1. Introduction

Portfolio construction is fundamental to the investment management process. The Nobel Prize winner Harry Markowitz with his innovative work in (

Markowitz 1952) established the underpinnings for the modern portfolio theory. This is an investment framework for the selection and construction of investment portfolios based on the maximization of expected portfolio returns and simultaneous minimization of investment risks that constitute the original mean-variance (MV) framework. This framework is appealing because it is efficient from a computational point of view. However, it also has well-established failings that can lead to portfolios that are not optimal from a financial point of view, see (

Michaud 1989). Among these criticisms of MV optimization are: concentrated asset class allocation, inability to account for skewness and kurtosis, and lack of risk diversification. To address these shortcomings, many extensions of MV have been proposed in the literature.

Zhou and Li (

2000) introduced the stochastic linear quadratic (LQ) control as a general framework to study the mean-variance optimization, and found an analytical optimal portfolio policy and an explicit expression of the efficient frontier for a continuous-time mean-variance portfolio selection problem.

Fahmy (

2020) proposed a theoretical extension of the MV framework by adding a time dimension, so that the construction of a portfolio is thought of as an activity that consists of monetary outcomes. This mean-variance time model has the ability to explain many of the observed time-related anomalies of stock returns.

Ötken et al. (

2019) proposed another extension of MV in which the problem specification has three additional sets of constraints: cardinality, sector capitalization, and tracking error, on top of the Markowitz model and other diversification constraints regarding the portfolio. Each one of these MV extensions addressed a particular aspect of portfolio optimization.

In this study, an extension of the classical MV approach was achieved by first incorporating investor psychology through the cumulative prospect theory, then by coupling it to the copula model. These models will be applied to two different classes of assets, namely, the Johannesburg Stock Exchange (JSE) traded assets and the Forex market. Another important aspect that we aim to investigate is the performance ability of these models on each asset class.

According to Markowitz, investors always make rational decisions in order to maximize their utility. Thus, the prime objective of an investor is to maximize his/her utility by either maximizing the portfolio mean (i.e., return) or minimizing the portfolio standard deviation (i.e., risk) or vice-versa. Still on this line of utility maximization, in the context of insurance contract design,

