An Updated Systematic Review of Business Accelerators: Functions, Operation, and Gaps in the Existing Literature

Abstract

:1. Introduction

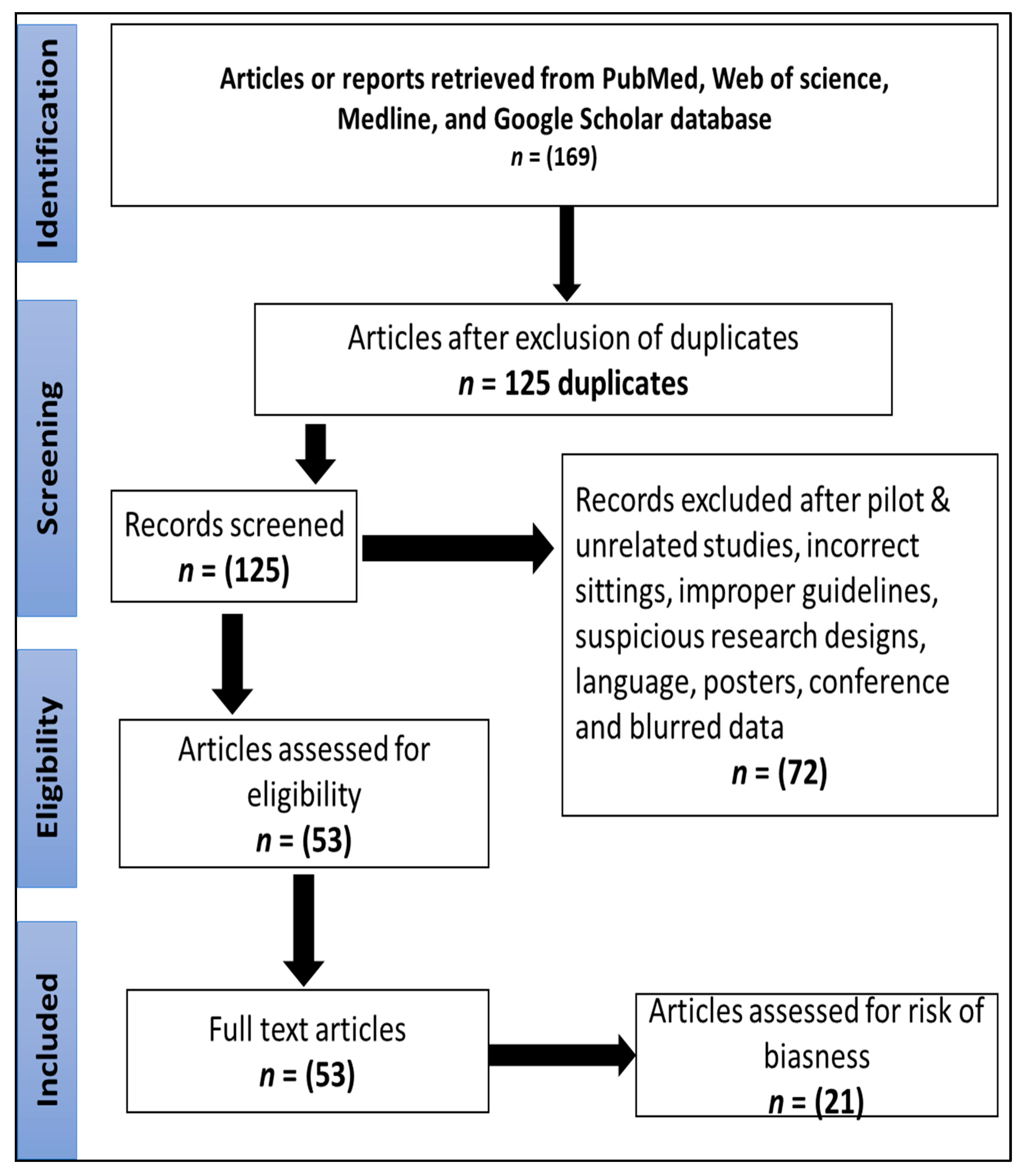

2. Materials and Methods

2.1. Literature Examination Approach

2.2. Inclusion and Exclusion Criteria

2.3. Data Extraction and Quality Assessment Tool

3. Results and Discussion

3.1. Demographic Details of the Study

3.2. Context-Intervention-Mechanism-Outcome Framework

3.3. Accelerator Context

3.4. Accelerators Intervention

3.5. Accelerators Intervention Types and Examples

4. Outcomes

5. Risk of Bias Assessment

6. Conclusions

7. Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Blank, T.H. When incubator resources are crucial: Survival chances of student startups operating in an academic incubator. J. Technol. Transf. 2021, 46, 1845–1868. [Google Scholar] [CrossRef]

- Colombo, M.G.; Rossi-Lamastra, C.; Wright, M. Accelerators: Insights for a research agenda. Accelerators 2018, 188–204. [Google Scholar] [CrossRef]

- Drover, W.; Busenitz, L.; Matusik, S.; Townsend, D.; Anglin, A.; Dushnitsky, G. A review and road map of entrepreneurial equity financing research: Venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators. J. Manag. 2017, 43, 1820–1853. [Google Scholar] [CrossRef] [Green Version]

- Ermilina, V.; Farrell, M.; Askarzadeh, F.; Zhang, J. Business owners’ features and access to entrepreneurial resources: New insights for accelerator acceptance. Rev. Int. Bus. Strategy 2021, 32, 246–266. [Google Scholar] [CrossRef]

- Frimodig, L.; Torkkeli, M. Sources for success-new venture creation in seed and business accelerators. Int. J. Bus. Excell. 2017, 12, 489–507. [Google Scholar] [CrossRef]

