Taxing the Digital Economy through Consumption Taxes (VAT) in African Countries: Possibilities, Constraints and Implications

Abstract

:1. Introduction

2. Review Methodology

3. VAT Administration on the Digital Economy in Africa

3.1. Consumption Taxes and Digital Economy Taxation

3.1.1. The Application of VAT Regulation in the Digital Economy and the International Tax Platform

3.2. Consumption or Indirect Taxes and Taxation of the Digital Economy in Africa

3.3. Benefits for Taxing the Digital Economy in Africa Using VAT

3.3.1. Superiority of VAT to Turnovers

3.3.2. Efficiency

3.3.3. Creation of a Competitive E-Commerce Environment

3.3.4. Increased Tax Revenue Mobilization

3.4. Constraints to Effectively Taxing the Digital Economy in Africa Using Consumption Taxes

3.4.1. Invisible or Borderless Nature of Digital Transactions

3.4.2. Ambiguities in VAT Legislation Provisions

- Definitions of Digital Services and Electronic Services

- Supply of Digital Services

- Place of Supply

3.4.3. Complexity of Some of the Provision of the VAT Legislation

3.4.4. Registration

3.4.5. Administration, Monitoring and Enforcement Challenges

- Administrative Constraints

- Monitoring and Enforcement Challenges

3.4.6. Lack of Knowledge and Awareness

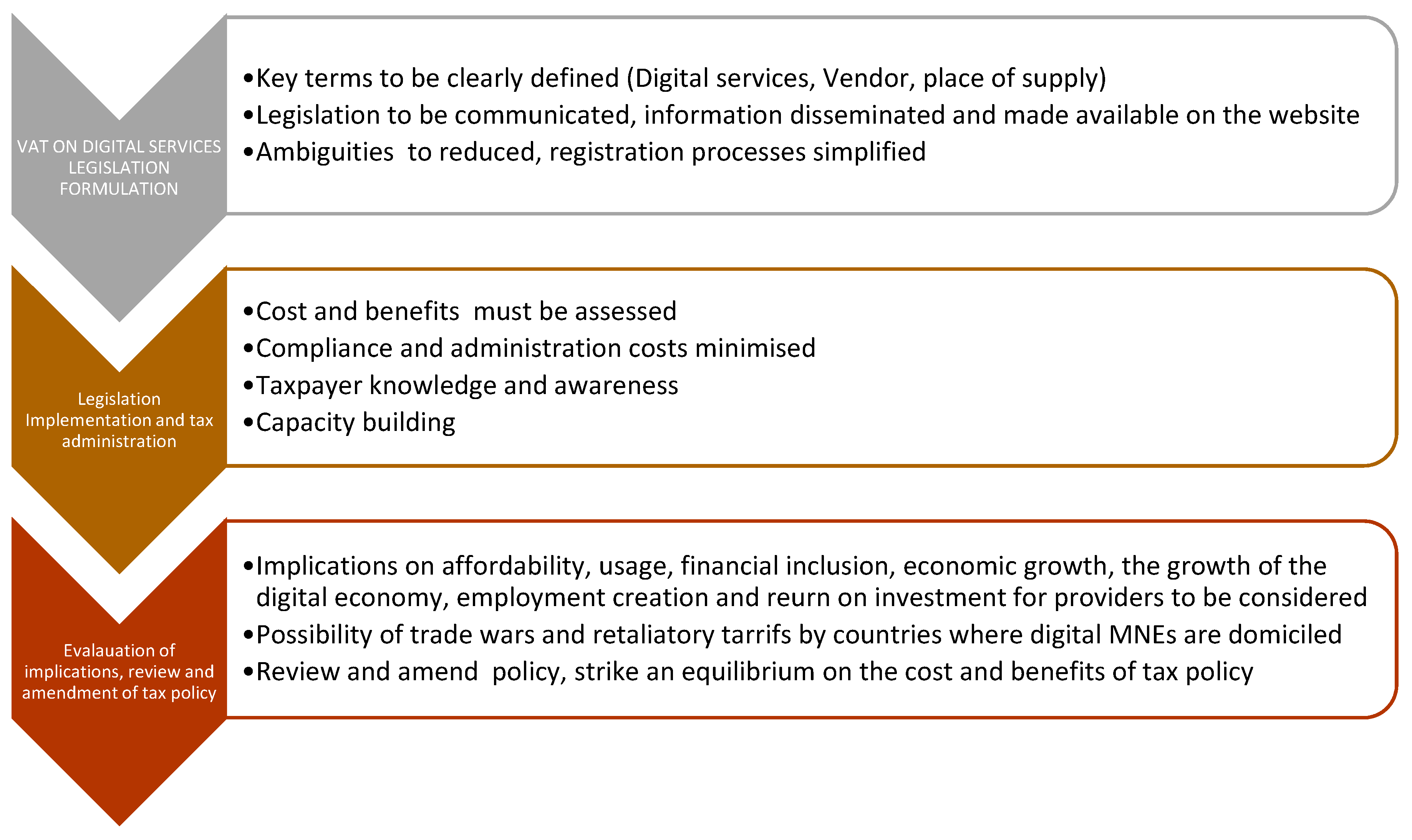

4. Implications and Recommendations for Future VAT Policy in Africa with Respect to the Digital Economy

4.1. Implications

Practical and Policy Implications for the Results

4.2. Recommendations

4.2.1. Full Development of VAT Legislation, Clarity in Definitions, Continuous Revisit and Amendment of VAT Legislation

4.2.2. Cooperation, Collaboration and Learning from One Another by African Countries

4.2.3. Capacity Building, Training, Information Dissemination

4.2.4. Cost and Benefit Analysis

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adhikari, Bibek. 2016. The Economic Effects of Broad-Based and Flat-Rate Tax Systems. Ph.D. dissertation, Tulane University, New Orleans, LA, USA. [Google Scholar]

