Research on the Evolution and Driving Factors of the Economic Spatial Pattern of the Guangdong–Hong Kong–Macao Greater Bay Area in the Context of the COVID-19 Epidemic

Abstract

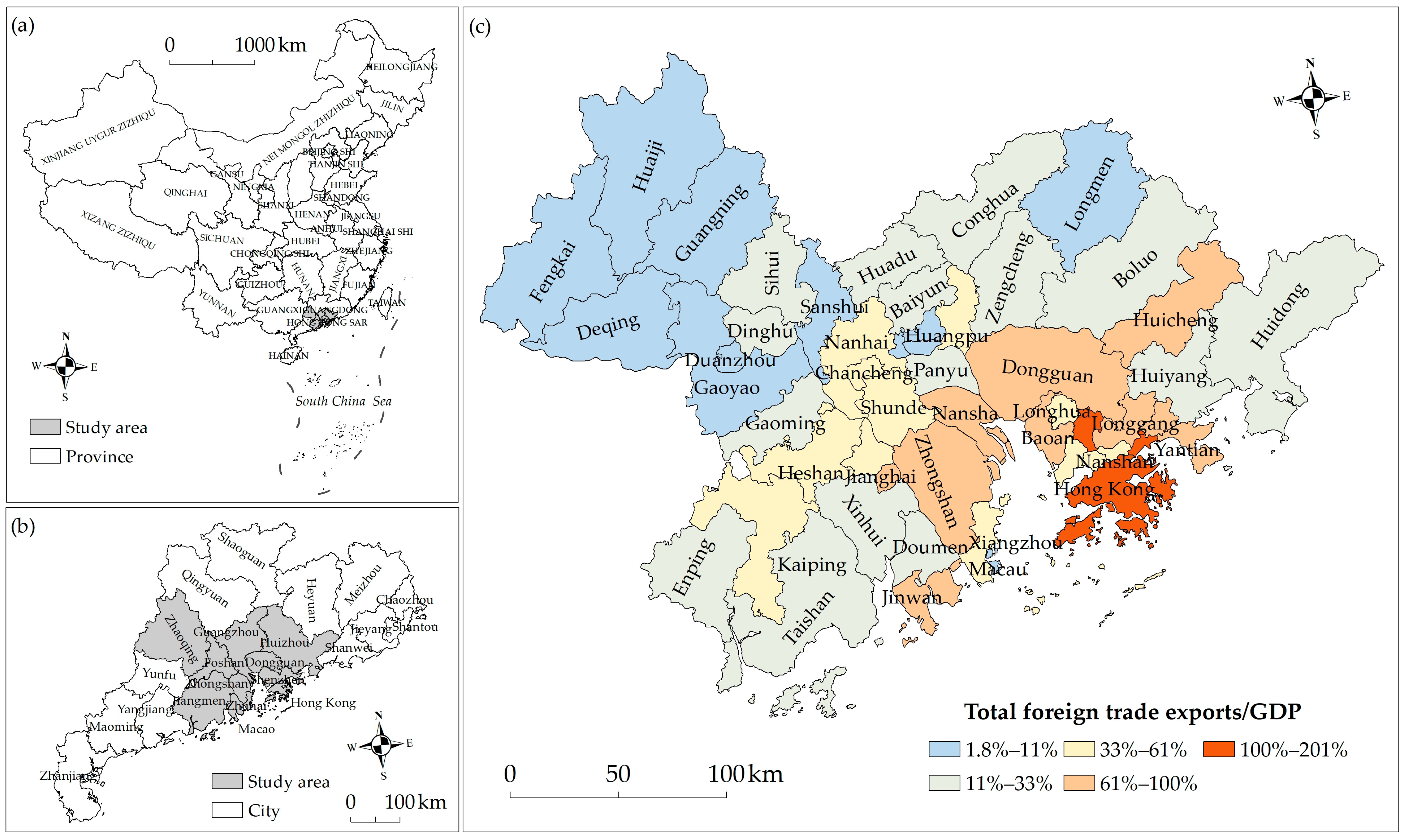

1. Introduction

2. Methods

2.1. Standard Deviational Ellipse Method (SDE)

2.2. Economic Concentration

2.3. Spatial Autocorrelation

2.4. Economic Growth Model

2.5. Spatial Weight Matrix

3. Overview of the Research Area and Database

4. Results

4.1. The Evolution of the Economic Spatial Pattern of the GBA

4.1.1. Identification of the Directionality and Core Area of Economic Spatial Distribution

4.1.2. Evolution of Economic Distribution

4.1.3. Changes in Major Economic Indicators

4.2. Comparation of Driving Factors of Economic Growth

4.2.1. Selection of Spatial Econometric Models

4.2.2. Comparison of Economic Growth Drivers and Spatial Spillover Effects

- (1)