- Gabrielsson, J.; Politis, D.; Persson, K.M.; Kronholm, J. Promoting water-related innovation through networked acceleration: Insights from the Water Innovation Accelerator. J. Clean. Prod. 2018, 17, S130–S139. [Google Scholar] [CrossRef] [Green Version]

- Drori, I.; Wright, A.M. Accelerators: Characteristics, trends and the new entrepreneurial ecosystem. In Accelerators; Edward Elgar Publishing: Cheltenham, UK, 2018. [Google Scholar]

- Gliedt, T.; Hoicka, C.E.; Jackson, N. Innovation intermediaries accelerating environmental sustainability transitions. J. Clean. Prod. 2018, 174, 1247–1261. [Google Scholar] [CrossRef]

- Goswami, K.; Mitchell, J.R.; Bhagavatula, S. Accelerator expertise: U nderstanding the intermediary role of accelerators in the development of the B angalore entrepreneurial ecosystem. Strateg. Entrep. J. 2018, 12, 117–150. [Google Scholar] [CrossRef]

- Gutstein, A.; Brem, A. Lead user projects in practice—Results from an analysis of an open innovation accelerator. Int. J. Innov. Technol. Manag. 2018, 15, 1850015. [Google Scholar] [CrossRef]

- González-Uribe, J.; Reyes, S. Identifying and boosting “Gazelles”: Evidence from business accelerators. J. Financ. Econ. 2021, 139, 260–287. [Google Scholar] [CrossRef]

- Gardner, J.; Webster, A. Accelerating innovation in the creation of biovalue: The cell and gene therapy catapult. Sci. Technol. Hum. Values 2017, 42, 925–946. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hallen, B.L.; Cohen, S.L.; Bingham, C.B. Do accelerators work? If so, how? Organ. Sci. 2020, 31, 378–414. [Google Scholar] [CrossRef]

- Aloulou, W.J. Mapping incubation mechanisms in Saudi Arabia: The state of the art and challenges for the future. In Handbook of Research on Business and Technology Incubation and Acceleration; Edward Elgar Publishing: Cheltenham, UK, 2021; pp. 351–366. [Google Scholar]

