A Textual Analysis of Logograms in Chinese IPO Roadshows: How Agreement between Investors and Management Relates to Pricing and Performance

Abstract

:1. Introduction

2. Literature Review

3. Hypothesis Development

4. Textual Modeling Methodology

Measuring Agreement

5. Data Description

5.1. Dependent Variables

5.2. Independent Variables

5.3. Data Descriptive Statistics

6. Empirical Results

6.1. Univariate Analysis

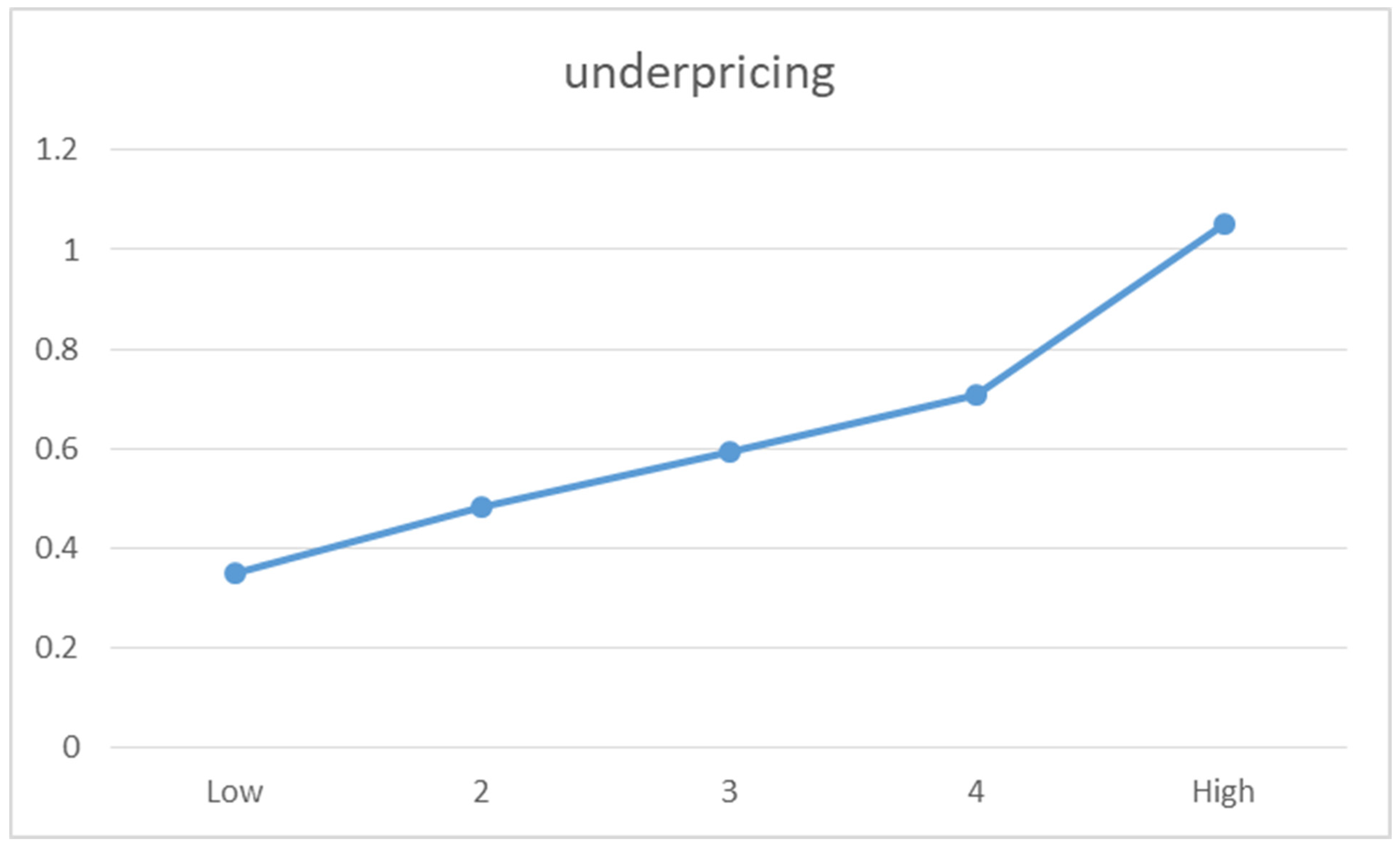

6.2. Agreement and Underpricing

6.3. Agreement and Long-Term Performance

7. Robustness Checks

7.1. Different Dependent Variables

7.2. Industry-Adjusted Agreement

8. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Text of Sample Questions and Responses

Appendix A.2. Translation Text of Sample Questions and Responses

Appendix A.3. Text of Sample Response

Appendix A.4. Translation Text of Sample Response

| 1 | See Jay Ritter’s IPO data found at https://site.warrington.ufl.edu/ritter/ipo-data/ (accessed on 7 February 2021). |

References

- Adcock, D. Kamiko Ho’okano, James C. Brau, and Jessica West. 2020. An empirical analysis of hospital public equity financing. Management in Healthcare 4: 360–74. [Google Scholar]

- Afanasyev, Dmitriy, Elena Fedorova, and Svetlana Ledyaeva. 2021. Strength of words: Donald Trump’s tweets, sanctions and Russia’s ruble. Journal of Economic Behavior and Organization 184: 253–77. [Google Scholar] [CrossRef]

- Akerlof, George A. 1970. The market for ‘lemons’: Qualitative uncertainty and the market mechanism. Quarterly Journal of Economics 84: 488–500. [Google Scholar] [CrossRef]