- Economic Drivers and Spatial Spillover Effects in the GBA

- (2)

- Comparison of different periods

5. Conclusions

6. Discussion

6.1. Spatial Spillover and Regional Inequality

6.2. The Economic Impact of COVID-19 on the GBA

6.3. Spatial Autocorrelation, Spatial Spillover Effect, and Spatial Agglomeration

6.4. Limitations and Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Takyi, P.O.; Dramani, J.B.; Akosah, N.K.; Aawaar, G. Economic activities’ response to the COVID-19 pandemic in developing countries. Sci. Afr. 2023, 20, e01642. [Google Scholar] [CrossRef] [PubMed]

- Wu, J.; Zhan, X.; Xu, H.; Ma, C. The economic impacts of COVID-19 and city lockdown: Early evidence from China. Struct. Chang. Econ. Dyn. 2023, 65, 151–165. [Google Scholar] [CrossRef] [PubMed]

- Goel, R.K.; Saunoris, J.W.; Goel, S.S. Supply chain performance and economic growth: The impact of COVID-19 disruptions. J. Policy Model. 2021, 43, 298–316. [Google Scholar] [CrossRef]

- Salamaga, M. Assessment of the risk of foreign divestment in Poland during the COVID-19 pandemic. Wiad. Stat. 2021, 66, 26–42. [Google Scholar] [CrossRef]

- Liu, H.; Fang, C.; Gao, Q.; Yang, J. Evaluating the Real-Time Impact of COVID-19 on Cities: China as a Case Study. Complexity 2020, 2020, 1–11. [Google Scholar] [CrossRef]

- Cheng, Y.; Liu, H.; Wang, S.; Cui, X.; Li, Q. Global Action on SDGs: Policy Review and Outlook in a Post-Pandemic Era. Sustainability 2021, 13, 1–25. [Google Scholar] [CrossRef]

- Dritsaki, C.; Stiakakis, E. Foreign Direct Investments, Exports, and Economic Growth in Croatia: A Time Series Analysis. Procedia Econ. Financ. 2014, 14, 181–190. [Google Scholar] [CrossRef]

- Szkorupová, Z. A Causal Relationship between Foreign Direct Investment, Economic Growth and Export for Slovakia. Procedia Econ. Financ. 2014, 15, 123–128. [Google Scholar] [CrossRef][Green Version]

- Rahman, M.M.; Alam, K. Exploring the driving factors of economic growth in the world’s largest economies. Heliyon 2021, 7, e07109. [Google Scholar] [CrossRef]

- E.Baldwin, R.; Martin, P.; Ottaviano, G.I.P. Global Income Divergence, Trade, and Industrialization: The Geography of Growth Take-Offs. J. Econ. Growth 2001, 6, 5–37. [Google Scholar] [CrossRef]

- Oosterhaven, J.; Hoen, A.R. Preferences, Technology, Trade and Real Income Changes in the European Union. Ann. Reg. Sci. 1998, 32, 505–524. [Google Scholar] [CrossRef]

- Wang, Y. The Stage Characteristics of the Evolution of Chinese Resident Consumption Patterns. Economist. 1994, 2, 52–58. [Google Scholar] [CrossRef]

- Lin, X. Multiple pathways of transportation investment to promote economic growth in China: A structural equation modeling perspective. Transp. Lett. 2019, 12, 471–482. [Google Scholar] [CrossRef]

- Ullah, S.; Ali, K.; Ehsan, M. Foreign direct investment and economic growth nexus in the presence of domestic institutions: A regional comparative analysis. Asia-Pac. J. Reg. Sci. 2022, 6, 735–758. [Google Scholar] [CrossRef]

- Minchun, H.; Lina, Z. The Impact of FDI Withdrawing in Manufacturing on Chinese Employment and the Effectiveness of Respongding Policies. J. Quant. Technol. Econ. 2015, 32, 56–72. [Google Scholar]

- Mah, J.S. Economic growth, exports and export composition in China. Appl. Econ. Lett. 2007, 14, 749–752. [Google Scholar] [CrossRef]

- Li, W. Changes in China’s Consumption, Investment and Export and Their Contributions to Economic Growth. Econ. Geogr. 2019, 39, 31–38. [Google Scholar] [CrossRef]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Krugman, P. Increasing Returns and Economic Geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Conley, T.G.; Ligon, E. Economic distance and cross-country spillovers. J. Econ. Growth 2002, 7, 157–187. [Google Scholar] [CrossRef]