- Assudani, R.; Mroczkowski, T.; Muñoz-Fernández, A.; Khilji, S.E. Entrepreneurial support systems: Role of the Czech accelerator. Int. J. Entrep. Innov. Manag. 2017, 21, 530–552. [Google Scholar] [CrossRef]

- Bendickson, J. Building entrepreneurship research for impact: Scope, phenomenon, and translation. Taylor Francis. 2021, 59, 535–543. [Google Scholar] [CrossRef]

- Bernthal, B. Investment accelerators. Stan. JL Bus. Fin. 2015, 21139. Available online: https://scholar.law.colorado.edu/faculty-articles/354 (accessed on 1 November 2022).

- Chen, C.; He, J. Teaching Them How to Fish: The Makings of Business Accelerators. Acad. Manag. Proc. 2022, 2022. [Google Scholar] [CrossRef]

- Davidson, H. The Incubator Investment in Network Events: Does the Business Incubator’s Quality of Programming and Founder Personality Traits Influence Startup Performance? Doctoral Dissertation, Pace University, New York, NY, USA, 2021. [Google Scholar]

- Gavrilenko, Z. Corporate Accelerators: How can companies utilize corporate accelerators to strengthen strategic market advantage? Master’s Thesis, The University of Oslo, Oslo, Norway, 2021. [Google Scholar]

- Gikabu, L.M. Influence of Accelerator Programs to the Growth of Micro, Small and Medium Enterprises (Msmes) Supported by Tony Elumelu Foundation-Kenya. Doctoral Dissertation, University of Nairobi, Nairobi, Kenya, 2020. [Google Scholar]

- Hawari-Latter, S.; Bruce, F.; McNicoll, B. The Design for Business Initiative: A Systematic Approach to Embedding Entrepreneurship in Design Education. In Proceedings of the 16th European Conference on Innovation and Entrepreneurship, Lisbon, Portugal, 16–17 September 2021; Academic Conferences International Limited; pp. 1301–1309. [Google Scholar]

- Hirvonen, J.; Nieminen, M.; Javanainen, N. Good Practices in Universities: Business Cooperation, Entrepreneurial Support Services and Sustainable Development; South-Eastern Finland University of Applied Sciences: Kouvola, Finland, 2021. [Google Scholar]

- Alpenidze, O.; Pauceanu, A.M.; Sanyal, S. Key success factors for business incubators in Europe: An empirical study. Acad. Entrep. J. 2019, 25, 1–13. [Google Scholar]

- Aragon, A.A.; Schoenfeld, B.J.; Wildman, R.; Kleiner, S.; VanDusseldorp, T.; Taylor, L.; Antonio, J. International society of sports nutrition position stand: Diets and body composition. J. Int. Soc. Sport. Nutr. 2017, 14, 16. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Battistella, C.; De Toni, A.F.; De Zan, G.; Pessot, E. Cultivating business model agility through focused capabilities: A multiple case study. J. Bus. Res. 2017, 73, 65–82. [Google Scholar] [CrossRef]

- Bauer, S.; Obwegeser, N.; Avdagic, Z. Corporate accelerators: Transferring technology innovation to incumbent. In Proceedings of the MCIS 2016, Paphos, Cyprus, 4–6 September 2016. [Google Scholar]

- Clarysse, B.; Wright, M.; Hove, J.V. A look inside accelerators in the United Kingdom: Building technology businesses. Technol. Entrep. Bus. Incubation Theory Pract. Lessons Learn. 2016, 28, 57–86. [Google Scholar] [CrossRef]

- Clayton, P.; Feldman, M.; Lowe, N. Behind the scenes: Intermediary organizations that facilitate science commercialization through entrepreneurship. Acad. Manag. Perspect. 2018, 32, 104–124. [Google Scholar] [CrossRef] [Green Version]