Xu et al. (

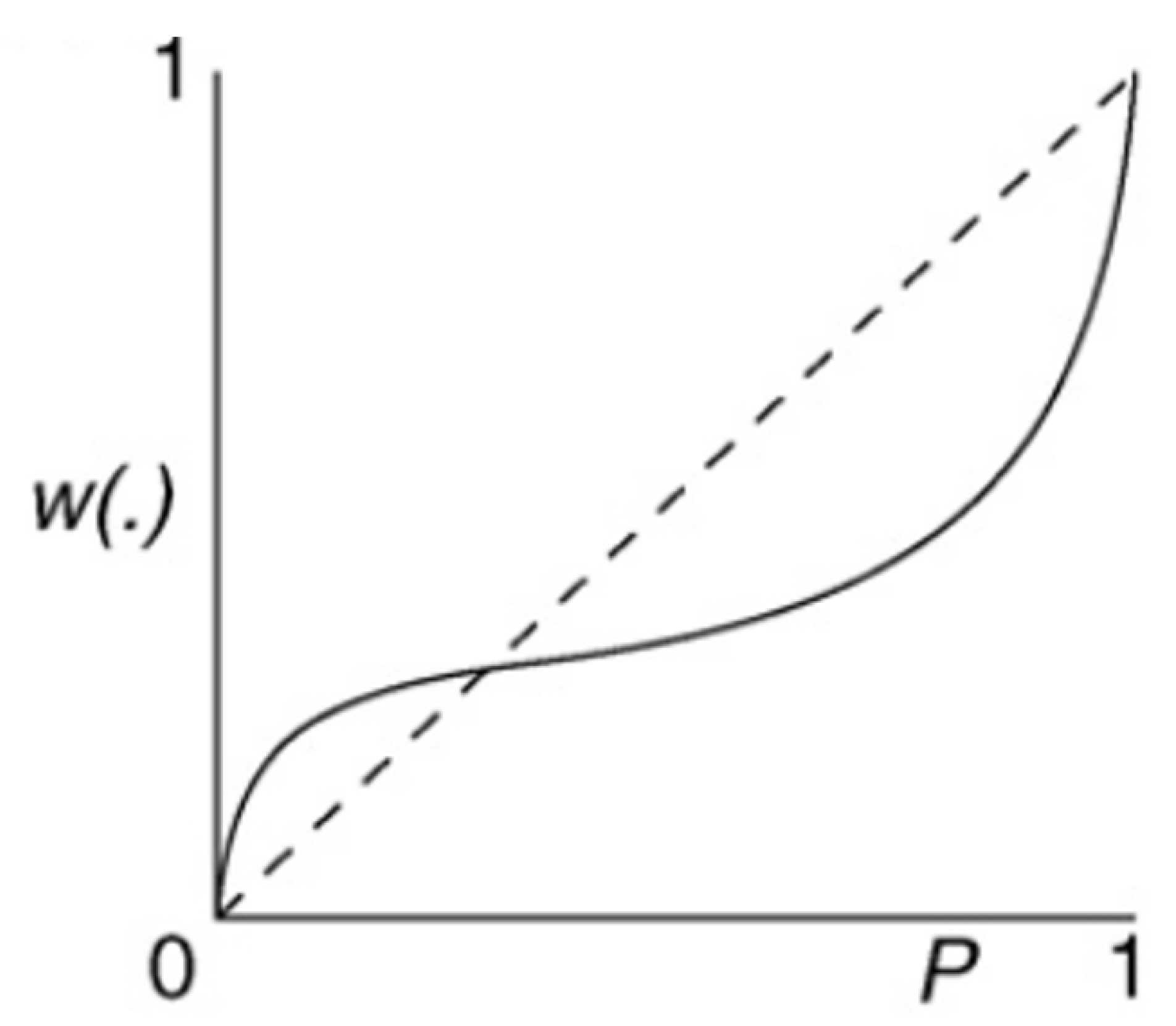

2019) presented the optimal insurance model under the rank-dependent utility (RDU) framework and derived a general necessary and sufficient condition for optimal solutions. However, other researchers working in the field of behavioral and experimental economics hold contrary views about some of the assumptions underlying Markowitz’s theory. They argue that investors are not fully rational and occasionally make sub-optimal decisions. In particular, investors are ’risk seeking’ in the region of gains, but ’risk averse’ in the region of losses (see, for example,

Kahneman and Tversky 1979,

1992). The goal of this paper is to show how mean-variance portfolio allocation can benefit, on the one hand, from the development of the cumulative prospect theory (CPT) introduced by (

Kahneman and Tversky 1992), and on the other hand, from copula, which embodies all of the information about the dependence between the components of a random vector. We will also assess the robustness and the sensitivity of these models to asset classes. As we will illustrate in this study, sensitivity of a model over asset classes should not be ignored in model building and validation. This assessment will be conducted in various portfolios constructed from the two asset classes (JSE and Forex) using their CPT scores.

The CPT theory is rooted in behavioral psychology and was demonstrated to possess sufficient explanatory power for use in actual decision-making problems. Few studies (see, for example,

Ababio et al. 2020;

Omane-Adjepong et al. 2019;

Simo-Kengne et al. 2018;

He and Zhou 2011) have delved into this area attempting to adopt some behavioral decision-making theories, to take a re-look at the Markowitz strategy. In these studies, the authors adopted the cumulative prospect theory with different probability weighting functions, such as the portfolio asset selection technique.

He and Zhou (

2011), in particular, introduced a new measure of loss aversion for large payoffs and investigated the sensitivity of the CPT value function with respect to the stock allocation.

Jin and Yu Zhou (

2008) established a continuous-time behavioral portfolio selection model-based cumulative prospect theory, featuring very general S-shaped utility functions and probability distortions, and obtained closed-form solutions for an important special case. With this approach, they were able to examine how the allocations to equity were influenced by behavioral criteria.

In this study, the impact of behavioral criteria on portfolio allocation is assessed empirically through two adjustments. The first one combines the traditional mean-variance, in what we will name behavioral mean-variance (BMV). A second adjustment to BMV with the copula function will be considered, and the resulting approach will be named copula behavioral mean-variance (CBMV).