- Sheng, Y.; Luo, H.; Song, J.; Zhao, J.; Zhang, X. Evaluation, influencing factors and spatial spillover of innovation efficiency in five major urban agglomerations in coastal China. Geogr. Res. 2020, 39, 257–271. [Google Scholar] [CrossRef]

- Tang, C.; Qiu, P.; Dou, J. The impact of borders and distance on knowledge spillovers—Evidence from cross-regional scientific and technological collaboration. Technol. Soc. 2022, 70, 1–11. [Google Scholar] [CrossRef]

- Sun, C.; Yang, Y.; Zhao, L. Economic spillover effects in the Bohai Rim Region of China: Is the economic growth of coastal counties beneficial for the whole area? China Econ. Rev. 2015, 33, 123–136. [Google Scholar] [CrossRef]

- Gong, W.; Ni, P.; Xu, H. The Spatial Spillover Effect and Spillover Bandwidth of Influential Factors to Urban Economic Competitiveness: Based on the Spatial Econometric Analysis of 285 Cities in China. Nanjing J. Soc. Sci. 2019, 9, 23–30, 38. [Google Scholar]

- Yan, D.; Yue, W.; Wei, S.; Li, P. A comparative study on the driving factors and spatial spillover effects of economic growth across different regions of China. Geogr. Res. 2021, 40, 3137–3153. [Google Scholar] [CrossRef]

- Wang, S.; Wang, Y.; Zhao, Y. Spatial spillover effects and multi-mechanism for regional development in Guangdong province since 1990s. Acta Geogr. Sin. 2015, 70, 965–979. [Google Scholar] [CrossRef]

- Sun, B.; Song, D. Do large cities contribute to economic growth of small cities? Evidence from Yangtze River Delta in China. Geogr. Res. 2016, 35, 1615–1625. [Google Scholar]

- Wu, S.; Li, L.; Li, S. Natural resource abundance, natural resource-oriented industry dependence, and economic growth: Evidence from the provincial level in China. Resour. Conserv. Recycl. 2018, 139, 163–171. [Google Scholar] [CrossRef]

- Zhu, F.; Wu, X.; Peng, W. Road transportation and economic growth in China: Granger causality analysis based on provincial panel data. Transp. Lett. 2021, 14, 710–720. [Google Scholar] [CrossRef]

- Zhang, X.; Yu, S.; Ding, X.; Li, M.; Miao, Y.; Wang, C. Urban growth and shrinkage with Chinese characteristics: Evidence from Shandong Province, China. Appl. Geogr. 2023, 159, 1–13. [Google Scholar] [CrossRef]

- Zeng, G.; Hu, Y.; Zhong, Y. Industrial agglomeration, spatial structure and economic growth: Evidence from urban cluster in China. Heliyon 2023, 9, 1–11. [Google Scholar] [CrossRef] [PubMed]

- Yang, Z.; Shao, S.; Xu, L.; Yang, L. Can regional development plans promote economic growth? City-level evidence from China. Socio-Econ. Plan. Sci. 2021, 83, 1–13. [Google Scholar] [CrossRef]

- Fang, Z.; Chen, Y. Human capital and energy in economic growth—Evidence from Chinese provincial data. Energy Econ. 2017, 68, 340–358. [Google Scholar] [CrossRef]

- Li, H.; Strauss, J.; Hu, S.; Lui, L. Do high-speed railways lead to urban economic growth in China? A panel data study of China’s cities. Q. Rev. Econ. Financ. 2018, 69, 70–89. [Google Scholar] [CrossRef]

- Li, S.; Hou, Y.; Liu, Y.; Chen, B. The Analysis on Survey of Local Protection in China Domestic Market. Econ. Res. J. 2004, 11, 78–84. [Google Scholar]

- Chen, P.; Zhu, X. Regional Inequalities in China at Different Scales. Acta Geogr. Sin. 2012, 67, 1085–1097. [Google Scholar]

- Li, D.; Yu, H.; Li, X. The Spatial-Temporal Pattern Analysis of City Development in Countries along the Belt and Road Initiative Based on Nighttime Light Data. Geomat. Inf. Sci. Wuhan Univ. 2017, 42, 711–720. [Google Scholar]

- Hengmei, G.; Xiaodong, M. Evolution of Economic Spatial Pattern and Centrality Measure of Huaihai Economic Zone Based on Night-Time Light Data. Geogr. Geo-Inf. Sci. 2020, 36, 34–40, 125. [Google Scholar]