- Mohammadi, N.; Sakhteh, S. Start-up accelerator value chain: A systematic literature review. Manag. Rev. Q. 2022, 1–34. [Google Scholar] [CrossRef]

- Del Sarto, N.; Isabelle, D.A.; Di Minin, A. The role of accelerators in firm survival: An fsQCA analysis of Italian startups. Technovation 2020, 90, 102102. [Google Scholar] [CrossRef]

- Cohen, S.; Fehder, D.C.; Hochberg, Y.V.; Murray, F. The design of startup accelerators. Res. Policy 2019, 48, 1781–1797. [Google Scholar] [CrossRef]

- Connolly, A.J.; Turner, J.; Potocki, A.D. IGNITE your corporate innovation: Insights from setting up an ag-tech start-up accelerator. Int. Food Agribus. Manag. Rev. 2018, 21, 833–846. [Google Scholar] [CrossRef]

- Coste, J.-D.; Gatzke, S. A novel approach to innovation platforms: Symbiotic on/off spaces, cross-industry sponsor. New Space 2017, 5, 155–162. [Google Scholar] [CrossRef]

- Gligor, O.; Mocan, A.; Moldovan, C.; Locatelli, M.; Crișan, G.; Ferreira, I.C. Enzyme-assisted extractions of polyphenols–A comprehensive review. Trends Food Sci. Technol. 2019, 88, 302–315. [Google Scholar] [CrossRef]

- Pattanasak, P.; Anantana, T.; Paphawasit, B.; Wudhikarn, R. Critical Factors and Performance Measurement of Business Incubators: A Systematic Literature Review. Sustainability 2022, 14, 4610. [Google Scholar] [CrossRef]

- Dushnitsky, G.; Sarkar, S. Variance decomposing of accelerator and cohort effects among London startups. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2018; Volume 2018, p. 10522. [Google Scholar]

- Fernandes, E.; Jung, J.; Prakash, A. Security analysis of emerging smart home applications. In Proceedings of the 2016 IEEE Symposium on Security and Privacy (SP), San Jose, CA, USA, 22–26 May 2016; IEEE: Piscataway, PA, USA; pp. 636–654. [Google Scholar]

- Fraiberg, S. Start-up nation: Studying transnational entrepreneurial practices in Israel’s start-up ecosystem. J. Bus. Tech. Commun. 2017, 31, 350–388. [Google Scholar] [CrossRef] [Green Version]

- Glinik, M. Gruendungsgarage—A Best-Practice Example of an Academic Start-up Accelerator. Int. J. Eng. Pedagog. 2019, 9, 33–43. [Google Scholar] [CrossRef]

- PattanasakLall, S.A.; Chen, L.W.; Roberts, P.W. Are we accelerating equity investment into impact-oriented ventures? World Dev. 2020, 131, 104952. [Google Scholar]

- Gutmann, T.; Kanbach, D.; Seltman, S. Exploring the benefits of corporate accelerators: Investigating the SAP Industry 4.0 Startup Program. Probl. Perspect. Manag. 2019, 17, 218. [Google Scholar] [CrossRef] [Green Version]

- Haines, J.K. Iterating an innovation model: Challenges and opportunities in adapting accelerator practices in evolving ecosystems. In Ethnographic Praxis in Industry Conference Proceedings; Wiley Online Library: New York, NY, USA, 2014; Volume 2014, pp. 282–295. [Google Scholar]

- Harima, A.; Freudenberg, J.; Halberstadt, J. Functional domains of business incubators for refugee entrepreneurs. J. Enterprising Communities People Places Glob. Econ. 2019, 14, 687–711. [Google Scholar] [CrossRef]

- Tobiassen, A.E.; Elvekrok, I.; Jahnsen, E.L.; Løtvedt, A.S. The value of accelerator programmes in the internationalization of Norwegian international new ventures. In Proceedings of the International Conference on Innovation and Entrepreneurship, Washington DC, USA, 5–6 March 2018; Academic Conferences International Limited: Reading, UK, 2018; pp. 1064–1072. [Google Scholar]