The copula function was introduced by (

Sklar 1959). It was designed to provide an idiosyncratic description of the dependence structure between random variables, irrespective of their marginal distributions. Sklar’s theorem in (

Sklar 1959) shows that copula fits well into a portfolio selection context, where various assets in the portfolio have different distributional characteristics. The interactions between assets have to be assessed in order to choose the copula that best models the dependence structure in the portfolio. One can immediately employ the multivariate copulae, such as t copula and Gaussian copula, thus discarding many available existing bivariate copulae with interesting properties. Thanks to vine copula, it is possible to simultaneously use different copulae in modeling the dependence structures in a multivariate setting. The first regular vine copula was introduced by (

Joe 1994) to extend parametric bivariate extreme value copula families to higher dimensions. In the regular vine class, we have the C-vine and the D-vine. A preliminary check to the study conducted in this paper has seen C-vine outperforming D-vine in terms of portfolio risk and return. More illustrations of copula in the portfolio selection context can be seen in (

Mba et al. 2018;

Mba and Mwambi 2020,

2021;

Ababio et al. 2020).

Ababio et al. (

2020) used CPT scores as portfolio selection criteria among two asset classes (indices and cryptocurrency) and employed t copula in the optimization process. Their results showed consistency throughout the various portfolios constructed: portfolios constructed from lower CPT scores outperformed those obtained from higher CPT scores irrespective of the asset class. Can we generalize these findings? The results we will obtain in this paper will show that such a generalization can be misleading. To assess this, we considered two different asset classes: JSE traded stocks on the Forex market. Instead of the t copula, as in the previous study, we use the vine copula, which is flexible enough to auto-select suitable bivariate copulae for dependence structure modeling. We can summarise the approach used in this paper as follows.

In this paper, we investigate the robustness of the conventional mean-variance (MV) optimization model by making two adjustments based, on the one hand, on a behavioral decision-making theory and investor psychology, called the behavioral mean-variance (BMV) approach, and on the other hand, by using the copula theory to extract the portfolio asset dependence structures, called the copula behavioral mean-variance (CBMV) approach. For this assessment, two markets will be considered: the Johannesburg Stock Exchange (JSE) and the Forex markets. The findings illustrate that CBMV is consistent with those in the literature; that is, portfolios with lower CPT scores outperform those with higher CPT scores. Whereas the BMV shows the reverse in the Forex market. This may be attributed to the lack of the classical MV to capture a nonlinear dependence structure.

The rest of the paper is organised as follows:

Section 2 describes the data, the behavioral selection process, the copula theory, and the optimization algorithm.

Section 3 presents the results and discussion.

Section 4 concludes the study.

Appendix A presents some basics of the JGR-GARCH model, introduced by (

Glosten et al. 1993), which is used in this study to simulate the dynamics of the conditional variance.

4. Conclusions

In this paper, we investigated the robustness of the conventional mean-variance (MV) optimization model by making two adjustments, based, on the one hand, on a behavioral decision-making theory and investor psychology, called the BMV approach, and on the other hand, by using the copula theory to extract the portfolio asset dependence structures, called CBMV. Applying the BMV and the CBMV on the JSE stock market, the results show that portfolios of stocks with lower behavioral scores outperform counterpart portfolios with higher behavioral scores. Whereas on the Forex market, the reverse is observed for the BMV, while the CBMV remains consistent. More specially, in the Forex market, the BMV portfolio with higher CPT scores was found to outperform the counterpart portfolio with lower CPT scores. This could be due to the failure of the classical MV to capture the non-linearity exhibited by a highly liquid market as the Forex. In the future, other markets, such as commodities, bonds, or derivatives, will be assessed. Applying the BMV and the CBMV on the combined portfolios within the same asset classes, the CBMV outperforms that of the BMV in the stock market, while in the Forex market, the reverse was observed. Based on the Sharpe ratio, the BMV appears to outperform the CBMV in almost all settings. It appears that investing the Forex market using the behavioral BMV approach is more promising and could add value to investors’ portfolios.

The approach presented in this study has the advantage of incorporating investor psychology in the portfolio selection since investors are not fully rational in their decision making. Previous studies on world indices and cryptocurrency markets have shown consistency with the indices/cryptoassets with lower CPT scores outperforming those with higher CPT scores. This was based on a t-copula type model. The same conclusion is drawn here with the vine copula type model (CBMV), whereas the BMV model does not align to such conclusions in the Forex market. Thus, is such a claim market-related or model-specific? We will investigate this in future work.