- African Tax Administration Forum (ATAF). 2019a. Technical Note: The Challenges Arising in Africa from the Digitalisation of the Economy. Available online: https://events.ataftax.org/includes/preview.php?file_id=25&language=en_US (accessed on 24 February 2022).

- African Tax Administration Forum (ATAF). 2019b. High Level Tax Policy Dialogue. Available online: https://www.globaltaxjustice.org/en/events/3rd-ataf-high-level-tax-policy-dialogue (accessed on 24 February 2022).

- African Tax Administration Forum (ATAF). 2020. ATAF Publishes an Approach to Taxing the Digital Economy. Available online: https://www.ataftax.org/ataf-publishes-an-approach-to-taxing-the-digital-economy (accessed on 20 February 2022).

- Ahmad, Tijjani H., Abubakar Umar Farouk, and Rabiu Saminu Jibril. 2021. Broadening Nigeria’s Tax Base: Focusing on the Taxation of Digital Transactions. Financing for Development 1: 65–76. [Google Scholar]

- Ahmed, Shamira, and Alison Gillwald. 2020. Multifaceted Challenges of Digital Taxation in Africa. Available online: https://www.africaportal.org/documents/20840/Final-Tax-PB_30112020.pdf (accessed on 16 March 2022).

- Ahmed, Shamira, Tapiwa Chinembiri, and Naila Govan-Vassen. 2021. COVID-19 Exposes the Contradictions of Social Media Taxes in Africa. Available online: https://www.africaportal.org/documents/21197/COVID-19-social_media_taxes_in_Africa.pdf (accessed on 20 February 2022).

- Akpen, Nater Paul. 2021. Digital Economy: An Emerging Economy in Africa. Available online: https://wataf-tax.org/wp-content/uploads/2022/02/WATAF_NATER_EN.pdf (accessed on 24 February 2022).

- Becker, Celia. 2021. Taxing the Digital Economy in Sub Saharan Africa. Available online: https://www.ibanet.org/Taxing-the-digital-economy-sub-Saharan-Africa (accessed on 16 March 2022).

- Beebeejaun, Ambareen. 2020. VAT on foreign digital services in Mauritius; a comparative study with South Africa. International Journal of Law and Management 63: 239–50. [Google Scholar] [CrossRef]

- Bowmans. 2020. VAT on Electronic Services-Amended Regulations and Guidance from SARS. Available online: https://www.bomanslaw.com/insights/tax/vat-on-electronic-services-amended-regulations-guidance-from-sars (accessed on 11 January 2022).