- Alti, Aydogan. 2005. IPO market timing. Review of Financial Studies 18: 1105–38. [Google Scholar] [CrossRef]

- Ang, James S., and James C. Brau. 2002. Firm transparency and the costs of going public. Journal of Financial Research 25: 1–17. [Google Scholar] [CrossRef]

- Ang, James S., and James C. Brau. 2003. Concealing and confounding adverse signals: Insider wealth-maximizing behavior in the IPO process. Journal of Financial Economics 67: 149–72. [Google Scholar] [CrossRef]

- Baron, David P. 1982. A model of the demand for investment banking advising and distribution services for new issues. Journal of Finance 37: 955–76. [Google Scholar] [CrossRef]

- Beatty, Randolph P., and Jay R. Ritter. 1986. Investment banking, reputation, and the underpricing of initial public offerings. Journal of Financial Economics 15: 213–32. [Google Scholar] [CrossRef] [Green Version]

- Beebe, Leslie M., and Howard Giles. 1984. Speech-accommodation theories: A discussion in terms of second-language acquisition. International Journal of the Sociology of Language 46: 5–32. [Google Scholar] [CrossRef]

- Benson, David F., James C. Brau, James Cicon, and Stephen P. Ferris. 2015. Strategically camouflaged corporate governance in IPOs: Entrepreneurial masking and impression management. Journal of Business Venturing 30: 839–64. [Google Scholar] [CrossRef]

- Bhabra, Harjeet S., and Richard H. Pettway. 2003. IPO prospectus information and subsequent performance. Financial Review 38: 369–97. [Google Scholar] [CrossRef]

- Blankespoor, Elizabeth, Bradley E. Hendricks, and Gregory S. Miller. 2017. Perceptions and price: Evidence from CEO presentations at IPO roadshows. Journal of Accounting Research 55: 275–327. [Google Scholar] [CrossRef]

- Borochin, Paul A., James E. Cicon, R. Jared DeLisle, and S. McKay Price. 2018. The effects of conference call tones on market perceptions of value uncertainty. Journal of Financial Markets 40: 75–91. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Alexis Cellier, Riadh Manita, and Narjess Toumi. 2020. Ownership structure and long-run performance of French IPO firms. Management International 24: 135–52. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Dimitrios Gounopoulos, Antonios Kallias, and Konstantinos Kallias. 2017. Management earnings forecasts and IPO performance: Evidence of a regime change. Review of Quantitative Finance and Accounting 48: 1083–121. [Google Scholar] [CrossRef] [Green Version]

- Boubaker, Sabri, Dimitrios Gounopoulos, and Hatem Rjiba. 2019. Annual report readability and stock liquidity. Financial Markets, Institutions & Instruments 28: 159–86. [Google Scholar]

- Boulton, Thomas J., Bill B. Francis, Thomas Shohfi, and Daqi Xin. 2021. Investor awareness or information asymmetry? Wikipedia and IPO underpricing. Financial Review 56: 535–61. [Google Scholar] [CrossRef]

- Brau, James C. 2012. Why do firms go public. In The Oxford Handbook of Entrepreneurial Finance. New York: Oxford University Press, pp. 467–94. [Google Scholar]

- Brau, James C., and C. Troy Carpenter. 2013. SB IPOs and IPO Anomalies: An Empirical Analysis of the Small Firm Uniqueness Hypothesis. The Journal of Entrepreneurial Finance (JEF) 16: 75–96. [Google Scholar]

- Brau, James C., and David Heywood. 2008. IPO and SEO waves in health care real estate investment trusts. Journal of Health Care Finance 35: 70–88. [Google Scholar]

- Brau, James C., and Gordon Gee. 2010. Micro-IPOs: An analysis of the Small Corporate Offering Registration (SCOR) procedure with national data. Journal of Entrepreneurial Finance, JEF 14: 69–89. [Google Scholar]

- Brau, James C., and Jonathan M. Holloway. 2009. An empirical analysis of health care IPOs and SEOs. Journal of Health Care Finance 35: 42–64. [Google Scholar] [PubMed]

- Brau, James C., and Javier Rodríguez. 2009. An empirical analysis of Mexican and US closed-end mutual fund IPOs. Research in International Business and Finance 23: 1–17. [Google Scholar] [CrossRef]

- Brau, James C., and Jerome S. Osteryoung. 2001. The determinants of successful micro-IPOs: An analysis of issues made under the Small Corporate Offering Registration (SCOR) procedure. Journal of Small Business Management 39: 209–27. [Google Scholar] [CrossRef]

- Brau, James C., and J. Troy Carpenter. 2012a. Small-Firm uniqueness and signaling theory. Journal of Business Economics and Finance 1: 50–63. [Google Scholar]

- Brau, James C., and J. Troy Carpenter. 2012b. Efficacy of the. 1992 Small Business Incentive Act. Journal of Financial Economic Policy 4: 204–17. [Google Scholar] [CrossRef]

- Brau, James C., and J. Troy Carpenter. 2017. Equity Issuance of Health Care Firms after the. 2007 Market Crash and the. 2010 Affordable Care Act. Journal of Health Care Finance 43: 1–15. [Google Scholar] [CrossRef]

- Brau, James C., and Peter M. Johnson. 2009. Earnings management in IPOs: Post-engagement third-party mitigation or issuer signaling? Advances in Accounting 25: 125–35. [Google Scholar] [CrossRef]

