 20–34. [Google Scholar] [CrossRef] [Green Version]

- Maula, M.; Keil, T.; Zahra, S.A. Top management’s attention to discontinuous technological change: Corporate venture capital as an alert mechanism. Organ. Sci. 2013, 24, 926–947. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.U.; Kang, J. Technological diversification through corporate venture capital investments: Creating various options to strengthen dynamic capabilities. Ind. Innov. 2015, 22, 349–374. [Google Scholar] [CrossRef] [Green Version]

- van de Vrande, V.; Vanhaverbeke, W.; Duysters, G. Technology in-sourcing and the creation of pioneering technologies. J. Prod. Innov. Manag. 2011, 28, 974–987. [Google Scholar] [CrossRef]

- Wadhwa, A.; Basu, S. Exploration and resource commitments in unequal partnerships: An examination of corporate venture capital investments. J. Prod. Innov. Manag. 2013, 30, 916–936. [Google Scholar] [CrossRef]

- Ceccagnoli, M.; Higgins, M.J.; Kang, H.D. Corporate venture capital as a real option in the markets for technology. Strat. Mgmt. J. 2018, 39, 3355–3381. [Google Scholar] [CrossRef]

- Tong, T.W.; Li, Y. Real options and investment mode: Evidence from corporate venture capital and acquisition. Organ. Sci. 2011, 22, 659–674. [Google Scholar] [CrossRef] [Green Version]

- van de Vrande, V.; Vanhaverbeke, W. How prior corporate venture capital investments shape technological alliances: A real options approach. Entrep. Theory Pract. 2013, 37, 1019–1043. [Google Scholar] [CrossRef]

- Zimmermann, A.; Raisch, S.; Birkinshaw, J. How is ambidexterity initiated? The emergent charter definition process. Organ. Sci. 2015, 26, 1119–1139. [Google Scholar] [CrossRef]

- Ardito, L.; Messeni Petruzzelli, A.; Dezi, L.; Castellano, S. The influence of inbound open innovation on ambidexterity performance: Does it pay to source knowledge from supply chain stakeholders? J. Bus. Res. 2018. [Google Scholar] [CrossRef]

- Rosing, K.; Frese, M.; Bausch, A. Explaining the heterogeneity of the leadership-innovation relationship: Ambidextrous leadership. Leadersh. Q. 2011, 22, 956–974. [Google Scholar] [CrossRef]

- Masulis, R.W.; Nahata, R. Financial contracting with strategic investors: Evidence from corporate venture capital backed IPOs. J. Financ. Intermediation 2009, 18, 599–631. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A.J. The paradox of openness: Appropriability, external search and collaboration. Res. Policy 2014, 43, 867–878. [Google Scholar] [CrossRef] [Green Version]

- Wadhwa, A.; Bodas Freitas, I.M.; Sarkar, M.B. The paradox of openness and value protection strategies: Effect of extramural R&D on innovative performance. Organ. Sci. 2017, 28, 873–893. [Google Scholar] [CrossRef]

| Purpose | Construct | References | ||

|---|---|---|---|---|

| Strengthening | Invigorate ongoing strategy by strengthening the core business | Opportunities | Protect the core business | [17,25,70,78,79] |

| Improve own technology, R&D efficiency or capacity | [17,21,25,45,69,79,80,81,82,83,84,85,86] | |||

| Limitations and Barriers | Status quo is less risky than investing in external R&D | [44] | ||

| Resource conflicts between internal R&D and external new ventures | [17,69] | |||

| Promising new ventures and start-ups operating in the same industry are less likely to seek CVC backing | [68,83,87,88] | |||

| Complementing | Leverage business by enhancing the ecosystem and exploit complementary assets | Opportunities | Strengthen, improve and extend supply and value chain | [25,69,70,78,79,81,83] |

| Develop technology standard through the ecosystem through complementarity | [25,68,69,70,79,81,89] | |||

| Complementary knowledge/experience spillovers through external knowledge acquisition | [42,79] | |||

| Create market entry barriers | [70] | |||

| Facilitate spin-offs | [69,90] | |||

| Limitations and Barriers | Staff of CVC unit lack experience or knowledge diversity in other fields than the core business | [91,92,93] | ||

| Expanding | Expand the organization by identifying and adopting novel and emerging technologies and opportunities | Opportunities | Expose and identify novel and innovative technologies and markets | [21,25,45,49,69,78,79,80,84,93,94,95,96,97] |

| Acquire technical and market knowledge in areas distant from the core business | [25,42,67,70,79,83,85,98,99] | |||

| Support acquisition intentions as real options approach | [31,79,80,84,95,99,100,101,102,103] | |||

| Limitations and Barriers | High internal innovation performance limits the need to explore external sources of new technologies | [44] | ||

| Economic slowdown can lead to a more defensive strategy to protect the core business | [69,70] | |||

| Natural limits of absorptive capacity | [23,79,84,92,96,98,99] | |||

| Staff of CVC unit lack experience or knowledge diversity in other fields than the core business | [69,91,92,93] | |||

| Restrictions through strategic boundaries | [23,69,70,86,96] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pinkow, F.; Iversen, J. Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 157. https://doi.org/10.3390/joitmc6040157

Pinkow F, Iversen J. Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):157. https://doi.org/10.3390/joitmc6040157

Chicago/Turabian StylePinkow, Felix, and Jasper Iversen. 2020. "Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 157. https://doi.org/10.3390/joitmc6040157

APA StylePinkow, F., & Iversen, J. (2020). Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 157. https://doi.org/10.3390/joitmc6040157