- Braun, Virginia, and Victoria Clarke. 2006. Using thematic analysis in psychology. Qualitative Research in Psychology 3: 77–101. [Google Scholar] [CrossRef] [Green Version]

- Braun, Virginia, and Victoria Clarke. 2019. Reflecting on reflexive thematic analysis. Qualitative Research in Sport, Exercise and Health 11: 589–97. [Google Scholar] [CrossRef]

- Bunn, Daniel, E. Asen, and Cristina Enache. 2020. Digital Taxation around the World. Washington, DC: Tax Foundation, Available online: https://files.taxfoundation.org/20200527192056/Digital-Taxation-Around-the-World.pdf (accessed on 20 February 2022).

- Chang, F. 2019. Netflix tax and after effects. International Journal of Law, Humanities and Social Sciences 5. [Google Scholar]

- de Lima Carvalho, L. 2020. Literature Review: Tax and the Digital Economy: Challenges and Proposals for Reform, W. Haslehner, G. Kofler, K. Pantazatou & A. Rust (editors), Series on International Taxation 69, Wolters Kluwer. 2019. Intertax 48: 1062–67. [Google Scholar]

- Deloitte. 2020a. Digital Services Tax in Africa—The Journey So Far. Implementation of Digital Taxes across Africa. Available online: https://www2.deloitte.com/za/en/pages/tax/articles/digital-services-tax-in-africa-the-journey-so-far (accessed on 20 February 2022).

- Deloitte. 2020b. VAT in a Digital Economy. Driving Co-Operation across Borders. Available online: https://www2.deloitte.com/za/en/pages/tax/articles/vat-in-digital-economy.html. (accessed on 20 March 2022).

- Domus, A., L. Latre, and Karler. 2017. International taxation and International Communications. Journal of Law and Legal Sciences 3. [Google Scholar]

- Etim, Raphael S., Ofonime O. Jeremiah, and Augustine Udonsek. 2020. The Implementation of Value Added Tax (Vat) On E-Transactions in Nigeria: Issues and Implications. American Journal of Business Management 3: 1–9. [Google Scholar]

- Gulkova, E., M. Karp, and M. Tipalina. 2019. Tax challenges of the digital economy. Vestnik Universiteta 4: 89–95. [Google Scholar] [CrossRef]

- Guyu, J. 2019. Taxing a Digital Economy. Exploring Intangible Assets to Broaden Revenue Base in Kenya. Available online: https://press.strathmore.edu/uploads/journals/strathmore-law-review (accessed on 24 February 2022).

- Hadzhieva, Eli. 2019. Impact of Digitalisation on International Tax Matters: Challenges and Remedies. Luxenmbourg: European Parliament. [Google Scholar]

- Isiandinso, O., and E. Omoju. 2019. Taxation of Nigeria’s Digital Economy: Challenges and Prospects. Andersen Tax. Available online: https://www.mondaq.com/nigeria/tax-authorities/810276/taxation-of-nigeria39s-digital-economy-challenges-and-prospects (accessed on 20 February 2022).

- Ismail, Y. 2020. Digital Economy: State of Play and Implications for Developing Countries. Geneva: CUTS. [Google Scholar]

- Janse van Vuuren, Peiter-Willem. 2019. Taxation of the Digital Economy: The Impact of South Africa’s Value-Added Tax Provisions on Tax Compliance. Pretoria: University of Pretoria. [Google Scholar]

- Kabala, Edna, and Manenga Ndulo. 2018. Transfer mispricing in Africa: Contextual issues. Southern African Journal of Policy and Development 4: 6. [Google Scholar]

- Kabwe, Ruddy, and Stephanus van Zyl. 2021. Value-added tax in the digital economy: A fresh look at the South African dispensation. Obiter 42: 499–528. [Google Scholar]

- Kapkai, Philip, Irene Muthee, Bonaventure Ngala, Nuh Musa, Ann Wanyeri, and Evelyn Gathoni. 2021. Enforcement of the Digital Economy Taxation. African Tax and Customs Review 4: 1–23. [Google Scholar]

- Katz, Raul. 2015. The impact of taxation on the digital economy. Paper presented at the 15th Global Symposium for Regulators, Libreville, Gabon, June 9–11; pp. 1–61. [Google Scholar]

- Kearney, A. T. 2014. A wealth of choices: From anywhere on Earth to no location at all. In The 2014 A.T. Kearney Global Services Location IndexTM. Chicago: A.T. Kearney, Inc. [Google Scholar]

- Kelbesa, Megersa. 2020. Digital Service Taxes and Their Application. Knowledge, Evidence and Learning for Development (K4D). Brighton: Institute of Development Studies, Available online: https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/16968/914_Digital_Service_Tax.pdf?sequence=1 (accessed on 15 March 2022).