- Yu, S.; Ting, L.; Yao, T.; Weiping, Z.; Wei, T. Quantitative analyses of changes in urban spatial morphology under rapid urbanization in China. Ecol. Sci. 2015, 34, 122–126. [Google Scholar] [CrossRef]

- Amelin, L. Local Indicators of Spatial Association-LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar]

- Chen, G.; Wang, Z. Local fiscal expenditure and economic growth in China Analysis of Linear Mixed Models for Inter provincial Data. Public Financ. Res. 2014, 8, 42–45. [Google Scholar] [CrossRef]

- Hu, G.; Liu, S. Economic Policy Uncertainty (EPU) and China’s Export Fluctuation in the Post-pandemic Era: An Empirical Analysis based on the TVP-SV-VAR Model. Front. Public Health 2021, 9, 1–11. [Google Scholar] [CrossRef] [PubMed]

- Di Stefano, E.; Giovannetti, G.; Mancini, M.; Marvasi, E.; Vannelli, G. Reshoring and plant closures in Covid-19 times: Evidence from Italian MNEs. Int. Econ. 2022, 172, 255–277. [Google Scholar] [CrossRef]

- Oosterhaven, J.; Van Der Linden, J.A. European Technology, Trade and Income Changes for 1975–85: An Intercountry Input–Output Decomposition. Econ. Syst. Res. 1997, 9, 393–412. [Google Scholar] [CrossRef]

- Yi, L.; Ji, J.; Zhang, Y.; Yu, Y. Economic resilience and spatial divergence in the GuangdongHong Kong-Macao Greater Bay Area in China. Geogr. Res. 2020, 39, 2029–2043. [Google Scholar] [CrossRef]

- Elhorst, J.P. Applied Spatial Econometrics: Raising the Bar. Spat. Econ. Anal. 2010, 5, 9–28. [Google Scholar] [CrossRef]

- Ye, A.; Chen, X. Impulse response analysis on FDI, innovation and economic growth in time and space. Geogr. Res. 2019, 38, 273–284. [Google Scholar]

| Type | Name | Unit | Description |

|---|---|---|---|

| Dependent variable (Y) | GDP | billion RMB | Gross Domestic Product |

| Core variables (X) | Investment (Inv) | ¥100 million | Fixed asset investment |

| Consumption (Con) | ¥100 million | The total retail sales of social consumer goods | |

| Foreign direct investment (FDI) | ¥100 million | Actual use of foreign direct investment | |

| Exports (Exp) | ¥100 million | Total foreign trade exports | |

| Control variables (Z) | Fiscal (Fis) | ¥100 million | Local general public budget expenditure |

| Labor (Lab) | people | Year-end employees of the entire society | |

| Innovation (Inn) | Items per 10,000 people | The number of authorized domestic invention patents 1/Year-end permanent population |

| Mainland China | Hong Kong | Macao |

|---|---|---|

| Gross Domestic Product (GDP) | Gross Domestic Product | Gross Domestic Product |

| Year-end permanent population | Mid-year permanent population | Mid-year population |

| Year-end employees of the whole society | Mid-year employed population | Mid-year employed population |

| Fixed asset investment | Gross domestic fixed capital formation | Gross Fixed Capital Formation |

| Local general public budget expenditure | Total government spending | Total government expenditure |

| Actual use of foreign direct investment | Year-end foreign investment position | Total foreign direct investment |

| The number of authorized domestic invention patents | Number of patents granted in Hong Kong * | Number of patents granted in Macao * |

| The total retail sales of social consumer goods | Total retail sales of social consumer goods | Major retail sales of social consumer goods |

| Total foreign trade exports | Overall exports of foreign merchandise trade | Foreign merchandise trade exports |

| Region | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Core area 1 | 2.62 | 2.62 | 2.63 | 2.67 | 2.66 | 2.67 |

| Edge area | 0.22 | 0.22 | 0.21 | 0.19 | 0.20 | 0.19 |

| Weight Matrix | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| W1 | 0.123 *** (3.371) | 0.131 *** (3.491) | 0.134 *** (3.554) | 0.154 *** (3.862) | 0.178 *** (4.028) | 0.185 *** (4.142) |

| W2 | 0.097 *** (2.201) | 0.101 ** (2.213) | 0.102 ** (2.214) | 0.117 ** (2.481) | 0.140 ** (2.684) | 0.145 ** (2.754) |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| lnInv | 0.220 *** (6.89) | 0.199 *** (6.48) | 0.086 *** (3.4) | 0.065 * (1.80) |