- Uhm, C.H.; Sung, C.S.; Park, J.Y. Understanding the accelerator from resources-based perspective. Asia Pac. J. Innov. Entrep. 2018, 12, 258–278. [Google Scholar] [CrossRef] [Green Version]

- Wright, M.; Siegel, D.S.; Mustar, P. An emerging ecosystem for student start-ups. J. Technol. Transf. 2017, 42, 909–922. [Google Scholar] [CrossRef]

- Yang, S.; Kher, R.; Newbert, S. What signals matter for social startups? It depends: The influence of gender role congruity on social impact accelerator selection decisions. J. Bus. Ventur. Forthcom. Baruch Coll. Zicklin Sch. Bus. Res. Pap. 2019, 35, 105932. [Google Scholar] [CrossRef]

- Yin, B.; Luo, J. How do accelerators select startups? Shifting decision criteria across stages. IEEE Trans. Eng. Manag. 2018, 65, 574–589. [Google Scholar] [CrossRef]

- Xiao, Y.; Watson, M. Guidance on conducting a systematic literature review. J. Plan. Educ. Res. 2019, 39, 93–112. [Google Scholar] [CrossRef]

- Crișan, E.L.; Salanță, I.I.; Beleiu, I.N.; Bordean, O.N.; Bunduchi, R. A systematic literature review on accelerators. J. Technol. Transf. 2021, 46, 62–89. [Google Scholar] [CrossRef]

- Zuquetto, R.D.; Martins, B.V.; Santini, M.A.F.; Facchin, K.; Balestrin, A. Business Accelerators: A Systematic Literature Review. In Proceedings of the ISPIM Conference Proceedings, Berlin, Germany, 20–23 June 2021. [Google Scholar]

- Miller, P.; Bound, K. The Startup Factories. NESTA. 2011. Available online: http://www.nesta.org.uk/library/documents/StartupFactories.pdf (accessed on 21 September 2022).

- Breznitz, S.M.; Zhang, Q.J.I.; Change, C. Fostering the growth of student start-ups from university accelerators: An entrepreneurial ecosystem perspective. Ind. Corp. Chang. 2019, 28, 855–873. [Google Scholar] [CrossRef]

- Mitra, S.; Euchner, J. Business Acceleration at Scale: An Interview with Sramana Mitra: Sramana Mitra talks with Jim Euchner about democratizing innovation through education and mentoring. Res. -Technol. Manag. 2016, 59, 12–20. [Google Scholar] [CrossRef]

- Clarysse, B.; Wright, M.; VanHove, J. A Look Inside Accelerators; Nesta: London, UK, 2015. [Google Scholar]

- Jackson, P.; Richter, N. Situational logic: An analysis of open innovation using corporate accelerators. Int. J. Innov. Manag. 2017, 21, 1750062. [Google Scholar] [CrossRef]

- Malek, K.; Maine, E.; McCarthy, I.P. A typology of clean technology commercialization accelerators. J. Eng. Technol. Manag. 2014, 32, 26–39. [Google Scholar] [CrossRef]

- Yang, S.; Kher, R.; Lyons, T.S. Where do accelerators fit in the venture creation pipeline? Different values brought by different types of accelerators. Entrep. Res. J. 2018, 8, 1–3. [Google Scholar]

- Denyer, D.; Tranfield, D.; Van Aken, J.E. Developing design propositions through research synthesis. Organ. Stud. 2008, 29, 393–413. [Google Scholar] [CrossRef]

- Andriushchenko, K.; Liezina, A.; Kuchai, O.; Petukhova, H. Corporate University as a Business Accelerator in the Field of Education. World 2022, 3, 657–671. [Google Scholar] [CrossRef]

- Leitão, J.; Pereira, D.; Gonçalves, Â. Business Incubators, Accelerators, and Performance of Technology-Based Ventures: A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2022, 8, 46. [Google Scholar] [CrossRef]