- Kennedy, Joe. 2019. Digital Services Taxes: A Bad Idea Whose Time Should Never Come. Washington, DC: Information Technology and Innovation Foundation, Available online: https://itif.org/publications/2019/05/13/digital-services-taxes-bad-idea-whose-time-should-never-come (accessed on 24 February 2022).

- Kim, Young Ran. 2020. Digital Services Tax: A Cross-Border Variation of the Consumption Tax Debate. Alabama Law Review 72: 131. [Google Scholar]

- Kirsten, Craig. 2019. Articles: Taxing the Digital Economy—Why Is Africa Not Getting Its Fair Share. Available online: https://www.bdo.co.za/en-za/insights/2019/tax/taxing-the-digital-economy-why-is-africa-not-getting-its-fair-share (accessed on 20 March 2022).

- KPMG. 2020. Zimbabwe: Taxation of Non-Resident e-Commerce Platforms, Satellite Broadcasting Services. Available online: https://home.kpmg/us/en/home/insight/2019/09/tnf-zimbabwe-taxation-non-resident-e-commerce-platforms-satellite-broadcasting-services.html (accessed on 15 February 2022).

- Kruger, Des, and Carmen Moss-Holdstock. 2014. The South African VAT implications for foreign suppliers of electronic services-the final regulations. Business Tax and Company Law Quarterly 5: 14–26. [Google Scholar]

- Latif, Layla. 2019. The Challenges in Imposing the Digital Tax in Developing African Countries. Journal of Legal Studies and Research 5: 102–33. [Google Scholar]

- Latif, Layla. 2020. The evolving ‘thunder’: The challenges around imposing the digital tax in developing African countries. International Journal of Digital Technology & Economy 4: 34–50. [Google Scholar]

- Liganya, Bhoke. 2020. Taxation of E-Commerce: Prospects and Challenges for Tanzania. Mzumbe: Mzumbe University. [Google Scholar]

- Lowry, Sean. 2019. Digital Services Taxes (DSTs): Policy and Economic Analysis. Washington, DC: Congressional Reasearch Service, Available online: https://www.wita.org/wp-content/uploads/2020/06/20190225_R45532_fab3b713f012038983da04c124f162170410f3e2.pdf (accessed on 20 February 2022).

- Luttmer, E. F., and M. Singhal. 2014. Tax morale. Journal of Economic Perspectives 28: 149–68. [Google Scholar] [CrossRef] [Green Version]

- Medina, Leandro, and Friedrich Schneider. 2018. Shadow Economies around the World: What Did We Learn over the Last 20 Years? Washington, DC: International Monetary Fund, Available online: https://www.elibrary.imf.org/view/journals/001/2018/017/article-A001-en.xml (accessed on 20 March 2022).

- Mpofu, Favourate Y. 2021a. A Critical Review of the Taxation of the Informal Sector in Zimbabwe. Ph.D. thesis, North-West University, Potchefstroom, South Africa. [Google Scholar]

- Mpofu, Favourate Y. 2021b. Review Articles: A Critical Review of the Pitfalls and Guidelines to effectively conducting and reporting reviews. Technium Social Sciences Journal 18: 550–74. [Google Scholar]

- Mpofu, Favourate Y. S. 2021c. Informal Sector Taxation and Enforcement in African Countries: How plausible and achievable are the motives behind? A Critical Literature Review. Open Economics 4: 72–97. [Google Scholar] [CrossRef]

- Munoz, Laura, Giulia Mascagni, Wilson Prichard, and Fabrizio Santoro. 2022. Should Governments Tax Digital Financial Services? A Research Agenda to Understand Sector-Specific Taxes on DFS. ICTD Working Paper 136. Brighton: Institute of Development Studies, Available online: https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/17171/ICTD_WP136.pdf?sequence=1 (accessed on 21 April 2022).