- Brau, James C., and Stanley E. Fawcett. 2006a. Initial public offerings: An analysis of theory and practice. The Journal of Finance 61: 399–436. [Google Scholar] [CrossRef]

- Brau, James C., and Stanley E. Fawcett. 2006b. Evidence on what CFOs think about the IPO process: Practice, theory, and managerial implications. Journal of Applied Corporate Finance 18: 107–17. [Google Scholar] [CrossRef]

- Brau, James C., Bill Francis, and Ninon Kohers. 2003. The choice of IPO versus takeover: Empirical evidence. The Journal of Business 76: 583–612. [Google Scholar] [CrossRef] [Green Version]

- Brau, James C., David A. Carter, Stephen E. Christophe, and Kimberly G. Key. 2004. Market reaction to the expiration of IPO lockup provisions. Managerial Finance 30: 87–103. [Google Scholar] [CrossRef]

- Brau, James C., Drew Dahl, Hongjing Zhang, and Mingming Zhou. 2014. Regulatory reforms and convergence of the banking Sector: Evidence from China. Managerial Finance 40: 956–68. [Google Scholar] [CrossRef]

- Brau, James C., Francis E. Laatsch, and Mingsheng Li. 2008. IPO Pricing and Equity Return Swap. Financial Decisions 20: 1–31. [Google Scholar]

- Brau, James C., James Cicon, and Grant McQueen. 2016. Soft strategic information and IPO underpricing. Journal of Behavioral Finance 17: 1–17. [Google Scholar] [CrossRef]

- Brau, James C., J. Troy Carpenter, Mauricio Rodriguez, and C. F. Sirmans. 2013. REIT going private decisions. The Journal of Real Estate Finance and Economics 46: 24–43. [Google Scholar] [CrossRef]

- Brau, James C., Mingsheng Li, and Jing Shi. 2007. Do secondary shares in the IPO process have a negative effect on aftermarket performance? Journal of Banking & Finance 31: 2612–31. [Google Scholar]

- Brau, James C., Ninon Kohers Sutton, and Nile W. Hatch. 2010. Dual-track versus single-track sell-outs: An empirical analysis of competing harvest strategies. Journal of Business Venturing 25: 389–402. [Google Scholar] [CrossRef]

- Brau, James C., Patricia A. Ryan, and Irv DeGraw. 2006. Initial public offerings: CFO perceptions. Financial Review 41: 483–511. [Google Scholar] [CrossRef]

- Brau, James C., Robert B. Couch, and Ninon Kohers Sutton. 2012. The desire to acquire and IPO long-run underperformance. Journal of Financial and Quantitative Analysis 47: 493–510. [Google Scholar] [CrossRef]

- Brau, James C., J. Troy Carpenter, James Cicon, and Shelly Howton. 2021. Soft Information and the underpricing of REIT Seasoned Equity Offerings. Journal of Real Estate Portfolio Management 27: 137–48. [Google Scholar] [CrossRef]

- Brau, James C., Val E. Lambson, and Grant McQueen. 2005. Lockups revisited. Journal of Financial and Quantitative Analysis 40: 519–30. [Google Scholar] [CrossRef]

- Brogi, Marina, Valentina Lagasio, and Valerio Pesic. 2020. Can governance help in making an IPO “successful”? New evidence from Europe. Journal of International Financial Management and Accounting 31: 239–69. [Google Scholar] [CrossRef]

- Cao-Alvira, Jose J., and Javier Rodríguez. 2017. IPO and Aftermarket Performance of Single-Listed Chinese ADRs. Journal of International Financial Management and Accounting 28: 5–26. [Google Scholar] [CrossRef] [Green Version]

- Chen, Yibiao, Steven Shuye Wang, Wei Li, Qian Sun, and Wilson H.S. Tong. 2015. Institutional environment, firm ownership, and IPO first-day returns: Evidence from China. Journal of Corporate Finance 32: 150–68. [Google Scholar] [CrossRef]

- Cicon, James. 2017. Say it again Sam: The information content of corporate conference calls. Review of Quantitative Finance and Accounting 48: 57–81. [Google Scholar] [CrossRef]

- Cohen, Lauren, Christopher Malloy, and Quoc Nguyen. 2020. Lazy prices. Journal of Finance 75: 1371–415. [Google Scholar] [CrossRef]

- Das, Sanjiv R., and Mike Y. Chen. 2007. Yahoo! for Amazon: Sentiment extraction from small talk on the web. Management Science 53: 1375–88. [Google Scholar] [CrossRef] [Green Version]

- Fedorova, Elena, Sergei Dryuchok, and Pavel Drogovoz. 2022. The impact of news sentiment and topics on the underestimation of IPO prices: US data. International Journal of Accounting and Information Management 30: 73–94. [Google Scholar] [CrossRef]

- Fischer, John L. 1958. Social influences on the choice of a linguistic variant. Word 14: 47–56. [Google Scholar] [CrossRef]

- Gasiorek, Jessica, and Howard Giles. 2012. Effects of inferred motive on evaluations of nonaccommodative communication. Human Communication Research 38: 309–31. [Google Scholar] [CrossRef]

- Giles, Howard. 2015. Communication accommodation theory. The International Encyclopedia of Communication Theory and Philosophy 1: 1–7. [Google Scholar]

- Giles, Howard, Anthony Mulac, James J. Bradac, and Patricia Johnson. 1987. Speech accommodation theory: The first decade and beyond. Annals of the International Communication Association 10: 13–48. [Google Scholar] [CrossRef]