| lnCon | 0.054 ** (2.15) | 0.051 ** (2.12) | 0.009 (0.56) | 0.137 *** (3.86) |

| lnFDI | −0.017 ** (−2.53) | −0.013 ** (−2.01) | −0.007 (−1.35) | −0.004 (−0.81) |

| lnExp | 0.093 *** (3.67) | 0.082 *** (3.35) | 0.044 ** (2.08) | 0.027 (1.48) |

| lnFis | 0.003 (0.50) | 0.003 (0.55) | ||

| lnLab | 0.090 * (1.88) | 0.096 * (1.93) | ||

| lnInn | 0.019 *** (2.74) | 0.016 ** (2.53) | ||

| WxlnInv | 0.107 (1.65) | 0.166 *** (2.61) | 0.013 (0.26) | 0.117 * (1.68) |

| WxlnCon | 0.017 (0.37) | −0.014 (−0.35) | 0.022 (0.78) | 0.432 *** (5.13) |

| WxlnFDI | −0.004 (−0.41) | −0.0003 (−0.02) | −0.003 (−0.44) | 0.013 (1.47) |

| WxlnExp | 0.100 ** (2.15) | 0.057 (1.15) | −0.044 (−1.19) | 0.023 (0.69) |

| WxlnFis | −0.014 (−0.62) | −0.027 *** (−2.73) | ||

| WxlnLab | −0.015 (−0.21) | −0.108 (−1.40) | ||

| WxlnInn | 0.003 (0.38) | −0.004 (−0.40) | ||

| 0.232 *** (3.50) | 0.328 *** (5.12) | 0.666 *** (11.10) | 0.3244 *** (4.02) | |

| Log-likelihood | 344.8771 | 360.3395 | 296.9834 | 301.8451 |

| R2 | 0.8007 | 0.7792 | 0.7661 | 0.7227 |

| N | 312 | 312 | 156 | 156 |

| Total Effect | Direct Effect | Indirect Effect | |

|---|---|---|---|

| lnInv | 0.423 *** | 0.231 *** | 0.192 *** |

| (5.67) | (7.13) | (2.80) | |

| lnCon | 0.097 | 0.055 ** | 0.042 |

| (1.62) | (2.27) | (0.76) | |

| lnFDI | −0.027 * | −0.017 *** | −0.010 |

| (−1.84) | (−2.61) | (−0.76) | |

| lnExp | 0.246 *** | 0.100 *** | 0.147 *** |

| (4.18) | (4.10) | (2.80) | |

| lnFis | −0.011 | 0.003 | −0.014 |

| (−0.36) | (0.40) | (−0.48) | |

| lnLab | 0.093 | 0.092 ** | 0.001 |

| (1.12) | (2.00) | (0.02) | |

| lnInn | 0.029 ** | 0.019 *** | 0.010 |

| (2.29) | (2.78) | (0.89) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, X.; Guo, R.; Li, X.; Li, M.; Fan, Y.; Li, Y. Research on the Evolution and Driving Factors of the Economic Spatial Pattern of the Guangdong–Hong Kong–Macao Greater Bay Area in the Context of the COVID-19 Epidemic. ISPRS Int. J. Geo-Inf. 2024, 13, 9. https://doi.org/10.3390/ijgi13010009

Huang X, Guo R, Li X, Li M, Fan Y, Li Y. Research on the Evolution and Driving Factors of the Economic Spatial Pattern of the Guangdong–Hong Kong–Macao Greater Bay Area in the Context of the COVID-19 Epidemic. ISPRS International Journal of Geo-Information. 2024; 13(1):9. https://doi.org/10.3390/ijgi13010009

Chicago/Turabian StyleHuang, Xiaojin, Renzhong Guo, Xiaoming Li, Minmin Li, Yong Fan, and Yaxing Li. 2024. "Research on the Evolution and Driving Factors of the Economic Spatial Pattern of the Guangdong–Hong Kong–Macao Greater Bay Area in the Context of the COVID-19 Epidemic" ISPRS International Journal of Geo-Information 13, no. 1: 9. https://doi.org/10.3390/ijgi13010009

APA StyleHuang, X., Guo, R., Li, X., Li, M., Fan, Y., & Li, Y. (2024). Research on the Evolution and Driving Factors of the Economic Spatial Pattern of the Guangdong–Hong Kong–Macao Greater Bay Area in the Context of the COVID-19 Epidemic. ISPRS International Journal of Geo-Information, 13(1), 9. https://doi.org/10.3390/ijgi13010009