- Ndajiwo, Mustapha. 2020. The Taxation of the Digitalised Economy: An African Study. ICTD Working Paper 107. Brighton: Institute of Development Studies. [Google Scholar]

- Ngeno, Nehemiah. 2020. Taxing Kenya’s Digital Economy: The Digital Service Tax (DST) Explained (Lawyer Hub, 2020). Available online: https://lawyerhub.org/blog/Taxing-Kenyas-Digital-Economy-The-Digital-Service-Explained (accessed on 22 March 2022).

- Nigeria Value Added Tax Act No 102 of 1993. 1993. Available online: https://www.mondaq.com/nigeria/sales-taxes-vat-gst/1110590/nigeria39s-value-added-tax-vat-regime-regulatory-update#:~:text=Certain%20goods%20and%20services%20including,from%20taxable%20persons%20in%20Nigeria (accessed on 20 March 2022).

- Onuoha, Raymond, and Alison Gillwald. 2022. Digital Taxation: Can It Contribute to More than Just Resource Mobilisation Post COVID-Pandemic Reconstruction? (Working Paper, No. 2), RIA. Digital New Deal for Africa-Research ICT Africa. Available online: https://www.africaportal.org/documents/22459/Digital-Taxation-contribute-to-more-just-resource-mobilisation-in-post-pandemi_HbbLoxs.pdf (accessed on 24 February 2022).

- Organization of Economic Co-operation and Development. 2014. Broader tax challenges raised by the digital economy. In Addressing the Tax Challenges of the Digital Economy. Paris: OECD Publishing. [Google Scholar]

- Organization for Economic Co-operation and Development (OECD). 2019. The Role of Digital Platforms in the Collection of VAT/GST. Available online: https://www.oecd.org/tax/consumption/the-role-of-digital-platforms-in-the-collection-of-vat-gst-on-online-sales-e0e2dd2d-en.htm (accessed on 16 March 2022).

- Organization for Economic Co-operation and Development (OECD). 2020. Revenue Statistics in Africa 2020. Available online: https://www.oecd.org/tax/tax-policy/brochure-revenue-statistics-africa-pdf (accessed on 12 December 2021).

- Paré, Guy, Marie-Claude Trudel, Mirou Jaana, and Spyros Kitsiou. 2015. Synthesizing information systems knowledge: A typology of literature reviews. Information & Management 52: 183–99. [Google Scholar]

- Price Waterhouse Coopers. 2020. Helping you navigate Africa’s VAT landscape. Available online: https://www.pwc.co.za/en/assets/pdf/vat-in-africa-2020.pdf (accessed on 24 March 2022).

- Rooi, Tsogo-Karabo. 2015. An Evaluation of the Practical Application of the South African VAT Legislation on Electronic Services: A Case Study. Potchefstroom: North-West University. [Google Scholar]

- Rukundo, Solomon. 2020. Addressing the Challenges of Taxation of the Digital Economy: Lessons for African Countries. ICTD Working Paper 105. Brighton: Institute of Development Studies, Available online: https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/14990/ICTD_WP105.pdf?sequence=1 (accessed on 20 February 2022).

- Russo, Karl. 2019. Superiority of the VAT to turnover tax as an indirect tax on digital services. National Tax Journal 72: 857–80. [Google Scholar] [CrossRef]

- Saint-Amans, Pascal. 2017. Tax Challenges, Disruption and the Digital Economy. Available online: https://www.oecd-ilibrary.org/content/paper/0bbf97ab-en?crawler=true&mimetype=application/pdf (accessed on 24 February 2022).

- Santoro, Fabrizio, Laura Munoz, Wilson Prichard, and Giulia Mascagni. 2022. Digital Financial Services and Digital Ids: What Potential Do They Have for Better Taxation in Africa? ICTD Working Paper 137. Brighton: Institute of Development Studies, Available online: https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/17113/ICTD_WP137.pdf?sequence=1 (accessed on 24 February 2022).

- Schiavone Panni, A. 2019. Taxing the Digital Economy: Issues and Possible Solutions. Available online: http://tesi.luiss.it/25811/1/699661_SCHIAVONE%20PANNI_ANNA.pdf (accessed on 24 February 2022).