- Giles, Howard, and Jessica Gasiorek. 2013. Parameters of non-accommodation: Refining and elaborating communication accommodation theory. In Social Cognition and Communication. Hove: Psychology Press, pp. 155–72. [Google Scholar]

- Giles, Howard, Donald M. Taylor, and Richard Bourhis. 1973. Towards a theory of interpersonal accommodation through language: Some Canadian data. Language in Society 2: 177–92. [Google Scholar] [CrossRef]

- Giles, Howard, Nikolas Coupland, and Justine Coupland. 1991. 1. Accommodation theory: Communication, context, and contexts of accommodation. In Developments in Applied Sociolinguistics. Cambridge: Cambridge University Press, pp. 1–68. [Google Scholar]

- Hajek, Christopher, Howard Giles, Valerie Barker, Mei-Chen Lin, Yan Bing Zhang, and Mary Lee Hummert. 2008. Expressed trust and compliance in police-civilian encounters: The role of communication accommodation in Chinese and American settings. Chinese Journal of Communication 1: 168–80. [Google Scholar] [CrossRef]

- Hanley, Kathleen W. 1993. The underpricing of initial public offerings and the partial adjustment phenomenon. Journal of Financial Economics 34: 231–50. [Google Scholar] [CrossRef] [Green Version]

- Hanley, Kathleen W., and Gerard Hoberg. 2010. The information content of IPO prospectuses. The Review of Financial Studies 23: 2821–64. [Google Scholar] [CrossRef] [Green Version]

- Huffaker, David A., Roderick Swaab, and Daniel Diermeier. 2011. The language of coalition formation in online multiparty negotiations. Journal of Language and Social Psychology 30: 66–81. [Google Scholar] [CrossRef]

- Ibbotson, Roger G. 1975. Price performance of common stock new issues. Journal of Financial Economics 2: 235–72. [Google Scholar] [CrossRef]

- Ibbotson, Roger G., Jody L. Sindelar, and Jay R. Ritter. 1988. Initial public offerings. Journal of Applied Corporate Finance 1: 37–45. [Google Scholar] [CrossRef]

- Ibbotson, Roger G., Jody L. Sindelar, and Jay R. Ritter. 1994. The market’s problems with the pricing of initial public offerings. Journal of Applied Corporate Finance 7: 66–74. [Google Scholar] [CrossRef]

- Jenkins, Porter, and Stephen Owen. 2021a. Structured Embeddings of Financial Documents with Graph Attention Networks. Working Paper. Denton: University of North Texas. [Google Scholar]

- Jenkins, Porter, and Stephen Owen. 2021b. Conference Call Information: The Effects of Dodgy Managers on Security Performance. Working Paper. Denton: University of North Texas. [Google Scholar]

- Jones, Simon, Rachel Cotterill, Nigel Dewdney, Kate Muir, and Adam N. Joinson. 2014. Finding Zelig in text: A measure for normalising linguistic accommodation. Coling 25: 455–65. [Google Scholar]

- Kulesza, Wojciech, Dariusz Dolinski, Avia Huisman, and Robert Majewski. 2014. The echo effect: The power of verbal mimicry to influence prosocial behavior. Journal of Language and Social Psychology 33: 183–201. [Google Scholar] [CrossRef]

- Kwon, Oh-Woog, and Jong-Hyeok Lee. 2003. Text categorization based on k-nearest neighbor approach for web site classification. Information Processing & Management 39: 25–44. [Google Scholar]

- Langberg, Nisan, and K Sivaramakrishnan. 2010. Voluntary disclosures and analyst feedback. Journal of Accounting Research 48: 603–46. [Google Scholar] [CrossRef]

- Li, Mingsheng, Thomas H. McInish, and Udomsak Wongchoti. 2005. Asymmetric information in the IPO aftermarket. Financial Review 40: 131–53. [Google Scholar] [CrossRef]

- Linnemann, G. A., and R. Jucks. 2016. As in the question, so in the answer? Language style of human and machine speakers affects interlocutors’ convergence on wordings. Journal of Language and Social Psychology 35: 686–97. [Google Scholar] [CrossRef]

- Logue, Dennis E. 1973. On the pricing of unseasoned equity issues: 1965–1969. Journal of Financial and Quantitative Analysis 8: 91–103. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2011. When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. The Journal of Finance 66: 35–65. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2013. IPO first-day returns, offer price revisions, volatility, and form S-1 language. Journal of Financial Economics 109: 307–26. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2014. Measuring readability in financial disclosures. Journal of Finance 69: 1643–71. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay R. Ritter. 1995. The new issues puzzle. Journal of Finance 50: 23–51. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay R. Ritter. 2002. Why don’t issuers get upset about leaving money on the table in IPOs? Review of Financial Studies 15: 413–44. [Google Scholar] [CrossRef]

- Ludwig, Stephan, Ko De Ruyter, Dominik Mahr, Martin Wetzels, Elisabeth Brüggen, and Tom De Ruyck. 2014. Take their word for it. MIS Quarterly 38: 1201–18. [Google Scholar] [CrossRef] [Green Version]

- Manning, Christopher, and Hinrich Schütze. 1999. Foundations of Statistical Natural Language Processing. Cambridge, MA: MIT press. [Google Scholar]

- Muir, Kate, Adam Joinson, Rachel Cotterill, and Nigel Dewdney. 2016. Characterizing the linguistic chameleon: Personal and social correlates of linguistic style accommodation. Human Communication Research 42: 462–84. [Google Scholar] [CrossRef]