- Anastasiei, B.; Dospinescu, N.; Dospinescu, O. The impact of social media peer communication on customer behaviour—Evidence from Romania. Argum. Oeconomica 2022, 2022, 247–264. [Google Scholar]

- Newell, R.; Newman, L.; Mendly-Zambo, Z. The Role of Incubators and Accelerators in the Fourth Agricultural Revolution: A Case Study of Canada. Agriculture 2021, 11, 1066. [Google Scholar] [CrossRef]

- Bergmann, T.; Utikal, H. How to Support Start-Ups in Developing a Sustainable Business Model: The Case of an European Social Impact Accelerator. Sustainability 2021, 13, 3337. [Google Scholar] [CrossRef]

- Pittaway, L.; Robertson, M.; Munir, K.; Denyer, D.; Neely, A. Networking and innovation: A systematic review of the evidence. Int. J. Manag. Rev. 2004, 5, 137–168. [Google Scholar] [CrossRef]

- Cao, Z.; Shi, X. A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Bus. Econ. 2021, 57, 75–110. [Google Scholar] [CrossRef]

- Mian, S.A. University’s involvement in technology business incubation: What theory and practice tell us? Int. J. Entrep. Innov. Manag. 2011, 13, 113–121. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Knowledge management in startups: Systematic literature review and future research agenda. Sustainability 2017, 9, 361. [Google Scholar] [CrossRef] [Green Version]

- Cohen, B.; Muñoz, P. Toward a theory of purpose-driven urban entrepreneurship. Organ. Environ. 2015, 28, 264–285. [Google Scholar] [CrossRef]

- Cohen, S.; Hochberg, Y.V. Accelerating Startups: The Seed Accelerator Phenomenon. 2014. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2418000 (accessed on 1 November 2022).

- Cohen, S.L. How to Accelerate Learning: Entrepreneurial Ventures Participating in Accelerator Programs. Doctoral Dissertation, The University of North Carolina at Chapel Hill, Chapel Hill, NC, USA, 2013. [Google Scholar]

| References | Source | Definition | Inclusion | Mechanism |

|---|---|---|---|---|

| (Aloulou, 2021) [14] | Journal | ND | Yes | Innovation |

| (Askarzadeh et al., 2021) [4] | Journal | OD | Yes | Access and growth |

| (Bendickson, 2021) [16] | Journal | CD | Yes | Learning and validation |

| (Blank, 2021) [1] | Journal | CD | Yes | Learning and validation |

| (Chen & He, 2021) [18] | Journal | OD | Yes | Access and growth |

| (Davidson, 2021) [19] | Journal | OD | Yes | Learning and validation |

| (Ermilina et al., 2021) [4] | Journal | CD, OD | Yes | Access and growth |

| (Gavrilenko, 2021) [20] | Thesis | CD | Yes | Innovation |

| (Gikabu, 2020) [21] | Thesis | ND | Yes | Learning, validation, access, and growth |

| (González-Uribe & Reyes, 2021) [11] | Journal | CD | No | Undefined |

| (Hawari-Latter et al., 2021) [22] | Journal | ND | Yes | learning |

| (Hirvonen et al., 2021) [23] | Book chapter | CD, OD | Yes | Learning |

| (Alpenidze et al., 2019) [24] | Journal | (OD) | Yes | Access and growth |

| (Aragon et al., 2017) [25] | Journal | ND | Yes | Innovation |

| (Assudani et al., 2017) [15] | Journal | (CD) | Yes | Learning and innovation |