- Sebele-Mpofu, Favourate Y. 2020a. Governance quality and tax morale and compliance in Zimbabwe’s informal sector. Cogent Business & Management 7: 1794662. [Google Scholar]

- Sebele-Mpofu, Favourate Y. 2020b. Saturation controversy in qualitative research: Complexities and underlying assumptions. A literature review. Cogent Social Sciences 6: 1838706. [Google Scholar] [CrossRef]

- Sebele-Mpofu, Favourate Y. 2021. The Informal Sector, the “implicit” Social Contract, the Willingness to Pay Taxes and Tax Compliance in Zimbabwe. Accounting, Economics, and Law: A Convivium, 1–44. [Google Scholar] [CrossRef]

- Sebele-Mpofu, Favourate Y., Eukeria Mashiri, and Patrick Korera. 2021a. Transfer Pricing Audit Challenges and Dispute Resolution Effectiveness in Developing Countries with Specific Focus on Zimbabwe. Accounting, Economics, and Law: A Convivium, 1–47. [Google Scholar] [CrossRef]

- Sebele-Mpofu, Favourate, Eukeria Mashiri, and Samantha C. Schwartz. 2021b. An exposition of transfer pricing motives, strategies and their implementation in tax avoidance by MNEs in developing countries. Cogent Business & Management 8: 1944007. [Google Scholar]

- Sigadah, Mariciana Nekesa. 2018. Challenges Faced by the Current Kenyan Tax Law in Dealing with Electronic Commerce. Ph.D. dissertation, Strathmore University, Nairobi, Kenya. [Google Scholar]

- Simbarashe, Hamudi. 2020. Digitalisation and the Challenges for African Administrations. Financing for Development 1: 177–203. [Google Scholar]

- Snyder, Hannah. 2019. Literature review as a research methodology: An overview and guidelines. Journal of Business Research 104: 333–39. [Google Scholar] [CrossRef]

- Statista. 2020a. Facebook Global Revenue. Available online: https://www.statista.com/statistics/268604/annual-revenue-of-facebook/ (accessed on 15 March 2022).

- Statista. 2020b. Annual Revenue of Google. Available online: https://www.statista.com/statistics/2666206/googles-annual-global-revenues (accessed on 20 March 2022).

- TaxWatch. 2021. Digital Giants and VAT in Africa. Tech Companies Fail to Collect VAT in Africa. Available online: https://www.taxwatchuk.org>africa_vat (accessed on 15 February 2022).

- Turina, Alessandro. 2018. Which ‘Source Taxation’ for the Digital Economy? Intertax 46: 495–519. [Google Scholar] [CrossRef]

- Turina, Alessandro. 2020. The progressive policy shift in the debate on the international tax challenges of the digital economy: A “pretext” for overhaul of the international tax regime? Computer Law & Security Review 36: 105382. [Google Scholar]

- United Nations Conference Trade and Development. 2020. Economic Development in Africa Report. Tackling Illicit Financial Flows for Sustainable Development in Africa. Available online: https://unctad.org/webflyer/economic-development-africa-report-2020 (accessed on 20 February 2022).

- Van Zyl, Stephanus Phillipus. 2013. The Collection of Value Added Tax on Online Cross-Border Trade in Digital Goods. Pretoria: University of South Africa. [Google Scholar]

- Van Zyl, Stephanus Phillipus. 2014. The collection of value added tax on cross-border digital trade-part 1: Registration of foreign vendors. Comparative and International Law Journal of Southern Africa 47: 154–86. [Google Scholar]

- Van Zyl, Stephanus Phillipus, and W. Schulze. 2014. The collection of value added tax on cross-border digital trade-part 2: VAT collection by banks. Comparative and International Law Journal of Southern Africa 47: 316–49. [Google Scholar]

- Youssef, Adel Ben, Sabri Boubaker, But Dedaj, and Mjellma Carabregu-Vokshi. 2021. Digitalization of the economy and entrepreneurship intention. Technological Forecasting and Social Change 164: 120043. [Google Scholar] [CrossRef]

| Country | Legal/Statutory Provisions | Effective Date | Reference(s) |

|---|---|---|---|

| Algeria | On 12 December 2019, the country broadened its VAT legislation to incorporate sales of digital services, which are liable to a downward revised rate of 9%. The law remains silent on the registration provisions for non-resident providers No VAT liability threshold. | 1 January 2020 | (Bunn et al. 2020; Kelbesa 2020; Simbarashe 2020) |