- Muir, Kate, Adam Joinson, Rachel Cotterill, and Nigel Dewdney. 2017. Linguistic style accommodation shapes impression formation and rapport in computer-mediated communication. Journal of Language and Social Psychology 36: 525–48. [Google Scholar] [CrossRef]

- Ober, Scot, Jensen J. Zhao, Rod Davis, and Melody W. Alexander. 1999. Telling it like it is: The use of certainty in public business discourse. The Journal of Business Communication 36: 280–96. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1991. The long-run performance of initial public offerings. Journal of Finance 46: 3–27. [Google Scholar] [CrossRef]

- Rock, Kevin. 1986. Why new issues are underpriced. Journal of Financial Economics 15: 187–212. [Google Scholar] [CrossRef]

- Sagi, Eyal, and Daniel Diermeier. 2017. Language use and coalition formation in multiparty negotiations. Cognitive Science 41: 259–71. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Simard, Lise M., Donald M. Taylor, and Howard Giles. 1976. Attribution processes and interpersonal accommodation in a bilingual setting. Language and Speech 19: 374–87. [Google Scholar] [CrossRef]

- Stoll, Hans R., and Anthony J. Curley. 1970. Small business and the new issues market for equities. Journal of Financial and Quantitative Analysis 5: 309–22. [Google Scholar] [CrossRef]

- Swaab, Roderick I., William W. Maddux, and Marwan Sinaceur. 2011. Early words that work: When and how virtual linguistic mimicry facilitates negotiation outcomes. Journal of Experimental Social Psychology 47: 616–21. [Google Scholar] [CrossRef] [Green Version]

- Taylor, Paul J., and Sally Thomas. 2008. Linguistic style matching and negotiation outcome. Negotiation and Conflict Management Research 1: 263–81. [Google Scholar] [CrossRef] [Green Version]

- Teoh, Siew Hong, Ivo Welch, and Tak J. Wong. 1998. Earnings management and the long-run market performance of initial public offerings. Journal of Finance 53: 1935–74. [Google Scholar] [CrossRef] [Green Version]

- Tetlock, Paul C. 2007. Giving content to investor sentiment: The role of media in the stock market. Journal of Finance 62: 1139–68. [Google Scholar] [CrossRef]

- Thakerar, Jitendra N., Howard Giles, and Jenny Cheshire. 1982. Psychological and linguistic parameters of speech accommodation theory. Advances in the Social Psychology of Language, 205–55. [Google Scholar]

- Triandis, Harry C. 1960. Cognitive similarity and communication in a dyad. Human Relations 13: 175–83. [Google Scholar] [CrossRef]

- Van Baaren, Rick B., Rob W. Holland, Bregje Steenaert, and Ad Van Knippenberg. 2003. Mimicry for money: Behavioral consequences of imitation. Journal of Experimental Social Psychology 39: 393–98. [Google Scholar] [CrossRef]

| Panel A: Industry Distribution | ||

| Industry Classification | Number of Firms | Percent of Sample |

| Agriculture, Forestry, and Fishing | 16 | 1.63% |

| Business Service | 15 | 1.53% |

| Construction | 26 | 2.65% |

| Culture Communication | 11 | 1.12% |

| Environment | 11 | 1.12% |

| Finance | 5 | 0.51% |

| Health | 4 | 0.41% |

| Information | 105 | 10.71% |

| Lodging, Catering | 2 | 0.20% |

| Manufacturing | 715 | 72.96% |

| Mining | 10 | 1.02% |

| Real Estate | 9 | 0.92% |

| Research Service | 9 | 0.92% |

| Transportation, Storage | 10 | 1.02% |

| Water, Electric, Gas | 8 | 0.82% |

| Wholesale Trade, Retail Trade | 24 | 2.45% |

| Total | 980 | 100% |

| Panel B: Annual Distribution | ||

| IPO Year | Number of Firms | Percent of Sample |

| 2004 | 33 | 3.37% |

| 2006 | 47 | 4.80% |

| 2007 | 97 | 9.90% |

| 2008 | 65 | 6.63% |

| 2009 | 89 | 9.08% |

| 2010 | 316 | 32.24% |

| 2011 | 230 | 23.47% |

| 2012 | 103 | 10.51% |

| Total | 980 | 100% |

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| IPO Underpricing | 0.636 | 0.375 | 0.797 | −0.263 | 5.381 |

| Agreement | 0.213 | 0.212 | 0.034 | 0.109 | 0.309 |

| Tone of question | 0.582 | 0.578 | 0.111 | 0.162 | 1.000 |

| Tone of answer | 0.800 | 0.807 | 0.057 | 0.558 | 0.952 |

| Firm Characteristics | |||||

| Age | 2.018 | 2.079 | 0.596 | 0.000 | 3.296 |

| Size | 19.946 | 19.863 | 0.782 | 18.043 | 24.758 |

| ROE | 0.277 | 0.256 | 0.126 | 0.018 | 1.669 |

| SOE | 0.110 | 0.000 | 0.313 | 0.000 | 1.000 |

| Offer Characteristics | |||||

| Lottery rate | 0.009 | 0.006 | 0.025 | 0.000 | 0.655 |

| Offer Price | 23.641 | 20.000 | 15.028 | 2.880 | 148.000 |

| Offer PE | 45.279 | 40.930 | 21.196 | 6.670 | 150.820 |

| Offer Proceeds | 6.898 | 5.420 | 5.550 | 0.905 | 59.348 |

| IPO Fees/IPO Proceeds (%) | 0.070 | 0.067 | 0.024 | 0.018 | 0.174 |

| Underwriter Prestige | 0.448 | 0.000 | 0.498 | 0.000 | 1.000 |

| 60.210 | 69.000 | 25.041 | 0.000 | 101.000 | |

| Industry Characteristics | |||||

| Prior 3 Month IPO Volume | 60.210 | 69.000 | 25.041 | 0.000 | 101.000 |

| Prior 3 Months Underpricing | 0.634 | 0.469 | 0.582 | 0.000 | 2.988 |

| 3 Week Prior Market Return | −0.000 | −0.001 | 0.070 | −0.212 | 0.212 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) | IPO Underpricing | 1 | ||||||||||||||||