| (Battistella et al., 2017) [26] | Journal | CD | Yes | Access and growth |

| (Bauer et al., 2016) [27] | Conference | CD | No | Undefined |

| (Bernthal, 2015) [17] | Journal | CD | Yes | Learning |

| (Clarysse et al., 2016) [28] | Report | CD, OD | Yes | Multiple mechanisms |

| (Clayton et al., 2018) [29] | Journal | CD | No | Undefined |

| (Mohammadi & Sakhteh, 2022) [30] | Journal | CD, OD | No | Undefined |

| (Del Sarto et al., 2022) [31] | Journal | OD | Yes | Innovation |

| (Cohen et al., 2019) [32] | Journal | CD | Yes | Access and growth |

| (Colombo et al., 2018) [2] | Book chapter | CD | No | Undefined |

| (Connolly et al., 2018) [33] | Journal | Other source definition OSD | Yes | Innovation |

| (Coste & Gatzke, 2017) [34] | Journal | ND | Yes | Innovation |

| (Gligor et al., 2019) [35] | Journal | CD | No | Undefined |

| (Pattanasak et al., 2022) [36] | Journal | CD | Yes | Access, and growth |

| (Drori & Wright, 2018) [7] | Chapter | CD | Yes | Innovation. Access |

| (Drover et al., 2017) [3] | Journal | OSD | No | Undefined |

| (Dushnitsky & Sarkar, 2018) [37] | Conference | CD | Yes | Undefined |

| (Fernandes et al., 2016) [38] | Journal | CD | Yes | Innovation |

| (Fraiberg, 2017) [39] | Journal | OD | Yes | Access and growth |

| (Frimodig & Torkkeli, 2017 [5]) | Journal | CD | No | Undefined |

| (Gabrielsson et al., 2018 [6]) | Journal | ND | Yes | Innovation |

| (Gardner & Webster, 2017 [12]) | Journal | ND | Yes | Innovation |

| (Gliedt et al., 2018) [8] | Journal | ND | No | Undefined |

| (Glinik, 2019) [40] | Journal | ND | Yes | Learning |

| (Gonzalez-Uribe & Leatherbee, 2018) [41] | Journal | CD, OD | Yes | Learning |

| (Goswami et al., 2018) [9] | Journal | CD | Yes | Access and growth |

| (Lall et al., 2020) [42] | Conference | CD | Yes | Innovation |

| (Gutmann, 2019) [43] | Journal | ND | No | Undefined |

| (Gutstein & Brem, 2018) [10] | Journal | ND | Yes | Validation |

| (Haines, 2014) [44] | Conference | CD | Yes | Innovation |

| (Hallen et al., 2020) [13] | Journal | OD | Yes | Learning |

| (Harima et al., 2019) [45] | Journal | ND | Yes | Access and growth |

| (Tobiassen et al., 2018) [46] | Conference | CD | Yes | Growth |

| (Uhm et al., 2018) [47] | Journal | CD | Yes | Access and growth |

| (Wright et al., 2017) [48] | Journal | CD | Yes | Learning |

| (Yang et al., 2019) [49] | Journal | CD | No | Undefined |

| (Yin & Luo, 2018) [50] | Journal | CD | Yes | Access and growth |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aljalahma, J.; Slof, J. An Updated Systematic Review of Business Accelerators: Functions, Operation, and Gaps in the Existing Literature. J. Open Innov. Technol. Mark. Complex. 2022, 8, 214. https://doi.org/10.3390/joitmc8040214

Aljalahma J, Slof J. An Updated Systematic Review of Business Accelerators: Functions, Operation, and Gaps in the Existing Literature. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(4):214. https://doi.org/10.3390/joitmc8040214

Chicago/Turabian StyleAljalahma, Jaber, and John Slof. 2022. "An Updated Systematic Review of Business Accelerators: Functions, Operation, and Gaps in the Existing Literature" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 4: 214. https://doi.org/10.3390/joitmc8040214

APA StyleAljalahma, J., & Slof, J. (2022). An Updated Systematic Review of Business Accelerators: Functions, Operation, and Gaps in the Existing Literature. Journal of Open Innovation: Technology, Market, and Complexity, 8(4), 214. https://doi.org/10.3390/joitmc8040214