| Kenya | From September 2013, Kenya levied VAT on digital services provided by foreign suppliers to the country ’residents. Kenya broadened its indirect tax policy in 2019 to include sales generated through digital sales markets, making VAT chargeable on these sales. Furthermore, the country widened the provisions for self-assessment under VAT. | 1 January 2020 | (Kapkai et al. 2021; Sigadah 2018; Simbarashe 2020; TaxWatch 2021) |

| Cameroon | The country introduced VAT on digital services. The provisions are such that the sale of goods and services to both businesses and individuals shall be VAT chargeable. All operators of e-platforms must register o VAT in relation to each transaction. | 17 January 2020 | (Simbarashe 2020; TaxWatch 2021) |

| Ghana | In 2013, Ghana put in place VAT regulations that if non-resident vendors selling/providing services to customers in Ghana should register for VAT. Threshold: GH 200,000 (estimated 25,000). | 1 January 2014 | (Simbarashe 2020; TaxWatch 2021). |

| Zimbabwe | The company put in place legislative requirements for non-resident vendors of television, radio and other digital services to customers or users in Zimbabwe to register, collect and remit VAT. | January 2020 | (Becker 2021; Deloitte 2020a; KPMG 2020; Simbarashe 2020) |

| Tanzania | The country’s tax rules require non-resident provers of business to customers of telecoms services and e-commerce services to be registered for VAT. | 1 July 2015 | (Liganya 2020; PWC 2020; Simbarashe 2020) |

| Uganda | The country’s revenue authority (Uganda Revenue Authority) released a public notice requirement for non-resident vendors or providers of digital services to customers in Uganda to register for VAT and collect the Tax. | 1 July 2018 | (Simbarashe 2020) |

| South Africa | South Africa had initially enacted VAT legislation in 2013 and the regulations became effective in 2014. These regulations were broadened in 2019 with broader definition for electronic services. The country’s VAT legislation requirement is that foreign providers of digital services must register as VAT vendors, collect VAT at a rate of 15% and remit it. The registration threshold was stipulated to be ZAR 1 million. | January 2019 | (Kabwe and van Zyl 2021; Van Zyl 2014; Van Zyl 2013; Stephanus P. Van Zyl and Schulze 2014) |

| Angola | VAT rules were drafted in October 2019, which became effective in January 2020, providing that digital service suppliers must register with the country’s revenue authority (Angolan Tax Authority) or appoint a local agent to collect and remit VAT in Angola. | January 2020 | (Simbarashe 2020) |

| Morocco | The country’s tax code provides that any service rendered or used using within the Moroccan territory is liable to the country’s VAT at a rate of 20% that is applicable to digital services. | 2019 | (Simbarashe 2020) |

| Nigeria | Section 10 of (Nigeria’s VAT Act 1993), No 102 provides that non-resident firms conducting business in Nigeria must register for tax, using the address of the person of whom the company has a standing contract. Accordingly, the non-resident company shall include tax charge on its invoice and the recipient of the service shall remit the tax to the Federal Inland Revenue Services (FIRS) in the currency of the whole transaction. | 2020 | (Ahmad et al. 2021) |

| Malawi | VAT on internet service was re-introduced in July 2013 at a threshold of MWK 10M (estimated at f 9.500). | 2013 | (TaxWatch 2021) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mpofu, F.Y. Taxing the Digital Economy through Consumption Taxes (VAT) in African Countries: Possibilities, Constraints and Implications. Int. J. Financial Stud. 2022, 10, 65. https://doi.org/10.3390/ijfs10030065

Mpofu FY. Taxing the Digital Economy through Consumption Taxes (VAT) in African Countries: Possibilities, Constraints and Implications. International Journal of Financial Studies. 2022; 10(3):65. https://doi.org/10.3390/ijfs10030065

Chicago/Turabian StyleMpofu, Favourate Y. 2022. "Taxing the Digital Economy through Consumption Taxes (VAT) in African Countries: Possibilities, Constraints and Implications" International Journal of Financial Studies 10, no. 3: 65. https://doi.org/10.3390/ijfs10030065

APA StyleMpofu, F. Y. (2022). Taxing the Digital Economy through Consumption Taxes (VAT) in African Countries: Possibilities, Constraints and Implications. International Journal of Financial Studies, 10(3), 65. https://doi.org/10.3390/ijfs10030065