| (2) | Agreement | 0.313 *** | 1 | |||||||||||||||

| (3) | Tone of question | −0.001 | −0.216 *** | 1 | ||||||||||||||

| (4) | Tone of answer | 0.059 * | 0.238 *** | 0.266 *** | 1 | |||||||||||||

| (5) | Age | −0.144 *** | −0.064 ** | −0.012 | −0.0230 | 1 | ||||||||||||

| (6) | Size | −0.105 *** | 0.038 | −0.015 | −0.061 * | 0.064 ** | 1 | |||||||||||

| (7) | ROE | −0.126 *** | 0.029 | −0.075 ** | 0.020 | −0.070 ** | −0.072 ** | 1 | ||||||||||

| (8) | SOE | 0.178 *** | 0.101 *** | 0.014 | 0.0450 | 0.007 | 0.186 *** | −0.153 *** | 1 | |||||||||

| (9) | Lottery rate | −0.190 *** | −0.130 *** | −0.029 | −0.029 | 0.028 | 0.118 *** | 0.204 *** | −0.073 ** | 1 | ||||||||

| (10) | Offer Price | −0.372 *** | −0.254 *** | 0.109 *** | −0.023 | 0.062 * | −0.021 | 0.435 *** | −0.163 *** | 0.243 *** | 1 | |||||||

| (11) | Offer PE | −0.271 *** | −0.348 *** | 0.217 *** | −0.040 | 0.009 | −0.202 *** | −0.069 ** | −0.125 *** | 0.0290 | 0.597 *** | 1 | ||||||

| (12) | Offer Proceeds | −0.302 *** | −0.135 *** | 0.072 ** | −0.018 | 0.016 | 0.527 *** | 0.366 *** | −0.014 | 0.247 *** | 0.639 *** | 0.330 *** | 1 | |||||

| (13) | IPO Fees / IPO Proceeds (%) | 0.051 | −0.015 | −0.048 | 0.001 | 0.130 *** | −0.435 *** | −0.175 *** | −0.075 ** | −0.039 | −0.245 *** | −0.120 *** | −0.478 *** | 1 | ||||

| (14) | Underwriter Prestige | −0.086 *** | −0.105 *** | 0.068 ** | 0.056 * | −0.002 | 0.045 | 0.029 | −0.002 | −0.013 | 0.063 ** | 0.066 ** | 0.063 ** | 0.0290 | 1 | |||

| (15) | Prior 3 Month IPO Volume | −0.503 *** | −0.387 *** | 0.109 *** | −0.131 *** | 0.095 *** | 0.010 | −0.007 | −0.147 *** | 0.153 *** | 0.485 *** | 0.575 *** | 0.355 *** | −0.0290 | 0.075 ** | 1 | ||

| (16) | Prior 3 Months Underpricing | 0.720 *** | 0.297 *** | 0.070 ** | 0.096 *** | −0.214 *** | −0.005 | −0.078 ** | 0.143 *** | −0.197 *** | −0.312 *** | −0.258 *** | −0.199 *** | −0.123 *** | −0.030 | −0.568 *** | 1 | |

| (17) | 3 Week Prior Market Return | 0.285 *** | 0.050 | 0.021 | 0.038 | 0.038 | −0.025 | −0.030 | −0.001 | −0.036 | −0.064 ** | −0.016 | −0.057 * | −0.018 | −0.032 | −0.086 *** | 0.137 *** | 1 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Agreement | 1.778 *** | 2.205 *** | 1.941 *** | 2.018 *** |

| (3.03) | (3.22) | (2.77) | (3.24) | |

| Tone of question | −0.033 | 0.089 | −0.001 | |

| (−0.17) | (0.56) | (−0.01) | ||

| Tone of answer | −0.444 | −0.336 | −0.437 * | |

| (−1.60) | (−1.36) | (−1.79) | ||

| Age | 0.022 | 0.024 | 0.006 | |

| (0.60) | (0.64) | (0.24) | ||

| Size | −0.162 *** | −0.130 *** | −0.119 *** | |

| (−5.54) | (−3.42) | (−3.38) | ||

| ROE | −0.443 ** | −0.092 | −0.204 | |

| (−2.63) | (−0.67) | (−1.33) | ||

| SOE | 0.134 ** | 0.126 * | 0.185 *** | |

| (2.19) | (1.88) | (3.22) | ||

| Lottery rate | −0.274 | 0.199 | ||

| (−0.87) | (0.59) | |||

| Offer Price | −0.005 *** | −0.004 *** | ||

| (−3.29) | (−3.26) | |||

| Offer PE | −0.001 | −0.002 * | ||

| (−1.19) | (−1.97) | |||

| Offer Proceeds | 0.002 | 0.002 | ||

| (0.52) | (0.60) | |||

| IPO Fees/IPO Proceeds (%) | 2.523 ** | 2.887 ** | ||

| (2.17) | (2.13) | |||

| Underwriter Prestige | −0.073 * | −0.059 * | ||

| (−1.86) | (−1.74) | |||

| Prior Three Month IPO Volume | −0.005 | |||

| (−1.40) | ||||

| Prior Three Months Underpricing | 0.622 *** | |||

| (5.61) | ||||

| Three Week Prior Market Return | 1.998 *** | |||

| (3.24) | ||||

| Year Fixed Effects | yes | yes | yes | yes |

| Industry Fixed Effects | yes | yes | yes | yes |

| Constant | 0.318 * | 3.773 *** | 2.885 *** | 2.692 *** |

| (1.91) | (7.26) | (3.74) | (3.09) | |

| Observations | 980 | 980 | 980 | 980 |

| R-squared | 0.516 | 0.542 | 0.556 | 0.629 |

| Variable | CARs 1 Year | CARs 2 Year | CARs 3 Year |

|---|---|---|---|

| Agreement | −0.768 ** | −1.059 *** | −1.135 ** |

| (−2.20) | (−2.69) | (−2.00) | |

| Tone of question | −0.219 * | −0.015 | −0.001 |

| (−1.83) | (−0.13) | (−0.01) | |

| Tone of answer | 0.423 ** | 0.538 ** | 1.006 *** |

| (2.04) | (2.03) | (3.91) | |

| Age | −0.014 | −0.015 | 0.016 |

| (−0.73) | (−0.45) | (0.50) | |

| Size | −0.026 | −0.054 * | −0.137 *** |

| (−0.97) | (−1.77) | (−3.59) | |

| ROE | −0.043 | −0.252 | −0.287 |

| (−0.28) | (−1.41) | (−1.41) | |

| SOE | 0.049 | 0.045 | 0.055 |

| (1.30) | (0.88) | (0.86) | |

| Lottery rate | 0.383 | −0.251 | −0.380 |

| (1.44) | (−0.86) | (−1.34) | |

| Offer Price | 0.002 * | 0.004 ** | 0.004 |

| (1.88) | (2.13) | (1.16) | |

| Offer PE | −0.000 | −0.002 | −0.002 |

| (−0.19) | (−1.45) | (−1.33) | |

| Offer Proceeds | −0.006 | −0.006 | −0.004 |

| (−1.58) | (−1.10) | (−0.59) | |

| IPO Fees/IPO Proceeds (%) | −0.603 | 0.293 | 1.335 |

| (−0.89) | (0.26) | (1.20) | |

| Underwriter Prestige | 0.025 | 0.012 | −0.031 |

| (0.92) | (0.33) | (−0.99) | |

| Prior Three Month IPO Volume | 0.002 * | 0.000 | 0.001 |

| (1.67) | (0.04) | (0.57) | |

| Prior Three Months Underpricing | 0.091 ** | 0.068 | 0.081 |

| (2.03) | (1.03) | (0.78) | |

| Three Week Prior Market Return | −0.060 | −0.217 | 0.087 |

| (−0.25) | (−0.93) | (0.25) | |

| Year Fixed Effects | yes | yes | yes |

| Industry Fixed Effects | yes | yes | yes |

| Constant | 0.303 | 0.993 | 1.881 ** |

| (0.49) | (1.41) | (2.58) | |

| Observations | 980 | 980 | 980 |

| R-squared | 0.205 | 0.285 | 0.320 |

| Variable | Underpricingadj | BHARs 1 Year | BHARs 2 Year | BHARs 3 Year |

|---|---|---|---|---|

| Agreement | 2.078 *** | −0.870 ** | −1.087 ** | −2.356 |

| (3.29) | (−2.40) | (−2.03) | (−1.58) | |

| Tone of question | −0.006 | −0.283 | 0.169 | −0.171 |

| (−0.03) | (−1.50) | (0.93) | (−0.39) | |

| Tone of answer | −0.447 * | 0.397 * | 0.309 | 2.211 ** |

| (−1.84) | (1.96) | (0.74) | (2.00) | |

| Age | 0.007 | −0.010 | −0.008 | 0.036 |

| (0.26) | (−0.64) | (−0.28) | (0.82) | |

| Size | −0.118 *** | −0.022 | −0.034 | −0.088 |

| (−3.33) | (−0.85) | (−0.80) | (−0.75) | |

| ROE | −0.205 | −0.076 | −0.127 | 0.044 |

| (−1.35) | (−0.54) | (−0.62) | (0.07) | |

| SOE | 0.194 *** | 0.035 | 0.016 | −0.011 |

| (3.30) | (0.92) | (0.24) | (−0.09) | |

| Lottery rate | 0.139 | 0.268 | 0.094 | −0.667 |

| (0.39) | (0.98) | (0.24) | (−1.26) | |

| Offer Price | −0.004 *** | 0.003 * | 0.004 * | 0.005 |

| (−2.99) | (1.68) | (1.79) | (1.13) | |

| Offer PE | −0.002 * | −0.001 | −0.002 | −0.002 |

| (−1.80) | (−0.50) | (−1.18) | (−0.98) | |

| Offer Proceeds | 0.002 | −0.004 | −0.004 | −0.007 |

| (0.59) | (−1.15) | (−0.53) | (−0.33) | |

| IPO Fees/IPO Proceeds (%) | 2.804 ** | −0.967 | 0.291 | 3.015 |

| (2.07) | (−1.53) | (0.20) | (1.26) | |

| Underwriter Prestige | −0.059 * | 0.045 | 0.002 | −0.122 |

| (−1.75) | (1.15) | (0.05) | (−1.41) | |

| Prior 3 Month IPO Volume | −0.005 | 0.003 ** | 0.001 | 0.007 |

| (−1.35) | (2.02) | (0.32) | (1.27) | |

| Prior 3 Months Underpricing | 0.647 *** | 0.128 *** | −0.057 | −0.099 |

| (5.60) | (3.40) | (−0.71) | (−0.85) | |

| 3 Week Prior Market Return | 1.410 ** | 0.054 | −0.070 | 0.350 |

| (2.23) | (0.24) | (−0.28) | (0.57) | |

| Year Fixed Effects | yes | yes | yes | yes |

| Industry Fixed Effects | yes | yes | yes | yes |

| Constant | 2.661 *** | 0.238 | 0.719 | 0.010 |

| (3.05) | (0.40) | (0.83) | (0.00) | |

| Observations | 980 | 980 | 980 | 980 |

| R-squared | 0.615 | 0.285 | 0.207 | 0.167 |

| Variable | Underpricing | CARs 1 Year | CARs 2 Year | CARs 3 Year |

|---|---|---|---|---|

| Agreement | 1.793 *** | −0.761 ** | −1.018 *** | −1.120 ** |

| (2.97) | (−2.11) | (−2.82) | (−2.28) | |

| Tone of question | −0.016 | −0.220 * | −0.013 | −0.001 |

| (−0.09) | (−1.82) | (−0.12) | (−0.01) | |

| Tone of answer | −0.394 * | 0.419 ** | 0.527 ** | 0.998 *** |

| (−1.67) | (2.03) | (1.99) | (3.97) | |

| Age | 0.007 | −0.014 | −0.015 | 0.015 |

| (0.26) | (−0.73) | (−0.46) | (0.49) | |

| Size | −0.119 *** | −0.026 | −0.054 * | −0.136 *** |

| (−3.35) | (−0.96) | (−1.77) | (−3.60) | |

| ROE | −0.202 | −0.043 | −0.252 | −0.286 |

| (−1.32) | (−0.28) | (−1.41) | (−1.41) | |

| SOE | 0.182 *** | 0.050 | 0.047 | 0.056 |

| (3.17) | (1.33) | (0.91) | (0.89) | |

| Lottery rate | 0.149 | 0.395 | −0.232 | −0.363 |

| (0.43) | (1.45) | (−0.80) | (−1.30) | |

| Offer Price | −0.004 *** | 0.002 * | 0.004 ** | 0.004 |

| (−3.29) | (1.90) | (2.15) | (1.17) | |

| Offer PE | −0.002 * | −0.000 | −0.002 | −0.002 |

| (−1.92) | (−0.20) | (−1.45) | (−1.34) | |

| Offer Proceeds | 0.003 | −0.006 | −0.006 | −0.004 |

| (0.67) | (−1.64) | (−1.15) | (−0.62) | |

| IPO Fees/IPO Proceeds (%) | 2.857 ** | −0.587 | 0.313 | 1.359 |

| (2.10) | (−0.87) | (0.28) | (1.23) | |

| Underwriter Prestige | −0.061 * | 0.025 | 0.012 | −0.031 |

| (−1.79) | (0.94) | (0.35) | (−0.97) | |

| Prior 3 Month IPO Volume | −0.005 | 0.002 * | 0.000 | 0.001 |

| (−1.40) | (1.68) | (0.06) | (0.59) | |

| Prior 3 Months Underpricing | 0.622 *** | 0.091 ** | 0.068 | 0.082 |

| (5.60) | (2.03) | (1.03) | (0.79) | |

| 3 Week Prior Market Return | 1.991 *** | −0.058 | −0.213 | 0.091 |

| (3.23) | (−0.24) | (−0.92) | (0.26) | |

| Year Fixed Effects | yes | yes | yes | yes |

| Industry Fixed Effects | yes | yes | yes | yes |

| Constant | 3.182 *** | 0.105 | 0.725 | 1.590 ** |

| (3.24) | (0.17) | (1.02) | (2.10) | |

| Observations | 980 | 980 | 980 | 980 |

| R-squared | 0.628 | 0.204 | 0.284 | 0.320 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brau, J.C.; Cicon, J.; Owen, S.R. A Textual Analysis of Logograms in Chinese IPO Roadshows: How Agreement between Investors and Management Relates to Pricing and Performance. Int. J. Financial Stud. 2022, 10, 25. https://doi.org/10.3390/ijfs10020025

Brau JC, Cicon J, Owen SR. A Textual Analysis of Logograms in Chinese IPO Roadshows: How Agreement between Investors and Management Relates to Pricing and Performance. International Journal of Financial Studies. 2022; 10(2):25. https://doi.org/10.3390/ijfs10020025

Chicago/Turabian StyleBrau, James C., James Cicon, and Stephen R. Owen. 2022. "A Textual Analysis of Logograms in Chinese IPO Roadshows: How Agreement between Investors and Management Relates to Pricing and Performance" International Journal of Financial Studies 10, no. 2: 25. https://doi.org/10.3390/ijfs10020025

APA StyleBrau, J. C., Cicon, J., & Owen, S. R. (2022). A Textual Analysis of Logograms in Chinese IPO Roadshows: How Agreement between Investors and Management Relates to Pricing and Performance. International Journal of Financial Studies, 10(2), 25. https://doi.org/10.3390/ijfs10020025